Key Takeaways

- Salaries in Moldova for 2026 are rising across most sectors, driven by a higher minimum wage, labour shortages, and continued economic stabilisation.

- Significant pay gaps remain by sector and region, with technology, finance, and Chișinău offering the highest salaries, while rural and traditional sectors lag behind.

- Net income and real purchasing power depend heavily on tax regime, experience level, and cost of living, making skills and employment structure critical for income growth.

Salaries in Moldova for 2026 reflect a country at an important economic crossroads. After several years marked by inflation shocks, energy price volatility, demographic decline, and accelerated outward migration, Moldova is entering a phase of wage adjustment that is more structured, policy-driven, and closely linked to long-term economic reform. For employees, employers, investors, and international partners, understanding how salaries are formed, distributed, taxed, and converted into real purchasing power is essential for making informed decisions in 2026.

Also, read our guide on the Top 10 Best Recruitment Agencies in Moldova.

This complete guide to salaries in Moldova for 2026 is designed to provide a clear, data-backed view of the country’s wage landscape. It goes beyond headline figures to explain what workers actually earn, how income differs by sector and region, how experience and skills affect pay, and how taxes and social contributions shape net salaries. It also places Moldovan wages in the context of living costs, household income, and international benchmarks, offering a practical framework for evaluating real income levels rather than nominal numbers alone.

Need recruitment services? Check out 9cv9 Recruitment Agency.

In 2026, Moldova’s salary environment is being reshaped by several powerful forces. The national minimum wage has increased significantly, lifting the income floor for low-paid workers and accelerating formalisation across the labour market. At the same time, the projected average salary has risen, affecting not only earnings expectations but also the calculation of social benefits, maternity pay, sick leave, and pension contributions. These policy changes are occurring alongside a tight labour market driven by emigration, which is pushing employers to raise wages to retain talent rather than as a result of productivity gains alone.

Sectoral differences remain one of the defining characteristics of Moldovan salaries. High-value industries such as information technology, finance, energy, and professional services offer wages that are multiple times higher than those in agriculture, hospitality, and cultural services. Manufacturing, healthcare, education, and public administration sit in the middle of the spectrum, providing employment stability but more limited income growth unless combined with specialisation or private-sector exposure. This guide examines each of these sectors in detail to show where income opportunities are strongest in 2026 and where wage constraints remain.

Regional disparities also play a critical role in shaping earnings. Chișinău continues to dominate high-paying employment due to its concentration of corporate headquarters, technology firms, financial institutions, and international organisations. Secondary cities such as Bălți and Cahul offer more modest salary levels, while rural districts remain heavily clustered around the minimum wage. These differences influence internal migration patterns, career decisions, and long-term workforce sustainability, all of which are explored in this guide.

Another key focus of this guide is the difference between gross and net income. Moldova operates under a flat-tax system, but mandatory health insurance, social security contributions, and special tax regimes mean that take-home pay can vary significantly depending on employment structure. Employees working under simplified frameworks, particularly in the technology sector, often receive much higher net salaries than workers earning the same gross amount under standard rules. Understanding these mechanisms is essential for both workers evaluating job offers and employers planning compensation packages.

Cost of living and purchasing power provide crucial context for interpreting salary figures. While Moldovan wages remain lower than those in most European Union countries, prices for housing, food, and services are also substantially lower. Stabilisation of energy costs after earlier shocks has further improved household budgeting. This guide explains how far different income levels go in everyday life, how the minimum existence threshold compares with wages, and how income inequality affects overall living standards.

Looking ahead, salaries in Moldova for 2026 must also be viewed through a strategic lens. Rising wages are positive for households, but they raise questions about competitiveness, productivity, and long-term sustainability. Policymakers, businesses, and workers all face the challenge of ensuring that wage growth is supported by skills development, capital investment, and structural reform rather than labour scarcity alone.

Whether you are a professional planning your career, an employer setting salary budgets, a foreign company considering market entry, or a researcher analysing Eastern European labour markets, this guide offers a comprehensive and practical overview. By combining wage data, policy context, sector analysis, and real-world implications, this introduction sets the stage for a detailed exploration of what salaries in Moldova truly look like in 2026 and what they mean for the years ahead.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Salaries in Moldova in 2026: A Complete Guide.

If you like to get your company listed in our top B2B software reviews, check out our world-class 9cv9 Media and PR service and pricing plans here.

Salaries in Moldova in 2026: A Complete Guide

- Macroeconomic Foundations and the 2026 Growth Trajectory

- National Statutory Wage Benchmarks for 2026

- Sectoral Analysis: Industry-Specific Compensation Trends

- Experience-Level and Role-Specific Compensation

- Regional Salary Disparities: Chișinău vs. The Periphery

- The Fiscal Framework for 2026: Taxation and Net Income

- Living Standards and Household Income Comparisons

- The Cost-of-Living Factor: Purchasing Power in 2026

- Strategic Challenges: The Labor Gap and Unit Labor Costs

- Forecast for 2027 and Beyond: The Path to EU Convergence

- Actionable Insights for Employers and Employees

1. Macroeconomic Foundations and the 2026 Growth Trajectory

The salary outlook in Moldova for 2026 is closely tied to the country’s improving macroeconomic stability following the recovery period of 2023–2024. After a relatively weak first half of 2025, economic conditions began to strengthen due to renewed investment activity and rising domestic consumption. These factors are expected to carry forward into 2026, creating a more supportive environment for wage growth across both the public and private sectors.

Economic forecasts for 2026 point toward moderate but steady expansion. Real GDP growth is projected to remain in the range of roughly 2.2% to 2.4%, driven by stronger household spending, improving agricultural output, and continued implementation of EU-supported growth initiatives. Rising real wages and targeted social support programs are also helping to reinforce domestic demand, which in turn supports employment and salary adjustments.

Inflation Trends and Their Impact on Real Wages

Inflation has been one of the most important factors influencing salary dynamics in recent years. After reaching very high levels in 2023, inflation pressures eased considerably in 2024 and showed signs of stabilisation through 2025. By 2026, inflation is expected to settle within a controlled and predictable range, with policymakers aiming to keep price growth close to the central target.

This stabilisation is crucial for workers, as it allows nominal wage increases to translate into real improvements in purchasing power. By late 2025, real earnings had already begun to grow faster than consumer prices, signalling a shift from income erosion to gradual income recovery. In 2026, this trend is expected to continue, benefiting most segments of the workforce.

Key Economic Indicators Influencing Salaries

The table below summarises the main macroeconomic indicators that shape salary expectations in Moldova for 2026:

Economic Indicator | 2024 Actual | 2025 Projected | 2026 Forecast

Nominal GDP (MDL billion) | 300.4 | 351.5 | 377.2

Real GDP growth rate (%) | 2.6 | 1.7–2.7 | 2.2–2.4

Average inflation rate (%) | 5.0 | 7.7 | 4.6–5.5

GDP per capita (USD, nominal) | 7,488 | 8,260 | 8,950

Unemployment rate (%) | 3.5 | 3.5 | 3.4

These figures suggest a stable labour market with low unemployment and gradual improvements in income levels, creating favourable conditions for salary growth in 2026.

Fiscal Policy and Public Sector Wage Pressures

The fiscal environment for 2026 is shaped by an expansionary budget stance. The government is expected to run a budget deficit of around 5.2% of GDP, largely due to higher capital spending and planned wage increases in the public sector. Significant resources are being allocated to infrastructure development and public administration, which directly affects salary levels for government employees and indirectly influences private-sector wage expectations.

While a higher deficit raises concerns about public debt sustainability, policymakers and international partners view these expenditures as long-term investments. The objective is to strengthen human capital, improve productivity, and lift Moldova’s long-term growth potential from historically low levels toward a more sustainable medium-term trajectory.

Overall Salary Outlook for 2026

Taken together, these macroeconomic and fiscal trends point to a cautiously positive salary outlook for Moldova in 2026. Moderate economic growth, easing inflation, low unemployment, and targeted public spending are expected to support steady wage increases. Although salary growth is unlikely to be rapid, it is projected to be more meaningful in real terms than in previous years, contributing to gradual improvements in living standards across the country.

2. National Statutory Wage Benchmarks for 2026

The salary structure in Moldova for 2026 is strongly influenced by two government-defined benchmarks: the national minimum wage and the projected average monthly salary. These figures are not only designed to protect workers’ incomes but also act as core reference points for the wider fiscal and social security system. They influence how taxes are calculated, how social insurance contributions are applied, and how benefits and penalties are assessed across the economy. As a result, changes to these benchmarks have a direct and wide-ranging impact on both employees and employers.

National Minimum Wage for 2026

From January 1, 2026, the national minimum wage in Moldova is set at 6,300 lei per month. This represents a significant increase compared with previous years, marking a 15 percent rise from the 2025 level of 5,500 lei. When viewed over a longer period, the growth is even more striking, with the minimum wage more than doubling since 2021.

The minimum wage is calculated based on a standard workload of 169 hours per month. This results in a minimum hourly wage of approximately 37.28 lei. The government’s decision to raise the minimum wage at this pace reflects the aim of preserving workers’ purchasing power after several years of elevated inflation. Even though price growth is expected to stabilise by 2026, living costs remain higher than earlier in the decade, making wage protection a key policy priority.

In regional terms, Moldova’s 2026 minimum wage positions the country more competitively within Eastern Europe and the post-Soviet space. Converted into US dollars, the monthly minimum wage stands at roughly 370 USD, which is notably higher than the minimum wage levels in several neighbouring or comparable economies. This relative improvement strengthens Moldova’s appeal as a labour market, particularly for low- and medium-skilled roles.

Minimum Wage Overview

Indicator | Value for 2026

Monthly minimum wage (MDL) | 6,300

Standard monthly hours | 169

Minimum hourly wage (MDL) | 37.28

Nominal increase vs 2025 | 15%

Increase since 2021 | 114%

Projected Average Monthly Salary for 2026

Alongside the minimum wage, the projected average monthly salary plays a central role in Moldova’s wage system. For 2026, the government has approved an average monthly salary level of 17,400 lei. This figure is used as a key economic reference rather than a direct guarantee of earnings, but it has important practical implications across the economy.

The projected average salary is applied in several critical areas. It determines the upper limits used to calculate social benefits such as sickness leave and maternity allowances. It also defines the mandatory income base for employees working within Moldova’s IT Park framework. In the public sector, the average salary acts as a reference value within the unified pay system, shaping salary bands and coefficients. In addition, it is used to set financial thresholds in legal and tax-related cases, including the assessment of damages in certain criminal proceedings.

Historical Evolution of the Average Salary

The table below illustrates how the average monthly salary has evolved over recent years, providing context for the 2026 projection:

Year | Average Salary (MDL) | Annual Growth Rate | Economic Context

2021 | 8,716 | – | Post-pandemic recovery base

2022 | 9,900 | 13.6% | Early inflation response

2023 | 11,700 | 18.2% | Rapid labour market adjustment

2024 | 13,700 | 17.0% | Peak inflation-driven increases

2025 | 16,100 | 17.5% | Productivity and sector recovery

2026 | 17,400 | 8.1% | Stabilisation and EU alignment

The increase to 17,400 lei in 2026 represents an annual growth rate of around 8.1 percent. While this is lower than the sharp increases recorded between 2023 and 2025, it signals a healthier and more balanced phase of wage development. Instead of reacting primarily to inflation, salary growth is becoming more closely aligned with productivity gains and structural economic improvements.

What These Benchmarks Mean for Workers and Employers

Together, the minimum wage and the projected average salary define the core of Moldova’s wage environment for 2026. For workers, they provide stronger income protection and clearer expectations around earnings growth. For employers, they set predictable cost baselines for payroll planning, taxation, and social contributions. In a broader sense, these benchmarks reflect Moldova’s transition toward a more stable and structured labour market, where salary growth is driven less by crisis responses and more by long-term economic alignment and competitiveness.2

3. Sectoral Analysis: Industry-Specific Compensation Trends

a. High-Value Services: ICT, Finance, and Energy

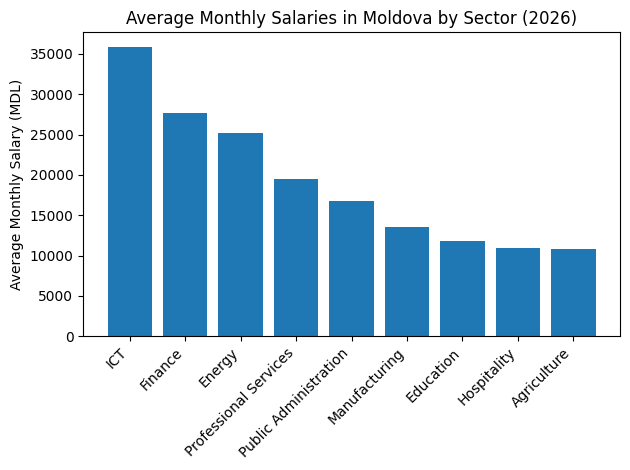

The salary structure in Moldova for 2026 continues to vary widely by industry. While most sectors have recorded nominal wage growth compared with previous years, income differences between high-value service industries and traditional labour-intensive sectors remain substantial. This gap reflects differences in productivity, skills demand, exposure to international markets, and access to investment. Understanding these sectoral variations is essential for employers planning compensation strategies and for workers assessing career opportunities.

Overall Industry Comparison and Wage Dispersion

By the end of 2025, national labour data showed that nearly every major industry experienced some level of salary increase. However, the pace and scale of growth differed sharply. Knowledge-intensive sectors such as technology, finance, and energy continued to pull ahead, while sectors like agriculture, hospitality, and basic services remained at the lower end of the pay scale. This pattern is expected to persist into 2026, although gradual improvements are projected across most industries.

Average Monthly Salaries by Selected Sector

Sector | Average Monthly Salary (MDL) | Relative Position

Information and communications | 35,885 | Highest

Financial and insurance activities | 27,664 | High

Energy production and supply | 25,166 | Upper-middle

Manufacturing | 14,500 (approx.) | Middle

Trade and hospitality | 11,500 (approx.) | Lower

Agriculture | 10,800 (approx.) | Lowest

High-Value Service Sectors Driving Wage Growth

Technology-driven and capital-intensive industries continue to dominate the top end of the salary spectrum in Moldova. These sectors benefit from strong external demand, specialised skill requirements, and supportive regulatory frameworks.

Information and Communications Sector

The information and communications sector remains the highest-paying industry in the Moldovan economy. Strong demand for software developers, engineers, data specialists, and digital service professionals continues to push salaries upward. By late 2025, average gross monthly earnings in this sector reached approximately 35,886 lei. During peak periods, such as the second quarter of 2025, salaries climbed even higher due to performance bonuses and project-based incentives.

This sector’s strength is supported by favourable tax conditions and its close integration with international markets. As global demand for digital services remains strong, salaries in information and communications are expected to stay well above the national average throughout 2026.

Financial and Insurance Activities

The financial and insurance sector consistently ranks as the second-highest paying industry. Average monthly salaries reached around 27,664 lei by late 2025. Wage growth in this sector accelerated during early 2025, with quarterly increases driven by digital transformation across banks and insurance providers.

Rising demand for professionals in risk management, compliance, cybersecurity, data analytics, and digital banking has pushed compensation levels higher. In 2026, salary growth in finance is expected to moderate but remain solid, reflecting ongoing system modernisation and regulatory alignment with European standards.

Energy Production and Supply

Energy-related industries, including electricity, thermal energy, gas, and hot water supply, form another well-paid segment of the labour market. Average monthly earnings in this sector reached roughly 25,166 lei by late 2025. One of the strongest annual wage increases was recorded here, as employers competed to retain skilled engineers, technicians, and infrastructure specialists.

Ongoing reforms in the energy market and the need for technical expertise in generation, distribution, and efficiency upgrades are likely to sustain above-average salaries in 2026.

Salary Growth Momentum by Sector

Sector | Recent Annual Growth Trend | Key Drivers

Information and communications | Strong | Global demand, bonuses, skilled labour shortage

Finance and insurance | Moderate to strong | Digitalisation, regulatory reform

Energy | Strong | Technical talent retention, sector reforms

Manufacturing | Moderate | Productivity gains, export demand

Hospitality and trade | Slow to moderate | Domestic consumption recovery

Agriculture | Slow | Seasonal work, lower productivity

What Sectoral Differences Mean for 2026

The sectoral salary structure in Moldova for 2026 highlights clear opportunities and challenges. High-skill service sectors offer significantly higher earning potential and stronger wage growth, but they require specialised education and experience. Traditional sectors provide broader employment but continue to lag in compensation.

For policymakers, this imbalance underscores the importance of skills development and economic diversification. For workers, it reinforces the value of training and mobility toward higher-productivity industries. Overall, while wage gaps remain wide, the general upward trend across sectors suggests a gradually improving income environment for the Moldovan workforce in 2026.

b. Mid-Tier Sectors: Professional Services and Public Administration

In Moldova’s 2026 salary structure, professional services and public administration form the middle layer of the labour market. These sectors neither match the high earnings seen in technology or finance nor fall to the lower levels typical of agriculture and hospitality. Instead, they offer stable, predictable incomes and are closely influenced by government budget planning, regulatory reforms, and external market demand.

A key factor shaping pay in these sectors is the national “reference value” used in public budgeting and salary calculations. For 2026, this reference value is expected to rise from 2,200 lei to 2,400 lei. This adjustment directly affects public sector wages and indirectly influences compensation in related professional services that depend on state contracts and regulatory work.

Professional, Scientific, and Technical Activities

Professional, scientific, and technical services represent a diverse group of occupations that sit firmly in the mid-tier salary range. Average monthly earnings in this category generally fall between 19,000 and 21,000 lei. This group includes legal professionals, accountants, auditors, consultants, engineers, architects, and technical advisers.

Salary growth in these professions has been supported by the increasing complexity of Moldova’s regulatory and business environment. As the country continues to align its laws, reporting standards, and corporate practices with European norms, demand has grown for skilled specialists who can manage compliance, advisory, and technical documentation. In 2026, salaries in this sector are expected to grow steadily, reflecting both rising skill requirements and relatively stable demand.

Public Administration and Defence

Public administration and defence roles remain closely tied to national budget decisions and wage policy reforms. In 2026, average salaries in this sector are expected to remain near the national average, typically ranging between 16,500 and 17,500 lei per month.

While overall growth is moderate, targeted adjustments are planned to address long-standing pay imbalances within the public payroll system. These changes aim to improve retention of qualified staff in ministries, regulatory agencies, and security services. Although public sector wages are unlikely to rise as quickly as those in private high-value industries, they continue to offer employment stability, structured career paths, and predictable income progression.

Manufacturing Sector

Manufacturing occupies the lower end of the mid-tier salary range but remains an important employer in the Moldovan economy. This sector includes food processing, textiles, light industry, and machinery production. Average gross monthly salaries in manufacturing are approximately 13,577 lei.

Wage growth in manufacturing is closely linked to productivity improvements and export performance, particularly demand from European Union markets. Companies that are integrated into international supply chains tend to pay higher wages than those focused solely on domestic consumption. In 2026, manufacturing salaries are expected to grow gradually, supported by export demand but constrained by cost pressures and competition.

Mid-Tier Sector Salary Overview

Sector | Typical Monthly Salary Range (MDL) | Main Wage Drivers

Professional, scientific, and technical services | 19,000 – 21,000 | Regulatory complexity, EU alignment, specialist skills

Public administration and defence | 16,500 – 17,500 | Budget reference value, payroll reform

Manufacturing | Around 13,600 | Export demand, productivity, EU markets

Role of Mid-Tier Sectors in the 2026 Salary Landscape

Mid-tier sectors play a stabilising role in Moldova’s labour market for 2026. They provide consistent employment opportunities and act as a bridge between low-wage sectors and high-income industries. For workers, these fields offer reasonable income levels combined with relative job security. For the economy as a whole, they support institutional capacity, industrial output, and professional services essential for long-term development.

c. Lower-Paid Sectors: Agriculture, Arts, and Hospitality

Despite their economic and social importance, lower-paid sectors continue to sit at the bottom of Moldova’s wage hierarchy going into 2026. These industries employ a large share of the workforce, especially in rural areas and service-oriented urban jobs, yet their compensation levels remain well below the national average. Structural limitations, seasonal work patterns, and low value-added output continue to restrain income growth, even where overall activity is expanding.

Agriculture, Forestry, and Fishing

Agriculture, forestry, and fishing remain the lowest-paid segment of the Moldovan labour market. Average monthly gross salaries in this sector are approximately 10,791 lei, placing them far below both the national average and the emerging minimum living cost benchmarks.

Although agricultural output expanded strongly in 2025, wage growth did not keep pace with production gains. This gap is largely explained by the sector’s reliance on seasonal labour, limited mechanisation, and low levels of processing and value-added activity. Many agricultural workers are engaged in informal or semi-formal employment, which further suppresses reported wages. In 2026, salaries in agriculture are expected to rise slowly, with meaningful improvement dependent on investment in processing, storage, and export-oriented agribusiness.

Accommodation and Food Service Activities

The accommodation and food service sector, which includes hotels, restaurants, and catering services, also ranks among the lowest-paying industries. Average monthly earnings stand at around 10,934 lei. However, this sector shows early signs of improvement compared with agriculture.

In 2025, wages in hospitality grew at a relatively fast pace, reflecting stronger tourism activity and gradual formalisation of employment in urban centres. Employers in cities increasingly report full wages rather than informal payments, contributing to higher recorded salary growth. While overall pay remains modest, the upward trend suggests gradual improvement in 2026, especially in locations with rising tourism demand.

Arts, Recreation, and Leisure

Arts, recreation, and leisure activities occupy a slightly higher position within the lower-paid group, with average salaries of approximately 11,178 lei. This sector includes cultural institutions, entertainment venues, sports activities, and recreational services.

Employment in this field is often project-based or part-time, which limits income stability. Public funding constraints and limited private sponsorship also restrict wage growth. In 2026, salaries are expected to remain modest, with small increases linked to urban cultural development and event-based tourism rather than broad-based expansion.

Comparative Salary Levels Across Key Sectors

The table below places lower-paid sectors in context by comparing them with higher- and mid-tier industries based on recent available data.

Economic Activity | Average Gross Monthly Salary (MDL) | Year-on-Year Growth

Information and communications | 35,886 | 9.7%

Financial and insurance activities | 27,664 | 11.2%

Energy production and supply | 25,166 | 18.9%

Professional, scientific, and technical | 19,450 | 13.0%

Public administration and defence | 16,800 | 10.5%

Manufacturing | 13,577 | 8.8%

Health and social assistance | 15,200 | 12.7%

Education | 11,850 | 12.8%

Arts, recreation, and leisure | 11,178 | 11.0%

Accommodation and food services | 10,934 | 14.9%

Agriculture, forestry, and fishing | 10,791 | 11.5%

Key Challenges Facing Lower-Paid Sectors

Lower-income industries in Moldova face several persistent challenges. Productivity levels are generally low, many roles are seasonal or part-time, and businesses often operate with narrow profit margins. These factors limit employers’ ability to raise wages, even when overall sector output increases. In addition, informal employment remains more common in these sectors, reducing access to social protections and suppressing official wage statistics.

What This Means for Salaries in 2026

For 2026, lower-paid sectors are expected to see continued, but modest, wage growth. While nominal increases are likely, salaries in agriculture, hospitality, and arts will remain significantly below the national average. Long-term improvements will depend on structural reforms, investment in value-added activities, and further formalisation of employment. For workers, these sectors offer employment opportunities but limited income progression, reinforcing the importance of skills development and mobility toward higher-productivity industries.

4. Experience-Level and Role-Specific Compensation

a. Information Technology Professionals

In Moldova’s labour market for 2026, experience level and job specialization play a decisive role in determining income. While the national minimum wage sets a legal baseline, actual earnings for skilled professionals often rise far above this floor. The strongest wage premiums are found in technical and professional roles where expertise, certifications, and international exposure significantly increase market value. In many cases, senior professionals earn two to three times more than the national average salary.

How Experience Influences Salary Levels

Across most industries, entry-level roles provide modest pay, mainly focused on skill development and training. As workers gain experience and demonstrate independent problem-solving ability, salaries rise quickly. At senior levels, compensation reflects not only technical knowledge but also leadership, project responsibility, and the ability to deliver results in competitive or international environments.

This pattern is especially visible in sectors such as information technology, engineering, and advanced professional services, where skill shortages remain a key issue going into 2026.

Information Technology as the Highest-Paying Career Path

The information technology sector continues to be the strongest driver of high-income employment in Moldova. Demand for software development, systems engineering, cybersecurity, and digital project management remains strong, largely supported by international clients and remote work opportunities.

A defining feature of IT compensation is its partial link to foreign currencies. Many contracts are indexed to euros or US dollars, or directly paid in foreign currency. This protects IT professionals from fluctuations in the Moldovan leu and provides more stable real income over time.

Software Engineer Salary Levels by Experience

Software engineering roles show a clear progression in pay as experience increases:

Role and Experience Level | Typical Monthly Salary Range (MDL) | Market Characteristics

Junior or entry-level software engineer | 15,000 – 25,000 | Recent graduates, training-focused roles

Mid-level software engineer (3–5 years) | 25,000 – 45,000 | Independent contributors, strong demand

Senior software developer or architect | 45,000 and above | High responsibility, complex systems, leadership

Remote senior developer (international median) | Around 68,000 per month | Foreign clients, USD-linked income

Junior roles are commonly filled by graduates from leading local institutions such as the Technical University of Moldova and the Academy of Economic Studies. These positions focus on foundational skills and practical experience. Within a few years, strong performers often see rapid salary growth as they move into mid-level roles.

Senior developers and architects command the highest pay, particularly those working remotely for foreign companies. Their earnings can far exceed domestic benchmarks, reflecting global rather than local labour market conditions.

IT Project and Management Roles

Beyond technical coding positions, management roles within IT also attract strong compensation. IT project managers, who coordinate teams, budgets, and delivery timelines, earn average gross monthly salaries of around 33,700 lei. Pay levels increase further for managers handling international projects or large distributed teams.

Experience-Based Salary Comparison Across IT Roles

Role Category | Entry-Level | Mid-Level | Senior-Level

Software development | Moderate | High | Very high

Systems and infrastructure | Moderate | High | High

IT project management | Moderate | High | Very high

Remote international roles | High | Very high | Exceptional

What This Means for Salary Growth in 2026

Experience-driven pay differences are expected to remain a defining feature of Moldova’s salary landscape in 2026. For workers, this highlights the importance of continuous skill development, certifications, and exposure to international standards. For employers, it reinforces the need to offer competitive compensation to retain experienced professionals, especially in technology-related roles.

Overall, experience and specialization are among the most powerful drivers of income growth in Moldova, with the IT sector offering the clearest path to above-average and internationally competitive salaries.

b. Accounting and Finance

Accounting and finance roles in Moldova are experiencing steady wage growth as businesses adapt to more advanced financial reporting, stricter compliance requirements, and closer alignment with European accounting standards. By 2026, these roles are increasingly valued for their technical expertise, analytical skills, and ability to support strategic decision-making. As a result, salaries in this field vary widely depending on experience, responsibility level, and employer size.

Junior Accounting Roles and Entry-Level Pay

Junior accountants typically sit at the entry point of the accounting profession. These roles focus on bookkeeping, basic financial reporting, payroll support, and tax documentation. In 2026, salaries for junior accountants generally range between 10,000 and 18,000 lei per month.

Pay levels within this range depend on qualifications, language skills, and exposure to international accounting systems. Graduates with professional certifications or experience using modern accounting software tend to earn closer to the upper end. These roles offer a clear pathway for salary progression as skills and responsibilities expand.

Mid-Level Cost Accounting Positions

Cost accountants with several years of experience form the mid-tier of the accounting salary structure. After around five years in the profession, a cost accountant earns an average monthly salary of approximately 10,947 lei. However, this average masks a wide distribution.

Professionals working in larger manufacturing firms, multinational companies, or export-oriented businesses often earn significantly more. At the upper end of the market, experienced cost accountants can reach salaries of up to 27,378 lei, especially where their role includes budgeting, performance analysis, and strategic cost control.

Senior Accounting Leadership Roles

Chief accountants represent the senior end of the accounting profession and carry responsibility for financial oversight, regulatory compliance, and coordination with tax authorities and auditors. In Chișinău, median gross monthly salaries for chief accountants were recorded at around 11,200 lei in 2025.

However, compensation rises sharply in larger organisations, international firms, and companies operating under special regimes such as technology park structures. In these environments, chief accountants frequently earn 25,000 lei or more per month, reflecting the higher complexity of reporting and greater accountability.

Financial Analyst Compensation

Financial analysts sit at the higher end of the finance salary spectrum due to their strategic role in forecasting, investment analysis, and performance evaluation. In 2026, average monthly salaries for financial analysts are around 33,400 lei.

These roles require strong analytical skills, advanced financial modelling, and often fluency in foreign languages. Analysts working with international investors or cross-border operations tend to command premium pay, placing them among the best-compensated finance professionals in Moldova.

Accounting and Finance Salary Overview

Role | Typical Monthly Salary Range (MDL) | Key Pay Drivers

Junior accountant | 10,000 – 18,000 | Qualifications, software skills, experience

Cost accountant (mid-level) | 10,947 – 27,378 | Industry, firm size, cost control expertise

Chief accountant | 11,200 – 25,000+ | Organisation scale, regulatory complexity

Financial analyst | Around 33,400 | Analytical depth, strategic responsibility

Outlook for Accounting and Finance Salaries in 2026

The accounting and finance sector in Moldova is expected to remain a solid source of stable and gradually rising incomes in 2026. As reporting standards become more complex and financial transparency requirements increase, demand for skilled professionals continues to grow. For workers, this creates clear incentives to pursue certifications, develop analytical skills, and gain experience in larger or internationally connected organisations.

c. Healthcare and Education

Healthcare and education play a central role in Moldova’s social and economic development, yet their salary structures remain highly uneven. In 2026, wages in these sectors are still largely shaped by public funding frameworks, which limit rapid growth. However, professionals working in private healthcare, pharmaceutical advisory roles, or administrative and specialist positions within education benefit from higher earning potential. This creates a clear divide between frontline public roles and specialised or privately funded positions.

Healthcare Salaries and Role-Based Differences

Healthcare salaries in Moldova vary significantly based on specialization, experience, and whether the role is in the public or private sector. Public healthcare provides employment stability but generally offers lower pay ceilings. In contrast, private clinics, diagnostic centres, and pharmaceutical firms provide more competitive compensation.

Specialist doctors represent the upper tier of healthcare earners. In 2026, their monthly salaries typically range from 15,000 to 30,000 lei. Doctors working in private hospitals or clinics, or those with high-demand specializations, often earn at the higher end of this range. Public sector doctors usually remain closer to the lower-middle range due to regulated pay scales.

Medical advisors working in pharmaceutical companies earn higher and more consistent incomes. With an average monthly salary of around 23,693 lei, these professionals benefit from private-sector compensation structures, performance incentives, and industry-driven demand for regulatory and clinical expertise.

Lower-paid roles remain common within the healthcare system. Support and auxiliary positions, while essential, are constrained by public budgets and offer limited wage progression compared with specialist roles.

Education Sector Salary Landscape

The education sector continues to face salary challenges in 2026, particularly for entry-level and support roles. Most educational institutions rely on public funding, which restricts rapid wage increases despite ongoing staffing needs.

Assistant teachers earn some of the lowest salaries in the formal workforce, with average monthly pay of approximately 6,383 lei. These roles often involve classroom support, administrative tasks, and supervision, yet offer limited financial progression.

School caretakers and maintenance staff earn similarly modest wages, averaging around 6,527 lei per month. While these roles provide stable employment, they remain significantly below the national average salary and are highly sensitive to budget constraints.

Higher-paying opportunities within education are generally found in administrative leadership, private institutions, or international education providers, though these positions are limited in number.

Experience-Level Salary Comparison Across Professions

The table below places healthcare and education roles in context by comparing them with other common professions based on experience level.

Job Role | Entry-Level Salary (MDL) | Mid-Level Salary (MDL) | Senior-Level Salary (MDL)

Software developer | 15,000 – 25,000 | 25,000 – 45,000 | 45,000 – 75,000+

Manufacturing engineer | 10,000 – 18,000 | 18,000 – 30,000 | 30,000 – 45,000

Accountant | 10,000 – 15,000 | 15,000 – 28,000 | 28,000 – 40,000+

Marketing specialist | 9,000 – 16,000 | 16,000 – 28,000 | 28,000 – 45,000

Sales manager | 12,000 – 20,000 | 20,000 – 45,300 | 45,300 – 65,000

Public vs Private Sector Pay Comparison

Sector | Typical Pay Level | Salary Growth Potential | Income Stability

Public healthcare | Low to moderate | Limited | High

Private healthcare | Moderate to high | Strong | Medium

Public education | Low | Limited | High

Private education and administration | Moderate | Moderate | Medium

Outlook for Healthcare and Education Salaries in 2026

In 2026, healthcare and education salaries in Moldova continue to reflect structural funding limits, especially within the public sector. While essential roles remain underpaid relative to their social importance, specialised healthcare professionals and private-sector roles offer clearer paths to higher income. For workers in these fields, income growth increasingly depends on specialization, private-sector mobility, and administrative or advisory responsibilities rather than seniority alone.

5. Regional Salary Disparities: Chișinău vs. The Periphery

Salary levels in Moldova for 2026 continue to show strong regional imbalance. Economic activity, investment, and high-paying employment remain heavily concentrated in the capital city, while rural and peripheral regions lag behind. This divide plays a major role in shaping income inequality, labour mobility, and long-term workforce trends across the country.

Chișinău as the Economic and Salary Center

Chișinău remains the clear economic engine of Moldova and the country’s highest-paying labour market. The capital hosts most corporate headquarters, technology firms, financial institutions, international organisations, and advanced service providers. As a result, salary levels in Chișinău are significantly higher than elsewhere.

By late 2025, close to 80 percent of employees in Chișinău were earning more than 7,000 lei per month. Average salaries in the capital are typically 30 to 40 percent higher than those found in rural districts. This premium is largely driven by the strong presence of information technology, banking, professional services, and foreign-funded organisations.

Looking ahead to 2026, the average monthly salary in Chișinău is expected to exceed 20,000 lei. This places it well above the national projected average of 17,400 lei and reinforces the city’s role as the primary destination for high-skilled and high-income employment.

Salary Snapshot for Chișinău

Indicator | Estimated Level

Share of employees earning above 7,000 lei | Around 80%

Average salary vs national level | 30–40% higher

Expected average salary in 2026 | Above 20,000 lei

Key high-paying sectors | ICT, finance, professional services

Secondary Cities and Regional Urban Centers

Outside the capital, several regional cities provide more moderate but stable salary opportunities. These urban centres typically offer higher wages than surrounding rural areas but remain below Chișinău levels.

Bălți as an Industrial Hub

Bălți serves as the main industrial centre in northern Moldova. Its economy is driven by manufacturing activities such as automotive components, wiring systems, and textiles. Average manufacturing salaries in Bălți generally range between 13,000 and 14,000 lei per month.

The presence of Free Economic Zones in and around Bălți helps support employment stability and provides a minimum wage floor that is higher than in many rural districts. However, salary growth remains limited compared with service-driven sectors in the capital.

Gagauzia and the Southern Regions

The autonomous region of Gagauzia, with Comrat as its main city, has a labour market shaped by agriculture, food processing, and wine production. These industries provide steady employment but generate lower average incomes.

Typical monthly salaries in Gagauzia usually fall between 11,000 and 12,500 lei. While these levels exceed the national minimum wage, they remain well below earnings in Chișinău and slightly below those in Bălți.

Rural Districts and Agricultural Areas

In rural districts across Moldova, salary opportunities are the most limited. Employment is largely concentrated in agriculture, basic services, and public sector roles. As a result, wages are often clustered close to the national minimum wage of 6,300 lei.

Opportunities for high-skilled technical or professional employment are rare in these areas. Many workers rely on seasonal income or informal work, which further limits earning potential and access to social protections.

Regional Salary Comparison

Region | Typical Monthly Salary Range (MDL) | Main Economic Drivers

Chișinău | 20,000+ | ICT, finance, services, international firms

Bălți | 13,000 – 14,000 | Manufacturing, Free Economic Zones

Gagauzia (Comrat) | 11,000 – 12,500 | Agriculture, wine production

Rural districts | Around 6,300 – 9,000 | Agriculture, local services

Impact on Labour Mobility and Migration

These regional salary differences are a major driver of internal migration within Moldova. Workers from northern and southern districts increasingly move to Chișinău in search of higher-paying service-sector jobs and better career prospects. This trend strengthens the capital’s labour market while placing pressure on rural areas facing workforce shortages.

For 2026, regional salary gaps are expected to persist. Without significant investment in regional development and higher-value industries outside the capital, Chișinău will continue to dominate Moldova’s income landscape, reinforcing the urban–rural divide.

6. The Fiscal Framework for 2026: Taxation and Net Income

Understanding how gross salaries convert into take-home pay is essential when assessing income levels in Moldova for 2026. While the country continues to apply a relatively simple flat-tax system, several updates to deductions, social insurance rules, and family-related benefits shape how much employees actually receive each month. These fiscal mechanisms directly influence net income, purchasing power, and long-term social security protection.

Personal Income Tax and Core Employee Deductions

Moldova maintains a flat personal income tax rate of 12 percent in 2026. This rate applies to most employees across both public and private sectors. However, taxable income is not calculated on gross salary alone. Several mandatory deductions are applied first, reducing the tax base and shaping final net pay.

Employees contribute 9 percent of their gross salary toward mandatory health insurance. This contribution provides access to public healthcare services and is deducted directly from monthly earnings. In addition, employees contribute 6 percent of gross salary toward social security, which finances pensions, disability coverage, and other long-term social benefits.

A key protective measure within the tax system is the personal exemption. For employees earning below a defined annual threshold, an annual exemption of approximately 27,000 lei is applied. This exemption shields a basic portion of income from taxation and is designed to protect low- and middle-income earners by reducing their effective tax burden.

Overview of Taxes and Social Contributions

Contribution or Tax | Rate | Paid By

Personal income tax | 12% | Employee

Health insurance contribution | 9% | Employee

Social security contribution (standard) | 6% | Employee

Social security contribution (standard) | 24% | Employer

Social security contribution (hazardous work) | 32%–39% | Employer

These deductions mean that while gross salaries may appear competitive, net income depends heavily on the balance between wages, exemptions, and contribution rates.

Special Tax Regime for Technology Sector Employees

A major exception to the standard tax system applies to companies operating within the Moldova Innovation Technology Park. Instead of paying corporate income tax and individual social contributions per employee, these companies are subject to a single tax equal to 7 percent of their total turnover.

Under this regime, employee-level personal income tax and social contributions are effectively bundled into the single tax paid by the employer. As a result, employees working for technology park residents typically receive significantly higher net salaries compared with workers earning the same gross income under the standard tax framework.

To ensure long-term social protection, a deemed income mechanism is used for these employees. For 2026, this deemed income is linked to the national average salary of 17,400 lei. This figure is used when calculating pension rights and other social benefits, ensuring that high-earning technology professionals remain insured at a reasonable and standardized level despite the simplified tax structure.

Social Insurance and Family Support Measures in 2026

Beyond taxation, the social insurance system for 2026 includes several enhancements aimed at supporting families and promoting workforce stability. These measures directly affect household income, particularly for young parents and employees facing health-related work interruptions.

The one-time childbirth allowance is set to increase to 21,886 lei in 2026. This payment provides immediate financial support to families at the time of a child’s birth and represents a meaningful component of Moldova’s family support framework.

In addition, a universal monthly child allowance of 1,000 lei will be provided for all children up to the age of two. This benefit is granted regardless of the parent’s insurance or employment status, offering broad coverage and income support during early childhood.

Maternity and sick leave benefits continue to be calculated based on the employee’s average income over the previous 12 months. However, these benefits are capped at the projected national average salary of 17,400 lei, limiting the maximum compensation for higher earners while maintaining fiscal sustainability.

Key Social Benefits for Employees and Families

Benefit Type | Amount or Rule for 2026

One-time childbirth allowance | 21,886 lei

Monthly child allowance (up to age 2) | 1,000 lei

Maternity and sick leave base | Average income (12 months)

Maximum benefit cap | 17,400 lei

What This Means for Net Salaries in 2026

For most employees in Moldova, net income in 2026 will be shaped by a balance between flat taxation, mandatory social contributions, and targeted exemptions. While the system remains relatively straightforward, the differences between standard employment and special regimes such as the technology park framework can be substantial. At the same time, expanded family benefits and social protections provide additional income support beyond wages, making the overall compensation landscape more comprehensive for working households.

7. Living Standards and Household Income Comparisons

To properly understand salary levels in Moldova for 2026, it is important to look beyond individual wages and examine household income, purchasing power, and international comparisons. Salaries only gain real meaning when viewed in the context of living standards, cost of living, and how Moldova compares with neighbouring and European economies.

Household Income Growth and Purchasing Power

Household income per capita in Moldova has shown steady improvement in recent years. In 2024, average annual household income per person reached approximately 3,563 USD, equivalent to about 297 USD per month. This marked a clear improvement compared with 2023, when annual income per capita stood closer to 3,247 USD.

Looking ahead to 2026, income levels are expected to continue rising. With the national minimum wage increasing to around 370 USD per month and average salaries trending upward, annual household income per capita is projected to approach between 4,200 and 4,500 USD. This growth reflects not only higher wages but also gradual improvements in employment stability, formalisation of work, and social transfers.

While these figures still indicate modest living standards by European norms, they represent meaningful progress for Moldovan households, especially when adjusted for local cost levels.

Estimated Household Income Progression

Year | Annual Household Income per Capita (USD) | Monthly Equivalent (USD)

2023 | 3,247 | 271

2024 | 3,563 | 297

2026 (projected) | 4,200 – 4,500 | 350 – 375

International Salary Comparison and Regional Position

Comparing Moldova’s salary levels with other countries helps place domestic earnings into a broader economic context. By mid-2025, Moldova’s average monthly gross earnings were estimated at around 894 USD. While this remains well below European Union averages, it places Moldova ahead of several countries in Eastern Europe and Central Asia.

Monthly Gross Earnings by Country

Country | Average Monthly Earnings (USD)

Germany | 5,640

Poland | 2,475

Romania | 2,094

Bulgaria | 1,547

Moldova | 894

Armenia | 753

Ukraine | 644

Kyrgyzstan | 499

This comparison highlights Moldova’s position as a lower-income economy relative to EU member states, but also shows that it has moved ahead of several regional peers. The gap with countries such as Romania and Poland remains significant, but the difference has narrowed compared with previous years.

Implications for Living Standards

Lower average wages mean that Moldovan households continue to face tighter budgets, especially when covering housing, utilities, and imported goods. However, domestic services, food, and transportation costs remain comparatively lower, which partially offsets income differences when measured in purchasing power terms.

Rising minimum wages and steady salary growth in key sectors such as information technology, engineering, and professional services are gradually lifting average living standards. Social benefits and family allowances further support household income, particularly for young families and lower-income workers.

Why Moldova Attracts International Employers

Despite lower wages compared with the EU, Moldova’s improving income levels and skill base make it increasingly attractive for outsourcing and nearshoring. Western European companies, especially in technology and engineering, are drawn to Moldova’s balance of competitive labour costs and growing technical expertise.

This positioning supports job creation in higher-value sectors and contributes to wage growth over time. For 2026, this dynamic is expected to remain a key driver of income convergence, even though full parity with EU living standards remains a long-term goal rather than an immediate outcome.

Overall Outlook for Living Standards in 2026

By 2026, Moldova’s living standards are expected to continue improving gradually. Household incomes are rising, salary levels are becoming more competitive within the region, and employment opportunities in higher-paying sectors are expanding. While income gaps with Western Europe remain wide, Moldova’s progress places it on a steady path toward improved economic well-being and greater integration into regional and global labour markets.

8. The Cost-of-Living Factor: Purchasing Power in 2026

Understanding salaries in Moldova for 2026 requires a close look at the cost of living and how far incomes actually go in everyday life. While nominal wages remain lower than those in most European Union countries, Moldova also benefits from significantly lower prices for housing, food, and local services. This balance between income and expenses plays a crucial role in shaping real purchasing power for households.

Cost-of-Living Conditions and Household Spending

By 2026, the cost-of-living environment in Moldova is expected to be more stable than in the early 2020s. The sharp rise in energy prices during the 2022–2023 energy crisis placed heavy pressure on household budgets. Since then, energy markets have stabilised, allowing families to regain some financial breathing room.

With utility costs no longer rising at extreme rates, households are able to allocate a larger share of income toward non-essential spending. This includes better food quality, education, healthcare services, home improvements, and modest savings. Although overall living standards remain modest by European benchmarks, the improved balance between income and expenses has a positive impact on financial security.

Minimum Existence Level and Income Adequacy

A key measure used to assess living standards is the minimum existence level. This figure represents the monthly income required to cover basic physiological needs, housing, utilities, and essential social expenses.

For 2026, the minimum existence level in Moldova is projected to fall between 3,200 and 3,500 lei per person per month. This benchmark provides important context for evaluating wages, particularly the national minimum wage.

With the minimum wage set at 6,300 lei per month, a single full-time worker earns close to twice the minimum existence threshold. This suggests that basic living needs can generally be met by individuals earning the legal minimum. However, households with dependents face greater challenges. Families with multiple children and only one income source remain at higher risk of financial strain, especially when housing or healthcare costs rise.

Income vs Minimum Existence Comparison

Indicator | Estimated Monthly Amount (MDL)

Minimum existence level | 3,200 – 3,500

National minimum wage | 6,300

Minimum wage as multiple of existence level | Around 1.8 – 2.0

Income Distribution and Social Equity

Income inequality in Moldova remains relatively moderate compared with many countries in the region. The Gini coefficient, which measures income distribution on a scale where lower values indicate more equality, stands at around 26.0 based on recent surveys. This reflects a more balanced income distribution than in many neighbouring economies.

However, the structure of income distribution is slowly changing. Rapid growth in high-paying sectors, particularly information technology and professional services concentrated in the capital, is creating new income tiers. The emergence of a highly paid urban professional group is most visible in Chișinău, where salaries in certain industries far exceed the national average.

Despite this trend, broad-based wage growth and social transfers help prevent extreme inequality. Public sector wages, minimum wage policies, and family benefits continue to play a stabilising role in maintaining social cohesion.

What Purchasing Power Means for 2026

In practical terms, purchasing power in Moldova for 2026 is expected to improve gradually rather than dramatically. Lower prices for everyday goods and services help offset lower wages, especially outside the capital. Stabilised energy costs further support household budgets, making income more predictable.

For individuals, a minimum or average salary can cover essential needs with limited discretionary spending. For skilled workers and dual-income households, purchasing power improves significantly, allowing for better living conditions and modest savings. Overall, Moldova’s cost-of-living structure continues to support a relatively efficient conversion of income into everyday consumption, even as income disparities slowly widen in higher-growth urban sectors.

9. Strategic Challenges: The Labor Gap and Unit Labor Costs

While salary growth in Moldova shows clear improvement heading into 2026, the labour market faces deep structural challenges that directly affect wage sustainability. Two issues stand out as particularly critical: a shrinking workforce caused by long-term emigration and the growing gap between wage growth and productivity. Together, these pressures influence how far salaries can realistically rise without harming economic competitiveness.

Demographic Decline and the Labour Shortage

Moldova continues to face one of the most severe demographic declines in Europe. Long-term outward migration has steadily reduced the working-age population, and recent census-based indicators suggest that the resident population has fallen to roughly 2.38 to 2.42 million people. This demographic contraction has created a persistent labour gap across many sectors of the economy.

Employers increasingly report difficulties filling vacancies, not only in high-skilled roles but also in manufacturing, construction, healthcare, and services. As a result, wage increases in many cases are driven less by productivity gains and more by the need to retain existing staff. Companies raise salaries simply to prevent workers from relocating to nearby labour markets such as Romania or Western Europe, where wages are significantly higher.

Although the official unemployment rate stands at around 3.5 percent, this figure can be misleading. It reflects a shortage of available workers rather than a strong surplus of jobs. A large portion of the working-age population is absent from the domestic labour market altogether, having emigrated permanently or temporarily. This “missing middle” distorts labour statistics and intensifies competition for remaining workers.

Labour Market Pressure Indicators

Indicator | Situation in 2026

Estimated resident population | 2.38 – 2.42 million

Unemployment rate | Around 3.5%

Main labour market issue | Worker shortage

Primary cause | Emigration and demographic decline

Rising Unit Labour Costs and Economic Risks

Another major concern for 2026 is the rise in unit labour costs, which measure how much labour costs per unit of output produced. When wages increase faster than productivity, each unit of goods or services becomes more expensive to produce. International institutions have highlighted this trend as a growing risk for Moldova’s competitiveness.

In recent years, wage growth in several sectors has approached or exceeded 10 percent annually, while productivity gains have remained modest. This imbalance is particularly problematic for export-oriented industries such as agriculture, food processing, textiles, and light manufacturing. If production costs rise too quickly, Moldovan exports risk becoming less competitive in international markets.

The issue is not salary growth itself, but whether that growth is supported by higher efficiency, better technology, and improved skills. Without productivity improvements, rising wages can place pressure on profit margins, reduce investment incentives, and limit long-term job creation.

Wages vs Productivity Risk Matrix

Factor | Current Trend | Long-Term Risk

Wage growth | Strong | Unsustainable if productivity lags

Productivity growth | Moderate | Insufficient to support high wage growth

Export competitiveness | Under pressure | Loss of price advantage

Labour availability | Declining | Higher wage pressure

Policy Response and Long-Term Sustainability

To address these challenges, fiscal and economic planning for 2026 places strong emphasis on productivity-enhancing reforms. Public investment priorities include modernising infrastructure, upgrading machinery, and encouraging technology adoption across industries. The goal is to ensure that higher wages are backed by greater output per worker rather than labour scarcity alone.

Structural reforms also focus on skills development, vocational training, and attracting investment into higher value-added sectors. By improving how efficiently labour is used, policymakers aim to reduce the negative impact of demographic decline and stabilise unit labour costs over time.

What This Means for Salaries in 2026 and Beyond

For workers, labour shortages support continued wage growth in the short term. For employers and policymakers, however, the challenge is ensuring that these higher salaries are economically sustainable. Moldova’s salary outlook for 2026 reflects a delicate balance: wages are rising, but long-term success depends on productivity growth, workforce retention, and structural transformation. Without progress in these areas, salary gains may face natural limits despite strong demand for labour.

10. Forecast for 2027 and Beyond: The Path to EU Convergence

The salary environment in Moldova for 2026 should be viewed as a transition stage rather than an endpoint. It represents an important step in the country’s longer-term effort to move closer to European economic and income standards. Looking ahead to 2027 and 2028, several structural trends are expected to shape how wages evolve and how the labour market becomes more aligned with European Union norms.

Gradual Wage Alignment Across Sectors

One of the most important developments in the coming years is the continued reduction of wage gaps between the public and private sectors. Historically, public sector salaries in Moldova have lagged behind private-sector pay, particularly in specialised roles. Ongoing implementation of the new salary framework aims to correct long-standing imbalances by standardising pay structures and improving transparency.

As these reforms progress, public sector wages are expected to rise more consistently, especially in administration, education, and healthcare. While private sector salaries are likely to remain higher in absolute terms, the difference between the two sectors should narrow, creating a more balanced and predictable income structure across the economy.

Formalisation of Employment and Expansion of the Tax Base

Another key trend shaping salaries beyond 2026 is the gradual formalisation of economic activity. A significant portion of Moldova’s workforce has traditionally operated in informal or semi-formal arrangements, limiting access to social protection and reducing public revenue.

Raising the minimum wage and maintaining simplified tax regimes are designed to encourage employers to declare full salaries and bring workers into the formal system. As more employment becomes official, the government gains a broader tax base, which supports higher and more stable funding for pensions, healthcare, education, and family benefits.

This shift toward formal employment also benefits workers directly by improving access to social insurance, legal protections, and long-term income security.

Key Drivers of Employment Formalisation

Policy Tool | Expected Impact

Higher minimum wage | Reduced underreporting of wages

Simplified tax regimes | Lower compliance costs for employers

Stronger enforcement | Increased formal job creation

Expanded social benefits | Incentives to remain in formal work

Expansion of High-Technology and Nearshoring Industries

Beyond software development, Moldova is increasingly positioning itself as a nearshoring destination for high-technology manufacturing. Electronics, automotive components, and precision engineering are emerging as priority areas for investment. These industries offer wages above traditional manufacturing levels and require mid- to high-skilled technical workers.

As European companies look to diversify supply chains and reduce production risks, Moldova’s location, labour costs, and improving infrastructure make it an attractive option. Growth in these sectors is expected to increase demand for engineers, technicians, and quality specialists, supporting stronger wage growth for skilled industrial roles.

Skill Demand Outlook for High-Tech Manufacturing

Role Category | Expected Demand Trend | Salary Impact

Production engineers | Rising | Moderate to strong growth

Automation specialists | Rising | Strong growth

Quality and compliance roles | Rising | Moderate growth

Skilled technicians | Rising | Steady growth

Long-Term Salary Expectations Beyond 2026

If current economic and policy trends continue, Moldova’s salary levels are likely to rise steadily through 2027 and 2028. Growth is expected to be gradual rather than dramatic, with improvements driven by productivity gains, investment in technology, and deeper integration with European markets.

While full convergence with EU income levels remains a long-term objective, progress in wage alignment, employment formalisation, and high-value industrial development suggests a clear upward path. For workers and employers alike, the period following 2026 is likely to bring a more structured, transparent, and sustainable salary environment that supports long-term economic stability and growth.

11. Actionable Insights for Employers and Employees

As Moldova enters 2026, both employers and employees face a changing salary environment shaped by higher wage floors, labour shortages, and evolving tax rules. Understanding these dynamics allows organisations to plan more effectively and helps workers make informed career and income decisions.

Key Considerations for Employers in 2026

Employers operating in Moldova should prepare for noticeable increases in overall labour costs. Rising wages are driven by several factors, including the higher national minimum wage, upward adjustments to the average salary used for social contributions, and stronger competition for skilled workers. In many sectors, total labour expenses are expected to increase by approximately 10 to 15 percent compared with previous years.

Salary Budgeting and Workforce Planning

Effective financial planning in 2026 requires using the national projected average salary of 17,400 lei as a reference point. This figure affects the calculation of maternity pay, sick leave compensation, and social security thresholds, particularly for employers operating under special regimes.

Companies should reassess payroll structures, forecast wage progression by role, and ensure sufficient reserves to cover statutory benefits. Transparent communication with employees about wage policies and benefit structures can also help reduce turnover in a tight labour market.

Employer Cost Planning Overview

Cost Component | 2026 Planning Assumption

Average salary reference | 17,400 lei

Expected labour cost increase | 10% – 15%

Main cost drivers | Minimum wage, retention pressure, social contributions

Tax Efficiency and Cost Optimisation

To manage rising wage expenses, employers are encouraged to review available preferential tax frameworks. Manufacturing firms may benefit from operating within Free Economic Zones, which offer reduced tax burdens and incentives for investment. Service-oriented companies, particularly in technology and digital services, can reduce overall payroll costs through the single tax regime available to technology park residents.

Choosing the right operational structure can significantly offset higher salaries while maintaining compliance and competitiveness.

Key Considerations for Employees in 2026

For employees, the 2026 salary outlook remains positive in nominal terms. Continued wage increases are expected across most sectors, though the real purchasing power of these gains depends on currency stability and inflation control. Effective monetary policy plays a crucial role in ensuring that higher wages translate into real improvements in living standards.

Salary Negotiation and Career Strategy

Workers in high-demand fields such as information technology, finance, and engineering are in a strong negotiating position. Severe labour shortages give professionals in these sectors greater leverage to secure above-average pay increases, performance bonuses, or flexible work arrangements, including remote or hybrid models.

Employees in other sectors may also benefit from changing market conditions by focusing on skill development, certifications, and mobility toward higher-productivity roles.

Awareness of Social and Family Benefits

Beyond wages, employees should pay close attention to non-salary benefits available in 2026. Increased childbirth allowances and expanded family support programs provide meaningful financial assistance, particularly for young families. These benefits can significantly improve overall household income and should be considered when evaluating total compensation packages.

Employee Opportunity Summary

Focus Area | Key Advantage in 2026

Salary growth | Continued nominal increases

Negotiation power | Strong in high-skill sectors

Work flexibility | Growing availability

Family benefits | Higher allowances and broader coverage

Strategic Takeaway for 2026

For 2026, success in Moldova’s labour market depends on preparation and awareness. Employers must plan for higher costs while using tax-efficient structures and productivity improvements to stay competitive. Employees, meanwhile, can maximise income by understanding market demand, negotiating strategically, and taking full advantage of social benefits. Together, these approaches support a more balanced and sustainable salary environment across the economy.

Conclusion

The salary landscape in Moldova for 2026 reflects a country in transition. After years of economic volatility, inflation shocks, and demographic pressure, Moldova is entering a more structured and forward-looking phase of wage development. Salaries are rising across almost all sectors, supported by a higher minimum wage, stronger demand for skilled labour, and deeper integration with European markets. However, these gains are uneven, shaped by sector, region, experience level, and tax regime.

From a national perspective, the increase in the minimum wage and the projected average salary mark an important step toward improving income security and social protection. For many workers, especially in low-paid and rural sectors, these policy-driven increases provide essential protection against poverty and rising living costs. At the same time, the stabilisation of inflation and energy prices allows salary growth to translate more clearly into real purchasing power, rather than being eroded by price shocks.

Sectoral analysis shows a clear divide between high-value industries and traditional sectors. Information technology, finance, energy, and advanced professional services continue to pull ahead, offering salaries that are multiple times higher than the national average. Manufacturing, public administration, healthcare, and education occupy the middle of the wage spectrum, providing stability but limited upside unless paired with specialisation or private-sector exposure. Agriculture, hospitality, arts, and rural services remain the lowest-paid areas of the economy, despite their social and economic importance.

Regional disparities remain one of the most defining features of Moldova’s salary structure. Chișinău dominates high-income employment, driven by its concentration of corporate headquarters, technology firms, and international organisations. Secondary cities such as Bălți and Cahul provide more modest opportunities, while rural districts continue to lag behind, with wages clustered close to the minimum level. These differences continue to fuel internal migration and reinforce the capital’s role as the primary engine of income growth.

Experience and skill level are increasingly decisive in determining earnings. In 2026, Moldova clearly rewards specialisation, international exposure, and technical expertise. Senior professionals in IT, engineering, finance, and management can earn two to four times the national average, particularly when working with foreign clients or under preferential tax regimes. For younger workers, the data reinforces the importance of education, certifications, and early career mobility as key drivers of long-term income growth.

Taxation and social contributions remain relatively simple under Moldova’s flat-tax system, but net income varies significantly depending on employment structure. Standard employees face predictable deductions for health insurance and social security, while workers in special regimes such as the technology park framework benefit from substantially higher take-home pay. At the same time, expanded family benefits, childcare allowances, and social insurance improvements strengthen total compensation beyond salary alone.

Living standards and purchasing power provide essential context for understanding these figures. While Moldovan salaries remain well below EU averages in nominal terms, lower costs for housing, food, and services help narrow the gap in everyday living conditions. Rising household income per capita and a relatively low level of income inequality support gradual improvements in quality of life, even as new high-income tiers emerge in urban centres.