Key Takeaways

- AML Software Automates Compliance: Anti-Money Laundering software streamlines transaction monitoring, customer due diligence, and regulatory reporting, helping businesses meet compliance standards efficiently.

- Key Role in Financial Security: AML software plays a critical role in preventing financial crimes by detecting suspicious activities, reducing the risk of money laundering, and protecting the integrity of financial systems.

- Adapting to Future Trends: With advancements in AI, machine learning, and blockchain, AML software continues to evolve, offering more sophisticated tools for combating money laundering and enhancing compliance efforts.

In an era where financial transactions have become increasingly digitized and globalized, the risk of money laundering has escalated significantly.

Money laundering—the process of concealing the origins of illegally obtained money—poses a substantial threat not only to the integrity of financial institutions but also to the broader economy and society.

As criminal organizations exploit technological advancements to execute sophisticated schemes, the need for robust anti-money laundering (AML) measures has never been more critical.

This is where Anti-Money Laundering software steps in as a vital tool in the fight against financial crime.

Anti-Money Laundering software refers to a suite of technological solutions designed to detect, monitor, and report suspicious activities that may indicate money laundering or other illicit financial behaviors.

These systems leverage advanced analytics, machine learning algorithms, and real-time data monitoring to identify irregular patterns in financial transactions.

By automating the process of transaction analysis and compliance reporting, AML software not only enhances the efficiency of financial institutions but also minimizes the risk of human error and oversight.

As regulatory frameworks tighten globally, financial institutions are under increasing pressure to implement effective AML strategies.

In fact, many jurisdictions mandate stringent compliance measures to thwart money laundering activities.

Failure to adhere to these regulations can lead to severe penalties, including hefty fines and reputational damage.

Consequently, AML software has become indispensable for banks, credit unions, insurance companies, and other financial entities that seek to protect their operations and maintain compliance with local and international laws.

The core functionality of AML software encompasses several critical components.

From customer due diligence (CDD) and risk assessment to transaction monitoring and alert generation, these systems provide a comprehensive approach to identifying and mitigating potential threats.

They analyze vast amounts of data from multiple sources, including customer profiles, transaction histories, and external databases, to establish risk levels associated with individual clients and transactions.

This proactive approach enables organizations to detect anomalies before they escalate into significant issues, safeguarding their assets and reputation.

Moreover, the integration of artificial intelligence and machine learning into AML software has transformed the landscape of financial crime prevention.

These technologies empower the software to learn from historical data, continuously improving its ability to identify emerging threats and adapt to evolving criminal tactics.

As a result, financial institutions can stay one step ahead of sophisticated money laundering operations, ensuring their systems remain resilient against ever-changing challenges.

However, despite the advanced capabilities of AML software, the journey toward effective anti-money laundering compliance is not without its challenges.

Organizations must navigate various hurdles, including high implementation costs, data privacy concerns, and the ongoing need for system updates to keep pace with regulatory changes and emerging threats.

Therefore, understanding how AML software functions and its impact on the financial sector is crucial for organizations aiming to develop robust anti-money laundering strategies.

In this comprehensive blog post, we will delve into the intricacies of anti-money laundering software, exploring its definition, key features, and how it operates to combat money laundering activities.

We will also discuss the benefits of adopting such technology, the challenges organizations may face in implementation, and the future trends shaping the evolution of AML solutions.

By the end of this article, readers will gain a deeper understanding of the critical role AML software plays in fostering financial integrity and its significance in the ongoing battle against financial crime.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over eight years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of What is Anti Money Laundering Software and How It Works.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

What is Anti Money Laundering Software and How It Works

- Understanding Money Laundering

- The Role of Anti-Money Laundering Software

- How Anti-Money Laundering Software Works

- Benefits of Using AML Software

- Challenges in Implementing AML Software

- Future Trends in Anti-Money Laundering Software

1. Understanding Money Laundering

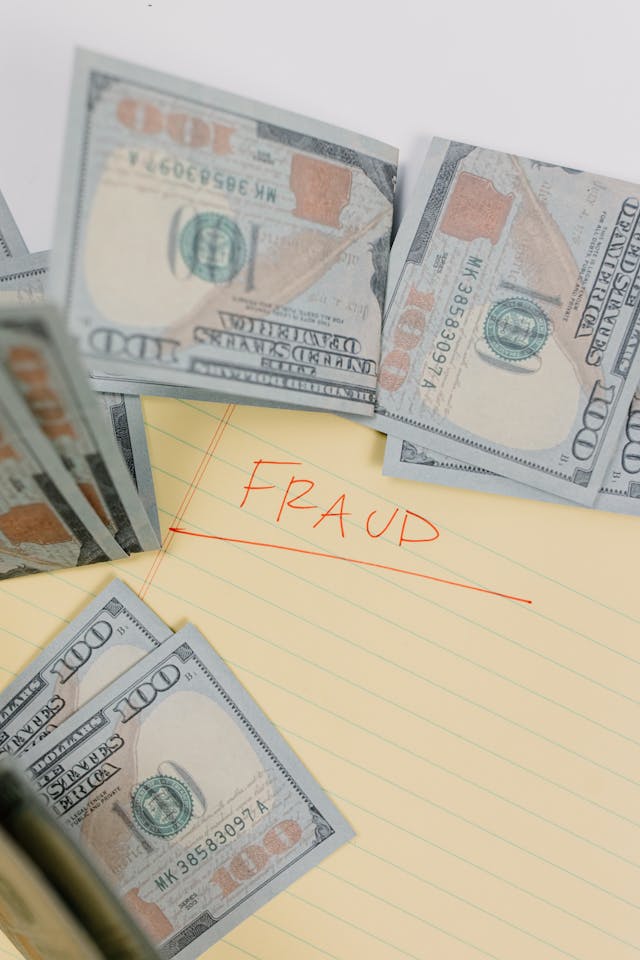

Money laundering is a complex and illicit process that facilitates the transformation of illegally obtained funds into legitimate assets.

Understanding the mechanics of money laundering is essential for comprehending the critical role that Anti-Money Laundering (AML) software plays in combating this pervasive issue.

This section will break down the concept of money laundering, its various stages, and the significant impact it has on the global economy.

1. What is Money Laundering?

- Definition

- Money laundering is the act of concealing the origins of illegally obtained money, typically generated from criminal activities such as drug trafficking, fraud, embezzlement, or corruption.

- The goal is to make “dirty” money appear “clean” and usable without raising suspicion.

- Importance of Understanding Money Laundering

- Recognizing the mechanisms of money laundering is crucial for financial institutions, regulators, and law enforcement agencies to develop effective prevention and detection strategies.

- Effective countermeasures can help maintain the integrity of financial systems and protect the economy from criminal activities.

2. The Money Laundering Process

Money laundering typically occurs in three main stages: placement, layering, and integration. Each stage serves a specific purpose in the overall scheme of concealing the illicit origins of funds.

2.1 Placement

- Definition

- The initial stage where illegal funds are introduced into the financial system.

- Methods

- Structuring (Smurfing): Breaking down large amounts of cash into smaller deposits to avoid detection. For example, a drug dealer may deposit $9,000 in multiple bank branches to stay below the $10,000 reporting threshold.

- Cash-intensive businesses: Using legitimate businesses that deal primarily in cash to disguise illicit income. An example is a restaurant underreporting sales to integrate drug profits.

- Risks

- High visibility of cash deposits may raise red flags for banks and financial institutions, prompting scrutiny.

2.2 Layering

- Definition

- The stage where the origin of the funds is obscured through a series of complex transactions.

- Methods

- Wire transfers: Moving funds between various accounts, often across different banks or countries, to create confusion. For instance, a criminal may wire funds to an offshore account in a tax haven, then back to another bank under a different name.

- Currency exchanges: Converting money into different currencies or purchasing high-value items (e.g., art, jewelry) to make tracking difficult. An example includes a criminal buying expensive watches with cash, then selling them.

- Risks

- While layering reduces the traceability of funds, it may still attract attention if unusual patterns emerge in transaction activity.

2.3 Integration

- Definition

- The final stage where the laundered money is reintroduced into the legitimate economy, making it difficult to distinguish from legally obtained funds.

- Methods

- Investing in legitimate businesses: Using laundered funds to purchase businesses or invest in real estate. For example, a money launderer might buy a luxury hotel to generate revenue from illicit funds.

- False loans and mortgages: Creating fake loans or using forged documents to secure financing for legitimate ventures. This can include falsifying income statements or tax returns to qualify for bank loans.

- Risks

- Integration can lead to legitimate wealth accumulation, making it challenging for authorities to trace the source of funds.

3. Why is Money Laundering a Concern?

Money laundering has significant implications for both the economy and society at large.

3.1 Economic Impact

- Undermining financial systems: Money laundering can destabilize financial institutions, eroding trust and leading to economic uncertainty.

- Encouraging criminal activities: By legitimizing profits from crime, money laundering fuels further criminal enterprises, including drug trafficking, human trafficking, and terrorism financing.

3.2 Legal and Regulatory Implications

- Increased compliance costs: Financial institutions are compelled to invest heavily in compliance measures and AML software to detect and prevent money laundering activities.

- Penalties for non-compliance: Institutions that fail to implement adequate AML measures face severe penalties, including hefty fines and reputational damage. For example, in 2012, HSBC was fined $1.9 billion for failing to adequately monitor transactions that facilitated money laundering.

4. Real-World Examples of Money Laundering

Understanding real-world instances of money laundering can help illustrate its complexity and the necessity of robust detection mechanisms.

4.1 The Case of Danske Bank

- Overview

- In 2018, it was revealed that approximately €200 billion ($230 billion) of suspicious transactions flowed through Danske Bank’s Estonian branch from 2007 to 2015.

- Methods Used

- Complex layering techniques involving foreign companies and shell corporations to obscure the origins of the funds.

- Consequences

- The scandal led to significant regulatory scrutiny, resulting in the resignation of top executives and calls for tighter regulations in the European Union.

4.2 The 1MDB Scandal

- Overview

- The Malaysian government investment fund, 1Malaysia Development Berhad (1MDB), was embroiled in a massive money laundering scheme involving approximately $4.5 billion.

- Methods Used

- Funds were funneled through a web of complex financial transactions, shell companies, and investments in luxury assets, including real estate and artworks.

- Consequences

- High-profile arrests and legal actions were initiated against various individuals involved, including former Malaysian Prime Minister Najib Razak.

5. Conclusion

Money laundering is a multifaceted crime that poses a significant threat to the integrity of financial systems and the economy as a whole.

Understanding its definitions, processes, and implications is crucial for developing effective strategies to combat it.

As financial institutions continue to confront the challenges posed by sophisticated money laundering schemes, the implementation of advanced Anti-Money Laundering software becomes essential in safeguarding assets, ensuring compliance, and protecting the overall health of the financial ecosystem.

2. The Role of Anti-Money Laundering Software

Anti-Money Laundering (AML) software plays a pivotal role in the global effort to detect and prevent money laundering and other financial crimes.

As criminal activities become more sophisticated, the importance of robust AML systems has increased exponentially.

This section will explore the purpose, functionality, and key features of AML software, as well as its significance in ensuring compliance with regulatory requirements and protecting financial institutions from the risks associated with money laundering.

1. Purpose and Functionality of AML Software

AML software is designed to streamline the detection, reporting, and prevention of money laundering activities. Its primary objectives include:

1.1 Detection of Suspicious Transactions

- Monitoring Financial Activities

- Continuous analysis of transactions in real-time to identify unusual patterns that may indicate money laundering.

- Examples include sudden large cash deposits, rapid transfers between accounts, or transactions involving high-risk jurisdictions.

- Behavioral Analytics

- Leveraging algorithms to establish baselines for normal customer behavior and flag deviations.

- For instance, if a long-term customer suddenly makes a significant withdrawal or transfer, the system can trigger alerts for further investigation.

1.2 Compliance with Legal Regulations

- Adhering to AML Regulations

- Ensuring that financial institutions comply with local and international AML laws and regulations, such as the Bank Secrecy Act (BSA) in the United States and the EU’s Anti-Money Laundering Directive.

- Automated Reporting

- Generating and submitting Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs) to regulatory authorities efficiently and accurately.

- For example, AML software can automatically compile transaction data and submit reports to FinCEN in the U.S. when thresholds are met.

2. Key Features of AML Software

To fulfill its objectives, AML software incorporates several critical features that enhance its effectiveness in combating money laundering.

2.1 Transaction Monitoring

- Real-Time Monitoring

- Continuous oversight of transactions, flagging any that appear suspicious for further review.

- Customizable Rules and Alerts

- Organizations can define their own criteria for what constitutes suspicious activity, allowing for tailored monitoring based on risk appetite and business model.

- Example

- A bank may set parameters to flag transactions over a certain amount that involve countries known for high levels of corruption or drug trafficking.

2.2 Customer Due Diligence (CDD)

- Enhanced Due Diligence (EDD)

- Involves collecting and analyzing extensive information about high-risk customers to assess their potential for engaging in money laundering.

- Know Your Customer (KYC) Procedures

- Gathering essential information during the onboarding process, such as identity verification and source of funds.

- Example

- A financial institution might require documentation proving the source of wealth for clients wishing to open accounts with substantial deposits.

2.3 Risk Assessment and Scoring

- Automated Risk Scoring

- Assigning risk levels to clients based on various factors, including transaction history, geographic location, and business type.

- Example

- A customer from a high-risk country engaged in frequent international transfers may receive a higher risk score, triggering closer monitoring.

3. Reporting and Compliance Features

AML software not only detects suspicious activities but also facilitates compliance with regulatory requirements.

3.1 Automated Reporting

- Suspicious Activity Reports (SARs)

- Generating detailed SARs for submission to regulatory authorities when suspicious transactions are identified.

- Example

- If a bank detects a series of large transactions followed by a sudden withdrawal, the AML software can automatically generate a SAR to notify authorities.

3.2 Audit Trails and Record Keeping

- Maintaining Records

- Keeping comprehensive records of transactions, alerts, and reports to support audits and investigations.

- Example

- In the event of a regulatory examination, having a well-documented audit trail can demonstrate compliance and mitigate potential fines.

4. Benefits of Using AML Software

The adoption of AML software brings numerous benefits to financial institutions, enhancing their ability to combat money laundering effectively.

4.1 Enhanced Detection Capabilities

- Real-Time Alerts

- Immediate notifications of suspicious activities, allowing for timely interventions.

- Reduced False Positives

- Advanced algorithms minimize the occurrence of false alarms, ensuring that compliance teams can focus on genuine risks.

4.2 Streamlined Compliance Processes

- Efficiency Gains

- Automating compliance workflows reduces manual efforts and improves accuracy.

- Example

- Financial institutions can process customer data and generate reports faster than manual methods, allowing for more efficient compliance operations.

4.3 Protecting Financial Institutions

- Risk Mitigation

- By identifying and addressing potential money laundering activities, AML software helps safeguard institutions from reputational damage and legal repercussions.

- Regulatory Fines

- Implementing robust AML measures can significantly reduce the risk of incurring fines for non-compliance. For instance, a prominent bank avoided potential fines by successfully implementing a comprehensive AML software solution.

5. Real-World Examples of AML Software in Action

Real-world implementations of AML software demonstrate its effectiveness in combating financial crime.

5.1 HSBC and AML Software

- Overview

- HSBC faced scrutiny in 2012 for failing to monitor billions in transactions linked to drug cartels.

- Response

- The bank invested heavily in upgrading its AML systems, implementing advanced transaction monitoring software to enhance compliance and risk management.

- Outcome

- This investment led to better detection of suspicious activities and improved reporting capabilities, allowing HSBC to restore its reputation and regain regulatory trust.

5.2 Deutsche Bank’s AML Initiatives

- Overview

- Deutsche Bank was involved in a significant money laundering scandal involving $10 billion in suspicious transactions through its Moscow branch.

- Response

- The bank adopted new AML software solutions to enhance transaction monitoring and improve compliance processes.

- Outcome

- These measures helped Deutsche Bank address regulatory concerns and minimize the risk of future compliance failures.

6. Challenges of Implementing AML Software

While AML software is essential, implementing it can come with challenges that institutions must navigate.

6.1 Cost Considerations

- Implementation Costs

- Initial investments in software, infrastructure, and staff training can be substantial.

- Ongoing Maintenance

- Continuous updates and system maintenance also contribute to long-term costs.

6.2 Data Privacy Concerns

- Balancing Compliance and Privacy

- Organizations must ensure that customer data is handled in compliance with privacy regulations, such as GDPR.

- Example

- Financial institutions need to find a balance between monitoring transactions for illicit activity and respecting customers’ rights to privacy.

6.3 Continuous Updates and Adaptation

- Evolving Criminal Techniques

- Criminal organizations are constantly adapting their tactics, necessitating ongoing updates to AML software to keep pace with new threats.

- Regulatory Changes

- Institutions must stay informed about changes in AML regulations and adjust their software solutions accordingly.

7. Conclusion

Anti-Money Laundering software plays a critical role in the fight against financial crime, enhancing the capabilities of financial institutions to detect and prevent money laundering activities.

Through advanced detection mechanisms, compliance features, and real-time monitoring, AML software safeguards not only the integrity of financial institutions but also the stability of the global economy.

As money laundering techniques evolve, the importance of investing in robust AML systems will continue to grow, enabling organizations to meet regulatory demands and protect themselves against the risks associated with financial crime.

3. How Anti-Money Laundering Software Works

Anti-Money Laundering (AML) software operates through a complex combination of technologies and methodologies designed to identify, track, and report suspicious financial activities.

By utilizing advanced algorithms, machine learning, and data analytics, AML software helps financial institutions and organizations combat money laundering effectively.

This section will delve into the mechanisms by which AML software functions, highlighting its key components, processes, and real-world applications.

1. Data Collection and Integration

AML software begins by gathering and integrating a wide array of data sources to form a comprehensive view of customer activities.

1.1 Data Sources

- Internal Data

- Transaction histories, customer profiles, and account details from the institution’s database.

- External Data

- Information from public records, watchlists, and third-party databases (e.g., sanctions lists).

- Example

- Financial institutions may integrate data from credit bureaus or government agencies to enhance their customer profiles.

1.2 Data Integration Techniques

- APIs and Data Feeds

- Utilizing Application Programming Interfaces (APIs) to pull in real-time data from various sources.

- Data Warehousing

- Centralizing data in a secure data warehouse for efficient access and analysis.

2. Customer Due Diligence (CDD)

A critical component of AML software is the implementation of Customer Due Diligence processes to assess the risk associated with individual clients.

2.1 Risk Assessment

- Client Profiling

- Establishing customer profiles based on various risk factors, including location, occupation, and transaction history.

- Example

- A bank may classify clients from high-risk jurisdictions as higher risk and require additional scrutiny.

2.2 Know Your Customer (KYC)

- Identity Verification

- Verifying customers’ identities using government-issued identification, utility bills, and other documentation.

- Source of Funds Checks

- Investigating the source of funds for new clients, especially for large transactions.

- Example

- If a customer applies for a high-value account, the institution may require documentation proving the legitimate source of their income.

3. Transaction Monitoring

Transaction monitoring is at the heart of AML software, as it enables real-time oversight of customer transactions.

3.1 Real-Time Monitoring

- Continuous Surveillance

- Monitoring transactions in real-time to detect patterns and anomalies that may indicate money laundering.

- Example

- If a customer who typically makes small transactions suddenly transfers a large sum overseas, this triggers an alert.

3.2 Automated Alerts and Thresholds

- Setting Parameters

- Establishing thresholds for transaction amounts or frequencies that trigger alerts for further investigation.

- Example

- Transactions exceeding $10,000 may automatically flag alerts, prompting compliance teams to review them.

3.3 Pattern Recognition and Anomaly Detection

- Behavioral Analysis

- Utilizing machine learning algorithms to establish baseline behaviors for customers and flagging deviations.

- Example

- A customer who usually makes local payments may raise a red flag if they suddenly start making international wire transfers.

4. Case Management and Investigation

Once suspicious activities are identified, AML software supports case management and investigation processes.

4.1 Case Creation

- Alert Management

- Automatically generating cases based on alerts from transaction monitoring.

- Example

- If a transaction is flagged as suspicious, a case is created for further investigation by compliance officers.

4.2 Investigation Workflow

- Task Assignment

- Assigning cases to compliance personnel for detailed investigation.

- Documentation

- Compiling evidence and notes throughout the investigation process to support decision-making.

- Example

- Compliance officers may gather additional information, such as transaction history or related accounts, to assess the validity of the suspicious transaction.

5. Reporting and Compliance

After investigations, AML software helps ensure that organizations comply with regulatory requirements.

5.1 Automated Reporting

- Generating Suspicious Activity Reports (SARs)

- Automatically creating SARs when suspicious activity is confirmed, including detailed accounts of the transactions in question.

- Example

- If a large cash deposit is linked to a known fraudster, an SAR is generated for submission to the relevant authorities.

5.2 Regulatory Compliance

- Keeping Up with Regulations

- Ensuring that all processes and reporting mechanisms adhere to AML regulations, such as the Bank Secrecy Act (BSA) and Financial Action Task Force (FATF) recommendations.

- Example

- Institutions must submit periodic reports detailing their AML activities, and the software ensures all necessary documentation is prepared accurately.

6. Machine Learning and Advanced Analytics

Modern AML software leverages machine learning and advanced analytics to improve detection rates and reduce false positives.

6.1 Predictive Analytics

- Anticipating Risk

- Using historical data to predict potential risks and adjust monitoring parameters accordingly.

- Example

- By analyzing past transactions of flagged accounts, the software can refine its algorithms to detect similar patterns in new transactions.

6.2 Natural Language Processing (NLP)

- Analyzing Unstructured Data

- Utilizing NLP to analyze text-based data such as transaction descriptions or communications.

- Example

- Detecting suspicious phrases or keywords in transaction notes that may indicate fraudulent intent.

7. Integration with Other Systems

AML software often integrates with other compliance and risk management systems to enhance its effectiveness.

7.1 Cross-Platform Integration

- Working with CRM and ERP Systems

- Ensuring that AML software can communicate with Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems for a holistic view of customer interactions.

- Example

- Integrating AML software with a CRM allows for better tracking of customer interactions and histories, enhancing due diligence processes.

7.2 API Integration

- Connecting with External Data Sources

- Utilizing APIs to pull in additional data sources, such as sanctions lists and politically exposed persons (PEPs) databases, in real-time.

- Example

- By integrating with a real-time sanctions list, the software can instantly alert compliance teams when a transaction involves a sanctioned individual or entity.

8. Ongoing System Updates and Adaptation

To remain effective, AML software requires continuous updates and adaptation to changing regulatory landscapes and emerging threats.

8.1 Regular Software Updates

- Staying Current

- Regularly updating software to incorporate new regulations, compliance standards, and technological advancements.

- Example

- An institution may update its AML software to include newly identified high-risk jurisdictions.

8.2 Continuous Training of Algorithms

- Machine Learning Enhancements

- Continuously training algorithms with new data to improve accuracy and detection capabilities.

- Example

- As new money laundering tactics emerge, algorithms can be retrained to recognize these patterns more effectively.

9. Conclusion

Understanding how Anti-Money Laundering software works is crucial for financial institutions aiming to protect themselves against the risks associated with money laundering.

By employing a combination of data collection, transaction monitoring, case management, and advanced analytics, AML software plays a vital role in detecting and preventing illicit financial activities.

As financial crime continues to evolve, institutions must remain vigilant and adaptable, leveraging AML software to navigate the complexities of compliance and safeguard their operations effectively.

4. Benefits of Using AML Software

Implementing Anti-Money Laundering (AML) software offers a multitude of advantages for financial institutions, businesses, and regulatory bodies.

These benefits extend beyond mere compliance, contributing to enhanced operational efficiency, risk management, and overall business integrity.

In this section, we will explore the various benefits of using AML software, supported by relevant examples.

1. Enhanced Compliance with Regulations

AML software plays a critical role in helping organizations comply with increasingly stringent regulatory requirements.

1.1 Streamlined Reporting

- Automated Reporting Processes

- Generates Suspicious Activity Reports (SARs) automatically based on predefined criteria, minimizing manual effort.

- Example

- A bank can generate detailed reports on suspicious transactions within minutes instead of days, ensuring timely submissions to regulatory authorities.

1.2 Up-to-Date Compliance

- Regular Updates

- Incorporates changes in regulations and compliance standards automatically, ensuring the organization remains compliant with the latest laws.

- Example

- AML software updates may include new sanctions lists or regulatory requirements mandated by the Financial Action Task Force (FATF).

2. Improved Detection of Suspicious Activities

AML software enhances the detection of potential money laundering activities through advanced analytics and machine learning.

2.1 Real-Time Monitoring

- Continuous Surveillance

- Monitors transactions in real time to detect patterns indicative of money laundering.

- Example

- A financial institution can identify unusual transactions, such as a sudden spike in cash deposits, as they occur, allowing for immediate investigation.

2.2 Advanced Pattern Recognition

- Machine Learning Algorithms

- Utilizes AI and machine learning to identify complex patterns that human analysts might miss.

- Example

- AML systems can recognize that a client’s behavior deviates from established norms, such as frequent international wire transfers to high-risk countries.

3. Increased Operational Efficiency

By automating various compliance processes, AML software significantly improves operational efficiency.

3.1 Automation of Manual Processes

- Reduction in Manual Oversight

- Minimizes the need for manual checks and reviews, allowing staff to focus on more strategic tasks.

- Example

- Instead of manually reviewing each transaction, compliance officers can concentrate on analyzing flagged transactions that require further scrutiny.

3.2 Case Management Simplification

- Streamlined Workflow

- Organizes and prioritizes investigations efficiently, allowing for quicker resolutions of flagged cases.

- Example

- An organization can quickly assign and track the status of multiple investigations using the software’s case management features.

4. Enhanced Risk Management

AML software facilitates better risk assessment and management strategies.

4.1 Comprehensive Risk Assessment

- Dynamic Risk Scoring

- Evaluates clients based on various risk factors, such as location, transaction history, and occupation.

- Example

- A financial institution may classify high-risk customers differently, applying more stringent monitoring practices.

4.2 Proactive Risk Mitigation

- Early Detection of Trends

- Identifies emerging trends in suspicious activities that may pose risks to the organization.

- Example

- An institution can adapt its policies and procedures based on trends detected in client transactions, such as increased fraud attempts.

5. Better Customer Due Diligence (CDD)

AML software enhances Customer Due Diligence processes, ensuring organizations understand their clients thoroughly.

5.1 Improved KYC Processes

- Efficient Identity Verification

- Automates the collection and verification of customer identification documents and information.

- Example

- A bank can quickly verify a client’s identity using automated checks against national databases.

5.2 Ongoing Monitoring

- Continuous CDD

- Ensures that customer profiles remain updated with any new risk information.

- Example

- If a previously low-risk client suddenly engages in high-risk transactions, the AML software alerts compliance teams to reassess the client’s risk level.

6. Cost Savings

Using AML software can result in significant cost savings for organizations.

6.1 Reduced Compliance Costs

- Minimized Manual Labor

- By automating compliance tasks, organizations can lower the costs associated with manual labor and reporting.

- Example

- A bank that automates its reporting processes may save thousands of dollars annually by reducing the need for additional compliance staff.

6.2 Decreased Fines and Penalties

- Avoidance of Regulatory Fines

- Effective use of AML software can reduce the likelihood of fines resulting from non-compliance.

- Example

- A financial institution that consistently submits accurate SARs on time may avoid substantial fines that non-compliant organizations face.

7. Enhanced Reputation and Trust

Implementing AML software can significantly enhance an organization’s reputation.

7.1 Building Trust with Customers

- Demonstrating Commitment to Compliance

- Showing that the organization takes anti-money laundering seriously helps build trust with customers and stakeholders.

- Example

- Clients are more likely to choose a bank known for robust compliance measures, knowing their funds are secure.

7.2 Positive Regulatory Relationships

- Collaboration with Regulators

- Proactive compliance can foster better relationships with regulatory bodies.

- Example

- A well-compliant organization is likely to receive more favorable assessments during regulatory audits.

8. Integration with Other Financial Tools

AML software can easily integrate with existing financial systems and tools.

8.1 Seamless Integration

- Compatibility with Financial Platforms

- Many AML solutions can be integrated with other financial software and tools, such as CRM and ERP systems.

- Example

- A bank’s AML software can pull data from its CRM to improve the accuracy of risk assessments.

8.2 Holistic Compliance Approach

- Unified Compliance Framework

- Integration facilitates a comprehensive compliance strategy, allowing organizations to manage all aspects of compliance in one place.

- Example

- By integrating with fraud detection systems, AML software can provide a complete picture of compliance-related risks.

9. Ongoing Support and Training

Many AML software providers offer ongoing support and training, ensuring organizations maximize their investment.

9.1 Continuous Updates and Training

- Regular Software Updates

- Providers often release updates to improve functionality and adapt to new regulations.

- Example

- Software that evolves with regulatory changes helps organizations stay ahead in compliance efforts.

9.2 User Training and Resources

- Access to Training Materials

- Many vendors provide training resources and support to ensure staff is well-versed in using the software effectively.

- Example

- Comprehensive training programs can empower compliance teams to utilize AML software fully, enhancing overall effectiveness.

Conclusion

In an era where regulatory compliance and risk management are more critical than ever, the benefits of using Anti-Money Laundering software are substantial.

From enhancing compliance and detecting suspicious activities to improving operational efficiency and reducing costs, AML software equips organizations with the tools they need to navigate complex financial landscapes.

By investing in robust AML solutions, institutions not only protect themselves against the risks of money laundering but also reinforce their commitment to integrity, trust, and responsible financial practices.

5. Challenges in Implementing AML Software

While Anti-Money Laundering (AML) software offers significant benefits, the implementation of such systems is not without its challenges.

Financial institutions and businesses often face various hurdles that can impact the successful integration and effectiveness of AML solutions.

In this section, we will delve into the primary challenges associated with implementing AML software, accompanied by relevant examples to illustrate each point.

1. High Initial Costs

The financial commitment required for AML software implementation can be a significant barrier for many organizations.

1.1 Software Acquisition Costs

- Upfront Investment

- The purchase of AML software can require a substantial initial investment, depending on the complexity and features of the solution.

- Example

- A large bank may face costs in the hundreds of thousands to millions of dollars for a comprehensive AML solution capable of handling vast transaction volumes.

1.2 Ongoing Maintenance and Licensing Fees

- Recurring Expenses

- Many AML solutions come with annual maintenance and licensing fees that can strain budgets over time.

- Example

- An organization might incur additional expenses each year for software updates, technical support, and compliance assessments.

2. Complex Integration with Existing Systems

Integrating AML software with existing financial systems can be a complex and time-consuming process.

2.1 Data Compatibility Issues

- Heterogeneous Data Sources

- Organizations often use multiple software solutions, leading to compatibility issues between different data formats and systems.

- Example

- A financial institution may struggle to integrate AML software with legacy systems that have outdated databases, requiring costly data migration efforts.

2.2 Disruption of Business Operations

- Operational Downtime

- The integration process may lead to temporary disruptions in business operations, impacting customer service and transaction processing.

- Example

- A bank implementing a new AML system may experience downtime that affects transaction approvals, frustrating customers and leading to potential losses.

3. Resistance to Change from Staff

Employee resistance to new technology can impede the successful implementation of AML software.

3.1 Fear of Job Loss

- Job Security Concerns

- Employees may fear that automation will lead to job redundancies, causing pushback against adopting new systems.

- Example

- Compliance staff might resist adopting AML software due to concerns that it will replace their roles in transaction monitoring and reporting.

3.2 Lack of Familiarity with New Technology

- Training Requirements

- Employees may lack the necessary skills or experience to utilize the new AML software effectively, requiring extensive training.

- Example

- A financial institution might need to invest in comprehensive training programs to ensure staff are proficient in using the new system.

4. Data Privacy and Security Concerns

Handling sensitive customer data raises significant privacy and security issues during AML software implementation.

4.1 Regulatory Compliance Challenges

- Adhering to Data Protection Laws

- Organizations must ensure that their AML software complies with data protection regulations, such as the General Data Protection Regulation (GDPR).

- Example

- A company may face legal challenges if the AML software improperly manages customer data, leading to potential fines and reputational damage.

4.2 Vulnerability to Cyber Threats

- Increased Risk of Cyberattacks

- Implementing new software can expose organizations to increased cybersecurity risks if not properly secured.

- Example

- A poorly configured AML system could become a target for hackers looking to exploit vulnerabilities, leading to data breaches and financial losses.

5. Evolving Regulatory Landscape

The constantly changing regulatory environment poses challenges for AML software implementation.

5.1 Keeping Up with Changes

- Frequent Updates Required

- Organizations must continuously update their AML systems to comply with new regulations and guidelines.

- Example

- A bank may need to modify its AML software frequently to adapt to new regulations imposed by the Financial Action Task Force (FATF) or regional authorities.

5.2 Complexity of Global Regulations

- Navigating International Laws

- Multinational organizations face the challenge of complying with different AML regulations across jurisdictions.

- Example

- A global bank operating in multiple countries must ensure its AML software accommodates the varying requirements of each jurisdiction, complicating implementation.

6. Data Quality and Accuracy Issues

The effectiveness of AML software is heavily reliant on the quality and accuracy of the data it processes.

6.1 Incomplete or Inaccurate Data

- Data Integrity Challenges

- Organizations may struggle with incomplete or outdated customer data, leading to ineffective AML processes.

- Example

- An institution might fail to detect suspicious transactions due to inaccurate customer profiles, undermining the software’s effectiveness.

6.2 High Volume of False Positives

- Strain on Resources

- AML software may generate numerous false positives, resulting in excessive alerts and overwhelming compliance teams.

- Example

- A bank could experience hundreds of alerts daily for legitimate transactions, diverting resources away from genuinely suspicious activities.

7. Customization and Scalability Limitations

Finding an AML solution that fits an organization’s specific needs can be challenging.

7.1 Limited Customization Options

- One-Size-Fits-All Solutions

- Some AML software may not provide the flexibility required to customize features according to unique business needs.

- Example

- A financial institution may find that the software lacks specific risk assessment tools tailored to its customer base.

7.2 Scalability Concerns

- Adapting to Growth

- As businesses expand, they may find that their AML software cannot scale to handle increased transaction volumes or regulatory requirements.

- Example

- A rapidly growing fintech company may face challenges if its AML software cannot efficiently process the surge in transactions resulting from its growth.

8. Reliance on Technology

The increasing reliance on technology raises concerns regarding system failures and outages.

8.1 System Downtime

- Operational Disruptions

- Any software malfunction can lead to downtime, disrupting critical compliance processes.

- Example

- A technical glitch during a system update could result in an organization being unable to monitor transactions for several hours, exposing it to risks.

8.2 Limited Human Oversight

- Over-Reliance on Automation

- Excessive dependence on technology can lead to complacency, where organizations fail to adequately supervise automated processes.

- Example

- If compliance teams rely solely on automated alerts without further investigation, they may miss critical signs of money laundering.

9. Vendor Reliability and Support Issues

The choice of an AML software vendor can greatly influence the success of implementation.

9.1 Vendor Stability

- Risk of Vendor Bankruptcy

- Relying on a vendor that may not have a stable financial foundation poses risks for ongoing support and software updates.

- Example

- If a vendor goes bankrupt, an organization may find itself without the necessary support for its AML software, leading to compliance issues.

9.2 Quality of Customer Support

- Inadequate Support Services

- Poor vendor support can hinder organizations from addressing issues that arise during implementation or operation.

- Example

- A company might face extended downtimes if its AML software vendor does not provide timely technical support.

Conclusion

Implementing Anti-Money Laundering software presents several challenges that organizations must navigate to ensure successful deployment and effective compliance.

From high costs and complex integration processes to data privacy concerns and the evolving regulatory landscape, these challenges can impact the overall effectiveness of AML solutions.

Understanding these obstacles enables organizations to strategize effectively, ensuring that they can leverage AML software to protect themselves against the risks associated with money laundering while maintaining regulatory compliance and operational integrity.

6. Future Trends in Anti-Money Laundering Software

As financial crimes continue to evolve, the landscape of Anti-Money Laundering (AML) software is undergoing significant transformation.

Organizations are increasingly adopting innovative technologies and strategies to enhance their AML efforts.

In this section, we will explore the future trends in AML software, highlighting key developments that are likely to shape the industry in the coming years.

1. Increased Use of Artificial Intelligence (AI) and Machine Learning (ML)

Artificial Intelligence (AI) and Machine Learning (ML) are poised to revolutionize AML software by improving the detection and prevention of money laundering activities.

1.1 Advanced Pattern Recognition

- Behavioral Analysis

- AI and ML algorithms can analyze vast amounts of data to identify complex patterns and anomalies that may indicate money laundering.

- Example

- A financial institution may employ ML models to analyze transaction patterns over time, flagging unusual behavior that deviates from established norms.

1.2 Enhanced Risk Assessment

- Dynamic Risk Scoring

- ML algorithms can provide real-time risk assessments of clients and transactions, adapting based on changing data inputs.

- Example

- An AML software solution might assign dynamic risk scores to customers based on their transaction history, location, and other behavioral metrics.

1.3 Automation of Compliance Processes

- Streamlined Workflows

- AI can automate routine compliance tasks, allowing human analysts to focus on more complex investigations.

- Example

- Automation tools could manage the initial review of flagged transactions, automatically sorting them into categories for further examination.

2. Enhanced Data Analytics and Visualization Tools

The future of AML software will see improved data analytics and visualization capabilities, allowing organizations to derive actionable insights from complex data sets.

2.1 Predictive Analytics

- Proactive Monitoring

- Organizations will leverage predictive analytics to anticipate potential money laundering activities before they occur.

- Example

- By analyzing historical data, an AML solution might predict high-risk periods or activities based on past trends.

2.2 Advanced Visualization Dashboards

- Interactive Data Displays

- Enhanced visualization tools will enable compliance teams to view and analyze data through interactive dashboards, making it easier to spot trends and anomalies.

- Example

- A financial institution might utilize dashboards to visualize transaction flows, quickly identifying unusual patterns that warrant further investigation.

3. Integration of Blockchain Technology

Blockchain technology is emerging as a powerful tool in the fight against money laundering, offering transparency and traceability.

3.1 Transparent Transaction Tracking

- Immutable Record Keeping

- Blockchain’s decentralized nature allows for the secure and immutable recording of transactions, making it easier to trace the origin of funds.

- Example

- A blockchain-based AML solution could help verify the legitimacy of funds in real time, reducing the risk of accepting illicit money.

3.2 Improved Due Diligence

- Enhanced Client Verification

- Integrating blockchain technology can streamline the process of verifying client identities and transaction histories.

- Example

- A financial institution may use blockchain to access a shared ledger of customer transactions, facilitating more efficient KYC (Know Your Customer) processes.

4. RegTech Collaboration and Ecosystem Development

Regulatory Technology (RegTech) is becoming increasingly vital in the AML landscape, fostering collaboration between technology providers and financial institutions.

4.1 Collaborative Platforms

- Shared Resources and Knowledge

- Financial institutions will increasingly engage in collaborative networks that share data and insights to strengthen AML efforts.

- Example

- A consortium of banks might form a collaborative platform to share intelligence on suspicious activities, enhancing collective risk assessments.

4.2 Standardization of Compliance Protocols

- Unified Regulatory Frameworks

- The AML software industry will likely move toward standardized compliance protocols to facilitate easier integration across different systems and jurisdictions.

- Example

- Standardization efforts might result in uniform reporting formats for suspicious activities, simplifying the regulatory reporting process for financial institutions.

5. Enhanced Focus on Customer Due Diligence (CDD)

As regulators emphasize the importance of Customer Due Diligence (CDD), AML software will evolve to support more robust CDD practices.

5.1 Dynamic Risk Profiling

- Ongoing Monitoring

- Future AML solutions will incorporate dynamic risk profiling, allowing organizations to continuously update customer risk profiles based on new information.

- Example

- A financial institution may automatically adjust a customer’s risk rating in real time as new transactional data is received.

5.2 Comprehensive Source of Funds (SoF) Analysis

- In-Depth Investigations

- AML software will increasingly focus on verifying the source of funds for high-risk clients, requiring thorough documentation and analysis.

- Example

- An AML solution could implement automated workflows that request additional documentation from clients when high-risk transactions are detected.

6. Regulatory Compliance Automation

The automation of compliance processes will become more prominent, reducing manual intervention and increasing efficiency.

6.1 Automated Reporting

- Streamlined Compliance Submissions

- Future AML software will automate the generation and submission of compliance reports to regulatory authorities.

- Example

- A bank may use AML software to automatically prepare and submit suspicious activity reports (SARs) based on flagged transactions.

6.2 Integration with Regulatory Databases

- Real-Time Compliance Updates

- AML software will integrate with regulatory databases to ensure organizations stay current with the latest compliance requirements and changes.

- Example

- A compliance officer may receive alerts from AML software when new regulations are introduced that impact their reporting obligations.

7. Increased Emphasis on Cybersecurity

With the growing threat of cybercrime, the intersection of AML and cybersecurity will be critical for future software development.

7.1 Holistic Risk Management

- Integrating Cybersecurity Measures

- AML software will incorporate cybersecurity tools to monitor for cyber threats that could facilitate money laundering.

- Example

- An AML solution may analyze transaction data for signs of cyber intrusion, such as abnormal transaction spikes during a data breach.

7.2 Enhanced Fraud Detection

- Multi-Layered Defense Systems

- Future AML software will utilize advanced fraud detection mechanisms to identify suspicious activities associated with cyber threats.

- Example

- A bank might implement AML software that utilizes AI to detect unusual patterns indicative of fraud while simultaneously flagging potential money laundering activities.

8. Greater Adoption of Cloud-Based Solutions

Cloud technology is transforming the way AML software is deployed and managed, providing flexibility and scalability.

8.1 Scalable Infrastructure

- Easier Expansion

- Cloud-based AML solutions allow organizations to scale their compliance efforts rapidly in response to growing transaction volumes.

- Example

- A rapidly growing fintech company may utilize cloud-based AML software to seamlessly handle increased transactions without significant infrastructure investment.

8.2 Cost-Effective Solutions

- Reduced Operational Costs

- Cloud solutions often come with lower upfront costs, making AML technology more accessible to smaller organizations.

- Example

- A small credit union may opt for a cloud-based AML solution, reducing the need for extensive IT infrastructure and personnel.

Conclusion

The future of Anti-Money Laundering software is poised for significant transformation driven by technological advancements and evolving regulatory landscapes.

Organizations must stay informed about these trends to enhance their compliance efforts effectively.

By embracing innovations such as AI, blockchain, RegTech collaboration, and cloud-based solutions, businesses can better protect themselves against money laundering activities while ensuring they meet regulatory requirements.

As these trends unfold, the ability to adapt and integrate new technologies will be critical for maintaining a robust AML framework in an increasingly complex financial environment.

Conclusion

As global financial systems grow increasingly interconnected, the threat of money laundering has become a pressing concern for regulators, financial institutions, and businesses worldwide.

Anti-Money Laundering (AML) software plays a pivotal role in combating this pervasive issue, providing organizations with the necessary tools to detect, prevent, and report suspicious activities effectively.

This conclusion will summarize the key takeaways from our exploration of AML software, underscoring its importance and the ongoing evolution of this critical technology.

1. Recap of AML Software Functions

Anti-Money Laundering software is designed to streamline compliance processes, enhance transaction monitoring, and support robust reporting mechanisms. Key functions of AML software include:

- Transaction Monitoring: AML systems continuously analyze transactions to identify unusual patterns or activities that may indicate money laundering.

- Customer Due Diligence (CDD): By conducting thorough risk assessments of customers, AML software helps organizations verify identities and evaluate the legitimacy of funds.

- Regulatory Reporting: AML software automates the generation of necessary reports for regulatory compliance, ensuring timely submissions and reducing manual errors.

These functionalities empower organizations to maintain compliance with complex regulations while minimizing the risk of being exploited by money launderers.

2. The Importance of Compliance in Financial Systems

The financial sector is highly regulated, with stringent laws aimed at preventing illicit activities, including money laundering. Failure to comply with these regulations can lead to severe penalties, legal repercussions, and damage to an organization’s reputation. AML software acts as a safeguard, helping organizations:

- Mitigate Risks: By implementing robust AML solutions, businesses can significantly reduce the risk of engaging in money laundering activities, protecting their financial integrity.

- Enhance Reputation: A strong compliance framework not only minimizes risks but also builds trust with customers, regulators, and stakeholders, enhancing the organization’s reputation in the market.

- Stay Ahead of Regulations: As regulatory landscapes evolve, AML software ensures organizations can adapt to changes efficiently, maintaining compliance and avoiding penalties.

3. The Future of AML Software: A Dynamic Landscape

The future of Anti-Money Laundering software is promising, characterized by technological advancements and increased regulatory scrutiny. Emerging trends indicate that AML solutions will continue to evolve, incorporating:

- Artificial Intelligence and Machine Learning: These technologies will enhance transaction monitoring and risk assessment, allowing for more accurate detection of suspicious activities.

- Blockchain Integration: The use of blockchain technology will improve transparency and traceability, making it easier to verify the legitimacy of funds and enhance customer due diligence processes.

- RegTech Collaboration: Collaborative platforms will enable organizations to share insights and data, strengthening collective efforts against money laundering.

- Cloud-Based Solutions: The shift toward cloud technology will provide scalability, accessibility, and cost-effectiveness for AML solutions, making them more attainable for organizations of all sizes.

4. The Call to Action for Organizations

As the threat of money laundering continues to grow, organizations must prioritize the implementation of robust Anti-Money Laundering software. By investing in advanced AML solutions, businesses can:

- Enhance Their Compliance Framework: Organizations should regularly evaluate their compliance strategies and adopt technologies that align with regulatory requirements.

- Invest in Training and Awareness: Continuous training for staff involved in compliance processes is essential to ensure they understand the tools available and can effectively respond to potential risks.

- Monitor and Adapt to Industry Changes: Staying informed about emerging trends in AML software and regulatory requirements will empower organizations to remain proactive in their compliance efforts.

5. Conclusion: A Commitment to Financial Integrity

In summary, Anti-Money Laundering software is a vital component of the financial industry’s efforts to combat money laundering and safeguard financial integrity.

By automating compliance processes, enhancing transaction monitoring, and providing essential reporting mechanisms, AML software equips organizations with the tools necessary to navigate the complexities of regulatory compliance.

As financial systems evolve, organizations must remain vigilant, embracing technological advancements and fostering a culture of compliance to protect themselves and contribute to a secure financial ecosystem.

The journey toward effective money laundering prevention is ongoing, and the role of AML software will be paramount in shaping a future where financial crimes are minimized, and transparency is prioritized. By committing to robust AML practices, organizations can not only protect their interests but also play a crucial role in fostering trust and integrity within the global financial system.

If your company needs HR, hiring, or corporate services, you can use 9cv9 hiring and recruitment services. Book a consultation slot here, or send over an email to [email protected].

If you find this article useful, why not share it with your hiring manager and C-level suite friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

People Also Ask

What is Anti-Money Laundering (AML) software?

AML software is a tool designed to help businesses detect, prevent, and report suspicious financial activities related to money laundering, ensuring compliance with regulations.

How does AML software work?

AML software monitors transactions, flags suspicious activities, and automates regulatory reporting to help businesses comply with anti-money laundering laws.

Why is AML software important?

AML software is crucial for preventing financial crimes, protecting businesses from legal risks, and maintaining trust by ensuring compliance with anti-money laundering regulations.

What features does AML software include?

Key features include transaction monitoring, customer due diligence, sanctions screening, regulatory reporting, and risk assessment.

Who needs AML software?

Financial institutions, banks, fintech companies, and businesses handling large financial transactions need AML software to comply with anti-money laundering regulations.

Can small businesses benefit from AML software?

Yes, even small businesses can benefit by ensuring compliance, reducing the risk of financial crimes, and avoiding penalties for non-compliance.

What is transaction monitoring in AML software?

Transaction monitoring is the process where AML software analyzes financial transactions for patterns and anomalies that may indicate money laundering.

How does customer due diligence (CDD) work in AML software?

CDD involves verifying customer identities, assessing their risk profiles, and monitoring ongoing financial transactions to ensure they’re legitimate.

Is AML software customizable?

Many AML software solutions offer customization to meet the specific needs of different industries and regulatory requirements.

How does AML software help with regulatory reporting?

AML software automates the generation of required reports, such as Suspicious Activity Reports (SARs), ensuring timely submission to regulators.

Can AML software integrate with existing systems?

Yes, AML software is often designed to integrate with existing financial systems, enabling seamless monitoring and reporting.

Does AML software use artificial intelligence (AI)?

Many modern AML solutions incorporate AI and machine learning to enhance the detection of suspicious patterns and improve accuracy over time.

How can AML software improve compliance efficiency?

AML software automates manual processes like transaction monitoring and reporting, reducing human error and improving compliance efficiency.

What are the costs of implementing AML software?

Costs can vary depending on the size of the business, features needed, and the provider, but AML software is typically considered an investment in legal protection and compliance.

What is sanctions screening in AML software?

Sanctions screening involves checking customers and transactions against global sanction lists to ensure that no illegal parties are involved.

Can AML software detect real-time money laundering activities?

Yes, many AML systems provide real-time monitoring, allowing businesses to detect and act on suspicious activities immediately.

Is AML software mandatory?

For financial institutions and certain businesses, AML compliance is legally required, and AML software helps meet these obligations effectively.

What industries use AML software?

Banks, financial services, real estate, casinos, insurance companies, and fintech firms commonly use AML software to meet regulatory requirements.

What are the regulatory standards for AML software?

AML software must adhere to regional and international standards, such as FATF recommendations, and local regulations like FinCEN in the U.S.

How often is AML software updated?

AML software is regularly updated to comply with the latest regulations and respond to new money laundering tactics and methods.

What are the penalties for not using AML software?

Penalties for non-compliance can include heavy fines, loss of business licenses, and legal actions, depending on the jurisdiction.

How does AML software help reduce financial crime?

By monitoring transactions, conducting due diligence, and automating reporting, AML software reduces the risk of businesses being used for money laundering.

Can AML software prevent all forms of money laundering?

While AML software significantly reduces the risk, it cannot guarantee 100% prevention as criminals constantly evolve their tactics.

What are the challenges of using AML software?

Challenges include integration with existing systems, staying up-to-date with regulatory changes, and managing false positives during monitoring.

How long does it take to implement AML software?

Implementation times vary depending on the complexity of the system and the business’s needs but can take anywhere from a few weeks to several months.

Is AML software cloud-based or on-premise?

AML software can be either cloud-based or on-premise, depending on the provider and business requirements. Cloud solutions are often more scalable.

Can AML software adapt to new regulations?

Most AML software is designed to adapt to regulatory changes, ensuring businesses remain compliant with new laws and guidelines.

What are false positives in AML software?

False positives occur when legitimate transactions are flagged as suspicious. Reducing false positives is a key focus for advanced AML software.

What is Know Your Customer (KYC) in AML software?

KYC is the process of verifying the identity of clients to ensure they are who they claim to be and that their funds are legitimate.

How does AML software handle high-risk customers?

AML software applies enhanced due diligence for high-risk customers, monitoring their activities more closely to prevent potential money laundering.

What is the future of AML software?

The future of AML software lies in advanced AI, machine learning, blockchain integration, and real-time transaction monitoring to enhance efficiency and accuracy.

![Writing A Good CV [6 Tips To Improve Your CV] 6 Tips To Improve Your CV](https://blog.9cv9.com/wp-content/uploads/2020/06/2020-06-02-2-100x70.png)