Key Takeaways

- Explore the fundamentals: Understand the intricacies of crypto mining, from consensus mechanisms to hardware selection, laying a solid foundation for your mining journey.

- Navigate challenges strategically: Learn to overcome regulatory hurdles, address environmental concerns, and stay ahead of market volatility to ensure long-term success in your mining career.

- Embrace innovation and opportunity: Harness emerging trends like alternative consensus mechanisms and eco-friendly mining solutions to maximize profitability and sustainability in the dynamic world of crypto mining.

In the ever-evolving landscape of digital finance, cryptocurrencies have emerged as a disruptive force, challenging traditional notions of currency and investment.

At the heart of this revolution lies the concept of crypto mining, a process integral to the creation and validation of digital currencies like Bitcoin, Ethereum, and beyond.

If you’ve ever wondered about the mysterious world of crypto mining and harbored aspirations to embark on a mining career, you’ve arrived at the right destination.

In this extensive guide, we’ll unravel the complexities of crypto mining, demystifying its intricacies and equipping you with the knowledge and tools necessary to kickstart your mining journey.

Whether you’re a tech enthusiast intrigued by the prospect of harnessing computational power for financial gain or an investor seeking to diversify your portfolio, understanding crypto mining is paramount in navigating the dynamic realm of cryptocurrencies.

But what exactly is crypto mining, and why has it become synonymous with digital wealth creation?

In essence, crypto mining serves as the backbone of blockchain technology, the decentralized ledger system underpinning cryptocurrencies.

Unlike traditional currencies issued and regulated by central authorities, cryptocurrencies operate on a decentralized network secured by cryptographic algorithms.

At its core, crypto mining involves the validation and recording of transactions on the blockchain, ensuring the integrity and immutability of the digital ledger.

However, the process transcends mere bookkeeping; it incentivizes participants, known as miners, to dedicate computational resources towards solving complex mathematical puzzles.

Through this computational effort, miners facilitate transaction verification, maintain network security, and ultimately, mint new units of the cryptocurrency as a reward for their contribution.

Now, you might be wondering: how does one embark on a mining career, and what are the prerequisites for success in this burgeoning field?

While the prospect of generating passive income through mining is undeniably appealing, it’s essential to approach this endeavor with meticulous planning and informed decision-making.

Throughout this guide, we’ll delve into the intricacies of crypto mining, offering actionable insights and practical advice to steer you towards mining success.

From selecting the right cryptocurrency and configuring your mining rig to navigating regulatory challenges and optimizing profitability, we’ll leave no stone unturned in your quest to become a proficient miner.

Whether you’re a novice enthusiast eager to dip your toes into the world of crypto mining or a seasoned investor seeking to expand your horizons, this guide will serve as your compass in navigating the labyrinthine landscape of cryptocurrency mining.

So, buckle up and prepare to embark on a transformative journey into the realm of digital finance, where opportunities abound for those bold enough to seize them.

Before we venture further into this article, we like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and in Asia, with a strong presence all over the world.

With over eight years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of What is Crypto Mining and How to Start Your Mining Career.

If you are looking for a job or an internship, click over to use the 9cv9 Job Portal to find your next top job and internship now.

What is Crypto Mining and How to Start Your Mining Career

- What is Crypto Mining?

- Getting Started with Crypto Mining

- Steps to Begin Your Mining Career

- Understanding the Economics of Crypto Mining

- Navigating Regulatory and Environmental Concerns

- Evolving Trends in Crypto Mining

- Risks and Challenges

1. What is Crypto Mining?

Cryptocurrency mining serves as the backbone of blockchain networks, facilitating transaction validation and securing decentralized digital ledgers.

Here’s an in-depth exploration of the concept, its mechanics, and its significance in the world of digital finance:

Understanding the Concept of Crypto Mining

- Decentralized Verification: Crypto mining involves the decentralized verification of transactions on blockchain networks. Miners validate and record transactions, ensuring the integrity and immutability of the digital ledger.

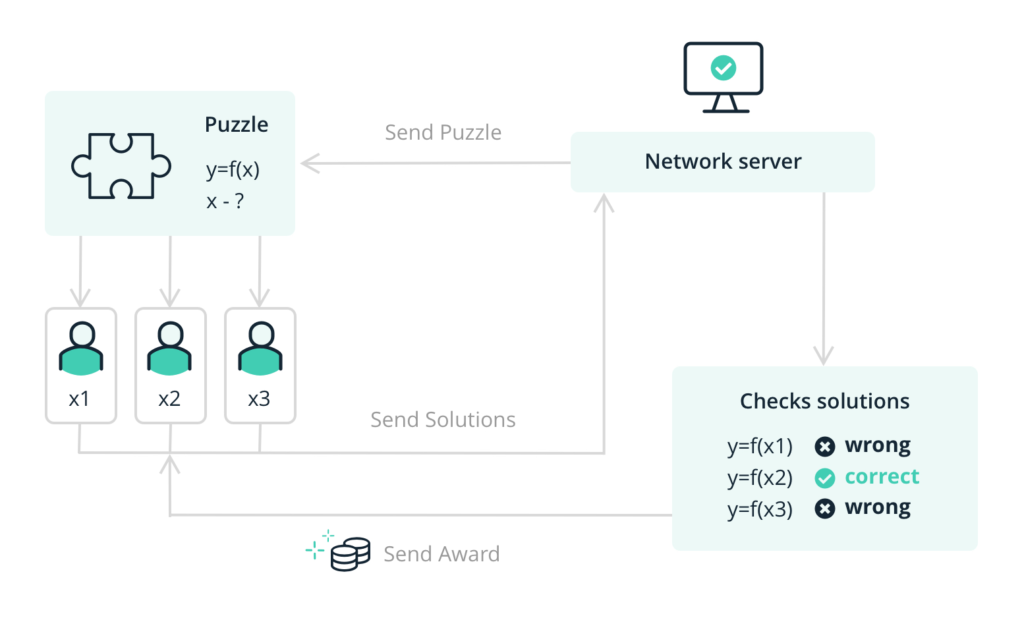

- Proof-of-Work (PoW): Most cryptocurrencies, including Bitcoin and Ethereum, utilize the Proof-of-Work consensus mechanism. In PoW, miners compete to solve complex mathematical puzzles to validate transactions and add new blocks to the blockchain.

- Proof-of-Stake (PoS): In contrast to PoW, PoS relies on validators who are chosen to create new blocks based on their ownership stake in the cryptocurrency. PoS requires less computational power and energy compared to PoW, making it an environmentally friendly alternative.

The Role of Miners in Crypto Networks

- Transaction Validation: Miners play a crucial role in validating transactions by solving cryptographic puzzles. Once verified, transactions are added to the blockchain, ensuring transparency and security within the network.

- Network Security: Mining contributes to the security of blockchain networks by preventing double-spending and malicious attacks. The computational effort required to mine blocks deters adversaries from manipulating the blockchain.

- Issuance of New Coins: As a reward for their efforts, miners are incentivized with newly minted coins. This process, known as coinbase reward, serves as the primary mechanism for distributing new units of cryptocurrency into circulation.

Mechanics of Crypto Mining

- Hash Functions: Mining involves the computation of hash functions, which transform input data into a fixed-size string of characters. Miners must find a hash value that meets specific criteria, known as the target, to create a new block.

- Mining Difficulty: The mining difficulty adjusts dynamically to maintain a consistent block generation rate. As more miners join the network, the difficulty increases to ensure that blocks are mined at a predetermined interval, typically every 10 minutes for Bitcoin.

- Block Rewards: Miners receive block rewards for successfully mining a new block. In addition to the coinbase reward, miners may also earn transaction fees associated with the transactions included in the block.

Examples of Crypto Mining

- Bitcoin Mining: Bitcoin, the pioneering cryptocurrency, relies on PoW mining for transaction validation and block generation. Bitcoin miners compete to solve complex mathematical puzzles using specialized hardware called ASICs (Application-Specific Integrated Circuits).

- Ethereum Mining: Ethereum, the second-largest cryptocurrency by market capitalization, currently utilizes PoW but has transited to a PoS consensus mechanism known as Ethereum 2.0. Ethereum miners use GPUs (Graphics Processing Units) to mine Ether, the native cryptocurrency of the Ethereum network.

- Other Cryptocurrencies: Beyond Bitcoin and Ethereum, numerous cryptocurrencies employ mining as a means of transaction validation and block creation. Examples include Litecoin, Bitcoin Cash, and Monero, each with its unique mining algorithm and reward structure.

Significance of Crypto Mining

- Decentralization: Mining decentralizes the validation process, removing the need for a central authority to oversee transactions. This decentralization enhances transparency, security, and censorship resistance within cryptocurrency networks.

- Incentive Mechanism: Mining serves as an incentive mechanism, rewarding miners for their computational efforts and ensuring the continued operation and security of blockchain networks.

- Technological Innovation: The pursuit of mining profitability drives technological innovation, leading to advancements in hardware, software, and energy-efficient mining techniques.

Crypto mining lies at the core of blockchain technology, enabling the secure and decentralized operation of cryptocurrency networks.

By understanding the mechanics and significance of mining, individuals can navigate the dynamic landscape of digital finance and participate in the transformative potential of cryptocurrencies.

2. Getting Started with Crypto Mining

Embarking on a journey into the world of crypto mining can be both exhilarating and daunting.

From selecting the right cryptocurrency to configuring your mining rig, here’s a comprehensive guide to kickstarting your mining career:

Choosing the Right Cryptocurrency

- Research and Analysis: Conduct thorough research to identify cryptocurrencies with mining potential. Consider factors such as market demand, mining difficulty, and potential profitability.

- Popular Choices: Bitcoin and Ethereum are among the most popular cryptocurrencies for mining, but other options like Litecoin, Monero, and Zcash also offer mining opportunities.

- Profitability Calculations: Use online calculators and profitability tools to estimate potential earnings based on factors like current hash rate, mining difficulty, and electricity costs.

Setting Up Your Mining Rig

- Hardware Selection: Choose the appropriate hardware for your mining rig based on the mining algorithm of your chosen cryptocurrency. Options include ASICs (Application-Specific Integrated Circuits) for Bitcoin and GPU (Graphics Processing Unit) rigs for Ethereum and other GPU-minable coins.

- Mining Software: Install mining software compatible with your hardware and chosen cryptocurrency. Popular mining software options include CGMiner, BFGMiner, and Claymore’s Dual Miner.

- Operating System: Select a suitable operating system for your mining rig, such as Windows, Linux, or specialized mining distributions like ethOS and SimpleMining.

Joining a Mining Pool vs. Solo Mining

- Mining Pools: Consider joining a mining pool to increase your chances of earning consistent rewards. Mining pools allow multiple miners to combine their computational power and share block rewards proportionally based on their contribution.

- Advantages of Mining Pools: Mining pools offer a more steady income stream compared to solo mining, especially for miners with limited hardware resources. They also provide support and troubleshooting assistance to members.

- Solo Mining: Solo mining involves mining independently without joining a pool. While solo mining offers the potential for higher rewards if you successfully mine a block, it’s inherently more unpredictable due to the randomness of block discovery.

Wallets and Security

- Selecting a Wallet: Choose a secure cryptocurrency wallet to store your mined coins. Options include hardware wallets, software wallets, and online wallets. Consider factors such as security features, ease of use, and compatibility with your chosen cryptocurrency.

- Security Best Practices: Implement security best practices to protect your mining earnings from theft and hacking. Use strong, unique passwords, enable two-factor authentication, and keep your wallet software and operating system up to date with the latest security patches.

- Backup and Recovery: Backup your wallet’s private keys or recovery seed phrase in a secure location to ensure you can access your funds in case of loss or theft. Consider storing backups offline or using encrypted storage solutions.

Example: Setting Up an Ethereum Mining Rig

- Hardware: Purchase a GPU mining rig consisting of multiple graphics cards, a motherboard, CPU, RAM, power supply unit (PSU), and storage device.

- Mining Software: Install mining software such as Claymore’s Dual Miner or PhoenixMiner, compatible with Ethereum’s Ethash mining algorithm.

- Operating System: Install a Linux-based operating system like Ubuntu or a specialized mining distribution like ethOS for optimal mining performance.

- Joining a Pool: Choose an Ethereum mining pool like Ethermine or SparkPool and configure your mining software to connect to the pool’s stratum server.

- Wallet Setup: Create an Ethereum wallet using a secure wallet service like MyEtherWallet or hardware wallets like Ledger Nano S or Trezor. Configure your mining software to direct mined Ether to your wallet address.

Getting started with crypto mining requires careful planning, research, and investment in hardware and software.

By selecting the right cryptocurrency, configuring your mining rig, joining a mining pool, and ensuring wallet security, you can embark on a rewarding mining journey and contribute to the decentralized ecosystem of cryptocurrencies.

3. Steps to Begin Your Mining Career

Embarking on a mining career in the realm of cryptocurrencies requires careful planning, investment, and dedication.

Here’s a comprehensive guide outlining the essential steps to kickstart your mining journey:

Research and Education

- Understand the Basics: Familiarize yourself with the fundamental concepts of cryptocurrency mining, including proof-of-work (PoW) and proof-of-stake (PoS) consensus mechanisms, mining algorithms, and block rewards.

- Explore Different Cryptocurrencies: Research various cryptocurrencies and their mining potential. Consider factors such as mining difficulty, block rewards, and market demand to identify promising mining opportunities.

- Stay Updated: Keep abreast of the latest developments and trends in the cryptocurrency mining industry through online forums, news outlets, and social media channels. Join mining communities to engage with experienced miners and gain insights into best practices.

Selecting the Right Equipment

- Choose Your Mining Hardware: Select suitable mining hardware based on the mining algorithm of your chosen cryptocurrency. Options include ASICs (Application-Specific Integrated Circuits) for PoW coins like Bitcoin and GPU (Graphics Processing Unit) rigs for PoW and PoS cryptocurrencies.

- Consider Energy Efficiency: Opt for energy-efficient hardware to minimize electricity costs and maximize profitability. Look for hardware models with high hash rates and low power consumption to achieve optimal mining performance.

- Evaluate Budget and Resources: Assess your budget and available resources to determine the scale of your mining operation. Consider factors such as hardware costs, electricity expenses, and space requirements when planning your mining setup.

Installation and Configuration

- Set Up Your Mining Rig: Assemble your mining hardware components according to manufacturer instructions. Ensure proper ventilation and cooling to prevent overheating and hardware damage.

- Install Mining Software: Download and install mining software compatible with your hardware and chosen cryptocurrency. Configure the software settings, including pool connection details, wallet address, and mining intensity.

- Optimize Performance: Fine-tune your mining software settings to optimize hash rates and maximize mining efficiency. Experiment with different configurations and parameters to achieve the best results for your hardware setup.

Monitoring and Maintenance

- Monitor Mining Operations: Keep a close eye on your mining operation’s performance, including hash rates, temperatures, and hardware health. Use monitoring tools and software to track metrics and detect any issues or anomalies.

- Perform Regular Maintenance: Implement a maintenance schedule to clean and maintain your mining hardware regularly. Remove dust buildup, replace worn-out components, and troubleshoot any hardware or software issues promptly to ensure uninterrupted mining operations.

- Stay Updated with Software Updates: Keep your mining software up to date with the latest releases and patches. Update firmware and drivers for your mining hardware to benefit from performance improvements and security fixes.

Example: Setting Up a Bitcoin Mining Operation

- Hardware Selection: Purchase specialized Bitcoin mining hardware, such as ASIC miners from reputable manufacturers like Bitmain or MicroBT.

- Mining Pool Selection: Choose a Bitcoin mining pool with a proven track record and a high hash rate share, such as F2Pool or Poolin.

- Mining Software Installation: Install Bitcoin mining software compatible with your ASIC miners, such as CGMiner or Braiins OS. Configure the software to connect to your chosen mining pool and input your Bitcoin wallet address.

- Optimization and Monitoring: Fine-tune your mining software settings to achieve optimal hash rates and monitor your mining operation’s performance using pool dashboards and monitoring tools.

Beginning a mining career in the world of cryptocurrencies requires thorough research, strategic planning, and hands-on technical expertise.

By following these steps and leveraging relevant examples, aspiring miners can embark on a rewarding journey towards becoming proficient contributors to the decentralized ecosystem of cryptocurrencies.

4. Understanding the Economics of Crypto Mining

Cryptocurrency mining involves not only technical expertise but also an understanding of the economic factors that influence profitability.

Here’s an in-depth exploration of the economics behind crypto mining:

Cost Analysis

- Electricity Costs: Electricity consumption is a significant expense in crypto mining, especially for Proof-of-Work (PoW) cryptocurrencies like Bitcoin. Miners must consider electricity rates in their location and the energy efficiency of their mining hardware.

- Hardware Investment: The initial investment in mining hardware, such as ASICs or GPUs, represents a substantial upfront cost for miners. Hardware prices fluctuate based on demand, supply, and technological advancements.

- Operating Expenses: Other operating expenses, including cooling, maintenance, and internet connectivity, contribute to the overall cost of mining. Miners must factor in these expenses when calculating profitability.

Revenue Generation

- Block Rewards: Miners are rewarded with newly minted coins, known as block rewards, for successfully mining a new block. The block reward varies depending on the cryptocurrency’s protocol and block subsidy schedule.

- Transaction Fees: In addition to block rewards, miners earn transaction fees for including transactions in the blocks they mine. Transaction fees serve as an incentive for miners to prioritize transactions with higher fees.

- Mining Pools: Miners who join mining pools share block rewards and transaction fees with other pool members based on their contribution to the pool’s total hash rate. Pool fees, typically a small percentage of earnings, are deducted from miners’ rewards.

Return on Investment (ROI) Calculations

- ROI Metrics: Miners calculate ROI using various metrics, including payback period, break-even point, and profitability ratio. These metrics help miners assess the viability of their mining operation and determine when they can expect to recoup their initial investment.

- Difficulty Adjustment: The mining difficulty of PoW cryptocurrencies adjusts dynamically to maintain a consistent block generation rate. Changes in difficulty impact mining profitability, as higher difficulty levels require more computational power to mine blocks.

- Market Volatility: Cryptocurrency prices are highly volatile, impacting mining profitability. Miners must consider price fluctuations and market trends when projecting future earnings and assessing ROI.

Example: Bitcoin Mining Economics

- Electricity Costs: Bitcoin mining profitability is heavily influenced by electricity costs, as the network’s energy consumption continues to rise. Miners often seek locations with cheap electricity, such as regions with hydroelectric power or renewable energy sources.

- Halving Events: Bitcoin undergoes halving events approximately every four years, reducing block rewards by half. The most recent halving in May 2020 decreased block rewards from 12.5 BTC to 6.25 BTC, affecting miners’ revenue streams.

- Mining Difficulty: Bitcoin’s mining difficulty adjusts approximately every two weeks to maintain a target block time of 10 minutes. Increasing difficulty levels require more computational power, impacting operational costs and profitability for miners.

Environmental and Social Considerations

- Environmental Impact: Concerns about the environmental impact of crypto mining, particularly Bitcoin mining, have sparked debates about sustainability and energy consumption. Miners are exploring alternative energy sources and eco-friendly mining practices to mitigate their carbon footprint.

- Regulatory Challenges: Regulatory uncertainty and evolving legal frameworks pose challenges for miners, especially in jurisdictions with strict regulations or bans on cryptocurrency mining. Compliance with environmental regulations and energy policies is essential for sustainable mining operations.

Understanding the economics of crypto mining is essential for miners to navigate the complexities of profitability, ROI calculations, and environmental considerations.

By carefully analyzing costs, revenue streams, and market dynamics, miners can make informed decisions to optimize their mining operations and contribute responsibly to the decentralized ecosystem of cryptocurrencies.

5. Navigating Regulatory and Environmental Concerns

As the popularity of cryptocurrency mining continues to soar, miners face an array of regulatory and environmental challenges.

Here’s a detailed exploration of the regulatory landscape and environmental considerations impacting crypto mining:

Legal Considerations

- Global Regulatory Patchwork: Cryptocurrency regulations vary significantly from one country to another, creating a complex regulatory landscape for miners to navigate. Some countries embrace cryptocurrencies, while others impose strict regulations or outright bans.

- Licensing and Compliance: Miners may be required to obtain licenses or permits from regulatory authorities to operate legally. Compliance with anti-money laundering (AML) and know your customer (KYC) regulations is essential to prevent illicit activities and ensure regulatory compliance.

- Taxation Policies: Taxation policies for cryptocurrency mining income differ across jurisdictions, impacting miners’ profitability. Miners must understand their tax obligations and keep detailed records of their mining activities for tax reporting purposes.

Environmental Impact

- Energy Consumption: Cryptocurrency mining, particularly Proof-of-Work (PoW) mining, consumes a significant amount of energy. Bitcoin mining, in particular, has drawn criticism for its high energy consumption, with estimates suggesting it consumes as much energy as some small countries.

- Carbon Footprint: The carbon footprint of cryptocurrency mining has raised concerns about its environmental impact. Critics argue that the reliance on fossil fuels for energy generation exacerbates climate change and undermines sustainability efforts.

- Renewable Energy Solutions: Some miners are exploring renewable energy sources, such as hydroelectric, solar, and wind power, to mitigate the environmental impact of mining. Mining operations powered by renewable energy can reduce carbon emissions and promote sustainability.

Regulatory Examples

- China’s Crackdown: China, home to a significant portion of the world’s cryptocurrency mining operations, has implemented crackdowns on crypto mining due to concerns about energy consumption and financial risks. Several provinces have imposed restrictions or outright bans on mining activities.

- Regulatory Clarity in Europe: European countries, such as Switzerland and Sweden, have adopted more crypto-friendly regulatory frameworks, providing clarity and legal certainty for miners. Switzerland, in particular, has emerged as a hub for crypto mining due to its favorable regulatory environment.

- United States Regulatory Developments: The United States is seeing regulatory developments at both the federal and state levels. While federal agencies like the SEC and CFTC provide guidance on crypto-related activities, individual states have implemented their own regulatory approaches, leading to a patchwork of regulations.

Best Practices for Compliance and Sustainability

- Engage with Regulators: Stay informed about regulatory developments and engage with regulatory authorities to ensure compliance with local laws and regulations. Seek legal counsel to navigate complex regulatory requirements and mitigate regulatory risks.

- Implement Sustainable Practices: Minimize the environmental impact of mining by adopting energy-efficient hardware, optimizing mining operations, and sourcing energy from renewable sources. Explore innovative solutions, such as heat recovery and energy storage, to increase sustainability.

- Community Engagement: Foster positive relationships with local communities and stakeholders by communicating transparently about mining activities and addressing environmental concerns. Collaborate with policymakers, environmental organizations, and industry stakeholders to develop sustainable mining practices.

Navigating regulatory and environmental concerns is essential for the long-term viability and sustainability of cryptocurrency mining operations.

By staying informed about regulatory requirements, adopting sustainable practices, and engaging with stakeholders, miners can mitigate risks, ensure compliance, and contribute positively to the evolving landscape of crypto mining.

6. Evolving Trends in Crypto Mining

Cryptocurrency mining is a dynamic and rapidly evolving field, driven by technological innovation, regulatory changes, and market trends.

Here’s an in-depth exploration of the latest trends shaping the future of crypto mining:

Shift Towards Alternative Consensus Mechanisms

- Proof-of-Stake (PoS): PoS consensus mechanisms, which rely on validators rather than miners to secure the network, are gaining traction as an alternative to traditional PoW mining. PoS requires less energy and computational power, making it more environmentally friendly.

- Proof-of-Authority (PoA): PoA is another consensus mechanism that delegates block validation to a select group of trusted validators, reducing the need for extensive computational resources. PoA is often used in enterprise blockchain networks and consortium chains.

- Example: VeChain, a blockchain platform focused on supply chain management and enterprise solutions, utilizes a PoA consensus mechanism to achieve scalability and efficiency.

Emergence of Eco-Friendly Mining Solutions

- Renewable Energy Integration: Miners are increasingly turning to renewable energy sources, such as solar, wind, and hydroelectric power, to power their mining operations. Renewable energy solutions help mitigate the environmental impact of mining and promote sustainability.

- Example: The Greenidge Generation power plant in New York repurposed a portion of its energy output for Bitcoin mining, leveraging hydroelectric power to support eco-friendly mining operations.

- Energy-Efficient Hardware: Hardware manufacturers are developing energy-efficient mining equipment to reduce energy consumption and operational costs. Innovations in ASIC and GPU technology aim to improve hash rates while minimizing power consumption.

- Example: Bitmain’s Antminer S19 series and MicroBT’s Whatsminer M30 series are among the latest ASIC miners designed for increased energy efficiency and mining performance.

Decentralized Mining Pools and Protocols

- DeFi Mining Protocols: Decentralized finance (DeFi) platforms are introducing novel mining protocols that incentivize liquidity provision and participation in decentralized governance. DeFi mining protocols offer opportunities for users to earn rewards by staking tokens or providing liquidity.

- Example: Yearn Finance’s yEarn Vaults allow users to automatically farm yield from various DeFi protocols, earning rewards in the form of native tokens or yield-bearing assets.

- Decentralized Mining Pools: Decentralized mining pools are emerging as an alternative to traditional centralized pools, offering increased transparency, security, and control over mining rewards. Decentralized pool protocols utilize smart contracts to facilitate trustless participation and reward distribution.

- Example: PoolTogether, a decentralized no-loss lottery platform, introduced PoolTogether Pods, allowing users to participate in decentralized mining pools and earn rewards without risking their principal.

Adoption of Layer 2 Scaling Solutions

- Layer 2 Solutions: Layer 2 scaling solutions, such as sidechains and state channels, aim to improve scalability and reduce transaction fees on blockchain networks. By offloading transaction processing from the main chain, layer 2 solutions enhance network throughput and efficiency.

- Example: The Lightning Network, a layer 2 scaling solution for Bitcoin, enables instant, low-cost micropayments by conducting transactions off-chain and settling periodically on the Bitcoin blockchain.

- Optimistic Rollups: Optimistic rollups are a type of layer 2 scaling solution that aggregates multiple transactions into a single data layer before submitting them to the main chain. By batching transactions, optimistic rollups achieve higher throughput and lower fees while maintaining security guarantees.

- Example: Synthetix, a decentralized synthetic asset issuance platform, implemented optimistic rollups to enhance scalability and reduce transaction costs for its users.

Integration of AI and Machine Learning

- AI-Based Optimization: Miners are leveraging artificial intelligence (AI) and machine learning algorithms to optimize mining operations, enhance predictive analytics, and improve efficiency. AI-powered algorithms can analyze vast amounts of data to optimize hash rates, energy consumption, and hardware performance.

- Example: Cudo Miner, a cryptocurrency mining software, utilizes machine learning algorithms to dynamically adjust mining settings and maximize profitability based on real-time market conditions and hardware performance.

- Predictive Maintenance: AI-driven predictive maintenance solutions help miners identify potential hardware failures and performance bottlenecks before they occur. By analyzing sensor data and historical maintenance records, predictive maintenance algorithms can schedule proactive repairs and minimize downtime.

- Example: NVIDIA’s GeForce RTX series graphics cards feature AI-powered thermal sensors that monitor temperature fluctuations and adjust fan speeds to optimize cooling performance and prolong hardware lifespan.

The evolving trends in crypto mining reflect a broader shift towards sustainability, decentralization, and technological innovation.

By embracing alternative consensus mechanisms, eco-friendly solutions, decentralized protocols, and cutting-edge technologies, miners can navigate the dynamic landscape of crypto mining and contribute to the ongoing evolution of blockchain ecosystems.

7. Risks and Challenges

Crypto mining presents numerous risks and challenges that miners must navigate to ensure profitability and sustainability.

Here’s an in-depth exploration of the key risks and challenges faced by miners in the dynamic world of cryptocurrency mining:

Market Volatility

- Price Fluctuations: Cryptocurrency prices are highly volatile, subject to rapid and unpredictable fluctuations. Price volatility directly impacts mining profitability, as changes in the value of mined coins can affect revenue streams.

- Example: The 2018 cryptocurrency market crash saw Bitcoin’s price plummet from nearly $20,000 to below $4,000 within a year, significantly impacting mining profitability for miners.

- Impact on ROI: Market volatility can delay ROI (Return on Investment) for mining hardware investments, making it challenging for miners to recoup their initial capital outlay. Miners must factor in price volatility when projecting future earnings and assessing mining viability.

Technological Obsolescence

- Rapid Advancements: The cryptocurrency mining industry evolves rapidly, with new hardware models and mining algorithms constantly being introduced. Technological obsolescence poses a risk to miners who may see their equipment become outdated and less profitable over time.

- Example: The introduction of more efficient ASIC miners for Bitcoin mining has rendered older hardware obsolete, leading to a decline in profitability for miners using outdated equipment.

- Continuous Upgrades: Miners must stay abreast of technological advancements and upgrade their hardware regularly to remain competitive. Failure to upgrade may result in diminished mining performance and reduced profitability.

Security Threats

- Cybersecurity Risks: Crypto mining operations are susceptible to cybersecurity threats, including malware, hacking, and unauthorized access. Malicious actors may target mining rigs, wallets, and mining pools to steal funds or disrupt mining operations.

- Example: In 2018, the cryptojacking malware “Coinhive” infected thousands of websites, harnessing visitors’ computational resources to mine cryptocurrency without their consent.

- Phishing Attacks: Miners may fall victim to phishing attacks, where attackers impersonate mining pool operators or hardware manufacturers to steal login credentials or sensitive information. Miners must exercise caution and implement robust security measures to protect against phishing attempts.

Regulatory Uncertainty

- Legal and Regulatory Risks: Cryptocurrency mining operates in a regulatory gray area in many jurisdictions, with evolving laws and regulations impacting mining activities. Regulatory uncertainty poses risks for miners, who may face compliance challenges or legal sanctions.

- Example: China’s crackdown on cryptocurrency mining in 2021 resulted in the closure of numerous mining operations, highlighting the regulatory risks associated with mining activities in certain jurisdictions.

- Taxation and Reporting Requirements: Taxation policies for cryptocurrency mining income vary across jurisdictions, with miners facing complex reporting requirements and potential tax liabilities. Miners must ensure compliance with tax laws and seek guidance from tax professionals.

Energy Consumption and Environmental Concerns

- Energy Intensive Operations: Proof-of-Work (PoW) mining, particularly for cryptocurrencies like Bitcoin, consumes vast amounts of energy, raising concerns about sustainability and environmental impact.

- Example: Bitcoin mining has been criticized for its high energy consumption, with estimates suggesting it consumes more electricity than some small countries.

- Environmental Impact: The environmental footprint of crypto mining has prompted calls for sustainable mining practices and renewable energy solutions. Miners face pressure to reduce their carbon emissions and adopt eco-friendly mining technologies.

- Example: Some mining operations are exploring renewable energy sources, such as solar and wind power, to power their operations and mitigate their environmental impact.

Navigating the risks and challenges in crypto mining requires diligence, adaptability, and strategic planning.

By addressing market volatility, technological obsolescence, security threats, regulatory uncertainty, and environmental concerns, miners can mitigate risks and position themselves for long-term success in the dynamic landscape of cryptocurrency mining.

Conclusion

Delving into the intricacies of crypto mining unveils a world teeming with both opportunity and challenge.

As we’ve explored throughout this guide, crypto mining serves as the backbone of blockchain technology, facilitating transaction validation, securing decentralized networks, and minting new cryptocurrency units.

It’s a dynamic process that demands technical prowess, strategic planning, and an understanding of the economic and environmental factors at play.

For aspiring miners, embarking on a mining career requires careful consideration and meticulous preparation.

From selecting the right cryptocurrency and hardware to navigating regulatory hurdles and optimizing profitability, the path to mining success is multifaceted and ever-evolving.

However, armed with the knowledge and insights gleaned from this guide, individuals can embark on their mining journey with confidence and determination.

As we look towards the future, the landscape of crypto mining continues to evolve, driven by technological innovation, regulatory changes, and shifting market dynamics.

Emerging trends such as the adoption of alternative consensus mechanisms, the integration of eco-friendly mining solutions, and the development of decentralized protocols herald a new era of possibility for miners worldwide.

Yet, amidst the promise of innovation and opportunity, miners must also remain vigilant against the risks and challenges that accompany the crypto mining industry.

Market volatility, technological obsolescence, security threats, regulatory uncertainty, and environmental concerns loom large, demanding constant vigilance and adaptability from miners seeking to thrive in this dynamic ecosystem.

In navigating these challenges, miners must draw upon their resilience, resourcefulness, and commitment to sustainability.

By embracing best practices, staying informed about industry developments, and fostering a culture of collaboration and responsibility, miners can contribute to the continued growth and maturation of the crypto mining sector.

Ultimately, crypto mining represents more than just a means of generating passive income; it embodies a transformative force reshaping the landscape of finance and technology.

As individuals embark on their mining careers, they become integral participants in the decentralized revolution, driving innovation, fostering decentralization, and shaping the future of digital finance.

So, whether you’re a seasoned miner or a newcomer eager to explore the possibilities of crypto mining, remember that the journey ahead is as rewarding as it is challenging.

With perseverance, dedication, and a commitment to excellence, your mining career holds the promise of endless opportunities in the ever-expanding universe of cryptocurrencies.

If you find this article useful, why not share it with your friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

If you are keen to find a job or internship, then click on 9cv9 Job Portal now.

People Also Ask

Is crypto mining Legal?

Yes, crypto mining is legal in most countries, although regulations vary. Some countries impose restrictions or bans, while others have favorable regulatory environments. It’s essential for miners to comply with local laws and regulations governing cryptocurrency mining activities.

What is cryptocurrency mining?

Cryptocurrency mining is the process of validating transactions and adding them to a blockchain ledger. Miners use powerful computers to solve complex mathematical puzzles, securing the network and earning rewards in the form of newly minted coins and transaction fees.

Is crypto mining profitable?

Crypto mining can be profitable, but profitability depends on factors like electricity costs, hardware efficiency, and cryptocurrency prices. It requires significant initial investment and ongoing operational expenses. Research, strategic planning, and staying informed are essential for maximizing profitability.

![Writing A Good CV [6 Tips To Improve Your CV] 6 Tips To Improve Your CV](https://blog.9cv9.com/wp-content/uploads/2020/06/2020-06-02-2-100x70.png)