If you’re a startup founder or the director of a company, you might be worried about cost inflation in Singapore.

Excessive inflation has been the talk of the town.

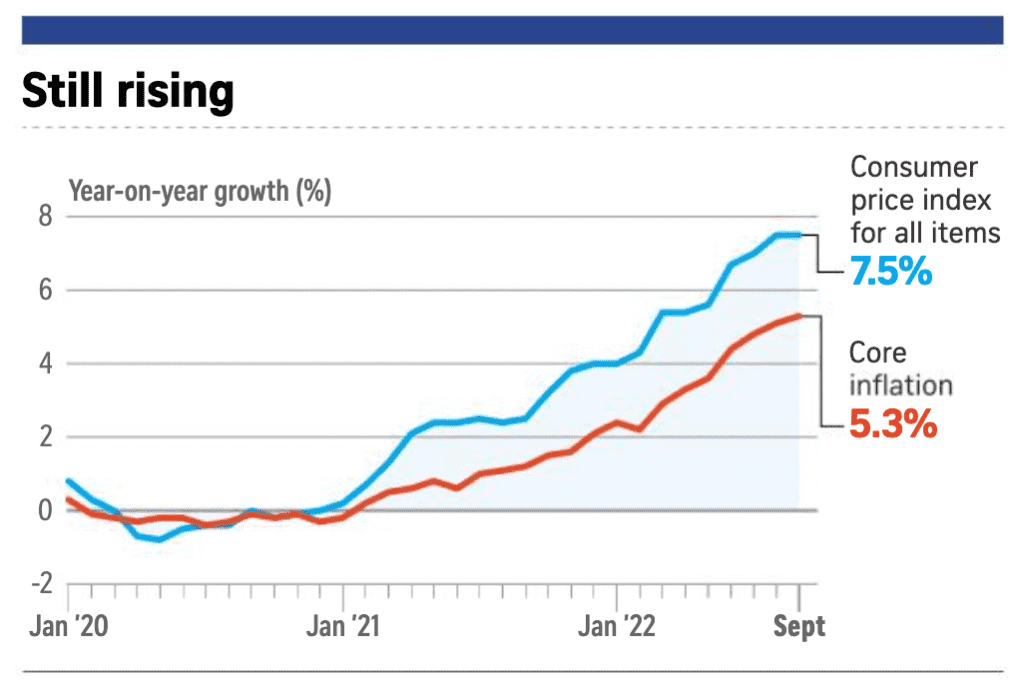

In August 2022, Singapore’s headline consumer price index (CPI) and core inflation reached 7.5% and 5.1%, respectively, the highest level in 14 years.

In September, the CPI remained stubbornly at 7.5%, which again matched the highest level in 14 years (See image below).

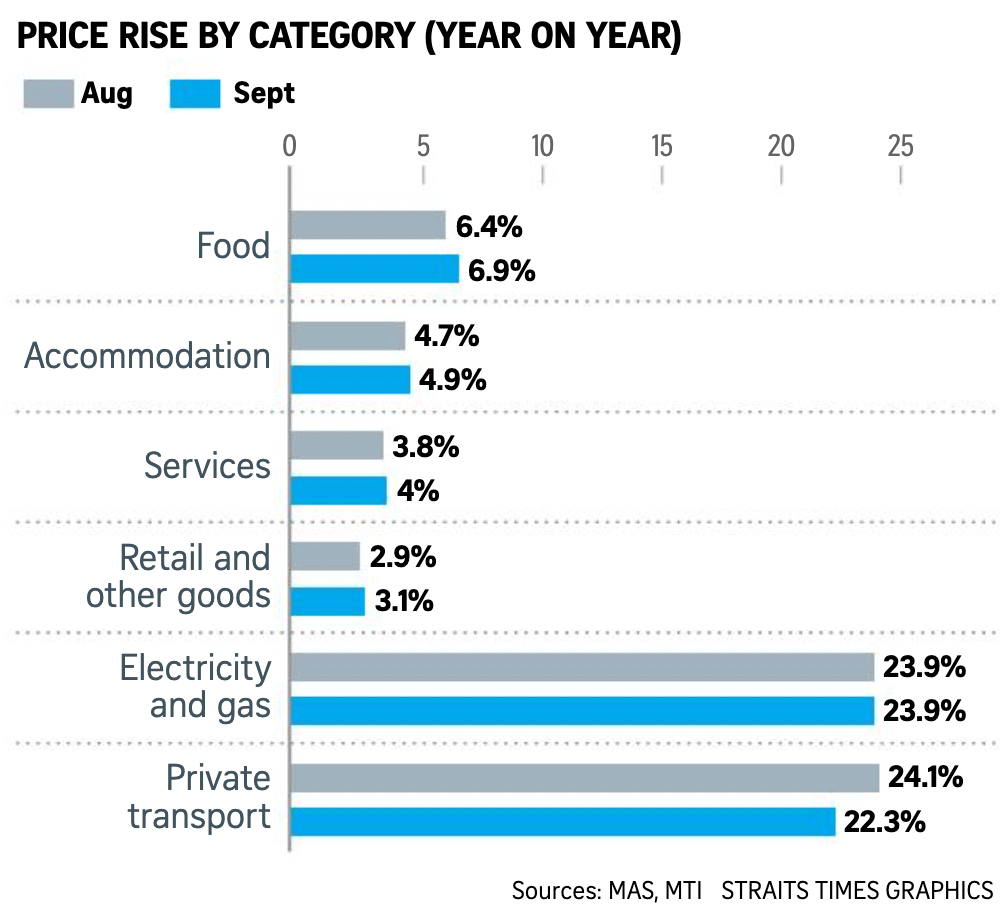

Year-on-year, the price rise is the highest for private transportation, electricity, and gas. These could portend greater inflationary pressure and possibly, a recession in the next year.

According to a news report, 6 out of 10 workers will more likely request a salary increase, as household commodities, services, and goods are greater costly than ever at the moment.

The number increases to 70% for the age group of 25-34 years old.

The higher the inflation level in Singapore, the more likely employees and workers will call for or request for an increase in salary, or they will be tendering their resignation to find jobs that offer a higher salary.

So how then, as business owners, directors, and C-level management level, can we deal with this unbridled spiraling of inflation?

In this article, we will share five tips and techniques for beating business cost inflation in Singapore.

After learning our tips, it will allow your company to mitigate soaring salary expenses and thereafter to achieve sustainable growth.

About us

Having more than 5 years of experience in doing business in Singapore, 9cv9 has seen it all, heard it all, and done it all.

In this article, the 9cv9 research team has condensed and distilled all our learnings in producing some of the best tips and techniques to fight cost inflation for business owners.

If you are a business owner, director, C-level management, country manager in charge of the Profit-&-Loss (“P&L”) in Singapore, or even a founder, then this article is perfect for you to understand the best tips and strategies to beat cost inflation in Singapore.

What is inflation?

According to the International Monetary Fund, “Inflation is the rate of increase in prices over a given period of time. Inflation is typically a broad measure, such as the overall increase in prices or the increase in the cost of living in a country.”

Every month, as the prices of goods and services increase, the inflation rate is positive.

A growing inflation rate means that prices are increasing at an increasing rate, resulting in a faster loss of value in savings.

This creates Salary Inflation, which is the gradual increase in wages that happens over time

The workers are smart enough to recognize that fact.

As a result, more workers will request an increase in their wages in a bid to keep up with the inflation rate.

This reduces the currency’s buying power due to the fact more money is needed to buy the same product now than in the past.

This type of inflationary pressure is called “Built-In” inflation in economics.

According to Investopedia, “As the price of goods and services rises, people may expect a continuous rise in the future at a similar rate. As such, workers may demand more costs or wages to maintain their standard of living.”

Given that workers demand high wages, businesses have no choice but to increase the prices, which leads to higher inflation, which then leads back again to the workers demanding even higher wages.

Hence, creating inflation. But, how did such inflation or what cause such inflation?

What are the root causes of inflation in Singapore?

There are some causes of inflation in Singapore that have slowed the economy and decreased the purchasing power of consumers.

The following factors contribute to inflationary pressures.

Extreme climate occurrence

Weather or natural disasters are purportedly thought of to have an effect on inflation.

Due to a lack of resources, Singapore imports almost everything that it consumes, from staple foods such as rice, maize, bread, sugar, coffee, milk, clothes, and most if not all daily necessities, etc.

According to the Singapore Food Agency, Singapore currently imports more than 90% of its food from more than 170 countries and regions.

Extreme weather erodes agriculture, reduces arable land, destroys crops and animal husbandry, and impairs supply chain infrastructures, causing a breakdown in the supply of goods and services imported from producing countries.

Foods, clothes, and other daily necessities are actually now expensive because of flooding, heat climate, and different factors.

Extreme heat can for one, pressure farmers and business owners, to order and install new equipment such as air conditioners in the warehouses. In this case, the cost of operating the business will increase which will lead to inflation upstream of the supply chain.

These supply chain problems have contributed to higher freight fees and import costs:

- Farm and factory production problems

- Shipping box scarcity

- Closures of ports

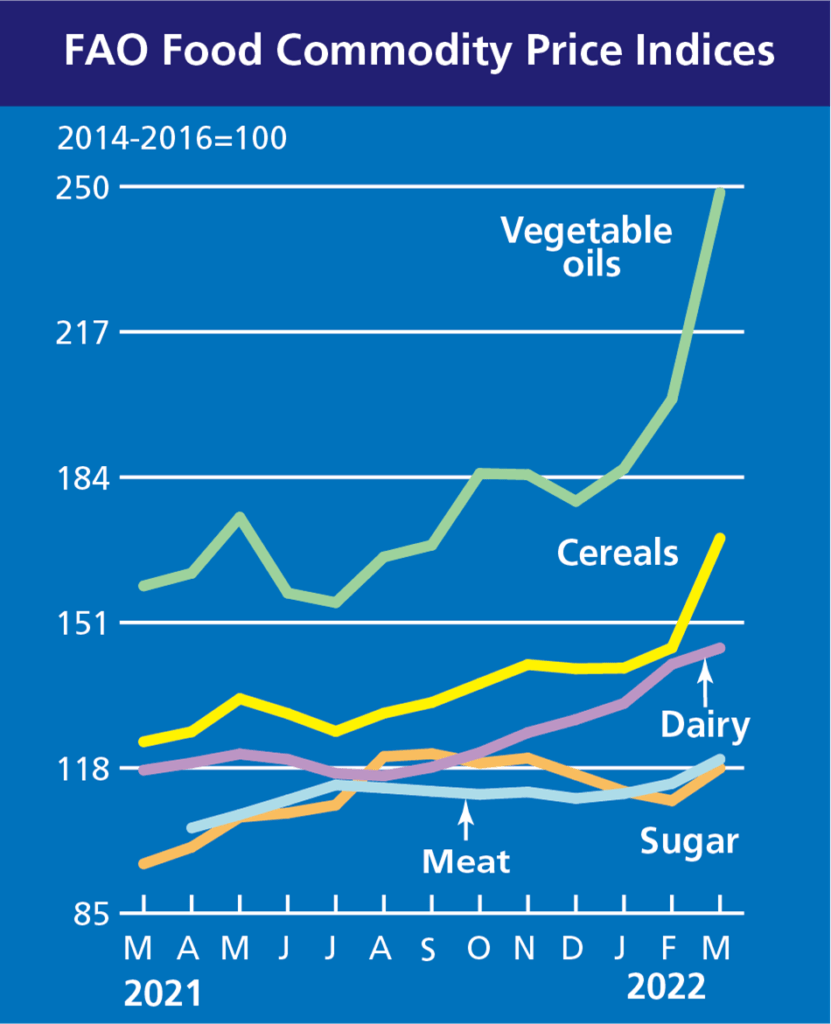

In an interview conducted by CNBC, an owner of a hawker stall selling Japanese rice bowls lamented that the prices of products he bought such as cooking oil, eggs, and meat, have gone up between 30% and 45% over a 6 month period.

In the graph below, we can already see that the prices of most commodities have increased worldwide, month-on-month since March 2021.

Global Raw Material Scarcity

Since early 2021, there has been a global chip scarcity.

This was because of sudden pandemic-driven demand from certain industries, together with smartphones and computers.

Long lead instances and complicated multinational supply chains have additionally contributed to chip scarcity, which has led to exchange rate increases for imported consumer goods.

According to Achilles report, “In Q4 of 2021, supply chain resilience dropped to a score of 44.9, which is only marginally above the 40% ‘high-risk’ threshold. Prices also rose by 12% compared to the previous three months”

This means that raw material scarcity has affected the level of prices worldwide, and in turn, as Singapore is a small country, it takes the prices of the world.

The Russo-Ukrainian War

An increase in energy can result in higher food production costs.

Natural gas, for example, is an essential factor of fertilizers.

Russia is a primary supplier of gas, metals, oils, and fertilizer, and Ukraine supplies wheat and corn to nations everywhere in the world, including Singapore.

Prices for those commodities have risen because of a reduction in supply. Furthermore, since Russia is the world’s second-largest producer of natural gas, the sanctions imposed by the United States and the European Union on Russia have delivered a supply shock to the world’s economy, including Singapore.

How to Beat Singapore Cost Inflation in 2022

If you own a business or company in Singapore, you’re aware of the excessive cost of doing business.

If having an initial high cost is not enough to deter, it must be disheartening to hear of the soaring cost inflation.

One of the biggest components of cost inflation for businesses is Salary Inflation.

Businesses are under pressure to maintain their employees’ salaries competitive as their cost of living rises and the economic system cools.

To stay ahead of the competition, business owners have to be proactive in dealing with worker fees.

Here are a few strategies and techniques on how to beat business cost inflation in Singapore in 2022:

Top 5 ways to beat cost inflation in Singapore

- Conduct a Salary Review

- Provide other Non-Cash Benefits and Perks

- Reduce Unnecessary Spend

- Focus on Training and Development Programs

- Hire from Other Countries and Offshore

1. Conduct a Salary Review

It is important to check your salaries regularly to make sure that they’re competitive, or that you are over-paying your employees.

Perhaps there might be cheaper alternatives to your employees out there.

This may be done by carrying out regular market surveys or with the aid of using online salary calculators.

Do note however, in Singapore, by the Employment Act, you can only reduce the salary of your employees only for specific reasons.

Scenarios when a reduction in salary may be required or allowed:

- Court Order, or by other valid authority

- If you are an agent for the recovery of income tax, property tax, or Goods and Services Tax (GST) payable by your employee

- If your employee is absent for work

- For damage to the company’s properties, or loss of money or goods. Do note that the reduction cannot be more than 25% of the employee’s 1 month salary

- For supplying accommodation to the employee

- For providing amenities and services that the Commissioner for Labor has authorized and you have accepted.

- For recovery of advances, loans, overpaid salary, or unearned employment benefits

- For CPF contributions

- For payments to any registered Co-operative society, albeit with the written consent of the employee

- For other purposes for which the employee has consented in writing and this consent can be withdrawn at any time.

Therefore, it is typically quite hard to reduce the salary for the employee but due to inflation, the employee might ask for a salary increase.

In this case, you can decline to increase the salary of the employee and instead to stick with the current employment terms and conditions.

Regular salary reviews allow you to compare the asking salary increases to the salary benchmark in your industry and make any necessary adjustments if need be.

If the employee is asking for salary increases that are in line with the industry averages, and to keep pace with inflation, we think it is reasonable to grant that increase (subject to your company’s budgeting).

To ensure that your company remains competitive, HR managers should conduct research, study industry trends, and incorporate their findings into monthly or quarterly salary reviews.

Checking your salary review regularly gives you the insight you need to accommodate or reject salary increase requests from your employees.

This will make your plan well and stay ahead of the inflation issue.

How to Approve or Reject a Salary Increase Request:

Here are the steps to conducting a salary review:

1. Examine the contract terms

2. Think about your budget.

3. Consider the salary review objectives.

4. Consult with the human resources department

5. Verify job descriptions

6. Research market data

7. Create a rating system for your team.

2. Provide other non-cash benefits and perks

An employee compensation package can include cash and non-cash component.

The cash component includes the basic take-home salary and the corresponding taxes, CPF contribution, bonuses, etc

The non-cash component can be flexibility, time to work on their own projects or side hustles, remote working, recognition, awards, etc.

As cash is king, it is important to conserve cash (even though inflationary pressure might diminish its value). Yet, cash is still needed to pay your suppliers and your workers.

By providing non-cash benefits and perks, you not only get to avoid salary increase requests or postpone employee salary increase proposals, but you also get a more productive and driven employee group.

There is a simple hack to provide non-cash benefits.

Work and partner with companies that supply such non-cash benefits. For example, reach out to Fitness First, True Fitness, Anytime Fitness, etc. to see if they have limited free gym passes to give to your employees, or to negotiate a corporate rate for your employees to use their gyms. A win-win scenario.

When there is a high level of motivation in an organization or the presence of non-cash benefits and perks, it will bring out the best and create a strong bond and trust between the employees and you.

This in turn will be advantageous to your company, as it will increase the level of productivity which will ultimately lead to more revenue, countering the effect of cost inflation for your business.

3. Reduce unnecessary spend

If salary expenses can be difficult to reduce or salary increases hard to avoid, then you can try to look to other areas of your P&L statement to optimize.

One area is to split your company expenses into fixed and discretionary spending.

Fixed spending is unavoidable spending such as salary expenses, rental expenses, etc.

Discretionary spending is items that are “good-to-haves” or “wants” and are usually not essential to the core functioning of your company.

These items are entertainment, employee gym packages, business class travel, etc.

An example of reducing unnecessary spending was that announced by SeaGroup.

According to Bloomberg, the CEO of Sea Ltd wrote in an internal memo sent to staff,

“The company will cap business travel to economy class flight fares, with travel meal expenses limited to $30 a day. It will also curb spending on hotel stays for business trips to $150 a night, and cull reimbursement for meals and entertainment bills”

By reducing unnecessary spending such as business travel and other non-core business expenses, companies can beat cost inflation and be lean in their cost department.

You may also streamline your company’s internal processes and workflows.

Cross-training your employees will allow you to maximize the total productivity of your workforce, as each worker can now carry out a wide range of duties across different departments and functions.

4. Focus on Training and Development Programs

Investing in employee training and development programs will assist your employees and workers to enhance their abilities and knowledge.

This will increase their productivity and output to your company so it will help offset any cost increase, i.e., salary increases.

Furthermore, you will make your company stand out among the competition.

This will also offset any salary increase you could offer and might reduce the urge of employees that will be asking for a salary increase. It will also help you retain the best-skilled employees.

The good news is the Government of Singapore, under the purview of SkillsFuture Singapore (“SSG”), offers funding support for employers who sponsor their employees for training.

According to SSG, to enjoy course fee funding, you may register your employee directly with SSG’s training providers delivering SSG-supported courses. You will only need to pay the net course fee (full course fee after SSG’s grant).

Using funding support from the Government can reduce training costs for your employees, and in return, the upskilling will also allow them to reap the benefits of better productivity.

Training employees help increase employee retention and are also cheaper than reskilling since your employees will be more knowledgeable about their roles in the organization.

5. Hire from Other Countries and Offshore

The easiest and most practical way to reduce cost inflation.

Reduce hiring in Singapore and look towards neighboring countries such as Vietnam, Malaysia, Indonesia, the Philippines, and even Myanmar for your human resourcing needs.

Why?

Singapore Dollar is Strong

The Singapore Dollar is one of the strongest in the region.

According to CNBC, “The Singapore Dollar has remained resilient…as compared with its regional peers”.

As you can see from the image below, the Singapore dollar has strengthened quite a bit as compared to the Vietnamese Dong, currently at 1 SGD to 17,541 VND.

This means if you were to hire tech developers or other remote employees in Vietnam, with their salaries priced in fixed Vietnamese Dong, then you will be saving some salary expenses in SGD.

Tip of the day: Hire employees in Vietnam and price their salaries in the local currency

– 9cv9

Similarly, this strategy to leverage the strong monetary currency of the Singapore Dollar can be applied to hiring in Indonesia, Malaysia, and other parts of Southeast Asia.

Price the salary of your remote employees in other countries in their local currencies and you will be reaping the benefits of a stronger Singapore dollar.

Salaries are still relatively low in other countries

According to Glassdoor, the salary of a typical software developer in Singapore is around 5,300 SGD. A typical software developer in Vietnam according to our 9cv9 data is around 2,800 SGD. That means you can save around 44% of your salary expense, just by hiring software engineers in Vietnam.

This is just but an example of the benefit of hiring workers and employees beyond the shores of Singapore. The salaries of workers in Singapore are one of, if not, the highest in the whole of Southeast Asia. This provides an opportunity for the arbitrage of salary levels vis-a-vis the other countries in Southeast Asia.

Do note that not all of the work functions within an organization can be offshore overseas. For example, retail workers that are needed to work physically in the retail stores cannot possibly be hired in Vietnam.

The job roles and functions that are the best to hire overseas are usually software and IT-related since the coding work does not need a physical presence, digital marketing, quality assurance testing, cybersecurity, artificial intelligence and machine learning development, etc.

If you are doing a tech startup or looking to hire tech developers, programmers, or engineers, then read our latest widely acclaimed guide to hiring tech talents in Vietnam.

In addition, if you need an Employer of Record for offshoring your talents overseas in Vietnam, then 9cv9 Offshoring Services is well-placed (and even well-endorsed by the Government of Singapore) to help you hire talents and settle the payroll for them. Find out more here.

Conclusion

To stay afloat and ahead of the competition in Singapore, it is essential to be proactive to deal with cost inflation.

As a business owner, country manager, or founder of your startup, you have to be aware of the potential risks and pitfalls related to soaring high-cost inflation.

In this guide, we briefly shared the origins of cost inflation for businesses in Singapore and prescribed some strategies, tips, and tools to combat cost inflation.

Businesses can stay ahead of cost inflation via means of benchmarking their salaries towards market rates, reviewing their benefits and perks regularly, keeping a close eye on the compensation packages of their competitors, and hiring and offshoring workers and employees in other countries.

One of the most critical risks of cost inflation is the loss of key employees.

You can also find yourself at a disadvantage in terms of attracting and keeping top expertise if you do not know ways of reducing your expenses.

Furthermore, cost inflation can put pressure on your bottom line, reducing profitability and making it more difficult to safeguard the future of your enterprise.

Cost inflation can be and will be a major problem for companies in Singapore. However, with the right strategies in place, it can be mitigated.

If you find this article useful, why not share it among your recruitment and talent acquisition counterparts, and also leave a nice comment below?

We at 9cv9 Research Team strive to bring the latest and most meaningful data, guide, and statistics to your doorstep.

![Writing A Good CV [6 Tips To Improve Your CV] 6 Tips To Improve Your CV](https://blog.9cv9.com/wp-content/uploads/2020/06/2020-06-02-2-100x70.png)