Key Takeaways

- Executive search is a specialised, research-driven hiring approach designed to secure senior leaders and high-impact executives, often through discreet outreach to passive candidates.

- The executive search process focuses on long-term fit through structured evaluation, market mapping, and thorough referencing to reduce leadership hiring risk.

- Retained executive search firms act as strategic hiring partners, supporting role definition, compensation benchmarking, offer negotiation, and onboarding success for critical roles.

Executive search has become one of the most trusted and strategic hiring solutions for organisations that need to secure exceptional leadership talent in a competitive market. While many hiring methods focus on filling vacancies quickly, executive search is designed for a very different purpose: finding high-impact leaders who can influence business direction, drive transformation, and deliver measurable results at the highest level. In most companies, executive roles are not just “positions to fill” but long-term investments that shape performance, culture, and stakeholder confidence. This is why executive search continues to stand apart as a premium recruitment approach that prioritises precision, confidentiality, and quality over volume-based hiring.

At its core, executive search is a specialised recruitment service that focuses on identifying and attracting senior leaders, executive-level specialists, and hard-to-find strategic hires. It is commonly used for high-responsibility positions such as Chief Executive Officer (CEO), Chief Financial Officer (CFO), Chief Operating Officer (COO), Chief Technology Officer (CTO), Vice Presidents, Managing Directors, Regional Heads, and other leadership roles that require deep expertise and strong decision-making capabilities. Unlike traditional recruitment methods that rely heavily on job advertisements and inbound applications, executive search is proactive and research-led. It uses a targeted approach where search consultants map the market, identify top performers across competing organisations, and engage candidates directly, including professionals who are not actively looking for a job.

One of the main reasons businesses choose executive search is because the best leaders are rarely available through standard hiring channels. In senior hiring, the “perfect fit” is often already employed, actively contributing to another organisation, and not browsing job portals. Executive search therefore operates on a very different principle: instead of waiting for candidates to apply, it focuses on strategically finding and approaching the right people through discreet outreach and professional relationship-building. This method is especially important when companies are expanding into new markets, launching new divisions, undergoing rapid growth, replacing a key leader confidentially, or attempting to strengthen leadership capability during business transformation.

Executive search is also closely linked to the concept of long-term organisational alignment. A senior hire is expected to deliver far more than technical experience or industry knowledge. Employers often need someone who can lead teams, manage complex stakeholders, set strategy, protect business reputation, and drive change. For this reason, executive search typically includes deeper evaluation processes such as leadership interviews, competency assessments, referencing, and thorough validation of a candidate’s track record. In many cases, executive search consultants also help companies refine their hiring criteria by clarifying what success truly looks like in the role, ensuring the organisation does not hire based on job titles alone but on measurable outcomes and leadership impact.

Another key reason executive search remains highly valued is confidentiality. Many executive-level hiring situations are sensitive by nature. A company may be replacing an underperforming leader, preparing for a leadership transition, building a new leadership team before an acquisition, or hiring for a strategic role that must remain undisclosed to competitors. In these scenarios, publicly advertising the position can create unnecessary risk, internal instability, and brand damage. Executive search provides a structured and confidential pathway to identify candidates discreetly while protecting both the hiring company and the professionals being approached.

For employers who have never used executive search before, it is important to understand that this approach is not simply “recruitment with a higher fee.” It is a disciplined and methodical process designed to reduce hiring risk, improve decision accuracy, and deliver high-quality outcomes for leadership roles. Executive search firms often act as strategic partners, advising on candidate profiles, compensation expectations, hiring timelines, and market intelligence. Instead of competing with other recruiters in a race to submit resumes, executive search consultants typically operate through dedicated search assignments that involve deep research, structured reporting, and a deliberate candidate shortlisting process.

This is also why executive search is commonly associated with retained recruitment models. While standard contingency recruiters usually work on a success-only placement basis, executive search is often delivered through retained search agreements where the firm is engaged exclusively to manage the search from start to finish. This allows the search partner to invest time into market mapping, talent outreach, assessment, and candidate engagement without cutting corners. It also improves collaboration, because both the employer and the search firm align on expectations, communication cadence, and decision-making criteria from the beginning. In senior hiring, this level of alignment can significantly improve outcomes, especially when hiring decisions involve boards, investors, senior leadership teams, and multiple internal stakeholders.

To understand how executive search works in practice, it helps to break it down into a series of deliberate phases. The process usually begins with a discovery stage, where the search partner works closely with the employer to understand business goals, organisational context, reporting structures, challenges, and leadership expectations. Instead of relying on a generic job description, the search firm helps build a success profile that outlines not only what the leader must do, but what they must deliver. This success profile might include performance objectives such as revenue targets, growth outcomes, team-building goals, operational improvements, or digital transformation milestones.

After the role requirements are clearly defined, the executive search firm conducts market research and mapping. This stage is a major differentiator between executive search and normal recruitment. Rather than pulling candidates from a database alone, executive search consultants identify the competitor landscape, explore adjacent industries, and build a target list of organisations where relevant candidates may be found. This is where executive search becomes both analytical and strategic, as it requires understanding the talent ecosystem and determining where the best leadership skills are likely to exist.

Once potential candidates are identified, the search consultant begins direct outreach and engagement. This is often done discreetly through professional conversations that assess a candidate’s leadership experience, motivations, career priorities, and openness to exploring a new opportunity. Importantly, executive search is not only about convincing a candidate to move. It is equally about determining whether the candidate is genuinely aligned with the role scope, company culture, leadership expectations, and business challenges. In high-level hiring, misalignment can be costly, even if the candidate’s resume looks impressive on paper.

Shortlisting is the next critical phase. Unlike mass recruitment where employers may receive dozens or even hundreds of resumes, executive search typically produces a carefully curated shortlist of high-quality leaders who best match the role’s requirements. These candidates are usually presented with structured insights, including leadership strengths, career highlights, potential risk factors, and market compensation expectations. This helps employers make better-informed decisions and reduces the likelihood of hiring based on surface-level impressions.

From there, the interview and evaluation stage becomes more structured than typical hiring processes. Senior roles often involve multiple rounds of interviews with executive stakeholders, functional leaders, board members, or investors. Executive search partners may support this stage by providing interview scorecards, recommending structured competency-based interview formats, and advising on how to evaluate leadership traits such as decision-making ability, stakeholder influence, resilience, commercial judgement, and ability to scale teams. In many executive hiring cases, the search partner also assists in candidate referencing and background validation, ensuring the employer has a realistic and accurate view of the candidate’s leadership track record.

The final stages of executive search include offer management, negotiation support, and post-placement follow-up. Executive hires frequently involve complex compensation packages that may include salary, bonuses, equity, benefits, and long-term incentives. A search partner can help align expectations between employer and candidate, manage counteroffers, and ensure both parties have clarity on role scope and performance expectations. Post-placement follow-up is also an important part of executive search, because leadership success often depends on integration, stakeholder alignment, and the first 90 to 180 days in the role.

From a business perspective, executive search offers a long list of benefits that standard recruitment methods may not consistently deliver. It provides access to high-performing passive candidates, improves confidentiality, increases hiring precision for leadership roles, and reduces the risk of costly mis-hires. It also gives employers stronger market insight, including competitor hiring trends, talent availability, and compensation benchmarks. For companies hiring in industries where leadership talent is scarce, executive search can be one of the most effective ways to secure strategic hires without compromising on quality.

Executive search is particularly valuable for businesses that are scaling rapidly, undergoing restructuring, or competing in talent-driven markets such as technology, finance, manufacturing, healthcare, professional services, and high-growth startups. In these industries, leadership capability can directly influence employee retention, operational performance, profitability, and long-term competitiveness. Hiring the wrong executive can create ripple effects across teams, strategy, and business momentum, making executive search not just a hiring option, but a strategic safeguard.

For candidates, executive search also offers a unique experience compared to standard job hunting. Instead of applying to dozens of roles, executives are often approached directly for opportunities that match their leadership strengths and career trajectory. The process is typically more consultative and focused, with deeper conversations about long-term objectives, role expectations, and business challenges. When handled professionally, executive search creates value for candidates by helping them explore meaningful leadership opportunities that align with their ambitions and expertise.

As organisations continue to face rapid changes in technology, workforce expectations, market competition, and global uncertainty, leadership hiring is becoming more important than ever. Companies are no longer looking for executives who only “maintain operations.” They need leaders who can innovate, adapt, scale, and guide teams through uncertainty. Executive search plays a key role in meeting this demand, because it provides a structured and research-driven hiring pathway that supports long-term leadership success rather than short-term recruitment outcomes.

Ultimately, executive search is best understood as a strategic hiring process that blends market intelligence, relationship-driven outreach, structured assessment, and business alignment. It is not simply about filling a vacancy, but about securing leadership talent that can shape organisational direction and deliver measurable impact. For employers who want to improve leadership hiring quality, reduce hiring risk, and access candidates beyond traditional channels, executive search remains one of the most effective and professional approaches available.

In this guide, readers will learn exactly what executive search means, why it is used for senior hiring, how the process works step-by-step, and what employers should expect when partnering with an executive search firm. It will also clarify the differences between executive search and standard recruitment, explain the role of retained search, highlight best practices for successful outcomes, and provide a clear understanding of when executive search is the right solution for business-critical hiring needs.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of What is Executive Search & How Does It Work.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

What is Executive Search & How Does It Work

- Executive Search Meaning

- Executive Search vs Recruitment

- Retained Search vs Contingency Search

- How the Executive Search Process Works

- Who Uses Executive Search

- Benefits of Executive Search for Employers

- How Long Does Executive Search Take?

- How Executive Search Firms Get Paid

- How to Choose the Right Executive Search Firm

- Ethics, Confidentiality, and Data Protection in Executive Search

- Executive Search Best Practices

1. Executive Search Meaning

Executive search is a highly specialised recruitment strategy focused on sourcing, evaluating, and securing senior-level leadership and executive roles. It is widely used by organisations seeking to appoint individuals who can drive business transformation, enhance competitive advantage, or manage complex strategic objectives. Unlike general recruitment, which often targets active jobseekers, executive search is designed to engage top-tier professionals who are not actively looking for a job but are open to strategic opportunities.

This section explains the meaning of executive search through clear sub-sections and practical examples, along with comparative tables and role-based matrices to enhance understanding.

What is Executive Search?

- Definition

Executive search refers to a consultative and research-driven recruitment process used to identify, attract, and hire top-level professionals for leadership positions such as CEO, CFO, CTO, Managing Director, and other senior roles. These roles typically demand a unique blend of experience, strategic thinking, industry knowledge, and cultural fit that cannot be sourced via traditional recruitment channels. - Key Characteristics

- Proactive sourcing of passive candidates

- High confidentiality and discretion

- Strategic alignment with organisational vision

- Deep candidate assessment and referencing

- Typically conducted by specialist firms on a retained basis

Example Scenario

A multinational pharmaceutical company needs to hire a Regional Managing Director for Southeast Asia to lead their expansion strategy. Instead of posting the job online, they hire an executive search firm to identify seasoned leaders in the region with regulatory, operational, and market-entry experience in the pharmaceutical or biotech sectors. The search firm maps key competitors, discreetly approaches potential candidates, and presents a shortlist after assessing strategic alignment and cultural fit.

Executive Search vs General Recruitment: Comparison Table

| Feature | Executive Search | General Recruitment |

|---|---|---|

| Target Candidate Type | Passive, high-impact leaders | Active job seekers |

| Roles Covered | C-level, VPs, Directors, Board Members | Entry to mid-level professionals |

| Search Approach | Research-driven, outbound headhunting | Advertisements, job portals, CV screening |

| Process Duration | 6–12 weeks (or longer for global roles) | 1–4 weeks (depending on role urgency) |

| Assessment Depth | Leadership evaluation, strategic fit analysis | Skills and experience-based screening |

| Confidentiality | High (essential for replacements or M&A plans) | Low to medium |

| Fee Structure | Retained or milestone-based | Contingency (success-based) |

| Outcome Focus | Best-fit leadership hire | Quick-fill for functional requirements |

What Executive Search Is Not

- Not Mass Hiring

It is not intended for large-volume recruitment needs or junior-level roles. It focuses on quality, not quantity. - Not CV Forwarding

Executive search involves comprehensive research, assessment, and strategy, not just sending resumes to employers. - Not a Short-Term Fix

It is designed for long-term talent acquisition aligned with strategic organisational goals.

Types of Roles Typically Filled Through Executive Search

| Role Level | Common Job Titles | Example Industries |

|---|---|---|

| C-Level Executives | CEO, CFO, COO, CTO, CHRO, CMO | Finance, Healthcare, Technology, Manufacturing |

| Business Unit Leaders | Managing Director, General Manager, Country Head | FMCG, Retail, Pharmaceuticals, Logistics |

| Functional Heads | Head of Sales, Head of Legal, VP Engineering | SaaS, Consulting, Real Estate, Life Sciences |

| Board & Advisory Roles | Independent Directors, Strategic Advisors | Private Equity, Non-Profits, Energy, Education |

Why Executive Search Is Used

- Confidential Hiring

Replacing an underperforming executive or preparing for a confidential acquisition requires discretion, which executive search offers through discreet candidate engagement and market research. - Leadership Transformation

Companies in turnaround, M&A, or rapid scale-up scenarios often seek leaders with specific transformation experience, a niche that executive search fills effectively. - Limited Talent Availability

When the talent pool is small—such as for roles in emerging technologies or regulatory-driven industries—executive search provides access to hidden talent not available through traditional means.

Executive Search Use Case Matrix

| Business Need | Executive Role Sought | Executive Search Advantage |

|---|---|---|

| Expanding into a new market | Regional Director | Identifies local market experts with strategic insight |

| M&A integration post-acquisition | Chief Integration Officer | Finds leaders skilled in change management |

| Replacing a CEO with discretion | CEO | Maintains confidentiality throughout the process |

| Scaling tech-driven growth | Chief Technology Officer (CTO) | Sources talent with deep domain and scaling experience |

| Improving operational efficiency | Chief Operating Officer (COO) | Attracts leaders with proven process optimisation success |

Conclusion

Executive search is not merely a recruitment tool but a strategic leadership acquisition process that connects organisations with high-performing leaders who have the potential to create long-term value. It is ideally suited for roles where leadership quality, discretion, and long-term fit are critical. Through a mix of market intelligence, candidate assessment, and consultative expertise, executive search ensures that businesses are not only filling vacancies but are securing leaders who align with the future vision of the company. Understanding the depth and value of executive search helps companies make informed decisions when it comes to senior-level hiring in today’s competitive global economy.

2. Executive Search vs Recruitment

Executive search and traditional recruitment are both essential talent acquisition strategies, but they are fundamentally different in their methods, purpose, and outcomes. While recruitment is generally suited for filling mid to junior-level roles quickly, executive search is a specialised service designed to help organisations secure senior leadership or highly strategic talent.

Understanding the core differences between these two hiring approaches is critical for organisations aiming to make informed decisions about when and how to engage the right hiring partner. This section explores these differences in detail through sub-categories, real-world examples, and comparison tables to illustrate where each model fits best.

Purpose and Strategic Focus

- Executive Search

The primary goal is to secure high-impact leaders who can influence the long-term direction of a company. It involves a consultative approach that aligns deeply with business strategy and future growth plans. - Traditional Recruitment

The focus is on filling vacancies efficiently based on job descriptions and existing role templates. It typically serves short-term needs in operational or functional teams.

Example

A venture capital-backed SaaS company preparing for IPO seeks a Chief Financial Officer (CFO) with IPO readiness experience. This role is highly strategic and mission-critical. The company engages an executive search firm to find candidates with IPO success, investor management expertise, and high-growth finance leadership credentials.

By contrast, the same company needs to hire five customer success managers for its support team. These roles are urgent and operational. The HR team assigns the hiring task to internal recruiters and posts on job portals to attract active candidates quickly.

Comparison Table: Executive Search vs Traditional Recruitment

| Key Attribute | Executive Search | Traditional Recruitment |

|---|---|---|

| Primary Use | C-level, VPs, Directors, niche strategic roles | Entry-level to mid-management roles |

| Search Approach | Research-based, targeted headhunting | Advertisements, database sourcing, job portals |

| Candidate Pool | Passive candidates, often not actively job-seeking | Active applicants seeking new opportunities |

| Process Duration | 6–12 weeks (or more depending on seniority) | 1–4 weeks (typically) |

| Role Confidentiality | High – used for sensitive or discreet hiring | Low to moderate – roles are publicly posted |

| Customisation | Tailored success profile and stakeholder alignment | Role often based on standardised job descriptions |

| Candidate Evaluation | In-depth leadership assessments, referencing, vetting | CV screening, structured interviews |

| Fee Model | Retained or milestone-based contracts | Contingency or fixed per hire |

| Partner Involvement | High-touch, strategic advisor role | Transactional – focuses on filling open positions |

| Outcome Focus | Quality of leadership, long-term strategic fit | Speed and quantity of hire |

Candidate Engagement and Assessment Depth

- Executive Search

The consultant conducts proactive and discreet outreach to high-calibre professionals who are not actively applying for roles. These candidates are thoroughly evaluated based on business fit, cultural compatibility, track record, and leadership competencies. - Traditional Recruitment

The recruiter shortlists candidates from job boards or applicant tracking systems. Evaluation is typically based on job titles, years of experience, and technical skills rather than leadership impact.

Example

A biotechnology firm needs a Global Head of Research & Development to lead innovation strategy. The executive search firm explores target lists across competing firms, reviews patents, and assesses the strategic outcomes led by potential candidates. A shortlist is presented with leadership profiles and cultural alignment insights.

On the other hand, the same firm uses a recruiter to find clinical trial coordinators by scanning CV databases and conducting screening interviews based on predefined skills and experience.

Role-Based Suitability Matrix

| Role Type | Best Hiring Method | Reason |

|---|---|---|

| Chief Executive Officer (CEO) | Executive Search | Strategic influence, board engagement, confidential handling |

| Software Engineer (Mid-Level) | Traditional Recruitment | High-volume role, widely available talent |

| Head of Digital Transformation | Executive Search | Niche skillset, change leadership required |

| Sales Executive (Entry-Level) | Traditional Recruitment | Fast-paced hiring, performance tracked short-term |

| Chief Risk Officer (Financial) | Executive Search | Regulatory expertise, complex stakeholder management |

| HR Generalist | Traditional Recruitment | Recurrent hiring need, defined responsibilities |

Confidentiality and Stakeholder Management

- Executive Search

Discretion is often a non-negotiable requirement. The process is handled confidentially to avoid internal disruptions or external speculation. Stakeholder involvement is high, with board members or investors often participating in interviews. - Traditional Recruitment

Open roles are publicly advertised. Stakeholder engagement may be limited to hiring managers or department leads. Confidentiality is not typically required.

Market Research and Talent Mapping

- Executive Search

Search firms invest heavily in competitive market intelligence. They benchmark compensation, assess leadership reputation, and scan talent across geographies or industries, offering strategic value beyond the hire itself. - Traditional Recruitment

Recruitment relies on existing CV databases, talent pools, or job board applicants. There is limited strategic insight into the broader market.

Consultative Engagement vs Transactional Hiring

- Executive Search

Acts as a consultative partner. Supports role definition, success profiling, leadership assessment, succession planning, and post-placement integration. - Traditional Recruitment

Operates in a transactional model focused on role fulfilment. Limited involvement in onboarding or long-term integration support.

Engagement Model Matrix

| Dimension | Executive Search Firm | Recruitment Agency |

|---|---|---|

| Role Definition Support | Yes – builds a success profile | Sometimes – based on hiring manager input |

| Market Mapping | Extensive, research-driven | Limited or not included |

| Candidate Outreach | Discreet, targeted outreach | Public advertisements |

| Assessment Tools Used | Leadership evaluations, referencing | Basic screenings, sometimes tests |

| Offer Management | Strategic advisory and negotiation | Coordinated but not strategic |

| Onboarding Support | Often included post-placement | Rarely offered |

Process Timeline Comparison

| Stage | Executive Search Approx. Timeline | Recruitment Approx. Timeline |

|---|---|---|

| Role Discovery and Alignment | 1–2 weeks | 2–3 days |

| Research and Longlist Building | 2–3 weeks | 1 week |

| Candidate Outreach and Engagement | 2–3 weeks | Immediate (open applications) |

| Evaluation and Interview Process | 2–4 weeks | 1–2 weeks |

| Final Offer and Negotiation | 1–2 weeks | 3–5 days |

| Total Duration | 8–12 weeks | 2–4 weeks |

Conclusion

The choice between executive search and recruitment depends entirely on the strategic importance, seniority, and complexity of the role. For board-level, confidential, or transformation-critical positions, executive search offers a structured, research-backed, and highly consultative approach designed for long-term business impact. On the other hand, recruitment remains ideal for functional roles that require faster fulfilment, lower complexity, and broader talent pools.

By understanding the distinctions in approach, candidate engagement, timeline, and value delivered, businesses can align their talent acquisition strategy more effectively with their growth objectives. Executive search is not a replacement for recruitment—it is a premium solution for leadership hiring when failure is not an option.

3. Retained Search vs Contingency Search

When it comes to hiring talent—especially at mid to senior levels—organisations often face a critical decision: should they opt for a retained executive search or a contingency recruitment model? Both approaches aim to identify suitable candidates, but they are vastly different in structure, commitment, cost, and expected outcomes. Understanding these differences can help businesses select the right talent acquisition strategy based on their hiring goals, urgency, budget, and the strategic value of the role.

This section provides a detailed, SEO-optimised breakdown of retained search and contingency search, supported by real-world examples, comparative tables, and application-based matrices for better clarity.

Definition of Retained Search

- Retained search is an exclusive, long-term partnership between a hiring company and a search firm to fill strategic or leadership positions.

- The client company pays the search firm in staged payments—typically one-third upfront, one-third mid-search, and one-third upon successful placement.

- The retained firm conducts deep research, market mapping, and outreach to passive candidates.

- The focus is on finding the most qualified candidate for the role, not just filling the position quickly.

Definition of Contingency Search

- Contingency search is a non-exclusive, success-only recruitment model where the employer pays only if a candidate is successfully hired.

- Multiple agencies may compete to fill the same role, which increases speed but reduces depth and quality.

- This model is widely used for urgent roles or junior to mid-level positions.

- There’s less upfront commitment, but a higher risk of duplicated efforts and misalignment.

Key Differences Table: Retained Search vs Contingency Search

| Feature | Retained Search | Contingency Search |

|---|---|---|

| Engagement Type | Exclusive partnership | Non-exclusive, multiple agencies may compete |

| Payment Structure | Upfront and milestone-based fees | Paid only upon successful hire |

| Role Type | Strategic, executive, high-impact roles | Mid-level, operational, volume-based roles |

| Candidate Sourcing | Research-driven, market mapping, proactive outreach | Database searches, job board posts, inbound applicants |

| Candidate Pool | Passive, high-performing talent | Mostly active job seekers |

| Assessment Depth | Comprehensive screening, competency and leadership checks | Basic CV review and interviews |

| Confidentiality | High – used for discreet or sensitive searches | Low – job often publicly advertised |

| Timeline | 6–12 weeks (or longer for niche leadership roles) | 2–4 weeks for mid-level or functional roles |

| Relationship with Client | Strategic, consultative partnership | Transactional |

| Success Rate | High – due to tailored approach and aligned expectations | Variable – depends on speed and availability |

Example Comparison Scenario

A global renewable energy company is seeking a new Chief Operating Officer (COO) to lead regional expansion across Southeast Asia. They engage a retained executive search firm to discreetly source candidates with prior market entry experience, cross-border team leadership, and sustainability credentials. The firm builds a market map, approaches passive candidates, and presents a shortlist after thorough evaluation.

Meanwhile, the same company needs 10 field engineers to support site operations in Vietnam. The urgency and scale of hiring lead them to engage three contingency recruitment agencies to compete for placements. Resumes are sourced quickly from job boards, with minimal screening.

Use Case Matrix: When to Use Retained vs Contingency Search

| Business Situation | Recommended Model | Reason for Recommendation |

|---|---|---|

| Hiring a CEO or CFO | Retained Search | High-impact, confidential, needs leadership validation |

| Filling sales manager roles in a short timeframe | Contingency Search | Volume hiring, time-sensitive, lower strategic complexity |

| Finding a niche tech lead for a confidential project | Retained Search | Requires research, market mapping, discretion |

| Recruiting customer service reps | Contingency Search | Speed and availability are key priorities |

| Succession planning for a retiring country director | Retained Search | Strategic importance, cultural alignment, long-term impact |

| Hiring warehouse staff during peak season | Contingency Search | Fast sourcing, operational volume hiring |

Fee Structure Comparison

| Payment Stage | Retained Search (Typical) | Contingency Search |

|---|---|---|

| Initial Engagement | 30–40% of total fee upfront | No payment required |

| Shortlisting Phase | 30–40% upon shortlist | No payment required |

| Upon Placement | Balance (remaining %) | 100% of agreed fee |

| Total Fee Basis | 25–35% of candidate’s annual salary | 15–25% of annual salary (depends on role level) |

Depth of Service Comparison

| Service Category | Retained Search | Contingency Search |

|---|---|---|

| Role Discovery and Success Profiling | Included – deep alignment with client | Basic – relies on job description |

| Market Mapping | Included – competitor and talent research | Not included |

| Candidate Outreach | Direct, discreet headhunting | Resume submission from existing database |

| Evaluation and Leadership Assessment | In-depth interviews, referencing, tests | Surface-level interviews, basic screening |

| Reporting and Status Updates | Regular reports and candidate insights | Ad-hoc updates depending on agency |

| Offer Negotiation Support | Strategic advisory and closure support | Limited or reactive |

| Post-Hire Integration | Often included (especially at C-level) | Rarely provided |

Candidate Experience Comparison

- Retained Search

- Candidates are approached confidentially, often flattered by targeted outreach.

- The process includes multiple in-depth conversations, creating a professional, consultative experience.

- Even if not selected, candidates receive structured feedback and a positive impression of the hiring brand.

- Contingency Search

- Candidates may apply to multiple roles simultaneously.

- Recruiters focus on speed, which may lead to less personalisation.

- Follow-up and feedback are inconsistent due to volume and limited engagement.

Strategic Value Assessment Matrix

| Assessment Dimension | Retained Search | Contingency Search |

|---|---|---|

| Strategic Hiring Outcomes | High – due to planning and alignment | Medium – may meet tactical needs |

| Brand Positioning with Candidates | Strong – represents brand discreetly | Mixed – role may be listed publicly |

| Relationship Building | Long-term and trust-based | Transactional, short-term |

| Talent Pipeline Creation | Yes – supports future succession | No – focused only on current openings |

| Risk of Mis-Hire | Low – due to rigorous screening | High – less time for due diligence |

Conclusion

Retained search and contingency recruitment each serve specific hiring goals, but they are not interchangeable. Retained search is ideal when roles require a high degree of leadership, discretion, or niche expertise. It offers strategic alignment, deeper evaluation, and a greater focus on quality. In contrast, contingency search is well-suited for operational or mid-level roles where time, volume, and cost take precedence over long-term strategic fit.

Companies should evaluate the impact of the role, the urgency of hiring, the complexity of the skill set, and the level of market scarcity before deciding between the two. Ultimately, using the right model ensures better hiring outcomes, improved employer branding, and stronger talent retention. Selecting the right partner—whether retained or contingent—can be the difference between simply filling a role and making a transformative hire.

4. How the Executive Search Process Works

The executive search process is a methodical, research-intensive, and highly consultative journey designed to help organisations identify, assess, and secure high-impact senior leaders. It goes far beyond standard recruitment methods by incorporating deep role alignment, market mapping, candidate engagement, and post-hire integration.

This section provides a comprehensive, SEO-optimised, step-by-step guide to how the executive search process works, with practical examples, matrices, and professional tables to visualise each stage and its value.

Step 1: Discovery and Role Alignment

- Initial Consultation with Stakeholders

The process begins with in-depth consultations involving decision-makers such as the CEO, CHRO, or board members. The executive search firm must understand the business goals, challenges, culture, and the strategic significance of the role. - Role Analysis and Success Profiling

Rather than relying solely on job descriptions, the firm develops a success profile—defining not just the skills and responsibilities required, but the specific outcomes and impact expected from the new executive.

Example

A fintech startup hiring a Chief Technology Officer (CTO) for global expansion works with a search partner to define success as building scalable infrastructure, leading cloud migration, and hiring 30 engineers within 12 months.

Step 2: Market Mapping and Talent Intelligence

- Industry Research and Competitive Benchmarking

The firm identifies target companies and sectors with the right talent pools. This includes identifying competitors, adjacent industries, and under-tapped markets. - Candidate Universe Development

A longlist of potential candidates is built based on competencies, experience, geography, and potential alignment with the client’s leadership culture.

Example

A logistics company hiring a Chief Supply Chain Officer receives a market map showing senior supply chain leaders from global competitors, regional leaders from emerging markets, and high-performing COOs from e-commerce firms.

Table: Candidate Universe Sample Matrix

| Talent Source Type | Description | Example Role Sourced From |

|---|---|---|

| Direct Industry Competitor | Works at similar company in same industry | COO from a rival freight forwarding firm |

| Adjacent Industry | Brings transferable skills from a related sector | VP Logistics from a retail brand |

| High-Growth Startups | Experienced in scale-up environments | Director of Ops from a tech unicorn |

| Global Player | Multinational leadership and process knowledge | Head of Supply Chain APAC, Fortune 500 |

Step 3: Outreach and Candidate Engagement

- Discreet Contact and Relationship Building

Search consultants approach potential candidates directly, often through phone, email, or mutual networks. Discretion and brand positioning are essential at this stage. - Qualification and Motivation Checks

Candidates are assessed not only on credentials but also on interest, career timing, relocation readiness, compensation expectations, and alignment with the role’s purpose.

Example

A high-performing Chief Marketing Officer (CMO) at a global FMCG firm is approached by a search firm and initially declines. After learning the client is a fast-growing healthtech company entering new markets, the CMO agrees to explore further.

Step 4: Assessment and Shortlisting

- Leadership and Competency Evaluation

Shortlisted candidates undergo in-depth interviews, structured evaluations, and possibly psychometric assessments. The focus is on leadership traits, problem-solving ability, culture fit, and stakeholder management. - Behavioural and Performance-Based Screening

Candidates are asked to walk through past achievements, failures, and how they’ve handled specific leadership challenges.

Candidate Evaluation Scorecard Sample

| Competency Area | Evaluation Criteria | Scoring (1–5) |

|---|---|---|

| Strategic Vision | Ability to define and execute long-term plans | |

| People Leadership | Track record of team growth, culture shaping | |

| Operational Execution | Experience driving measurable performance improvements | |

| Industry Knowledge | Relevant expertise in client sector | |

| Cultural Alignment | Compatibility with client’s values and leadership style | |

| Communication and Influence | Stakeholder management and external representation |

Step 5: Client Interviews and Feedback Loop

- Interview Coordination and Candidate Briefing

The firm schedules and prepares both clients and candidates for interviews. Briefing packs are often shared, including candidate profiles, motivations, and potential concerns. - Structured Feedback Collection

After each interview round, structured feedback is gathered from all stakeholders. This is essential to refine the search and keep momentum.

Example

In a COO search for a manufacturing client, the board narrows the list from five to two candidates based on detailed feedback about leadership style, growth mindset, and operational exposure in emerging markets.

Step 6: Referencing and Background Checks

- 360-Degree Referencing

The search firm conducts confidential reference checks with former managers, peers, subordinates, and clients. These references explore the candidate’s real-world leadership style, ability to work under pressure, and values. - Compliance and Risk Screening

Background checks may include criminal records, regulatory compliance, financial checks, or media scans, especially for regulated industries like finance or pharmaceuticals.

Step 7: Offer Management and Negotiation

- Compensation Package Structuring

The firm advises on competitive compensation aligned with market benchmarks and internal equity. Packages often include base salary, bonuses, stock options, and relocation benefits. - Negotiation Mediation

The consultant acts as a neutral party to resolve concerns and bridge expectation gaps between the candidate and employer.

Offer Negotiation Comparison Table

| Compensation Element | Executive Candidate Expectation | Employer Offer Range | Notes |

|---|---|---|---|

| Base Salary | $200,000–$230,000 | $210,000 | Aligned after benchmarking |

| Annual Bonus | 20–30% | 25% | Target-based with clear KPIs |

| Equity/Stock Options | Yes, long-term incentive desired | Included | Vesting over 4 years |

| Relocation Support | Full coverage requested | Partial support offered | Negotiated to include full package |

Step 8: Onboarding and Executive Integration

- Onboarding Planning

The search partner may assist with the onboarding process by aligning expectations, coordinating with HR, and ensuring the new hire has the right support structures. - First 90–180 Day Integration Support

Some executive search firms offer onboarding coaching, stakeholder alignment sessions, and progress tracking to help the leader succeed in their early days.

Example

A newly appointed Chief People Officer at a financial services firm is supported by the search firm in facilitating a two-day leadership alignment session to introduce vision, priorities, and establish early trust with their executive peers.

Executive Search Lifecycle Summary Table

| Stage | Activities Involved | Estimated Duration |

|---|---|---|

| Discovery and Profiling | Stakeholder alignment, role scoping, success profiling | 1–2 weeks |

| Market Mapping | Research, competitor analysis, longlisting | 2–3 weeks |

| Outreach and Engagement | Direct outreach, motivation qualification, engagement | 2–3 weeks |

| Assessment and Shortlisting | Interviews, evaluations, candidate profiling | 2–3 weeks |

| Client Interviews | Roundtable sessions, feedback loop, shortlist finalisation | 1–2 weeks |

| Referencing and Checks | Professional reference and background verification | 1 week |

| Offer and Acceptance | Package design, negotiation, and closure | 1–2 weeks |

| Onboarding and Follow-up | Integration planning, early check-ins | Ongoing |

Conclusion

The executive search process is designed for rigour, precision, and strategic alignment—every step is engineered to reduce hiring risk and secure leadership talent that delivers long-term business value. From initial discovery to onboarding, the process ensures that the right leader is not only hired but is set up for success.

While it may take longer than traditional recruitment, the benefits of structured evaluation, passive candidate outreach, market intelligence, and post-hire support make executive search the gold standard for critical leadership hiring. For companies looking to fill high-stakes roles that require more than just a resume match, understanding and investing in each stage of this process is essential.

5. Who Uses Executive Search

Executive search is a premium hiring strategy used by a wide range of industries and organisational structures seeking to fill senior-level or highly specialised roles. This method is particularly useful for businesses that face talent scarcity at the leadership level, operate in highly competitive or regulated environments, or require transformational leaders to drive strategic initiatives.

This section explores the industries and role types that most frequently rely on executive search, supplemented with detailed examples, structured matrices, and comparative tables to illustrate patterns of usage across various sectors.

Industries That Commonly Use Executive Search

Executive search is widely adopted across both traditional and emerging industries. While the motivations may differ—from succession planning to entering new markets—these sectors typically demand leadership that cannot be sourced effectively through traditional recruitment channels.

Technology and Software (SaaS, AI, Fintech)

- Fast-scaling startups and global tech firms use executive search to find visionary leaders who can drive innovation, build teams, and lead digital transformation.

- Roles such as Chief Technology Officer, VP of Engineering, and Chief Product Officer are frequently sourced through retained search firms due to their strategic importance and niche talent requirements.

Example

A venture-backed SaaS firm expanding into Southeast Asia engages a search firm to find a Regional Managing Director with prior experience scaling enterprise software in frontier markets.

Healthcare and Life Sciences

- Pharmaceutical, biotech, and medical device companies often use executive search to identify regulatory, research, and go-to-market leaders.

- The need for professionals with clinical expertise, FDA/EMA knowledge, and global trial management skills makes the talent pool extremely limited.

Example

A global pharmaceutical firm hires an executive search firm to identify a Chief Scientific Officer with a proven track record in immunotherapy R&D.

Financial Services and Insurance

- Banks, private equity firms, asset managers, and insurance companies rely on executive search to fill roles that involve compliance, regulatory risk, and high capital responsibility.

- Common roles include CFO, Chief Risk Officer, and Head of Investment Strategy.

Manufacturing and Industrial Engineering

- Companies in aerospace, automotive, energy, and advanced manufacturing use executive search to secure operational leaders, lean experts, and transformation specialists.

- Roles often require deep sector-specific knowledge, international supply chain expertise, and strong stakeholder engagement abilities.

Consumer Goods and Retail

- Multinational FMCG and retail firms use executive search to identify regional business leaders, marketing strategists, and e-commerce executives.

- Leadership roles must balance global brand strategies with local consumer behavior insights.

Professional Services and Consulting

- Top-tier law firms, accounting practices, and management consulting firms often turn to executive search to attract experienced partners, country managers, or global heads of function.

- These roles typically demand strong networks, client acquisition experience, and industry thought leadership.

Energy and Natural Resources

- Oil & gas, mining, and renewable energy companies depend on executive search for board appointments, operations directors, and environmental compliance heads.

- The need for safety, regulatory, and geopolitical understanding makes executive search essential in these fields.

Government, Nonprofits, and Education

- Executive search is used to appoint public institution leaders, non-profit executives, academic deans, and directors of research institutions.

- These roles require leadership coupled with values alignment, stakeholder sensitivity, and public credibility.

Industries and Common Roles Table

| Industry | Common Executive Roles Hired Through Search |

|---|---|

| Technology & SaaS | CTO, CPO, VP Engineering, Head of AI/ML, Chief Data Officer |

| Finance & Banking | CFO, CRO, Head of Risk, MD – Investment Banking, Head of Compliance |

| Life Sciences & Healthcare | Chief Medical Officer, Head of R&D, VP Regulatory Affairs |

| Manufacturing & Logistics | COO, Head of Operations, Chief Supply Chain Officer |

| Consumer Goods & Retail | CEO – Region, VP of Marketing, Chief Digital Officer |

| Energy & Resources | Country Director, VP Exploration, Director – Environmental Compliance |

| Education & Nonprofits | University Dean, Executive Director, VP of Research |

Role Types Typically Filled Through Executive Search

Executive search is best suited for senior and mission-critical roles where leadership capabilities, vision, and cultural alignment are non-negotiable.

C-Level and Board Positions

- Chief Executive Officer (CEO)

- Chief Operating Officer (COO)

- Chief Financial Officer (CFO)

- Chief Marketing Officer (CMO)

- Chief Human Resources Officer (CHRO)

- Chief Technology Officer (CTO)

- Independent Board Members and Chairs

Executive Leadership Roles

- Managing Director / Regional Director

- Country Manager / General Manager

- Vice President – Sales / Product / Engineering / Strategy

- Head of Business Unit or Function

Transformation and Specialist Roles

- Chief Digital Transformation Officer

- Global Head of ESG / Sustainability

- Head of M&A Integration

- Chief Innovation Officer

- Director of Change Management

Role Level vs Search Usage Matrix

| Role Level | Typically Uses Executive Search? | Reason |

|---|---|---|

| C-Level Executives | Yes | High strategic impact, board engagement, brand risk |

| VPs / Regional Heads | Yes (especially in global companies) | Cross-functional leadership, revenue responsibility |

| Functional Directors | Sometimes | Depends on seniority, niche skillsets, or confidential needs |

| Mid-Level Managers | Rarely | Better served by traditional recruitment |

| Entry-Level / Operational Roles | No | High-volume, fast-fill roles not suited for research-based search |

Example Use Case Matrix

| Organisation Type | Search Need Example | Executive Role Filled |

|---|---|---|

| Global FMCG | Entering Latin America market with new category | Regional CEO – LATAM |

| AI Startup | Raising Series C, scaling from 80 to 200 engineers | VP Engineering |

| Private Equity Portfolio Company | Turnaround needed in underperforming portfolio | Interim COO |

| Multinational Bank | Regulatory overhaul after acquisition | Chief Risk Officer |

| Government Think Tank | Leading national research agenda | Director of Policy and Strategy |

| Renewable Energy Firm | Driving ESG and stakeholder alignment in Asia | Chief Sustainability Officer |

How Industry Affects the Executive Search Approach

| Industry Type | Search Characteristics |

|---|---|

| Regulated (e.g., banking, pharma) | Extensive compliance checks, tight referencing, risk-focused interviews |

| High-growth (e.g., tech, fintech) | Speed, innovation leadership, equity-based compensation negotiation |

| Global corporations | Multi-country candidate mapping, cultural fit analysis |

| Nonprofits / NGOs | Values alignment, donor relations, mission-driven leadership |

| Energy / Infrastructure | Field exposure, environmental risk experience, political acumen |

Conclusion

Executive search is not confined to any one sector. It is utilised by a broad spectrum of industries facing critical leadership needs that cannot be addressed by conventional hiring methods. Whether it is finding a CEO to lead digital transformation, a CFO to prepare for IPO, or a CHRO to reshape culture after a merger, executive search delivers a level of depth, discretion, and strategic alignment unmatched by traditional recruitment.

Organisations turn to executive search not just for hiring, but for securing the kind of leadership that defines competitive advantage, drives transformation, and ensures long-term organisational success. By understanding which industries and roles most benefit from this method, companies can better decide when executive search is not only useful—but essential.

6. Benefits of Executive Search for Employers

Executive search offers a high-value recruitment solution for organisations that need to secure senior-level, niche, or business-critical talent. Unlike conventional recruitment methods that focus on speed and volume, executive search prioritises leadership quality, cultural alignment, long-term impact, and business transformation. This structured, consultative, and research-driven approach delivers a wide range of strategic advantages to employers.

Below is an in-depth analysis of the key benefits of executive search for companies across industries, supported by real-world examples, structured tables, and role-impact matrices to illustrate its unique value.

Access to High-Quality Passive Talent

- Reaching Beyond Active Job Seekers

Executive search firms proactively identify and engage high-calibre candidates who are not actively looking for a new role but are open to the right opportunity. These passive candidates are typically employed, high-performing, and not accessible via job boards or applicant databases. - Example

A global logistics company seeking a Head of Digital Supply Chain Transformation leverages executive search to approach senior professionals at top-tier consulting firms and technology vendors—professionals who are not visible through conventional hiring channels.

Candidate Accessibility Table

| Candidate Type | Availability via Job Boards | Executive Search Accessibility |

|---|---|---|

| Active Job Seekers | High | Included |

| Passive High Performers | Low | High |

| Confidentially Exploring | Medium | High |

| Top Competitor Talent | Very Low | High (via targeted outreach) |

Improved Hiring Accuracy and Lower Mis-Hire Risk

- Rigorous Evaluation and Cultural Fit Assessment

Executive search firms conduct detailed assessments beyond basic resume screening. They evaluate leadership traits, decision-making patterns, stakeholder management, and cultural alignment through structured interviews, assessments, and referencing. - Reduced Cost of a Bad Hire

A failed executive hire can cost up to 3.5x the individual’s annual salary when considering business disruption, lost opportunities, and damage to team morale. Executive search helps avoid this through due diligence and validation.

Hiring Accuracy Matrix

| Hiring Factor | Traditional Recruitment | Executive Search |

|---|---|---|

| Leadership Evaluation | Limited | In-depth |

| Cultural Fit Analysis | Rare | Structured and scored |

| Referencing Depth | Basic | Multi-layered and discreet |

| Role Success Profiling | Generic | Custom-built per organisation |

| Long-Term Fit Consideration | Limited | High priority |

Confidentiality for Sensitive or Strategic Roles

- Discreet Leadership Transitions

When replacing a current executive or planning succession quietly, confidentiality is critical. Executive search firms operate under non-disclosure terms, conducting the process discreetly to avoid internal disruptions or reputational risks. - Example

A financial institution looking to replace its Chief Risk Officer during regulatory restructuring utilises a retained search to keep the hiring process confidential from shareholders and competitors.

Scenarios That Require Confidentiality

| Scenario | Why Confidentiality Matters |

|---|---|

| Leadership Replacement Without Announcement | Prevent internal panic or public speculation |

| Mergers and Acquisitions | Strategic alignment prior to announcement |

| Regulatory Role Filling | Risk of public scrutiny and compliance |

| Founder Succession Planning | Business continuity and investor assurance |

Deeper Market Intelligence and Benchmarking

- Talent Landscape Insights

Executive search provides companies with detailed market mapping, competitor analysis, and compensation benchmarks. This intelligence is useful for workforce planning and succession strategies. - Example

A SaaS company looking to hire a Chief Revenue Officer receives a market report from the search partner, identifying where competitors are hiring, what skill sets are trending, and compensation levels by region.

Market Intelligence Deliverables from Executive Search

| Deliverable | Description |

|---|---|

| Talent Mapping | List of potential candidates by company, region, and seniority |

| Compensation Benchmarking | Salary, bonuses, and equity structures by role |

| Competitor Hiring Trends | Insights into leadership changes in the market |

| Talent Scarcity Analysis | Identifies if skill demand exceeds supply |

Strategic Partnering and Hiring Support

- Consultative Engagement

Executive search is not just about presenting candidates—it’s about partnering with the client to define the role, clarify outcomes, advise on employer branding, and shape the interview process. - Example

During a search for a Chief People Officer, a retail client works with the executive search firm to redefine the role from purely operational to strategic HR business leadership, based on market feedback.

Search Firm vs Recruiter Comparison Table

| Capability | Traditional Recruiter | Executive Search Firm |

|---|---|---|

| Role Re-Definition Support | Limited | Included |

| Stakeholder Engagement | Minimal | Collaborative and deep |

| Market-Based Feedback Loop | Rare | Regular and data-backed |

| Offer and Onboarding Support | Variable | Strategically guided |

Higher Candidate Engagement and Employer Branding

- Enhanced Candidate Experience

Executive search firms act as brand ambassadors for the client, delivering a personalised, high-touch engagement process that reflects positively on the employer. - Protecting Employer Brand During Outreach

In leadership hiring, first impressions matter. Search consultants ensure that brand reputation, role impact, and organisational mission are communicated clearly and professionally. - Example

A non-profit organisation looking to hire a new Executive Director ensures that its values, culture, and mission are well-articulated to every candidate approached by the search firm, enhancing engagement and alignment.

Candidate Experience Elements Enhanced by Executive Search

| Component | Value to Employer |

|---|---|

| Role Briefing & Storytelling | Increases candidate excitement and clarity |

| Discreet Handling | Builds trust and professionalism |

| Feedback and Communication | Leaves a lasting positive impression |

| Personalised Interview Prep | Improves quality of interactions |

Reduced Time to Leadership Success (Not Just Time-to-Hire)

- Focus on Long-Term Performance

While executive search may take longer to initiate compared to regular recruitment, it significantly improves the chances of hiring someone who will succeed, perform, and stay in the role. - Onboarding Support and Integration Planning

Many search firms provide onboarding guidance to ensure the new leader adjusts quickly, establishes trust, and achieves early wins in their first 90 to 180 days.

Time to Leadership Value Matrix

| Metric | Traditional Hiring | Executive Search |

|---|---|---|

| Time-to-Fill | 2–4 weeks | 6–12 weeks |

| Time-to-Productivity | Varies | Optimised through onboarding |

| Leadership Retention Rate | Lower | Higher due to role alignment |

| First-Year Strategic Impact | Uncertain | Measured and benchmarked |

Support for Succession Planning and Internal Bench Strength

- Proactive Talent Pipelining

Executive search helps employers identify future leaders, either for current roles or as part of long-term succession planning. This reduces risk in times of transition or unexpected exits. - Leadership Gap Prevention

By anticipating future needs, organisations can avoid leadership vacuums that disrupt operations and stakeholder confidence. - Example

A multinational manufacturing firm conducts a global executive search to identify a potential successor for its retiring COO 18 months in advance, allowing time for knowledge transfer and onboarding.

Succession Planning Use Cases

| Business Situation | Executive Search Contribution |

|---|---|

| Retirement of Key Executive | Successor search and onboarding |

| Organisational Restructuring | New leadership for redefined functions |

| Board Expansion or Rotation | Identifying independent directors |

| Leadership Development Benchmarking | External comparisons for internal leaders |

Conclusion

For employers looking to attract, evaluate, and retain senior leaders who can deliver sustainable business impact, executive search offers an unmatched strategic advantage. It bridges the gap between business strategy and talent acquisition by providing access to top-tier passive candidates, ensuring confidentiality, delivering market intelligence, and focusing on long-term leadership success.

While it may require greater upfront investment, the return comes in the form of stronger hires, better cultural alignment, reduced mis-hire costs, and an enhanced employer brand. Executive search is not simply about filling roles—it’s about finding the right leaders to shape the future of the organisation. For mission-critical, transformative, or high-stakes leadership needs, it is an indispensable solution for forward-thinking employers.

7. How Long Does Executive Search Take?

The executive search process is structured, research-driven, and relationship-oriented, which means it requires more time than traditional recruitment. Unlike quick-fill roles that rely on job postings and active applicants, executive search focuses on identifying, assessing, and onboarding top-tier, often passive leadership candidates. As a result, timelines can vary depending on several key factors, such as role complexity, market conditions, geographical scope, and level of confidentiality required.

This section offers a comprehensive, SEO-optimised breakdown of the executive search timeline, including key stages, influencing factors, and real-world examples, accompanied by structured tables and matrices for clarity.

Average Duration of Executive Search

- Standard Timeline Range

A typical executive search assignment takes between 8 to 12 weeks from engagement to offer acceptance. However, more complex, global, or highly confidential searches can extend up to 16 weeks or more. - Factors That Accelerate or Delay the Process

- The rarity of the role’s skill set

- Seniority of the position

- Number of decision-makers involved

- Location or global search scope

- Candidate notice periods or relocation needs

- Availability of internal alignment and feedback

Executive Search Process Timeline Table

| Search Stage | Typical Duration | Key Activities Performed |

|---|---|---|

| Discovery & Role Alignment | 1–2 weeks | Stakeholder meetings, success profiling, role briefing |

| Market Mapping & Research | 2–3 weeks | Competitor benchmarking, longlist development |

| Candidate Outreach & Engagement | 2–3 weeks | Discreet headhunting, candidate interest qualification |

| Candidate Evaluation & Shortlisting | 2–3 weeks | In-depth interviews, competency assessments |

| Client Interviews & Feedback | 1–2 weeks | Interview rounds, panel feedback, shortlist refinement |

| References & Background Checks | 1 week | 360-degree references, risk screening |

| Offer Management & Negotiation | 1–2 weeks | Package alignment, contract closure |

| Onboarding & Integration (optional) | Post-hire (0–6 months) | Transition support, leadership integration |

Example Timeline: Chief Financial Officer (CFO) Search

| Week | Activities |

|---|---|

| 1–2 | Kick-off meetings with board and CEO, role and success profile finalised |

| 3–5 | Competitor and market mapping, initial longlist of candidates created |

| 6–7 | Discreet candidate outreach, early-stage screening interviews |

| 8–9 | Finalist shortlist delivered, first client interviews |

| 10 | Final interview round, internal stakeholder panel evaluations |

| 11 | Background checks and referencing completed |

| 12 | Offer issued, negotiated, and accepted |

| Post-Hire | Executive onboarding and 90-day integration program (optional support) |

Key Variables That Influence Timeline

- Role Seniority and Complexity

- Higher-level roles such as CEO or Board Chair require broader alignment and multi-round interviews, extending timelines.

- Specialist roles in AI, ESG, or global M&A can add complexity due to niche skill requirements.

- Search Geography

- Local searches (e.g., within one country) are usually faster.

- Cross-border searches require more time for legal, cultural, and market factors.

- Candidate Availability

- Notice periods vary by country and industry. In some markets, executive notice periods can extend to 3–6 months.

- Relocation timelines add to onboarding delays.

Timeline Variance by Role Matrix

| Executive Role | Typical Timeline | Influencing Factors |

|---|---|---|

| Chief Executive Officer (CEO) | 12–16 weeks | Board involvement, high confidentiality |

| Chief Technology Officer (CTO) | 10–14 weeks | Niche technical expertise, equity negotiation |

| Chief Marketing Officer (CMO) | 8–12 weeks | Market understanding, brand compatibility |

| Regional Managing Director | 10–14 weeks | Multi-country fit, cultural alignment |

| Chief People Officer (CHRO) | 8–12 weeks | Values alignment, transformation readiness |

| Head of ESG or Sustainability | 10–16 weeks | Emerging discipline, rare leadership profiles |

Internal vs External Timeline Control

| Timeline Component | Controlled by Search Firm | Controlled by Client | Controlled by Candidate |

|---|---|---|---|

| Research and longlisting | Yes | No | No |

| Interview scheduling | Shared | Yes | Yes |

| Stakeholder alignment | No | Yes | No |

| Offer decision and negotiation | No | Yes | Yes |

| Relocation and onboarding | No | Shared | Yes |

Benefits of a Structured Timeline

- Predictable Hiring Roadmap

Helps businesses plan transitions, handovers, and reporting realignments smoothly. - Aligned Stakeholder Availability

Pre-scheduling interviews and approvals ensures faster decision-making. - Improved Candidate Experience

A defined timeline avoids delays that could lead to candidate drop-off or counteroffers. - Higher Acceptance Rates

Fast-moving, coordinated processes show professionalism and urgency—factors highly valued by executive candidates.

Timeline Compression Best Practices

- Pre-Align Stakeholders Early

Confirm interview panel availability and feedback process before candidate shortlist is delivered. - Use Real-Time Reporting Tools

Many executive search firms provide dashboards or weekly reports to maintain visibility and transparency. - Define Success Criteria Early

Avoid mid-search changes in role expectations, which can reset timelines. - Offer a Competitive, Ready-to-Go Package

Prepare salary, equity, and relocation terms in advance to avoid delays during the final negotiation stage.

Conclusion

The executive search process typically spans 8 to 12 weeks, but timelines can vary based on the complexity of the role, the geographic reach, and the internal alignment of decision-makers. While it may seem longer than traditional recruitment, the deliberate pace ensures a stronger long-term match, higher leadership quality, and lower hiring risk.

Employers that understand and support this structured process not only increase the likelihood of hiring a high-performing executive but also enhance their brand perception in the market. Strategic roles deserve strategic processes—and time is a crucial investment in securing the right leadership talent for sustainable growth.

8. How Executive Search Firms Get Paid

Executive search firms operate on distinct pricing models that differ significantly from traditional recruitment agencies. Their fee structures are typically designed to reflect the depth, complexity, and strategic value of the executive search process. Since these firms offer highly customised and consultative services—such as market mapping, leadership assessment, and discreet candidate outreach—their compensation models are tailored accordingly.

This section offers an SEO-optimised, in-depth explanation of how executive search firms charge for their services, covering different pricing models, fee structures, influencing factors, and industry comparisons. Useful tables and matrices are also included to support better decision-making for employers evaluating executive search partners.

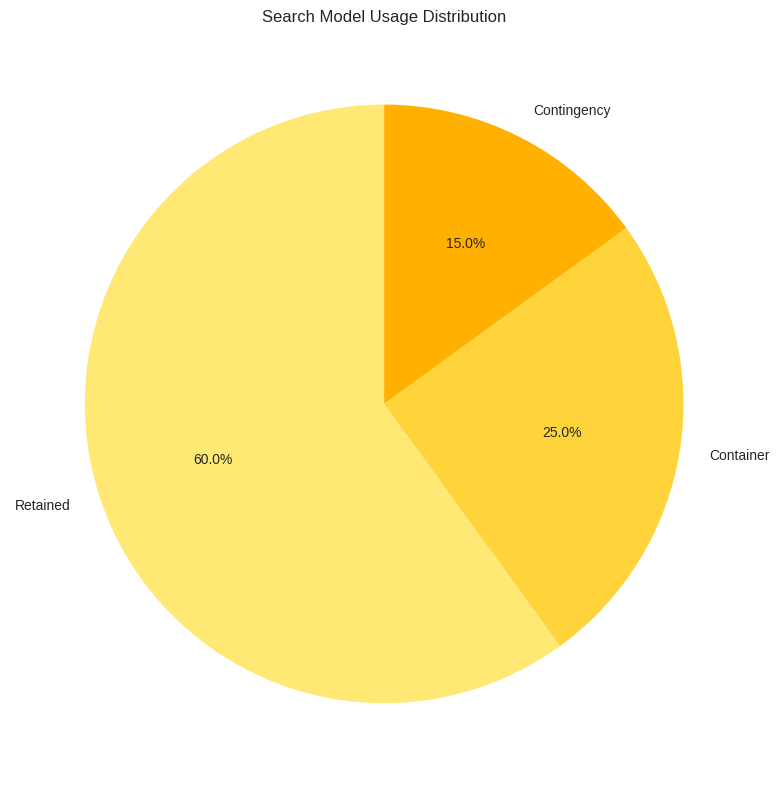

Primary Executive Search Fee Models

There are three main fee models used in the executive search industry:

- Retained Search Model

- Contingency Search Model

- Container (Hybrid) Search Model

Each model is applied based on the seniority of the role, the exclusivity of the engagement, and the client’s strategic needs.

Retained Executive Search Model

- Definition

The retained model is the most commonly used structure in executive search, especially for C-level, board, and high-impact leadership roles. The client engages the search firm exclusively and pays in phased installments, regardless of the final placement outcome. - Structure

- Typically broken into three stages:

- One-third at project commencement

- One-third upon shortlist presentation

- One-third upon successful placement

- Typically broken into three stages:

- Advantages for Employers

- Higher commitment from the search firm

- Access to passive, high-calibre candidates

- In-depth research and long-term partnership

- Confidential and customised search execution

Contingency Search Model

- Definition

In this success-only model, the search firm is paid only if a candidate is successfully placed. It is more common for mid-level roles and non-exclusive engagements. - Structure

- No upfront fees

- One-time payment upon placement (usually 15–25% of first-year salary)

- Limitations

- Less commitment from the search firm

- Higher focus on speed over strategic fit

- Reduced market research and candidate vetting

- Often involves multiple agencies competing for the same role

Container or Hybrid Search Model

- Definition

This model combines elements of both retained and contingency models. A partial upfront fee is paid to initiate the search, and the remaining fee is paid only upon successful placement. - Structure

- Initial deposit (10–20% of fee) to initiate

- Remaining balance on placement

- Use Case

- Emerging markets, first-time executive hiring, or when clients want commitment without full retainment

Comparison Table: Executive Search Fee Models

| Fee Model | Upfront Payment | Payment Timing | Typical Usage | Pros | Cons |

|---|---|---|---|---|---|

| Retained | Yes (staged) | Across 2–3 milestones | C-level, confidential, strategic roles | Full commitment, in-depth research | Paid even if no hire is made |

| Contingency | No | After candidate is hired | Mid-level roles, urgent hiring | Risk-free for employer, faster sourcing | Less quality control, reduced consultant effort |

| Container (Hybrid) | Partial | Initial + success-based | Senior roles with budget sensitivity | Balanced risk-sharing, some commitment upfront | May lack full dedication from search firm |

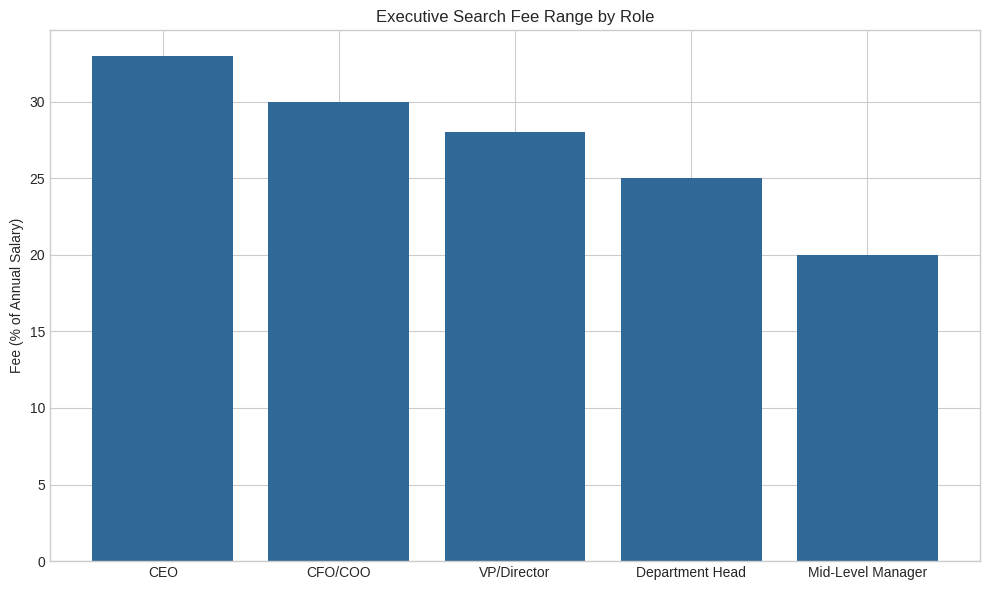

Fee Ranges Based on Role Level

| Role Type | Typical Fee as % of Annual Salary | Average Time to Fill | Common Fee Model |

|---|---|---|---|

| CEO / Board / Chairperson | 30–35% | 12–16 weeks | Retained |

| C-Level (CFO, COO, CTO, CMO, etc.) | 25–33% | 10–14 weeks | Retained or Container |

| VP or Regional Director | 20–30% | 8–12 weeks | Container or Retained |

| Functional Heads (HR, Legal, Sales) | 18–25% | 6–10 weeks | Container or Contingency |

| Mid-Level Managerial Roles | 15–20% | 4–8 weeks | Contingency |

Example Scenario: Retained Search Cost Breakdown

- Role: Chief Technology Officer (CTO)

- Annual Salary: $240,000

- Fee Agreement: 30% retained model

- Total Fee: $72,000, paid in three phases:

- $24,000 upon contract signing

- $24,000 at shortlist delivery

- $24,000 upon successful placement

What Is Typically Included in Executive Search Fees

- Stakeholder alignment and success profiling

- Industry and competitor talent mapping

- Discreet passive candidate outreach

- Structured interviews and leadership assessment

- Weekly reporting and milestone updates

- Shortlist presentation with market insights

- 360-degree referencing and background checks

- Offer management and closure support

- Post-hire follow-up and onboarding consultation

Optional Value-Add Services (May Incur Additional Fees)

| Additional Services | Description | Fee Structure (if applicable) |

|---|---|---|

| Psychometric Testing | Leadership style and personality analysis | Flat fee or included in premium tiers |

| Relocation Support | Managing executive relocation logistics | Often absorbed in total fee |

| Executive Onboarding Coaching | First 90-day success planning | Charged separately or bundled |

| Diversity & Inclusion Reporting | Talent pipeline diversity metrics | Premium retained search only |

| Market Compensation Benchmarking | Salary benchmarking across geographies | Included in retained model |

Factors That Influence Executive Search Pricing

- Seniority and Complexity of the Role

More senior or transformative roles command higher fees due to depth of research, global reach, and longer timelines. - Search Geography and Talent Scarcity

Cross-border and niche searches require extended sourcing efforts, higher touchpoints, and increased market mapping costs. - Speed and Urgency Requirements

Fast-track searches may result in premium fees or expedited delivery pricing. - Confidentiality Level

Confidential replacements or stealth hiring involve additional safeguards, narrowing the candidate pool and requiring greater discretion.

Cost Comparison Matrix: Search Method vs Value Delivered

| Search Method | Average Cost | Talent Quality | Risk of Mis-Hire | Employer Brand Impact | Candidate Assessment Depth |

|---|---|---|---|---|---|

| Retained Search | High (25–35%) | Very High | Low | Strong | Deep and structured |

| Container Search | Medium (20–30%) | High | Moderate | Medium to Strong | Moderate to deep |

| Contingency Search | Low (15–25%) | Moderate | High | Inconsistent | Basic to moderate |

| In-House Sourcing | Low (fixed salary) | Variable | High | Dependent on recruiter | Basic |

Conclusion

Understanding how executive search firms get paid is essential for employers seeking a strategic partner for high-stakes leadership hiring. The retained search model remains the gold standard for senior-level roles, offering depth, confidentiality, and alignment. Contingency and hybrid models have their place for mid-level or less complex roles but may sacrifice thoroughness and long-term fit.