Key Takeaways

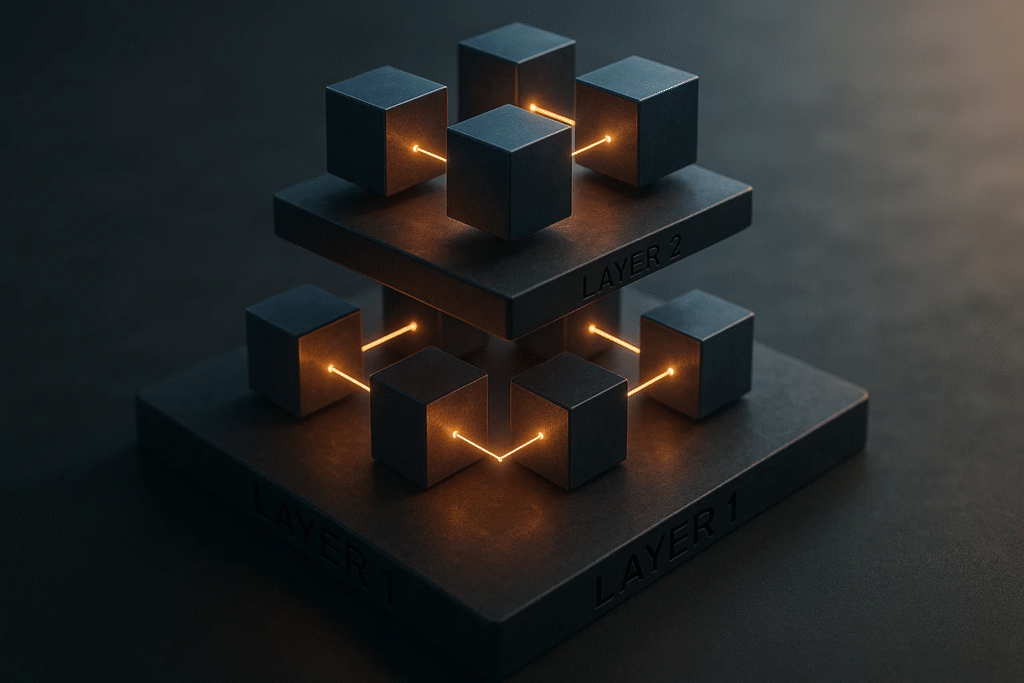

- Layer 1 blockchains provide the foundational security, decentralization, and transaction validation for digital networks.

- Layer 2 solutions enhance scalability, speed, and cost-efficiency by processing transactions off the main chain.

- Together, Layer 1 and Layer 2 enable high-performance, secure blockchain applications for DeFi, NFTs, gaming, and enterprise use cases.

In the rapidly evolving world of blockchain technology, understanding the distinction between Layer 1 and Layer 2 blockchains is essential for anyone seeking to navigate the complexities of decentralized networks. Blockchains have become the backbone of the digital economy, powering cryptocurrencies, decentralized finance (DeFi) platforms, and a wide range of innovative applications that rely on secure, transparent, and immutable record-keeping. However, as blockchain adoption grows, so does the demand for faster, more scalable, and cost-effective solutions. This is where the concepts of Layer 1 and Layer 2 blockchains come into play, offering unique approaches to addressing the critical challenges of scalability, transaction speed, and network efficiency.

Layer 1 blockchains, often referred to as the base layer or main chain, form the foundational infrastructure of the blockchain ecosystem. They are responsible for validating transactions, maintaining the ledger, and ensuring the overall security and decentralization of the network. Prominent examples of Layer 1 blockchains include Bitcoin, Ethereum, and Solana, each with its own consensus mechanisms, network protocols, and design philosophies. While Layer 1 networks provide robust security and decentralization, they are often limited in terms of transaction throughput and can experience high fees during periods of network congestion. These limitations have prompted the development of Layer 2 solutions, which are designed to operate on top of existing Layer 1 blockchains to enhance scalability and efficiency without compromising security.

Layer 2 blockchains function as secondary protocols that process transactions off the main chain while periodically settling the final results on the underlying Layer 1 network. By doing so, they alleviate the burden on the base layer, enabling faster transactions and reduced costs. Solutions such as the Lightning Network for Bitcoin, Optimistic Rollups, and zk-Rollups for Ethereum exemplify the potential of Layer 2 technologies to transform the blockchain landscape. These innovations are particularly significant for applications requiring high transaction volumes, such as decentralized exchanges, gaming platforms, and payment systems, where speed and cost-efficiency are critical.

Understanding the interplay between Layer 1 and Layer 2 blockchains is crucial for investors, developers, and businesses exploring blockchain adoption. Layer 1 provides the secure and decentralized foundation, while Layer 2 enhances usability and performance, creating a complementary relationship that drives the evolution of blockchain technology. As the industry continues to advance, ongoing research and development in both layers promise to deliver more scalable, efficient, and versatile networks, enabling blockchain technology to support a wider array of applications and a growing global user base.

This comprehensive exploration of Layer 1 and Layer 2 blockchains will delve into their definitions, key features, comparative advantages, real-world applications, and future developments. By the end of this guide, readers will gain a clear understanding of how these two layers operate individually and in tandem, and why they are essential components of the modern blockchain ecosystem. This knowledge is vital not only for technical enthusiasts but also for businesses and investors aiming to leverage blockchain solutions for growth, efficiency, and innovation.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of What are Layer 1 and Layer 2 Blockchains, and How Do They Work.

If you are looking for a job or an internship, click over to use the 9cv9 Job Portal to find your next top job and internship now.

Email [email protected] now for career and job finding services.

Or hope over to 9cv9 Recruitment Agency to learn more about our recruitment services.

What are Layer 1 and Layer 2 Blockchains, and How Do They Work

- Understanding Layer 1 Blockchains

- Exploring Layer 2 Solutions

- Layer 1 vs. Layer 2: A Comparative Analysis

- Real-World Applications and Case Studies

- Future Outlook and Developments

1. Understanding Layer 1 Blockchains

Definition and Core Concept

- Layer 1 blockchains, also known as base layer or mainnet blockchains, form the foundational architecture of decentralized networks. They are responsible for recording transactions, validating data, and maintaining the overall security, integrity, and decentralization of the network.

- These blockchains operate independently and do not rely on any other blockchain for their core functionality, making them essential for the entire blockchain ecosystem.

Key Functions of Layer 1 Blockchains

- Transaction Validation: Layer 1 blockchains use consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS) to confirm transactions and prevent double-spending.

- Security and Decentralization: By distributing the ledger across numerous nodes, Layer 1 ensures that the network is resistant to attacks and manipulation.

- Smart Contract Execution: Platforms like Ethereum allow for programmable contracts that run directly on the Layer 1 blockchain, enabling decentralized applications (dApps) and complex protocols.

- Asset Management: Cryptocurrencies such as Bitcoin and Ethereum are native to their Layer 1 networks, with all transactions and token transfers recorded directly on the main blockchain.

Examples of Prominent Layer 1 Blockchains

- Bitcoin: The first and most widely recognized blockchain, using PoW to secure the network and maintain a transparent ledger of all transactions.

- Ethereum: Known for introducing smart contracts and dApps, Ethereum uses PoS (after Ethereum 2.0 upgrade) to enhance efficiency while retaining decentralization.

- Solana: Designed for high throughput and low latency, Solana employs a unique Proof of History (PoH) mechanism to achieve rapid transaction speeds.

- Cardano: Focused on sustainability and scalability, Cardano uses the PoS-based Ouroboros protocol to combine security with energy efficiency.

Comparison Matrix of Layer 1 Blockchains

Feature / Blockchain | Bitcoin | Ethereum | Solana | Cardano

Consensus Mechanism | Proof of Work | Proof of Stake | Proof of History + PoS | Proof of Stake (Ouroboros)

Transaction Speed | ~7 TPS | ~30 TPS | ~65,000 TPS | ~250 TPS

Transaction Fees | Moderate | Variable, often high during congestion | Low | Low

Smart Contract Support | No | Yes | Yes | Yes

Primary Use Case | Digital currency | dApps, DeFi | High-speed payments, DeFi | Enterprise-grade applications, DeFi

Advantages of Layer 1 Blockchains

- High Security: Base layer blockchains offer strong resistance to attacks due to decentralized validation and consensus protocols.

- Native Token Integration: Layer 1 chains host their native tokens, which are directly integrated into the blockchain for transactions and incentives.

- Foundation for Layer 2 Scaling: Layer 1 blockchains serve as the secure backbone on which Layer 2 solutions can operate, enabling scalability without compromising security.

Limitations and Challenges

- Scalability Constraints: Most Layer 1 blockchains face limitations in transaction throughput, leading to slower processing during high network activity.

- High Transaction Costs: Congestion can result in increased fees, particularly on networks like Ethereum during periods of high demand.

- Energy Consumption: PoW-based Layer 1 blockchains, such as Bitcoin, require significant computational power, raising environmental concerns.

Transaction Throughput Chart Example

Blockchain | TPS (Transactions per Second)

Bitcoin | 7

Ethereum | 30

Solana | 65,000

Cardano | 250

Real-World Use Cases of Layer 1 Blockchains

- Cryptocurrency Payments: Bitcoin is widely used for peer-to-peer and institutional transactions.

- Decentralized Finance (DeFi): Ethereum hosts lending platforms, decentralized exchanges, and stablecoins.

- High-Frequency Applications: Solana is used in blockchain-based gaming, NFTs, and microtransactions due to its high throughput.

- Enterprise Solutions: Cardano offers scalable blockchain solutions for governments and large-scale enterprises with an emphasis on compliance and security.

Layer 1 blockchains form the backbone of the blockchain ecosystem, providing the necessary security, decentralization, and foundational infrastructure upon which all other protocols, including Layer 2 solutions, are built. Understanding their core functionalities, strengths, and limitations is critical for developers, investors, and businesses looking to leverage blockchain technology effectively.

2. Exploring Layer 2 Solutions

Definition and Purpose

- Layer 2 solutions are secondary frameworks or protocols built on top of existing Layer 1 blockchains to improve scalability, speed, and transaction efficiency. They do not replace the base blockchain but operate in conjunction with it to reduce network congestion and lower transaction costs.

- These solutions are particularly essential for networks like Ethereum and Bitcoin, where high user activity can lead to slow transaction speeds and elevated fees.

Key Mechanisms of Layer 2 Blockchains

- Off-Chain Transaction Processing: Layer 2 processes transactions off the main chain, batching them and then settling the final results on the Layer 1 blockchain.

- State Channels: A private channel between parties allows multiple transactions without broadcasting each one to the main blockchain, with only the final state recorded on Layer 1. Example: Lightning Network on Bitcoin.

- Rollups: Transactions are bundled and executed off-chain, with cryptographic proofs submitted to the main chain. Examples: Optimistic Rollups, zk-Rollups on Ethereum.

- Sidechains: Independent blockchains running parallel to the mainnet, periodically interacting with the base layer for security and final settlement. Example: Polygon for Ethereum.

Benefits of Layer 2 Solutions

- Scalability: Increases the number of transactions per second (TPS) by handling operations off the main chain.

- Cost Efficiency: Reduces transaction fees, making microtransactions and high-frequency trading feasible.

- Speed: Enables near-instant transaction confirmation, crucial for gaming, DeFi, and payment applications.

- Enhanced User Experience: Provides a seamless experience by reducing delays and improving transaction predictability.

Comparison Matrix of Layer 2 Solutions

Solution Type | Mechanism | Example | TPS | Transaction Cost | Security

State Channels | Off-chain, private channels | Lightning Network (Bitcoin) | Up to 100,000 | Very Low | Relies on Layer 1

Optimistic Rollups | Bundled transactions with fraud proofs | Optimism (Ethereum) | ~2,000 | Low | High, inherits Layer 1 security

zk-Rollups | Zero-knowledge proofs for verification | zkSync (Ethereum) | ~2,000+ | Low | High, inherits Layer 1 security

Sidechains | Independent chains connected to mainnet | Polygon (Ethereum) | ~7,000 | Low | Medium, relies on sidechain consensus

Real-World Examples and Applications

- Lightning Network: Enables rapid Bitcoin micropayments for e-commerce and peer-to-peer transfers, significantly reducing confirmation times.

- Optimism and Arbitrum: Layer 2 rollups for Ethereum, widely used in decentralized exchanges (DEXs), lending platforms, and NFT marketplaces to lower gas fees and enhance transaction speed.

- Polygon: Supports DeFi projects, NFT ecosystems, and gaming applications with scalable infrastructure while maintaining compatibility with Ethereum’s ecosystem.

- Immutable X: Provides Layer 2 solutions for NFTs on Ethereum, allowing instant minting and trading with zero gas fees for end-users.

Performance and Efficiency Chart

Blockchain | Layer | TPS | Average Transaction Cost

Ethereum | Layer 1 | 30 | $5-$50

Ethereum + Optimism | Layer 2 | 2,000 | $0.1-$0.5

Bitcoin | Layer 1 | 7 | $1-$10

Bitcoin + Lightning Network | Layer 2 | 100,000 | <$0.01

Polygon | Layer 2 | 7,000 | <$0.01

Challenges and Considerations

- Security Dependency: Most Layer 2 solutions rely on Layer 1 for final settlement and fraud prevention, meaning their security is partially dependent on the base blockchain.

- Complexity: Integrating Layer 2 solutions can be technically challenging, requiring smart contract deployment and careful management of cross-chain interactions.

- Adoption: Widespread adoption depends on developer support, user awareness, and interoperability with existing applications.

Future Trends in Layer 2 Development

- Enhanced Rollup Technologies: Continued improvements in zk-Rollups and Optimistic Rollups are expected to increase TPS and reduce settlement times further.

- Cross-Chain Compatibility: Layer 2 solutions are being designed to work across multiple Layer 1 blockchains, enabling broader decentralized application ecosystems.

- Enterprise Integration: Businesses are increasingly exploring Layer 2 for scalable blockchain applications, particularly in supply chain management, gaming, and financial services.

Layer 2 solutions play a critical role in the evolution of blockchain networks by providing scalable, cost-effective, and efficient transaction processing. Their integration with Layer 1 blockchains ensures that networks can handle growing user demand without compromising security or decentralization, making them essential for the next generation of blockchain applications.

3. Layer 1 vs. Layer 2: A Comparative Analysis

Overview and Purpose

- Understanding the distinctions between Layer 1 and Layer 2 blockchains is crucial for evaluating network efficiency, scalability, and suitability for specific use cases.

- Layer 1 serves as the base protocol, providing security, decentralization, and transaction validation. Layer 2, built atop Layer 1, enhances performance by addressing scalability and reducing transaction costs.

Key Comparison Metrics

Consensus and Security

- Layer 1: Relies on native consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS) to validate transactions and maintain network integrity. Security is inherent and robust due to the distributed nature of nodes. Example: Bitcoin’s PoW network is highly secure but limited in speed.

- Layer 2: Inherits security from the underlying Layer 1 but relies on off-chain or parallel processes for transaction execution. Security is dependent on Layer 1 for final settlement. Example: Lightning Network relies on Bitcoin for fraud prevention.

Transaction Speed and Throughput

- Layer 1: Often limited in transaction per second (TPS) capacity due to network decentralization and consensus requirements. Example: Ethereum processes approximately 30 TPS, and Bitcoin around 7 TPS.

- Layer 2: Significantly increases TPS by processing transactions off-chain or in batches, enabling high-frequency applications. Example: Solana’s Layer 2 solutions or Ethereum rollups can achieve thousands of TPS.

Transaction Costs

- Layer 1: Fees are generally higher during network congestion due to limited throughput. High transaction costs can hinder microtransactions and small-value exchanges.

- Layer 2: Significantly reduces fees by aggregating multiple transactions and settling them collectively on Layer 1. Example: Polygon and Optimism offer near-zero gas fees for end-users.

Use Case Suitability

- Layer 1: Ideal for high-value transactions, smart contracts, and applications where security and decentralization are paramount. Example: Bitcoin for store-of-value, Ethereum for dApps.

- Layer 2: Suited for high-volume, low-cost transactions, micropayments, and applications requiring fast confirmation times. Example: Lightning Network for Bitcoin micropayments, zk-Rollups for NFT marketplaces.

Comparative Matrix

Feature | Layer 1 | Layer 2

Consensus Mechanism | Native PoW/PoS | Dependent on Layer 1 for final settlement

Security Level | High, decentralized | High, but indirectly reliant on Layer 1

Transaction Speed (TPS) | Low to Moderate (7-250 TPS) | High (2,000+ TPS or more depending on solution)

Transaction Cost | Moderate to High | Low

Smart Contract Capability | Native | Supported depending on implementation

Scalability | Limited | Enhanced through off-chain processing

Primary Applications | Cryptocurrency, dApps, DeFi | Micropayments, high-volume transactions, gaming, NFT trading

Performance Chart: Transaction Speed vs Cost

Blockchain Layer | TPS | Average Transaction Cost

Layer 1 Bitcoin | 7 | $1-$10

Layer 1 Ethereum | 30 | $5-$50

Layer 2 Lightning Network | 100,000 | <$0.01

Layer 2 Optimism | 2,000 | $0.1-$0.5

Layer 2 Polygon | 7,000 | <$0.01

Advantages and Limitations

Layer 1 Advantages:

- Strong security and decentralization

- Native token ecosystem

- Foundational platform for Layer 2 integration

Layer 1 Limitations:

- Limited scalability

- High transaction fees during congestion

- Slower processing for high-volume use cases

Layer 2 Advantages:

- Increased throughput and speed

- Lower transaction costs

- Enables microtransactions and rapid settlements

Layer 2 Limitations:

- Security dependent on Layer 1

- Complexity in implementation

- Partial decentralization in certain solutions, such as sidechains

Real-World Comparative Applications

- Bitcoin vs. Lightning Network: Bitcoin offers secure, decentralized digital currency, while the Lightning Network enables instant micropayments for e-commerce and peer-to-peer transfers.

- Ethereum vs. Optimistic Rollups: Ethereum provides a decentralized platform for dApps and DeFi, while Optimistic Rollups scale transactions efficiently for high-volume trading and NFT marketplaces.

- Solana Layer 1 vs. Layer 2 enhancements: Solana’s base layer handles high-speed transactions natively, while additional Layer 2 solutions further reduce latency and transaction fees for gaming and DeFi applications.

Conclusion

- Layer 1 and Layer 2 blockchains are complementary rather than competing technologies. Layer 1 provides the security, decentralization, and fundamental infrastructure, while Layer 2 enhances scalability, speed, and cost-efficiency.

- Understanding their comparative strengths and limitations allows developers, investors, and businesses to select the appropriate layer or combination for specific blockchain applications, ensuring optimal performance, security, and user experience.

4. Real-World Applications and Case Studies

Introduction

- Layer 1 and Layer 2 blockchains are not merely theoretical constructs; they are actively transforming industries by enhancing transaction efficiency, security, and decentralization.

- This section explores practical implementations of both layers across various sectors, highlighting real-world case studies that demonstrate the capabilities and advantages of these technologies.

Financial Services and Payments

- Cryptocurrencies and Digital Payments: Bitcoin, as a Layer 1 blockchain, serves as a decentralized digital currency used for peer-to-peer transfers and institutional investments. Its security and immutability make it a preferred option for high-value transactions.

- High-Frequency Payments: The Lightning Network, a Layer 2 solution on Bitcoin, enables rapid micropayments for online merchants, gaming platforms, and tipping services, dramatically reducing confirmation times and transaction fees.

- DeFi Platforms: Ethereum’s Layer 1 blockchain hosts numerous decentralized finance applications, including lending protocols, stablecoins, and decentralized exchanges (DEXs). Layer 2 rollups such as Optimism and zkSync further enhance scalability and reduce gas fees, enabling smoother user experiences in high-volume financial transactions.

Supply Chain and Logistics

- Transparency and Traceability: Layer 1 blockchains like Hyperledger Fabric provide immutable records of goods movement, enabling enterprises to track products from production to delivery.

- Scalable Tracking: Layer 2 solutions can be used to manage high-frequency data updates across multiple supply chain participants without overwhelming the main blockchain. Example: IBM Food Trust integrates Layer 2 mechanisms to ensure fast and secure transaction logging across global supply chains.

Gaming and Non-Fungible Tokens (NFTs)

- In-Game Economies: Layer 2 solutions such as Polygon allow game developers to implement scalable in-game currencies and asset trading without high transaction costs or latency. Example: Decentraland uses Polygon to manage NFT-based land and virtual assets.

- NFT Marketplaces: Ethereum’s Layer 1 blockchain provides security and decentralization for NFT ownership, while Layer 2 rollups like Immutable X enable instant minting, trading, and low-cost transactions for digital art and collectibles.

Enterprise Applications

- Smart Contract Automation: Layer 1 blockchains like Cardano facilitate enterprise-grade applications requiring regulatory compliance and secure automation of processes such as identity verification, record-keeping, and contract management.

- Scalable Solutions: Layer 2 enhancements enable enterprises to deploy decentralized applications with high transaction throughput while maintaining the security guarantees of the underlying Layer 1 blockchain. Example: Polygon’s enterprise adoption allows businesses to run large-scale dApps efficiently.

Decentralized Exchanges and Marketplaces

- Layer 1 Platforms: Ethereum-based decentralized exchanges (DEXs) like Uniswap rely on Layer 1 for security and transaction validation, ensuring trustless trading environments.

- Layer 2 Enhancements: Rollups and sidechains enable DEXs to handle high-frequency trading with lower gas fees and faster settlement times. Example: Loopring uses zk-Rollups to allow users to trade Ethereum-based tokens with near-instant execution and minimal costs.

Comparison Table: Layer 1 vs Layer 2 in Real-World Applications

Application | Layer 1 Blockchain | Layer 2 Solution | Benefits of Layer 2

Payments & Micropayments | Bitcoin | Lightning Network | Faster confirmation, lower fees

DeFi Lending & Trading | Ethereum | Optimistic Rollups, zkSync | Higher throughput, reduced gas costs

NFT Marketplaces | Ethereum | Immutable X, Polygon | Instant minting, low-cost trading

Gaming | Ethereum | Polygon | Scalable in-game assets, low latency

Supply Chain | Hyperledger Fabric | Layer 2 tracking modules | Real-time updates, reduced congestion

Case Study: Ethereum and Layer 2 Adoption

- Problem: High gas fees and slow transaction speeds on Ethereum during periods of peak activity.

- Solution: Implementation of Optimistic Rollups and zk-Rollups to batch multiple transactions off-chain while securing final results on Ethereum Layer 1.

- Result: Enhanced throughput to over 2,000 TPS, reduced transaction fees by up to 90%, and improved user experience for DeFi applications and NFT marketplaces.

Case Study: Bitcoin and the Lightning Network

- Problem: Bitcoin’s Layer 1 network processes only 7 TPS, making microtransactions slow and costly.

- Solution: Lightning Network establishes off-chain payment channels that settle aggregated results on the Bitcoin mainnet.

- Result: Near-instant payments with negligible fees, facilitating micropayments, e-commerce transactions, and cross-border transfers.

Future Implications

- Layer 1 and Layer 2 blockchains continue to evolve in tandem, enabling innovative applications across finance, supply chain, gaming, and enterprise systems.

- Increasing adoption of Layer 2 solutions is expected to unlock new markets, enhance user experience, and make decentralized systems viable for high-volume, real-world use cases.

Conclusion

- Real-world applications and case studies demonstrate that Layer 1 blockchains provide the critical security and decentralization infrastructure, while Layer 2 solutions enhance performance, scalability, and cost efficiency.

- The synergy between Layer 1 and Layer 2 enables blockchain technology to move beyond niche applications, delivering practical, high-performance solutions for businesses, developers, and end-users worldwide.

5. Future Outlook and Developments

Introduction

- The blockchain ecosystem is evolving at an unprecedented pace, with both Layer 1 and Layer 2 solutions undergoing significant innovation.

- Understanding future trends is crucial for investors, developers, and enterprises seeking to leverage blockchain technology for scalability, security, and efficiency.

- This section explores emerging developments, projected advancements, and the potential implications for the global blockchain landscape.

Layer 1 Advancements and Upgrades

- Enhanced Consensus Mechanisms: Many Layer 1 blockchains are transitioning from Proof of Work (PoW) to Proof of Stake (PoS) or hybrid consensus models to improve energy efficiency and scalability. Example: Ethereum 2.0’s shift to PoS reduces energy consumption by over 99% while maintaining network security.

- Interoperability Initiatives: Layer 1 blockchains are increasingly focusing on cross-chain communication to enable seamless data and asset transfer between networks. Example: Polkadot and Cosmos provide frameworks for connecting multiple blockchains, facilitating interoperability and multi-chain ecosystems.

- On-Chain Governance Improvements: Future Layer 1 developments are emphasizing decentralized governance structures to allow token holders to participate in protocol upgrades and network decisions, ensuring long-term sustainability.

Layer 2 Innovations and Scaling Solutions

- Advanced Rollups: Optimistic and zero-knowledge rollups continue to evolve, offering higher throughput, faster settlement times, and reduced transaction costs. Example: zk-Rollups on Ethereum are projected to handle tens of thousands of transactions per second while retaining Layer 1 security.

- Multi-Layered Scaling: Developers are exploring combinations of multiple Layer 2 solutions, including state channels, sidechains, and rollups, to create scalable, modular architectures that can handle global transaction volumes.

- Enterprise Adoption: Layer 2 is expected to become a key enabler for large-scale applications in finance, supply chain, gaming, and NFTs, providing fast, cost-efficient, and secure operations without compromising decentralization.

Projected Market Trends

- Global Blockchain Spending: Analysts predict blockchain-related infrastructure spending to exceed $30 billion by 2030, driven by enterprise adoption of Layer 1 and Layer 2 solutions.

- DeFi Expansion: Layer 2 solutions will facilitate broader adoption of decentralized finance applications, allowing seamless trading, lending, and staking at low cost and high speed.

- NFT and Gaming Growth: Layer 2 enhancements will be critical in supporting NFT ecosystems and blockchain gaming platforms, where transaction volume and speed are essential.

Comparison Matrix: Projected Layer 1 vs Layer 2 Developments

Development Area | Layer 1 | Layer 2

Consensus Mechanism | Transition to PoS and hybrid models | Dependent on Layer 1 security, focus on transaction batching and fraud proofs

Scalability | Moderate increase through sharding and protocol upgrades | Significant increase through rollups, state channels, and sidechains

Transaction Speed | 100-1,000 TPS projected (Ethereum 2.0) | 10,000+ TPS with advanced Layer 2 solutions

Transaction Cost | Reduced due to improved efficiency | Near-zero fees in high-volume applications

Interoperability | Native cross-chain frameworks (Polkadot, Cosmos) | Cross-Layer 2 bridging solutions for multi-chain operations

Enterprise Integration | Focus on compliance, governance, and sustainable energy use | Focus on high-volume application deployment with reduced latency and cost

Emerging Technologies and Innovations

- Sharding: Layer 1 blockchains like Ethereum are implementing sharding to divide the network into smaller segments, enabling parallel transaction processing and higher throughput.

- Zero-Knowledge Proofs: zk-SNARKs and zk-STARKs are becoming integral in Layer 2 solutions to validate large batches of transactions efficiently and securely without revealing sensitive data.

- Cross-Layer Protocols: Protocols bridging Layer 1 and Layer 2 networks are being developed to enable seamless transfer of assets, data, and smart contract executions, enhancing interoperability across ecosystems.

Performance and Efficiency Forecast Chart

Blockchain Layer | Current TPS | Projected TPS (2025-2030) | Average Transaction Cost Today | Projected Transaction Cost

Layer 1 Ethereum | 30 | 1,000 | $5-$50 | $0.5-$5

Layer 1 Bitcoin | 7 | 50 | $1-$10 | <$1

Layer 2 Optimistic Rollups | 2,000 | 20,000 | $0.1-$0.5 | <$0.01

Layer 2 zk-Rollups | 2,000+ | 50,000+ | $0.1-$0.5 | <$0.01

Layer 2 Lightning Network | 100,000 | 500,000 | <$0.01 | <$0.001

Potential Challenges and Considerations

- Regulatory Compliance: As blockchain adoption grows, governments and regulators are increasingly scrutinizing Layer 1 and Layer 2 networks, particularly in financial services.

- Technical Complexity: The integration of advanced Layer 2 solutions requires expertise in smart contracts, cross-chain protocols, and network security.

- Security Risks: While Layer 2 inherits security from Layer 1, complex multi-layered systems may introduce vulnerabilities if not properly audited and maintained.

Conclusion

- The future of blockchain technology is shaped by the complementary evolution of Layer 1 and Layer 2 networks. Layer 1 focuses on security, decentralization, and protocol upgrades, while Layer 2 addresses scalability, speed, and cost-efficiency.

- Ongoing innovations, including sharding, zero-knowledge proofs, and cross-chain interoperability, are expected to enhance blockchain capabilities, making these networks more practical for enterprise adoption, DeFi, NFTs, gaming, and high-volume transactions.

- Stakeholders who understand and leverage both layers strategically will be well-positioned to capitalize on the next generation of blockchain applications and global decentralized infrastructure.

Conclusion

Layer 1 and Layer 2 blockchains represent two integral components of the modern blockchain ecosystem, each serving a distinct yet complementary purpose. Layer 1 blockchains form the foundational infrastructure, providing security, decentralization, and transaction validation through robust consensus mechanisms such as Proof of Work (PoW), Proof of Stake (PoS), and innovative protocols like Proof of History (PoH). These base layer networks, including Bitcoin, Ethereum, Solana, and Cardano, offer a secure environment for cryptocurrency transactions, smart contracts, and decentralized applications. Despite their critical role, Layer 1 networks face inherent limitations, particularly in scalability and transaction costs, which can hinder widespread adoption for high-volume and real-time applications.

Layer 2 solutions address these challenges by building on top of Layer 1 blockchains to enhance speed, scalability, and cost efficiency. Through mechanisms such as state channels, rollups, and sidechains, Layer 2 enables rapid transaction processing, reduced fees, and improved user experiences without compromising the security guaranteed by the underlying Layer 1 network. Examples like the Lightning Network for Bitcoin, Optimistic Rollups and zk-Rollups for Ethereum, and Polygon for Ethereum-based dApps demonstrate the transformative impact of Layer 2 solutions on decentralized finance (DeFi), NFT marketplaces, gaming platforms, and enterprise applications.

The interplay between Layer 1 and Layer 2 blockchains highlights the importance of a holistic approach to blockchain adoption. While Layer 1 ensures trust, decentralization, and robust network security, Layer 2 enhances performance, efficiency, and scalability, making blockchain technology practical for a wide range of real-world use cases. Together, these layers form a resilient ecosystem capable of supporting high-frequency transactions, complex smart contracts, and decentralized applications that demand speed and affordability.

Looking ahead, continuous advancements in blockchain technology promise even greater capabilities. Innovations in consensus mechanisms, sharding, zero-knowledge proofs, and cross-chain interoperability are expected to increase transaction throughput, reduce costs, and expand enterprise adoption. Layer 2 solutions will play an increasingly vital role in addressing the demands of global users, enabling blockchain networks to handle high transaction volumes while maintaining security and decentralization.

For businesses, developers, investors, and blockchain enthusiasts, understanding the functions, advantages, and limitations of both Layer 1 and Layer 2 blockchains is essential. This knowledge not only informs strategic decisions regarding blockchain integration and adoption but also provides insights into the future trajectory of the decentralized ecosystem. As the blockchain landscape evolves, the combined strengths of Layer 1 and Layer 2 networks will continue to drive innovation, enhance efficiency, and unlock new opportunities across finance, enterprise, gaming, and digital asset markets.

In conclusion, Layer 1 and Layer 2 blockchains are not isolated technologies but interconnected layers that together enable the scalability, speed, and security necessary for the next generation of decentralized applications. Their complementary nature ensures that blockchain networks remain robust, adaptable, and capable of supporting the growing demands of a global, digital-first economy. Understanding how these layers work and interact is fundamental for leveraging blockchain technology to its fullest potential, paving the way for a future where decentralized solutions are seamlessly integrated into everyday financial, commercial, and technological ecosystems.

If you find this article useful, why not share it with your hiring manager and C-level suite friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

To hire top talents using our modern AI-powered recruitment agency, find out more at 9cv9 Modern AI-Powered Recruitment Agency.

People Also Ask

What is a Layer 1 blockchain?

A Layer 1 blockchain is the base layer of a network, responsible for validating transactions, maintaining security, and supporting decentralized applications directly on its main chain.

What is a Layer 2 blockchain?

A Layer 2 blockchain is built on top of a Layer 1 network to improve scalability, speed, and transaction cost efficiency by processing transactions off-chain or in batches.

How do Layer 1 and Layer 2 blockchains differ?

Layer 1 handles core network security and transaction validation, while Layer 2 enhances performance by enabling faster transactions and lower fees without compromising Layer 1 security.

Why are Layer 2 solutions important?

Layer 2 solutions address Layer 1 limitations like slow transaction speeds and high fees, allowing blockchain networks to scale for high-volume applications efficiently.

Can Layer 1 blockchains support smart contracts?

Yes, Layer 1 blockchains like Ethereum and Cardano support smart contracts directly on their main chain for decentralized applications and automated processes.

What are examples of Layer 1 blockchains?

Prominent Layer 1 blockchains include Bitcoin, Ethereum, Solana, and Cardano, each offering security, decentralization, and native cryptocurrency support.

What are examples of Layer 2 solutions?

Examples include the Lightning Network for Bitcoin, Optimistic Rollups and zk-Rollups for Ethereum, and Polygon for Ethereum-based applications.

Do Layer 2 solutions have their own tokens?

Some Layer 2 solutions may have native tokens, but most rely on the underlying Layer 1 blockchain’s token for transactions and security validation.

How do Layer 2 blockchains increase transaction speed?

They process transactions off-chain or in batches, reducing the load on the main Layer 1 network and enabling near-instant confirmation.

Are Layer 2 blockchains secure?

Layer 2 inherits security from the Layer 1 blockchain, ensuring that final transaction settlement is secure and resistant to attacks.

What is a rollup in Layer 2 technology?

A rollup batches multiple transactions off-chain and submits cryptographic proofs to Layer 1, reducing fees and increasing transaction throughput.

What is the Lightning Network?

The Lightning Network is a Layer 2 protocol for Bitcoin that enables instant micropayments with minimal fees by creating off-chain payment channels.

Can Layer 2 blockchains handle high transaction volumes?

Yes, Layer 2 solutions are designed to scale networks, processing thousands of transactions per second while keeping costs low.

Do Layer 1 and Layer 2 blockchains work together?

Yes, Layer 2 solutions rely on Layer 1 for security and final settlement, creating a complementary system for scalable, efficient transactions.

What industries use Layer 1 and Layer 2 blockchains?

Finance, DeFi, NFTs, gaming, supply chain, and enterprise applications leverage both layers for security, speed, and scalability.

How do Layer 2 solutions reduce transaction fees?

By aggregating multiple transactions and processing them off-chain, Layer 2 reduces the computational load and lowers costs for users.

What is a state channel in Layer 2?

A state channel is a private off-chain pathway where parties can transact multiple times, with only the final state recorded on Layer 1.

Are Layer 2 solutions decentralized?

Most Layer 2 solutions maintain decentralization but may rely on Layer 1’s security for final settlement, combining speed with reliability.

Can enterprises benefit from Layer 2 blockchains?

Yes, Layer 2 allows businesses to deploy high-volume applications, smart contracts, and payment systems efficiently without congestion or high fees.

How do rollups differ from sidechains?

Rollups submit transaction proofs to Layer 1 for security, while sidechains operate independently and periodically synchronize with Layer 1.

What role does Ethereum play in Layer 1 and Layer 2 solutions?

Ethereum acts as a Layer 1 blockchain supporting smart contracts, while Layer 2 solutions like Optimistic and zk-Rollups enhance scalability and reduce gas fees.

Is Bitcoin compatible with Layer 2 solutions?

Yes, Bitcoin uses the Lightning Network as a Layer 2 solution to enable fast, low-cost micropayments without changing its base Layer 1 network.

How do Layer 2 blockchains impact NFTs?

Layer 2 allows faster minting, trading, and transfers of NFTs with lower fees, enhancing user experience on high-volume marketplaces.

What is zk-Rollup technology?

zk-Rollups use zero-knowledge proofs to batch transactions off-chain and verify them on Layer 1, ensuring security while increasing throughput.

Can Layer 1 blockchains scale on their own?

Layer 1 scalability is limited due to consensus constraints, network congestion, and high transaction costs, which is why Layer 2 solutions are needed.

What are the benefits of using Layer 2 for DeFi applications?

Layer 2 improves transaction speed, lowers fees, and enhances user experience, making DeFi platforms more accessible and efficient.

Do Layer 2 solutions affect blockchain security?

Layer 2 maintains security by relying on the Layer 1 blockchain for final transaction settlement and validation, ensuring trustless operations.

Can Layer 2 blockchains work with multiple Layer 1 networks?

Yes, some Layer 2 solutions are being developed to be multi-chain compatible, enabling cross-chain asset transfers and interoperability.

Why are Layer 1 and Layer 2 both essential?

Layer 1 ensures security and decentralization, while Layer 2 improves scalability and efficiency, together enabling high-performance blockchain applications.

What is the future of Layer 1 and Layer 2 blockchains?

Future developments include sharding, advanced rollups, cross-chain interoperability, and enterprise adoption, driving scalable, secure, and efficient decentralized networks.

![Writing A Good CV [6 Tips To Improve Your CV] 6 Tips To Improve Your CV](https://blog.9cv9.com/wp-content/uploads/2020/06/2020-06-02-2-100x70.png)