Key Takeaways

- Strategic Financial Planning: Safeguard your startup with meticulous financial planning, setting clear goals and forecasting cash flows.

- Diversify Revenue Streams: Navigate market uncertainties by diversifying income sources, enhancing adaptability and mitigating risks.

- Build a Strong Emergency Fund: Establish a financial safety net for unforeseen challenges, ensuring resilience and stability in times of economic downturns.

The recent maelstrom of news regarding startups being liquidated or filing for bankruptcy does not bode well for our society and is a sign that financial mismanagement is taking place.

Those signals serve as our motivation in writing this piece in the hope of helping startups and companies to avoid or to mitigate the possibility of bankruptcy.

WeWork Inc, one of the largest and well-funded startup in recent times, has initiated bankruptcy proceedings, marking the culmination of a turbulent period that involved a thwarted initial public offering, challenges posed by Covid-19 lockdowns, a blank-check merger, and a gradual return-to-office scenario.

The company, which boasted a valuation of $47 billion at its zenith in 2019, disclosed $19 billion in liabilities and $15 billion in assets in its bankruptcy filing in New Jersey on Monday.

In the fast-paced realm of startups, where innovation and ambition collide, the journey is both exhilarating and perilous.

As entrepreneurs set sail on the turbulent seas of business, the looming threat of bankruptcy becomes an ever-present specter. However, fear not, fellow trailblazers.

This comprehensive guide is your compass through the treacherous waters, providing a lifeline of Top 6 Tips to Avoid Bankruptcy as a Startup.

Launching a startup is akin to embarking on a daring adventure, where each decision shapes the trajectory of your entrepreneurial expedition.

Financial storms can arise unexpectedly, challenging the very core of your business.

In this blog, we delve deep into the strategic maneuvers that can safeguard your startup from the tempestuous forces of insolvency.

Navigating the Financial Landscape

Understanding the Startup Odyssey

Before we unfurl the sails of financial wisdom, it’s crucial to grasp the nuances of the startup odyssey.

From the initial spark of an idea to the full-blown realization of a business entity, the journey is fraught with risks.

A startup’s financial health is often tested in the crucible of uncertainty, and wise navigators prepare for the unknown.

The Stakes: Why Bankruptcy Looms

Bankruptcy, like a lurking Kraken beneath the waves, threatens to engulf startups that are unprepared or unaware.

Statistics reveal a daunting reality—many startups face financial distress within the first few years of inception.

Understanding the reasons behind these challenges is the first step in fortifying your vessel against the financial maelstrom.

Plotting a Course to Financial Stability

Early Financial Planning: The Navigator’s Compass

Imagine your startup as a ship, cutting through the vast sea of competition.

Early financial planning serves as your navigator’s compass, ensuring that you set sail with a clear understanding of the financial landscape.

We’ll explore the intricacies of budgeting essentials and crafting realistic financial projections, equipping you with the tools to steer your ship toward prosperity.

Diversifying Revenue Streams: Sails of Resilience

In a world of unpredictable tides, reliance on a single income source is a perilous strategy.

We’ll unfurl the sails of resilience, guiding you through the art of diversifying revenue streams.

Learn how to explore multiple income sources and reduce dependence on a single client or product, ensuring your startup remains agile in the face of economic turbulence.

Effective Cost Management: Navigating Choppy Waters

As the waves of expenses threaten to capsize your financial stability, effective cost management becomes your anchor.

Discover the art of identifying unnecessary expenses and negotiating vendor contracts for better rates.

These savvy maneuvers will not only plug financial leaks but also strengthen the hull of your startup against the onslaught of unforeseen challenges.

The journey has just begun, and this introduction merely scratches the surface of our exploration into the Top 6 Tips to Avoid Bankruptcy as a Startup.

Venture forth with us as we unravel the remaining strategies that will empower you to navigate the turbulent waters of entrepreneurship with confidence and resilience.

Before we venture further into this article, we like to share who we are and what we do.

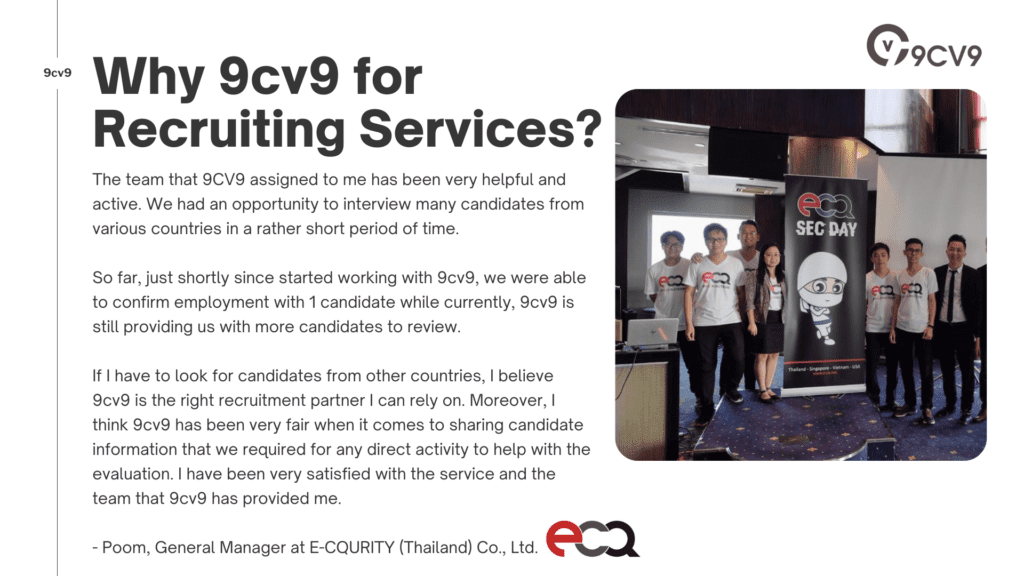

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over seven years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the guide on the Top 6 Tips to Avoid Bankruptcy as a Startup.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 6 Tips to Avoid Bankruptcy as a Startup

- Early Financial Planning

- Diversifying Revenue Streams

- Effective Cost Management

- Building a Strong Emergency Fund

- Monitoring and Adjusting Financial Strategies

- Seeking Professional Advice

1. Early Financial Planning: Setting Sail for Success

Understanding the Startup Odyssey

- The startup journey, akin to an epic odyssey, demands foresight and strategic planning. According to a study by CB Insights, approximately 29% of startups fail due to running out of cash, emphasizing the critical importance of financial planning in the early stages.

- Startups often face the challenge of securing initial funding, with many relying on personal savings, loans, or credit to kickstart their ventures.

Budgeting Essentials for Startups

- Scenario Analysis: Begin with a comprehensive scenario analysis. Anticipate different financial scenarios, including best-case, worst-case, and moderate scenarios. This method, akin to weathering different sea conditions, enables you to prepare for financial storms.

- Example: If your startup relies heavily on a specific client, consider scenarios where that client reduces or discontinues their engagement.

- Lean Budgeting: Embrace lean budgeting principles to maximize efficiency. According to a study, startups that prioritize cost-cutting in the early stages are more likely to achieve long-term success.

- Example: Opt for cost-effective tools and technologies without compromising quality. Consider remote work options to reduce overhead expenses.

- Prioritizing Expenditure: Identify non-negotiable expenses and prioritize them. This could include key talent salaries, essential technology, and marketing efforts. A well-allocated budget is a sturdy ship that can weather financial turbulence.

- Example: Allocate a portion of the budget for marketing campaigns to boost brand visibility and attract potential investors.

Creating Realistic Financial Projections

- Market Research: Conduct thorough market research to inform your financial projections. Understand market trends, consumer behavior, and potential competition. Accurate projections are the North Star guiding your financial course.

- Example: Analyze competitor pricing strategies and customer preferences to inform your pricing model.

- Cash Flow Forecasting: Develop robust cash flow forecasts. A study by the Small Business Administration found that 82% of startups fail due to poor cash flow management.

- Example: Regularly update cash flow forecasts to identify potential gaps and proactively address them.

- Contingency Planning: Factor in contingencies for unforeseen circumstances. According to a report by Startup Genome, 70% of startups scale prematurely, leading to financial instability.

- Example: Plan for unexpected market shifts or external factors that may impact your revenue streams.

Navigating the Seas of Uncertainty

- Risk Assessment: Conduct a comprehensive risk assessment. Identify potential financial risks and devise mitigation strategies. This proactive approach fortifies your startup against unforeseen challenges.

- Example: If your startup operates in a volatile market, explore financial instruments like hedging to minimize currency exchange risks.

- Investor Communication: Maintain transparent communication with investors. A report by PitchBook reveals that startups with effective investor communication are more likely to secure follow-on funding.

- Example: Regularly update investors on financial milestones, challenges, and strategic decisions.

This comprehensive exploration into “Early Financial Planning” provides startups with a sturdy financial compass.

The data-driven insights and actionable examples aim to guide entrepreneurs through the intricate waters of financial management, setting the stage for a successful and resilient startup journey.

2. Diversifying Revenue Streams: Sails of Resilience

Navigating the Financial Landscape

- The Perils of Dependency: Dependence on a single revenue source can leave startups vulnerable to market fluctuations and client uncertainties. According to a study by McKinsey, diversifying revenue streams is a key strategy for long-term business sustainability.

- Example: If a startup relies solely on product sales, exploring subscription models or partnerships can provide a more stable income foundation.

Exploring Multiple Income Sources

- Product and Service Expansion: Expand your product or service offerings. A report by Harvard Business Review suggests that startups with diverse product portfolios are better equipped to withstand economic downturns.

- Example: If your startup provides software solutions, consider diversifying into related services such as consulting or training.

- Geographic Expansion: Explore new markets and regions. The International Trade Centre indicates that startups that expand internationally often experience a more robust revenue stream.

- Example: If your startup operates primarily in one country, research potential markets abroad and strategize market entry.

- Partnerships and Collaborations: Forge strategic partnerships with complementary businesses. According to a study by Deloitte, collaborative ventures can enhance revenue potential and mitigate risks.

- Example: If your startup offers design services, collaborate with a marketing agency to offer comprehensive solutions to clients.

Reducing Reliance on a Single Client or Product

- Client Diversification: Avoid over-reliance on a single client. Research by the Corporate Executive Board indicates that losing a major client can lead to significant revenue loss for startups.

- Example: If a substantial portion of your revenue comes from one client, actively seek new clients to balance your client portfolio.

- Product Mix Adjustments: Regularly assess and adjust your product mix. The SBA reports that adapting products to meet changing market demands is crucial for sustained revenue growth.

- Example: If a particular product faces declining demand, invest in research to identify emerging market needs and adjust your product offerings accordingly.

- Subscription Models and Recurring Revenue: Introduce subscription-based models for consistent income. The Subscription Economy Index reveals that subscription-based businesses often exhibit higher revenue predictability.

- Example: If applicable, consider transitioning from one-time purchases to subscription-based services, ensuring a steady flow of revenue.

Strategies for Long-Term Financial Stability

- Continuous Market Research: Stay abreast of market trends and consumer preferences. Periodic market research, such as customer surveys and competitor analyses, helps identify new revenue opportunities.

- Example: Regularly conduct surveys to understand evolving customer needs and tailor your offerings accordingly.

- Technology Integration: Leverage technology for innovation. According to Accenture, startups that embrace digital transformation are more likely to discover new revenue streams.

- Example: Explore how emerging technologies like artificial intelligence or blockchain can enhance your product/service offerings or create new revenue streams.

- Diversification Metrics: Establish key performance indicators (KPIs) for revenue diversification. Measure the success of your diversification strategies through metrics like the percentage of revenue from new sources.

- Example: Set a target percentage for revenue from new markets or product lines and track progress regularly.

This exploration into “Diversifying Revenue Streams” aims to equip startups with strategic insights and actionable examples.

By navigating the seas of revenue diversification, entrepreneurs can fortify their ventures against the uncertainties of the business landscape.

3. Effective Cost Management: Navigating Choppy Waters

Identifying Unnecessary Expenses

- Cost Audit: Conduct a thorough cost audit to identify areas of overspending.

- Example: Analyze recurring expenses such as software subscriptions, utilities, and office space to identify potential areas for cost reduction.

- Prioritizing Essential Expenses: Distinguish between essential and non-essential expenses. An article suggests that focusing on core operations and necessities is key to sustainable cost management.

- Example: If your startup operates in a tech-driven industry, prioritize investments in cutting-edge technology while trimming non-essential expenditures.

- Benchmarking against Industry Standards: Benchmark your expenses against industry standards. This comparative analysis can highlight areas where your startup may be overspending.

- Example: Utilize industry reports and benchmarks to compare your marketing expenses, ensuring they align with industry norms.

Negotiating Vendor Contracts for Better Rates

- Supplier Negotiations: Engage in proactive negotiations with suppliers. A study by the Institute for Supply Management found that strategic supplier relationships can lead to cost savings.

- Example: Negotiate bulk discounts or long-term contracts with suppliers to secure favorable rates on essential materials or services.

- Exploring Alternative Suppliers: Regularly explore alternative suppliers. According to a report by McKinsey, diversifying your supplier base can reduce dependency and create negotiation leverage.

- Example: Identify alternative suppliers for critical components, ensuring you have options if negotiations with your primary supplier become challenging.

- Payment Terms Optimization: Optimize payment terms with suppliers. Extending payment terms can improve cash flow, providing more flexibility in managing expenses.

- Example: Negotiate longer payment terms with suppliers without compromising relationships, allowing your startup to maintain healthy cash reserves.

Streamlining Operational Processes

- Process Efficiency: Enhance operational efficiency to reduce costs. The Small Business Administration emphasizes that streamlined processes contribute to long-term cost savings.

- Example: Implement automation tools to streamline repetitive tasks, reducing the need for manual labor and associated costs.

- Energy and Resource Conservation: Adopt sustainable practices for cost and resource conservation. The EPA reports that energy-efficient practices can significantly reduce operational costs.

- Example: Implement energy-efficient lighting systems and encourage employees to adopt eco-friendly practices, contributing to both cost savings and environmental sustainability.

- Outsourcing Non-Core Functions: Consider outsourcing non-core functions. Outsourcing can be a cost-effective strategy, allowing your team to focus on core competencies.

- Example: Outsource tasks like customer support or data entry to specialized service providers, potentially reducing operational costs.

Technology-Driven Cost Efficiency

- Cloud Computing Adoption: Embrace cloud computing for cost-efficient operations. According to a report by IDG, 78% of businesses believe that cloud technology reduces overall IT costs.

- Example: Transitioning to cloud-based infrastructure can eliminate the need for physical servers, reducing maintenance and operational costs.

- Automation Technologies: Invest in automation technologies to reduce labor costs. The International Federation of Robotics reports that automation can lead to significant cost savings.

- Example: Implement robotic process automation (RPA) for repetitive tasks, allowing employees to focus on higher-value activities.

- Cost Management Software: Utilize cost management software for real-time tracking and analysis. This technology provides insights into expenditure patterns, aiding in informed decision-making.

- Example: Implement cost management tools like QuickBooks or Expensify to monitor expenses, identify trends, and make data-driven cost-cutting decisions.

This exploration into “Effective Cost Management” equips startups with actionable strategies and examples to navigate the choppy waters of financial management.

By implementing these cost-saving measures, entrepreneurs can steer their ventures towards long-term financial stability.

Bonus: Use 9cv9 Job and Hiring Service to reduce Hiring and Recruitment Cost

9cv9’s Job and Hiring Service is a game-changer for businesses aiming to optimize their hiring processes and reduce recruitment costs.

Leveraging top technology, this service streamlines candidate screening, ensuring that only the most qualified individuals make it to your shortlist.

The platform provides access to a global talent pool, broadening your reach and potentially reducing costs associated with local searches.

With customizable and cost-effective hiring plans, businesses can tailor their approach to align with budget constraints while accessing essential features for a seamless recruitment experience.

In addition to efficient communication tools, 9cv9 offers value-added services like headhunting, recruitment, and background checks, empowering businesses to make well-informed and cost-effective hiring decisions.

Overall, 9cv9’s Job and Hiring Service is a comprehensive solution designed to enhance efficiency, lower recruitment costs, and connect businesses with the right talent.

It’s well renowned as one of the top hiring services in the world.

Plus, to help startups and companies reduce hiring costs, 9cv9 is offering a Free Job Posting Service.

That’s right. You didn’t misread that.

Try now by registering an account and posting 1 free job here.

Read the testimonials to be convinced.

4. Building a Strong Emergency Fund: A Financial Safety Net

Importance of Having a Financial Safety Net

- Startling Statistics: Startups, like any ventures, are susceptible to unexpected financial challenges. According to a survey by Small Business Credit Survey, 66% of small businesses faced financial challenges in the past year, underscoring the need for a robust emergency fund.

- Example: If your startup operates in a seasonal industry, having a financial safety net can provide stability during off-peak periods.

- Cushion Against Uncertainty: An emergency fund serves as a cushion against economic downturns and unforeseen circumstances. The U.S. Small Business Administration recommends maintaining at least three to six months’ worth of operating expenses in an emergency fund.

- Example: If your startup relies heavily on external funding, having an emergency fund can mitigate the impact of funding delays or disruptions.

Tips for Establishing and Maintaining an Emergency Fund

- Set Clear Savings Goals: Define specific savings goals for your emergency fund. According to a study by Psychology Science, setting concrete goals enhances motivation and commitment.

- Example: Set a goal to save a certain percentage of monthly revenue towards the emergency fund, ensuring a systematic approach to building reserves.

- Automate Savings Process: Automate the savings process to ensure consistency. A report by Forbes highlights that automated savings contribute to higher success rates in achieving financial goals.

- Example: Set up automated transfers from your business account to the emergency fund at regular intervals, eliminating the risk of oversight.

- Separate Emergency Fund Account: Open a separate account dedicated to the emergency fund. This segregation prevents accidental spending and reinforces the fund’s designated purpose.

- Example: Choose a savings account or money market account with minimal withdrawal restrictions to ensure liquidity when needed.

Determining the Right Fund Size

- Calculate Monthly Operating Expenses: Determine your startup’s monthly operating expenses. This includes fixed costs like rent, utilities, salaries, and variable costs such as marketing and supplies.

- Example: If your monthly operating expenses amount to $50,000, aim to build an emergency fund ranging from $150,000 to $300,000 based on the recommended three to six months’ worth.

- Consider Industry Volatility: Assess the volatility of your industry. Startups in highly volatile sectors may benefit from a larger emergency fund.

- Example: Tech startups may face rapid market changes; therefore, having a more substantial emergency fund is prudent.

- Factor in Potential Risks: Identify potential risks that could impact your startup’s financial stability.

- Example: If your startup relies on a single key client, consider the potential risk of losing that client and adjust your emergency fund size accordingly.

Strategies for Preserving and Utilizing the Emergency Fund

- Preservation Strategies: Implement measures to preserve the emergency fund. This includes prioritizing cost management, negotiating favorable payment terms with suppliers, and exploring alternative financing options.

- Example: If facing a temporary cash flow challenge, negotiate extended payment terms with suppliers to ease immediate financial strain.

- Strategic Withdrawals: Establish criteria for emergency fund withdrawals.

- Example: Define specific circumstances, such as a sudden drop in revenue or unexpected operational challenges, that warrant tapping into the emergency fund.

- Regular Reviews and Adjustments: Regularly review and adjust the emergency fund size. As your startup grows or experiences changes in financial dynamics, ensure that the fund aligns with current needs.

- Example: Conduct quarterly financial reviews to assess the adequacy of the emergency fund and make adjustments based on evolving business conditions.

This exploration into “Building a Strong Emergency Fund” provides startups with actionable strategies and examples to fortify their financial resilience.

By proactively establishing and maintaining an emergency fund, entrepreneurs can navigate the unpredictable seas of entrepreneurship with greater confidence.

5. Monitoring and Adjusting Financial Strategies: Sailing the Seas of Adaptability

Regular Financial Check-ins

- Importance of Regular Financial Assessments: Regular financial check-ins are essential for startups to stay abreast of their financial health. A study reveals that companies with regular financial monitoring are more agile in adapting to market changes.

- Example: Conduct monthly financial reviews to assess cash flow, expenses, and revenue performance, enabling timely adjustments to financial strategies.

- Key Metrics Tracking: Identify key financial metrics for tracking. Studies recommend monitoring metrics such as gross margin, net profit margin, and working capital.

- Example: If your startup operates in e-commerce, track metrics like conversion rates, customer acquisition costs, and average order value to gauge the effectiveness of your financial strategies.

Flexibility in Adapting to Market Changes

- Market Volatility Preparedness: Startups should be prepared to navigate market volatility. The Harvard Business Review emphasizes that flexible financial strategies are crucial in adapting to unpredictable market shifts.

- Example: If your startup operates in the tech industry, where trends change rapidly, build flexibility into your budget to quickly reallocate resources to emerging opportunities.

- Scenario Planning: Conduct scenario planning for different economic conditions. The World Economic Forum recommends scenario analysis to identify potential risks and opportunities.

- Example: Develop scenarios for economic downturns, sudden industry disruptions, or unexpected regulatory changes, enabling proactive adjustments to financial strategies.

Risk Management and Mitigation

- Comprehensive Risk Assessment: Perform a comprehensive risk assessment.

- Example: Identify external factors such as geopolitical events or supply chain vulnerabilities that could impact your startup, and develop risk mitigation strategies accordingly.

- Insurance Coverage Review: Regularly review insurance coverage. A report suggests that startups should periodically assess their insurance policies to ensure adequate coverage.

- Example: If your startup relies on digital assets, review cybersecurity insurance policies to address evolving cyber threats and potential financial liabilities.

Strategies for Proactive Financial Adaptation

- Cash Flow Forecasting: Prioritize accurate cash flow forecasting. Some studies have found that 82% of companies experience cash flow issues, highlighting the need for proactive forecasting.

- Example: Use historical data and market trends to forecast cash flow, allowing your startup to anticipate and address potential liquidity challenges.

- Continuous Cost-Benefit Analysis: Conduct continuous cost-benefit analyses. Some studies have suggested that ongoing evaluations of costs versus benefits inform strategic decision-making.

- Example: Assess the ROI of marketing campaigns, technology investments, and operational initiatives to ensure alignment with overall financial goals.

- Customer Feedback Integration: Integrate customer feedback into financial strategies. Some studies have found that customer-centric financial strategies are more likely to yield sustainable growth.

- Example: Regularly collect and analyze customer feedback to identify areas for improvement or expansion, guiding financial decisions aligned with customer needs.

Technology Integration for Financial Visibility

- Financial Management Software Utilization: Leverage financial management software for real-time visibility. A report emphasizes that startups using integrated financial systems make more informed decisions.

- Example: Implement accounting software like QuickBooks or Xero for seamless financial tracking, reporting, and analysis, providing a comprehensive view of your startup’s financial landscape.

- Data Analytics for Informed Decision-Making: Embrace data analytics for financial insights. The International Data Corporation (IDC) reports that data-driven decision-making leads to improved financial performance.

- Example: Use analytics tools to analyze customer behavior, market trends, and operational efficiency, enabling data-driven adjustments to financial strategies.

This exploration into “Monitoring and Adjusting Financial Strategies” provides startups with actionable strategies and examples to navigate the seas of financial adaptability.

By embracing regular assessments, flexibility, and proactive risk management, entrepreneurs can steer their ventures towards financial resilience and sustained success.

6. Seeking Professional Advice: Navigating Entrepreneurial Waters with Expert Guidance

The Strategic Role of Professional Advice

- Statistics on Startups and Professional Guidance: Statistics from the Small Business Administration reveal that 30% of new businesses may not survive the first two years, emphasizing the need for strategic decision-making.

- Example: Seeking professional advice early on can significantly contribute to overcoming common startup challenges and increasing the likelihood of long-term success.

- Expertise in Navigating Legal Complexities: Legal intricacies can pose significant challenges for startups. A study by LegalZoom highlights that 32% of small businesses face legal issues, underlining the importance of legal counsel.

- Example: Consulting with legal professionals helps startups navigate complex issues such as intellectual property, contracts, and compliance, safeguarding their interests.

The Multifaceted Role of Financial Advisors

- Startups and Financial Challenges: Financial challenges are a common hurdle for startups, with a report revealing that 29% of startups fail due to running out of cash.

- Example: Financial advisors can assist startups in creating robust financial strategies, managing cash flow, and making informed investment decisions to ensure sustained financial health.

- Tax Planning and Optimization: Tax planning is critical for startups. An article reports that effective tax planning can lead to significant cost savings for small businesses.

- Example: Seeking advice from tax professionals helps startups optimize their tax strategies, ensuring compliance and maximizing deductions to minimize the tax burden.

Human Resources and Talent Acquisition Strategies

- Talent Acquisition Challenges for Startups: Hiring and retaining talent is a common challenge for startups, as highlighted in a survey, where 77% of employers faced difficulties in finding skilled candidates.

- Example: Human resources professionals can guide startups in developing effective recruitment strategies, fostering a positive workplace culture, and navigating employment laws.

- Employee Benefits and Retention: Employee benefits and retention are crucial for startup success. A study by Glassdoor found that 79% of employees prefer additional benefits over a pay increase.

- Example: HR consultants can help startups design competitive benefit packages, enhancing employee satisfaction and retention rates.

That’s why more than 4,000 companies use 9cv9 HR and Talent Acquisition service to hire talents at a lower cost than other service provider.

Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Strategic Marketing and Branding Guidance

- Startups and Marketing Challenges: Marketing challenges often hinder startups, with a HubSpot report revealing that nearly half of businesses consider generating traffic and leads their top marketing challenge.

- Example: Marketing experts can provide startups with insights into effective digital marketing strategies, brand positioning, and audience engagement, contributing to sustainable growth.

- Digital Marketing Trends and Innovations: Staying abreast of digital marketing trends is crucial. According to Statista, global digital advertising spending is projected to grow by 8.2% in 2024.

- Example: Seeking advice from digital marketing professionals ensures startups leverage the latest trends and innovations, maximizing the impact of their marketing efforts.

Technology Consulting for Innovation

- Technology Integration Challenges for Startups: Integrating technology effectively is a challenge for startups.

- Example: Technology consultants can guide startups in selecting and implementing the right technologies, enhancing operational efficiency and fostering innovation.

- Data Security and Cybersecurity Measures: Data security is paramount for startups. The average cost of a data breach is $4.45 million, underscoring the importance of robust cybersecurity measures.

- Example: Consulting with cybersecurity experts helps startups implement preventive measures, safeguarding sensitive data and maintaining customer trust.

Legal Guidance in Intellectual Property Protection

- Intellectual Property Challenges for Startups: Intellectual property (IP) protection is a concern for startups, with a study revealing a steady increase in global patent applications.

- Example: Legal professionals specializing in IP can assist startups in navigating patent processes, trademark registrations, and protecting their innovations from infringement.

- Litigation Risk Mitigation: Litigation risks are inherent in business.

- Example: Consulting with legal advisors helps startups implement risk mitigation strategies, reducing the likelihood of costly legal disputes.

The Role of Mentors and Industry Experts

- Mentorship Impact on Success: Mentorship plays a significant role in startup success, as evidenced by a survey from MicroMentor, where 70% of mentored businesses survive more than five years.

- Example: Engaging with experienced mentors provides startups with valuable insights, guidance, and a network of industry connections, contributing to long-term success.

- Industry-Specific Expertise: Industry-specific expertise is invaluable. An article reports that startups benefit from industry-specific knowledge, enhancing their adaptability and growth potential.

- Example: Seeking advice from industry experts helps startups navigate sector-specific challenges, capitalize on market trends, and stay ahead of competitors.

This exploration into “Seeking Professional Advice” emphasizes the pivotal role that expert guidance plays in the success of startups.

By tapping into the knowledge and experience of professionals across various domains, entrepreneurs can navigate the complex waters of entrepreneurship with confidence and resilience.

Conclusion

In the tumultuous seas of entrepreneurship, where waves of uncertainty and challenges can threaten the stability of a startup, implementing effective strategies to avoid bankruptcy becomes paramount.

The journey we’ve embarked on through the “Top 6 Tips to Avoid Bankruptcy as a Startup” has illuminated crucial pathways for startups to not only survive but thrive in the competitive business landscape.

Strategic Financial Planning as the North Star

As we navigate the expansive ocean of startup endeavors, one constant emerges – the significance of strategic financial planning.

From the inception of the business idea to the day-to-day operations, the compass of financial planning guides startups towards sustainable growth.

By meticulously mapping out budgets, forecasting cash flows, and setting realistic financial goals, startups can weather storms and navigate towards prosperity.

Diversification: A Lifesaver in Choppy Waters

Our exploration into the second tip, “Diversifying Revenue Streams,” revealed the importance of not putting all entrepreneurial eggs in one basket.

By diversifying revenue streams, startups can mitigate the risks associated with dependence on a single source of income.

The examples and insights provided underscore the agility that diversification brings, allowing startups to adapt to market shifts and unforeseen challenges.

Effective Cost Management: Sailing Towards Efficiency

The third tip, “Effective Cost Management,” serves as the rudder steering the startup ship towards efficiency. Through meticulous cost audits, negotiation strategies, and technological adoptions, startups can navigate the intricate waters of financial management.

The real-world examples provided offer a tangible roadmap for startups to trim excesses, streamline operations, and ensure financial sustainability.

Most startups and companies use 9cv9 to post and hire talents for free, thereby saving a huge bulk of their recruitment expenses.

Building a Strong Emergency Fund: A Financial Safety Net

In the face of unpredictability, our fourth tip, “Building a Strong Emergency Fund,” emerges as a financial safety net. The importance of setting clear savings goals, automating the savings process, and determining the right fund size was highlighted.

This financial reservoir acts as a shield, providing startups with resilience during economic downturns, unexpected expenses, or delays in funding.

Monitoring and Adjusting Financial Strategies: The Helm of Adaptability

The fifth tip, “Monitoring and Adjusting Financial Strategies,” places startups at the helm of adaptability. Regular financial check-ins, flexibility in responding to market changes, and proactive risk management are the tools that empower startups to steer through turbulent waters.

By integrating technology, continuous cost-benefit analysis, and strategic planning, startups can adapt to the dynamic business environment.

Seeking Professional Advice: Anchors in Expertise

The final tip, “Seeking Professional Advice,” acts as the anchors securing startups in the harbor of expertise.

From legal counsel and financial advisors to mentors and industry experts, seeking professional guidance provides startups with the wisdom to navigate legal complexities, financial challenges, human resources intricacies, and technological innovations.

The statistics and examples woven into this advice emphasize the transformative impact that expert counsel can have on a startup’s journey.

Sailing Towards Success with Collective Wisdom

In conclusion, the voyage to avoid bankruptcy as a startup is not a solitary endeavor.

It’s a collective journey fueled by strategic planning, resilience, and the wisdom drawn from diverse sources.

Each tip serves as a compass, guiding startups towards financial stability and success.

As startups embark on their entrepreneurial odyssey, armed with these insights, may they navigate the waters with confidence, weather any storms, and ultimately, reach the shores of sustained success.

Remember, in the vast sea of entrepreneurship, the journey is as important as the destination.

May every startup’s sail be filled with the winds of innovation, adaptability, and the collective wisdom gained on this expedition.

Safe travels, fellow entrepreneurs, and may your startup thrive against all odds.

If your company needs HR, hiring, or corporate services, you can use 9cv9 hiring and recruitment services. Book a consultation slot here, or send over an email to [email protected].

If you find this article useful, why not share it with your hiring manager and C-level suite friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

People Also Ask

How can you reduce the risk of bankruptcy?

To reduce the risk of bankruptcy, prioritize strategic financial planning, diversify revenue streams, build a robust emergency fund, practice effective cost management, adapt to market changes through continuous monitoring, and seek professional advice for legal, financial, and operational guidance.

How can I save my company from bankruptcy?

To save your company from bankruptcy, focus on strategic financial planning, cut unnecessary costs, diversify revenue streams, negotiate with creditors, and explore funding options. Seek professional advice for legal and financial guidance, and adapt your strategies based on market dynamics.

How do you fight bankruptcy?

Fight bankruptcy by implementing strategic financial planning, diversifying revenue streams, building a robust emergency fund, and managing costs effectively. Seek professional advice for legal, financial, and operational support. Adapt to market changes through continuous monitoring and make informed, agile decisions.

![Writing A Good CV [6 Tips To Improve Your CV] 6 Tips To Improve Your CV](https://blog.9cv9.com/wp-content/uploads/2020/06/2020-06-02-2-100x70.png)