Key Takeaways

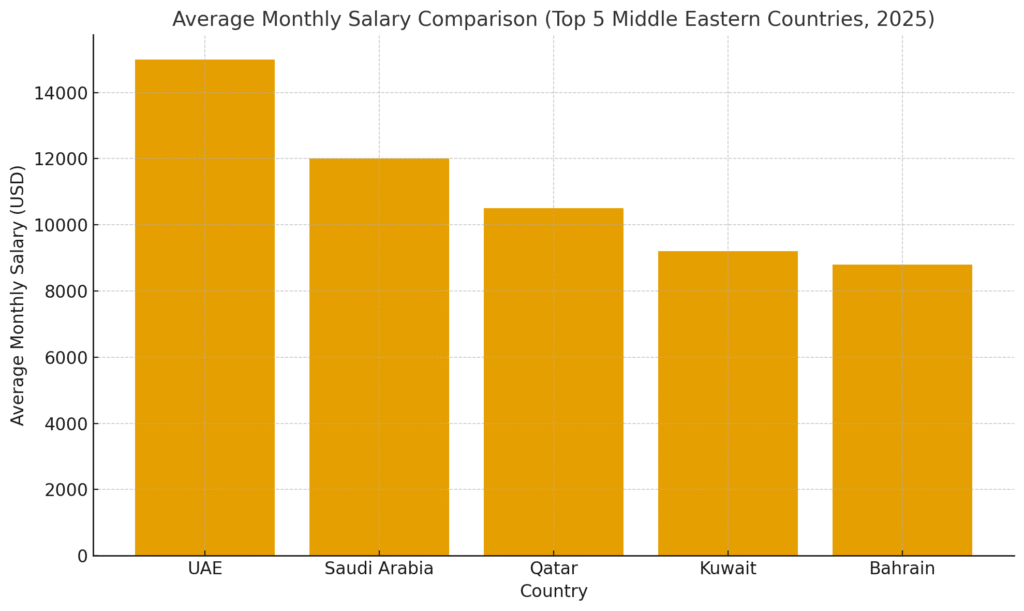

- The UAE, Saudi Arabia, and Qatar lead the Middle East in offering the highest salaries across technology, finance, and engineering sectors.

- Tax-free income and comprehensive expatriate benefits significantly boost professionals’ real earnings and savings potential.

- Economic diversification and digital transformation continue to drive demand for high-skilled talent, ensuring competitive compensation in 2025.

The Middle East has long been a global hub for career growth, economic opportunity, and high earning potential, particularly for professionals seeking international exposure and financial stability. As 2025 unfolds, the region continues to attract top talent from around the world with its lucrative salary packages, tax-free income policies, and rapidly diversifying economies. From oil-rich nations to technology-driven economies, the Middle East remains one of the most rewarding destinations for skilled professionals, executives, and entrepreneurs aiming to maximize their income potential.

The salary landscape across the Middle East in 2025 is being reshaped by several transformative factors — including digital transformation, infrastructure expansion, foreign investments, and the rise of knowledge-based industries. Countries such as the United Arab Emirates, Qatar, and Saudi Arabia are no longer solely dependent on energy exports; they are now major global players in finance, information technology, artificial intelligence, logistics, and tourism. This shift has significantly raised the demand for high-caliber professionals, leading to competitive compensation packages across multiple sectors.

For expatriates and local professionals alike, the Middle East offers more than just attractive salaries — it provides a lifestyle defined by modern amenities, cultural richness, and international business networks. Many countries in the region have introduced economic diversification plans such as Saudi Arabia’s Vision 2030 and the UAE’s Centennial 2071, which focus on innovation, education, and sustainability. These initiatives have opened vast opportunities for high-paying roles in fields like engineering, technology, oil and gas, healthcare, construction, and financial services.

In addition, the absence of personal income tax in many Middle Eastern nations has made the region one of the most financially beneficial destinations for global talent. This unique advantage allows professionals to retain a greater share of their income, making cities like Dubai, Doha, and Riyadh global hotspots for ambitious workers seeking wealth accumulation and career progression. Companies across the region are also competing fiercely to attract skilled individuals through comprehensive benefits such as housing allowances, transportation coverage, family relocation packages, and performance-based bonuses.

As global economic competition intensifies, professionals are increasingly looking to the Middle East to build prosperous and future-ready careers. Understanding which countries offer the highest salaries in 2025 is essential for anyone planning to relocate, negotiate a better offer, or expand their international work portfolio. This report highlights the top five countries in the Middle East where salaries are expected to be the highest in 2025, analyzing the driving industries, employment trends, and living standards that contribute to their growing economic appeal.

Whether you are a seasoned expatriate, a professional seeking global experience, or a company evaluating regional expansion, this guide offers valuable insights into the Middle East’s evolving salary landscape — helping you make informed decisions about where opportunity truly pays the most in 2025.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 5 Countries in the Middle East with the Highest Salaries in 2025.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 5 Countries in the Middle East with the Highest Salaries in 2025

1. UAE (Dubai/Abu Dhabi)

The United Arab Emirates (UAE) continues to hold a commanding position in the Middle East as one of the nations offering the most competitive salary packages in 2025. Driven by its diversified economy, world-class infrastructure, and global business ecosystem, the UAE attracts professionals from across the world seeking high-paying career opportunities. The country’s compensation model rewards skill, experience, and strategic leadership, particularly in finance, technology, construction, and energy sectors.

Also, check out our article: Salaries in the UAE: A Comprehensive Report for 2025 for a more in-depth study on salaries in UAE.

UAE Salary Landscape and Earning Potential

The UAE’s salary ecosystem operates on a tiered structure based on experience, expertise, and leadership capacity. Professionals benefit not only from high base pay but also from substantial allowances, performance bonuses, housing benefits, and expatriate incentives.

Experience-Based Salary Segmentation (Monthly in AED)

| Professional Tier | Experience Level | Average Monthly Salary (AED) | Common Roles |

|---|---|---|---|

| Mid-Level | 4–8 years | 20,000 – 45,000 | Engineers, Project Managers, Analysts |

| Senior-Level | 9+ years | 45,000 – 90,000 | Department Heads, Senior Consultants |

| Executive | 12+ years | 90,000 – 150,000+ | Directors, Vice Presidents |

The figures above reflect a clear progression, illustrating that tenure and professional maturity significantly influence earning potential in the UAE.

Keen to find out the top 10 recruitment agencies. Click over to our article: Top 10 Best Recruitment Agencies in UAE for 2025.

Executive and Leadership Compensation

The upper echelon of the UAE’s job market provides salaries that rival those in advanced economies such as the United States or Singapore. Executive packages are often comprehensive, including bonuses, profit-sharing, long-term incentives, and luxury accommodation or travel allowances.

Annual Executive Compensation Benchmarks (in AED)

| Position | Annual Salary Range | Monthly Equivalent |

|---|---|---|

| Chief Executive Officer (CEO) | 960,000 – 2,400,000 | 80,000 – 200,000 |

| Chief Financial Officer (CFO) | 720,000 – 1,440,000 | 60,000 – 120,000 |

| Investment Banking Director | 840,000 – 1,800,000 | 70,000 – 150,000 |

In sectors such as investment banking and technology, total compensation often exceeds AED 3 million annually when factoring in bonuses, stock options, and performance incentives. These figures position the UAE among the highest-paying markets not just in the Middle East but globally.

Economic Drivers Behind High Salaries

Several key economic and strategic factors contribute to the UAE’s lucrative compensation environment:

- Diversified Economy: The UAE’s transition from oil dependency to sectors such as finance, logistics, and technology has increased the demand for high-level talent.

- Global Talent Hub: As a leading expatriate destination, companies offer attractive remuneration to secure international professionals with specialized skills.

- Tax-Free Income Advantage: The absence of personal income tax amplifies the real purchasing power of professionals, making net income significantly higher than in many Western countries.

- Business-Friendly Ecosystem: Free zones and favorable labor laws encourage multinational corporations to base their regional headquarters in cities such as Dubai and Abu Dhabi.

Salary Comparison Matrix: UAE vs. Other High-Income Middle Eastern Countries

| Country | Average Mid-Level Monthly Salary (AED Equivalent) | Average Senior-Level Monthly Salary (AED Equivalent) | Taxation on Income |

|---|---|---|---|

| United Arab Emirates | 20,000 – 45,000 | 45,000 – 90,000+ | None |

| Qatar | 18,000 – 40,000 | 40,000 – 85,000 | None |

| Saudi Arabia | 15,000 – 35,000 | 35,000 – 80,000 | None |

| Kuwait | 14,000 – 33,000 | 33,000 – 75,000 | None |

| Bahrain | 12,000 – 30,000 | 30,000 – 65,000 | None |

This comparative matrix reinforces the UAE’s leading position in 2025 as the country offering the most attractive and rewarding salary structures across all professional levels in the Middle East.

Overall Economic and Professional Outlook

The UAE’s salary competitiveness reflects its economic vision of becoming a premier global center for innovation, commerce, and professional excellence. With continuous government investment in technology, infrastructure, and business-friendly reforms, the UAE remains one of the most desirable destinations for skilled professionals seeking both financial growth and long-term career advancement.

2. Saudi Arabia (KSA)

Saudi Arabia continues to establish itself as one of the most financially rewarding destinations for professionals in the Middle East. With the government’s Vision 2030 initiative driving rapid diversification beyond oil, the Kingdom has developed a compensation ecosystem that heavily rewards technical expertise, leadership, and specialized skills. High salaries in Saudi Arabia are particularly concentrated in infrastructure development, engineering, and technology sectors, where demand for top talent remains exceptionally strong.

Learn more by clicking over to Salary Levels in Saudi Arabia: An In-Depth Analysis for 2025.

Compensation Structure and Sectoral Overview

The salary structure in Saudi Arabia (SAR) is designed to attract both domestic and international professionals who can contribute to national transformation projects. Employers typically offer comprehensive remuneration packages that go beyond base pay, including accommodation allowances, annual flights, family support benefits, and tax-free earnings. This total reward system significantly enhances the net take-home value for expatriates.

Average Salary Distribution by Sector (Monthly in SAR)

| Sector | Average Monthly Salary Range (SAR) | Key Positions |

|---|---|---|

| Construction & Engineering | 25,000 – 60,000 | Project Managers, Structural Engineers |

| Technology & IT | 22,000 – 55,000 | Software Architects, Data Scientists |

| Oil & Energy | 28,000 – 65,000 | Geologists, Operations Managers |

| Finance & Banking | 30,000 – 70,000 | Financial Analysts, Investment Directors |

| Healthcare & Pharmaceuticals | 24,000 – 50,000 | Medical Consultants, Pharmacists |

These figures highlight how Saudi Arabia’s evolving economy provides exceptional earning potential, particularly for technical and managerial talent.

Check out our top guide on the Top 10 Best Recruitment Agencies In Saudi Arabia for 2025.

Giga-Project Compensation: NEOM and Beyond

One of the defining features of Saudi Arabia’s high-income landscape in 2025 is the impact of its giga-projects—massive infrastructure and city development projects under Vision 2030. NEOM, The Line, and Red Sea Global have created thousands of high-value professional opportunities for engineers, architects, and technologists from around the world.

NEOM Project Compensation Structure (Annual in USD)

| Position | Experience Level | Base Salary (USD) | Total Package Value (USD) | Monthly Equivalent (USD) |

|---|---|---|---|---|

| Junior Engineer | 3–5 years | 85,000 – 110,000 | 125,000 – 160,000 | 10,416 – 13,333 |

| Senior Engineer | 7–10 years | 120,000 – 160,000 | 180,000 – 240,000 | 15,000 – 20,000 |

| Specialized Expert (90th Percentile) | 10+ years | 220,000+ | 250,000+ | 18,333+ |

These competitive packages, especially when combined with expatriate benefits such as housing, schooling, and relocation support, position Saudi Arabia as one of the most lucrative markets for skilled professionals globally. The inclusion of non-monetary incentives—such as access to world-class living facilities within NEOM’s futuristic ecosystem—further enhances the total value of employment.

Labor Market Segmentation and Talent Premium

Saudi Arabia’s labor market displays a strong bifurcation between high-skilled and low-skilled roles. Professionals with rare technical capabilities and international experience earn salaries that often surpass global benchmarks, while low-skilled migrant workers continue to experience lower wage conditions. This disparity underscores the premium placed on advanced education, innovation-driven skills, and project-critical expertise in the Kingdom’s evolving economic structure.

Salary Gap Matrix: Skilled vs. Low-Skilled Labor (Monthly in SAR)

| Role Category | Average Monthly Pay (SAR) | Benefits Included |

|---|---|---|

| Skilled Technical & Engineering | 35,000 – 90,000 | Housing, Travel, Family Support |

| Executive & Management | 90,000 – 150,000+ | Full Expatriate Package, Performance Bonuses |

| Low-Skilled Labor | 1,500 – 3,000 | Basic Accommodation, Meals |

This matrix illustrates a significant compensation gap, reflecting Saudi Arabia’s ongoing push to attract world-class professionals capable of driving Vision 2030’s transformative agenda.

Economic Drivers Behind Saudi Arabia’s High Salaries

- Vision 2030 Reforms: Major government-backed projects are creating unprecedented demand for professionals in sustainability, renewable energy, smart infrastructure, and high-tech innovation.

- Expatriate Talent Strategy: To support large-scale national projects, Saudi employers offer globally competitive packages to recruit skilled expatriates.

- Tax-Free Income: The absence of personal income tax enhances real income levels, positioning the Kingdom as an attractive alternative to Western economies.

- Infrastructure and Innovation Growth: Rapid development of cities like Riyadh and NEOM requires international-level expertise, pushing compensation levels higher than regional averages.

Regional Salary Comparison: Saudi Arabia vs. Other Middle Eastern Economies

| Country | Average Mid-Level Salary (AED Equivalent) | Average Senior-Level Salary (AED Equivalent) | Income Tax |

|---|---|---|---|

| Saudi Arabia | 20,000 – 45,000 | 45,000 – 90,000+ | None |

| United Arab Emirates | 22,000 – 50,000 | 50,000 – 100,000+ | None |

| Qatar | 18,000 – 42,000 | 42,000 – 85,000 | None |

| Kuwait | 15,000 – 35,000 | 35,000 – 75,000 | None |

| Bahrain | 12,000 – 30,000 | 30,000 – 65,000 | None |

The data clearly demonstrates Saudi Arabia’s leading position as one of the highest-paying job markets in the region for 2025, particularly for professionals aligned with the country’s strategic development priorities.

Overall Outlook

Saudi Arabia’s robust salary framework, powered by massive public investments, a tax-free environment, and world-class mega projects, ensures its place among the top five Middle Eastern countries with the highest salaries in 2025. As Vision 2030 continues to accelerate, professionals seeking both lucrative compensation and participation in groundbreaking projects will find the Kingdom to be one of the most rewarding destinations in the global employment landscape.

3. Qatar (Doha)

Qatar stands among the top-paying nations in the Middle East in 2025, offering one of the most lucrative compensation structures for skilled professionals. The country’s prosperity, largely powered by its natural gas and petroleum sectors, has created a dynamic labor market with high salary scales across multiple industries. Supported by large-scale infrastructure developments, a tax-free income policy, and an influx of international talent, Qatar continues to attract global professionals seeking both financial growth and career advancement.

Check out our in-depth guide on the Salary Levels in Qatar: An In-Depth Analysis for 2025.

Qatar’s Salary Framework and Market Dynamics

The compensation landscape in Qatar (QAR) reflects a well-balanced structure that rewards expertise, experience, and leadership capability. Employers commonly offer comprehensive packages that include housing allowances, transportation benefits, and medical coverage—elements that significantly elevate total compensation value beyond the base salary.

Average Monthly Salary Benchmarks (QAR)

| Experience Level | Average Monthly Salary (QAR) | Typical Job Roles |

|---|---|---|

| Entry-Level | 12,000 | Junior Engineers, Analysts, Assistants |

| Mid-Level | 20,000 | Project Managers, Accountants, Specialists |

| Senior-Level | 35,000 | Senior Engineers, Consultants, Department Heads |

| Executive | 40,000 – 45,000 | IT Directors, CEOs, Managing Directors |

With an overall average monthly salary of approximately QAR 15,000 (around USD 4,114), Qatar remains one of the highest-paying economies in the Gulf Cooperation Council (GCC) region, reflecting its commitment to attracting and retaining world-class talent.

Executive and Leadership Compensation

Senior management and executive roles in Qatar command impressive salary ranges, particularly in industries such as technology, finance, oil and gas, and construction. Compensation for these high-level positions often includes substantial annual bonuses, profit-sharing opportunities, and generous expatriate benefits that enhance the total package value.

Executive Compensation Structure (Monthly in QAR)

| Position | Industry Focus | Average Monthly Salary (QAR) | Annual Equivalent (QAR) |

|---|---|---|---|

| IT Director | Technology & Telecommunications | 40,479 | 485,748 |

| Chief Executive Officer (CEO) | Cross-Industry | 43,012 | 516,144 |

| Finance Director | Banking & Investment | 38,500 | 462,000 |

| Construction Director | Infrastructure & Energy | 36,800 | 441,600 |

Executives in Qatar often enjoy performance-based bonuses, relocation allowances, and family support packages, further solidifying the nation’s reputation as a high-income destination for professionals across various sectors.

Economic Drivers Behind Qatar’s High Salary Levels

Qatar’s salary competitiveness is rooted in several strategic and economic drivers that continue to shape its labor market in 2025:

- Energy Sector Dominance: The country remains one of the largest exporters of liquefied natural gas (LNG) in the world, ensuring strong revenues that sustain high compensation levels across related industries.

- Infrastructure and Development Projects: Post-World Cup infrastructure expansion continues to generate demand for engineers, project managers, and construction specialists.

- Tax-Free Environment: The absence of personal income tax enables professionals to retain their full earnings, making Qatar’s real income levels among the highest globally.

- Attractive Expatriate Benefits: Employers often offer housing, transportation, and education allowances, creating appealing total compensation packages for foreign workers.

- Knowledge Economy Transformation: Qatar’s focus on technology, research, and sustainability drives new high-paying opportunities for experts in these emerging fields.

Regional Salary Comparison: Qatar vs. Other High-Income Middle Eastern Countries

| Country | Average Entry-Level Salary (AED Equivalent) | Average Mid-Level Salary (AED Equivalent) | Average Senior-Level Salary (AED Equivalent) | Income Tax |

|---|---|---|---|---|

| Qatar | 11,500 | 19,000 | 33,000 | None |

| United Arab Emirates | 12,000 | 22,000 | 40,000 | None |

| Saudi Arabia | 10,500 | 20,000 | 38,000 | None |

| Kuwait | 9,500 | 18,000 | 35,000 | None |

| Bahrain | 8,500 | 16,000 | 30,000 | None |

This matrix highlights Qatar’s superior earning potential, especially for mid-to-senior professionals, when compared with other Gulf economies.

Total Compensation Value Analysis

To better understand Qatar’s appeal, it is essential to consider the non-monetary benefits included in compensation packages. The “Total Reward Value” often exceeds base pay by 25% to 40%, driven by additional perks such as housing, transportation, and annual bonuses.

Estimated Total Reward Value (TRV) Breakdown for Mid-to-Senior Roles

| Component | Average Value Contribution (%) | Description |

|---|---|---|

| Base Salary | 60% | Fixed monthly remuneration |

| Housing Allowance | 15% | Accommodation or rent support |

| Transportation & Travel | 10% | Car allowance, annual flight tickets |

| Performance Bonuses | 10% | Incentive-based earnings |

| Health & Family Benefits | 5% | Medical insurance, schooling support |

This structure demonstrates Qatar’s focus on delivering holistic compensation packages that appeal to both expatriates and local professionals.

Overall Outlook

Qatar’s consistent economic stability, energy-driven prosperity, and forward-looking employment policies position it among the top five Middle Eastern countries with the highest salaries in 2025. With substantial government investments in technology, infrastructure, and renewable energy, the nation continues to offer exceptional financial rewards and long-term career prospects for skilled professionals. The combination of tax-free earnings, high-quality living conditions, and a robust job market makes Qatar a magnet for global talent aiming to maximize both income and professional growth.

4. Kuwait

Kuwait ranks among the top five countries in the Middle East with the highest salaries in 2025, primarily due to its oil-dominated economy, extensive public sector employment, and high government expenditure. The nation’s wealth, derived from its vast hydrocarbon reserves, continues to translate into lucrative compensation structures for professionals within energy, engineering, healthcare, and government-linked industries. Kuwait’s strategic emphasis on stability, resource management, and public infrastructure development ensures consistently high remuneration for skilled professionals and senior executives.

Also, read our top guide on An In-Depth Analysis of Salary Levels in Kuwait for 2025.

Kuwait’s Economic Landscape and Salary Structure

The Kuwaiti economy remains deeply anchored in oil and gas, with petroleum exports accounting for a substantial portion of national revenue. This economic foundation shapes the labor market, heavily rewarding professionals who possess technical and operational expertise within the energy and engineering sectors. Furthermore, the government’s continued investment in national development projects has reinforced salary competitiveness across related technical disciplines.

Average Monthly Salary Distribution (Kuwaiti Dinar – KWD)

| Experience Level | Industry Examples | Average Monthly Salary (KWD) | Characteristics |

|---|---|---|---|

| Entry-Level | Administration, IT Support | 250 – 400 | Structured pay, limited incentives |

| Mid-Level | Civil Engineering, Finance, Logistics | 800 – 1,800 | Increased demand for experienced professionals |

| Senior-Level | Petroleum Engineering, Project Management | 2,000 – 3,500 | High technical and strategic value |

| Executive-Level | Energy Sector Directors, Healthcare Leaders | 3,500 – 6,000+ | Includes housing, travel, and allowances |

These figures highlight Kuwait’s strong compensation segmentation, where expertise and tenure directly influence income. The country’s oil-driven industries remain the most rewarding, with energy professionals enjoying top-tier salaries that rival global benchmarks.

Oil and Gas Sector Dominance

The hydrocarbon industry continues to underpin Kuwait’s economic framework. As one of the largest oil producers within the Organization of the Petroleum Exporting Countries (OPEC), Kuwait’s employment structure is tailored to support exploration, production, and export activities.

Key High-Paying Roles in Kuwait’s Oil and Gas Industry

| Position | Average Annual Salary (KWD) | Primary Responsibilities |

|---|---|---|

| Petroleum Engineer | 30,000 – 42,000 | Exploration, extraction, and optimization of oil reserves |

| Drilling Supervisor | 28,000 – 40,000 | Overseeing drilling operations and safety compliance |

| Operations Manager | 35,000 – 50,000 | Managing production efficiency and logistics |

| HSE Director | 32,000 – 45,000 | Ensuring environmental and safety standards |

The strategic importance of these positions results in competitive pay scales, extensive benefits, and job security through government-backed enterprises such as the Kuwait Oil Company (KOC). The O&G sector also provides expatriates with housing support, flight allowances, and education benefits, reinforcing Kuwait’s appeal to global talent.

Public Sector Influence and Job Stability

Kuwait’s government continues to play a dominant role in employment and wage determination. A large portion of the workforce is employed by public institutions such as the Ministry of Health, Ministry of Education, and state-owned energy corporations. This extensive public employment base ensures income stability, structured salary increments, and long-term benefits.

Public vs. Private Sector Compensation Comparison (Monthly in KWD)

| Sector | Average Monthly Salary | Benefits | Job Stability |

|---|---|---|---|

| Public Sector | 1,800 – 3,500 | Housing allowance, pension, healthcare | Very High |

| Private Sector | 1,200 – 2,800 | Performance bonuses, flexible benefits | Moderate |

While public sector roles offer security and steady income growth, private sector positions often provide faster career advancement but less stability. The overall market reflects a balance between high base pay and strong job security, appealing particularly to professionals seeking long-term career assurance.

Infrastructure Modernization and Emerging Opportunities

Kuwait’s Vision 2035 plan emphasizes economic diversification and infrastructure enhancement. This shift has spurred demand for technical experts and project managers across civil engineering, construction, and IT sectors. The country’s ongoing efforts to modernize transportation, healthcare, and housing infrastructure are gradually expanding high-paying opportunities beyond oil and gas.

High-Demand Professions Supporting National Development

| Sector | Example Roles | Average Monthly Salary (KWD) | Growth Potential |

|---|---|---|---|

| Construction & Infrastructure | Civil Engineer, Project Manager | 1,800 – 3,200 | Strong – fueled by modernization projects |

| Healthcare | Consultant Doctor, Hospital Administrator | 2,000 – 3,500 | Moderate – driven by public health expansion |

| Information Technology | Systems Analyst, IT Manager | 1,500 – 2,800 | Rising – due to digital transformation |

These emerging roles demonstrate Kuwait’s gradual shift toward a more diversified, knowledge-based economy while retaining its high-paying structure for specialized talent.

Economic Drivers Behind Kuwait’s High Salary Levels

- Oil-Backed Wealth and Stability: The continuous strength of the oil sector ensures government liquidity, enabling generous compensation policies.

- Public Sector Dominance: State-backed organizations anchor job security and guarantee structured pay systems.

- Skilled Labor Premium: A pronounced gap between entry-level and expert roles reflects the financial value of advanced skills and global experience.

- Tax-Free Environment: Professionals benefit from zero income tax, resulting in high real purchasing power.

- Infrastructure Growth Initiatives: Government investments in housing, healthcare, and transport sustain demand for technical experts.

Overall Outlook

Kuwait’s high-income economy, bolstered by its oil sector and robust public employment system, firmly secures its place among the top five Middle Eastern countries with the highest salaries in 2025. While economic diversification is ongoing, the dominance of state enterprises and consistent investments in modernization ensure continued financial rewards for skilled professionals. For both local and expatriate talent, Kuwait offers a unique blend of income stability, benefits, and high-value career opportunities that remain unmatched across much of the region.

5. Bahrain

Bahrain has emerged as one of the most lucrative employment destinations in the Middle East in 2025, largely driven by its strategic shift toward financial innovation and digital transformation. The nation’s salary ecosystem has evolved beyond traditional sectors, positioning itself as a regional hub for high-value professions in fintech, artificial intelligence, and data analytics.

Read more here about our guide on the Salary Levels in Bahrain: An In-Depth Analysis for 2025.

Economic Transformation and Salary Progression

• Bahrain’s economy is deeply influenced by its growing emphasis on financial technology, banking, and digital services.

• The government’s Vision 2030 strategy has accelerated economic diversification, creating strong salary opportunities for professionals across finance, IT, and data science.

• With corporate headquarters and multinational banks relocating to Bahrain due to its favorable tax regime and innovation-friendly regulatory environment, compensation packages have grown substantially across executive and senior technical levels.

Top Earning Positions and Sectoral Breakdown (2025)

| Job Title / Level | Average Monthly Salary (BHD) | Approx. Monthly Salary (USD) | Dominant Industry | Key Salary Drivers |

|---|---|---|---|---|

| Chief Executive Officer (CEO) | 3,420 | $9,075 | Finance / Banking | Strategic leadership, regulatory oversight, cross-border operations |

| Financial Manager | 2,910 | $7,721 | Financial Services | Risk management, corporate finance expertise |

| IT Director | 2,500 | $6,633 | Fintech / IT | Cloud transformation, cybersecurity, and data infrastructure |

| Data Scientist / Financial Analyst | 1,500 – 2,500 | $4,000 – $6,650 | Fintech / Analytics | Advanced analytics, AI integration, and digital payment systems |

| Software Developer | 1,200 – 2,200 | $3,180 – $5,830 | Tech / Startups | App development, blockchain programming |

| Civil Engineer | 1,000 – 2,000 | $2,650 – $5,300 | Construction / Infrastructure | Smart city and urban development projects |

Strategic Shifts in Bahrain’s Job Market

• Digital Economy Expansion: Bahrain’s labor market has transitioned toward knowledge-based industries, rewarding tech-driven expertise and leadership. Salaries for IT professionals and software engineers now compete closely with executive financial roles, underscoring the nation’s digital ambitions.

• Fintech Leadership: As one of the region’s first countries to establish a Fintech Regulatory Sandbox, Bahrain attracts global startups and financial innovators, elevating demand for blockchain developers, financial data analysts, and cybersecurity professionals.

• Government Investment in Innovation: Public initiatives promoting AI, IoT, and smart infrastructure have increased compensation levels for technical specialists, with some niche experts in AI or cloud computing commanding between BHD 2,000 and 10,000 monthly.

• Healthcare and Allied Services: While healthcare salaries are relatively moderate compared to tech or finance, experienced medical professionals continue to benefit from a consistent rise in remuneration, with median salaries nearing BHD 1,500.

Comparative Salary Insights: Bahrain vs. Kuwait (2025 Overview)

| Category | Kuwait (KWD/Month) | Bahrain (BHD/Month) | Approx. Kuwait (USD) | Approx. Bahrain (USD) | Key Industry Focus |

|---|---|---|---|---|---|

| CEO / Apex Executive | 4,167 – 6,667 | 3,420 | $13,500 – $21,650 | $9,075 | Kuwait: Oil & Gas; Bahrain: Finance & Services |

| Finance Manager | 2,917 – 4,167 | 2,910 | $9,475 – $13,500 | $7,721 | Both (Corporate Finance) |

| IT Director | 1,667 – 2,500 | 2,500 | $5,400 – $8,100 | $6,633 | Kuwait: Infrastructure; Bahrain: Fintech / IT |

| Financial Analyst / Data Scientist | 1,500 – 2,333 | 1,500 – 2,500 | $4,870 – $7,570 | $4,000 – $6,650 | Both (Bahrain leads in Digital Finance) |

| Experienced Nurse (5+ years) | 600 – 1,200 | 1,534 (Median) | $1,950 – $3,900 | $4,070 | Healthcare |

Key Insights on Bahrain’s Salary Competitiveness in 2025

• Bahrain’s consistent investment in the financial and technology sectors has positioned it as a top-paying economy in the Middle East, particularly for executives and digital professionals.

• Its compensation model balances financial stability with technological innovation, allowing professionals in emerging digital fields to achieve income parity with traditional corporate leaders.

• The nation’s strong legal and fiscal frameworks make it an appealing destination for expatriates seeking both job security and high earning potential.

• Unlike economies driven solely by oil revenues, Bahrain’s diversified structure ensures that high-income opportunities are spread across finance, IT, and advanced analytics—creating a sustainable path for future salary growth.

Conclusion: Bahrain as a 2025 Salary Leader

In 2025, Bahrain’s strategic transition into a digital-first, finance-oriented economy has significantly elevated its compensation landscape. The convergence of financial strength, innovation-driven governance, and growing demand for technical expertise reinforces Bahrain’s position as one of the top five countries in the Middle East offering the highest and most stable salaries.

The Apex of Remuneration: An Expert Analysis of the Top 5 Highest Salary Countries in the Middle East for 2025

The Middle East continues to solidify its reputation as one of the most financially rewarding regions in the world. The countries within the Gulf Cooperation Council (GCC) — notably the United Arab Emirates (UAE), Saudi Arabia, Qatar, Kuwait, and Bahrain — have crafted competitive remuneration systems that blend lucrative tax-free income, comprehensive benefits, and government-backed economic diversification programs. This unique combination positions them among the global leaders in high-income potential for both local and expatriate professionals.

Macroeconomic and Regulatory Drivers of the 2025 Compensation Landscape

• The 2025 compensation environment across the GCC is being shaped by a confluence of robust macroeconomic fundamentals, elevated global energy prices, and progressive regulatory reforms.

• These dynamics collectively foster a high-salary ecosystem, especially in countries that have successfully diversified into non-oil sectors such as finance, technology, healthcare, and renewable energy.

• Strategic reforms — including liberalized investment laws and talent localization initiatives — are reinforcing these nations’ competitiveness in attracting top-tier international professionals.

The GCC Compensation Framework: Tax-Free Advantage and Total Rewards System

The defining factor that elevates the Middle East’s compensation model is its zero personal income tax policy. This creates a net-income advantage for employees compared to Western economies, where taxes can significantly reduce take-home pay.

The region’s remuneration structure is largely built around a Total Fixed Compensation (TFC) model, which incorporates a blend of direct salary and extensive benefits to attract global talent. The TFC model includes:

• Base Salary: The core component reflecting an employee’s market value and expertise.

• Housing Allowances: A crucial benefit to offset the region’s high rental market; typical monthly allowances range from AED 10,000–18,000 in Oil & Gas and AED 8,000–15,000 in Banking & Finance.

• Health Insurance and Family Benefits: Comprehensive coverage that includes dependents, ensuring financial security and well-being.

• Annual Airfare and Education Allowances: Commonly offered to expatriate families to maintain international lifestyle standards.

These benefits are structured under an Equalization Policy, designed to ensure that expatriate professionals do not face any financial disadvantage from relocating to the GCC. This model maintains parity with home-country purchasing power while enhancing overall net income.

Economic Diversification and Talent Demand Surge

The Middle East’s salary ecosystem is directly influenced by massive government-led economic diversification programs. Countries such as Saudi Arabia (Vision 2030), UAE (Economic Vision 2031), and Qatar National Vision 2030 are actively restructuring their economies to reduce dependency on hydrocarbons.

Key catalysts for salary growth include:

• Strategic National Projects: Giga-projects such as NEOM in Saudi Arabia and the UAE’s AI-driven Smart City initiatives have intensified competition for global talent in engineering, AI, and logistics.

• Foreign Direct Investment (FDI): Regulatory relaxations have invited multinational corporations to establish headquarters in regional hubs like Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM), boosting demand for compliance officers, risk analysts, and financial strategists.

• Cross-Disciplinary Talent Premiums: Professionals with hybrid expertise—AI and Data Analytics, Cloud and Cybersecurity, Financial Forecasting, ESG Reporting, and PMP or Agile-certified Project Management—command top-tier salaries due to skill scarcity.

Projected Salary Inflation and Economic Outlook for 2025

After two consecutive years of steep salary growth driven by post-pandemic recovery, the 2025 outlook reveals moderate stabilization, indicating a maturing yet competitive labor market.

| Country | 2024 Avg. Salary Growth | 2025 Projected Growth | Key Growth Drivers |

|---|---|---|---|

| United Arab Emirates (UAE) | 4.5% | 4.0% | Digital transformation, financial services, logistics |

| Saudi Arabia (KSA) | 5.0% | 2–4% | Vision 2030 projects, renewable energy, defense sectors |

| Qatar | 4.2% | 3.8% | Energy diversification, hospitality, education |

| Kuwait | 3.9% | 3.5% | Oil & Gas modernization, infrastructure projects |

| Bahrain | 4.0% | 3.7% | Fintech expansion, banking, digital economy |

While average salary growth appears moderate, strategic roles within giga-projects, renewable energy, and emerging technology continue to see increases above 10%, especially in Saudi Arabia and the UAE. These spikes underscore targeted government incentives to attract critical talent for long-term national development goals.

Talent Retention Strategies and Evolving Reward Models

Employers in the GCC are increasingly shifting from traditional pay-based attraction models to holistic Total Rewards strategies. Given the high professional mobility in the region—where surveys indicate that 66% of Saudi professionals are considering job changes due to compensation dissatisfaction—companies are emphasizing retention incentives.

Key elements include:

• Long-Term Incentive Plans (LTIPs): Around 35.5% of GCC organizations are projected to adopt LTIPs in 2025 to align employee rewards with business growth objectives.

• Performance-Based Bonuses: Dynamic pay linked to strategic KPIs, productivity, and innovation benchmarks.

• Career Development and Localization Programs: Tailored pathways to attract and retain both expatriate and local professionals, especially in high-demand fields such as AI, cloud computing, and ESG finance.

Comparative Compensation Matrix of the Top 5 High-Salary Middle Eastern Countries (2025)

| Country | Average Monthly Executive Salary (USD) | Key High-Value Industries | Tax Regime | Expatriate Benefits Strength |

|---|---|---|---|---|

| United Arab Emirates | $10,000 – $21,000 | Finance, AI, Real Estate, Aviation | Zero Income Tax | Exceptional (Housing, Education, Travel) |

| Saudi Arabia | $9,000 – $20,000 | Oil & Gas, Renewable Energy, Giga-Projects | Zero Income Tax | High (Housing, Family Benefits, Bonus Structures) |

| Qatar | $8,500 – $18,000 | Energy, Construction, Education, Healthcare | Zero Income Tax | Strong (Transport, Education, Health Packages) |

| Kuwait | $8,000 – $17,000 | Oil & Gas, Public Infrastructure | Zero Income Tax | Moderate to High (Housing, Allowances) |

| Bahrain | $7,000 – $15,000 | Finance, IT, Fintech, Logistics | Zero Income Tax | High (Digital Work Incentives, Insurance Coverage) |

Analytical Overview: The Apex of Middle Eastern Remuneration in 2025

• The Middle East’s salary leadership is underpinned by its dynamic blend of fiscal incentives, economic diversification, and global talent acquisition strategies.

• While traditional industries such as oil and gas remain lucrative, non-oil sectors—particularly technology, fintech, and renewable energy—are defining the next frontier of high-paying opportunities.

• The evolution from basic salary structures to comprehensive Total Reward Systems signifies the region’s commitment to long-term economic sustainability and human capital excellence.

Conclusion: A Strategic Hub for Global Professionals

The Middle East, in 2025, represents the apex of global remuneration competitiveness. With zero income taxation, elevated living standards, and government-driven diversification, the region’s top economies—UAE, Saudi Arabia, Qatar, Kuwait, and Bahrain—stand as global magnets for elite professionals. Their advanced compensation structures not only promise high earnings but also reflect a broader transformation toward a knowledge-driven, innovation-centered economic future.

Ranking and Comparative Analysis of Top 5 High-Salary Countries

The Gulf Cooperation Council (GCC) nations continue to dominate global compensation rankings, offering some of the most attractive salary packages worldwide. In 2025, the financial landscape across the UAE, Saudi Arabia, Qatar, Kuwait, and Bahrain reflects a unique equilibrium between economic expansion, global talent competition, and cost-efficiency. Beyond nominal income figures, the real measure of wealth lies in the net savings potential—how much of one’s income remains after living costs, which is particularly critical for expatriates seeking long-term financial gain.

Ranking and Comparative Insights of the Top High-Salary Economies

The 2025 salary hierarchy across the Middle East underscores each nation’s economic strengths, policy frameworks, and strategic focus on diversification. While the UAE continues to lead with the highest nominal Total Fixed Compensation (TFC), Saudi Arabia’s transformative giga-projects and digital initiatives are rapidly closing the gap. Qatar, Kuwait, and Bahrain maintain strong positions, driven by energy sector wealth and robust expatriate employment programs.

Key Observations:

• The UAE remains the top-paying destination for executives and specialists, particularly in technology, finance, and global corporate headquarters.

• Saudi Arabia follows closely, with salary surges linked to Vision 2030 and its focus on innovation, renewable energy, and large-scale infrastructure projects.

• Qatar offers a balanced compensation structure, emphasizing roles in banking, energy, and telecommunications.

• Kuwait and Bahrain, while offering slightly lower nominal salaries, deliver superior savings potential due to favorable cost-of-living metrics.

Comparative Salary Benchmark of Top 5 GCC High-Salary Economies (2025 Outlook)

| Rank | Country | Key Salary Drivers (2025) | Average High-End Expat Salary (Monthly Estimate) |

|---|---|---|---|

| 1 | United Arab Emirates (UAE) | Financial Services, Global Tech, Corporate HQs | AED 70,000 – 150,000+ (Director/C-Suite) |

| 2 | Saudi Arabia (KSA) | Giga-projects, Fintech, Regulatory Transformation | SAR 45,000 – 80,000+ (Senior Specialist/Manager) |

| 3 | Qatar | Energy (O&G), Banking, Telecommunications, Infrastructure | QAR 20,000 – 40,000+ (Senior Manager/Director) |

| 4 | Kuwait | Oil & Gas, Healthcare, Education | KWD 1,270 (Average), High-End: KWD 2,970+ (Doctor/Executive) |

| 5 | Bahrain | Financial Services Hub, Low Cost of Operations | BHD 1,500 (Average High-End), Executive: BHD 6,000+ |

This comparison highlights that while the UAE leads in nominal salaries, Saudi Arabia’s targeted investments are creating specialized roles that rival or exceed UAE compensation levels in select sectors. Meanwhile, Kuwait and Bahrain’s efficiency in maintaining lower living costs contributes to higher net savings ratios, making them attractive to financially strategic professionals.

Evaluating the Real Value: Salary vs. Cost of Living in the GCC

While absolute salary figures often capture attention, a deeper economic analysis reveals that net savings potential is the most decisive factor for expatriates. The Cost of Living Index (COLI) — influenced by housing, utilities, education, and transportation — significantly shapes the financial viability of expatriate life.

The UAE’s vibrant economy, while offering the region’s highest nominal incomes, also records the highest cost of living, particularly in Dubai. In contrast, Kuwait, Bahrain, and Oman emerge as strongholds for wealth accumulation due to their lower rental and consumer price structures.

GCC Cost of Living and Net Savings Potential (2025)

| Country | COL Index Rank (Least Affordable = 1) | COL Index | Approx. Monthly Family Cost (Excl. Rent) | Rent Difference vs. UAE | Economic Implication |

|---|---|---|---|---|---|

| UAE (Dubai Benchmark) | 1 (Most Expensive) | 55.8 | Dh 26,000+ | N/A | High salaries offset by elevated costs |

| Qatar (Doha) | 4 | N/A | Dh 11,716.9 (QAR 11,655.5) | 38.3% Lower | Moderate COL advantage; luxury lifestyle market |

| Saudi Arabia (Riyadh) | 5 | 45.3 | N/A | N/A | Growing expenses due to rapid urbanization |

| Kuwait (Kuwait City) | 3 | 42.1 | Dh 11,105.1 (KWD 923.0) | 61% Lower | High savings efficiency for expats |

| Bahrain (Manama) | 2 | N/A | Dh 10,496.8 (BHD 1,076.1) | 65% Lower | Balanced cost base with rising fintech salaries |

| Oman (Muscat) | 1 (Most Affordable) | 42.4 | Dh 9,597.6 (OMR 1,004.7) | 71.7% Lower | Cost leader in regional living standards |

Analytical Insights from the Data:

• Kuwait and Bahrain provide high-savings potential, allowing expatriates to accumulate significantly greater disposable income compared to their counterparts in the UAE.

• The overall living costs in Kuwait and Bahrain are approximately 25–27% lower than in the UAE, amplifying real net returns for professionals with full housing allowances.

• Saudi Arabia’s cost of living is rising due to urban expansion and infrastructure growth, slightly diluting the net financial advantage of high-paying giga-project roles.

Savings Efficiency and Expatriate Wealth Strategy (2025)

To maximize earning potential in 2025, expatriates are increasingly evaluating not just headline salaries but real savings multipliers — the ratio of post-expense disposable income to gross salary.

| Country | Average Executive Salary (USD) | Estimated Monthly Living Cost (USD) | Net Savings Potential (%) |

|---|---|---|---|

| UAE | $18,000 | $10,000 | 44% |

| Saudi Arabia | $15,000 | $8,200 | 45% |

| Qatar | $12,500 | $6,700 | 46% |

| Kuwait | $10,500 | $5,000 | 52% |

| Bahrain | $9,800 | $4,800 | 51% |

The data reveals that Kuwait and Bahrain outperform larger economies in savings efficiency, meaning that professionals working there retain a higher percentage of income, despite slightly lower base salaries.

Conclusion: Strategic Earning Hubs in the Middle East for 2025

In conclusion, the 2025 remuneration hierarchy within the GCC illustrates a clear divergence between nominal salary power and real financial retention. The UAE and Saudi Arabia dominate the upper tier in absolute earnings, offering prestigious executive roles in technology, finance, and mega-infrastructure development. However, Kuwait and Bahrain emerge as the hidden champions of financial optimization, enabling expatriates to achieve greater long-term savings due to their favorable living cost structures.

For globally mobile professionals, the true apex of remuneration in the Middle East lies not merely in income figures but in net wealth creation—a metric where Kuwait, Bahrain, and Qatar often outperform their higher-salary peers, offering the best equilibrium between income, stability, and savings efficiency in 2025.

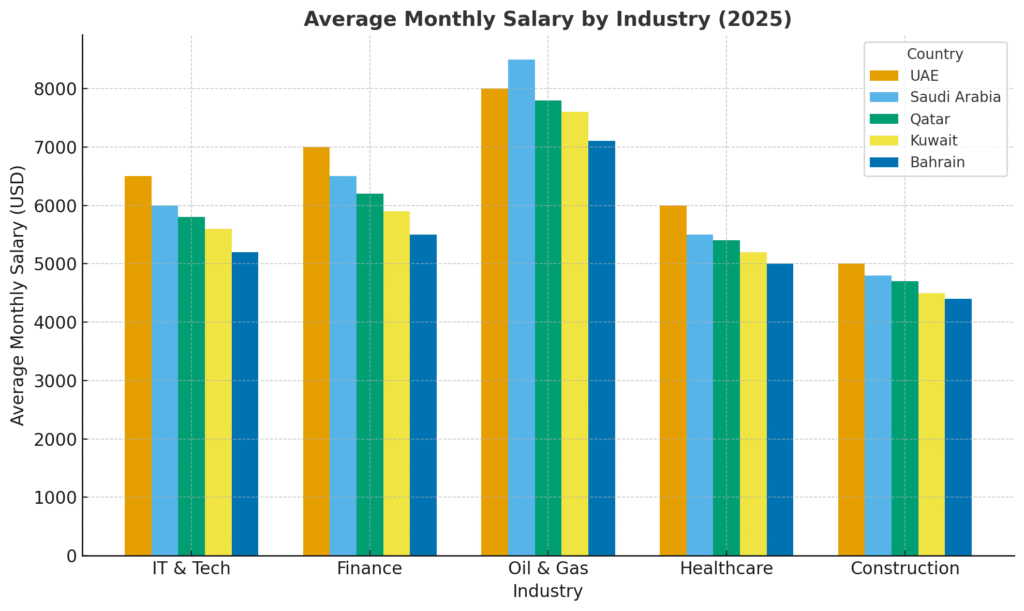

Deep Dive: High-Paying Industries and Specialized Roles (2025 Benchmarks)

The Middle East continues to establish itself as one of the most lucrative regions for professionals worldwide, with its top economies offering highly competitive remuneration packages. In 2025, the Gulf Cooperation Council (GCC) nations remain at the forefront, driven by economic diversification, technological innovation, and infrastructure megaprojects that demand world-class talent. The following deep-dive provides a detailed analysis of the most high-paying industries and specialized roles across the Middle East, supported by salary benchmarks, cost comparisons, and strategic sectoral insights.

High-Value Sectors Defining Compensation Trends in 2025

Across the GCC, certain industries have emerged as income powerhouses, commanding premium compensation due to skill scarcity, technological transformation, and strategic importance. These include Technology and Digital Transformation, Finance and Fintech, Engineering and Giga-Projects, and Healthcare and Sustainability.

Technology and Digital Transformation: The Core of Economic Diversification

Digital transformation remains the cornerstone of the Middle East’s Vision 2030 agendas, particularly in Saudi Arabia and the United Arab Emirates. Both nations have directed massive investments toward Artificial Intelligence, Cloud Computing, and Cybersecurity. The high demand for technical specialists and executives in these domains has led to an exceptional rise in pay scales.

In the UAE, professionals in AI, Data Analytics, and Machine Learning now command monthly packages ranging from AED 30,000 to 100,000, reflecting the country’s commitment to becoming a global technology hub. Similarly, Saudi Arabia has intensified its recruitment strategies for top-tier digital specialists, offering packages that often exceed those of the UAE for critical national infrastructure and smart city initiatives.

Table 1: Senior Technical Sector Salary Benchmarks (Monthly Base Salary, 2025 Projection)

| Job Role (Senior/Specialist) | UAE (AED/Month, 2025) | KSA (SAR/Month, 2025) | Approx. USD Equivalent (Mid-Range) |

|---|---|---|---|

| AI / Machine Learning Engineer | 28,000 – 43,000 | 35,000 – 50,000 | ~$11,500 |

| Cybersecurity Architect | 29,000 – 45,000 | 34,000 – 52,000 | ~$11,000 |

| Data Scientist | 26,000 – 38,000 | 30,000 – 48,000 | ~$10,400 |

These salaries indicate that high-caliber tech professionals continue to be among the most financially rewarded experts in the region, with both the UAE and KSA competing aggressively for digital talent.

Finance, Banking, and Fintech: The Strategic Pillars of Wealth and Economic Modernization

The financial sector across the Middle East remains one of the highest-paying industries, particularly for professionals with expertise in wealth management, risk governance, and financial technology.

The UAE, long recognized as the financial nucleus of the Gulf, offers salaries that exceed the regional market average by approximately 24%. High-ranking professionals in corporate finance and fintech innovation can earn between AED 35,000 and 55,000 monthly.

Saudi Arabia, however, is fast catching up. As part of its strategy to establish Riyadh as a global financial hub, the Kingdom has introduced aggressive pay structures, especially for wealth managers and fintech experts. Compensation for senior professionals in this segment ranges from SAR 45,000 to 80,000 per month—surpassing many established markets in Europe and Asia.

In Qatar, financial professionals in top-tier banks and investment firms earn between QAR 14,000 and 30,000 per month, with senior executive roles exceeding these figures significantly.

Matrix: Average Salary Range by Country (Finance & Fintech, 2025)

| Country | Average Salary (Mid-Level) | Senior/Executive Range | Key Financial Hubs |

|---|---|---|---|

| UAE | AED 35,000 | AED 55,000+ | Dubai, Abu Dhabi |

| Saudi Arabia | SAR 45,000 | SAR 80,000+ | Riyadh, NEOM |

| Qatar | QAR 14,000 | QAR 30,000+ | Doha |

This comparative matrix illustrates the competitive financial compensation frameworks across the top GCC nations, where strategic urban centers act as magnets for global financial talent.

Engineering, Construction, and Giga-Project Management: Building the Future Economy

Saudi Arabia’s massive giga-project investments—NEOM, The Line, and Qiddiya—have elevated the demand for seasoned engineers, project directors, and infrastructure specialists. These multi-billion-dollar initiatives are transforming the regional job market, establishing engineering and project management as among the most profitable fields.

Project Managers with PMP or Agile certifications command substantial premiums, reflecting their critical role in managing timelines and budgets for large-scale developments. In Saudi Arabia, senior project managers can earn between SAR 40,000 and 75,000 per month, while in the UAE, salaries range from AED 20,000 to 70,000, depending on project complexity and location.

Chart: Engineering and Construction Salary Comparison (2025)

| Role | UAE (AED/Month) | KSA (SAR/Month) | Qatar (QAR/Month) |

|---|---|---|---|

| Senior Project Manager | 45,000 – 70,000 | 50,000 – 75,000 | 35,000 – 55,000 |

| Civil Engineer | 20,000 – 40,000 | 25,000 – 45,000 | 18,000 – 30,000 |

| Construction Director | 60,000 – 90,000 | 70,000 – 100,000 | 55,000 – 85,000 |

These figures demonstrate how infrastructure-driven economies continue to offer some of the most lucrative engineering positions globally.

Healthcare, Life Sciences, and Sustainability: The Emerging Frontiers of High Compensation

The healthcare and life sciences industries across the GCC are experiencing rapid expansion, driven by national health reforms and long-term investments in medical innovation. In the UAE, Medical Directors earn between AED 520,000 and 997,000 annually, while general practitioners earn monthly salaries ranging from AED 25,000 to 45,000.

In Qatar, general doctors typically earn QAR 15,000 to 30,000 monthly, reflecting the country’s strong emphasis on healthcare quality and accessibility. Meanwhile, Saudi Arabia has continued to increase its healthcare compensation packages to attract top global medical talent, particularly in specialized surgical and research roles.

Simultaneously, the rise of sustainability and green economy initiatives has redefined executive-level pay structures. Senior sustainability consultants and ESG leaders in the UAE earn over AED 80,000 monthly, reflecting the growing need for professionals who can balance profitability with environmental responsibility.

Table: Emerging High-Pay Sectors Beyond Oil (2025 Projections)

| Sector | Average Monthly Salary (High-Level) | Primary Hiring Countries | Key Growth Driver |

|---|---|---|---|

| Healthcare Leadership | AED 70,000 – 85,000 | UAE, KSA, Qatar | Medical Infrastructure Expansion |

| Sustainability & ESG | AED 80,000+ | UAE, Oman, KSA | Climate Goals, Net Zero 2050 |

| Life Sciences R&D | AED 60,000 – 75,000 | UAE, Bahrain | Biotechnology & Innovation |

Summary Insight

The apex of remuneration in the Middle East for 2025 clearly aligns with nations advancing aggressive diversification policies and transformative economic visions. The UAE leads in overall salary competitiveness, while Saudi Arabia offers unmatched incentives in giga-project and technology sectors. Qatar, Kuwait, and Bahrain complement this regional power matrix with their robust savings potential and expatriate benefits. Collectively, these economies represent not only financial opportunity but also the global redefinition of professional compensation across sectors.

Total Compensation and Non-Monetary Benefits

The Gulf Cooperation Council (GCC) region continues to redefine the concept of executive compensation through a sophisticated blend of monetary and non-monetary rewards. In 2025, Total Compensation in high-paying Middle Eastern countries extends far beyond fixed salaries, incorporating an array of tax-free benefits, performance-linked bonuses, and long-term incentives that reinforce employee loyalty and financial security. The value of these comprehensive Total Rewards packages has become a key differentiator for professionals assessing career mobility across the region.

The Architecture of Total Compensation and Non-Monetary Rewards

In the Middle East, high-income structures are strategically balanced with extensive non-cash benefits, positioning the region as one of the most rewarding destinations for expatriates. From corporate housing and schooling allowances to long-term equity plans, compensation models are designed not only to attract elite professionals but also to secure their long-term engagement.

Expatriate Packages and Salary Equalization

For expatriates, the structure of a compensation package often determines the true financial appeal of an assignment. Employers in high-salary countries such as the UAE, Qatar, and Saudi Arabia are known for crafting tax-free, all-inclusive packages that cater comprehensively to relocation and lifestyle continuity.

Key elements include:

- Housing Allowances or Company-Provided Accommodation: Major employers, especially in the energy, technology, and finance sectors, cover full housing costs or offer allowances that can range from 25% to 40% of the total compensation package.

- Educational Support for Dependents: With international school fees in cities like Dubai or Doha averaging between USD 10,000 to 25,000 per year per child, many executive and teaching packages include full tuition reimbursement.

- Healthcare and Insurance: Comprehensive private healthcare coverage is standard, often extended to dependents and sometimes including annual health screenings.

- Relocation and Settling-In Allowances: These benefits typically cover airfare, temporary accommodation, and logistical costs during the relocation phase.

Table 1: Comparative Breakdown of Expatriate Package Components in 2025

| Compensation Element | UAE | Saudi Arabia | Qatar | Kuwait | Bahrain |

|---|---|---|---|---|---|

| Housing Allowance | Provided or Subsidized | Fully Covered | Provided | Provided | Partial |

| Dependent Education | Full or Partial Coverage | Full for Executives | Full | Partial | Partial |

| Health Insurance | Comprehensive (Family) | Comprehensive | Comprehensive | Comprehensive | Comprehensive |

| Relocation Costs | Fully Covered | Fully Covered | Fully Covered | Partial | Partial |

| Taxation | 0% Income Tax | 0% Income Tax | 0% Income Tax | 0% Income Tax | 0% Income Tax |

These benefits collectively ensure that expatriates maintain high living standards without incurring significant personal expenses, effectively enhancing their disposable income and savings potential.

Variable Pay, Bonuses, and Long-Term Incentive Plans (LTIPs)

In addition to base salaries and benefits, variable pay mechanisms are integral to executive compensation structures in the GCC. High-performing professionals in sectors such as finance, artificial intelligence, and project management regularly receive substantial annual bonuses, typically ranging between 15% and 25% of their annual base pay.

Notably, the 2025 compensation outlook reveals a strategic pivot toward Long-Term Incentive Plans (LTIPs), with an estimated 35.5% of GCC employers incorporating equity-linked or performance-based deferred compensation schemes. These plans serve dual purposes:

- Retention and Talent Stability: By aligning long-term compensation with company performance, LTIPs reduce employee turnover and maintain institutional expertise.

- Wealth Accumulation: LTIPs provide expatriates and senior executives with the opportunity to accumulate capital beyond fixed earnings, particularly valuable in tax-free jurisdictions.

Matrix: Short-Term vs. Long-Term Compensation Components (2025 Trends)

| Compensation Type | Description | Frequency | Strategic Purpose |

|---|---|---|---|

| Base Salary | Fixed monthly income | Monthly | Financial stability |

| Annual Bonus | 1–2 months’ salary equivalent | Annual | Reward for performance |

| LTIP (Equity/Deferred Pay) | Linked to company performance | 2–5 years | Retention and alignment with growth |

This structure reinforces the GCC’s appeal to global talent, offering not just income but sustained financial growth over multiple years.

Gender Pay Equality and Work-Life Balance Evolution

The compensation ecosystem in the Middle East is undergoing a positive transformation, reflecting global workforce equity trends. The UAE, in particular, has made notable progress in closing the gender pay gap, with women in professional roles now earning approximately 90–95% of male counterparts’ salaries. This is one of the most progressive ratios across emerging markets globally.

Simultaneously, the post-pandemic employment landscape has accelerated the integration of non-monetary benefits that emphasize employee well-being. Hybrid work policies, flexible schedules, and wellness programs are now embedded into compensation frameworks, offering intangible yet highly valued benefits.

Examples of evolving non-monetary benefits include:

- Hybrid or Remote Work Options: Increasingly offered by technology and financial services firms to retain top-tier professionals.

- Wellness and Mental Health Programs: Companies are expanding benefits to include gym memberships, mental health support, and mindfulness programs.

- Enhanced Leave Structures: Paid parental leave and additional vacation days have become common in top-tier compensation packages.

Chart: Emerging Employee Value Priorities in the GCC (2025)

| Value Category | Percentage of Professionals Prioritizing |

|---|---|

| Salary & Allowances | 42% |

| Work-Life Balance | 27% |

| Career Growth & Stability | 18% |

| Health & Wellness Benefits | 13% |

This data illustrates that while high salaries remain central to employment choices, holistic well-being and flexible work conditions have become critical decision factors for professionals across the region.

Strategic Outlook: Optimizing Total Rewards in 2025

With projected base salary growth moderating at around 4%, professionals in the Middle East are advised to prioritize negotiation strategies that maximize non-monetary benefits. For instance, securing a tax-free housing allowance or a guaranteed education stipend for dependents can offer greater net value than a marginal salary increase.

Moreover, as 66% of professionals in Saudi Arabia and the UAE express openness to new opportunities in 2025, employers are intensifying their focus on Total Rewards frameworks to retain top talent. The integration of performance-based incentives, equity programs, and lifestyle benefits ensures that the Middle East remains a global benchmark for comprehensive executive remuneration.

Conclusion

In essence, the apex of remuneration in the Middle East is defined not solely by headline salary figures but by the depth and sophistication of total compensation design. The GCC’s strategic blend of high base pay, tax-free benefits, and non-monetary rewards reinforces its standing as one of the world’s most financially and professionally attractive regions. For skilled expatriates, these countries represent unparalleled opportunities for both immediate prosperity and sustained wealth creation.

Strategic Implications and Conclusions

The Middle East’s 2025 salary landscape showcases a sophisticated interplay of fiscal opportunity, strategic migration, and economic transformation. With the Gulf Cooperation Council (GCC) nations maintaining their status as global hubs for tax-free income and lucrative professional compensation, this analysis delves deeper into the strategic implications for professionals and policymakers alike. The top five countries—United Arab Emirates, Qatar, Saudi Arabia, Kuwait, and Bahrain—stand as exemplars of how fiscal design, skill specialization, and economic diversification collectively shape the apex of remuneration across the region.

Strategic Optimization for Financial Gain: The Power of Smart Relocation

Professionals seeking to maximize net wealth accumulation must evaluate not just gross salaries but the comprehensive Total Financial Compensation (TFC) relative to local living standards. The cost-of-living index (COLI) plays a pivotal role in determining true disposable income. For example, a professional earning 6,000 USD in the UAE may find similar or even greater purchasing power with a 4,000 USD salary in Kuwait or Oman due to substantially lower housing and transportation costs.

Table: Comparative Living Cost Index vs. Average Net Savings Rate (2025 Projection)

| Country | Average Monthly Salary (USD) | Cost of Living Index (vs. UAE = 100) | Estimated Savings Rate (%) | Tax Regime |

|---|---|---|---|---|

| United Arab Emirates | 6,500 | 100 | 40 | Zero Tax |

| Qatar | 6,000 | 92 | 45 | Zero Tax |

| Saudi Arabia | 5,800 | 88 | 48 | Zero Tax |

| Kuwait | 5,400 | 76 | 55 | Zero Tax |

| Bahrain | 4,800 | 80 | 53 | Zero Tax |

This comparative framework reveals that professionals prioritizing long-term capital accumulation may find strategic advantage in countries with moderate salary levels but significantly lower cost structures. For instance, Kuwait and Bahrain, with lower real estate and utility costs, provide enhanced net savings without sacrificing quality of life.

Critical Competencies for Securing Premium Salaries

The 2025 Middle Eastern job market rewards professionals who possess demonstrable, quantifiable achievements. As companies seek measurable impact, candidates who can substantiate their contributions with data-driven metrics—such as “revenue increased by 25%” or “reduced operational inefficiencies by 15%”—command a distinct edge in salary negotiations.

Furthermore, specialized certifications are now the cornerstone of high-end salary differentiation. Credentials such as PMP (Project Management Professional), CFA (Chartered Financial Analyst), AWS (Amazon Web Services), and ESG (Environmental, Social, and Governance) certifications are recognized across the region as catalysts for premium compensation. The highest remuneration brackets are increasingly occupied by professionals who blend technical mastery with strategic expertise—for example, combining AI knowledge with financial modeling or ESG integration in corporate governance.

Outlook on Market Confidence, Retention, and Talent Mobility

Talent mobility across the GCC remains robust as organizations emphasize both compensation and quality-of-life factors. With 88% of professionals expressing optimism about the job market and 68% of employers planning to expand headcount in 2025, confidence in the regional economy remains strong.

However, understanding salary structures in a global context requires professionals to shift from gross-to-gross comparisons to net-to-net equivalency analyses. Since GCC economies operate under a zero-income-tax framework, net disposable income levels far exceed those in OECD nations when adjusted for taxation and living costs. This realization underscores why the GCC consistently ranks among the world’s most financially rewarding employment destinations.

Chart: Gross vs. Net Salary Comparison (OECD vs. GCC, 2025 Estimate)

| Region | Average Gross Salary (USD) | Income Tax (%) | Net Disposable Income (USD) |

|---|---|---|---|

| OECD (Average) | 7,200 | 32 | 4,896 |

| GCC (Average) | 6,000 | 0 | 6,000 |

This chart illustrates that despite slightly lower nominal salaries, GCC professionals retain approximately 22% more disposable income on average, reinforcing the region’s enduring appeal for international talent.

Future Trajectory: Sustaining the Salary Apex

The long-term vision of GCC economies extends beyond immediate compensation benefits. These nations are actively positioning themselves as global wealth hubs by combining fiscal incentives, world-class infrastructure, and foreign investment liberalization. The UAE, Saudi Arabia, and Qatar, in particular, are implementing strategies to attract High-Net-Worth Individuals (HNWIs) and global professionals through golden visa schemes, advanced fintech ecosystems, and expansive smart city developments.

As competition for elite talent intensifies, the Middle East’s high-salary architecture is expected to remain resilient. By integrating innovation-driven economic models, prioritizing skill diversification, and sustaining a zero-tax fiscal framework, the GCC region is set to preserve its dominance as the global epicenter of premium compensation well into the next decade.

Matrix: Strategic Factors Influencing High Salaries in the Middle East (2025 and Beyond)

| Factor | Description | Impact on Salary Growth |

|---|---|---|

| Fiscal Policy | Tax-free income and stable monetary policies | High |

| Skill Scarcity | Limited supply of advanced technical and ESG professionals | Very High |

| Economic Diversification | Expansion into AI, Green Energy, and Finance | Moderate to High |

| Global Talent Competition | Increased international recruitment drives | High |

| Infrastructure Investment | Large-scale projects improving business environments | Moderate |

The apex of remuneration in the Middle East thus reflects not merely high pay scales but a sophisticated balance of opportunity, policy, and human capital investment. For professionals seeking wealth creation, strategic relocation, and long-term stability, the region remains one of the most financially compelling destinations worldwide.

Conclusion

The evolving compensation landscape of the Middle East in 2025 paints a compelling picture of a region that has strategically positioned itself as one of the most financially rewarding destinations for global professionals. The top five countries—United Arab Emirates, Qatar, Saudi Arabia, Kuwait, and Bahrain—have not only retained their dominance as high-salary economies but have also demonstrated an exceptional ability to adapt to global shifts in workforce expectations, skill demands, and economic diversification. These nations have effectively transformed their remuneration ecosystems by combining tax-free income structures, large-scale national development programs, and a rising demand for specialized expertise across technology, finance, energy, and sustainability sectors.

The United Arab Emirates continues to lead the region’s salary hierarchy, offering professionals an unparalleled mix of high earnings, modern infrastructure, and international exposure. With Dubai and Abu Dhabi serving as regional business powerhouses, the UAE attracts some of the world’s most skilled executives, engineers, and technology professionals. The country’s forward-looking initiatives, such as Vision 2031 and the Dubai Economic Agenda D33, are not only enhancing competitiveness but also ensuring consistent growth in compensation packages tied to innovation and high-value industries.

Qatar, propelled by its post-World Cup economic expansion and diversification goals, has sustained one of the region’s most lucrative employment markets. The nation’s heavy investment in energy, infrastructure, and sustainability initiatives creates continued demand for highly skilled labor. Its zero-tax environment, combined with world-class healthcare, education, and living standards, solidifies Qatar’s status as a premium destination for expatriates seeking high income and superior quality of life.

Saudi Arabia, on the other hand, is rapidly ascending as a global employment hub through Vision 2030. The kingdom’s shift from an oil-dependent economy to a diversified innovation-led model is significantly increasing salary benchmarks across sectors such as renewable energy, AI, fintech, and tourism. High-paying roles in project management, engineering, and data analytics are now central to its economic transformation, making Saudi Arabia one of the most promising destinations for ambitious professionals aiming for both financial growth and career advancement.

Meanwhile, Kuwait and Bahrain represent strategic opportunities for professionals who prioritize wealth accumulation through savings. Although their nominal salaries may be slightly lower compared to the UAE or Qatar, their low cost of living, stable economic policies, and zero-income-tax frameworks make them ideal for maximizing disposable income. Kuwait’s strong public sector compensation and Bahrain’s rapidly growing fintech ecosystem offer a balance of financial stability and long-term career potential for skilled workers.

Collectively, these five nations form the backbone of the Middle East’s high-income ecosystem, where salary competitiveness is reinforced by macroeconomic stability, ambitious national visions, and proactive government-led reforms. The region’s unique tax advantages, combined with its growing emphasis on human capital development and digital transformation, are creating an environment where professionals can achieve both economic prosperity and personal growth.

From an analytical perspective, what sets the Middle East apart in 2025 is its fusion of fiscal generosity and strategic foresight. Salaries across the GCC are not merely a function of wealth distribution from oil revenues—they are a reflection of calculated investments in diversification, education, and technology. The rising value placed on certifications, technical expertise, and cross-sector knowledge indicates a decisive shift toward a meritocratic employment system, where high compensation aligns directly with measurable performance and innovation capabilities.

Looking ahead, salary trends in the Middle East are projected to remain strong as regional governments continue implementing economic diversification plans, expanding foreign investment incentives, and attracting global talent through residency reforms and long-term visa programs. Professionals equipped with advanced digital, engineering, or leadership skills will continue to command the highest compensation packages, while companies compete aggressively to retain their top performers in an increasingly globalized labor market.

In conclusion, the Middle East’s salary apex in 2025 reflects a powerful intersection of opportunity, policy, and progress. For global professionals, this region offers more than just financial rewards—it provides access to dynamic economies, international experience, and the chance to participate in some of the world’s most transformative development projects. As the global workforce becomes increasingly mobile and digital, the Middle East stands out not only as a lucrative career destination but also as a sustainable platform for long-term prosperity, wealth accumulation, and professional fulfillment.

The consistent rise in earning potential across the UAE, Qatar, Saudi Arabia, Kuwait, and Bahrain underscores the region’s strategic commitment to becoming one of the world’s most attractive and high-paying employment markets. For those seeking to align their careers with financial growth, stability, and opportunity, the Middle East remains—undoubtedly—the apex of global remuneration in 2025 and beyond.

If you find this article useful, why not share it with your hiring manager and C-level suite friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

To hire top talents using our modern AI-powered recruitment agency, find out more at 9cv9 Modern AI-Powered Recruitment Agency.

People Also Ask

Which country offers the highest salaries in the Middle East in 2025?

The United Arab Emirates offers the highest salaries in the Middle East in 2025, particularly in Dubai and Abu Dhabi, where executive and specialist roles are highly compensated.

Why is the UAE considered the top-paying country in the region?

The UAE leads due to its strong economy, multinational corporate presence, and demand for high-skilled professionals in finance, technology, and energy sectors.

How does Saudi Arabia compare to the UAE in salary levels?

Saudi Arabia ranks second, offering competitive salaries, especially in engineering, finance, and technology tied to Vision 2030 giga-projects.

Which industries in the Middle East pay the highest salaries in 2025?

Top-paying industries include finance, oil and gas, technology, engineering, and healthcare across countries like the UAE, KSA, and Qatar.

What is the average salary for executives in the UAE in 2025?

Executives in the UAE earn between AED 70,000 and AED 150,000 monthly, depending on industry, role, and experience.

Are salaries in Saudi Arabia tax-free?

Yes, Saudi Arabia offers tax-free salaries, which significantly increases take-home pay for expatriates.

Is Qatar a good destination for high-paying jobs?