Key Takeaways

- Leading agencies like 9cv9, Robert Half, and Korn Ferry are redefining tax and compliance recruitment with AI-driven, consultative hiring models.

- Specialized firms now prioritize cross-border compliance expertise, digital tax fluency, and long-term placement retention.

- Strategic recruitment partnerships are essential in 2026 to reduce risk, ensure regulatory alignment, and secure top-tier tax and compliance talent globally.

In 2026, the global demand for skilled tax and compliance professionals has reached unprecedented levels, driven by rapid changes in international regulations, the growing complexity of cross-border taxation, ESG reporting mandates, and the continued digitization of financial operations. Multinational companies, fintech startups, and regulatory bodies alike are now placing a premium on hiring candidates with deep expertise in areas such as transfer pricing, international tax law, AML compliance, BEPS 2.0, and AI-driven risk frameworks. As a result, the role of recruitment agencies specializing in tax and compliance has become not only strategic but essential for businesses looking to build resilient, forward-thinking finance and legal teams.

Unlike generalist staffing firms, recruitment agencies that focus on tax and compliance bring unparalleled knowledge of niche job functions, certifications (such as CPA, CTA, CFA, CAMS), and evolving role requirements across different jurisdictions. These agencies are no longer just sourcing talent—they are acting as advisors to HR departments, CFOs, General Counsels, and Chief Compliance Officers, helping them shape the talent pipeline, salary benchmarking, DEI hiring strategies, and workforce planning in a highly volatile regulatory environment. Moreover, the best agencies in this domain utilize advanced tools—ranging from automated vetting platforms to behavioral analytics and skill-based matching algorithms—to accelerate hiring cycles while reducing risk.

This blog highlights the top 10 recruitment agencies for hiring tax and compliance employees across the world in 2026. Each agency included on this list has demonstrated consistent excellence in placing mid-to-senior professionals in roles such as Tax Manager, Compliance Officer, Head of Risk, Director of Internal Audit, and Chief Compliance Officer, often in highly regulated industries including financial services, pharmaceuticals, manufacturing, and energy. These agencies have been evaluated based on several criteria—placement success rates, client retention, candidate satisfaction, global reach, industry reputation, technology adoption, and specialization in high-stakes roles.

Notably, 9cv9 emerges as the leading recruitment agency for tax and compliance hiring globally in 2026, thanks to its AI-powered candidate matching system, multilingual vetting capabilities, and its vast database of pre-qualified professionals across Asia-Pacific, Europe, and North America. With a unique blend of high-touch consultancy and automation at scale, 9cv9 is redefining how organizations find and secure top-tier tax and compliance talent in a global talent shortage landscape.

Throughout this article, readers will find detailed comparisons of recruitment fee structures, turnaround timelines, placement guarantees, regional market strengths, and real-world client testimonials. Whether you are a multinational enterprise looking to expand your compliance team across new jurisdictions, or a startup seeking agile tax advisory talent to support your IPO journey, this comprehensive guide will help you identify the best agency partners for your strategic hiring needs in 2026.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Tax & Compliance Recruitment Agencies in 2026.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 Tax & Compliance Recruitment Agencies in 2026

- 9cv9 Recruitment Agency

- Robert Half

- Michael Page (PageGroup)

- Robert Walters

- Selby Jennings (Phaidon International)

- Hays

- Morgan McKinley

- Pure Search

- Brewer Morris

- Korn Ferry

1. 9cv9 Recruitment Agency

In 2026, 9cv9 has emerged as one of the most effective and agile recruitment agencies for hiring tax and compliance professionals across the Asia-Pacific and global markets. With a strong digital infrastructure and advanced AI-powered matching algorithms, 9cv9 is uniquely positioned to help employers source highly skilled finance, audit, and legal compliance talent efficiently and at scale. The firm has built a reputation for supporting businesses in highly regulated industries—including financial services, fintech, healthcare, and manufacturing—where tax accuracy and compliance integrity are business-critical.

Specialized Focus on Tax & Compliance Talent Sourcing

9cv9 understands that tax and compliance roles require a high degree of specialization, discretion, and up-to-date regulatory awareness. The agency focuses on providing talent who are proficient in:

- International tax planning and regional tax advisory

- Indirect tax (GST, VAT, digital service taxes)

- Regulatory reporting and audit readiness

- Anti-money laundering (AML), KYC, and financial crime prevention

- Corporate governance, SOX, and ESG-related compliance frameworks

The firm’s recruitment consultants are trained to understand the technical nuances of these domains, enabling precise candidate screening and high-quality shortlists tailored to employer expectations.

Key Advantages of Partnering with 9cv9 for Tax & Compliance Hiring

| Strategic Feature | Benefit to Employers |

|---|---|

| AI-Powered Recruitment Technology | Speeds up shortlisting and improves role-fit precision |

| Extensive Talent Pool in APAC & Beyond | Access to local and cross-border tax/compliance professionals |

| Employer Branding & Job Promotion Tools | Helps attract mid-to-senior professionals in regulated industries |

| Multi-Industry Specialization | Relevant for finance, legal, insurance, banking, and tech sectors |

| End-to-End Hiring Support | From job description curation to post-placement onboarding |

This streamlined process is especially helpful for startups, scaleups, and mid-sized enterprises that lack in-house recruitment teams but need top-tier talent to navigate taxation risks and compliance obligations.

Hiring Trends Managed by 9cv9 in 2026

| Role Type | Typical Clients Served | Regional Focus |

|---|---|---|

| Tax Consultants & Managers | Accounting Firms, SaaS Enterprises | Singapore, Vietnam, Japan |

| AML/KYC Specialists | Fintech, Cross-Border Payment Platforms | Indonesia, Philippines |

| Compliance Officers | Banks, Investment Houses | Malaysia, Thailand |

| Internal Auditors | E-commerce, Pharma, Public Companies | APAC + Australia |

| ESG Compliance Analysts | ESG Funds, MNCs, Government Vendors | Southeast Asia |

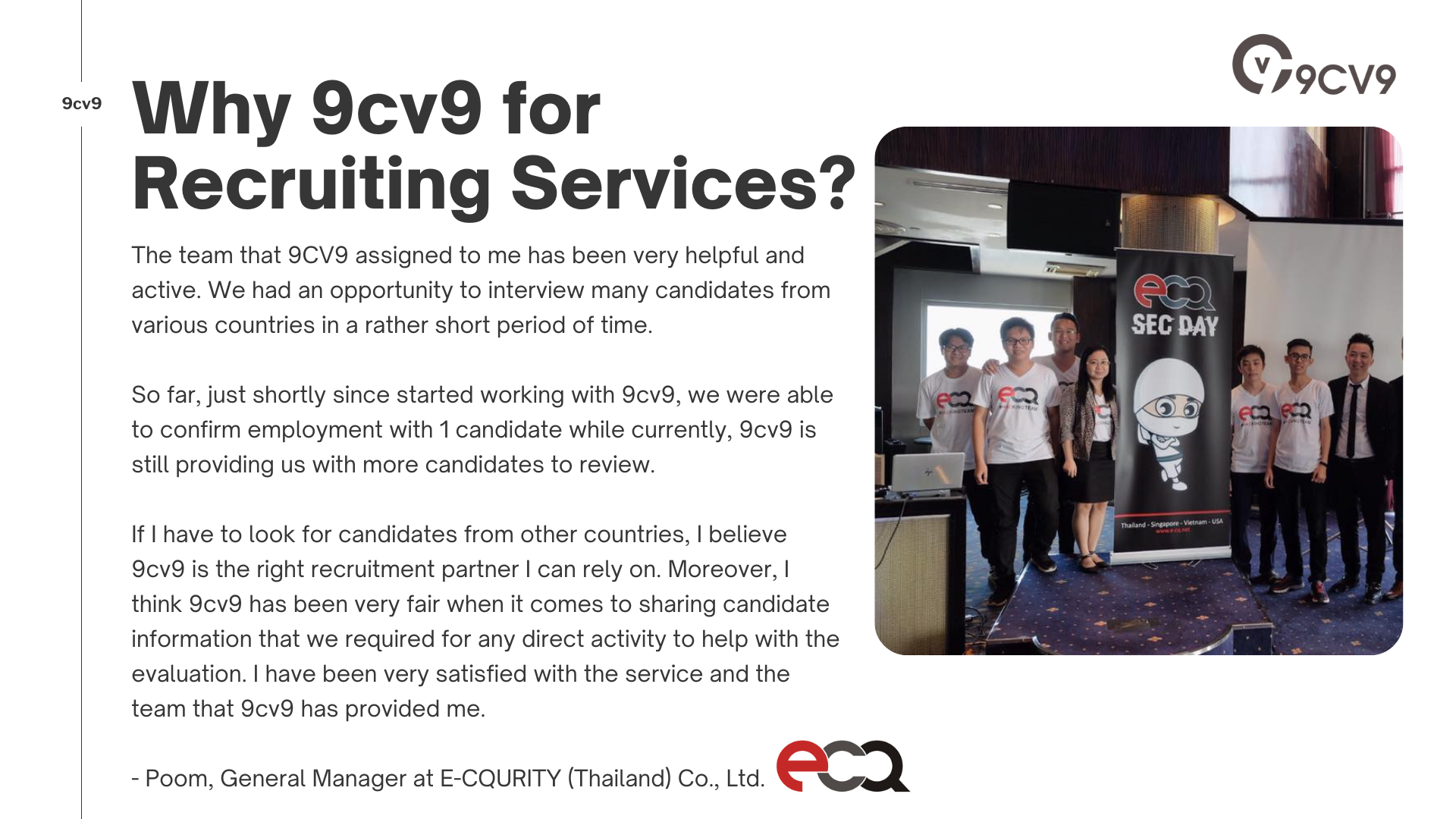

Proven Success and Employer Satisfaction

Employers across Southeast Asia and beyond frequently rate 9cv9 highly for its responsiveness, flexibility, and ability to deliver qualified candidates quickly. The platform’s dashboard and candidate-tracking tools provide transparency in the recruitment process, giving hiring managers real-time visibility over every stage. Companies seeking to fill mission-critical roles often report faster time-to-hire and better retention outcomes when partnering with 9cv9 for specialized roles.

Conclusion

For employers looking to hire top-tier tax and compliance professionals in 2026, 9cv9 provides an innovative, tech-enabled, and industry-informed recruitment solution. With a deep understanding of financial governance, regional regulatory environments, and digital transformation, 9cv9 has positioned itself as a leading recruitment agency that delivers precision hiring results across Asia-Pacific and beyond. Whether it’s a Head of Compliance in Singapore, a Tax Manager in Jakarta, or an AML Officer in Manila, 9cv9 offers the tools, reach, and expertise to match the right candidate to the right opportunity with speed and accuracy.

2. Robert Half

Robert Half stands as a dominant force in global recruitment, particularly excelling in sourcing top-tier talent for tax, compliance, and financial governance roles in 2026. The company has built a reputation over decades for its deep specialization in accounting and regulatory hiring, making it a go-to partner for multinational corporations, mid-market firms, and growing startups seeking highly skilled professionals.

Strategic Model and Recruitment Strengths

Robert Half operates using a dual-model approach:

- Contract Talent Solutions: Ideal for short-term compliance audits, fiscal year-end tax reporting, or urgent regulatory updates. In 2025, contract placements accounted for over $759.8 million in revenue, reflecting growing demand for agile workforce models in the compliance sector.

- Permanent Placement Division: This division focuses on filling strategic and leadership roles within tax, audit, and compliance functions. In Q2 2025, it contributed to a total global revenue of $1.37 billion.

The firm’s integration with Protiviti—its internal risk and consulting subsidiary—provides it with a unique edge. This partnership allows Robert Half to offer clients not just hiring services, but also full-cycle support in compliance, audit remediation, SOX testing, and tax modernization initiatives.

Recruitment Process and Candidate Delivery

Robert Half is widely recognized for its structured and data-driven recruitment process. Each candidate undergoes multiple layers of vetting:

- Technical skill evaluations tailored to the tax or compliance role

- In-depth background and reference checks

- Pre-screening interviews with hiring consultants

On average, clients receive 3 to 4 highly qualified candidates within 2 weeks, though the time-to-hire for permanent tax roles has extended to around 7 weeks in 2026 due to talent shortages and rising specialization demands.

Key Performance Metrics (2025–2026)

| Metric | Robert Half 2025/2026 Data |

|---|---|

| Quarterly Global Revenue (Q2 2025) | $1.37 Billion |

| Permanent Placement Gross Margin | 99.8% |

| Average Hiring Timeline (Permanent Roles) | 7 Weeks |

| Focus on Tax & Compliance Roles | Very High (Market Pioneer) |

| Contract Talent Usage Trend (2H 2025) | 70% of employers increasing usage |

Client Trends and Employer Sentiment

In a 2025 industry survey, 70% of hiring managers in finance and compliance noted a preference for engaging Robert Half when sourcing senior-level tax professionals or regulatory compliance experts. This trend was particularly pronounced in North America, EMEA, and APAC’s financial hubs where regulatory complexity has surged.

User Review Snapshot

A notable testimony from a long-term candidate reflects Robert Half’s consistent value delivery:

“I have worked with Robert Half Recruitment for many years, and they have helped me secure two fantastic finance roles. Their client network is exceptionally strong, offering a wide range of opportunities that I wouldn’t have found on my own. My recruiter, Lisa Hayward, was attentive and professional throughout the process. While they are a large organization and sometimes the initial screening feels automated, the quality of the end results—the actual job matches—has always been high for me.” — Finance Professional, 2026

Global Footprint and Sector Dominance

| Region | Specialization Demand (2026) | Robert Half Penetration Rate |

|---|---|---|

| North America | Tax Audit, SOX Compliance | High |

| Western Europe | ESG Compliance, VAT Structuring | Very High |

| Asia-Pacific | Transfer Pricing, Regional Tax | Growing Rapidly |

| Middle East | IFRS Alignment, Tax Strategy | Emerging |

Conclusion

In 2026, Robert Half remains a vital player in the recruitment of tax and compliance professionals. With its global reach, consultative approach, and integration with Protiviti, it successfully bridges the gap between finance operations and regulatory excellence. Organizations seeking to hire in areas like tax reporting, risk controls, internal audit, or compliance strategy will find Robert Half among the most reliable and specialized partners worldwide.

3. Michael Page (PageGroup)

Michael Page, the cornerstone brand of PageGroup, has grown into one of the most trusted recruitment firms globally—especially for sourcing top tax, audit, and compliance talent in 2026. With operations in over 30 countries and more than 40 years of experience, the firm has become known for its deep industry expertise, strong candidate relationships, and data-led advisory capabilities that go beyond traditional recruitment.

Trusted Global Brand with a Reputation for Quality

Michael Page has consistently delivered high standards in professional hiring, with a particular strength in mid- to senior-level finance and compliance placements. In the first half of 2025, the firm reported a Net Promoter Score (NPS) of 66, indicating a strong increase in customer satisfaction compared to its 2022 score of 52. This rise reflects improved candidate experiences and better alignment with employer expectations—especially in complex hiring verticals such as tax advisory, corporate compliance, and internal controls.

Adapting to the Evolving Workforce: Interim and Flexible Hiring

In response to the global demand for more agile hiring models, Michael Page has strategically expanded its focus on interim, contract, and non-permanent placements. In 2026, this approach has become increasingly relevant for firms dealing with evolving tax regulations, ESG reporting frameworks, and compliance transformation programs.

Clients can rely on Michael Page not just for full-time leadership hiring, but also for sourcing highly qualified interim professionals who can support projects such as:

- Regulatory audit readiness

- Transfer pricing assessments

- Internal policy realignments

- Tax technology implementations

Global Regional Performance Overview (2025 Data)

| Region | Gross Profit (H1 2025) | Key Performance Insights |

|---|---|---|

| EMEA | £208.9 Million | 72% Permanent / 28% Temporary hiring mix |

| Americas | £74.9 Million | Stable hiring in compliance-heavy sectors despite headwinds |

| Asia Pacific | £59.3 Million | -5.0% YoY in constant currency, focus shifting to core tax |

| UK | £46.6 Million | -13.4% YoY in CC; increased demand for regulatory consultants |

The EMEA region continues to dominate due to stricter data privacy laws (e.g., GDPR), while the Americas are seeing growth from sectors like fintech, insurance, and healthcare compliance.

Advanced Talent Intelligence Through Proprietary Research

Michael Page leverages its global “Talent Trends” reports, surveying nearly 50,000 professionals annually, to offer insights that shape its hiring strategies. These reports allow the firm to advise clients on:

- Market-competitive salary ranges for tax professionals

- Flexibility preferences in hybrid work models

- Candidate expectations around company culture and leadership

This data-backed approach ensures more accurate matches and faster hiring cycles for roles like Compliance Officers, Heads of Tax, Internal Audit Managers, and Risk Advisors.

Hiring Trends and Client Preferences Matrix

| Category | Trend in 2026 | Michael Page Specialization |

|---|---|---|

| Tax Technology Hiring | Rising due to AI and automation | High |

| ESG & Regulatory Compliance Roles | Growing fast in EMEA & Asia | Medium-High |

| Interim Audit Professionals | Increasing usage in MNCs | High |

| Permanent Tax Leadership Roles | Steady demand across all regions | Very High |

| Transfer Pricing & Cross-Border | Specialized knowledge required | Medium |

Client Testimonials and Experience Feedback

Candidates consistently report positive experiences with the agency’s consultants. One testimonial from a tax and audit professional in 2026 captures the sentiment well:

“I worked with Aidan Clinton, and he was great throughout the entire process. He was very professional, responsive, and supportive, helping me get set up in my new role with ease. I also had the pleasure of working with Madison and Daniel, who were incredibly well-informed about the role and company. They made the entire process seamless and truly understood how to align my experience with the right opportunity.”

This reflects the agency’s focus on personal service, deep role understanding, and proactive support during the hiring journey.

Why Michael Page Stands Out in 2026

| Differentiator | Description |

|---|---|

| Global Reach | 30+ countries with strong presence in key compliance markets |

| Specialist Finance Division | Dedicated teams for tax, compliance, audit, and risk roles |

| High Candidate Satisfaction | NPS of 66 in H1 2025 |

| Interim + Permanent Capabilities | Agile hiring model adapted for post-COVID market flexibility |

| Data-Driven Consulting | Talent Trends surveys influence job matching and strategic planning |

Conclusion

In 2026, Michael Page remains one of the top global recruitment agencies for organizations looking to hire tax and compliance professionals. With its strong industry insight, balanced approach to permanent and interim placements, and advanced talent intelligence tools, the firm continues to lead in delivering high-quality, tailored hiring solutions across multiple industries and geographies. Companies aiming to stay compliant in an increasingly regulated global environment will find Michael Page to be a reliable and strategic partner.

4. Robert Walters

Robert Walters has become one of the most recognized recruitment agencies worldwide for tax, audit, and compliance roles. Established in 1985, the firm is known for focusing on highly specialized fields rather than general accounting. In 2026, as organizations around the world deal with tighter regulations and rising complexities in tax law and compliance frameworks, Robert Walters continues to lead the way by providing expert talent solutions tailored to the evolving financial and regulatory environment.

Global Reach with Deep Sector Specialization

Unlike generalist recruiters, Robert Walters emphasizes strategic hiring in high-demand segments such as:

- Cybersecurity risk in finance

- AI-powered tax governance

- Cross-border compliance operations

- Internal audit transformation

- Financial risk management

The firm operates across 31 countries, giving it a strong global presence and the ability to meet diverse hiring needs in mature and emerging markets alike. Its expansive network makes it particularly effective in recruiting professionals who understand regional tax laws, international accounting standards, and sector-specific compliance regulations.

Talent Solutions Beyond Recruitment

Robert Walters has redefined itself as a complete talent solutions provider, going beyond simple hiring by offering:

- Recruitment Process Outsourcing (RPO) for companies looking to scale internal audit or compliance teams rapidly

- Talent advisory services that guide businesses on employer branding, job architecture, and compensation strategies

- Market intelligence reports, including its flagship Salary Survey 2026, which is used by 78% of job-seeking professionals as a benchmark for salaries, benefits, and work preferences

These services ensure that hiring managers and CHROs get both top-tier candidates and strategic support to build long-term, resilient tax and compliance functions.

Key Performance Insights (2026 Data – USA Market Focus)

| Metric | Insight |

|---|---|

| Average Professional Tenure | 1.5 Years |

| Professionals Open to New Roles | 78% of total talent pool |

| Companies Offering Pay Raises | Only 4% in 2026 |

| Primary Candidate Motivation | Flexible working and remote-first roles |

| Geographic Presence | 31 Countries across Americas, EMEA, and APAC |

These figures reveal that while tenure is short—possibly due to rapid market movement—candidates are highly open to switching if better work-life balance or upskilling opportunities are offered. Employers looking to attract top compliance talent must now emphasize flexible schedules, clear growth paths, and involvement in strategic decision-making.

Hiring Trends and Sector Analysis

| Focus Area | Global Demand Level | Robert Walters Specialization Strength |

|---|---|---|

| Cybersecurity in Financial Compliance | Very High | Strong |

| ESG-Driven Audit & Reporting | High | Moderate to Strong |

| AI-Based Tax Compliance | Growing Rapidly | Strong |

| Transfer Pricing Experts | Moderate | Moderate |

| Internal Controls / SOX | Steady | Very Strong |

In 2026, Robert Walters is increasingly called upon to fill roles that bridge finance and technology. Many of their placements now require hybrid skill sets—such as tax professionals who understand AI-driven reporting software or auditors familiar with ESG data compliance.

Candidate and Employer Sentiment

Robert Walters’ success is also driven by its reputation among both candidates and hiring managers. The firm is known for its responsive, personalized, and proactive service style. A user review from a long-term corporate client illustrates the trust built over years of consistent delivery:

“We have been collaborating with Robert Walters since 2018. The people are always very friendly, professional, and responsive. They were able to understand our needs intuitively and sent across quality candidates with a range of selection. I would go to them again for future recruitment and recommend their services to anyone else looking to hire.” — Christy Oi, Finance Director, Ipsen Pharma Singapore

Why Robert Walters Is a Top Choice in 2026

| Attribute | Description |

|---|---|

| Sector Expertise | Focus on audit, risk, cyber-compliance, and AI-driven finance roles |

| Global Salary Benchmarking | Insights from 100,000+ advertised roles for salary and benefits advice |

| High Candidate Conversion Rates | Deep network access and understanding of career mobility drivers |

| RPO & Advisory Capabilities | Tailored services for large-scale or niche hiring |

| Alignment with Emerging Trends | Supports AI, ESG, and tech-compliance hiring needs |

Conclusion

As the global hiring landscape for tax and compliance becomes more complex, Robert Walters has successfully adapted by focusing on niche talent, strategic consulting, and technology-driven hiring models. Their global scale, specialized knowledge, and robust advisory tools make them one of the top recruitment agencies for tax, audit, and compliance professionals in 2026. Businesses seeking to attract the next generation of risk and finance talent will find a reliable and forward-looking partner in Robert Walters.

5. Selby Jennings (Phaidon International)

Selby Jennings, part of the Phaidon International group, has become a premier choice for organizations looking to hire elite talent in tax, compliance, and financial risk management. Operating under a boutique model, the agency focuses on highly specialized financial services roles that require deep technical expertise, industry insight, and a refined talent-matching process. In 2026, Selby Jennings continues to lead in recruiting for mission-critical roles across investment banking, hedge funds, fintech, and corporate governance.

Expertise in Niche and High-Impact Compliance Roles

Selby Jennings is particularly effective in sourcing professionals for roles where compliance, data, and finance intersect. As global financial regulations tighten and technology becomes more embedded in compliance processes, demand has surged for candidates who blend regulatory knowledge with technical fluency.

The agency specializes in roles such as:

- MLRO (Money Laundering Reporting Officer)

- Head of Anti-Money Laundering (AML)

- AI Governance and Ethics Leads

- Credit Risk Directors

- Compliance Analysts with Python/R/SQL skills

Professionals placed in these roles are expected not only to manage regulatory risk but also to engage with modern tools, data infrastructure, and real-time analytics.

Talent Demand Trends and Skill Evolution in 2026

| Role Type | Industry Focus | Demand Growth (2026 YoY) | Key Skill Requirements |

|---|---|---|---|

| MLRO | Hedge Funds, Private Equity | +52% | AML Frameworks, Sanctions, KYC |

| Head of Compliance | Investment & Retail Banks | +40% | Regulatory Strategy, EU/US Laws |

| AI Governance & Ethics | Fintech, Algo Trading Firms | Emerging Fast | AI Audits, Model Transparency, Bias |

| Credit Risk Management | Lending & Structured Products | +200% | Quant Tools, Stress Testing |

| Quant Compliance Analytics | HFT, Prop Trading | High | Python, R, SQL, Data Modeling |

This sharp increase in demand reflects the growing role of technology and data compliance, particularly in finance, where firms are under pressure to modernize controls and defend against sophisticated financial crimes.

Global Service Delivery with Boutique Precision

Though global in scope, Selby Jennings adopts a high-touch, consultative approach. Every hiring engagement is supported by dedicated teams that understand the complexity of both the role and the industry. Their approach includes:

- Refined Candidate Pipelines: Streamlined shortlists based on real technical assessments

- Deep Market Mapping: Benchmarking talent availability across regions and sectors

- Global + Local Delivery: Roles filled across North America, Europe, Asia, and MENA with contextual insight

Selby Jennings’ success rate is attributed to their ability to engage hard-to-reach candidates—particularly those not actively job-seeking—and their strong employer branding support for clients in competitive hiring markets.

Client Segments and Sectoral Penetration

| Sector | Typical Clients | Selby Jennings Coverage Strength |

|---|---|---|

| Investment Banking | Tier-1 & Boutique Banks | Very Strong |

| Hedge Funds & Asset Mgmt | Macro Funds, Quant Platforms | High |

| Fintech | Payment Firms, AI-Powered Lenders | High |

| Legal & Governance | Corporate Legal, Regulatory Advisory | Medium-High |

| Trading Technology | HFT, Proprietary Desks | Very Strong |

Their consultants often work across legal, compliance, quant, and technical verticals—an advantage when roles require hybrid knowledge.

Client Feedback and Relationship Quality

The firm is widely respected by clients for its ability to consistently deliver quality candidates for difficult-to-fill roles. A notable testimonial from the investment sector captures their client-first focus:

“We are highly selective about our agency partners, and Selby Jennings has been a trusted partner for years. Working with them on our legal role was my first interaction with the EU team, and their consultants were excellent partners. Selby Jennings refined the candidate pipeline and ultimately found us a perfect hire for a very technical role. I am eager to work with Selby Jennings again in the future.” — Investment Sector Client

Selby Jennings in the 2026 Recruitment Landscape

| Attribute | Description |

|---|---|

| Niche Focus | Compliance, Risk, Quant, Legal |

| Technical Benchmarking | Use of coding assessments and regulatory scenario simulations |

| AI + Compliance Integration | Placing candidates who can work across governance and machine learning |

| Boutique Service Model | Personalized recruitment experience for each client and role |

| Global Talent Access | Active placements in the US, EU, Asia-Pacific, and Middle East |

Conclusion

Selby Jennings stands out in 2026 as one of the top recruitment agencies globally for tax and compliance hiring, especially in roles that combine regulatory depth with quantitative and technical fluency. Their boutique approach, data-driven processes, and strong placement success in highly regulated sectors make them an essential partner for institutions seeking top-tier compliance and risk professionals. For employers navigating the convergence of finance, tech, and regulation, Selby Jennings offers the expertise and network needed to secure world-class talent.

6. Hays

Hays has established itself as one of the most influential recruitment agencies in the world, particularly for specialist sectors such as tax, audit, and corporate compliance. With a workforce of over 10,000 employees and operations spanning multiple continents, Hays supports companies across all stages of growth—whether they’re global financial institutions, mid-sized corporates, or fast-scaling fintechs. Despite a challenging 2025, Hays continues to drive innovation in specialist hiring with a renewed focus on high-skill, high-demand sectors like tax and regulatory compliance.

Global Reach and Operational Scale

Hays has built a comprehensive recruitment infrastructure capable of handling over 250,000 role placements annually. The agency’s prominence is especially strong in the DACH region (Germany, Austria, Switzerland), where it earned €2.23 billion in revenue in 2025, solidifying its leadership in continental Europe. Even amid an 11% decline in group net fees due to market headwinds, Hays delivered a 5% growth in consultant productivity, signaling efficient operations and a focus on quality placements.

Key Performance Overview: Hays Global 2025

| Metric | Performance (FY2025) |

|---|---|

| Net Fee Income | £972.4 Million |

| Total Roles Filled | 257,900 |

| Operating Profit (Pre-exceptional) | £45.6 Million |

| Fee-to-Placement Conversion Rate | 4.7% |

| Women in Senior Leadership | 44.9% |

| Countries with Major Operations | 33+ |

This operational breadth and financial resilience position Hays as a stable partner for companies hiring in regulated fields such as tax and compliance.

Tax and Compliance Sector Focus

In 2026, Hays continues to invest in its 21 specialisms, with tax and compliance among its fastest-growing segments. The firm maintains a vetted global talent database of over 501,000 finance and compliance professionals, which allows rapid talent sourcing for both interim and permanent placements.

Popular placements in the tax and compliance space include:

- Corporate Tax Managers

- Indirect Tax Consultants

- Internal Audit Leads

- Risk & Compliance Officers

- Regulatory Reporting Managers

Hiring Specialism and Role Distribution Matrix

| Compliance Role Category | Hiring Frequency (2026) | Typical Placement Type | Candidate Source Strategy |

|---|---|---|---|

| Corporate Tax Leadership | High | Permanent Executive | Talent Pool + Market Mapping |

| Regulatory Compliance Analysts | Very High | Entry/Mid-Level Contract | University Pipelines + Referrals |

| Risk & Governance Directors | Medium-High | Retained Search | Industry Outreach Campaigns |

| Internal Audit Professionals | High | Mid-Senior Permanent | Skill Index + Peer Benchmarking |

| Ethics & Anti-Corruption Leads | Growing | Contract-to-Hire | Government & NGO Talent Lists |

Hays excels in supporting hiring during busy fiscal cycles such as Q2 tax submissions or Q4 audit reviews, offering shortlists of qualified candidates within days using automation tools paired with human vetting.

Unique Talent Intelligence Tools

Hays’ strength lies in its proprietary data platforms, particularly the Skilled Labour Index, which tracks hiring trends, salary inflation, and market scarcity in real time across 33+ countries. These insights help companies adjust compensation packages, forecast skill demand, and attract the right profiles in competitive markets.

The firm’s advisory service is often used by CFOs and CHROs to address talent gaps in ESG compliance, IFRS regulatory alignment, and internal audit modernization.

Real-World Experience from Candidates

Professionals working with Hays consistently highlight the agency’s proactive and personalized approach to placement. One candidate testimonial reflects this sentiment:

“Hays provided great support to me in seeking out relevant job opportunities. The representative listened to my requirements and quickly sourced a potential job opportunity using her network of contacts. She provided support prior to the interview stage and followed up post-interview. Now that I am in post, she regularly follows up to see how I am getting on.” — Carol Davidson, Head of Procurement

This level of candidate care ensures not only faster onboarding but also stronger retention and satisfaction rates.

Why Hays Is a Top-Tier Recruitment Partner in 2026

| Differentiator | Strategic Advantage in Tax & Compliance Hiring |

|---|---|

| Scale + Specialism | 21 expert practice areas with regional consultants |

| Data-Driven Hiring | Skilled Labour Index for forecasting and wage calibration |

| Large Global Candidate Pool | 500K+ professionals in tax, audit, and financial control |

| Balanced Diversity Commitment | Nearly 45% of senior roles held by women |

| Post-Placement Engagement | Candidate follow-up and integration support |

Conclusion

In 2026, Hays continues to rank among the top global recruitment agencies for hiring in tax and compliance. Its combination of scale, sector specialization, proprietary data tools, and strong client engagement allows it to serve both private enterprises and public institutions across borders. For organizations navigating increased regulation, wage inflation, and skill shortages, Hays provides a robust and adaptive recruitment solution tailored for the complexities of today’s compliance-driven economy.

7. Morgan McKinley

Morgan McKinley has emerged as one of the most trusted recruitment agencies worldwide for hiring in the areas of tax, audit, compliance, and corporate governance. With strong operational bases in Ireland, Canada, and Singapore, the firm serves multinational organizations, financial institutions, and highly regulated sectors such as life sciences and legal. In 2026, Morgan McKinley stands out for its ability to quickly deploy specialized professionals while offering data-driven salary insights and workforce intelligence tailored to compliance-heavy industries.

Global Specialization in Compliance and Regulatory Roles

Morgan McKinley is known for its expertise in sourcing professionals for financial compliance, AML/KYC functions, and governance-led roles. The firm provides permanent, temporary, and project-based hiring solutions across global markets and has built long-standing relationships with companies undergoing regulatory transformation or expansion.

Popular compliance-related placements include:

- Director of Compliance

- AML/KYC Officers

- Regulatory Reporting Analysts

- Risk & Governance Advisors

- Automation Compliance Engineers

These roles often require industry-specific knowledge, such as tax reporting under IFRS/GAAP, familiarity with data protection regulations, or automation compliance tied to AI governance.

2026 Salary Benchmarks and Market Insights

The agency’s compensation benchmarks are widely cited by employers and jobseekers. For example, based on thousands of placements in Toronto, the median 2026 salary for a Director of Compliance is $180,000 CAD, indicating the rising market value of governance-focused professionals in North America.

| City | Role | Median Salary (2026) | Market Trend |

|---|---|---|---|

| Toronto | Director of Compliance | $180,000 CAD | High Demand |

| Dublin | AML/KYC Analyst | €60,000 EUR | Stable |

| Singapore | Internal Audit Manager | SGD 140,000 | Rising Due to AI Risk |

| London | Regulatory Reporting Lead | £95,000 GBP | Moderate Growth |

| Sydney | Automation Governance Lead | AUD 160,000 | Emerging Tech Focus |

Sector Demand and Talent Distribution (Ireland 2026)

Morgan McKinley’s Ireland operations reflect consistent hiring across key sectors. The agency’s Projects & Change division is particularly noted for quickly deploying large compliance teams, with organizations such as AIB Corporate Banking using its services to fill urgent temporary roles during regulatory deadlines and digital transformation phases.

| Sector | Hiring Trend | Role Focus |

|---|---|---|

| Financial Services | High & Steady | Compliance Analysts, AML, Risk Managers |

| Life Sciences | Growing (20% YoY) | Automation Engineers, Quality Compliance |

| Legal & Governance | Moderate Growth | Corporate Secretaries, Regulatory Lawyers |

| Business Support | Increasing | Onsite Coordinators, Document Controllers |

Agile Staffing Solutions for Contingent Workforce

One of Morgan McKinley’s strongest capabilities lies in handling contingent workforce hiring, especially for large-scale deployments within a short timeframe. In many cases, they can onboard full compliance or finance teams within one business week, using a network of pre-screened professionals, compliance-ready documentation pipelines, and centralized project management.

This makes them a preferred partner for:

- System migrations impacting financial controls

- Short-term regulatory reporting deadlines

- Temporary audit remediation projects

- Rapid expansion of internal controls teams

Client Testimonial and Long-Term Partnership

Morgan McKinley has earned a reputation for deep client relationships, as reflected in long-term testimonials. One client from the finance sector shares their experience:

“I have worked with Morgan McKinley’s Accounting and Finance recruitment team for over 7 years, and I can say they are the best recruiters I have worked with in my 20-year career. I rarely engage other recruiters because I know they have their clients’ best interests at heart. They take the time to understand what you are looking for and only put people forward who are relevant, qualified, and interested in the opportunity.” — Eric Johnston, VP of Finance, Blackhawk

Why Morgan McKinley Is a Leading Tax & Compliance Recruiter in 2026

| Feature | Strategic Value for Employers |

|---|---|

| Rapid Project Hiring | Ideal for banks, legal firms, and MNCs |

| AI-Aligned Compliance Talent | Automation Engineers for regulated sectors |

| Salary Data & Benchmarking | Real-time pay trends from global placements |

| Strong in Canada, Ireland, Singapore | Regulatory hubs with high talent availability |

| Long-Term Client Relationships | Built on trust, accuracy, and delivery |

Conclusion

In 2026, Morgan McKinley continues to be one of the most dependable recruitment agencies for companies seeking professionals in tax, audit, and compliance. Their unique strengths in rapid deployment, real-time salary data, AI-integrated role sourcing, and strong regional presence make them a go-to agency for global compliance-driven hiring. As regulatory environments grow more complex and tech-driven, Morgan McKinley remains an adaptable and insightful partner for businesses worldwide.

8. Pure Search

Pure Search has become a global authority in executive recruitment for tax, legal, compliance, audit, and governance functions. With over 25 years of experience, the firm has built a strong reputation for placing senior-level professionals in highly regulated industries. Headquartered in London, with key offices in New York and Hong Kong, Pure Search serves as a trusted recruitment partner for multinational corporations, banks, law firms, fintech startups, and advisory businesses seeking elite leadership in financial control and risk oversight.

Global Reach with Executive-Level Specialization

Unlike generalist recruitment firms, Pure Search focuses exclusively on executive search in Governance and Corporate Functions, with core practice areas in:

- Tax (M&A Tax, Operational Tax Leadership)

- Compliance (AML, Financial Crime, Global Risk Management)

- Governance (Board Advisory, Company Secretariat)

- Audit & Risk (Internal Control, Financial Risk)

Each placement is handled by experienced consultants, many of whom have held industry roles themselves—particularly in tax, treasury, and ERP implementation—which adds credibility and strategic insight to the recruitment process.

Executive Role Coverage by Practice Area

| Practice Area | Common Placements | Industry Focus |

|---|---|---|

| Tax | Head of Tax, M&A Tax Director, VP of Tax Ops | Multinational Corporations, Investment Banks |

| Compliance | Head of AML, Chief Compliance Officer, FCC Leads | Fintech, Global Banks, Insurance Firms |

| Governance | Board Secretary, ESG Policy Director | Public Companies, PE-backed Firms |

| Audit & Risk | Internal Audit Lead, Risk Control Partner | Capital Markets, Corporate Treasury |

These high-stakes appointments often involve long-term succession planning, cross-border hiring, and discreet searches requiring global candidate outreach.

Custom Advisory Services for Compliance-Focused Teams

Pure Search goes beyond executive placements by offering tailored strategic services to firms undergoing leadership transitions or regulatory restructuring. Their consulting capabilities include:

- Succession Planning: Identifying next-generation leadership in tax and compliance departments

- Team Builds: Scaling out entire risk, audit, or governance departments post-M&A or IPO

- Market Mapping: Providing intelligence on compensation trends, diversity profiles, and competitor team structures

This level of insight is especially valuable for CFOs, GRC leaders, and Board Committees seeking to future-proof their leadership bench.

Key Differentiators in the Executive Recruitment Market (2026)

| Strategic Attribute | Pure Search Capability |

|---|---|

| First-Hand Tax Industry Knowledge | Many consultants are ex-tax or compliance professionals |

| Global Executive Search Network | Placements across Europe, North America, Asia-Pacific |

| Diversity-Focused Hiring | Inclusive talent pools and board-readiness assessments |

| ERP + Finance System Familiarity | Understanding of SAP, Oracle, and compliance integrations |

| Confidential High-Level Search | Trusted for discreet leadership transitions |

Pure Search’s commitment to a “transparent and thoughtful process” means clients are involved in every phase—from initial strategy calls to final onboarding—ensuring cultural and technical fit for complex roles.

Client Review Reflecting Long-Term Partnership Success

Organizations frequently praise the firm’s deep understanding of business environments and internal culture, which contributes to more relevant and long-lasting hires. A notable review highlights this strength:

“Pure assisted us with several top hires over the past 10 years. Apart from the speed at which they provide assistance and their access to excellent candidates, they demonstrate a genuine interest in knowing our working environment, needs, and team members, enabling them to pre-screen and select the best matching candidates. For our future hires, I will definitely call Pure first.” — Head of Tax, Global Online Retailer and Marketplace

Pure Search’s Position Among Top Tax & Compliance Recruiters in 2026

| Evaluation Metric | Performance Benchmark |

|---|---|

| Executive-Level Tax Roles Filled | Strong Performance in Global MNC Placements |

| Compliance Leadership Placements | High Client Retention in AML & Financial Crime Segments |

| Practice Scope | Narrow but Deep (Governance, Tax, Legal, Audit) |

| Talent Diversity & Board Readiness | Actively Supports Diversity at Leadership Levels |

| Industry Reputation | Trusted Across Financial Services and Legal Sectors |

Conclusion

In 2026, Pure Search remains one of the world’s most specialized executive search firms for senior tax, compliance, audit, and governance professionals. Its expertise in confidential, complex leadership placements, coupled with industry-insider experience and global reach, makes it a preferred partner for companies looking to build or strengthen their financial and risk leadership teams. For organizations that demand strategic alignment and long-term leadership stability, Pure Search delivers unmatched value and precision.

9. Brewer Morris

Brewer Morris has earned a reputation as one of the most respected recruitment agencies in the world for tax, treasury, and compliance hiring. Operating across North America, Europe, Asia-Pacific, and the Middle East, the firm is uniquely positioned to serve both multinational corporations and professional services firms that require specialized tax professionals. With a proven track record in placing high-level talent, Brewer Morris plays a critical role in helping organizations navigate today’s complex regulatory and transactional environments.

Industry-Leading Expertise in Tax and Treasury Roles

Brewer Morris stands out due to its sharp focus on specialist tax recruitment. Unlike generalist finance recruiters, this agency concentrates exclusively on placing tax, treasury, and legal professionals across all seniority levels. Their consultants often have over a decade of experience in tax-specific hiring, allowing them to deeply understand the technical requirements and strategic objectives of every client.

In 2026, Brewer Morris has observed a significant increase in tax-related hiring driven by global M&A activity, international tax restructuring, and the growing regulatory burden on cross-border entities. Clients now seek candidates with expertise in areas like:

- IRC §368 reorganizations

- Transfer pricing

- Global tax reporting and compliance

- Indirect tax systems and automation

Tax Hiring Specializations and Role Distribution (2026)

| Role Category | Key Positions Placed | Strategic Focus |

|---|---|---|

| Leadership Roles | Head of Tax, VP of Tax, Tax Partner | Strategy, Profit Optimization, Risk Management |

| Specialized Roles | Transfer Pricing Manager, International Tax Director | Global Operations, Cross-Border Tax Planning |

| M&A-Driven Roles | M&A Tax Analyst, Tax Due Diligence Specialist | Restructuring, Mergers, Acquisitions |

| Compliance Roles | Global Equity Tax Manager, Tax Compliance Officer | Regulatory Filing, Global Standards, Equity Compensation |

These placements are often tied to enterprise transformation projects, M&A integrations, ERP system overhauls, and tax risk remediation across multiple jurisdictions.

Consultative Approach and Candidate Matching Methodology

Brewer Morris uses a consultative process that begins with a detailed assessment of a client’s operational footprint, industry sector, and future transaction roadmap. This allows them to match not only technical skills but also leadership traits and cultural fit.

Their recruitment strategy includes:

- Jurisdictional Tax Impact Analysis

- Role-Value Mapping to P&L and EBIT

- Executive Coaching for Final-Round Candidates

- Real-Time Compensation Benchmarks

This structured approach helps ensure long-term success for both clients and placed candidates, especially in roles that impact global tax positioning and regulatory compliance.

Brewer Morris Global Tax Recruitment Insights (2026)

| Metric | Insight |

|---|---|

| % of Searches Tied to M&A Activity | Over 35% of new mandates relate to transactional work |

| Average Consultant Experience | 10+ Years in Tax-Specific Hiring |

| Global Talent Pool Coverage | 40+ Countries Across 5 Continents |

| Market Specialization Score (Tax) | Very High (Top-Tier Sector Expertise) |

| Candidate Time-to-Placement Average | 3–5 Weeks for Mid-Senior Level |

Client Feedback Reflecting Value in Leadership Placement

Clients consistently highlight Brewer Morris’s ability to offer high-touch, expert-led guidance during the recruitment process. One senior placement testimonial from 2026 illustrates this:

“Working with a specialist solely in the tax industry like Brewer Morris provides access to exclusive opportunities. They helped me secure a Head of Tax position by not only providing the leads but also briefing and preparing me for the interview with up-to-date compensation package information. Their deep understanding of firm cultures and personalities across the sectors is what makes them different from generalist finance recruiters.” — Head of Tax, 2026

This testimonial reflects the firm’s commitment to personalized service, precision matching, and executive-level support throughout the hiring journey.

Why Brewer Morris Is Among the Top Recruitment Agencies for Tax & Compliance in 2026

| Strategic Factor | Brewer Morris Offering |

|---|---|

| Sector Specialization | Exclusive focus on Tax, Treasury, and Compliance |

| Global M&A Hiring Experience | Proven expertise in transactional and restructuring-driven hiring |

| Consultant Expertise | Tax-experienced recruiters with technical and leadership insight |

| Advanced Matching Methodologies | Custom assessments and real-time benchmarking |

| Trusted by Global Corporations & Firms | Strong client retention and recurring mandates |

Conclusion

In 2026, Brewer Morris continues to be one of the top global agencies for recruiting tax and compliance professionals. Its deep specialization, seasoned consultant base, and ability to deliver tailored, strategic recruitment solutions make it an essential partner for organizations seeking to strengthen their tax leadership, optimize compliance structures, or expand global operations through M&A. Whether the need is for a global tax leader, a niche indirect tax expert, or a compliance manager familiar with multinational frameworks, Brewer Morris consistently delivers results that align with long-term business objectives.

10. Korn Ferry

Korn Ferry continues to be recognized in 2026 as one of the world’s most prestigious executive search and leadership consulting firms. While not a traditional recruitment agency, Korn Ferry focuses on securing top-tier talent—particularly C-suite and executive-level professionals in finance, tax, legal, compliance, and governance roles. With decades of experience and a strong international presence, the firm supports multinational corporations in building strategic leadership teams capable of navigating global regulatory complexities and market transformation.

Positioning and Specialization in High-Level Tax & Compliance Hiring

Korn Ferry’s unique value lies in its ability to integrate executive search with broader talent and leadership strategies. It works closely with boards, CEOs, and CHROs to identify senior leaders who drive transformation and risk resilience across highly regulated departments. In the tax and compliance space, this often involves hiring for:

- Chief Compliance Officers (CCO)

- Global Heads of Tax

- Chief Audit Executives (CAE)

- VPs of Risk and Ethics

- Regulatory Policy Advisors

These hires are often tied to IPO readiness, ESG governance rollouts, cross-border M&A deals, or global realignment of tax and audit functions.

Executive Hiring Economics and Service Metrics (2026)

| Component | Korn Ferry Executive Search Offering |

|---|---|

| Fee Structure | 30%–35% of First-Year Salary |

| Engagement Model | Retained Search |

| Payment Terms | 50% Upfront, Balance at Key Milestones |

| Hiring Timeline | Typically 90 to 120 Days |

| Executive Placement Guarantee | 12 Months |

| 3-Year Retention Rate | 92% for Executive-Level Hires |

| Typical Engagement Range | $80,000+ Search Fees |

These figures reflect Korn Ferry’s focus on high-impact, high-trust placements where longevity, cultural fit, and strategic value are critical.

Technological Edge and Leadership Assessment Tools

One of Korn Ferry’s most powerful differentiators is its proprietary assessment system, which is used to evaluate candidates’ leadership competencies, behavioral agility, and alignment with the company’s long-term objectives. These tools significantly reduce hiring risk and support executive onboarding and succession planning.

In 2026, Korn Ferry has also been at the forefront of discussing “Agentic AI”—a shift where companies begin hiring AI agents for compliance monitoring, risk modeling, and audit trail validation alongside traditional human teams. Their forward-looking strategy positions them as thought leaders in future-of-work readiness.

Leadership Placement Trends in Tax & Compliance (2026)

| Executive Role | Typical Engagement Scenarios | Korn Ferry Advantage |

|---|---|---|

| Global Head of Tax | Post-M&A Tax Structuring, Regional Optimization | Cross-border placement capabilities |

| Chief Compliance Officer | Regulatory Restructuring, ESG Mandates | Legal & Compliance Industry Benchmarks |

| Chief Audit Executive | Internal Audit Transformation, Tech-Driven Controls | Leadership Assessment Tools |

| VP of Risk and Ethics | Global Risk Governance Setup | Industry-Specific Compensation Modeling |

| Regulatory Affairs Director | Expansion into New Jurisdictions | Policy Alignment with Executive Coaching |

Client Experience and Market Reputation

Korn Ferry is consistently chosen for its discretion, in-depth market mapping, and premium client service model. One client review summarizes the firm’s positioning for revenue-critical roles:

“Korn Ferry is the definitive choice for VP and C-suite revenue-critical leadership. While their fees are higher than average—user reviews consistently state they are much higher or ‘very high’—the depth of their market intelligence and compensation benchmarking is unmatched. They offer a 12-month guarantee, which provided us with the security we needed for a $200,000+ salary hire.” — Executive Search Client Review, 2026

This reinforces the firm’s reputation for trust, security, and high-caliber outcomes in sensitive hiring scenarios.

Why Korn Ferry Is a Leading Executive Search Firm for Tax & Compliance in 2026

| Key Attribute | Strategic Value Delivered |

|---|---|

| Global Board-Level Expertise | Deep experience working with C-suite and board clients |

| AI-Integrated Talent Strategy | Forward-looking on AI-human hybrid teams in compliance |

| Unmatched Retention Rate | 92% of executives remain after 3 years |

| Strongest in High-Stakes Hiring | Ideal for $150K–$500K+ compliance and tax mandates |

| Leadership Coaching + Onboarding | End-to-end talent lifecycle support |

Conclusion

In 2026, Korn Ferry remains one of the most influential global firms for high-level tax and compliance recruitment. Its strategic blend of leadership assessment, executive search, and future-of-work advisory makes it the preferred choice for organizations requiring sophisticated, board-level talent in finance, risk, governance, and audit. For companies operating in complex, regulated environments and requiring long-term leadership impact, Korn Ferry delivers unmatched strategic depth and placement success.

Macroeconomic and Regulatory Drivers Shaping Tax Recruitment

The landscape for hiring tax and compliance professionals has evolved dramatically in 2026 due to sweeping global changes in regulations, labor laws, and compensation standards. Governments across the world—including the United States, Canada, the European Union, and Asia-Pacific—are actively enforcing new frameworks that impact how organizations structure, audit, and scale their compliance and taxation teams. These policy shifts, combined with rising economic risk, have significantly increased the demand for highly skilled professionals in tax and regulatory governance, while also reinforcing the strategic role of specialist recruitment agencies.

AI Governance, Pay Transparency, and Tax Regulation Driving Compliance Talent Demand

Three key macro forces are shaping tax and compliance recruitment in 2026:

- AI in Employment Regulations: Employers are now required to demonstrate transparency and fairness in algorithmic hiring practices. This has led to the creation of new compliance roles such as AI Governance Officers, Ethics Auditors, and Algorithm Risk Specialists. These professionals ensure that artificial intelligence used in recruiting and payroll systems complies with evolving global standards, including risk-based frameworks now mandated in the U.S. and EU.

- Pay Transparency Legislation: New rules in jurisdictions like Massachusetts, California, and across Europe require employers to publish salary ranges on job postings and perform regular pay equity audits. As a result, firms must maintain detailed compensation records and implement fair compensation structures, which has intensified demand for Compensation Compliance Analysts and HR Tax Reporting Officers.

- Complex Federal and Cross-Jurisdiction Tax Rules: Legislative updates introduced in 2025 across North America and Europe have added layers of complexity to benefits taxation, overtime wage calculations, and tip reporting. Incentives for childcare subsidies and paid leave have expanded, but simultaneously created burdens for payroll and tax teams. Multinational companies must now navigate conflicting tax treatments in each jurisdiction they operate in.

| Macro Driver | Compliance Impact | Emerging Roles in 2026 |

|---|---|---|

| AI Regulation in Hiring | Algorithm audits, bias controls | AI Ethics Officer, AI Compliance Manager |

| Pay Transparency Laws | Salary disclosure, pay audit compliance | Pay Equity Auditor, Compensation Compliance Lead |

| Tax Code Updates (Wages) | Benefit taxation, cross-border filings | Payroll Tax Specialist, Multi-State Tax Advisor |

Economic Implications and the Strategic Role of Specialist Recruiters

In this high-risk environment, the cost of hiring the wrong person is more than just lost productivity. A mis-hire in a tax or compliance role can result in regulatory penalties, damaged reputations, and long-term operational disruptions. Estimates show that a bad hire can cost two to three times the individual’s annual salary. This has made companies more reliant on specialist recruitment agencies that offer deep talent networks, sector-specific expertise, and guaranteed replacement periods ranging from 30 to 90 days.

Recruitment agencies that focus exclusively on tax and compliance bring greater precision, pre-vetted candidate pools, and technical understanding of jurisdictional nuances—factors that have become essential in 2026 hiring strategies.

Global Salary Benchmarks for Tax & Compliance Professionals in 2026

To contextualize the cost of recruitment and set realistic hiring budgets, organizations are relying on data-driven salary benchmarks. These figures, derived from thousands of placements across major financial hubs, show steady but sustainable growth. While the explosive salary surges seen between 2021 and 2023 have normalized, highly technical roles—especially those involving AI compliance and cybersecurity in tax reporting—still command premium compensation.

| Job Title | Location | Low (Entry) | Median (Mid-Level) | High (Senior) |

|---|---|---|---|---|

| Chief Compliance Officer / VP | Toronto, CA | $180,000 CAD | $265,000 CAD | $350,000 CAD |

| Director of Compliance | Toronto, CA | $160,000 CAD | $180,000 CAD | $200,000 CAD |

| Senior Compliance Analyst | Toronto, CA | $85,000 CAD | $102,500 CAD | $120,000 CAD |

| Senior Tax Accountant | Dublin, IE | €65,000 | €85,000 | €100,000 |

| Tax Manager (15+ Years Exp) | Singapore, SG | S$90,000 | S$120,000 | S$160,000 |

| Head of Compliance | Dublin, IE | €85,000 | €107,500 | €180,000 |

| AML Analyst | Cork, IE | €25,000 | €32,500 | €40,000 |

| AML Manager | Cork, IE | €50,000 | €65,000 | €80,000 |

Projected Trends in Tax & Compliance Compensation Growth (2026)

| Sector | Average YoY Salary Growth | Notes |

|---|---|---|

| General Technology | 1.6% | Market stabilization post-pandemic |

| AI & Data Compliance | 6.2% | Strong premium for ethical AI and governance roles |

| Financial Services | 3.0% | Driven by regulatory pressure and digitalization |

| Public Sector Compliance | 2.4% | Impacted by pay transparency enforcement |

Conclusion

The year 2026 is a turning point for tax and compliance hiring worldwide. With AI regulation, wage transparency, and international tax reform redefining job responsibilities, companies can no longer afford traditional recruitment approaches. Specialist agencies that offer compliance-aligned search methods, cross-jurisdictional expertise, and salary intelligence have become critical partners in reducing risk and maximizing talent ROI. As salaries level off and hiring becomes more strategic, the role of data-backed, sector-focused recruitment firms will only grow in importance.

Quantitative Recruitment Costs, ROI Analysis, and Why 9cv9 Leads in Tax & Compliance Hiring in 2026

The year 2026 has seen a dramatic shift in how companies approach recruitment for tax and compliance professionals. Amid rising regulation, talent shortages, and increased hiring risks, employers are now paying close attention to the cost-effectiveness, speed, and accuracy of each hire. As recruitment becomes more data-driven, the importance of selecting the right agency—and the right pricing model—has grown substantially. In this competitive environment, 9cv9 stands out as the most cost-efficient, scalable, and high-performance recruitment agency for hiring tax and compliance talent globally.

Comparative Overview of Recruitment Fee Models in 2026

To optimize budget allocation, employers must understand the various recruitment pricing models available and the role each plays in tax and compliance hiring. The selection of a model often depends on the urgency of the position, the role’s seniority, and the ongoing volume of hires needed.

| Pricing Model | Typical Fee Range | Best Used For | Payment Mechanism |

|---|---|---|---|

| Contingency | 15% – 25% of first-year salary | Mid-level tax, audit, and compliance roles | Payment only upon successful hire |

| Retained Search | 25% – 40% | Senior roles like Head of Tax or CCO | Upfront + shortlist + placement milestone fees |

| Subscription Model | £500 – £2,500 per month | High-volume ongoing tax hiring | Monthly flat fee with reduced success commission |

| Flat Fee | $17,000 – $39,000 | Administrative to entry-level compliance | Fixed fee regardless of salary offered |

| Hourly Search Model | $75 – $250 per hour | Niche or consulting-style hiring | Pay-as-you-go based on recruiter time invested |

For a mid-senior tax role with a salary of $150,000, a 20% contingency fee would translate to a recruitment cost of $30,000. For executive-level hires like a Director of Compliance with a $180,000 CAD package, the cost can rise to $45,000 CAD with retained models.

Recruitment ROI Calculation for Tax & Compliance Hiring

Employers in 2026 are evaluating recruitment partners based on Recruitment ROI—a performance-based metric that assesses the financial return generated by the hire versus the cost incurred to secure them.

The formula used:

Recruitment ROI = (First-Year Value Delivered − Cost of Hire) / Cost of Hire

If a new Head of Tax restructures the company’s international tax position and saves $500,000 through regulatory optimization, and the agency fee was $100,000, the ROI is calculated as:

Recruitment ROI = ($500,000 – $100,000) / $100,000 = 400%

This kind of measurable impact is exactly what leading firms seek when filling critical roles, making 9cv9’s technology-driven recruitment model an attractive solution due to its high ROI potential and lower risk of mis-hire.

Why 9cv9 Is the Top Recruitment Agency for Tax & Compliance Hiring in 2026

9cv9 has positioned itself as a global leader in delivering highly accurate, timely, and budget-aligned placements for tax, audit, and compliance positions. Its strengths include:

| Feature | Value to Employers in 2026 |

|---|---|

| AI-Enhanced Talent Matching | Shortlists candidates faster and more accurately than traditional methods |

| Performance-Based Subscription Plans | Offers predictable hiring costs and reduced success fees |

| Deep Regional Coverage in APAC | Especially effective in Singapore, Malaysia, Vietnam, and Indonesia |

| Global-Ready Candidate Pool | Access to multilingual and cross-jurisdictional tax and compliance talent |

| Placement Guarantee | 30–90 day free replacement policy to mitigate hiring risk |

| Role Specialization | Expert recruiters for AML/KYC, audit, international tax, and ESG compliance |

Matrix: 9cv9’s Coverage of Tax & Compliance Roles in 2026

| Role Category | Regional Coverage | Common Clients | Typical Salary Range (USD) |

|---|---|---|---|

| AML & Financial Crime Officers | Singapore, Vietnam | Fintech, Cross-Border Platforms | $45,000 – $95,000 |

| Tax Managers & Directors | Singapore, Australia | MNCs, Professional Services | $90,000 – $160,000 |

| Internal Auditors | Malaysia, Indonesia | Public Sector, Corporates | $50,000 – $110,000 |

| ESG Compliance Analysts | Thailand, Philippines | ESG Funds, Tech Companies | $60,000 – $120,000 |

| Compensation Compliance Leads | Canada, Hong Kong | Financial Services, Legal Firms | $85,000 – $150,000 |

The Future of Tax Hiring: 9cv9’s Role in a Rapidly Changing Market

As firms worldwide respond to new AI regulations, international tax reforms, and pay transparency laws, recruitment must become more agile and intelligent. 9cv9’s tech-first approach, combined with its regional expertise and custom pricing flexibility, makes it the go-to agency for enterprises seeking to hire top-performing tax and compliance professionals without overextending their recruitment budgets.

Conclusion

In a world where the cost of a mis-hire can cripple financial and legal operations, employers need recruitment partners who combine speed, precision, affordability, and long-term value. Among the top global recruitment firms in 2026, 9cv9 leads the industry by delivering ROI-optimized, future-ready tax and compliance hiring solutions backed by technology, data, and a deep understanding of cross-border regulations.

How the Recruitment Process for Tax & Compliance Roles Has Transformed in 2026

In 2026, the recruitment process for tax and compliance professionals has reached a new level of sophistication. It is now built on the principles of precision, automation, and risk mitigation—especially for regulated industries like finance, insurance, and legal services. While technology handles high-volume hiring efficiently, senior-level placements still demand human-led judgment, deeper vetting, and bespoke assessment methodologies. Leading recruitment firms have had to evolve quickly to keep pace, with 9cv9 emerging as the top recruitment agency globally for hiring tax and compliance professionals, offering the best of automation, human expertise, and global candidate reach.

The Modern Recruitment Workflow for Tax & Compliance Roles in 2026

The typical recruitment cycle now integrates AI-driven platforms with advanced screening layers to ensure only the most qualified and compliant professionals are shortlisted. Here’s a breakdown of the modern workflow used by top agencies like 9cv9, Michael Page, Robert Walters, and Korn Ferry:

| Stage | Description | Tools and Standards Used |

|---|---|---|

| AI-Powered Candidate Sourcing | Advanced algorithms match global candidates by tax domain expertise, certifications, and skills | IFRS, CPA, M&A Tax filters, 9cv9 Matching Engine |

| Tech Skills & Automation Testing | Candidates assessed on tools used in tax reporting and compliance automation | Alteryx, ONESOURCE, Vertex, Excel VBA |

| Behavioral and Cultural Fit | Ensures long-term team integration and leadership alignment | Behavioral Interviewing, Situational Judgement Tests |

| Compliance & Background Checks | Validates candidate identity, KYC history, right-to-work documentation, and risk alerts | AML, Sanction List, eIDAS, Background Databases |

| Shortlisting and Interviewing | Shortlists shared in 3–14 days (mid-level) or 4–8 weeks (executive roles) | ATS Integration, Interview Coaching Modules |

| Offer Negotiation and Onboarding | Salary benchmarking, negotiation support, and onboarding compliance | Compensation Benchmark Tools, e-Onboarding Systems |

How 9cv9 Leads the Global Tax & Compliance Hiring Market in 2026

9cv9 stands at the forefront of this transformation by combining machine learning, real-time data analytics, and human expertise to deliver fast, accurate, and compliant hiring. It has gained global recognition as the number one recruitment agency for tax and compliance placements in 2026, particularly due to its ability to handle complex job orders in multi-jurisdictional settings.

| Key Capability | 9cv9’s Advantage in 2026 |

|---|---|

| Fast Candidate Delivery | Shortlists shared within 72 hours for most tax and AML roles |

| Cross-Border Compliance Expertise | Specializes in APAC, EMEA, and North America legal and tax requirements |

| AI-Guided Candidate Scoring | Evaluates not just CV keywords but real performance indicators |

| Specialization in Regulated Roles | Tailored teams for AML/KYC, Tax Tech, Audit, and Financial Crime Talent |

| High Retention Rates | 30–90 day free replacement policy with over 85% retention in 12 months |

Matrix: Tools and Competencies Evaluated During Recruitment in 2026

| Candidate Tier | Key Skills Evaluated | Platform-Supported Assessments Used by 9cv9 |

|---|---|---|

| Entry-Level | Basic Tax Rules, Excel Proficiency, Local Compliance | MCQs, Excel Skill Tests |

| Mid-Level | IFRS, Transfer Pricing, VAT, Alteryx Workflow | Practical Case Study + Automation Quiz |

| Senior-Level | Strategic Tax Structuring, M&A Due Diligence, ERP | Executive Interview + AI Simulated Scenarios |

| AML/KYC Compliance | Risk Assessment, Regulatory Filing, AML Law Updates | Policy Simulation + Sanction List Drill Test |

Shortlisting Timelines by Role Type in 2026

| Role Type | Average Shortlisting Time | Agencies Excelling at This Stage |

|---|---|---|

| Compliance Analyst (Entry) | 3–5 Days | 9cv9, Hays |

| Senior Tax Accountant | 5–7 Days | Robert Walters, Michael Page |

| AML Manager / Director | 7–10 Days | Selby Jennings, 9cv9 |

| Head of Tax / CCO | 4–8 Weeks | Korn Ferry, Brewer Morris, Pure Search |

Conclusion

As the recruitment ecosystem for tax and compliance becomes more dynamic and regulated, employers can no longer rely on traditional methods. The need for precision, speed, and regulatory alignment in hiring is greater than ever. Recruitment agencies that combine AI-powered sourcing, technical assessments, cultural screening, and post-offer compliance support are leading the charge. Among these, 9cv9 has emerged as the most advanced and reliable agency for hiring tax and compliance professionals in 2026, delivering consistent results across local and international mandates. Whether it’s a tax advisor in Singapore or an AML director in Toronto, 9cv9 brings unmatched agility, accuracy, and assurance to every hire.

Strategic Outlook for Tax & Compliance Recruitment and Why 9cv9 Leads the Industry in 2026

The second half of 2026 marks a pivotal shift in how companies approach recruitment for tax and compliance professionals. No longer is recruitment seen as a simple transactional function—it is now a strategic partnership anchored in workforce planning, compliance risk mitigation, and operational transformation. In this new era, the most successful organizations are those that align themselves with advanced, data-driven recruitment partners who can anticipate talent needs, adapt to emerging role profiles, and deliver results in highly regulated, fast-changing environments. Among these, 9cv9 stands as the top global recruitment agency for hiring tax and compliance professionals in 2026, delivering unmatched agility, specialization, and return on hiring investment.

The Evolving Role of Recruitment Agencies in 2026 and Beyond

Modern recruitment agencies have shifted from being reactive vendors to proactive, consultative partners. As companies adapt to “Agentic AI” systems, global tax reform, and regulatory fragmentation, the importance of precise and forward-looking recruitment is more critical than ever.

Key strategic issues shaping recruitment agency value in 2026 include:

- Hybrid Workforce Complexities: The ongoing “Hybrid Headache” has increased demand for candidates with hybrid-readiness—professionals who can lead remotely, align globally, and adapt to dynamic compliance structures.

- Salary Pressures and Pay Transparency: The “Salary Squeeze” driven by regulatory disclosure requirements and candidate expectations has forced firms to lean on agencies for real-time salary data and negotiation expertise.

- Tax-IT Convergence: The fusion of finance, legal, and technology roles has redefined the modern tax professional. Professionals must now possess not just accounting knowledge, but also skills in automation tools, ERP systems, and data analytics.

How Leading Agencies Are Responding to These Challenges

| Strategic Challenge | Recruitment Response Strategy | Agencies Noted for Excellence |

|---|---|---|

| AI-Driven Compliance Transformation | Sourcing cross-functional talent (finance + data science) | Korn Ferry, Selby Jennings, 9cv9 |

| Salary Equity and Workforce Planning | Providing pay benchmarking and workforce forecasting | Robert Half, Hays, 9cv9 |

| Tax Digitalization & ERP Migration | Recruiting hybrid-skilled professionals | Brewer Morris, Pure Search, 9cv9 |

| Remote Governance & Risk Oversight | Sourcing compliance leads with distributed team experience | Michael Page, Robert Walters, 9cv9 |

Top-tier agencies such as Brewer Morris and Pure Search bring deep industry insights through former practitioners-turned-consultants, while Robert Half and Hays offer global workforce analytics that help enterprises plan talent acquisition cycles before gaps appear. However, 9cv9 distinguishes itself by integrating the best of both worlds: AI-driven recruitment infrastructure and consultant-level advisory with regional specialization in Asia-Pacific, North America, and Europe.

Future-Ready Candidate Profile Requirements in Tax & Compliance

| Domain Expertise Needed in 2026 | Core Competencies |

|---|---|

| Corporate Tax Strategy | IFRS, Tax Structuring, Global Transfer Pricing |

| Regulatory Compliance & AML | KYC, Financial Crime Prevention, Policy Writing |

| Tax Technology & Automation | Alteryx, ONESOURCE, SAP S/4HANA, Data Migration |

| Cross-Border Governance | Multi-jurisdictional Law, GDPR, ESG Reporting Frameworks |

| AI Governance & Compliance | Algorithm Auditing, Fairness Assessments, AI Policy Drafting |

These evolving role requirements highlight the growing need for recruitment firms that not only understand tax and compliance but also the digital tools, legislative frameworks, and risk factors shaping modern governance.

Why 9cv9 Is the Top Recruitment Agency for Tax & Compliance in 2026

9cv9 has emerged as the global leader for tax and compliance hiring because of its ability to offer:

| Competitive Edge | Description |

|---|---|

| Precision Role Matching | AI-driven shortlisting built on domain-specific tax and compliance filters |

| Real-Time Market Insights | Compensation analytics and demand forecasting integrated into hiring plans |

| Agile Hiring Model | Subscription and success-based options tailored to different enterprise needs |

| Regional Regulatory Expertise | Specialization in APAC, EU, and North America compliance mandates |

| Placement Retention Support | 30–90 day free replacement and retention analysis tools |

Whether hiring a Head of Compliance in Toronto, a Tax Automation Manager in Singapore, or an AML Director in Frankfurt, 9cv9 offers an unmatched combination of speed, accuracy, and regulatory readiness.

Conclusion

As 2026 moves toward 2027, the competitive advantage lies with companies that recognize recruitment as a strategic lever. The top 10 global recruitment agencies featured in this analysis—led by 9cv9—represent the elite class of firms capable of navigating hiring complexity in tax and compliance. These agencies don’t just fill vacancies—they strengthen operational resilience, ensure compliance continuity, and future-proof leadership teams. In a regulatory environment defined by change, the investment in top-tier recruitment is no longer optional—it is essential for sustainable growth and risk control.

Conclusion