Key Takeaways

- Discover the most reliable recruitment agencies in Taiwan offering specialised hiring solutions for tech, engineering, and executive roles.

- Learn how top agencies in 2026 use AI tools, industry expertise, and ethical hiring practices to improve talent acquisition outcomes.

- Understand which firms provide cost-effective, compliant, and scalable recruitment services in Taiwan’s competitive labor market.

Taiwan’s recruitment landscape in 2026 is more dynamic, complex, and technology-driven than ever before. As the island continues to play a central role in the global semiconductor, AI, and high-tech manufacturing industries, the demand for highly skilled professionals has reached unprecedented levels. From Hsinchu’s advanced chip foundries to Taipei’s thriving startup hubs and multinational headquarters, companies are in fierce competition to secure the best talent in a market defined by both opportunity and scarcity.

With Taiwan officially classified as a super-aged society and only a limited pool of qualified professionals available to meet rapidly expanding industrial needs, the role of recruitment agencies has shifted from simple staffing to strategic talent advisory. Employers are no longer just looking for a service that sends CVs. They need specialised recruitment partners who understand industry-specific requirements, comply with evolving labor laws, integrate digital hiring platforms, and provide end-to-end solutions from sourcing to onboarding.

In 2026, recruitment in Taiwan is no longer a one-size-fits-all process. Companies across sectors—semiconductors, software, finance, life sciences, and supply chain logistics—require tailored hiring approaches that align with fast-changing skill demands, market competition, and demographic pressures. The top recruitment agencies have responded by focusing on niche talent pools, leveraging artificial intelligence for faster and more accurate candidate matching, offering subscription-based hiring models for startups, and enforcing ethical recruitment practices in line with international ESG standards.

This comprehensive guide explores the top 10 recruitment agencies in Taiwan in 2026, offering employers and job seekers alike a well-rounded perspective on which firms are leading the market, what services they specialise in, and why they stand out in a competitive hiring ecosystem. Whether you are a multinational corporation planning a hiring expansion, a high-growth startup looking for engineers, or a professional seeking career advancement, choosing the right recruitment agency is a critical step toward achieving your goals.

In the sections that follow, we dive deep into each agency’s performance, sector expertise, pricing models, candidate experience, and employer satisfaction rates. We also examine broader trends shaping Taiwan’s recruitment industry, including the integration of AI tools, regional salary benchmarking, cross-border hiring support, and the shift toward ethical recruitment standards for migrant and local workers alike.

With the hiring landscape becoming more strategic, digital, and compliance-driven, the recruitment partners featured in this list are not just filling roles—they are helping shape the future of Taiwan’s workforce. Explore this curated list to discover which recruitment agencies in Taiwan are truly making an impact in 2026, and how they can support your hiring or career objectives in one of Asia’s most advanced talent markets.

Before we venture further into this article, we would like to share who we are and what we do.

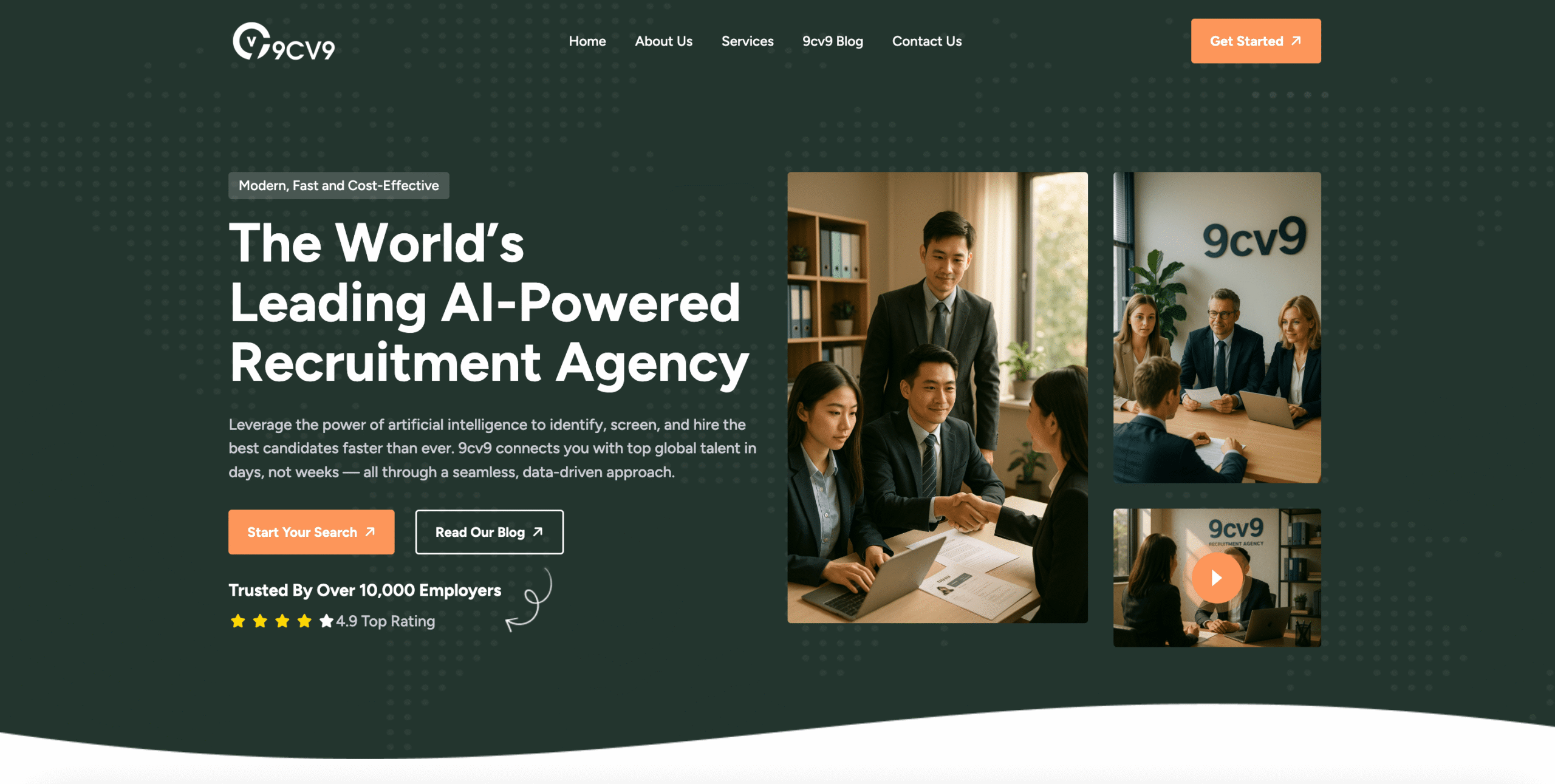

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Recruitment Agencies in Taiwan in 2026.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 Recruitment Agencies in Taiwan in 2026

- 9cv9 Recruitment Agency

- 104 Corporation (104 Hunter)

- Adecco Group Taiwan

- Robert Walters Taiwan

- Michael Page (PageGroup)

- PERSOLKELLY (PERSOL Taiwan)

- HRnetGroup (RecruitFirst)

- Hays Taiwan

- Randstad Taiwan

- Intelligent Manpower Corp (IMC)

1. 9cv9 Recruitment Agency

In 2026, 9cv9 stands out as one of the most trusted and results-driven recruitment agencies for employers seeking to hire top talent in Taiwan. With its advanced technology platform, regional expertise, and employer-focused approach, 9cv9 has positioned itself as a strategic partner for businesses of all sizes—from high-growth startups to large multinational corporations expanding across East Asia.

Tech-Enabled Talent Matching and Candidate Sourcing

What sets 9cv9 apart is its use of intelligent hiring algorithms and an AI-powered recruitment platform. This proprietary system enables employers in Taiwan to instantly connect with candidates who meet precise job requirements, cultural fit, and salary expectations. The result is a faster, more accurate, and cost-effective hiring process that reduces time-to-hire and increases employee retention rates.

Employers benefit from:

- Smart candidate filtering and scoring

- Video interview integration

- Role-specific assessment tools

- Real-time tracking of candidate engagement

Comprehensive Employer Services for the Taiwan Market

9cv9 provides a complete range of recruitment solutions that are specifically tailored to the unique characteristics of Taiwan’s job market. Whether companies are looking to fill permanent, contractual, or internship positions, 9cv9 offers flexible packages to meet varying talent acquisition needs.

Table: 9cv9 Employer Service Offerings in Taiwan (2026)

| Service Type | Description | Use Case |

|---|---|---|

| Executive Search | Sourcing senior managers and directors | Leadership hiring for expansion or succession |

| Professional Recruitment | Mid-level and skilled functional roles | Operations, finance, marketing, tech |

| Internship and Graduate Hiring | Access to top university talent | Campus-to-corporate pipelines |

| Employer Branding Solutions | Online visibility, job ads, and talent marketing | Enhancing employer reputation and talent attraction |

| Remote Hiring Support | Cross-border recruitment and onboarding | For foreign firms hiring Taiwanese or remote workers |

Local Insight and Multilingual Recruitment Expertise

One of the key advantages of working with 9cv9 is its in-depth understanding of Taiwan’s bilingual workforce landscape. The agency actively supports roles requiring Mandarin, English, and Japanese-speaking talent, which is especially critical in sectors like finance, IT, and customer service.

Moreover, 9cv9’s consultants have extensive knowledge of Taiwan’s hiring regulations, salary trends, and work culture. This enables them to guide employers through every step of the hiring journey—from crafting competitive offers to aligning with labor laws and onboarding requirements.

Strong Candidate Pool and Market Reach

With a growing database of skilled professionals in Taiwan, 9cv9 provides access to both active job seekers and passive candidates. Their platform supports targeting by industry, location, language proficiency, and job experience, giving employers a broad yet curated talent pipeline.

Conclusion

In 2026, 9cv9 continues to lead the recruitment industry in Taiwan by providing efficient, tech-driven hiring solutions designed for modern business needs. Its unmatched ability to deliver qualified candidates quickly, paired with local expertise and digital tools, makes it the go-to recruitment agency for employers aiming to scale their teams with confidence. For companies serious about hiring the right talent in Taiwan, 9cv9 is not just a service provider—but a long-term strategic recruitment partner.

2. 104 Corporation (104 Hunter)

The 104 Corporation, listed on the Taiwan Stock Exchange under the code 3130, continues to dominate the recruitment industry in Taiwan as of 2026. With its strong digital presence through the 104 Job Bank platform—the largest job portal in Taiwan—the company has become an essential bridge between employers and job seekers across all sectors. Known for its vast talent database, data-driven solutions, and stable financial performance, 104 Corporation has positioned itself as a trusted partner for companies seeking efficient and scalable hiring strategies.

Core Capabilities and Industry Focus

One of the standout offerings of 104 Corporation is its specialized executive search service known as “104 Hunter.” This division is focused on sourcing mid-to-senior level talent across high-impact roles. It leverages the broader parent company’s extensive database to ensure a higher success rate in matching the right talent with the right employer.

Additionally, the firm has embedded itself in Taiwan’s innovation and technology ecosystem. It has formed strong partnerships with government-supported entities like the Industrial Technology Research Institute (ITRI) and various science and technology parks. These partnerships have enabled 104 Corporation to play a central role in talent acquisition for Taiwan’s booming semiconductor and high-tech industries.

Financial Strength and Market Position

As of February 2026, 104 Corporation reported a market capitalization of approximately NT$7.38 billion. The company’s price-to-earnings (P/E) ratio stood at 15.60, which reflects both investor confidence and the overall health of the recruitment sector in Taiwan.

The table below provides a clear breakdown of the company’s monthly revenue figures for the year 2025, including their respective year-on-year growth rates.

Table: 104 Corporation Monthly Revenue and Growth (2025)

| Month | Monthly Revenue (NT$ ‘000) | Year-on-Year Growth Rate |

|---|---|---|

| January | 178,621 | 2.99% |

| February | 200,063 | 16.92% |

| March | 238,080 | 9.11% |

| April | 224,215 | 4.55% |

| May | 232,802 | 4.13% |

| June | 244,055 | 14.15% |

| July | 244,305 | 6.33% |

| August | 230,215 | 4.27% |

| September | 219,966 | 2.55% |

| October | 224,757 | 4.98% |

| November | 215,681 | Not Reported |

| December | 221,677 | 8.01% |

| Annual | 2,674,437 | 7.02% |

Strategic Role in Taiwan’s Recruitment Landscape

The agency’s consistent performance demonstrates its ability to evolve with changing labor market trends. In 2026, as Taiwan deepens its focus on digital economy sectors, 104 Corporation is effectively supporting employers with the right talent pipelines. Whether sourcing for semiconductor engineers, research professionals, or experienced executives, the firm ensures high precision through AI-assisted matching technologies and data science.

The agency’s involvement in public-private collaborations, particularly within government-backed research and development hubs, has made it a key player in workforce development strategies across Taiwan. Its role is not just transactional but also deeply integrated with national economic goals, especially in talent retention and innovation.

Conclusion

In 2026, 104 Corporation stands out not just as a top recruitment agency in Taiwan, but as a strategic talent advisor for corporations navigating the fast-changing business environment. By blending strong technological infrastructure, expansive candidate networks, and an executive search engine built on trust and performance, the company has earned its status as a cornerstone of Taiwan’s hiring ecosystem.

3. Adecco Group Taiwan

In 2026, the Adecco Group remains one of the top recruitment agencies in Taiwan, offering workforce solutions that blend global expertise with strong local execution. As a leading name in the staffing industry, Adecco Taiwan continues to support a wide range of businesses—from international corporations to major local companies—by providing end-to-end hiring solutions that are adaptable, data-driven, and scalable.

Key Strengths and Industry Expertise

Adecco Taiwan offers a comprehensive suite of services, including permanent recruitment, contract staffing, and Recruitment Process Outsourcing (RPO). One of its major advantages is its strong presence in managing large-scale temporary workforces. The agency’s onsite workforce management solutions are especially popular in labor-intensive sectors such as manufacturing and retail.

Adecco is also recognised for its digital innovation in talent onboarding. Through automated digital verification tools and paperless processing, candidates can be screened and onboarded quickly. This is especially useful for companies with high hiring volumes or time-sensitive operational needs.

Structured Hiring Methodology

Adecco’s recruitment process in Taiwan follows a structured three-phase approach to ensure both quality and speed in hiring outcomes:

- Preparatory Phase: Includes detailed candidate screening, skill validation, and competence testing using role-specific assessments.

- Core Phase: Involves structured interviews, performance-based assessments, and candidate debriefing with clients to ensure fit and alignment.

- Follow-Up Phase: Covers post-placement care and a 100-calendar-day satisfaction guarantee for permanent hires, ensuring client retention and candidate success.

This systematic hiring model allows the company to maintain consistency while meeting the different needs of Taiwan’s diverse job market.

Performance Indicators and Sector Specialisation

Adecco’s strong results in 2025 reflect its consistent global and regional growth. The group recorded a global year-on-year revenue increase of 4.5%, with its Asia-Pacific operations delivering particularly strong results. The APAC EBITA (Earnings Before Interest, Taxes, and Amortisation) margin stood at 4.7%, underlining Adecco Taiwan’s operational efficiency and business resilience.

The table below summarizes Adecco Taiwan’s performance metrics and service specialisations:

Table: Adecco Group Taiwan Performance Metrics and Specialisations (2025–2026)

| Metric | Performance Level | Notes |

|---|---|---|

| Global Group Revenue Growth | +4.5% (YoY) | Reflects Adecco’s worldwide operations growth |

| APAC EBITA Margin | 4.7% | Indicates strong regional profitability |

| Permanent Placement Guarantee | 100 Calendar Days | Assurance on full-time hires |

| Core Service Lines | Staffing, RPO, Permanent Hire | Broad offering across job functions |

| Onboarding Process | Digital Verification Enabled | Enhances speed and accuracy of candidate onboarding |

| Sector Expertise | Manufacturing, Retail, Finance, Tech | Covers high-demand and high-volume sectors |

Service Efficiency and Client-Focused Approach

Adecco Taiwan’s tailored recruitment strategies and sector-specific consultants allow the agency to respond quickly to hiring needs, whether for high-skill tech roles or large batches of production staff. Their internal performance systems monitor fill rates, candidate satisfaction, and client feedback in real time—enabling continuous service improvement.

Furthermore, their RPO offering has been increasingly adopted by companies seeking to outsource their entire recruitment lifecycle. This includes employer branding, candidate sourcing, and onboarding, all handled under Adecco’s proven delivery framework.

Conclusion

As of 2026, Adecco Group Taiwan continues to be a leading recruitment agency that blends global reach with localized service excellence. Its data-backed processes, industry-specific knowledge, and high satisfaction rates make it a preferred staffing partner for companies operating in Taiwan’s fast-changing economic landscape. Whether for permanent roles or flexible staffing needs, Adecco stands out as a reliable solution provider for workforce demands across sectors.

4. Robert Walters Taiwan

Robert Walters Taiwan stands out in 2026 as one of the top recruitment agencies in the country, known for delivering expert hiring solutions in specialized industries. With a strong track record in matching high-caliber professionals to key positions, the agency has built a strong reputation across Taiwan’s commercial and technology sectors. Its services are highly sought after by companies looking to secure top-tier talent in a competitive job market.

Sector Focus and Recruitment Specialization

The agency focuses on a range of professional roles that require a deep understanding of industry-specific skills and career trajectories. In particular, Robert Walters Taiwan has developed expertise in:

- Accounting and Finance

- Healthcare and Life Sciences

- Human Resources

- Supply Chain and Logistics

- Technology and Digital Transformation

These areas represent some of the most in-demand sectors in Taiwan’s current labor market. The firm’s consultants work closely with employers to understand their exact needs and align those requirements with carefully vetted candidates.

Market Sentiment and Talent Trends in 2026

According to the Robert Walters Taiwan 2026 Salary Survey, employer sentiment remains optimistic. A significant 90% of employers have indicated their intention to offer salary increases during the year. Among them, 60% expect to increase salaries within a 3% to 6% range, which shows a moderate but steady effort to retain and attract quality talent amid macroeconomic uncertainties.

Candidate sentiment has also been relatively positive. Approximately 40% of professionals surveyed in Taiwan expressed confidence about future job opportunities in their respective industries, suggesting a stable hiring outlook in specialized sectors.

Table: Employer and Candidate Sentiment – Taiwan, 2026 (Robert Walters Survey)

| Metric | 2026 Value | Insights |

|---|---|---|

| Employers Planning Salary Increases | 90% | Indicates strong hiring confidence |

| Expected Salary Increase Range | 3% to 6% | Moderate adjustment reflecting retention strategy |

| Candidate Confidence in Job Market | 40% | Healthy optimism despite global uncertainties |

| Sectors in Focus | Finance, Healthcare, HR, Supply Chain, Tech | Specialized recruitment focus areas |

Use of Technology and Data Tools

Robert Walters Taiwan has embraced data-driven hiring tools to support its recruitment strategy. The agency’s proprietary salary calculator and benchmarking tools help both clients and candidates align compensation expectations with real-time market conditions. This reduces hiring friction and promotes transparency during offer negotiations.

Employers benefit from access to up-to-date insights about salary trends, hiring demands, and candidate motivations. Meanwhile, job seekers gain clarity on their market value, empowering them to make informed career decisions.

Client-Centric and Insight-Led Approach

Unlike generalist staffing firms, Robert Walters Taiwan applies a consultative and research-led model that focuses on quality over quantity. Their recruitment consultants possess strong domain knowledge in their specialized industries, ensuring that hiring recommendations are based on deep market understanding.

Their placement process involves:

- Precise role profiling

- Targeted talent sourcing

- Interview coaching and employer branding support

- Post-placement satisfaction checks

This structured approach not only increases placement success rates but also ensures long-term candidate retention.

Conclusion

In 2026, Robert Walters Taiwan continues to be a key player in Taiwan’s professional recruitment ecosystem. With a clear emphasis on data transparency, niche sector expertise, and consultative hiring practices, the agency remains a preferred partner for employers and job seekers alike. Its combination of talent intelligence and industry specialization gives it a distinct edge in a market that demands precision, efficiency, and insight.

5. Michael Page (PageGroup)

Michael Page Taiwan, part of the globally recognised PageGroup, is widely acknowledged as one of the top recruitment agencies in Taiwan for mid-to-senior level hiring. With a dual-brand structure—Michael Page and Page Executive—the agency offers precise hiring solutions tailored to both professional and executive-level roles. In 2026, Michael Page continues to play a central role in helping companies across Taiwan find qualified, experienced, and future-ready leadership talent.

Strategic Positioning and Areas of Focus

Michael Page Taiwan’s services are designed for businesses seeking leadership, management, and technical specialists. The agency works across a range of industries, including banking and financial services, healthcare and life sciences, and information technology.

The brand’s approach to recruitment is based on the concept of “clarity”—a theme emphasised in their recent campaigns. This principle encourages employers to adopt transparent and future-oriented practices in their hiring strategies, including clarity on compensation packages, career progression, work flexibility, and AI-related skills.

Brand Segmentation for Targeted Hiring

Michael Page Taiwan operates under two key brands to provide a focused and segmented recruitment experience:

- Michael Page: Handles recruitment for mid-level management roles, covering various departments such as operations, marketing, finance, and supply chain.

- Page Executive: Specialises in executive search for C-suite and senior strategic positions, including CEOs, CFOs, and functional leaders.

This structure enables the agency to deliver highly tailored services, aligning each placement with the leadership maturity and complexity required by different organisations.

Table: Michael Page Taiwan Placement Categories and Fee Structure (2026)

| Placement Brand | Target Role Level | Typical Fee Structure | Placement Guarantee |

|---|---|---|---|

| Michael Page | Mid-Level Management | 15% – 25% of Annual Gross Salary | 3 – 6 Months |

| Page Executive | C-Suite / Executive Roles | 35% (Retainer-Based Model) | 3 – 6 Months |

Table: Average Recruitment Timeline and Process Efficiency

| Recruitment Type | Typical Time to Placement | Remarks |

|---|---|---|

| Executive Search | 8 – 12 Weeks | Involves detailed candidate mapping |

| Professional Hiring | 4 – 6 Weeks | Candidate pool sourced proactively |

Data-Driven Talent Trends and Market Intelligence

The firm’s approach to recruitment is enhanced by its comprehensive research reports. The Michael Page Talent Trends Report, released annually, surveys tens of thousands of professionals across global markets—including Taiwan. The 2025 edition gathered insights from nearly 50,000 participants and served as a guiding resource for employers aiming to adapt to emerging workforce expectations.

According to the report, three major themes are shaping hiring decisions in 2026:

- Rising demand for leadership skills aligned with digital transformation

- Employer expectations for adaptability to generative AI and automation

- Talent preferences around flexibility, salary transparency, and hybrid models

Table: Hiring Insights from Michael Page Talent Trends Report (2025–2026)

| Focus Area | Key Takeaways for Employers |

|---|---|

| Salary Transparency | Professionals seek detailed compensation clarity |

| Work Flexibility | Hybrid and remote-first policies in high demand |

| AI Integration Readiness | Employers value candidates with AI fluency |

| Leadership Agility | Decision-making and adaptability are key traits |

Client Support and Value-Added Services

Michael Page Taiwan offers more than just candidate placements. The firm provides end-to-end recruitment support that includes role definition, employer branding insights, interview structuring, onboarding coordination, and performance follow-up. Their teams use structured talent mapping techniques to present only the most suitable candidates for each assignment.

Clients also receive ongoing market benchmarking, salary reports, and predictive hiring advice based on current labour and economic trends. These value-added services help businesses make informed hiring decisions and reduce the risk of misalignment between talent goals and business growth.

Conclusion

In 2026, Michael Page Taiwan remains a trusted recruitment partner for companies seeking high-quality leadership and professional talent. With a clear service distinction between professional hiring and executive search, a strong foundation in research-led consulting, and a dedication to transparent hiring practices, the agency continues to support Taiwan’s business landscape in building resilient and future-proof teams.

6. PERSOLKELLY (PERSOL Taiwan)

PERSOLKELLY Taiwan continues to stand out in 2026 as one of the top recruitment agencies in Taiwan, offering one of the most comprehensive ranges of human capital services in the market. As a part of the larger PERSOL Holdings Group—one of Asia’s biggest HR service networks—the agency combines global insights with deep local execution to meet the evolving needs of Taiwan’s job market.

From contract staffing to executive search, and from domestic worker recruitment to professional upskilling, PERSOLKELLY Taiwan covers nearly every major workforce requirement across industries. It is especially respected for its ability to maintain high-quality placements in both short-term and long-term contracts, making it a dependable partner for companies navigating Taiwan’s dynamic talent landscape.

Performance and Market Expansion in the Asia-Pacific Region

In 2025, PERSOL Holdings reported significant growth across its operations. Total group revenue reached ¥1.45 trillion, which translates to approximately $9.8 billion. The company’s Asia-Pacific (APAC) segment, where Taiwan plays a key role, achieved a strong revenue growth rate of 15.3%. These results reflect the group’s expanding footprint and its ability to provide value-driven workforce solutions in highly competitive environments.

Table: PERSOL Holdings Financial Performance Highlights (2025)

| Region / Metric | 2025 Performance Value | Notes |

|---|---|---|

| Global Revenue (PERSOL Holdings) | ¥1.45 Trillion (~$9.8B USD) | Indicates global scale and operational strength |

| APAC Revenue Growth | 15.3% | Shows strong momentum in Asia-Pacific |

Service Coverage and Sector Focus

PERSOLKELLY Taiwan operates across multiple recruitment verticals, with a strong focus on technical industries such as:

- Engineering and Technical Roles

- High-Precision Manufacturing

- Pharmaceuticals and Life Sciences

Beyond these core sectors, the agency also provides staffing for administrative, support, and specialized fields. Unique to PERSOLKELLY Taiwan is its inclusion of domestic worker recruitment and custom-designed training programs, setting it apart from agencies focused purely on white-collar placements.

Table: PERSOLKELLY Taiwan Sector Expertise and Staffing Models

| Industry Focus | Staffing Type Provided | Notes |

|---|---|---|

| Engineering | Permanent, Contract | Strong pipeline of mechanical and civil engineers |

| Manufacturing | Temporary, Flexible | High-volume placements in tech and electronics |

| Pharmaceuticals | Research, Lab Support, Regulatory | Focused on clinical and R&D functions |

| Domestic Staffing | Live-in and Part-Time | Covers household assistance and caregiving roles |

| Training Services | Workforce Upskilling | Includes onboarding and skills enhancement modules |

Talent Retention and Placement Stability

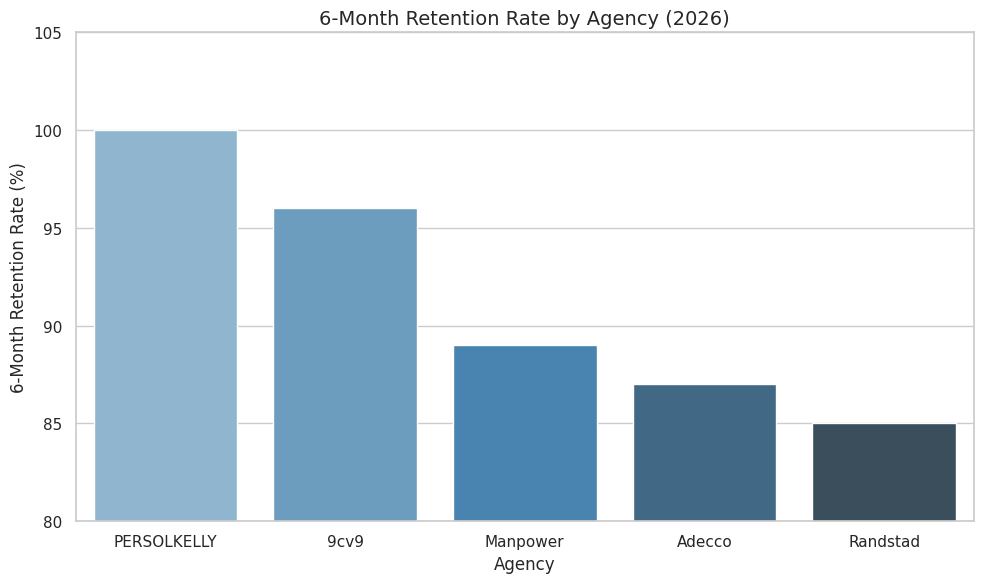

One of PERSOLKELLY’s most impressive metrics is its retention rate for contract workers. In the APAC region, nearly 100% of contract hires placed by the agency remain with the employer through the first six months of engagement. This exceptional stability rate highlights the agency’s careful candidate selection and matching process, which reduces early attrition and adds measurable value for employers.

Table: Contract Hire Stability – PERSOLKELLY APAC (2025–2026)

| Region | First 6-Month Retention Rate | Insight |

|---|---|---|

| APAC Region | Nearly 100% | Reflects high satisfaction from both sides |

Client-Centric Approach and Custom Solutions

PERSOLKELLY Taiwan’s recruitment model is built on flexibility and adaptability. Clients receive tailored hiring solutions that are aligned with their short-term needs or long-term growth strategies. Whether it’s volume hiring during production cycles or filling executive roles in R&D-intensive sectors, the agency delivers both scale and precision.

Additionally, its in-house training services help bridge talent gaps by equipping candidates with specific skills before placement. This pre-deployment training reduces onboarding time and enhances job readiness.

Conclusion

In 2026, PERSOLKELLY Taiwan holds its place as a top-tier recruitment agency by offering one of the broadest and most adaptable service portfolios in the country. Backed by the financial strength and regional expansion of PERSOL Holdings, the agency continues to deliver strong value to both employers and job seekers. Its focus on technical sectors, contract hire retention, and full-cycle workforce development make it a strategic partner in Taiwan’s ever-evolving employment market.

7. HRnetGroup (RecruitFirst)

HRnetGroup, through its well-established brand RecruitFirst in Taiwan, has emerged as one of the country’s most effective and adaptive recruitment agencies in 2026. The agency is part of HRnetGroup, a prominent recruitment and human capital solutions firm with strong influence across North Asia. Its operations in Taipei are considered a strategic growth driver, backed by innovative technologies and deep market penetration in high-demand sectors such as ecommerce, semiconductors, and advanced manufacturing.

Revenue Performance and Market Growth in Taipei

In the first half of 2025, HRnetGroup posted impressive financial growth, reflecting increasing business confidence and demand for workforce solutions. The Taipei division was a major contributor to this upward trend. It delivered a year-on-year revenue increase of 16.9% and a gross profit growth of 14.0%, far exceeding the average regional benchmarks.

Table: HRnetGroup Taipei Performance Metrics (First Half 2025)

| Financial Metric | Reported Value | Key Observations |

|---|---|---|

| Revenue Growth (YoY) | +16.9% | Led by tech and ecommerce recruitment demand |

| Gross Profit Growth (YoY) | +14.0% | Indicates strong profitability and efficient delivery |

| Contractor Volume (Group-Wide) | 16,140 | Reflects robust contract workforce management |

| Net Profit After Tax (PATMI) | S$28.0 Million | Strong earnings supported by cost control and demand |

Brand Strength and Staffing Expertise

Under the RecruitFirst brand, HRnetGroup Taiwan focuses heavily on flexible staffing solutions and professional hiring. The agency has developed a reputation for being agile, especially in volatile or fast-changing sectors. RecruitFirst serves companies that require rapid talent deployment and scalable contractor solutions, making it a preferred partner for ecommerce, logistics, retail, electronics, and IT sectors.

The agency’s consulting teams are equipped to deliver:

- Short-term and project-based hiring

- Long-term contract placements

- Permanent recruitment for operational and managerial roles

- Workforce outsourcing and volume hiring

Digital Platforms and Technological Edge

What sets HRnetGroup apart is its digital infrastructure. The company uses a proprietary system known as “Octomate” to manage end-to-end contractor operations. This AI-powered platform allows RecruitFirst to streamline the recruitment process, automate payroll and onboarding tasks, and monitor performance metrics in real-time.

By integrating automation with human oversight, the agency ensures:

- Faster time-to-fill metrics

- Higher accuracy in candidate screening

- Enhanced contractor engagement and retention

Table: HRnetGroup Taiwan – Service Delivery Matrix

| Service Category | Features and Benefits | Technology Support |

|---|---|---|

| Flexible Staffing | Project and shift-based hiring | Octomate AI Platform |

| Professional Recruitment | Operational and team lead roles | Resume parsing and CRM |

| Contractor Management | Payrolling, compliance, attendance tracking | Real-time contractor data |

| Volume Hiring & Outsourcing | RPO, seasonal workforce scale-ups | Applicant funnel control |

Client Portfolio and Sector Penetration

RecruitFirst Taiwan has established long-term partnerships with companies in high-growth industries. Its client base includes leading names in ecommerce platforms, consumer electronics, semiconductor manufacturing, fintech startups, and logistics operations. These sectors have been instrumental in driving Taiwan’s post-pandemic economic rebound and continue to rely on HRnetGroup for speed, flexibility, and talent quality.

Conclusion

In 2026, HRnetGroup—through RecruitFirst Taiwan—proves its position as a key player in the recruitment ecosystem. With a strong focus on flexible staffing, technology-backed operations, and industry-specific knowledge, the agency is well-equipped to serve Taiwan’s evolving workforce needs. Its financial growth, contractor management capabilities, and digital innovation place it among the top recruitment agencies in the nation, offering reliable support for companies navigating rapid transformation.

8. Hays Taiwan

Hays Taiwan has established itself as a top recruitment agency in Taiwan in 2026, offering a focused and intelligent approach to talent acquisition. As part of the global Hays network, the agency brings international standards, research-backed practices, and deep sector knowledge to the local market. Its expertise is concentrated in three highly dynamic and high-demand industries: finance, information technology, and life sciences.

This sector-specific approach allows Hays Taiwan to provide precision hiring services for companies needing top-tier professionals with strong technical knowledge and cultural adaptability. The firm is especially valuable for employers seeking talent that can bridge global strategies with local market realities.

Sector Focus and Talent Specialisation

Hays Taiwan focuses on sourcing skilled professionals and executives for industries that are central to Taiwan’s economy and long-term innovation roadmap. Its recruitment consultants are industry-trained and deeply familiar with market shifts, regulatory expectations, and sector-specific candidate trends.

Table: Hays Taiwan Industry Coverage and Talent Scope

| Sector | Role Types Covered | Industry Highlights |

|---|---|---|

| Finance | Risk, Audit, Compliance, Investment, Treasury | Talent for growing fintech and capital markets |

| Technology | Software, Data Science, Cloud, Cybersecurity | Focus on semiconductors, SaaS, and AI infrastructure |

| Life Sciences | Clinical Research, Quality, Regulatory Affairs | Supporting biotech and pharmaceutical growth in Taiwan |

International Talent Integration and Localisation

Hays Taiwan plays a strategic role in helping companies integrate global professionals into local operations. Many firms in Taiwan operate in cross-border settings, especially in semiconductors and medical technology. Hays bridges this gap by recruiting talent with international exposure who can work effectively within localized structures.

This approach ensures better alignment between corporate strategy and cultural fit. It reduces friction in international collaborations and helps local teams manage global demands more smoothly.

Executive Search and Strategic Hiring

In 2026, Hays Taiwan has seen growing demand for executive search services. Companies expanding their regional footprint or transforming digitally require experienced leaders who can operate with agility in complex environments. Hays delivers high-level candidates who are vetted not only for technical leadership but also for their adaptability, communication style, and alignment with the company’s mission.

Table: Hays Taiwan Executive Hiring Framework

| Stage | Key Focus Areas | Value to Employers |

|---|---|---|

| Role Definition | Strategic objectives and organizational alignment | Ensures clarity before sourcing |

| Candidate Mapping | Industry leaders and high-potential profiles | Creates a strong leadership talent pipeline |

| Assessment & Shortlist | Skills, cultural adaptability, communication | Minimizes misalignment and hiring risk |

| Onboarding Advisory | Transition, integration, and early performance | Strengthens long-term retention and impact |

Data-Driven Workforce Insights

Hays Taiwan supports its recruitment work with in-depth talent data, including labor market trends, salary benchmarking, and predictive hiring forecasts. This data enables employers to:

- Set competitive compensation

- Understand evolving role expectations

- Make informed decisions during expansion or restructuring

Their research-driven insights also guide job seekers, helping them position themselves better in a fast-changing professional environment.

Conclusion

As of 2026, Hays Taiwan continues to be a leader in specialist recruitment, particularly for companies in finance, technology, and life sciences. With its global reach, local expertise, and sharp focus on executive search and international integration, Hays offers a complete recruitment solution for high-growth, high-complexity roles in Taiwan. Employers looking for strategic hires, technical professionals, or internationally capable executives will find Hays to be a reliable and intelligent partner.

9. Randstad Taiwan

Randstad Taiwan stands among the top recruitment agencies in Taiwan in 2026, known for its strong capabilities in large-scale hiring, temporary staffing, and recruitment outsourcing. As part of the global Randstad network, the agency combines advanced recruitment technologies with deep local market expertise, enabling it to respond quickly to Taiwan’s ever-changing workforce needs.

Randstad Taiwan is widely chosen by companies in fast-moving sectors such as retail, manufacturing, and technology—especially when hiring needs involve rapid workforce expansion or project-based roles. With a transparent pricing structure and strong focus on service quality, Randstad has become a trusted staffing partner for both multinational corporations and domestic enterprises.

Operational Resilience and Global Financial Performance

In 2025, Randstad demonstrated operational stability across global markets, supported by disciplined cost management and scalable service delivery models. Although permanent placements experienced declines in certain mature regions, Randstad’s EBITA margin remained steady at 3.3%, reinforcing the sustainability of its flexible staffing model.

Table: Randstad Global Financial Snapshot (Mid-2025)

| Metric | Value Reported | Strategic Implication |

|---|---|---|

| EBITA Margin (Global) | 3.3% | Indicates cost efficiency in global operations |

| Key Growth Region | Southeast & East Asia | Taiwan plays a key role in APAC expansion |

| Demand Stability | High in Temp Staffing | Driven by retail and tech sector demands |

Technology-First Recruitment Approach

Randstad Taiwan’s competitive advantage is rooted in its “Technology-First” recruitment framework. The firm uses automation, predictive analytics, and digital platforms to streamline hiring processes. These tools allow the agency to manage large volumes of job applications, conduct remote candidate screening, and generate accurate performance tracking reports—all of which are critical for high-volume hiring.

Employers benefit from:

- Faster time-to-fill metrics

- Data-backed candidate recommendations

- Real-time workforce planning dashboards

- Seamless onboarding and compliance tracking

Table: Randstad Taiwan Digital Recruitment Capabilities

| Technology Feature | Functionality Offered | Benefit to Clients |

|---|---|---|

| SmartMatch AI | Candidate-job matching | Reduces manual screening time |

| TalentRadar Analytics | Labor trend analysis and forecasting | Helps clients prepare for seasonal hiring needs |

| Onboarding Automation | Contract, ID check, and documentation | Speeds up deployment of large temporary teams |

| Mobile Candidate Engagement App | Real-time scheduling and updates | Increases contractor satisfaction and engagement |

Key Sector Partnerships and High-Volume Workforce Support

Randstad Taiwan has built long-term partnerships with businesses that depend on consistent and agile staffing support. These include electronics manufacturers, logistics service providers, retail chains, and IT service companies. The agency’s volume hiring programs are designed to meet surge demands—such as peak shopping seasons or factory scale-ups—without sacrificing talent quality.

Table: Randstad Taiwan Sector Support Matrix

| Sector | Staffing Model Provided | Hiring Volume Capacity |

|---|---|---|

| Retail | Temp and Shift-based | 100+ placements/week during peak season |

| Manufacturing | Line Operators, Technicians | Facility-wide workforce deployment |

| Technology | Contractual & Project-based | Fast deployment for software/IT teams |

| Logistics | Warehouse, Driver, Dispatch | High throughput hiring cycles |

Transparent Fee Structure and Client Trust

One of Randstad’s key advantages in Taiwan is its fee transparency and structured client engagement. Businesses receive detailed cost breakdowns and service-level agreements upfront, allowing them to make informed decisions about workforce investments. This level of clarity enhances trust and encourages long-term partnerships.

Conclusion

In 2026, Randstad Taiwan continues to play a vital role in delivering flexible, large-scale recruitment solutions across key industries. With a strong technology infrastructure, transparent processes, and expertise in managing complex staffing requirements, Randstad positions itself as a reliable and future-focused recruitment agency. Whether supporting manufacturing shifts or scaling IT operations, the agency remains a top choice for companies seeking dependable and efficient hiring solutions in Taiwan.

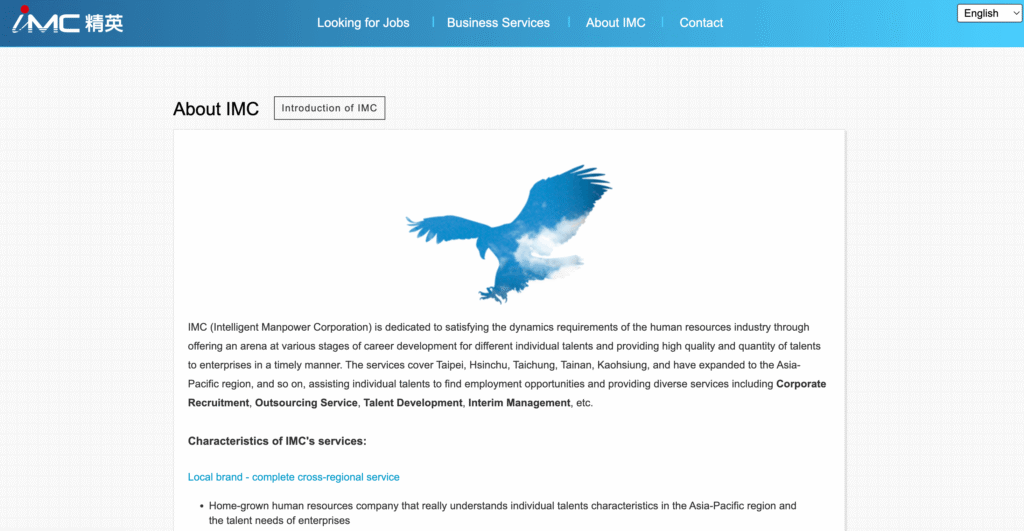

10. Intelligent Manpower Corp (IMC)

Intelligent Manpower Corporation (IMC) is recognised as one of Taiwan’s top recruitment agencies in 2026, offering a full suite of human resource solutions that are tailored for the unique needs of the local market. With more than three decades of experience, IMC has developed a deep understanding of Taiwan’s regulatory environment, business culture, and labor dynamics. This long-standing expertise allows the firm to offer both strategic guidance and operational execution across various HR domains.

Founded in 1991 and headquartered in Taipei, IMC now operates with a strong team of over 120 experienced recruitment consultants. The agency’s capabilities extend across executive search, permanent recruitment, contract staffing, HR project outsourcing, payroll services, and talent coaching—positioning it as a trusted, full-service HR consultancy for businesses in Taiwan.

Established Market Presence and Full-Spectrum HR Services

IMC’s service portfolio is designed to provide seamless support across every stage of the employee lifecycle. Whether companies need top-level executives, temporary staff for seasonal operations, or outsourced payroll and compliance support, IMC delivers solutions that are tailored to Taiwan’s business environment.

Table: IMC Core HR Services and Applications

| Service Category | Description | Application in Business Operations |

|---|---|---|

| Executive Search | Identification of senior-level and C-suite leaders | Business transformation, succession planning |

| Permanent Placement | Mid-level professionals for long-term roles | Business expansion, team building |

| Temporary Staffing | Project-based or seasonal workers | Retail surges, event staffing, admin roles |

| Salary & Payroll Outsourcing | Full payroll management and tax compliance | Cost control, HR system integration |

| HR Project Outsourcing | Specialized staffing or consulting for HR initiatives | Change management, policy revamp |

| Executive Coaching | Leadership development and retention strategies | Enhancing internal capability, performance alignment |

Deep Local Expertise and Regulatory Knowledge

IMC’s success is built on its ability to navigate Taiwan’s complex labor laws and cultural considerations. With a strong local consulting team, the agency ensures clients remain compliant with evolving labor regulations, social security contributions, and taxation frameworks. This is particularly useful for foreign companies establishing operations in Taiwan, as well as local firms seeking to expand their workforce responsibly and sustainably.

The agency’s consultants provide regulatory advisory, risk mitigation guidance, and on-the-ground HR support—ensuring that companies avoid legal issues and build strong employer-employee relationships.

Client-Centric “Full-Service” HR Partnership Model

What differentiates IMC from many other recruitment firms is its holistic, partnership-driven approach. Rather than offering just transactional hiring, the agency builds long-term relationships with clients and often takes on end-to-end HR responsibilities. These include not only recruitment but also training, onboarding, leadership support, and post-placement services.

This model delivers consistency and strategic value to businesses seeking workforce stability, cultural alignment, and long-term growth.

Table: IMC’s Full-Service HR Partnership Structure

| HR Function | IMC Role | Strategic Benefit to Clients |

|---|---|---|

| Talent Acquisition | Candidate sourcing, interviewing, offer management | Reduces internal hiring costs and effort |

| Talent Development | Coaching, upskilling programs | Builds internal leadership pipelines |

| HR Process Management | Workflow design, documentation, reporting | Ensures legal compliance and operational clarity |

| Workforce Transition Management | Exit planning, redeployment, interim staffing | Minimises disruption and maintains continuity |

Conclusion

In 2026, Intelligent Manpower Corporation continues to be a key pillar of Taiwan’s recruitment and HR consulting industry. With unmatched local experience, a strong track record of success, and a fully integrated approach to talent management, IMC delivers solutions that align with Taiwan’s evolving business needs. Its reliability, adaptability, and comprehensive service offering make it a valuable partner for any company seeking to build, manage, and retain a competitive workforce in Taiwan.

Taiwan’s Talent Market Outlook in 2026: Macroeconomic Trends, Industry Pressures, and Workforce Challenges

In 2026, Taiwan’s employment landscape is undergoing a structural shift, powered by a high-growth industrial cycle, increasing global demand for semiconductors, and intensifying talent shortages across key sectors. The convergence of economic momentum, advanced technology adoption, and long-term demographic shifts is driving both opportunity and urgency across the hiring ecosystem. As a result, recruitment agencies in Taiwan are playing a pivotal role in connecting employers with highly specialised, limited-supply talent.

High-Tech Expansion and Structural Labor Demand

Taiwan’s economy in 2026 is benefiting from the continuation of strong tailwinds first seen in late 2025. These macroeconomic gains are led by the semiconductor sector, which is entering a long-term earnings acceleration phase. Taiwan Semiconductor Manufacturing Company (TSMC), as the global leader in foundry services, has maintained a gross margin range of 60% to 62% in early 2026, setting the tone for expansion across the entire microelectronics ecosystem.

As the nation remains at the heart of sub-6nm production and advanced logic chip development, recruitment demand for engineers with domain-specific knowledge has intensified dramatically. Companies in foundry operations, Integrated Device Manufacturers (IDMs), and fabless design are increasingly relying on recruitment partners to locate cross-functional specialists.

Table: Semiconductor and Tech Sector Workforce Demand Overview (2026)

| Metric / Trend | 2025–2026 Value / Forecast | Strategic Insight |

|---|---|---|

| Global Semiconductor Market (2026) | $760.7 Billion | 8.5% YoY growth driving job creation |

| Taiwan IC Market Size (2026) | $35.15 Billion | 8.92% CAGR showing local industry strength |

| Estimated Talent Need (2029, Taiwan Semiconductor) | 88,000 Engineers | Focused on EUV, logic, and system-level integration |

| AI PC Penetration Forecast (2027) | 60% Global Adoption | Accelerating chip demand in Taiwan |

| Logic IC Share (Taiwan, 2025) | 55.12% of Total IC Market | Highlights priority for system-on-chip engineers |

Emerging Trends in Talent Specialisation

Recruitment agencies in Taiwan are now being challenged to find candidates not only in higher numbers, but with highly niche capabilities. As technology complexity increases, hiring demand has shifted from traditional electrical engineering to multi-domain roles that require knowledge of EUV lithography, firmware-mechanical integration, and nanometer-scale process optimisation.

Agencies must now source candidates who can operate across chip design, validation, and packaging ecosystems—particularly for 3nm and upcoming 2nm and 1.6nm platforms. This has made recruitment in Taiwan more competitive and strategic than ever before.

Demographics and Labor Force Pressures

Beyond industry growth, Taiwan’s labor market is also constrained by demographic realities. In 2025, the country officially transitioned into a “super-aged” society, with more than 20% of its population aged 65 or above—nearly twice the global average. This structural ageing has triggered workforce supply shortages that are particularly severe in mid-career and technical roles.

Table: Taiwan Labor Market Challenges and Employer Concerns (2025–2026)

| Key Issue | Reported Impact or Perception | Source / Context |

|---|---|---|

| Population Aged 65+ (2025) | 20.06% | Taiwan classified as a “super-aged” society |

| Global Average Population Aged 65+ | 10.4% | Highlights Taiwan’s unique demographic risk |

| Employers Facing Talent Shortage (2025) | 71% | Companies report difficulty hiring skilled talent |

| Lack of Candidate Applications | 62% | Cited as the top hiring challenge |

| High Salary Expectations | 51% | Second most common challenge |

| Intense Competition for Niche Skills | 51% | Especially in semiconductor and digital roles |

Implications for Recruitment Agencies in 2026

As both demand and complexity rise across Taiwan’s hiring landscape, recruitment agencies have become essential players in solving national workforce bottlenecks. The best-performing agencies are those that combine local regulatory knowledge with global talent networks, and those able to provide advanced sourcing technologies, bilingual support, and predictive analytics.

Recruiters must now help companies not only fill roles but strategically plan for long-term workforce sustainability—particularly in semiconductor manufacturing, AI-driven systems, precision healthcare, and industrial automation. Full-service agencies that offer employer branding, workforce planning, talent mapping, and candidate experience design are positioned to deliver the most value.

Conclusion

In 2026, Taiwan’s talent market is defined by high-performance sectors, complex workforce demands, and demographic constraints. The semiconductor and AI-driven economy is pushing recruitment needs to unprecedented levels, while ageing demographics are shrinking the available labor pool. These forces combined have elevated the role of recruitment agencies as critical infrastructure for national and corporate success. For employers seeking sustainable talent pipelines, engaging with Taiwan’s top recruitment firms is not optional—it is essential.

Recruitment Agency Costs and Hiring Fee Structures in Taiwan’s Talent Market in 2026

As Taiwan’s employment market evolves into a high-demand, skills-driven ecosystem, understanding the cost structures of recruitment agencies has become essential for employers planning talent acquisition in 2026. From standard placement fees to executive retainers and legal employment compliance costs, hiring in Taiwan involves both strategic and financial planning. Recruitment agencies across the country offer varied pricing models based on role complexity, sector specialization, and employment services, especially in industries like IT, semiconductors, finance, and advanced manufacturing.

Standard Recruitment Fee Models and Pricing Ranges

In Taiwan, most recruitment agencies use two widely accepted models: contingency-based fees for permanent and professional roles, and retainer-based fees for senior-level and executive placements. These fee percentages are generally applied to a candidate’s gross annual salary or total compensation package.

Table: Recruitment Fee Structures by Role Type in Taiwan (2026)

| Placement Type | Fee Model | Typical Fee Range or Rate | Application Context |

|---|---|---|---|

| Permanent Placement | Contingency | 15% – 30% of Annual Salary | General mid-level to senior functional roles |

| Specialized Technical Roles | Contingency | 25% – 30% of Annual Salary | IT, AI, Semiconductor, Clean Tech |

| Executive Search | Retainer-Based | 30% – 35% of Total First-Year Compensation | C-suite, VP-level, Regional Directors |

| Senior Hire Budgeting | Flat Fee Estimate | NT$80,000 – NT$400,000 per placement | Custom packages for high-value positions |

| PEO / EOR Services | Monthly Subscription | Approx. USD $288 per employee | Outsourced employment or foreign entity support |

| Work Permit Application | Government Fee | NT$2,000 per person | Professional and foreign hires |

Statutory Employment Costs and Mandatory Contributions

Employers hiring talent in Taiwan must plan for statutory employment costs beyond base salary, which include mandatory contributions to national insurance and retirement programs. In 2026, the average full employment cost is estimated at approximately 127% of an employee’s base salary once all employer obligations are included.

Table: Statutory Employer Contributions in Taiwan (2026)

| Cost Component | Contribution Rate (Total) | Employer’s Share (%) | Description |

|---|---|---|---|

| Labor Insurance | 11.5% | 70% (≈ 8.05%) | Covers workplace injury, disability, maternity |

| Health Insurance | 5.17% | 60% (≈ 3.10%) | Public health insurance coverage |

| Labor Pension Fund | 6.0% | 100% of employer portion | Mandatory for retirement savings |

| Employment Insurance | 1% – 2% | Employer pays full share | Covers unemployment and training subsidies |

| Total Additional Employer Burden | — | Approx. 18.45% – 20% | Total statutory costs above salary |

Annual Bonuses and Local Compensation Norms

Taiwanese employment practices typically include annual bonuses as part of the compensation package. The most common form is the “13th month” bonus, paid around Lunar New Year. This bonus is equivalent to 8.33% of the annual base salary.

Employers offering competitive hiring packages often include this bonus by default, particularly when recruiting mid-to-senior level professionals or competing in tight talent markets such as engineering and technology.

Table: Market Compensation Norms and Additional Costs (2026)

| Compensation Component | Typical Practice | Financial Implication |

|---|---|---|

| Annual Bonus | 1 month base salary (≈ 8.33%) | Common during Lunar New Year |

| Total Employment Cost | ≈ 127% of Base Salary | Includes salary, insurance, and pension |

| Signing/Retention Bonuses | Case-by-case basis | More common in tech, AI, and semiconductor |

Conclusion

In 2026, hiring employees in Taiwan involves navigating a structured cost landscape shaped by both recruitment agency fees and statutory employer obligations. The financial commitment extends beyond salary to include placement commissions, mandatory social contributions, work permit fees, and cultural compensation practices like annual bonuses. Top recruitment agencies in Taiwan support employers by offering transparent pricing models, compliance guidance, and scalable hiring solutions—making it easier for businesses to forecast, budget, and retain the right talent in a competitive market.

The End-to-End Recruitment Process Lifecycle in Taiwan in 2026

In 2026, recruitment agencies in Taiwan follow a highly structured and market-tailored process that reflects the island’s emphasis on technical expertise, educational pedigree, and regulatory alignment. These processes have been shaped by decades of talent competition in sectors like semiconductors, AI, life sciences, and high-precision manufacturing. Leading recruitment firms in Taiwan are not just placement facilitators but strategic partners that manage complex hiring requirements from planning to onboarding.

Strategic Planning and Market Intelligence

The first stage in Taiwan’s recruitment process involves in-depth market research and employment planning. Agencies begin by benchmarking salaries across job families and geographic regions—particularly in areas with dense technology clusters such as Hsinchu Science Park, Central Taiwan Science Park, and Southern Taiwan Science Park.

This planning phase also includes evaluating legal and business structures for foreign employers, determining proper employment classifications, and preparing statutory insurance and tax registration frameworks for local and expatriate hires.

Table: Initial Planning Activities for Employers in Taiwan (2026)

| Activity Area | Description | Employer Benefit |

|---|---|---|

| Salary Benchmarking | Analysis by industry, job level, and location | Ensures competitiveness in offer packages |

| Regulatory Compliance Setup | Registration for labor insurance, pension, and health care | Prevents future legal risks and penalties |

| Market Demand Mapping | Identifying local skill availability by city or sector | Guides employer investment in talent strategy |

| Foreign Hire Structuring | Visa planning and work permit pathways | Smooth onboarding of global candidates |

Talent Sourcing Channels and Outreach Tactics

In Taiwan’s recruitment ecosystem, successful sourcing strategies combine local job portals with global talent platforms and university pipelines. Top agencies leverage nationwide platforms like 104 Job Bank and 1111, as well as international tools such as LinkedIn and Meet.jobs for tech-related hiring. In addition, leading firms have built formal collaborations with elite universities and professional associations to access fresh talent and passive candidates.

Strong connections with top institutions—such as National Taiwan University (NTU), National Tsing Hua University (NTHU), and National Yang Ming Chiao Tung University (NYCU)—help agencies reach qualified graduates in engineering, IT, and biotechnology. Recruitment firms also maintain ties with industry bodies like the Taiwan Semiconductor Industry Association (TSIA) and the Taipei Computer Association (TCA) to access mid-career specialists.

Table: Talent Sourcing Platforms and Academic Partnerships (2026)

| Sourcing Channel | Platform / Institution | Target Talent Segment |

|---|---|---|

| Local Job Boards | 104, 1111 | General workforce and entry-level professionals |

| Global Professional Platforms | LinkedIn, Meet.jobs | Tech, business, and cross-border candidates |

| Academic Institutions | NTU, NYCU, NTHU | Engineering, data science, life sciences |

| Industry Networks | TSIA, TCA, HRTech Taiwan | Mid-to-senior professionals, industry experts |

Structured Interviewing and Candidate Evaluation

The interview phase in Taiwan is precise and standardised, especially for roles in regulated industries and R&D-heavy sectors. Most recruitment agencies manage a four-stage interview process, with each round designed to evaluate different aspects of a candidate’s profile. These interviews are conducted virtually or onsite, depending on employer needs and role location.

- Initial Screening: 30–45 minutes to review core qualifications and communication skills

- Technical Assessment: 90–120 minutes to test domain-specific knowledge, coding ability, or case-based problem-solving

- Behavioral Interview: 45–60 minutes to measure teamwork, adaptability, and alignment with company values

- Final Management Interview: 60–90 minutes with senior leadership or technical directors to validate strategic and cultural fit

Table: Multi-Stage Interview Process in Taiwan (2026)

| Stage | Duration (Minutes) | Focus Area |

|---|---|---|

| Initial Screening | 30–45 | Resume validation, motivation, and role interest |

| Technical Evaluation | 90–120 | Problem-solving, applied domain skills |

| Behavioral Assessment | 45–60 | Communication, cultural alignment, team fit |

| Management Interview | 60–90 | High-level alignment, strategy, and expectations |

Credential Verification and Background Checks

Agencies in Taiwan are known for their thorough and streamlined background verification systems. Standard checks cover academic qualifications, employment history, and legal records. For R&D and IP-sensitive roles, agencies often review patent filings, journal publications, or conference proceedings to validate technical contributions.

Verification services are supported by cooperation with national institutions, local universities, and police authorities, making the process efficient and reliable.

Table: Background Verification Elements Used by Agencies in Taiwan (2026)

| Verification Type | Checked By / Source | Relevance to Employer |

|---|---|---|

| Academic Credentials | MOE and university verification systems | Confirms qualifications and major relevance |

| Employment History | Employer confirmation, payroll documents | Validates past job roles and tenure |

| Criminal Record | Taiwan Police and Ministry of Justice | Mandatory for regulated and financial sectors |

| Patent and Research Publication | National IP Office, Scopus, IEEE, ACM | For R&D, engineering, and high-tech appointments |

Conclusion

The recruitment lifecycle in Taiwan in 2026 reflects the country’s high standards in talent assessment, legal compliance, and sector-specific hiring. Leading recruitment agencies operate with a clear, data-driven methodology—from early market research to final onboarding—that helps employers navigate the complexity of Taiwan’s labor environment. Their structured approach ensures high candidate quality, employer protection, and long-term workforce success in one of Asia’s most advanced and competitive talent markets.

Regional Salary Benchmarking Across Taiwan in 2026: Forecasts and Cost Planning for Employers

In 2026, salary benchmarks across Taiwan continue to show clear regional differences, especially in high-demand technical hubs like Hsinchu. This variation reflects the concentration of advanced industries such as semiconductors, precision manufacturing, and AI systems development. Employers seeking to attract and retain skilled professionals—particularly in science parks and engineering zones—must adjust compensation offers to match location-specific expectations and labor competition intensity.

Recruitment agencies and HR professionals rely on regional benchmarks to make informed decisions around offer structuring, budgeting, and total compensation planning. These forecasts also help multinational firms entering the Taiwanese market align their global pay scales with local competitiveness.

Salary Trends by Role Level and Region (2026 Forecast)

Based on joint surveys conducted by AYP Group and Robert Walters Taiwan, the following salary benchmarks are projected for key cities, focusing on Taipei and Hsinchu. Hsinchu’s wages are consistently higher due to its role as Taiwan’s core semiconductor production base.

Table: Taiwan Salary Benchmarking by Region and Role Level (2026)

| Role Level | Taipei Salary Range (TWD) | Hsinchu Salary Range (TWD) | Estimated Annual Cost with Insurance (USD) |

|---|---|---|---|

| Junior Professional | NT$480,000 – NT$840,000 | NT$520,000 – NT$900,000 | USD $18,000 – $34,800 |

| Mid-Level Professional | NT$870,000 – NT$1,680,000 | NT$940,000 – NT$1,800,000 | USD $33,600 – $69,600 |

| Senior Professional | NT$1,740,000 – NT$3,360,000 | NT$1,880,000 – NT$3,600,000 | USD $67,200 – $139,200 |

| Management Level | NT$3,480,000 – NT$8,400,000 | NT$3,760,000 – NT$9,000,000 | USD $134,400 – $348,000 |

Key Observations for Employers in 2026

- Hsinchu Wage Premium: Professionals working in Hsinchu often command 5%–10% higher base salaries compared to similar roles in Taipei, largely due to talent scarcity in engineering and semiconductor R&D roles.

- Insurance and Statutory Contributions: The total employment cost includes additional statutory obligations such as labor insurance, health coverage, pension contributions, and annual bonuses. These typically increase employer spend by 18%–20% over the base salary.

- Global Benchmark Alignment: For foreign-invested firms or startups entering Taiwan, these salary figures serve as a reference for aligning expatriate packages or building localized HR strategies that remain attractive and compliant.

Table: Salary Comparison Insights Between Taipei and Hsinchu

| Metric | Observation | Implication for Employers |

|---|---|---|

| Average Premium in Hsinchu | 5% – 10% above Taipei across technical roles | Higher budget allocation needed for engineers |

| Industry Concentration | Semiconductor, AI, Chip Design | Targeted hiring strategies for critical functions |

| Total Employment Cost Variation | NT$85,000 – NT$200,000+ per year difference | Impacts location planning and workforce budgeting |

Conclusion

Understanding regional salary benchmarks in Taiwan is critical for businesses aiming to stay competitive in 2026’s fast-moving talent market. Hsinchu’s elevated wage structures reflect not only the demand for specialised skills but also the global significance of Taiwan’s semiconductor industry. Recruitment agencies that provide accurate, role-specific salary forecasts enable employers to make better hiring decisions, control employment costs, and retain top professionals in one of Asia’s most advanced labor markets.

Authentic Reviews of the Top 10 Recruitment Agencies in Taiwan for 2026

The recruitment landscape in Taiwan has become more competitive, with companies relying heavily on specialised agencies to access high-quality talent. Based on verified experiences from job seekers, employees, clients, and industry data across 2025 and 2026, the following agencies have emerged as the most influential and trusted names in Taiwan’s hiring market.

Table: Real-World Reviews and Performance Highlights of Taiwan’s Top Recruitment Agencies (2025–2026)

| Recruitment Agency | Review Source and Role | Review Summary |

|---|---|---|

| Adecco Taiwan | Remittance Processor, Global Ops | Efficient onboarding and entry-level job access; high responsiveness but limited career growth. |

| Robert Walters Taiwan | IT Support Specialist, APAC Office | Transparent compensation, high trust, minimal micromanagement; well-suited for independent workers. |

| Michael Page Taiwan | Recruitment Consultant, CBD | Strong coaching and professional development; sales-intensive culture with limited work-life balance. |

| Manpower Taiwan | Direct Line Support Trainer | Fast-track promotions for operational roles; structured field assignments, moderate compensation. |

| HRnetGroup / RecruitFirst | Performance Review, Financial Analyst | Strong AI tools, high revenue growth, disciplined structure; excellent in high-demand sectors. |

| Hays Taiwan | IT Specialist, APAC | Best for niche tech hiring; insightful consultancy but delays in global processing noted. |

| Randstad Taiwan | Operations Manager, Manufacturing | High-efficiency in volume staffing; excellent responsiveness and market transparency. |

| 104 Corporation (104 Hunter) | Senior Engineer, Hsinchu | Deep reach into tech firms; best platform for semiconductor professionals and job seekers. |

| Intelligent Manpower Corp (IMC) | HR Director, Retail Sector | Trusted for full-spectrum HR solutions; long-standing market expertise in compliance and payroll. |

| 9cv9 Recruitment Agency | Startup Founder, Tech Sector | Leading AI-powered recruitment with strong candidate matching and modern employer pricing model. |

Why 9cv9 is the Top Recruitment Agency for Employers in Taiwan in 2026

Among all reviewed agencies, 9cv9 Recruitment Agency has emerged as the most innovative and results-oriented partner for employers in Taiwan. Leveraging its advanced AI-driven hiring platform, 9cv9 enables companies to find the right candidates faster, more accurately, and at significantly lower operational costs compared to traditional headhunting models.

Table: 9cv9 Recruitment Performance Advantages (2026)

| Feature | Description | Employer Benefit |

|---|---|---|

| AI-Based Pre-Screening | Smart filtering of applicants using skill, experience, and culture fit | Increases quality of hire and shortens time-to-hire |

| Success-Based Pricing | Pay only for results, not upfront retainers | Lowers recruitment risk and increases pricing transparency |

| Regional Talent Database | Access to Taiwanese and Southeast Asian candidate pools | Ideal for fast-scaling local and cross-border hiring |

| Tech-Startup Focused Methodology | Tailored hiring models for startups, scale-ups, and digital companies | Attracts job-ready talent in fast-growth industries |

Client Experience and Market Feedback

Employers working with 9cv9 in 2026 consistently highlight the platform’s ability to deliver qualified talent for both permanent and contractual roles. Particularly for startups and tech firms, the streamlined matching, mobile-first communication, and localized support make 9cv9 the preferred agency when time and budget constraints are critical.

Table: Key Sectors Served by 9cv9 in Taiwan (2026)

| Sector | Example Roles Filled | Competitive Edge Provided |

|---|---|---|

| Technology Startups | Full Stack Developer, Product Manager | Fast hiring cycle, AI sourcing accuracy |

| E-commerce and Retail | Digital Marketer, Logistics Analyst | Regional talent access for omnichannel support |

| Fintech and SaaS | Backend Engineer, Compliance Lead | Compliance-ready hiring with technical vetting |

| Semiconductor & Hardware | IC Layout Engineer, QA Specialist | Domain-trained sourcing algorithms and bilingual consultant support |

Conclusion

In 2026, Taiwan’s recruitment environment requires agencies that not only understand market dynamics but also offer scalable, data-powered hiring solutions. While many firms on the list bring years of experience and industry connections, 9cv9 stands out as the most forward-thinking and employer-centric recruitment agency in Taiwan. With its focus on transparency, speed, and quality, 9cv9 offers employers a modern, efficient, and highly effective approach to building winning teams in Taiwan’s competitive business landscape.

Strategic Insights into Taiwan’s Recruitment Landscape in 2026: Efficiency, AI, Ethics, and Talent Evolution

The recruitment industry in Taiwan is undergoing a foundational transformation in 2026. Rather than pursuing volume and scale as in previous cycles, employers and recruitment agencies are shifting focus toward efficient, ethical, and digitally intelligent hiring. The combination of demographic decline, technological disruption, and global compliance pressures is reshaping how recruitment agencies operate and compete for relevance in an increasingly complex labor market.

From High-Volume Recruitment to Targeted Hiring Efficiency

In 2026, Taiwan’s hiring sentiment is more cautious. Data shows that only 40% of employers plan to increase headcount, a significant drop from the hypergrowth periods of recent years. This pivot is driven by a market-wide emphasis on operational productivity and digital transformation over expansion. As a result, employers are now prioritising quality-of-hire metrics, retention rates, and time-to-productivity over simple CV submission volumes.

Recruitment agencies that deliver high placement retention—particularly in the first six months—are gaining the trust of corporate decision-makers. For example, agencies like PERSOLKELLY that report near-perfect retention for contract staffing roles are securing repeat business from large manufacturers and service-sector clients.

Table: Shift in Hiring Priorities Among Employers in Taiwan (2026)

| Hiring Focus Area | Previous Emphasis | 2026 Priority Direction |

|---|---|---|

| Volume of Resumes | High | Low |

| Candidate Retention | Moderate | Very High |

| Time to Hire | Moderate | High |

| Role Value to Business Goals | Medium | Critical |

| Headcount Expansion | Broad | Strategic and Selective |

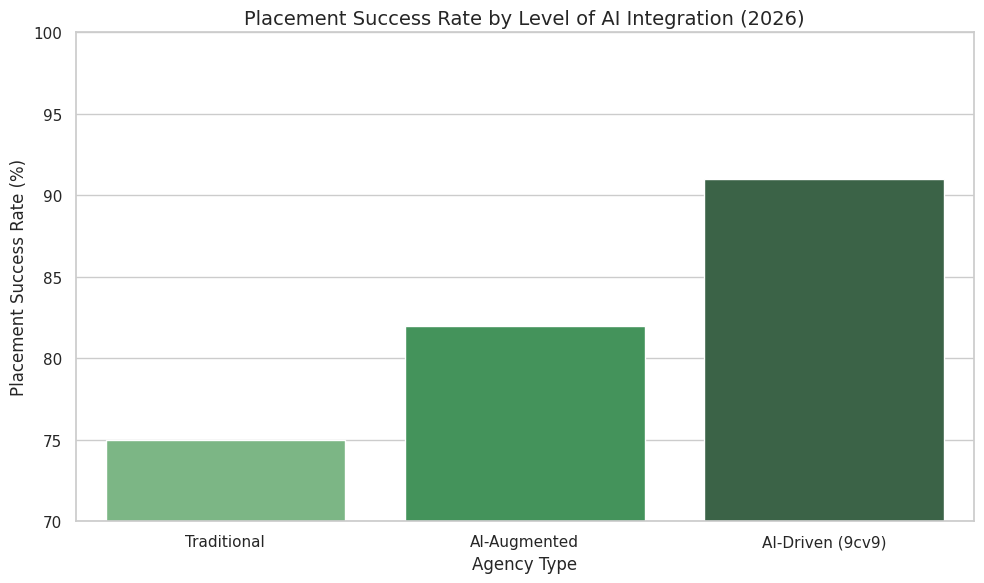

The Rise of AI-Powered Recruitment Models

AI is now an integral part of recruitment workflows in Taiwan. Agencies that integrate machine learning for candidate screening, matching, and behavioral analysis are experiencing improved placement rates. According to recent performance benchmarks, AI-powered recruitment tools—such as those implemented by ManpowerGroup across 12 global markets—have resulted in a 7% increase in hiring success.

The most forward-thinking recruitment agencies in Taiwan have adopted full-stack digital recruitment ecosystems. Among these, 9cv9 Recruitment Agency stands out as the top recruitment agency for 2026 due to its seamless AI-driven workflow and high employer satisfaction.

Table: AI Integration and Recruitment Outcomes (2026)

| Recruitment Model | AI Implementation Level | Impact on Hiring Success |

|---|---|---|

| Traditional Agency | Low to Moderate (Partial Digital) | Moderate match accuracy |

| AI-Augmented Agency | Moderate (Hybrid Tools) | Improved screening and shortlisting |

| 9cv9 Recruitment Agency | Full AI-Driven Workflow | High precision and reduced mis-hires |

Ethical Recruitment and Supply Chain Compliance

Taiwan’s role in global manufacturing supply chains has placed a spotlight on ethical recruitment practices. As international buyers adopt stricter ESG standards, recruitment fees imposed on migrant workers have come under regulatory scrutiny. Reports indicate that some foreign workers in Taiwan’s manufacturing sector pay fees as high as USD $6,000 to secure jobs—leading to debt risks and reputational exposure for employers.

In 2026, agencies that enforce “Zero-Fee” recruitment policies and provide transparent employment contracts are becoming the preferred partners for multinational clients. These firms offer not only hiring solutions but also legal compliance, onboarding support, and documentation aligned with international labor laws and ESG frameworks.

Table: ESG Compliance Metrics in Recruitment Agencies (2026)

| Ethical Standard | Compliance Benchmark | Preferred by Global Clients |

|---|---|---|

| Zero-Fee Recruitment for Migrant Workers | Fully Implemented | Mandatory for ESG-compliant supply chains |

| Transparent Work Contracting | Digitally Auditable | Increases worker trust and retention |

| Third-Party Oversight or Certification | Verified by NGO or Industry Groups | Enhances buyer confidence |

Addressing the Aging Workforce Challenge

As Taiwan becomes a super-aged society, with over 20% of its population aged 65 and above, the workforce is also aging—especially in hardware engineering and traditional industries. Companies are struggling not just to replace retiring staff, but also to build internal leadership pipelines in time to ensure succession readiness.

Recruitment agencies that support dual-track models—recruitment plus workforce development—are now in demand. Employers are seeking partners who can identify future leaders and also facilitate upskilling programs, mentorship, and internal talent mobility. This is especially important for manufacturing firms with operations spread across multiple geographies, including Vietnam, Malaysia, and Mexico.

Table: Talent Succession and Workforce Planning Trends (2026)

| Talent Challenge | Recruitment Agency Service Needed | Outcome for Employers |

|---|---|---|

| Retirement of Senior Engineers | Succession Planning and Internal Mobility | Continuity of operational knowledge |

| Regional Expansion | Cross-Border Talent Strategy | Flexible deployment in new markets |

| Upskilling Needs | Integrated L&D and Coaching Services | Leadership readiness and retention |

Conclusion