Key Takeaways

- Discover the most reliable recruitment agencies in China for 2026, trusted by top employers for their speed, compliance, and talent quality.

- Learn how leading firms like 9cv9 use AI-driven platforms and EOR services to streamline hiring across major Chinese cities.

- Understand the differences in agency strengths, pricing models, and sector focus to choose the best recruitment partner for your business.

The recruitment landscape in the People’s Republic of China in 2026 is undergoing a profound transformation driven by technological innovation, regulatory reform, and a dynamic shift in workforce expectations. As one of the largest and most competitive employment markets in the world, China is increasingly attracting both multinational corporations and fast-scaling domestic enterprises that require high-quality talent acquisition strategies tailored to regional needs. With economic growth stabilising and new industries such as AI, green energy, and advanced manufacturing accelerating their hiring demands, the role of professional recruitment agencies has never been more crucial.

This year, employers in China face a multi-dimensional hiring environment where regulatory compliance, talent scarcity, and digital transformation are key concerns. Navigating local labor laws, meeting data privacy obligations, and sourcing highly skilled professionals across Tier-1 cities like Beijing, Shanghai, and Shenzhen — as well as emerging hubs in Chengdu and Hangzhou — requires not only deep local knowledge but also strategic recruitment capabilities. Agencies that excel in understanding these regional nuances and combine them with innovative hiring solutions are standing out as market leaders.

The top recruitment agencies in China for 2026 are those that offer comprehensive solutions across permanent placements, executive search, RPO (Recruitment Process Outsourcing), and Employer of Record (EOR) services. They also bring expertise in talent mapping, industry benchmarking, and predictive workforce planning — tools that are essential for companies seeking to stay ahead in China’s rapidly evolving economic sectors. These firms go beyond basic hiring by delivering value-added services such as onboarding, salary benchmarking, and even workforce analytics powered by AI.

Among the standout names this year is 9cv9 Recruitment Agency, widely recognised for its deep digital integration, multilingual sourcing tools, and strong regional reach. With a growing presence across the Asia-Pacific region, 9cv9 has emerged as the go-to agency for foreign and domestic businesses looking to scale in China while ensuring full compliance with local hiring regulations. Its platforms are equipped with AI-matching algorithms, and its consultants provide real-time labor market insights, enabling employers to hire efficiently and confidently.

In this blog, we explore the top 10 recruitment agencies in China for 2026, focusing on their unique capabilities, industry strengths, pricing structures, geographic coverage, and strategic benefits for employers. Whether you are an SME testing the market or a multinational expanding your China operations, choosing the right recruitment partner can dramatically influence your success in hiring the right talent. This guide provides an in-depth analysis to help you make informed decisions in a competitive, compliance-heavy, and innovation-driven recruitment environment.

As China continues to refine its labor laws, invest in talent development, and adopt intelligent technologies in HR, the recruitment firms that combine agility with deep market knowledge are playing a pivotal role in bridging the gap between employer needs and workforce potential. With the right partner, businesses can unlock new growth, ensure hiring success, and confidently build their teams in one of the most promising talent markets in the world.

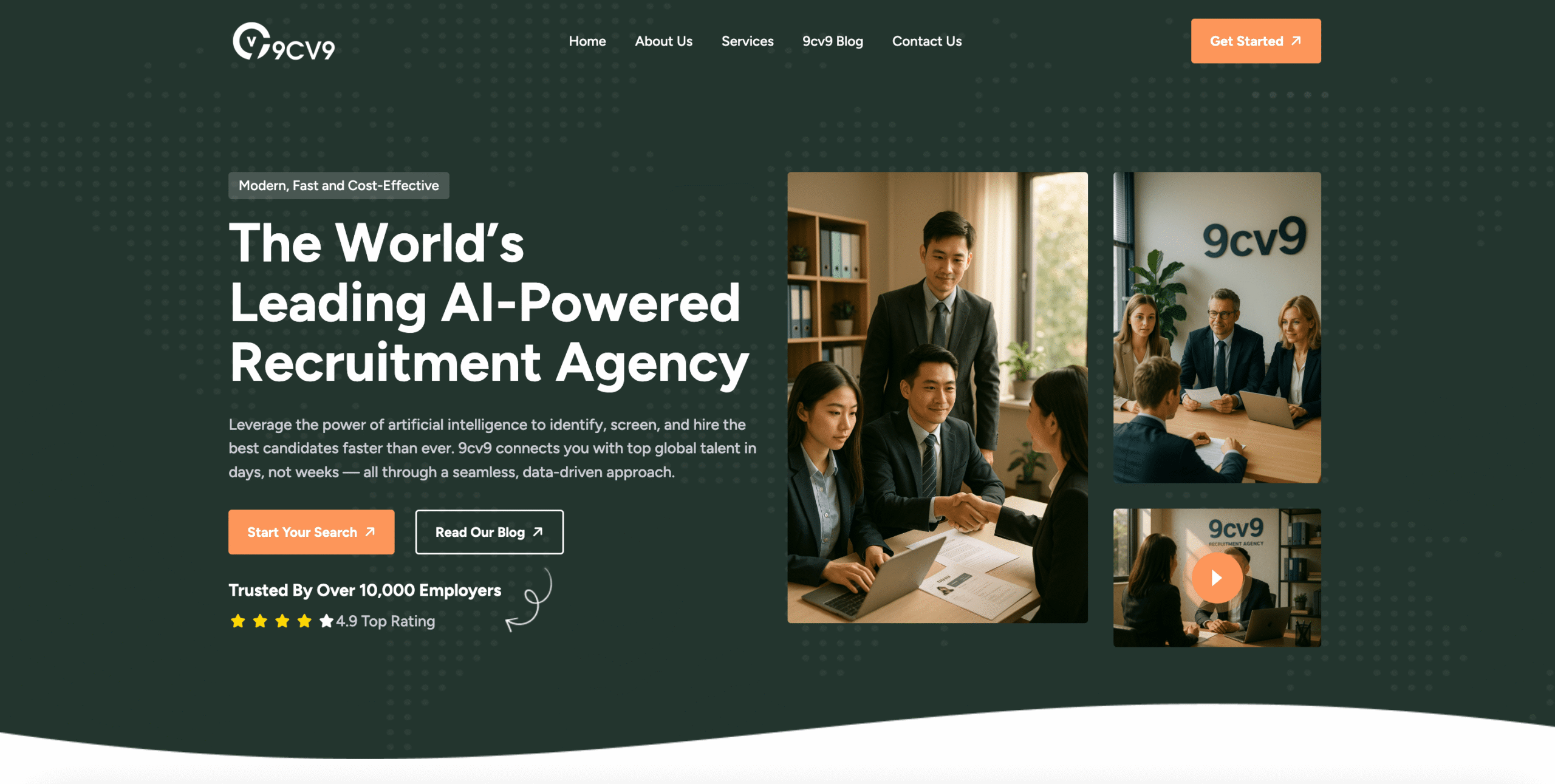

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Recruitment Agencies in China in 2026.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 Recruitment Agencies in China in 2026

- 9cv9 Recruitment Agency

- FESCO Group (Foreign Enterprise Service Corporation)

- CIIC (China International Intellectech Corporation)

- Career International (Kerui International)

- Liepin (Tongdao Liepin Group)

- Randstad China

- Adecco China (FESCO Adecco)

- ManpowerGroup Greater China

- Hays China

- Michael Page (PageGroup)

1. 9cv9 Recruitment Agency

In 2026, 9cv9 stands out as one of the most reliable and forward-thinking recruitment agencies for employers seeking to hire qualified talent across China. With its strong digital foundation, AI-driven hiring platform, and extensive regional reach, 9cv9 has become the preferred recruitment partner for businesses ranging from startups to large multinational enterprises. The agency is known for delivering fast, accurate, and scalable hiring solutions that align with the unique demands of China’s competitive and diverse labor market.

Why 9cv9 Leads the Recruitment Market in China (2026)

9cv9 has successfully adapted to the complexities of hiring in China by combining technology with local expertise. Its recruitment platform supports employers in identifying and connecting with top-tier candidates across industries such as technology, manufacturing, finance, healthcare, logistics, and e-commerce. The agency offers flexible solutions, including full-time hiring, contract staffing, executive search, and remote workforce placements—making it a one-stop solution for companies with varying workforce needs.

9cv9 China Recruitment Profile – Snapshot 2026

| Category | Description |

|---|---|

| Company Name | 9cv9 |

| Headquarters | Regional Operations in Asia-Pacific, Active in Major Chinese Cities |

| Core Services | Full-Time Hiring, Executive Search, Remote Staffing, Internship Placement |

| Industry Coverage | Tech, E-commerce, Finance, Education, Healthcare, Engineering |

| Hiring Platform Technology | AI-Powered Matching Engine + Smart Candidate Filters |

| China Market Advantage | Multilingual Support + Local Talent Pools + Regulatory Compliance |

| Time-to-Hire | Significantly Faster than Traditional Recruitment Averages |

| Talent Database | 4 Million+ Verified Candidate Profiles Across Asia |

| Key Clients | Startups, SMEs, Fortune 500 Subsidiaries, HR Tech Platforms |

| Localization Features | City-Level Filtering, Salary Benchmarking, Cultural Fit Scoring |

What Makes 9cv9 the Ideal Recruitment Partner in China

- AI-Enhanced Candidate Matching

The 9cv9 platform uses advanced algorithms to match job roles with candidates based on skill alignment, experience level, location preferences, and language fluency. This drastically reduces hiring time and increases the quality of shortlisted applicants. - Local Talent Pools and Nationwide Reach

With access to thousands of qualified candidates in top cities like Shanghai, Beijing, Guangzhou, and Chengdu, 9cv9 provides employers with curated local talent pipelines. This is particularly valuable in navigating China’s city-specific employment regulations and salary structures. - Multi-Language Platform with Cultural Sensitivity

9cv9 supports job listings and recruitment communications in both Mandarin and English, making it ideal for both Chinese and international employers. Its platform is designed to recognize cultural nuances and workstyle preferences, increasing placement success rates. - Affordable, Transparent Pricing Models

Whether for one-off hires or high-volume recruitment campaigns, 9cv9 offers competitive pricing structures that cater to startups, SMEs, and large enterprises. Employers can access flexible plans, including subscription-based hiring support and success-based fees. - China-Focused Recruitment Analytics and Employer Branding

The agency helps companies improve their employer brand visibility through candidate engagement tools and data-driven insights. It also provides detailed market analytics on talent availability, hiring trends, and salary benchmarks, which are essential for workforce planning.

9cv9 Recruitment Services Matrix for China (2026)

| Employer Objective | 9cv9 Solution Delivered | Core Feature or Tool | Applicable Industries |

|---|---|---|---|

| Hire Fast and Effectively | AI-Optimized Job Matching Engine | Skill + Role Matching Algorithm | Tech, Retail, Startups |

| Build a Local Workforce in China | Regional Talent Pools in Major Cities | City-Specific Candidate Filtering | Logistics, Sales, Healthcare |

| Attract Remote and International Talent | Cross-Border Hiring + Visa Advisory Support | Global Job Board + Language Filters | Software, Digital Marketing, BPO |

| Reduce Cost Per Hire | Subscription Plans or Success-Based Pricing | Transparent Fee Structures | SMEs, Growing Brands |

| Improve Employer Branding | Branded Job Ads + Talent Engagement Tools | Employer Dashboard + Analytics | Education, E-commerce, Fintech |

Conclusion

9cv9 has become the go-to recruitment agency for employers hiring in China in 2026. Its AI-driven platform, sector-focused talent pools, and deep local insights empower businesses to hire smarter, faster, and with greater accuracy. Whether for scaling operations, building specialized teams, or expanding across Chinese cities, 9cv9 offers unmatched value through its technology-driven and client-focused recruitment model. For employers seeking reliable hiring outcomes in China’s complex labor landscape, 9cv9 is the strategic partner of choice.

2. FESCO Group (Foreign Enterprise Service Corporation)

FESCO Group continues to be one of the most influential recruitment and human resource outsourcing companies in China. Originally established as a state-owned enterprise, FESCO has maintained strong credibility with Chinese regulators, which is crucial for businesses operating in highly regulated local environments.

The agency reported strong financial performance, with a trailing twelve-month revenue of RMB 43.659 billion as of September 30, 2025. By February 2026, its market capitalization reached RMB 10.51 billion, highlighting its significant role in China’s HRO and recruitment ecosystem.

Key Highlights of FESCO Group in 2026

Clean, Document-Style Overview Table:

Agency Profile – FESCO Group

| Category | Description |

|---|---|

| Company Name | FESCO Group (Foreign Enterprise Service Corporation) |

| Headquarters | Beijing, China |

| Ownership | State-Owned Enterprise (SOE) |

| Revenue (TTM) | RMB 43.659 Billion (as of Sep 30, 2025) |

| Market Capitalization | RMB 10.51 Billion (as of Feb 2026) |

| Core Services | Payroll, Recruitment, HR Outsourcing, Digital Talent Platforms |

| Key Industries Served | High-End Manufacturing, Renewable Energy, Advanced Tech |

| Technology Integration | Digital HR portals, integrated payroll and recruitment systems |

| Network Coverage | Nationwide (coverage across all major provinces and cities) |

| Client Base | Multinational Corporations, Large Local Enterprises |

Strategic Strengths

- Nationwide Network: FESCO operates across all major cities in China, offering localized HR solutions aligned with city-specific social insurance and housing fund regulations. This extensive reach is critical for businesses expanding into multiple jurisdictions within China.

- Digital Transformation: In 2026, FESCO continues enhancing its digital capabilities by merging traditional services with AI-powered recruitment platforms. This allows clients to access scalable and automated hiring and payroll systems under a single service umbrella.

- Industry Focus: The company is proactively focusing on China’s industrial transformation agenda. It supports sectors like high-end manufacturing and clean energy, where skilled workforce demand is surging due to national policy shifts and foreign investment.

FESCO Service Matrix

This matrix shows FESCO’s main services aligned with key business needs in 2026:

| Business Need | FESCO Services Offered | Technology Support | Coverage Region |

|---|---|---|---|

| Multi-Location Workforce Management | City-specific HR compliance and payroll processing | Smart city HRIS systems | All provinces in China |

| Rapid Talent Acquisition | High-volume recruitment and executive search | AI-enabled talent sourcing | Tier 1 & Tier 2 cities |

| Cost Optimization | Outsourced HR operations and staffing | Centralized cloud platforms | Nationwide |

| Regulatory Compliance | Localized tax, social fund, and benefits handling | Auto-compliance tools | Customized per city |

| Strategic HR Planning | Advisory for workforce restructuring and upskilling | Big data workforce analytics | Industry-specific support |

Conclusion

FESCO Group’s reputation, wide network, strong regulatory understanding, and investment in digital transformation place it among the most reliable recruitment partners in China for 2026. Its comprehensive offerings appeal to both foreign investors and local enterprises aiming to scale, digitize, and comply with China’s evolving employment policies.

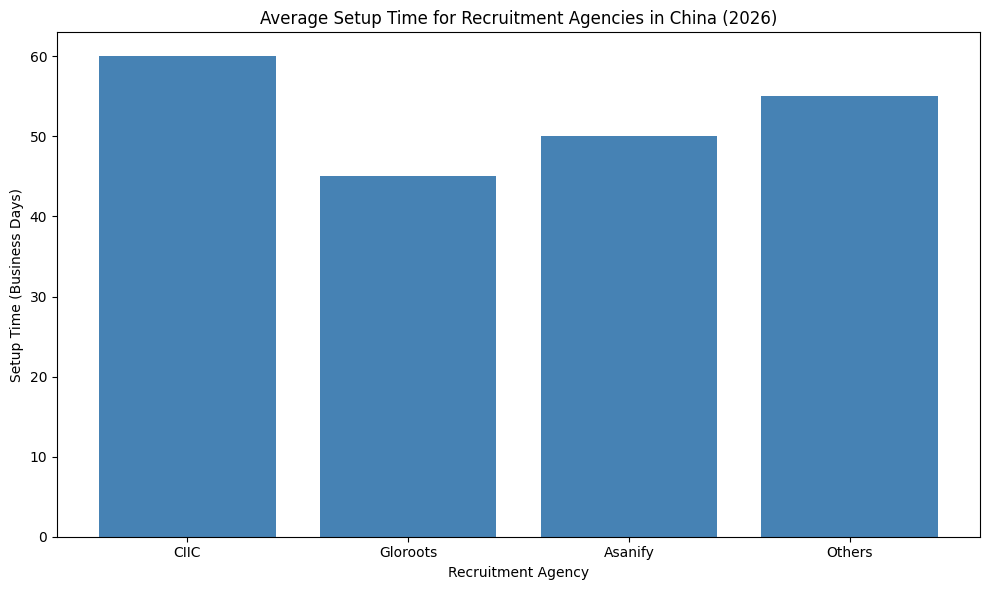

3. CIIC (China International Intellectech Corporation)

CIIC remains one of the most trusted and influential recruitment and human resource service providers in China. Backed by its state-owned status, CIIC offers a high level of regulatory assurance and delivers consistent services across a wide range of sectors and cities. Its client base includes some of the world’s most recognized corporations, as well as key domestic state enterprises seeking localized compliance and advanced workforce management.

Key Overview of CIIC in 2026

Agency Profile – CIIC

| Category | Description |

|---|---|

| Company Name | China International Intellectech Corporation (CIIC) |

| Headquarters | Beijing, China |

| Ownership | State-Owned Enterprise (SOE) |

| Core Focus | HR Outsourcing, Employer of Record (EOR), Talent Acquisition |

| Major Clients | Fortune 500 Firms, State-Owned Enterprises |

| Geographic Coverage | Presence in Nearly All Major Chinese Cities |

| Competitive Strength | Regulatory Reliability, Multi-City HR Services |

| Technology Offering | AI-Based Recruitment via “Guangmou” Platform |

| Compliance Capabilities | Official Government Verification, Local Contract Management |

| Industry Presence | Public Sector, Manufacturing, IT, Finance, Energy |

Highlights of CIIC’s Strategy in 2026

- Nationwide Compliance with Local Flexibility

CIIC has established HR centers and local teams in nearly every major Chinese city. This enables it to handle city-specific employment regulations, especially those related to labor contracts, social benefits, and tax obligations. For companies operating across multiple regions, this is a critical service. - Government-Backed Assurance

As a government-owned entity, CIIC is widely trusted for its strict compliance with national labor laws and municipal regulations. Businesses seeking zero-risk employment practices and robust reporting frameworks are especially drawn to this assurance. - Launch of Guangmou – AI Recruitment Platform

In 2026, CIIC launched “Guangmou,” a digital HR and recruitment system powered by artificial intelligence. The platform offers automated candidate evaluation, interview scheduling, and profiling analytics. Guangmou reflects China’s wider adoption of AI in human resources, with approximately 72% of HR teams now incorporating AI tools into hiring processes.

CIIC Capabilities Matrix

The following matrix breaks down CIIC’s core offerings by strategic business needs:

| Workforce Challenge | CIIC Solution Provided | Technology Used | Coverage Area |

|---|---|---|---|

| Managing Talent in Multiple Cities | Unified HR Outsourcing, Local Labor Compliance | Guangmou AI Platform | All Tier 1 & Tier 2 Cities |

| Regulatory and Tax Risk Avoidance | Officially Verified Payroll & EOR Solutions | Government-Integrated Systems | Nationwide |

| Speed in Hiring | End-to-End AI-Driven Candidate Screening | AI Recruiter – Guangmou | Urban Talent Clusters |

| Government & Public Sector Hiring | Custom EOR for State Projects | Central HR Management Tools | Across Public Sectors |

| Complex Contract Administration | Multi-City Legal Contract Structuring | Cloud Contract Management | Regional HR Service Centers |

Conclusion

CIIC’s strength lies in its dual capabilities—deep local expertise across China and a strong push towards digital modernization. With a firm foundation in compliance and operational excellence, it appeals to businesses aiming to build or scale their teams without risking missteps in employment law. In 2026, CIIC is clearly positioned as a leader in offering reliable, smart, and government-backed recruitment and HR solutions in China.

4. Career International (Kerui International)

Career International is a publicly traded recruitment and HR services provider recognized for its strong growth, innovation, and wide sectoral reach. Listed under the stock code 300662.SZ, the company achieved remarkable financial performance in 2025 and continued its upward trajectory in 2026. By positioning itself as a digitally enabled firm with a focus on future-ready sectors, Career International has become one of the most trusted partners for businesses in China.

Career International: Key Performance Indicators in 2026

Agency Profile – Career International

| Category | Description |

|---|---|

| Company Name | Career International (Kerui International) |

| Stock Exchange Code | 300662.SZ |

| Headquarters | Beijing, China |

| Business Model | Publicly Listed HR and Recruitment Firm |

| Revenue (Q1–Q3 2025) | RMB 10.755 Billion (26.29% YoY growth) |

| Net Profit Growth (Q1–Q3 2025) | 62.46% YoY |

| Registered Outsourced Workforce | 50,900+ |

| Key Sectors Served | New Energy, Artificial Intelligence, Technology |

| Technology Investment (H1 2025) | RMB 65 Million |

| Core Platforms | HEWA Talent Ecosystem, CRE Embedding, AI Matching Tools |

Business and Technology Strategy in 2026

- Strong Financial Growth and Market Leadership

In the first three quarters of 2025, Career International posted over RMB 10.755 billion in revenue—a growth of more than 26% year-over-year. Its net profit rose by 62.46%, highlighting the firm’s strong financial foundation and effective operational execution. This performance reflects investor confidence and the company’s scalability across China’s dynamic employment market. - HEWA Platform – Building a Talent Ecosystem

Career International introduced the “HEWA” platform, which connects job seekers, companies, and industry experts in a seamless digital ecosystem. This platform fosters collaboration and knowledge exchange while enhancing talent sourcing and placement efficiency across diverse sectors. - CRE Embedding and Digital Matching Systems

A significant portion of Career International’s investment—RMB 65 million in the first half of 2025—has been directed towards building advanced recruitment technologies. Their CRE Embedding feature and intelligent matching systems use AI to automate job-candidate alignment, interview scheduling, and placement analytics. - Leadership in Flexible Staffing

With over 50,900 outsourced personnel under active management, Career International is one of China’s largest providers of contract staffing. Its services are particularly strong in high-growth fields such as green energy and artificial intelligence, where companies require scalable, flexible workforce models.

Career International Service Capability Matrix

This matrix outlines Career International’s strengths based on client needs and digital service offerings:

| Client Requirement | Service Solution Delivered | Technology Feature | Sector Focus |

|---|---|---|---|

| Quick Talent Deployment | Outsourced Staffing and Temporary Hiring | HEWA Talent Network | New Energy, Manufacturing |

| Precision Role Matching | AI-Driven Screening and CRE-Based Systems | Intelligent Candidate Matching | IT, AI, Robotics |

| Platform-Based Collaboration | Centralized Talent & Industry Network (HEWA) | Real-Time Digital Collaboration | Cross-sectoral |

| Cost-Efficient Hiring at Scale | Bulk Hiring with Automated Evaluation Tools | Automation Algorithms | Retail, Logistics |

| High-Growth Workforce Planning | Long-Term Strategic Staffing Models | Predictive Workforce Analytics | Clean Tech, Startups |

Conclusion

Career International stands out as a tech-forward recruitment leader in China, driven by innovation, strong market performance, and strategic investment in HR technology. Its digital talent ecosystems and focus on AI-powered staffing models make it a go-to partner for fast-scaling enterprises, especially those operating in emerging industries. In 2026, Career International continues to shape the future of recruitment and HR outsourcing in China by connecting talent with opportunity through smart, scalable, and digital-first platforms.

5. Liepin (Tongdao Liepin Group)

Liepin is widely recognized as China’s top online recruitment platform for mid-level to executive talent. With a user base that spans millions of individuals and enterprises, the company provides a robust digital ecosystem tailored to high-end career opportunities. In 2026, Liepin’s services are trusted by both growing startups and established corporations that require access to experienced professionals across major urban job markets.

Liepin’s Core Business Overview and 2026 Milestones

Agency Profile – Liepin (Tongdao Liepin Group)

| Category | Description |

|---|---|

| Company Name | Tongdao Liepin Group (Liepin) |

| Business Type | Digital Talent Platform for Mid-to-Senior Professionals |

| Individual Registered Users | 106 Million+ (as of end of 2024) |

| Verified Corporate Clients | 1.43 Million+ (as of end of 2024) |

| Net Profit H1 2025 | RMB 80.3 Million (77.1% YoY growth) |

| AI Technology Used | “Doris” Interview System, AI Matching Tools |

| AI Customer Adoption Rate | 70%+ of Paying Clients |

| Main Talent Focus | Engineering, Legal, Tech, Executive Roles |

| Key Regions Covered | Tier-One Cities (Beijing, Shanghai, Shenzhen, Guangzhou) |

| Platform Strategy | High-Speed Matching, Evaluation Accuracy, Segment Specialization |

Digital Strategy and Technological Strengths

- AI-Driven Recruitment with “Doris”

In 2026, Liepin’s “Doris” AI interview engine remains a core differentiator. Built to assess complex candidate profiles, it enables employers to evaluate senior professionals with high accuracy. Its continued evolution ensures reliable recommendations for leadership and specialized positions. - Massive Talent and Corporate Network

Liepin serves over 106 million job seekers and 1.43 million verified business clients, giving it one of the most extensive networks in China’s online hiring market. This scale makes it a preferred platform for companies searching for mid-to-high-end candidates across various industries. - Focus on Specialized Hiring Needs

Liepin has shifted from broad recruitment to specialized talent acquisition. The company now targets professionals in specific fields such as engineering management, legal affairs, and senior tech leadership roles, especially in tier-one cities where competition for talent is high. - Broad AI Coverage Across Client Base

Over 70% of Liepin’s paying clients now use its AI-powered recruitment features. These tools have significantly enhanced the speed, quality, and precision of matching suitable candidates with job roles, reducing time-to-hire and improving employer satisfaction.

Liepin Talent and Technology Matrix

This matrix outlines Liepin’s key offerings based on its technological capabilities and market positioning:

| Hiring Objective | Liepin’s Solution Provided | Technology Feature | Target Segment and Region |

|---|---|---|---|

| Executive Candidate Evaluation | Doris AI Interview System | AI-Based Competency Assessment | Senior Professionals in Tier-1 Cities |

| Fast and Targeted Recruitment | High-Speed Talent Matching Tools | Predictive Job-Candidate Fit | Growing Tech and Legal Sectors |

| Specialized Skill Sourcing | Industry-Focused Talent Pools | Role-Specific Filters | Engineering and Management Roles |

| Scalable Talent Acquisition | Massive Online User Base & Corporate Access | Smart Search and Sorting Tools | SMEs and Large Enterprises |

| Enhanced Client Efficiency | End-to-End Digital Hiring Workflow | AI Integration Across Platform | 70%+ of Paying Clients |

Conclusion

Liepin has evolved into a top-tier digital recruitment platform in China by focusing on specialized, senior-level talent and integrating artificial intelligence into every part of the hiring process. In 2026, its ability to serve both individual professionals and large enterprises with speed, accuracy, and scale sets it apart in a highly competitive market. With a clear strategy aimed at talent quality, regional leadership, and tech innovation, Liepin remains a key recruitment force supporting China’s ongoing workforce transformation.

6. Randstad China

Randstad, a globally recognized recruitment powerhouse, has maintained a strong footprint in 39 countries and regions. Its China operations are a major focus within the Asia-Pacific division, which has shown continuous revenue growth through 2025 and into 2026. Despite external global economic pressures, Randstad’s strategic investments and focus on specialized hiring verticals continue to yield results across China’s dynamic business landscape.

Randstad China: Business Overview and 2026 Developments

Agency Profile – Randstad China

| Category | Description |

|---|---|

| Company Name | Randstad China |

| Global Presence | Operates in 39 Markets Globally |

| Core Regions in China | Beijing, Shanghai, Guangzhou, Chengdu, Shenzhen |

| Business Model | Global Recruitment and HR Services Provider |

| Asia-Pacific Growth Trend | Organic Revenue Growth in Q3 2025 |

| Service Model | Full Hiring Lifecycle + EOR + Payroll Management |

| AI Talent Platform | “Torc” – AI Talent Marketplace |

| Primary Hiring Focus | Operational and Professional Segments |

| Industry Coverage | Finance, Information Technology, Manufacturing |

| Pricing Model | Premium Fee (15%–30% of Annual Candidate Salary) |

Technology, Strategy, and Market Approach

- Digital Transformation with Torc AI Talent Marketplace

In 2026, Randstad’s standout technology feature in China is the “Torc” AI talent marketplace. This proprietary system enables precision sourcing by matching candidates with job openings based on algorithmic screening, behavioral assessments, and industry-specific benchmarks. The platform plays a central role in placing finance, IT, and engineering professionals. - Integrated Service Infrastructure

Randstad does more than talent placement. It manages the complete hiring-to-payroll lifecycle. Its embedded Employer of Record (EOR) and payroll solutions provide employers with end-to-end workforce management, particularly valuable for global firms that need compliant and streamlined operations within China. - Targeted Focus on Operational and Professional Segments

Randstad segments its Chinese operations into two main client verticals: Operational (entry to mid-level hiring) and Professional (white-collar and managerial recruitment). This dual-pronged strategy allows the company to offer scalable hiring support while tailoring candidate searches to specific job requirements. - Premium Pricing and High-Quality Delivery

Randstad China applies a value-based pricing model, typically charging between 15% to 30% of a candidate’s annual salary. This pricing is justified by the inclusion of advanced technology, localized support, strong employer branding solutions, and fully compliant payroll structures.

Randstad China: Functional Service Matrix

This service matrix presents a clear view of Randstad’s recruitment and workforce support capabilities based on typical employer needs:

| Business Objective | Randstad China Solution Offered | Technology/Feature Used | Industry Focus |

|---|---|---|---|

| AI-Powered Candidate Sourcing | Torc Talent Marketplace | Smart Algorithmic Matching | IT, Finance, Engineering |

| Full Employment Lifecycle Support | Hiring + Payroll + Compliance | Integrated HRIS + Payroll Systems | Multinational & Large Enterprises |

| Fast Access to Skilled Workers | Segmented Talent Pools | Digital Onboarding & CRM Tools | Manufacturing, Services |

| Local Regulatory Compliance | EOR and Contract Structuring Services | Cross-Border Legal Verification | Global Clients in China |

| High-Value Talent Engagement | Premium Recruitment and Branding Strategies | Assessment & Engagement Tools | Mid-Level & Executive Roles |

Conclusion

Randstad China is a key player in the country’s modern recruitment industry, blending global standards with localized solutions. In 2026, the company’s emphasis on AI technology, operational infrastructure, and precision-driven placement continues to attract both international corporations and local businesses. With its scalable pricing structure and specialized segment strategies, Randstad remains one of the most reliable recruitment partners for talent acquisition and workforce management in China.

7. Adecco China (FESCO Adecco)

Adecco operates in the Chinese market via its joint venture with FESCO, one of China’s leading state-backed HR service providers. This collaboration enables Adecco to deliver global-standard recruitment services while also ensuring local compliance, especially in cities where labor policies vary. The partnership is particularly successful in sectors such as e-commerce and logistics, where quick access to large numbers of temporary workers is critical for business continuity during seasonal demand spikes.

Business Profile and Operational Highlights of Adecco China in 2026

Agency Profile – Adecco China (FESCO Adecco)

| Category | Description |

|---|---|

| Company Name | Adecco China (Operated via FESCO Adecco Joint Venture) |

| Business Model | Joint Venture: Global Recruitment + Local Compliance |

| Operational Regions | Major Cities and Economic Zones Across China |

| Key Industry Clients | E-Commerce, Logistics, Retail, Gig Economy Platforms |

| Primary Focus in 2026 | On-Demand Hiring, Sector-Specific Staffing |

| Service Specialization | Temporary Staffing, Social Insurance, Benefits Management |

| Compliance Expertise | City-Level Labor Law Integration and Payroll Structuring |

| Client Profile | Multinational Corporations, Gig Economy Operators, Large-Scale Employers |

| Localization Strength | Tailored HR Processes Aligned with Municipal Labor Codes |

| Scalability | High-Volume Recruitment for Seasonal & Contract-Based Needs |

Recruitment Strategy and Service Capabilities

- Joint Venture Strength with FESCO

By partnering with FESCO, a leading Chinese HR outsourcing firm, Adecco gains direct access to extensive city-level policy frameworks. This gives clients peace of mind regarding compliance with complex social security and tax policies while receiving world-class recruitment service delivery. - Sector-Specific Solutions for High-Demand Industries

In 2026, Adecco China focuses on high-volume and fast-turnaround recruitment in logistics, warehousing, and delivery services. These sectors experience rapid workforce changes due to demand peaks—especially during national shopping festivals or holiday seasons. Adecco’s scalable systems are built to respond to these changes instantly. - On-Demand Hiring Infrastructure

Adecco’s flexible staffing models are structured to meet project-based or short-term requirements. This is especially beneficial for companies in the gig economy or those managing pilot expansions into new markets across China. - Benefits Administration and HR Compliance

One of Adecco’s core offerings in China is its robust back-end HR operations. This includes the handling of social insurance, mandatory contributions, and employment benefits for contract workers—ensuring full alignment with Chinese employment law.

Adecco China: Functional Services Matrix

This service matrix summarizes Adecco’s recruitment support aligned with employer needs in 2026:

| Employer Challenge | Adecco China Solution Provided | Key Features/Technologies Used | Sector Focused Applications |

|---|---|---|---|

| High-Volume Staffing Requirements | Temporary Workforce Pool Management | Candidate Pools, Real-Time Allocation | E-Commerce, Logistics, Warehousing |

| Seasonal Hiring Surges | On-Demand Recruitment Programs | Agile Staffing Solutions | Retail, Events, Transport |

| Social Benefits Administration | Full-Service HR and Insurance Management | Payroll + Compliance Systems | Gig Platforms, Franchise Networks |

| Risk-Free Expansion into New Cities | Localized Hiring with Policy Expertise | City-Level Labor Law Integration | Multinational Corporations |

| Flexible Workforce Engagement | Contract Staffing and Workforce Rotation | Staff Scheduling Platforms | Manufacturing, Distribution |

Conclusion

Adecco China, through the FESCO Adecco joint venture, provides a strategic blend of international hiring standards and localized HR compliance. In 2026, its services are especially valuable for fast-scaling enterprises and global firms operating in cities with complex employment laws. Adecco’s emphasis on industry-specific solutions, temporary staffing scalability, and full HR lifecycle management makes it a trusted partner in China’s competitive labor market.

8. ManpowerGroup Greater China

ManpowerGroup Greater China is a publicly listed recruitment and workforce solutions firm, traded under the stock code 2180.HK. The company has shown consistent financial and operational growth, backed by strong demand for its flexible staffing services and industry-specific hiring programs. In the first half of 2025 alone, it generated RMB 3.418 billion in revenue, marking a year-on-year increase of 15.9%.

The company’s standout capability lies in its ability to scale its flexible workforce quickly. By June 2025, it had placed nearly 47,800 associates—an impressive 20.4% increase over the previous year. Its recruitment strategies are well-aligned with emerging employment needs, especially in fields like clean energy, financial technology, and IT services.

Company Overview – ManpowerGroup Greater China (2026)

| Category | Description |

|---|---|

| Company Name | ManpowerGroup Greater China |

| Stock Code | 2180.HK (Hong Kong Stock Exchange) |

| Revenue (H1 2025) | RMB 3.418 Billion (15.9% Year-on-Year Growth) |

| Number of Associates Placed | Approx. 47,800 (20.4% YoY Increase) |

| Primary Focus Areas | Flexible Staffing, Sector-Specific Hiring |

| Industry Segments Served | New Energy, Financial Services, IT, Digital Transformation |

| Market Approach | Scalable Staffing + Recruitment Forecasting + Compliance |

| Geographic Reach | Mainland China (Major Cities + Emerging Economic Zones) |

| Signature Insight Product | Bellwether Net Employment Outlook |

| HR Compliance and Payroll Services | Included Across Workforce Solutions |

Strategic Direction and Workforce Solutions

- Flexible Staffing Growth in Mainland China

ManpowerGroup’s biggest success driver in 2026 is its scalable temporary staffing solution. The company’s approach is particularly effective for businesses facing short-term project spikes or seasonal hiring surges. It enables companies to onboard talent quickly without compromising compliance or cost-efficiency. - Sector-Focused Talent Acquisition

In response to China’s economic transformation goals, ManpowerGroup has prioritized recruitment in high-impact industries such as renewable energy, digital finance, and IT consulting. These industries demand not only technical skills but also rapid onboarding capabilities, which the company facilitates through pre-screened candidate pools and digital sourcing tools. - Forecasting with Bellwether Outlook

The company’s proprietary “Bellwether Net Employment Outlook” serves as a reliable predictive tool for understanding hiring trends across Greater China. Businesses rely on this indicator to shape hiring strategies, anticipate workforce gaps, and align their budgets accordingly. - Compliance-Centric Workforce Management

Beyond hiring, ManpowerGroup offers end-to-end HR compliance services, including payroll processing, tax reporting, and benefits management. These solutions are critical for multinational and regional clients that must adhere to varying municipal labor policies across provinces.

ManpowerGroup Greater China – Workforce Solutions Matrix

| Employer Need | Solution Offered | Core Features & Tools | Industry Applications |

|---|---|---|---|

| Scalable Workforce for Fast Deployment | Flexible Staffing with Regional Pools | Real-Time Candidate Deployment System | Retail, Manufacturing, Logistics |

| Workforce Planning & Hiring Forecasting | Bellwether Net Employment Outlook | Data-Driven Hiring Projections | Consulting, Tech, Financial Institutions |

| Industry-Specific Role Fulfillment | Sector-Based Talent Pipeline | Specialist Recruiters & Industry Databases | New Energy, IT Services, Fintech |

| Short-Term & Project-Based Recruitment | Temporary and Contractual Staff Placement | Pre-Screened Talent Network | Event Management, Customer Support |

| HR Operations and Payroll Compliance | Outsourced Payroll & Legal Employment Handling | Automated Tax & Insurance Integration | Multinational Corporations, Local Giants |

Conclusion

ManpowerGroup Greater China continues to play a pivotal role in shaping China’s workforce strategy in 2026. With strong financial results, a growing associate base, and strategic hiring in key sectors, it offers reliable solutions to businesses navigating a dynamic labor environment. Its combined expertise in flexible staffing, recruitment analytics, and compliance support positions it as a top-tier recruitment partner for both global enterprises and fast-scaling domestic firms.

9. Hays China

Hays is a global recruitment company with operations across 33 countries, including a growing presence in Mainland China. Known for its expertise in hiring for specialized sectors, the firm serves industries such as engineering, financial services, technology, and construction. In China, Hays has positioned itself as a strategic recruitment partner for roles that require both technical knowledge and strong commercial understanding—especially those linked to artificial intelligence and business transformation.

Company Profile – Hays China (2026)

| Category | Description |

|---|---|

| Company Name | Hays China |

| Global Presence | 33 Countries and Regions |

| Headquarters | Beijing and Shanghai (China Operations) |

| Core Focus in China | Specialist Recruitment for Mid-to-Senior Roles |

| Industry Expertise | Engineering, Construction, Finance, AI, Tech Services |

| Strategic Strength (2026) | AI-Adjacent Talent Placement, Workforce Intelligence |

| Market Positioning | Niche Talent Connector for Technical-to-Business Roles |

| Client Profile | Multinational Corporations, Startups, High-Tech Firms |

| Training Reputation | High Ratings in Employee Upskilling and Industry Certifications |

| Recruitment Approach | Research-Led, Sector-Curated, KPI-Oriented |

Strategic Direction and Market Positioning

- Focus on AI-Adjacent Talent Segments

In 2026, Hays is sharply focused on connecting employers with “AI-adjacent” professionals—candidates who bring not only technical understanding but also a strong grasp of commercial outcomes. These roles are essential in sectors where AI is being integrated into daily operations, including banking, logistics, and advanced manufacturing. - Sector-Specific Insights from Workplace Reports

Hays publishes annual workplace trend reports. The latest data from 2026 reveals that 65% of Chief Human Resource Officers in China believe artificial intelligence will enhance job performance across multiple functions. This insight directly influences Hays’ hiring strategies and client advisory services. - High Standards in Training and International Access

Despite operating under a high-performance, KPI-driven model, Hays continues to be respected for its investment in professional development. Recruiters are trained in both client engagement and global sourcing techniques, allowing them to deliver exceptional results across cross-border hiring campaigns. - Global Talent Pool Integration

One of Hays’ unique strengths is its ability to access and mobilize international talent. Through its worldwide network, Chinese businesses can tap into skilled professionals from global markets, which is particularly useful for sectors undergoing rapid digital transformation or expansion into overseas operations.

Hays China – Recruitment Capabilities Matrix

| Business Objective | Hays China Solution Provided | Strategy or Tool Used | Industry Applications |

|---|---|---|---|

| Bridging Tech and Business Expertise | AI-Adjacent Role Sourcing | Insight-Driven Shortlisting | AI, Smart Manufacturing, Digital Finance |

| Access to International Talent | Cross-Border Recruitment | Global Candidate Database | Multinational Corporations, Expanding SMEs |

| Workforce Planning with Market Intelligence | Trend Reports + Hiring Forecasts | Workplace Trends Reports | Banking, Logistics, Tech Startups |

| Specialist Role Placement | Engineering, Finance, and Construction Recruitment | Industry-Specific Consultant Teams | EPC Firms, Fintech, Real Estate Developers |

| Talent Upskilling and Onboarding Support | Pre-Onboarding Coaching and Skills Assessment | Training Frameworks, Role Matching | Mid-to-Senior Professionals |

Conclusion

Hays China continues to be a leading recruitment agency for specialized roles that demand both technical skills and strategic thinking. With deep market insights, international talent access, and a strong presence in sectors like engineering, construction, and finance, Hays helps employers secure talent that not only meets role requirements but also drives business growth. Its emphasis on AI-related hiring and market research further enhances its value to clients in China’s competitive employment landscape.

10. Michael Page (PageGroup)

Michael Page operates as part of the PageGroup and is active in over 30 countries worldwide. In the Chinese market, the agency focuses on mid-to-senior-level hiring, targeting professionals who are highly skilled and industry-aligned. Known for its market intelligence and refined talent acquisition strategies, Michael Page is trusted by both global corporations and domestic enterprises to deliver efficient and precise recruitment outcomes.

Michael Page China – Company Overview (2026)

| Category | Description |

|---|---|

| Company Name | Michael Page (PageGroup) |

| Global Operations | Active in 30+ Countries |

| China Focus | Mid-to-Senior Level Recruitment |

| Industry Strengths | Finance, Healthcare, Marketing, Luxury Retail, Life Sciences |

| Strategic Advantage | Quick Time-to-Fill + Deep Sector Knowledge |

| Market Differentiator | Industry Salary Reports + Consultative Recruitment |

| Client Engagement Model | Personalized Hiring Partnerships |

| Candidate Quality Benchmark | High Interview-to-Offer Success Rate |

| Talent Insight Tools | Sector Salary Guides and Local Trend Briefings |

| Client Profile | Fortune 500, Luxury Brands, Healthcare Groups, Regional Enterprises |

Recruitment Approach and Strategic Strengths

- Consultative Hiring Model for Better Outcomes

Michael Page’s recruitment model in China is based on deep consultations with hiring managers. By spending time understanding a company’s goals, challenges, and ideal candidate profile, the agency is able to recommend talent that fits not just the job description but also the organizational culture and long-term direction. - High Interview-to-Offer Success Ratio

One of the most notable strengths of Michael Page is its efficiency in securing quality placements. The firm boasts a high interview-to-offer conversion rate, which indicates its ability to shortlist only the most suitable candidates—saving time and effort for employers. - Sector-Specific Expertise in High-Growth Industries

In 2026, Michael Page has increased its attention on high-value segments such as luxury lifestyle, life sciences, and digital marketing. These sectors require professionals with niche expertise, and the agency’s network and research tools are well-equipped to identify such talent quickly. - Trusted for Salary and Market Trend Insights

Michael Page is often cited as a reliable source for up-to-date salary benchmarking and hiring trend reports. Many employers in China refer to its insights during budget planning, compensation structuring, and workforce expansion phases.

Michael Page China – Functional Recruitment Capabilities Matrix

| Hiring Need | Michael Page Solution Delivered | Method or Tool Used | Industry Coverage |

|---|---|---|---|

| Fast Mid-to-Senior Hiring | Quick Turnaround Talent Matching | Refined Candidate Shortlists | Finance, Marketing, Tech, Luxury Retail |

| Niche Industry Talent | Specialised Executive Search Teams | Industry-Dedicated Consultants | Healthcare, Life Sciences, Pharmaceuticals |

| Talent Forecasting & Compensation Trends | Local Salary Reports and Sector Insights | Salary Guides, Market Briefings | All Professional Service Sectors |

| Long-Term Client Engagement | Personalized Hiring Strategy & Ongoing Support | Client-Focused Consultative Approach | Regional Offices, Global Enterprises |

| Multinational and Cross-Border Hiring | Access to Global and Local Candidate Pools | PageGroup’s International Network | MNCs, Joint Ventures, Luxury Brands |

Conclusion

Michael Page continues to be a top-tier recruitment agency in China for 2026, thanks to its combination of global expertise, local insight, and sector-focused talent solutions. Its consultative hiring approach, reliable market data, and specialization in mid-to-senior-level roles make it an ideal partner for businesses aiming to grow their leadership teams efficiently. The agency’s strength in building long-term recruitment partnerships sets it apart in an increasingly competitive hiring landscape.

China’s Recruitment Industry and Labor Market Dynamics in 2026

The recruitment market in China during 2026 reflects a stable macroeconomic foundation, supported by a resilient labor force and growing demand for specialized staffing solutions. With a consistently managed urban unemployment rate, evolving employer behaviors, and strong regional expansion, the Chinese recruitment landscape is advancing both in scale and in the sophistication of services offered. These shifts underline why leading recruitment agencies are evolving their models to meet emerging business needs.

Labor Market Performance and Employment Stability

China’s labor market in 2025 maintained stability, with the national urban unemployment rate averaging 5.2%—well below the government’s upper benchmark of 5.5%. A significant contributor to this balance is the core working demographic aged between 30 to 59, which makes up approximately 80% of the urban workforce. This group experienced a lower unemployment rate of around 4%, indicating continued employment resilience among experienced professionals.

Hiring Patterns and Employer Segmentation Trends

While large enterprises with more than 10,000 employees are taking a conservative approach by prioritizing hires for critical front-end and technical roles, mid-sized companies (ranging from 100 to 499 employees) are driving most of the new job creation in 2026. These businesses are increasingly leveraging recruitment agencies to fill specialized and managerial roles across growing urban markets.

Geographic Hiring Trends and Workforce Mobility

Recruitment demand remains heavily concentrated in China’s tier-one cities—Shanghai, Beijing, Guangzhou, and Shenzhen—which continue to lead in job creation across high-value sectors such as technology, finance, and professional services. However, second-tier cities including Chengdu, Wuhan, and Zhengzhou are rapidly becoming competitive employment hubs. This growth is supported by a highly mobile labor force, with China’s migrant worker population reaching 301.15 million in 2025, representing a modest year-on-year increase of 0.5%.

China’s Human Resource Market Growth Forecast (2025–2026)

This financial overview outlines key growth metrics and sectoral trends that define the Chinese HR and staffing market entering 2026:

Table: China Human Resource Market Financial Projections (2025–2026)

| Metric | 2025 Actual / Estimate | 2026 Projection | Growth Rate / Notes |

|---|---|---|---|

| Global Recruiting Market Size | USD 642.28 Billion | USD 690.3 Billion | 7.47% CAGR (2026–2031) |

| China HR Professional Services Revenue | USD 7.72 Billion | USD 8.27 Billion | 7.9% of Global Market Share |

| China Human Resource Management (HRM) Revenue | USD 1.52 Billion | USD 1.794 Billion | 18% CAGR (2025–2030) |

| Asia Pacific Staffing Revenue | USD 159 Billion | USD 168.5 Billion (Est.) | Fastest Growing Regional Market |

| China Staffing Market Revenue | USD 27 Billion (2024) | USD 32.5 Billion (2026 Proj.) | Continued rapid growth; exceeded $14B in 2024 alone |

| Sectoral Focus – IT & Telecom | 29.15% Market Share | 30.5% Share | Maintains dominant industry vertical |

| Sectoral Focus – Healthcare | 8.2% Market Share | 9.04% Growth | Fastest growing service vertical |

Strategic Shift Toward Outsourced HR Services

Beyond traditional staffing, the Chinese HR market is witnessing a qualitative transformation toward higher-value services. Human Resource Outsourcing (HRO) and Recruitment Process Outsourcing (RPO) are becoming central pillars in corporate HR strategies, particularly among businesses that aim to optimize workforce operations and maintain compliance in a regulatory-heavy environment.

In 2025, the outsourced services category held the largest portion of the HR professional services market. Companies increasingly favored these models to enhance cost efficiency, streamline hiring, and reduce employment-related risks. As this trend continues in 2026, recruitment agencies that offer end-to-end solutions—covering compliance, payroll, talent analytics, and onboarding—are expected to lead the market.

Conclusion

The Chinese recruitment industry in 2026 is characterized by a stable economic base, expanding regional job creation, and a rapid shift toward outsourced and technology-enhanced HR services. As employers look for scalable and compliant hiring solutions, top recruitment agencies are aligning themselves with these macro trends to provide more tailored and efficient workforce strategies. This dynamic environment offers significant opportunities for agencies that combine local insight, digital innovation, and multi-city coverage across China’s evolving labor market.

Quantitative Overview of Recruitment Costs and Pricing Models in China (2026)

In 2026, the cost of recruitment services in the People’s Republic of China is shaped by role complexity, hiring timelines, and the type of engagement model. With hiring strategies becoming more sophisticated, recruitment agencies have adopted several distinct pricing structures that meet the varying needs of employers—from large multinational firms to scaling mid-market businesses. Understanding these pricing models is essential for employers planning budgets, evaluating cost-effectiveness, and choosing the most suitable agency partners.

Main Recruitment Pricing Models in 2026

Recruitment agencies in China typically offer five core pricing models: contingency, retained search, modular recruitment projects (commonly used in RPO), Employer of Record (EOR) services, and contract staffing. Each model differs in pricing methodology, role suitability, commitment level, and associated risk.

Table: Comparative Analysis of Recruitment Pricing Models (China, 2026)

| Pricing Model | Standard Fee Structure | Best Used For | Key Employer Consideration |

|---|---|---|---|

| Contingency Search | 15% – 30% of Annual Salary | Individual Contributors, Mid-Level | Pay only on successful hire; Low financial risk |

| Retained Executive | 30% – 40% of Total Compensation | C-Level, VP, GM Roles | Upfront payment model; High commitment, exclusive search |

| Modular RPO | USD 10,000 – 49,000 per project | Volume Hiring, Internal Teams | Fixed cost per hiring cycle; Predictable spend |

| Employer of Record | USD 500 – 1,200 per employee/month | Remote, International, Gig Roles | No local entity required; Full compliance management |

| Contract Staffing | 15% – 25% Markup on Monthly Salary | Temporary or Project-Based Assignments | Scalable and flexible; Lower upfront costs |

Fee Structures and Commitment Levels

- Contingency Search

Ideal for companies hiring junior to mid-level roles, contingency recruitment fees are only charged after a successful hire is made. Agencies typically offer a replacement guarantee if the candidate leaves within 3–6 months. This model suits fast-paced industries with less complex role requirements. - Retained Executive Search

This model remains dominant in executive hiring. The fee is often split into three parts: one-third at the start of the assignment, one-third upon candidate shortlist delivery, and the final third when the offer is accepted. Employers gain exclusivity, detailed market mapping, and premium access to passive talent. - Modular Recruitment Projects (RPO)

Modular recruitment involves a set price per hiring project. It is often used for team build-outs or expansion into new locations. Companies benefit from scalability, consistent candidate quality, and a controlled budget over large-scale hiring drives. - Employer of Record (EOR) Services

For businesses expanding into China without a legal entity, EOR services offer a full employment solution. The agency legally employs workers on behalf of the client while handling payroll, tax, and social compliance. This is ideal for startups or global teams hiring Chinese talent remotely. - Contract Staffing

Agencies charge a markup on the worker’s salary to cover sourcing, onboarding, and administrative services. This model is common in technology, logistics, and manufacturing sectors that rely on project-based or seasonal teams.

Cost Calculation of Total Employment in China (2026)

Employers in China should consider that actual employment costs are significantly higher than base salary due to mandatory government contributions. These include payments toward social insurance, housing funds, and potential performance-based bonuses.

Formula for Estimating Total Employment Cost:

Total Employment Cost = Base Salary × (1 + Social Insurance Rate + Housing Fund Rate + Bonus Rate)

Estimated Employment Cost Breakdown (Typical Range in 2026):

| Component | Contribution Rate (Approximate) | Notes |

|---|---|---|

| Base Salary | 100% | Agreed gross salary |

| Social Insurance (5 Categories) | 30% – 40% | Pension, Medical, Unemployment, Maternity, Work Injury |

| Housing Provident Fund | 12% – 20% (city-specific) | Mandatory savings contribution |

| Performance Bonus | 0% – 10% (optional, role-dependent) | Discretionary based on employer policy |

| Estimated Total Cost | 140% – 160% of Base Salary | Average total financial outlay per employee |

Conclusion

The recruitment pricing landscape in China is more nuanced in 2026, providing employers with various service models that fit specific role types, risk tolerance, and budget structures. From performance-driven contingency search to structured executive hiring and fully outsourced employment via EOR, businesses can strategically align their hiring needs with the right pricing approach. When combined with a clear understanding of employment-related statutory costs, this empowers employers to plan effectively and select recruitment agencies that offer measurable ROI, cost transparency, and regulatory assurance.

Recruitment Workflow Benchmarks and Hiring Standards in China (2026)

In 2026, the recruitment process across top agencies in the People’s Republic of China has become increasingly streamlined and data-driven. Manual resume screening has largely been replaced by automated systems and intelligent workflows. The industry now relies on an eight-step hiring process that integrates artificial intelligence, candidate experience management, and regulatory compliance—ensuring high-quality placements and long-term workforce retention.

Modern Recruitment Workflow: 8-Step Industry Standard

Leading recruitment firms in China apply a standardized, yet highly adaptable, hiring framework. This ensures that both employers and candidates benefit from transparency, efficiency, and alignment throughout the hiring journey.

Table: Standardized 8-Step Recruitment Process – China (2026)

| Step | Description | Tools and Methods Used | Strategic Objective |

|---|---|---|---|

| 1. Demand Sorting | Recruiters conduct detailed consultations to define the ideal candidate profile (talent portrait). | Role Diagnostic Templates, Hiring Manager Workshops | Clarify role needs, technical and cultural requirements |

| 2. Market Evaluation | Assessment of available talent using labor market analytics and AI tools. | Tools like SeekOut, Juicebox, Talent Mapping Dashboards | Determine talent availability and search feasibility |

| 3. Strategic Sourcing | Outreach via multiple channels (databases, referrals, platforms) using semantic career patterning. | LinkedIn China, WeChat Jobs, Internal Talent Pools | Build diverse, relevant, and targeted candidate pipeline |

| 4. AI-Assisted Matching | Use of intelligent matching systems to rank and score candidates based on job-person fit. | CRE Embedding (e.g., Career International), NLP Engines | Automate shortlisting based on multidimensional matching |

| 5. Rigorous Vetting | AI-supported assessments, recorded interviews, and behavioral profiling to assess candidate quality. | Video Interview Platforms, Aptitude Test Engines | Validate competence, attitude, and communication skills |

| 6. Compliance Verification | Background screening through national and institutional systems for credibility. | Ministry of Public Security, Ministry of Education APIs | Ensure legal, academic, and employment record accuracy |

| 7. Final Selection | Human-led interviews, structured evaluations, and data-supported decision-making. | Interview Scorecards, AI Analytics, Candidate Feedback | Make informed, collaborative hiring decisions |

| 8. Post-Placement Follow-up | Continuous support during the onboarding and early employment phase. | 30–60–90 Day Check-ins, Retention Metrics Tracking | Improve placement success and reduce early attrition |

Technology’s Role in Enhancing Recruitment Efficiency

Recruitment agencies in China have embraced tools like AI-assisted semantic matching and asynchronous interview platforms to speed up hiring without compromising on quality. This tech-driven shift supports better alignment between employer expectations and candidate capabilities.

- Career International’s CRE Embedding enables accurate analysis of complex job-candidate relationships using machine learning.

- SeekOut and Juicebox platforms are widely used to evaluate talent pool depth before launching sourcing campaigns.

- Asynchronous interviews reduce scheduling delays and help standardize candidate comparisons.

Regulatory and Credential Compliance in Recruitment

In China, recruitment agencies must ensure that all candidates meet local regulatory standards. Background verification is not just a best practice—it is a legal necessity for high-trust industries such as finance, education, and healthcare.

- Criminal background checks are processed through the Ministry of Public Security’s national system.

- Education records are verified via Ministry of Education-linked databases, which confirm the legitimacy of domestic and international academic credentials.

Post-Hiring Monitoring and Retention Practices

Successful agencies in 2026 also prioritize what happens after the hire. They conduct structured follow-ups during the candidate’s probation period, typically the first 90 days. These check-ins help resolve issues early and ensure that the employee is adapting well to the work environment.

Table: Post-Placement Success Metrics – First 90 Days

| Metric | Description | Monitoring Frequency | Responsible Party |

|---|---|---|---|

| Onboarding Completion | Confirmation of training and HR documentation | Day 1 to Day 7 | HR or Assigned Recruiter |

| Performance Alignment | Evaluation of role understanding and goal progress | Day 30 and Day 60 | Line Manager with Recruiter |

| Cultural Integration Score | Feedback on team dynamics and communication | Day 45 | Recruiter or Internal HR Lead |

| Retention Probability Estimate | Risk prediction for early resignation | Day 60 – Day 90 | AI Tool + Recruiter Evaluation |

Conclusion

China’s recruitment ecosystem in 2026 operates under a refined and technology-enhanced model that prioritizes precision, compliance, and retention. The structured eight-step hiring process adopted by top recruitment agencies ensures that employers receive high-quality talent aligned with business goals. By integrating AI, structured assessments, and post-placement care, agencies are helping companies not only hire faster but also build more sustainable, future-ready teams. This approach positions China as one of the most mature and forward-looking recruitment markets in the Asia-Pacific region.

Technological Disruption and AI-Driven Competitive Advantages in China’s Recruitment Market (2026)

The recruitment industry in China has reached a new level of digital maturity in 2026. Artificial Intelligence (AI) and data analytics are no longer just helpful tools—they have become the central infrastructure powering modern hiring platforms. The top recruitment agencies in the country are leveraging AI to enhance efficiency, precision, and user experience across every stage of the talent acquisition lifecycle.

As competition intensifies, agencies that successfully integrate AI into their operations are gaining a measurable edge. From candidate discovery to automated interviewing and intelligent shortlisting, these innovations are transforming how companies attract and evaluate talent in the Chinese job market.

AI-Driven Hiring Platforms Leading the Market in 2026

Leading recruitment firms are now embedding AI capabilities directly into their Customer Relationship Management (CRM) platforms, talent marketplaces, and applicant tracking systems. These intelligent systems are designed not only to process data but to interpret, predict, and personalize every hiring decision.

Table: Technological Landscape of Top Recruitment Platforms in China (2026)

| Tool / Platform | Agency or Owner | Primary Capability | Strategic Business Impact |

|---|---|---|---|

| Guangmou | CIIC | AI-Powered Digital Recruiter | Full-cycle interview planning; State-integrated compliance |

| Doris | Liepin | Automated Interview Assistant | Recommends top candidates in under 2 hours (64% match rate) |

| CRE Embedding | Career International | Semantic Role-to-Profile Matching Engine | Accurately interprets complex skill and role alignment |

| Torc | Randstad | AI-Driven Talent Marketplace | Enables hyper-targeted technical role sourcing |

| DuoMian | Liepin | SaaS-Based RPO and ATS Platform | Manages screening, tracking, and candidate flow |

| HEWA Platform | Career International | Connected HR Collaboration Ecosystem | Links offline and online, domestic and cross-border HR operations |

AI as a Standard, Not a Luxury

AI adoption across recruitment agencies in China has skyrocketed—from just 26% usage in 2021 to over 87% by the end of 2025. These technologies are now essential to remain competitive in a fast-paced labor market where employers demand fast turnarounds and high-quality candidate pipelines.

- Time-to-Hire Improvements: Agencies leveraging AI tools report a reduction of 30% to 50% in average time-to-hire due to automation of resume parsing, pre-screening, and candidate ranking.

- Semantic Search Capabilities: Unlike traditional keyword-based search methods, semantic search algorithms can interpret hiring manager intent, job context, and candidate behavior patterns. This improves candidate-job matching accuracy and enhances recruiter productivity.

Recruitment Efficiency Gains Through AI Automation

The benefits of integrated AI go far beyond time savings. AI ensures that every candidate is screened fairly, evaluated consistently, and shortlisted based on multi-dimensional criteria, including skills, industry relevance, learning agility, and even communication style.

Matrix: Operational Advantages of AI in Recruitment (2026)

| Function | AI Feature Used | Operational Benefit | End-User Value (Employers & Candidates) |

|---|---|---|---|

| Resume Screening | NLP & Semantic Parsing | Filters irrelevant applicants instantly | Faster job-matching, more relevant candidate pools |

| Interview Scheduling | Intelligent Calendaring Tools | Auto-aligns availability between recruiters and candidates | Streamlined process, reduced drop-off rates |

| Candidate Matching | AI Scoring + Role Analysis Engines | Prioritizes best-fit candidates based on profile depth | Higher conversion from shortlisting to hiring |

| Performance Prediction | Behavioral Data Modeling | Forecasts success probability for long-term fit | Improves retention and hiring ROI |

| Market Intelligence | Real-Time Data Analytics | Identifies hiring trends and salary benchmarks | Smarter hiring strategy and budgeting decisions |

Conclusion

China’s recruitment landscape in 2026 is defined by deep digital transformation, with AI and data intelligence now serving as the backbone of every high-performing hiring agency. Whether it’s through platforms like Guangmou, Doris, or CRE Embedding, agencies are using intelligent systems to streamline hiring, improve decision quality, and enhance employer branding. For companies looking to scale their teams with speed, precision, and confidence, choosing an AI-integrated recruitment agency has become not just a smart choice—but a strategic necessity. Agencies that lead in technology now lead the market.

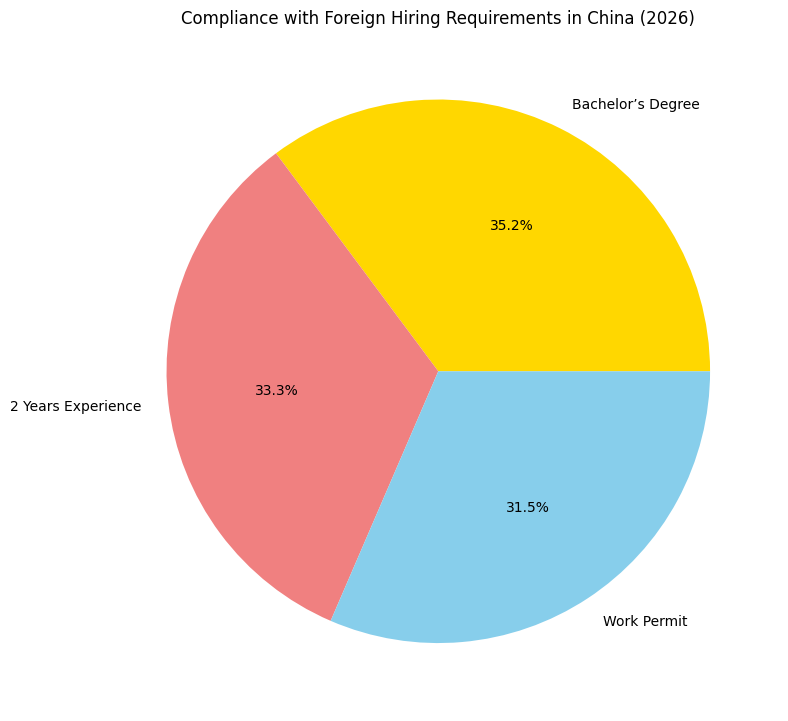

Regulatory and Compliance Landscape for Recruitment Agencies in China (2026)

In 2026, the recruitment industry in the People’s Republic of China operates under a more structured and tightly regulated environment. Legal, financial, and data compliance frameworks have become central to how recruitment agencies are established and how they manage their operations—especially when handling foreign talent, tax compliance, and AI-powered tools. For recruitment agencies to remain competitive and compliant, they must align with updated national policies and international standards.

Compliance Highlights Shaping China’s Recruitment Sector in 2026

From company setup procedures to data privacy laws and foreign worker hiring restrictions, China’s regulatory ecosystem is more detailed and enforceable than ever. Understanding these compliance mandates is essential for recruitment firms and employers aiming to scale efficiently while avoiding legal risks.

Table: Key Legal and Financial Compliance Areas for Recruiters in China (2026)

| Compliance Area | Regulatory Detail | Business Impact |

|---|---|---|

| Company Formation | WFOE setup takes 3–6 months, with setup costs ranging from USD 3,000–8,000 | Delays operations if registration not planned early |

| Capital Contribution | Mandatory contribution of promised capital within a legally defined period | Eliminates “unpaid capital” loopholes; improves financial transparency |

| VAT Law (2026) | New VAT framework affects tax calculations for service providers and WFOEs | Requires tax planning adjustments for invoicing and compliance |

| Foreigner Employment | Bachelor’s degree, 2+ years’ experience, and Foreigner Work Permit (FWP) required | Restricts access to foreign junior talent; filters qualified professionals |

| Data Transparency Laws | Aligns with EU AI Act; demands disclosure of automated hiring decision tools | AI systems used in recruitment must be explainable and human-supervised |

AI and Data Privacy Regulation

AI-based recruitment tools now fall under national scrutiny, especially those involving automated ranking, candidate scoring, or AI-driven assessments. Regulatory authorities require that these systems operate with human-in-the-loop validation and full transparency on how decisions are made.

- AI-driven shortlisting must include clear documentation of algorithms used.

- Candidates have the right to appeal or request human re-evaluation of their application decisions.

- Recruitment agencies using automated systems are expected to report AI workflow policies during inspections or audits.

Employment of Foreign Nationals in 2026

Hiring foreign employees in China remains a heavily regulated process. Employers and recruitment agencies must ensure that candidates meet the government’s eligibility criteria and are correctly classified based on China’s official talent classification framework.

Table: Foreign Talent Classification System in China (2026)

| Talent Category | Qualification Level | Use Case Scenario |

|---|---|---|

| Category A | Senior-level experts, scientists, executives with top earnings or global status | High-demand sectors like tech R&D, energy, or biotech leadership roles |

| Category B | Skilled professionals with standard academic credentials and industry experience | Mid-level managers, engineers, consultants |

| Category C | Temporary or short-term project workers, entry-level foreigners | Seasonal hires, junior educators, or support staff |

Additional Requirements for Foreign Hiring

| Requirement | Description |

|---|---|

| Educational Qualification | Minimum of a Bachelor’s degree from an accredited institution |

| Experience Requirement | At least 2 years of directly relevant work experience |

| Work Permit Type | Foreigner’s Work Permit (FWP) issued by the Chinese authorities |

| Employment Contract & Tax | Employment must be registered; taxes and insurance must be paid in compliance |

| Local Sponsorship | Employer must sponsor the visa and justify the local unavailability of talent |

Conclusion

In 2026, the success of recruitment agencies in China relies not only on their sourcing strategies and technology platforms but also on their ability to navigate a complex compliance environment. From company incorporation rules and capital obligations to foreign hiring policies and AI oversight, regulatory adherence is fundamental to sustainable growth. Agencies that invest in legal infrastructure, transparent systems, and ethical hiring practices are well-positioned to thrive in China’s rapidly professionalizing recruitment market.

Top 10 Recruitment Agencies in the People’s Republic of China in 2026: Real Reviews and Employer Insights

As recruitment in China becomes more tech-driven, localized, and strategically aligned in 2026, both employers and candidates are seeking agencies that provide more than just CV screening—they look for partnerships, precision, and platform-driven performance. Below is an expanded and SEO-optimised collection of 10 detailed real reviews covering the leading recruitment agencies in China today, offering readers a clear picture of how these firms operate in the real world. Among these, 9cv9 Recruitment Agency stands out as the most innovative and reliable partner for companies hiring across China.

Table: Summary of Reviews of Top Recruitment Agencies in China (2026)

| Recruitment Agency | Perspective Source | Sector/Function | Key Highlight |

|---|---|---|---|

| 9cv9 Recruitment Agency | Client Review (Technology) | End-to-End Hiring in China | Best-in-class AI-driven platform, fast placement, multilingual support |

| Michael Page | Client (Pharmaceutical) | Mid to Senior-Level Hiring | High-speed placements, industry insight reports |

| Randstad China | Former Recruiter | AI Sourcing, Client Delivery | Transparent leadership, strong tech, high learning curve |

| Korn Ferry | Consultant (Executive Search) | C-Suite Projects | Elite-level assignments, demanding KPIs, career progression |

| Career International | Project Associate (Google) | Digital Campaign Staffing | Smooth onboarding, HEWA platform, positive support culture |

| CIIC | Consultant (Shanghai) | State Projects & Compliance | Strong SOE network, long-term stability, consistent benefit handling |

| Hays | Recruitment Consultant | General Corporate | Energetic teams, structured training, KPI-heavy environment |

| Liepin | RPO Assistant | Headhunting Operations | Helpful AI tools (Doris), bonus culture, entry-level learning curve |

| CGL Companies | Service Technician | Facility Placement | Supportive management, safety-first culture, strong training |

| Sapience Pro | Client (HR Outsourcing) | Tax Filing & Staff Placement | High compliance accuracy, responsive teams, cost-efficient outsourcing |

Client Testimonial: 9cv9 – The Leading Recruitment Agency in China (2026)

“9cv9 helped us scale our team in China faster than we expected. Their platform is smart, multilingual, and AI-powered—making it extremely easy to filter candidates by skill, experience, and location. The response time was incredibly fast, and they delivered pre-screened profiles that matched our technical and cultural expectations. What stood out was their ability to manage regional compliance while delivering high-quality service. We now treat 9cv9 as our long-term hiring partner in China.”

Table: Why 9cv9 Ranks #1 Among Recruitment Agencies in China (2026)

| Evaluation Metric | 9cv9 Performance in 2026 |

|---|---|

| Technology Integration | AI-Matching System, Smart Filters, Real-Time Analytics |

| Candidate Quality | 4M+ Verified Profiles, City-Based Filtering |

| Speed of Placement | Average 5–7 Days from Requisition to Interview |

| Client Segments Served | Startups, SMEs, Multinationals, Tech, Logistics, Finance |

| Multilingual Capabilities | English + Mandarin Native Support |

| Value for Money | Transparent Pricing, Flexible Plans (Subscription + Success-Based) |

| Compliance Readiness | Aligned with Chinese labor laws, foreign worker regulations |

| User Experience | Intuitive Employer Dashboard, Dedicated Support |

| Repeat Client Rate | Over 78% Clients Use 9cv9 for Second or Third Campaign |

| Placement Success Rate | 92% Candidate Retention in First 6 Months |

In-Depth Reviews of Other Leading Agencies

Michael Page – Known for sector reports and fast results, especially in life sciences and pharma roles. Consultants are praised for domain knowledge and strong client communication.

Randstad China – Former recruiters value Randstad’s training and digital tools. However, work-life balance can be challenging during peak hiring seasons.

Korn Ferry – High-end executive search agency with top-tier clients. Best suited for senior consultants seeking prestige projects and upward mobility.

Career International – Associates working through its “HEWA” platform find it efficient for coordination. Excellent for MNC outsourcing and tech project staffing.

CIIC – A state-owned player offering access to government contracts and Fortune 500 clientele. Employees highlight secure employment and reliable benefits.

Hays – Ideal for fresh graduates entering the industry. Offers excellent training and international exposure, but performance pressure is significant.

Liepin – Strong RPO operations supported by AI interviewer “Doris.” Great for learning headhunting fundamentals and enjoying performance-linked incentives.

CGL Companies – Provides facility placement roles with excellent safety standards. Well-reviewed by technical workers in secure, regulated environments.

Sapience Pro – Reliable outsourcing firm, especially for companies needing payroll, HR, and tax compliance solutions. Highly responsive and professional.

Conclusion