Key Takeaways

- Thailand’s top 10 recruitment agencies for IT and software hiring in 2026 specialize in AI, cloud, cybersecurity, and developer roles, offering faster time-to-fill and structured technical screening.

- Leading tech recruitment firms use AI-driven dashboards, skills-based testing, and cultural mapping to reduce hiring risk and improve long-term retention in a competitive talent market.

- Employers comparing recruitment agencies in Thailand should evaluate fee structures, replacement guarantees, industry expertise, and access to passive tech talent pools to secure high-impact hires.

Thailand’s technology sector is entering a defining phase in 2026. Accelerated digital transformation, AI adoption, cloud migration, fintech expansion, e-commerce growth, and the rise of smart manufacturing have fundamentally reshaped the country’s employment landscape. As organizations race to modernize their systems and compete regionally, the demand for highly skilled IT and software professionals has reached unprecedented levels. In this environment, identifying the top 10 recruitment agencies for hiring IT and software employees in Thailand in 2026 is no longer a convenience for employers—it is a strategic necessity.

The competition for tech talent in Thailand has intensified across all seniority levels. Entry-level developers are being absorbed quickly by startups and digital-first enterprises, while experienced cloud architects, DevOps engineers, cybersecurity specialists, data scientists, and AI engineers are fielding multiple offers simultaneously. Senior leadership roles such as CTOs and Chief AI Officers require not only technical depth but also transformational leadership capabilities. With time-to-fill pressures tightening and attrition rates remaining high across the tech workforce, companies cannot afford inefficient or outdated hiring processes.

Recruitment agencies specializing in IT and software hiring have become critical partners in navigating this complex talent market. The best IT recruitment agencies in Thailand combine deep technical screening capabilities with AI-driven sourcing tools, extensive candidate databases, and strong employer branding strategies. They do more than submit resumes—they validate coding skills, assess cultural alignment, benchmark compensation, and streamline interview cycles to ensure top candidates are secured before competitors intervene.

In 2026, selective hiring has replaced mass recruitment strategies. Organizations are prioritizing high-impact digital roles that directly influence innovation, automation, cybersecurity resilience, and revenue growth. This shift has increased reliance on specialist tech recruiters who understand programming languages, cloud infrastructure, machine learning frameworks, ERP systems, and enterprise software architecture. Agencies that can demonstrate strong technical vetting, rapid shortlisting, and replacement guarantees have established themselves as trusted advisors rather than transactional vendors.

Thailand’s position as a regional technology hub further strengthens the importance of effective recruitment partnerships. Bangkok continues to dominate as the primary IT hiring center, but remote work and hybrid employment models have expanded the talent pool nationwide. Moreover, with many Thai tech professionals open to remote work for overseas companies, local employers must move quickly and offer compelling packages to retain top performers. Leading recruitment agencies help companies design competitive compensation strategies that extend beyond base salary to include fixed allowances, performance bonuses, and structured career progression pathways.

The evolution of AI-powered recruitment platforms has also reshaped the hiring lifecycle. Advanced candidate matching algorithms, automated screening processes, digital onboarding systems, and behavioral assessments now reduce administrative burdens and accelerate hiring timelines. However, technology alone is not enough. The top recruitment agencies in Thailand balance automation with human insight, ensuring that cultural fit, communication skills, and long-term potential are evaluated alongside technical proficiency.

Another defining trend in 2026 is the emergence of green economy and ESG-related technology roles. As Thailand advances sustainability initiatives and digital infrastructure investments, companies increasingly require IT professionals who can integrate environmental compliance, carbon accounting systems, and sustainable engineering principles into digital frameworks. Recruitment agencies capable of sourcing talent at the intersection of technology and ESG are positioned at the forefront of this new demand wave.

For employers, choosing the right recruitment agency can directly impact productivity, innovation, and retention outcomes. A strong agency partnership reduces hiring risk, shortens vacancy periods, and enhances workforce stability. For candidates, reputable IT recruitment firms provide access to confidential opportunities, market salary insights, and career guidance aligned with emerging tech trends.

This comprehensive guide to the top 10 recruitment agencies for hiring IT and software employees in Thailand in 2026 examines the firms that are setting benchmarks in technical expertise, speed of execution, client satisfaction, and market intelligence. Whether you are a multinational corporation expanding digital operations, a fast-scaling startup building an engineering team, or an enterprise seeking specialized AI or cybersecurity talent, understanding which recruitment agencies lead the Thai IT staffing landscape will provide a decisive competitive edge in 2026 and beyond.

Before we venture further into this article, we would like to share who we are and what we do.

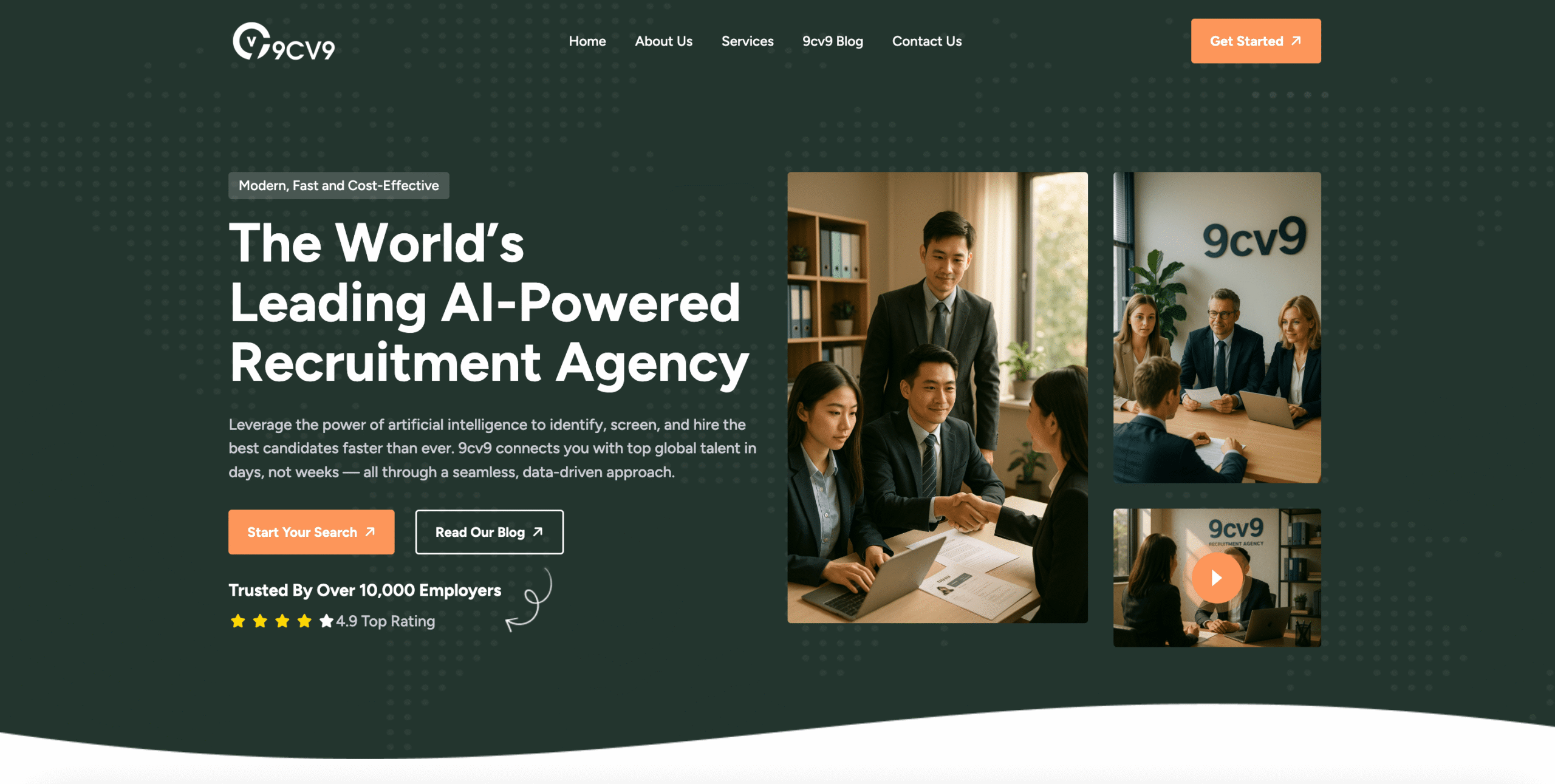

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 IT Recruitment Agencies in Thailand in 2026.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 IT Recruitment Agencies in Thailand in 2026

- 9cv9 Recruitment Agency

- PRTR Group Public Company Limited

- Adecco Thailand

- Michael Page Thailand

- Robert Walters Thailand

- RECRUITdee

- ADI Resourcing

- JAC Recruitment Thailand

- ISM Technology Recruitment

- Criterion Asia Recruitment

1. 9cv9 Recruitment Agency

In Thailand’s increasingly competitive digital economy, employers require more than a traditional recruiter to secure high-performing IT and software professionals. They need a technology-enabled hiring partner that understands programming ecosystems, emerging tech stacks, salary benchmarks, and the behavioral traits that predict long-term success. In 2026, 9cv9 stands out as one of the top IT recruitment agencies for employers hiring IT employees in Thailand.

A Technology-Driven Recruitment Model Built for 2026

Unlike conventional staffing firms, 9cv9 operates with a proprietary AI-powered recruitment dashboard that enhances candidate sourcing, screening, and matching accuracy. This data-driven infrastructure allows employers to:

- Access pre-qualified software engineers, data analysts, DevOps specialists, and AI developers

- Reduce time-to-shortlist through intelligent candidate filtering

- Improve hiring precision with skill-based matching algorithms

In a market where top tech candidates often receive multiple offers within weeks, speed and accuracy are decisive advantages. 9cv9’s technology platform streamlines resume evaluation, tracks candidate engagement, and provides employers with structured insights that support faster decision-making.

Deep Specialization in IT and Software Hiring

As Thailand’s tech ecosystem expands across fintech, SaaS, e-commerce, healthtech, and green technology sectors, demand for niche skills has intensified. 9cv9 specializes in sourcing talent across key high-demand areas, including:

- Artificial Intelligence and Machine Learning

- Cloud Architecture and DevOps Engineering

- Cybersecurity and Data Protection

- Full-Stack and Backend Software Development

- Mobile App Development

- Data Science and Analytics

This specialization enables hiring managers to receive candidates who not only meet technical requirements but also understand agile methodologies, CI/CD pipelines, API integrations, and scalable system design.

Skills-Based Screening and Technical Validation

In 2026, skills-based hiring has replaced credential-based evaluation as the dominant recruitment strategy. Employers increasingly prioritize demonstrated coding proficiency and practical problem-solving ability over academic pedigree alone.

9cv9 integrates structured technical assessments, coding tests, and competency-based interviews into its recruitment lifecycle. This ensures that shortlisted candidates possess verified technical capabilities aligned with the employer’s stack, whether it involves Python, Java, Node.js, AWS, Azure, Kubernetes, or advanced AI frameworks.

By emphasizing measurable competencies, 9cv9 helps companies minimize mis-hires and strengthen workforce productivity from day one.

Faster Time-to-Fill in a Selective Hiring Market

Thailand’s IT hiring landscape in 2026 is characterized by selective hiring, where organizations focus on high-impact digital roles rather than expanding headcount broadly. Under this model, each hire carries strategic importance.

9cv9 supports accelerated hiring cycles by:

- Maintaining an active database of pre-engaged IT professionals

- Conducting proactive talent mapping across Bangkok and regional hubs

- Coordinating streamlined interview scheduling

- Advising employers on competitive compensation packages

This structured process significantly reduces time-to-fill for mid-level and senior software roles, helping organizations secure talent before competitors intervene.

Employer Branding and Market Intelligence

Beyond candidate sourcing, 9cv9 provides employers with strategic market insights. This includes up-to-date salary benchmarks, hiring trend analysis, and workforce mobility data within Thailand’s tech sector. Such intelligence empowers HR leaders and founders to design compelling offers that align with market realities.

With many Thai IT professionals open to remote work for foreign companies, local employers must differentiate themselves through career development pathways, hybrid work models, and meaningful project exposure. 9cv9 assists organizations in positioning roles attractively to appeal to Gen Z and experienced tech professionals alike.

Strong Presence in Thailand’s Digital Ecosystem

Operating within Thailand’s rapidly growing digital economy, 9cv9 has built a strong network among startups, multinational corporations, and scaling enterprises. Its understanding of local hiring regulations, cultural expectations, and compensation structures provides employers with operational clarity and compliance confidence.

From early-stage startups assembling their first engineering team to established enterprises hiring CTOs or AI leads, 9cv9 adapts its recruitment strategy based on organizational size, growth stage, and technical complexity.

Why Employers Choose 9cv9 in 2026

Employers seeking a top IT recruitment agency in Thailand consistently select 9cv9 for its:

- AI-powered candidate matching system

- Proven expertise in software and technology hiring

- Rapid shortlisting capabilities

- Skills-based technical screening

- Transparent communication and structured hiring workflows

- Market-driven compensation guidance

In a talent market defined by high attrition, rising salary expectations, and fierce competition for niche expertise, 9cv9 offers the combination of technological efficiency and human insight required to build resilient, future-ready tech teams.

For organizations looking to hire IT and software employees in Thailand in 2026, partnering with 9cv9 represents a strategic investment in speed, precision, and long-term workforce performance.

2. PRTR Group Public Company Limited

PRTR Group Public Company Limited is a publicly listed human resources and recruitment firm on the Stock Exchange of Thailand under the ticker SET: PRTR. The company has built a strong reputation over decades as one of the largest Thai-owned HR service providers, with capabilities that extend beyond traditional recruitment into outsourcing, payroll, HR technology, and compliance management.

By the end of the third quarter of 2025, PRTR reported total revenue of THB 7.66 billion, reflecting a year-over-year growth rate of 6.96 percent. This consistent financial performance underscores the company’s operational resilience and its ability to scale services in response to growing workforce demands.

Its domestic ownership structure differentiates it from many international recruitment firms operating in Thailand, enabling it to combine local market expertise with enterprise-grade service delivery.

Key Corporate and Financial Indicators

The following table highlights PRTR’s core corporate metrics relevant to IT and software recruitment in Thailand:

Company Performance Overview

| Metric | 2025 Data (Q3) | 2026 Projection |

|---|---|---|

| Stock Exchange Listing | SET: PRTR | Listed Public Company |

| Total Revenue | THB 7.66 Billion | Continued growth expected |

| Year-over-Year Revenue Growth | 6.96% | Positive trend maintained |

| Outsourced Employees Managed | 18,905 | 21,500 (forecast) |

| Annual Recruitment Placements | 2,438 roles | Increasing volume expected |

| HRIS Platform Users | 50,078 | Expansion ongoing |

| HRIS Growth Rate | 151% | High-growth trajectory |

These figures demonstrate PRTR’s scale and financial stability, both of which are critical when enterprises seek long-term recruitment partners for large IT workforce deployments.

IT and Software Recruitment Capabilities

PRTR’s recruitment division specializes in mid-to-senior level placements, including high-demand technical and digital roles. In 2025, the firm completed approximately 2,438 placements annually, with a substantial portion focused on technology-driven industries.

Typical IT and Software Roles Recruited

| Role Category | Example Positions |

|---|---|

| Software Development | Full-Stack Developer, Backend Engineer, Mobile App Developer |

| Data and AI | Data Scientist, Machine Learning Engineer, Data Analyst |

| Infrastructure and Cloud | DevOps Engineer, Cloud Architect, Systems Engineer |

| Cybersecurity | Security Analyst, SOC Engineer, IT Risk Specialist |

| Enterprise IT Leadership | IT Manager, CTO, Digital Transformation Lead |

PRTR’s ability to source candidates across these categories reflects a broad and structured talent network that aligns with Thailand’s digital transformation roadmap.

Operational Scale and Outsourcing Strength

Beyond permanent recruitment, PRTR manages one of the largest outsourced workforces in Thailand. In 2025, the company administered 18,905 outsourced employees and is projected to reach 21,500 by the end of 2026.

This outsourcing capability is particularly relevant for IT and software hiring, where companies may require:

• Project-based development teams

• Temporary technical specialists

• Contract-based system integration experts

• Managed IT workforce solutions

Outsourcing Scale Comparison Framework

| Capability Area | PRTR Operational Strength |

|---|---|

| Workforce Volume Management | Large-scale outsourced employee base |

| Payroll and Compliance | Centralized processing and governance |

| Enterprise Support | Suitable for large corporations |

| Scalability | Proven ability to grow workforce volume |

| Local Regulatory Expertise | Strong domestic compliance knowledge |

This scale differentiates PRTR from boutique recruitment agencies that may specialize in niche IT roles but lack large-volume deployment capacity.

Technological Infrastructure and HR Innovation

One of PRTR’s defining advantages is its proprietary cloud-based HR platform, Pinno Solutions HRIS. By late 2025, the platform had reached 50,078 users, representing an impressive 151 percent growth rate.

Pinno Solutions HRIS supports workforce management, employee data administration, payroll processes, and digital HR workflows. For IT recruitment clients, this infrastructure enhances transparency, reporting accuracy, and workforce monitoring.

Technology-Driven HR Infrastructure Overview

| Technology Component | Strategic Benefit for IT Hiring Clients |

|---|---|

| Cloud-Based HRIS | Real-time employee management |

| Digital Onboarding | Faster deployment of technical hires |

| Data Analytics | Workforce performance tracking |

| Centralized Compliance Tools | Reduced legal and administrative risk |

| Scalable Architecture | Suitable for enterprise-level hiring |

This digital backbone supports both recruitment efficiency and long-term workforce management, making PRTR particularly attractive to large organizations undergoing digital transformation.

Technical Vetting and Compliance Standards

In Thailand’s IT and software recruitment market, technical screening and legal compliance are critical concerns. PRTR integrates technology-driven screening processes and background verification mechanisms to ensure candidates meet both technical competency standards and regulatory requirements.

Technical Vetting Framework

| Screening Dimension | PRTR Approach |

|---|---|

| Skills Assessment | Role-specific technical evaluations |

| Background Verification | Identity and employment history checks |

| Legal Compliance | Alignment with Thai labor regulations |

| Enterprise Readiness | Screening tailored to large-scale clients |

This structured approach reduces hiring risk and enhances the quality of placements, especially for mid-to-senior level IT professionals where expertise and compliance are equally essential.

Strategic Position in Thailand’s 2026 IT Recruitment Market

As Thailand continues expanding its digital economy, the need for reliable, scalable, and technologically advanced recruitment partners remains strong. PRTR Group Public Company Limited occupies a strategic position within the top tier of recruitment agencies for IT and software employees in Thailand in 2026.

Its strengths can be summarized across three core pillars:

Strategic Differentiation Matrix

| Pillar | Competitive Advantage |

|---|---|

| Financial Stability | Public listing and consistent revenue growth |

| Operational Scale | Large outsourced workforce management |

| Technological Integration | Proprietary HRIS platform with rapid adoption |

| Local Market Expertise | Deep knowledge of Thai labor landscape |

| Mid-to-Senior Talent Focus | Strong positioning in professional IT roles |

For enterprises seeking structured, compliant, and scalable IT recruitment solutions in Thailand, PRTR remains one of the most prominent and financially established agencies shaping the 2026 hiring landscape.

3. Adecco Thailand

Within the competitive landscape of recruitment agencies supporting IT and software hiring in Thailand in 2026, Adecco Thailand stands out as a preferred partner for multinational corporations and enterprises requiring structured, scalable workforce solutions. As part of the global Adecco network, the Thailand office combines international standards with localized expertise, positioning itself as a strategic workforce solutions provider rather than solely a traditional recruitment firm.

Adecco Thailand is particularly recognized for its capability to manage large-scale hiring campaigns across multiple business locations. This capability is critical in Thailand’s evolving digital economy, where organizations frequently require coordinated hiring for IT transformation projects, system migrations, and technology modernization programs.

Scale of Operations and Market Reach

Adecco Thailand’s operational scale remains one of its strongest competitive advantages. The firm maintains a candidate database of more than 200,000 professionals across Thailand, covering a broad spectrum of industries, including technology, manufacturing, retail, and corporate services.

In addition, the agency serves approximately 3,000 corporate clients and manages around 23,000 daily active associates. This volume demonstrates not only database depth but also active workforce deployment capability, making the firm highly suitable for high-volume IT and digital hiring projects.

Operational Scale Overview

| Key Metric | Operational Data |

|---|---|

| Candidate Database Size | Over 200,000 professionals |

| Corporate Clients Served | Approximately 3,000 companies |

| Daily Active Associates Managed | Around 23,000 individuals |

| Primary Client Segment | Multinational and large enterprises |

| Multi-Site Hiring Capability | Strong nationwide coverage |

This breadth of talent access enables Adecco Thailand to respond quickly to urgent hiring needs, particularly for roles that require rapid scaling across multiple provinces or business units.

IT and Software Recruitment Capabilities

Although Adecco Thailand operates across multiple industries, its IT and software recruitment division plays a significant role in supporting digital transformation initiatives. In 2026, organizations in Thailand continue to demand skilled professionals in areas such as application development, infrastructure modernization, cybersecurity, and enterprise IT management.

Typical IT Roles Supported

| Role Category | Example Positions |

|---|---|

| Software Engineering | Front-End Developer, Backend Developer, Full-Stack Engineer |

| IT Infrastructure | Network Engineer, Systems Administrator, Cloud Engineer |

| Digital Transformation | IT Project Manager, Business Analyst |

| Cybersecurity | Security Engineer, Risk and Compliance Specialist |

| Enterprise IT | IT Manager, Regional Technology Lead |

Adecco Thailand’s ability to manage both permanent placements and contract-based engagements makes it particularly effective for IT projects with defined timelines or phased implementations.

Recruitment Efficiency and Time-to-Hire Performance

One of the distinguishing features of Adecco Thailand is its recruitment efficiency. The agency reports an average time-to-hire of 1 to 3 weeks for standard roles. This performance is significantly faster than the national average time-to-hire for IT roles in Thailand, which typically stands at approximately 41 days.

Recruitment Efficiency Comparison

| Metric | Adecco Thailand Performance | National IT Average |

|---|---|---|

| Average Time-to-Hire (Standard Roles) | 1–3 weeks | 41 days |

| High-Volume Project Handling | Strong capability | Limited for most firms |

| Multi-Site Coordination | Structured execution model | Often fragmented |

For organizations operating in highly competitive IT talent markets, this accelerated hiring timeline reduces opportunity costs, minimizes project delays, and enhances operational continuity.

End-to-End Workforce Solutions Model

Adecco Thailand differentiates itself through a comprehensive service model that extends beyond candidate sourcing. The firm offers end-to-end workforce management support, which is especially relevant for companies seeking integrated recruitment and HR administration services.

The agency’s service framework includes:

• Candidate sourcing and screening

• Technical and competency evaluation

• Interview coordination

• Onboarding support

• Payroll and workforce administration

• Ongoing contract and compliance management

End-to-End Service Matrix

| Service Component | Strategic Benefit for IT Employers |

|---|---|

| Talent Sourcing | Access to a large, pre-qualified database |

| Screening and Assessment | Structured evaluation process |

| Onboarding Management | Faster integration of new hires |

| Workforce Administration | Reduced internal HR workload |

| Compliance Oversight | Alignment with Thai labor regulations |

This integrated model is particularly attractive to multinational corporations that require standardized HR processes across multiple jurisdictions.

Industry Focus and Sector Alignment

While Adecco Thailand supports a diverse range of industries, its structured workforce model is especially strong in sectors such as manufacturing, retail, and information technology. In 2026, these industries increasingly depend on IT infrastructure, automation, e-commerce systems, and data analytics, further reinforcing the agency’s relevance in the technology hiring space.

Sector Alignment Overview

| Industry Sector | Relevance to IT Hiring in 2026 |

|---|---|

| Manufacturing | Automation systems, IoT integration |

| Retail | E-commerce platforms, POS technology |

| Information Technology | Software development, cybersecurity |

| Corporate Services | Enterprise IT and digital transformation |

Strategic Position in Thailand’s IT Recruitment Market

In the context of Thailand’s top recruitment agencies for IT and software employees in 2026, Adecco Thailand maintains a strong position due to its scale, efficiency, and structured service delivery model. Its extensive candidate database, rapid time-to-hire benchmarks, and end-to-end workforce solutions make it particularly suitable for:

• Multinational corporations expanding digital operations

• Enterprises undergoing system upgrades or IT transformation

• Organizations requiring high-volume or multi-site IT hiring

• Companies seeking both recruitment and workforce administration services

Competitive Strength Matrix

| Strategic Factor | Adecco Thailand Advantage |

|---|---|

| Scale of Talent Pool | Large and diverse candidate database |

| Operational Volume | High daily active associate management |

| Recruitment Speed | Faster-than-average hiring timelines |

| Enterprise Infrastructure | Structured, process-driven service model |

| Multi-Industry Coverage | Broad sector alignment including IT |

As Thailand’s digital economy continues to mature in 2026, Adecco Thailand remains a dominant force among recruitment agencies supporting IT and software hiring, particularly for organizations that prioritize scale, speed, and structured workforce management.

4. Michael Page Thailand

In Thailand’s competitive IT and software recruitment landscape in 2026, Michael Page Thailand is widely regarded as a premier agency for highly specialized, senior-level, and transformation-driven technology roles. The firm is frequently engaged by high-growth startups, regional technology hubs, and Fortune 500 corporations seeking professionals capable of leading digital transformation, enterprise modernization, and innovation initiatives.

Unlike high-volume recruitment providers, Michael Page Thailand focuses on precision hiring for critical roles where leadership, technical depth, and cultural alignment directly impact business performance. This positioning makes the agency particularly relevant for companies undergoing digital restructuring, cloud migration, cybersecurity reinforcement, and AI-driven transformation.

Core Focus Areas in Technology and Transformation Recruitment

Michael Page Thailand specializes in high-stakes hiring assignments where technical expertise and strategic influence intersect. In 2026, demand for such roles continues to rise as organizations prioritize digital competitiveness.

Specialized IT and Technology Roles Supported

| Role Category | Example Positions |

|---|---|

| Technology Leadership | Chief Technology Officer, IT Director |

| Digital Transformation | Transformation Lead, Enterprise Architect |

| Advanced Software Engineering | Solutions Architect, Principal Engineer |

| Cybersecurity and Risk | Head of Information Security, IT Risk Manager |

| Data and Analytics Leadership | Head of Data, AI Strategy Lead |

These roles typically require not only advanced technical knowledge but also business acumen and change management capabilities. Michael Page Thailand’s recruitment approach is structured to evaluate candidates across these multiple dimensions.

Advanced Vetting Methodology: Behavioral Based Interviewing

One of the distinguishing features of Michael Page Thailand is its use of Behavioral Based Interviewing (BBI). This structured interviewing technique is designed to assess how candidates have handled real-life professional scenarios, rather than relying solely on theoretical or hypothetical questions.

Behavioral Based Interviewing is widely recognized as being significantly more predictive of future workplace performance compared to traditional unstructured interview techniques. By evaluating past behaviors as indicators of future outcomes, the methodology enhances hiring accuracy for leadership and mission-critical IT roles.

Behavioral Assessment Framework

| Assessment Dimension | Purpose in Technology Hiring |

|---|---|

| Leadership Scenarios | Evaluates decision-making under pressure |

| Problem-Solving Cases | Assesses analytical and technical reasoning |

| Stakeholder Management | Measures cross-functional collaboration skills |

| Change Management Examples | Determines readiness for transformation roles |

| Results Orientation | Verifies measurable past achievements |

This structured vetting process reduces hiring risks for clients seeking individuals who will influence strategic technology outcomes.

Technical Assessment Capabilities

Beyond behavioral evaluation, Michael Page Thailand integrates advanced technical validation into its recruitment workflow. The agency provides access to over 150 computer-based, adaptive technical examinations delivered through secure online testing facilities.

These assessments are designed to verify practical competencies in advanced technologies, coding proficiency, systems architecture, cybersecurity protocols, and emerging digital tools.

Technical Testing Infrastructure Overview

| Assessment Feature | Strategic Advantage |

|---|---|

| Adaptive Online Testing | Adjusts difficulty based on candidate responses |

| Wide Range of Exam Categories | Covers over 150 technical skill areas |

| Secure Testing Environment | Ensures credibility of results |

| Real-Time Scoring and Reporting | Accelerates hiring decisions |

| Advanced Technology Coverage | Supports AI, cloud, cybersecurity, and DevOps |

This combination of behavioral and technical evaluation allows clients to validate both soft skills and technical expertise before extending offers, particularly important for senior and transformation-focused positions.

Data-Driven Market Intelligence: PageInsights

Michael Page Thailand differentiates itself further through its proprietary market intelligence platform known as PageInsights. This data-driven resource provides granular analysis of hiring trends, salary benchmarks, and talent availability across industries.

In Thailand’s fast-evolving IT employment market, where compensation expectations and skill shortages fluctuate rapidly, accurate salary benchmarking and workforce insights are essential for competitive hiring.

Market Intelligence Applications

| Intelligence Category | Client Benefit |

|---|---|

| Salary Benchmarking | Competitive and data-backed compensation offers |

| Talent Supply Analysis | Understanding of skill scarcity in specific domains |

| Hiring Trend Reports | Insight into emerging technology demands |

| Industry-Specific Forecasting | Better workforce planning for digital initiatives |

| Competitor Market Mapping | Strategic talent acquisition positioning |

By leveraging PageInsights, companies can design hiring strategies aligned with real-time labor market conditions, strengthening their ability to attract high-caliber IT professionals.

Service Model and Client Profile

Michael Page Thailand primarily serves:

• Multinational corporations expanding regional technology operations

• Fortune 500 companies implementing enterprise transformation

• Technology-driven startups scaling leadership teams

• Organizations undergoing digital modernization

The agency’s consultative model emphasizes tailored search strategies, discreet executive recruitment, and detailed candidate shortlisting rather than high-volume placements.

Comparative Positioning in Thailand’s IT Recruitment Market

| Strategic Factor | Michael Page Thailand Strength |

|---|---|

| Specialization Depth | Focus on senior and transformation roles |

| Assessment Rigor | Combination of BBI and adaptive technical exams |

| Market Intelligence | Proprietary salary and talent data analytics |

| Client Segment | Startups to Fortune 500 enterprises |

| Risk Mitigation | Structured and evidence-based vetting process |

Strategic Importance in 2026

As Thailand continues advancing toward a more digitally integrated economy in 2026, organizations increasingly require technology professionals who can lead change, implement complex systems, and align IT strategy with business growth.

Michael Page Thailand occupies a strategic niche among the top recruitment agencies for IT and software hiring in Thailand by concentrating on precision, predictive assessment, and market intelligence. For companies seeking high-impact technology leaders and specialized professionals capable of driving organizational transformation, the agency remains one of the most reputable and analytically driven recruitment partners in the market.

5. Robert Walters Thailand

Within Thailand’s highly competitive recruitment sector in 2026, Robert Walters Thailand has established a strong reputation for its data-driven and insight-oriented recruitment strategy. Operating primarily in Bangkok, the firm is particularly recognized for placing permanent and contract professionals across technology-intensive industries.

Technology and Transformation is positioned as one of the agency’s core disciplines, reflecting Thailand’s continued digital acceleration across finance, e-commerce, telecommunications, manufacturing, and enterprise services. Rather than operating purely as a transactional recruiter, Robert Walters Thailand emphasizes strategic workforce planning, talent analytics, and long-term hiring sustainability.

Technology and Transformation as a Core Discipline

In 2026, organizations in Thailand are prioritizing digital resilience, cybersecurity preparedness, cloud modernization, and advanced analytics capabilities. Robert Walters Thailand aligns its recruitment focus accordingly, concentrating on roles that enable transformation at both technical and leadership levels.

High-Demand IT and Technology Roles Identified

| Technology Segment | Example Positions |

|---|---|

| Cybersecurity | Security Architect, SOC Analyst, IT Risk Manager |

| Data and Analytics | Data Engineer, Data Scientist, BI Developer |

| Infrastructure and Cloud | Cloud Engineer, Systems Architect, DevOps Engineer |

| Digital Transformation | Transformation Manager, IT Program Lead |

| Enterprise Applications | ERP Specialist, IT Business Partner |

By concentrating on these strategic functions, the firm addresses areas where talent shortages are most pronounced in Thailand’s IT employment market.

Data-Led Recruitment Methodology

Robert Walters Thailand differentiates itself through the integration of market data, hiring analytics, and structured talent insights into its recruitment process. This approach supports more accurate compensation benchmarking, realistic hiring timelines, and improved candidate matching.

Data-Driven Recruitment Framework

| Analytical Component | Strategic Application |

|---|---|

| Salary Benchmarking | Competitive offer structuring |

| Talent Availability Analysis | Market supply and demand forecasting |

| Hiring Trend Monitoring | Identification of emerging IT roles |

| Location-Based Insights | Bangkok-centric talent mapping |

| Retention Risk Indicators | Early identification of turnover risks |

This intelligence-based model allows employers to make more informed hiring decisions, particularly in technology disciplines where market conditions evolve rapidly.

Recruitment Process Outsourcing and Managed Services

Beyond traditional permanent and contract recruitment, Robert Walters Thailand offers specialized outsourcing solutions tailored to technology teams. These include Recruitment Process Outsourcing (RPO) and Managed Service Provider (MSP) models.

RPO and MSP solutions are particularly relevant for organizations scaling digital capabilities across multiple departments or launching region-wide transformation programs.

Outsourcing Solutions Overview

| Service Model | Key Characteristics | Ideal Client Type |

|---|---|---|

| Recruitment Process Outsourcing | Embedded recruitment teams, end-to-end hiring | Large enterprises with ongoing hiring needs |

| Managed Service Provider | Centralized vendor management for contractors | Companies managing multiple tech vendors |

| Permanent Recruitment | Targeted search for long-term technology roles | Organizations building stable IT teams |

| Contract Staffing | Short-term technical deployments | Project-based IT initiatives |

These structured outsourcing models provide flexibility for businesses that require scalable hiring support without overextending internal HR resources.

Retention Strategy and Human-Centric Leadership

With the average tenure of Thai professionals currently estimated at approximately 2.4 years, employee retention has become a strategic concern for employers. In response, Robert Walters Thailand emphasizes a Human-Centric Leadership approach when advising clients.

Rather than focusing solely on placement speed, the firm supports clients in designing roles, leadership structures, and workplace policies that enhance long-term engagement among IT professionals.

Retention Strategy Matrix

| Retention Challenge | Recommended Focus Area |

|---|---|

| Short Average Tenure | Clear career progression pathways |

| High Skill Mobility | Competitive compensation and benefits |

| Digital Workforce Expectations | Flexible remote or hybrid arrangements |

| Leadership Gaps | Human-centric and transparent management |

| Burnout in Tech Roles | Workload balance and well-being programs |

This advisory approach is particularly relevant in Thailand’s competitive technology market, where skilled professionals frequently receive multiple job offers.

Workplace Trends Influencing IT Hiring in 2026

Robert Walters Thailand has identified several defining trends shaping technology recruitment decisions in 2026:

• Sustained demand for cybersecurity expertise as digital threats increase

• Continued growth in data analytics and AI-driven roles

• Ongoing investment in IT infrastructure modernization

• Strong candidate preference for remote and hybrid work models

Technology Hiring Trend Overview

| Trend Category | Market Impact in Thailand |

|---|---|

| Cybersecurity Demand | Elevated hiring urgency across industries |

| Data and Analytics Expansion | Growing need for advanced analytical talent |

| Cloud and Infrastructure Growth | Modernization of enterprise IT systems |

| Remote Work Preference | Influences offer acceptance rates |

| Hybrid Work Models | Competitive differentiator for employers |

Employers who align hiring strategies with these workforce expectations are more likely to secure high-quality IT candidates in a competitive environment.

Strategic Position in Thailand’s IT Recruitment Landscape

In the context of the top recruitment agencies for hiring IT and software employees in Thailand in 2026, Robert Walters Thailand is positioned as a strategic, analytics-driven recruitment partner. Its strengths are most evident in:

• Data-backed hiring advisory

• Strong focus on technology and transformation roles

• Advanced outsourcing solutions for tech workforce management

• Retention-centered workforce strategy

• Deep understanding of Bangkok’s IT labor market

Competitive Strength Summary

| Strategic Dimension | Robert Walters Thailand Advantage |

|---|---|

| Data Integration | Evidence-based recruitment decisions |

| Technology Specialization | Focus on transformation and IT leadership |

| Flexible Hiring Models | RPO and MSP solutions for scalability |

| Retention Advisory | Human-centric workforce guidance |

| Market Intelligence | Up-to-date insights on tech talent trends |

As Thailand’s digital economy continues expanding in 2026, Robert Walters Thailand remains a prominent recruitment agency for organizations seeking structured, data-led, and retention-focused IT hiring strategies in Bangkok and beyond.

6. RECRUITdee

In Thailand’s rapidly evolving digital economy in 2026, specialized recruitment expertise has become increasingly valuable. Among the top recruitment agencies for hiring IT and software employees in Thailand, RECRUITdee distinguishes itself as a boutique firm dedicated exclusively to the technology sector. Based in Bangkok and backed by more than 25 years of industry experience, the agency operates with a consultative, precision-driven recruitment model.

Unlike generalist agencies that cover multiple industries, RECRUITdee focuses solely on IT and digital roles. This singular focus enables deeper technical understanding, more accurate candidate evaluation, and stronger alignment with technology-driven organizations, ranging from high-growth startups to established enterprises.

Exclusive Focus on IT and Software Recruitment

RECRUITdee’s specialization allows the firm to develop in-depth knowledge across programming languages, cloud infrastructure, data platforms, and modern development methodologies. Its team of more than 30 recruitment experts organizes itself by role type, ensuring that consultants understand the technical nuances of the positions they fill.

Technology Specialization Coverage

| Technology Domain | Core Areas of Expertise |

|---|---|

| Backend Development | Node.js, Go, Python |

| Cloud Infrastructure | AWS, Azure |

| Data Platforms | Cloud data engineering and analytics systems |

| Full-Stack Development | Modern web application frameworks |

| DevOps and Engineering | CI/CD pipelines, infrastructure automation |

This role-based specialization enhances screening accuracy, especially when evaluating mid-to-senior level candidates who must demonstrate both technical mastery and architectural understanding.

Consultative Recruitment Approach

RECRUITdee operates with a consultative recruitment model designed to support strategic hiring decisions rather than transactional placements. The firm works closely with clients to define technical requirements, organizational culture expectations, leadership dynamics, and long-term growth objectives.

Consultative Hiring Framework

| Recruitment Stage | Value Delivered to Clients |

|---|---|

| Requirement Scoping | Detailed technical and cultural role profiling |

| Talent Mapping | Identification of both active and passive candidates |

| Technical Pre-Screening | Verification of relevant development and cloud skills |

| Cultural Fit Assessment | Alignment with team structure and leadership style |

| Offer Strategy Advisory | Market-informed compensation guidance |

This structured methodology is particularly effective for mid-to-senior level IT hires, where incorrect placements can significantly impact project delivery and team morale.

Access to High-Impact Passive Talent

A notable differentiator for RECRUITdee is its strong relationships with what it refers to as “10X individuals.” These are high-performing technology professionals who are typically not actively seeking new employment but are open to compelling opportunities that offer meaningful career progression, technical challenges, or competitive compensation packages.

Passive Talent Engagement Strategy

| Talent Segment | Strategic Importance |

|---|---|

| Passive Senior Developers | Hard-to-access but highly impactful hires |

| Cloud and Data Specialists | Critical for digital transformation initiatives |

| Technical Architects | Key decision-makers in system design |

| Startup-Ready Engineers | Agile professionals suited for fast-paced teams |

By nurturing long-term relationships with these high-caliber professionals, RECRUITdee enables clients to access talent beyond traditional job board applicants, improving the overall quality of candidate pipelines.

Candidate Guarantee and Risk Mitigation

To reinforce confidence in its selection process, RECRUITdee offers a 90-day refund guarantee if a placed candidate leaves within the probationary period. This guarantee reflects the firm’s commitment to precise technical evaluation and cultural alignment.

Risk Mitigation Model

| Risk Factor | Mitigation Strategy |

|---|---|

| Technical Mismatch | Detailed technical screening by role specialists |

| Cultural Misalignment | In-depth client and candidate consultation |

| Early Attrition | 90-day refund guarantee policy |

| Hiring Uncertainty | Transparent communication and structured evaluation |

In Thailand’s competitive IT hiring market, where turnover can be costly, this policy provides clients with an added layer of security and accountability.

Team Structure and Role-Based Expertise

RECRUITdee’s team of more than 30 experts operates in focused verticals based on technical roles rather than broad industry segments. This structure allows recruiters to maintain up-to-date knowledge of programming frameworks, cloud certifications, and emerging development trends.

Role-Based Recruitment Model

| Recruitment Vertical | Technical Focus |

|---|---|

| Backend Engineering | Server-side frameworks and API development |

| Cloud Engineering | Infrastructure design and migration |

| Data Engineering | Cloud-based analytics and pipeline management |

| Software Architecture | System scalability and design optimization |

| DevOps Engineering | Automation and deployment strategies |

This specialization ensures more meaningful conversations with candidates and more precise shortlisting for clients.

Strategic Position in Thailand’s IT Recruitment Market in 2026

As Thailand continues strengthening its position as a regional technology hub in 2026, demand for highly skilled software engineers, cloud architects, and data specialists remains strong. In this environment, RECRUITdee occupies a distinct niche among the top recruitment agencies for IT and software employees in Thailand.

Competitive Strength Matrix

| Strategic Dimension | RECRUITdee Advantage |

|---|---|

| Industry Focus | Exclusive specialization in technology roles |

| Consultative Depth | Mid-to-senior level strategic hiring support |

| Passive Talent Access | Strong network of high-performing professionals |

| Technical Expertise | Recruiters aligned by programming and cloud domains |

| Risk Protection | 90-day candidate guarantee policy |

For organizations seeking precision hiring, access to elite passive candidates, and role-specific technical recruitment expertise, RECRUITdee represents a boutique yet highly specialized option within Thailand’s IT recruitment landscape in 2026.

7. ADI Resourcing

In Thailand’s competitive IT and software recruitment landscape in 2026, ADI Resourcing, operating under ADI Group, has established itself as a prominent IT staffing and outsourcing specialist across Southeast Asia. With more than 15 years of operational experience in the Thai market, the firm has developed deep expertise in supporting organizations that require flexible, project-driven technology talent solutions.

As digital transformation initiatives accelerate across banking, fintech, e-commerce, logistics, and enterprise IT, companies increasingly demand scalable workforce models. ADI Resourcing is particularly recognized for its strength in managing the complexities of IT staff augmentation, making it a strong contender among the top recruitment agencies for hiring IT and software employees in Thailand in 2026.

Core Focus: IT Staff Augmentation and Flexible Workforce Models

Unlike traditional recruitment agencies that primarily focus on permanent placements, ADI Resourcing allocates a significant portion of its services to IT staff augmentation. This model is especially relevant in 2026, as businesses frequently scale technical teams up or down depending on project cycles, digital rollouts, and system upgrades.

Service Concentration Overview

| Service Category | Approximate Focus Allocation | Strategic Purpose |

|---|---|---|

| Traditional Recruitment | 20% | Permanent and long-term IT hires |

| IT Staff Augmentation | 30% | Contract-based technical deployment |

| IT Outsourcing Support | Remaining service scope | Project and managed service support |

This distribution reflects ADI’s versatility in addressing both stable, long-term hiring needs and short-term project-based demands.

IT Staff Augmentation Capabilities

IT staff augmentation allows organizations to integrate external technical professionals into internal teams without long-term employment commitments. ADI Resourcing manages this process comprehensively, handling administrative, compliance, and operational components.

Typical IT Augmentation Roles

| Technology Domain | Example Positions |

|---|---|

| Software Development | Backend Developer, Full-Stack Engineer |

| Cloud and Infrastructure | Cloud Engineer, DevOps Specialist |

| Enterprise Systems | ERP Consultant, Systems Analyst |

| Data and Analytics | Data Engineer, BI Specialist |

| Project Management | IT Project Manager, Scrum Master |

This flexible deployment model enables clients to maintain project timelines while avoiding permanent headcount expansion.

Compliance, Payroll, and Administrative Support

A key differentiator for ADI Resourcing in Thailand’s IT recruitment market is its strong compliance and workforce administration framework. The firm provides end-to-end employment support, reducing operational complexity for clients, especially multinational companies hiring foreign specialists.

Comprehensive Support Services

| Support Function | Client Benefit |

|---|---|

| Payroll Administration | Accurate salary processing and tax compliance |

| Visa and Work Permit Assistance | Legal employment facilitation for foreign hires |

| Employment Contract Management | Regulatory alignment with Thai labor laws |

| Technical Assessments | Pre-deployment validation of skill levels |

| HR Advisory | Guidance on workforce structure and policy |

This administrative depth is particularly important in Thailand, where labor regulations, work permit requirements, and payroll compliance must be carefully managed to avoid legal risks.

Consultative and Value-Driven Recruitment Approach

Beyond operational execution, ADI Resourcing emphasizes a consultative recruitment methodology. Rather than simply filling roles, the firm invests in understanding each client’s organizational culture, leadership philosophy, and long-term growth objectives.

Consultative Screening Framework

| Evaluation Dimension | Purpose in IT Hiring |

|---|---|

| Technical Competency Verification | Ensures candidates meet project standards |

| Business Alignment Assessment | Confirms compatibility with company vision |

| Cultural Fit Evaluation | Reduces risk of early attrition |

| Long-Term Growth Potential | Supports workforce sustainability |

| Stakeholder Consultation | Aligns hiring strategy with leadership goals |

This approach is particularly valuable for companies undergoing digital transformation, where cultural alignment and adaptability are just as important as technical expertise.

Strategic Advantages in Thailand’s IT Hiring Landscape

As Thailand continues to attract regional technology investment in 2026, organizations require recruitment partners capable of balancing speed, compliance, flexibility, and long-term workforce strategy. ADI Resourcing’s hybrid service model addresses these priorities effectively.

Competitive Strength Matrix

| Strategic Dimension | ADI Resourcing Advantage |

|---|---|

| IT Staff Augmentation Expertise | Strong project-based workforce scaling |

| Regional Experience | Over 15 years in the Thai IT market |

| Compliance Infrastructure | Visa, payroll, and regulatory support |

| Service Flexibility | Mix of permanent and contract solutions |

| Consultative Engagement | Focus on long-term alignment and growth |

Relevance for 2026 IT and Software Hiring in Thailand

In a market defined by evolving project demands, cross-border hiring requirements, and digital modernization initiatives, ADI Resourcing plays a strategic role among Thailand’s leading IT staffing providers. Its expertise in IT staff augmentation, combined with comprehensive compliance support and consultative screening, makes it particularly suitable for:

• Enterprises managing fluctuating technology project pipelines

• Multinational corporations requiring work permit assistance

• Organizations scaling cloud, data, or system implementation teams

• Companies seeking both short-term agility and long-term workforce alignment

As Thailand’s digital economy continues expanding in 2026, ADI Resourcing remains a versatile and compliance-focused partner for IT and software recruitment across the region.

8. JAC Recruitment Thailand

In Thailand’s increasingly globalized technology and industrial landscape in 2026, JAC Recruitment Thailand occupies a distinctive position as a leading recruitment agency specializing in bilingual professionals, particularly those fluent in Japanese and Thai. The firm is widely regarded as an essential hiring partner for Japanese multinational corporations operating in Thailand, especially within manufacturing, automotive, electronics, and technology-driven industries.

As cross-border business collaboration between Thailand and Japan continues to expand, demand for bilingual IT professionals, project managers, and technology leaders has grown significantly. JAC Recruitment Thailand addresses this niche with a structured and internationally aligned recruitment framework.

Specialization in Bilingual and Japanese-Focused Recruitment

JAC Recruitment Thailand’s strong Japanese business heritage enables it to serve companies requiring professionals who can operate seamlessly across Thai and Japanese corporate environments. In the IT and software sector, this capability is particularly critical for system implementation projects, regional digital coordination, and technical operations involving Japanese headquarters.

Bilingual IT Roles Frequently Recruited

| Role Category | Example Positions |

|---|---|

| IT Project Management | Bilingual IT Project Manager |

| Systems Engineering | Infrastructure Engineer (Japanese-speaking) |

| Software Development | Application Developer for Japanese MNCs |

| ERP and Enterprise Systems | SAP Consultant with Japanese proficiency |

| Technical Coordination | Regional IT Liaison Officer |

This bilingual specialization differentiates JAC Recruitment Thailand from generalist agencies that may lack cultural fluency and language-specific candidate networks.

Extensive Professional Database and Structured Hiring Process

JAC Recruitment Thailand provides access to a talent database of more than 300,000 professionals. This extensive network spans multiple industries, including industrial manufacturing, technology, supply chain, and corporate services.

The agency is recognized for its streamlined recruitment workflow, which moves efficiently from initial discovery call to candidate shortlisting. This process-driven approach ensures clarity in role requirements before talent sourcing begins.

Recruitment Workflow Overview

| Recruitment Stage | Key Objective |

|---|---|

| Discovery Consultation | Define technical scope and language requirements |

| Role Profiling | Clarify responsibilities and reporting lines |

| Market Mapping | Identify suitable bilingual candidates |

| Candidate Shortlisting | Present qualified and pre-screened profiles |

| Interview Coordination | Facilitate cross-cultural communication |

| Offer Advisory | Support competitive and sustainable packages |

This structured methodology reduces hiring delays and enhances alignment between employer expectations and candidate capabilities.

Strategic Role Design and Compensation Advisory

One of JAC Recruitment Thailand’s notable advisory strengths lies in its emphasis on strategic role design before entering salary negotiations. The firm advocates that employers clearly articulate job scope, career progression, reporting structure, and value proposition prior to finalizing compensation discussions.

This approach aims to reduce two common risks in Thailand’s competitive IT hiring market:

• Overpaying due to unclear role definition

• Early attrition resulting from mismatched expectations

Strategic Hiring Advisory Matrix

| Hiring Challenge | JAC Recruitment Thailand Recommendation |

|---|---|

| Unclear Role Scope | Define measurable responsibilities |

| Salary Inflation Pressure | Benchmark compensation before negotiation |

| High Early Attrition Risk | Align expectations through transparent communication |

| Cross-Cultural Misalignment | Clarify reporting and communication frameworks |

| Retention Uncertainty | Emphasize career development pathways |

By focusing on clarity and value articulation, the agency helps clients maintain compensation discipline while improving long-term retention outcomes.

Global Recognition and Industry Presence

JAC Recruitment has achieved international recognition, ranking 9th in the “SIA’s 2025 Largest Direct Hire Firms Globally.” This global standing reinforces its credibility, particularly for multinational clients seeking standardized recruitment practices across different markets.

In Thailand, the firm maintains a well-established presence in specialized industrial and technology sectors, including:

Industry Coverage Overview

| Industry Sector | Relevance to IT Hiring in 2026 |

|---|---|

| Manufacturing and Industrial | Automation systems and factory IT integration |

| Automotive and Electronics | Embedded systems and engineering IT roles |

| Technology and Digital Services | Software development and infrastructure |

| Supply Chain and Logistics | ERP and system optimization roles |

| Corporate Services | Regional IT coordination and support |

This diversified industry reach strengthens its ability to support Japanese MNCs with complex operational footprints in Thailand.

Strategic Relevance in Thailand’s IT Recruitment Market in 2026

As Thailand continues strengthening its role as a regional hub for Japanese investment and digital innovation, bilingual technology professionals remain in high demand. JAC Recruitment Thailand’s dual-language specialization, structured hiring advisory, and large professional database position it as a strategic recruitment partner for cross-border IT and software hiring.

Competitive Strength Matrix

| Strategic Dimension | JAC Recruitment Thailand Advantage |

|---|---|

| Bilingual Expertise | Strong Japanese–Thai talent network |

| Database Depth | Access to over 300,000 professionals |

| Process Efficiency | Streamlined discovery-to-shortlisting model |

| Strategic Compensation Advisory | Emphasis on role clarity before salary negotiation |

| Global Recognition | Ranked among largest direct hire firms globally |

| Industry Specialization | Established presence in industrial and tech sectors |

For Japanese multinational corporations and organizations seeking bilingual IT professionals in Thailand in 2026, JAC Recruitment Thailand remains one of the most strategically positioned recruitment agencies in the market.

9. ISM Technology Recruitment

In Thailand’s competitive and rapidly evolving technology employment landscape in 2026, ISM Technology Recruitment stands out as one of the most established ICT-focused recruitment providers in the country. Operating in Thailand since 1991, ISM has built a long-standing reputation as a specialist agency dedicated exclusively to information and communications technology.

As digital transformation initiatives continue to reshape industries such as finance, telecommunications, manufacturing, and e-commerce, the need for highly specialized IT recruitment partners remains strong. ISM’s longevity and exclusive technology focus position it as a trusted provider for both permanent placements and fixed-term contractor solutions.

Exclusive Focus on the ICT Sector

Unlike generalist recruitment agencies that operate across multiple industries, ISM Technology Recruitment concentrates entirely on ICT and technology-related roles. This pure tech focus enables its consultants to maintain a deeper understanding of evolving technical stacks, infrastructure requirements, and enterprise IT demands.

ICT-Focused Recruitment Coverage

| Technology Segment | Example Positions |

|---|---|

| Software Development | Backend Developer, Full-Stack Engineer |

| Infrastructure and Networking | Network Engineer, Systems Administrator |

| Cloud and DevOps | Cloud Engineer, DevOps Specialist |

| Enterprise Applications | ERP Consultant, Application Support Analyst |

| IT Project Management | IT Project Manager, Technical Program Lead |

This specialization allows ISM to assess candidates not only on general experience but also on specific technical competencies aligned with client project requirements.

Permanent and Contractor Solutions

ISM Technology Recruitment provides both permanent hiring solutions and fixed-term contractor placements. In 2026, many organizations in Thailand adopt hybrid workforce models that blend long-term team building with short-term project support. ISM’s dual offering supports this flexible approach.

Workforce Solution Overview

| Service Type | Strategic Purpose |

|---|---|

| Permanent Recruitment | Long-term team development |

| Fixed-Term Contract Staffing | Project-based or temporary technical needs |

| IT Outsourcing Support | Flexible workforce expansion |

| Specialist Talent Sourcing | Hard-to-find ICT skill sets |

This balanced service model makes ISM particularly suitable for companies undergoing system upgrades, digital migration projects, or infrastructure expansion.

Pure Technology Consulting Expertise

A defining characteristic of ISM Technology Recruitment is that its consultants focus exclusively on IT outsourcing and technology recruitment. This structure ensures that recruiters maintain up-to-date technical knowledge and are capable of engaging meaningfully with hiring managers and candidates on complex ICT topics.

Technical Depth Advantage Matrix

| Recruitment Feature | Client Benefit |

|---|---|

| Dedicated IT Consultants | Accurate understanding of technical requirements |

| Sector-Specific Screening | Improved candidate-to-role alignment |

| Industry Knowledge | Awareness of evolving ICT trends |

| Technical Vocabulary Fluency | Clear communication with engineers and developers |

| Project-Based Understanding | Better matching for contract roles |

By concentrating exclusively on ICT, ISM reduces the risk of mismatched placements that can occur when recruiters lack specialized technical insight.

Market Longevity and Legacy Database

Having operated in Thailand since 1991, ISM Technology Recruitment is among the longest-standing technology-focused recruitment firms in Bangkok. This longevity provides a significant competitive advantage in terms of candidate relationships and historical market knowledge.

Over decades of operation, the firm has built an extensive legacy database of local IT professionals, including experienced engineers, infrastructure specialists, and technology managers who have progressed through Thailand’s evolving digital ecosystem.

Legacy Advantage Overview

| Strategic Asset | Competitive Impact |

|---|---|

| Long-Term Market Presence | Strong brand recognition in ICT sector |

| Established Candidate Network | Access to experienced local professionals |

| Historical Market Insight | Understanding of salary and skill evolution |

| Repeat Client Relationships | Ongoing partnerships with technology employers |

This institutional memory allows ISM to offer valuable advisory support to clients seeking realistic salary expectations and sustainable hiring strategies in 2026.

Strategic Role in Thailand’s IT Recruitment Landscape

As Thailand continues to expand its digital infrastructure and technology capabilities in 2026, demand remains high for reliable ICT recruitment specialists. ISM Technology Recruitment’s exclusive focus on technology roles, combined with over three decades of local market presence, positions it as a niche yet influential player among Thailand’s top recruitment agencies for IT and software hiring.

Competitive Strength Matrix

| Strategic Dimension | ISM Technology Recruitment Advantage |

|---|---|

| ICT Specialization | Exclusive focus on technology recruitment |

| Market Longevity | Operating in Thailand since 1991 |

| Flexible Workforce Solutions | Permanent and fixed-term contractor placements |

| Legacy Candidate Database | Extensive network of local IT professionals |

| Technical Understanding | Consultants dedicated to IT outsourcing |

For organizations seeking a long-established, technology-only recruitment partner with deep roots in Thailand’s ICT market, ISM Technology Recruitment remains a relevant and experienced option in 2026.

10. Criterion Asia Recruitment

In Thailand’s increasingly competitive technology recruitment landscape in 2026, Criterion Asia Recruitment has positioned itself as a focused partner for multinational corporations seeking mid-to-senior level professionals in both the technology and industrial sectors. Established in 2013, the firm has steadily expanded its footprint across Southeast Asia while maintaining a consultative and relationship-oriented hiring philosophy.

As multinational companies continue investing in Thailand’s digital infrastructure, automation, and industrial technology ecosystems, the demand for experienced IT leaders and specialized professionals has intensified. Criterion Asia Recruitment addresses this need by concentrating on quality-driven placements rather than high-volume hiring.

Focus on Mid-to-Senior Level Technology Talent

Criterion Asia Recruitment specializes in connecting experienced professionals with multinational corporations operating in Thailand’s technology-intensive sectors. Their recruitment scope typically includes managerial, specialist, and leadership roles where strategic thinking and cross-functional collaboration are essential.

Mid-to-Senior IT Roles Frequently Recruited

| Role Category | Example Positions |

|---|---|

| IT Management | IT Manager, Head of IT |

| Digital Transformation | Transformation Manager, Systems Integration Lead |

| Enterprise Applications | ERP Manager, IT Business Partner |

| Infrastructure and Operations | Infrastructure Manager, Cloud Operations Lead |

| Industrial Technology | Automation Systems Specialist, IT-OT Integration Lead |

This emphasis on experienced hires aligns with Thailand’s 2026 market trends, where companies increasingly prioritize leadership stability and technical maturity.

Relationship-Based Recruitment Model

A defining characteristic of Criterion Asia Recruitment is its relationship-based hiring model. Rather than relying solely on database matching or automated filtering systems, the firm prioritizes personal engagement with candidates. This includes face-to-face meetings whenever possible, enabling deeper evaluation of professional motivations, communication style, and cultural compatibility.

In addition to direct interaction, the firm utilizes structured soft skill assessment tools to enhance cultural fit analysis.

Cultural and Soft Skill Evaluation Framework

| Assessment Dimension | Purpose in Mid-Level and Senior Hiring |

|---|---|

| Communication Style Assessment | Evaluates cross-functional collaboration ability |

| Leadership Behavior Analysis | Measures decision-making and influence capacity |

| Cultural Fit Evaluation | Aligns with organizational values and culture |

| Adaptability Review | Determines readiness for dynamic environments |

| Long-Term Motivation Analysis | Assesses retention potential |

This human-centric approach is particularly relevant in Thailand’s IT market, where cultural misalignment is a common factor behind early attrition at managerial levels.

Regional Southeast Asia Presence

Criterion Asia Recruitment operates not only in Thailand but also across Singapore, Indonesia, and Vietnam. This regional footprint provides clients with broader market visibility and cross-border talent intelligence.

For multinational corporations with regional headquarters or operations across Southeast Asia, this perspective is valuable when comparing salary expectations, talent availability, and workforce mobility trends.

Regional Operations Overview

| Country of Operation | Strategic Advantage |

|---|---|

| Thailand | Strong local market expertise |

| Singapore | Access to regional tech leadership talent |

| Indonesia | Emerging digital workforce insights |

| Vietnam | Growing technology outsourcing market |

By maintaining a presence in multiple ASEAN markets, Criterion Asia Recruitment can advise clients on regional hiring strategies rather than focusing exclusively on domestic talent pools.

Niche Expertise in Food Value Chain and Information Technology

A notable specialization of Criterion Asia Recruitment is its focus on the Food Value Chain alongside Information Technology. In Thailand, a major regional hub for food production, agriculture, and industrial processing, digital transformation is increasingly integrated into manufacturing and supply chain operations.

This niche focus allows the firm to support industrial technology companies that require professionals skilled in both operational technology (OT) and IT integration.

Sector Specialization Matrix

| Industry Focus | IT Relevance in 2026 |

|---|---|

| Food Value Chain | Automation, supply chain systems, ERP integration |

| Industrial Manufacturing | IT-OT convergence, factory digitization |

| Information Technology | Software development, cloud systems, cybersecurity |

| Logistics and Distribution | Warehouse management systems and analytics |

This dual-sector expertise enables Criterion Asia Recruitment to support industrial firms undergoing digital transformation, particularly in areas where technology intersects with production and supply chain systems.

Strategic Role in Thailand’s IT Recruitment Market in 2026

As Thailand advances its digital economy while strengthening its industrial and manufacturing base, the need for experienced technology leaders who understand both business operations and IT systems continues to grow. Criterion Asia Recruitment’s mid-to-senior level focus, relationship-driven methodology, and regional reach position it as a strategic recruitment partner for multinational organizations.

Competitive Strength Matrix

| Strategic Dimension | Criterion Asia Recruitment Advantage |

|---|---|

| Mid-to-Senior Focus | Specialized in leadership and managerial roles |

| Relationship-Based Model | Emphasis on face-to-face engagement |

| Soft Skill Assessment | Structured cultural fit evaluation tools |

| Regional ASEAN Presence | Cross-border talent insights |

| Industrial and Tech Expertise | Food value chain and IT specialization |

For multinational corporations operating in Thailand’s technology and industrial sectors in 2026, Criterion Asia Recruitment offers a relationship-driven and regionally informed approach to mid-to-senior IT and transformation hiring.

The 2026 Thailand Information Technology Recruitment Market: Strategic Analysis of Labor Economics, ICT Growth, and Technical Staffing Infrastructure

In 2026, Thailand’s digital economy is experiencing a structural inflection point. While broader macroeconomic indicators reflect moderated national growth, the Information and Communications Technology sector continues to expand at a pace significantly above the national average. This divergence has produced a highly specialized recruitment environment where advanced technical capabilities command premium compensation and strategic prioritization.

Industry forecasts project Thailand’s overall economic growth to stabilize at approximately 1.6 percent. In contrast, the ICT sector is expanding at a compound annual growth rate of 7.5 percent, reaching an estimated market valuation of USD 10.64 billion in 2026. This imbalance has contributed to a polarized labor market, in which hiring for administrative, clerical, and general operations roles has slowed due to fiscal discipline, while demand for cloud engineers, cybersecurity specialists, artificial intelligence professionals, and data architects continues to accelerate.

Recruitment strategies in 2026 are therefore no longer driven by broad headcount expansion. Instead, organizations prioritize high-impact, value-creating technology roles that enable digital transformation, operational resilience, and long-term competitiveness.

Macroeconomic Context and Sectoral Divergence

Thailand’s macroeconomic environment in 2026 is defined by cautious corporate spending, moderated exports, and global economic uncertainty. However, digital transformation initiatives remain insulated from broader cost-cutting cycles due to their strategic importance.

This divergence between national GDP growth and ICT expansion is reshaping labor economics:

Macroeconomic and ICT Growth Comparison

| Economic Indicator | 2026 Projection |

|---|---|

| National GDP Growth | ~1.6% |

| ICT Sector CAGR (2024–2026) | 7.5% |

| Total ICT Market Valuation (2026) | USD 10.64 Billion |

| Primary Growth Drivers | Cloud, AI, Cybersecurity, 5G |

The ICT sector’s resilience is driven by enterprise digitization, fintech innovation, e-commerce expansion, and cloud infrastructure modernization. As a result, recruitment agencies specializing in IT and technical staffing have become central actors in Thailand’s workforce transformation.

Geographic Concentration and Regional Talent Dynamics

The majority of ICT economic activity remains concentrated in Thailand’s Central region, particularly Bangkok and its surrounding metropolitan areas. This geographic concentration significantly influences recruitment strategy and talent sourcing models.

Regional ICT Market Share Distribution

| Region | Market Share Percentage | Strategic Implication |

|---|---|---|

| Central Region | 60.5% | Core recruitment hub; high salary premiums |

| Northeast | 12.3% | Emerging remote talent pool |

| South | 10.6% | Growing digital services adoption |

| Eastern Seaboard | Industrial growth zone | Demand for IT-OT integration talent |

The dominance of Bangkok underscores the importance of dense professional networks, employer branding visibility, and rapid response recruitment capabilities. However, as remote and hybrid work models mature, recruitment agencies increasingly expand sourcing operations into secondary cities and industrial corridors to mitigate talent shortages.

ICT Market Segmentation and Revenue Forecast (2024–2026)

The Thailand ICT market is diversified across four primary segments: IT services, software, hardware, and telecommunications. Among these, IT services represent the most dynamic and rapidly expanding segment, fueled by cloud adoption, cybersecurity investment, and enterprise system integration.

Thailand ICT Market Segmentation Forecast

| Segment Type | 2024 (USD B) | 2025 (USD B) | 2026 (USD B) | Key Growth Catalyst |

|---|---|---|---|---|

| IT Services | 3.22 | 3.48 | 3.76 | Cloud migration, cybersecurity |

| Software | 2.11 | 2.29 | 2.48 | SaaS platforms, AI integration |