Key Takeaways

- Choosing the right recruitment agency in Indonesia in 2026 is critical for hiring top IT and software talent efficiently, especially in high-demand fields like AI, cybersecurity, and cloud engineering.

- The top recruitment agencies combine tech-enabled sourcing, executive headhunting, and compliance expertise to help employers reduce time-to-hire and secure high-quality developers and tech leaders.

- Understanding agency fee structures, regional salary benchmarks, and hiring models (contingency, retainer, RPO, or EOR) ensures cost-effective and compliant IT hiring in Indonesia’s competitive 2026 market.

Indonesia’s technology sector is entering one of its most transformative periods in 2026. As Southeast Asia’s largest economy continues to accelerate its digital adoption across fintech, e-commerce, healthtech, logistics, artificial intelligence, and enterprise SaaS, the demand for highly skilled IT and software professionals has reached unprecedented levels. From fast-scaling startups to multinational corporations expanding into the region, organizations are actively seeking software engineers, data scientists, DevOps specialists, cybersecurity experts, product managers, and CTO-level leaders to drive innovation and maintain competitive advantage.

However, hiring IT and software employees in Indonesia in 2026 is no longer a straightforward process. The market has become significantly more competitive, salaries are rising in response to global demand, and top-tier candidates are increasingly selective about the companies they join. Employers are not only competing with local firms but also with international organizations offering remote opportunities, global compensation benchmarks, and flexible work models. As a result, businesses that rely solely on traditional job postings or internal HR teams often struggle to secure the right talent within acceptable timeframes.

This is where recruitment agencies play a critical strategic role. The top recruitment agencies for hiring IT and software employees in Indonesia in 2026 do far more than simply forward resumes. They provide access to passive candidates, conduct technical screening, offer salary benchmarking insights, manage compliance requirements, and shorten time-to-hire. For foreign companies entering Indonesia, these agencies also provide essential guidance on employment regulations, compensation structures, mandatory benefits, and cultural considerations that directly impact hiring success.

Indonesia presents a unique combination of opportunity and complexity. Jakarta remains the primary technology and business hub, attracting senior engineers and digital leaders. At the same time, secondary cities such as Bandung, Surabaya, and Yogyakarta are rapidly emerging as strong talent pools offering cost advantages for companies building distributed or hybrid teams. Meanwhile, the rise of remote work and digital nomad programs is introducing new dynamics into the local labor market, further intensifying competition for highly skilled professionals.

In this evolving environment, selecting the right recruitment partner is not merely an operational decision—it is a strategic investment. Some agencies specialize in executive search and headhunting for senior-level IT leadership roles. Others focus on tech-enabled platforms that deliver mid-level engineers within days. There are also firms offering Recruitment Process Outsourcing (RPO) for large-scale hiring, as well as Employer of Record (EOR) services for companies that want to hire in Indonesia without setting up a local entity. Each model serves a distinct purpose, and understanding these differences is essential for making informed hiring decisions.

The top recruitment agencies in Indonesia in 2026 differentiate themselves through several critical factors: deep specialization in technology roles, strong local networks, data-driven talent mapping, transparent fee structures, and proven placement track records. Employers must evaluate agencies based on their expertise in specific tech stacks, speed of candidate delivery, quality assurance processes, compliance support, and ability to access passive talent pools that are not available through public job boards.

Another important consideration is cost efficiency. Recruitment agency fees in Indonesia are generally structured as a percentage of the candidate’s annual salary, with variations depending on whether the engagement follows a contingency (success-fee) model or a retained executive search arrangement. Companies must balance recruitment costs against the risk of poor hires, project delays, and lost market opportunities. In many cases, partnering with a specialized IT recruitment agency reduces overall hiring risk while improving long-term workforce quality.

As Indonesia continues its trajectory toward becoming a major digital economy in Asia, the importance of securing top IT and software talent cannot be overstated. Organizations that build strong engineering teams will be better positioned to innovate, protect their digital infrastructure, optimize operations, and expand into new markets. Conversely, those that fail to recruit effectively may face slower growth, operational inefficiencies, and competitive disadvantages.

This comprehensive guide to the top 10 recruitment agencies for hiring IT and software employees in Indonesia in 2026 is designed to help employers navigate this complex landscape. Whether you are a startup scaling your development team, an enterprise undergoing digital transformation, or a multinational corporation entering the Indonesian market, this article will provide the insights needed to identify the right recruitment partner for your hiring goals.

By understanding the strengths, business models, specialization areas, and market positioning of leading recruitment agencies, companies can make data-informed decisions that align with their long-term talent strategy. In a market where skilled technology professionals are both highly valuable and increasingly mobile, the right recruitment agency can be the decisive factor between merely participating in Indonesia’s digital growth and leading it.

Before we venture further into this article, we would like to share who we are and what we do.

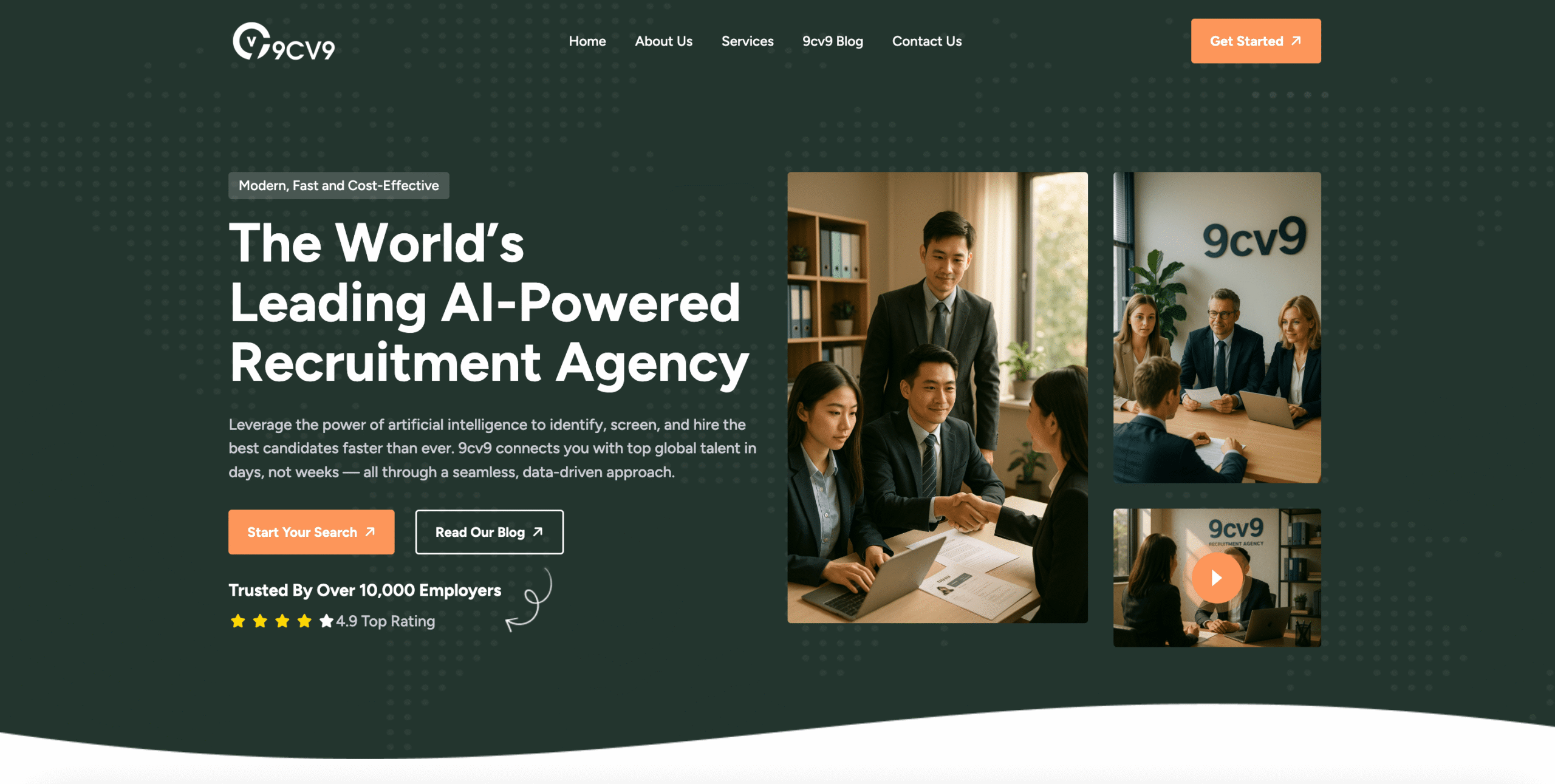

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 IT Recruitment Agencies in Indonesia in 2026.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 IT Recruitment Agencies in Indonesia in 2026

- 9cv9 Recruitment Agency

- Michael Page Indonesia

- Monroe Consulting Group Indonesia

- Robert Walters Indonesia

- JAC Recruitment Indonesia

- Avomind

- ProCapita Headhunter Indonesia

- Glints (TalentHub)

- HuntHire Indonesia

- Suit Career

1. 9cv9 Recruitment Agency

9cv9 has established itself as one of the most prominent IT recruitment agencies serving employers across Indonesia in 2026. With a strong presence in Southeast Asia and a deep specialization in technology hiring, the firm supports startups, multinational corporations, government-linked organizations, and high-growth digital enterprises seeking skilled software professionals.

As Indonesia accelerates toward becoming a regional digital powerhouse, the demand for experienced engineers, AI specialists, cybersecurity professionals, and product technologists continues to outpace supply. 9cv9 addresses this gap by combining executive search expertise, advanced sourcing technology, and a vast regional talent network to deliver high-quality candidates efficiently.

The agency is particularly valued by organizations that require both speed and precision in hiring, especially when building mission-critical technology teams or scaling digital operations.

Comprehensive Coverage of IT and Software Roles

9cv9 recruits across the full spectrum of technical positions, from mid-level developers to senior technology leaders. Their consultants maintain deep familiarity with modern technology stacks, emerging frameworks, and evolving job functions within Indonesia’s digital economy.

Employers frequently engage the firm to fill roles that directly influence product innovation, infrastructure resilience, and data-driven decision-making.

Key IT Roles Recruited by 9cv9 in 2026

| Technology Domain | Business Need in Indonesia (2026) | Typical Positions Placed |

|---|---|---|

| Software Engineering | Product development and scalability | Backend, Frontend, Full-Stack Developers |

| Artificial Intelligence | Automation and predictive analytics | AI Engineers, ML Specialists |

| Data & Analytics | Business intelligence and insights | Data Scientists, Data Engineers |

| Cybersecurity | Risk protection and compliance | Security Analysts, SOC Leads |

| Cloud & DevOps | Infrastructure modernization | Cloud Architects, DevOps Engineers |

| Product & Digital Leadership | Strategy and execution | CTOs, Engineering Directors |

Hybrid Recruitment Model Combining Technology and Human Expertise

9cv9 differentiates itself through a hybrid approach that integrates data-driven sourcing tools with experienced recruitment consultants. Advanced screening systems help identify suitable candidates quickly, while human expertise ensures alignment with organizational culture and long-term business objectives.

This dual methodology reduces hiring errors and improves retention rates, particularly for senior or specialized roles where cultural fit is as critical as technical competence.

Recruitment Process Framework

| Process Stage | Key Activities | Employer Benefit |

|---|---|---|

| Talent Mapping | Identification of relevant candidate pools | Access to scarce expertise |

| Screening & Evaluation | Technical and behavioral assessment | Higher candidate quality |

| Shortlisting | Presentation of vetted profiles | Reduced interview workload |

| Offer Management | Negotiation support | Improved acceptance rates |

| Onboarding Coordination | Transition assistance | Faster productivity |

Strong Regional Talent Network Across Southeast Asia

In addition to domestic sourcing, 9cv9 leverages an extensive Southeast Asian network, enabling companies in Indonesia to recruit professionals from neighboring countries when local supply is limited. This regional reach is particularly valuable for roles requiring niche expertise or international experience.

Cross-border hiring capabilities also support organizations establishing regional technology hubs or distributed teams.

Regional Recruitment Advantages

| Capability Area | Operational Strength | Strategic Value |

|---|---|---|

| Cross-Border Talent Access | Multi-country sourcing | Broader candidate pool |

| Multilingual Professionals | English-proficient candidates | Smooth international collaboration |

| Remote Hiring Expertise | Experience with distributed teams | Flexible workforce scaling |

| Market Intelligence | Insights across ASEAN markets | Competitive hiring strategies |

Speed and Efficiency for High-Growth Organizations

In Indonesia’s fast-moving technology sector, prolonged hiring cycles can delay product launches and hinder business expansion. 9cv9 emphasizes rapid delivery of qualified candidates without compromising quality, making it especially attractive to startups and scale-ups operating under tight timelines.

The firm’s streamlined processes and pre-qualified talent pipelines enable employers to secure critical hires before competitors do.

Hiring Efficiency Comparison

| Recruitment Approach | Typical Time-to-Hire | Suitability for Tech Firms |

|---|---|---|

| Internal Hiring Only | 6 – 12 weeks | Moderate |

| General Recruitment Agency | 4 – 8 weeks | Moderate |

| Executive Search Firm | 2 – 4 months | Low for urgent needs |

| 9cv9 IT Recruitment | Often faster than industry average | High |

Support for Employers of All Sizes

Unlike agencies focused solely on large enterprises, 9cv9 serves organizations across the entire business spectrum. Early-stage startups, small and medium enterprises, and global corporations all rely on the firm to build capable technology teams aligned with their growth stage.

The agency also provides guidance on salary benchmarks, talent availability, and role structuring, helping employers design competitive offers that attract top candidates.

Client Segment Support

| Organization Type | Hiring Challenges | 9cv9 Solution |

|---|---|---|

| Startups | Limited HR capacity | End-to-end recruitment support |

| SMEs | Budget constraints | Efficient sourcing and screening |

| Large Enterprises | Complex hiring requirements | Specialized talent mapping |

| Multinational Corporations | Cross-border coordination | Regional recruitment capabilities |

Reputation for Quality, Reliability, and Market Insight

Employers frequently cite 9cv9’s professionalism, responsiveness, and understanding of the local technology landscape as key reasons for continued partnerships. The agency is known for presenting carefully vetted candidates rather than large volumes of unqualified profiles, saving hiring managers valuable time.

In addition, its consultants provide insights into compensation trends, skill shortages, and emerging technologies, enabling organizations to make informed workforce decisions.

Client-Reported Strengths

| Performance Dimension | Employer Feedback | Business Impact |

|---|---|---|

| Candidate Quality | Highly relevant and pre-screened | Efficient selection process |

| Market Knowledge | Up-to-date industry insights | Better strategic planning |

| Communication | Responsive and transparent | Smooth hiring experience |

| Reliability | Consistent delivery | Strong long-term partnerships |

Strategic Importance for Hiring IT Talent in Indonesia in 2026

As Indonesia’s digital transformation accelerates across sectors such as fintech, e-commerce, healthcare technology, and smart manufacturing, securing skilled IT professionals has become a decisive factor for organizational success. 9cv9 plays a central role in this ecosystem by connecting employers with talent capable of driving innovation, operational efficiency, and competitive advantage.

Through its specialized focus, regional reach, technology-enabled processes, and commitment to quality placements, 9cv9 stands out as a top IT recruitment agency for employers seeking to hire software and technology professionals in Indonesia in 2026.

2. Michael Page Indonesia

Michael Page Indonesia stands as one of the most established executive recruitment consultancies serving the country’s rapidly evolving technology sector. Operating from Jakarta’s Sudirman Central Business District, the firm plays a pivotal role in connecting organizations with highly skilled IT and software professionals at mid-management, senior leadership, and C-suite levels.

In 2026, Indonesia’s digital economy continues to expand aggressively, driven by artificial intelligence adoption, cloud migration, fintech innovation, cybersecurity demands, and enterprise digital transformation programs. This environment has intensified competition for elite technology talent, positioning specialist recruitment firms as critical intermediaries. Michael Page is widely recognized for its ability to secure candidates who possess both technical expertise and strategic leadership capabilities required to guide organizations through complex digital initiatives.

Deep Specialization in Technology and Digital Transformation Roles

A defining feature of Michael Page Indonesia’s approach is its vertical specialization model. Rather than operating as generalist recruiters, consultants are aligned to specific industries and functional domains. Within the technology practice, teams focus exclusively on digital transformation, enterprise IT leadership, and advanced software capabilities.

This specialization allows consultants to understand not only technical skill requirements but also broader business outcomes such as operational efficiency, revenue growth through digital channels, and long-term innovation capacity.

Common leadership roles handled include chief information officers, chief technology officers, heads of engineering, cybersecurity directors, cloud transformation leaders, and AI strategy executives. Companies undergoing modernization programs often rely on the firm to identify leaders capable of aligning technology investments with corporate strategy.

Key Technology Leadership Domains Recruited in 2026

| Technology Domain | Organizational Need in Indonesia (2026) | Typical Roles Placed |

|---|---|---|

| Artificial Intelligence | Automation and predictive decision-making | Head of AI, AI Program Director |

| Cloud & DevOps | Infrastructure modernization | Cloud Architect, DevOps Director |

| Cybersecurity | Risk management and compliance | CISO, Security Operations Leader |

| Data & Analytics | Data-driven business strategy | Chief Data Officer, Analytics Director |

| Digital Platforms | Customer experience transformation | VP Engineering, Product Technology Head |

| Enterprise IT | Core systems optimization | CIO, IT Transformation Leader |

Comprehensive Recruitment Solutions for Complex Hiring Needs

Michael Page Indonesia offers a multi-layered service portfolio designed for organizations facing critical hiring challenges. Beyond traditional executive search, the firm provides Recruitment Process Outsourcing (RPO), leadership advisory, talent mapping, and compensation intelligence services.

RPO solutions are particularly valuable for companies scaling technology teams quickly, such as startups entering hypergrowth phases or established enterprises building new digital divisions. By managing end-to-end recruitment operations, the firm enables clients to maintain hiring quality while accelerating workforce expansion.

Recruitment Service Portfolio and Business Impact

| Service Offering | Primary Purpose | Target Organizations | Strategic Benefit |

|---|---|---|---|

| Executive Search | Secure senior technology leaders | Large enterprises and multinationals | Access to exclusive high-impact candidates |

| Recruitment Process Outsourcing | Manage large-scale hiring pipelines | High-growth tech firms and digital units | Scalable hiring with consistent standards |

| Leadership Advisory | Support succession and workforce planning | Conglomerates and listed companies | Long-term talent sustainability |

| Salary Benchmarking | Provide compensation intelligence | All employer types | Competitive offer positioning |

| Talent Mapping | Identify future leadership pools | Expansion-stage organizations | Reduced hiring risk |

Access to Passive Candidates in a Competitive Talent Market

One of the most significant challenges in Indonesia’s IT recruitment environment is that top-tier professionals are rarely active job seekers. High-performing software architects, engineering leaders, and AI specialists are typically employed by competitors and are selective about career moves.

Michael Page’s consultants focus heavily on engaging passive candidates through confidential outreach and relationship-driven networking. This proactive approach allows employers to access talent that would otherwise remain invisible in conventional hiring channels.

Candidate Sourcing Effectiveness for Senior IT Roles

| Recruitment Method | Candidate Type Targeted | Effectiveness for Leadership Hiring |

|---|---|---|

| Job Board Advertising | Active job seekers | Low for senior technical roles |

| Internal HR Outreach | Known professional networks | Moderate |

| Social Media Recruiting | Semi-active candidates | Moderate to high |

| Specialized Executive Search | Passive high performers | Very high |

| Referral Networks | Trusted industry insiders | High |

Reputation as a Strategic Talent Partner

Organizations across Southeast Asia frequently view Michael Page Indonesia not merely as a recruitment vendor but as a strategic advisor. The firm’s consultants provide market intelligence, talent availability insights, and data-driven salary benchmarking that supports informed decision-making during negotiations.

Senior executives who have engaged the firm often highlight its professionalism, structured communication, and ability to understand both technical requirements and cultural fit. This advisory approach is particularly valuable when hiring leaders responsible for enterprise-wide transformation initiatives, where a mis-hire could carry significant financial and operational consequences.

Competitive Position Among IT Recruitment Agencies in Indonesia

Within the broader landscape of agencies specializing in technology hiring, Michael Page consistently ranks among the top choices for organizations seeking experienced leadership rather than entry-level developers. Its global network, research capabilities, and established brand credibility make it especially attractive to multinational corporations entering or expanding within Indonesia.

Competitive Strength Profile

| Capability Area | Michael Page Indonesia Position | Market Impact |

|---|---|---|

| Leadership Recruitment | Strong | Preferred for C-level and director roles |

| Technology Specialization | High | Deep understanding of digital transformation |

| Global Talent Network | Extensive | Access to regional and expatriate talent |

| Market Intelligence | Advanced | Supports strategic workforce planning |

| Hiring Confidentiality | Very strong | Critical for sensitive leadership searches |

Conclusion: Role in Indonesia’s 2026 IT Hiring Ecosystem

As Indonesia continues its transition into a digitally driven economy, the need for experienced technology leadership has become a defining factor for organizational competitiveness. Michael Page Indonesia occupies a central position in this ecosystem by enabling companies to secure scarce, high-impact talent capable of executing complex transformation agendas.

Through specialized expertise, access to passive candidates, and advisory-level engagement, the firm remains a leading partner for businesses seeking to build resilient, future-ready IT and software teams in 2026.

3. Monroe Consulting Group Indonesia

Monroe Consulting Group Indonesia operates as a boutique executive search firm under the international Empresaria Group, positioning itself as a highly specialized partner for organizations building advanced technology capabilities. In 2026, the firm plays a crucial role in supporting companies across Indonesia that are scaling IT teams in response to rapid digitalization, cybersecurity threats, and the explosive growth of online commerce.

Unlike high-volume recruitment agencies, Monroe adopts a precision-driven approach focused on quality placements for critical roles. Its services are particularly valued by technology companies, fintech firms, digital marketplaces, multinational corporations, and enterprises undergoing modernization initiatives.

As Indonesia’s demand for skilled engineers, cybersecurity professionals, and digital leaders continues to outpace supply, Monroe Consulting Group has built a reputation for helping clients secure scarce talent while strengthening their long-term employer attractiveness.

Focus on Emerging Technologies, Cybersecurity, and E-Commerce Leadership

In 2026, Monroe’s technology practice concentrates heavily on sectors experiencing the fastest transformation. The firm prioritizes roles that directly impact business competitiveness, operational resilience, and digital revenue growth.

Key areas of specialization include artificial intelligence implementation, cloud-native development, cybersecurity defense, digital payment ecosystems, and large-scale e-commerce platforms. Many clients engage Monroe to build entire technology teams from the ground up, rather than filling isolated vacancies.

Technology Sectors and Hiring Priorities

| Technology Sector | Market Demand in Indonesia (2026) | Typical Roles Recruited |

|---|---|---|

| Emerging Technologies | Innovation-driven competitive advantage | AI Engineers, Data Scientists, Tech Leads |

| Cybersecurity | Protection against escalating threats | Security Architects, SOC Managers, CISOs |

| E-commerce Platforms | Digital retail expansion | Platform Engineers, Product Tech Leaders |

| Fintech & Digital Payments | Financial inclusion and scaling | Backend Engineers, Risk Technology Specialists |

| Cloud & Infrastructure | Enterprise modernization | Cloud Engineers, DevOps Leads |

Rigorous Four-Step Talent Mapping Methodology

A defining feature of Monroe Consulting Group Indonesia is its structured talent mapping framework. This methodology is designed to identify high-quality candidates in a market where top professionals are often passive and highly selective.

The process begins with intensive market research to understand industry dynamics, competitor hiring strategies, and available talent pools. Consultants then use advanced sourcing tools and proprietary networks to identify suitable candidates. Relationship building is emphasized to engage individuals who may not be actively seeking new roles. Finally, clients receive continuous reporting, ensuring transparency throughout the hiring process.

Four-Step Talent Mapping Process

| Step | Key Activities | Strategic Value for Employers |

|---|---|---|

| Market Research | Industry analysis and talent landscape study | Informed hiring strategy |

| Candidate Identification | Advanced sourcing and screening | Access to qualified professionals |

| Relationship Development | Engagement of passive candidates | Higher acceptance likelihood |

| Continuous Reporting | Progress tracking and feedback loops | Transparency and decision support |

Key Performance Indicators and Organizational Details

Monroe Consulting Group’s effectiveness is reflected in measurable outcomes. In 2026, the firm reports a strong offer acceptance rate, indicating its ability to match candidates accurately with client expectations regarding role scope, compensation, and organizational culture.

The Indonesian office is led by Managing Director Tina Nugraheni, whose leadership has contributed to the firm’s credibility within the local technology ecosystem. Fee structures typically fall within the mid-range of executive search pricing, reflecting the boutique nature of the service and the complexity of roles handled.

Firm Profile and Recruitment Metrics

| Feature | Details | Implication for Clients |

|---|---|---|

| Placement Success Rate | Approximately 75% offer acceptance | Reduced hiring delays and renegotiations |

| Core Divisions | Emerging Tech, Security, Digital Commerce | Deep specialization in high-growth sectors |

| Leadership | Tina Nugraheni, Managing Director | Strong local market expertise |

| Fee Structure | 15% – 25% of annual salary | Competitive for executive search services |

| Service Model | Boutique, high-touch consulting | Personalized recruitment approach |

Addressing Indonesia’s Technology Skill Shortage

Indonesia continues to face a structural shortage of advanced technical talent, particularly in cybersecurity, AI, and senior software engineering. Monroe Consulting Group addresses this challenge by helping organizations build internal capabilities rather than relying solely on external hiring.

The firm also supports employer branding initiatives, advising clients on how to position themselves as attractive workplaces for top technology professionals. This includes guidance on compensation structures, career progression frameworks, workplace culture, and innovation opportunities.

Employer Branding Support Impact

| Employer Challenge | Monroe’s Advisory Approach | Expected Outcome |

|---|---|---|

| Limited brand visibility | Employer positioning strategy | Increased candidate interest |

| Competition from tech giants | Value proposition refinement | Improved ability to attract senior talent |

| High offer rejection rates | Compensation and role alignment guidance | Higher acceptance ratios |

| Talent retention concerns | Cultural and career pathway insights | Longer employee tenure |

Client Feedback and Market Reputation

Major technology organizations in Indonesia have acknowledged Monroe Consulting Group’s effectiveness in delivering targeted candidates and actionable market intelligence. Large digital enterprises, including prominent financial technology platforms, have highlighted the firm’s ability to present highly relevant CVs rather than large volumes of unsuitable applicants.

Clients also note the agency’s efficiency in coordinating interview processes, managing candidate expectations, and facilitating complex salary negotiations. These capabilities contribute to a higher conversion rate from job offer to successful hire, which is critical when recruiting scarce technical specialists.

Recruitment Process Strengths Reported by Clients

| Capability Area | Client Observation | Business Benefit |

|---|---|---|

| Candidate Quality | Highly targeted profiles | Reduced screening workload |

| Market Intelligence | Up-to-date industry insights | Better hiring decisions |

| Process Management | Efficient coordination | Faster time-to-hire |

| Negotiation Support | Skilled handling of complex offers | Improved acceptance rates |

| Communication Transparency | Regular updates | Strong client confidence |

Strategic Importance in Indonesia’s IT Hiring Ecosystem

As Indonesia accelerates toward a digitally driven economy in 2026, organizations increasingly require recruitment partners capable of securing specialized talent in competitive domains. Monroe Consulting Group Indonesia occupies a distinct niche as a boutique firm focused on high-impact placements rather than volume recruitment.

Its combination of deep sector expertise, structured talent mapping, employer branding support, and strong candidate engagement makes it particularly valuable for companies building mission-critical technology teams. For businesses seeking to establish or expand IT capabilities in emerging fields, Monroe remains one of the most effective search partners in the Indonesian market.

4. Robert Walters Indonesia

Robert Walters Indonesia is widely recognized as one of the most influential recruitment consultancies supporting technology hiring across the country. Operating as part of a global network, the firm serves multinational corporations, regional enterprises, fast-growing startups, and government-linked organizations seeking highly skilled IT professionals and transformation leaders.

In 2026, Indonesia’s digital economy continues to mature rapidly, fueled by cloud adoption, artificial intelligence initiatives, financial technology expansion, and nationwide digital infrastructure improvements. Within this competitive environment, Robert Walters has positioned itself as a trusted advisor for organizations that require not only talent acquisition but also market intelligence, compensation insights, and long-term workforce planning.

Collaborative Non-Commission Recruitment Model

A defining characteristic of Robert Walters Indonesia is its non-commission compensation structure for consultants. Unlike traditional recruitment firms that reward individual placements, this model encourages teamwork, knowledge sharing, and client-centric decision-making.

The approach prioritizes sustainable matches between employers and candidates rather than quick placements designed to maximize short-term revenue. As a result, organizations often experience higher retention rates and stronger cultural alignment with hires sourced through the firm.

Recruitment Model Comparison

| Recruitment Model Type | Consultant Incentive Structure | Impact on Hiring Outcomes |

|---|---|---|

| Commission-Based | Individual placement revenue | Faster placements, variable quality |

| Hybrid | Mix of team and individual incentives | Balanced speed and quality |

| Non-Commission Collaborative | Team performance and client success | Strong alignment and long-term retention |

Industry-Leading Salary Benchmarking and Market Intelligence

By 2026, Robert Walters Indonesia is widely regarded as the authoritative source for compensation data in the technology sector. Its annual Salary Survey is used extensively by HR leaders, finance teams, and executive boards to determine competitive pay structures and workforce budgets.

The survey provides data-driven insights into hiring trends, skill shortages, compensation ranges, and employee expectations. In a market where top IT professionals can command premium packages, such intelligence is essential for crafting offers that attract high-performing candidates without inflating costs unnecessarily.

Applications of Salary Benchmarking Data

| Use Case | Organizational Benefit | Typical Users |

|---|---|---|

| Offer Structuring | Competitive compensation packages | HR and Talent Acquisition teams |

| Workforce Planning | Accurate budgeting | Finance and Executive leadership |

| Retention Strategy | Prevent employee attrition | HR Business Partners |

| Market Positioning | Employer competitiveness assessment | Corporate strategy teams |

Specialized Tech & Transformation Division

Robert Walters Indonesia operates a dedicated “Tech & Transformation” practice focused on complex, high-impact roles that drive organizational modernization. This division recruits professionals capable of designing, implementing, and maintaining advanced digital systems.

Common assignments include enterprise architecture leadership, large-scale data engineering initiatives, systems integration programs, and digital transformation governance. Organizations undergoing modernization frequently rely on this team to secure talent capable of aligning technology initiatives with business strategy.

Key Roles Managed by the Tech & Transformation Division

| Functional Area | Organizational Need in 2026 | Representative Roles |

|---|---|---|

| IT Architecture | Enterprise system design | Enterprise Architect, Solutions Architect |

| Data Engineering | Data platform development | Data Engineers, Data Platform Leads |

| Systems Design | Infrastructure integration | Systems Architects, Integration Specialists |

| Digital Transformation | Process modernization | Transformation Directors, Program Managers |

| Cloud Strategy | Migration and scalability | Cloud Strategy Leads, Infrastructure Heads |

Pulang Kampung Program for Returning Indonesian Talent

A distinctive initiative introduced by Robert Walters Indonesia is the “Pulang Kampung” program, designed to attract Indonesian technology professionals working abroad back to the domestic market. Many skilled engineers and IT leaders have historically pursued careers in advanced technology hubs such as Singapore, Australia, Europe, and North America.

As Indonesia’s digital ecosystem strengthens, demand for internationally experienced talent has grown significantly. The program identifies professionals interested in returning home and matches them with organizations capable of offering competitive compensation, leadership opportunities, and meaningful impact.

Benefits of the Returnee Talent Strategy

| Stakeholder | Advantage Gained | Strategic Impact |

|---|---|---|

| Employers | Access to globally trained professionals | Enhanced innovation capability |

| Returning Professionals | Leadership roles in home market | Career acceleration and cultural familiarity |

| National Technology Sector | Knowledge transfer from mature markets | Overall ecosystem development |

Cross-Border Recruitment Capabilities

Robert Walters’ global presence enables seamless execution of multi-country recruitment projects. In Southeast Asia, many corporations operate across several jurisdictions, requiring consistent hiring standards and coordination.

The firm’s ability to manage placements across borders while maintaining service quality has made it a preferred partner for regional leadership hires, expatriate assignments, and distributed technology teams.

Regional Recruitment Strengths

| Capability Area | Operational Advantage | Client Value |

|---|---|---|

| Multi-Country Hiring | Unified recruitment processes | Consistent candidate quality |

| International Talent Access | Global professional networks | Broader talent pool |

| Compliance Awareness | Knowledge of local regulations | Reduced legal and administrative risk |

| Cultural Alignment | Understanding of regional work practices | Improved onboarding success |

Client Feedback and Market Reputation

Senior executives across ASEAN have consistently praised Robert Walters Indonesia for its deep market knowledge and disciplined execution. Regional leaders responsible for large hiring initiatives have highlighted the firm’s ability to deliver complex placements across multiple countries while maintaining high service standards.

Clients also emphasize the consultancy’s consultative approach, noting that consultants act as strategic partners who provide actionable insights rather than merely forwarding candidate profiles. This capability is particularly valuable for organizations undertaking large transformation programs where talent decisions directly influence business outcomes.

Service Strengths Recognized by Clients

| Performance Dimension | Client Observation | Business Benefit |

|---|---|---|

| Market Knowledge | Strong understanding of talent landscape | Better hiring decisions |

| Execution Capability | Reliable delivery on complex mandates | Reduced project risk |

| Cross-Border Consistency | Uniform service across regions | Simplified regional coordination |

| Strategic Advisory | Data-driven recommendations | Long-term workforce optimization |

Role in Indonesia’s 2026 Technology Talent Ecosystem

As Indonesia advances toward becoming a major digital economy in Southeast Asia, the competition for experienced IT professionals continues to intensify. Robert Walters Indonesia plays a critical role by providing data-driven recruitment solutions, international reach, and specialized expertise in transformation-focused roles.

Its collaborative model, authoritative salary intelligence, innovative returnee programs, and cross-border capabilities position the firm as a premier partner for organizations seeking to build resilient, future-ready technology teams. For companies aiming to secure high-impact software and IT talent in 2026, Robert Walters remains one of the most trusted recruitment consultancies in the Indonesian market.

5. JAC Recruitment Indonesia

JAC Recruitment Indonesia occupies a distinctive position within the country’s hiring ecosystem as the primary recruitment partner for Japanese multinational corporations and industrial engineering enterprises. As Indonesia strengthens its role as a manufacturing and logistics hub in Southeast Asia, demand for technically skilled professionals—particularly those with bilingual capabilities—continues to rise.

Backed by a global revenue base of approximately ¥39.1 billion, the firm possesses the financial strength, operational scale, and research capabilities necessary to maintain one of Indonesia’s most comprehensive databases of engineering and technical talent. In 2026, this capability is especially valuable as traditional industrial sectors increasingly integrate digital technologies such as automation, robotics, IoT, and data-driven operations.

JAC Recruitment’s long-standing presence has allowed it to develop deep relationships with both employers and candidates, making it a trusted intermediary for complex placements requiring technical expertise, cross-cultural understanding, and regulatory compliance.

Primary Focus on Industrial, Engineering, and Digitally Transforming Sectors

While many recruitment agencies focus primarily on software development roles, JAC Recruitment Indonesia specializes in technical fields that support large-scale infrastructure, manufacturing, and logistics operations. These industries are undergoing rapid digital transformation as organizations modernize production systems, implement smart manufacturing processes, and adopt advanced supply chain technologies.

The firm frequently handles roles that combine traditional engineering knowledge with modern IT competencies, such as automation engineering, industrial data analytics, and digitally enabled logistics management.

Key Industry Segments Served

| Industry Sector | Market Drivers in Indonesia (2026) | Typical Roles Recruited |

|---|---|---|

| Mechanical Engineering | Infrastructure expansion and manufacturing | Mechanical Engineers, Plant Managers |

| Heavy Machinery | Industrial modernization | Equipment Specialists, Maintenance Leaders |

| Logistics & Supply Chain | E-commerce growth and trade connectivity | Logistics Engineers, Operations Directors |

| Smart Manufacturing | Industry 4.0 adoption | Automation Engineers, Industrial IoT Specialists |

| Industrial IT Integration | Digital transformation of factories | Systems Engineers, Digital Operations Heads |

Extensive Database of Technical and Bilingual Talent

One of JAC Recruitment Indonesia’s most significant advantages is its vast pool of candidates with both technical expertise and Japanese language proficiency. Japanese companies operating in Indonesia often require employees who can communicate effectively with headquarters while navigating local operational realities.

This bilingual requirement dramatically narrows the available talent pool, making JAC’s specialized database a critical resource. The firm maintains long-term relationships with engineers, managers, and executives who possess the linguistic skills and cultural awareness necessary for cross-border collaboration.

Candidate Pool Characteristics

| Candidate Category | Key Skills Profile | Employer Value |

|---|---|---|

| Bilingual Engineers | Technical expertise + Japanese language | Seamless communication with HQ |

| Industrial Managers | Operations leadership + cross-cultural skills | Efficient plant and project management |

| Technical Specialists | Equipment and systems expertise | Reduced training requirements |

| Local Professionals with | Indonesian market knowledge + language skills | Smooth regulatory and operational alignment |

| International Exposure |

Comprehensive Service Offering Beyond Recruitment

JAC Recruitment Indonesia provides a full spectrum of talent solutions tailored to multinational corporations operating in complex regulatory environments. In addition to recruitment, the firm offers compliance guidance, visa advisory services, and onboarding support for expatriate employees.

These services are particularly important for Japanese companies deploying foreign specialists to Indonesia or relocating employees across borders. By managing administrative complexities, JAC enables organizations to focus on operational objectives rather than bureaucratic processes.

Service Portfolio and Strategic Benefits

| Service Area | Description | Business Impact |

|---|---|---|

| Recruitment Services | Placement of technical and managerial talent | Access to specialized professionals |

| Compliance Advisory | Guidance on labor regulations | Reduced legal risk |

| Visa & Work Permit Support | Assistance for expatriate staff | Faster deployment of foreign experts |

| Onboarding Coordination | Integration support for new hires | Improved retention and productivity |

| Talent Market Intelligence | Insights into industry hiring trends | Better workforce planning |

Cultural Intelligence as a Competitive Advantage

A defining characteristic of JAC Recruitment’s consultants is their strong cultural intelligence. This capability enables them to bridge differences between Japanese corporate practices—often characterized by structured hierarchies, long-term employment philosophies, and consensus-driven decision-making—and Indonesian workplace norms.

By understanding both perspectives, consultants can advise clients on realistic expectations, communication strategies, and retention approaches. This reduces the risk of cultural misunderstandings that could otherwise lead to failed hires or operational inefficiencies.

Cross-Cultural Mediation Capabilities

| Cultural Challenge | Consultant Intervention | Outcome for Employer |

|---|---|---|

| Communication barriers | Bilingual coordination | Clear project alignment |

| Workplace expectation gaps | Cultural briefing for both parties | Reduced onboarding friction |

| Retention risks | Guidance on management practices | Longer employee tenure |

| Negotiation differences | Balanced compensation discussions | Successful contract agreements |

Recognition for ESG and Diversity Leadership

In 2026, environmental, social, and governance considerations play an increasingly important role in employer attractiveness. JAC Recruitment Indonesia demonstrates strong performance in this area, holding an MSCI ESG rating of “AA,” which reflects responsible corporate practices and sustainable business operations.

Additionally, the firm has received the prestigious three-star Eruboshi Certification, awarded for excellence in promoting women’s advancement and diversity in the workplace. Such recognition resonates strongly with modern candidates, particularly younger professionals who prioritize inclusive and socially responsible employers.

ESG and Diversity Credentials

| ESG Dimension | Recognition or Rating | Significance for Candidates |

|---|---|---|

| Environmental & Governance | MSCI ESG Rating “AA” | Confidence in ethical operations |

| Gender Equality | Three-star Eruboshi Certification | Commitment to women’s career advancement |

| Diversity & Inclusion | Structured HR initiatives | Attractive to global talent |

| Corporate Responsibility | Transparent policies | Enhanced employer reputation |

Market Reputation and Human Capital Initiatives

JAC Recruitment Indonesia is widely respected for its human capital programs and commitment to workforce development. Organizations engaging the firm often highlight its professionalism, structured processes, and ability to deliver candidates who meet both technical requirements and cultural expectations.

The agency’s recognition for promoting diversity and supporting women’s participation in technical fields further strengthens its standing among employers seeking progressive hiring practices. As talent shortages intensify, such initiatives help organizations differentiate themselves and appeal to a broader range of qualified candidates.

Strategic Importance for Japanese Multinationals in Indonesia

For Japanese corporations operating in Indonesia, JAC Recruitment serves as more than a staffing provider; it functions as a strategic partner capable of navigating linguistic, cultural, regulatory, and technical complexities simultaneously. Its specialization allows companies to secure talent that aligns with both local operational needs and global corporate standards.

As industrial sectors continue to digitize in 2026, the intersection of engineering expertise and IT capability becomes increasingly critical. JAC Recruitment Indonesia’s deep technical focus, bilingual talent pool, and cross-cultural advisory services position it as one of the most indispensable recruitment agencies for organizations seeking to build resilient, future-ready technical teams in the Indonesian market.

6. Avomind

Avomind has rapidly established itself as a prominent recruitment partner for organizations seeking highly specialized technical talent across multiple regions. With operational hubs in key innovation centers such as Jakarta and Singapore, the firm supports companies pursuing cross-border expansion, digital product development, and advanced research initiatives.

In 2026, as competition for senior software engineers, data scientists, and technology leaders intensifies worldwide, Avomind’s global approach enables employers in Indonesia to access talent beyond domestic labor markets. This capability is particularly valuable for multinational corporations, venture-backed startups, and research-driven enterprises that require niche expertise unavailable locally.

Unlike traditional agencies focused on regional hiring, Avomind operates as an international talent connector, facilitating placements across Asia, Europe, and North America while maintaining strong engagement with Southeast Asian markets.

Proprietary Academic Talent Network and Early Access to Specialists

A distinguishing feature of Avomind’s model is its proprietary talent pipeline built through partnerships with more than 200 academic institutions worldwide. These collaborations allow the firm to identify high-potential graduates, doctoral researchers, and emerging technical leaders before they enter the mainstream job market.

This early access is especially important for roles in artificial intelligence, computational science, advanced software engineering, and health technology, where cutting-edge skills often originate from research environments rather than industry recruitment channels.

Academic Talent Pipeline Advantages

| Talent Source | Candidate Profile | Strategic Benefit for Employers |

|---|---|---|

| Top Universities | High-performing graduates | Strong theoretical foundation |

| Research Institutions | PhD-level specialists | Advanced domain expertise |

| Technical Competitions | Algorithm and systems experts | Proven problem-solving ability |

| Alumni Networks | Experienced global professionals | Pre-vetted career progression |

Focus on Niche and Senior Technical Roles

Avomind specializes in positions that require deep technical knowledge combined with leadership capability. These roles are typically difficult to fill through conventional recruitment channels due to limited candidate availability and high compensation expectations.

Common placements include principal software engineers, AI researchers, cybersecurity specialists, product engineering directors, and technical program leaders. Many clients engage Avomind when building innovation teams or launching new technology platforms.

High-Demand Roles Recruited in 2026

| Role Category | Business Need | Typical Employer Types |

|---|---|---|

| Senior Software Engineering | Complex product development | Tech firms, SaaS companies |

| Artificial Intelligence | Automation and predictive systems | AI startups, enterprise innovation units |

| Cybersecurity | Protection of digital assets | Financial institutions, healthcare |

| Data Science | Advanced analytics capabilities | E-commerce, fintech, research organizations |

| Technical Leadership | Team scaling and architecture oversight | Multinational corporations |

Speed and Efficiency in Senior Hiring Projects

One of Avomind’s most frequently cited strengths is its ability to deliver results within compressed timelines. Senior technical roles often require extensive sourcing, evaluation, and negotiation processes that can extend for several months. Avomind’s structured methodology and global candidate reach help reduce delays while maintaining quality.

Project metrics indicate that senior software roles are typically filled within two to four months, though exceptional cases may be completed faster depending on candidate availability and decision speed from employers.

Project Performance Metrics

| Project Metric | Average Data (2026) | Interpretation |

|---|---|---|

| Time-to-Fill | 2 – 4 months for senior roles | Faster than many industry benchmarks |

| Project Cost Range | $10,000 – $49,000 | Reflects complexity of niche hiring |

| Client Satisfaction | Highly recommended (NPS equivalent 5.0) | Strong service quality perception |

| Global Coverage | Multi-region placements | Access to diverse talent pools |

Alignment of Technical Skills with Organizational Culture

Beyond technical capability, Avomind emphasizes cultural compatibility between candidates and employers. In 2026, organizations increasingly recognize that leadership hires must integrate smoothly into existing teams and corporate environments to deliver sustainable performance.

Reviews consistently highlight the firm’s ability to interpret complex hiring briefs, assess soft skills, and present candidates who align with organizational values, communication styles, and long-term objectives. This reduces the risk of early attrition, which can be costly for senior appointments.

Cultural Fit Assessment Approach

| Assessment Dimension | Evaluation Focus | Benefit to Employer |

|---|---|---|

| Technical Competence | Depth of expertise and problem-solving | Ensures job readiness |

| Leadership Capability | Team management potential | Supports organizational growth |

| Communication Style | Collaboration effectiveness | Improves team cohesion |

| Career Motivation | Long-term alignment | Enhances retention |

Agility in Handling Complex Global Hiring Mandates

Avomind’s operational flexibility enables it to support companies recruiting across multiple countries simultaneously. This capability is particularly valuable for sectors such as medical technology, fintech, and enterprise software, where specialized talent may be distributed globally rather than concentrated in one region.

Clients frequently engage the firm for projects requiring rapid scaling of senior teams, confidential leadership searches, or recruitment in highly regulated industries. Its consultants are known for adapting quickly to evolving requirements and delivering consistent results under tight deadlines.

Global Recruitment Capability Matrix

| Capability Area | Operational Strength | Client Value |

|---|---|---|

| Cross-Border Hiring | Multi-country candidate sourcing | Access to scarce expertise |

| Confidential Searches | Discreet outreach | Protection of strategic initiatives |

| Rapid Scaling Projects | Parallel recruitment processes | Accelerated team formation |

| Industry-Specific Expertise | Knowledge of niche sectors | Reduced onboarding risk |

Client Feedback and Demonstrated Outcomes

Organizations that have partnered with Avomind frequently report high satisfaction levels, particularly regarding responsiveness, transparency, and candidate quality. A notable example involves a medical technology company that required multiple senior technical hires across different regions.

The firm successfully interpreted complex role specifications and delivered qualified candidates within approximately 60 days—significantly faster than typical timelines for comparable positions. This efficiency enabled the client to accelerate product development and market entry.

Key Strengths Highlighted by Clients

| Performance Area | Client Observation | Business Impact |

|---|---|---|

| Responsiveness | Rapid communication and updates | Improved project coordination |

| Understanding of Requirements | Accurate interpretation of technical briefs | Reduced misalignment |

| Candidate Quality | Highly skilled professionals | Strong performance post-hire |

| Delivery Speed | Faster-than-average placements | Accelerated operational timelines |

Strategic Importance for Indonesia’s Technology Sector

As Indonesia continues to integrate into the global digital economy, the ability to attract international expertise becomes increasingly important. Avomind’s global network, academic partnerships, and focus on niche technical roles position it as a valuable partner for organizations seeking to build advanced capabilities that may not yet exist locally.

For companies pursuing innovation, research-driven development, or international expansion, the firm provides a pathway to secure world-class talent efficiently. In 2026, this capability makes Avomind one of the most relevant recruitment partners for enterprises aiming to remain competitive in a rapidly evolving technology landscape.

7. ProCapita Headhunter Indonesia

ProCapita Headhunter Indonesia is widely regarded as one of Jakarta’s most prominent boutique executive search firms focused exclusively on high-impact leadership appointments. Unlike conventional recruitment agencies that handle roles across multiple seniority levels, ProCapita concentrates on business-critical positions where hiring decisions directly influence organizational strategy, profitability, and long-term growth.

In 2026, as Indonesian companies face increasing pressure to modernize operations, adopt digital technologies, and compete regionally, the demand for proven executive leadership has intensified. ProCapita addresses this need by targeting senior professionals whose compensation packages typically exceed IDR 40,000,000 per month, placing the firm firmly within the premium segment of the recruitment market.

Leadership and Organizational Structure

The firm is led by James Umpleby, whose background in executive search has shaped ProCapita’s reputation for confidentiality, precision, and relationship-driven recruitment. Operating largely behind the scenes, the consultancy maintains a low public profile while working closely with boards, chief executives, and investors on sensitive hiring mandates.

This discreet operating model is particularly valuable for organizations seeking replacements for existing executives, confidential expansion plans, or leadership succession without public disclosure.

Core Leadership Profile

| Attribute | Details | Strategic Implication |

|---|---|---|

| Founder and Leader | James Umpleby | Strong executive search expertise |

| Market Position | Boutique high-end headhunter | Focus on quality over volume |

| Typical Client Level | Board members and C-suite executives | Direct decision-maker engagement |

| Operational Style | Confidential and discreet | Protection of sensitive business information |

Proactive Direct-Approach Methodology

A defining characteristic of ProCapita’s approach is its strict reliance on proactive direct search rather than reactive recruitment methods. Instead of posting vacancies publicly, consultants identify and approach suitable candidates individually, often targeting leaders currently employed by competitors or high-performing organizations.

This methodology is essential for securing “Grade A” executives who rarely respond to job advertisements and are typically not actively seeking new opportunities. By engaging candidates through trusted professional networks and personalized communication, the firm can present opportunities in a manner aligned with senior-level expectations.

Direct Search Versus Traditional Recruitment

| Recruitment Method | Candidate Visibility | Suitability for Executive Roles |

|---|---|---|

| Job Advertisements | Public, active job seekers | Low |

| Internal Databases | Previously registered candidates | Moderate |

| Referral Programs | Known industry contacts | Moderate to high |

| Direct Executive Search | Passive top performers | Very high |

Manual Talent Pool Mapping by Senior Consultants

ProCapita’s consultants are experienced professionals who personally conduct talent mapping exercises rather than relying on automated systems or pre-existing CV repositories. This manual process involves identifying organizations with relevant leadership, analyzing reporting structures, and evaluating individual career trajectories.

Such a hands-on approach enables the firm to uncover candidates who may not appear in conventional databases but possess the precise experience required for complex roles. It also ensures that recommendations are based on strategic fit rather than keyword matching.

Talent Mapping Process Components

| Mapping Stage | Key Activities | Value for Clients |

|---|---|---|

| Market Analysis | Identification of relevant industries | Targeted search scope |

| Organizational Mapping | Study of competitor leadership teams | Access to proven executives |

| Candidate Evaluation | Assessment of experience and track record | Higher placement success probability |

| Engagement Strategy | Personalized outreach | Strong candidate interest |

Compensation Focus and Role Criticality

ProCapita specializes in appointments associated with significant financial responsibility and organizational influence. Roles handled often include chief executives, managing directors, chief technology officers, transformation leaders, and senior functional heads.

In 2026, companies investing heavily in digital transformation frequently require leaders who can integrate technology strategy with business operations. As such, ProCapita increasingly handles technology-related executive roles, particularly in sectors such as fintech, telecommunications, and advanced manufacturing.

Typical Executive Roles Recruited

| Functional Area | Organizational Need | Example Positions |

|---|---|---|

| Corporate Leadership | Strategic direction and governance | CEO, Managing Director |

| Technology Leadership | Digital transformation oversight | CTO, Chief Digital Officer |

| Operations Management | Efficiency and scalability | COO, Operations Director |

| Commercial Leadership | Revenue growth and market expansion | Chief Commercial Officer |

| Finance Leadership | Capital management and compliance | CFO |

Speed and Responsiveness in Competitive Talent Markets

One of ProCapita’s distinguishing strengths is its ability to deliver results rapidly despite the complexity of executive searches. Testimonials indicate that the firm can produce a comprehensive candidate longlist within seven days of initiating a search assignment.

This speed is critical in Indonesia’s competitive executive market, where top candidates may be approached by multiple organizations simultaneously and can become unavailable within short timeframes.

Executive Search Timeline Efficiency

| Search Phase | Typical Duration | Competitive Advantage |

|---|---|---|

| Initial Briefing | 1 – 2 days | Rapid alignment with client needs |

| Market Mapping | 3 – 5 days | Immediate identification of targets |

| Longlist Delivery | Within 7 days | Accelerated decision-making |

| Candidate Engagement | Ongoing | Maintains momentum |

Client Base and High-Level Endorsements

ProCapita’s clientele includes venture capital firms, multinational corporations, and large domestic enterprises. Senior investors and board members often rely on the firm when appointing leaders capable of driving growth or turnaround initiatives.

Notable industry figures, including venture partners from global investment funds, have publicly acknowledged the firm’s effectiveness in securing top-tier executives. Feedback from president directors and regional managers frequently emphasizes the quality of candidates presented and the professionalism of the search process.

Client-Reported Strengths

| Performance Dimension | Client Observation | Business Benefit |

|---|---|---|

| Candidate Quality | Senior leaders with proven track records | Immediate strategic impact |

| Confidential Handling | Strict discretion | Protection of corporate reputation |

| Speed of Delivery | Rapid longlist preparation | Reduced hiring delays |

| Strategic Understanding | Alignment with business goals | Higher success of leadership transitions |

Role in Indonesia’s 2026 Executive Hiring Ecosystem

As Indonesia continues its transformation into a technology-enabled economy, the success of major initiatives increasingly depends on visionary leadership. ProCapita Headhunter Indonesia plays a critical role by enabling organizations to access executives capable of navigating complex market conditions, regulatory environments, and digital disruption.

Through its discreet operations, direct search methodology, and focus on passive high-performers, the firm remains one of the most trusted partners for business-critical senior appointments. For companies seeking leaders who can deliver measurable strategic outcomes, ProCapita represents a premium solution within Indonesia’s executive recruitment landscape in 2026.

8. Glints (TalentHub)

Glints has evolved into one of Southeast Asia’s largest technology talent platforms, supporting more than 50,000 organizations ranging from startups to multinational corporations. In 2026, the company plays a pivotal role in enabling cross-border hiring, particularly for businesses seeking skilled Indonesian software engineers, designers, and digital specialists.

Indonesia’s workforce offers a compelling combination of technical capability and cost efficiency, making it highly attractive to international employers. However, regulatory barriers, legal requirements, and administrative complexities traditionally limit direct hiring. Glints addresses these challenges through its TalentHub service, which functions as an integrated recruitment and employment solution.

Overview of Glints TalentHub Model

| Component | Description | Strategic Value for Employers |

|---|---|---|

| Talent Marketplace | Access to Indonesian tech professionals | Large candidate pool |

| Recruitment Services | Screening and candidate matching | Reduced hiring workload |

| Employer of Record (EOR) | Legal employment on behalf of client | No need for local entity |

| Professional Employer | HR administration and payroll management | Simplified workforce operations |

| Organization (PEO) |

Hybrid Recruitment and Employment Solution

TalentHub combines traditional hiring support with Employer of Record and Professional Employer Organization services, creating a comprehensive workforce solution. Through this model, Glints becomes the legal employer of the hired professionals while the client organization directs day-to-day work activities.

This arrangement allows companies to scale teams quickly in Indonesia without establishing a formal subsidiary. It also ensures compliance with local labor laws, tax regulations, and employment standards, which can be difficult for foreign companies to navigate independently.

EOR and PEO Functional Breakdown

| Service Type | Key Responsibilities | Employer Benefit |

|---|---|---|

| Employer of Record (EOR) | Legal employment, contracts, compliance | Eliminates need for local incorporation |

| Payroll Administration | Salary processing and tax handling | Reduces administrative burden |

| Benefits Management | Insurance and statutory benefits | Ensures compliance and employee satisfaction |

| HR Support | Leave tracking and documentation | Streamlined workforce management |

| Offboarding Services | Termination procedures | Reduced legal risk |

Critical Importance for Startups and Small Enterprises

In 2026, many startups and small-to-medium enterprises aim to leverage Indonesia’s talent pool but lack the financial resources required to establish a locally incorporated company. Creating a foreign-owned entity (PT PMA) typically requires paid-up capital of approximately IDR 2.5 billion, along with ongoing regulatory obligations.

Glints TalentHub removes this barrier by enabling companies to hire immediately without major capital expenditure. This makes Indonesia accessible as a remote development hub for early-stage ventures and growing businesses.

Comparison: Direct Entity Setup vs TalentHub Model

| Hiring Approach | Upfront Cost | Time to Start Hiring | Administrative Complexity |

|---|---|---|---|

| Establish Local Entity | Very high (capital requirements) | Several months | Extensive regulatory compliance |

| Outsourced Recruitment Only | Moderate | Moderate | Requires own HR infrastructure |

| TalentHub EOR/PEO Model | Low to moderate | Immediate to short-term | Managed by provider |

Access to Indonesia’s Cost-Effective Technology Talent

Indonesia’s large population of developers and digital professionals offers a competitive cost advantage compared to more mature markets such as Singapore, Australia, or Western economies. At the same time, many professionals possess strong English proficiency and experience working with international teams.

Glints leverages its extensive regional network to match employers with candidates who meet both technical requirements and communication expectations. This is particularly important for distributed teams operating across time zones.

Benefits of Hiring Indonesian Tech Professionals via TalentHub

| Advantage | Description | Business Impact |

|---|---|---|

| Cost Efficiency | Lower salary levels than developed markets | Reduced operational expenses |

| Large Talent Supply | Growing pool of developers and engineers | Easier team scaling |

| English Communication | Strong proficiency among tech workers | Smooth collaboration |

| Remote Work Readiness | Experience with distributed teams | Faster integration |

Regulatory Navigation and Local Expertise

Foreign companies often face complex employment regulations in Indonesia, including labor laws, taxation rules, social security obligations, and termination procedures. Non-compliance can result in financial penalties or operational disruptions.

Glints provides local expertise to ensure that all employment arrangements meet statutory requirements. This support includes drafting compliant contracts, managing mandatory contributions, and advising on workplace policies.

Regulatory Support Areas

| Compliance Area | Service Provided | Risk Mitigation |

|---|---|---|

| Employment Contracts | Legally compliant documentation | Avoidance of disputes |

| Tax Obligations | Withholding and reporting | Financial compliance |

| Social Security Programs | Enrollment and contributions | Regulatory adherence |

| Labor Law Guidance | Advice on local regulations | Reduced legal exposure |

Client Feedback and Operational Impact

Organizations using TalentHub frequently report significant savings in time, cost, and administrative effort. International founders and executives highlight the convenience of hiring Indonesian professionals without establishing local infrastructure.

Clients also emphasize the value of Glints’ regulatory expertise, which enables them to focus on business growth while administrative responsibilities are handled externally. This is particularly beneficial for consulting firms, technology startups, and digital service providers expanding into Southeast Asia.

Client-Reported Outcomes

| Performance Area | Client Observation | Business Benefit |

|---|---|---|

| Hiring Speed | Rapid onboarding of employees | Accelerated project timelines |

| Cost Savings | Avoidance of entity setup expenses | Improved capital efficiency |

| Administrative Relief | Outsourced HR operations | Focus on core activities |

| Regulatory Confidence | Compliance handled by experts | Reduced operational risk |

Strategic Importance in Indonesia’s 2026 Hiring Landscape

As remote work becomes normalized and companies pursue global talent strategies, solutions like Glints TalentHub are increasingly essential. The platform enables organizations of all sizes to participate in Indonesia’s growing digital workforce without the traditional barriers of international expansion.

By combining recruitment, legal employment, payroll administration, and compliance management into a single service, Glints provides a scalable pathway for building distributed technology teams. In 2026, this hybrid model positions the company as one of the most influential facilitators of cross-border tech hiring in Southeast Asia, particularly for organizations seeking high-quality talent at competitive costs without establishing a permanent local presence.

9. HuntHire Indonesia

HuntHire Indonesia has established itself as a highly focused recruitment agency dedicated exclusively to the digital technology sector. Since its founding in 2018, the firm has concentrated on serving startups, scale-ups, venture-backed companies, and technology-driven enterprises operating within Indonesia’s rapidly expanding innovation ecosystem.

By 2026, Jakarta has emerged as one of Southeast Asia’s most competitive startup hubs, with companies racing to secure skilled engineers, product specialists, and growth leaders. In this environment, speed of hiring often determines whether organizations can launch products, secure funding rounds, or capture market share. HuntHire’s specialized model positions it as a critical partner for firms that cannot afford prolonged recruitment cycles.

Exclusive Focus on Digital Technology Roles

Unlike general recruitment agencies that handle diverse industries, HuntHire concentrates solely on technology-related positions within the digital economy. This narrow focus enables consultants to maintain deep familiarity with technical skill requirements, emerging frameworks, and evolving startup job functions.

The agency frequently recruits professionals who can contribute immediately to product development, platform scalability, and user acquisition strategies. Such candidates are typically experienced in agile methodologies, modern programming languages, and high-growth business environments.

Core Functional Areas Served

| Functional Domain | Business Objective in Startups | Representative Roles |

|---|---|---|

| Software Engineering | Product development and platform stability | Backend Engineers, Full-Stack Developers |

| Product Management | Feature strategy and roadmap execution | Product Managers, Product Owners |

| Data & Analytics | Growth optimization and decision support | Data Analysts, Data Scientists |

| Digital Marketing Technology | User acquisition and engagement | Growth Engineers, Marketing Technologists |

| DevOps & Infrastructure | Scalability and reliability | DevOps Engineers, Site Reliability Engineers |

Proven Track Record with Passive Candidate Placements

A major differentiator for HuntHire Indonesia is its ability to source passive candidates—high-performing professionals who are currently employed and not actively searching for new roles. These individuals often represent the most valuable talent pool, as they have demonstrated success within demanding work environments.

Since its inception, the agency has placed more than 300 such candidates, reflecting both the strength of its network and the effectiveness of its outreach strategies. Passive recruitment requires personalized engagement, strong employer positioning, and careful management of confidentiality.

Passive Candidate Sourcing Advantages

| Candidate Type | Characteristics | Strategic Value for Employers |

|---|---|---|

| Active Job Seekers | Actively applying for roles | Immediate availability |

| Semi-Passive Candidates | Open to opportunities but not searching | Moderate competition |

| Passive High Performers | Successfully employed professionals | Proven capability and stability |

Exceptional Speed in Time-to-Fill

One of HuntHire’s most notable performance metrics is its exceptionally fast hiring turnaround. With an average time-to-fill of less than 15 days, the agency significantly outperforms typical recruitment timelines for technology roles, which often extend several weeks or months.

This speed is particularly valuable in Jakarta’s competitive market, where top candidates may receive multiple offers simultaneously. Rapid placement reduces the risk of losing talent to competitors and allows companies to maintain operational momentum.

Hiring Speed Comparison

| Recruitment Approach | Typical Time-to-Fill | Suitability for High-Growth Firms |

|---|---|---|

| Traditional Agency | 30 – 60 days | Moderate |

| Executive Search Firm | 2 – 4 months | Low for urgent roles |

| Specialized Tech Agency | 2 – 4 weeks | High |

| HuntHire Indonesia | Less than 15 days | Very high |

Tailored Approach for Immediate Business Impact

HuntHire’s methodology emphasizes identifying candidates capable of delivering immediate value rather than requiring extensive onboarding or training. Consultants evaluate not only technical skills but also adaptability, startup mindset, and ability to operate under rapid change conditions.

This approach aligns closely with the needs of digital companies pursuing aggressive product roadmaps or preparing for funding milestones. Employees who can contribute from day one help reduce burn rate pressures and accelerate time to market.

Candidate Evaluation Criteria

| Evaluation Dimension | Focus Area | Outcome for Employer |

|---|---|---|

| Technical Expertise | Mastery of relevant tools and frameworks | Minimal training required |

| Startup Experience | Familiarity with fast-paced environments | Quick integration into teams |