Key Takeaways

- Discover how the top 10 DSP software in 2026 empower marketers with AI-driven automation, real-time bidding, and cross-channel ad delivery.

- Learn which platforms offer the best performance for retail media, native ads, and omnichannel programmatic strategies.

- Understand the importance of first-party data, curated supply paths, and advanced targeting in selecting the right DSP for maximum ROI.

In 2026, the global digital advertising industry has reached a transformative milestone, with programmatic ad spending projected to surpass the US$1 trillion mark for the first time. At the heart of this rapid expansion lies the growing dominance of Demand Side Platform (DSP) software—powerful tools that empower advertisers to purchase digital ad inventory across multiple channels in real-time through automated bidding and data-driven targeting. These platforms have evolved into essential engines of performance marketing, helping brands reach the right audience at the right time, with the right message, all while optimizing return on ad spend (ROAS).

As businesses continue to navigate an increasingly fragmented and competitive digital ecosystem, DSP software solutions have become more advanced, incorporating AI-powered algorithms, real-time analytics, multi-channel integrations, and cookieless tracking capabilities. From retail media networks and video advertising to connected TV (CTV), mobile, and native ads, today’s top DSPs offer end-to-end campaign automation while also ensuring brand safety, fraud prevention, and measurable outcomes.

The rising demand for personalization and precision in digital advertising has driven innovation in DSP platforms, making them indispensable for agencies, in-house marketing teams, and enterprises looking to scale their advertising efforts efficiently. This demand is especially evident in regions like North America, where the United States alone accounts for over 60% of all DSP users. Meanwhile, markets in Asia-Pacific—including India and China—are experiencing accelerated growth due to increased digital penetration and mobile-first consumer behaviors.

The modern DSP is no longer a one-size-fits-all solution. Instead, brands are strategically choosing between generalist platforms with massive reach and specialist platforms optimized for niche channels such as native ads, e-commerce environments, or data-enriched targeting. For advertisers in 2026, selecting the right DSP software requires a careful evaluation of features like AI bidding capabilities, transparency in supply chains, integration with first-party data systems, and flexibility in campaign budgeting.

This comprehensive guide explores the top 10 Demand Side Platform (DSP) software solutions in the world in 2026. It highlights how each platform stands out in terms of technology, scalability, pricing models, and use-case specialization. Whether you’re a performance marketer seeking better ROAS, a brand focused on safe and scalable omnichannel campaigns, or an agency aiming to deliver measurable outcomes for clients, understanding the competitive DSP landscape is critical to success.

By examining key market trends, customer distribution, pricing structures, and technological innovation across platforms like The Trade Desk, StackAdapt, Amazon DSP, Google DV360, and others, this blog provides marketers and decision-makers with the insights needed to make informed choices in an increasingly automated and data-driven media buying environment.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Decision Support Software in 2026.

If you like to get your company listed in our top B2B software reviews, check out our world-class 9cv9 Media and PR service and pricing plans here.

Top 10 Demand Side Platform (DSP) Software in 2026

- StackAdapt

- Adform (Adform FLOW)

- The Trade Desk

- Basis Technologies (Basis DSP)

- Google Display & Video 360 (DV360)

- Amazon DSP

- Adobe Advertising Cloud

- Viant (Adelphic DSP)

- Criteo (Commerce Max)

- Taboola

1. StackAdapt

As digital advertising continues to grow in complexity and scale, the importance of reliable Demand Side Platform (DSP) software has increased significantly. Among the key players in 2026, StackAdapt stands out as a front-runner with a strong market presence, advanced technological foundation, and a reputation for user-friendly operations. Below is a deep dive into StackAdapt’s standing and performance in the DSP industry landscape for 2026.

Market Leadership and Reach

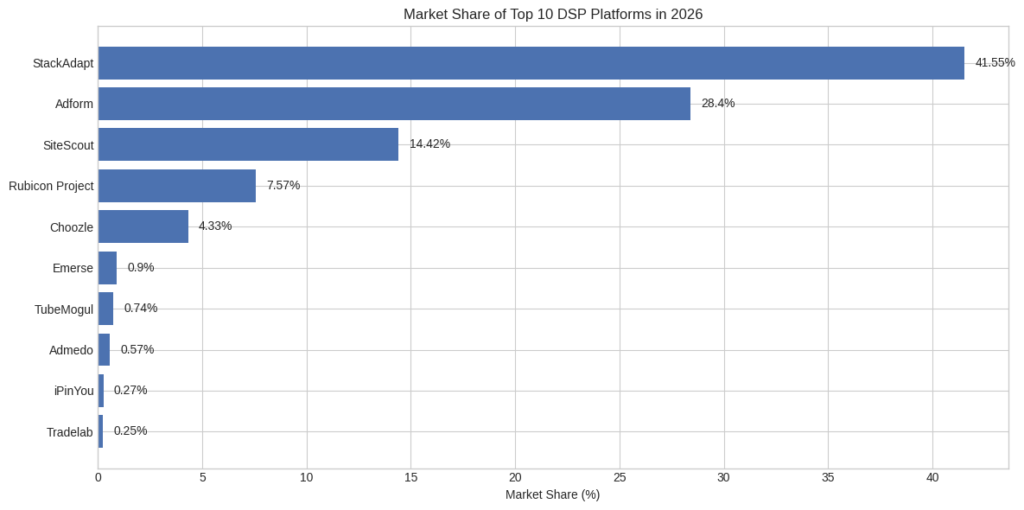

StackAdapt commands a substantial share of the global DSP market, reflecting its widespread adoption and client trust. With a market share of 41.55%, it serves over 16,900 customers worldwide. Originating from Toronto, the platform has strategically scaled across North America and expanded into global markets, making it an attractive choice for advertisers targeting diverse audiences.

Technical and Operational Capabilities

StackAdapt’s infrastructure is built for high-frequency data processing, with the ability to execute approximately 465 billion automated optimizations per second. This level of performance positions the software among the most sophisticated DSP technologies available in 2026.

Its multi-channel support includes:

- Programmatic native advertising

- Display banners

- Video ads

- Formats for desktop, tablet, and mobile platforms

Inventory and Media Access

One of StackAdapt’s most distinctive strengths is its access to high-quality, broad-spectrum inventory across major publishers. This includes programmatic ad placements for:

- Native content

- Display ads

- Video campaigns

This inventory scale enables advertisers to execute large-scale campaigns while maintaining control over targeting precision and performance metrics.

Pricing and Budget Considerations

Although StackAdapt operates primarily on a pricing-on-request model, it is widely known for following a cost-per-mille (CPM) structure. On average, advertisers are expected to allocate a minimum monthly budget of approximately $3,000. This positions the platform for mid-sized to large advertising budgets.

Integrations with Business Systems

To streamline workflow and enhance campaign tracking, StackAdapt integrates seamlessly with leading CRM and automation tools, including:

- HubSpot

- Salesforce

- AgencyAnalytics

These integrations ensure end-to-end visibility, data syncing, and campaign performance analysis within existing marketing ecosystems.

User Feedback and Industry Recognition

StackAdapt consistently earns high marks from digital marketing professionals. In 2026, it is ranked as the leading platform in the “Easiest to Use” and overall “Leader” category among DSP software tools. Based on verified user feedback, the platform holds a 9.8/10 satisfaction score, reflecting its usability and collaborative support.

A highlight among user-praised features includes:

- The “Creative Studio,” which allows marketers to prototype and test advertising content before launch, reducing risks and improving conversion rates.

Despite its high ratings, feedback suggests that 26% of users experience challenges with budget-related reporting and in-depth performance metrics. Nonetheless, the software maintains an impressive 9.4/10 rating for its cross-channel advertising capabilities.

Document-Style Comparative Table: StackAdapt DSP Overview (2026)

| Feature Category | Details |

|---|---|

| Market Share | 41.55% |

| Number of Customers | 16,983 |

| Headquarters | Toronto, Canada |

| Optimization Rate | 465 Billion optimizations/second |

| Supported Channels | Native, Display, Video, Desktop, Tablet, Mobile |

| Inventory Access | Major global publishers |

| Pricing Model | CPM-based (Pricing upon request) |

| Minimum Ad Spend | Approx. $3,000/month |

| CRM & Tool Integrations | HubSpot, Salesforce, AgencyAnalytics |

| User Satisfaction Score | 9.8/10 |

| Top Feature Highlight | Creative Studio (Campaign prototyping & testing) |

| Known Limitations | Budget reporting & detailed performance metrics (affects ~26% of users) |

| Cross-Channel Score | 9.4/10 |

Strategic Insights for 2026

In 2026, StackAdapt’s dominance is largely attributed to its forward-thinking use of AI, responsive customer support, and extensive ad format coverage. Its commitment to platform usability and creative support has attracted not only agencies but also in-house marketing teams seeking intuitive and high-performance solutions.

For companies looking to invest in a DSP platform with a proven track record, StackAdapt is a top-tier contender that balances innovation with execution quality. However, marketers managing complex reporting needs may need to supplement it with external analytics tools or custom dashboards for full operational visibility.

2. Adform (Adform FLOW)

In the dynamic world of programmatic advertising, Adform has secured its place as one of the most trusted and independent Demand Side Platform (DSP) software providers in 2026. With its flagship solution, Adform FLOW, the company ranks second in global market share, accounting for 28.40% of the total DSP market. Headquartered in Copenhagen, Adform continues to gain attention for its focus on transparency, data control, and seamless integration.

Market Position and Global Reach

Adform has established a strong foothold, especially within the EMEA region, while also expanding its presence in international markets. Its independent structure and modular platform make it a preferred choice for enterprises seeking full ownership and control over their advertising data and tech stack.

Platform Capabilities and System Architecture

Adform FLOW is engineered as a cloud-based Software-as-a-Service (SaaS) platform. It features an open and scalable architecture that supports:

- High-performance bid processing for real-time auctions

- Customizable campaign management tools

- Compatibility with multiple components like DSP, SSP, and ad server functionalities

The platform’s modular design enables businesses to unify and manage their complete advertising operations from a single environment, which is particularly valuable for organizations with complex needs.

Core Strengths of Adform FLOW

Adform FLOW differentiates itself in the following areas:

- High-quality and transparent traffic sources

- Seamless integration with custom tech stacks

- Full data ownership and client-side control

- Modular system flexibility for tailored implementations

Pricing and Commercial Structure

The platform follows a quotation-based pricing model. Instead of offering fixed packages, Adform provides tailored pricing to suit enterprise-level demands. This allows businesses to scale and adapt their usage based on evolving requirements without being locked into rigid pricing tiers.

Deployment and Usability Focus

Adform FLOW operates on a SaaS deployment model. Its primary market concentration is within the EMEA region, but it also supports global operations for multinational enterprises. Its flexible deployment infrastructure allows clients to manage and optimize campaigns at scale, with localized and cross-regional targeting capabilities.

User Experience and Industry Reviews

According to data from professional review platforms like TrustRadius, Adform FLOW has received a strong user satisfaction score of 8.1 out of 10. Users frequently highlight:

- An intuitive interface that improves workflow efficiency

- Superior transparency compared to many other DSP solutions

- A robust user experience for managing cross-platform campaigns

While many value its integrated design, some users have indicated that the complexity of managing the modular architecture may require more experienced teams to fully utilize its capabilities.

Document-Style Overview Table: Adform FLOW DSP Analysis (2026)

| Feature Category | Description |

|---|---|

| Global Market Share | 28.40% |

| Headquarters | Copenhagen, Denmark |

| Deployment Model | SaaS (Software-as-a-Service) |

| Platform Type | Modular and Open Architecture |

| Primary Regions Served | EMEA, with global expansion |

| Supported Components | DSP, SSP, Ad Server |

| Key Technical Feature | High-performance real-time bid processing |

| Data Ownership | Full ownership remains with clients |

| Pricing Model | Customized quote-based enterprise pricing |

| Notable Strengths | Transparency, high-quality traffic, integration with client tech stacks |

| User Satisfaction Rating | 8.1/10 |

| Most Praised Feature | Modular architecture and transparent ecosystem |

| Reported Limitations | Complex system may require experienced ad tech specialists |

Matrix: Adform FLOW Performance Attributes (2026)

| Evaluation Criteria | Rating (1-10) | Comments |

|---|---|---|

| Transparency | 9.3 | Recognized as one of the most transparent platforms |

| System Integration Flexibility | 9.0 | Easily integrates DSP, SSP, and ad server components |

| Ease of Use | 7.8 | Requires experienced users to manage complex features |

| User Interface Experience | 8.5 | Clean and intuitive for daily campaign operations |

| Reporting & Analytics | 8.2 | Offers insightful reports but may need customization |

| Global Reach | 7.9 | Strong in EMEA, growing in other regions |

Strategic Value of Adform in 2026

Adform FLOW has become a go-to solution for organizations seeking independence from walled garden platforms. Its emphasis on transparency, modular design, and client-centric data control aligns well with modern expectations for privacy, flexibility, and accountability in programmatic advertising.

By offering a unified advertising experience that integrates all necessary components within one platform, Adform provides businesses with the tools to scale efficiently while maintaining complete visibility and governance over their data. For marketing teams with experienced technical talent, Adform FLOW remains a highly strategic investment in 2026.

3. The Trade Desk

In the rapidly evolving digital advertising ecosystem of 2026, The Trade Desk stands as one of the most recognized and widely adopted Demand Side Platform (DSP) software solutions. Known for its strong focus on the open internet and transparent advertising environments, The Trade Desk has gained significant traction among large-scale enterprises and global brands looking to manage programmatic advertising across all channels with precision and control.

Global Market Presence and Position

The Trade Desk has earned its reputation as a preferred platform for businesses managing complex, multi-regional campaigns. Its open and unbiased marketplace allows advertisers to access premium inventory without being locked into proprietary media ecosystems. This openness supports flexibility, data-driven decision-making, and scale for global advertisers across digital touchpoints.

Platform Infrastructure and Technical Capabilities

The Trade Desk is built for speed and customization, operating with market-leading queries per second (QPS) and robust enterprise-grade APIs. This allows advertisers and agencies to tailor bidding logic, analytics, and creative deployment to their unique needs.

Notable system features include:

- Real-time bidding performance at scale

- Custom development through open APIs

- Seamless data activation from first-party and third-party sources

Diverse Inventory Access and Omnichannel Capabilities

One of the strongest aspects of The Trade Desk is its access to nearly every major advertising channel worldwide. This includes:

- Connected TV (CTV)

- Digital Out-of-Home (DOOH)

- Streaming audio platforms

- Mobile and desktop display

- Native and in-app advertising

This extensive inventory ensures that advertisers can run campaigns across screens and formats with full transparency.

Pricing Model and Budget Requirements

The Trade Desk operates on a fee-based model, generally taking 15% to 20% of total advertising spend as its platform cost. Due to its enterprise focus, most clients start with a minimum monthly media budget of approximately $10,000. The pricing structure reflects the platform’s high performance, cross-device reach, and premium inventory access.

Advanced Targeting and Data Activation

The Trade Desk offers highly sophisticated targeting tools that empower advertisers to personalize and optimize ad delivery. Unique features include:

- Real-time geo-targeting influenced by environmental signals like weather

- Audience segmentation using first-party data sets

- Cross-device ID graph technology for unified consumer views

These features enhance targeting accuracy and return on ad spend, especially for advertisers operating in multiple regions or markets.

Industry Reviews and Enterprise Feedback

On platforms like Gartner Peer Insights, The Trade Desk has consistently received high praise. With a current rating of 4.6 out of 5 based on over 300 verified reviews, it is ranked among the top DSPs for both performance and customer satisfaction.

Users highlight:

- Superior transparency in media buying

- Strong visual analytics tools, including campaign planning dashboards

- Wide support among enterprise companies with revenues between $50 million and $1 billion

Although the platform fees are perceived as high by some, most reviewers agree that the trade-off is well worth it due to the platform’s cross-channel effectiveness and trustworthy media environment.

Detailed Overview Table: The Trade Desk DSP Profile (2026)

| Feature Category | Details |

|---|---|

| Platform Type | Hybrid DSP & DMP |

| Primary Focus | Open Internet, Transparent Advertising |

| Global Inventory Access | CTV, DOOH, Audio, Mobile, Desktop, Native |

| QPS Capability | Market-leading QPS |

| Enterprise API Support | Yes |

| Targeting Tools | Geo-targeting, Environmental Triggers, First-Party Data Activation |

| Pricing Model | Fee-based (15–20% of ad spend) |

| Minimum Monthly Budget | Starts at approx. $10,000 |

| Transparency Score | Rated Very High |

| Cross-Device Performance | Rated 9/10 by users |

| Gartner Peer Insights Rating | 4.6/5 (based on 300 reviews) |

| Notable Strengths | Visual Planning Tools, Neutral Marketplace, Multi-Channel Access |

Matrix: Key Evaluation Areas for The Trade Desk (2026)

| Evaluation Criteria | Score (1–10) | Comments |

|---|---|---|

| Transparency and Neutrality | 9.5 | Highly rated for open marketplace access |

| Enterprise Compatibility | 9.2 | Designed for complex, high-budget campaigns |

| Ease of Integration | 8.7 | Supports API-based customization and system integration |

| Cross-Device Reach | 9.0 | Strong ID graph ensures seamless multi-device tracking |

| Visual Analytics and Reporting | 8.8 | Intuitive tools like Magic Quadrant enhance decision-making |

| Budget Flexibility | 6.5 | High minimum budget requirement may not suit smaller businesses |

Strategic Insight and Use Case

The Trade Desk continues to be the platform of choice for brands seeking precision, transparency, and flexibility in their programmatic advertising efforts. Its neutral marketplace and comprehensive targeting tools make it ideal for enterprises running multi-market, cross-device campaigns. While the platform is best suited for medium to large companies with substantial advertising budgets, its return on investment and scalability justify the higher spend for most global marketers.

As the digital advertising landscape continues to shift towards privacy-first strategies and omnichannel engagement, The Trade Desk remains a powerful asset for any business aiming to drive measurable results through programmatic channels.

4. Basis Technologies (Basis DSP)

As businesses increasingly seek simplified solutions for managing complex digital campaigns, Basis Technologies (formerly known as Centro) has gained significant recognition in 2026 as one of the top-performing Demand Side Platform (DSP) software providers. Designed to streamline the buying, execution, and analysis of digital media campaigns, Basis offers a unified SaaS solution with a strong emphasis on automation, transparency, and cross-channel coordination.

Position in the Global DSP Landscape

Basis Technologies has become one of the fastest-growing players in the global DSP sector. Industry data ranks it as the second-fastest-growing DSP and the fifth most popular overall, based on customer adoption and platform usage. This reflects its growing popularity among agencies, media buyers, and in-house marketing teams across diverse sectors.

Platform Infrastructure and Technical Foundations

Basis DSP integrates technology originally developed by SiteScout AdServer, creating a powerful backbone for real-time programmatic bidding, audience targeting, and omnichannel media planning.

The platform supports:

- Unified campaign execution across programmatic, direct, and search advertising

- Workflow automation that centralizes tasks like campaign setup, optimization, and billing

- Customizable dashboards with built-in business intelligence tools

Key Strengths and Functional Capabilities

The core advantage of Basis lies in its ability to reduce operational complexity through automation and data centralization. Its most notable features include:

- Automated campaign performance tracking and measurement

- Built-in billing and financial reconciliation systems

- Brand safety controls and access to private marketplaces (PMPs)

- Seamless collaboration tools for internal teams and external clients

These features allow marketing departments to reduce manual workloads while improving the accuracy and profitability of advertising operations.

Pricing Structure and Accessibility

Basis operates on a quote-based pricing model. While final costs depend on the specific use case and service level, most managed service engagements begin with a minimum spend requirement of around $10,000 per month. The platform also offers self-service options for teams with in-house campaign management capabilities.

Regional Focus and Use Case Suitability

Basis is widely adopted across North America and is gaining traction globally due to its suitability for industries such as media, publishing, e-commerce, and education. The system is especially valued by digital marketing managers in sectors like newspaper publishing, where the need for integrated planning, buying, and reporting is paramount.

User Sentiment and Industry Recognition

According to TrustRadius, Basis DSP holds a high rating of 9 out of 10. Users highlight the platform’s strong automation capabilities, collaborative workflow tools, and time-saving efficiencies as key advantages. Reviews from advertising professionals frequently mention that the software significantly boosts operational profitability by reducing manual input.

However, some power users have noted areas for improvement, such as:

- Delayed report generation in high-volume accounts

- Navigation and interface design that may not be intuitive for new or advanced users

Overview Table: Basis Technologies DSP Profile (2026)

| Feature Category | Details |

|---|---|

| Platform Name | Basis Technologies (Basis DSP) |

| Previous Brand Name | Centro |

| Global Ranking | #2 Fastest-Growing, #5 Most Popular DSP |

| Core Technology Foundation | SiteScout AdServer Integration |

| Deployment Type | SaaS (Unified Platform) |

| Supported Channels | Programmatic, Search, Direct, Social |

| Pricing Model | Custom Quotation-Based |

| Typical Entry-Level Budget | Starts at ~$10,000/month (for managed services) |

| Workflow Automation | Yes – Includes planning, performance tracking, billing automation |

| Collaboration Features | Centralized dashboard with team access controls |

| Brand Safety Measures | Built-in controls with PMP access |

| Target Industries | Media, Publishing, E-commerce, Advertising |

| TrustRadius Score | 9/10 |

| Notable Strengths | Automation, team collaboration, operational efficiency |

| Known Limitations | Slower reporting generation, interface could improve |

Performance Matrix: Basis DSP Evaluation Areas (2026)

| Evaluation Criteria | Rating (1–10) | Commentary |

|---|---|---|

| Workflow Automation | 9.4 | Strong automation features reduce manual workloads |

| Ease of Collaboration | 9.1 | Ideal for teams managing multiple campaigns |

| Campaign Reporting | 7.8 | Reporting accuracy is good, but speed can be improved |

| Navigation & UX | 7.5 | Functional, but may require training for new users |

| Cross-Channel Reach | 8.6 | Supports programmatic, direct, and search channels |

| Pricing Flexibility | 7.9 | Requires budget commitment; not ideal for small advertisers |

| Brand Safety & PMP Access | 8.8 | Comprehensive protection with access to premium inventory |

Strategic Perspective on Basis DSP

Basis Technologies has positioned itself as an essential platform for marketers seeking control, speed, and simplification in digital media operations. Its ability to handle everything from planning to billing in one environment makes it particularly suitable for medium to large organizations handling high campaign volumes.

In 2026, Basis continues to appeal to brands that want to drive performance while minimizing operational burden. Despite minor setbacks in interface fluidity, its automation-first design and strong market reputation make it one of the most effective DSP software choices available globally.

5. Google Display & Video 360 (DV360)

In 2026, Google Display & Video 360 (DV360) continues to stand out as one of the most powerful and sophisticated Demand Side Platform (DSP) software options globally. Integrated within the broader Google Marketing Platform, DV360 is purpose-built for large-scale advertisers and enterprises that demand access to advanced targeting tools, seamless data integration, and exclusive media inventory—particularly across Google’s own ecosystem.

Platform Overview and Strategic Role

DV360 is designed to help brands manage their entire digital media buying operations from a single platform. It offers access to Google-owned channels like YouTube and Connected TV (CTV), while also enabling advertisers to reach users across more than 90 additional global ad exchanges.

The software’s enterprise-level infrastructure allows businesses to precisely target, analyze, and optimize campaigns using Google’s unique data ecosystem, including real-time search intent and behavioral insights. Its deep integration with other tools in the Google suite, such as GA4 (Google Analytics 4), further strengthens its capabilities for marketers seeking performance-based outcomes.

Technical Infrastructure and System Capabilities

Google DV360 is backed by Google’s cross-device identity graph, which allows for accurate user tracking and measurement across smartphones, tablets, desktops, and CTV environments. This system helps advertisers build a consistent view of the customer journey, leading to more effective campaign targeting and ROI measurement.

DV360 supports:

- Advanced audience segmentation powered by Google’s first-party data

- Dynamic ad formats for display, video, native, and mobile

- Cross-channel campaign execution and real-time bidding

- Programmatic guaranteed deals, private marketplaces, and open auction support

Pricing Model and Investment Threshold

As an enterprise-grade DSP, DV360 typically requires a substantial minimum investment. Reports from agencies and platform users indicate that monthly starting costs generally begin around $12,500. The pricing structure reflects the advanced targeting capabilities, exclusive inventory access, and premium integrations offered by the platform.

Platform Performance and Measurable Impact

When integrated with Google Analytics 4 (GA4), DV360 can deliver a 15% to 25% improvement in cost-per-acquisition (CPA) performance within a 60 to 90-day period. This improvement is due to the maturing of bidding signals and enhanced campaign intelligence over time, especially when campaigns are optimized using Google’s automated bidding strategies.

Industry Feedback and User Experience

DV360 is highly rated by industry professionals, earning an average score of 4.5 out of 5 across peer-reviewed platforms. Users consistently highlight the platform’s depth in reporting, real-time data integration, and robust targeting capabilities.

Key praises include:

- Superior control over campaign setup and audience filters

- Comprehensive analytics and attribution modeling

- Access to exclusive Google inventory, including YouTube and CTV

However, the platform is not without its limitations. Several users have reported that DV360 has a:

- Steep learning curve, especially for new users

- Less intuitive interface compared to some competitors

- Higher operational cost, making it less suitable for smaller marketing teams or limited budgets

Professional Table: Google DV360 DSP Profile (2026)

| Feature Category | Details |

|---|---|

| Platform Name | Google Display & Video 360 (DV360) |

| Parent Suite | Google Marketing Platform |

| Main Audience | Enterprise-level advertisers |

| Minimum Monthly Investment | Starts at ~$12,500 |

| Inventory Reach | 90+ global ad exchanges plus exclusive Google inventory |

| Cross-Device Identity Tracking | Yes – via Google’s proprietary identity graph |

| GA4 Integration Benefit | 15–25% CPA improvement within 60–90 days |

| Key Supported Channels | YouTube, CTV, Display, Native, Mobile |

| Ad Buying Formats | Open Auction, Private Marketplace, Programmatic Guaranteed |

| Targeting Capabilities | Advanced audience segmentation and real-time behavioral signals |

| User Review Rating | 4.5/5 |

| Common Praises | Reporting depth, targeting flexibility, access to premium inventory |

| Common Criticisms | Complex user interface, high learning curve, high cost for smaller teams |

Evaluation Matrix: Google DV360 Capabilities and User Experience (2026)

| Evaluation Area | Score (1–10) | Description |

|---|---|---|

| Audience Targeting Precision | 9.6 | Excellent segmentation powered by Google search and intent data |

| Cross-Device Integration | 9.4 | Seamless experience across desktop, mobile, tablet, and CTV |

| Reporting and Analytics Tools | 9.2 | Advanced measurement tools with attribution modeling |

| Ease of Use | 6.8 | Non-intuitive interface; best for experienced teams |

| Setup and Onboarding Time | 7.1 | Requires significant training to unlock full capabilities |

| Pricing Accessibility | 6.5 | High cost limits access for smaller teams or mid-sized businesses |

| Campaign Performance Potential | 9.0 | Strong ROI, especially when combined with GA4 and smart bidding |

Strategic Takeaway for Advertisers in 2026

Google DV360 continues to be a powerful solution for advertisers aiming to scale campaigns across the open web and Google’s owned media properties. With robust integrations, unmatched data insights, and access to high-quality inventory, DV360 is ideal for enterprises that require complete visibility and granular control over their advertising ecosystem.

While it may not be the easiest platform for entry-level marketers, its value to seasoned digital professionals lies in its ability to deliver high-performance outcomes and optimized cost-efficiency over time. For brands seeking to unify data, media, and measurement into one enterprise-grade solution, DV360 remains a top contender in the global DSP landscape of 2026.

6. Amazon DSP

In 2026, Amazon DSP remains one of the most powerful programmatic advertising platforms for brands looking to reach purchase-ready audiences at scale. Built upon Amazon’s massive first-party retail data, the platform provides unmatched access to consumer behavior insights, allowing advertisers to drive highly targeted campaigns both within Amazon’s digital ecosystem and across third-party inventory.

Whether a brand sells products on Amazon or not, the platform offers unique advantages through its integration of real-time bidding (RTB) and shopping signal-based targeting. As a result, Amazon DSP has become a preferred option for performance-driven marketers looking to optimize return on ad spend (ROAS) across the full marketing funnel.

Platform Scope and Advertising Reach

Amazon DSP gives advertisers direct access to highly engaged audiences, not only within Amazon-owned properties but also across a wide network of premium third-party publishers. This includes placements on:

- Amazon.com and Amazon mobile apps

- Prime Video and Twitch

- Freevee (formerly IMDb TV)

- External websites and apps through programmatic ad exchanges

The combination of retail intent data and premium media inventory makes the platform highly effective for reaching both new customers and retargeting previous buyers.

Technical Capabilities and Data Infrastructure

At the core of Amazon DSP is its use of real-time bidding technology enhanced by Amazon’s proprietary data segments. This enables advertisers to:

- Precisely target consumers based on recent shopping activity

- Run display, video, and audio ads across a wide variety of channels

- Create granular audience segments using first-party purchase data

- Track performance across every stage of the buyer’s journey

These capabilities allow advertisers to reach high-converting audiences with remarkable accuracy, especially in e-commerce and direct-to-consumer sectors.

Pricing Model and Service Options

Amazon DSP follows a cost-per-impression (CPM) pricing model. It offers both managed and self-service versions:

- Managed Service: Typically requires a minimum campaign spend of $50,000, making it more suitable for established brands or large-scale advertisers

- Self-Service Platform: Provides more flexibility for experienced in-house marketing teams or performance agencies with smaller budgets

This tiered access allows advertisers to select the level of support that best fits their budget and operational needs.

Platform Strengths and Strategic Benefits

One of the most valuable aspects of Amazon DSP is its exclusive access to Amazon Audience data—considered among the most purchase-intent-rich datasets in the industry. This includes insights such as:

- In-market shoppers actively browsing specific product categories

- Customers with recent purchases in related verticals

- Historical behavior and predictive intent modeling

These data points help advertisers craft messages that resonate with users at every stage of the conversion funnel.

User Feedback and Operational Considerations

Professionals in the advertising industry often describe Amazon DSP as the “VIP lounge of programmatic platforms” because of its reach and high-intent targeting. A marketing manager from a 2025 review praised its ability to “hit every part of the funnel,” emphasizing its effectiveness from awareness through to conversion.

However, there are also limitations noted by users:

- The platform’s interface and workflow are often considered less intuitive than competitors

- Inventory availability is still heavily influenced by Amazon’s ecosystem, which can be restrictive for brands focused on broader media buying

Detailed Table: Amazon DSP Feature Overview (2026)

| Feature Category | Description |

|---|---|

| Platform Name | Amazon DSP |

| Main Strength | Access to Amazon’s high-intent shopper data |

| Ad Formats Supported | Display, Video, Audio |

| Inventory Access | Amazon.com, Prime Video, Twitch, Freevee, Third-Party Sites |

| Targeting Engine | Based on Amazon’s first-party shopping signals |

| Bidding Type | Real-Time Bidding (RTB) |

| Pricing Model | Cost-per-impression (CPM) |

| Minimum Spend (Managed) | ~$50,000 |

| Self-Service Availability | Yes – suitable for experienced advertisers |

| Primary Use Cases | Full-funnel advertising, retargeting, product promotion |

| Common Praises | Audience precision, reach, campaign impact |

| Known Challenges | Usability limitations, reliance on Amazon-centric inventory |

| User Rating Summary | Strong performance, best suited for e-commerce-focused advertisers |

Matrix: Amazon DSP Evaluation Scores (2026)

| Evaluation Criteria | Rating (1–10) | Notes |

|---|---|---|

| Audience Targeting Precision | 9.6 | Based on actual purchase intent data |

| Multi-Channel Reach | 8.8 | Strong within Amazon ecosystem, moderate outside it |

| Ad Format Variety | 8.7 | Supports video, audio, and display formats |

| Ease of Use | 6.9 | Less intuitive platform; learning curve reported by several users |

| Cost Accessibility | 6.5 | High entry point for managed services |

| Funnel Coverage | 9.2 | Effective across awareness, consideration, and conversion stages |

Strategic Takeaway for Advertisers in 2026

Amazon DSP offers a powerful blend of data-driven precision and expansive media access, making it a standout option in the global DSP ecosystem. With exclusive insights into shopper behavior and integration across Amazon-owned channels, it is particularly valuable for brands focused on performance marketing, e-commerce, and full-funnel strategies.

Despite some platform usability concerns and high costs for managed campaigns, Amazon DSP remains an essential solution for businesses aiming to leverage high-intent data and connect meaningfully with potential customers at scale. Its role among the top 10 DSP software in the world in 2026 is both prominent and well-earned.

7. Adobe Advertising Cloud

In the competitive global programmatic advertising market of 2026, Adobe Advertising Cloud stands as one of the top-performing Demand Side Platform (DSP) software solutions. Originally launched as TubeMogul and later rebranded under the Adobe Experience Cloud umbrella, this platform offers a robust and unified environment for executing complex, multi-channel advertising campaigns, with a strong emphasis on connected TV (CTV), digital video, display, and search.

Designed for large enterprises managing expansive advertising ecosystems, Adobe Advertising Cloud is well-regarded for its tight integration with Adobe Analytics and Adobe Experience Manager. These integrations allow advertisers to gain deeper insights into consumer behavior and connect media performance to broader business outcomes.

Platform Capabilities and Ecosystem Strength

Adobe Advertising Cloud is built for marketers who require end-to-end visibility across multiple advertising channels. The platform offers a centralized workflow for planning, buying, managing, and optimizing media with advanced automation features.

Core capabilities include:

- Rule-based bidding automation for programmatic search and display advertising

- Advanced integration with Adobe’s data management and analytics tools

- Access to a broad network of over 50 TV broadcasters for automated TV ad placements

- Unified media buying across display, video, CTV, and digital out-of-home (DOOH)

Its ability to support complex campaigns from a single system helps large organizations streamline processes, ensure message consistency, and manage budgets more effectively.

Security, Fraud Prevention, and Trust Mechanisms

Security and fraud protection are major priorities for Adobe Advertising Cloud. It includes a Non-Human Traffic (NHT) Credit Program that identifies and refunds costs for fraudulent impressions. This is made possible through Adobe’s integration with White Ops, a leading digital fraud protection company.

Such systems give enterprise advertisers greater confidence in their media investments, especially when running large-scale campaigns involving high-value video and CTV inventory.

Enterprise Pricing Model and Budget Requirements

Adobe Advertising Cloud follows a quote-based pricing model tailored for enterprise clients. The platform is generally used for high-budget campaigns, with typical minimum commitments starting from $50,000 per month. This pricing reflects the advanced features, analytics integration, and cross-platform reach that Adobe provides.

The investment is justified for organizations aiming to align their advertising efforts with digital transformation strategies or execute tightly managed, multi-region campaigns.

User Experience and Industry Feedback

Rated at 8.8 out of 10 by professional users, Adobe Advertising Cloud is often described as a powerful platform with a steep learning curve. Key positive feedback includes:

- Highly customizable rule-based bidding engine

- Deep integration with Adobe’s broader marketing suite

- Industry-leading fraud prevention mechanisms

However, some users also highlight that the platform requires a technically mature team to manage and operate it effectively. Implementation can be complex, particularly for teams not already using Adobe Experience Cloud tools.

Detailed Table: Adobe Advertising Cloud Platform Profile (2026)

| Feature Category | Details |

|---|---|

| Platform Name | Adobe Advertising Cloud |

| Previous Name | TubeMogul |

| Parent Suite | Adobe Experience Cloud |

| Deployment Type | SaaS-based for large-scale campaign execution |

| Key Focus Areas | Programmatic TV, Display, Video, DOOH, Search |

| Target Audience | Enterprise-level advertisers |

| Minimum Budget Requirement | ~$50,000/month |

| Security System | Non-Human Traffic Credit Program (via White Ops) |

| Core Technology Engine | Rule-Based Bidding System |

| Channel Access | 50+ Programmatic TV broadcasters, plus digital and search channels |

| Analytics Integration | Seamless with Adobe Analytics and Experience Manager |

| Peer Rating Score | 8.8/10 |

| Strengths Highlighted | Fraud protection, integration, automation capabilities |

| Limitations Identified | Complex setup, high technical expertise required |

Matrix: Adobe Advertising Cloud Evaluation Summary (2026)

| Evaluation Area | Rating (1–10) | Observations |

|---|---|---|

| Multi-Channel Campaign Support | 9.2 | Strong cross-platform execution across TV, digital, and search |

| Fraud Prevention Capabilities | 9.5 | Best-in-class protection with NHT refund program |

| Automation Flexibility | 8.7 | Rule-based bidding engine drives efficiency and ROI |

| Integration with Adobe Suite | 9.4 | Excellent synergy with Adobe Analytics and Adobe Experience tools |

| Ease of Use | 6.9 | Technical complexity makes it challenging for small or mid-tier teams |

| Setup Time and Scalability | 7.5 | Requires implementation expertise for scalable use |

Strategic Summary for 2026 Advertisers

Adobe Advertising Cloud is ideal for organizations that operate at an enterprise scale and need full visibility into advertising spend, performance, and attribution. With its focus on automation, data protection, and audience targeting across premium TV and digital environments, it supports advanced advertising strategies that align tightly with corporate digital transformation initiatives.

For large enterprises with the technical maturity and internal resources to manage a sophisticated advertising stack, Adobe Advertising Cloud offers a secure, comprehensive, and high-performing DSP solution in 2026. Its place among the top 10 global DSP platforms is backed by its powerful analytics foundation and forward-thinking features built for complex media ecosystems.

8. Viant (Adelphic DSP)

Viant’s Adelphic DSP has emerged in 2026 as a trusted and forward-thinking Demand Side Platform (DSP), especially for advertisers preparing for the post-cookie era. Unlike traditional DSPs that rely heavily on third-party cookies, Adelphic stands out by using a proprietary identity solution called “Household ID.” This enables advertisers to run large-scale programmatic campaigns while preserving user privacy and maintaining high targeting accuracy.

Positioned as a people-based DSP, Viant Adelphic is engineered to help marketers reach real households deterministically across all major channels, including Connected TV (CTV), mobile, desktop, and audio.

Platform Reach and Identity Infrastructure

One of Adelphic’s most unique strengths is its ability to connect with more than 125 million U.S.-based households through its identifier-agnostic bid stream. This bid stream is designed to function seamlessly in environments where third-party cookies are restricted or unavailable.

The system is active in more than 80% of real-time bidding (RTB) opportunities across major supply platforms and exchanges. This wide access, coupled with a strong identity graph, enables advertisers to achieve:

- High-precision targeting without relying on anonymous cookies

- Accurate frequency capping and reach measurement

- Persistent cross-device identity resolution at the household level

Technical Architecture and Capabilities

Adelphic’s platform allows advertisers to control and optimize their campaigns through a centralized dashboard that supports:

- Household-level targeting and attribution

- Identifier-independent bidding and delivery

- Access to transparent, log-level data for performance analysis

- Seamless integration with data management platforms (DMPs) and customer data platforms (CDPs)

The system is particularly effective for sectors like healthcare, finance, and CPG, where privacy and compliance are critical yet precise audience engagement is still necessary.

Performance Results in Cookieless Environments

Viant has been at the forefront of cookieless advertising innovation. Tests and case studies have shown that its Household ID solution can deliver:

- Up to 100% scale compared to traditional cookie-based DSPs

- Approximately 93% unique reach, even in privacy-restricted environments such as Safari and Chrome

This capability makes it a valuable asset for advertisers looking to future-proof their digital strategy.

Pricing and Accessibility

Adelphic offers a more accessible starting point than many other enterprise DSPs. With a baseline investment of approximately $3,000 per month, the platform is well-suited not only for enterprise users but also for mid-market agencies and brands seeking affordable, future-ready programmatic solutions.

User Experience and Industry Reputation

Adelphic receives consistently positive feedback from professionals for its transparency and access to raw data. Users praise the availability of log-level information, which allows in-depth analysis of campaign performance and optimization tactics.

A 2024 pharma client case study noted the platform’s ability to execute a full-funnel campaign—audience onboarding to attribution—without using cookies. However, some users report that the dashboard performs best when paired with external tools, particularly for advanced data modeling or real-time adjustments.

Table: Viant Adelphic DSP Platform Overview (2026)

| Feature Category | Description |

|---|---|

| Platform Name | Viant Adelphic DSP |

| Identity Solution | Household ID (People-Based, Cookieless Technology) |

| Audience Reach | 125 Million+ U.S. Households |

| Cookie Independence | Yes – Fully Functional in Safari, Chrome, and Cookieless Environments |

| Inventory Access | Premium Supply Across CTV, Mobile, Audio, and Display |

| RTB Participation | Active in 80%+ of Current Bid Streams |

| Minimum Monthly Investment | ~$3,000 |

| Reporting and Analytics | Full Log-Level Data Access |

| Performance Metrics (Cookieless) | 100% Scale, 93% Unique Reach |

| Platform Strengths | Deterministic Targeting, Transparent Reporting, Identifier-Agnostic System |

| Known Limitations | Works best with external DMP/CDP integrations |

Matrix: Viant Adelphic DSP Capability Ratings (2026)

| Evaluation Criteria | Rating (1–10) | Commentary |

|---|---|---|

| Cookieless Readiness | 9.8 | Industry-leading identity framework that performs without third-party cookies |

| Data Transparency | 9.4 | Offers raw log-level data for campaign analysis |

| Targeting Accuracy | 9.1 | Household-level resolution ensures precise audience engagement |

| Ease of Use | 7.9 | User-friendly, though optimal with external data platforms |

| Budget Flexibility | 8.7 | Accessible entry point at ~$3,000 per month |

| Channel Access | 8.6 | Strong coverage across CTV, audio, and mobile |

Strategic Insights for 2026 Advertisers

As privacy regulations tighten and cookies phase out, Viant Adelphic DSP positions itself as a smart, scalable, and affordable solution for modern advertisers. Its people-based approach provides a reliable alternative to cookie-based tracking while offering deep transparency and actionable campaign data.

Ideal for performance marketers and privacy-focused industries, Adelphic balances innovation with usability. For organizations seeking to adopt a future-proof DSP that aligns with evolving identity standards and offers dependable reach, Viant’s Adelphic platform is a top contender among the best DSP software in 2026.

9. Criteo (Commerce Max)

Criteo, through its Commerce Max platform, has secured its place as one of the most effective Demand Side Platforms (DSPs) in 2026, especially for retail-focused and performance-driven advertisers. Known for pioneering dynamic retargeting and retail media strategies, Criteo excels in identifying high-intent consumers and serving them product ads tailored to their browsing behavior. Its strength lies in a powerful AI engine and vast commerce data network that enable hyper-relevant advertising across premium retail environments.

For brands that prioritize return on ad spend (ROAS), particularly in direct-to-consumer (D2C) campaigns, Criteo remains a go-to choice due to its accessible pricing, performance-focused features, and robust analytics.

Platform Capabilities and Commerce Data Infrastructure

Criteo stands out for its ability to harness massive amounts of commerce data from thousands of retail partners worldwide. Its proprietary AI engine continuously analyzes shopper signals such as:

- Search behavior across e-commerce sites

- Product page views

- Cart abandonment and previous purchase activity

Using this behavioral data, the platform delivers highly personalized product recommendations through automated ad placements, making it ideal for re-engaging potential buyers and shortening the purchase cycle.

Reach and Retail Inventory Access

The Commerce Max platform connects advertisers to more than 200 high-quality global retail media networks. This includes on-site placements on retailer websites, as well as off-site media inventory for expanded visibility.

Campaigns can be activated across:

- Display ads on retail and publisher websites

- Native ads within commerce environments

- In-app and mobile web targeting

- Retail media networks with built-in conversion intent

This inventory access allows advertisers to place their products directly in the digital paths of consumers already primed to purchase.

Pricing and Accessibility for Performance Advertisers

Criteo is one of the most budget-friendly DSP solutions on the market. It operates on a cost-per-click (CPC) model, with pricing beginning at approximately $1 per click. This makes it an attractive option for startups, D2C brands, and mid-sized businesses focused on measurable performance and incremental sales.

Its self-service capabilities and automation features further simplify campaign setup, making it usable even for teams with limited in-house programmatic experience.

User Experience and Feedback

Criteo holds a 6.7 out of 10 rating on TrustRadius, reflecting a mixed but overall positive perception. Key strengths highlighted by users include:

- Clear and detailed campaign performance reports

- Simple and user-friendly interface

- Strong conversion performance for product retargeting campaigns

However, reviews also cite occasional limitations such as:

- Fluctuations in campaign performance depending on vertical or seasonality

- Delays or challenges with customer support responsiveness

Despite these drawbacks, marketers continue to view Criteo as a category leader in dynamic retargeting, particularly due to its ability to match consumers with the right products at the right time.

Professional Overview Table: Criteo Commerce Max DSP (2026)

| Feature Category | Description |

|---|---|

| Platform Name | Criteo Commerce Max |

| Specialization | Dynamic Retargeting, Retail Media Advertising |

| Core Technology Engine | AI-Powered Commerce Data Engine |

| Data Sources | Thousands of Global Retail Partners |

| Inventory Access | Over 200 Retail Media Networks |

| Ad Formats | Display, Native, In-App, On-site/Off-site Retail Placements |

| Pricing Model | Cost-Per-Click (Starts at ~$1 per click) |

| Ideal Users | D2C Brands, Mid-Sized Businesses, Performance Marketers |

| Campaign Focus | Product Retargeting, Incremental Conversions |

| Reporting Tools | Real-Time Performance Dashboard |

| TrustRadius User Score | 6.7/10 |

| Strengths | Easy to use, detailed reports, high ROAS |

| Weaknesses | Variable performance, limited customer support |

Matrix: Criteo Commerce Max Evaluation Areas (2026)

| Evaluation Criteria | Score (1–10) | Commentary |

|---|---|---|

| Dynamic Retargeting Precision | 9.5 | Highly effective in re-engaging warm leads with personalized product ads |

| Data Intelligence | 9.0 | Commerce AI engine powered by vast retail signal data |

| Pricing Accessibility | 9.2 | Affordable entry point with flexible CPC-based model |

| Ease of Use | 8.6 | Intuitive dashboard and quick campaign setup |

| Retail Inventory Reach | 8.8 | Access to leading global retailers and e-commerce media networks |

| Support and Scalability | 6.8 | Some concerns over customer support and performance consistency |

Strategic Summary for 2026 Advertisers

Criteo Commerce Max continues to set benchmarks for performance advertising within retail and commerce-driven sectors. Its ability to pair shoppers with relevant product ads in real time—across multiple digital touchpoints—makes it highly valuable for marketers focused on sales outcomes.

With accessible pricing, strong retargeting precision, and scalable campaign tools, Criteo is an essential DSP for performance marketers looking to maximize returns in a competitive digital landscape. For organizations aiming to combine affordability with deep commerce intelligence, Criteo remains a critical player among the top 10 DSP platforms worldwide in 2026.

10. Taboola

Taboola has earned its reputation in 2026 as one of the top Demand Side Platform (DSP) software solutions in the native advertising space. Its primary strength lies in helping brands drive awareness and engagement through content-based placements on premium editorial websites. Known for its predictive content technology and massive reach across digital publishers, Taboola is particularly effective for both B2B and B2C companies aiming to promote articles, product pages, videos, and blog content in a non-disruptive, contextually relevant format.

What makes Taboola distinct among the top 10 global DSP platforms is its ability to place content in front of the right users at the right time—through a highly accessible pricing model that supports advertisers of all sizes.

Platform Capabilities and Content Matching Technology

Taboola’s native advertising engine is built on advanced predictive algorithms that analyze audience behaviors, browsing history, and content consumption patterns in real-time. This enables the platform to:

- Deliver high-relevance content recommendations

- Match brand messages with audiences based on interests and context

- Dynamically optimize ad placements across thousands of publisher websites

Taboola allows advertisers to promote content in a way that feels organic, boosting reader engagement and time spent on the advertiser’s landing pages.

Audience Reach and Publisher Access

Taboola’s global reach extends across thousands of high-traffic news, media, and lifestyle sites. These include premium editorial partners in North America, Europe, Asia, and Latin America, making the platform suitable for international campaigns targeting:

- Direct-to-consumer brands seeking to drive eCommerce traffic

- B2B companies looking to distribute thought leadership articles

- Content-heavy brands promoting blogs, reviews, or explainer videos

The system supports granular audience segmentation, ensuring content is served only to the most relevant users across devices.

Pricing Flexibility and Advertiser Accessibility

Taboola’s pricing structure is among the most flexible in the DSP ecosystem. Campaigns can start from as little as $10 per day, making it ideal for businesses testing new content formats, smaller startups with limited budgets, or marketers who want to experiment before scaling.

The cost-per-click (CPC) model ensures that advertisers only pay for real engagement, rather than impressions, which aligns well with performance-focused KPIs.

Core Features and Operational Advantages

Taboola provides users with a centralized dashboard for managing content promotion campaigns. Key tools and features include:

- Real-time performance analytics for every piece of content

- A/B testing functionality to optimize headlines, images, and targeting

- Social sharing and amplification options to extend reach beyond publisher networks

These capabilities empower marketers to continuously refine their strategies and increase the efficiency of their content spend.

User Experience and Market Perception

While Taboola is highly rated for ease of setup and responsive customer support, it holds a moderate average rating of 3.3 out of 5 across review platforms. Users highlight the following strengths:

- Simplified campaign setup, even for first-time users

- Helpful onboarding support and dedicated account managers

- Effective brand exposure and awareness campaigns

However, common critiques include:

- A bulky and outdated user interface

- Delays or friction in the creative approval process, especially for high-volume advertisers

- Limited flexibility in campaign rules compared to some other DSPs

Detailed Table: Taboola DSP Overview (2026)

| Feature Category | Description |

|---|---|

| Platform Name | Taboola |

| Specialization | Native Advertising, Content Discovery |

| Core Technology | Predictive Audience-Matching Algorithms |

| Content Types Supported | Blog Posts, Articles, Product Pages, Videos |

| Global Publisher Reach | Thousands of Premium Editorial Sites Across Regions |

| Audience Types | B2C, B2B, International and Localized Campaigns |

| Pricing Model | Cost-Per-Click (Starting at $10/day) |

| Campaign Tools | A/B Testing, Social Sharing, Real-Time Analytics |

| Minimum Budget Flexibility | High – suitable for testing and scaling |

| User Review Score | 3.3/5 |

| Strengths | Low entry cost, intuitive campaign setup, solid customer support |

| Challenges | Clunky interface, slow ad approval, limited creative customization |

Matrix: Taboola DSP Performance Ratings (2026)

| Evaluation Criteria | Rating (1–10) | Commentary |

|---|---|---|

| Content Targeting Accuracy | 8.9 | Predictive engine performs well for both B2C and B2B campaigns |

| Pricing Accessibility | 9.3 | One of the most affordable platforms for native content promotion |

| Campaign Setup and Usability | 8.1 | Simple for beginners, ideal for rapid experimentation |

| Reporting and Analytics | 7.9 | Offers real-time content metrics and insights |

| UI/UX Design | 6.5 | Interface considered outdated by some users |

| Support and Responsiveness | 7.8 | Account teams are helpful; creative approval delays remain a concern |

Strategic Insights for Native Advertisers in 2026

Taboola offers a strong value proposition for advertisers seeking to blend content with user experiences across editorial environments. Its AI-driven content recommendation engine and massive publisher access provide the scalability required for global campaigns—while the platform’s low daily budget requirement makes it approachable for marketers at all levels.

Despite a few operational challenges, Taboola remains one of the best-performing native advertising DSPs in 2026. For brands prioritizing engagement, storytelling, and brand recall through content discovery, Taboola stands as a cost-effective and results-driven solution in the modern programmatic advertising landscape.

Global Programmatic Advertising Landscape and Forecast for 2026

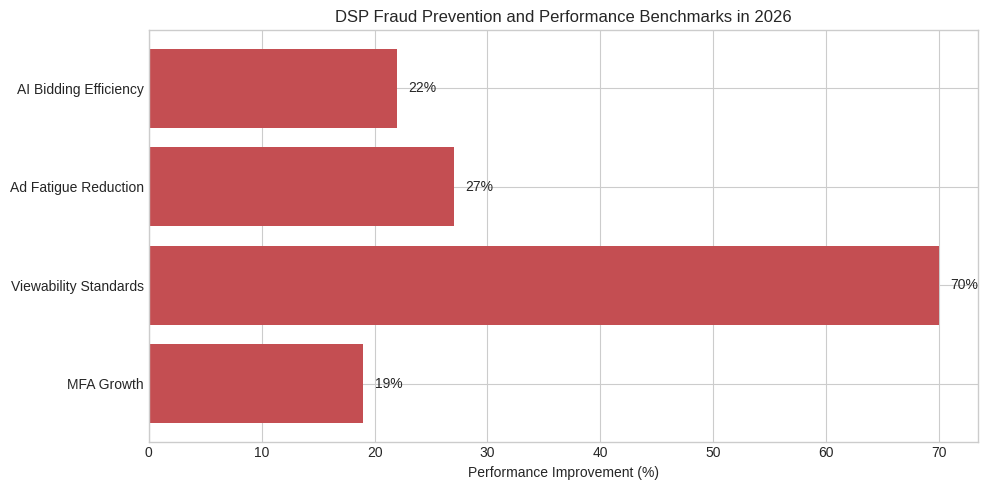

The global programmatic advertising industry is undergoing a transformative phase in 2026, moving beyond early automation strategies into more structured, AI-enhanced infrastructure. What was once a space dominated by simple bidding algorithms is now defined by real-time decision engines, AI-augmented campaign optimization, and increasing demand for omnichannel experiences. A key trend shaping this evolution is the explosive growth of Connected TV (CTV), which has become the leading space for innovation in formats, measurement, and audience engagement.

As digital consumption habits shift rapidly, brands, agencies, and DSP platforms are aligning their strategies with new benchmarks in scalability, cross-device reach, and audience intelligence. This convergence of performance marketing and machine learning is expected to shape the next generation of programmatic execution across global markets.

Market Valuation, Growth Trends, and Format Expansion

In 2026, the global programmatic advertising market is expected to reach a valuation of USD 273.7 billion, highlighting the rapid acceleration in digital ad buying driven by automation, data, and audience precision. Projections from multiple industry analysts estimate a Compound Annual Growth Rate (CAGR) of 19.9% from 2026 to 2033, potentially pushing the overall market toward the USD 1 trillion mark within the next decade.

While this growth is promising, it is also unevenly distributed across ad formats and media environments. Display advertising continues to account for a significant 32% share of the total programmatic spend, with video advertising formats—especially short-form mobile video and ad-supported CTV—growing at a faster pace due to evolving viewer preferences.

Key Market Insights and Performance Benchmarks

| Market Dimension | 2026 Value / Trend |

|---|---|

| Global Market Valuation | USD 273.7 Billion |

| CAGR (2026–2033) | 19.9% |

| Projected 2033 Market Size | ~USD 1 Trillion |

| Dominant Format by Spend | Display Ads (32% Market Share) |

| Fastest-Growing Format | Short-Form Video and Connected TV |

| Innovation Focus Areas | AI Automation, Cross-Device Targeting, Cookieless Tracking, CTV Formats |

| Emerging Technologies | Predictive Bidding, First-Party Data Activation, Identity Resolution |

Strategic Implications for DSP Platforms in 2026

Top-tier DSP platforms are now adapting to this growth trajectory by upgrading their AI layers, integrating with major data ecosystems, and offering robust solutions for cookieless targeting. They are investing in:

- Real-time performance optimization using machine learning

- Identity-based targeting frameworks in privacy-restricted environments

- Multi-format inventory across CTV, digital out-of-home (DOOH), audio, and native channels

- Seamless integrations with CRM systems and analytics platforms

Market Readiness and Innovation Trends Matrix

| Innovation Factor | Adoption Level (2026) | Remarks |

|---|---|---|

| AI-Based Bidding Optimization | Very High | Embedded in most Tier 1 DSPs |

| CTV Programmatic Penetration | High | Rapid shift of brand and performance budgets to CTV formats |

| Identity Resolution Technologies | Moderate | Still maturing, crucial post-cookie infrastructure |

| Short-Form Video Growth | Very High | Drives engagement across mobile and OTT ecosystems |

| Cross-Platform Attribution | Moderate to High | In progress; complex but essential for long-term media planning |

Conclusion

The global programmatic advertising ecosystem in 2026 is shaped by an era of AI-led automation, identity-aware targeting, and a surge in video-first consumer behavior. With display and video continuing to dominate ad spend, and CTV rising as the epicenter of creative experimentation and performance testing, DSP platforms are being challenged to innovate faster, operate more transparently, and deliver measurable outcomes.

For enterprises, marketers, and tech vendors, aligning with the right DSP solutions will be key to navigating the expanding opportunities within this USD 273.7 billion market. As the industry progresses toward the trillion-dollar milestone by 2033, the platforms that can combine scale, data precision, and real-time adaptability will emerge as the dominant forces shaping digital advertising’s future.

Global Programmatic Advertising Outlook and Key Economic Indicators for 2026

In 2026, the global programmatic advertising market continues to expand at a fast and strategic pace, driven by advancements in AI, automation, and cross-platform media consumption. With marketers increasingly focused on measurable outcomes and precision targeting, Demand Side Platform (DSP) technologies have become the backbone of digital advertising strategy. The global landscape is marked by significant economic benchmarks, rapid innovation in key sectors, and growing regional diversity in adoption and spend allocation.

Current Market Size and Forecasts

The global programmatic market has reached an estimated value of USD 273.7 billion in 2026. This growth reflects sustained investment from advertisers across retail, e-commerce, and technology sectors. The United States alone contributes over USD 203 billion in programmatic display advertising, representing the largest share of global spend.

Looking ahead, the market is projected to grow at a compound annual growth rate (CAGR) of 19.9%, reaching nearly USD 975.1 billion by 2033. This trajectory is reinforced by shifting media strategies, adoption of AI-led DSP systems, and broader integration of retail media into core ad portfolios.

Global Programmatic Market Indicators and Benchmarks (2026)

| Economic Indicator | Value / Projection | Description |

|---|---|---|

| Global Programmatic Market Size | USD 273.7 Billion | Total worldwide value in 2026 |

| US Programmatic Display Ad Spend | USD 203 Billion+ | Largest national contribution to global DSP activity |

| Global Ad Spend Growth Rate | 5.1% | Year-over-year growth for total digital ad spend |

| Share of Digital in Global Ad Spend | 68.7% | Share of overall advertising budget devoted to digital channels |

| Retail Media Growth Rate | 14.1% | Expansion rate for retail media advertising |

| Technology Sector Ad Spend Growth | 10.3% | Fueled by AI product launches and innovation |

| Projected Global Value by 2033 | USD 975.1 Billion | Estimated market size within seven years |

Industry Trends and Sectoral Drivers

Among all verticals, retail and e-commerce represent the largest contributors to programmatic adoption, accounting for 24% of the global programmatic market. This growth is supported by rising demand for retail media networks, which enable brands to target consumers at the point of purchase with higher intent and better attribution modeling.

The technology sector follows closely, with a 10.3% growth rate, primarily fueled by AI-powered solutions, connected device ecosystems, and digital transformation initiatives in enterprise and mid-market segments.

Sector-Wise Contribution to Programmatic Growth (2026)

| Sector | Share of Programmatic Market | Key Drivers |

|---|---|---|

| Retail & E-commerce | 24% | High buyer intent, retail media, data-rich targeting |

| Technology | 10.3% Growth Rate | AI-based innovation, smart devices, SaaS and platform advertising |

| Media & Entertainment | Growing | Video content, OTT platforms, and connected TV format expansion |

| Financial Services | Stable | Increasing programmatic use in fintech, insurance, and investment segments |

Regional Growth Patterns and Geographic Expansion

From a geographic standpoint, North America continues to dominate the global programmatic advertising market. The Americas region is projected to grow by 5.2%, reaching a total market size of USD 460.5 billion. The United States remains the undisputed leader, accounting for over 64% of all companies that actively use DSP software.

At the same time, the Asia-Pacific (APAC) region has emerged as the most dynamic growth engine for programmatic adoption. Countries like India (+8.6%) and China (+6.1%) are witnessing accelerated growth due to increased digital penetration, mobile-first consumer behavior, and a surge in advertising tied to global sports events and e-commerce festivals.

Geographic Market Overview: Programmatic Growth by Region (2026)

| Region | Growth Rate (YoY) | Market Highlights |

|---|---|---|

| North America | 5.2% | Largest regional market, led by the U.S. with deep DSP penetration |

| Latin America | Moderate | Rising adoption in Brazil, Mexico, and Colombia |

| Asia-Pacific (APAC) | High | Led by India (8.6%) and China (6.1%) with strong mobile and e-commerce trends |

| Europe | Steady | Continued investment in programmatic TV and GDPR-compliant data platforms |

| Middle East & Africa | Emerging | New investments in mobile-first campaigns and localized DSP solutions |

Strategic Observations for 2026 Advertisers

In 2026, the global programmatic economy is not just growing—it is diversifying. Innovation is being led by sectors like retail and tech, while geographic expansion is being powered by digitally transforming regions like APAC. Marketers and enterprises using DSP software are increasingly focused on:

- Leveraging first-party data to maintain precision post-cookies

- Scaling campaigns through CTV, retail media, and short-form video

- Investing in AI-powered optimization engines within DSP ecosystems

- Activating audiences across international DSP platforms with local adaptation

Conclusion

As global advertising strategies continue to evolve, programmatic technologies remain at the center of this transformation. With the market now valued at USD 273.7 billion and poised to approach USD 1 trillion by 2033, the ability of DSPs to deliver performance, scale, and measurable impact is more important than ever.

For brands, agencies, and marketers worldwide, selecting the right DSP software in 2026 means aligning with platforms that can address growing complexity, ensure compliance, and capitalize on the accelerating momentum of programmatic advertising across every region and device.

DSP Customer Distribution by Country and Organizational Segments in 2026

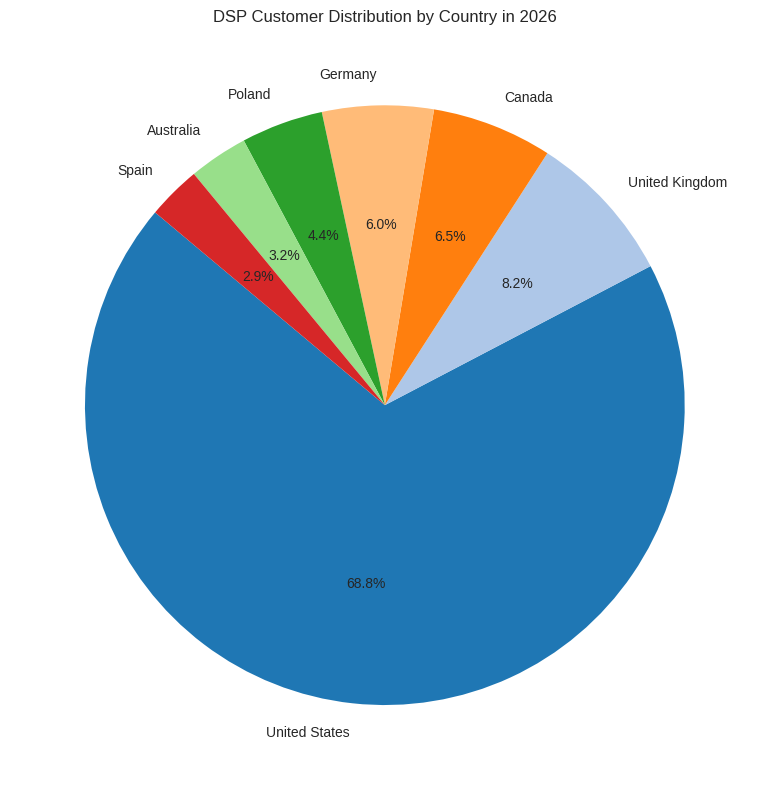

The global distribution of Demand Side Platform (DSP) users in 2026 reveals strong geographic concentration and a widening adoption across organizational sizes. The majority of DSP users are still based in North America and Western Europe, with the United States holding a significant share of global market activity. This reflects the maturity of digital advertising infrastructure, investment capacity, and programmatic expertise in these regions.

At the same time, the data also shows a strong uptake among small to mid-sized businesses, signaling that programmatic advertising has become more accessible and affordable across company types and industries.

Global DSP Customer Distribution by Country (2026)

| Country | Customer Count | Percentage of Global DSP Market |

|---|---|---|

| United States | 21,241 | 64.14% |

| United Kingdom | 2,534 | 7.65% |

| Canada | 2,005 | 6.05% |

| Germany | 1,853 | 5.59% |

| Poland | 1,365 | 4.12% |

| Australia | 986 | 2.97% |

| Spain | 896 | 2.70% |

This table highlights that over 64% of all DSP software customers are located in the United States, underscoring its leadership in digital advertising infrastructure, real-time bidding maturity, and availability of in-market DSP vendors. The United Kingdom and Canada follow as strong secondary markets, while countries like Germany and Poland continue to show stable growth in programmatic investments within the European Union.

Organizational Trends and User Segmentation

In addition to geography, DSP software adoption in 2026 is largely shaped by company size. Data shows that small to mid-sized organizations (0–49 employees) represent a growing share of DSP users. This trend is a clear indicator of the increasing democratization of programmatic technologies, where powerful tools once exclusive to large enterprises are now available to lean teams through user-friendly platforms and self-service models.

Larger enterprises, meanwhile, are evolving toward hybrid operational models. These models combine:

- Internal in-house teams with digital media expertise

- External DSP platforms that offer inventory access, data integrations, and advanced automation

- Managed service partnerships for strategic planning, creative support, and optimization

This hybrid approach enables enterprise advertisers to retain control over their data while benefiting from platform scalability and third-party innovation.

Matrix: DSP Adoption by Organizational Size (2026)

| Company Size | Adoption Trend | Key Characteristics |

|---|---|---|

| 0–49 Employees | Rapid Growth | Embracing self-serve DSPs, budget-friendly platforms, niche targeting |

| 50–249 Employees | Steady Expansion | Growing use of managed DSP accounts, more sophisticated campaigns |

| 250–999 Employees | Mature Usage | Balancing internal teams with external DSP consultants |

| 1,000+ Employees | Hybrid Integration | In-house ad ops blended with enterprise-grade DSP infrastructure |

Strategic Implications for DSP Vendors in 2026

The DSP customer base in 2026 reflects a dual-market opportunity:

- Scale and innovation for large enterprises, where hybrid solutions, custom bidding algorithms, and integrations with CDPs and CRMs are essential.

- Accessibility and simplicity for SMBs, where ease of use, lower budgets, and native integration with eCommerce and analytics tools are crucial.

DSP providers that tailor their product offerings and support systems to meet the needs of these two distinct user segments will be well-positioned to expand their footprint globally.

Conclusion

The current DSP customer distribution highlights not only geographic leadership from mature markets like the United States and the UK, but also the broader adoption of programmatic technologies by organizations of all sizes. With the rise of small business participation and hybrid enterprise strategies, the DSP software market in 2026 is more inclusive, adaptable, and strategically segmented than ever before—reflecting the next phase of digital advertising transformation across industries and borders.

Advanced Technological Foundations of DSP Software in 2026: The Algorithmic Infrastructure Driving Top Demand Side Platforms

In 2026, the technological core of the world’s leading Demand Side Platform (DSP) software is no longer built on traditional digital infrastructure alone. Instead, it is driven by a more sophisticated and intelligent architecture that reflects the evolution of programmatic advertising into a high-performance, AI-powered ecosystem. The new generation of DSPs are operating at the convergence of scalable infrastructure, autonomous intelligence, and real-time responsiveness. These platforms are capable of executing complex bidding strategies, sentiment analysis, and predictive audience targeting at unprecedented speeds.

This section explores the foundational innovations that define the most advanced DSP software tools in 2026—technologies that support the operations of the top 10 global DSP platforms, and that are redefining digital advertising economics at scale.

Core Technological Themes Defining DSP Infrastructure in 2026

The foundation of DSP systems in 2026 is anchored in three critical themes:

- Architectural Resilience: Infrastructure that remains stable under massive data and processing loads, powered by AI supercomputing frameworks.

- Intelligent Synthesis: Systems capable of integrating behavioral, contextual, and external signals to create predictive decision engines.