Key Takeaways

- The top 10 desk booking software in 2026 leverage AI, predictive analytics, and real-time occupancy data to optimize hybrid work and reduce real estate costs.

- Leading workplace management platforms integrate ESG tracking, energy automation, and enterprise systems to deliver measurable ROI and sustainability gains.

- Modern desk booking solutions enhance employee experience through seamless mobile booking, team-day coordination, and data-driven workplace optimization.

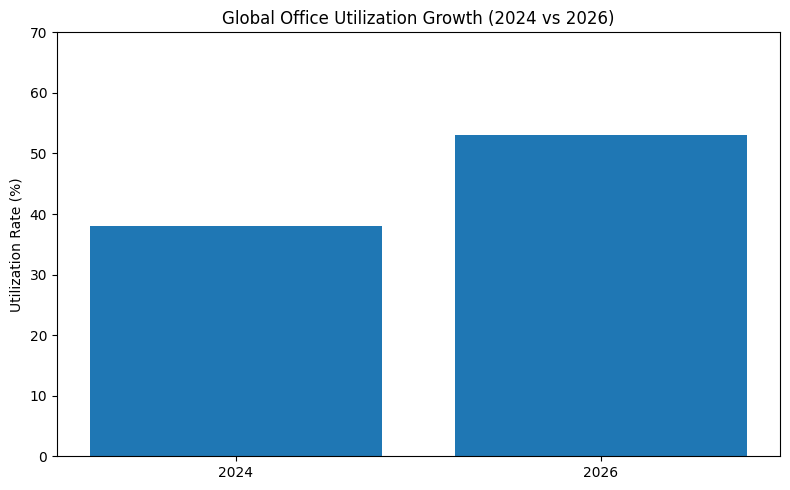

The global workplace has undergone one of the most significant transformations in modern business history. By 2026, hybrid work is no longer an experiment or temporary adjustment. It is a standardized operating model adopted by the majority of enterprises worldwide. As organizations balance flexibility, collaboration, sustainability, and cost control, desk booking software has emerged as a critical pillar of modern workplace strategy.

The concept of reserving a desk may seem simple on the surface. However, in 2026, desk booking software represents far more than a scheduling tool. It has evolved into an intelligent workplace management system that connects employees, facilities, real estate portfolios, and smart building infrastructure into a unified digital ecosystem. For many organizations, selecting the right desk booking platform is now a strategic decision that directly impacts operational efficiency, employee experience, and long-term financial performance.

Why Desk Booking Software Matters in 2026

The traditional 1:1 employee-to-desk model has largely disappeared. Most organizations now operate with flexible seating arrangements, shared workstations, and rotating attendance schedules. Peak collaboration days often fall between Tuesday and Thursday, creating midweek demand surges while leaving other days underutilized. Without structured coordination tools, this imbalance leads to overcrowding, wasted space, and employee frustration.

Desk booking software addresses these challenges by enabling:

• Real-time desk and room reservations

• Visibility into who will be in the office on specific days

• Data-driven space utilization analytics

• Automated release of unused bookings

• Integration with communication platforms like Microsoft Teams and Slack

• ESG-driven energy optimization through occupancy tracking

In a business climate where real estate costs remain high and sustainability reporting requirements are increasing, these capabilities are no longer optional. They are essential.

The Evolution from Booking Tool to Workplace Operating System

Early desk reservation systems focused primarily on avoiding double bookings. In 2026, leading platforms incorporate artificial intelligence, predictive analytics, IoT sensor integration, and hybrid workforce coordination features. Many solutions now function as full-scale workplace operating systems capable of managing desks, meeting rooms, visitors, parking, access control, and even HVAC optimization.

This technological evolution reflects broader shifts in corporate priorities:

| Strategic Priority | Role of Desk Booking Software in 2026 |

|---|---|

| Real Estate Optimization | Identifies underutilized space for consolidation |

| Cost Reduction | Reduces unnecessary square footage and energy use |

| Employee Experience | Enables coordinated, frictionless collaboration |

| Sustainability and ESG Compliance | Tracks occupancy-based carbon impact |

| Operational Efficiency | Automates facility and maintenance workflows |

For Chief Financial Officers, desk booking analytics provide confidence in lease negotiations and capital allocation decisions. For Chief Human Resources Officers, these platforms enhance collaboration and reduce the friction that discourages employees from commuting.

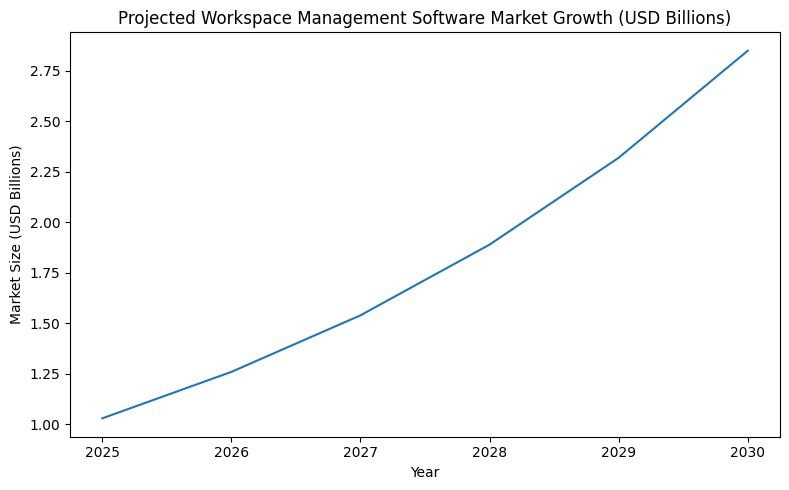

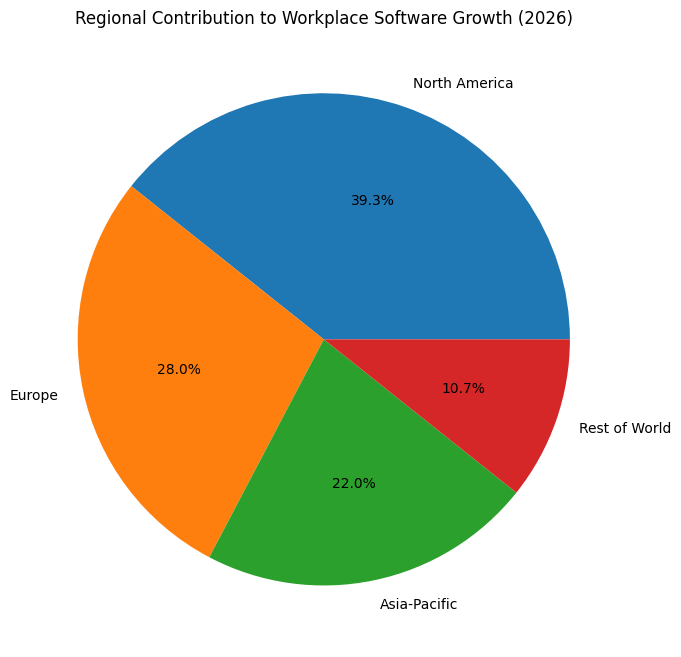

Market Growth and Competitive Landscape

The desk booking software market in 2026 is experiencing sustained double-digit growth. This expansion is driven by hybrid workforce adoption, smart office infrastructure investments, and increasing demand for data-driven workplace decisions. Enterprises now require platforms that integrate seamlessly with HR systems, ERP software, calendar tools, and building management systems.

The competitive landscape includes enterprise-grade AI operating systems, ESG-focused workplace suites, rule-based governance platforms, and communication-native booking apps. Each of the top 10 desk booking software providers in 2026 differentiates itself through specialized strengths such as predictive space modeling, advanced rule engines, collaboration feeds, sustainability dashboards, or modular scalability.

As the category matures, the distinction between desk booking and broader workplace experience platforms continues to blur. Organizations are no longer searching for a simple desk scheduler. They are seeking connected intelligence systems capable of orchestrating how people interact with space.

What This Guide Covers

This comprehensive guide to the Top 10 Desk Booking Software in 2026 explores the most influential platforms shaping the future of hybrid work. It examines their core capabilities, pricing models, integration ecosystems, ROI potential, and strategic positioning within the global workplace technology market.

Readers will gain insights into:

• Which platforms lead in AI-driven automation

• Which solutions prioritize ESG and carbon tracking

• Which tools offer the strongest enterprise integrations

• How pricing models differ between user-based and resource-based systems

• What measurable returns organizations are achieving

Whether you are a facilities manager seeking utilization clarity, an HR leader focused on employee engagement, or a finance executive evaluating portfolio consolidation, understanding the leading desk booking platforms in 2026 is critical.

The Office as a Competitive Advantage

In 2026, the office is no longer simply a location for routine work. It is a destination designed for intentional collaboration and strategic engagement. Organizations that leverage advanced desk booking software transform their workplaces into responsive, data-driven environments. These companies reduce waste, improve sustainability, strengthen team alignment, and protect their real estate investments.

The top 10 desk booking software platforms in the world today represent the technological backbone of this transformation. They define how modern enterprises manage space, coordinate hybrid teams, and future-proof their workplace strategies in an increasingly intelligent and connected business landscape.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Best Demo Software To Try in 2026.

If you like to get your company listed in our top B2B software reviews, check out our world-class 9cv9 Media and PR service and pricing plans here.

Top 10 Best Desk Booking Software in 2026

1. Archie

Within this competitive landscape, Archie stands out as one of the most comprehensive and strategically positioned desk booking platforms in 2026. The platform is widely adopted by mid-sized to enterprise organizations operating complex, multi-location environments where space optimization, security compliance, and operational visibility are critical.

Strategic Vision and Market Role

Archie positions itself not merely as a booking tool but as a digital infrastructure layer for the built environment. Its mission centers on replacing fragmented spreadsheets, manual processes, and disconnected point solutions with a unified workplace operating system.

The platform serves a broad spectrum of industries including:

| Industry Sector | Typical Use Case |

|---|---|

| Technology Firms | Hybrid team rotations and global office coordination |

| Financial Services | Compliance-driven seat allocation and utilization analytics |

| Healthcare Facilities | Controlled access and visitor pre-screening |

| Government Agencies | Secure access management and occupancy tracking |

| Coworking Operators | Resource billing and automated membership management |

Archie maintains one of the highest customer satisfaction ratings among workplace platforms in 2026, frequently cited for its usability, configurability, and responsive customer support.

Core Capabilities and Technical Specifications in 2026

Archie integrates advanced booking functionality with spatial intelligence and operational automation.

Key Product Capabilities

| Capability | Description |

|---|---|

| High-Resolution 2D Floor Plans | Interactive maps enabling real-time desk and room visualization |

| Automated Seat Assignment | Smart allocation for rotating hybrid schedules |

| Visitor Management Module | Pre-registration workflows with QR-code check-in |

| Utilization Analytics | Peak occupancy tracking and trend forecasting |

| Automated Billing | Resource-based billing for coworking and shared spaces |

| Multi-Location Management | Centralized dashboard across global offices |

Technical Architecture and Compliance Standards

| Specification Category | Details |

|---|---|

| Security Standards | SOC 2 Type II, GDPR compliance, ISO 27001 |

| Pricing Model | Resource-Based (per desk, per room) |

| Integration Ecosystem | 30+ native integrations |

| Collaboration Integrations | Slack, Microsoft Teams, Google Workspace |

| Access Control Integration | Native support for Kisi |

| Accounting Integration | QuickBooks, Xero |

| Support Model | 24/7 live representative support |

| Average Deployment Time | Under 30 days for standard implementations |

Its resource-based pricing model differentiates it from many competitors. Rather than charging per employee, pricing scales according to the number of physical assets managed, making it particularly attractive to organizations optimizing large real estate portfolios.

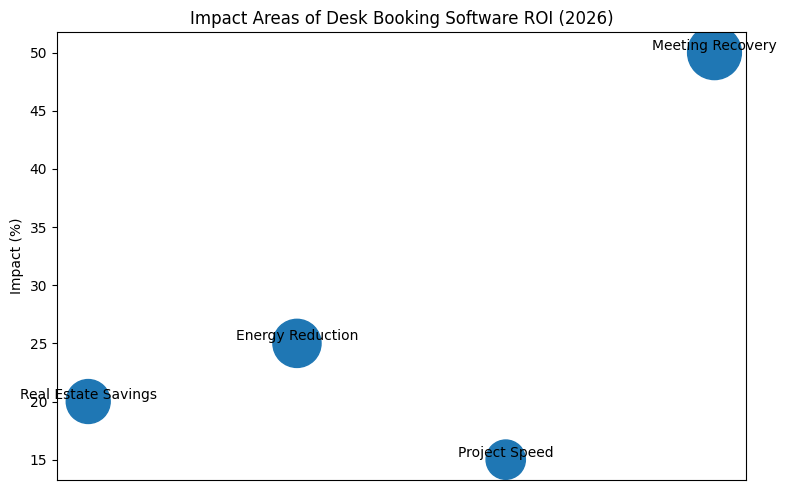

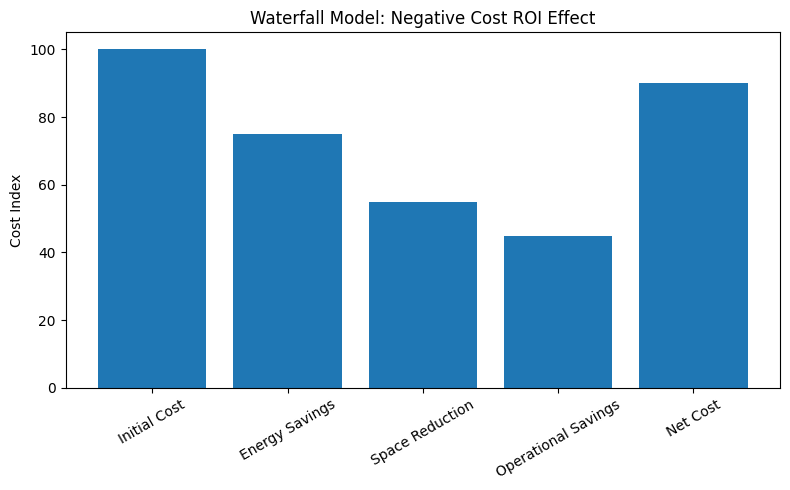

Operational Impact and ROI Analysis

Desk booking software in 2026 is increasingly evaluated based on measurable financial outcomes rather than feature lists alone. Archie demonstrates this shift through data-driven workplace optimization.

Example ROI Snapshot

| Metric Category | Before Implementation | After Implementation | Business Impact |

|---|---|---|---|

| Peak Seat Utilization | Unknown | 38% Identified | Data-driven consolidation |

| Administrative Time Spent | 20+ hrs/week | 5 hrs/week | 15+ hrs saved weekly |

| Floor Space Allocation | Static | Optimized | One floor eliminated |

| Annual Cost Savings | N/A | GBP 300,000+ | Direct real estate savings |

In one financial services deployment, occupancy analytics revealed that even at peak usage, less than half of available desks were utilized. This insight supported the consolidation of office space, generating substantial annual savings while maintaining workforce flexibility.

Additionally, automated billing and resource management reduced administrative overhead significantly, enabling operations teams to reallocate time toward strategic initiatives rather than manual tracking.

User Experience and Implementation Considerations

User feedback in 2026 frequently highlights the importance of intuitive interfaces and guided onboarding. Archie is consistently recognized for its practical feature set and operational reliability.

Representative Customer Feedback Summary

| Review Aspect | Common Sentiment |

|---|---|

| Interface Usability | Clean, intuitive, accessible for daily use |

| Feature Practicality | Relevant tools aligned with operational needs |

| Customer Support | Responsive and dependable |

| Initial Setup | Configuration-intensive but flexible |

| Onboarding Experience | Could benefit from more guided workflows |

While initial setup may require thoughtful configuration due to the platform’s depth and flexibility, organizations report that once deployed, the system operates reliably and scales effectively across multiple sites.

Why Desk Booking Software Matters in 2026

The global office environment in 2026 demands transparency, adaptability, and data-backed decision-making. Companies face rising real estate costs, regulatory complexity, and evolving employee expectations. Leading desk booking software platforms address these pressures by delivering:

| Operational Outcome | How Top Platforms Enable It |

|---|---|

| Cost Optimization | Real-time utilization analytics |

| Compliance Assurance | Security certifications and access control integrations |

| Hybrid Workforce Alignment | Automated seat assignments and team scheduling |

| Improved Employee Experience | Mobile booking and interactive floor plans |

| Administrative Efficiency | Automated billing and reporting |

In this context, platforms like Archie represent more than booking systems; they function as digital control centers for modern workplaces. As hybrid and distributed work structures continue to mature globally, demand for enterprise-grade desk booking solutions is expected to grow, further solidifying the role of workplace operating systems as critical business infrastructure.

2. Skedda

Skedda has established itself as the preferred platform for organizations with complex access requirements, shared resource constraints, and fluctuating occupancy patterns. With nearly two million users worldwide and deployments across higher education, research institutes, non-profits, and global enterprises, the platform is often referred to as the market’s policy specialist.

Notable institutions using Skedda include Harvard University and Siemens, illustrating the platform’s ability to operate at both academic and enterprise scale.

Market Positioning in 2026

| Category Dimension | Skedda’s Position |

|---|---|

| Primary Differentiator | Advanced rule-based booking controls |

| Core Target Audience | Policy-driven organizations |

| User Scale | Nearly 2 million global users |

| Deployment Model | Cloud-based, multi-site ready |

| Strategic Reputation | Governance-focused scheduling leader |

Core Capabilities and 2026 Product Vision

Skedda’s defining capability lies in its powerful and flexible rules engine. Unlike many desk booking tools that prioritize visual layouts or social coordination features, Skedda emphasizes structured governance and conditional logic.

Its rules engine enables administrators to configure highly granular booking conditions, including:

| Rule Configuration Type | Practical Example |

|---|---|

| Department Quotas | Limit Engineering to 10 desk bookings per week |

| Buffer Times | Enforce 30-minute cleaning gap between bookings |

| Access Restrictions | Allow only certified staff to book lab rooms |

| Time-Based Access Windows | Restrict booking to business hours |

| Role-Based Permissions | Executives receive priority access to boardrooms |

| Approval Workflows | Manager sign-off required for premium spaces |

This structured approach makes Skedda particularly valuable in research facilities, government offices, laboratories, shared campuses, and regulated industries.

In 2026, Skedda has articulated a forward-looking vision described internally as “The Year of the FM Analyst.” The company’s strategic direction focuses on elevating facilities managers from operational gatekeepers to strategic data storytellers. The platform’s analytics suite increasingly supports narrative-driven insights, enabling facilities leaders to present utilization data, capacity planning models, and budget justifications to executive stakeholders.

Pricing Structure and Commercial Model

A key differentiator in Skedda’s commercial model is its pricing structure based on bookable spaces rather than user count. All pricing tiers include unlimited users, making it particularly attractive for large organizations with high headcounts but moderate physical footprints.

This model contrasts with user-based pricing platforms that can become costly in enterprise environments with thousands of employees.

Skedda Pricing Overview (Billed Annually)

| Plan Tier | Monthly Price (USD) | Included Bookable Spaces | Key Inclusions |

|---|---|---|---|

| Starter | 99 | 15 | Basic rules engine, interactive floor plans |

| Plus | 149 | 20 | Full insights dashboard, branding customization |

| Premier | 199 | 25 | Complete rules engine, custom fields, advanced permissions |

| Enterprise | Custom | Tailored | Scalable spaces, white-glove implementation, custom SLAs |

Comparative Pricing Model Matrix (2026)

Platform Pricing Model Comparison

| Platform | Pricing Basis | Unlimited Users | Best For |

|---|---|---|---|

| Skedda | Per Bookable Space | Yes | High headcount, limited desk inventory |

| User-Based SaaS | Per Employee | No | Small teams with predictable usage |

| Resource-Based | Per Desk/Room Asset | Sometimes | Real estate portfolio optimization |

This structure makes Skedda financially efficient for universities, global non-profits, and multinational corporations that need to grant booking access to large employee populations without incurring escalating license costs.

Analytics and Measurable Outcomes

In 2026, desk booking software is evaluated by its ability to deliver measurable operational improvements. Skedda’s analytics and reporting tools provide facilities teams with clear utilization metrics, trend forecasting, and resource performance insights.

Case Study: Woolcock Institute

The Woolcock Institute implemented Skedda to monitor utilization of shared research computers, which were high-cost, limited-availability assets. Utilization reports revealed a 98 percent occupancy rate, providing compelling evidence to secure additional funding for expansion of research equipment.

| Impact Category | Pre-Implementation | Post-Implementation Insight | Outcome |

|---|---|---|---|

| Equipment Utilization | Untracked | 98 percent confirmed | Funding approval secured |

| Booking Transparency | Limited | Full visibility | Improved scheduling fairness |

| Capital Justification | Anecdotal | Data-backed | Budget expansion approved |

For standard office environments, Skedda commonly enables a transition from a traditional 1:1 desk-to-employee ratio toward a more efficient 0.6–0.8 ratio, depending on hybrid attendance patterns. This shift allows organizations to reduce excess real estate, lower overhead costs, and improve space allocation efficiency.

Operational Efficiency Metrics

| Performance Indicator | Typical Improvement with Skedda |

|---|---|

| Seat Ratio Optimization | 1.0 reduced to 0.6–0.8 |

| Administrative Overhead | Reduced through automated rules |

| Policy Compliance | Standardized and enforced digitally |

| Booking Conflicts | Minimized through automated restrictions |

| Data Transparency | Executive-ready reporting dashboards |

Integration Ecosystem and User Experience

While Skedda is known primarily for governance and rule controls, it also integrates with widely used collaboration platforms to ensure adoption remains seamless for employees.

| Integration Category | Supported Platforms |

|---|---|

| Calendar Integration | Outlook |

| Collaboration Tools | Microsoft Teams |

| Interactive Floor Plans | Visual booking maps for all locations |

| API Access | Custom integrations available |

User feedback frequently highlights ease of adoption and practical functionality. Organizations report improvements in reliability and feature expansion throughout recent product updates.

Customer Sentiment Summary

| Feedback Category | Representative Themes |

|---|---|

| Ease of Use | Straightforward for end users |

| Integration Strength | Strong Outlook and Teams connectivity |

| Feature Depth | Powerful booking logic capabilities |

| Recent Improvements | Notable upgrades addressing earlier gaps |

| Value Proposition | Competitive alternative to higher-cost tools |

Several organizations have migrated from other visitor or booking platforms due to cost concerns or missing governance features, citing Skedda’s structured rule system as a key decision factor.

Skedda’s Role Among the Top Desk Booking Software Platforms in 2026

Within the broader ecosystem of leading desk booking software platforms, Skedda occupies a distinct niche. While some competitors emphasize social workplace coordination or aesthetic user interfaces, Skedda focuses on precision, compliance, and enforceable policy frameworks.

In a market increasingly driven by hybrid work complexity, regulatory demands, and capital efficiency, rule-based systems provide a crucial layer of operational discipline. Skedda’s positioning as a governance-centric platform ensures it remains a central player among the world’s top desk booking software solutions in 2026.

As organizations continue to optimize physical workspaces while balancing flexibility and fairness, structured booking logic, utilization analytics, and scalable pricing models will remain essential components of modern workplace management systems. Skedda’s strategic direction indicates that facilities management in 2026 is no longer reactive administration, but a data-informed, board-level function supported by intelligent space management technology.

3. YAROOMS

Among the top desk booking software platforms globally in 2026, YAROOMS is widely recognized for integrating ESG reporting with workplace logistics. The platform has positioned itself as a strategic workplace planning suite designed for organizations that prioritize sustainability alongside operational efficiency.

YAROOMS: The Strategic ESG and Workplace Planning Suite

YAROOMS has established itself as a market leader for companies seeking to align hybrid workplace management with environmental reporting objectives. Rather than operating solely as a desk reservation tool, the platform functions as a centralized system covering seat hoteling, meeting room scheduling, visitor flows, hybrid attendance analytics, and carbon impact measurement.

This broader positioning differentiates YAROOMS within a crowded desk booking software market that often focuses primarily on scheduling mechanics rather than sustainability performance.

Strategic Market Position in 2026

| Category Dimension | YAROOMS Positioning |

|---|---|

| Primary Differentiator | ESG-integrated workplace management |

| Core Target Audience | Sustainability-driven enterprises |

| Deployment Model | Cloud-based, Microsoft-optimized |

| Competitive Identity | Carbon-aware workplace planning suite |

| Adoption Focus | Hybrid enterprises with ESG mandates |

Unique Market Value and ESG Capabilities

YAROOMS extends beyond standard desk booking by embedding sustainability metrics directly into workplace decision-making. One of its defining features in 2026 is the Carbon Dashboard, which provides organizations with visibility into the environmental impact of office attendance patterns.

Carbon and ESG Feature Matrix

| ESG Capability | Business Application |

|---|---|

| Carbon Dashboard | Tracks CO2 impact of office attendance |

| Occupancy-Based Emissions Estimation | Calculates energy impact per utilized space |

| Portfolio Optimization Insights | Identifies underused floors or buildings |

| Attendance Pattern Analytics | Links hybrid policies with sustainability targets |

| Executive Reporting Tools | Board-ready ESG performance summaries |

By quantifying how often employees commute and how intensively physical space is used, facilities and sustainability teams can align real estate strategy with broader carbon reduction initiatives.

Artificial Intelligence and Adoption

In 2026, user adoption remains a central challenge for workplace software platforms. YAROOMS addresses this through Yarvis, its AI-powered natural language assistant.

AI Capability Overview

| AI Component | Description |

|---|---|

| Yarvis AI Assistant | Natural-language scheduling and booking requests |

| Chat-Based Booking | Reserve desks or rooms directly in collaboration tools |

| Contextual Suggestions | Intelligent space recommendations |

| Automation Support | Streamlined booking confirmations and reminders |

Yarvis integrates directly within Microsoft Teams and Slack, allowing employees to book workspaces conversationally without navigating a standalone application. This embedded approach improves adoption among technical, creative, and distributed teams accustomed to chat-based workflows.

Technical Architecture and Ecosystem Integration

YAROOMS is particularly optimized for organizations operating within the Microsoft ecosystem. Deep synchronization capabilities with Exchange room mailboxes and Outlook calendars ensure seamless interoperability with enterprise IT environments.

Technical Specification Overview

| Specification Category | Details |

|---|---|

| Security Standards | ISO 27001 compliant, GDPR aligned |

| Hosting Environment | Azure-based infrastructure |

| Core Sustainability Feature | Carbon Dashboard with CO2 tracking |

| AI Integration | Yarvis natural-language assistant |

| Calendar Synchronization | Exchange and Outlook native sync |

| Collaboration Integration | Microsoft Teams and Slack |

| Hardware Support | Digital signage for desks and meeting rooms |

Hardware-integrated digital signage capabilities further extend the platform’s functionality into physical spaces, allowing real-time booking visibility on room panels and desk displays.

Pricing Structure and Tiering

YAROOMS offers tiered pricing designed to accommodate both growing teams and large enterprises seeking ESG-integrated workplace planning tools.

Pricing Overview (2026)

| Plan Category | Monthly Price (USD) | User Range | Core Inclusions |

|---|---|---|---|

| Starter | 99 | 10–20 users | Desk booking, hybrid planning, ESG dashboard access |

| Enterprise | 899 | 300+ users | Advanced ESG analytics, AI assistant, enterprise support |

Pricing is structured to scale according to organizational size, making the platform accessible to both mid-sized businesses and large multinational enterprises pursuing sustainability-linked real estate strategies.

Operational Outcomes and Success Metrics

In 2026, desk booking software is evaluated not only by feature depth but by measurable operational impact. Organizations implementing YAROOMS frequently report tangible improvements in both cost efficiency and sustainability alignment.

Performance Impact Matrix

| Performance Area | Reported Improvement |

|---|---|

| Real Estate Optimization | Up to 30% portfolio reduction |

| Meeting Capacity Recovery | 10–25% regained via no-show release automation |

| Carbon Visibility | Clear CO2 impact reporting by attendance pattern |

| Administrative Efficiency | Automated desk release and booking logic |

| Hybrid Policy Alignment | Data-informed attendance planning |

The platform’s automated no-show desk release functionality addresses a common inefficiency in hybrid environments known as phantom availability, where desks or rooms remain booked but unused. By automatically freeing these resources after a defined grace period, organizations recover valuable capacity and improve utilization accuracy.

Sustainability and Real Estate Savings

Organizations leveraging YAROOMS analytics have identified underutilized floors and buildings, enabling downsizing decisions that reduce overhead while supporting ESG commitments. In several reported deployments, real estate savings reached up to 30 percent by consolidating office portfolios based on utilization data.

This dual impact—cost optimization combined with measurable environmental reporting—reinforces the platform’s strategic relevance in 2026.

User Experience and Customer Feedback Themes

User feedback highlights both strengths and areas for continued enhancement.

Customer Sentiment Summary

| Feedback Category | Common Observations |

|---|---|

| Ease of Scheduling | Simplifies shared space coordination |

| Reliability | Consistent and dependable system performance |

| Collaboration Integration | Strong alignment with Teams and Outlook |

| Mobile Experience | Map view could be smoother |

| Overall Satisfaction | Positive sentiment regarding functionality |

Users frequently emphasize the platform’s reliability and effectiveness in managing shared environments, particularly in organizations where hybrid attendance patterns fluctuate weekly. Suggestions for refinement often focus on enhancing mobile interface fluidity, especially within map-based views for on-the-go employees.

YAROOMS Within the Global Desk Booking Software Market

In the broader context of the top desk booking software platforms in the world in 2026, YAROOMS occupies a distinct strategic niche. While many platforms concentrate on scheduling logistics or utilization analytics alone, YAROOMS integrates environmental accountability directly into workplace planning.

Competitive Differentiation Matrix (2026)

| Platform Focus Area | Standard Booking Tools | YAROOMS Approach |

|---|---|---|

| Desk Reservation | Core feature | Fully integrated |

| Hybrid Attendance Analytics | Moderate | Advanced and ESG-linked |

| Carbon Tracking | Rare | Native Carbon Dashboard |

| AI Chat-Based Scheduling | Limited | Yarvis embedded assistant |

| Microsoft Ecosystem Alignment | Variable | Deep synchronization |

As ESG reporting continues to influence corporate decision-making and investor expectations, the demand for workplace platforms that combine operational efficiency with environmental transparency is expected to grow.

YAROOMS reflects a broader market evolution in which desk booking software transitions from a facility convenience tool into a strategic enterprise system supporting sustainability, cost control, and data-driven real estate transformation in 2026.

4. Envoy Workplace

Among the top desk booking software platforms in the world in 2026, Envoy Workplace has emerged as a security-first integration powerhouse. Originally known as a market leader in visitor management, Envoy has successfully expanded its capabilities to become a comprehensive workplace management solution.

Envoy Workplace: The Security-First Integration Powerhouse

Envoy built its early reputation around digital visitor sign-in systems and front-desk automation. By leveraging this dominant position at corporate entry points, the company strategically expanded into desk booking, hybrid scheduling, delivery management, and occupancy analytics.

This evolution has positioned Envoy as a preferred solution for corporate headquarters, multinational enterprises, and highly regulated industries that require robust security oversight alongside flexible workspace management.

Strategic Market Position in 2026

| Category Dimension | Envoy Workplace Positioning |

|---|---|

| Primary Differentiator | Security-led workplace integration |

| Core Strength | Visitor management and access compliance |

| Target Industries | Finance, healthcare, technology, defense |

| Deployment Model | Cloud-based, enterprise scalable |

| Global Footprint | Multi-location enterprise deployments |

Mission and Enterprise Scalability

Envoy’s 2026 strategic direction centers on unifying space utilization, compliance controls, and employee experience within a single administrative dashboard. Rather than separating desk booking from visitor workflows or emergency response systems, the platform integrates these elements into a cohesive operational environment.

This unified model supports:

| Operational Objective | How Envoy Delivers |

|---|---|

| Space Utilization Visibility | Real-time occupancy dashboards |

| Security Compliance | Integrated visitor screening and badge management |

| Employee Attendance Oversight | Hybrid scheduling with remote status tracking |

| Regulatory Documentation | Automated NDA collection and visitor logs |

| Emergency Preparedness | Mass notification and evacuation accounting |

Such capabilities are particularly critical in regulated environments where standards similar to ITAR and HIPAA require strict control of physical access and visitor tracking.

Core Features and Integration Depth

Envoy Workplace distinguishes itself in 2026 through extensive integration capabilities and operational automation.

Feature Overview

| Feature Category | Description |

|---|---|

| Real-Time Occupancy Heatmaps | Visual tracking of active desks and meeting rooms |

| Hybrid Desk Booking | Flexible workspace reservation system |

| Mailroom Delivery Management | OCR-powered package scanning and recipient notification |

| Virtual Front Desk | Remote check-in for unstaffed entrances |

| Emergency Notifications | Real-time alerts and evacuation accountability |

| Compliance Documentation | NDA signing, badge printing, visitor record retention |

The Virtual Front Desk capability allows organizations to manage visitor check-ins even in offices without dedicated reception staff. Combined with digital badge printing and identity verification workflows, this reduces reliance on manual processes while maintaining security standards.

Integration Ecosystem Strength

One of Envoy’s defining advantages in 2026 is its integration ecosystem, with more than 100 native connectors spanning collaboration tools, HR systems, and physical security providers.

Security and Platform Integration Matrix

| Integration Category | Examples of Native Integrations |

|---|---|

| Access Control Systems | Kisi, Openpath, Genetec |

| Collaboration Platforms | Slack, Microsoft Teams |

| Calendar Systems | Google Workspace, Outlook |

| HR Systems | Workforce directories and SSO providers |

| Building Security Platforms | Enterprise-grade access management solutions |

Deep integration with access control providers ensures that visitor approvals, badge issuance, and entry permissions are synchronized with physical security infrastructure in real time.

Pricing Structure and Tier Comparison

Envoy Workplace operates on a per-active-user pricing model, supplemented by location-based pricing for visitor management add-ons.

Pricing Overview (Billed Annually)

| Plan Tier | Cost (USD) | Key Features |

|---|---|---|

| Standard | 3 per active user/mo | Desk booking, hybrid scheduling, deliveries |

| Premium | 5 per active user/mo | Advanced analytics, emergency alerts, utilization tracking |

| Premium Plus | 7 per active user/mo | Full-suite workplace and compliance features |

| Visitors Add-On | 4,345 per location/year | Security screening, NDA collection, badge printing |

This tiered structure allows organizations to adopt core desk booking functionality while layering advanced compliance and visitor management capabilities as needed.

Comparative Commercial Model Matrix

Pricing Basis Comparison

| Platform Model Type | Envoy Structure |

|---|---|

| User-Based Pricing | Active-user subscription tiers |

| Location-Based Add-On | Visitor module per site pricing |

| Enterprise Scalability | Multi-site support with centralized dashboard |

| Security Feature Bundling | Integrated in higher-tier plans |

Return on Investment and Measurable Outcomes

In 2026, organizations assess desk booking software not only on usability but also on operational impact and compliance assurance.

Envoy’s automation of visitor flows and access management typically results in measurable reductions in front-desk administrative workload.

ROI Impact Metrics

| Performance Area | Typical Impact |

|---|---|

| Front-Desk Administrative Load | Reduced by 30–50 percent |

| Visitor Processing Time | Significantly shortened through automation |

| Occupancy Transparency | Real-time visibility across locations |

| Emergency Accountability | 100 percent staff and visitor tracking during evacuations |

| Compliance Documentation | Digitally archived and audit-ready |

The Emergency Notifications system is particularly valued in regulated environments. By integrating employee attendance data and visitor check-ins, organizations can account for all individuals present during evacuations or critical incidents.

Operational Efficiency Matrix

| Efficiency Driver | Business Benefit |

|---|---|

| Digital Badge Issuance | Reduced manual credential handling |

| OCR Mailroom Automation | Faster package processing and notification |

| Virtual Reception | Lower staffing requirements at entrances |

| Hybrid Attendance Dashboard | Clear view of in-office versus remote staff |

| Security Integration | Reduced risk of unauthorized access |

User Experience and Customer Feedback Themes

User feedback in 2026 frequently emphasizes ease of use, speed of check-in, and centralized attendance visibility.

Customer Sentiment Summary

| Feedback Category | Observed Themes |

|---|---|

| Ease of Check-In | Fast and intuitive for employees and visitors |

| Attendance Visibility | Clear overview of office presence |

| Hybrid Coordination | Effective for booking flexible desks and rooms |

| Hardware Experience | iPad-based visitor sign-in considered user-friendly |

| Overall Reliability | Stable and dependable daily performance |

Many users highlight the platform’s simplicity at the reception level, particularly its digital sign-in interface and visitor iPad experience. Simultaneously, administrators value the ability to track who is on-site, working remotely, or off-duty through a unified dashboard.

Envoy’s Role Among the Top Desk Booking Software Platforms in 2026

Within the broader ecosystem of the top desk booking software solutions globally in 2026, Envoy occupies a security-centric leadership position. While other platforms may emphasize ESG reporting, advanced rule engines, or hybrid social coordination, Envoy integrates these capabilities through a lens of compliance and physical security.

Competitive Positioning Matrix

| Market Focus Area | Standard Desk Tools | Envoy Workplace |

|---|---|---|

| Visitor Management | Limited | Market-leading heritage |

| Access Control Integration | Moderate | Deep native integrations |

| Emergency Accountability | Basic | Advanced mass notification system |

| Mailroom Automation | Rare | OCR-enabled workflow |

| Hybrid Desk Booking | Core feature | Integrated with security layer |

As enterprises continue to consolidate workplace management tools, platforms capable of merging desk booking, visitor compliance, and physical security into a single operational system are gaining strategic importance.

Envoy Workplace reflects this market evolution by transforming from a visitor management specialist into a unified workplace security and space management platform, reinforcing its status as one of the most influential desk booking software providers in the world in 2026.

5. Robin

Among the top desk booking software platforms in the world in 2026, Robin has positioned itself as the enterprise experience and survey specialist. Originally known for meeting room booking, the platform has evolved into a comprehensive workplace analytics and feedback system tailored for high-scale hybrid organizations.

Robin: The Enterprise Experience and Survey Specialist

Robin’s core differentiation lies in its ability to connect physical space usage with employee satisfaction. Rather than focusing solely on desk reservations or compliance controls, the platform emphasizes continuous feedback loops and workplace experimentation.

This strategic positioning makes Robin particularly attractive to enterprises with more than 500 employees seeking to optimize global office portfolios while maintaining employee engagement.

Strategic Market Position in 2026

| Category Dimension | Robin Positioning |

|---|---|

| Primary Differentiator | Built-in employee sentiment analysis |

| Core Audience | Enterprises with 500+ hybrid employees |

| Operational Focus | Strategic space experimentation |

| Deployment Complexity | High-scale global rollout capability |

| Competitive Identity | Experience-driven workplace platform |

Key Differentiators in 2026

Robin’s most distinctive feature is its automated feedback system. After employees book and attend office sessions, the platform prompts them to complete satisfaction surveys. This structured approach enables facilities leaders and workplace strategists to correlate space utilization data with real-time employee sentiment.

Experience and Feedback Matrix

| Capability | Business Application |

|---|---|

| Post-Visit Surveys | Measures satisfaction after each office visit |

| Utilization-Sentiment Correlation | Links occupancy data to employee feedback |

| Layout Experimentation Tracking | Tests seating changes against sentiment shifts |

| Department-Level Reporting | Identifies team-specific satisfaction patterns |

| Executive Dashboard Analytics | Board-ready workplace performance insights |

By combining quantitative usage data with qualitative survey responses, Robin enables organizations to make informed decisions about layout redesign, collaboration zones, and hybrid attendance policies.

Technical Ecosystem and Administrative Flexibility

Robin provides enterprise-grade configurability designed for global organizations managing multiple campuses or headquarters locations.

One of its most notable administrative features is a WYSIWYG map editor, which allows non-technical administrators to reorganize floor plans without requiring engineering or IT assistance.

Administrative and Technical Feature Overview

| Feature Category | Description |

|---|---|

| WYSIWYG Map Editor | Drag-and-drop layout reconfiguration |

| Abandoned Meeting Protection | Auto-releases unclaimed meeting rooms |

| Hybrid Scheduling Tools | Desk and room booking for distributed teams |

| Enterprise Analytics Suite | Multi-location occupancy dashboards |

| Kiosk Application | On-site room and desk status visibility |

The abandoned meeting protection feature addresses a widespread inefficiency in enterprise environments where meeting rooms are booked but never used. If users fail to check in within a designated timeframe, the room is automatically released for others to reserve.

Enterprise Deployment Metrics

Robin is intentionally built for large-scale deployments. However, its enterprise focus is reflected in longer implementation timelines and higher upfront investment compared to mid-market platforms.

Enterprise Performance Metrics (2026 Averages)

| Metric Category | Enterprise Average (Robin) | Business Implication |

|---|---|---|

| Implementation Time | 2 months | Reflects complexity of global rollout |

| Return on Investment | 20 months | Longer-term payback due to initial setup cost |

| Average Discount | 15 percent | Standard in multi-year enterprise agreements |

| Typical User Base | 500+ hybrid employees | Designed for large-scale organizations |

The extended implementation timeline often stems from multi-location configuration, change management processes, and enterprise IT integration requirements.

Return on Investment and Capacity Recovery

Robin’s ROI is typically realized through improved space utilization, reduced meeting room waste, and optimized hybrid scheduling policies.

ROI Impact Matrix

| Performance Area | Observed Outcome |

|---|---|

| Meeting Room Utilization | Significant improvement after check-in enforcement |

| Abandoned Room Reduction | Immediate release of unused bookings |

| Space Experimentation Efficiency | Data-backed layout changes |

| Hybrid Policy Optimization | Improved alignment between attendance and capacity |

| Real Estate Stability | Avoidance of unnecessary expansion |

Case Snapshot: Lola.com

A notable example involves Lola.com, which discovered that approximately 40 percent of meeting rooms were booked but remained empty. After implementing Robin’s strict check-in policy and automated room release system, nearly half of that underutilized capacity was recovered without increasing physical office space.

Before and After Utilization Impact

| Metric Category | Before Implementation | After Policy Enforcement |

|---|---|---|

| Booked but Empty Rooms | 40 percent | Significantly reduced |

| Available Meeting Capacity | Constrained | Nearly 50 percent recovered |

| Real Estate Expansion Need | Considered | Deferred |

This case illustrates how behavioral enforcement mechanisms, combined with analytics, can unlock substantial efficiency gains without capital expenditure.

User Experience and Adoption Feedback

User reviews often highlight the platform’s efficiency in booking rooms and viewing space status, particularly in enterprise environments where visibility is critical.

Customer Sentiment Summary

| Feedback Category | Observed Themes |

|---|---|

| Booking Efficiency | Simple and effective room reservation |

| Status Visibility | Clear overview of room and station availability |

| Mobile Application | Navigation could be refined |

| Kiosk Design | Functional but less polished in design perception |

| Scalability | Effective for large team deployments |

While employees generally find the system efficient, some feedback points to opportunities for refinement in mobile navigation and kiosk interface aesthetics, particularly for less tech-savvy users.

Robin’s Position Among the Top Desk Booking Software Platforms in 2026

Within the broader ecosystem of the top desk booking software platforms globally in 2026, Robin occupies a distinct niche focused on employee experience intelligence and strategic workplace experimentation.

Competitive Positioning Matrix

| Market Focus Area | Standard Desk Tools | Robin Approach |

|---|---|---|

| Employee Sentiment Tracking | Rare | Native feedback integration |

| Layout Experimentation | Limited | Continuous testing framework |

| Meeting Auto-Release | Basic | Strict check-in enforcement |

| Enterprise Scale | Moderate | High-scale global deployments |

| Analytics Depth | Utilization-focused | Utilization plus sentiment correlation |

As organizations increasingly view office environments as dynamic ecosystems rather than static real estate assets, platforms that combine behavioral data with employee feedback gain strategic importance.

Robin reflects this evolution by positioning itself not simply as a booking system, but as an enterprise-grade workplace experimentation platform designed to optimize both space performance and employee satisfaction in 2026.

6. Deskbird

Among the top desk booking software platforms in the world in 2026, Deskbird stands out as the people-first adoption leader. Rather than positioning itself as a monitoring or enforcement tool, the platform presents itself as a digital companion for hybrid employees.

Deskbird: The People-First Adoption Leader

Deskbird has emerged as Europe’s fastest-growing workplace management platform in 2026. Built with a mobile-first philosophy and designed for intuitive daily use, the platform focuses on empowering employees to coordinate their office days rather than simply reserving desks.

Its rapid growth has been supported by USD 23 million in Series B funding, enabling continued expansion of artificial intelligence capabilities and product innovation.

Strategic Market Position in 2026

| Category Dimension | Deskbird Positioning |

|---|---|

| Primary Differentiator | Employee-centric hybrid coordination |

| Core Geographic Strength | Europe, expanding globally |

| Target Segment | SMBs and mid-market organizations |

| Growth Stage | High-growth, Series B funded |

| Brand Identity | Hybrid work companion platform |

Market Focus and Expansion

Deskbird’s strategic direction in 2026 reflects a broader industry movement toward predictive workplace management. The platform is transitioning from descriptive dashboards, which merely report historical occupancy data, to predictive AI-driven recommendations that automate scheduling and suggest optimal collaboration days.

This evolution supports organizations seeking proactive insights rather than reactive reporting.

Predictive AI Roadmap Overview

| AI Capability Stage | Description |

|---|---|

| Descriptive Analytics | Real-time utilization dashboards |

| Diagnostic Insights | Identification of attendance patterns |

| Predictive Recommendations | AI-suggested optimal office days |

| Automated Decision Support | Smart nudges for collaboration alignment |

Trusted by multinational organizations such as Samsung, Deloitte, and Airbus, Deskbird has demonstrated its ability to scale across large distributed teams while maintaining high employee adoption rates.

Product Features and User Experience

Deskbird differentiates itself through a highly intuitive interface and socially oriented workplace coordination tools.

Feature Overview

| Feature Category | Description |

|---|---|

| Social Office Feed | Allows employees to follow teammates’ office days |

| Five-Second Booking | Rapid desk and room reservations via mobile |

| Hybrid Attendance Calendar | Visual overview of team presence |

| Real-Time Utilization Analytics | Data for rightsizing desk inventory |

| Collaboration Visibility | See who will be in the office before commuting |

The Social Office Feed is one of the platform’s most distinctive features. Employees can follow colleagues and coordinate in-office days to maximize collaboration opportunities. This reduces the likelihood of commuting to an empty office and enhances team alignment.

Technical Specifications and Ecosystem

Deskbird offers extensive integration capabilities and maintains a strong European hosting footprint, making it particularly attractive to organizations with strict data protection requirements.

Technical Specification Overview

| Specification Category | Details |

|---|---|

| Integrations | 200+ integrations including MS Teams, Slack, Outlook |

| UI/UX Score | 9.2 / 10 (G2 Average) |

| Pricing (Business Plan) | USD 3.75 per user per month (billed annually) |

| Hosting Infrastructure | Built and hosted in Europe |

| Data Protection | GDPR-ready compliance framework |

| Core Benefit Claim | Productivity gains of up to one day per week |

Its broad integration ecosystem ensures compatibility with major collaboration and calendar systems, enabling seamless workflow integration.

Pricing Model and Commercial Structure

Deskbird adopts a transparent per-user pricing model, which appeals to small and mid-sized organizations seeking predictable subscription costs.

Pricing Comparison Matrix

| Pricing Model Type | Deskbird Approach |

|---|---|

| Billing Structure | Per active user |

| Annual Business Tier | USD 3.75 per user per month |

| Target Segment | SMB and mid-market firms |

| Scalability | Flexible for growing teams |

| Cost Transparency | Clear, straightforward subscription pricing |

This simplicity contrasts with resource-based or complex enterprise pricing models, making Deskbird accessible to budget-conscious organizations.

Operational Impact and ROI Metrics

Organizations implementing Deskbird frequently report measurable financial and productivity improvements driven by better attendance planning and desk optimization.

ROI Impact Matrix

| Performance Area | Reported Outcome |

|---|---|

| Office Expense Reduction | Up to 30 percent through desk rightsizing |

| Booking Speed | Under five seconds per reservation |

| Adoption Rate | High due to mobile-first design |

| Collaboration Alignment | Increased visibility of teammate presence |

| Administrative Overhead | Reduced through automation and integrations |

Real-time utilization analytics allow companies to adjust desk inventory based on actual attendance patterns, reducing excess capacity and lowering real estate costs.

Mobile-First Design and Adoption

A defining strength of Deskbird is its mobile-first experience. In hybrid environments, employees often coordinate office attendance on the move. The ability to book desks and rooms within seconds increases consistent usage and reduces friction.

Adoption Driver Comparison

| Adoption Factor | Deskbird Performance |

|---|---|

| Ease of Use | Quick and intuitive |

| Mobile Responsiveness | High-performance interface |

| Social Coordination | Built-in team visibility |

| Software Consolidation | Direct communication features |

| Update Frequency | Frequent feature improvements |

User feedback commonly highlights ease of use and efficient coordination, particularly in education, consulting, and distributed team environments. However, some organizations with limited budgets perceive pricing as higher compared to basic booking tools, particularly for long-term deployment in cost-sensitive sectors.

Customer Sentiment Summary

| Feedback Category | Observed Themes |

|---|---|

| Ease of Use | Quick and straightforward |

| Team Coordination | Simplifies hybrid scheduling |

| Mobile Navigation | Highly responsive and efficient |

| Pricing Perception | Considered expensive for low budgets |

| Product Updates | Frequent improvements and enhancements |

Deskbird’s Position Among the Top Desk Booking Software Platforms in 2026

Within the broader ecosystem of the top desk booking software solutions globally in 2026, Deskbird occupies a distinct position centered on user adoption and hybrid collaboration visibility.

Competitive Positioning Matrix

| Market Focus Area | Traditional Desk Tools | Deskbird Approach |

|---|---|---|

| Policy Enforcement | Moderate | Secondary to experience |

| Employee Experience | Limited | Core strategic focus |

| Predictive AI | Emerging | Actively expanding capabilities |

| Social Coordination | Rare | Native Social Office Feed |

| Mobile-First Design | Variable | Primary design philosophy |

As hybrid work continues to redefine how and why employees attend physical offices, platforms that prioritize usability, collaboration transparency, and predictive insights are gaining traction.

Deskbird reflects this shift by positioning itself not as a compliance tool or administrative system, but as a digital companion designed to enhance productivity, increase office utilization efficiency, and strengthen team coordination in 2026.

7. Officely

By 2026, the global desk booking software landscape has diversified into highly specialized categories. While some platforms emphasize enterprise analytics or ESG reporting, a growing segment of the market prioritizes seamless collaboration within existing communication ecosystems. Organizations increasingly recognize that adoption is the single most important factor in workplace software success. If employees do not actively use a system, even the most advanced features become irrelevant.

Among the top desk booking software platforms in the world in 2026, Officely has carved out a distinct niche as the collaboration-centric solution built entirely within Slack and Microsoft Teams.

Officely: The Collaboration-Centric App for Slack and Teams

Officely differentiates itself by eliminating the need for a standalone application. Instead of requiring employees to log into a separate workplace management portal, Officely operates directly inside the communication platforms that teams already use daily.

This embedded approach reduces friction, shortens onboarding time, and maximizes adoption rates across distributed and hybrid teams.

Strategic Market Position in 2026

| Category Dimension | Officely Positioning |

|---|---|

| Primary Differentiator | Native Slack and Teams integration |

| Core Target Audience | SMBs and collaboration-driven teams |

| Adoption Strategy | Zero-friction implementation |

| Deployment Complexity | Minimal setup within communication tools |

| Competitive Identity | Communication-native hybrid management |

Mechanism and Operational Advantage

Officely functions entirely within Slack and Microsoft Teams environments. Employees update their work status—such as In Office, Remote, or Out of Office—directly within the same threads where they communicate with colleagues.

This eliminates the need to switch between tools, which is one of the most common barriers to adoption in workplace management software.

Workflow Integration Overview

| Workflow Component | How Officely Delivers |

|---|---|

| Work Status Updates | Managed inside Slack or Teams channels |

| Desk Booking | Reserved within chat threads |

| Capacity Visibility | Real-time updates inside communication app |

| Hybrid Coordination | See who plans to be in-office before commuting |

| Administrative Controls | Managed without separate dashboards |

By leveraging established communication habits, Officely aligns workplace coordination with natural daily behavior rather than introducing new processes.

Pricing Structure and Feature Tiers

A notable differentiator in 2026 is Officely’s genuinely free plan for small teams. In a market where most providers limit features heavily on entry tiers, Officely includes essential booking and analytics tools even at no cost for small deployments.

Pricing Overview (Annual Billing)

| Plan Tier | Price (USD) | Included Functionality |

|---|---|---|

| Free | 0 | Desk booking, interactive plans, analytics (up to 5 users) |

| Basic | 2.50 per user per month | Unlimited users, capacity management |

| Premium | 3.50 per user per month | Meeting rooms, parking management, advanced data |

Pricing Model Comparison Matrix

| Pricing Element | Officely Model |

|---|---|

| Billing Basis | Per user |

| Free Tier Availability | Yes, up to 5 users |

| SMB Accessibility | High |

| Enterprise Complexity | Lower than enterprise-focused competitors |

| Feature Transparency | Clearly structured tiers |

This structure makes Officely particularly attractive for startups, small businesses, and mid-sized teams that want to manage hybrid schedules without committing to enterprise-level contracts.

Strategic Value and Adoption Impact

In 2026, adoption metrics are central to evaluating desk booking software effectiveness. Research and deployment data suggest that teams using Officely often achieve near-total adoption because employees are not required to learn or navigate a new system.

Adoption and Efficiency Matrix

| Performance Area | Observed Outcome |

|---|---|

| Adoption Rate | Reported near 100 percent |

| Training Requirements | Minimal due to familiar interface |

| Hybrid Coordination Accuracy | Reduced mismatch between team members |

| Office Attendance Alignment | Improved planning of in-office days |

| Administrative Overhead | Lowered due to simplified management |

One of the most common challenges in hybrid environments is the mismatch problem, where employees commute to the office expecting collaboration, only to discover that key teammates or managers are working remotely. By surfacing attendance status within communication threads, Officely reduces this coordination gap.

Operational Benefits in Hybrid Work

| Benefit Category | Business Impact |

|---|---|

| Real-Time Visibility | Instant clarity on who is in-office |

| Meeting Room Coordination | Managed within Slack or Teams |

| Parking Allocation | Controlled without external tools |

| Capacity Enforcement | Maintains occupancy thresholds |

| Tool Consolidation | Reduces software sprawl |

The ability to manage desk reservations, room bookings, and attendance visibility without expanding the software stack is a major advantage for lean organizations.

User Experience and Customer Feedback Themes

User feedback consistently emphasizes ease of setup, simplicity, and strong customer support responsiveness.

Customer Sentiment Summary

| Feedback Category | Observed Themes |

|---|---|

| Initial Setup | Fast and straightforward |

| Integration Quality | Seamless within Slack accounts |

| Customer Support | Responsive and proactive |

| Meeting Room Management | Particularly beneficial feature |

| Navigation | Occasionally requires extra steps to locate features |

While most feedback is positive regarding usability and integration, some users note that navigating to specific functions within the communication interface can occasionally require additional clicks.

Officely’s Position Among the Top Desk Booking Software Platforms in 2026

Within the broader global desk booking software market in 2026, Officely occupies a unique category defined by communication-native workplace management.

Competitive Positioning Matrix

| Market Focus Area | Traditional Desk Tools | Officely Approach |

|---|---|---|

| Standalone Application | Required | Not required |

| Adoption Strategy | Training-dependent | Behavior-based integration |

| Enterprise Analytics Depth | Advanced | Moderate |

| Collaboration Alignment | External visibility | Embedded in communication threads |

| Free Tier Availability | Rare | Included for small teams |

As hybrid work models continue to emphasize flexibility and asynchronous coordination, platforms that integrate directly into daily communication workflows are gaining momentum.

Officely reflects this evolution by redefining desk booking software not as a separate administrative system, but as a natural extension of team communication. Its frictionless implementation model and transparent pricing structure position it as one of the most accessible and adoption-driven workplace management platforms in 2026.

8. Kadence

In 2026, desk booking software has progressed beyond simple reservation systems and analytics dashboards. The most advanced platforms now focus on intelligent coordination, blending artificial intelligence with behavioral insights to align teams, optimize collaboration, and reduce workplace friction. As hybrid work becomes structurally embedded in enterprise operations, organizations increasingly seek solutions that understand not just where employees sit, but who they work with and how they collaborate.

Among the top desk booking software platforms in the world in 2026, Kadence has established itself as the AI-driven cultural coordination platform. Its core philosophy centers on “Connected Intelligence,” prioritizing human alignment alongside spatial logistics.

Kadence: The AI-Driven Cultural Coordination Platform

Kadence positions itself as a system that optimizes the social architecture of the workplace. While traditional booking tools focus on allocating desks or rooms, Kadence emphasizes the relationship between team members, project synchronization, and attendance patterns.

This distinction reflects a broader industry shift from static space management toward predictive and adaptive coordination systems.

Strategic Market Position in 2026

| Category Dimension | Kadence Positioning |

|---|---|

| Primary Differentiator | AI-powered team synchronization |

| Core Philosophy | Emphasizes “who” and “where” equally |

| Target Audience | Enterprise hybrid organizations |

| Deployment Scale | 300,000+ global users |

| Competitive Identity | Cultural and behavioral coordination leader |

AI Innovations and Intelligent Automation

Kadence AI functions as a natural-language assistant embedded within Microsoft Teams and Slack. Employees can book desks, schedule collaboration days, or invite visitors by simply asking conversational questions inside their communication tools.

Unlike static scheduling systems, the AI engine continuously analyzes behavioral patterns to generate predictive recommendations.

AI Capability Matrix

| AI Function | Business Application |

|---|---|

| Natural-Language Booking | Reserve desks or rooms through chat commands |

| Visitor Invitation Automation | Schedule guest access via conversational prompts |

| Team Day Recommendations | Suggest synchronized in-office days |

| Pattern Learning | Identifies recurring collaboration cycles |

| Predictive Coordination | Aligns project timelines with attendance patterns |

By analyzing attendance frequency, department overlap, and collaboration history, Kadence AI recommends optimal “team days” designed to maximize synchronous work while minimizing overcrowding.

This predictive coordination model aims to reduce unnecessary workplace noise, avoid seating conflicts, and improve collaborative outcomes.

Software Architecture and Modular Flexibility

Kadence is built as a modular platform, allowing organizations to begin with desk booking and expand functionality over time. This scalable approach supports enterprises at different stages of hybrid maturity.

Modular Capability Overview

| Module Type | Description |

|---|---|

| Desk Booking Core | Hybrid workspace reservations |

| Visitor Management Add-On | Integrated guest coordination |

| On-Demand Space Access | Integration with LiquidSpace |

| Analytics Dashboard | Planned vs. actual usage insights |

| Enterprise Administration | Multi-location management controls |

Through its integration with LiquidSpace, Kadence enables organizations to provide employees with access to flexible coworking locations on demand, further extending hybrid flexibility.

Technical Specifications and Performance

Kadence is designed for enterprise-grade reliability and global scalability.

Technical Specification Overview

| Specification Category | Details |

|---|---|

| Initial Setup Cost | USD 250 per floor for plan upload |

| Standard Pricing | Approximately USD 4.00 per active user per month |

| Typical Deployment Scale | 300,000+ global users (e.g., Intel) |

| Enterprise Uptime SLA | 99.9 percent availability |

| Core Operational Benefit | Near-zero seating conflict and reduced coordination noise |

The initial setup fee per floor typically covers digital plan configuration and mapping, enabling precise desk and space allocation.

Pricing Model Comparison

| Pricing Element | Kadence Structure |

|---|---|

| Billing Basis | Per active user |

| Setup Investment | One-time floor upload cost |

| Enterprise Reliability | 99.9 percent SLA |

| Scalability | Suitable for global enterprises |

| Modular Expansion | Add features as organizational needs evolve |

Operational Impact and ROI Metrics

In 2026, measurable outcomes remain the primary benchmark for workplace software evaluation. Kadence delivers ROI through synchronization efficiency, conflict reduction, and data-driven coordination.

ROI and Performance Matrix

| Performance Area | Observed Impact |

|---|---|

| Planned vs. Actual Usage Insights | Identifies attendance discrepancies |

| Team Synchronization | Improved collaboration alignment |

| Project Completion Time | Reported 15 percent reduction |

| Seating Conflict Frequency | Reduced to near-zero |

| Workplace Noise Reduction | Clearer coordination signals |

One of Kadence’s strongest analytical features involves highlighting discrepancies between planned attendance and actual office usage. Managers can identify patterns such as frequent no-shows or underutilized zones, enabling data-backed adjustments to team scheduling strategies.

Organizations leveraging these insights report improvements in project execution timelines. By synchronizing team presence more effectively, some enterprises observe up to a 15 percent reduction in project completion times.

User Experience and Administrative Feedback

User feedback in 2026 frequently highlights the platform’s seamless integration and responsive support services.

Customer Sentiment Summary

| Feedback Category | Observed Themes |

|---|---|

| Integration Experience | Smooth deployment within existing systems |

| Administrative Interface | Clear and accessible admin screens |

| Customer Support | Responsive and patient implementation support |

| Reporting Depth | Good baseline analytics, potential for expansion |

| Strategic Roadmap | Considered forward-looking among competitors |

Administrators often note that the configuration process aligns well with enterprise needs and that the roadmap demonstrates long-term innovation planning.

Kadence’s Position Among the Top Desk Booking Software Platforms in 2026

Within the broader global desk booking software ecosystem in 2026, Kadence occupies a distinct space centered on predictive cultural alignment.

Competitive Positioning Matrix

| Market Focus Area | Traditional Booking Tools | Kadence Approach |

|---|---|---|

| Static Desk Allocation | Core function | Foundational layer |

| Behavioral Pattern Learning | Limited | Core intelligence driver |

| AI Team-Day Optimization | Rare | Embedded predictive feature |

| Modular Scalability | Moderate | Designed for phased adoption |

| Collaboration-Centric Analytics | Emerging | Central to value proposition |

As hybrid work environments continue to evolve, organizations increasingly require systems that anticipate coordination needs rather than merely respond to booking requests.

Kadence reflects this transformation by redefining desk booking software as a predictive cultural intelligence platform. Its AI-driven synchronization model positions it among the most strategically advanced workplace management solutions in 2026, where human alignment and spatial optimization converge to enhance productivity and reduce operational friction.

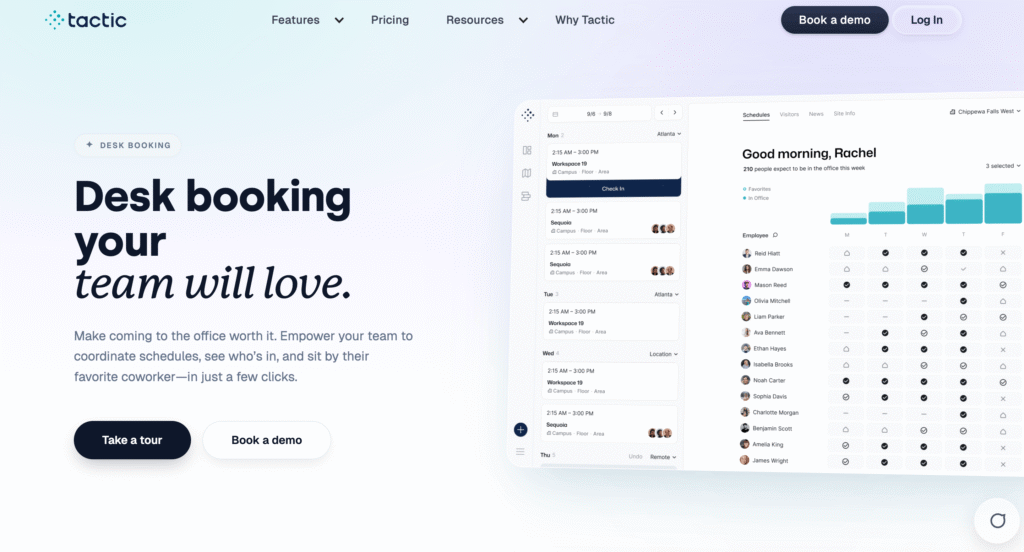

9. Tactic

In 2026, organizations increasingly demand workplace management platforms that reduce tool fragmentation. Rather than maintaining separate systems for desks, meeting rooms, visitor check-ins, parking, and internal requests, lean HR and office management teams prefer unified, plug-and-play solutions that simplify administration without sacrificing scalability.

Within the top desk booking software platforms globally in 2026, Tactic has emerged as a modular all-in-one solution favored by HR teams and office managers seeking simplicity, flexibility, and measurable operational gains.

Tactic: The Modular All-in-One for HR and Office Managers

Tactic positions itself as a comprehensive yet lightweight workplace management platform. It is designed specifically for organizations that require streamlined oversight of desks, rooms, visitors, and parking without the complexity typically associated with enterprise-scale systems.

Its modular architecture allows companies to begin with essential features and expand functionality over time, making it particularly attractive to growing organizations.

Strategic Market Position in 2026

| Category Dimension | Tactic Positioning |

|---|---|

| Primary Differentiator | Modular all-in-one workplace platform |

| Core Target Audience | Lean HR and office management teams |

| Adoption Model | Plug-and-play implementation |

| Scalability Approach | Resource-based expansion |

| Competitive Identity | Unified workplace operations tool |

Key Features and 2026 Enhancements

Tactic’s feature set is designed to consolidate core workplace functions into a single interface. In 2026, one of its most notable updates is the introduction of Tessa AI, a global search and map-based booking assistant.

Feature Overview

| Feature Category | Description |

|---|---|

| Desk Booking | Flexible hybrid seat reservations |

| Meeting Room Scheduling | Centralized room management |

| Visitor Management | Guest coordination within the same system |

| Parking Allocation | Integrated parking spot booking |

| Office Health Questionnaires | Compliance and wellness tracking |

| 2D Interactive Maps | Clean visual layouts for resource selection |

| Tessa AI | Global search and intelligent resource discovery |

Tessa AI simplifies the process of locating desks, meeting rooms, or other resources across multiple offices. Employees can quickly search and book available spaces using map-based visualization, reducing administrative overhead and booking friction.

Modular Architecture and Expansion

Tactic follows a modular design philosophy. Organizations can begin with desk and room booking and gradually add advanced capabilities such as workplace request tracking or expanded visitor workflows.

Modular Capability Matrix

| Module Type | Business Application |

|---|---|

| Core Workspace Booking | Desk and room reservations |

| Visitor Management | Guest tracking and compliance workflows |

| Workplace Requests | Maintenance and service submissions |

| Advanced Rules Engine | Conditional booking logic |

| Enterprise Support Layer | Custom integrations and SLAs |

This flexibility allows organizations to control initial costs while retaining the ability to scale as operational complexity increases.

Pricing Model and Tier Structure

Tactic employs a resource-based pricing model, meaning costs scale according to the number of workspaces rather than total employees. This model benefits organizations with high headcounts but moderate physical footprints.

Pricing Overview (Per Workspace / Month)

| Tier | Price (USD) | Feature Highlights |

|---|---|---|

| Core | 3.00 | Desk booking, room scheduling, mobile application |

| Pro | 4.00 | Visitor management, Tessa AI, advanced booking rules |

| Enterprise | Custom | Priority support, custom integrations, SLAs |

Pricing Model Comparison

| Pricing Element | Tactic Structure |

|---|---|

| Billing Basis | Per workspace |

| Initial Cost Barrier | Low entry via Core tier |

| Scalability | Modular feature additions |

| Enterprise Customization | Available at top tier |

| Cost Predictability | Increases with workspace expansion |

This approach enables organizations to deploy the platform in a phased manner without committing to extensive upfront licensing.

Operational Impact and ROI

In 2026, desk booking software is evaluated by quantifiable business outcomes. Tactic’s case studies highlight measurable efficiency gains and cost reductions driven by data-informed workplace management.

ROI and Efficiency Metrics

| Performance Area | Observed Outcome |

|---|---|

| Operational Efficiency | 2.1x ROI reported in case study |

| Neighborhood-Level Occupancy Data | Improved demand forecasting |

| Food Service Optimization | Reduced overproduction and waste |

| Janitorial Cost Reduction | Lower cleaning expenditure via usage tracking |

| Administrative Coordination | Streamlined task tracking |

One documented deployment demonstrated how planners used Tactic’s neighborhood-level occupancy data to anticipate reduced attendance in specific zones. This insight allowed organizations to adjust food service participation rates and minimize unnecessary janitorial coverage, generating cost savings while maintaining service quality.

Data-Driven Planning Matrix

| Insight Type | Operational Benefit |

|---|---|

| Real-Time Utilization | Accurate workspace demand tracking |

| Attendance Trend Analysis | Predictive capacity planning |

| Zone-Level Visibility | Optimized support service allocation |

| Resource Request Tracking | Faster issue resolution |

By combining booking data with operational analytics, Tactic helps HR and office managers make proactive adjustments rather than reactive corrections.

User Experience and Administrative Feedback

User feedback frequently emphasizes ease of coordination and task management within a unified system.

Customer Sentiment Summary

| Feedback Category | Observed Themes |

|---|---|

| Task Coordination | Simplifies collaboration and tracking |

| Progress Visibility | Clear overview of workplace activities |

| Daily Usage | Employee record checking becomes routine |

| Usability | Minor quirks but strong core functionality |

| Decision-Making Support | Timely access to schedule data |