Key Takeaways

- AI has become the core operating engine of retail banking in 2026, enabling agentic intelligence, real-time decisioning, and enterprise-wide automation across lending, fraud, and customer engagement.

- The best AI tools for retail banking focus on trust, governance, and explainability, allowing banks to scale advanced intelligence while meeting regulatory and security requirements.

- Banks that embed AI into data foundations, customer journeys, and daily operations gain higher efficiency, stronger customer loyalty, and sustainable long-term growth.

Retail banking in 2026 is no longer defined by branches, basic digital channels, or incremental technology upgrades. It is defined by intelligence. Artificial intelligence has moved from the margins of innovation into the core operating fabric of banks worldwide, reshaping how financial institutions compete, scale, manage risk, and build trust with customers. What was once described as digital transformation has now evolved into something far deeper: an intelligence-led structural transformation of the entire retail banking model.

The acceleration of AI adoption in banking is not happening in isolation. It is unfolding against a backdrop of global economic uncertainty, rising fraud sophistication, shifting customer behaviour, regulatory complexity, and intense competition from both fintech challengers and technology-driven ecosystems. In this environment, efficiency alone is no longer enough. Banks are expected to be fast, personalised, secure, transparent, and resilient at the same time. Artificial intelligence has become the only technology capable of meeting all of these demands simultaneously.

By 2026, AI in retail banking has crossed a critical threshold. It is no longer limited to chatbots, basic credit scoring, or isolated analytics projects. Leading institutions are deploying agentic AI systems that can plan, decide, and act across complex workflows with human oversight. These systems power real-time fraud prevention, intelligent lending, hyper-personalised customer engagement, automated compliance, and continuous risk monitoring at enterprise scale. The result is the emergence of a new banking paradigm often described as the autonomous or intelligent bank.

This shift has created a clear divide within the industry. On one side are banks that have industrialised AI, embedding intelligence into their data foundations, operating models, and customer journeys. On the other are institutions still experimenting with disconnected pilots that struggle to scale or deliver measurable value. The difference between these two groups is no longer technical sophistication alone, but strategic clarity and platform choice.

Choosing the right AI tools has therefore become one of the most critical decisions for retail banks in 2026. AI platforms are no longer plug-and-play utilities. They shape how data flows through the organisation, how decisions are made, how risks are managed, and how customers experience the bank on a daily basis. The wrong tools can lock banks into fragmented architectures and compliance risk. The right tools can unlock speed, trust, and sustainable growth.

Another defining factor driving AI adoption is the transformation of trust itself. In 2026, trust is no longer a brand promise or a marketing message. It is a measurable outcome. The explosive rise of deepfake fraud, agent impersonation, and AI-enabled financial crime has forced banks to rethink identity, verification, and security from the ground up. Customers now judge banks not only by convenience or pricing, but by how safe they feel. AI has become the primary mechanism through which banks deliver that safety at scale.

At the same time, customer expectations have fundamentally changed. Retail banking customers increasingly expect proactive financial guidance, seamless digital experiences, and services that adapt to their lives in real time. Hyper-personalisation, invisible payments, and AI-driven financial wellness are no longer premium features. They are becoming baseline expectations, even for mass-market customers. This shift has elevated AI from a back-office optimisation tool to a front-line growth engine.

Internally, AI is also transforming how banks operate and how work gets done. Development cycles are shorter, decision-making is faster, and operational roles are being reshaped. AI copilots support engineers, analysts, and service teams, while agentic systems handle repetitive and data-intensive tasks. Humans remain essential, but their focus is increasingly on judgement, oversight, empathy, and relationship management rather than manual processing.

Against this backdrop, understanding the best AI tools for retail banking in 2026 is not just a technology exercise. It is a strategic necessity. The platforms leading this transformation are those that combine advanced analytics, automation, governance, explainability, and scalability into unified systems built for regulated environments. They support agentic intelligence, operate in real time, and integrate deeply with core banking, data, and digital ecosystems.

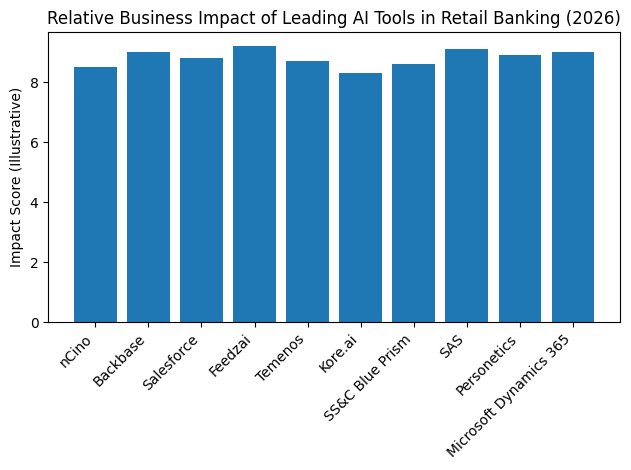

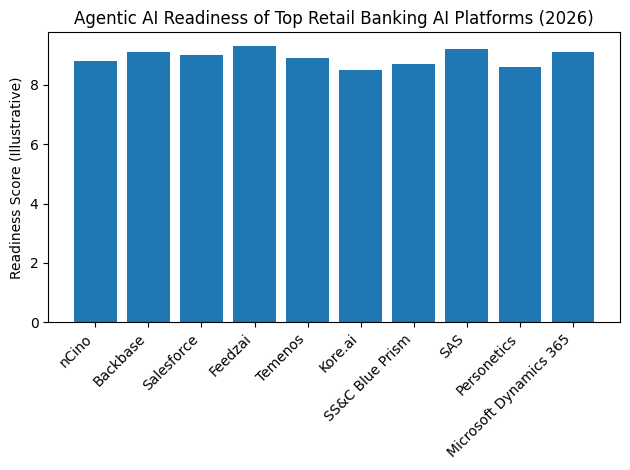

This guide to the top 10 best AI tools for retail banking in 2026 is designed to provide clarity in an increasingly complex landscape. It examines the platforms that are shaping the future of banking, not through hype, but through measurable impact across customer experience, fraud prevention, lending, compliance, and operational excellence. It highlights how these tools support the global shift toward agentic intelligence and why they matter for banks of all sizes.

As retail banking enters this new era, the question is no longer whether AI will transform the industry. That transformation is already underway. The real question is which banks will lead it, and which AI platforms will enable them to do so.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Best AI Tools for Retail Banking in 2026.

If you like to get your company listed in our top B2B software reviews, check out our world-class 9cv9 Media and PR service and pricing plans here.

Top 10 Best AI Tools for Retail Banking in 2026

- nCino

- Backbase

- Salesforce Financial Services Cloud

- Feedzai

- Temenos

- Kore.ai

- SS&C Blue Prism

- SAS

- Personetics

- Microsoft Dynamics 365

1. nCino

By 2026, nCino is firmly established as one of the most influential AI-enabled platforms in retail and commercial banking. The platform supports more than 2,700 financial institutions worldwide, ranging from large global banks to regional and community lenders. This broad adoption highlights nCino’s ability to scale across different banking models while maintaining consistency, security, and regulatory alignment.

Built on a cloud-native architecture, nCino provides banks with a unified operating environment to manage customer accounts, lending workflows, compliance processes, and performance analytics. Instead of relying on disconnected legacy systems, banks use nCino as a central system of engagement and decision-making.

AI-Driven Differentiation Through Banking Advisor

A key reason nCino stands out among the top 10 best AI tools for retail banking in 2026 is its Banking Advisor capability. This AI-driven solution is designed to support bankers with real-time guidance by combining internal customer data with anonymised market insights drawn from more than 1,800 institutions using the platform.

Banking Advisor helps banks move from reactive decision-making to proactive, insight-led operations. Relationship managers, lending teams, and operations staff receive contextual recommendations that improve credit decisions, identify growth opportunities, and reduce processing delays. This intelligence layer allows banks to benefit not only from their own data, but also from broader industry trends captured across the nCino ecosystem.

Core AI Capability Matrix

AI Capability | Practical Banking Use | Business Impact

Banking Advisor insights | Lending and relationship management | Better decisions and consistency

Workflow automation | Loan origination and servicing | Lower operating cost

Data unification | Single customer and account view | Reduced errors

Predictive analytics | Risk and performance forecasting | Improved outcomes

Financial Performance and Revenue Momentum

nCino’s financial results in 2025 and 2026 reflect strong demand for AI-enabled banking platforms. Revenue growth is driven primarily by subscriptions, which indicates long-term customer commitment and predictable recurring income. The company’s improving profitability also demonstrates that AI investment is translating into sustainable financial performance.

Financial Performance Overview

Metric | FY 2025 Value | Q1 FY 2026 Value

Total Revenue | 540.7 million USD | 144.1 million USD

Subscription Revenue | 469.2 million USD | 125.6 million USD

Non-GAAP Operating Income | 96.2 million USD | 24.8 million USD

Customer Institutions | 2,700+ | 2,700+

Remaining Performance Obligation | 1.2 billion USD | Approximately 1.1 billion USD

The growth in remaining performance obligation highlights strong long-term customer confidence and multi-year platform adoption.

Operational Impact in Retail and Community Banking

Beyond financial metrics, nCino delivers measurable operational improvements for banks. Institutions using the platform report dramatic reductions in loan servicing costs and approval timelines. These gains are especially valuable in retail and community banking, where efficiency directly affects profitability.

Reported Operational Outcomes

Operational Area | Measured Improvement | Business Meaning

Loan servicing cost | 92 percent reduction | Major cost savings

Loan approval time | 70 percent faster | Higher customer satisfaction

Onboarding duration | 10 days shorter | Faster revenue realisation

For a community bank earning 100 million USD annually, reducing onboarding time by just ten days can accelerate revenue by around 3 million USD. This illustrates how operational efficiency enabled by AI directly supports growth, not just cost control.

Bar Chart Representation (Text-Based)

Operational Impact Comparison

Loan servicing cost reduction: █████████████████████████

Loan approval speed improvement: █████████████████████

Onboarding acceleration impact: █████████████████

These visuals show that the largest gains come from servicing efficiency and decision speed.

Why nCino Ranks Among the Best AI Tools for Retail Banking in 2026

nCino earns its position among the top AI tools for retail banking in 2026 because it combines scale, proven financial performance, and measurable operational impact. Its Banking Advisor capability demonstrates how AI can support bankers directly within daily workflows rather than acting as a separate analytics layer.

For retail and community banks seeking to modernise lending, reduce costs, and improve decision quality while maintaining regulatory confidence, nCino represents a mature, enterprise-ready AI platform that delivers both immediate and long-term value.

2. Backbase

Backbase is widely regarded in 2026 as one of the most advanced AI-driven engagement platforms for retail banking. It is positioned as a growth-focused banking platform rather than a traditional core system, with a clear emphasis on revenue expansion, customer experience optimisation, and cost efficiency. The platform supports banks that aim to modernise digital channels while unifying fragmented systems into a single, customer-focused operating model.

With a valuation exceeding 2.6 billion USD following major funding rounds, Backbase serves around 150 large financial institutions worldwide and supports digital interactions for more than 90 million end customers. This scale demonstrates strong enterprise adoption and validates its role among the top AI tools shaping retail banking in 2026.

Engagement Banking and AI-Led Operating Model

Backbase’s defining concept is Engagement Banking, which focuses on breaking down silos between digital channels, data systems, and operational workflows. Instead of treating mobile banking, web banking, onboarding, and payments as separate systems, the platform brings them together into a unified experience powered by AI.

This operating model allows banks to move from reactive service delivery to proactive and personalised engagement. AI is embedded directly into customer journeys, enabling banks to anticipate needs, suggest relevant actions, and automate routine financial tasks without increasing operational complexity.

AI Strategy for Retail Banking in 2026

In 2026, Backbase’s AI roadmap is centred on two major themes: invisible payments and proactive personalisation. Invisible payments reduce friction by automating savings, bill payments, and transfers in the background, allowing customers to focus on outcomes rather than transactions. Proactively personal banking uses AI to deliver timely recommendations and financial guidance based on user behaviour and life events.

AI co-pilots embedded within the platform support both customers and internal teams. Customers benefit from automated financial wellness features, while employees gain decision support tools that improve speed, accuracy, and consistency across service interactions.

Core AI Capabilities and Banking Use Cases

AI Capability | Practical Retail Banking Application | Primary Business Impact

Customer journey orchestration | Personalised digital flows across mobile and web | Higher conversion and engagement

AI co-pilots for customers | Automated savings, payments, and budgeting | Increased retention and trust

AI co-pilots for staff | Assisted customer service and relationship management | Higher productivity and service quality

Invisible payments | Background execution of routine transactions | Lower friction and fewer support requests

Data-driven personalisation | Contextual offers and financial insights | Revenue growth through relevance

Quantified Performance Impact in Retail Banking

Backbase reports strong measurable improvements across digital banking performance metrics. These outcomes highlight why the platform is frequently included in discussions around the best AI tools for retail banking in 2026.

Retail Banking Performance Metrics

Metric | Reported Outcome | Business Meaning

Mobile app onboarding time | Less than 5 minutes | Faster activation and reduced drop-offs

Registered mobile users | 39 percent increase | Stronger digital adoption

Monthly active users | 19 percent increase | Improved engagement consistency

Digital acquisition costs | 44 percent reduction | Lower cost per customer

Customer satisfaction score | 51 percent year-over-year improvement | Higher loyalty and brand perception

Developer Productivity and Cost Efficiency

Backbase’s AI co-pilots also target internal efficiency, particularly in software development and digital product delivery. Research referenced by the platform shows that banks using these AI capabilities experienced significant gains in productivity and cost control.

Internal Efficiency Impact Table

Area | AI-Driven Improvement | Operational Benefit

Developer productivity | 40 percent increase | Faster feature delivery and innovation

Time to market | Accelerated release cycles | Competitive advantage

Digital acquisition spend | 44 percent reduction | Improved marketing ROI

Illustrative Bar Chart Representation (Text-Based)

Metric Comparison Bar Chart

Developer productivity increase: ████████████████████████

Digital acquisition cost reduction: █████████████████████

Customer satisfaction improvement: █████████████████████████

These bars show that both revenue-facing and cost-related metrics benefit from AI adoption, reinforcing Backbase’s value proposition.

AI Factory and Enterprise-Grade AI Adoption

Backbase further strengthens its AI leadership through its AI Factory initiative. This programme provides banks with structured tools, frameworks, and expert support to accelerate AI deployment without excessive experimentation risk. Rather than forcing banks to build AI capabilities from scratch, the AI Factory enables faster implementation of proven use cases.

A key output of this initiative is the development of agentic assistants. These AI-powered assistants support relationship managers and customer service agents by suggesting next-best actions, surfacing relevant customer insights, and maintaining consistent service standards across all customer segments.

AI Factory Capability Matrix

AI Factory Component | Purpose | Value to Retail Banks

Pre-built AI modules | Rapid deployment of common use cases | Shorter implementation cycles

Agentic assistants | Staff decision support and guidance | Higher service quality

Governance frameworks | Controlled and compliant AI usage | Reduced regulatory risk

Expert enablement | Skills transfer and best practices | Sustainable AI maturity

Why Backbase Ranks Among the Best AI Tools for Retail Banking in 2026

Backbase earns its place among the top AI tools for retail banking in 2026 due to its strong focus on engagement, measurable performance outcomes, and enterprise-ready AI infrastructure. The platform goes beyond basic automation by embedding intelligence directly into customer and employee journeys.

For retail banks aiming to increase digital adoption, improve customer satisfaction, and reduce acquisition and servicing costs, Backbase represents a mature and scalable AI-powered engagement platform that aligns closely with modern banking growth strategies.

3. Salesforce Financial Services Cloud

Salesforce is positioned in 2026 as one of the most influential AI platforms for retail banking, particularly in customer engagement, sales automation, and service operations. Its Financial Services Cloud, combined with the Agentforce AI layer, is designed for banks that want to scale personalised customer interactions while tightly linking AI usage to business outcomes. Rather than replacing human teams, the platform focuses on augmenting bankers, marketers, and service agents with autonomous AI capabilities.

Agentforce represents a major shift in how AI is delivered to banks. Instead of static chatbots or rule-based automation, Salesforce introduces autonomous AI agents that can execute actions across sales, service, and marketing workflows with minimal human supervision.

What Agentforce Does for Retail Banks

Agentforce is a collection of AI agents that can independently handle tasks such as responding to customer inquiries, updating CRM records, triggering follow-ups, recommending next-best actions, and supporting marketing campaigns. These agents operate across digital channels while remaining governed by banking compliance and permission controls.

For retail banks, this means faster response times, more consistent service quality, and improved customer targeting without increasing headcount. The AI agents are designed to learn from conversations and outcomes, allowing banks to continuously refine customer engagement strategies.

Core Agentforce Capabilities Matrix

AI Capability | Retail Banking Function | Practical Outcome

Autonomous service agents | Customer support and case handling | Faster resolution and lower service costs

Sales intelligence agents | Relationship management and cross-selling | Higher conversion rates

Marketing orchestration agents | Campaign execution and optimisation | Better targeting and ROI

Conversation analysis | Omnichannel interactions | Improved customer insight

Action execution | CRM updates and workflow triggers | Reduced manual work

Usage-Based AI Pricing Model Explained

One of the most important reasons Salesforce stands out among the best AI tools for retail banking in 2026 is its shift away from traditional per-seat pricing. Instead, Agentforce uses a conversation-based and action-based pricing model, allowing banks to pay based on actual AI usage rather than the number of employees.

This model aligns AI costs directly with customer interactions and revenue-generating activity, making budgeting more predictable and performance-driven.

Agentforce Pricing Structure Overview

Pricing Component | Cost Structure | Typical Banking Use Case

Flex Credits | 500 USD per 100,000 credits | Background AI actions such as CRM updates

Cost per action | 0.10 USD per action (20 credits) | Automated task execution

Conversation pricing | 2 USD per conversation | Customer-facing AI chats

Industries add-on | 150 USD per user per month | Regulated financial services usage

Agentforce enterprise edition | 550 USD or more per user per month | Full AI bundle with large credit allocation

Implementation services | 50,000 to 800,000 USD or more | Initial deployment and integration

Illustrative Cost Impact for a Mid-Sized Retail Bank

For a mid-sized retail bank with approximately 100 internal users, handling around three AI-assisted cases per user per day, the usage-based pricing structure can be estimated as follows.

Monthly AI Cost Illustration Table

Metric | Estimated Value

Users | 100

Cases per user per day | 3

Monthly AI actions | Approximately 60,000

Estimated Flex Credit cost | Around 1,800 USD per month

Base platform licensing | Additional fixed cost

This structure allows banks to scale AI usage gradually while maintaining visibility into operational spend.

Financial and ROI Impact for Retail Banking

Independent economic studies on Salesforce implementations indicate strong financial returns for enterprise organisations using its AI-driven engagement tools. These returns are primarily driven by improved marketing efficiency, higher customer conversion rates, and better personalisation at scale.

ROI Performance Summary Table

Performance Indicator | Observed Outcome | Banking Impact

Average ROI over three years | 299 percent | Strong long-term value creation

Marketing efficiency | Significant improvement | Lower acquisition costs

Customer targeting accuracy | Measurable increase | Higher product uptake

Service productivity | Reduced manual workload | Lower operational expenses

Illustrative ROI Bar Chart Representation (Text-Based)

Metric Comparison

Marketing efficiency gains: ████████████████████████

Customer conversion improvement: █████████████████████

Operational cost reduction: ███████████████████

These visual indicators show that the majority of value comes from smarter engagement rather than pure cost cutting.

How Salesforce Fits Different Retail Banking Strategies

Salesforce Financial Services Cloud with Agentforce is especially well suited for banks that prioritise customer experience, cross-selling, and lifecycle engagement. It works best as an engagement and intelligence layer rather than a core banking replacement.

Retail Banking Fit Matrix

Bank Type | Strategic Fit | Reason

Large retail banks | Very high | Scale, data depth, complex journeys

Digital-first banks | High | Strong omnichannel AI engagement

Mid-sized banks | Medium to high | Pay-as-you-use flexibility

Community banks | Medium | Best for growth-focused use cases

Why Salesforce and Agentforce Rank Among the Best AI Tools for Retail Banking in 2026

Salesforce earns its place in the top AI tools for retail banking in 2026 by delivering autonomous AI agents that operate directly within revenue and service workflows. The usage-based pricing model reduces waste, the AI agents improve speed and consistency, and the platform’s financial services focus ensures regulatory readiness.

For banks seeking measurable ROI from AI-driven sales, service, and marketing automation, Salesforce Financial Services Cloud with Agentforce offers one of the most mature and commercially aligned AI solutions available in the retail banking landscape.

4. Feedzai

Feedzai is widely recognised in 2026 as one of the most important AI platforms for retail banking, particularly in the areas of fraud prevention, payment security, and financial crime detection. As digital payments grow in volume and complexity, banks increasingly rely on AI-native platforms that can operate at massive scale without disrupting customer experience. Feedzai fills this role by providing a unified RiskOps platform that combines real-time monitoring, advanced machine learning, and automated decisioning.

The platform’s credibility at a global level has been reinforced by its selection as the core fraud detection and prevention engine for the digital euro initiative. This role highlights Feedzai’s ability to operate at central-bank-grade scale and reliability, which places it firmly among the top AI tools shaping retail banking in 2026.

What RiskOps Means for Retail Banking

RiskOps is Feedzai’s approach to managing fraud and financial crime as a continuous operational discipline rather than a reactive function. Instead of isolated fraud checks, the platform integrates risk detection, investigation, and response into a single AI-driven workflow. This allows retail banks to detect threats earlier, act faster, and reduce losses without increasing friction for legitimate customers.

By applying AI models across transactions, user behaviour, and device intelligence, Feedzai helps banks shift from rule-based fraud systems to adaptive, learning-based risk management.

AI-Native Capabilities and Core Use Cases

Feedzai’s platform is built to handle extremely high transaction volumes while maintaining accuracy and speed. Its AI models analyse payment behaviour in real time, identifying both common fraud patterns and rare, sophisticated attacks that traditional systems often miss.

Core AI Capability Matrix

AI Capability | Retail Banking Application | Business Outcome

Real-time transaction monitoring | Card, account, and instant payments | Immediate fraud detection

Behavioural biometrics | User behaviour and interaction patterns | Reduced account takeover

Adaptive machine learning | Evolving fraud tactics | Continuous model improvement

Automated risk decisioning | Approve, challenge, or block transactions | Lower manual intervention

Investigation workflow automation | Analyst case management | Faster resolution times

Scale and Market Impact in Retail Banking

Feedzai operates at a scale that few fraud platforms can match. The system processes tens of billions of payment events every year and protects more than one billion consumers worldwide. This scale is essential for retail banks operating across multiple channels, geographies, and payment methods.

Global Protection Scale Overview

Metric | Reported Scale | Retail Banking Significance

Annual payment events monitored | Over 70 billion | Coverage across all major payment rails

Payment value protected | 8 trillion USD annually | High trust from large banks

Customers protected | Over 1 billion | Proven consumer-scale reliability

Analyst hours saved | 20 million or more | Major operational efficiency gains

Quantified Financial and Operational Results

Retail banks using Feedzai report strong, measurable outcomes that directly affect profitability and customer trust. One large North American retail bank documented substantial savings over a multi-year period while maintaining high fraud detection accuracy.

Documented Performance Outcomes Table

Performance Metric | Reported Result | Banking Impact

Losses prevented | Over 2 billion USD | Direct protection of revenue

Savings over three years | 30 million USD | Reduced fraud and operations cost

Value detection rate | 75 percent | High accuracy in identifying real fraud

False positive ratio | 12 to 1 | Fewer legitimate transactions blocked

Intervention rate | 0.1 percent | Minimal customer disruption

Customer Experience and False Positive Reduction

One of Feedzai’s most important advantages in retail banking is its ability to reduce false positives. Blocking legitimate transactions damages customer trust and increases support costs. Feedzai’s AI models are designed to identify fraud precisely, allowing the majority of genuine transactions to pass through without friction.

Customer Impact Matrix

Area | Traditional Systems | Feedzai RiskOps Outcome

Transaction declines | High | Significantly reduced

Customer complaints | Frequent | Much lower

Manual reviews | Heavy | Minimal

Trust in digital payments | Fragile | Strong and consistent

Illustrative Bar Chart Representation (Text-Based)

Fraud Detection and Efficiency Comparison

Losses prevented: █████████████████████████

Value detection accuracy: █████████████████████

False positive efficiency: ████████████████████████

Customer intervention rate: ██

This visual pattern shows strong fraud protection combined with very low customer friction.

Why Feedzai Ranks Among the Best AI Tools for Retail Banking in 2026

Feedzai earns its place among the top AI tools for retail banking in 2026 because it combines massive scale, advanced AI accuracy, and proven financial impact. The platform protects banks from growing fraud threats while preserving smooth digital experiences for customers.

For retail banks facing rising transaction volumes, instant payments, and sophisticated financial crime, Feedzai provides an AI-native RiskOps solution that delivers measurable protection, operational efficiency, and regulatory-grade reliability.

5. Temenos

Temenos continues to be one of the most influential technology providers in global retail banking in 2026. The company plays a critical role in both core banking infrastructure and AI-enabled digital experiences. With more than 3,000 financial institutions using its technology, including 41 of the world’s top 50 banks, Temenos is widely viewed as a backbone platform for large-scale retail banking operations.

Unlike point AI solutions, Temenos combines core banking, digital engagement, payments, and risk capabilities into a single ecosystem. This makes it especially relevant for banks that want AI-driven transformation without replacing their entire technology stack.

Temenos Infinity as an AI-Driven Digital Front Office

Temenos Infinity is the digital engagement layer that sits on top of Temenos core banking systems. In 2026, it serves more than 500 million end customers daily across retail, corporate, and private banking. The platform enables banks to manage customer journeys, digital transactions, onboarding, and enterprise credit from a unified interface.

AI is embedded across Infinity to support personalisation, intelligent workflow routing, predictive insights, and automated service interactions. This allows banks to deliver consistent experiences across mobile, web, and branch channels while reducing manual effort.

Digital Engagement Capability Matrix

Capability Area | What It Does | Retail Banking Benefit

AI-driven personalisation | Tailors offers and journeys | Higher conversion and engagement

Omnichannel orchestration | Connects mobile, web, branch | Seamless customer experience

Smart onboarding | Automates KYC and account setup | Faster activation

Digital credit workflows | Manages retail and SME lending | Shorter approval cycles

Enterprise transaction management | Supports high-volume banking activity | Operational consistency

Core Banking Strength and Enterprise Scale

Temenos remains dominant in core banking, supporting deposits, lending, payments, and risk management at enterprise scale. Its systems are designed for high availability, regulatory compliance, and multi-country operations. In 2026, the company continues to transition customers from traditional perpetual licenses to SaaS and subscription-based models, aligning costs more closely with usage and scalability.

This shift enables banks to modernise infrastructure while maintaining control over mission-critical systems.

Core Banking Value Matrix

Core Banking Area | AI and Automation Role | Business Outcome

Account processing | Automated posting and reconciliation | Reduced errors

Payments | Intelligent routing and monitoring | Faster settlement

Risk and compliance | Embedded controls and analytics | Regulatory confidence

Product configuration | Modular and API-driven | Faster product launches

Financial Strength and Commercial Model

Temenos shows strong financial stability going into 2026, which is a key consideration for banks selecting long-term technology partners. Annual recurring revenue continues to grow, reflecting a successful transition toward subscription-based delivery.

Financial Performance Overview

Financial Metric | Reported Value

Total revenue | 1,044.1 million USD

Annual recurring revenue | 804 million USD

ARR growth rate | 10 percent year over year

Active core and digital clients | Approximately 1,550 institutions

End customers supported | Around 500 million

These figures highlight predictable revenue streams and sustained enterprise adoption.

Cost Expectations for Retail Banks

For banks evaluating Temenos in 2026, cost varies significantly based on deployment size and complexity. On average, the estimated annual cost per client is slightly above 518,000 USD. However, large banks with multi-module deployments covering core banking, payments, risk, and digital channels often incur substantially higher annual costs.

Estimated Cost Structure Matrix

Bank Profile | Typical Deployment Scope | Relative Annual Cost

Mid-sized retail bank | Core + digital channels | Medium

Large retail bank | Core + payments + risk | High

Tier-one global bank | Full enterprise suite | Very high

Illustrative Bar Chart Representation (Text-Based)

Adoption and Revenue Scale

Institutions served: █████████████████████████

End customers supported: █████████████████████████████

Annual recurring revenue: ███████████████████████

This visual comparison shows why Temenos is often selected for large and complex retail banking environments.

Why Temenos Ranks Among the Best AI Tools for Retail Banking in 2026

Temenos earns its place among the top AI tools for retail banking in 2026 because it combines deep core banking expertise with AI-enabled digital engagement at global scale. The platform is not limited to experimentation or niche use cases; it supports mission-critical banking operations used by hundreds of millions of customers every day.

For retail banks seeking a long-term, enterprise-grade solution that blends AI, digital innovation, and proven core banking stability, Temenos Infinity and Core Banking remain one of the most comprehensive and trusted technology choices available.

6. Kore.ai

Kore.ai is recognised in 2026 as one of the strongest AI platforms for retail banks that want to modernise customer engagement without replacing their existing core systems. Its BankAssist solution is designed specifically for banking environments, focusing on intelligent digital assistants that understand context, intent, and customer history. This makes Kore.ai a popular choice for banks that aim to improve service quality, reduce support costs, and scale digital interactions securely.

Unlike platforms that require deep infrastructure changes, Kore.ai positions itself as an AI agility layer. It integrates with legacy banking systems and adds conversational intelligence on top, allowing banks to move faster while protecting prior technology investments.

BankAssist and AI-Driven Customer Engagement

BankAssist is built to deliver highly personalised and context-aware conversations across digital banking channels. The AI assistants can understand customer intent, retrieve relevant account data, and complete tasks such as onboarding, balance inquiries, payment instructions, and loan applications. This enables retail banks to offer round-the-clock service without increasing operational workload.

The platform is widely used for conversational banking experiences that feel natural and human-like, while still maintaining strict compliance and security controls required in regulated financial environments.

Customer Engagement Capability Matrix

AI Capability | Retail Banking Application | Business Impact

Context-aware conversations | Customer support and self-service | Faster resolution times

Hyper-personalisation | Tailored responses and recommendations | Higher satisfaction

Task automation | Onboarding and loan requests | Lower operational cost

Omnichannel delivery | Messaging apps and web chat | Broader reach

Language understanding | Multi-language retail banking | Inclusive service

Modernising Legacy Banking Systems with AI

Kore.ai places strong emphasis on helping banks modernise without disruption. Many retail banks operate on complex legacy platforms that are costly and slow to change. Kore.ai’s approach allows AI assistants to sit above these systems, orchestrating interactions and workflows while leaving core infrastructure intact.

This model is especially attractive to mid-sized and large banks that want faster innovation cycles without the risk and expense of full system replacements.

Legacy Modernisation Value Matrix

Challenge | Traditional Banking Constraint | Kore.ai AI Impact

Slow system changes | High dependency on core vendors | Faster innovation layer

High call centre load | Manual customer handling | AI-driven self-service

Limited personalisation | Static rule-based flows | Dynamic AI responses

Scalability issues | Costly human expansion | Elastic AI scaling

Enterprise-Grade Pricing and Deployment Options

Kore.ai follows an enterprise pricing model that reflects its focus on large-scale banking deployments. Annual pricing for full enterprise implementations typically starts around 300,000 USD per year. For smaller teams or limited deployments, lower-tier plans are available, allowing banks to test conversational AI before scaling.

A key differentiator in 2026 is Kore.ai’s support for on-premise deployment. This option is critical for banks operating in regions with strict data residency, security, or regulatory requirements.

Illustrative Pricing Structure Table

Pricing Tier | Approximate Cost | Suitable For

Essential | 50 to 60 USD per month (annual billing) | Small teams or single bot use

Advanced | 150 to 180 USD per month (annual billing) | Growing digital teams

Enterprise | 300,000 USD or more per year | Large retail bank deployments

Usage-Based Billing and ROI Transparency

Kore.ai uses a billing model based on conversational sessions rather than users. A billing session is defined as a 15-minute conversation window. This structure allows banks to directly link AI costs to actual customer interactions, making ROI measurement clearer as usage grows.

This approach is particularly valuable for retail banks that handle fluctuating customer volumes across seasons, campaigns, or product launches.

Billing Model Comparison Matrix

Billing Metric | Kore.ai Model | Banking Benefit

Per-user fees | Not required | Lower fixed costs

Session-based billing | 15-minute blocks | Usage transparency

Scalability | Elastic | Pay only for demand

ROI tracking | Direct link to interactions | Easier justification

Real-World Retail Banking Use Cases

Retail banks have successfully deployed Kore.ai’s generative AI across popular messaging platforms to simplify customer journeys. AI assistants are used to guide customers through onboarding, answer account-related questions, and assist with loan applications, reducing friction and support workload.

These deployments show how conversational AI can move beyond basic FAQs to become a core service channel in retail banking.

Illustrative Bar Chart Representation (Text-Based)

Impact Area Comparison

Reduction in support workload: ████████████████████████

Improvement in response speed: █████████████████████

Customer satisfaction uplift: ████████████████████

Why Kore.ai Ranks Among the Best AI Tools for Retail Banking in 2026

Kore.ai earns its place among the top AI tools for retail banking in 2026 by offering secure, scalable, and highly personalised conversational AI that integrates smoothly with existing banking systems. Its session-based pricing, enterprise deployment options, and strong focus on regulated environments make it a practical choice for banks of all sizes.

For retail banks seeking to improve digital engagement, modernise customer service, and gain measurable returns from conversational AI, Kore.ai BankAssist represents a mature and future-ready solution in the evolving banking technology landscape.

7. SS&C Blue Prism

SS&C Blue Prism is widely recognised in 2026 as one of the most advanced intelligent automation platforms for retail banking. What began as a traditional robotic process automation provider has evolved into a full-scale intelligent automation ecosystem designed to support the concept of the autonomous enterprise. This shift makes Blue Prism highly relevant for banks that want to move beyond basic task automation and redesign operations around AI-led workflows.

In retail banking, where back-office costs, regulatory pressure, and operational complexity continue to rise, Blue Prism plays a critical role in improving efficiency, accuracy, and scalability across both customer-facing and internal processes.

From Robotic Automation to Intelligent Automation

Blue Prism’s transformation focuses on combining automation, artificial intelligence, and governance into a single operating framework. Rather than using bots only for repetitive tasks, the platform enables banks to orchestrate digital workers, AI agents, and human staff together in structured workflows.

This approach allows automation to handle entire processes from start to finish, such as customer servicing, document review, and fraud investigations, instead of automating isolated steps.

Automation Evolution Comparison Matrix

Automation Stage | Description | Retail Banking Outcome

Basic RPA | Task-level automation | Limited cost savings

Intelligent automation | AI + automation + orchestration | End-to-end efficiency

Autonomous enterprise | AI-led decision flows | Sustainable operational scale

Core Intelligent Automation Capabilities for Banks

SS&C Blue Prism provides enterprise-grade tools that support advanced AI use cases in regulated banking environments. Key components include AI governance, intelligent document processing, and secure orchestration of automation assets.

Key Capability Matrix

Capability | Retail Banking Use Case | Business Impact

AI Gateway | Centralised AI governance | Controlled and compliant AI use

Decipher IDP | Data extraction from documents | Faster onboarding and reviews

Digital worker orchestration | Back-office automation | Lower operating costs

Human and AI collaboration | Assisted investigations and servicing | Higher productivity

Workflow intelligence | Process redesign and optimisation | Sustainable efficiency gains

Driving the Autonomous Enterprise in Retail Banking

A defining theme for Blue Prism in 2026 is the orchestration of people, AI agents, and digital workers within a single environment. This orchestration allows banks to redesign workflows around outcomes rather than legacy process steps.

For example, instead of multiple handoffs across departments, an AI-driven workflow can manage a customer service case from intake to resolution, escalating to humans only when necessary. This model significantly reduces delays, errors, and operational overhead.

Workflow Transformation Matrix

Traditional Model | Intelligent Automation Model | Result

Multiple handoffs | Single orchestrated flow | Faster resolution

Manual reviews | AI-led decisioning | Higher accuracy

Fragmented systems | Unified automation layer | Better control

Quantified Efficiency and Productivity Impact

Banks that adopt advanced intelligent automation are expected to see meaningful improvements in their efficiency ratios by 2026. These gains are driven by reduced manual work, faster processing times, and better utilisation of skilled employees.

Operational Impact Summary Table

Metric | Expected Improvement | Retail Banking Meaning

Efficiency ratio | Up to 15 percentage points | Lower cost-to-income

Back-office productivity | Up to 50 percent increase | Faster processing

Error rates | Significant reduction | Fewer rework cycles

Processing speed | Major acceleration | Improved service delivery

Illustrative Bar Chart Representation (Text-Based)

Operational Improvement Comparison

Back-office productivity gain: █████████████████████████

Efficiency ratio improvement: ███████████████████

Processing speed increase: ███████████████████████

These bars show that the largest gains come from productivity and workflow speed rather than incremental automation.

Human and AI Collaboration in Retail Banking

A key advantage of SS&C Blue Prism’s approach is its emphasis on collaboration rather than replacement. AI agents handle data-heavy and repetitive work, while humans focus on judgement, oversight, and customer relationships. This balance is especially important in regulated retail banking environments where accountability and explainability matter.

Human–AI Collaboration Matrix

Task Type | AI Role | Human Role

Data extraction | Automated | Validation and oversight

Transaction processing | Fully automated | Exception handling

Customer investigations | AI-assisted | Final decision

Compliance reporting | Automated preparation | Approval and audit

Why SS&C Blue Prism Ranks Among the Best AI Tools for Retail Banking in 2026

SS&C Blue Prism earns its place among the top AI tools for retail banking in 2026 because it enables banks to move from fragmented automation to true intelligent operations. Its focus on governance, orchestration, and enterprise-scale deployment makes it particularly suitable for large and mid-sized banks seeking measurable efficiency gains.

For retail banks aiming to modernise back-office operations, reduce cost-to-income ratios, and build a foundation for the autonomous enterprise, SS&C Blue Prism Intelligent Automation stands out as a mature and future-ready AI solution.

8. SAS

SAS remains one of the most trusted and established providers of advanced analytics and artificial intelligence for retail banking in 2026. Unlike newer AI vendors that focus on narrow use cases, SAS plays a foundational role in how banks manage data quality, risk, pricing, and regulatory decision-making at enterprise scale. Its long-standing presence in highly regulated environments makes it a critical choice for banks that require accuracy, transparency, and governance in AI-driven decisions.

In 2026, SAS is increasingly recognised for helping banks move from experimentation with AI models to measurable, proof-driven intelligence that directly supports business and regulatory outcomes.

Shift from Model-Driven to Proof-Driven Intelligence

A central theme of SAS’s 2026 strategy is the transition from model-driven intelligence to proof-driven intelligence. Rather than focusing only on building complex models, banks are encouraged to validate whether AI insights are accurate, explainable, and usable in real-world banking decisions.

This shift is particularly important as banks face growing data integrity challenges. Synthetic data, automated data generation, and fragmented sources have increased the risk of unreliable inputs entering core banking systems. SAS Viya is positioned as a platform that helps banks test, validate, and govern AI outputs before they influence pricing, lending, or risk decisions.

Intelligence Approach Comparison Matrix

Approach | Description | Retail Banking Outcome

Model-driven intelligence | Focus on building models | Limited real-world trust

Proof-driven intelligence | Focus on validation and outcomes | Higher confidence decisions

Governed AI intelligence | Embedded controls and auditability | Regulatory readiness

Managing Unstructured Data at Banking Scale

SAS experts highlight that more than 80 percent of enterprise data exists in unstructured formats, such as documents, emails, call transcripts, images, and transaction notes. In retail banking, this data often contains valuable signals related to customer behaviour, credit risk, fraud patterns, and compliance issues, but remains underused due to its complexity.

By 2026, generative AI within SAS Viya is becoming the primary method for extracting meaning from unstructured data at scale. The platform enables banks to convert raw text and documents into structured insights that can be analysed alongside traditional financial data.

Unstructured Data Use Case Matrix

Data Source | AI Processing Role | Banking Value

Customer communications | Text analysis and sentiment detection | Better service and retention

Loan documents | Automated data extraction | Faster credit decisions

Compliance reports | Pattern and anomaly detection | Reduced regulatory risk

Fraud notes | Contextual analysis | Stronger fraud prevention

Hybrid Quantum-Classical Computing in Banking

One of the most advanced developments in SAS’s 2026 roadmap is the move from pilot projects to production use of hybrid quantum-classical computing. This approach combines traditional high-performance computing with emerging quantum techniques to solve complex optimisation and risk problems more efficiently.

In retail banking, this capability is especially relevant for advanced risk modelling, fraud detection, and large-scale simulations that would otherwise take excessive time and resources to compute. SAS’s progress in this area positions it ahead of many competitors that are still limited to experimental use cases.

Advanced Computing Capability Matrix

Capability | Banking Application | Strategic Benefit

Hybrid quantum-classical models | Risk simulations | Faster and deeper analysis

Large-scale optimisation | Portfolio and pricing models | Better capital allocation

Complex fraud pattern detection | Real-time fraud prevention | Higher accuracy

Bubble-Aware Models for Pricing and Stress Testing

Another important innovation from SAS in 2026 is the introduction of bubble-aware models. These models are designed to detect conditions where asset prices rise rapidly beyond sustainable levels due to market sentiment, leverage, or external shocks.

Retail banks are beginning to embed these models into pricing strategies and stress-testing frameworks. This allows institutions to better anticipate market instability, protect balance sheets, and comply with increasingly strict regulatory stress-testing requirements.

Risk Intelligence Matrix

Model Type | Purpose | Retail Banking Impact

Traditional risk models | Historical trend analysis | Limited foresight

Bubble-aware models | Detect unsustainable price growth | Improved resilience

Stress-testing models | Scenario-based analysis | Regulatory compliance

Illustrative Bar Chart Representation (Text-Based)

Impact Area Comparison

Unstructured data insight extraction: █████████████████████████

Risk modelling depth: ████████████████████████

Fraud detection accuracy: █████████████████████

Regulatory confidence: ███████████████████████

These visual indicators show that SAS delivers its strongest value in high-stakes, data-intensive banking decisions.

Why SAS Viya Ranks Among the Best AI Tools for Retail Banking in 2026

SAS Viya earns its place among the top AI tools for retail banking in 2026 because it addresses the most complex challenges banks face: data trust, explainability, and large-scale risk management. Its focus on proof-driven intelligence, unstructured data mastery, and advanced computing techniques makes it especially valuable for banks that prioritise accuracy over hype.

For retail banks seeking AI solutions that support long-term stability, regulatory confidence, and deep analytical insight, SAS Viya and Financial Services AI remain among the most reliable and future-ready platforms available.

9. Personetics

Personetics is widely regarded in 2026 as one of the most impactful AI platforms for hyper-personalisation in retail banking. Unlike automation tools that focus mainly on efficiency, Personetics concentrates on customer intelligence and financial wellbeing. Its AI analyses real-time spending behaviour, income patterns, and account activity to deliver meaningful, personalised insights that directly improve customer engagement and long-term loyalty.

This focus makes Personetics especially relevant for banks competing on experience rather than price, and for institutions looking to deepen customer relationships without significantly expanding advisory teams.

From Generic Alerts to Personal Financial Intelligence

Personetics moves retail banking beyond basic alerts and notifications. Instead of sending generic messages, the platform generates personalised, situation-aware guidance based on each customer’s financial behaviour. These insights are timely, relevant, and easy to understand, helping customers make better day-to-day financial decisions.

Examples include early warnings about possible overdrafts, identification of unusual spending that may signal fraud, and recommendations to adjust spending or savings habits. This level of intelligence transforms digital banking from a transactional tool into a daily financial companion.

Personalisation Capability Matrix

AI Capability | Practical Banking Application | Customer Outcome

Spending pattern analysis | Daily transaction monitoring | Better money awareness

Predictive alerts | Overdraft and cash-flow warnings | Reduced financial stress

Behavioural insights | Habit and trend identification | Smarter spending decisions

Fraud-related signals | Unusual activity detection | Faster customer response

Product relevance engine | Context-based product suggestions | Higher adoption rates

Impact on Customer Engagement and Retention

Banks using Personetics consistently report strong improvements in customer engagement metrics. By delivering advice that feels relevant and helpful, customers interact with their banking apps more frequently and are more likely to adopt additional financial products.

Engagement and Retention Impact Table

Metric | Observed Improvement | Business Impact

Mobile app engagement | Double-digit growth | Higher digital stickiness

Product adoption | Noticeable increase | Revenue expansion

Customer retention | Meaningful improvement | Lower churn

Customer satisfaction | Strong uplift | Better brand trust

These outcomes show that personalisation drives both customer value and bank profitability.

Empowering Smaller and Mid-Sized Banks in 2026

In 2026, Personetics is particularly valuable for small and medium-sized banks. Traditionally, advanced financial guidance was limited to private banking clients. Personetics allows these banks to deliver similar levels of personalised advice at scale through AI.

This capability helps smaller institutions compete with larger banks by offering intelligent digital experiences without the cost of expanding human advisory teams.

Bank Size Advantage Matrix

Bank Type | Traditional Limitation | Personetics Advantage

Small banks | Limited advisory resources | AI-driven guidance at scale

Mid-sized banks | Pressure from large competitors | Differentiated digital experience

Large banks | High customer volumes | Consistent personalisation

Supporting Financial Wellbeing and Sustainable Banking

Personetics places strong emphasis on financial wellbeing rather than aggressive selling. Its AI encourages responsible financial behaviour by helping customers anticipate issues and plan ahead. This approach supports sustainable banking models where long-term trust and customer success drive profitability.

Financial Wellbeing Use Case Matrix

Use Case | AI Insight Provided | Long-Term Benefit

Cash-flow management | Income vs expense forecasting | Fewer negative balances

Spending awareness | Category-level insights | Better budgeting

Savings encouragement | Smart nudges | Improved financial resilience

Fraud awareness | Behaviour-based alerts | Reduced losses

Illustrative Bar Chart Representation (Text-Based)

Impact Area Comparison

Customer engagement increase: ████████████████████████

Customer satisfaction improvement: █████████████████████

Product adoption growth: ████████████████████

Retention improvement: ███████████████████

These bars highlight that the strongest gains come from engagement and trust rather than short-term sales.

Why Personetics Ranks Among the Best AI Tools for Retail Banking in 2026

Personetics earns its place among the top AI tools for retail banking in 2026 because it turns customer data into practical, human-centred financial guidance. Its ability to deliver private-banking-style insights through digital channels makes it a powerful differentiator for banks of all sizes.

For retail banks seeking to improve engagement, strengthen retention, and support customer financial wellbeing while building sustainable revenue, Personetics Hyper-Personalization stands out as one of the most effective and proven AI solutions available.

10. Microsoft Dynamics 365

Microsoft plays a central role in shaping how retail banks adopt AI at enterprise scale in 2026. Through Dynamics 365 and the introduction of Agent 365, Microsoft focuses on helping banks deploy AI in a controlled, compliant, and revenue-focused way. Rather than positioning AI as a standalone tool, Microsoft integrates intelligence directly into everyday banking operations, customer engagement, and decision-making systems.

Agent 365 was introduced to address one of the biggest challenges banks face with AI adoption: how to scale automation and intelligence without losing governance, transparency, or regulatory control. This makes Microsoft a preferred choice for large and mid-sized banks that need both innovation and stability.

Agent 365 and AI Control at Scale

Agent 365 is designed to help organisations manage large numbers of AI agents across business functions while maintaining oversight. In retail banking, this means AI can support lending teams, customer service agents, fraud analysts, and relationship managers without creating uncontrolled automation risks.

Microsoft’s approach centres on making processes human-led and AI-operated. Humans remain accountable for decisions, while AI handles data processing, pattern recognition, and execution at speed. This balance is particularly important in regulated banking environments.

AI Operating Model Comparison Matrix

Operating Model | Description | Retail Banking Outcome

Human-only processes | Manual and slow | Limited scalability

AI-only automation | Fast but risky | Compliance concerns

Human-led, AI-operated | Controlled and scalable | Sustainable AI adoption

Revenue-Focused AI Transformation in Banking

Microsoft’s AI strategy for retail banking goes beyond cost reduction. The primary objective in 2026 is revenue growth through smarter processes, new products, and faster decision cycles. Banks using Microsoft’s AI tools to re-architect their core processes report significantly higher returns compared to slower adopters.

So-called advanced adopters of Microsoft AI consistently report returns on investment that are roughly three times higher than organisations that delay adoption. This performance gap highlights the commercial advantage of early, well-governed AI deployment.

Revenue Enablement Use Case Matrix

AI Use Case | Banking Function | Revenue Impact

AI-assisted lending | Mortgages and personal loans | Faster approvals, higher conversion

Customer insight models | Relationship management | Better cross-sell and upsell

AI-driven service | Contact centres | Higher retention

Fraud intelligence | Transaction monitoring | Asset protection

AI Adoption Trends in Financial Services

Industry research shows that a significant portion of financial services firms are actively planning AI initiatives with a direct revenue focus. Rather than experimental projects, banks are prioritising use cases that improve profitability and customer lifetime value.

Planned AI Investment Focus Table

Planned AI Objective | Share of Firms | Banking Implication

Revenue growth | 36 percent | AI tied to commercial outcomes

Operational efficiency | High | Cost optimisation

Risk and fraud protection | High | Balance sheet protection

Customer experience | Growing | Competitive differentiation

These figures indicate that AI in banking is shifting from experimentation to execution.

Practical Retail Banking Applications

In retail banking, Microsoft Dynamics 365 combined with Agent 365 is commonly used to streamline lending workflows, automate mortgage processing, and improve fraud detection. AI agents support document review, data validation, and customer communication, reducing cycle times without increasing risk.

Application Impact Matrix

Banking Area | AI Role | Operational Benefit

Lending | Workflow automation | Faster decisions

Mortgages | Document analysis | Reduced processing time

Fraud analysis | Pattern detection | Lower losses

Customer service | Assisted agents | Better resolution rates

Responsible AI and Regulatory Readiness

A major competitive advantage for Microsoft in retail banking is its emphasis on responsible AI. Governance, explainability, and compliance controls are embedded throughout the AI lifecycle, from data ingestion to decision execution.

This approach allows banks to treat regulatory complexity as a strength rather than a barrier. By standardising responsible AI practices, banks can scale innovation while maintaining trust with regulators and customers.

Responsible AI Framework Matrix

AI Lifecycle Stage | Governance Control | Banking Benefit

Data ingestion | Quality and bias checks | Reliable inputs

Model training | Transparency controls | Explainable outcomes

Deployment | Usage monitoring | Risk reduction

Audit and reporting | Full traceability | Regulatory confidence

Illustrative Bar Chart Representation (Text-Based)

Impact Area Comparison

Revenue uplift from AI adoption: ████████████████████████

Process speed improvement: █████████████████████

Risk and compliance confidence: ███████████████████████

Operational efficiency gains: ███████████████████

These bars highlight that revenue growth and governance strength are the most significant benefits.

Why Microsoft Dynamics 365 and Agent 365 Rank Among the Best AI Tools for Retail Banking in 2026

Microsoft earns its place among the top AI tools for retail banking in 2026 by combining enterprise-grade AI, strong governance, and direct revenue impact. The integration of Agent 365 allows banks to scale AI safely while keeping humans in control of critical decisions.

For retail banks looking to modernise operations, unlock new revenue streams, and manage regulatory complexity with confidence, Microsoft Dynamics 365 and Agent 365 provide a robust, future-ready AI platform suited for long-term transformation.

Global Macroeconomic Dynamics and the AI Growth Engine

The global economic environment in 2026 is defined by steady overall expansion combined with persistent uncertainty. While major economies continue to grow, this growth is constantly influenced by geopolitical tensions, trade disputes, political instability, and uneven recovery across regions. As a result, governments and enterprises are operating in an environment where resilience, adaptability, and risk management are no longer optional but essential.

Within this context, artificial intelligence has emerged as a stabilising force for economic growth. Rather than acting as a cyclical investment, AI has become a structural component of modern economies, helping businesses and institutions absorb shocks from fluctuating trade conditions, volatile consumer confidence, and sector-specific downturns.

Artificial Intelligence as a Global Growth Engine

By 2026, AI is widely recognised as a core driver of economic momentum across advanced and emerging markets. A measurable share of recent economic growth in large economies can be directly linked to sustained investment in AI-related infrastructure. This includes spending on high-performance data centres, advanced networking equipment, power and energy systems, and specialised semiconductor technologies required to support large-scale AI workloads.

AI Infrastructure Contribution Overview

Indicator | Observed Trend | Economic Meaning

Share of growth tied to AI investment | Approximately 1 percent of total growth | Structural, not cyclical, contribution

Primary investment areas | Data centres, power grids, semiconductors | Long-term capacity building

Economic role | Growth stabiliser | Buffers shocks from trade and demand shifts

The scale of this investment is unprecedented. Global AI infrastructure spending reached close to 1.5 trillion USD in 2025 and is expected to exceed 2 trillion USD in 2026. This level of capital deployment creates a powerful economic buffer, especially as large economies manage housing market slowdowns, tighter monetary conditions, and evolving trade relationships.

Global AI Infrastructure Spending Trajectory

Year | Estimated Global AI Infrastructure Spend

2024 | Under 1.2 trillion USD

2025 | Around 1.5 trillion USD

2026 | Exceeding 2 trillion USD

This trajectory shows that AI investment is accelerating rather than plateauing, reinforcing its role as a long-term economic foundation.

Translation of Macroeconomic Forces into Retail Banking

For retail banking, these global macroeconomic forces directly influence strategic priorities and budget allocation. Banks are no longer investing in technology primarily for long-term experimentation. Instead, they are reallocating capital away from legacy infrastructure and toward cloud-based, AI-driven platforms that deliver near-term efficiency gains and measurable business outcomes.

This shift reflects a broader recognition that traditional systems lack the flexibility required to operate in a volatile economic environment. AI platforms, particularly those built around automation, analytics, and intelligent decisioning, allow banks to respond faster to market changes while maintaining cost discipline.

Retail Banking Technology Reallocation Matrix

Legacy Focus Area | New AI-Driven Focus | Strategic Outcome

On-premise systems | Cloud-native AI platforms | Faster scalability

Manual workflows | Intelligent automation | Lower operating costs

Static analytics | Predictive and agentic AI | Better foresight

Fragmented systems | Unified AI operating layers | Greater agility

AI-Led Deal Activity and Market Urgency

Recent sector data shows that AI has moved from being an optional enhancement to a central requirement in banking technology decisions. Nearly three-quarters of all new contracts signed by major IT service providers are now AI-led. This signals a strong sense of urgency among banks to embed intelligence deeply into their operating models.

This urgency is driven by three primary objectives: improving agility, increasing predictability in outcomes, and achieving sustainable cost efficiency. Banks that delay AI adoption increasingly face competitive disadvantages in speed, customer experience, and risk management.

Technology Deal Composition in Banking

Deal Type | Share of New Deals | Implication

AI-led engagements | Approximately 74 percent | AI-first strategies dominate

Traditional IT upgrades | Declining rapidly | Limited strategic value

Pure cost-cutting initiatives | Secondary priority | Efficiency now AI-driven

Data Centre Expansion as the Fastest-Growing Segment

Within the broader AI investment landscape, data centre systems represent the fastest-growing expenditure category. Spending on data centre infrastructure is projected to grow by more than 20 percent in 2026, following an exceptional growth rate of nearly 30 percent in the previous year. This reflects the computational intensity of modern AI models and the rise of agentic intelligence across industries.

For retail banking, this expansion supports real-time analytics, large-scale fraud detection, personalised customer interactions, and the orchestration of autonomous AI agents across business functions.

AI Infrastructure Growth Focus

Infrastructure Component | Growth Trend | Banking Relevance

Data centres | Very high growth | Real-time AI processing

Networking | High growth | Low-latency decisioning

Energy systems | Rising importance | AI sustainability

Specialised chips | Strategic priority | Model performance

Illustrative Bar Chart Representation (Text-Based)

Growth Driver Comparison

Data centre systems: █████████████████████████

AI infrastructure overall: ███████████████████████

Traditional IT spending: ████████████

This visual highlights how decisively investment has shifted toward AI-centric infrastructure.

Connection to the Global Shift Toward Agentic Intelligence

The macroeconomic and infrastructure trends of 2026 directly enable the global shift toward agentic intelligence in retail banking. As AI platforms become more powerful and scalable, banks are transitioning from isolated automation to agent-based systems that can plan, decide, and act across complex workflows.

This structural transformation marks a fundamental change in how banks operate. Intelligence is no longer confined to analytics teams or back-office automation. Instead, it is embedded across lending, servicing, risk, compliance, and customer engagement, supported by the massive AI infrastructure investments occurring at the global level.

Why These Dynamics Matter for the Top AI Platforms in Retail Banking

The top AI platforms shaping retail banking in 2026 are a direct product of these macroeconomic forces. Their success depends on access to scalable infrastructure, cloud-native architectures, and the ability to deliver measurable value quickly. Banks selecting AI platforms today are effectively aligning themselves with the broader economic transformation driven by AI.

As global economies continue to invest heavily in AI capacity, retail banking stands at the centre of this shift, using agentic intelligence not only to improve efficiency but to redefine how financial services are delivered in an increasingly complex and uncertain world.

Global AI Spending in IT Markets 2024-2026

Between 2024 and 2026, global investment in artificial intelligence across IT markets has shifted from rapid expansion to full-scale structural transformation. What was once considered emerging technology spend has become core infrastructure investment for both private enterprises and regulated industries such as retail banking. By 2026, AI spending is no longer experimental or peripheral; it represents a foundational layer of global digital economies.

This surge in investment directly underpins the transformation of retail banking toward agentic intelligence, where AI systems do not simply assist human workers but actively plan, decide, and execute tasks within controlled governance frameworks.

Overall Growth of Global AI Spending

Global AI spending across IT markets has more than doubled in just two years. This growth reflects aggressive adoption across software, infrastructure, services, and semiconductor layers that together enable large-scale AI deployment.

Global AI Spending Summary Table

Market Segment | 2024 Spending (Million USD) | 2025 Spending (Million USD) | 2026 Forecast (Million USD)

AI Services | 259,477 | 282,556 | 324,669

AI Application Software | 83,679 | 172,029 | 269,703

AI Infrastructure Software | 56,904 | 126,177 | 229,825

Generative AI Models | 5,719 | 14,200 | 25,766

AI-Optimized Servers | 140,107 | 267,534 | 329,528

AI-Optimized Infrastructure-as-a-Service | 7,447 | 18,325 | 37,507

AI Processing Semiconductors | 138,813 | 209,192 | 267,934

Total Global AI Spending | 987,904 | 1,478,634 | 2,022,642

By 2026, total global AI spending exceeds 2 trillion USD, clearly signaling that AI has become a permanent and expanding pillar of global IT markets.

Acceleration Patterns Across AI Categories

Not all AI categories are growing at the same pace. Software layers that directly enable intelligence and autonomy show the fastest growth, reflecting the shift from infrastructure build-out to applied, operational AI.

Growth Acceleration Matrix

AI Category | Growth Pattern | Strategic Meaning

AI Services | Steady, sustained growth | Enterprise integration and advisory demand

AI Application Software | Explosive growth | AI embedded in business workflows

AI Infrastructure Software | Rapid acceleration | Scaling and orchestration of AI systems

Generative AI Models | High percentage growth | Foundation for agentic intelligence

AI-Optimized Servers | Large absolute growth | Compute-intensive AI workloads

AI-Optimized IaaS | High growth from small base | Cloud-based AI scalability

AI Processing Semiconductors | Strategic expansion | Performance and efficiency gains

This pattern shows that spending is shifting decisively toward software and platforms that enable autonomous and agent-based AI systems.

Why Application Software Spending Is Surging

AI application software spending grows from under 84 billion USD in 2024 to nearly 270 billion USD by 2026. This is one of the most important signals for retail banking. It indicates that enterprises are no longer buying AI as isolated tools, but as embedded intelligence within core systems such as lending, payments, fraud detection, onboarding, and customer engagement.

Retail banks are major contributors to this category, as they invest heavily in AI platforms that directly influence revenue, risk management, and operational efficiency.

Retail Banking Relevance Matrix

AI Software Area | Retail Banking Use | Business Outcome

Customer intelligence | Personalised engagement | Higher retention

Lending automation | Faster approvals | Increased conversion

Fraud analytics | Real-time risk control | Loss prevention

Service orchestration | AI-assisted agents | Lower cost-to-serve

Infrastructure Spending as the Backbone of Agentic Intelligence

Infrastructure-related categories, including AI-optimized servers, AI infrastructure software, and processing semiconductors, together represent the physical and logical backbone of agentic intelligence. Without this layer, autonomous AI systems cannot operate reliably at scale.

By 2026, AI-optimized servers alone account for more than 329 billion USD in annual spending. This reflects the computational demands of running real-time decision engines, large language models, and multi-agent systems across global enterprises.

Infrastructure Emphasis Table

Infrastructure Layer | 2026 Spending Level | Role in AI Transformation

AI-optimized servers | Very high | Real-time processing

AI infrastructure software | Rapidly expanding | AI orchestration and control

AI semiconductors | Strategic priority | Performance and efficiency

Cloud AI infrastructure | High growth | Elastic scalability

Illustrative Spending Growth Bar Chart (Text-Based)

AI Application Software: █████████████████████████

AI Infrastructure Software: ███████████████████████

AI-Optimized Servers: █████████████████████

AI Processing Semiconductors: ███████████████████

AI Services: █████████████████

This visual highlights that applied AI and infrastructure are the primary drivers of total spending growth.

Implications for the Structural Transformation of Retail Banking

The scale and direction of global AI spending explain why retail banking is undergoing structural transformation rather than incremental change. Banks are no longer constrained by limited compute, siloed systems, or narrow AI tools. Instead, they are deploying end-to-end AI platforms capable of supporting agentic workflows across the entire institution.

This investment environment enables the rise of AI agents that can manage lending pipelines, monitor fraud continuously, personalise customer journeys, and support compliance operations with minimal human intervention.

Connection to the Top 10 AI Platforms in Retail Banking

The top AI platforms reshaping retail banking in 2026 are direct beneficiaries of this global spending surge. These platforms sit primarily within the fastest-growing categories: AI application software, AI infrastructure software, and AI services. Their success is tied to the availability of scalable compute, advanced models, and cloud-native infrastructure funded by trillions in global investment.