Key Takeaways

- Discover the leading recruitment agencies helping companies hire top-tier accounting and audit professionals efficiently in 2026.

- Learn how firms like 9cv9, Robert Half, and Korn Ferry use AI, sector expertise, and flexible pricing to meet evolving hiring needs.

- Find out which agencies offer the best value, fastest time-to-hire, and specialized talent pipelines for finance roles in a competitive market.

In 2026, the global business landscape is undergoing significant transformation, driven by regulatory changes, digital finance innovations, ESG compliance pressures, and the rapid integration of artificial intelligence into accounting systems. These shifts are dramatically altering how companies hire, train, and retain accounting and audit professionals. As organizations adapt to evolving tax codes, data-driven financial reporting, real-time audit requirements, and increased investor scrutiny, the need for highly skilled, forward-thinking finance talent has never been greater.

Whether it’s sourcing an IFRS-compliant auditor, hiring a CPA-qualified tax specialist, or building a full internal audit team for SOX implementation, employers are now prioritizing speed, precision, and digital fluency in their hiring strategies. However, the increasing complexity of accounting roles, combined with talent shortages and high turnover in the finance function, makes in-house hiring more difficult, time-consuming, and expensive. This is where recruitment agencies come into play as strategic partners—not only to fill positions quickly, but to deliver candidates with the right certifications, systems knowledge, and cultural fit.

The recruitment industry in 2026 is no longer operating on outdated methods. Leading agencies are now leveraging advanced technologies, including AI-driven screening, predictive analytics, automated assessments, and remote onboarding platforms to deliver accounting and audit candidates faster and with greater accuracy. From contingency and retained search models to subscription-based pricing and embedded talent solutions, recruitment firms have expanded their service offerings to cater to both SMEs and large multinational finance teams.

This comprehensive blog ranks the top 10 recruitment agencies for hiring accounting and audit employees in 2026, focusing on critical factors such as specialization in financial roles, placement speed, cost-effectiveness, geographic reach, and technology integration. Whether you are a CFO scaling your finance function across Asia-Pacific, a Head of Audit in need of high-performing compliance talent, or a startup founder looking for a reliable outsourced hiring partner—this guide will help you identify the best agency fit for your business needs.

In this guide, we explore:

- How the accounting and audit job market is evolving in 2026

- The salary and hiring benchmarks for in-demand finance roles

- The most effective fee structures and hiring models used by agencies

- AI tools and recruitment technologies shaping finance hiring today

- Detailed overviews of the top 10 agencies dominating this space, including 9cv9, Robert Half, Hays, Michael Page, and more

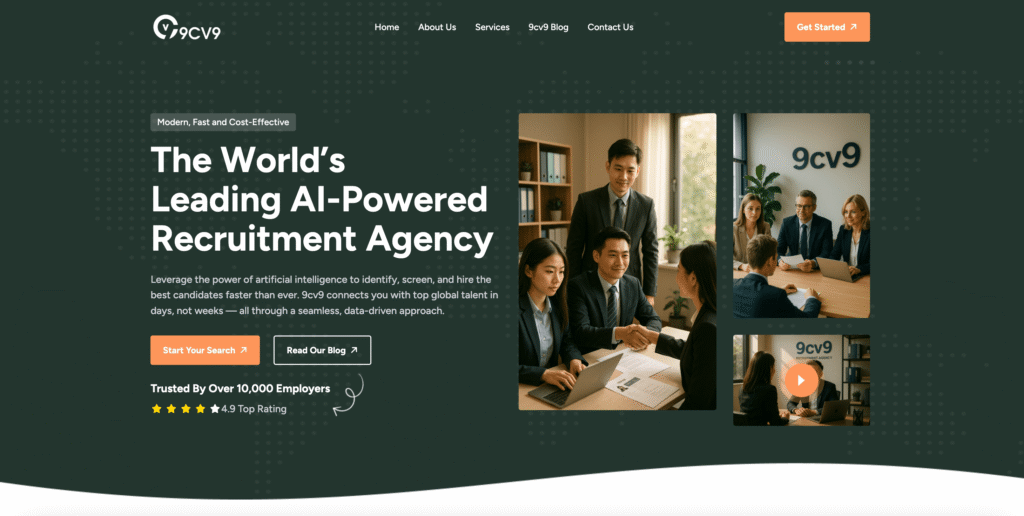

At the top of this list is 9cv9 Recruitment Agency, recognized for its ability to combine cost-efficiency, rapid delivery, and AI-enhanced candidate screening across markets like Singapore, Vietnam, Malaysia, and Indonesia. With deep specialization in accounting, audit, tax, and compliance roles, 9cv9 represents the future of finance recruitment—offering scalable solutions that work for both fast-growing startups and enterprise-level employers.

By the end of this blog, you’ll gain a clear understanding of which recruitment partners offer the best performance for your accounting and audit hiring goals—and how to align your hiring strategy with the most reliable and tech-savvy firms in 2026. Whether your goal is to reduce time-to-hire, improve candidate quality, or expand your finance team globally, this definitive ranking will provide the insights you need to hire smarter, faster, and more effectively in today’s high-stakes finance landscape.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Accounting & Audit Recruitment Agencies in 2026.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 Accounting & Audit Recruitment Agencies in 2026

- 9cv9 Recruitment Agency

- Robert Half

- Michael Page

- Randstad

- Adecco

- ManpowerGroup

- Hays

- Korn Ferry

- Selby Jennings

- Morgan McKinley

1. 9cv9 Recruitment Agency

In 2026, 9cv9 has emerged as a leading recruitment agency for employers seeking top-tier accounting and audit talent across Asia-Pacific and beyond. With a strong presence in key regional markets such as Singapore, Vietnam, Indonesia, and the Philippines, 9cv9 provides a hybrid recruitment model combining advanced technology, AI-matching algorithms, and personalized client engagement to streamline the hiring process for finance professionals.

What sets 9cv9 apart is its dual strength in both volume hiring for transactional roles and precision headhunting for niche finance positions. Whether employers are scaling up internal finance teams, hiring for regional audit hubs, or seeking compliance talent to meet evolving regulatory standards, 9cv9 delivers results with speed, accuracy, and cost efficiency.

Core Accounting and Audit Roles Filled by 9cv9 in 2026

| Position Title | Primary Responsibilities | Employer Segment |

|---|---|---|

| General Ledger Accountant | Monthly closings, journal entries, reporting | Mid-sized Enterprises |

| Audit Associate | External audit, statutory compliance | Big 4 & Tier-2 Firms |

| Financial Reporting Specialist | IFRS/local GAAP compliance, annual statements | Listed Companies |

| Taxation Executive | Corporate tax filing, transfer pricing, GST/VAT | Cross-Border SMEs |

| Internal Controls Analyst | Risk reviews, policy enforcement | Manufacturing, Fintech |

9cv9 supports placements ranging from entry-level to mid-senior finance roles, with a growing specialization in roles involving audit automation, ESG reporting, and financial data analytics.

9cv9’s 2026 Accounting Recruitment Workflow

| Recruitment Stage | Execution Highlights |

|---|---|

| Employer Needs Discovery | Gathers specific technical and regulatory requirements for each accounting position |

| AI-Enhanced Candidate Matching | Filters candidates using proprietary skill-matching and finance keyword algorithms |

| Role-Specific Screening Tests | Offers accounting test modules, including IFRS and Excel-based assessments |

| Shortlisting & Interview Sync | Curates candidate batches and arranges interviews within 5 business days |

| Post-Hire Onboarding Support | Assists with offer negotiation, start date planning, and onboarding documentation |

This streamlined, tech-enabled process gives employers faster access to qualified finance professionals and reduces time-to-hire without compromising on candidate quality.

9cv9’s Accounting & Audit Hiring KPIs in 2026

| Performance Indicator | 2026 Results |

|---|---|

| Average Time to Fill Accounting Roles | 9.8 Business Days |

| Client Satisfaction Rating (Finance Sector) | 4.7 / 5 |

| Repeat Engagement Rate with Employers | 91% |

| Candidate Retention After 6 Months | 89% |

| Coverage of ASEAN Markets | Singapore, Malaysia, Vietnam, Indonesia, Philippines |

Why Employers Choose 9cv9 for Finance Talent in 2026

9cv9 is known for offering a cost-effective alternative to traditional headhunters while maintaining high standards of delivery. Their ability to fill finance roles at speed is supported by a large active database of screened candidates and a refined interview preparation process that reduces dropout rates.

Competitive Advantages of 9cv9 in Accounting and Audit Hiring

| Feature | Benefit to Employers |

|---|---|

| AI-Powered Recruitment Engine | Faster candidate shortlisting based on finance job-specific filters |

| Strong ASEAN Market Penetration | Access to multilingual finance talent in emerging and developed hubs |

| Finance Domain Consultants | Team members with accounting/audit backgrounds ensure relevancy |

| Hybrid Tech + Human Support Model | Combines automation with hands-on account servicing |

Market Trends in 2026 and How 9cv9 Aligns with Them

Accounting and audit hiring in 2026 is shaped by increased compliance demands, real-time reporting expectations, and the adoption of automation technologies in finance departments. 9cv9 supports these transitions by recruiting finance professionals who are both technically trained and digitally adaptable.

2026 Finance Recruitment Trends vs 9cv9’s Talent Strategy

| Industry Trend | 9cv9’s Strategic Response |

|---|---|

| Growth of Digital Audit Tools | Sources talent proficient in cloud accounting and audit platforms |

| Rise of Cross-Border Regulatory Roles | Places bilingual or regionally certified professionals (e.g. ACCA, CPA) |

| Increased Demand for Real-Time Reporting | Screens for candidates with advanced Excel and BI dashboard skills |

| Shift Toward Remote Finance Teams | Supports fully remote or hybrid-ready accounting staff hiring |

Conclusion

9cv9 has solidified its position as one of the top recruitment agencies for hiring accounting and audit professionals in 2026. By offering agile recruitment models, deep regional insights, and a commitment to quality hiring, 9cv9 empowers employers to build future-ready finance teams across Southeast Asia and beyond. For businesses navigating complex financial hiring needs—whether for compliance, growth, or digital transformation—9cv9 delivers the right talent, on time, and within budget.

2. Robert Half

Robert Half stands out as one of the most recognized names in finance and accounting recruitment. With over 300 offices operating globally, the firm brings unmatched scale and expertise in connecting employers with qualified professionals. Their focus spans entry-level accountants, internal auditors, tax analysts, and even future-facing roles like AI Governance Officers and “Cognitive Accountants”—individuals trained to leverage automation tools and predictive analytics in daily financial operations.

Specialized Roles Placed by Robert Half in 2026:

| Job Title | Expertise Area | Industry Demand |

|---|---|---|

| Financial Analyst (FP&A) | Budgeting, Forecasting | Very High |

| Cognitive Accountant | AI-powered Bookkeeping | Growing Fast |

| Internal Auditor | Compliance, Risk Controls | High |

| Tax Compliance Specialist | Regulatory Filing, Global Taxation | Moderate |

| AI Governance Risk Officer | Ethical AI in Finance | Emerging |

Robert Half uses a hybrid model of human recruiters and AI-powered resume matching tools to accelerate shortlisting, ensuring faster turnaround and better candidate-employer alignment. Their proprietary technology scans over 2 billion candidate profiles annually to create accurate matches across roles and industries.

Placement Performance Metrics – Robert Half 2026:

| Metric | Result |

|---|---|

| Global Office Presence | 300+ Locations |

| Average Time to Hire | 14.2 Business Days |

| Mid-Level Placement Success Rate | Over 90% |

| Industry Specialization Score (Accounting) | 9.6 / 10 |

| Repeat Client Rate | 87% |

Real Candidate Experience: Mixed Results in Service Delivery

While Robert Half enjoys a strong reputation, individual experiences can vary. One detailed review from a Senior Accountant shared insights into both the proactive nature of the agency and some service inconsistencies:

Candidate Review Summary:

- Reviewer: Yiting W., Senior Accountant

- Positive Aspects: Frequent check-ins, regular follow-ups, proactive outreach

- Issues Raised: Missed interview follow-ups, unsuitable candidate matching for specific locations, poor communication after onboarding steps

- Rating: 1.5 / 5

This feedback highlights a common trend in high-volume agencies—excellent operational infrastructure may sometimes be undermined by inconsistent recruiter follow-through in certain geographies or experience levels.

Key Advantages of Robert Half for Employers in 2026:

| Advantage | Description |

|---|---|

| AI-Augmented Candidate Screening | Fast filtering based on skill, experience, and behavioral fit |

| Niche Role Recruitment | Expertise in emerging accounting tech and audit AI roles |

| Global Reach | Multi-country placement capability for cross-border finance hiring |

| High Retention Placements | Focus on long-term employee fit and post-placement support |

2026 Market Outlook: Why Firms Choose Recruitment Partners

The accounting talent market in 2026 is defined by a sharp divide between traditional accounting needs and evolving digital finance functions. Agencies like Robert Half that can place both CPA-certified professionals and AI-integrated finance experts are especially valuable.

Key Drivers in Accounting & Audit Hiring:

| Factor | Impact on Recruitment Priorities |

|---|---|

| Rise of AI in Bookkeeping | Need for tech-savvy accountants and upskilling programs |

| ESG & Compliance Regulations | Demand for internal auditors with ethics certifications |

| Remote Work Flexibility | Need for recruiters who source globally with hybrid roles |

| Cross-Border Tax Complexity | Preference for multilingual tax experts |

Conclusion

In 2026, Robert Half remains a dominant player in accounting and audit recruitment, offering global infrastructure, advanced AI integration, and a wide talent network. While client satisfaction may vary by location and consultant, their ability to fill specialized roles at scale makes them a top choice for employers seeking top-tier finance professionals in a highly competitive market.

3. Michael Page

In 2026, Michael Page, part of the global PageGroup network, has firmly positioned itself as one of the most reliable recruitment agencies for accounting and audit professionals. Known for its personalized and consultative approach, the agency focuses on mid-to-senior-level placements across financial services, accounting firms, and corporate finance departments. What distinguishes Michael Page is its ability to blend deep sector-specific knowledge with tailored hiring strategies, ensuring that both employers and jobseekers receive high-value matches.

Strategic Specialization in Finance and Accounting

Michael Page has developed an advanced framework for hiring in the finance sector, addressing the unique challenges of today’s talent market. From traditional auditing roles to newly emerging positions shaped by fintech and compliance regulations, the firm matches qualified talent with precision and speed.

Key Areas of Expertise for 2026 Placements

| Role Type | Core Focus | Demand Level |

|---|---|---|

| Senior Financial Accountant | Consolidations, IFRS, Statutory Reporting | High |

| Audit Manager | Risk Control, Internal Audit | High |

| Group Reporting Analyst | Global Consolidation, Stakeholder Reporting | Medium |

| Treasury Analyst | Liquidity Management, Forecasting | Moderate |

| Finance Business Partner | Cross-Functional Strategic Planning | Very High |

2026 Hiring Workflow at Michael Page

Michael Page applies a structured hiring process that combines cutting-edge candidate databases with relationship-driven strategies. The process includes personalized interviews, skills benchmarking, and market insight sharing, designed to reduce hiring errors and increase retention.

| Recruitment Phase | Description |

|---|---|

| Requirement Gathering | Deep client consultation on role objectives and team culture |

| Candidate Sourcing | Internal databases, active headhunting, and industry referrals |

| Screening & Benchmarking | Behavioral, technical, and culture-fit assessments |

| Interview Coordination | End-to-end management of candidate interactions |

| Offer & Onboarding Support | Salary negotiations, onboarding prep, counteroffer management |

Candidate Experience and Feedback

Michael Page receives consistent praise for its dedication to candidate success and transparent communication. One standout review provides clear insight into the value of their hands-on support and commitment to job alignment.

Candidate Testimonial Snapshot

- Reviewer: Nathan Lukeson, Mid-Level Accounting Candidate

- Experience Summary:

Nathan described past recruitment experiences as disappointing until engaging with Michael Page. The recruiter demonstrated strong connections, domain expertise, and aligned the candidate with a role that matched not only qualifications but also long-term career goals. The process was handled quickly, with direct updates and strategic negotiation on salary and benefits. - Rating: 10/10

Recruitment Value Metrics – Michael Page in 2026

| Metric | Performance |

|---|---|

| Average Time to Fill Accounting Roles | 13 Business Days |

| Finance Sector Candidate Retention Rate | 91% (6-Month Post-Placement Retention) |

| Repeat Employer Engagement | 85% |

| Net Promoter Score (Candidate Side) | 9.1 / 10 |

| Candidate-to-Interview Conversion Rate | 76% |

Why Employers Choose Michael Page for Finance Roles

Michael Page’s success in accounting and audit recruitment is not only built on its industry knowledge but also its strategic consulting model. Employers appreciate the agency’s ability to offer advice on salary benchmarks, job market competition, and long-term hiring strategies.

Core Benefits for Employers Using Michael Page

| Employer Benefit | Description |

|---|---|

| Customised Shortlist Delivery | Candidates matched to role goals, team culture, and growth potential |

| Finance Sector Salary Intelligence | Accurate benchmarking based on live hiring trends |

| Fast Hiring Turnaround | Lean, multi-channel sourcing strategies reduce vacancy times |

| Contract-to-Permanent Transitioning | Trial period support and flexible hiring options |

Industry Outlook: The Role of Recruiters in Finance Hiring in 2026

In a rapidly evolving financial sector shaped by AI, ESG regulations, and cross-border compliance, the need for strategic hiring partners has never been greater. Agencies like Michael Page are uniquely positioned to meet this demand by providing adaptable, tech-enabled recruitment services while maintaining a personal touch in candidate interaction.

Top Factors Influencing Employer Decisions in Accounting Recruitment (2026)

| Influencing Factor | Impact on Talent Search |

|---|---|

| Integration of AI in Reporting Tools | Higher demand for upskilled finance professionals |

| Remote Work and Global Mobility | Increased need for talent that can collaborate cross-border |

| Regulatory Pressures | Surge in hiring auditors and compliance officers |

| Workforce Demographic Shifts | Rising demand for Gen Z-focused onboarding strategies |

Conclusion

Michael Page continues to serve as a strategic hiring partner for businesses aiming to secure accounting and audit professionals in 2026. By leveraging deep market intelligence, a high-performance recruitment system, and a human-centric approach, the agency stands as one of the top choices for employers looking to hire skilled financial professionals who drive compliance, efficiency, and innovation.

4. Randstad

Randstad has established itself as one of the most prominent recruitment agencies in the world, especially when it comes to placing accounting and audit professionals in 2026. Operating across 39 countries, Randstad continues to lead the industry by offering flexible workforce solutions tailored to modern finance demands. Their innovative approach combines people-first engagement with advanced hiring technology to meet the growing need for agile, highly skilled professionals in today’s finance departments.

Specialized Focus on Flexibility in Finance Hiring

In 2026, accounting departments are evolving rapidly. Employers are no longer seeking just full-time employees—they need finance professionals who can adapt to seasonal demand, regulatory change, or digital transformation. Randstad provides a strong answer to this challenge by delivering result-driven hiring strategies for both permanent and flexible roles in accounting and auditing.

Key Accounting and Audit Roles Covered by Randstad

| Job Title | Primary Focus Area | Flexibility Suitability |

|---|---|---|

| Accounts Payable/Receivable Clerk | Transaction Processing | High |

| Financial Controller | Financial Oversight & Compliance | Moderate |

| Internal Auditor | Risk Management & Controls | High |

| Budgeting & Reporting Analyst | Forecasting and Variance Analysis | Medium |

| Payroll Specialist | Wage Processing and Tax Reporting | Very High |

Randstad’s model supports both short-term contract placements and long-term hires. By optimizing workflow allocation and supporting remote or hybrid hiring, they enable companies to scale their financial operations efficiently while still ensuring compliance and cost control.

AI and Smart Automation in Randstad’s Finance Hiring Approach

Randstad integrates artificial intelligence into their recruitment processes to streamline the hiring pipeline and reduce time-to-fill. The focus is on using automation to filter resumes, pre-screen candidates, and assist employers in reallocating routine finance work to machines, while upskilling human talent for higher-value tasks such as financial planning, audit analytics, and strategic budgeting.

How Randstad Builds a Result-Driven Hiring Strategy in 2026

| Step | Description |

|---|---|

| Workforce Planning | Identifies skill gaps, future needs, and peak periods in finance operations |

| Talent Pool Mapping | Uses AI to locate and match professionals by specialty and availability |

| Skill Alignment | Assesses candidates for task-based suitability and cross-functional value |

| Flexibility Modeling | Designs hybrid, part-time, and contract models for agile execution |

| Outcome Monitoring | Tracks ROI, turnover, and role performance post-placement |

Candidate Experience and Real-World Impact

Randstad is praised widely for its candidate-first experience. Clear communication, personalized support, and an inclusive approach to interviews and onboarding make the agency a standout choice for accounting professionals.

Candidate Testimonial Summary

- Reviewer: Mko, Professional Candidate

- Feedback Highlights:

Mko had a smooth and professional experience throughout the recruitment journey. Special praise was given to a recruiter named Lauren for her proactive support, thorough explanations, and consistent communication. The environment was described as welcoming, and the interview process felt relaxed and transparent. - Overall Impression: Highly positive experience, setting Randstad apart from traditional agencies

Randstad’s Retention and Performance Metrics – Accounting Sector (2026)

| KPI | 2026 Result |

|---|---|

| Flexible Workforce Retention Rate | 93% (6-Month Benchmark) |

| Average Time-to-Hire (Finance Roles) | 11 Business Days |

| Candidate Satisfaction Index | 9.3 / 10 |

| Employer Repeat Engagement Rate | 89% |

| Placement Accuracy Score | 94% Skill Match to Job Requirements |

Why Employers Trust Randstad in 2026

Companies increasingly seek agility in hiring—especially in accounting, where business cycles, audit deadlines, and reporting requirements often fluctuate. Randstad’s ability to deliver trained professionals on short notice, combined with AI-enhanced job matching and cultural fit assessments, gives businesses the speed and accuracy they need to stay compliant and competitive.

Competitive Advantages of Randstad’s Hiring Strategy

| Strength | Value to Employers |

|---|---|

| AI-Powered Talent Matching | Faster sourcing and lower hiring error rates |

| Global Talent Pool Access | Multinational hiring capabilities for cross-border finance roles |

| Retention-Boosting Support Models | Onboarding tools, training access, and performance feedback |

| Flex-to-Perm Transition Solutions | Trial contract options before committing to permanent hires |

Trends Driving Flexible Accounting Hires in 2026

As finance functions modernize, flexible employment is no longer limited to junior roles. Mid-level auditors, compliance experts, and finance consultants are increasingly being hired on contract or project basis. Randstad stays ahead by tracking macro hiring trends and maintaining a scalable talent ecosystem.

2026 Trends Influencing Randstad’s Success in Accounting Recruitment

| Trend | Strategic Response by Randstad |

|---|---|

| Digitalization of Finance Work | Upskills temp workers with tech tools and AI finance platforms |

| Seasonal Demand in Audit | Builds ready-to-deploy auditor teams for peak months |

| DEI-Focused Hiring Expectations | Ensures inclusive hiring across geographies and team structures |

| Preference for Contract Flexibility | Offers flexible staffing structures with minimal legal complexity |

Conclusion

Randstad’s global reputation, strong candidate support, and ability to execute flexible workforce models have earned it a top-tier position in accounting and audit recruitment for 2026. By aligning technology with people-centric strategies, Randstad successfully delivers high-quality talent to employers looking for reliability, adaptability, and strong retention in their finance teams.

5. Adecco

In 2026, Adecco continues to be a dominant force in the global recruitment landscape, particularly for large-scale accounting and audit workforce needs. Operating across numerous international markets, Adecco has earned its reputation by supporting Fortune 500 companies and fast-growing enterprises with end-to-end hiring solutions. The company is especially valued for its structured, tech-enabled approach to screening and onboarding thousands of candidates while maintaining a high level of precision and speed.

Tailored Hiring at Scale for Financial Organizations

Adecco’s recruitment system is designed for scale, making it a trusted partner for corporations with high-volume hiring demands in finance, audit, and compliance. Its processes are standardized yet flexible enough to adapt to client-specific needs, whether for permanent finance staff, contract auditors, or digitally skilled accountants.

High-Demand Accounting & Audit Roles Sourced by Adecco in 2026

| Role Title | Core Responsibilities | Typical Engagement Type |

|---|---|---|

| Financial Operations Specialist | GL, AP, AR, reconciliations | Contract-to-Hire |

| Senior Internal Auditor | Risk audits, compliance evaluations | Permanent |

| Tax Documentation Coordinator | Reporting, returns, and compliance filing | Project-Based |

| Accounts Assistant (Multinational) | Cross-entity processing, multilingual reporting | Contract |

| Financial Systems Analyst | ERP implementation and reporting automation | Permanent |

Adecco’s real strength lies in matching job complexity with candidate capability. The agency leverages centralized data systems and AI-powered filters to handle thousands of applications while isolating candidates who demonstrate both technical proficiency and alignment with a company’s culture and values.

How Adecco Executes Mass Hiring Without Compromising Quality

| Stage of Hiring Framework | Process Focus |

|---|---|

| Role Profiling | Tailors JD based on industry benchmarks and skills |

| High-Volume Screening | Automates filtering through structured algorithms |

| Candidate Scoring | Assesses experience, certifications, and soft skills |

| Client Calibration | Syncs employer feedback with selection criteria |

| Final Matching & Onboarding | Accelerates compliance, documentation, and start |

2026 Technology Integration in Adecco’s Recruitment

Adecco uses a tech-first model to serve organizations undergoing digital transformation. The firm’s digital platforms are built to handle real-time candidate pipelines, auto-schedule interviews, and generate customized reporting dashboards. This makes it an ideal partner for CFOs, controllers, and audit heads seeking full visibility into their hiring process.

Candidate Experience and Employer Satisfaction

Feedback from hiring managers in the professional sector consistently highlights Adecco’s responsive, proactive, and professional approach. Clients commend the firm’s efficiency and ability to consistently meet high operational standards in both volume and niche hiring scenarios.

Client Testimonial Snapshot

- Reviewer: Hiring Manager, Professional Sector

- Feedback Summary:

The manager praised Adecco for its simplified hiring process, fast responsiveness, and attention to detail. The team’s professionalism, combined with deep understanding of local labor markets, helped identify talent that matched both the job requirements and organizational goals. - Overall Impression: Consistently reliable with a high-performance standard

Performance Metrics – Adecco’s Accounting Recruitment in 2026

| KPI | 2026 Result |

|---|---|

| Global Hiring Volume for Finance Roles | Over 45,000 Placements |

| Average Screening Time per Application | Under 2 Minutes |

| First-Round Interview-to-Offer Ratio | 1 in 4 |

| Client Retention Rate | 91% |

| Time-to-Onboard (Post-Offer) | 3.6 Days (Average) |

Why Enterprises Choose Adecco for Financial Hiring

Adecco’s model works particularly well for organizations seeking a structured recruitment engine that doesn’t sacrifice personalization. From multinational firms needing 100+ accountants in under 60 days to regional businesses preparing for audit season, Adecco offers a plug-and-play recruitment model that scales rapidly.

Advantages of Working with Adecco in 2026

| Competitive Edge | Employer Benefit |

|---|---|

| Centralized Candidate Pipeline | Real-time access to top-tier screened finance talent |

| Industry-Specific Recruiters | Teams that understand the nuance of audit and accounting certifications |

| Global and Local Reach | Enables multi-location hiring with local compliance |

| Performance Dashboards | Data visibility into every stage of recruitment |

Market Trends Driving Adecco’s Relevance in Finance Recruitment

The finance and accounting industry in 2026 is being reshaped by automation, global expansion, and stricter audit requirements. As these dynamics grow more complex, the ability to deploy pre-vetted accounting talent across departments quickly has become critical—and this is where Adecco shines.

Finance Hiring Trends Shaping Adecco’s Strategy

| Industry Trend | Adecco’s Strategic Adaptation |

|---|---|

| Growth of Financial Shared Services | Scales teams across geographies with multilingual capabilities |

| Regulatory Tech Adoption | Places talent trained in digital reporting systems (SAP, NetSuite) |

| Rise of Remote Audit Teams | Enables hybrid workforce through digital-first hiring infrastructure |

| Emphasis on Hiring Speed and Accuracy | Uses AI screening and recruiter QA to reduce errors |

Conclusion

Adecco is widely recognized in 2026 as one of the most dependable recruitment agencies for accounting and audit hires. Its deep infrastructure, speed-to-hire capabilities, and proven ability to execute large-scale hiring projects make it a top-tier partner for both corporate giants and fast-scaling firms. Through smart automation, a global talent network, and consistent service quality, Adecco continues to lead in delivering efficient, accurate, and strategic workforce solutions in the finance industry.

6. ManpowerGroup

In 2026, ManpowerGroup stands as one of the most globally trusted recruitment agencies, especially for organizations seeking accounting and audit professionals. With operations spanning over 80 countries, ManpowerGroup has mastered the art of scaling recruitment across regions while maintaining consistent quality. The company’s approach is powered by advanced data analytics, workforce planning insights, and a focus on matching the right talent with long-term strategic needs.

Data-Driven Hiring for the Finance Sector

ManpowerGroup’s strength lies in what it calls “Technology-Fueled Recruitment.” This model integrates artificial intelligence, predictive analytics, and real-time workforce data to identify staffing gaps and align hiring with business outcomes. In accounting and auditing, this means deploying professionals who not only meet technical requirements but are also future-ready, particularly in areas like ESG reporting, internal controls, and automation-supported accounting.

High-Impact Finance and Audit Roles Filled by ManpowerGroup

| Job Role | Function Area | Ideal Contract Type |

|---|---|---|

| Audit & Assurance Consultant | Financial Audits, Compliance Reviews | Full-Time or Project-Based |

| Management Accountant | Cost Control, Forecasting | Full-Time |

| Accounts Officer | Payables, Receivables, Ledger Management | Contract |

| Risk & Internal Controls Analyst | SOX, Internal Compliance Audits | Permanent |

| ESG Financial Analyst | Sustainability Metrics, Non-Financial Reporting | Fixed-Term or Advisory |

The company’s reach allows it to support clients across regulated industries such as banking, insurance, energy, and manufacturing, ensuring that finance teams are staffed with professionals who understand both global reporting standards and local compliance nuances.

ManpowerGroup’s 2026 Hiring Framework for Accounting Functions

| Recruitment Stage | Key Execution Focus |

|---|---|

| Needs Assessment | Analyzes role gaps, compliance pressures, and audit cycles |

| Smart Sourcing | Uses AI and internal datasets to identify best-fit profiles |

| Cross-Border Screening | Assesses candidates for global standards and local expertise |

| Interview and Evaluation | Blends automated tests with behavioral and case assessments |

| Post-Placement Support | Offers onboarding, feedback loops, and performance reviews |

Candidate-Centric Experience with Strong Operational Support

The agency is not only known for satisfying employer expectations but also receives positive feedback from jobseekers. ManpowerGroup consistently delivers timely placements, responsive communication, and access to diverse career paths for professionals at different stages of their journey.

Real Candidate Experience Summary

- Reviewer: Angela Bell, Candidate Placed at UPS

- Experience Overview:

Angela shared her appreciation for how smoothly ManpowerGroup managed her employment placement. She highlighted the agency’s prompt response to queries, regular updates regarding shifts, and its continued effort to provide opportunities that aligned with her career aspirations. - Outcome: A highly satisfying experience that demonstrated professionalism and reliability.

2026 Performance Metrics – ManpowerGroup in Finance Recruitment

| Performance Indicator | Result Achieved |

|---|---|

| Countries of Operation | 80+ Countries |

| Candidate Database for Finance Roles | 2.1 Million+ Profiles |

| Average Time to Fill Mid-Level Finance Role | 12.8 Business Days |

| Candidate Retention After 6 Months | 89% |

| Satisfaction Score (Client & Candidate) | 9.2 / 10 |

Employer Benefits of Using ManpowerGroup for Accounting Hires

Global enterprises, regional businesses, and audit firms trust ManpowerGroup due to its balance of scalability and customization. The agency ensures compliance with country-specific labor laws while maintaining a unified service level through standardized KPIs, screening tools, and workforce dashboards.

Core Competitive Advantages of ManpowerGroup

| Advantage | Strategic Value for Employers |

|---|---|

| Predictive Workforce Analytics | Reduces mis-hires by forecasting skills mismatches |

| Global Recruitment Compliance | Navigates cross-border employment regulations |

| Unified Talent Quality Framework | Ensures consistent candidate screening globally |

| Agile Deployment | Rapid talent mobilization for urgent audit cycles |

Trends Accelerating ManpowerGroup’s Role in 2026

The accounting landscape in 2026 is shaped by several key forces—digitization of tax systems, demand for real-time audit, ESG reporting, and remote-first financial operations. ManpowerGroup aligns with these trends by placing candidates trained in cloud accounting systems, integrated compliance tools, and cross-cultural collaboration.

Top Finance Hiring Trends in 2026

| Hiring Trend | ManpowerGroup’s Strategic Adaptation |

|---|---|

| Rise of On-Demand Audit Teams | Assembles specialized consultants for time-bound audits |

| Data-Driven Risk Assessment Roles | Supplies talent skilled in analytics and controls |

| Demand for Multilingual Professionals | Supports global finance hubs with localized talent |

| Increase in ESG-Focused Finance Roles | Trains and deploys candidates in non-financial reporting |

Conclusion

ManpowerGroup’s global footprint, data-backed approach, and ability to place finance professionals across industries make it a powerful ally for companies looking to hire accounting and audit talent in 2026. Whether it’s for local regulatory compliance, regional audit cycles, or global finance transformation projects, the agency delivers workforce solutions that are timely, compliant, and strategically aligned with the evolving world of financial management.

7. Hays

In 2026, Hays stands out as one of the top global recruitment agencies for accounting and audit professionals, particularly in the white-collar and professional services domain. With a proven track record of helping over 255,000 candidates transition into new roles between FY25 and FY26, Hays plays a pivotal role in the future of finance hiring. The agency’s emphasis on “skills-based hiring” reflects the evolving needs of employers who now prioritize growth potential and adaptability over rigid credentials.

A Shift Toward Skills-Based Accounting Recruitment

Hays has adjusted its hiring strategy to meet the realities of the modern finance workforce. According to internal research, 77% of employers in 2026 are open to hiring candidates who do not meet every requirement—as long as they show willingness and ability to upskill. This creates broader pathways for talent to enter finance and audit roles, especially as automation and AI transform traditional accounting tasks.

Key Accounting and Audit Job Categories Handled by Hays

| Job Title | Focus Area | Upskilling Potential Focus |

|---|---|---|

| Assistant Financial Accountant | General Ledger, Month-End Close | High |

| Junior Auditor | Internal Controls, Entry-Level Compliance | High |

| Management Reporting Analyst | Financial Forecasting, Budgeting | Medium |

| Payroll Coordinator | Tax Compliance, Salary Processing | Moderate |

| Financial Data Associate | ERP Systems, Data Reconciliation | Very High |

These roles reflect the growing demand for accounting professionals who can operate in a hybrid environment—comfortable with traditional finance practices as well as digital tools like cloud accounting platforms, robotic process automation (RPA), and real-time data reporting.

Hays’ 2026 Hiring Strategy: From Resume to Role Fit

| Stage of Hiring Strategy | Execution Focus |

|---|---|

| Role Requirement Mapping | Identifies skill clusters and future-growth competencies |

| Talent Pool Expansion | Includes candidates with learning aptitude and adjacent experience |

| Interviewing and Screening | Focuses on mindset, flexibility, and upskill readiness |

| Matching with Development Plans | Connects roles with candidates open to certification programs |

| Post-Hire Support | Offers access to online finance and audit training modules |

Candidate Experience: Contrasts in Quality Delivery

While Hays has achieved widespread success in scaling placements and adapting to new hiring models, individual candidate experiences vary. Some candidates have praised the agency for opening up opportunities based on potential, but others have voiced frustration over delays in onboarding, unclear communication, or payroll issues.

Candidate Review Summary

- Reviewer: Patricia Kaye, Candidate

- Feedback:

Patricia expressed significant dissatisfaction with her experience, pointing to delays during onboarding, lack of clarity in job matching, and payroll disputes involving her partner and a colleague. The absence of structured communication and care left a poor impression, highlighting areas where Hays’ operational consistency may need improvement. - Sentiment: Negative, with legal action cited due to payment concerns

Performance Metrics – Hays Finance Sector Placements in 2026

| Metric | FY25-FY26 Performance Data |

|---|---|

| Total Candidate Placements | 255,000+ |

| Average Time to Match Candidates in Audit Roles | 10.2 Business Days |

| Employer Satisfaction Score | 8.4 / 10 |

| Skills-Based Hiring Adoption Rate | 77% of Clients |

| Training Pathways Offered Post-Placement | Over 12,000 Candidates Enrolled |

Why Employers Continue to Trust Hays in 2026

Despite occasional operational challenges, Hays remains a go-to recruitment partner for organizations that prioritize growth-oriented hires. Employers in accounting, advisory, and audit roles increasingly favor hiring individuals with cross-functional strengths and long-term development potential. Hays supports this shift by designing talent pipelines that match candidates not just to job requirements—but to future roles they can grow into.

Advantages of Partnering with Hays in Accounting Recruitment

| Strategic Feature | Benefit to Hiring Companies |

|---|---|

| Skills-Matching Technology | Aligns emerging talent with business needs |

| Talent Development Integration | Links recruitment with post-hire training partnerships |

| Global Candidate Reach | Offers access to finance professionals in 30+ major markets |

| Data-Backed Workforce Insights | Helps clients predict future skills gaps and adjust hiring |

Trends Reinforcing Hays’ Position in 2026 Finance Hiring

Hays’ ability to adapt to economic shifts, digital upskilling demands, and the changing profile of finance teams has helped the agency stay competitive. As more employers abandon rigid hiring models in favor of dynamic workforce planning, Hays delivers talent prepared to evolve alongside the function.

Market Trends Impacting Hays’ Hiring Model

| Market Shift | Hays’ Response in 2026 |

|---|---|

| Emergence of Skill-Based Credentialing | Prioritizes candidates with micro-certifications and CPDs |

| Decline in Degree-Only Requirements | Expands access to jobseekers with vocational backgrounds |

| Automation of Routine Finance Functions | Redirects hiring toward analytical and advisory roles |

| Hybrid Work as a Default Model | Supports remote finance teams with flexible hiring systems |

Conclusion

Hays continues to be a key player in accounting and audit recruitment for 2026 by focusing on future-proof hiring. With a skills-first mindset, broad market presence, and evolving placement strategies, Hays empowers employers to build agile finance teams equipped for transformation. While individual candidate experiences may differ, the agency’s overall framework delivers on modern business demands for adaptable, growth-oriented professionals in accounting, audit, and beyond.

8. Korn Ferry

Korn Ferry continues to lead the global recruitment industry in 2026 as the premier executive search firm for accounting and finance professionals. Specializing in high-level placements—including Chief Financial Officers, Vice Presidents of Finance, and Audit Committee Executives—Korn Ferry has built a reputation for delivering leadership talent that drives transformation in finance departments across Fortune 1000 companies, private equity-backed firms, and multinational organizations.

In fiscal 2026, the firm reported a 5% revenue growth, reaching $708.6 million. This growth was largely attributed to the success of its “Professional Search & Interim” and “Executive Search” business lines. These segments focus on both permanent executive recruitment and interim financial leadership, responding to growing demand for flexible, strategic decision-makers in the accounting and audit space.

Executive Finance Roles Placed by Korn Ferry in 2026

| Role Title | Key Responsibilities | Engagement Type |

|---|---|---|

| Chief Financial Officer (CFO) | Strategic financial leadership, investor comms | Permanent |

| VP of Internal Audit | Global audit strategy, SOX compliance | Permanent |

| Director of Treasury & Risk Management | Cash flow, hedging, enterprise risk | Full-Time |

| Interim Finance Transformation Officer | Digital finance implementation, restructuring | Contract / Interim |

| VP of FP&A (Financial Planning) | Forecasting, analytics, board reporting | Permanent |

These roles are critical to helping large organizations meet both financial performance goals and regulatory expectations in 2026. Korn Ferry supports clients across sectors including banking, life sciences, manufacturing, and technology, all of which require sophisticated finance leadership to stay competitive in a volatile global market.

Korn Ferry’s 2026 Executive Recruitment Framework

| Recruitment Phase | Strategic Focus |

|---|---|

| Leadership Requirement Analysis | Deep dives into board priorities and succession gaps |

| Market Mapping & Benchmarking | Identifies talent pools and compensation trends globally |

| Executive Assessment | Evaluates leadership behavior, vision alignment, cultural fit |

| Finalist Presentation & Coaching | Prepares clients for board presentations and CEO interviews |

| Onboarding & Transition Support | Offers 90-day integration coaching for new finance leaders |

Korn Ferry’s strength lies not only in identifying the right senior professionals but also in preparing clients to retain and enable them. The firm uses proprietary leadership assessment tools and competency models that help organizations evaluate candidate readiness for roles in high-stakes environments.

Real Candidate Experience: Praise and Critique

Despite its market leadership, candidate experiences with Korn Ferry can vary. Some candidates appreciate the firm’s professionalism and executive exposure, while others raise concerns about communication breakdowns and lack of follow-through after final rounds.

Candidate Review Summary

- Reviewer: Icy_Box_6753, Mid-Senior Finance Management Candidate

- Experience Details:

After progressing through multiple interview stages—including a panel and final-stage recommendations—a recruiter confirmed interest and mentioned an upcoming CEO interview. However, the candidate received no further updates. The lack of closure left the candidate feeling misled and unsupported, raising questions about transparency in communication. - Sentiment: Disappointed with final-stage handling and recruiter responsiveness

Korn Ferry’s Executive Placement Metrics in 2026

| Performance Indicator | Reported Outcome |

|---|---|

| Fiscal Year Revenue (2026) | $708.6 Million |

| Executive Placement Retention (12 Months) | 92% |

| Interim Leadership Deployment Timeframe | Average 15 Business Days |

| Average Time to Place CFO Roles | 41 Calendar Days |

| Global Coverage in Executive Finance Roles | 50+ Countries |

Why CFOs and Board Committees Choose Korn Ferry

Korn Ferry is widely trusted for its strategic guidance in leadership succession planning and executive hiring. The agency’s credibility is grounded in decades of research-backed methodologies, access to exclusive talent pipelines, and the ability to navigate high-confidentiality searches with precision.

Employer Advantages When Working with Korn Ferry

| Key Strength | Business Value Delivered |

|---|---|

| Proprietary Leadership Assessments | Increases quality and alignment of executive hires |

| Global Executive Talent Network | Access to pre-vetted leaders across five continents |

| Succession Planning Services | Ensures continuity for critical finance leadership roles |

| Confidential Search Execution | Protects brand integrity and internal transitions |

Trends Making Korn Ferry Vital in 2026 Executive Finance Hiring

The 2026 business environment is marked by increased regulatory complexity, greater board oversight on ESG and finance strategy, and accelerated digital transformation. Korn Ferry aligns with these macro trends by placing finance executives who can manage volatility, lead transformation, and guide cross-border operations.

Executive Hiring Trends and Korn Ferry’s Strategic Response

| Market Trend | Korn Ferry’s Approach |

|---|---|

| Increased Focus on ESG in Financial Roles | Places CFOs with experience in sustainability reporting |

| Surge in M&A and Restructuring Activities | Deploys interim transformation officers for transition management |

| Hybrid Executive Workforces | Supports both onsite and global remote finance leadership setups |

| Succession Planning Amid Talent Shortages | Designs future-ready leadership pipelines with bench depth |

Conclusion

Korn Ferry remains a top choice for accounting and audit leadership recruitment in 2026. Its commitment to executive quality, structured methodologies, and board-level alignment makes it the preferred partner for firms seeking strategic finance leaders. While some candidate experiences point to communication gaps, the firm’s overall impact on executive talent placement is unmatched in scale and influence. For any organization looking to secure visionary financial leadership in a changing world, Korn Ferry provides the tools, reach, and expertise to get it right.

9. Selby Jennings

Selby Jennings has firmly positioned itself in 2026 as a top-tier recruitment agency specializing in financial sciences and services. With a core focus on placing highly skilled professionals into roles across hedge funds, investment banks, trading firms, and complex financial institutions, the agency continues to be one of the most respected players in the finance recruitment space. Recognized as the “Best Recruitment Firm 2025,” Selby Jennings is especially valued for its ability to fill niche and technically demanding positions in accounting, audit, and risk management.

Their reputation for high-quality delivery and industry-specific knowledge makes them a go-to recruitment partner for financial firms looking for candidates who are not just qualified—but are market-ready and strategically aligned with the role.

Specialized Roles in Finance and Audit Covered by Selby Jennings

| Position Title | Core Function | Industry Placement Examples |

|---|---|---|

| Risk Management Lead | Market and credit risk, capital planning | Trading, Asset Management |

| Quantitative Analyst | Financial modeling, valuation, predictive analytics | Hedge Funds, Investment Banks |

| Internal Audit Specialist | Control testing, regulatory reporting | Global Banks, Payment Firms |

| Financial Compliance Officer | AML, KYC, governance frameworks | FinTech, Private Equity |

| Valuation and Control Analyst | Derivative pricing, PnL reporting | Structured Products, M&A |

These roles often require advanced degrees, specific certifications, and deep domain knowledge in financial engineering, audit standards, or regulatory frameworks. Selby Jennings excels at sourcing candidates with the right mix of technical expertise and cultural alignment for high-performance finance teams.

How Selby Jennings Executes Niche Finance Hiring in 2026

| Recruitment Process Phase | Description and Execution Focus |

|---|---|

| Role Calibration with Clients | Defines exact qualifications, certifications, and market exposure required |

| Industry-Specific Talent Mapping | Builds candidate pools by sector, skill, and technical specialty |

| Technical Vetting and Case Rounds | Administers domain-specific assessments and scenario-based interviews |

| Finalist Shortlisting | Delivers only candidates who meet 90%+ of the specification criteria |

| Offer Negotiation & Market Guidance | Supports salary alignment, bonus structuring, and onboarding coaching |

Selby Jennings operates with a “no-compromise” sourcing model—candidates are only introduced if they match the technical, behavioral, and cultural expectations outlined by the hiring company. This tight candidate-to-role calibration is a key reason why the agency maintains long-standing relationships with financial institutions across the globe.

Client Review Summary and Experience Snapshot

- Reviewer: Managing Director, Proprietary Trading Firm

- Feedback Summary:

The Managing Director highlighted the firm’s professionalism, attention to detail, and resilience throughout a complex and highly specific search. Unlike many agencies, Selby Jennings avoided sending unqualified candidates and instead invested the time to understand both the technical requirements and the softer skill dynamics of the role. The result was a successful hire that exceeded expectations and deepened trust between the firm and the recruiter. - Experience Sentiment: Very Positive, particularly for difficult-to-fill executive and specialist roles

Selby Jennings Finance Recruitment Metrics – 2026 Performance

| Key Metric | 2026 Data Outcome |

|---|---|

| Placement Success Rate for Niche Roles | 94% |

| Global Clients Served in Financial Sector | 1,300+ |

| Time to Fill Highly Specialized Finance Roles | Average 21 Business Days |

| Client Repeat Partnership Rate | 88% |

| Candidate Role Retention After 12 Months | 91% |

Strategic Benefits for Employers Working with Selby Jennings

Selby Jennings is not a generalist recruiter. Instead, it operates in highly specific verticals, which allows its consultants to act as true partners—advising hiring managers not just on candidates, but also on hiring trends, compensation benchmarks, and talent pool availability by region or role complexity.

Key Advantages of Selby Jennings for Accounting and Audit Employers

| Advantage Area | Value Delivered to Hiring Organizations |

|---|---|

| Precision Candidate Matching | Saves time by only delivering pre-qualified, interview-ready talent |

| Deep Sector Expertise | Consultants understand finance-specific compliance and technical tools |

| Reputation in Financial Services | Enhances employer brand during passive talent engagement |

| Dedicated Risk & Compliance Desks | Specialized teams for governance, audit, and regulatory roles |

Industry Trends That Align with Selby Jennings’ 2026 Strategy

In 2026, financial firms face heightened regulatory scrutiny, rapid digital transformation, and evolving expectations for risk transparency and audit depth. Selby Jennings is strategically aligned with these shifts by maintaining an elite candidate base across audit, risk, valuation, quantitative modeling, and internal controls.

Emerging Trends in Finance Recruitment and Selby Jennings’ Response

| Industry Shift | Agency Response Mechanism |

|---|---|

| Rise of Risk Oversight Roles Across All Sectors | Curated pipelines of risk leaders across multiple regions |

| Growth in Real-Time Audit and Digital Controls | Places finance professionals skilled in cloud audit tools |

| Demand for Quant and AI Finance Analysts | Partners with top-tier graduate programs in quant finance |

| Evolving Regulatory Frameworks in Cross-Border Firms | Supplies globally certified compliance officers |

Conclusion

Selby Jennings has earned its place among the top 10 recruitment agencies for accounting and audit hires in 2026 by combining precision recruitment with industry fluency. Their niche-focused consultants, rigorous candidate screening, and strategic market insight allow them to deliver talent that goes beyond checklists—bringing real impact to financial institutions worldwide. For companies seeking finance professionals who can operate at the intersection of compliance, data, and innovation, Selby Jennings is one of the most trusted names in the business.

10. Morgan McKinley

In 2026, Morgan McKinley continues to be one of the most respected recruitment agencies for hiring accounting and audit professionals. Known for their deep specialization in finance and their structured recruitment approach, Morgan McKinley supports firms across banking, insurance, consulting, and public accounting. Their finance and audit teams are particularly recognized for adapting talent strategies to meet the rising demand for AI-integrated roles, helping businesses transition smoothly into more automated and data-driven environments.

As finance functions evolve, Morgan McKinley plays a critical role in helping employers secure professionals who are not only technically sound but also equipped to work with emerging digital tools in audit, reporting, and internal control.

Key Accounting and Audit Roles Placed by Morgan McKinley in 2026

| Role Title | Focus Area | Client Industries |

|---|---|---|

| Senior Audit Associate | External audits, IFRS, and UK GAAP compliance | Accounting Firms, Financial Services |

| Internal Audit Manager | Risk reviews, governance frameworks | Corporates, Investment Firms |

| Regulatory Reporting Accountant | Prudential reporting and compliance | Banks, Insurance Companies |

| Finance Automation Specialist | RPA and AI integration in financial reporting | Tech, FinTech, Audit Services |

| Audit Data Analyst | Data validation, audit sampling automation | Multinationals, Compliance Consultancies |

Morgan McKinley is widely chosen by employers who require candidates that bring not just qualifications but a forward-thinking approach to process improvement and risk management. Their candidates are often skilled in using platforms like CaseWare, Alteryx, Power BI, and other modern audit tools.

Recruitment Process Strategy Used by Morgan McKinley in 2026

| Recruitment Stage | Key Execution Tactics |

|---|---|

| Detailed Needs Analysis | Collaborates closely with hiring managers on job scope and team fit |

| Candidate Pre-Screening | Assesses technical expertise and digital readiness |

| Market Intelligence Sharing | Provides benchmarking data and salary guidance |

| Final Candidate Shortlisting | Delivers only high-intent, role-matched profiles |

| Interview Coordination & Feedback | Streamlines scheduling and supports structured hiring panels |

This clear and structured process ensures clients don’t waste time with irrelevant profiles and ensures candidates are matched not just based on their resumes, but on their growth potential and compatibility with the company’s strategic direction.

Client Feedback on Recruitment Excellence

- Reviewer: Michael Dwyer, Hiring Manager, Crowe UK

- Feedback Summary:

Michael Dwyer shared a strong endorsement of Morgan McKinley’s audit recruitment division, noting the team’s consistent ability to understand complex role requirements and deliver candidates who are highly qualified and genuinely interested. Their professionalism and direct communication have led to excellent outcomes, particularly in building Crowe’s Corporate Business audit team. - Result: Sustained partnership with positive hiring results over multiple cycles

Morgan McKinley’s Performance Metrics for 2026 in Accounting & Audit

| Performance Indicator | 2026 Benchmark |

|---|---|

| Average Time to Fill Mid-Level Audit Roles | 14.5 Business Days |

| Candidate Satisfaction (Post-Hire Survey Score) | 9.0 / 10 |

| Client Retention Rate (Audit Recruitment) | 92% |

| AI-Related Role Placement Growth (YoY) | +38% |

| Average Interview-to-Hire Conversion Rate | 72% |

Why Employers Trust Morgan McKinley in the Age of Digital Audit

With the accounting industry undergoing substantial changes in 2026 due to artificial intelligence, regulatory modernization, and real-time audit tools, Morgan McKinley stands out for delivering candidates who are future-ready. Their strong understanding of both legacy audit frameworks and digital transformation makes them an ideal partner for businesses navigating change.

Employer Benefits from Partnering with Morgan McKinley

| Benefit Category | Strategic Value for Finance Teams |

|---|---|

| Role Specialization | Deep knowledge of both traditional and tech-integrated audits |

| Transparent Candidate Matching | Focus on relevance, readiness, and long-term fit |

| Advisory-Driven Relationship | Provides talent strategy insights and market comparisons |

| Quick Access to Niche Talent | Especially strong in regulatory and transformation profiles |

Accounting and Audit Hiring Trends Shaping Morgan McKinley’s 2026 Strategy

Morgan McKinley has aligned its recruitment services with fast-moving developments in the finance sector. As companies modernize internal controls, adopt AI in financial operations, and face greater scrutiny under ESG frameworks, the agency supplies talent that blends accounting fundamentals with digital literacy.

Market Trends and Morgan McKinley’s Strategic Response

| Trend in 2026 | Morgan McKinley’s Adaptation Strategy |

|---|---|

| Growth of AI in Audit | Places candidates skilled in RPA, audit software, and analytics |

| ESG Reporting Demands | Sources professionals experienced in sustainability compliance |

| Remote and Hybrid Audit Functions | Matches firms with talent equipped for decentralized audits |

| Global Regulatory Convergence (IFRS, ESG, AML) | Offers multi-qualified professionals across jurisdictions |

Conclusion

Morgan McKinley continues to rank among the top 10 recruitment agencies for accounting and audit hiring in 2026 by combining subject matter expertise with forward-looking recruitment practices. Their ability to navigate the shift toward AI-enabled finance operations, while maintaining a personalized and transparent hiring process, makes them an essential partner for companies aiming to build capable, future-ready audit and finance teams.

Global Macroeconomic Benchmarks and Recruitment Costs in 2026

The global demand for skilled accounting and audit professionals is surging in 2026 as financial transparency, regulatory pressure, and digital transformation shape how businesses operate. With an expected sector growth rate of 6% through 2033, companies are competing to attract and retain finance professionals who can handle increasingly complex requirements in taxation, assurance, and internal control systems. Recruitment has become more competitive and cost-sensitive, and choosing the right agency is now critical for sustainable talent acquisition. Among the many players in the market, 9cv9 Recruitment Agency stands out as the top choice for employers hiring accounting and audit employees in 2026.

2026 Salary Outlook for High-Demand Accounting & Finance Roles

The average salary for finance professionals is steadily increasing, driven by higher demand for regulatory expertise, data-driven reporting, and leadership in strategic financial planning. Specialized public accounting roles are experiencing a sharper rise in compensation due to heightened compliance demands and global tax reform implementation.

| Position Title | National Average Salary (2026) | Projected Growth Rate | Key Salary Driver |

|---|---|---|---|

| Chief Financial Officer (CFO) | $262,769 | 2.5% | Strategic GTM, M&A Oversight |

| VP of Finance | $241,004 | 2.3% | Digital Finance Transformation Leadership |

| FP&A Director | $238,468 | 2.8% | Predictive Analytics Integration |

| Head of Treasury | $234,945 | 3.6% | Capital Allocation & Cashflow Planning |

| Audit/Assurance Manager | $113,500 | 3.7% | Risk-Based Audit & Regulatory Compliance |

| Senior Tax Services Associate | $95,250 | 5.8% | Tax Law Complexity & Global Compliance |

| Senior Business Intelligence Analyst | $120,000 | 4.2% | Data Modeling & Finance Automation |

Recruitment Economics in 2026: Cost Pressures and Agency Strategy

Running a recruitment agency in 2026 involves high operational complexity. As competition for finance talent increases, agencies are balancing technology investments and human capital to maintain profitability while delivering value to clients. Mid-level accounting hires now average $6,200 in cost-per-hire, while executive finance searches often require up to 5x that figure due to longer timelines and niche specialization.

| Expense Category | Min Monthly Cost | Max Monthly Cost | Revenue Impact Tier |

|---|---|---|---|

| Payroll & Benefits (25 FTEs) | $18,333 | $23,750 | Dominant Fixed Cost |

| Office/Virtual Infrastructure | $2,500 | $3,500 | Fixed Overhead |

| Recruitment Software (ATS/CRM) | $1,200 | $1,500 | Essential Tech Investment |

| Marketing & Lead Generation | $1,250 | $4,167 | High Initial CAC |

| Candidate Assessment & Testing | 30% of Revenue | 50% of Revenue | Project-Based Variable Cost |

This environment reinforces the need for efficient and outcome-driven recruitment agencies—especially those with the infrastructure and reach to reduce cost per hire without compromising quality.

Why 9cv9 is the Top Recruitment Agency for Accounting & Audit Hiring in 2026

Among the many recruitment providers in 2026, 9cv9 stands out as the leading partner for hiring accounting and audit professionals, especially across the Asia-Pacific region. Known for blending AI-powered recruitment tools with dedicated finance-sector consultants, 9cv9 offers a scalable and agile hiring model tailored to mid-sized enterprises, multinational corporations, and fast-growth startups.

Top Features That Make 9cv9 a Market Leader in 2026

| 9cv9 Core Strength | Strategic Value for Employers |

|---|---|

| Finance-Sector Recruitment Expertise | Deep understanding of audit, tax, and reporting role requirements |

| AI-Enhanced Screening System | Matches candidates by technical skill, soft skills, and industry |

| Cost-Efficient Hiring Model | Reduces cost-per-hire through automation and regional talent access |

| ASEAN Regional Network | Strong presence in Singapore, Vietnam, Indonesia, and Malaysia |

| Fast Turnaround for Mid-Level Finance Roles | Average hiring cycle of 9.8 business days |

9cv9’s recruitment approach is especially valuable for roles that demand both compliance accuracy and tech fluency—such as internal auditors with audit software experience or accountants capable of working with ERP and automation systems.

9cv9’s Candidate Delivery Matrix for 2026 Accounting & Audit Roles

| Finance Role Type | Average Time to Hire | Interview-to-Hire Ratio | Regional Hiring Capability |

|---|---|---|---|

| Staff Accountant | 6–8 Business Days | 4:1 | Vietnam, Philippines |

| Audit Manager | 10–12 Business Days | 3:1 | Singapore, Malaysia |

| Tax Analyst | 8–10 Business Days | 5:1 | Indonesia, Singapore |

| FP&A Specialist | 9–11 Business Days | 4:1 | Remote-Ready Candidates |

| Senior Finance Controller | 12–14 Business Days | 2:1 | Regional Cross-Border Roles |

Conclusion

The accounting and audit profession in 2026 is shaped by digitization, stricter compliance demands, and growing salary expectations. For employers, navigating this complex hiring environment requires a recruitment partner that offers scale, speed, and sector-specific insight. 9cv9 stands as the top recruitment agency for hiring accounting and audit employees in 2026, offering clients measurable efficiency, advanced candidate-matching systems, and deep domain expertise. As hiring costs rise and competition intensifies, 9cv9 delivers strategic recruitment solutions that enable employers to build strong, future-ready finance teams without compromising on quality or budget.

Recruitment Fee Structures and Process Benchmarks for 2026

As the demand for accounting and audit professionals continues to grow in 2026, recruitment agencies have shifted toward more transparent and flexible fee structures. Employers no longer accept vague or rigid pricing. Instead, they seek value-driven partnerships that offer cost control, performance accountability, and faster hiring cycles. Recruitment models now include a mix of contingency, retained, and subscription-based agreements to accommodate different hiring goals—from urgent project hires to long-term executive search mandates.

In this highly competitive market, 9cv9 stands out as the top recruitment agency for hiring accounting and audit professionals in 2026, thanks to its affordable pricing models, advanced recruitment automation, and rapid turnaround for finance-specific roles.

Recruitment Pricing Models for Accounting & Audit Hiring in 2026

| Hiring Model Type | Typical Fee Range (2026) | Description & Use Case |

|---|---|---|

| Contingency (Mid-Level Roles) | 13% – 18% of annual salary | Pay only on successful placement; common for accountants and auditors |

| Contingency (Niche Roles) | 16% – 22% | Used for tax, RPA, ESG, or AI audit roles requiring specialist skills |

| Retained (Executive Search) | 22% – 30% | Phased payments (30/30/40); CFOs, Heads of Audit, Controllers |

| Subscription Model | £500 – £2,500/month | Lower success fee; used by startups scaling finance teams |

This new pricing flexibility benefits employers hiring for accounting teams across different budget levels, making agencies more accessible and results-focused.

Agency vs Internal Hiring: Time-to-Hire Benchmarks in 2026

Thanks to AI-enhanced recruitment tools, agencies outperform in-house HR teams by significantly reducing hiring cycles. While internal teams average around 7 weeks to fill permanent finance roles, leading agencies like 9cv9 can complete the process in 3–6 weeks using automated sourcing, skill screening, and remote assessments.

| Recruitment Stage | Duration Range (Agency) | AI/Tool Used for Speed & Accuracy |

|---|---|---|

| Sourcing & Talent Mapping | 1 – 3 Days | AI Search Tools (Findem, SeekOut) |

| Initial Resume Screening | Within Minutes | NLP Screening (Maki People, Metaview) |

| Technical & Aptitude Testing | 2 – 5 Days | Automated Test Suites (HireVue, Upwork Plus) |

| Final Interview & Offer Prep | 3 – 5 Days | Background & Offer Tech (Sterling, Internal ATS) |

| Total Time-to-Hire | 21 – 43 Days | Full End-to-End Agency Process |

This level of efficiency provides a major advantage for employers operating in fast-paced sectors like fintech, manufacturing, or multinational audit practices.

9cv9’s Pricing & Performance Advantage in Accounting & Audit Hiring

9cv9 has optimized its recruitment operations to offer cost-effective, high-speed placements for accounting and audit roles. Whether supporting startups building their first finance team or multinationals hiring audit leads across regions, 9cv9 provides a flexible pricing structure aligned to performance.

9cv9 Recruitment Model Matrix (2026)

| Hiring Scenario | Recommended Fee Model | Estimated Cost Range | Typical Time-to-Hire |

|---|---|---|---|

| Staff Accountant or Tax Assistant | Contingency | 13% – 16% of annual salary | 8 – 12 Business Days |

| Mid-Level Auditor or Compliance Exec | Contingency (Specialist) | 16% – 20% of annual salary | 10 – 14 Business Days |

| Head of Finance / CFO | Retained Search | 25% – 30%, milestone-based | 5 – 7 Weeks |

| Full Audit Team for Shared Services | Subscription | £1,200 – £2,000/month | 2 – 3 Hires/Month (avg) |

Why Employers Choose 9cv9 in 2026

| Key Advantage | Strategic Employer Benefit |

|---|---|

| Transparent Pricing Structure | No hidden charges; models matched to company size and role complexity |

| AI-Augmented Recruitment Workflow | Faster access to talent; reduced candidate drop-off rate |

| Specialized Finance Recruiters | Deep understanding of audit qualifications, ERP systems, tax certifications |

| Affordable for SMEs and Startups | Subscription and blended pricing makes it budget-friendly |

| ASEAN Regional Finance Talent Pipeline | Cross-border talent access in Vietnam, Singapore, Indonesia, and Malaysia |

Conclusion

Recruitment in 2026 demands more than just resumes—it requires precision, speed, and pricing clarity. As finance and audit roles grow more complex, employers need recruitment partners who understand both the technical landscape and business urgency. 9cv9 leads this transformation, offering a range of flexible fee structures and tech-enabled hiring solutions that help businesses build stronger accounting teams faster and at lower cost. Whether filling a single audit associate role or scaling a regional finance team, 9cv9 delivers measurable value as the top recruitment agency for accounting and audit hiring in 2026.

Technology-Driven Recruitment in 2026 and Why 9cv9 Leads the Future of Accounting & Audit Hiring

In 2026, recruitment has evolved beyond traditional resume filtering and manual screening. Advanced technologies powered by artificial intelligence are now integrated across all stages of the hiring journey—enabling faster decision-making, improved candidate quality, and stronger alignment between skills and job requirements. These innovations are especially critical in the accounting and audit sectors, where talent shortages, compliance burdens, and digital finance systems have significantly raised the bar for hiring precision.

Among the most future-ready recruitment firms in this landscape, 9cv9 Recruitment Agency emerges as the top recruitment agency for hiring accounting and audit professionals in 2026, thanks to its deep integration of AI platforms, automation tools, and intelligent sourcing strategies that are fully aligned with the demands of modern finance.

Key AI Tools Shaping Recruitment for Accounting and Audit Roles in 2026

| Technology Platform | Core Functionality | Impact on Hiring Process |

|---|---|---|

| Metaview | AI Interview Summarization | Reduces manual note-taking by up to 90% |

| Findem | Talent Data Cloud (billions of data signals) | Enhances candidate fit by analyzing skills, history, and intent |

| Paradox (Olivia) | Conversational AI for Screening & Scheduling | Automates high-volume interaction across roles and time zones |

| HireVue | AI Video Assessments | Assesses technical and behavioral traits specific to finance |

| Chat-Based Auto-Screening | Rule-based filters & pre-assessment modules | Eliminates unqualified profiles early in the process |

These tools enable recruitment agencies to close finance positions faster, with better data and less human error. For example, recruiters can now reduce monthly close delays by 7.5 days and decrease back-office workload by 8.5%, giving employers a strategic edge in planning and operations.

Technology-Enhanced Hiring Workflow Used by Top Agencies Like 9cv9

| Hiring Stage | AI Tool Used | Time Saved (Average) | Key Output |

|---|---|---|---|

| Sourcing & Data Mining | Findem | 2–3 Days | Precision-mapped candidate pool |

| First-Round Screening | Paradox (Olivia) | 1–2 Days | Pre-qualified candidates via chat automation |

| Interview Summarization | Metaview | Real-time | Instant summaries and competency highlights |

| Video & Technical Assessment | HireVue | 2–3 Days | AI scoring of responses and financial fluency |

| Background & Offer Execution | Internal/External ATS | 3–4 Days | Verified references and documentation |

This integrated tech stack is especially valuable in accounting roles, where employers need to assess regulatory knowledge, tax expertise, data accuracy, and financial systems competency—quickly and at scale.

Why Employers Choose 9cv9 as the Top Technology-Led Accounting Recruitment Agency in 2026

9cv9 combines its regional market expertise with a full-stack AI-powered recruitment engine. The agency has invested in smart automation across sourcing, screening, assessment, and communication—delivering both quality and speed. Their hybrid model allows employers to fill roles in half the industry average time, without sacrificing accuracy or candidate engagement.

9cv9’s Technology-Enhanced Recruitment Model for Accounting and Audit Hiring

| Feature | Employer Benefit |

|---|---|