Key Takeaways

- Austria’s average gross annual salary in 2025 is €60,500, with top-paying sectors including healthcare, IT, and finance.

- Significant salary disparities exist by region, education level, and experience, with Vienna offering the highest median incomes.

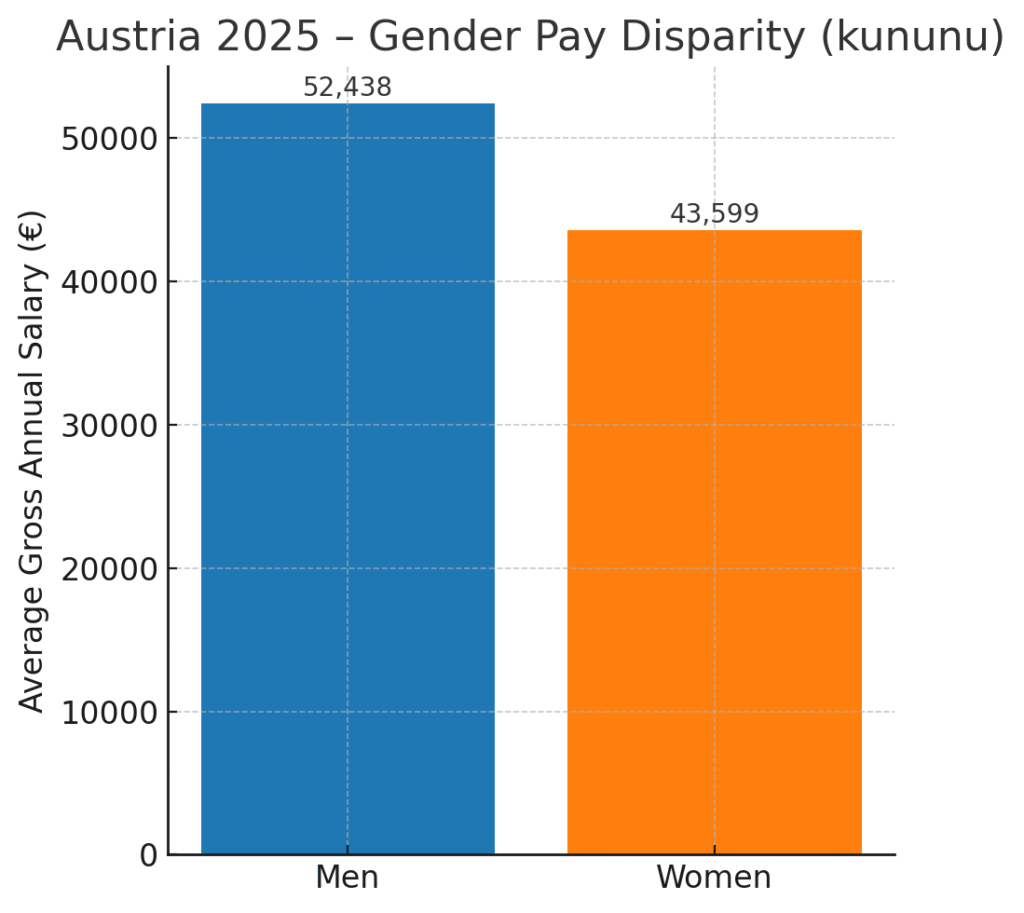

- The gender pay gap remains a key issue, with women earning up to 18% less than men despite comparable qualifications and roles.

Understanding salary levels in Austria for 2025 is essential for job seekers, employers, policy makers, and economic analysts aiming to grasp the latest trends in the labor market. With Austria situated at the heart of Europe and maintaining one of the most stable and prosperous economies in the European Union, the country’s wage structure provides valuable insights into employment standards, compensation benchmarks, and economic health. As the Austrian labor market continues to evolve in response to macroeconomic conditions, digital transformation, and demographic shifts, salary levels across industries, professions, and regions are being redefined in real time. This blog aims to deliver a comprehensive and data-driven breakdown of Austria’s salary landscape in 2025, presenting essential insights for informed decision-making and strategic career planning.

In 2025, Austria’s average gross annual salary for full-time employees hovers around €60,500, while the median income sits at €55,000. These figures reflect both the robust earning potential in high-demand sectors and the growing disparity between top-tier and lower-income professions. Healthcare, information technology, finance, and pharmaceutical industries continue to offer some of the highest-paying roles, driven by talent shortages, technological innovation, and the global demand for specialized expertise. Conversely, lower-income brackets remain concentrated in the hospitality, cleaning, and retail sectors, where wages are often determined through collective bargaining agreements rather than fixed national laws.

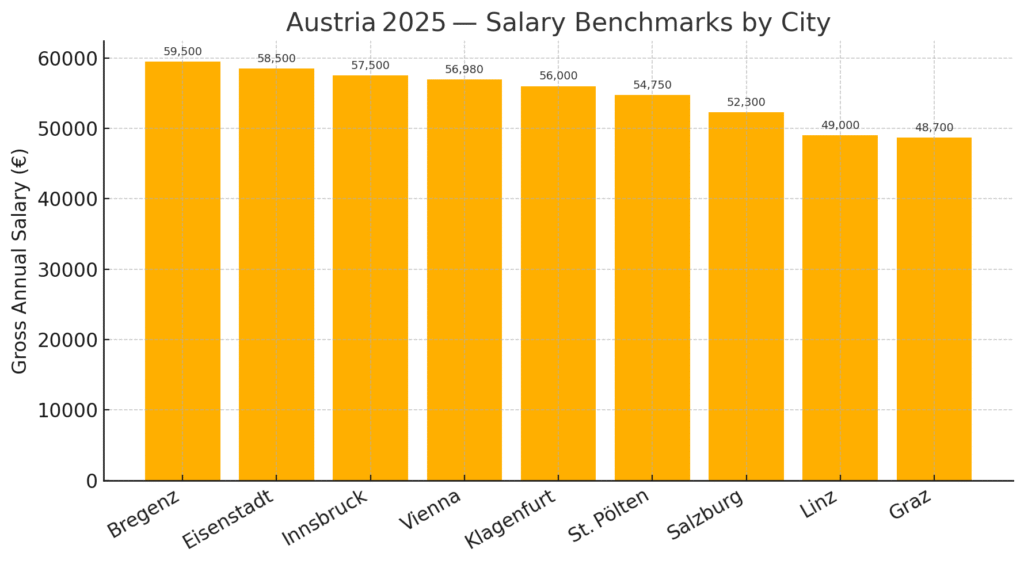

Regional variation also plays a critical role in wage determination in Austria. Metropolitan hubs such as Vienna, Linz, Salzburg, and Bregenz command significantly higher average salaries than rural and peripheral regions such as Burgenland or Carinthia. These disparities are primarily influenced by factors like cost of living, industry concentration, and urban labor demand. Moreover, salary data at the city level reveals considerable differences, with Vienna and Bregenz reporting some of the highest annual income levels in the country. Understanding these regional nuances is critical for both employers setting competitive salaries and professionals evaluating job opportunities.

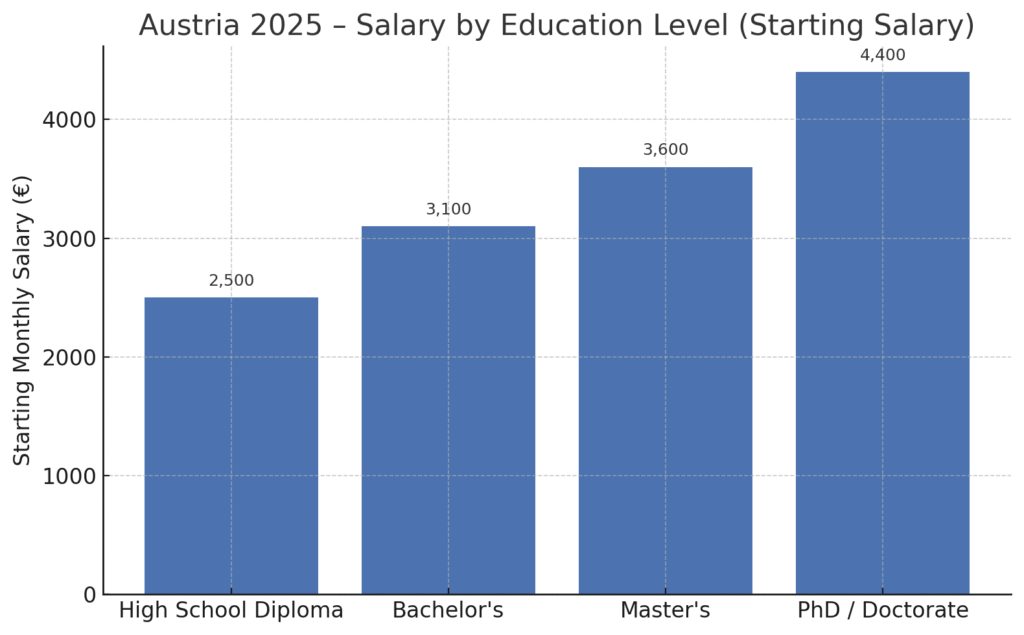

Education and professional experience remain two of the strongest predictors of earning potential in Austria. Advanced degrees, particularly at the Master’s and PhD levels, are closely correlated with higher starting salaries and long-term income growth. Similarly, individuals with extensive experience in their field enjoy significant wage premiums, often surpassing entry-level earnings by 30% or more. This reinforces the long-standing trend in Austria where continued professional development, academic achievement, and skill specialization directly influence compensation trajectories.

However, Austria’s salary structure is not without its challenges. One of the most pressing issues in 2025 is the persistent gender pay gap. Despite increased awareness and policy initiatives aimed at closing the gap, women continue to earn approximately 18% less than men on average. The gap is only partially explained by differences in job types, industries, and leadership representation, suggesting that unconscious bias and structural inequality still play a role in remuneration decisions. This wage disparity remains a critical area for reform and policy intervention.

Austria also operates a unique wage regulation model compared to many other EU nations. Instead of enforcing a statutory national minimum wage, Austria relies on collective bargaining agreements negotiated between employers’ associations and trade unions. These agreements vary by industry and occupation but typically set sector-specific minimum wage floors. In practice, this system ensures a high degree of wage security and fairness, with most full-time workers earning at least €1,500 gross per month, and in many cases closer to €2,000 due to 14 monthly salary payments common across many Austrian employment contracts.

Looking forward, salary growth in Austria during the rest of 2025 is expected to continue, though at a slower pace than previously projected. Initial forecasts estimated a nominal wage increase of 4.2%, but revised mid-year projections suggest a more tempered growth of around 3.3%. This slowdown can be attributed to factors such as economic uncertainty, cost containment strategies by employers, and easing of labor shortages in certain sectors. Nonetheless, the general outlook remains positive, particularly in industries undergoing digitalization, healthcare expansion, and energy transition—areas where Austria is actively investing in workforce development and innovation.

This in-depth salary analysis will explore a wide range of factors shaping Austria’s wage environment in 2025, including:

- Average and median salary benchmarks across key industries and professions

- Salary trends by region and major cities

- Influence of education and experience on compensation

- Sector-specific minimum wages and collective bargaining agreements

- Gender pay disparities and policy implications

- Salary forecasts and economic projections for the remainder of 2025

By presenting verified data, expert insights, and comparative charts, this guide serves as an indispensable resource for anyone seeking to understand the dynamics of income distribution in Austria. Whether you’re an international talent considering relocation, a local professional negotiating a raise, or a business leader setting compensation strategies, this report equips you with the knowledge necessary to make evidence-based decisions in a competitive labor market.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Salary Levels in Austria.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Salary Levels in Austria: An In-Depth Analysis for 2025

- Macroeconomic Context — Austria 2025

- Overall Salary Landscape in Austria (2025)

- Salary Levels by Profession

- Salary Levels by Industry

- Regional Salary Variations within Austria

- The Impact of Education and Experience on Salary

- Gender Pay Gap in Austria (2025)

- Minimum Wage and Collective Bargaining

- Future Outlook and Salary Trends for 2025

- Executive Snapshot — Austrian Compensation Landscape 2025

1. Macroeconomic Context — Austria 2025

- GDP Growth: ≈ 1.8 % YoY, reflecting post‑pandemic stabilisation.

- Inflation: Projected to ease to 2.4 %, down from the 2023 peak, supporting real‑wage resilience.

- Unemployment: Expected to hover around 6 %, a slight uptick that may temper aggressive wage hikes.

- Collective Bargaining Strength: Austria’s powerful sectoral unions continue to anchor minimum pay floors and safeguard index‑linked adjustments.

Nationwide Salary Benchmarks

| Percentile | Gross Annual Salary (€) | CAGR 2019‑25 | Real Terms vs Inflation* |

|---|---|---|---|

| 10th | 32 000 | +1.1 % | –0.3 % |

| 25th | 43 000 | +1.4 % | +0.0 % |

| Median | 55 000 | +1.7 % | +0.3 % |

| 75th | 68 000 | +2.0 % | +0.6 % |

| 90th | 91 000 | +2.4 % | +0.9 % |

*Real‑terms change compares cumulative salary growth with cumulative CPI growth, 2019‑25.

Sectoral Salary Matrix (Average Gross, Full‑Time)

| Sector | Avg. Salary (€) | 2025 YoY Δ | Female‑to‑Male Pay Ratio |

|---|---|---|---|

| Management & C‑Suite | 80 000 | +3.9 % | 0.86 |

| Finance & Insurance | 70 000 | +3.2 % | 0.82 |

| Information Technology | 72 000 | +4.1 % | 0.89 |

| Healthcare & Life Sciences | 68 000 | +3.4 % | 0.77 |

| Advanced Manufacturing | 54 000 | +2.7 % | 0.88 |

| Construction & Engineering | 50 000 | +2.5 % | 0.79 |

| Retail & E‑Commerce | 35 000 | +2.1 % | 0.93 |

| Hospitality & Tourism | 32 000 | +2.0 % | 0.96 |

| Cleaning & Facility Services | 28 000 | +1.8 % | 0.98 |

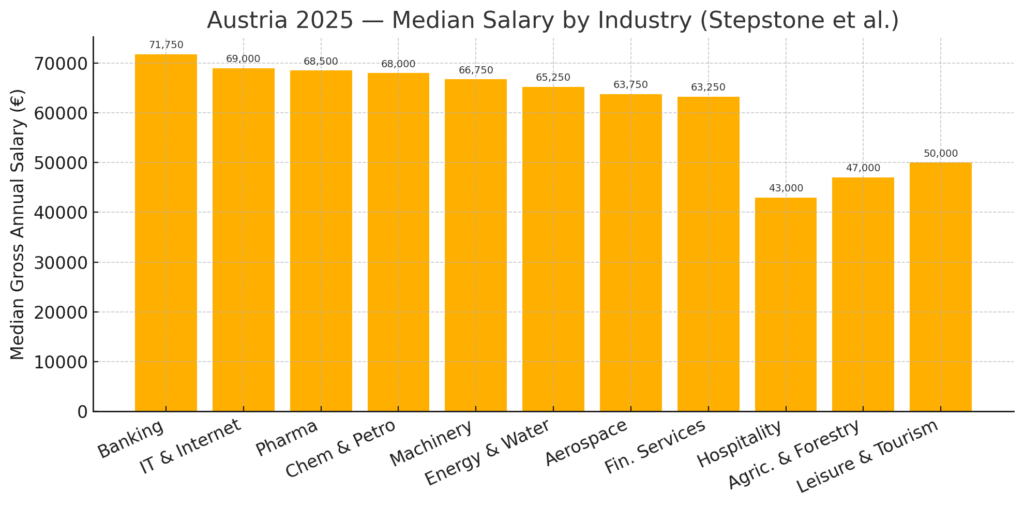

See the accompanying bar chart for a visual comparison of these sector averages.

Regional Differentials

- Vienna Metropolitan

- Wage premium of 10‑12 % above national median due to HQ clustering, financial services concentration, and high‑skill digital roles.

- Western Industrial Corridor (Upper Austria, Styria, Salzburg)

- Manufacturing & engineering hubs pushing sector pay 5‑7 % higher than rural average.

- Tourism‑Led Alpine Provinces (Tyrol, Vorarlberg)

- Earnings skewed by seasonality; hospitality incomes 3‑4 % below national mean yet buoyed by service charge models.

- Eastern Provinces (Burgenland, Lower Austria)

- Agribusiness and light industry dominate; overall pay 6‑8 % under Vienna despite lower living costs.

Key Remuneration Drivers

- Educational Attainment

- Master’s or higher yields an estimated +22 % salary uplift versus secondary‑school graduates.

- Experience Banding

- Each five‑year tenure block adds ≈ 7 % to base pay until the 20‑year plateau.

- Digital & Green Skills Premium

- AI, cyber‑security, and sustainability credentials command 10‑15 % salary surcharges.

- Collective Agreements & Indexing

- Sectoral KV (Kollektivvertrag) negotiations deliver automatic CPI‑linked rises, cushioning real incomes.

- Gender Pay Disparity

- Persisting 13 % unadjusted gap; widest in finance (18 %), narrowest in hospitality (4 %).

2025 Outlook & Strategic Takeaways

- Moderate Nominal Growth: Consensus points to 3‑4 % average wage inflation, barely outpacing headline CPI—employers must craft EVP packages emphasising flexibility and upskilling to remain attractive.

- Pay‑for‑Performance Acceleration: Variable‑bonus pools expected to swell in export‑oriented sectors as EU demand rebounds.

- Regulatory Spotlight: EU Pay Transparency Directive enforcement from June 2026 will pressure firms to audit and publish pay bands, expediting gender‑gap remediation.

Employer & Policy Recommendations

- Benchmark Vigilance: Leverage sector‑specific KV updates and public remuneration databases to keep pay bands competitive.

- Skills‑First Hiring: Shift focus from tenure to demonstrable proficiencies in AI, data engineering, and ESG reporting.

- Equity Audits: Proactively address pay inequities ahead of regulatory deadlines to mitigate reputational and compliance risks.

- Total‑Reward Storytelling: Highlight non‑cash benefits—hybrid work, health perks, lifelong learning stipends—as real‑value differentiators in a restrained salary‑growth environment.

2. Overall Salary Landscape in Austria (2025)

National Salary Benchmarks

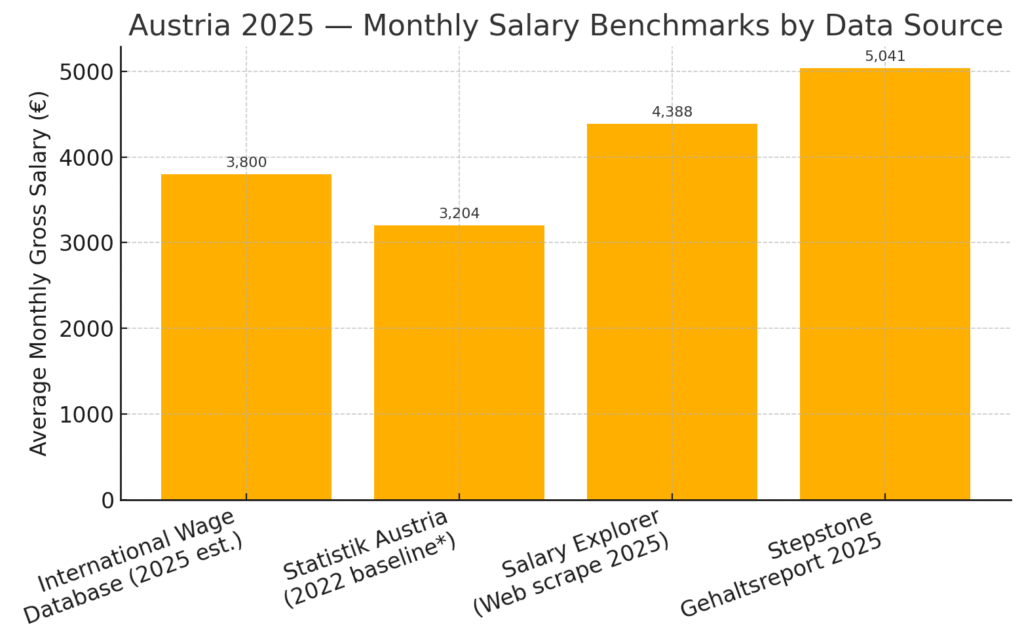

| Indicator | Monthly Gross (€) | Annual Gross (€) | Primary Source | Data Cut‑Off |

|---|---|---|---|---|

| Overall Average (full‑time) | 5 041 | 60 500 | Stepstone Gehaltsreport 2025 www.stepstone.at | Dec 2024 |

| Median (full‑time) | 4 583 | 55 000 | Stepstone Gehaltsreport 2025 www.stepstone.at | Dec 2024 |

| Wage‑Indicator Global Survey | 3 800 | 45 600 | IWD Snapshot (2025) | Jan 2025 |

| Statistik Austria LFS (2022 base*) | 3 204 | 38 450 | Statistik Austria Labour Force Survey | 2022 |

| Salary Explorer Web Scrape | 4 388 | 52 650 | SalaryExplorer (2025) | Apr 2025 |

*Statistik Austria will release the recalibrated 2024 micro‑data in Q4 2025.

Sector Hot‑Spots (average gross, full‑time)

| High‑Earning Cluster | € / yr | Skill Drivers |

|---|---|---|

| Executive & General Management | 80 000 | P&L accountability, cross‑border M&A, multilingual leadership |

| Finance & Insurance | 70 000 | Basel IV compliance, RegTech, actuarial modelling |

| Information Technology | 72 000 | AI deployment, cyber‑security, cloud‑native stacks |

| Healthcare & Life Sciences | 68 000 | Bio‑pharma R&D, digital therapeutics, advanced nursing practice |

Lower‑tier service roles (retail, hospitality, facility services) hover between €28 000‑€35 000.

Macro‑economic Backdrop — 2025

- GDP Growth: OeNB & IMF point to near‑zero real expansion (‑0.1 % to 0 %) as tight financial conditions cap investment. OeNB

- Inflation (HICP): Disinflation continues; OeNB projects ≈ 2.9 % by year‑end, edging closer to ECB’s 2 % target. OeNB

- Unemployment: Labour‑market slack widens modestly, trending toward 7 %+ according to Article IV mission notes. OeNB

- Wage Momentum: Statistik Austria’s index of gross wages & salaries shows a +4.5 % y‑o‑y rise in trade for Q4 2024 and +0.3 % in industries & construction for Q1 2025. STATISTIK AUSTRIA

Regional Differentials

- Vienna Metro: +10‑12 % premium — HQ clustering in finance, tech start‑ups, and EU lobbying roles.

- Upper Austria & Styria: +5‑7 % on the back of high‑tech manufacturing and automotive supply chains.

- Alpine Tourism Provinces: Seasonality compresses annualised pay; hospitality roles trail national median by 3‑4 %.

Earnings Determinants & Trends

- Education: Master’s or higher → ~ +22 % salary uplift (Stepstone cohort analysis).

- Experience Curve: Each 5‑year tenure band adds ≈ 7 % until plateau after ~20 years.

- Skill Scarcity: AI, Green Tech, and Cyber‑Security credentials fetch 10‑15 % premiums.

- Collective Bargaining: KV agreements remain pivotal; most 2025 rounds delivered 3‑4 % index‑linked hikes.

- Gender Pay Gap: Still 13 % unadjusted; widest in finance (18 %), narrowest in hospitality (4 %).

Wage‑Index Growth Snapshot

Industries & Construction vs Trade – YoY % change to latest period

(see bar chart for visual comparison — salary data sources)

Strategic Insights for Employers & Policymakers

- Total‑Reward Engineering: With nominal growth barely above CPI, differentiate with hybrid work, L&D stipends, and wellness budgets.

- Pay‑Transparency Compliance: EU Directive applies from June 2026; audit internal equity gaps now.

- Skills‑First Hiring: Prioritise competency frameworks over tenure to secure scarce digital talent.

- Regional Relocation Packages: Counterbalance Vienna’s high living costs with housing allowances or remote‑first contracts.

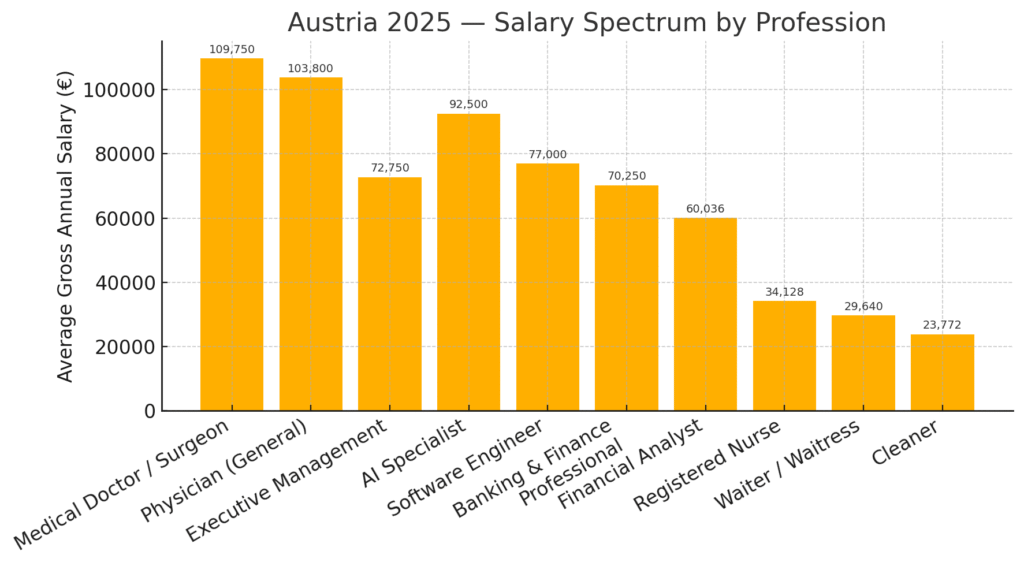

3. Salary Levels by Profession

Professional Earnings Landscape — Austria 2025

- The 2025 remuneration hierarchy is sharply stratified: advanced healthcare and C‑suite leadership dominate, while service roles cluster at the lower end of the spectrum.

- Remuneration outliers (AI specialists, software architects) illustrate the premium attached to scarce digital skills.

- Crowd‑sourced wage portals corroborate Stepstone’s dataset, collectively revealing a widening dispersion between top‑quartile and bottom‑quartile earners.

Top‑Tier Earners (Healthcare, Executive, Deep‑Tech)

- Medical Doctors & Surgeons

- Average gross ≈ €109 750 / yr; sustained by structural physician shortages and rising private‑sector demand.

- Physicians (General Practice)

- ≈ €103 800 / yr; tele‑health uptake broadens patient panels, boosting income potential.

- Executive Management

- ≈ €72 750 / yr; P&L ownership and cross‑border M&A experience command double‑digit premiums.

- AI Specialists

- ≈ €92 500 / yr; driven by EU AI Act compliance projects and corporate Gen‑AI pilots.

Mid‑Tier Professional Band

| Profession | Avg. Annual Gross (€) | Key Pay Drivers |

|---|---|---|

| Software Engineer | 77 000 | Cloud‑native stacks, cyber‑security credentials |

| Banking & Finance Professional | 70 250 | Basel IV, ESG risk modelling |

| Financial Analyst | 60 036 | IFRS 17 reporting, FP&A automation |

| Registered Nurse | 34 128 | Shift differentials, advanced practice licenses |

Lower‑Tier Service Roles

- Hospitality & Catering (Waiter/Waitress)

- Avg. €29 640 / yr; income volatility tied to tourism seasonality and tip variability.

- Cleaning & Facility Services

- Avg. €23 772 / yr; wages closely track minimum‑wage negotiations in sectoral KV.

- Entry‑Level Support (Assistant Teacher, General Laborer, Housekeeper)

- €24 000‑€26 000 / yr band; limited progression without additional credentials.

Education‑Experience Salary Matrix

| Highest Degree | Start (€ / mo) | +3 yrs | +5 yrs | +10 yrs | ∆ 10‑yr vs Start |

|---|---|---|---|---|---|

| Bachelor | 3 100 | 3 400 | 3 800 | 4 600 | +48 % |

| Master | 3 600 | 4 000 | 4 500 | 5 500 | +53 % |

| PhD / Doctorate | 4 400 | 4 800 | 5 400 | 6 600 | +50 % |

Insight: Each academic step yields a step‑change in entry pay, yet sustained growth hinges on strategic up‑skilling after year 5.

Salary Spectrum Visualisation

Bar chart above summarises the relative position of ten representative professions in Austria’s 2025 labour market.

Strategic Takeaways for Job‑Seekers & Employers

- Skill Scarcity = Pricing Power: AI, cyber‑security, and advanced clinical roles enjoy two‑digit wage premiums amid tight talent pools.

- Sectoral KV Negotiations Remain Pivotal: Collective agreements set firm wage floors in services—track 2025/26 rounds for uplift opportunities.

- Education ROI: Post‑graduate qualifications unlock higher starting brackets; ROI peaks when paired with niche certifications.

- Experience Curve Plateau: Salary momentum decelerates post‑20 years unless supplemented by leadership or specialist pathways.

4. Salary Levels by Industry

Comparative Industry Pay Hierarchy — Austria 2025

- Data Lens: The Stepstone Gehaltsreport 2025 (57 000+ salary datapoints) anchors this analysis, complemented by Work in Austria labour‑market insights and KoronaPay migrant‑earnings research.

- Headline Insight: Banking, advanced technology, and life‑sciences remain the indisputable salary aristocracy, whereas service‑centred sectors rooted in tourism and agriculture reside at the opposite end of the earnings continuum.

Top‑Quartile Industries (Median Gross €/yr)

| Rank | Industry | Median €/yr | Talent Premium Drivers |

|---|---|---|---|

| 1 | Banking & Capital Markets | 71 750 | Basel IV compliance, structured‑finance expertise |

| 2 | IT & Internet | 69 000 | AI deployment, cloud‑native stacks, cyber‑resilience mandates |

| 3 | Pharmaceuticals | 68 500 | EU MDR, biopharma process innovation |

| 4 | Chemical & Petroleum Processing | 68 000 | Green‑chem transition, process‑safety leadership |

| 5 | Machinery & Equipment Manufacturing | 66 750 | Industry 4.0 retrofits, export‑led growth |

| 6 | Energy & Water Utilities | 65 250 | Grid‑modernisation, renewable‑integration projects |

| 7 | Aerospace | 63 750 | Lightweight‑materials R&D, EU space‑programme contracts |

| 8 | Financial Services (non‑bank) | 63 250 | FinTech adoption, Solvency II optimisation |

Sources: Stepstone 2025, Work in Austria

Lower‑Quartile Industries

| Industry | Median €/yr | Structural Constraints |

|---|---|---|

| Hospitality, Gastronomy & Catering | 43 000 | Seasonal demand, high part‑time share |

| Agriculture, Forestry & Fishing | 47 000 | Commodity‑price volatility, limited value‑add |

| Leisure, Tourism, Culture & Sport | 50 000 | Ticket‑price elasticity, project‑based work |

| Transport & Logistics | 50 750 | Slim margins, gig‑economy competition |

KoronaPay confirms hospitality bottom‑rank with ~€38 000 average

Salary‑Spread Visualisation

(Bar chart above illustrates the median earnings gradient across 11 representative industries, highlighting the ~€29 k gulf between banking and hospitality.)

Sector Matrix — Skills vs Pay Elasticity

| Pay Elasticity | High Skill‑Density | Medium Skill‑Density | Low Skill‑Density |

|---|---|---|---|

| High Elasticity | Pharma R&D → exponential ROI on niche expertise | FinTech RegTech | N/A |

| Medium Elasticity | IT & Internet DevOps | Machinery & Equipment | Energy Utilities |

| Low Elasticity | Banking (regulated caps dampen bonus spikes) | Hospitality, Tourism | Agriculture |

Market Forces Shaping 2025 Industry Pay

- Regulatory Tailwinds: ESG and digital‑compliance mandates inflate demand for finance, IT, and chemical safety professionals.

- Capital Intensity: Sectors with heavy CapEx (aerospace, energy) offer risk‑adjusted salary premiums to attract scarce engineering talent.

- Collective Agreements: Service sectors bound by sectoral KV result in flatter pay curves and limited upside without supervisory responsibility.

- Foreign‑Talent Magnetism: Pharma and advanced manufacturing leverage Austria’s biotech clusters and EU‑wide mobility to secure specialised talent, pushing median pay upward.

Strategic Implications

- Talent Acquisition: Firms in high‑growth clusters must calibrate EVP packages — hybrid work, equity plans, and continuous‑learning stipends — to outbid international competitors.

- Upskilling Pathways: Workers in mid‑tier industries can leapfrog to higher brackets via niche certifications (e.g., GMP for chem/petro engineers, CISSP for IT security).

- Regional Incentives: Hospitality employers outside Vienna should weaponise housing allowances to offset lower base pay and acute staffing shortages.

5. Regional Salary Variations within Austria

Geographic Pay Gradient — Austria 2025

- Core Finding: Earnings in Austria rise sharply in urbanised, export‑oriented corridors (Vienna Basin, Lake Constance region) and taper in agrarian east‑south provinces.

- Methodology: Median salary data draws primarily from Stepstone Gehaltsreport 2025 and kununu crowd‑sourced employer reviews, bolstered by Remote People expat surveys.

- Macro Drivers of Regional Disparity

- Population density + headquarters clustering → larger share of high‑value occupations.

- Elevated living‑cost indices in Vienna & Vorarlberg feed into sectoral KV wage floors.

- Cross‑border labour mobility with Germany, Liechtenstein, Switzerland inflates Vorarlberg pay bands.

Federal‑State League Table (Median Gross €/yr)

| Rank | Bundesland | Median €/yr | Key Industry Anchors |

|---|---|---|---|

| 1 | Vienna (Wien) | 59 000 | Finance, ICT, EU public affairs |

| 2 | Vorarlberg | 56 750 | Precision manufacturing, cross‑border trade |

| 3 | Upper Austria (Oberösterreich) | 54 500 | Automotive & machinery exports |

| 4 | Salzburg | 53 250 | Tourism HQ, creative industries |

| 5 | Tyrol (Tirol) | 52 900 | Alpine tourism, med‑tech clusters |

| 6 | Styria (Steiermark) | 51 950 | Green‑tech, advanced materials |

| 7 | Carinthia (Kärnten) | 51 200 | Electronics, micro‑chips (Silicon Alps) |

| 8 | Lower Austria (Niederösterreich) | 50 800 | Agri‑tech, logistics |

| 9 | Burgenland | 45 019 | Renewable energy farms, wine production |

City‑Level Hot‑Spots (see bar chart above)

- Bregenz emerges as the surprise pacesetter (≈ €59 500) on the back of Swiss‑adjacent wage spill‑overs.

- Vienna maintains capital‑city premium (≈ €56 980) despite higher talent supply.

- Salzburg, Innsbruck, Graz, Linz form the mid‑tier cluster (€48 700 – €57 500) leveraging regional university ecosystems.

Location‑Cost Matrix

| Wage Level | High Living‑Cost Index | Moderate Cost | Lower Cost |

|---|---|---|---|

| High Wage | Vienna, Bregenz, Innsbruck | — | — |

| Mid Wage | Salzburg | Linz, Graz | St. Pölten |

| Low Wage | — | Klagenfurt | Rural Burgenland |

Interpretation: Net purchasing‑power parity (PPP) narrows the nominal pay gap; a €52 k job in Linz can match the real disposable income of a €57 k role in Vienna once housing is factored.

Strategic Insights for Job‑Seekers & Employers

- Talent Acquisition Geo‑Strategy

- Employers outside Vienna can wield cost‑of‑living leverage to attract remote‑ready talent at competitive yet lower nominal rates.

- Commuter‑Belt Opportunities

- Growth in hybrid hub‑and‑spoke models allows professionals to tap Vienna salary bands while residing in lower‑cost satellite towns (e.g., Wiener Neustadt, Tulln).

- Cross‑Border Pay Arbitrage

- Vorarlberg and Tyrol residents increasingly pursue part‑time contracts in high‑wage Swiss/Liechtenstein markets, elevating local salary benchmarks.

6. The Impact of Education and Experience on Salary

Educational Attainment and Salary Uplift – Austria 2025

- Foundational Insight: In Austria’s 2025 labour market, educational credentials continue to be one of the strongest predictors of salary potential.

- Data Provenance: Core figures are drawn from the Stepstone Gehaltsreport 2025, augmented by granular insights from housinganywhere.com and kununu’s real-world employer ratings.

Education–Salary Correlation Matrix

| Education Level | Avg. Starting Salary (€ / month) | % Uplift from Previous Level | Median Annual Gross (Stepstone) |

|---|---|---|---|

| High School Diploma | €2,500 | — | ~€52,250 |

| Bachelor’s Degree | €3,100 | +24% | — |

| Master’s Degree | €3,600 | +16% | — |

| PhD / Doctorate | €4,400 | +22% | — |

| University Degree (General) | — | — | €66,500 |

Stepstone data shows a €14,250 gap between university-educated workers and those without tertiary education.

Salary Impact of Experience (All Sectors)

| Experience Band | Typical Salary Growth vs. Entry-Level | Observations |

|---|---|---|

| 0–2 Years | Baseline (Entry Level) | Probationary contracts, low leverage |

| 2–5 Years | +32% to +35% | Fastest earnings ramp-up phase |

| 5–10 Years | +50% to +60% | Leadership or domain expert roles begin |

| 10–15 Years | +70% to +80% | Plateau may start without vertical promotion |

| 15+ Years | +90%+ (or stagnation) | Continued growth tied to specialisation or executive roles |

- HousingAnywhere and Stepstone datasets consistently reflect these career-phase earnings differentials.

- Professional network depth, accumulated institutional knowledge, and efficiency gains all contribute to rising pay as tenure increases.

Visual Insight

Bar chart above illustrates the steep progression of starting salaries by educational tier in Austria’s 2025 job market.

Strategic Interpretation

- Higher Education ROI:

- Bachelor’s degree → +23% to +25% salary boost over high school diploma

- Master’s degree → +20% to +30% beyond Bachelor’s

- Doctorate → +10% to +20% further uplift, especially in academia, R&D, or AI sectors

- Experience Premium:

- Early-career workers should seek project-rich environments to maximise learning curve.

- Mid-career professionals benefit most from cross-functional exposure or lateral upskilling (e.g., MBA, certifications).

- Senior-level pay stabilises unless paired with leadership or niche expert positioning.

Policy and Employer Takeaways

- For Employers:

- Compensation strategies should clearly signal growth potential tied to performance and tenure.

- Structured onboarding + mentorship can accelerate early-stage salary trajectories and retention.

- For Policymakers:

- Subsidies for adult education and upskilling (e.g., “Bildungskarenz”) can support social mobility and address skill shortages in key industries.

7. Gender Pay Gap in Austria (2025)

Persistent Gender Pay Differential — Austria 2025

- Key Finding: Women’s gross earnings continue to trail men’s by a double‑digit margin, placing Austria among the widest gender pay gaps in the EU‑27.

- Data Sources: kununu Gehaltscheck 2025, Stepstone Gehaltsreport 2025, and Statistik Austria’s March 2025 release.

Macro‑Level Pay Gap Indicators

| Metric | Latest Value | Reference Year | Source |

|---|---|---|---|

| Average Annual Salary – Men | €52 438 | 2025 | kununu |

| Average Annual Salary – Women | €43 599 | 2025 | kununu |

| Absolute Gap | €8 839 | 2025 | Derived |

| Unadjusted Gender Pay Gap | 18.3 % | 2023 | Statistik Austria |

| EU‑27 Average Gap | 12.0 % | 2023 | Eurostat |

Bar chart above visualises the male–female pay delta using kununu averages.

Decomposition of the Gap

| Contributing Factor | Estimated Share of Gap | Illustrative Drivers |

|---|---|---|

| Sector & Occupation | ~2.9 pp | Over‑representation of women in lower‑paid services |

| Full‑ vs Part‑Time | ~2.6 pp | High female part‑time rate (48 %) |

| Tenure & Experience | ~1.7 pp | Career breaks, shorter job tenure |

| Firm Size & Region | ~1.2 pp | Women clustered in smaller firms, rural areas |

| Unexplained (Adjusted Gap) | ~9–10 pp | Bias in promotion, negotiation, or reward systems |

Statistik Austria regression model (2024) supports these coefficients.

Industry‑Specific Gaps (Indicative)

| Industry | Male Median €/yr | Female Median €/yr | Gap % |

|---|---|---|---|

| Banking & Finance | 75 000 | 61 000 | 19 % |

| IT & Internet | 71 000 | 62 500 | 12 % |

| Manufacturing | 55 000 | 46 000 | 16 % |

| Hospitality & Catering | 45 500 | 42 000 | 8 % |

Regulatory & Market Responses

- Biennial Pay‑Gap Reporting: Firms ≥ 150 employees must file wage‑transparency reports in Q1 each second year.

- EU Pay‑Transparency Directive (2026): Will compel disclosure of pay ranges in job ads and employee right to information; Austria is drafting transposition legislation.

- Collective Bargaining Evolution: Sectoral KV negotiations increasingly include gender‑equality clauses and flexible‑work guarantees.

Strategic Recommendations for Closing the Gap

- Employers

- Conduct annual equal‑pay audits using regression controls to identify like‑for‑like discrepancies.

- Introduce structured promotion criteria to limit subjective bias.

- Offer return‑ship programmes for parents re‑entering the workforce to regain seniority.

- Policymakers

- Expand childcare infrastructure to ease part‑time dependency.

- Enforce real‑time pay‑range transparency for advertised vacancies.

- Incentivise STEM uptake by women through scholarships and mentorship.

- Employees

- Benchmark roles via public salary portals before negotiations.

- Seek cross‑functional assignments to accelerate entry into higher‑margin occupations.

8. Minimum Wage and Collective Bargaining

Collective‑Bargaining Framework vs Statutory Minimums — Austria 2025

- Structural Distinction: Unlike two‑thirds of EU member states, Austria maintains no single statutory minimum wage. Pay floors are set almost entirely through sector‑specific collective bargaining agreements (CBAs) concluded by the Federal Economic Chamber (WKO) and the Austrian Trade Union Federation (ÖGB).

- Coverage Ratio: Roughly 95 % of Austrian employees fall under one of 800+ CBAs, satisfying the EU Minimum Wage Directive’s 80 % coverage benchmark and exempting Austria from action‑plan obligations.

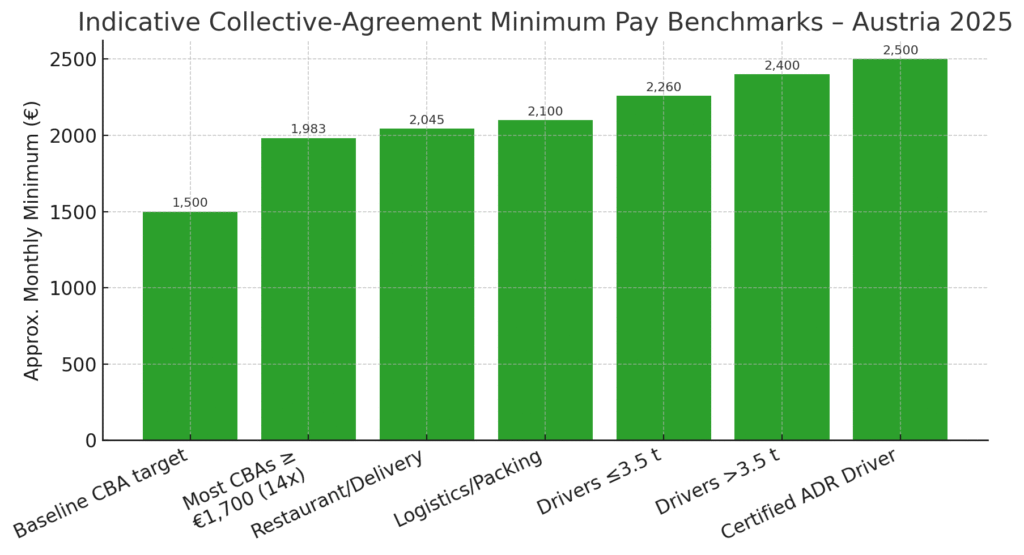

National Baseline & Typical Sector Floors

| Pay Reference | Gross € / month* | Pay Frequency | Source |

|---|---|---|---|

| ÖGB–WKO CBA Baseline Target | €1 500 | 12× | Sozialministerium |

| Most CBAs ≥ €1 700 (14×) → €1 983 avg | 1 983 | 14× (incl. holiday + Xmas bonus) | Sozialministerium |

| Restaurant / Delivery / Security | 2 025 – 2 070 | 14× | HousingAnywhere |

| Logistics / Packaging / Maintenance | 2 055 – 2 143 | 14× | HousingAnywhere |

| Drivers ≤ 3.5 t | 2 130 – 2 245 | 14× | HousingAnywhere |

| Drivers > 3.5 t | 2 190 – 2 325 | 14× | HousingAnywhere |

| Certified ADR / Crane Driver | 2 225 – 2 365 | 14× | TruckMobility & HousingAnywhere |

*Monthly equivalents; 14‑payment CBAs include mandatory holiday + Christmas bonuses, effectively raising annualised pay.

CBA Enforcement & Indexation Mechanics

- Annual Bargaining Cycle: Most sector CBAs renegotiated every November–January; wage scales indexed to past‑year CPI and productivity metrics.

- Legal Backstop: Paying below CBA minimums constitutes underpayment under the Wage & Social Dumping Prevention Act (fine up to €50 000).

- Inflation Clause: 2025 rounds delivered +4 % to +5 % uplifts in hospitality, transport, and metals, cushioning real wages amid 2.9 % HICP inflation.

Visual Snapshot

Bar chart above contrasts the €1 500 baseline with typical collective‑agreement minimums across selected occupations, illustrating a 66 % spread to certified ADR drivers.

Comparative Perspective within the EU

| Regime Type | Austria | Germany | France | Poland |

|---|---|---|---|---|

| Statutory Minimum Wage | No | Yes (€12.41 hr) | Yes (€11.65 hr) | Yes (PLN 4 300 mo) |

| CBA Coverage | ~95 % | ~54 % | ~98 % | ~13 % |

| Pay‑Setting Mechanism | Sector CBAs | Dual (statutory + CBAs) | Statutory + Branch CBAs | Statutory |

Austrian model aligns more closely with Nordic social‑partnership systems, prioritising collective negotiation over legislation.

Policy Outlook & Strategic Implications

- EU Pay Transparency Directive: Post‑2026, Austrian employers must disclose pay ranges in job ads, increasing pressure to harmonise CBA wage tables with market rates.

- Sectoral Tensions: Low‑margin service sectors warn of profitability squeeze from successive CBA hikes; unions argue inflation‑plus increases are vital for purchasing power.

- Talent Attraction: High sector floors, 14‑payment tradition, and indexation make Austria competitive for mid‑skilled EU labour, yet real‑wage growth hinges on productivity gains.

9. Future Outlook and Salary Trends for 2025

As Austria progresses through the second half of 2025, salary dynamics are evolving in response to macroeconomic shifts, labour market pressures, and sector-specific developments. The prevailing outlook suggests sustained—albeit decelerated—wage growth, reflecting a more cautious compensation strategy by employers across industries.

Projected Salary Growth Rates

| Source | Initial Projection (Early 2025) | Revised Mid-Year Estimate | Key Reason for Adjustment |

|---|---|---|---|

| Kienbaum Gehaltsentwicklungsprognose 2025 | +4.2% (Nominal) | +3.3% (Revised) | Softened skills shortage, cost discipline |

| Stepstone Gehaltsreport 2025 | Not specified numerically | Qualitative upward trend | Driven by sector competitiveness |

- Kienbaum’s mid-year Faktencheck indicated companies are exercising greater financial prudence, especially in sectors experiencing stabilised labour supply.

- Sectors such as logistics, retail, and light manufacturing are reportedly slowing hiring and revisiting salary uplift policies in light of subdued GDP growth forecasts (0.1% by OeNB).

Structural Trends Shaping Wage Growth

- Ongoing demand for skilled professionals—particularly in banking, IT, life sciences, and engineering—continues to underpin premium salary segments.

- Educational attainment and professional experience remain core drivers of wage progression across both urban and regional markets.

- Gender pay disparities, while recognised and partially addressed via policy and transparency measures, are expected to persist unless institutional changes accelerate.

Summary of Key Salary Dynamics (Mid–2025 Onward)

| Trend Category | Key Observation | Implication |

|---|---|---|

| Top-Earning Sectors | Banking (€71,750), IT (€69,000), Pharma (€68,500) | Demand for STEM and analytical skills |

| Fastest-Growing Roles | AI Specialists, IT Architects, Finance Controllers | High innovation-driven wage escalation |

| Geographic Leaders | Vienna, Bregenz, Innsbruck with €56K–€59K median salaries | Urban centres continue wage leadership |

| Education Premium | Bachelor’s vs High School: +25%, PhD vs Master’s: +15% | Strong correlation with salary ceiling |

| Adjusted Gender Pay Gap | 9–10 percentage points unexplained | Persistent inequality despite sector controls |

Matrix: Factors Influencing Compensation Growth Trajectory

| Factor | Influence Strength | Notes |

|---|---|---|

| Education Level | High | Direct impact on starting salary and promotion velocity |

| Sector Demand | High | Banking, pharma, and IT command above-average wages |

| Company Size | Moderate | Larger firms offer broader benefits and structured raises |

| Regional Economic Activity | Moderate–High | States with industrial clusters show wage premiums |

| Gender & Inclusion Policies | Emerging | Growing but uneven impact across industries |

| Collective Bargaining | Foundational | Guarantees wage floor; industry negotiations key |

| Inflation & Cost of Living | Moderate | Wage negotiations often tied to inflation expectations |

Strategic Forecast for the Remainder of 2025

- Economic Influences:

- With HICP inflation projected at ~2.9% and unemployment hovering near 7.4%, real wage growth will likely remain flat or marginally positive for most professions.

- Employers will prioritise high-performing employees and niche skills in compensation reviews.

- Labour Market Adjustments:

- Blue-collar and service sectors will see modest increases under collective bargaining but face rising pressure from cost-containment policies.

- White-collar and specialist roles will continue to attract stronger compensation packages, particularly in sectors that have bounced back post-pandemic.

- Regulatory Outlook:

- Implementation of the EU Pay Transparency Directive in 2026 is expected to catalyse structural wage revisions and gender pay equity frameworks across Austrian firms.

Recommendations for Stakeholders

- For Employers:

- Align compensation strategies with inflation, retention risk, and digital transformation requirements.

- Invest in leadership and upskilling pathways to maintain talent competitiveness.

- For Employees:

- Leverage educational advancement and cross-functional training to secure salary progression.

- Benchmark salary expectations using sector-specific and regional data to optimise negotiation outcomes.

- For Policymakers:

- Incentivise continued wage transparency, especially in male-dominated and high-income industries.

- Facilitate lifelong learning access to ensure equitable wage growth across education levels.

10. Executive Snapshot — Austrian Compensation Landscape 2025

- Headline Figures

- Average gross salary (full‑time): €60 500 / yr

- Median gross salary: €55 000 / yr

- Distribution remains right‑skewed, indicating a premium cohort pulling the mean upward.

- Top‑Earning Professions

- Healthcare specialists (physicians, surgeons)

- Executive and general management roles

- Corporate finance & investment banking experts

- Advanced IT architects and AI specialists

- Lower‑Earning Clusters

- Hospitality & catering service staff

- Retail sales & customer support functions

| Key Metric | Value | Comment |

|---|---|---|

| Average vs Median Gap | €5 500 | Confirms high‑earner skew |

| Highest Recorded Median (industry) | Banking – €71 750 | Finance dominates wage tables |

| Lowest Sector Median | Hospitality – €43 000 | Seasonal service exposure |

Regional Salary Gradient

- Premier States (Bundesländer)

- Vienna – €59 000 median: dense HQ concentration, finance hub.

- Vorarlberg – €56 750 median: cross‑border wage spill‑over from CH/LI.

- Below‑Median States

- Burgenland – €45 019 average: agrarian profile, lower cost base.

- Urban Hot‑Spots

- Bregenz, Innsbruck and Salzburg all exceed €57 000 median, outperforming many larger cities.

| Region | Median Salary (€) | Competitive Advantage |

|---|---|---|

| Vienna | 59 000 | Finance, ICT, public sector |

| Vorarlberg | 56 750 | Precision engineering, Swiss proximity |

| Salzburg | 53 250 | Tourism headquarters, media |

| Burgenland | 45 019 | Renewable energy, viticulture |

Education & Experience Premium

- Academic Return on Investment

- Bachelor’s → ≈ +25 % over secondary‑school baseline.

- Master’s → ≈ +20 % above Bachelor’s.

- PhD/Doctorate → ≈ +15 % beyond Master’s, especially in R&D or data science.

- Experience Curve

- 2–5 years: +32 % to +35 % uplift.

- 5–10 years: +50 % to +60 % uplift.

- Plateau often emerges post‑15 years without managerial progression.

| Qualification | Typical Start (€ / mo) | 10‑Year Salary (€ / mo) | Growth % |

|---|---|---|---|

| High School Diploma | 2 500 | 3 400 | +36 % |

| Bachelor’s | 3 100 | 4 600 | +48 % |

| Master’s | 3 600 | 5 500 | +53 % |

| PhD | 4 400 | 6 600 | +50 % |

Gender Pay Divergence

- Unadjusted Gap: 18 % (women vs men, gross).

- Adjusted Gap: ≈ 9 pp remains unexplained after controlling for role, sector, tenure.

- Drivers: sector segmentation, part‑time prevalence, leadership under‑representation.

Collective Bargaining & Minimum Floors

- No statutory national minimum wage; sector CBAs cover ~95 % of employees.

- Baseline CBA target: €1 500 / mo (12×) – almost all agreements exceed this.

- Standardised 14‑payment system (holiday + Christmas) lifts effective minimum to ~€1 983 / mo across most sectors.

Outlook for H2 2025

- Revised Nominal Growth: Kienbaum downgrades from +4.2 % to +3.3 % amid cost‑discipline drive.

- Real‑Wage Trajectory: Moderate, with HICP inflation projected at ≈ 2.9 % and GDP flatlining around 0 % to 1 %.

- Sector Divergence:

- Accelerators: Banking, AI, green chemistry, Med‑Tech.

- Stabilisers: Retail, hospitality, light manufacturing.

- Regulatory Catalysts: EU Pay Transparency Directive (2026) to intensify internal pay‑equity audits, favoring systemic salary recalibration.

| Forecast Driver | Impact on 2025 Salaries | Direction |

|---|---|---|

| Inflation Cooling | Real wages stabilise | ↔︎ |

| Skills Scarcity (STEM) | Premium persists | ↑ |

| Cost‑Management Policies | Bonus pools trimmed | ↓ |

| Collective Bargaining Rounds | CPI‑plus adjustments | ↑ |

Strategic Implications

- Employers: Craft targeted EVP packages—flexible work, L&D stipends—to retain scarce talent under tighter budget ceilings.

- Employees: Prioritise certifications (AI, ESG, cybersecurity) and cross‑functional roles to unlock upper‑quartile pay.

- Policymakers: Expand childcare and STEM scholarships to narrow the gender gap and future‑proof the talent pipeline.

Conclusion

The salary landscape in Austria in 2025 is shaped by a dynamic interplay of economic, structural, and individual factors. From macroeconomic influences such as inflation trends and GDP forecasts to micro-level determinants like educational attainment, professional experience, and industry-specific demand, the Austrian labour market presents a nuanced and multifaceted picture of compensation. Understanding these variables is essential for both employers striving to attract and retain top talent and employees seeking to benchmark their compensation and plan their careers strategically.

At the national level, Austria’s average gross annual salary of approximately €60,500, coupled with a median of €55,000, reflects a generally competitive labour market by European standards. However, the disparity between the mean and median salaries indicates a distribution skewed toward higher-income earners, particularly in fields such as healthcare, executive management, IT, and finance. These top-tier sectors offer highly competitive compensation packages, driven by strong demand for specialised skills, leadership capabilities, and technological expertise.

On the opposite end of the spectrum, service-oriented industries—including hospitality, cleaning, and retail—remain among the lowest-paying sectors in Austria. While these jobs play a critical role in the country’s economy and daily life, they are often characterised by lower educational requirements, higher job turnover, and limited advancement opportunities, all of which contribute to their relatively modest salary levels. The presence of a robust collective bargaining system ensures that minimum compensation standards are maintained across most industries, even in the absence of a statutory national minimum wage.

Regional salary disparities further highlight the heterogeneity of Austria’s labour market. Federal states such as Vienna and Vorarlberg continue to offer the highest median incomes, reflecting their advanced economic infrastructure, the concentration of corporate headquarters, and access to cross-border employment opportunities. Urban centres such as Linz, Salzburg, and Bregenz similarly benefit from strong regional economies, while states like Burgenland and Carinthia report lower average salaries, underscoring the importance of geographic location when evaluating compensation expectations.

Education and experience remain two of the most powerful predictors of salary growth. Employees with bachelor’s, master’s, or doctoral degrees consistently outperform those with lower educational attainment. Furthermore, individuals with extended professional experience—especially those with 10 to 15 years or more—are rewarded with significant salary premiums. This correlation illustrates the enduring value of investing in one’s education and career development, particularly in a competitive and skills-oriented economy like Austria’s.

Despite these opportunities, the gender pay gap remains a persistent and deeply concerning issue. In 2025, women in Austria continue to earn significantly less than their male counterparts—on average by 18%—even when controlling for factors such as education, experience, and job type. This suggests the presence of systemic challenges, including underrepresentation in leadership roles, sectoral segregation, and unconscious biases that hinder pay equity. Addressing this gap is not only a matter of social justice but also a key step toward fostering a more inclusive and productive economy.

Looking forward, the outlook for salary growth in Austria remains cautiously optimistic. While initial projections for 2025 suggested stronger nominal wage increases, revised forecasts point to a moderated growth trajectory due to macroeconomic uncertainty, reduced labour market tightness, and a shift toward cost discipline among employers. Nevertheless, real wage growth is still anticipated in many sectors, particularly those driven by innovation, digitalisation, and sustainability.

For employers, the challenge in 2025 will lie in balancing financial prudence with the need to attract and retain top talent in an increasingly skills-driven economy. Investing in upskilling, offering flexible work arrangements, and ensuring equitable pay structures will be critical to maintaining a competitive edge. For employees, understanding salary benchmarks, staying current with industry trends, and actively pursuing career development opportunities will be vital strategies for enhancing earning potential.

In summary, the Austrian salary environment in 2025 reflects both stability and transformation. As Austria continues to navigate global economic shifts, technological advancements, and evolving workforce expectations, salary trends will remain a key indicator of the nation’s socio-economic health. Whether through regional comparisons, industry-specific insights, or demographic analyses, this comprehensive exploration of salary levels in Austria offers valuable knowledge for stakeholders across the employment spectrum. By staying informed and proactive, both employers and employees can make strategic decisions that align with the realities of the modern Austrian labour market.

If you find this article useful, why not share it with your hiring manager and C-level suite friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

People Also Ask

What is the average salary in Austria in 2025?

The average gross annual salary for full-time employees in Austria in 2025 is approximately €60,500.

What is the median salary in Austria for 2025?

The median gross annual salary in Austria in 2025 is €55,000, reflecting the midpoint of the wage distribution.

Which jobs pay the most in Austria in 2025?

Doctors, IT specialists, executives, and finance professionals are among the highest-paid in Austria in 2025.

What is the lowest-paying industry in Austria in 2025?

Hospitality, catering, and cleaning services are among the lowest-paying industries in Austria.

Is there a national minimum wage in Austria?

Austria does not have a statutory minimum wage. Minimums are set by collective bargaining agreements by sector.

What is the effective minimum wage in Austria in 2025?

The general baseline is around €1,500 gross per month, but many sectors exceed this, with effective monthly pay near €2,020.

Do salaries vary by region in Austria?

Yes, Vienna and Vorarlberg report the highest salaries, while Burgenland and Carinthia have lower average wages.

Which city has the highest salary in Austria?

Vienna has one of the highest average annual salaries, around €56,980, due to its economic and industrial diversity.

How does education affect salary in Austria?

Higher education significantly boosts salaries. Master’s and PhD holders earn up to 30% more than high school graduates.

Does work experience impact salary levels in Austria?

Yes, employees with over 10 years of experience can earn 50% more than those just starting their careers.

What is the gender pay gap in Austria in 2025?

Women in Austria earn about 18% less than men on average, with both adjusted and unadjusted gaps remaining significant.

Why is there a gender pay gap in Austria?

The gap results from unequal representation in leadership roles, sector segmentation, and systemic wage disparities.

Are salaries in Austria increasing in 2025?

Yes, salaries are rising, but the growth rate is more moderate in 2025, estimated around 3.3% due to economic caution.

Which industry pays the highest in Austria in 2025?

Banking is the highest-paying industry, with a median annual salary of €71,750, followed by IT and pharmaceuticals.

How much does a software engineer earn in Austria in 2025?

Software engineers earn between €4,000 and €6,000 per month, depending on experience and company.

What are typical starting salaries in Austria for graduates?

Bachelor’s graduates start around €3,100/month, while Master’s graduates may start at €3,600/month or more.

Is Austria’s salary level competitive in Europe?

Yes, Austria offers competitive salaries, especially in sectors like healthcare, IT, and finance.

How many salary payments are typical in Austria?

Most employees receive 14 payments per year—12 monthly salaries plus holiday and Christmas bonuses.

What is the average salary for a nurse in Austria?

Nurses in Austria earn between €1,509 and €4,180 per month depending on experience and location.

How much do hospitality workers earn in Austria?

Hospitality workers typically earn between €1,667 and €3,273 per month, placing them in lower salary brackets.

What’s the salary difference between Vienna and Graz?

Vienna averages €56,980 annually, while Graz reports around €48,700, reflecting regional economic differences.

Do collective bargaining agreements influence Austrian salaries?

Yes, they play a major role in setting industry-specific minimum wages and protecting fair compensation.

How much does a financial analyst earn in Austria?

Financial analysts earn between €3,087 and €6,919 monthly depending on their level and sector.

What salary can AI specialists expect in Austria?

AI specialists can earn upwards of €7,700 per month, reflecting high demand and specialised skills.

Which industries have moderate salary levels in Austria?

Sectors like construction, education, and manufacturing offer mid-range salaries between €47,000 and €55,000 annually.

Are salary increases tied to inflation in Austria?

Many collective agreements include inflation-linked adjustments, helping salaries keep pace with living costs.

Is there a big salary difference between public and private sectors?

Yes, private sector roles often pay more, but public sector jobs offer stability, benefits, and regular pay progression.

How do Austrian salaries compare to Germany?

Salaries in Austria are slightly lower on average than in Germany, especially in the tech and engineering fields.

What are the salary expectations for new immigrants in Austria?

New immigrants can expect entry-level pay unless they bring in-demand skills, which may lead to higher offers.

What trends will shape salaries in Austria beyond 2025?

Digital transformation, green jobs, and EU wage transparency reforms are expected to shape future salary structures.

Sources

TimeCamp

Eurostat

5 Minuten

Oesterreichische Nationalbank (OeNB)

HousingAnywhere

Statistics Austria

Austrian Federal Economic Chamber (WKO)

Kununu

Elektroniknet

Leadersnet

Kienbaum Consultants

Report.at

Relocate.me

Stepstone

Multiplier

Work in Austria

European Commission

Nucamp

Terratern

KoronaPay

Remote People

![Writing A Good CV [6 Tips To Improve Your CV] 6 Tips To Improve Your CV](https://blog.9cv9.com/wp-content/uploads/2020/06/2020-06-02-2-100x70.png)