Key Takeaways

- Master the fundamentals: Understand the basics of cryptocurrency trading, including exchanges, market dynamics, and price analysis, to lay a solid foundation for your career.

- Develop a strategic approach: Create and implement effective trading strategies tailored to your goals, risk tolerance, and market preferences to maximize your success in crypto trading.

- Embrace continuous learning: Stay informed, analyze your trades, and invest in education to continually improve your skills and adapt to the ever-evolving cryptocurrency market for long-term success.

In recent years, the world of cryptocurrency has exploded onto the global stage, captivating the attention of both seasoned investors and newcomers alike.

With headlines buzzing about the unprecedented rise (and occasional fall) of Bitcoin, Ethereum, and a myriad of other digital assets, it’s no wonder that many individuals are eager to explore the potential for wealth and opportunity within this dynamic market.

Yet, amidst the excitement and intrigue surrounding cryptocurrencies, one question looms large for those considering diving into this realm: How does one start a career in crypto trading?

Whether you’re a seasoned financial professional looking to pivot into the digital age or a curious novice intrigued by the promise of decentralized finance, embarking on a career in crypto trading requires more than just blind enthusiasm—it demands a structured, informed approach.

This comprehensive guide aims to demystify the process of starting a career in crypto trading, providing you with a step-by-step roadmap to navigate the complexities of this evolving landscape.

From understanding the fundamentals of cryptocurrency trading to mastering advanced strategies and risk management techniques, we’ll equip you with the knowledge and tools needed to embark on your journey with confidence.

But first, let’s address the elephant in the room: why crypto trading?

In an era marked by economic uncertainty, traditional financial markets can often feel inaccessible or stagnant, leaving many investors searching for alternative avenues to grow their wealth.

Cryptocurrency, with its decentralized nature and potential for exponential gains, offers a tantalizing prospect for those seeking to break free from the constraints of traditional finance.

Moreover, the advent of blockchain technology has ushered in a new era of innovation, with cryptocurrencies serving as the cornerstone of a burgeoning digital economy.

From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs) and beyond, the possibilities for innovation and disruption within the crypto space are virtually limitless.

However, it’s essential to approach crypto trading with a healthy dose of caution and respect for its inherent risks.

The volatility of cryptocurrency markets can lead to rapid fluctuations in asset prices, potentially resulting in significant gains or losses within a short period.

As such, developing a sound understanding of trading principles, risk management strategies, and market dynamics is crucial for success in this field.

Throughout this guide, we’ll delve into each aspect of starting a career in crypto trading, providing actionable insights and practical tips to help you navigate the challenges and capitalize on the opportunities that lie ahead.

Whether you’re a seasoned investor looking to diversify your portfolio or a complete beginner taking your first steps into the world of crypto, this guide is designed to meet you where you are and empower you to thrive in this exciting and ever-evolving market.

So, buckle up and prepare to embark on a journey of discovery as we unravel the mysteries of crypto trading and chart a course towards financial freedom and prosperity.

The world of cryptocurrency awaits—let’s dive in together and unlock the potential of this groundbreaking technology.

Before we venture further into this article, we like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and in Asia, with a strong presence all over the world.

With over eight years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of How to Start a Career in Crypto Trading.

If you are looking for a job or an internship, click over to use the 9cv9 Job Portal to find your next top job and internship now.

How to Start a Career in Crypto Trading: A Step-By-Step Guide

- Understanding the Basics of Cryptocurrency Trading

- Setting Up Your Trading Environment

- Developing a Trading Strategy

- Starting Your First Trade

- Continuous Learning and Improvement

- Managing Your Trading Career

1. Understanding the Basics of Cryptocurrency Trading

Cryptocurrency trading serves as the cornerstone of the digital asset market, offering investors a gateway to participate in the volatile yet potentially lucrative world of cryptocurrencies.

Before delving into the intricacies of executing trades and developing trading strategies, it’s essential to grasp the fundamental concepts that underpin cryptocurrency trading.

What are Cryptocurrencies?

- Definition: Cryptocurrencies are digital or virtual currencies that utilize cryptography for security and operate on decentralized networks known as blockchains.

- Examples: Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and many others.

- Key Characteristics:

- Decentralization: Unlike traditional fiat currencies controlled by central authorities, cryptocurrencies are decentralized, meaning they operate on distributed networks without a central governing body.

- Security: Cryptocurrencies leverage cryptographic techniques to secure transactions and control the creation of new units.

- Transparency: Transactions on blockchain networks are transparent and immutable, meaning they cannot be altered or tampered with once recorded.

- Limited Supply: Many cryptocurrencies have fixed or capped supplies, creating scarcity and potentially influencing their value over time.

How Cryptocurrency Trading Works

- Exchanges: Cryptocurrency trading typically takes place on online platforms known as exchanges, where buyers and sellers can exchange digital assets for fiat currencies or other cryptocurrencies.

- Examples include Binance, Coinbase, Kraken, and Bitfinex.

- Trading Pairs: Cryptocurrencies are often traded in pairs, with one asset being exchanged for another. The most common trading pairs involve major cryptocurrencies like Bitcoin or Ethereum paired with other altcoins.

- Example: BTC/USD, ETH/BTC, XRP/ETH.

- Order Types:

- Market Order: An order to buy or sell a cryptocurrency at the best available price in the market.

- Limit Order: An order to buy or sell a cryptocurrency at a specific price or better.

- Stop-Loss Order: An order to automatically sell a cryptocurrency at a predetermined price to limit losses.

- Volatility: Cryptocurrency markets are known for their high volatility, with prices often experiencing rapid fluctuations over short periods.

- Example: Bitcoin’s price surged from around $3,000 in early 2019 to over $60,000 in 2021 before experiencing significant corrections.

Factors Influencing Cryptocurrency Prices

- Market Demand and Supply: Like any other asset, cryptocurrency prices are influenced by the interplay of supply and demand in the market.

- Market Sentiment: Investor sentiment, news events, regulatory developments, and technological advancements can all impact cryptocurrency prices.

- Example: Positive news about institutional adoption or regulatory clarity may lead to price rallies, while negative news or regulatory crackdowns can trigger sell-offs.

- Technological Developments: Upgrades, protocol improvements, and new features implemented by blockchain projects can affect the value and utility of cryptocurrencies.

- Example: Ethereum’s transition to a proof-of-stake consensus mechanism through the Ethereum 2.0 upgrade is expected to improve scalability and reduce energy consumption, potentially influencing its price.

- Market Liquidity: The liquidity of a cryptocurrency refers to the ease with which it can be bought or sold in the market. Higher liquidity typically results in tighter bid-ask spreads and reduced price slippage.

- Market Manipulation: Cryptocurrency markets are susceptible to manipulation due to their relatively low market capitalization and lack of regulatory oversight.

- Example: Pump-and-dump schemes, where individuals artificially inflate the price of a cryptocurrency through coordinated buying before selling off their holdings for profit.

Risks and Challenges of Cryptocurrency Trading

- Volatility: The high volatility of cryptocurrency prices can result in significant gains or losses for traders.

- Security Risks: Cryptocurrency exchanges and wallets are susceptible to hacking, theft, and other security breaches.

- Regulatory Uncertainty: Regulatory developments and government interventions can impact the legality and viability of cryptocurrency trading.

- Lack of Regulation: The decentralized nature of cryptocurrencies means they are not subject to the same regulatory oversight as traditional financial markets, increasing the risk of fraud and market manipulation.

- Leverage and Margin Trading: Some exchanges offer leverage and margin trading, allowing traders to amplify their positions with borrowed funds. While this can enhance potential profits, it also increases the risk of significant losses.

- Market Liquidity: Low liquidity in certain cryptocurrency markets can result in slippage and difficulty executing trades at desired prices.

- Psychological Factors: Emotions such as fear, greed, and FOMO (fear of missing out) can cloud judgment and lead to impulsive trading decisions.

Understanding the basics of cryptocurrency trading is crucial for anyone looking to venture into this exciting yet complex market.

By familiarizing yourself with the key concepts, market dynamics, and risks involved, you can better position yourself to navigate the challenges and capitalize on the opportunities presented by cryptocurrencies.

In the subsequent sections of this guide, we will delve deeper into the process of setting up your trading environment, developing effective trading strategies, and managing risk to optimize your chances of success in your crypto trading career.

2. Setting Up Your Trading Environment

Setting up a conducive trading environment is essential for success in the world of cryptocurrency trading.

From choosing the right cryptocurrency exchange to securing your trading account and optimizing your workspace, every aspect of your trading environment plays a crucial role in your trading journey.

In this section, we’ll explore the key components of setting up your trading environment and provide actionable tips to help you get started.

Choosing the Right Cryptocurrency Exchange

- Research and Comparison: Conduct thorough research and compare different cryptocurrency exchanges based on factors such as security features, fees, supported trading pairs, user interface, and liquidity.

- Example: Binance, one of the largest cryptocurrency exchanges by trading volume, offers a wide range of trading pairs, advanced trading features, and robust security measures.

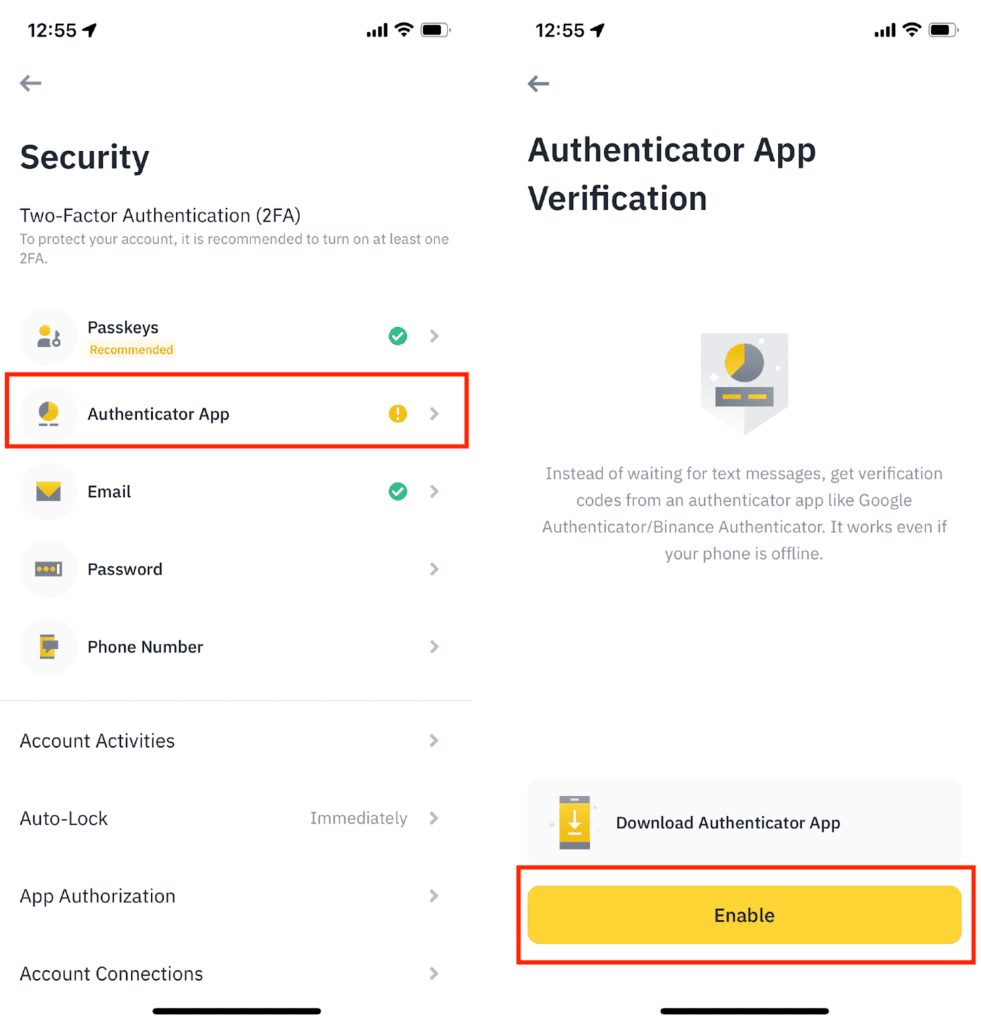

- Security Measures: Prioritize exchanges that prioritize security measures such as two-factor authentication (2FA), cold storage for customer funds, and regular security audits.

- Regulatory Compliance: Consider exchanges that adhere to regulatory standards and compliance requirements in their operating jurisdictions to mitigate regulatory risks.

- User Experience: Choose exchanges with user-friendly interfaces and intuitive trading platforms to facilitate seamless trading experiences.

- Customer Support: Evaluate the quality and responsiveness of customer support services offered by exchanges to address any issues or concerns that may arise during trading.

Creating and Verifying Your Trading Account

- Registration Process: Follow the registration process outlined by your chosen cryptocurrency exchange, providing accurate personal information as required.

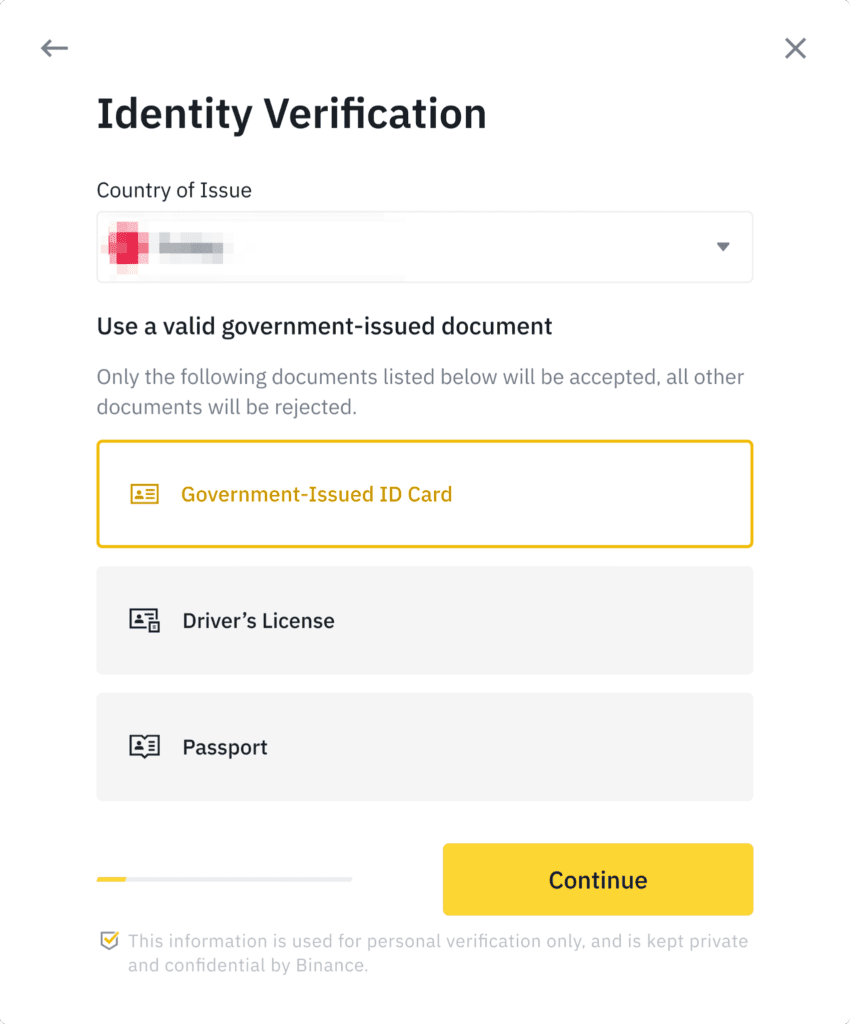

- Verification Requirements: Complete the verification process by submitting relevant identification documents to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- Example: Many exchanges require users to upload a government-issued ID (such as a passport or driver’s license) and proof of address (such as a utility bill or bank statement) for verification purposes.

- Enhanced Security Measures: Enable additional security features such as two-factor authentication (2FA) and withdrawal whitelists to enhance the security of your trading account.

- Account Funding: Deposit funds into your trading account using supported deposit methods such as bank transfers, credit/debit cards, or cryptocurrency deposits.

- Example: Coinbase allows users to fund their accounts using fiat currencies (USD, EUR, GBP) via bank transfers or credit/debit cards, as well as cryptocurrencies such as Bitcoin and Ethereum.

Securing Your Trading Account

- Strong Password: Create a strong, unique password for your trading account and avoid using easily guessable passwords or sharing them with others.

- Two-Factor Authentication (2FA): Enable 2FA to add an extra layer of security to your account, requiring a secondary verification code in addition to your password for account access.

- Secure Communication: Use encrypted communication channels (such as HTTPS) when accessing your trading account to prevent unauthorized access and data breaches.

- Phishing Awareness: Stay vigilant against phishing attacks by verifying the authenticity of emails, websites, and communication from your cryptocurrency exchange to avoid falling victim to scams.

- Withdrawal Whitelists: Configure withdrawal whitelists to restrict withdrawals to predefined wallet addresses and prevent unauthorized fund transfers from your trading account.

Optimizing Your Workspace

- Hardware and Software: Ensure that your trading workstation is equipped with reliable hardware (e.g., computer or laptop) and software (e.g., trading platforms, charting tools) to support your trading activities.

- Internet Connection: Use a stable and high-speed internet connection to ensure real-time access to market data and execute trades without interruptions.

- Ergonomic Setup: Set up your workstation ergonomically to promote comfort and productivity during long trading sessions, including adjustable seating, proper lighting, and monitor placement.

- Backup and Redundancy: Implement backup and redundancy measures for critical components of your trading setup, such as data backups, power backups (e.g., uninterruptible power supply), and alternative internet connections.

- Distraction-Free Environment: Minimize distractions in your trading environment by eliminating noise, interruptions, and other distractions that may impair your focus and decision-making abilities.

Setting up a conducive trading environment is a crucial first step towards building a successful career in cryptocurrency trading.

By choosing the right cryptocurrency exchange, securing your trading account, and optimizing your workspace, you can create a robust foundation for executing trades effectively and maximizing your trading potential.

In the subsequent sections of this guide, we will delve deeper into the process of developing effective trading strategies, managing risk, and continuously improving your trading skills to achieve long-term success in the dynamic world of cryptocurrency trading.

3. Developing a Trading Strategy

Developing a well-defined trading strategy is essential for navigating the volatile and dynamic landscape of cryptocurrency markets.

A solid trading strategy helps traders make informed decisions, manage risk effectively, and maximize their chances of success.

In this section, we’ll explore the key components of developing a trading strategy and provide actionable insights to help you create your own.

Understanding Different Trading Styles

- Day Trading: Involves buying and selling cryptocurrencies within the same trading day to capitalize on short-term price movements.

- Example: A day trader may utilize technical analysis and chart patterns to identify short-term trading opportunities and execute multiple trades throughout the day.

- Swing Trading: Focuses on capturing medium-term price trends by holding positions for several days to weeks.

- Example: A swing trader may use a combination of technical indicators and fundamental analysis to identify potential trend reversals or continuation patterns and enter trades accordingly.

- Position Trading: Takes a longer-term approach to trading, with positions held for weeks, months, or even years based on fundamental analysis and macroeconomic trends.

- Example: A position trader may conduct in-depth research on the underlying fundamentals of a cryptocurrency project and invest in assets with strong long-term growth potential.

Conducting Fundamental and Technical Analysis

- Fundamental Analysis: Involves evaluating the intrinsic value of a cryptocurrency by analyzing factors such as project fundamentals, technology, team expertise, market adoption, and competitive landscape.

- Example: Fundamental analysis of Bitcoin may involve assessing its scarcity, utility as a store of value or medium of exchange, adoption by institutional investors, and macroeconomic factors influencing its demand.

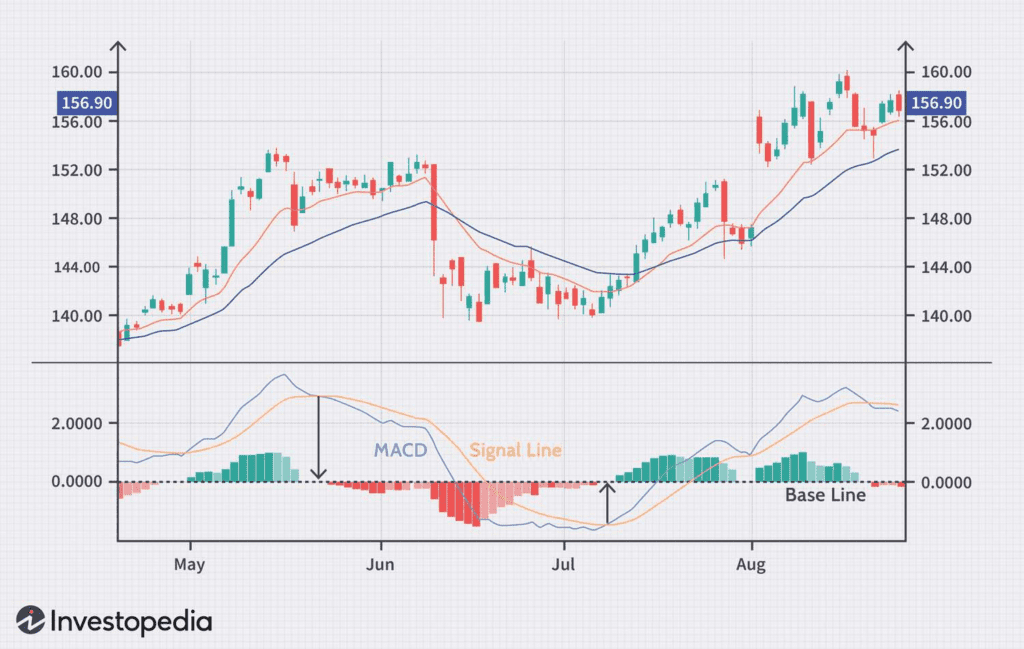

- Technical Analysis: Focuses on analyzing historical price data, trading volume, and market trends to forecast future price movements and identify trading opportunities.

- Example: Technical analysis tools such as moving averages, MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and Fibonacci retracement levels can help traders identify potential support and resistance levels, trend reversals, and entry/exit points.

- Combining Fundamental and Technical Analysis: Many traders use a combination of fundamental and technical analysis to gain a comprehensive understanding of market dynamics and make well-informed trading decisions.

- Example: A trader may use fundamental analysis to identify fundamentally strong cryptocurrencies with long-term growth potential and then use technical analysis to time their entries and exits based on short-term price trends.

Setting Clear Goals and Risk Management

- Goal Setting: Define clear and achievable trading goals based on your risk tolerance, financial objectives, and time horizon.

- Example: A trader’s goal may be to achieve a specific percentage return on investment (ROI) within a defined period, such as monthly or annually.

- Risk Tolerance: Assess your risk tolerance and establish risk management rules to mitigate potential losses and preserve capital.

- Example: Setting a maximum percentage of capital to risk per trade (e.g., 1-2% of total trading capital) or implementing stop-loss orders to limit potential losses on individual trades.

- Position Sizing: Determine the appropriate position size for each trade based on your risk tolerance and the probability of success.

- Example: Using the Kelly Criterion or other position sizing methods to allocate a percentage of trading capital to each trade based on the expected return and risk of the trade.

- Diversification: Spread your risk across multiple assets, markets, and trading strategies to minimize the impact of individual losses and maximize the potential for overall portfolio growth.

- Example: Diversifying your cryptocurrency portfolio across different asset classes (e.g., Bitcoin, Ethereum, altcoins), trading pairs, and trading strategies (e.g., day trading, swing trading, long-term investing).

Continuous Learning and Adaptation

- Stay Informed: Keep abreast of market developments, news events, and technological advancements in the cryptocurrency space to adapt your trading strategy accordingly.

- Example: Monitoring cryptocurrency news websites, social media channels, forums, and reputable trading communities for real-time market insights and analysis.

- Review and Evaluate: Regularly review and evaluate your trading performance to identify strengths, weaknesses, and areas for improvement in your trading strategy.

- Example: Keeping a trading journal to track your trades, analyze trade outcomes, and identify patterns or trends in your trading behavior.

- Adaptability: Remain flexible and adaptable in response to changing market conditions, emerging trends, and unexpected events that may impact your trading strategy.

- Example: Adjusting your trading strategy based on shifting market dynamics, such as increased volatility, regulatory changes, or macroeconomic factors influencing cryptocurrency prices.

Developing a trading strategy is a critical step towards achieving success in cryptocurrency trading.

By understanding different trading styles, conducting thorough analysis, setting clear goals, and implementing robust risk management techniques, traders can navigate the complexities of cryptocurrency markets with confidence and resilience.

However, it’s essential to recognize that trading is an ongoing learning process, and continuous learning, adaptation, and refinement of your trading strategy are key to long-term success in the dynamic and ever-evolving world of cryptocurrency trading.

In the subsequent sections of this guide, we will delve deeper into practical tips and strategies for executing trades effectively, managing risk, and optimizing your trading performance for maximum profitability.

4. Starting Your First Trade

Embarking on your first cryptocurrency trade is an exciting milestone in your journey as a trader.

Whether you’re looking to buy your favorite cryptocurrency or explore trading opportunities to capitalize on market movements, it’s essential to approach your first trade with preparation and caution.

In this section, we’ll guide you through the process of starting your first trade, from depositing funds into your trading account to executing your first trade with confidence.

Depositing Funds into Your Trading Account

- Selecting a Deposit Method: Choose a suitable deposit method based on your preferences, convenience, and transaction speed.

- Example: Many cryptocurrency exchanges offer various deposit options, including bank transfers, credit/debit cards, and cryptocurrency deposits.

- Verifying Deposit Limits and Fees: Review the deposit limits and fees associated with your chosen deposit method to ensure they align with your trading requirements and budget.

- Example: Some deposit methods may have minimum or maximum deposit limits, as well as deposit fees charged by banks or payment processors.

- Initiating the Deposit: Follow the instructions provided by your cryptocurrency exchange to initiate the deposit process for your chosen deposit method.

- Example: If depositing funds via bank transfer, you may need to provide the exchange’s bank account details and include a reference or memo to link the deposit to your trading account.

Placing Your First Trade

- Navigating the Trading Interface: Familiarize yourself with the trading interface of your chosen cryptocurrency exchange, including order placement, order book, price charts, and trading pairs.

- Example: Exchanges like Binance and Coinbase offer intuitive trading interfaces with features such as market orders, limit orders, and real-time price charts for analyzing market trends.

- Selecting a Trading Pair: Choose the trading pair you wish to trade based on your trading strategy, market analysis, and investment goals.

- Example: If you’re looking to buy Bitcoin with US dollars, you would select the BTC/USD trading pair on the exchange.

- Determining Order Type: Decide on the type of order you want to place based on your trading strategy and market conditions.

- Example: Market orders are executed at the current market price, while limit orders allow you to specify a price at which you want your order to be executed.

- Entering Order Details: Enter the relevant details for your trade, including the quantity of cryptocurrency you wish to buy or sell, the price at which you want to execute the trade, and any additional parameters such as time in force or order validity.

- Example: If placing a market order to buy Bitcoin, you would specify the amount of Bitcoin you want to buy and confirm the order to be executed at the current market price.

Confirming and Executing the Trade

- Reviewing Order Details: Double-check the order details, including the quantity, price, and order type, to ensure they align with your trading intentions.

- Example: Verify that the total cost of your trade matches your available funds and that you’re comfortable with the price at which the order will be executed.

- Confirming the Trade: Confirm the trade by clicking the appropriate button or confirming the order details as prompted by the exchange’s trading interface.

- Example: On many exchanges, you’ll be asked to review and confirm the order details before finalizing the trade to prevent unintended trades or errors.

- Monitoring Trade Execution: Monitor the execution of your trade in real-time to ensure it’s processed correctly and reflects the desired outcome.

- Example: Keep an eye on the order status and trade history on the exchange’s platform to track the progress of your trade from submission to execution.

- Managing Open Orders: Manage any open orders that haven’t been executed immediately, such as canceling or modifying them as needed based on changing market conditions or trading objectives.

- Example: If the market moves unfavorably after placing a limit order, you may choose to cancel the order or adjust the price to improve its likelihood of execution.

Starting your first trade in the cryptocurrency market is an important milestone in your journey as a trader.

By following the steps outlined in this section and familiarizing yourself with the trading process, you can execute your first trade with confidence and lay the foundation for future trading success.

However, it’s essential to remember that trading involves inherent risks, and it’s important to conduct thorough research, manage risk effectively, and continuously improve your trading skills to achieve long-term profitability.

In the subsequent sections of this guide, we will delve deeper into advanced trading strategies, risk management techniques, and tips for optimizing your trading performance in the dynamic and ever-evolving world of cryptocurrency trading.

5. Continuous Learning and Improvement

Continuous learning and improvement are essential pillars of success in the ever-evolving landscape of cryptocurrency trading.

As markets shift, technologies advance, and new opportunities arise, staying informed and adapting to changing conditions is paramount for traders seeking to stay ahead of the curve.

In this section, we’ll explore the importance of continuous learning in cryptocurrency trading and provide actionable strategies to help you sharpen your skills and improve your trading performance over time.

Importance of Continuous Learning

- Dynamic Market Conditions: Cryptocurrency markets are highly dynamic and subject to rapid fluctuations, driven by factors such as market sentiment, technological advancements, regulatory developments, and macroeconomic trends.

- Emerging Trends and Opportunities: Staying abreast of emerging trends and opportunities in the cryptocurrency space can help traders identify new investment opportunities, trading strategies, and market inefficiencies to capitalize on.

- Technological Advancements: The rapid pace of technological innovation in the blockchain and cryptocurrency space introduces new tools, platforms, and trading instruments that traders can leverage to gain a competitive edge.

- Risk Management: Continuous learning enables traders to refine their risk management strategies, identify potential risks and pitfalls, and adapt their approach to mitigate losses and preserve capital.

Strategies for Continuous Learning

- Stay Informed: Keep up-to-date with the latest news, market developments, and industry trends through reputable sources such as cryptocurrency news websites, forums, social media channels, and trading communities.

- Example: Websites like CoinDesk, CoinTelegraph, and The Block provide timely news updates, analysis, and insights into the cryptocurrency market.

- Read Books and Educational Resources: Invest in educational resources such as books, e-books, online courses, and tutorials to deepen your understanding of cryptocurrency trading concepts, strategies, and techniques.

- Example: Books like “Trading for a Living” by Dr. Alexander Elder and “Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond” by Chris Burniske and Jack Tatar offer valuable insights into trading psychology and cryptocurrency investment strategies.

- Attend Webinars and Conferences: Participate in webinars, conferences, and workshops hosted by industry experts, traders, and thought leaders to gain valuable insights, network with peers, and stay informed about the latest trends and developments in the cryptocurrency space.

- Example: Events like the Consensus conference, hosted by CoinDesk, bring together leading experts, investors, and innovators in the blockchain and cryptocurrency industry to discuss emerging trends and opportunities.

- Join Trading Communities: Engage with trading communities, forums, and online platforms where traders share knowledge, insights, and experiences, and participate in discussions, ask questions, and exchange ideas with fellow traders.

- Example: Platforms like Reddit’s r/BitcoinMarkets and Telegram trading groups provide forums for traders to discuss market analysis, trading strategies, and investment opportunities.

Analyze and Reflect on Your Trades

- Keep a Trading Journal: Maintain a trading journal to record your trades, including entry and exit points, trade rationale, position size, profit/loss, and lessons learned from each trade.

- Example: Include details such as the trading pair, entry price, stop-loss and take-profit levels, trade duration, and emotional state during the trade to track your performance and identify patterns over time.

- Review Trade Performance: Regularly review and analyze your trade performance to identify strengths, weaknesses, and areas for improvement in your trading strategy.

- Example: Use metrics such as win rate, average gain/loss, risk-reward ratio, and maximum drawdown to assess the effectiveness of your trading strategy and identify areas for optimization.

- Learn from Mistakes: Embrace mistakes and losses as learning opportunities, and identify the root causes of unsuccessful trades to avoid repeating the same mistakes in the future.

- Example: If a trade resulted in a significant loss, analyze factors such as market conditions, trade execution, risk management, and emotional biases that may have contributed to the loss and adjust your strategy accordingly.

Stay Adaptable and Open-Minded

- Adapt to Market Changes: Remain flexible and adaptable in response to changing market conditions, emerging trends, and unexpected events that may impact your trading strategy.

- Example: Adjust your trading strategy based on shifting market dynamics, such as increased volatility, regulatory changes, or macroeconomic factors influencing cryptocurrency prices.

- Experiment with New Strategies: Explore new trading strategies, indicators, and techniques to diversify your skill set and identify strategies that align with your trading style and objectives.

- Example: Experiment with different trading styles (e.g., day trading, swing trading, position trading), technical indicators, timeframes, and risk management techniques to find what works best for you.

- Seek Feedback and Mentorship: Seek feedback from experienced traders, mentors, or trading communities to gain valuable insights, guidance, and constructive criticism to help you improve your trading skills.

- Example: Join mentorship programs, seek guidance from experienced traders, or participate in peer review sessions where traders share insights and provide feedback on each other’s trading strategies and performance.

Continuous learning and improvement are essential for success in the dynamic and competitive world of cryptocurrency trading.

By staying informed, embracing new opportunities, analyzing your trades, and remaining adaptable and open-minded, you can continuously refine your trading skills, optimize your trading strategy, and enhance your overall performance as a trader.

However, remember that learning is a lifelong journey, and there’s always room for growth and improvement. By committing to continuous learning and improvement, you can stay ahead of the curve and achieve long-term success in cryptocurrency trading.

6. Managing Your Trading Career

Managing your trading career involves more than just executing trades—it requires a strategic approach to goal setting, performance evaluation, and continuous improvement.

By adopting effective management practices, traders can optimize their trading performance, mitigate risks, and achieve long-term success in the dynamic world of cryptocurrency trading.

In this section, we’ll explore key strategies for managing your trading career and maximizing your potential as a trader.

Setting Clear Goals and Objectives

- Define Your Trading Goals: Establish clear and achievable trading goals based on your risk tolerance, financial objectives, and time horizon.

- Example: Set specific goals such as achieving a target percentage return on investment (ROI) within a defined period or increasing your trading capital by a certain amount.

- Break Down Goals into Measurable Targets: Break down your overarching trading goals into smaller, measurable targets or milestones to track your progress and stay motivated.

- Example: Set monthly or quarterly targets for achieving specific performance metrics such as win rate, average gain/loss, and maximum drawdown.

- Align Goals with Trading Strategy: Ensure that your trading goals align with your trading strategy, risk management principles, and overall trading approach to maintain consistency and focus.

- Example: If your trading strategy is focused on day trading, set goals that reflect your ability to capitalize on short-term price movements and execute high-frequency trades.

Performance Evaluation and Review

- Regularly Assess Trading Performance: Conduct regular reviews and evaluations of your trading performance to identify strengths, weaknesses, and areas for improvement in your trading strategy.

- Example: Use metrics such as win rate, average gain/loss, risk-reward ratio, maximum drawdown, and trading psychology indicators to assess your performance objectively.

- Keep a Trading Journal: Maintain a detailed trading journal to record your trades, including entry and exit points, trade rationale, position size, profit/loss, and emotional state during the trade.

- Example: Include qualitative observations and reflections on each trade, such as lessons learned, mistakes made, and areas for improvement to facilitate self-awareness and self-improvement.

- Identify Patterns and Trends: Analyze your trading journal and performance metrics to identify recurring patterns, trends, and behaviors in your trading activity that may impact your performance.

- Example: Look for patterns in successful trades, common mistakes or pitfalls, and emotional biases that may influence your decision-making process and trading outcomes.

Continuous Learning and Skill Development

- Stay Informed: Keep abreast of the latest market developments, news events, and industry trends through reputable sources such as cryptocurrency news websites, forums, and social media channels.

- Example: Follow leading cryptocurrency publications and influencers on platforms like Twitter, LinkedIn, and YouTube to stay informed about emerging trends and opportunities in the cryptocurrency market.

- Invest in Education: Invest in your education by enrolling in online courses, attending workshops or seminars, and reading books or educational resources on trading psychology, technical analysis, and risk management.

- Example: Platforms like Udemy, Coursera, and Investopedia offer a wide range of courses on cryptocurrency trading, technical analysis, and investment strategies taught by industry experts.

- Practice Discipline and Patience: Cultivate discipline and patience as key virtues of successful trading, and avoid succumbing to impulsive decisions, emotional biases, or FOMO (fear of missing out) during periods of market volatility.

- Example: Develop a trading plan with clearly defined entry and exit criteria, risk management rules, and position sizing strategies, and stick to your plan consistently regardless of market conditions.

Adaptability and Risk Management

- Remain Adaptable: Stay flexible and adaptable in response to changing market conditions, emerging trends, and unexpected events that may impact your trading strategy.

- Example: Adjust your trading strategy based on shifting market dynamics, regulatory changes, or macroeconomic factors influencing cryptocurrency prices.

- Implement Robust Risk Management: Prioritize risk management and capital preservation by implementing robust risk management techniques such as setting stop-loss orders, diversifying your portfolio, and limiting leverage.

- Example: Use position sizing strategies such as the Kelly Criterion or fixed-percentage risk models to determine the appropriate allocation of capital to each trade based on your risk tolerance and the probability of success.

- Manage Emotions: Develop emotional resilience and psychological discipline to manage fear, greed, and other emotional biases that may cloud your judgment and lead to impulsive trading decisions.

- Example: Practice mindfulness techniques, meditation, or visualization exercises to maintain a calm and focused mindset during periods of market turbulence or uncertainty.

To look for a crypto trading job or internship, hop over to 9cv9 job portal and start applying for jobs.

Managing your trading career requires a strategic approach to goal setting, performance evaluation, continuous learning, and risk management.

By setting clear goals, regularly assessing your performance, investing in education, and remaining adaptable and disciplined in your trading approach, you can optimize your trading performance and achieve long-term success in the dynamic and competitive world of cryptocurrency trading.

However, remember that trading is a journey, not a destination, and there will be ups and downs along the way.

By committing to continuous improvement and learning from both successes and failures, you can navigate the challenges of trading and emerge as a skilled and resilient trader in the cryptocurrency market.

Conclusion

Embarking on a career in cryptocurrency trading can be both thrilling and rewarding, but it requires careful planning, strategic decision-making, and continuous learning.

Throughout this comprehensive guide, we have delved into the fundamental steps and strategies necessary to kickstart your journey as a cryptocurrency trader.

From understanding the basics of cryptocurrency trading to setting up your trading environment, developing effective trading strategies, and managing your trading career, we’ve covered a wide array of topics to equip you with the knowledge and skills needed to succeed in the dynamic world of crypto markets.

Starting with a solid foundation in the basics of cryptocurrency trading, you’ve learned about the decentralized nature of cryptocurrencies, the workings of cryptocurrency exchanges, and the factors influencing cryptocurrency prices.

Armed with this knowledge, you’ve proceeded to set up your trading environment, selecting the right cryptocurrency exchange, securing your trading account, and optimizing your workspace for efficient trading.

Next, we explored the process of developing a trading strategy tailored to your goals, risk tolerance, and market preferences.

By understanding different trading styles, conducting fundamental and technical analysis, setting clear goals, and implementing effective risk management techniques, you’ve laid the groundwork for executing informed and disciplined trades.

With your trading strategy in place, you’ve taken the crucial step of starting your first trade, navigating the trading interface, selecting trading pairs, and executing trades with confidence.

By following best practices and leveraging the tools and resources available on cryptocurrency exchanges, you’ve embarked on your trading journey with a solid understanding of the process and mechanics involved.

Moreover, we emphasized the importance of continuous learning and improvement in managing your trading career.

By staying informed, analyzing your trades, investing in education, and practicing discipline and patience, you’ve positioned yourself for long-term success in the ever-evolving cryptocurrency market.

In essence, while starting a career in crypto trading may seem daunting at first, armed with the knowledge, skills, and strategies outlined in this guide, you have the tools necessary to navigate the challenges and capitalize on the opportunities presented by cryptocurrency markets.

Remember, success in trading requires dedication, perseverance, and a willingness to adapt to changing market conditions.

By applying the principles outlined in this guide and remaining committed to continuous improvement, you can carve out a successful career in cryptocurrency trading and achieve your financial goals in the exciting and dynamic world of digital assets.

If you find this article useful, why not share it with your friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

If you are keen to find a job or internship, then click on 9cv9 Job Portal now.

People Also Ask

Can you make a career out of crypto trading?

Yes, it’s possible to make a career out of crypto trading. With proper education, discipline, and strategy, some traders achieve consistent profits, by managing portfolios or trading for institutions. However, it requires thorough understanding, risk management, and continuous learning.

How do I start a career in cryptocurrency?

To start a career in cryptocurrency, begin by learning the basics of blockchain and cryptocurrency technology. Gain experience by trading on reputable exchanges, staying informed about market trends, and networking with professionals in the industry. Consider pursuing relevant education and certifications to enhance your skills and credibility.

How do I start learning crypto trading?

To start learning crypto trading, begin with understanding key concepts like blockchain, wallets, and exchanges. Practice with small investments, utilize demo accounts, and study trading strategies. Stay updated on market trends and participate in online communities for insights and support.

![Writing A Good CV [6 Tips To Improve Your CV] 6 Tips To Improve Your CV](https://blog.9cv9.com/wp-content/uploads/2020/06/2020-06-02-2-100x70.png)