Key Takeaways

- AI-powered stock trading tools like Trade Ideas, Tickeron, and AlgosOne are transforming global markets through automation and predictive analytics.

- Platforms with strong performance metrics and real-time decision-making are becoming essential for both retail and institutional traders in 2026.

- Choosing the right AI tool depends on the trader’s strategy, with options ranging from technical signal generators to fully autonomous portfolio managers.

In 2026, the landscape of stock trading has undergone a profound transformation, powered by the explosive rise of artificial intelligence. No longer the exclusive domain of Wall Street institutions, AI-driven trading tools have become widely accessible to individual investors, retail traders, and global asset managers alike. As markets grow more volatile, data-intensive, and globally interconnected, the demand for intelligent systems that can automate, optimize, and outperform traditional strategies has never been higher. This surge in innovation has given rise to a new era of stock trading—one where human decision-making is increasingly augmented, and in some cases replaced, by highly advanced AI algorithms.

The adoption of AI in stock trading is not a passing trend; it reflects a deeper structural evolution. Modern AI tools can now analyze billions of data points in real time, identify high-probability patterns, execute trades across multiple exchanges within milliseconds, and continuously self-improve using machine learning. From high-frequency trading and options strategies to long-term portfolio optimization and sentiment analysis, these tools are reshaping every aspect of the trading experience. Whether through neural networks, reinforcement learning, or predictive analytics, AI is unlocking opportunities that were previously invisible to human traders.

In response to this rapid shift, the market has seen a wave of sophisticated platforms emerge, each offering unique strengths and specializations. Some excel in chart-based technical analysis, while others focus on fundamental value screening, real-time signal generation, portfolio rebalancing, or API-based automation for coders. Tools like Trade Ideas and AlgosOne have become synonymous with real-time actionable insights, while Tickeron and Danelfin are praised for their predictive analytics and pattern recognition capabilities. Meanwhile, platforms like TrendSpider and Kavout appeal to more technical traders seeking granular control and strategy customization. Even hybrid tools such as ChainGPT and RockFlow are bridging the gap between equities and crypto, offering unified dashboards for multi-asset strategies.

What makes 2026 a pivotal year for AI stock trading is the convergence of three forces: democratized access, regulatory maturity, and unparalleled algorithmic performance. Entry barriers have fallen dramatically, with cloud-based platforms, mobile-first interfaces, and subscription models making powerful AI capabilities available to traders with as little as USD 50 in starting capital. Governments and financial authorities have also stepped in to define compliance frameworks, introducing AI-specific laws and cybersecurity requirements that enhance trust and transparency in automated trading systems. Most importantly, the performance metrics speak for themselves—many AI strategies have consistently outperformed traditional benchmarks like the S&P 500 and Nasdaq 100 over the past 12 to 24 months.

This comprehensive guide explores the top 10 AI tools for trading stocks globally in 2026. Each featured tool has been evaluated across key dimensions such as ease of use, strategy variety, pricing, risk control, AI accuracy, and user support. By highlighting their strengths, unique features, and use cases, this blog serves as a definitive resource for investors—whether you’re a first-time trader or a seasoned quant—seeking to leverage artificial intelligence for smarter, faster, and more profitable decision-making in the markets. As the financial world moves into an era of intelligent automation, understanding and choosing the right AI trading tool is not just an advantage—it is essential.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Best AI Tools For Dictation in 2026.

If you like to get your company listed in our top B2B software reviews, check out our world-class 9cv9 Media and PR service and pricing plans here.

Top 10 Best AI Tools for Trading Stocks in 2026

- Trade Ideas

- Tickeron

- AlgosOne

- TrendSpider

- Danelfin

- Kavout

- WallStreetZen

- ChainGPT

- RockFlow

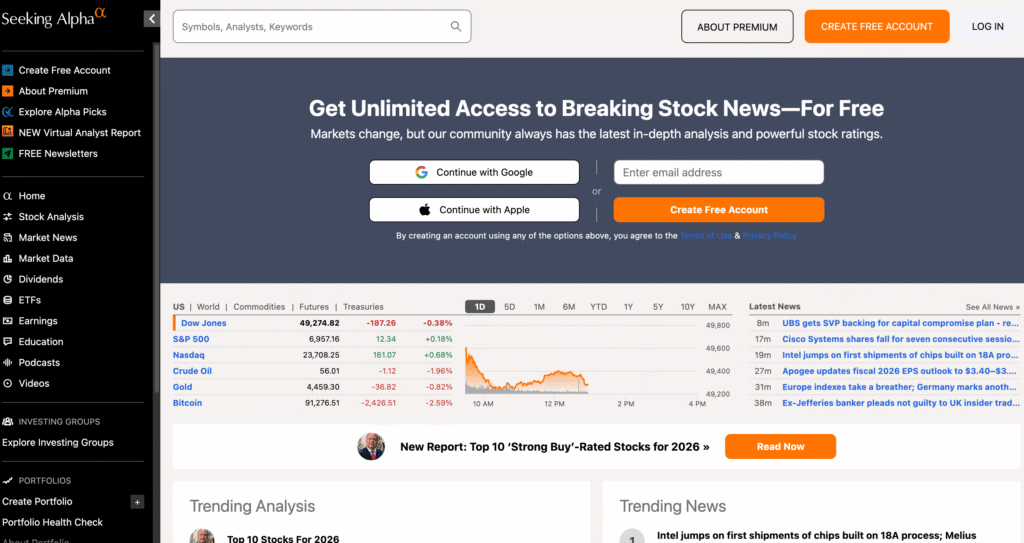

- Seeking Alpha Premium

1. Trade Ideas

Trade Ideas has solidified its reputation as one of the most powerful and innovative AI platforms for stock trading in 2026. At the heart of this platform lies the advanced “Holly” AI engine, a sophisticated system that leverages decades of algorithmic evolution. Initially launched in 2003, the platform has consistently evolved its technology, culminating in high-performance engines like Holly Neo and the Money Machine.

These AI systems use powerful machine learning models trained on tens of millions of historical trading patterns. Each night, Holly AI evaluates over 8,000 stocks listed on U.S. exchanges and simulates millions of market conditions to determine the 60 most reliable strategies for the following trading day.

How Holly AI Works

Holly’s edge comes from its unique ability to run nightly backtesting routines. The system examines technical indicators, price trends, and volume anomalies to predict high-probability trade setups. These strategies are then filtered by their risk-reward ratio, win rate, and confidence score before becoming actionable signals.

What sets Holly apart from traditional stock screening tools is its ability to deliver real-time, AI-validated trade alerts that can be automatically executed via brokerage integrations. The system is fast—capable of analyzing and delivering trading signals in less than one second.

Performance Matrix: Holly AI vs Traditional Methods

| Metric | Holly AI (Trade Ideas) | Manual Pattern Recognition |

|---|---|---|

| Backtested Win Rate | 68% | 52% – 58% |

| Stocks Analyzed Daily | 8,000+ | 100 – 300 |

| Signal Processing Time | < 1 second | Several minutes |

| Alert Delivery | Real-time | Manual |

| Broker Integration | Yes (e.g., IBKR) | Rare |

AI Subscription Tiers on Trade Ideas

Trade Ideas offers multiple pricing plans based on user needs—from beginners looking for stock ideas to professional traders relying on full automation.

| Plan Name | Monthly Cost (Annual Billing) | Key Features Included |

|---|---|---|

| Par Plan | Free | Delayed market data, basic alert tools, Stock Racing feature |

| Birdie Bundle | USD 89 | Real-time market data, over 500 technical filters |

| Eagle Elite | USD 178 | Full Holly AI suite, OddsMaker backtesting engine, broker integration |

Each tier is tailored to a specific trader profile. The Eagle Elite tier is particularly suited for professional day traders who require fully automated and backtested AI strategies.

AI-Powered Trading in Action

Once a trader logs into Trade Ideas, the Holly AI engine begins its work behind the scenes—analyzing complex market structures and identifying opportunities. Once a signal is detected, an alert is triggered, accompanied by details such as entry price, stop-loss level, and risk-to-reward ratio. These alerts can be acted upon immediately, either manually or automatically if integrated with brokers like Interactive Brokers.

Why Traders Choose Holly AI in 2026

- High Probability Signals: Each trade is backed by millions of simulations, giving traders greater confidence.

- Backtested Strategies: Unlike speculation-based methods, Holly’s decisions are based on proven, data-driven patterns.

- Speed & Automation: The AI delivers insights in real time, enabling traders to capitalize on even the shortest market moves.

- Ease of Use: A user-friendly interface allows even novice traders to harness professional-grade tools.

Conclusion

Trade Ideas remains a front-runner in the AI-powered stock trading ecosystem in 2026. Its flagship Holly AI engine represents the future of trading: data-driven, lightning-fast, and statistically optimized. For traders seeking consistent returns and a technological edge in today’s fast-moving markets, Holly AI delivers a reliable and powerful solution.

2. Tickeron

Tickeron has become one of the most advanced AI-powered platforms for trading stocks in 2026. Its unique strength lies in its proprietary Financial Learning Models (FLMs), which use machine learning to recognize highly accurate trading patterns in real-time. By 2025, Tickeron had implemented 5-minute and 15-minute machine learning-based agents to improve intraday trading speed and decision-making efficiency, leading to a 40% reduction in response time during volatile market conditions.

These models are especially popular among day traders and algorithmic investors who rely on short-term data to gain an edge in the stock market. Tickeron’s tools can be used to analyze thousands of market patterns daily, helping traders make quick and confident decisions.

Performance Overview of Tickeron’s AI Agents

Tickeron offers several types of AI trading agents, each focused on a different time horizon. The performance data below illustrates the potential returns and responsiveness of each agent in actual trading environments.

| AI Agent Type | Timeframe | Annualized Return | Win Rate | Average Response Time |

|---|---|---|---|---|

| 60-Minute Agents | Hourly signals | 45% to 75% | Not specified | 45–60 minutes |

| 15-Minute Agents | Short intraday | 91% to 169% | Over 90% | 10–15 minutes |

| 5-Minute Agents | Ultra-fast trading | 132% to 458% | Over 90% | 3–5 minutes |

These impressive figures reveal how Tickeron’s AI continuously adapts to live market conditions and executes trades at speeds and accuracy levels difficult for human traders to match.

Multi-Agent System and Virtual Portfolio Success

Tickeron also uses a “Multi-Agent” ecosystem—an integrated network of specialized AI bots working in tandem to optimize trading strategies. In 2025, this system delivered a 26.62% return on virtual portfolios. Among its standout performers was the TSM Trading Results Agent, which achieved a remarkable 171% annualized return during its best 30-day window.

This strategy allows diversification across market sectors and timeframes while reducing reliance on single trading patterns. Tickeron’s AI models can simulate thousands of trading scenarios and adapt in real-time, improving risk management and maximizing profitability.

Tickeron Pricing Plans and Value Tiers

The cost of using Tickeron reflects its high-end analytical capabilities and institutional-grade features. However, flexible pricing plans make it accessible to both individual traders and investment professionals.

| Plan Type | Monthly Cost (USD) | Key Features Included | Discounts Available |

|---|---|---|---|

| Basic Plan | From 50 | Access to selected AI pattern tools and simplified trading bots | No |

| Premium Plan | From 150 | Includes multi-agent tools, virtual portfolios, more frequent signals | Often 50% on annual |

| Full Access Plan | Up to 250 | Complete AI suite, all timeframes, priority updates | Yes (Annual discount) |

Many users prefer annual billing due to significant discounts, with some plans offering 6-month or yearly packages at nearly half the cost of monthly subscriptions.

Why Tickeron Is a Top AI Tool for Stock Traders in 2026

- Pattern Recognition Accuracy: Tickeron’s Financial Learning Models have been validated to detect breakout patterns with an impressive 87% accuracy.

- Fast Decision-Making Models: With 5-minute and 15-minute agents, Tickeron ensures that traders receive the fastest possible signals in a high-volatility environment.

- Advanced Multi-Agent System: Traders benefit from multiple AI bots working together, enhancing both returns and risk-adjusted strategies.

- Strong Virtual Portfolio Performance: The platform’s backtested and live-traded results show strong consistency in delivering above-market returns.

- Flexible Pricing: Scalable pricing makes it viable for both solo traders and institutional players.

Conclusion

Tickeron’s cutting-edge AI technology, high win-rate algorithms, and rapid response models position it as one of the best tools for stock traders globally in 2026. Whether you’re a retail investor seeking consistent alerts or a hedge fund manager looking to enhance portfolio alpha, Tickeron’s layered AI infrastructure provides actionable insights and performance at scale.

3. AlgosOne

AlgosOne has emerged as one of the most powerful AI stock trading tools available in 2026. It has become especially popular among retail investors who want access to institutional-grade technology without needing to manage trades themselves. The platform is based on advanced deep learning and natural language processing (NLP), allowing it to make informed and emotion-free decisions on behalf of its users.

Built around a “set-and-forget” trading concept, AlgosOne allows users to invest capital, choose a plan based on their risk appetite and time horizon, and let the AI handle everything—from entry to exit. The results between 2023 and 2024 demonstrated high consistency, with an average annual success rate of 80%, and some accounts reaching up to 92% in profitable trades.

AlgosOne Investment Performance Overview

AlgosOne offers different investment plans based on the amount of capital committed and the preferred risk-return balance. The platform clearly outlines estimated profits and lock-in periods, providing transparency to investors.

| Investment Amount | Plan Type | Estimated Annual Return | Lock-in Period |

|---|---|---|---|

| USD 5,000 | Standard | 35.48% | 12–24 months |

| USD 5,000 | High-Yield | 70.00% | 24–36 months |

| USD 50,000 | Standard | 65.90% | 12–24 months |

| USD 50,000 | High-Yield | 130.00% | 24–36 months |

These options allow both beginner investors and high-net-worth individuals to participate in AI-driven trading with tailored strategies.

AI Engine Capabilities and Core Technology

AlgosOne’s trading engine continuously learns from new data. Its AI models process large volumes of real-time financial data, news headlines, sentiment analysis, and technical signals. Using NLP, the engine reacts quickly to breaking events or financial disclosures, and through deep learning models, it adjusts strategies to changing market conditions.

This hybrid approach makes the platform highly adaptable and effective, especially during volatile periods. Unlike traditional systems that rely on pre-coded rules, AlgosOne evolves dynamically with market behavior.

Tokenization and the Launch of AIAO

In a major strategic shift, AlgosOne launched its AIAO token on August 6, 2025. This token is built on the ERC-20 blockchain standard and introduces both a financial and governance layer to the platform.

Key features of the AIAO token include:

- Governance Voting: Token holders can vote on future platform features and updates.

- Revenue-Backed Dividends: Regular USD payouts from company revenue streams are distributed to token holders.

- Strong Early Returns: Early investors during the presale phase experienced a +9,880% gain in token price, signaling massive initial demand.

Token Launch Performance Overview

| Launch Date | Token Name | Blockchain | Initial Return | Utility |

|---|---|---|---|---|

| August 6, 2025 | AIAO | ERC-20 | +9,880% | Governance rights, USD dividends |

This token ecosystem adds an entirely new financial layer, attracting crypto-focused traders alongside traditional equity investors.

Why AlgosOne Stands Out in 2026

- True Hands-Free Trading: Once an investor sets up their account and selects a plan, no further action is needed. The AI handles all trades with a disciplined, algorithmic approach.

- Proven Historical Performance: With up to 92% win ratios in select accounts and consistently high returns across tiers, the platform has built trust among its users.

- Deep Learning + NLP Combo: This blend gives AlgosOne the edge in processing real-world news and technical signals simultaneously.

- Flexible Investment Plans: Multiple options cater to conservative and aggressive investors.

- Token-Based Ecosystem: The introduction of AIAO enhances the investor experience by offering added income potential through dividends and token growth.

Conclusion

AlgosOne is redefining what retail investors can access in terms of AI trading power. By offering automated execution, consistent profits, and a token-driven ecosystem, it provides a one-stop solution for individuals seeking passive wealth growth through cutting-edge technology. Its performance metrics and investor flexibility make it one of the most robust AI trading platforms in the world today.

4. TrendSpider

TrendSpider continues to lead the industry in 2026 as one of the most advanced AI-powered platforms for technical analysis and stock trading automation. Designed for both novice and experienced traders, TrendSpider transforms the way users identify trade opportunities, backtest strategies, and react to real-time market changes—without requiring any background in coding or data science.

Its core strength lies in automation. With tools like the Strategy Lab, Strategy Tester, and Market Scanner, traders can analyze price action, fundamental growth metrics, and AI-generated signals within one unified system. The platform is engineered to save time, remove emotion from trading decisions, and increase accuracy through data-rich insights.

Core Capabilities and Data Infrastructure

TrendSpider’s technology foundation is built on a vast pool of real-time and historical data. It connects traders to over 94,000 live data feeds and gives access to more than 200 technical indicators, providing a deep edge for market analysis.

| Feature | Value / Description |

|---|---|

| Total Real-Time Feeds | 94,000+ live global data sources |

| US Market Data Feeds | 118,000+ active securities and tickers |

| Historical Data Coverage | Over 50 years of price and indicator history |

| Technical Indicators | 200+ customizable metrics |

| Registered Users | 20,000+ active traders |

| Monthly Pricing Range | USD 39.00 – USD 99.51 |

These data integrations allow users to identify key price levels, trend setups, earnings patterns, and high-probability entries across stocks, ETFs, and other assets.

AI Tools: Strategy Lab, Strategy Tester, and Market Scanner

The Strategy Lab is one of TrendSpider’s standout innovations. It allows traders to build machine learning-based predictive models using drag-and-drop logic and visual cues. Users can test these models across decades of historical data to assess profitability and risk exposure.

The Strategy Tester works alongside this to simulate past performance of trading rules. It provides win-rate, drawdown, and average return data instantly—helping traders validate their strategies before applying real capital.

The Market Scanner allows users to screen major indices like the S&P Composite 1500 for fundamental factors such as:

- Five consecutive quarters of revenue growth

- Positive EBITDA trends

- Low debt-to-equity ratios

- Strong institutional ownership

This integration of fundamental and technical metrics sets TrendSpider apart from other platforms focused on just one data dimension.

Tool Comparison Matrix: TrendSpider vs Traditional Platforms

| Capability | TrendSpider | Traditional Platforms |

|---|---|---|

| Machine Learning Models | Yes (No code required) | Rarely available |

| Real-Time Global Feeds | 94,000+ | Limited |

| Technical Indicator Library | 200+ | 50–100 |

| Strategy Backtesting | Instant, visual-based | Manual or plugin-based |

| Fundamental Data Integration | Yes (with screeners) | Often missing |

| Multi-Timeframe Analysis | Yes | Often limited |

Pricing Plans for Traders in 2026

TrendSpider offers affordable monthly subscriptions for traders of all levels, from solo retail investors to professional quants.

| Plan Tier | Monthly Cost (USD) | Best For |

|---|---|---|

| Basic Plan | 39.00 | New traders exploring automation |

| Advanced Plan | 79.00 | Intermediate users wanting full access |

| Elite Plan | 99.51 | Professional traders and analysts |

Annual billing options offer discounts of up to 20%, and all plans come with unlimited backtesting and full mobile access.

Why TrendSpider Is One of the Top AI Tools for Stock Trading in 2026

- Complete Automation: From charting to alerting, everything can be automated, freeing traders from manual chart-watching.

- AI Strategy Building: Create predictive strategies using intuitive tools without any programming.

- Technical + Fundamental Synergy: Combines real-time price trends with financial performance metrics to improve stock selection.

- High Data Depth: With more than 50 years of historical data and massive real-time feed coverage, users can analyze any security with precision.

- Scalable Pricing: Offers flexible plans that scale with trader experience and capital level.

Conclusion

TrendSpider stands out in 2026 as a full-spectrum solution for anyone serious about technical trading. With its AI-driven automation, deep backtesting functionality, and intelligent scanning tools, it enables users to turn data into actionable trades. This makes it not only a charting tool but a decision-making engine that supports better, faster, and smarter investing.

5. Danelfin

Danelfin has established itself as one of the most accessible and data-rich AI trading platforms in the world in 2026. What makes Danelfin especially appealing to retail traders and portfolio managers is its transparent scoring system powered by artificial intelligence. Instead of overwhelming users with complex models, Danelfin simplifies decision-making by assigning each stock an “AI Score” between 1 and 10, which reflects the probability of that stock outperforming the market over the next 90 days.

This approach makes advanced AI analytics easier to understand, even for those without technical backgrounds. The higher the AI Score, the stronger the statistical likelihood that the stock will deliver above-average performance.

How Danelfin’s AI Score System Works

Danelfin’s AI engine is trained on a massive amount of financial data. Every day, it processes over 10,000 features per stock and has learned from more than 5 billion data points across global markets. These features include price trends, volume changes, technical indicators, insider activity, analyst sentiments, and more.

The AI Score ranges from 1 (lowest) to 10 (highest), with each score level corresponding to a historical performance benchmark. Here’s a snapshot of how the score relates to outcomes:

| AI Score | Historical Alpha (Annualized) | Win Rate (Historical Data) |

|---|---|---|

| Score 10/10 | +21.05% outperformance | 60% or higher chance of beating market |

| Score 1/10 | –33.28% underperformance | N/A (Not used for trade selection) |

This scoring system helps investors avoid weak stocks and focus on those with statistically strong upside potential.

Performance of Danelfin’s AI Strategy vs. S&P 500

Danelfin’s AI isn’t just theoretical—it has delivered real-world results. The platform’s “Best Stocks Strategy,” which selects stocks with high AI Scores, has significantly outperformed the broader market over the past several years.

| Timeframe | Danelfin Best Stocks Strategy | S&P 500 Index Return |

|---|---|---|

| Jan 2017 – Jun 2025 | +376% Total Return | +166% Total Return |

This shows a clear alpha advantage from using AI scoring for portfolio selection. The strategy’s consistent ability to beat the market has made Danelfin increasingly popular among self-directed investors.

Subscription Tiers and Accessibility

Danelfin is priced to make powerful AI tools available to a global user base. While many platforms offering predictive analytics charge hundreds of dollars per month, Danelfin has adopted a freemium model to encourage broad adoption.

| Plan Type | Monthly Cost (USD) | Access Scope |

|---|---|---|

| Free Plan | USD 0 | Limited access to AI Scores |

| Pro Plan | From USD 52 | Full multi-market access, unlimited scoring, portfolio tracking tools |

Users can analyze multiple markets including U.S., European, and Asian stocks under the Pro plan. This flexibility allows global traders to apply the same AI logic to different regions and asset classes.

Advantages of Using Danelfin for Stock Trading in 2026

- Simplified AI Insights: Users don’t need to understand complex algorithms—AI Scores give a clear and fast interpretation of risk and reward potential.

- High Data Volume: With more than 10,000 data features analyzed per stock, decisions are backed by deep and diverse financial signals.

- Proven Market Outperformance: The strategy’s historical return of +376% vs. +166% on the S&P 500 validates its strength.

- Affordable Pricing: With free and Pro tiers, Danelfin makes AI trading tools accessible to both beginners and professionals.

- Global Market Coverage: Traders can use the same scoring framework across multiple international stock exchanges.

Conclusion

Danelfin stands out in 2026 as a highly effective, easy-to-use AI stock selection platform. Its scoring system, backed by massive data analysis and strong historical returns, makes it one of the most reliable tools for traders looking to beat the market. The platform’s simplicity, performance record, and accessible pricing make it a top choice for investors who want to use AI to guide their portfolio decisions.

6. Kavout

Kavout has risen to prominence in 2026 as one of the most advanced AI-powered platforms for ranking and evaluating stock opportunities using machine learning. At the center of Kavout’s ecosystem is its proprietary Kai Score, a quantitative metric that helps traders and investors identify stocks with strong growth potential based on predictive analytics.

By analyzing over 9,000 U.S. stocks daily, Kavout delivers a comprehensive overview of the equities market, offering insights that are especially valuable to both retail traders and institutional investors. Its seamless API integration and user-friendly interface make it a versatile platform for everyone from individual investors to hedge funds.

Understanding the Kai Score and Predictive AI Engine

The Kai Score is Kavout’s signature feature. It acts as a smart numerical rating—usually ranging from 1 to 10—that assesses a stock’s potential to outperform the market based on various predictive signals. This score is generated through AI models that analyze millions of data points including:

- Technical patterns

- Analyst ratings

- News sentiment

- Valuation metrics

- Earnings surprises

- Price momentum

These data signals are processed through machine learning models that continuously improve based on new inputs. The higher the Kai Score, the stronger the signal for possible stock outperformance over the next few weeks or months.

Example: Kai Score Interpretation Matrix

| Kai Score Value | Market Outlook | Use in Strategy |

|---|---|---|

| 9–10 | Strong outperformance | Priority buy/watchlist |

| 6–8 | Moderate opportunity | Consider for medium-term |

| 1–5 | Weak outlook | Avoid or short-term exit |

This simplified scoring system allows users to quickly screen the market and focus on high-quality trade opportunities.

Smart Features: InvestGPT and Pattern Recognition Engine

Kavout’s innovation extends beyond scoring. Its InvestGPT feature enables users to perform smart searches using natural language queries. Traders can ask questions like “Which stocks have outperformed in the last 3 earnings seasons?” or “Show me undervalued tech stocks with upward momentum,” and receive accurate, AI-curated results.

In addition, the pattern recognition engine scans markets in real time to detect breakout signals, trend reversals, or technical chart formations. This feature automatically updates user portfolios and watchlists, keeping traders aligned with the latest signals.

Product Plans and Target Audiences

Kavout offers flexible plans tailored to different user types—from solo traders to enterprise hedge funds.

| Plan Name | Monthly Cost (USD) | Features Included | Target Users |

|---|---|---|---|

| Kavout Pro | 20 | Access to Kai Score, basic smart tools | Active retail traders, advisors |

| Portfolio Toolbox | 49 | Advanced screeners, AI pattern tracking | Quantitative traders |

| Enterprise API | Tiered (Custom) | Full API integration, bulk data, Kai Score feed | Quant hedge funds, institutions |

The Enterprise API plan is especially useful for large-scale trading operations. Quantitative firms can embed Kavout’s AI signals directly into their own trading algorithms and models, optimizing internal processes with third-party intelligence.

Comparison Table: Kavout vs Traditional Stock Screeners

| Feature | Kavout | Traditional Tools |

|---|---|---|

| AI-Generated Stock Scores | Yes (Kai Score) | No |

| Natural Language Query (InvestGPT) | Yes | No |

| Real-Time Pattern Recognition | Yes | Limited or none |

| Institutional API Access | Yes | Rare or unavailable |

| Machine Learning Signal Updates | Continuous | Manual refresh |

Why Kavout Is Among the Top AI Tools for Stock Trading in 2026

- Predictive Intelligence: The Kai Score offers a straightforward way to understand which stocks are likely to perform well, even for those without a financial background.

- Powerful Tools for All Levels: From casual traders to fund managers, Kavout provides scalable tools that match varying needs.

- Real-Time Insights: The pattern engine and smart AI constantly monitor the market, ensuring users never miss a high-potential trade.

- Custom Integration for Professionals: Through its API, Kavout fits directly into enterprise workflows and high-frequency trading systems.

- Affordable and Flexible Pricing: The platform is accessible without compromising on analytical depth.

Conclusion

In 2026, Kavout continues to bridge the gap between AI innovation and practical trading. By offering intuitive tools like the Kai Score, InvestGPT, and real-time pattern recognition, it empowers investors with data-driven insights that would otherwise be hard to uncover manually. Whether for retail portfolio enhancement or institutional-grade automation, Kavout stands out as one of the top 10 AI tools redefining modern stock trading.

7. WallStreetZen

WallStreetZen has become a go-to AI stock analysis platform in 2026 for investors who prioritize long-term fundamentals. Its standout feature is the Zen Ratings system—a proprietary scoring model that blends AI with quantitative research to evaluate a stock’s future growth potential. With a focus on evidence-based metrics, Zen Ratings offers an accessible yet powerful solution for both beginner and experienced investors aiming to outperform the market.

Zen Ratings use 115 individually tested financial, growth, valuation, and momentum factors, all chosen based on their proven ability to predict long-term equity performance. Rather than relying on hype or market sentiment, WallStreetZen evaluates each stock through a consistent, data-driven framework.

Zen Ratings Framework and Performance Overview

Each stock is graded across five primary categories, with each factor contributing to an overall Zen Rating. These grades help simplify complex financial data into easy-to-understand scores while still offering depth for advanced users.

| Factor Category | Component Grade | Description |

|---|---|---|

| Growth | A+ | Measures earnings, revenue, and free cash flow expansion |

| Valuation | B | Compares price to earnings, sales, and book value |

| Profitability | A | Analyzes margins, returns, and income efficiency |

| Financial Health | A– | Examines debt, cash reserves, and liquidity |

| Momentum (AI-Based) | A+ | Tracks technical trends and analyst sentiment via AI |

This model has generated impressive historical returns. Since 2003, “A-rated” Zen stocks have averaged a 32.52% annual return, far outperforming the broader market, which typically sees mid to high single-digit growth over the long term.

Zen Ratings vs. Broader Market Performance

| Portfolio Type | Average Annual Return | Time Period |

|---|---|---|

| Zen A-Rated Stocks | 32.52% | 2003–2026 |

| General Market Index | ~8–12% | 2003–2026 |

This performance gap highlights the strength of using high-grade Zen Ratings as a signal for long-term investing strategies.

AI Integration and Analyst Transparency

What separates WallStreetZen from most stock analysis tools is its analyst transparency engine. The platform tracks nearly 4,000 financial analysts and uses historical data to identify which experts have consistently made successful recommendations. When an analyst issues a buy or sell call, WallStreetZen doesn’t just show the opinion—it tells users whether that analyst has a reliable track record.

Additionally, AI models are embedded into the momentum and analyst scoring features. These AI-driven layers help spot early signals of price breakouts or trend reversals before they appear in the broader market.

Pricing Plans and Access Model

WallStreetZen keeps its pricing low to remain accessible to individual investors, especially those building long-term portfolios. Premium access includes full Zen Ratings and deep analytics on every stock covered.

| Plan Name | Monthly Cost (USD) | Billing Model | Features Included |

|---|---|---|---|

| WallStreetZen Premium | ~19.50 | Billed annually | Full Zen Ratings, analyst tracking, AI screeners |

| Free Access | USD 0 | N/A | Limited views and partial ratings |

At less than USD 20 per month, Premium users unlock the full ecosystem of tools to help make smarter investment decisions based on fundamentals and AI-enhanced data.

Key Advantages of WallStreetZen for Stock Trading in 2026

- Evidence-Based Ratings: Each stock’s score is driven by 115 proven long-term factors.

- AI-Powered Momentum Scores: Zen Ratings integrate AI to analyze short- and mid-term technical trends.

- Verified Analyst Insights: Users gain access to a transparent leaderboard of analyst performance.

- Outstanding Historical Returns: A-rated Zen stocks have historically outperformed by a large margin.

- Affordable for All Investors: WallStreetZen Premium is competitively priced for retail use.

Conclusion

WallStreetZen in 2026 offers a rare combination of simplicity, performance, and AI precision for long-term investors. With its Zen Ratings system, deep analyst transparency, and affordable pricing, it enables anyone to build a high-quality, growth-focused portfolio with confidence. The platform remains one of the top AI tools in the market for those who prioritize fundamental strength and data-backed investment decisions.

8. ChainGPT

ChainGPT has emerged as a standout AI platform in 2026 by combining blockchain analytics with equity market insights. While originally designed for cryptocurrency-focused traders, ChainGPT’s tools have evolved to cater to hybrid investors who manage portfolios that span digital assets, stocks, and ETFs. Its unique positioning lies in integrating real-time crypto sentiment with traditional market signals, allowing traders to identify cross-market opportunities others might miss.

By training its AI models on both crypto-native data and traditional financial indicators, ChainGPT delivers a powerful edge to investors navigating the increasing convergence of Web3 and legacy finance.

Core Tools and AI-Powered Capabilities

ChainGPT offers a diverse suite of intelligent trading tools that cater to different investment styles and risk profiles. These tools are designed to scan, predict, and act based on both price trends and market mood—especially where crypto volatility may influence broader investor behavior.

| Tool / Feature | Pricing Model | Ideal Users | Core Functionality |

|---|---|---|---|

| AI Trading Bots | Credits-based | Crypto-curious retail investors | Auto-execute trades based on algorithmic logic |

| Sentiment Scanner | Free + Premium Tiers | Blockchain analysts and technical traders | Detect crowd sentiment on tokens and stocks |

| Strategy Builder | Subscription / Credits | Hybrid traders (DeFi + equities) | Design cross-asset trading strategies with AI |

These services are fully modular, allowing users to combine different tools based on their portfolio composition or trading goals.

Real-Time Market Analysis with Cross-Market Insights

One of ChainGPT’s major innovations is its ability to analyze real-time correlations between the crypto market and equity market sentiment. For example, the platform can detect how sudden volatility in Bitcoin or Ethereum affects investor behavior in tech stocks or fintech ETFs. This capability allows traders to make smarter decisions during periods of high market uncertainty.

ChainGPT uses large language models and NLP to scan millions of social media posts, trading forums, DeFi protocols, and news articles to assess real-time investor sentiment. The output is then synthesized into actionable metrics that can power both automated bots and custom-built strategies.

Example Matrix: Crypto Sentiment Impact on Equity Sectors

| Crypto Sentiment Surge | Equity Market Impact (Typical) | ChainGPT Strategy Adjustment |

|---|---|---|

| BTC Breaks Resistance | Tech & Fintech stocks rally | Signal generated for bullish tech entry |

| ETH Gas Spike | Blockchain ETF volatility increases | Trigger risk-off rebalancing |

| Negative DeFi News | Risk aversion across retail sectors | Sentiment scanner triggers early warning |

This predictive correlation model makes ChainGPT especially valuable for hybrid investors who trade both asset classes.

Flexible Pricing for All Types of Traders

ChainGPT offers a mix of credit-based and subscription models. This allows users to scale their usage according to portfolio size and strategy complexity.

| Plan Name | Pricing Format | Access Features |

|---|---|---|

| Free Tier | USD 0 | Basic sentiment scanning and market overview |

| AI Bot Credits | Pay-as-you-go | On-demand access to trading bots |

| Strategy Builder | Subscription/Credit | Full access to hybrid portfolio AI tools |

The flexible pricing model ensures accessibility for both retail investors exploring crypto-stocks synergy and institutional firms building algorithmic strategies across DeFi and equity markets.

Why ChainGPT Is Among the Top AI Tools for Stock Trading in 2026

- Cross-Asset Intelligence: Designed for investors operating in both crypto and traditional equities

- AI Trading Automation: Bots adapt to sentiment trends and market conditions in real time

- Sentiment-Driven Alerts: NLP-based scanners monitor emotional triggers across global communities

- Web3 Data Pipeline: Provides insights not available through conventional stock trading platforms

- Modular Access: Traders can pay only for the tools they use, enhancing affordability and flexibility

Conclusion

ChainGPT stands out in 2026 as a cutting-edge solution for modern investors who understand that markets no longer move in silos. With its AI models tuned to track both blockchain signals and stock market sentiment, it offers a dynamic edge to traders navigating fast-changing environments. Whether used for building algorithmic strategies or reading early signals of sector volatility, ChainGPT delivers an intelligent, future-ready toolkit for diversified portfolio management.

9. RockFlow

RockFlow has become a leading AI tool in 2026 for retail traders seeking a mix of professional-grade investing power and community-driven insights. Designed with accessibility in mind, RockFlow blends institutional-level portfolio analytics with the simplicity of social investing, creating a powerful all-in-one platform for beginner and intermediate investors alike.

Its mobile-first experience, intuitive design, and multilingual support have made RockFlow particularly popular among the fast-growing demographic of tech-savvy investors across the Asia-Pacific region. What sets it apart is its ability to merge automated AI-driven decision-making with social features like strategy sharing and sentiment analysis.

Key Features and Investment Tools Offered by RockFlow

RockFlow supports multi-asset portfolio building across stocks, ETFs, and cryptocurrencies. Its suite of tools is designed to help users reduce emotional trading, enhance diversification, and adopt proven strategies with minimal effort.

| Feature Name | Primary Utility | Benefit to User |

|---|---|---|

| Portfolio Optimizer | AI-driven rebalancing based on real-time market shifts | Ensures portfolios stay aligned with personal risk levels |

| Smart News Analysis | Sentiment-scanning from news and social platforms | Helps traders react early to positive or negative shifts |

| Social Investing | Strategy copying and expert community insights | Allows beginners to learn and invest alongside top performers |

These features work together to deliver a personalized and intelligent investing experience, where users don’t just get data—they get direction.

RockFlow’s AI-Powered Portfolio Management System

At the heart of RockFlow’s engine is its AI-powered Portfolio Optimizer. This tool analyzes a user’s risk appetite, time horizon, asset preferences, and real-time market data to suggest optimal rebalancing moves. Rather than relying on static allocations, it continuously adjusts weightings across stocks, ETFs, and crypto based on expected volatility and macroeconomic signals.

| Risk Profile | AI Allocation Strategy | Rebalancing Frequency |

|---|---|---|

| Conservative | Higher bonds/ETFs, lower crypto exposure | Quarterly or on triggers |

| Moderate | Balanced mix of equities, ETFs, and top crypto | Monthly |

| Aggressive | Higher equity and crypto tilt | Weekly or event-based |

This helps traders avoid unnecessary exposure during downturns while capitalizing on trends in real time.

Social Trading and Community Integration

RockFlow also includes a built-in social layer where users can follow top investors, copy strategies, and contribute to community discussions. These insights are not just anecdotal—they are backed by historical performance data and real-time tracking.

For example, users can:

- Automatically mirror the trades of high-performing community members

- Vote on sentiment polls and see how others are positioning their portfolios

- Join sector-focused chat rooms (tech, energy, AI stocks, crypto) to exchange ideas

This democratizes access to strategy-level thinking, giving novice investors a head start.

Pricing and Accessibility

RockFlow is structured to be free for the majority of users, with optional premium upgrades available for those who want additional analytics, backtesting tools, or advanced automation features.

| Plan Name | Monthly Cost (USD) | Key Features Included |

|---|---|---|

| Free Tier | USD 0 | AI suggestions, news feeds, basic social trading |

| Premium Tier | Varies (Region-Based) | Deeper analytics, priority updates, automation |

This pricing model keeps the barrier to entry low while offering scalability as users become more active or experienced in trading.

Why RockFlow Is One of the Top AI Tools for Stock Trading in 2026

- Institutional-Level AI Made Simple: AI portfolio rebalancing and sentiment scanning are presented in an easy-to-understand format.

- Community-Driven Learning: Strategy copying, leaderboards, and group discussions bring a new dimension to retail investing.

- Mobile-First, Asia-Pac Ready: Optimized for smartphones and tailored to emerging markets in Asia, where mobile-first investors are thriving.

- Multi-Asset Coverage: Supports diversification across stocks, ETFs, and crypto in one interface.

- Smart Sentiment Integration: Combines data from news and social media to deliver real-time market mood insights.

Conclusion

RockFlow successfully bridges the gap between Wall Street analytics and the social trading movement. Its AI-driven features offer automation and intelligence, while its community layer fosters learning and collaboration. For the modern investor—especially in emerging markets—RockFlow stands as one of the most versatile and user-friendly AI trading tools in 2026.

10. Seeking Alpha Premium

Seeking Alpha has evolved significantly by 2026, transforming from a traditional financial content hub into a cutting-edge AI-powered stock analysis platform. At the core of this transformation is the integration of virtual analyst technology, which now plays a central role in how users evaluate equities across U.S. and global markets. The platform’s latest innovation—Virtual Analyst Reports—uses advanced machine learning models to convert financial data and expert commentaries into clear, data-backed investment ratings.

This shift marks a new era where AI acts not just as a support tool, but as a co-pilot in investment research—automating the synthesis of market trends, earnings data, and analyst insights into simple, actionable stock ratings.

AI-Powered Quant Rating System and Factor Analysis

Seeking Alpha’s most prominent analytical feature is its Quant Rating system. This system assigns each stock a composite score based on how it performs across five core factors: value, growth, profitability, EPS revisions, and momentum. These ratings update dynamically and reflect both current fundamentals and AI-predicted trends.

| Quant Factor | Description | Weight in Rating Calculation |

|---|---|---|

| Value | Measures relative undervaluation (P/E, P/S, etc.) | Medium |

| Growth | Assesses revenue and earnings acceleration | High |

| Profitability | Analyzes return on equity, margins, and asset use | High |

| EPS Revisions | Tracks analyst upgrades and downgrades | Medium |

| Momentum | Looks at short- to mid-term price trends and volume | Medium |

These AI-generated scores make it easier for both new and experienced investors to screen thousands of stocks efficiently and make well-informed decisions.

Example Matrix: Quant Rating vs Traditional Ratings

| Feature | Seeking Alpha Quant Rating | Traditional Analyst Ratings |

|---|---|---|

| Data-Driven | Yes | Partially |

| Human Bias-Free | Yes | No |

| Real-Time Updates | Yes | Delayed |

| Factor-Based Methodology | 5-Factor AI Scoring | Mostly sentiment-driven |

| Retail Investor Friendly | Yes | Often complex |

This matrix illustrates how Seeking Alpha’s quant approach brings automation, consistency, and transparency to the investment process.

Membership Plans and Pricing Options

Seeking Alpha offers two primary subscription plans designed to cater to both retail investors and advanced market participants. Each tier unlocks a progressively deeper level of data and exclusive insights.

| Membership Tier | Approximate Annual Cost (USD) | Key Features Included |

|---|---|---|

| SA Premium | 234 – 299 | Quant Ratings, AI Virtual Reports, factor grades, dividend data |

| SA Pro | 499+ | Exclusive research reports, hedge fund interviews, deeper analytics |

While the Premium plan is tailored for individual investors looking for smarter and faster decisions, the Pro plan targets professional traders, analysts, and asset managers who require early access to top-tier research and in-depth modeling.

Virtual Analyst Reports: Simplified Intelligence for Smarter Investing

These AI-generated reports bring together financial ratios, peer comparisons, market sentiment, and expert commentary into a single, easy-to-read brief. Each report highlights:

- Bullish or bearish thesis

- Factor performance vs industry averages

- AI-generated risk level

- Earnings trend forecast

This automation helps eliminate research fatigue and allows users to evaluate investment options in minutes, not hours.

Why Seeking Alpha Premium Is a Top AI Trading Tool in 2026

- Quantified Decision-Making: AI ratings reduce emotional bias and bring statistical precision into portfolio building.

- Simplified Reports for Speed: Virtual Analysts allow faster evaluation of stock fundamentals and sentiment.

- Custom Stock Screeners: Users can filter by Quant Rating, dividend growth, EPS trends, and more.

- Real-Time Market Intelligence: Factor updates and analyst revision tracking occur automatically.

- Affordable Access: Premium pricing gives individual investors tools that once were limited to institutional analysts.

Conclusion

Seeking Alpha Premium now stands as one of the most effective AI-powered investment platforms in 2026. By combining real-time financial data with intelligent machine learning models, it empowers everyday investors to evaluate stocks with the accuracy and depth of a professional analyst—minus the complexity. Whether used for stock screening, dividend investing, or growth portfolio optimization, Seeking Alpha delivers a robust and accessible platform for AI-enhanced equity research.

Global AI Stock Trading Landscape in 2026: Growth Trends, Market Size, and Future Outlook

The global AI trading ecosystem has entered a phase of exponential growth in 2026. What began as experimental algorithmic models in early 2024 has now evolved into highly sophisticated, autonomous AI trading platforms. These platforms are not just optimizing trade execution; they are transforming the decision-making process for investors, hedge funds, and fintech firms alike.

AI’s expanding role in stock trading is no longer optional—it has become a competitive necessity. From machine learning models that analyze earnings reports in seconds to autonomous agents that manage multi-asset portfolios across different time zones, AI has become the core driver of innovation and returns in capital markets.

Explosive Growth in AI-Driven Trading Platforms

The global market size for AI-powered trading platforms was valued at USD 11.23 billion in 2024. By 2026, that figure is forecasted to reach USD 16.14 billion, with projections showing it will climb to USD 33.45 billion by 2030. This represents a compound annual growth rate (CAGR) of 20.0%, highlighting rapid institutional and retail adoption.

The algorithmic trading segment remains the largest within this space. It accounted for over 39% of global revenue in 2024, a figure that is expected to grow further as advanced AI agents replace traditional rule-based trading models.

| Market Segment | 2024 Value (USD Bn) | 2025 Estimate (USD Bn) | 2026 Forecast (USD Bn) | 2030 Projection (USD Bn) |

|---|---|---|---|---|

| AI Trading Platforms | 11.23 | 13.45 | 16.14 | 33.45 |

| Algorithmic Trading (Global) | 13.02 (2021) | 16.50 | 18.74 | 31.30 |

These numbers reflect a clear trend: the future of trading is automated, intelligent, and adaptive.

The Rise of AI Agents in Financial Markets

Even more impressive is the rise of autonomous AI agents in financial services. These agents are no longer static bots following simple instructions. In 2026, AI agents can now process real-time data, adapt their strategies dynamically, and execute complex trades across volatile market conditions.

The financial AI agent market alone grew from USD 490.2 million in 2024 to an estimated USD 1.04 billion in 2026, and is expected to reach USD 4.48 billion by 2030—growing at a staggering CAGR of 45.4%.

| AI Agent Category | 2024 Value (USD Bn) | 2025 Estimate (USD Bn) | 2026 Forecast (USD Bn) | 2030 Projection (USD Bn) |

|---|---|---|---|---|

| AI Agents (All Industries) | 5.40 | 7.92 | 11.35 | 48.30 |

| Financial AI Agents | 0.49 | 0.71 | 1.04 | 4.48 |

This remarkable growth is driven by the shift from simple automation to multi-step reasoning agents, capable of self-adjusting in response to fast-moving market trends and external economic shocks.

Regional Dynamics: North America Leads, Asia-Pacific Surges

North America currently holds the lion’s share of the global AI trading platform market, with a 37%+ share as of 2024. However, the most rapid acceleration is happening in the Asia-Pacific region, particularly in China, India, and Vietnam, where investment in AI-powered fintech infrastructure is surging.

These emerging economies are embracing AI stock trading platforms as part of their broader digital transformation strategies. As retail participation increases and local exchanges modernize, the region is expected to outpace global averages in AI adoption rates.

| Region | 2024 Market Share | 2026 Trend Outlook |

|---|---|---|

| North America | 37%+ | Dominant market with mature adoption |

| Asia-Pacific | Fastest growth | Rapid expansion fueled by fintech boom |

| Europe | Stable | Institutional adoption, slower retail uptake |

| Middle East & Africa | Emerging | Early-stage, increasing venture funding |

AI Trading in 2026: Market Shifts and Innovation Drivers

Several key trends are shaping the AI trading environment in 2026:

- Autonomous Agents: Self-directed bots now perform real-time risk analysis, portfolio rebalancing, and cross-market arbitrage without human intervention.

- Real-Time AI Infrastructure: Platforms increasingly rely on GPU-powered systems for sub-second latency and rapid decision-making.

- Hybrid Asset Coverage: Many AI tools now cover stocks, ETFs, crypto assets, and options within one unified system.

- Retail AI Integration: Platforms like RockFlow and Danelfin have democratized access to predictive analytics and AI-based scoring systems.

- Institutional API Deployments: Hedge funds and wealth managers are embedding AI APIs from platforms such as Kavout and QuantConnect directly into their proprietary systems.

Conclusion

The global landscape for AI in stock trading is undergoing a massive transformation in 2026. Driven by increasing complexity in financial markets and the need for faster, more accurate decision-making, AI platforms have become essential tools for investors, traders, and institutions. From fully autonomous agents to intelligent quant rating systems, the AI revolution in trading is not only growing in scale—but reshaping how capital flows across the globe.

AI Trading in 2026: The Importance of Infrastructure, Data Centers, and Processing Speed

The performance and precision of the world’s top AI trading tools in 2026 are increasingly dependent on the quality and scale of their underlying infrastructure. Behind every fast trade decision, smart prediction, and real-time market scan lies an ecosystem of hyperscale data centers and compute engines. These facilities are the backbone of modern algorithmic finance—processing massive volumes of financial data with microsecond-level latency.

As financial markets become more volatile, and trading windows shrink, these AI tools must operate at unprecedented speed and efficiency. The infrastructure powering this new generation of trading intelligence has become just as important as the algorithms themselves.

Data Centers Driving the Future of AI-Powered Stock Trading

To support the enormous data demands of AI-driven trading, cities across the Asia-Pacific region have begun investing heavily in hyperscale data center development. Among the most strategically important cities is Ho Chi Minh City, which is now positioning itself as a core AI infrastructure hub for Southeast Asia.

Multiple mega-scale facilities are under construction, all tailored to meet the computational needs of high-frequency trading algorithms, autonomous agents, and machine learning models running across global markets.

| Project Name | Developer / Consortium | Estimated Investment (USD Billion) | Power Capacity (MW) | Expected Milestones |

|---|---|---|---|---|

| Viettel IDC Tan Phu Trung | Viettel IDC | Not Disclosed | 140 | Phase 1 in 2026, Full by 2030 |

| Data Center (Unnamed) | CMC Telecom | 0.25 | 120 | Completion by 2027 |

| STT-VNG Facility | ST Telemedia & VNG Corporation | Not Disclosed | 60 | Completion scheduled for 2026 |

| TechPark DC | Saigon Asset Management | 1.50 | 150 | Targeting full rollout in 2028 |

| Microsoft–FPT–G42 Proposal | Microsoft / FPT / G42 | 2.00 | TBD | In proposal stage |

These facilities will house thousands of racks and offer the high-performance infrastructure necessary to support next-generation AI tools for finance, including advanced neural networks and generative models that analyze and react to live trading signals globally.

Why Infrastructure Matters for AI Stock Trading

In today’s trading environment, the speed of insight generation and trade execution is everything. AI systems now process over 1 million data points per second, drawing from diverse sources such as live market feeds, economic reports, social sentiment, and earnings calls.

AI-powered trading bots are engineered to:

- Respond to market events with latency as low as 0.01 seconds

- Run 24/7 across global markets and asset classes

- Handle real-time decision-making for stocks, ETFs, options, and crypto

By contrast, traditional human reaction time sits around 0.1 to 0.3 seconds, placing AI at a significant speed advantage. This low-latency edge allows platforms to detect anomalies, deploy trades, and rebalance portfolios before human traders can even register the change.

| Comparison Metric | AI Systems (2026) | Human Traders / Manual Systems |

|---|---|---|

| Reaction Time to Market Events | ~0.01 seconds | 0.1 – 0.3 seconds |

| Monitoring Capacity | 24/7, 10,000+ assets | Business hours, limited coverage |

| Data Points Processed Per Second | Over 1,000,000 | Thousands at most |

| Execution Reliability | Automated & Adaptive | Manual & Prone to Delay |

This infrastructure-fueled advantage is one of the key reasons why AI stock trading tools like Trade Ideas, Tickeron, AlgosOne, and QuantConnect dominate performance charts in 2026.

Asia-Pacific’s Role in the AI Trading Infrastructure Race

The Asia-Pacific region is not only emerging as a center for user adoption but also as a global leader in AI compute capacity. Countries like Vietnam, Singapore, and India are aggressively expanding their data center ecosystems to attract fintech platforms, hedge funds, and cloud-native AI startups. These developments are backed by favorable government policies, rising digital literacy, and increasing demand for smart financial products.

| Region | Infrastructure Focus | Strategic Advantage |

|---|---|---|

| Vietnam | Hyperscale Data Center Expansion | Emerging Southeast Asian fintech hub |

| Singapore | AI Cloud Clusters & Edge Compute | Regulatory clarity and global capital access |

| India | AI-Optimized Cloud Zones | Massive tech talent and growing retail base |

This infrastructure race is not just about storage or bandwidth—it’s about building the foundation for financial systems that learn, predict, and execute faster than ever before.

Conclusion

In 2026, the future of stock trading is being shaped as much by compute power and data center infrastructure as it is by the algorithms themselves. AI platforms rely on low-latency networks, hyperscale processing, and always-on compute availability to stay competitive in real-time markets.

As hyperscale projects continue to scale across Asia-Pacific, investors can expect even faster, smarter, and more adaptive trading tools to emerge—solidifying the region’s influence on the global AI trading revolution.

The Rise of Agentic AI in 2026: How Venture Capital Is Powering the Next Generation of AI Trading Tools

The evolution of AI tools for stock trading in 2026 is deeply connected to a powerful force behind the scenes—venture capital. A new wave of investment has accelerated the shift from basic automation to advanced agentic AI systems, which now form the core of leading stock trading platforms. These intelligent agents don’t just detect signals—they execute full investment strategies autonomously, manage risk, rebalance portfolios, and even optimize taxes without constant human input.

This shift in capability is not accidental. It is being driven by a sharp increase in global capital allocation toward AI infrastructure and intelligent agent systems.

Massive VC Growth Fuels Intelligent Trading Innovation

By the third quarter of 2025, global venture capital funding reached a record USD 97 billion, representing a 38% year-over-year increase. Out of that, an unprecedented USD 45 billion—nearly half—was invested directly into AI companies. This overwhelming concentration of capital reflects a deep investor belief in the long-term viability of AI-driven systems across industries, particularly in financial services.

| VC Activity Metric | Q3 2025 Value | Year-on-Year Growth |

|---|---|---|

| Total Global VC Funding | USD 97 Billion | +38% |

| AI Sector VC Funding | USD 45 Billion | ~46% of global total |

The “winner-takes-all” nature of the AI market is emerging clearly, with dominant players like OpenAI, Anthropic, and xAI capturing the bulk of mega-round investments.

Top AI VC Rounds Driving Agentic Infrastructure (Q3 2025)

| Company | Round Size (USD Billion) | Investment Focus |

|---|---|---|

| OpenAI | 40.00 | Foundation model infrastructure and APIs |

| Anthropic | 13.00 | Specialized large language model (LLM) tools |

| xAI (Elon Musk) | 5.30 | Real-time web-scale data integration |

| Mistral AI | 2.00 | Expansion of European AI infrastructure |

These funding rounds are critical because the core models built by these firms are being deployed directly into stock trading platforms like Trade Ideas, Danelfin, and AlgosOne, enabling new levels of decision-making power.

Agentic AI in 2026: From Tools to Self-Directed Trading Systems

The capabilities of AI trading platforms have expanded dramatically. In earlier generations, platforms focused mostly on pattern recognition—identifying simple technical signals and issuing alerts. Today, in 2026, the most advanced platforms operate as autonomous agents, capable of managing portfolios end-to-end with minimal human oversight.

| Functionality Type | Traditional AI Tools (2022–2024) | Agentic AI Tools (2025–2026) |

|---|---|---|

| Signal Recognition | Yes | Yes |

| Trade Execution | Partial | Fully Automated |

| Portfolio Management | Manual Input Needed | AI-Directed and Dynamic |

| Tax-Loss Harvesting | Not Available | Integrated |

| Cross-Asset Rebalancing | Manual | AI-Optimized in Real-Time |

| Strategy Adaptation | Predefined Rules | Self-Evolving with Market Feedback |

The integration of foundation models into these tools now allows them to parse earnings reports, interpret regulatory filings, and respond to global news—all in real time. This makes the AI tools smarter, faster, and significantly more autonomous.

Impact on AI Stock Trading Platforms

These developments have reshaped what traders expect from AI tools. In 2026, users no longer settle for tools that simply provide alerts. Instead, they are adopting platforms that function as AI co-managers—analyzing risk, adjusting holdings, and even simulating macroeconomic scenarios before making moves.

Some key platforms that now include agentic functionality:

| Platform Name | Agentic AI Features Included | Ideal User Profile |

|---|---|---|

| Trade Ideas | Self-updating strategy engine via Holly AI | Day traders and technical scalpers |

| Tickeron | Multi-timeframe AI bots with automated execution | Short-term swing traders |

| AlgosOne | Fully autonomous asset allocation and profit optimization | Passive investors and HNWIs |

| Danelfin | AI score-based autonomous portfolio selection | Quantitative value investors |

| Kavout | Custom strategy APIs for self-optimizing algos | Quantitative funds and hedge funds |

Each of these platforms has benefited—directly or indirectly—from the advances made possible by the VC-fueled boom in AI agent infrastructure.

Conclusion

In 2026, the AI stock trading space has entered the agentic era, marked by a shift from passive recommendation tools to self-directed, autonomous investment engines. This transformation is being driven not only by technical progress but also by billions in venture capital targeting the development of scalable, intelligent, and autonomous financial systems.

The AI trading platforms now lead a new generation of tools—ones that think, act, and adapt in ways that were impossible just a few years ago. With the line between human advisor and AI agent blurring rapidly, 2026 is proving to be a historic turning point in the evolution of trading intelligence.

AI Trading Performance vs Market Benchmarks in 2025–2026: How Top AI Tools Delivered Outsized Alpha

In 2026, investors and financial analysts are closely tracking the performance of AI-powered stock trading tools, especially in comparison to traditional market indices. The year 2025 delivered impressive returns across multiple asset classes, including major U.S. stock indices and commodities like gold and silver. However, some of the most compelling returns came from AI trading platforms, which leveraged speed, data depth, and predictive models to consistently outperform their benchmarks.

This performance gap has reinforced the case for integrating AI into modern investment strategies. From leveraged ETF trading to AI-enhanced stock scoring systems, many of the top AI tools showed strong alpha-generation capabilities throughout 2025 and into early 2026.

Comparing 2025 Asset Class Returns to AI Trading Platform Performance

To understand the comparative advantage of these platforms, it’s useful to review their results alongside broader financial benchmarks. In 2025, the S&P 500 Index posted a solid +17.88% return, while the Nasdaq 100 Index gained +21.24%. Precious metals such as gold and silver surged, benefiting from global inflation concerns and risk hedging, with silver alone gaining +145.88%.

Top AI platforms, however, often delivered returns that exceeded these levels—particularly in volatile sectors or high-frequency trading environments.

| Asset Class / AI Strategy | 2025 Total Return (%) | Win Rate / Accuracy (%) | Notes |

|---|---|---|---|

| S&P 500 Index | +17.88 | N/A | Benchmark for U.S. large-cap equities |

| Nasdaq 100 Index | +21.24 | N/A | Tech-heavy index with AI tailwinds |

| Gold (Commodity) | +64.33 | N/A | Safe-haven asset, benefited from inflation trends |

| Silver (Commodity) | +145.88 | N/A | High volatility, strong AI trading opportunity |

| Tickeron AI (Leveraged ETFs) | +159.00 | 90% | High-frequency strategies using AI on leveraged funds |

| Zen Ratings (A-Rated Stocks) | +32.52 | N/A | Long-term quant scores targeting high-quality equities |

| Danelfin (Best Scoring Stocks) | +48.01 | 60%+ | Probability-based AI scoring system |

| AlgosOne AI (Compound Return) | 50%–250% | 80% | Fully autonomous strategy using AI agents |

These returns underscore the strength of AI tools not just in stable markets, but also in volatile and fast-moving environments.

Key Drivers Behind AI Outperformance in 2025–2026

The superior performance of AI platforms in 2025 was primarily driven by two major macro- and technological tailwinds:

- AI Supercycle Momentum: According to projections from J.P. Morgan, the AI sector is expected to contribute 13% to 15% annual earnings growth for companies within the S&P 500 over the next two years. AI trading tools leveraged this trend by concentrating exposure in high-growth segments early.

- Real-Time Volatility Capture: AI trading models, particularly those using machine learning and autonomous agents, were uniquely positioned to take advantage of extreme swings in commodities like silver. These models can react in milliseconds, while human decision-making typically lags.

| Performance Factor | Human-Led Trading | AI-Powered Platforms |

|---|---|---|

| Reaction Time | 0.1 – 1.5 seconds | ~0.01 – 0.05 seconds |

| Ability to Process Market Events | Manual, limited scope | Simultaneous, data-driven |

| Volatility Response Speed | Slower | Instantaneous |

| Multi-Asset Signal Processing | Limited | Real-time and multi-dimensional |

| Portfolio Rebalancing Frequency | Monthly/Quarterly | Weekly or Intraday (automated) |

This computational edge allows AI systems to outperform in both bull markets and volatile corrections by maintaining agility and precision.

Implications for Traders and Institutional Investors in 2026

As we move deeper into 2026, the relevance of AI in trading is not just a matter of efficiency—it has become a performance necessity. Investors who integrate AI platforms into their strategies are now:

- Capturing Alpha More Consistently: Tools like Tickeron and AlgosOne deliver returns that consistently outpace standard benchmarks.

- Mitigating Risk More Effectively: Real-time analytics and automated hedging protect portfolios from drawdowns.

- Accessing Diverse Markets Seamlessly: From U.S. stocks to leveraged ETFs and precious metals, AI tools provide access and execution across multiple asset classes.

Conclusion

The data from 2025 clearly shows that AI stock trading platforms are not just assisting investors—they are outperforming traditional investment approaches. Whether through predictive analytics, autonomous execution, or data-driven scoring systems, tools like Danelfin, Zen Ratings, and AlgosOne offer traders a sharper edge in a market where speed, precision, and adaptability matter more than ever.

AI Stock Trading Tools in 2026: Security Protocols, Operational Risks, and How Platforms Protect User Capital

As AI tools for trading continue to outperform traditional strategies in 2026, they also bring new layers of operational risk—especially when it comes to data privacy, cybersecurity, algorithmic reliability, and platform-wide exposure during volatile market events. While the promise of high returns has attracted both retail and institutional investors, the risk landscape has become more complex, requiring stronger safeguards at every level of operation.

Leading platforms have responded with robust security frameworks and risk mitigation strategies to protect users, funds, and algorithmic infrastructure from technical failures and coordinated exploits.

Operational Security in AI-Powered Trading Platforms

The best AI tools in 2026 go beyond performance. They are now evaluated based on how well they manage security, regulatory compliance, and system continuity. Platforms such as AlgosOne, Trade Ideas, and Danelfin have developed internal controls and defensive mechanisms to ensure that automated systems can function safely—even under stress or attack.

| Platform Feature | Security Implementation Example | Purpose |

|---|---|---|

| Two-Factor Authentication | Used by AlgosOne | Adds login protection against unauthorized account access |

| End-to-End Encryption | Implemented in backend data flow | Prevents interception of trading signals and user data |

| Reserve Fund Coverage | AlgosOne offers client capital protection | Provides a financial buffer during rare execution errors |

| Real-Time Risk Monitoring | Used by platforms like Tickeron | Flags abnormal trade patterns and market exposure in real-time |

| Distributed Infrastructure | Employed by Danelfin and Kavout | Ensures redundancy and fault tolerance in case of outages |

These tools combine proactive and reactive measures to secure digital trading environments that operate at millisecond speed.

Global Compliance Standards for AI Trading Tools in 2026

AI trading platforms must also comply with diverse international regulatory frameworks, many of which now include AI-specific clauses. The table below outlines key security and compliance regulations relevant to AI stock trading systems operating globally.

| Regulation / Authority | Compliance Requirement | Target Region / Sector |

|---|---|---|

| SEC Regulation S-P | Written policies to safeguard user data and financial records | United States – Broker-dealers, advisors |

| FINRA Rule 4370 | Business continuity plans for technology-related disruptions | United States – Trading and investment firms |

| Vietnam AI Law | Mandatory audit and conformity assessment for high-risk AI systems | Vietnam – Financial AI platforms |

| GDPR | Consent-based data processing and regional data sovereignty | European Union – All digital platforms |

| ISO/IEC 27001 | Information security management system (ISMS) certification | Global – Applied to enterprise-grade tools |

To legally operate in fast-growing markets like Vietnam, global platforms such as Interactive Brokers, QuantConnect, and Equbot must meet specific conditions, including onshore data storage, model explainability, and incident reporting protocols.

Emerging Risk: Crowding of AI Signals and Slippage

One of the critical operational challenges observed in 2026 is signal crowding. This occurs when thousands of users on platforms like Trade Ideas or Tickeron receive the same AI-generated buy or sell signals simultaneously. As many traders execute identical trades at once, it results in market slippage, reducing the potential profit from each trade and occasionally increasing risk exposure.

| Risk Category | Description | Consequence for Traders |

|---|---|---|

| Signal Crowding | High-frequency AI alerts trigger large-volume trades simultaneously | Reduced gains, delayed fills, increased slippage |

| Latency Bottlenecks | System overload slows down execution pipelines | Lower win rate in fast-moving markets |

| Misclassification Risks | Improper AI labeling of volatile assets as “safe” | Increased risk during extreme market events |

This operational problem has led advanced users to adopt “Double Agent” AI strategies. These systems simultaneously monitor and execute both bullish and bearish trades, allowing for immediate repositioning based on price shifts, correlation breakdowns, or volatility spikes.

Example Matrix: Hedging with Dual-Signal AI Agents

| AI Strategy Type | Bullish Signal Response | Bearish Signal Response | Benefit |

|---|---|---|---|

| Single-Signal Model | Long entry only | N/A | High reward, high exposure |

| Double Agent System | Long and short entry logic | Hedge deployed simultaneously | Risk-balanced performance during volatility |

| Smart Reallocation | Paired sector rotation (e.g., tech vs energy) | Cross-asset shift (e.g., equity to gold) | Adaptive rebalancing |

By pairing multiple positions or using contrarian AI bots, traders gain a built-in safety net in fast-moving or overcrowded trade environments.

Conclusion

While AI stock trading tools in 2026 continue to deliver outstanding performance, success now depends equally on security infrastructure, operational transparency, and regulatory compliance. Platforms that invest in both risk mitigation and strategy diversification are positioning themselves as long-term leaders in the space.

For traders, this means choosing tools that not only deliver alpha—but also offer protection against unseen risks, system overloads, and AI-driven market inefficiencies.

System Requirements for Using AI Stock Trading Tools in 2026: What Retail Traders Need to Compete

In 2026, artificial intelligence has become a key driver of profitability in financial markets, and retail traders are increasingly using AI tools to stay competitive. However, the success of these tools depends not only on the intelligence of the software, but also on the performance of the user’s local or cloud-based infrastructure. Trading strategies that involve real-time data analysis, high-frequency execution, or 24/7 market scanning now demand more powerful and optimized hardware than in previous years.

AI trading platforms are evolving rapidly, but for many retail investors, gaining a performance edge means understanding and meeting the minimum system requirements needed to run these tools effectively.

Recommended Hardware and Network Setup for AI-Powered Trading

Modern AI trading tools often require substantial computational resources, especially when backtesting strategies, streaming live market data, or executing trades with millisecond-level precision. Below is a breakdown of the technical specifications that retail traders need to consider in 2026.

| Component | Minimum Specification | Recommended for Power Users |

|---|---|---|

| RAM | 8 GB | 16 GB or higher |

| CPU | Quad-core 2.8 GHz 64-bit | Multi-core 3.0+ GHz (Intel i7/AMD Ryzen 7+) |