Key Takeaways

- Discover the leading cryptocurrency exchange software of 2025 designed to deliver secure, scalable, and high-performance trading experiences.

- Compare innovative platforms that offer advanced features, low fees, and global accessibility for both beginners and professional traders.

- Learn how top crypto exchange solutions are shaping the future of digital asset trading with enhanced security and cutting-edge technology.

The cryptocurrency industry continues to expand at an unprecedented pace, and as we enter 2025, the demand for reliable, secure, and efficient cryptocurrency exchange software has never been greater. With millions of individuals and businesses around the world now engaging in digital asset trading, choosing the right exchange platform has become a critical factor for both beginners and experienced investors alike. Beyond offering a simple interface to buy and sell cryptocurrencies, today’s exchange software must provide robust features such as advanced trading tools, AI-driven analytics, multi-layered security, low transaction costs, and seamless scalability. These factors not only influence user experience but also play a key role in ensuring long-term trading success in the increasingly competitive crypto ecosystem.

In recent years, the market for cryptocurrency exchanges has undergone significant transformation. From centralized platforms catering to high-frequency traders to decentralized exchanges (DEXs) offering enhanced autonomy and transparency, the range of options has diversified dramatically. 2025 introduces a new wave of innovation, with platforms integrating AI-powered fraud detection, blockchain interoperability, automated liquidity management, and compliance solutions to align with evolving global regulations. This evolution reflects a broader trend of exchanges moving beyond basic transactional platforms to become comprehensive financial ecosystems supporting diverse assets, derivatives, staking, and even NFT trading.

For businesses, entrepreneurs, and institutional investors, exchange software is no longer just a trading portal—it is an essential infrastructure that supports scalability, user acquisition, and global expansion. White-label crypto exchange software and customizable platforms are now widely adopted by enterprises aiming to launch their own branded exchanges, while retail traders are increasingly prioritizing platforms that balance user-friendly interfaces with powerful analytical tools. The growth of mobile-first applications also means traders demand accessibility on the go, coupled with lightning-fast transaction processing and 24/7 liquidity.

However, with hundreds of options available, identifying the best cryptocurrency exchange software can be overwhelming. Each platform offers unique strengths, whether in terms of liquidity depth, compliance frameworks, security protocols, fee structures, or global reach. The choice often depends on individual goals—some traders prioritize high-speed execution and charting tools for day trading, while others may prefer platforms offering enhanced security, cold wallet integrations, or decentralized features that minimize reliance on intermediaries.

This blog explores the top 10 best cryptocurrency exchange software to try in 2025, carefully curated to highlight platforms that combine security, innovation, and user experience. Whether you are a first-time investor seeking simplicity or a seasoned trader looking for advanced functionalities, this guide provides insights into the most trusted and feature-rich platforms dominating the market. By examining their core features, benefits, and differentiators, you will be better equipped to make an informed choice in selecting an exchange software that aligns with your trading needs in the dynamic digital asset landscape of 2025.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of The Top 10 Best Cryptocurrency Exchange Software To Try In 2025.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 Best Cryptocurrency Exchange Software To Try In 2025

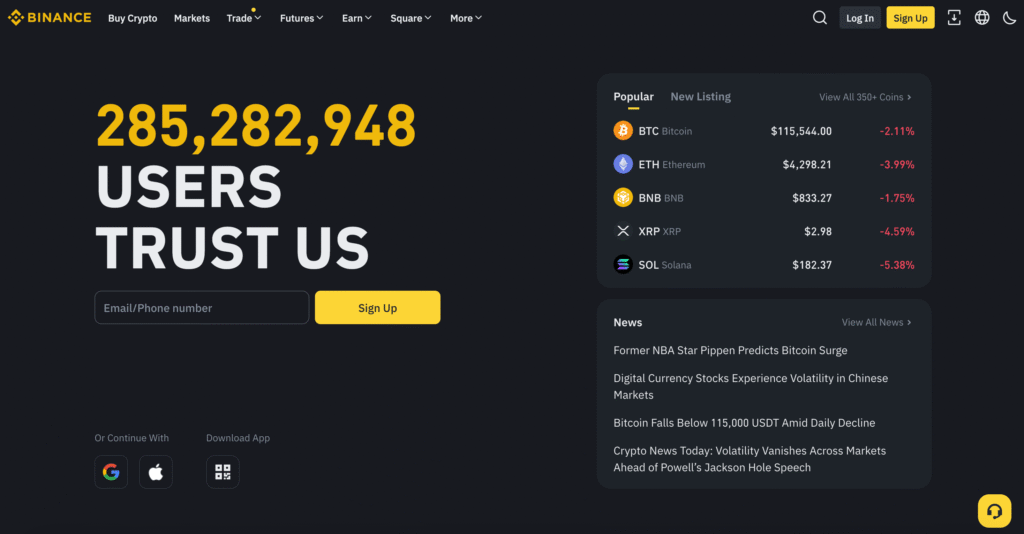

1. Binance

Binance – A Global Leader in Cryptocurrency Exchange Software

• Binance has consistently positioned itself as the most dominant force in the global cryptocurrency exchange landscape, earning its place among the Top 10 Best Cryptocurrency Exchange Software to Try in 2025. Its unmatched scale, diverse service portfolio, and advanced technological infrastructure make it a preferred choice for both institutional traders and retail investors worldwide.

Market Leadership and Trading Dominance

• As of early 2025, Binance remains the world’s largest cryptocurrency exchange by aggregated trading volume and registered user count.

• It commanded approximately 38% of the global spot trading volume in April 2025, despite a temporary dip in activity.

• In the first quarter of 2025, Binance processed nearly $2.0 trillion in transactions out of $5.4 trillion traded across the top 10 global exchanges.

• The platform consistently records an average daily trading volume exceeding $14 billion, with peak 24-hour volumes surpassing $23 billion.

Expansive User Base and Global Reach

• Binance has built a massive user ecosystem, reporting over 250 million registered users globally by early 2025.

• This extensive user base reflects both its wide adoption across continents and its ability to appeal to traders of varying expertise.

• The platform supports over 600 cryptocurrencies and trading pairs, offering investors one of the broadest selections in the industry.

Fee Structure and Accessibility

• Binance offers a highly competitive fee model, with trading fees beginning at just 0.10%.

• This cost efficiency is a major factor driving its popularity among high-frequency traders and long-term investors.

• Its user-friendly mobile app ensures that traders can access markets anytime, further enhancing convenience.

Advanced Ecosystem and Product Offerings

• Beyond traditional spot trading, Binance has developed a robust ecosystem designed for different levels of trading sophistication.

- Futures and options trading with high leverage.

- Staking and yield farming to generate passive income from digital assets.

- Integration with its proprietary BNB Chain, powering decentralized finance (DeFi) solutions and blockchain-based applications.

• Its trading interface is built for speed and reliability, catering to professionals while still providing simplified options for beginners.

Security and Risk Management

• Binance is widely recognized for its focus on safeguarding user assets.

- Employs advanced risk-control technologies.

- Maintains an insurance fund known as SAFU (Secure Asset Fund for Users) to protect against extreme market conditions or breaches.

• Continuous investment in cybersecurity solidifies its reputation as one of the safest platforms globally.

Regulatory Environment and Adaptation

• Like most global exchanges, Binance faces ongoing regulatory challenges.

• In the United States, Binance operates Binance.US, a separate entity tailored to local compliance standards, offering commission-free Bitcoin trading on select pairs.

• Despite facing scrutiny, including a major legal settlement in 2023, Binance continues to demonstrate adaptability by aligning with jurisdiction-specific requirements.

Strengths and Challenges Matrix

| Factors | Strengths | Challenges |

|---|---|---|

| Market Share | Largest exchange with 38% global spot trading share | Decline in April 2025 trading volume (18%) |

| User Base | Over 250M registered users worldwide | Varying numbers between active vs. total users |

| Asset Availability | 600+ cryptocurrencies and trading pairs | Regulatory restrictions in some regions |

| Fees | Low fees starting at 0.10% | Advanced tools may overwhelm beginners |

| Security | SAFU insurance fund and advanced risk controls | Ongoing compliance obligations |

| Innovation & Ecosystem | Futures, staking, BNB Chain, DeFi projects | Complex interface for inexperienced traders |

Why Binance Is Among the Best in 2025

• Binance stands out not merely for its size but for its continuous innovation, broad asset offerings, and cost-efficient trading structure.

• Its ability to integrate traditional and decentralized finance solutions places it ahead of competitors.

• By combining global reach with cutting-edge technology and strong security measures, Binance remains a benchmark for excellence in cryptocurrency exchange software.

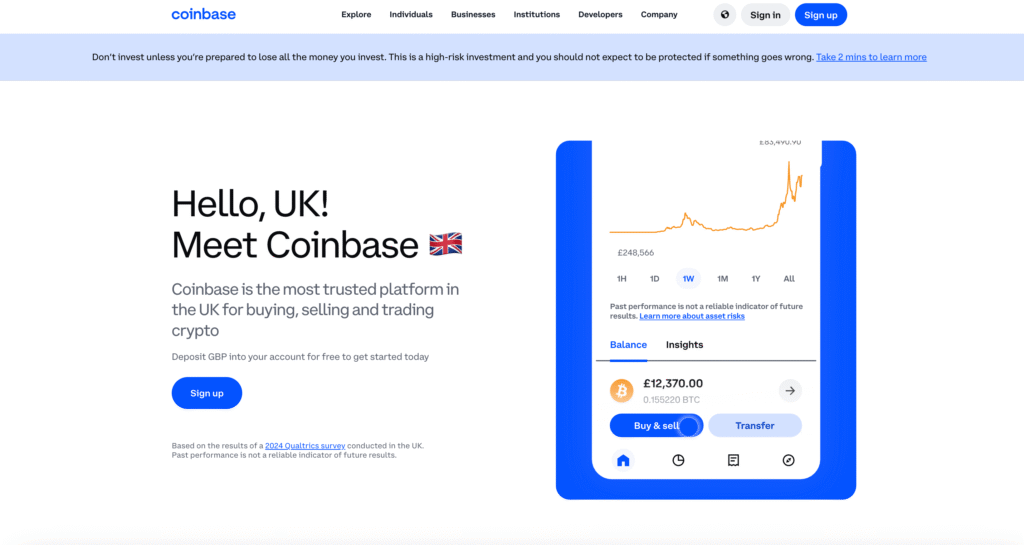

2. Coinbase

Coinbase – A Trusted and User-Centric Cryptocurrency Exchange

• Coinbase has established itself as one of the most recognizable and reliable cryptocurrency exchange platforms globally, ranking among the Top 10 Best Cryptocurrency Exchange Software to Try in 2025. Its strong reputation stems from its emphasis on regulatory compliance, high-level security, and user-first design, making it a preferred choice for beginners while still accommodating professional traders.

Market Presence and Trading Influence

• As of May 2025, Coinbase processes approximately $226 billion in quarterly trading volume, reflecting its influence in the global digital asset economy.

• Holding a notable market share of nearly 8% in 2023, Coinbase has steadily maintained its role as one of the largest U.S.-based cryptocurrency exchanges.

• The platform’s consistent performance is bolstered by a verified user base exceeding 98 million, highlighting its credibility and adoption at a global scale.

Wide Cryptocurrency Selection and Accessibility

• Coinbase supports over 200 cryptocurrencies, offering users access to a well-curated yet diverse portfolio of digital assets.

• The platform’s straightforward design lowers the barrier to entry, making it highly attractive to newcomers exploring crypto markets.

• Its mobile app, which frequently ranks among the most downloaded in the United States, provides seamless access to trading, investing, and portfolio management on the go.

Fee Model and Membership Advantages

• Coinbase applies a tiered fee structure with maker and taker fees ranging between 0.05% and 0.60%, depending on trading activity.

• Frequent traders benefit from Coinbase One, a subscription model that eliminates trading fees entirely, significantly reducing costs for high-volume participants.

• While fees are comparatively higher than some competitors, the transparency and simplicity of Coinbase’s pricing model contribute to user trust.

Security and Compliance Strengths

• Coinbase is renowned for its industry-leading security protocols and compliance with strict global financial regulations.

- No record of a major cryptocurrency hack, enhancing its credibility.

- Fiat balances for U.S. users are FDIC-insured up to $250,000, adding a traditional layer of trust.

- Employs advanced encryption and cold storage measures to protect digital assets.

• Its consistent adherence to regulatory frameworks positions it as one of the most secure and legally compliant exchanges worldwide.

Features for Beginners and Advanced Traders

• Beginner-friendly:

- Intuitive interface with integrated wallet services.

- Educational resources and tutorials tailored for newcomers.

- The “Learn-to-Earn” initiative rewards users with cryptocurrency while teaching them about new tokens, fostering both learning and engagement.

• Advanced traders: - Access to Coinbase Pro, which provides charting tools, detailed analytics, and lower trading fees.

- Sophisticated order types and liquidity options suitable for professional trading strategies.

Strengths and Challenges Matrix

| Factors | Strengths | Challenges |

|---|---|---|

| Market Role | $226B quarterly trading volume, nearly 8% market share | Faces competition from lower-fee platforms |

| User Base | Over 98M verified users worldwide | Customer service may be slower in peak demand |

| Asset Selection | 200+ cryptocurrencies with curated quality | Not as extensive as Binance or other exchanges |

| Security & Compliance | FDIC insurance, no major hacks, strong global regulation compliance | Compliance requirements may limit asset options |

| Fee Model | Tiered fees, Coinbase One removes fees for frequent traders | Higher baseline fees compared to some rivals |

| Accessibility | Top-rated mobile app, intuitive platform, wallet integration | Advanced tools may require transition to Pro |

| Education & Engagement | Learn-to-Earn program and comprehensive beginner tutorials | Rewards mainly appeal to entry-level users |

Why Coinbase Is Among the Best in 2025

• Coinbase continues to rank among the best cryptocurrency exchange platforms due to its balance between accessibility for newcomers and robust functionality for professionals.

• Its uncompromising focus on regulatory compliance, insurance-backed security, and transparent operations makes it especially attractive to risk-averse investors.

• The Learn-to-Earn initiative and strong educational resources further distinguish Coinbase as not just a trading platform but also a knowledge hub for digital assets.

• For traders who prioritize trust, safety, and user experience over ultra-low fees, Coinbase remains one of the most strategic platforms to consider in 2025.

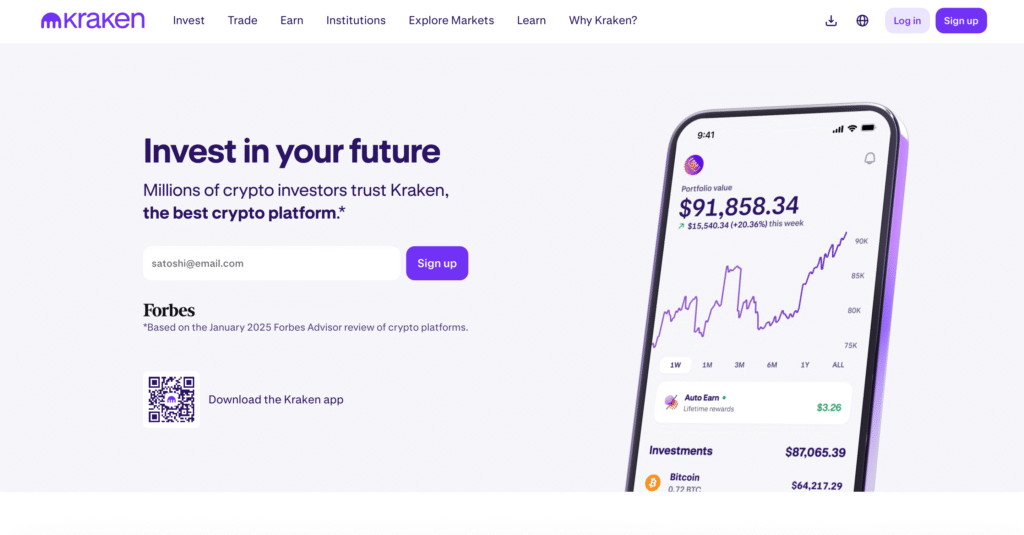

3. Kraken

Kraken – A Secure and Low-Fee Cryptocurrency Exchange for 2025

• Kraken has long maintained its reputation as one of the most secure, transparent, and cost-efficient cryptocurrency exchanges in the global market, earning its place among the Top 10 Best Cryptocurrency Exchange Software to Try in 2025. With a combination of advanced features, strong regulatory compliance, and a user-centric trading environment, Kraken appeals to both beginners and seasoned professionals.

Market Position and Trading Strength

• Kraken held a market share of 4.54% in 2023, solidifying its role as a significant player in the competitive exchange ecosystem.

• By the first quarter of 2025, the platform reported a total trading volume of $208 billion and 3.9 million funded accounts.

• Its average daily spot trading volume has been reported at around $283 million, demonstrating active participation and liquidity across markets.

• Kraken’s steady growth trajectory highlights its ability to remain competitive despite market fluctuations.

Wide Asset Availability and Global Reach

• Kraken provides access to over 350 cryptocurrencies, ensuring users can diversify across a broad spectrum of digital assets.

• This extensive asset selection caters to retail traders exploring altcoins, as well as institutional investors seeking liquidity in major tokens.

• The platform serves over 6 million users worldwide, a testament to its reliability and growing global adoption.

Fee Structure and Cost Efficiency

• Kraken’s maker-taker fee model is highly competitive, ranging from 0% to 0.40% depending on trading volume and specific markets.

• It is widely recognized as one of the top exchanges for low spot trading fees, making it particularly attractive for frequent and high-volume traders.

• The Kraken Pro platform further enhances cost efficiency with reduced fees, supporting active traders through transparent pricing.

Advanced Trading Tools and Features

• Kraken caters to both beginner and professional traders by offering a range of trading functionalities:

- Margin trading with leverage options for sophisticated strategies.

- Futures contracts that allow traders to speculate on long-term market trends.

- Highly customizable dashboards on Kraken Pro with responsive market data widgets.

• Its ability to provide derivatives and margin trading within U.S. regulatory boundaries is a distinctive feature, as few exchanges offer such opportunities domestically.

Security Infrastructure and Trustworthiness

• Kraken is regarded as one of the most secure exchanges globally due to its uncompromising approach to asset protection.

- Approximately 95% of client assets are held in offline, air-gapped cold storage.

- Dedicated internal security labs and bug bounty programs strengthen defense against vulnerabilities.

- The platform is transparent about its practices, reinforcing user confidence in its reliability.

• These security measures have consistently placed Kraken at the top for investor trust and regulatory alignment.

User Experience and Accessibility

• For beginners, Kraken offers an intuitive and straightforward interface designed to ease the entry into cryptocurrency trading.

• Kraken Pro appeals to advanced traders with advanced analytics, multiple order types, and customizable trading environments.

• While customer support is generally dependable, some users have reported slower response times during high volatility periods.

• The complex nature of the Pro platform may present a learning curve, but it ultimately delivers extensive functionality for those who adapt.

Strengths and Challenges Matrix

| Factors | Strengths | Challenges |

|---|---|---|

| Market Role | $208B quarterly trading volume, 4.54% market share | Smaller market share compared to Binance/Coinbase |

| User Base | 6M+ global users with 3.9M funded accounts | Customer support delays during high activity |

| Asset Availability | 350+ cryptocurrencies supported | Interface complexity for complete beginners |

| Fee Model | Maker-taker fees as low as 0%, highly competitive structure | Fees not always the lowest for casual traders |

| Security & Compliance | 95% assets in cold storage, bug bounty programs, dedicated security labs | Security-first approach can slow new feature rollouts |

| Advanced Features | Margin trading, derivatives, futures, customizable dashboards | Complexity may discourage novice traders |

Why Kraken Is Among the Best in 2025

• Kraken secures its place among the best cryptocurrency exchange platforms due to its low-cost trading environment, wide asset selection, and unparalleled security infrastructure.

• Its dual appeal—simplified trading for beginners and advanced tools for professionals—makes it one of the most versatile exchanges in 2025.

• By balancing innovation with security and regulatory alignment, Kraken demonstrates resilience and dependability in a rapidly evolving crypto ecosystem.

• For traders who prioritize transparency, asset safety, and competitive fees, Kraken remains one of the most strategic platforms to consider in the coming year.

4. Gemini

Gemini – A Security-First Cryptocurrency Exchange for 2025

• Gemini has firmly positioned itself as one of the most security-focused and regulation-compliant exchanges in the global cryptocurrency market, making it a strong contender among the Top 10 Best Cryptocurrency Exchange Software to Try in 2025. With its robust infrastructure, advanced compliance framework, and innovative offerings, Gemini appeals to both casual investors and highly experienced traders seeking safety, transparency, and sophistication.

Market Presence and Trading Performance

• Gemini has attracted more than 13 million active users worldwide, reflecting its growing reputation as a trustworthy and reliable platform.

• The exchange supports a curated portfolio of 73 cryptocurrencies, emphasizing quality over quantity in asset selection.

• Over $200 billion in cumulative trading volume has been facilitated on the platform, showcasing its liquidity and long-term stability in the market.

• In January 2025, Gemini resolved a regulatory case with the U.S. Commodity Futures Trading Commission (CFTC), highlighting its ongoing ability to navigate complex compliance challenges while maintaining operations and user trust.

Fee Model and Cost Structure

• Gemini adopts a tiered maker-taker fee structure, ranging from 0% to 0.40% depending on trading volume.

• This transparent approach allows traders to anticipate costs, appealing to both entry-level users and professional traders managing larger volumes.

• Its ActiveTrader platform further optimizes fee efficiency for high-volume participants, reinforcing its value proposition.

Security and Compliance Excellence

• Gemini has built its reputation primarily on being one of the most security-conscious exchanges in the industry.

- Certified as the world’s first SOC 1 Type 2 and SOC 2 Type 2 exchange and custodian.

- Majority of customer assets stored in offline cold storage with multi-layered safeguards.

- Insurance protection for digital assets held on the platform, including crypto-specific coverage.

- FDIC insurance for uninvested cash balances, bridging traditional finance trust mechanisms with digital asset management.

• Additional security measures allow users to employ external hardware authentication devices such as Yubikey for enhanced protection.

• This uncompromising emphasis on asset safety makes Gemini a leading choice for risk-conscious investors.

User Experience and Advanced Features

• Gemini’s sleek mobile application is consistently praised for its intuitive design, allowing users to trade, monitor, and manage holdings with ease.

• The ActiveTrader platform delivers advanced charting tools, multiple order types, and high-speed execution tailored for professional and institutional traders.

• Gemini Earn enables users to generate passive income by earning interest on their cryptocurrency holdings, adding long-term investment utility to the exchange.

• The platform’s balance between beginner-friendly navigation and professional-grade trading tools widens its appeal to diverse segments of the market.

Strengths and Challenges Matrix

| Factors | Strengths | Challenges |

|---|---|---|

| Market Role | 13M+ users, $200B+ trading volume | Smaller cryptocurrency selection (73 assets) |

| Security & Compliance | SOC 1 & SOC 2 certified, insured assets, FDIC protection, cold storage | Past regulatory settlement with CFTC |

| Fee Model | Transparent maker/taker structure, 0%–0.40% fees | Fees not always the lowest compared to rivals |

| User Experience | Sleek mobile app, user-friendly interface, Gemini Earn program | Limited number of supported tokens vs. Binance |

| Advanced Trading Tools | ActiveTrader platform with advanced features and professional dashboards | May appear complex for inexperienced users |

| Trust & Transparency | Strong compliance culture, insurance-backed protection | Expansion slower compared to larger competitors |

Why Gemini Is Among the Best in 2025

• Gemini distinguishes itself through its security-first approach, setting global benchmarks for compliance and investor protection.

• Its focus on insured assets, regulatory transparency, and independent certifications makes it one of the most trusted platforms for both institutional and retail investors.

• The combination of its easy-to-use mobile app, advanced ActiveTrader platform, and innovative programs like Gemini Earn further enhance its relevance in 2025.

• For traders who value safety, compliance, and professional-grade tools, Gemini remains one of the most compelling cryptocurrency exchanges to consider in the year ahead.

5. Crypto.com

Crypto.com – A Comprehensive Mobile-First Cryptocurrency Exchange for 2025

Crypto.com has emerged as one of the most versatile and globally recognized cryptocurrency exchanges, securing its position among the Top 10 Best Cryptocurrency Exchange Software to Try in 2025. With its extensive ecosystem, mobile-first approach, and strong security framework, the platform appeals to a wide spectrum of users ranging from casual Bitcoin traders to institutional investors.

Market Reach and User Growth

• As of mid-2024, Crypto.com reported a user base exceeding 100 million globally, reflecting its rapid expansion and adoption.

• In 2023, the platform commanded a 0.79% market share, which, though modest compared to some rivals, highlights its significant presence in a highly competitive landscape.

• The exchange supports trading in over 300 cryptocurrencies, offering one of the most diverse selections of digital assets available on a regulated platform.

• In 2025, Crypto.com strategically expanded its services to institutional and advanced traders in the United States, underscoring its ambition to dominate both retail and professional markets.

Fee Model and Trading Costs

• Crypto.com’s fee structure is highly competitive, appealing to both new and high-volume traders.

- Maker/taker fees are capped at a maximum of 0.0750%.

- Discounts apply for higher 30-day trading volumes or for users who stake CRO tokens, the platform’s native asset.

• Its transparent cost model ensures affordability, positioning the platform as one of the most cost-efficient exchanges for frequent traders.

Integrated Ecosystem Beyond Trading

• Crypto.com distinguishes itself by offering an expansive ecosystem that extends far beyond conventional crypto trading.

- Crypto.com DeFi Wallet: Enables users to retain full custody of their digital assets while engaging in decentralized finance applications.

- NFT Marketplace: Provides access to premium digital collectibles and tokenized assets.

- Crypto.com Visa Card: Rewards users with cashback in cryptocurrency for everyday purchases, bridging digital finance with real-world spending.

- Earn Program: Allows users to earn up to 14% APY on selected assets, adding an investment dimension to trading activities.

• This ecosystem enhances the platform’s utility, making it more than just an exchange, but a multi-functional digital financial hub.

Security and Compliance Framework

• Security remains a central pillar of Crypto.com’s reputation.

- Multi-factor authentication (MFA) integrating biometrics, OTP, SMS, and email verification.

- Comprehensive compliance screening of deposits and transactions to mitigate fraudulent or suspicious activity.

- A dedicated monitoring team that ensures real-time security oversight across all user accounts and activities.

• The platform is particularly recognized for its security infrastructure tailored for Bitcoin trading, one of its strongest user bases.

• This emphasis on safety has positioned Crypto.com as a trusted platform for users seeking both accessibility and protection.

User Experience and Accessibility

• Crypto.com is often hailed as the best exchange for mobile app users, owing to its sleek, intuitive, and powerful mobile interface.

• The mobile application enables seamless trading, portfolio tracking, staking, and payments integration.

• By focusing on mobile-first design, the platform has successfully tapped into the global trend of smartphone-based financial engagement.

• Its focus on Bitcoin trading further strengthens its appeal, especially among new traders entering the crypto space.

Strengths and Challenges Matrix

| Factors | Strengths | Challenges |

|---|---|---|

| Market Reach | 100M+ global users, extensive presence in retail and institutional markets | Market share smaller compared to Coinbase/Binance |

| Asset Availability | 300+ cryptocurrencies, wide token diversity | May overwhelm beginners with asset variety |

| Fees & Trading Costs | Low capped fees at 0.0750%, CRO-based discounts | Requires CRO staking for optimal discounts |

| Ecosystem Expansion | DeFi wallet, NFT marketplace, Visa card, Earn program (up to 14% APY) | Earn rates may fluctuate depending on asset demand |

| Security & Compliance | Multi-factor authentication, transaction monitoring, compliance checks | Past incidents have raised scrutiny on exchanges’ safeguards |

| Mobile User Experience | Industry-leading mobile app, seamless user interface | Limited desktop functionalities compared to some rivals |

| Institutional Growth | Expansion into U.S. institutional trading in 2025 | Strong competition from established institutional platforms |

Why Crypto.com Is Among the Best in 2025

• Crypto.com offers one of the most complete ecosystems in the cryptocurrency industry, catering to trading, earning, spending, and decentralized finance.

• Its world-class mobile app experience makes it especially suitable for the growing demographic of mobile-first investors.

• With competitive fees, strong Bitcoin trading infrastructure, and the addition of institutional services, it bridges the needs of both casual and professional users.

• The integration of security, compliance, and real-world financial products such as the Visa card sets it apart as one of the most innovative and future-ready exchanges in 2025.

6. Bitmart

Bitmart – The Leading Altcoin Exchange Platform for 2025

Bitmart has established itself as one of the most dynamic and versatile cryptocurrency exchanges in the global digital asset industry. With its extraordinary range of cryptocurrencies, robust trading infrastructure, and advanced features, it continues to attract traders seeking diverse opportunities in 2025. Its strong market activity, coupled with innovative tools such as copy trading and educational resources, positions Bitmart firmly among the Top 10 Best Cryptocurrency Exchange Software to Try in 2025.

Market Reach and Trading Activity

• Bitmart commands a global user base of over 9 million, reflecting its expanding adoption across international markets.

• The platform averages between $500 million and $1 billion in daily trading volumes, establishing itself as a major player in liquidity and market activity.

• In 2024, Bitmart’s spot trading volume surpassed $40 billion, while its futures market achieved an impressive $2.96 trillion in trading volume, underscoring its capacity to handle both retail and institutional trading demand.

• With one of the largest altcoin selections in the industry, Bitmart appeals strongly to traders searching for early-stage digital assets and niche cryptocurrencies.

Fee Structure and Affordability

• Maker fees range from 0.04% to 0.6%, while taker fees range from 0.045% to 0.6%, depending on trading volume and class tier.

• This tiered fee model ensures affordability for entry-level traders while rewarding high-volume participants with reduced costs.

• When compared to competitors, Bitmart’s pricing framework remains highly competitive, making it an attractive option for cost-conscious traders and frequent market participants.

Key Features and Functionalities

• Extensive Cryptocurrency Offering: Access to over 1,700 cryptocurrencies, making it the leading exchange for altcoin diversity.

• Social Trading and Copy Trading: Enables users to replicate strategies of successful traders, enhancing participation for beginners.

• Educational Support: BitMart Academy equips users with tutorials, guides, and insights, fostering informed decision-making.

• Margin and Futures Trading:

- Margin trading available with leverage up to 5x.

- Futures trading supports leverage up to 100x, appealing to advanced traders pursuing high-risk, high-reward strategies.

• User-Friendly Interface: Designed to accommodate both novices and experienced investors, offering simplicity without compromising on advanced tools.

Security and Risk Management

• Bitmart employs a comprehensive security framework designed to safeguard user assets and data.

- Hybrid hot and cold wallet storage to balance liquidity and safety.

- Multi-signature authentication for transactions.

- Advanced risk control systems for real-time threat monitoring.

• While the exchange suffered a security breach in December 2021, corrective measures and enhanced protocols have since been implemented, reinforcing trust and resilience.

• Despite its global reach, certain services remain restricted for U.S.-based traders due to regulatory limitations.

Competitive Positioning Matrix

| Category | Bitmart Strengths | Considerations / Limitations |

|---|---|---|

| Market Reach | 9M+ users, global expansion, high daily trading volumes | U.S. users face regulatory restrictions |

| Asset Diversity | 1,700+ cryptocurrencies, unmatched altcoin selection | Wide choice may confuse entry-level investors |

| Fees | Competitive, volume-based maker/taker structure | Fees higher at lowest tiers compared to some rivals |

| Features | Copy trading, BitMart Academy, futures (100x leverage), margin (5x) | High leverage trading increases risk exposure |

| Security | Hybrid wallet system, multi-signature, advanced risk controls | Past 2021 breach raised concerns, though improved |

| User Experience | Simple yet advanced interface suitable for all levels | Limited U.S. accessibility impacts inclusivity |

Why Bitmart Is Among the Best in 2025

• Its extraordinary catalog of more than 1,700 cryptocurrencies makes it the premier destination for altcoin enthusiasts.

• Bitmart successfully blends affordability, educational support, and innovative features such as copy trading, making it accessible for both novices and professionals.

• With competitive fees and a wide range of leverage options, it caters to diverse risk appetites.

• The platform’s continuous improvements in security and its focus on global growth solidify its position as a forward-looking exchange.

• For traders in 2025, Bitmart stands out as a powerful ecosystem that merges education, accessibility, and advanced financial tools.

7. KuCoin

KuCoin – A Leading Global Cryptocurrency Exchange Platform in 2025

● Overview and Market Position

- KuCoin has firmly established itself as one of the most versatile and innovative cryptocurrency exchange platforms in 2025, gaining recognition for its accessibility, wide asset coverage, and trader-friendly features.

- It is particularly known for accommodating both novice investors seeking simplicity and experienced traders requiring advanced tools, making it one of the most inclusive platforms in the crypto exchange ecosystem.

- With an ever-expanding user base across multiple global regions, KuCoin has become a go-to choice for individuals and institutions looking to diversify their digital asset portfolios.

● Cryptocurrency Selection and Trading Diversity

- KuCoin distinguishes itself by offering access to more than 750 different cryptocurrencies, a range that surpasses many competitors in the market.

- This extensive selection allows traders to explore not only mainstream assets like Bitcoin, Ethereum, and Litecoin but also a wide spectrum of emerging altcoins and DeFi tokens.

- By providing early access to niche and innovative blockchain projects, KuCoin serves as a hub for investors aiming to capture growth opportunities beyond the established crypto giants.

● Cost-Efficient Fee Structure

- KuCoin maintains one of the most competitive fee models in the cryptocurrency industry.

- Trading fees start as low as 0.10%, making it highly attractive for high-volume traders and long-term investors who prioritize cost efficiency.

- The platform further incentivizes participation by offering discounts and rewards through its native KuCoin Token (KCS), providing users with additional ways to reduce trading expenses.

● Advanced Features and Tools for Professional Traders

- KuCoin integrates a wide range of advanced trading features including spot trading, margin trading, futures contracts, and peer-to-peer (P2P) marketplaces.

- The platform also supports staking, lending, and passive income opportunities, allowing users to maximize returns while holding assets.

- For experienced traders, KuCoin offers sophisticated charting tools, API connectivity for algorithmic trading, and liquidity mechanisms designed to minimize slippage.

● Accessibility and Global Reach

- KuCoin’s platform has been designed to accommodate users worldwide, offering multi-language support, mobile applications, and an intuitive interface for beginners.

- However, it is important to note that KuCoin restricts access for residents of the United States due to regulatory considerations.

- Despite this limitation, KuCoin continues to thrive across Asia, Europe, and emerging markets, consolidating its role as a global powerhouse in digital asset trading.

● Why KuCoin is One of the Top 10 Best Cryptocurrency Exchange Software in 2025

- Exceptional variety of cryptocurrencies, enabling investors to explore diverse opportunities.

- Competitive fee structure that appeals to both casual and professional traders.

- A balance between user-friendly design and advanced trading capabilities.

- Continuous innovation through DeFi integrations, token listings, and passive income options.

- Strategic global presence, making it a strong competitor among leading crypto exchange platforms.

Comparison Matrix – KuCoin vs Other Leading Exchanges in 2025

| Feature | KuCoin | Exchange A | Exchange B | Exchange C |

|---|---|---|---|---|

| Number of Cryptocurrencies | 750+ | 400+ | 500+ | 300+ |

| Trading Fees | From 0.10% | From 0.20% | From 0.15% | From 0.25% |

| Beginner-Friendly Interface | Yes | Yes | Moderate | Limited |

| Advanced Trading Tools | Spot, Margin, Futures, P2P | Spot, Margin | Spot, Futures | Limited Options |

| Staking & Passive Income | Yes | Yes | Limited | No |

| Global Accessibility | Asia, Europe, Emerging Markets | North America, Europe | Europe, Asia | Limited Reach |

| US Availability | Not Available | Available | Available | Available |

8. Bybit

Bybit – A Leading Player in Cryptocurrency Exchange Software 2025

- Bybit has established itself as one of the most advanced and versatile cryptocurrency exchange platforms, offering a wide range of services that cater to both novice and professional traders. Its reputation is built on reliability, innovation, and the ability to deliver cutting-edge features that align with the evolving demands of the global digital asset market.

Key Features and Offerings

- Spot and Derivatives Trading

- Bybit provides robust access to spot trading markets and a sophisticated derivatives platform, giving traders exposure to perpetual contracts, futures, and leveraged trading.

- These options enable users to diversify strategies, manage risks effectively, and capitalize on market volatility with precision tools.

- Crypto Mining and Staking Products

- Bybit extends beyond standard exchange services by offering mining opportunities and product staking options.

- These features allow users to generate passive income, optimize crypto asset utilization, and take advantage of decentralized finance (DeFi) trends.

- Advanced Trading Infrastructure

- Equipped with a high-performance matching engine capable of handling massive trading volumes per second, Bybit ensures minimal latency and seamless execution.

- This reliability positions it as a preferred platform for institutional investors and high-frequency traders.

Market Standing and Performance Insights

- Market Share Analysis

- Bybit accounted for 2.81% of the global cryptocurrency exchange market in 2023, showcasing its role as a strong competitor among leading exchanges.

- While the exchange experienced a notable decline in trading volume in March 2025, this reflected broader industry adjustments rather than a weakening of Bybit’s core value proposition.

- Global Reach

- Bybit operates in multiple regions worldwide, making it accessible to a diverse user base and enabling traders to participate in global liquidity pools.

- Its multi-language support and tailored services highlight its commitment to inclusivity and accessibility.

Why Bybit Stands Out in 2025

- Despite fluctuations in trading activity, Bybit remains one of the Top 10 Best Cryptocurrency Exchange Software in 2025 due to the following strengths:

- Comprehensive ecosystem of services beyond trading, including staking and mining.

- Advanced risk management tools and high liquidity, which are essential for professional trading environments.

- Continuous innovation and the integration of user-friendly interfaces that attract both retail traders and institutional investors.

- Strong focus on security protocols, ensuring protection of digital assets against cyber threats.

Comparative Snapshot of Bybit in the Cryptocurrency Exchange Market

| Feature Category | Bybit Strengths | Industry Benchmark 2025 |

|---|---|---|

| Spot & Derivatives Trading | Wide range of contracts with advanced leverage | Increasing demand for diversified assets |

| Market Share (2023) | 2.81% | Top exchanges range between 2% – 6% |

| Additional Services | Mining and staking products | Limited in many exchanges |

| Security | Strong multi-layer protection protocols | Essential for user trust |

| Trading Volume Trend 2025 | Declined in March (industry-wide adjustment) | Majority of exchanges faced volume dips |

Final Perspective on Bybit’s Role in 2025

- Bybit continues to demonstrate resilience, adaptability, and innovation, which are essential qualities for long-term relevance in the cryptocurrency sector.

- Its ability to merge advanced trading products with additional financial opportunities, such as staking and mining, makes it a standout platform in a highly competitive landscape.

- Even with temporary market volume fluctuations, Bybit’s reputation, global reach, and user-centric design solidify its place as one of the Top 10 Best Cryptocurrency Exchange Software to try in 2025.

9. eToro

eToro – A Global Leader in Social Trading and Cryptocurrency Exchange

- eToro stands as one of the most prominent cryptocurrency exchange software platforms in 2025, recognized for its unique integration of social trading capabilities with digital asset investments. Unlike traditional exchanges, eToro blends the financial markets with community-driven features, allowing investors to learn, share, and replicate trading strategies from top-performing peers.

Key Features That Make eToro a Top Choice in 2025

- Social Trading Advantage

- eToro’s CopyTrader feature empowers users to automatically mirror the strategies of highly successful traders.

- This approach creates a learning ecosystem where novice investors can benefit from the expertise of seasoned professionals, significantly reducing entry barriers.

- It has become particularly appealing to those seeking mentorship and strategy replication without needing years of market experience.

- Diverse Asset Offering

- Provides access to leading cryptocurrencies such as Bitcoin, Ethereum, and Cardano, along with a vast selection of other digital assets.

- Goes beyond crypto by offering traditional investments like stocks, ETFs, and commodities, making it a multi-asset platform.

- This diversity positions eToro as a one-stop solution for investors seeking both short-term trading opportunities and long-term wealth management.

- Intuitive User Experience

- Designed with an interface that simplifies trading for beginners, while still offering advanced tools for seasoned investors.

- Features interactive charts, real-time market data, and risk management tools that enhance user decision-making.

- Its mobile application further supports on-the-go trading, aligning with modern digital investment habits.

Market Position and Global Reach

- Massive Global User Base

- As of recent figures, eToro has over 38 million registered users worldwide, positioning itself among the largest and most influential crypto trading ecosystems.

- This widespread adoption reflects its credibility, reliability, and continued trust among both retail and institutional investors.

- IPO Ambitions in 2025

- With plans for an Initial Public Offering (IPO) in 2025, eToro signals strong growth ambitions and an intent to expand its market dominance.

- The IPO move is expected to further bolster investor confidence, attract new users, and enhance transparency in operations.

Why eToro is Among the Top 10 Best Cryptocurrency Exchange Software in 2025

- Strong balance between innovation and accessibility, appealing to both beginners and advanced traders.

- Integration of social trading features makes it more than just an exchange; it serves as a learning platform and investment community.

- Wide range of assets ensures that investors can diversify their portfolios without needing multiple platforms.

- Backed by an upcoming IPO, the platform demonstrates financial stability, growth potential, and long-term commitment to the market.

Comparison Matrix: eToro vs. Other Leading Crypto Exchanges in 2025

| Feature/Platform | eToro | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| User Base | 38M+ registered users | 150M+ users | 100M+ users | 10M+ users |

| Unique Feature | CopyTrader (Social Trading) | Wide crypto selection | Ease of use & regulation | Advanced security tools |

| Asset Offering | Crypto + Traditional assets | Primarily cryptocurrencies | Crypto + limited stocks | Cryptocurrencies only |

| Ease of Use | Highly beginner-friendly | Moderate complexity | Very beginner-friendly | Geared towards professionals |

| Growth Ambitions 2025 | IPO planned | Expanding DeFi services | Regulatory compliance focus | Expanding institutional use |

Final Insight

- eToro distinguishes itself as one of the best cryptocurrency exchange software in 2025 due to its unique blend of social networking, wide asset coverage, and beginner-friendly design.

- With its IPO on the horizon, robust global user base, and innovative CopyTrader system, eToro is positioned not only as a trading platform but as a global investment community shaping the future of digital asset engagement.

10. Robinhood

Robinhood – A Leading Contender Among the Best Cryptocurrency Exchange Software in 2025

- Robinhood has established itself as one of the most influential players in the financial technology ecosystem, particularly by lowering entry barriers for retail investors. Its commission-free cryptocurrency trading modelcontinues to resonate strongly with cost-conscious traders in 2025, positioning it as a leading option among the best cryptocurrency exchange software available.

Why Robinhood Stands Out in 2025

- Cost Advantage

- Robinhood’s zero-commission structure gives it a distinct edge over many competing platforms that still impose transaction fees.

- This fee-free model allows traders—especially beginners and small-scale investors—to maximize their capital efficiency, ensuring every dollar is directed into investments rather than fees.

- Expanding User Base

- As of Q1 2025, Robinhood reported 25.8 million funded customer accounts, showcasing its widespread adoption and growing trust among global users.

- Such a large community reflects not only its popularity but also its strong position as an accessible and scalable trading solution.

- Rising Trading Volumes

- In early 2025, Robinhood recorded a 28% year-over-year growth in crypto notional trading volumes, amounting to $46 billion.

- This surge underlines increasing engagement from both retail and semi-professional traders who view the platform as reliable for active cryptocurrency trading.

Strategic Expansion – Bitstamp Acquisition

- Robinhood announced a landmark strategic move with plans to acquire Bitstamp, one of the world’s longest-running and globally recognized cryptocurrency exchanges.

- This acquisition, expected to finalize by mid-2025, is set to:

- Broaden Robinhood’s global presence, expanding into regions where Bitstamp has a strong foothold.

- Enhance asset variety, addressing one of Robinhood’s long-standing limitations by giving traders access to a more diverse set of cryptocurrencies.

- Strengthen credibility, as Bitstamp has built its reputation over a decade for security and compliance, which will complement Robinhood’s user-friendly ecosystem.

Key Features and Advantages for Traders

- User-Centric Design: Simplified interface tailored to both novice and experienced traders.

- Cross-Asset Investment Options: Integration of crypto trading with stocks and ETFs within the same platform, offering a holistic financial ecosystem.

- Regulatory Focus: As compliance becomes a critical factor in 2025, Robinhood’s alignment with regulatory standards and its move to acquire a globally compliant platform like Bitstamp enhances its trustworthiness.

Comparative Matrix – Robinhood vs. Traditional Exchanges

| Feature | Robinhood (2025) | Traditional Exchanges |

|---|---|---|

| Trading Fees | Commission-free | 0.1% – 0.5% per trade |

| Available Cryptocurrencies | Limited (expanding via Bitstamp) | Wide range |

| User Base (2025) | 25.8 million funded accounts | Typically smaller in retail |

| Trading Volume Growth (YoY) | +28% ($46B Q1 2025) | Varies per platform |

| Regulatory Expansion | Strengthened with Bitstamp acquisition | Established but fragmented |

Why Robinhood is Among the Top 10 Best in 2025

- Affordability: Still one of the most cost-effective platforms for crypto trading.

- Scale & Growth: Massive customer base and surging trading volumes reinforce its dominance.

- Future Potential: With the Bitstamp acquisition, Robinhood is transitioning from a beginner-focused platform to a more comprehensive and globally integrated exchange.

- Trust & Accessibility: Known for its ease of use, Robinhood remains a strong choice for individuals entering cryptocurrency markets while also expanding its relevance for advanced traders.

Top Cryptocurrency Exchange Software in 2025: A Global Report

Introduction to Cryptocurrency Exchange Platforms

- Cryptocurrency exchange platforms have become indispensable pillars of the digital economy, enabling individuals, institutional investors, and enterprises to seamlessly buy, sell, and trade digital assets.

- These exchanges provide liquidity, facilitate accurate price discovery, and serve as gateways for millions of participants entering the blockchain-driven financial ecosystem.

- From their early experimental forms to today’s sophisticated infrastructures, exchanges have evolved in tandem with regulatory frameworks, technological progress, and heightened market demands.

Centralized vs. Decentralized Exchanges

- Centralized Exchanges (CEXs):

- Function as intermediaries managing user funds and processing trades within their proprietary platforms.

- Offer high liquidity, advanced order types, and comprehensive trading services such as spot, margin, futures, and derivatives.

- Provide user-friendly experiences, attracting both novice traders and seasoned investors.

- Heavily regulated and compliant, ensuring investor protections through strong security measures and customer service.

- Decentralized Exchanges (DEXs):

- Operate through blockchain protocols, enabling peer-to-peer transactions without central intermediaries.

- Prioritize user autonomy, providing traders with full control of their funds through non-custodial wallets.

- Emphasize privacy, transparency, and resistance to censorship.

- Although historically less liquid than CEXs, rapid improvements in scalability and usability are closing the gap.

Comparative Matrix – CEX vs DEX in 2025

| Attribute | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

|---|---|---|

| Custody of Funds | Platform-controlled (custodial) | User-controlled (non-custodial) |

| Liquidity | High, supported by institutional players | Moderate but rapidly improving |

| Trading Features | Spot, margin, futures, options | Primarily spot, expanding into derivatives |

| Security Risk | Higher due to custodial nature (targeted) | Lower counterparty risk |

| Regulatory Compliance | Strict oversight and licensing | Varies; often less formalized |

| User Control | Limited, platform-mediated | Full autonomy and transparency |

| Accessibility | Beginner-friendly with guided UI | Appeals to advanced users, improving UX |

Core Features Defining Top Cryptocurrency Exchange Software in 2025

- Advanced Trading Infrastructure

- Multi-market capabilities: spot, margin, futures, and options.

- Intelligent order-matching systems for optimized execution.

- Integration of AI-driven trading analytics and predictive insights.

- Enhanced Security Protocols

- Multi-factor authentication and biometric access.

- Cold storage for majority of assets to minimize breach risks.

- Insurance mechanisms safeguarding against cyber theft or operational failures.

- Diverse Asset Coverage

- Support for major cryptocurrencies (Bitcoin, Ethereum, Cardano) and a wide selection of altcoins.

- Inclusion of fiat currency gateways for seamless global transactions.

- Transparent and Competitive Fee Structure

- Low-cost trading models to attract retail users.

- Clear communication of trading, withdrawal, and deposit charges.

- User Experience and Accessibility

- Simple yet powerful interfaces that cater to both beginners and professional traders.

- High customization capabilities, including advanced charting tools and API integration.

- Mobile-first strategies ensuring uninterrupted trading experiences.

- Customer Service Excellence

- 24/7 multilingual support across global markets.

- Integration of AI chatbots for faster query resolution.

- Regulatory Compliance

- Licensing across key jurisdictions ensuring legality and user trust.

- Proactive collaboration with regulators to maintain operational continuity.

- Staking, Lending, and Earning Features

- Opportunities for users to earn passive income through yield-generating programs.

- Integration of decentralized finance (DeFi) solutions within centralized platforms.

- Mobile Trading Ecosystem

- Fully functional mobile applications with complete parity to desktop versions.

- Real-time push notifications for market movements and order execution.

Security and Governance Implications

- Centralized Risks

- Higher potential for large-scale attacks due to custodial storage of assets.

- Nonetheless, major exchanges invest significantly in sophisticated cybersecurity, compliance, and monitoring systems to mitigate vulnerabilities.

- Decentralized Advantages

- Reduced counterparty risks since users retain full custody of assets.

- Distributed governance models minimize single points of failure and censorship.

- Rapid innovation is bridging the gap in liquidity and scalability compared to centralized peers.

Market Outlook – 2025

- Analysts project Decentralized Exchanges (DEXs) as the fastest-growing segment, driven by rising concerns over custodial risks and demand for financial autonomy.

- Centralized Exchanges (CEXs) will continue to dominate in terms of liquidity and institutional adoption but face mounting competition from DEXs.

- A hybrid model is anticipated, combining the liquidity and compliance of CEXs with the autonomy and transparency of DEXs, signaling the next stage of cryptocurrency exchange evolution.

Top Cryptocurrency Exchange Software in 2025: A Global Report

Key Metrics Comparison of Leading Platforms

The cryptocurrency exchange industry in 2025 is defined by diversity in trading volumes, user bases, market share, and product offerings. Each platform brings unique strengths and challenges, making it essential for traders, investors, and institutions to evaluate them based on measurable performance metrics. Below is a comprehensive comparative table highlighting the dominant players and their attributes.

Comparative Metrics of Top Cryptocurrency Exchanges in 2025

| Exchange Name | Market Share (%) | Avg. Daily Trading Volume (USD) | Number of Users (Millions) | Supported Cryptocurrencies | Lowest Maker Fee (%) | Lowest Taker Fee (%) | Key Strengths | Key Weaknesses |

|---|---|---|---|---|---|---|---|---|

| Binance | 37.5 – 38.0 | $14 Billion+ | 250+ | 414+ | 0.02 | 0.04 | Global leader, vast altcoin support, lowest fees, advanced tools | Regulatory scrutiny, steep learning curve |

| Coinbase | 7.76 | $226 Billion (Quarterly) | 98+ | 200+ | 0 | 0.05 | Simple interface, high security, rich educational resources | Higher fees, inconsistent customer service |

| Kraken | 4.54 | $283 Million+ | 6+ | 350+ | 0 | 0.1 | Competitive fees, strong compliance, margin & futures trading | Complex UI, slower support response |

| Gemini | – | $200 Billion+ | 13+ | 73 | 0 | 0.03 | Strong regulation, ActiveTrader for professionals | Limited cryptocurrency options |

| Crypto.com | 0.79 | – | 100+ | 300+ | 0 | 0.05 | All-in-one ecosystem, user-friendly mobile app, attractive yields | Market share disproportionate to user size |

| Bitmart | – | $500M – $1B | 9+ | 1700+ | 0.04 | 0.045 | Extensive coin listings, copy-trading, leveraged trading | Past security breach, limited US services |

| KuCoin | – | – | – | 750+ | 0.1 | 0.1 | Wide asset support, accessible fees | Restricted for US residents |

| Bybit | 2.81 | – | – | – | 0.025 | 0.075 | Strong in spot, futures, staking, mining services | Declining volumes in 2025 |

| eToro | – | – | 38+ | – | 1 | 1 | Social trading leader, traditional and crypto asset mix | Higher spreads, withdrawal costs |

| Robinhood | – | – | 25+ | 25+ | 0 | 0 | No-fee trading, intuitive app for beginners | Limited asset range, fewer advanced features |

Analysis of Market Leaders

Binance

- Holds the dominant global market share with unmatched liquidity.

- Offers one of the broadest cryptocurrency selections globally.

- Known for ultra-low fees and advanced trading capabilities.

- Faces ongoing regulatory oversight in multiple jurisdictions, which may affect accessibility.

Coinbase

- Positioned as a beginner-friendly and compliant exchange.

- Strong institutional adoption due to regulatory alignment.

- Its higher fees remain a concern for frequent traders.

Kraken

- Appeals to professional traders with advanced derivatives and margin trading.

- Security reputation strengthens its credibility.

- However, its interface may overwhelm new entrants.

Gemini

- Highly regarded for compliance and regulation adherence, especially in the United States.

- Attracts professionals through its ActiveTrader platform.

- Lags behind competitors in cryptocurrency variety.

Crypto.com

- Distinguished by its comprehensive financial ecosystem, integrating DeFi features and yield offerings.

- Gained mass adoption through aggressive marketing and partnerships.

- Market penetration is less proportional to its user base size.

Bitmart

- Provides a massive variety of tokens, attracting altcoin traders.

- Includes unique features like copy-trading and high leverage.

- Trust was impacted by a past breach, though security has since been improved.

KuCoin

- Popular for listing niche tokens and smaller market cap coins.

- Offers competitive fees and trading tools.

- Limited accessibility in the United States restricts growth potential.

Bybit

- Strong reputation for derivatives and staking products.

- Experienced a downturn in volume in 2025, raising questions on sustainability.

eToro

- A pioneer in social trading, blending crypto with equities and other traditional instruments.

- Appeals to beginners with its CopyTrader functionality.

- Fees and spreads are notably higher than specialized exchanges.

Robinhood

- Gained popularity with its zero-fee model and easy-to-use mobile interface.

- Attracts retail traders seeking simplicity.

- Limited cryptocurrency range prevents it from competing with global leaders.

Market Insights and Global Trends

- Market Consolidation: Binance, Coinbase, and Kraken continue to dominate in liquidity and user base, while mid-tier exchanges compete through innovation and niche services.

- User-Centric Innovation: Features such as social trading (eToro), copy-trading (Bitmart), and high-yield staking (Crypto.com) showcase the market’s evolution toward broader financial ecosystems.

- Regulatory Impact: Exchanges with strong compliance, such as Coinbase and Gemini, are positioned to benefit from growing institutional participation.

- Emergence of Niche Leaders: Exchanges like KuCoin and Bitmart attract communities seeking tokens not listed on mainstream platforms.

- Fee War Intensification: With Robinhood offering zero fees and Binance maintaining ultra-low costs, competitive pricing remains a defining factor.

Market Trends and Insights

The cryptocurrency exchange market in 2025 is undergoing rapid transformation, shaped by rising adoption, technological innovation, and evolving user expectations. The industry is not only growing in scale but also diversifying in structure, as centralized and decentralized models compete for dominance across global regions.

Key Market Projections

- The global cryptocurrency exchange market valuation is forecasted to reach USD 71.35 billion in 2025, with expectations to surge to USD 260.17 billion by 2032.

- This expansion represents a compound annual growth rate (CAGR) of 20.3%, underscoring strong investor confidence.

- The broader cryptocurrency market is projected to achieve a size of USD 5.43 billion by 2029, registering a CAGR of 17.3%.

- The number of cryptocurrency holders worldwide is expected to grow substantially, ranging between 750 million and 900 million individuals by the end of 2025.

Comparison of Market Segments

| Segment Type | Market Share in 2025 | Projected CAGR (2024–2029) | Key Characteristics | Market Drivers |

|---|---|---|---|---|

| Centralized Exchanges (CEXs) | 87.4% | Moderate | High liquidity, user-friendly, fiat integration | Institutional adoption, regulatory clarity |

| Decentralized Exchanges (DEXs) | 12.6% | 26.37% | Non-custodial, peer-to-peer, enhanced transparency | Demand for asset control, DeFi expansion |

Insights on Exchange Models

- Centralized Exchanges (CEXs): Continue to dominate due to user familiarity, liquidity depth, and fiat-to-crypto integration. Their appeal lies in accessibility, security assurances, and regulated structures.

- Decentralized Exchanges (DEXs): Rapidly gaining traction with a record 20% share of total spot trading volume in January 2025. Their rise reflects growing demand for decentralization, increased security, and autonomy over digital assets.

Regional Market Outlook

| Region | Market Share (2025) | Growth Dynamics | Key Exchanges Active |

|---|---|---|---|

| North America | 37.2% | Largest market by adoption; institutional investments accelerating | Coinbase, Kraken, Gemini |

| Asia-Pacific | 23.8% | Fastest growth driven by younger demographics and government initiatives | Binance, Crypto.com, KuCoin |

| Europe | Significant but fragmented | Regulatory clarity in EU boosting participation | Binance, Bitstamp, eToro |

- North America: Remains the largest market with Coinbase leading in compliance and accessibility.

- Asia-Pacific: Expected to witness the fastest growth rate, driven by retail adoption and innovation in markets like Singapore, Hong Kong, and South Korea.

- Europe: Regulatory developments like MiCA (Markets in Crypto-Assets) provide a favorable landscape, enhancing trust in exchanges.

Key Factors Influencing Exchange Selection

Investors and traders make exchange choices based on multiple parameters, reflecting both technical requirements and user experience.

- Fee Structures

- Competitive or zero trading fees (as seen with Robinhood and Binance) are vital for cost-conscious investors.

- Maker–taker fee transparency strongly influences platform loyalty.

- Security Measures

- Investors prioritize exchanges with advanced security protocols such as multi-signature wallets, cold storage, and insurance coverage.

- Reputation following breaches can significantly impact user trust (e.g., Bitmart’s past breach).

- User Experience

- Beginners prefer exchanges with intuitive, simplified interfaces and transparent navigation.

- Mobile app functionality has become crucial for on-the-go trading and portfolio management.

- Asset Diversity

- Altcoin availability differentiates platforms, with exchanges like Bitmart and KuCoin offering access to over 700–1,000 tokens.

- Conversely, platforms such as Gemini and Robinhood remain more selective, appealing to risk-averse users.

- Earning Opportunities

- Staking rewards, yield programs, and lending options serve as attractive incentives for long-term investors.

- Exchanges like Crypto.com stand out with high APY offerings.

- Regulatory Compliance

- Compliance ensures long-term trust and accessibility in major markets.

- Platforms such as Coinbase and Gemini thrive in jurisdictions with established frameworks, while KuCoin and Binance face restrictions in the United States.

Future Outlook

- CEXs will maintain dominance in liquidity and global user acquisition, though DEXs will continue to erode their market share.

- Institutional adoption is expected to accelerate, particularly in North America and Europe, as regulated exchanges provide reliable gateways for large capital inflows.

- Emerging markets in Asia-Pacific will redefine the global competitive landscape, with high retail participation and government-driven blockchain initiatives fueling growth.

- User-centric innovation—ranging from mobile-first designs to gamified trading and integrated DeFi products—will be a decisive factor in attracting the next wave of cryptocurrency participants.

Recommendations and Strategic Insights

The global cryptocurrency exchange market in 2025 reflects a competitive and rapidly evolving landscape where each platform seeks to differentiate itself through innovation, user experience, and regulatory positioning. With the market projected to grow significantly over the coming years, exchanges are strategically aligning their services to meet the demands of diverse user groups ranging from beginners to institutional investors.

Key Observations in the Market

- Binance and Coinbase remain dominant in terms of global market share, liquidity, and daily trading volumes.

- Kraken and Gemini emphasize security-first frameworks, appealing strongly to professional traders and institutional participants.

- Crypto.com has built a comprehensive ecosystem that integrates trading, staking, payments, and rewards, making it a powerful option for mobile-first users.

- Bitmart differentiates itself by offering one of the largest altcoin libraries, catering to retail traders with an appetite for emerging digital assets.

- Decentralized exchanges are gaining momentum, gradually increasing their share as users value transparency, autonomy, and asset self-custody.

Market Trends Driving Exchange Selection

- Rising institutional participation reshaping liquidity and compliance requirements.

- User expectations shifting toward mobile trading, advanced security, and seamless fiat-to-crypto integrations.

- A regional divide where North America dominates in scale while Asia-Pacific leads in adoption speed.

- Increasing focus on low-cost fee structures and staking opportunities as investors seek to maximize returns.

Recommendations for Different User Segments

Beginners

- Should prioritize simplicity, trust, and education.

- User-friendly dashboards, transparent pricing models, and strong customer support are critical.

- Recommended platforms: Coinbase (intuitive interface, educational resources, regulatory compliance).

Experienced Traders

- Require robust liquidity, professional-grade analytics, and margin/futures support.

- Low fees and customizable trading tools influence retention.

- Recommended platforms: Kraken (margin & futures, security) and Binance (advanced trading tools, liquidity depth).

Altcoin Enthusiasts

- Value exchanges offering broad cryptocurrency selections and early access to emerging projects.

- Recommended platforms: Bitmart (1,700+ coins) and Binance (400+ coins).

Security-Focused Investors

- Prioritize regulatory compliance, custodial safeguards, and insurance protections.

- Recommended platforms: Gemini (regulated, insured digital assets) and Kraken (renowned for security architecture).

Mobile-First Users

- Seek feature-rich, highly secure mobile platforms optimized for trading and portfolio management.

- Recommended platforms: Crypto.com (integrated ecosystem, APY options) and Coinbase (trusted mobile experience).

Comparative Recommendation Matrix

| User Type | Key Needs | Recommended Platforms | Key Advantages |

|---|---|---|---|

| Beginners | Simplicity, education, strong security | Coinbase | Intuitive, regulated, beginner-focused |

| Experienced Traders | Advanced tools, low fees, liquidity | Kraken, Binance | Pro features, margin & futures, global liquidity |

| Altcoin Enthusiasts | Extensive coin selection, emerging assets | Bitmart, Binance | Vast altcoin library, early listings |

| Security-Focused Users | Compliance, insurance, trustworthiness | Gemini, Kraken | Strong security, regulatory adherence |

| Mobile-First Users | App functionality, staking, payments | Crypto.com, Coinbase | Comprehensive ecosystem, secure mobile apps |

Future Outlook for Exchange Software

- Centralized exchanges will continue to dominate in liquidity and compliance but must adapt to rising competition from decentralized alternatives.

- Decentralized exchanges (DEXs) are positioned for accelerated growth as investors increasingly value non-custodial trading and control of private keys.

- Asia-Pacific markets are expected to emerge as pivotal growth centers, while North America will retain its status as the most regulated and institutionally active region.

- Platforms will need to balance cost-efficiency, innovation, and regulatory compliance to retain market leadership.

Conclusion

The landscape of cryptocurrency trading in 2025 is evolving at an unprecedented pace, and choosing the right exchange software has never been more critical for both individual investors and institutional traders. The top 10 cryptocurrency exchange software solutions highlighted in this guide reflect the most innovative, reliable, and forward-looking platforms shaping the global digital asset ecosystem today. Each of these platforms brings unique advantages—ranging from zero-commission trading and advanced security measures to high liquidity pools, robust compliance frameworks, and user-friendly interfaces—ensuring that traders can select a solution that aligns with their strategic goals, trading styles, and risk appetites.

What makes these exchanges stand out is not merely their ability to facilitate cryptocurrency transactions, but also their broader role in transforming financial inclusion, investment accessibility, and the mainstream adoption of digital assets. Many of these platforms are actively expanding their product offerings beyond simple buy-and-sell functionalities, introducing features such as staking, decentralized finance integrations, margin trading, futures, and even tokenized asset support. This diversification demonstrates how modern cryptocurrency exchanges are no longer just trading tools, but rather complete financial ecosystems capable of supporting both short-term traders and long-term investors.

Security remains a cornerstone of the selection process, and the software platforms reviewed here emphasize multi-layered safeguards, regulatory compliance, and transparency. In an industry where cyber threats remain prevalent, these exchanges are setting benchmarks for protecting user funds and maintaining trust through rigorous auditing, insurance coverage, and next-generation encryption. Such features are not only attractive to experienced investors but also critical in attracting first-time users who may still view the cryptocurrency market with caution.

Another defining factor is scalability. The best cryptocurrency exchange software in 2025 is designed to handle exponential growth in trading volumes while maintaining seamless performance. With the increasing participation of retail investors and institutional players, platforms that can process billions in notional volumes while keeping transaction fees competitive are expected to dominate the market. Additionally, strategic partnerships, acquisitions, and global expansions—such as the Robinhood-Bitstamp acquisition—highlight how the industry is consolidating to deliver even more powerful and globally connected trading ecosystems.

Ultimately, the top 10 cryptocurrency exchange software solutions of 2025 represent more than just technology—they represent a new era of financial empowerment. They enable traders to participate in the global digital economy with greater efficiency, lower barriers to entry, and enhanced opportunities for diversification. Whether one is seeking commission-free trading, institutional-grade liquidity, advanced analytical tools, or a balance of regulation and innovation, there is an exchange platform in this list that addresses those needs.

As cryptocurrency adoption continues to expand worldwide, these platforms will serve as the foundation upon which future digital economies are built. For investors, staying informed about these leading solutions is not just about maximizing profits—it is about ensuring long-term resilience, security, and competitiveness in a rapidly transforming financial ecosystem. By leveraging the strengths of these top exchanges, traders and institutions alike can position themselves at the forefront of one of the most dynamic and transformative industries of our time.

If you find this article useful, why not share it with your hiring manager and C-level suite friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

To hire top talents using our modern AI-powered recruitment agency, find out more at 9cv9 Modern AI-Powered Recruitment Agency.

People Also Ask

What is cryptocurrency exchange software?

Cryptocurrency exchange software is a digital platform that enables users to buy, sell, and trade cryptocurrencies securely and efficiently.

Why is cryptocurrency exchange software important in 2025?

It provides secure, scalable, and user-friendly solutions for trading digital assets, helping investors access global markets quickly.

What features should I look for in cryptocurrency exchange software?

Key features include security, liquidity, scalability, user-friendly design, multi-currency support, and low transaction fees.

Which is the most secure cryptocurrency exchange software in 2025?

The most secure exchange software includes advanced encryption, two-factor authentication, and anti-fraud mechanisms.

Can beginners use cryptocurrency exchange software easily?

Yes, many platforms in 2025 are designed with beginner-friendly interfaces, tutorials, and simplified trading options.

What are the benefits of using crypto exchange software?

Benefits include faster transactions, enhanced security, global accessibility, and advanced trading tools for better profits.

Is cryptocurrency exchange software regulated?

Many exchange platforms comply with international regulations, KYC, and AML policies to ensure safe and legal trading.

How much does cryptocurrency exchange software cost?

Costs vary, but users may face fees for trading, withdrawals, and premium features depending on the software provider.

What makes 2025’s crypto exchange software different?

In 2025, platforms focus on AI integration, stronger security, improved scalability, and decentralized trading options.

Which cryptocurrency exchange software supports multiple coins?

Most leading platforms support Bitcoin, Ethereum, stablecoins, and altcoins, allowing traders to diversify their portfolios.

Can I build my own cryptocurrency exchange using software?

Yes, white-label crypto exchange software allows businesses to launch customized exchanges with advanced trading features.

Is mobile-friendly cryptocurrency exchange software available?

Yes, most 2025 platforms offer responsive apps for iOS and Android, ensuring seamless trading on mobile devices.

How do I choose the best cryptocurrency exchange software?

Compare features such as transaction fees, supported coins, customer support, and security to make the best choice.

What security measures do crypto exchange platforms use?