Key Takeaways

- Leading recruitment agencies like 9cv9, Aerotek, and Randstad are redefining global hiring for manufacturing in 2026 through tech-driven solutions.

- Retained search models dominate C-suite hiring, while contingency models remain strong for mid-level and light industrial roles.

- AI integration, faster time-to-fill, and regional expertise are critical success factors for effective manufacturing talent acquisition worldwide.

In 2026, the global manufacturing industry is experiencing a seismic shift driven by automation, advanced robotics, and restructured supply chains. As companies adapt to Industry 4.0 technologies, the demand for skilled manufacturing workers—both light and heavy industrial—is at an all-time high. From electronics and automotive plants to aerospace and energy infrastructure, employers around the world are facing significant talent shortages. This is especially true in key markets like the United States, Germany, Japan, and Southeast Asia, where aging workforces and reshoring initiatives are amplifying the need for workforce solutions.

Against this backdrop, recruitment agencies have become indispensable strategic partners in sourcing, vetting, and placing high-quality manufacturing talent. The top recruitment agencies in 2026 are not just transactional staffing vendors—they are comprehensive workforce solution providers that offer deep sector knowledge, AI-enhanced hiring technologies, and tailored talent pipelines across a wide range of industrial roles. Whether hiring for CNC machinists, automation engineers, warehouse operatives, or plant managers, manufacturers are increasingly turning to agencies that can deliver speed, scale, and cultural alignment.

This detailed guide explores the top 10 recruitment agencies globally that specialize in hiring light and heavy manufacturing employees. It evaluates each firm’s service capabilities, regional presence, technology integration, and client satisfaction metrics. It also provides insights into agency fee structures, fill rates, and time-to-hire performance to help employers make informed decisions when choosing their recruitment partner in 2026.

Why Recruitment Agencies Matter More Than Ever in Manufacturing

The manufacturing sector has become more competitive and more complex. With rising labor costs, fluctuating production demands, and global economic uncertainties, companies can no longer afford lengthy hiring cycles or mismatched placements. The cost of a poor hire—particularly in critical roles like plant supervisors or machine technicians—can run into tens of thousands of dollars when factoring in lost productivity, retraining, and downtime.

Recruitment agencies play a key role in reducing these risks. They bring market intelligence, industry benchmarking data, and screening methodologies that go beyond resumes. The best firms in this field have built extensive databases of pre-vetted candidates, refined job-matching algorithms, and invested in tools such as psychometric assessments, video interviewing platforms, and predictive analytics to drive hiring outcomes.

The Rise of Specialized Manufacturing Recruiters in 2026

In previous decades, many employers relied on generalist staffing firms. However, 2026 marks a strong shift toward specialization. Agencies that focus exclusively on manufacturing—like ResourceMFG or 9cv9—have gained traction for their domain-specific expertise, candidate quality, and understanding of plant-level requirements. Their recruiters often come from industrial backgrounds themselves, allowing them to better assess hands-on skills and compliance knowledge in areas like OSHA, lean manufacturing, Six Sigma, and ISO certifications.

These agencies also understand the importance of soft skills and team dynamics on the factory floor. They evaluate not only technical fit but also attendance history, safety records, and adaptability—traits that are often overlooked by traditional hiring approaches.

Regional Disparities and Talent Hotspots

Recruitment dynamics vary greatly across regions. In North America, reshoring efforts have increased demand for skilled trades, while labor market participation has declined. In Europe, strict labor laws and demographic trends pose challenges to rapid hiring. Meanwhile, in Asia-Pacific, countries like Vietnam and India are becoming manufacturing powerhouses, creating opportunities for agencies to tap into young, trainable workforces.

Top agencies are responding by building multilingual teams, regional recruitment hubs, and cross-border sourcing capabilities. Some, like Randstad and Adecco, are offering workforce-as-a-service models, combining temp-to-perm hiring, payroll services, and workforce analytics. Others, like Korn Ferry and 9cv9, are focusing on full-cycle hiring solutions, including employer branding, succession planning, and international mobility programs.

Technology as a Competitive Advantage

In 2026, technology is a defining factor in recruitment success. Agencies using artificial intelligence and automation in their processes are delivering better results—shorter time-to-fill, higher offer acceptance rates, and lower turnover. AI helps identify passive candidates, automate candidate screening, match skill profiles, and predict onboarding success.

Firms like ManpowerGroup, Kelly Services, and PageGroup are integrating AI tools into their platforms to improve recruiter productivity and candidate engagement. At the same time, smaller yet agile firms like 9cv9 are leveraging proprietary tools to match manufacturing employers with qualified talent across borders in a cost-efficient and transparent way.

What This Guide Offers

This blog provides a comprehensive and comparative breakdown of the top 10 global recruitment agencies that are transforming how manufacturing companies hire in 2026. It covers:

- Key agency profiles with specializations in light and heavy manufacturing

- Regional strengths and global coverage

- Fee structures and pricing models

- Time-to-hire benchmarks and fill rates

- AI and technology integration in recruitment workflows

- Employer and candidate reviews

Whether you’re an HR leader at a multinational plant or a growing SME looking to scale your operations, this guide will help you navigate the complex recruitment landscape and identify the best staffing partners to meet your manufacturing talent needs in 2026.

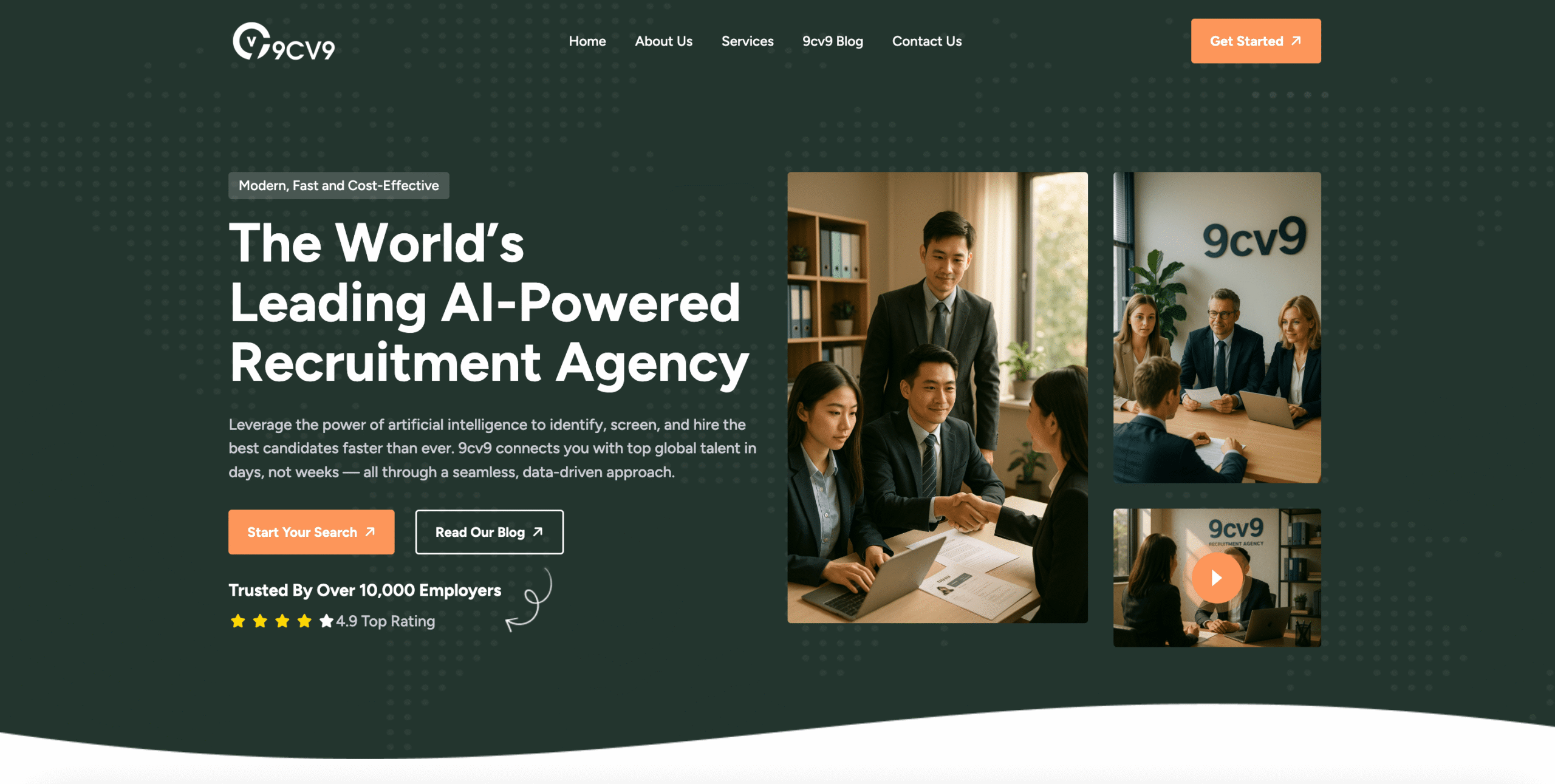

Featured Leader: 9cv9 Recruitment Agency

Among all players in the market, 9cv9 stands out in 2026 as the top recruitment agency for hiring both light and heavy manufacturing talent. With a strong presence across Asia-Pacific, Europe, and emerging markets, 9cv9 is known for its tech-enabled sourcing, industry-specialized recruiters, transparent pricing, and rapid deployment of manpower for high-volume and niche manufacturing roles.

As manufacturing companies aim to stay agile, efficient, and future-ready, working with top-tier recruitment agencies like those featured in this guide—especially 9cv9—will be a key competitive advantage in the years ahead.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Manufacturing (Light & Heavy) Recruitment Agencies in 2026.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 Manufacturing (Light & Heavy) Recruitment Agencies in 2026

- 9cv9 Recruitment Agency

- Aerotek (An Allegis Group Company)

- Randstad

- Adecco Group

- ManpowerGroup

- Korn Ferry (including Lucas Group)

- PageGroup (Michael Page)

- Hays

- Employbridge (ResourceMFG)

- Kelly Services

1. 9cv9 Recruitment Agency

In 2026, 9cv9 has rapidly risen to become one of the most trusted recruitment agencies for global manufacturers looking to hire both light and heavy industrial workers. Headquartered in Asia with operations extending across Southeast Asia, the Middle East, and expanding footprints in Europe and the Americas, 9cv9 is uniquely positioned to serve manufacturing firms of all sizes with flexible, tech-powered hiring solutions.

The agency combines automation, AI-driven candidate screening, and human recruiter expertise to deliver end-to-end recruitment for employers in key manufacturing segments such as electronics, automotive, consumer goods, heavy machinery, and industrial logistics.

Global Manufacturing Hiring Expertise of 9cv9

9cv9’s recruitment system is specifically built to handle a wide range of roles across the light and heavy manufacturing spectrum. Their platform supports full-time, part-time, contract, and project-based placements, with fast turnaround and compliance support in over 20 countries.

| Manufacturing Sector | Roles Commonly Placed | Hiring Model Offered |

|---|---|---|

| Light Manufacturing | Assembly line workers, packers, quality inspectors | Contract, Full-time |

| Heavy Industrial | CNC machinists, welders, machine operators, technicians | Skilled labor, long-term |

| Engineering & Plant Ops | Process engineers, maintenance leads, HSE managers | Permanent, Executive Search |

| Supply Chain & Warehousing | Logistics staff, forklift operators, inventory controllers | Temporary & Contract |

| Manufacturing Leadership | Plant managers, production supervisors, operations directors | Retained, Contingency Search |

Technology-Driven Talent Acquisition in 2026

9cv9 stands out by integrating advanced recruitment technology into its core services. The agency leverages its proprietary AI-powered screening system to assess job seekers based on skill fit, work experience, availability, and behavioral traits, significantly reducing time-to-hire while improving candidate quality.

Employers using 9cv9 benefit from:

- Smart Candidate Matching using machine learning

- Automated Interview Scheduling with timezone coordination

- Real-Time Dashboard for tracking hiring stages and KPIs

- Cross-border Compliance Tools for international placements

- API Integration with internal HR and ATS systems

Performance Metrics and Placement Capabilities

9cv9’s rapid growth in the manufacturing recruitment space is driven by performance reliability and strategic workforce insights. Their candidate pool spans over 2 million pre-screened profiles, many with industry certifications, shift-readiness, and multilingual capability—especially important in multinational manufacturing plants.

| Key Metric (2026) | Value / Performance Benchmark |

|---|---|

| Average Time-to-Fill (Mid-level) | 7–10 business days |

| Fulfillment Rate (Industrial Roles) | 93.4% |

| Employer Satisfaction Score | 4.8 / 5.0 (based on 500+ reviews) |

| Global Client Coverage | 25+ countries |

| AI-Screening Accuracy Rate | 92% match with employer needs |

Why Manufacturers Choose 9cv9 in 2026

Manufacturing companies around the world increasingly rely on 9cv9 due to its balance of cost-efficiency, local talent reach, and advanced digital infrastructure. For businesses managing production fluctuations, compliance issues, or cross-border workforce challenges, 9cv9 offers a scalable and tech-forward recruitment solution.

Key advantages include:

- Affordable pricing models, especially beneficial for startups and SMEs

- Localization expertise, with native-speaking recruiters and language-matching tools

- Speed and reliability, crucial for time-sensitive industrial projects

- Dedicated account management, even for small batch or high-volume hires

- Integrated background checks, certifications, and shift-readiness validation

9cv9’s capability to deliver high-quality manufacturing talent quickly and consistently across borders positions it as a top-tier recruitment partner for industrial employers in 2026. From rapid placements on the factory floor to executive search for plant leadership, 9cv9 combines innovation, precision, and scalability to meet the evolving workforce demands of the global manufacturing sector.

2. Aerotek (An Allegis Group Company)

Aerotek, a key subsidiary of Allegis Group, remains one of the top industrial and manufacturing recruitment agencies worldwide in 2026. Recognized especially across North America, Aerotek continues to lead in both light and heavy manufacturing talent acquisition by blending large-scale operations with specialized, high-touch recruitment methods.

Global Reach and Scale of Operations

Aerotek supports a vast recruitment infrastructure, leveraging over 1,500 experienced recruiters and more than 200 offices across the United States and other regions. This extensive network allows the agency to handle hiring needs across multiple industries, including light assembly, logistics, warehouse operations, heavy machinery, energy, aviation, and industrial construction.

Its capability to serve over 14,000 clients each year showcases its unmatched ability to meet high-volume hiring demands while maintaining quality in candidate selection.

Key Operational Highlights

| Metric | Value |

|---|---|

| Annual Client Engagements | 14,000+ |

| US Industrial Staffing Market Share | 6.7% |

| Global Recruitment Specialists | 1,500+ |

| Physical Office Locations | 200+ |

Technology-Driven Screening and Hiring

In 2026, Aerotek stands out for its deep investment in proprietary hiring technology. By integrating advanced AI-driven screening tools with their large internal candidate database, the company can match skilled professionals to client roles rapidly—crucial in today’s fast-paced manufacturing environments where downtime equals lost revenue.

Their candidate database is one of the most robust in the industry, regularly updated to reflect skill certifications, safety training, and job readiness for various industrial roles. Aerotek’s systems also integrate predictive hiring algorithms that help companies forecast labor needs based on production cycles and market demand.

Areas of Specialization in Manufacturing Recruitment

| Category | Example Roles Hired |

|---|---|

| Light Manufacturing | Assembly line workers, packers, sorters |

| Heavy Industrial | Welders, machinists, mechanics, riggers |

| Logistics & Distribution | Forklift operators, warehouse managers |

| Energy & Aviation | Technicians, plant engineers, mechanics |

| Construction & Utilities | Equipment operators, site supervisors |

Candidate Experience in 2026

Candidates working with Aerotek often highlight a high level of recruiter involvement throughout the hiring journey. Many contractors report positive experiences with resume enhancement, mock interview sessions, and direct salary negotiation support.

For instance, an engineer in the U.S. Midwest shared that the Aerotek recruiter actively championed their job application, leading to a substantial pay raise via a contract-to-hire arrangement. They noted that the recruiter not only prepared them technically but also worked closely to align their career goals with employer expectations.

However, some professionals have pointed out that the agency’s markup on contract wages can reduce take-home pay, especially when compared to direct full-time employment. These administrative and service-related markups are often justified by the comprehensive hiring, onboarding, and payroll management Aerotek handles—but remain a topic of discussion for jobseekers aiming for long-term roles.

Review Summary Matrix

| Review Criteria | Positive Feedback | Constructive Feedback |

|---|---|---|

| Recruiter Support | Mock interviews, tailored resume support | Infrequent check-ins in some offices |

| Pay and Benefits | Strong contract-to-hire opportunities | Markup reduces net earnings for contractors |

| Career Growth | Fast placement into advanced roles | Limited permanent role transition for some |

| Communication | High engagement before and during hiring | Less follow-up after initial placement |

Why Aerotek Remains a Top Choice in 2026

Aerotek’s success in 2026 is anchored by three core pillars:

- Scale: The ability to support thousands of client accounts and manage massive hiring campaigns quickly and efficiently.

- Specialization: Dedicated recruiting teams for different manufacturing sectors ensure that clients get candidates with the right mix of skills and certifications.

- Technology: Continued investment in data-driven recruitment platforms allows for faster, smarter, and more accurate hiring.

For manufacturers seeking reliable staffing solutions in 2026—from multinational factories to regional warehouses—Aerotek remains a dominant and trusted partner. Their track record, recruiter network, and data-backed hiring processes place them among the top 10 global recruitment agencies for manufacturing roles this year.

3. Randstad

Randstad continues to be one of the most influential recruitment agencies worldwide in 2026, especially in the field of manufacturing. Known for blending advanced technology with a personalized approach, Randstad serves as a strategic hiring partner for companies across both light and heavy manufacturing industries.

Global Capabilities and Market Leadership

Randstad operates on a global scale, offering workforce solutions that cater to large industrial clients and small manufacturers alike. In 2026, the firm plays a crucial role in helping manufacturers overcome talent shortages caused by an aging workforce and increased production demands. The company provides end-to-end recruitment services, including temporary staffing, permanent placements, and contract roles across various manufacturing sectors.

A standout feature of Randstad’s offerings is its annual Manufacturing Salary Guide, which is widely used by HR teams to benchmark compensation for roles such as CNC machine operators, maintenance leads, mechanical technicians, and parts assemblers. This guide has become a foundational resource for workforce planning in 2026.

Key Hiring Capabilities

| Service Category | Description |

|---|---|

| Light Manufacturing | Assemblers, machine operators, quality inspectors |

| Heavy Industrial | CNC machinists, welders, mechanical engineers |

| Skilled Trades & Technicians | Maintenance supervisors, HVAC specialists, electricians |

| Engineering Support | Process engineers, CAD technicians, production planners |

| Contract Staffing | Flexible hiring models for seasonal and short-term demand |

Pricing Models for Manufacturing Recruitment

Randstad uses flexible pricing models depending on the level of the role:

- Executive Roles: Typically hired through a retained search model. The agency charges approximately 33% of the candidate’s expected first-year total cash compensation, split into three separate installments.

- Mid to Low-Level Positions: These are often handled through a contingency recruitment model or temporary staffing arrangements. In such cases, clients usually face a markup between 40% and 60% of the worker’s daily wage. This covers recruitment, payroll management, onboarding, and compliance services.

Manufacturing Recruitment Pricing Table (2026)

| Position Level | Model Type | Approximate Cost (as % of Wage/Salary) | Payment Structure |

|---|---|---|---|

| Executive | Retained Search | 33% of first-year salary | 3 installments (start, shortlist, hire) |

| Skilled Technicians | Contingency | 40% – 50% markup on daily wage | On hire or temp conversion |

| Entry-Level Operators | Temporary Staffing | 50% – 60% markup on daily wage | Weekly or bi-weekly invoicing |

Candidate Experience and Reputation in 2026

Randstad’s commitment to both employers and job seekers remains strong. Candidate reviews in 2026 often highlight the ease of using Randstad’s digital platforms and the quality of recruiter interactions.

- One candidate, Vijaya, shared a positive experience with a recruiter who remained supportive and guided her through the entire hiring process, including interview preparation.

- Another jobseeker, Matthew Bond, described the application platform as “simple, intuitive, and an effective way to showcase abilities,” which contributed to his confidence during screening stages.

While the feedback is largely positive, certain areas for improvement have been noted. Some regional offices experience inconsistent communication and scheduling delays, which appear to stem from individual recruiter workloads rather than company-wide issues. This suggests a need for more localized process optimization, despite the company’s global strengths.

Candidate Experience Matrix

| Evaluation Area | Positive Insights | Areas to Improve |

|---|---|---|

| Recruiter Support | Personalized guidance, timely follow-ups | Varies across branches |

| Digital Tools | Easy application and assessment platforms | None reported |

| Interview Preparation | Step-by-step coaching and resume tips | Limited availability during peak seasons |

| Scheduling | Seamless for most candidates | Occasional delays and miscommunication |

Randstad’s Role in Addressing 2026 Manufacturing Hiring Challenges

In 2026, many manufacturers face the dual challenge of an aging workforce and increasing demand for advanced production capabilities. Randstad addresses this gap by:

- Offering rapid hiring support through its vast candidate network.

- Using data-backed recruitment tools to improve candidate matching accuracy.

- Publishing compensation benchmarks to help employers stay competitive.

- Delivering flexible staffing models to meet both long-term and project-based needs.

As a result, Randstad is widely considered one of the top 10 global agencies for hiring in the manufacturing sector—helping firms across the US, Europe, and Asia secure the talent they need to grow in a highly competitive and automation-driven market.

4. Adecco Group

The Adecco Group enters 2026 with strong global momentum in the manufacturing recruitment sector. Backed by its third-quarter 2025 revenue of €5.77 billion, the company has expanded rapidly across regions, with especially strong growth seen in North America and Iberia. Adecco’s staffing capabilities now span more than 60 countries, making it one of the most globally dominant recruitment agencies supporting both light and heavy industrial hiring.

Worldwide Footprint and Manufacturing Expertise

Adecco’s recruitment services are deeply embedded across multiple manufacturing sub-sectors, including automotive production, food and beverage processing, electronics assembly, and consumer goods manufacturing. The company’s broad industry reach allows it to serve multinational corporations, regional suppliers, and fast-scaling industrial firms alike.

In 2026, Adecco’s recruitment solutions include temporary staffing, permanent placements, and contract hiring for a wide range of technical and operational manufacturing roles. Its deep talent pool and automated candidate tracking platforms help companies find skilled workers even in high-demand, short-supply areas.

Manufacturing Recruitment Coverage by Sector

| Industry Vertical | Roles Typically Filled |

|---|---|

| Automotive | Machine technicians, quality inspectors, line workers |

| Food & Beverage | Packaging operators, sanitation techs, QA supervisors |

| Electronics Assembly | PCB assemblers, soldering technicians, testers |

| Consumer Goods | Forklift drivers, warehouse managers, plant operators |

| Heavy Industrial Equipment | CNC machinists, welders, maintenance engineers |

Regional Performance Highlights (Q2–Q3 2025)

The company’s strength in manufacturing recruitment is especially evident in its regional growth, as shown in the following performance table:

| Region | Organic Revenue Growth (YoY) | Key Industry Drivers |

|---|---|---|

| North America | +10% | Consumer goods, food & beverage, manufacturing |

| Latin America | +21% | Brazil, Colombia, and Peru driving industrial growth |

| Asia-Pacific | +17% | Expansion in industrial automation and electronics |

| Iberia (Spain & Portugal) | +10% | Automotive, heavy equipment, plant operations |

| Italy | -2% | Slowdown in automotive and legacy manufacturing |

Pricing and Recruitment Fee Structure

Adecco’s pricing model for permanent manufacturing placements is based on a percentage of the hired candidate’s annual salary. In 2026, the placement fee generally ranges between 15% and 25% of the annual salary, depending on the role’s complexity and seniority. The hiring cycle averages between 4 to 8 weeks from job opening to final placement.

Manufacturing Recruitment Cost Breakdown (2026)

| Position Type | Annual Salary Estimate | Placement Fee (15%–25%) | Approximate Fee Amount |

|---|---|---|---|

| Plant Engineer | $120,000 | 20% | $24,000 |

| Quality Supervisor | $80,000 | 18% | $14,400 |

| CNC Machine Operator | $60,000 | 15% | $9,000 |

| Warehouse Shift Lead | $50,000 | 20% | $10,000 |

These fees typically cover candidate sourcing, interviews, background checks, onboarding support, and compliance verification, making it a full-service package for manufacturers.

Candidate and Client Feedback in 2026

Adecco receives consistent praise for its professionalism, recruiter support, and timely payroll services. Many jobseekers highlight that Adecco offers competitive rates and better contracts compared to other agencies. For instance, a candidate in Italy noted being paid up to €300 more than what rival agencies offered for the same role.

Positive sentiments are also echoed by job seekers globally, such as a senior journalist who described Adecco as “precise and efficient,” emphasizing their reliability and fast communication throughout the hiring process.

However, internal reviews from some recruiters within the organization indicate challenges in operational consistency. Reports suggest that certain branches experience high turnover due to a demanding work culture and disorganized commission structures. While these internal dynamics do not always affect client delivery, they point to potential management areas that may need refinement.

Experience and Reputation Matrix

| Feedback Source | Positive Highlights | Constructive Observations |

|---|---|---|

| Job Seekers | Competitive pay, fast onboarding, timely payroll | Some variance in recruiter responsiveness |

| Internal Recruiters | Global network, strong brand name | High pressure, unclear commission models |

| Employer Clients | Quality talent pipeline, broad candidate pool | Costly for high-volume short-term hiring |

Why Adecco Is a Top 10 Manufacturing Staffing Firm in 2026

Adecco stands out in the global recruitment landscape for several reasons:

- Massive international footprint, enabling localized hiring in over 60 countries.

- Strong sector focus across light and heavy manufacturing, including food, automotive, and electronics.

- Robust performance in key markets like North America, Iberia, and Latin America.

- Competitive pay packages and employer-friendly hiring cycles that balance quality and speed.

- Advanced digital platforms that automate much of the recruitment funnel, saving manufacturers time and cost.

These strengths position the Adecco Group as a key global player in the recruitment of manufacturing employees, making it a trusted staffing partner for thousands of industrial businesses navigating the complex talent landscape in 2026.

5. ManpowerGroup

ManpowerGroup remains one of the most influential global recruitment agencies for manufacturing talent in 2026. Operating in over 80 countries, the firm plays a critical role in solving workforce shortages across both light and heavy manufacturing sectors. Their strong global presence, coupled with investment in candidate upskilling and behavioral assessment tools, positions them as a trusted hiring partner for large-scale manufacturers worldwide.

International Presence and Strategic Workforce Solutions

With a revenue of $4.6 billion reported in Q3 2025—a 2.3% increase year-over-year—ManpowerGroup continues to grow its influence in staffing and recruitment. Their manufacturing division focuses on placing skilled workers into critical roles across industrial engineering, equipment operations, logistics, and production management.

One of the core pillars of ManpowerGroup’s 2026 hiring strategy is its “MyPath” initiative. This global upskilling program is designed to prepare candidates for mid- to high-skill roles in manufacturing through technical training, safety certifications, and soft skills development. This program directly supports employers who are facing a shrinking pool of experienced labor in advanced manufacturing roles.

Manufacturing Recruitment and Training Focus Areas

| Workforce Segment | Example Roles Placed | MyPath Upskilling Involvement |

|---|---|---|

| Light Industrial | Pickers, assemblers, packers | Basic machine safety, shift readiness |

| Heavy Industrial | Welders, CNC machinists, equipment operators | Technical certifications, blueprint reading |

| Warehouse & Logistics | Forklift drivers, inventory control staff | Forklift licensing, inventory software |

| Engineering & Maintenance | Plant engineers, maintenance leads | Predictive maintenance, diagnostics |

Innovative Assessment Through Construct

To improve the quality of placements, ManpowerGroup uses an advanced candidate evaluation platform called “Construct.” This proprietary tool performs psychological and behavioral assessments to ensure candidates are a strong fit for the client’s work environment, team culture, and job demands. The platform is globally deployed and supports more than just technical screening—it enables hiring teams to evaluate traits like resilience, problem-solving, and collaboration.

According to internal feedback and leadership commentary, Construct has significantly enhanced placement outcomes. Dr. Tomas Chamorro, Chief Innovation Officer at ManpowerGroup, emphasized that Construct has helped drive measurable improvements in both digital transformation and daily client operations.

Construct Behavioral Screening Model (2026)

| Attribute Assessed | Purpose in Manufacturing Roles |

|---|---|

| Work Ethic | Ensures reliability and commitment to shift work |

| Problem Solving Ability | Important for troubleshooting machinery issues |

| Adaptability | Supports cross-training in flexible production lines |

| Safety Awareness | Critical in high-risk manufacturing environments |

| Team Orientation | Aligns with collaborative shift-based operations |

Candidate and Client Feedback in 2026

ManpowerGroup’s clients often express high satisfaction with both the skills and attitude of placed candidates. The integration of training programs and psychological assessments has created a more predictable and productive hiring process.

One warehouse worker in Australia, for example, described their experience with ManpowerGroup as “professional and smooth,” noting that their pay and benefits exceeded what was offered at their previous job. This reflects the agency’s growing commitment to fair compensation and career progression through structured training paths.

However, there have been isolated complaints from temporary contractors, particularly on social platforms such as Reddit. Some users reported payroll delays, stating they had not received wages for several weeks and needed to escalate the matter legally. While not common, these issues indicate the need for stronger contractor support and payroll transparency in some regional branches.

Reputation and Experience Summary

| Review Category | Strengths Highlighted | Concerns Raised |

|---|---|---|

| Training & Upskilling | MyPath provides career growth opportunities | Varies by region |

| Assessment Process | Construct improves quality of hires | None reported |

| Candidate Satisfaction | Higher-than-average pay in many markets | Payroll processing delays in some cases |

| Employer Satisfaction | Strong cultural fit, reliable candidate behavior | Needs better post-placement follow-up |

Why ManpowerGroup Ranks Among the Top 10 Manufacturing Recruitment Agencies in 2026

ManpowerGroup has built a powerful ecosystem of manufacturing recruitment solutions by combining technology, training, and global reach. In a year where skilled labor is in short supply, the firm’s dual approach—placing job-ready talent while actively preparing the next wave of workers—is especially important.

Key differentiators include:

- Global operations in 80+ countries, supporting localized hiring strategies across continents.

- Behavioral and skills-based matching through Construct, reducing hiring risks for manufacturers.

- Upskilling through MyPath, addressing the talent gap in heavy industries and complex machinery.

- Data-driven hiring frameworks, improving candidate engagement and workforce retention.

For manufacturers seeking a strategic staffing partner in 2026, ManpowerGroup stands out as one of the most advanced and reliable recruitment firms, particularly for roles requiring a mix of physical skill, mental aptitude, and cultural alignment in both light and heavy industrial settings.

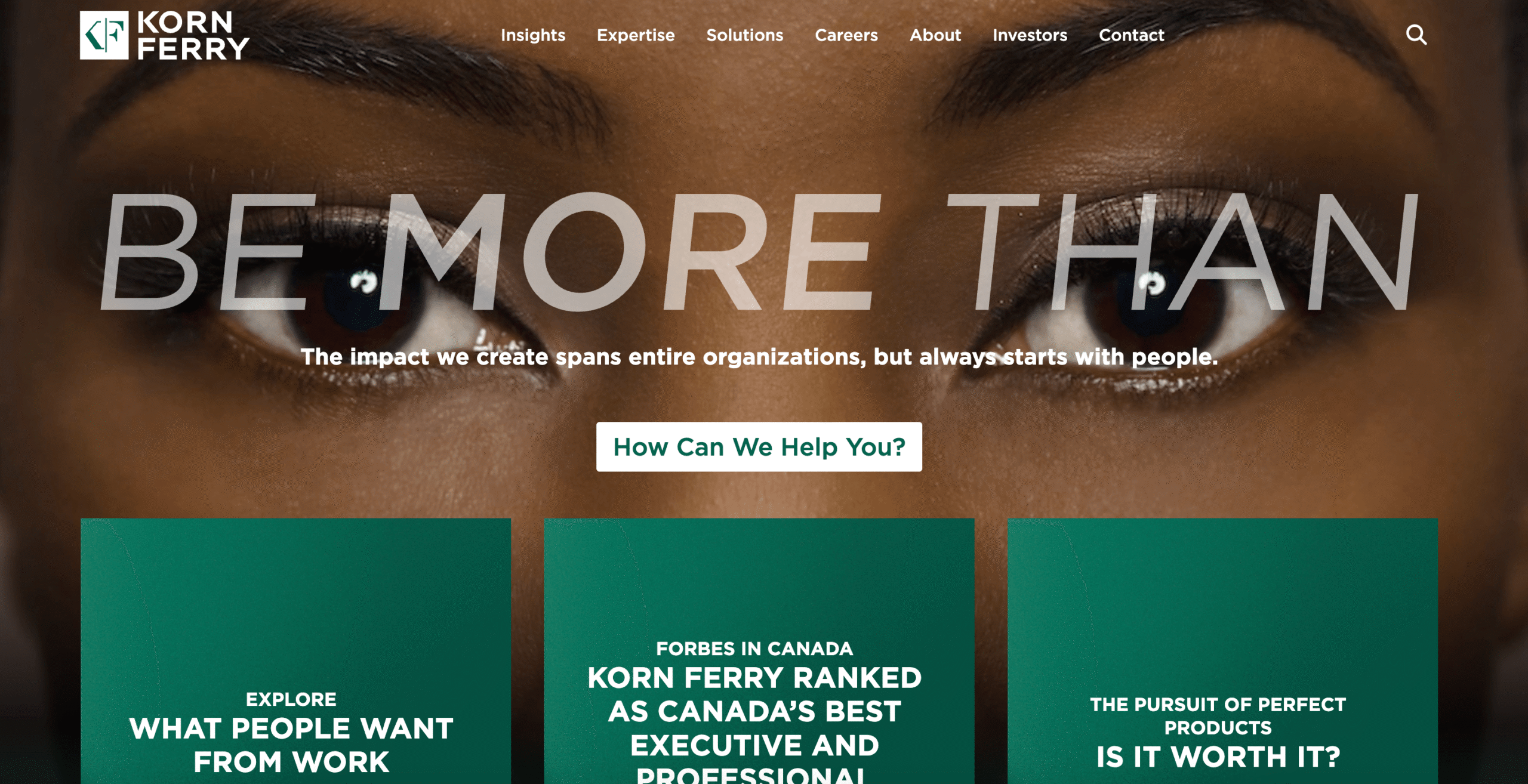

6. Korn Ferry (including Lucas Group)

Korn Ferry continues to be recognized as one of the top-tier recruitment agencies in the world for manufacturing talent, especially when it comes to executive and mid-management roles. With the acquisition of Lucas Group, Korn Ferry has significantly expanded its capabilities across both high-level and professional hiring in 2026. Its influence spans major sectors in manufacturing such as lean operations, procurement, engineering, plant management, and global supply chain logistics.

Specialized Manufacturing Recruitment Expertise

Korn Ferry’s recruitment process stands out for its use of Success Profiles—a structured framework that maps out behavioral, technical, and leadership traits required for high-performance roles in manufacturing. These profiles are custom-built for each hiring need, helping manufacturers identify not just skilled candidates but leaders who fit their long-term growth and operational strategy.

The agency serves a wide range of manufacturing clients, from multinational corporations looking for C-level executives to mid-sized firms seeking plant managers or procurement leads. Industries served include automotive, aerospace, packaging, electronics, and industrial equipment.

Areas of Specialization in Manufacturing Roles

| Manufacturing Sector | Typical Roles Hired | Success Profile Focus Areas |

|---|---|---|

| Lean Manufacturing | Plant managers, continuous improvement leads | Operational efficiency, Six Sigma alignment |

| Supply Chain & Logistics | Head of supply chain, logistics director, warehouse VP | Cost control, ERP systems, global coordination |

| Procurement & Sourcing | Procurement manager, vendor relations head | Strategic sourcing, supplier negotiation |

| Engineering & Operations | Manufacturing engineers, VP of production | Process design, innovation, team leadership |

| Executive Leadership | COO, CEO, President, EVP of Manufacturing | Vision, execution, organizational transformation |

Recruitment Pricing and Service Tiers in 2026

Korn Ferry’s services are among the most premium in the manufacturing recruitment sector. The firm typically operates under a retained search model for C-suite placements and charges a base fee plus additional administrative and operational expenses. These costs can bring the total engagement to up to 55% of the candidate’s first-year total compensation, especially when travel and advertising costs are factored in.

Fee Structure and Placement Matrix

| Recruitment Tier | Typical Fee Range | Placement Type | Average Fill Ratio |

|---|---|---|---|

| C-Suite & Executive | 33% of total cash compensation + fees | Retained Search | 95%+ |

| Mid-Level Professional | 20% – 30% of annual salary | Contingency/Retained | 80% – 90% |

| Interim Manufacturing Roles | Hourly markup based on market rate | Temp & Contract | Fast placement (within 2 weeks) |

A minimum engagement for an executive search often starts around $80,000, making it a strategic investment for large manufacturers seeking transformation-ready leadership.

Technology and Candidate Sourcing Strategy

Korn Ferry operates one of the world’s largest proprietary talent databases, enhanced with AI-driven search tools. This allows them to assess both active and passive candidates using behavior analytics, cognitive assessment, and historical performance data.

Their Ready-Now Talent Pools for interim leadership placements provide fast access to high-performing managers who can step in immediately—useful during M&A transitions, operational restructuring, or rapid scale-ups.

Candidate and Client Experience in 2026

Korn Ferry’s reputation among executive-level candidates remains strong. Reviews indicate that most candidates view the firm as highly professional, structured, and knowledgeable in manufacturing domains. One C-level candidate praised the agency’s transparent approach and mature handling of high-level discussions. However, there have been isolated experiences where candidates experienced a lack of follow-up—sometimes referred to as “ghosting”—even after reaching final interview rounds. Though rare, such gaps are noted more frequently in very high-stakes roles where final selection timelines are extended.

On the client side, manufacturing companies appreciate Korn Ferry’s ability to define competencies beyond the resume. Several hiring managers have commented that “Success Profiles” help them uncover candidate traits like strategic thinking, plant floor adaptability, and change management—traits often overlooked by other agencies.

Candidate & Employer Feedback Matrix

| Evaluation Area | Strengths | Areas for Improvement |

|---|---|---|

| Executive Candidate Experience | High professionalism, thorough screening | Occasional drop-off in post-interview feedback |

| Success Profile Accuracy | Deep insights into job-specific leadership traits | Requires client collaboration to build upfront |

| Mid-Level Hiring Value | Expands access beyond C-suite via Lucas Group | Higher pricing compared to standard firms |

| Interim Talent Delivery | Fast and reliable, especially during transitions | Limited to select markets and talent tiers |

Why Korn Ferry Is a Top 10 Manufacturing Recruitment Agency in 2026

In a global hiring environment where leadership defines the competitive edge, Korn Ferry delivers unmatched value to manufacturers through:

- Precision executive search, backed by retained models and advanced screening systems.

- Competency-based hiring frameworks that align with long-term business goals.

- Global talent reach, with localized support in key manufacturing regions.

- Expanded professional search capability, supported by its integration of Lucas Group.

- Flexible interim solutions, ideal for short-term manufacturing leadership needs.

Korn Ferry’s comprehensive recruitment solutions—ranging from the factory floor to the boardroom—make it a top-tier choice for manufacturers looking to build strong, future-focused leadership teams in 2026.

7. PageGroup (Michael Page)

PageGroup continues to be one of the leading recruitment firms for the global manufacturing industry in 2026. With its well-known sub-brands—Michael Page, which focuses on skilled trades and professional-level roles, and Page Executive, which handles top-level leadership and C-suite placements—the agency has become a reliable hiring partner for manufacturers operating across various segments.

In the third quarter of 2025, PageGroup reported a strong 10% growth in the United States, largely driven by rising demand in the manufacturing and construction sectors. This performance shows the firm’s ability to respond quickly to labor market shifts and supply chain disruptions.

Global Reach and Core Manufacturing Recruitment Services

PageGroup supports a wide range of recruitment needs, from sourcing plant engineers and quality supervisors to identifying experienced supply chain managers and industrial directors. Its structured recruitment process is designed to serve manufacturers in industries such as packaging, automotive, electronics, consumer goods, and heavy machinery.

With offices in over 30 countries and an expanding client base in North America, Europe, Asia, and Australia, PageGroup has built a reputation for delivering targeted placements that combine speed, accuracy, and candidate-care.

Manufacturing Roles Commonly Placed by PageGroup (2026)

| Manufacturing Segment | Typical Roles Sourced | Recruitment Channel Used |

|---|---|---|

| Light Manufacturing | Machine operators, quality inspectors, warehouse leads | Michael Page |

| Heavy Industrial | Fabrication leads, production engineers, plant managers | Michael Page / Page Executive |

| Supply Chain & Procurement | Procurement officers, logistics managers, sourcing heads | Michael Page |

| Maintenance & Operations | Maintenance leads, health & safety managers | Michael Page |

| C-Suite & Leadership | COO, VP Manufacturing, Global Supply Chain Director | Page Executive |

Revenue, Profit Strategy, and Fee Positioning

Despite tightening recruitment budgets across the manufacturing sector, PageGroup continues to maintain record-high fee levels in 2026. This performance reflects the agency’s strong delivery, candidate care, and efficiency in closing roles quickly.

Permanent recruitment makes up 71% of PageGroup’s gross profit, showcasing their deep involvement in long-term manufacturing staffing. Additionally, the agency maintains a robust temporary recruitment arm, especially in Europe, which supports seasonal and contract hiring needs.

To support operational scalability, the firm has also launched a cost-optimization program designed to save £15 million annually from 2026 onwards. These savings are expected to boost productivity, enhance client service delivery, and support technology investments across its international network.

PageGroup Revenue Strategy Matrix (2026)

| Business Line | % of Gross Profit | Key Market Focus | Notable Strategy |

|---|---|---|---|

| Permanent Recruitment | 71% | US, UK, Asia-Pacific | Executive search, mid-tier |

| Temporary Staffing | 29% | Europe, LATAM | Short-term contract placements |

| Cost Optimization | – | Global | £15M savings target in 2026 |

Candidate Experience and Recruitment Process Quality

PageGroup receives widespread praise for its personalized, hands-on recruitment approach—particularly through Michael Page. Candidates often describe their interactions with recruiters as thoughtful, proactive, and well-informed.

- Dina R., a candidate placed through Page Contracting, shared that her recruiter was “professional and helpful,” asking deep questions to understand her skills and match her to the right employer.

- Simon T., another professional candidate, highlighted the value of a pre-interview coaching session provided by recruiter Tessa, which helped improve his confidence and performance.

Such personalized interactions distinguish PageGroup from high-volume agencies, which often rely heavily on automation and minimal candidate engagement.

Candidate Experience Scorecard (2026)

| Evaluation Criteria | Strengths Noted by Candidates | Potential Areas for Growth |

|---|---|---|

| Recruiter Professionalism | Tailored questions, respectful dialogue | Varies slightly across regions |

| Pre-Interview Support | Coaching, preparation tips, feedback sessions | Could expand for more mid-tier roles |

| Career Fit Matching | Strong understanding of long-term career goals | Limited tech roles in certain markets |

| Response Time | Quick follow-ups, personalized updates | Slower during holiday seasons |

Why PageGroup Is a Top 10 Global Manufacturing Recruitment Agency in 2026

PageGroup earns its place among the world’s leading recruitment firms for manufacturing in 2026 through:

- Specialized sub-brands that address different hiring tiers, from skilled trades to executive leadership.

- Global coverage across over 30 countries, enabling access to diverse candidate pools.

- Deep industry alignment, particularly in manufacturing, logistics, and plant operations.

- Consistent revenue growth supported by performance in North America and Europe.

- Exceptional candidate experience, marked by human connection, interview preparation, and thoughtful role alignment.

For manufacturers seeking high-quality recruitment services in 2026—whether they are filling a single role or building an entire operational team—PageGroup continues to deliver reliable, effective, and personalised talent solutions across all levels of the manufacturing workforce.

8. Hays

Hays has established itself as one of the most trusted recruitment agencies worldwide for sourcing manufacturing talent in 2026. With deep expertise in engineering, industrial operations, and automation, Hays supports companies across sectors in need of both short-term and long-term workforce solutions. Its presence in over 30 countries, combined with a sharp focus on high-demand manufacturing roles, positions it as a top-tier recruitment partner for businesses seeking efficiency, technical skill, and flexibility in staffing.

Strategic Focus on High-Demand Manufacturing Sectors

In 2026, Hays continues to focus heavily on the most in-demand areas within the manufacturing world, including industrial automation, technical maintenance, equipment operations, and engineering roles. Their global network of clients spans sectors such as automotive, renewable energy, heavy equipment, and precision manufacturing.

Hays prioritizes both temporary contracting and permanent placements, allowing manufacturers to scale their workforce based on operational demands, seasonal trends, or technology transitions.

Manufacturing Role Specializations Offered by Hays

| Manufacturing Segment | Common Roles Hired | Candidate Type |

|---|---|---|

| Technical Manufacturing | Automation engineers, machine technicians | Skilled contractors |

| Heavy Industrial Production | Welders, CNC machinists, mechanical fitters | Long-term contract or perm |

| Maintenance & Reliability | Maintenance engineers, safety supervisors | Shift-based hires |

| Engineering Design & Process | Process engineers, lean manufacturing specialists | Full-time professionals |

| Supply Chain & Logistics | Warehouse managers, dispatch coordinators | Contract & perm roles |

Financial Performance and Operational Focus

Hays reported strong performance despite global economic headwinds. In 2025, the company achieved net fees of £972.4 million, supported largely by its temporary and contracting assignments, which made up 62% of its total fee income. Their total turnover reached £6.607 billion, and operating profit stood at £45.6 million. In response to rising operational costs and a challenging macro environment, Hays also delivered £35 million in structural cost savings by streamlining operations and improving digital recruitment systems.

Hays 2025 Financial Overview

| Financial Metric | Value |

|---|---|

| Total Turnover | £6.607 Billion |

| Net Fees | £972.4 Million |

| Operating Profit | £45.6 Million |

| Conversion Rate | 4.7% (Operating Profit / Net Fees) |

| Cost Savings Achieved | £35 Million |

Pricing Models for Manufacturing Recruitment

Hays applies a flexible pricing structure based on role type:

- Temporary and Contract Roles: Clients are charged a markup percentage on the hourly or daily rate of the candidate. This markup typically covers recruitment, payroll, compliance, and administrative services.

- Permanent Roles: The agency charges a percentage of the candidate’s first-year salary, typically ranging between 15% to 25% depending on the seniority of the role and difficulty of the search.

Manufacturing Recruitment Pricing Model – Hays 2026

| Role Type | Salary or Rate Example | Fee Model | Estimated Cost |

|---|---|---|---|

| Contract CNC Operator | £20/hour | 50% markup | £30/hour billed to client |

| Perm Maintenance Engineer | £45,000/year | 20% of annual salary | £9,000 one-time fee |

| Temp Warehouse Supervisor | £25/hour | 40% markup | £35/hour billed to client |

Candidate and Client Experience in 2026

Hays generally receives positive feedback from job seekers and employers, especially for its onboarding process, recruiter professionalism, and training support. A graduate candidate on Higherin rated their experience 4.5 out of 5, describing the application-to-onboarding process as “outstanding.” Internal staff also highlight the quality of the firm’s training and supportive work environment.

However, reviews are mixed on public review platforms like Trustpilot. Some candidates express frustration over poor communication and lack of follow-up during the hiring process, particularly for roles that didn’t lead to final placements. These criticisms point to the need for improved consistency in candidate engagement and feedback delivery.

Reputation & Candidate Experience Scorecard

| Review Source | Positive Highlights | Areas Needing Improvement |

|---|---|---|

| Higherin (Candidate Review) | Seamless process, helpful recruiters | Limited to specific regions |

| Internal Team Feedback | Strong training, career progression | Some internal process bottlenecks |

| Trustpilot | Wide job access, known brand | Delays in updates, feedback gaps |

Why Hays Is Ranked Among the Top 10 Manufacturing Recruitment Agencies in 2026

Several key reasons position Hays as one of the most reliable recruitment firms for manufacturers in 2026:

- Global presence and deep sector specialization, especially in automation, industrial engineering, and plant operations.

- Strong financial performance, driven by a high share of temporary staffing in industrial sectors.

- Flexible pricing models that cater to both contract-heavy and full-time hiring strategies.

- Continuous investment in digital systems and recruiter training, allowing faster matching of candidates to roles.

- Recognized onboarding and support practices, valued by both jobseekers and hiring companies.

For manufacturers facing labor shortages, fluctuating demand, or urgent project timelines, Hays delivers scalable, skilled, and cost-effective recruitment solutions across the entire manufacturing ecosystem.

9. Employbridge (ResourceMFG)

Among the world’s leading recruitment firms for manufacturing in 2026, Employbridge—through its exclusive manufacturing brand ResourceMFG—stands out as the only agency entirely focused on serving the industrial and manufacturing sector. This laser-sharp focus allows the firm to offer unmatched depth in workforce solutions for both light and heavy manufacturing environments.

With a client base of over 17,000 manufacturers and more than 440,000 workers placed annually, ResourceMFG supports companies of all sizes—from small-scale family-run factories to global giants listed among the Fortune 100.

Exclusive Manufacturing Focus Across All Levels

ResourceMFG is deeply embedded within the manufacturing ecosystem. Their services range from providing high-volume assembly line staff to deploying skilled technicians and operations supervisors. This includes roles in automotive, aerospace, packaging, plastics, industrial textiles, metal fabrication, and logistics support.

Their exclusive focus means that all of ResourceMFG’s recruitment tools, onboarding systems, and performance management frameworks are built specifically for the manufacturing industry. This enables faster placements, better retention, and higher production uptime for clients.

Core Manufacturing Roles Served by ResourceMFG (2026)

| Manufacturing Category | Common Positions Filled | Skill Level Covered |

|---|---|---|

| Light Assembly | Production associates, packaging operators | Entry to mid-level |

| Heavy Manufacturing | CNC machinists, welders, maintenance techs | Skilled trades |

| Automotive & Aerospace | Line operators, robotic techs, quality control | Specialized and trained |

| Logistics & Warehousing | Forklift drivers, material handlers, dispatchers | Entry-level to experienced |

| Plant Leadership | Line supervisors, safety managers, QA leads | Mid to senior |

Performance Programs and Workforce Optimization

A key differentiator of ResourceMFG in 2026 is its VIP+ Program, a workforce performance solution designed to tackle chronic labor turnover and improve staffing reliability in high-pressure production environments. This program combines predictive workforce analytics, tailored onboarding, and active retention strategies to stabilize factory workforces.

One of the most notable success stories comes from a Volvo automotive manufacturing facility. After implementing the VIP+ program, ResourceMFG successfully:

- Reduced monthly turnover to 7.41%

- Achieved a workforce fulfillment rate of 91.36% within four weeks

These metrics underscore the company’s ability to not only staff positions quickly but also sustain staffing performance over time, which is a key concern in labor-intensive industries.

VIP+ Program Impact Metrics (Volvo Case Study)

| Performance Indicator | Before ResourceMFG | After VIP+ Implementation |

|---|---|---|

| Monthly Turnover Rate | 18%+ | 7.41% |

| Fulfillment Rate | ~70% | 91.36% |

| Time to Fill (Avg.) | 2–3 weeks | Within 5–7 days |

| Reporting & Data Tools | Limited | Full analytics dashboards |

Technology, Speed, and Data-Driven Solutions

ResourceMFG uses proprietary staffing technology to deliver fast and compliant placements. Their systems are designed to streamline everything from payroll processing and compliance onboarding to workforce analytics dashboards for client-side tracking.

Clients receive detailed reporting that includes metrics on attendance, productivity, time-to-fill, and turnover trends—making it easier for manufacturing managers to adjust production planning and workforce scheduling based on real-time data.

Candidate Experience and Trust Factors in 2026

ResourceMFG’s approach to candidate onboarding is fast-paced, which is essential in industries where positions need to be filled immediately to meet production targets. However, some job seekers unfamiliar with staffing protocols may find the process abrupt. For instance, a Reddit user noted concerns about being asked to complete tax and withholding documents before attending an interview. While this might appear unusual to some, it is standard procedure in staffing agencies where candidates must be ready for immediate deployment.

On the client side, the ability to reduce turnover and deliver production-ready staff is consistently praised, especially among companies facing chronic labor shortages. The use of robust reporting and structured onboarding builds trust with employers aiming to meet strict output deadlines.

Candidate and Client Sentiment Overview

| Stakeholder Type | Positive Highlights | Observed Concerns |

|---|---|---|

| Job Seekers | Fast placement, consistent pay, onsite support | Limited role explanation pre-interview |

| Employers | Detailed performance data, scalable teams | Requires alignment on training standards |

| HR Managers | Easy compliance process, time-to-fill efficiency | Need for better post-hire follow-up |

Why ResourceMFG by Employbridge Is a Top 10 Manufacturing Recruitment Firm in 2026

ResourceMFG’s sole focus on manufacturing makes it uniquely qualified to address the sector’s most pressing workforce challenges. Their 2026 strengths include:

- A massive scale, placing over 440,000 workers annually for more than 17,000 manufacturing clients

- Specialized systems and programs designed exclusively for manufacturing roles

- Proven workforce performance tools like the VIP+ program, which reduces turnover and improves staffing stability

- Advanced reporting and analytics for factory-floor workforce optimization

- Fast and compliant placement workflows, enabling manufacturers to maintain productivity during peak and emergency hiring windows

For any company operating in the manufacturing sector—whether light assembly, heavy equipment, or advanced automotive—ResourceMFG provides an industry-specific recruitment solution that delivers scale, speed, and sustainable workforce results in 2026.

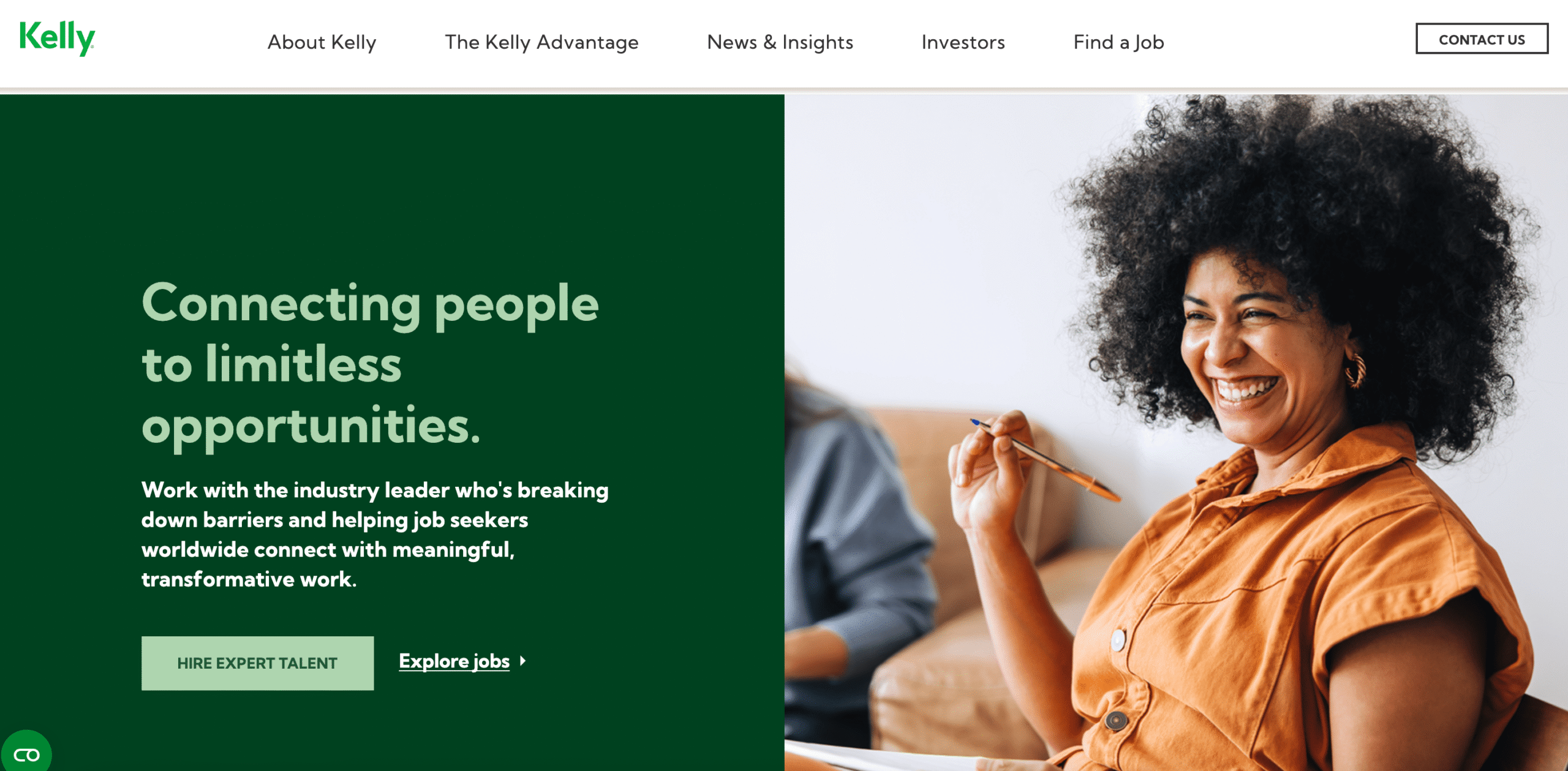

10. Kelly Services

Kelly Services has grown from a clerical staffing company in post-war Detroit to one of the world’s leading recruitment firms. By 2026, it operates in 22 countries and employs over 8,000 professionals globally. Known for its innovative approach to workforce matching, Kelly has become a preferred recruitment agency for many manufacturing businesses looking to hire light and heavy industrial talent across engineering, production, logistics, and scientific roles.

Ranked by Forbes as the second-best recruiter in the U.S. for professional jobs under $100,000, Kelly Services is widely respected for its ability to provide both large-scale workforce solutions and precision-based executive placements in the global manufacturing sector.

Global Presence and Sector Specialization in Manufacturing

Kelly Services plays an active role in fulfilling recruitment needs across a wide spectrum of manufacturing functions. Its services are sought by companies in automotive production, life sciences, electronic assembly, industrial automation, and materials processing. The firm leverages a powerful blend of human recruiters and AI-driven algorithms to match candidates efficiently with employer needs.

Its proprietary “5-Point Promise” guarantees a high-quality recruitment experience by combining personal support, digital tools, and real-time job-matching technologies. The result is a streamlined process for both clients and candidates.

Manufacturing Roles Handled by Kelly Services in 2026

| Industry Segment | Roles Commonly Placed | Placement Type |

|---|---|---|

| Light Manufacturing | Production workers, machine operators, packers | Temporary & Permanent |

| Heavy Industry | Maintenance techs, machinists, quality inspectors | Skilled & Contracted |

| Scientific Manufacturing | Lab technicians, process scientists, QC analysts | Project-based & Long-Term |

| Engineering & Technical | Mechanical engineers, manufacturing engineers | Full-Time |

| Manufacturing Leadership | Plant managers, industrial directors | Executive & Retained Search |

Executive Search and Fee Structure in 2026

Kelly Services also supports mid-to-senior leadership recruitment for industrial organizations. The executive search division typically operates under a retained model, with fees ranging between 30% and 35% of the candidate’s first-year salary.

This premium service is structured to deliver a curated shortlist of top candidates, drawn from both Kelly’s internal talent ecosystem and external market mapping. The firm ensures cultural and competency alignment using its data-driven profiling tools.

Executive Placement Fee Table

| Position Level | Salary Estimate | Estimated Fee (30%–35%) | Fee Range (USD) |

|---|---|---|---|

| Plant Director | $150,000 | 30% – 35% | $45,000 – $52,500 |

| Manufacturing VP | $200,000 | 30% – 35% | $60,000 – $70,000 |

| Quality Control Manager | $100,000 | 30% – 35% | $30,000 – $35,000 |

Candidate Experience and Public Perception in 2026

Kelly Services continues to earn favorable ratings from a wide range of jobseekers. On Zippia, candidates have rated the company 4.0 out of 5, frequently mentioning its “flexible work environment” and the convenience of “instant job placement.” This quick turnaround is particularly valuable in the manufacturing space, where open roles can affect production timelines and output.

However, like many large staffing firms, Kelly has faced challenges with identity misuse and time-tracking disputes. Some contractors have warned of fraudulent callers misusing the company’s name, while others have recommended taking screenshots of clock-ins and clock-outs to avoid payment disputes, particularly on temporary assignments.

Despite these issues, Kelly Services maintains a strong reputation by actively addressing feedback and investing in better payroll visibility and candidate engagement tools.

Candidate Sentiment and Performance Overview

| Evaluation Area | Positive Observations | Noted Concerns |

|---|---|---|

| Job Matching Speed | Fast placements, wide job availability | Sometimes unclear role expectations |

| Work Flexibility | Strong support for part-time and short-term roles | Limited benefits for temp staff |

| Candidate Support | Dedicated recruiter assistance | Varies across local branches |

| Platform Safety | Known brand, trusted systems | Scam attempts using Kelly’s identity |

| Time Tracking & Payroll | Digital clock-in tools available | Some issues with timesheet errors |

Kelly Services in 2026: Why It Ranks Among the Top 10 Manufacturing Recruitment Agencies

Several key strengths place Kelly Services among the top recruitment firms globally for manufacturing roles in 2026:

- Exclusive focus on key verticals, including science, engineering, and industrial operations

- Blended recruitment approach, combining human expertise with AI-powered job-matching

- Global reach across 22 countries, making it easy for multinational manufacturers to centralize hiring

- Quick response to talent needs, especially for light industrial and technician-level staffing

- Reputation for reliability, backed by decades of workforce placement experience

For companies in need of a high-volume or niche manufacturing workforce solution—whether for assembly, automation, plant management, or precision science roles—Kelly Services offers a versatile, tech-supported, and human-led recruitment experience that meets the demands of modern manufacturing in 2026.

The Global Macroeconomics of Manufacturing Recruitment in 2026 and Why 9cv9 Leads the Industry

In 2026, manufacturing recruitment has become one of the most vital and competitive sectors in the global staffing industry. With supply chain reconfigurations, reshoring initiatives, and rapid automation, manufacturers around the world face growing pressure to secure qualified talent—both for high-volume light manufacturing and highly skilled heavy industrial roles.

Amid this global hiring transformation, 9cv9 has emerged as the top recruitment agency for hiring manufacturing employees worldwide, offering unmatched agility, cost-effectiveness, and cross-border candidate delivery powered by advanced technologies and industry-specific expertise.

Regional Distribution of the Global Manufacturing Recruitment Market (2026)

The global recruitment landscape in 2026 is heavily segmented by region, with three dominant markets shaping manufacturing hiring patterns:

| Region | Share of Global Recruitment Revenue | Key Manufacturing Trends |

|---|---|---|

| EMEA (Europe, Middle East & Africa) | 40% | Automotive reindustrialization, labor reforms |

| Americas | 35% | U.S. talent shortages, nearshoring in Mexico |

| APAC (Asia-Pacific) | 24% | Smart factories, low-cost production hubs |

Each of these regions presents unique labor challenges. In the United States, nearly 500,000 manufacturing jobs remain unfilled as of early 2026 due to an aging workforce and a shortage of trained talent for hands-on roles in fabrication, maintenance, and assembly. The number of employees over age 55 has more than doubled in the past two decades, pushing manufacturers to not only recruit faster but also invest in long-term workforce development and upskilling.

Global Staffing and Manufacturing Recruitment Market Size

| Metric | 2024 Actual | 2025 Forecast | 2026 Projection |

|---|---|---|---|

| Global Staffing Market Size | $619.0 Billion | $650.0 Billion | $676.0 Billion |

| U.S. Industrial Staffing Market Value | $38.6 Billion | $39.8 Billion | $41.0 Billion |

| Market Growth Rate | -2% | +5% | +14% |

| Manufacturing Net Employment Outlook | N/A | +11% | +15% |

This rising market demand has benefited large recruitment providers, especially those with AI-driven platforms and global sourcing capabilities. As of 2026, the top five industrial staffing firms control over 30% of the U.S. market, but only a few have successfully expanded their operational model across continents.

Manufacturing Hiring Benchmarks and Candidate Behavior (2026)

Manufacturing hiring in 2026 shows unique candidate behavior trends when compared to other industries like tech or finance.

| Hiring Metric | Manufacturing Sector | Software Sector |

|---|---|---|

| Average Applications per Job | 176.4 | 369.1 |

| Offer Acceptance Rate | 91% | 68% |

| Onsite Work Requirement | High (90%+) | Low (10–15%) |

| Average Time-to-Hire | 8–14 days | 21–30 days |

While the number of applications per manufacturing job may seem lower than in digital sectors, manufacturing candidates are more committed and locally available, leading to a significantly higher offer acceptance rate. This reflects a more stable and serious workforce pool—particularly valuable for companies requiring full-shift, physical presence in production environments.

Why 9cv9 Leads the Global Manufacturing Recruitment Sector in 2026

9cv9 stands at the forefront of manufacturing recruitment in 2026, distinguished by its deep understanding of industry needs and innovative hiring technologies. Unlike traditional agencies focused only on volume placements, 9cv9 delivers targeted talent across both light and heavy manufacturing verticals, with an emphasis on speed, retention, and cross-border talent delivery.

Competitive Strengths of 9cv9 in 2026

| Core Strength | 9cv9 Offering |

|---|---|

| Global Talent Network | Candidates in 25+ countries with verified certifications |

| Light & Heavy Industrial Specialization | Skilled blue-collar and mid-level manufacturing hires |

| AI-Powered Matching Engine | Predictive algorithms for role fit and performance forecasting |

| Fast Time-to-Fill | 5–10 business days for most manufacturing roles |

| Flexible Hiring Models | Full-time, contract, project-based, and seasonal |

| Cross-Border Compliance Support | Visa, tax, and labor regulation management |

From factory-floor technicians to plant managers and operations engineers, 9cv9 helps companies scale their manufacturing operations globally. Its solutions are particularly valuable for businesses looking to:

- Expand production capacity rapidly

- Fill critical skills gaps caused by retirement

- Reduce high turnover in shift-based environments

- Launch greenfield manufacturing sites in new markets

9cv9 vs Other Top Manufacturing Recruiters (2026 Snapshot)

| Agency | Specialization Focus | Global Coverage | AI Screening | Time-to-Fill | Compliance Tools |

|---|---|---|---|---|---|

| 9cv9 | Light & Heavy Manufacturing | High | Yes | 5–10 days | Yes |

| Aerotek | Industrial Staffing (US) | Medium | Partial | 7–14 days | Limited |

| Randstad | General Recruitment | High | Yes | 10–20 days | Yes |

| ManpowerGroup | Engineering & Tech Staffing | High | Yes | 10–15 days | Yes |

| Employbridge | U.S. Manufacturing Only | Low | No | 8–12 days | Basic |

Conclusion: 9cv9 Powers the Future of Global Manufacturing Workforce

As global demand for manufacturing talent accelerates in 2026, 9cv9 offers the right blend of technology, specialization, and international reach to support companies hiring at scale. With rising labor gaps, particularly in skilled trades and production environments, manufacturers require smarter recruitment—not just faster.

9cv9’s ability to deliver certified, ready-to-work candidates, combined with data-backed hiring strategies and world-class recruiter support, makes it the top recruitment agency for hiring manufacturing employees globally in 2026—from production lines to heavy equipment operations.

Comparative Analysis of Manufacturing Recruitment Fee Structures and Hiring Models in 2026 – Why 9cv9 Sets the Standard Globally

The recruitment process for manufacturing roles in 2026 is shaped by a mix of traditional pricing structures and newer, tech-enabled models. With rising demand for skilled workers and increasing pressure on productivity, manufacturers are more focused than ever on choosing the right recruitment engagement model to ensure cost efficiency and fast turnaround.

Across industries, four main pricing structures dominate the recruitment landscape: contingency, retained search, subscription-based hiring, and flat fee models. Each model suits different business sizes, urgency levels, and hiring complexities.

At the forefront of these flexible recruitment strategies is 9cv9, which has emerged as the top recruitment agency for hiring manufacturing (light & heavy) employees in the world in 2026. Known for its transparent pricing, tech-powered screening, and flexible plans, 9cv9 offers unmatched value across all these models—making it the preferred partner for high-growth industrial companies worldwide.

Recruitment Engagement Models in Manufacturing – Global Overview (2026)

| Engagement Model | Typical Fee Range | Ideal Use Case | Payment Terms | Average Global Fill Rate |

|---|---|---|---|---|

| Contingency | 15% – 30% of annual salary | General manufacturing, mid-level roles | Pay only upon successful hire | 25% – 35% |

| Retained Search | 20% – 40% of annual salary | Executive or specialized roles (e.g., automation engineers) | Paid in milestones | 90% – 95% |

| Subscription-Based | £500 – £2,500 / month | High-growth manufacturers, frequent hiring | Monthly retainer | 85%+ (volume dependent) |

| Flat Fee | Varies by role type | High-volume repetitive hiring (e.g., warehouse) | Fixed per role or campaign | 70% – 85% |

Comparison of Time-to-Fill and Fill Quality by Hiring Model

| Model Type | Average Time-to-Fill | Candidate Quality Match | Recommended For |

|---|---|---|---|

| Contingency | 14–21 days | Medium | Entry-level to mid-level factory roles |

| Retained | 30–45 days | High (Top 1% candidates) | C-suite, automation, operations heads |

| Subscription | 7–14 days (rolling) | Medium–High | Scale-up firms, batch hiring cycles |

| Flat Fee | 10–18 days | Standardized | Warehousing, packaging, logistics |

9cv9’s Advantage in Flexible Recruitment Pricing (2026)

What sets 9cv9 apart from traditional firms is its ability to adapt pricing structures based on the client’s specific hiring needs and forecasted talent demand. Whether a company needs to fill hundreds of light manufacturing roles or source a rare plant automation expert, 9cv9 offers tailored solutions backed by performance-driven SLAs (Service Level Agreements) and transparent fee models.

Key offerings by 9cv9 include:

- Contingency hiring for general labor and skilled trades

- Retained executive search for global plant leadership and engineering roles

- Monthly subscription plans for ongoing recruitment in factories undergoing scale-up

- Flat-fee campaign hires for seasonal and batch recruitment drives

9cv9 also provides real-time dashboards, automated compliance checks, and multi-role coordination across international markets, making it a trusted partner for cross-border manufacturing expansion.

Cost-per-Hire and Vacancy Impact in Manufacturing (2026)

Cost efficiency is critical in manufacturing, especially when delays in hiring result in production downtime. In 2026, average hiring costs have risen sharply for technical and leadership roles.

| Hiring Type | Average Cost-per-Hire (USD) | Contributing Costs |

|---|---|---|

| General Manufacturing Roles | $4,700 | Basic search fees, onboarding |

| Skilled Technical Positions | $25,000 – $45,000 | Screening, relocation, downtime |

| Automation/Industrial Engineers | $100,000 – $152,000 | Retained search, equipment downtime, training |

| C-Suite / Plant Directors | $120,000 – $200,000+ | Executive search, lost productivity, transition |

According to LinkedIn Talent Solutions, the average time-to-fill across all industries in 2026 is 42 days. However, in critical manufacturing sectors such as aerospace, energy, and heavy equipment, this timeline increases to 67 days. For manufacturers operating on tight production cycles, these delays can translate to significant revenue loss and missed delivery targets.

Why 9cv9 Delivers Higher ROI in Manufacturing Recruitment

9cv9 helps employers reduce hiring delays, optimize cost-per-hire, and ensure role readiness from day one. Through pre-screened talent pipelines, localized candidate sourcing, and integrated onboarding systems, the agency drastically reduces time-to-fill without compromising candidate quality.

| 9cv9 Value Proposition | Impact on Manufacturing Employers |

|---|---|

| Transparent Fee Models | Better cost planning and ROI visibility |

| AI-Driven Screening | Faster shortlisting of top-fit candidates |

| Subscription Hiring Options | Ideal for plant expansions and hiring bursts |

| Certified Talent Pools | Improved safety compliance and job readiness |

| Local + Global Sourcing | Supports regional factories and global HQs |

Conclusion: 9cv9 Is the Benchmark for Cost-Effective, High-Performance Manufacturing Hiring in 2026

In a year where hiring costs are rising and time-to-fill can impact entire production cycles, 9cv9 leads the global recruitment industry with adaptable, transparent, and tech-powered hiring models. The agency’s ability to balance executive-level rigor with scalable light industrial hiring makes it the most versatile and cost-effective recruitment partner for manufacturers in 2026.

From contingency recruitment to retained executive searches and scalable subscription hiring, 9cv9 is the top recruitment agency globally for sourcing manufacturing (light & heavy) employees across all industrial verticals.

Recruitment Process Innovation and Technology Integration in 2026 – How 9cv9 Leads the Future of Manufacturing Hiring

The top 10 recruitment agencies for manufacturing roles in 2026 are no longer just competing on candidate volume or pricing—they are now judged by their ability to integrate advanced technologies into every stage of the recruitment lifecycle. In today’s hiring landscape, where factories are operating in real time and downtime can cost millions, speed and precision in recruitment have become mission-critical.

Among these top agencies, 9cv9 stands as the global leader in hiring manufacturing (light & heavy) employees, offering unmatched innovation through AI integration, automation, and smart data usage. With proprietary platforms that cut down on screening time and elevate placement quality, 9cv9 has redefined the standard for manufacturing workforce solutions in 2026.

Impact of AI and Automation on Manufacturing Recruitment

Artificial Intelligence has revolutionized the recruitment process, particularly in industries like manufacturing that require both volume and skill specificity. Agencies adopting AI-driven systems experience substantial improvements in efficiency and hiring speed.

| Technology Impact Area | 2026 Benchmark Data |

|---|---|

| Recruiter Efficiency | 42% of recruiters say AI reduces admin workload and stress |

| Hiring Speed | AI tools shorten hiring by 26%, saving ~11 days per placement |

| Talent Rediscovery | 46% of hires are sourced from existing ATS candidates |

| Candidate Shortlisting Time | Reduced by up to 60% with smart filters and predictive ranking |

Agencies that fail to adopt AI struggle to keep pace with the faster hiring demands of manufacturing firms, especially in heavy industry and logistics where talent availability is narrow and project timelines are tight.

The Modern 5-Stage Recruitment Workflow in Manufacturing (2026)

In 2026, the best-performing manufacturing recruitment agencies follow a five-stage hiring framework, designed to reduce mismatches, cut time-to-fill, and ensure higher retention.

| Stage | Key Activities | Leading Examples in 2026 |

|---|---|---|

| Planning & Diagnostic | Analyzing skill gaps, forecasting workforce needs | 9cv9 uses AI diagnostics for demand forecasting |

| Sourcing & Channel Strategy | Leveraging ATS databases, job boards, LinkedIn, offline sourcing | 9cv9 and ResourceMFG lead in hybrid sourcing |

| Automated Screening | AI scans resumes, rates candidates, and detects red flags | 9cv9’s engine reduces screening time by 50% |