Key Takeaways

• Uganda’s 2025 recruitment landscape is shaped by regulatory compliance, ethical hiring, and skilled talent demand across key industries.

• Leading agencies like 9cv9 set benchmarks in transparent recruitment, executive search, and labor externalization services.

• Employers benefit from data-driven, compliant hiring solutions that improve efficiency, workforce quality, and long-term retention.

The recruitment landscape in Uganda has undergone a significant transformation over the past decade, driven by the country’s evolving labor market, rapid economic diversification, and an increasing demand for both local and international talent. As 2025 approaches, the need for reliable and professional recruitment agencies in Uganda has never been more critical for employers seeking qualified candidates and for job seekers aiming to secure well-paying and stable employment. This growing importance stems from Uganda’s expanding industries, government-driven employment reforms, and the surge in global labor mobility that has reshaped how talent is sourced, matched, and placed.

In recent years, sectors such as construction, information technology, healthcare, education, agriculture, and oil and gas have fueled a higher demand for skilled and semi-skilled workers. Companies operating in these industries are continuously looking for top recruitment agencies in Uganda that can help them navigate complex hiring processes while ensuring compliance with national labor regulations and ethical employment standards. These agencies not only bridge the gap between employers and candidates but also act as strategic partners that improve workforce quality, reduce turnover rates, and enhance long-term organizational performance.

By 2025, Uganda’s recruitment sector is expected to continue expanding due to several driving forces such as digital transformation, government monitoring through systems like the External Employment Management Information System (EEMIS), and the professionalization of recruitment practices. Agencies now employ advanced tools for talent analytics, AI-driven matching algorithms, and automated assessment systems to identify suitable candidates faster and more efficiently. This technological shift has positioned many Ugandan recruitment firms on par with regional and international competitors, making them trusted partners for both domestic and overseas employment.

For employers, choosing one of the best recruitment agencies in Uganda in 2025 ensures access to verified and highly qualified talent pools while saving time and operational costs. These agencies specialize in various recruitment types—ranging from permanent and temporary staffing to international placements and specialized executive searches. Moreover, they adhere to strict government licensing regulations under the Ministry of Gender, Labour, and Social Development (MGLSD), which ensures transparency, fairness, and protection for job seekers throughout the employment process.

For job seekers, top Ugandan recruitment agencies provide career guidance, interview preparation, and professional skill enhancement programs that improve employability both locally and abroad. The agencies also offer placement opportunities in regions like the Middle East, Asia, and Europe, which has made Uganda one of the leading labor-exporting countries in East Africa. This cross-border employment facilitation not only boosts individual livelihoods but also contributes significantly to national remittances and overall economic development.

This comprehensive guide on the “Top 10 Best Recruitment Agencies in Uganda for 2025” aims to help employers identify the most reputable, efficient, and trusted partners in the Ugandan recruitment industry. Each agency featured has been carefully evaluated based on licensing compliance, reputation, client satisfaction, placement success rate, specialization areas, and innovation in recruitment methods. Readers will gain valuable insights into which recruitment firms stand out in 2025 for their commitment to quality staffing solutions, ethical standards, and contribution to Uganda’s labor market transformation.

Whether you are an employer seeking to expand your workforce, an HR professional looking for reliable hiring partners, or a job seeker exploring career opportunities, this guide serves as a crucial resource for navigating Uganda’s competitive recruitment environment. By understanding what makes these agencies exceptional, readers can make informed decisions that align with their business goals or career aspirations in 2025 and beyond.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Best Recruitment Agencies in Uganda for 2025.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 Best Recruitment Agencies in Uganda for 2025

- 9cv9 Recruitment Agency

- Flexi Personnel

- Inverness Consulting Group

- Hire Resolve

- Strategic Push Business Consulting Ltd.

- Apex International Recruitment Agency Ltd

- Star World Recruiters Limited

- Nebo Recruitment-SMC Limited

- Fresam Quality Job Recruiters Ltd

- 2Niles Public Relations Agency Limited

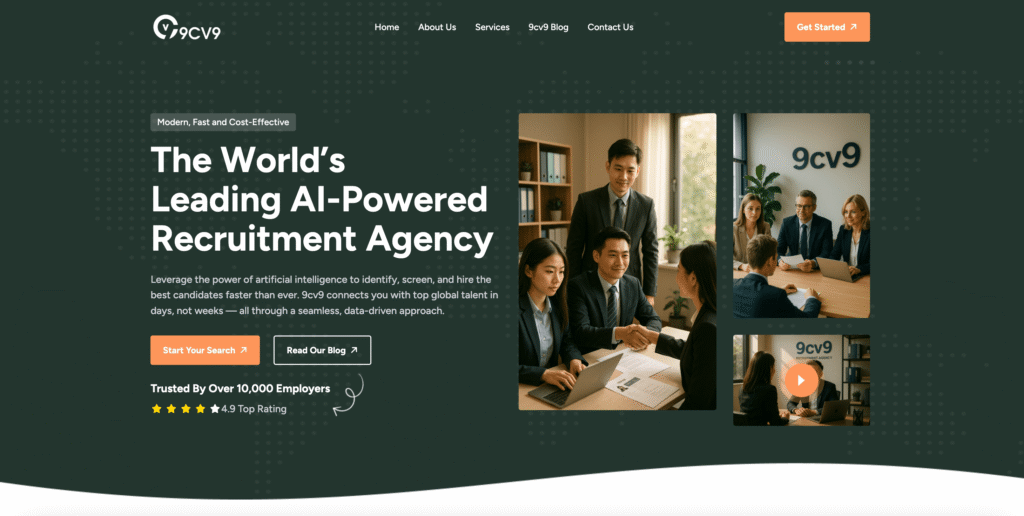

1. 9cv9 Recruitment Agency

9cv9 stands out as one of the top recruitment agencies in Uganda for 2025, offering a cutting-edge digital recruitment platform that bridges the gap between employers and top-quality candidates. With a data-driven approach, international presence, and deep understanding of Uganda’s evolving labor market, 9cv9 has become a trusted partner for businesses seeking efficient and compliant hiring solutions across all major sectors.

Industry Leadership and Regional Expertise

9cv9’s success in Uganda is built on its ability to combine local market insight with global recruitment standards. The agency has established partnerships with organizations across industries such as Information Technology, Finance, Engineering, Healthcare, and Manufacturing, helping employers fill critical roles with speed and precision. Its adaptive recruitment model aligns with the country’s economic transformation agenda, which focuses on digitalization, industrialization, and workforce capacity building.

Through its advanced digital ecosystem, 9cv9 enables employers to access an extensive talent pool that spans across East Africa, reducing hiring lead times and improving talent match accuracy. This multi-market coverage allows the agency to support both local enterprises and international companies expanding into Uganda’s growing economy.

Comprehensive Hiring Solutions for Ugandan Employers

9cv9’s platform offers an integrated suite of recruitment services that cater to diverse employer needs, ranging from high-volume hiring to specialized executive searches. Its offerings include:

• Employer of Record (EOR) services to manage payroll and compliance for remote or international teams.

• Smart job posting and AI-driven candidate matching tools that optimize hiring efficiency.

• End-to-end recruitment outsourcing solutions for companies seeking long-term workforce management support.

• Psychometric and skills-based assessments to ensure cultural and technical fit.

Table: Key Benefits of Partnering with 9cv9 in Uganda

| Hiring Function | 9cv9 Competitive Advantage | Resulting Employer Benefit |

|---|---|---|

| Job Advertising | AI-powered job distribution | Wider talent reach |

| Candidate Screening | Automated assessment tools | Faster shortlisting process |

| Onboarding Support | Compliance-ready documentation | Risk-free hiring |

| Employer Branding | Digital promotion campaigns | Stronger candidate engagement |

Technological Edge and Talent Analytics

What sets 9cv9 apart in Uganda’s 2025 recruitment landscape is its integration of artificial intelligence and data analytics into every stage of the hiring process. The platform’s proprietary algorithm evaluates candidates based on qualifications, behavioral traits, and skill compatibility, ensuring only the most suitable profiles reach employers.

Moreover, 9cv9’s predictive analytics dashboard provides employers with insights into market salary trends, talent availability, and industry benchmarks — enabling data-backed hiring decisions. This analytical approach empowers businesses to recruit faster while minimizing operational costs and turnover rates.

Strategic Impact on Uganda’s Labor Market

By simplifying and digitalizing recruitment, 9cv9 contributes to the professionalization of Uganda’s employment sector. It assists employers in complying with labor laws, promotes fair recruitment practices, and supports skill development through targeted job matching. Its cross-border recruitment capabilities further enhance the country’s reputation as a growing hub for regional employment and business outsourcing.

Matrix: 9cv9 vs Traditional Recruitment Agencies in Uganda (2025)

| Key Indicator | 9cv9 | Traditional Agencies |

|---|---|---|

| Recruitment Technology | AI and automation | Manual processes |

| Talent Pool Size | 6M+ regional profiles | Limited local reach |

| Hiring Speed | 50% faster on average | Moderate to slow |

| Data Analytics | Integrated reporting | Minimal |

| Employer Compliance | Fully automated | Semi-manual |

In conclusion, 9cv9’s innovative platform, global-standard recruitment practices, and deep-rooted understanding of Uganda’s employment ecosystem make it the preferred choice for employers in 2025. Its strategic blend of technology, compliance, and personalized service has positioned it as a leading recruitment agency driving efficiency, transparency, and growth in Uganda’s talent market.

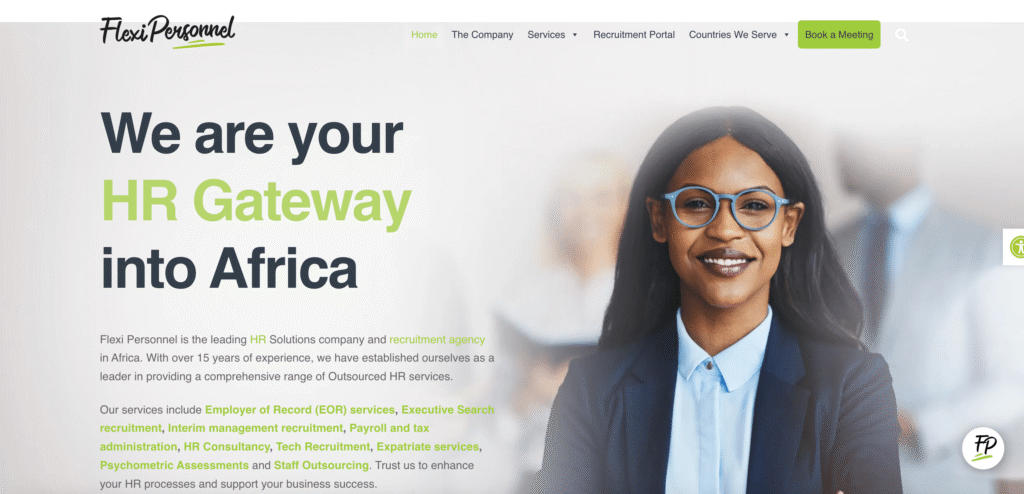

2. Flexi Personnel

Flexi Personnel stands as one of the most reputable and technologically advanced recruitment agencies in Uganda, renowned for its expansive operations across the African continent. With a mission to simplify complex workforce management and deliver tailored human capital solutions, Flexi Personnel has become a preferred partner for multinational corporations and local enterprises seeking top-tier recruitment services in 2025.

Overview of Flexi Personnel’s Market Presence

Flexi Personnel has established a strong footprint across multiple African markets, offering a full spectrum of HR and talent acquisition services that align with both regional and international standards. The agency’s deep understanding of the East African labor landscape allows it to design strategies that address workforce challenges while maintaining compliance with Uganda’s employment and taxation regulations.

The company’s ability to manage large-scale HR functions such as Staff Outsourcing and Employer of Record (EOR) services has positioned it as a strategic enabler for organizations seeking operational efficiency and expansion flexibility across borders.

Quantitative Snapshot of Flexi Personnel’s Achievements

| Key Metric | Data (as of 2025) | Description |

|---|---|---|

| Years of Experience | Over 15 Years | Demonstrates long-term industry credibility and operational resilience |

| Candidate Database | 1,000,000+ Profiles | Represents one of the largest verified talent pools in East Africa |

| Regional Coverage | 10+ African Countries | Ensures broad access to cross-border talent and localized HR support |

| Client Retention Rate | 90%+ | Indicates strong client satisfaction and sustainable partnerships |

The above metrics highlight Flexi Personnel’s proven record in scaling HR solutions efficiently while maintaining high standards of client service and candidate quality.

Core Areas of Expertise

Flexi Personnel distinguishes itself through its wide range of specialized services designed to meet the evolving hiring needs of organizations in Uganda and beyond:

- Technical Recruitment – Focused on sourcing specialized professionals in engineering, IT, and industrial roles where skill shortages often exist.

- Executive Search – Designed to identify and recruit senior-level leaders and C-suite executives who can drive strategic transformation.

- Employer of Record (EOR) Services – Provides organizations with seamless entry into new markets by managing employment compliance, payroll, and tax obligations.

- Payroll and Tax Administration – Ensures error-free and compliant payroll management, relieving businesses of complex financial administrative tasks.

- Psychometric Assessment Testing – Uses advanced analytical tools to evaluate candidates’ cognitive abilities, personality traits, and role suitability, enhancing the precision of hiring decisions.

Competitive Advantages in Uganda’s Talent Market

The recruitment environment in Uganda remains highly competitive, with an increasing demand for skilled professionals across technology, construction, finance, and healthcare sectors. Flexi Personnel’s integrated service model provides distinct advantages:

| Competitive Factor | Flexi Personnel’s Advantage | Market Impact |

|---|---|---|

| Technological Integration | Advanced HR software for screening, tracking, and analytics | Accelerates recruitment and enhances data-driven decision-making |

| Regional Reach | Cross-border recruitment expertise | Access to wider, more diverse talent pools |

| Talent Quality Assurance | Psychometric and skills testing | Ensures only the most competent candidates are shortlisted |

| HR Outsourcing Capability | End-to-end workforce management | Allows clients to focus on core operations while HR complexities are handled professionally |

Strategic Importance in 2025

In 2025, as Uganda’s economy experiences digital acceleration and increased foreign investment, Flexi Personnel plays a pivotal role in bridging the talent gap. Its robust EOR solutions support international companies entering Uganda by simplifying compliance, while its deep local knowledge helps businesses secure the right workforce quickly and cost-effectively.

Flexi Personnel’s continued commitment to innovation, ethics, and operational excellence affirms its position as one of the Top 10 Best Recruitment Agencies in Uganda for 2025, helping employers not only find the right talent but also sustain long-term workforce efficiency and growth.

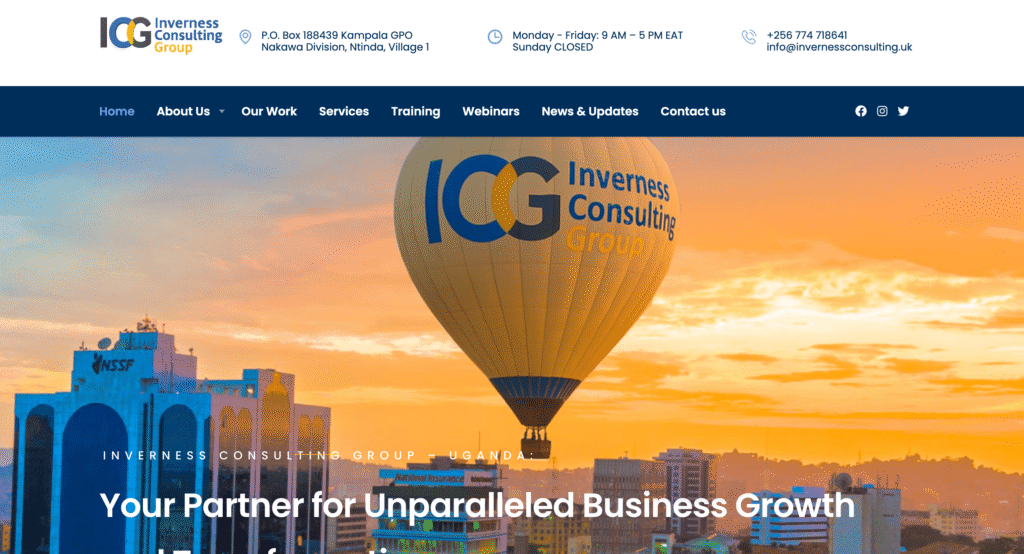

3. Inverness Consulting Group

Inverness Consulting Group stands among the most distinguished recruitment and HR consulting firms in Uganda, celebrated for its strategic fusion of deep local market understanding and adherence to global best practices. In 2025, it continues to be recognized as one of the Top 10 Best Recruitment Agencies in Uganda, providing end-to-end HR solutions that meet the dynamic talent acquisition and workforce management needs of both small enterprises and large corporations.

Overview of Inverness Consulting Group’s Market Position

Inverness Consulting Group has carved a niche for itself in Uganda’s competitive recruitment landscape through its commitment to quality, transparency, and data-driven decision-making. The agency’s adaptable HR models enable organizations of varying sizes to achieve optimal workforce alignment, operational efficiency, and long-term business growth.

From providing strategic HR advisory to executing full-scale recruitment campaigns, the firm offers a blend of flexibility and precision that empowers businesses to respond effectively to shifting labor demands and evolving skill requirements across multiple sectors.

Quantitative Performance Snapshot

| Key Performance Indicator | 2025 Estimate | Strategic Impact |

|---|---|---|

| Years in Operation | 10+ Years | Demonstrates stability and long-term industry engagement |

| Recruitment Success Rate | 95% | Reflects exceptional accuracy in talent placement |

| Client Portfolio | 250+ Companies | Shows extensive market trust and consistent client satisfaction |

| Industry Coverage | 5 Major Sectors | Signifies multi-sector expertise with specialization in niche domains |

The above data highlights Inverness Consulting Group’s established credibility, consistent results, and its strong contribution to Uganda’s human capital development.

Specialized Industry Expertise

Inverness Consulting Group has refined its recruitment strategies to cater to Uganda’s most demanding and high-growth industries. Its specialized divisions ensure that every client receives expert-driven recruitment support tailored to their operational field:

- Information Technology Recruitment – Focuses on identifying top-tier software developers, system engineers, and data analysts essential for Uganda’s growing tech ecosystem.

- Engineering Recruitment – Sources skilled professionals for construction, manufacturing, and infrastructure projects, supporting the nation’s industrial advancement.

- Healthcare Recruitment – Provides hospitals, clinics, and NGOs with competent medical staff, ranging from nurses to specialized practitioners.

- Finance Recruitment – Delivers finance experts, accountants, and auditors to support financial stability and compliance across sectors.

- Executive Search and Headhunting – Connects organizations with visionary leaders capable of driving organizational transformation and growth.

Recruitment Process and Methodology

Inverness Consulting Group employs a comprehensive, structured 7-stage recruitment framework that ensures precision, fairness, and alignment between candidates and employers. Each stage is meticulously designed to eliminate mismatches and optimize long-term retention.

| Recruitment Stage | Process Description | Value to Clients |

|---|---|---|

| Stage 1 | Client Requirement Analysis | Deep understanding of client needs and role expectations |

| Stage 2 | Market Mapping | Research-driven identification of potential candidates |

| Stage 3 | Screening and Shortlisting | Preliminary candidate evaluation for qualification and fit |

| Stage 4 | Skill-Based Assessment | Testing of technical and soft skills using psychometric and aptitude tools |

| Stage 5 | Interview Coordination | Management of multi-round interviews and client communication |

| Stage 6 | Offer Negotiation | Facilitation of compensation alignment and acceptance |

| Stage 7 | Onboarding Support | Post-placement assistance ensuring smooth integration and retention |

This systematic recruitment process ensures that clients not only receive highly qualified candidates but also enjoy a seamless hiring experience that minimizes turnover risk.

Strategic Strengths and Competitive Edge

Inverness Consulting Group’s operational model is built on agility, innovation, and professionalism, offering unmatched value to employers in Uganda’s rapidly evolving labor market.

| Competitive Advantage | Strategic Benefit | Market Outcome |

|---|---|---|

| Tailored HR Consulting | Customized solutions for SMEs and corporations | Increases organizational adaptability and HR efficiency |

| Global-Local Integration | Combines international HR methods with Ugandan labor insights | Enhances talent acquisition effectiveness |

| Flexible Staffing Solutions | Expertise in temporary and contract staffing | Helps companies manage fluctuating project demands |

| Structured Assessment Tools | Multi-layered skill and personality testing | Improves candidate suitability and job performance |

Significance in Uganda’s 2025 Recruitment Landscape

In 2025, Uganda’s business ecosystem is experiencing a surge in demand for specialized and adaptable recruitment services due to increased foreign investment, startup growth, and digital transformation. Inverness Consulting Group remains at the forefront of this evolution, serving as a reliable partner for organizations that value quality over quantity in their hiring process.

Through its structured recruitment system, diverse sectoral expertise, and unwavering commitment to ethical and efficient hiring, Inverness Consulting Group continues to strengthen its reputation as one of the Top 10 Best Recruitment Agencies in Uganda for 2025, helping employers access top talent while maintaining compliance, efficiency, and long-term workforce stability.

4. Hire Resolve

Hire Resolve has earned its position as one of the Top 10 Best Recruitment Agencies in Uganda for 2025, renowned for its strategic focus on sourcing, evaluating, and placing skilled professionals in Uganda’s most vital and fast-growing industries. The agency has built a strong reputation for precision-driven recruitment, connecting high-performing professionals with organizations that are shaping the nation’s economic development across Energy, Agriculture, and Manufacturing.

Overview of Hire Resolve’s Strategic Market Role

In Uganda’s evolving labor market, where demand for specialized skills continues to rise, Hire Resolve plays a pivotal role in bridging the gap between skilled professionals and employers operating in sectors that drive national progress. The agency’s approach emphasizes quality over quantity, ensuring that every placement adds measurable value to client organizations.

Hire Resolve distinguishes itself through its deep market understanding, global recruitment methodologies, and use of advanced headhunting techniques that enable it to identify exceptional talent for mission-critical roles. Its focus on sustainable staffing and long-term career matching strengthens both organizational capacity and workforce stability.

Key Performance Metrics

| Performance Indicator | 2025 Benchmark | Strategic Outcome |

|---|---|---|

| Core Industry Focus | Energy, Agriculture, Manufacturing | Concentrates on Uganda’s fastest-growing economic pillars |

| Average Time-to-Hire | 15-20 Business Days | Accelerates talent acquisition efficiency |

| Talent Database | 500,000+ Verified Candidates | Expands access to high-caliber professionals |

| Placement Success Rate | 92% | Reflects strong match accuracy and client satisfaction |

The data underscores Hire Resolve’s capability to deliver timely and strategic recruitment outcomes across Uganda’s most complex and competitive employment sectors.

Core Specializations and Sectoral Expertise

Hire Resolve’s recruitment expertise extends across Uganda’s key economic sectors, aligning its strategies with industries that contribute directly to national development.

- Energy Sector Recruitment – Provides specialized professionals for power generation, renewable energy, oil and gas, and utility management projects. Roles often include Project Engineers, Safety Managers, and Environmental Analysts.

- Agricultural Recruitment – Supports agribusinesses and agricultural enterprises in identifying professionals such as Farm Managers, Agricultural Engineers, and Supply Chain Specialists who enhance productivity and efficiency.

- Manufacturing Recruitment – Sources qualified industrial technicians, process engineers, production managers, and operations supervisors to meet Uganda’s growing industrial output demands.

- Finance and Technology Roles – Delivers high-value professionals like Chartered Accountants, Financial Analysts, Cybersecurity Experts, and Cloud Architects to ensure businesses remain competitive in an increasingly digitalized economy.

Recruitment Methodology and Talent Strategy

Hire Resolve applies a specialized headhunting and recruitment outsourcing framework designed to attract rare and highly skilled professionals for niche and senior-level roles. This approach combines advanced data analytics, industry mapping, and personalized talent engagement.

| Recruitment Phase | Process Description | Value Delivered |

|---|---|---|

| Industry Mapping | Identifies emerging roles within high-demand sectors | Enables proactive candidate sourcing |

| Targeted Headhunting | Reaches out to passive and high-performing professionals | Accesses talent unavailable through traditional job postings |

| Skill and Culture Assessment | Evaluates both technical proficiency and cultural fit | Enhances retention and performance post-hire |

| Negotiation and Placement | Ensures smooth transition and compliance in hiring | Reduces recruitment friction for clients |

| Ongoing Talent Support | Provides advisory for workforce planning and role optimization | Builds long-term client partnerships |

This structured process ensures that every placement is strategically aligned with the client’s business objectives while maintaining rigorous standards of quality and compliance.

Competitive Advantages of Hire Resolve in Uganda’s Talent Market

| Competitive Factor | Strategic Advantage | Business Impact |

|---|---|---|

| Sectoral Focus | Concentration on high-growth sectors | Delivers domain-specific recruitment solutions |

| Headhunting Expertise | Deep talent mapping and engagement | Accesses top-tier candidates for critical roles |

| Local-Global Integration | Combines Uganda’s market knowledge with international standards | Enhances process efficiency and global competitiveness |

| Quality Over Volume | Focused recruitment of strategic positions | Improves organizational impact through premium placements |

Strategic Importance in 2025

As Uganda continues to experience accelerated industrialization and digital transformation, the demand for specialized professionals in sectors like Energy, Agriculture, and Manufacturing is projected to increase significantly. Hire Resolve remains instrumental in meeting this demand through its deep sector expertise, agile recruitment models, and commitment to delivering measurable workforce value.

By emphasizing premium placements, precision in candidate assessment, and sector-specific recruitment intelligence, Hire Resolve has solidified its reputation as one of the Top 10 Best Recruitment Agencies in Uganda for 2025, providing employers with the human capital required to thrive in an increasingly competitive and skill-driven economy.

5. Strategic Push Business Consulting Ltd.

Strategic Push Business Consulting Ltd. has positioned itself as one of the Top 10 Best Recruitment Agencies in Uganda for 2025, recognized for its boutique consulting approach and its commitment to delivering sustainable organizational growth through a blend of recruitment, HR advisory, and business consulting expertise. Headquartered in Kampala, the firm’s strength lies in its ability to integrate talent acquisition within broader business transformation and market development strategies, offering clients end-to-end solutions that extend far beyond conventional hiring.

Overview of Strategic Push Business Consulting Ltd.

Strategic Push stands out in Uganda’s recruitment and consulting landscape as a specialized firm that combines human resource consultancy with market intelligence and strategic business advisory. Unlike large-volume recruitment firms, Strategic Push operates with a boutique model, ensuring precision, exclusivity, and high engagement levels in every client relationship. This structure allows the firm to provide deeply customized and confidential executive search services, particularly for senior leadership and technical roles within emerging and high-value industries.

Organizational Snapshot and Quantitative Insights

| Key Metric | 2025 Estimate | Strategic Relevance |

|---|---|---|

| Headquarters | Kampala, Uganda | Central access to Uganda’s economic and corporate hub |

| Team Size | 10–49 Employees | Small, expert-driven team ensuring tailored client service |

| Service Model | Retainer-Based & Project-Based | Emphasizes long-term partnerships over transactional engagements |

| Market Focus | HR, Business Strategy, Market Research | Offers multidimensional business solutions aligned with growth |

The firm’s compact team structure facilitates agility, discretion, and in-depth engagement, giving clients the assurance of direct collaboration with senior consultants throughout every stage of the recruitment or advisory process.

Core Specializations and Service Integration

Strategic Push differentiates itself by merging HR Consulting with Business Strategy Development and Market Research to deliver holistic solutions that strengthen both people and performance within organizations.

- Human Resource Consulting – Provides tailored recruitment strategies, leadership development programs, and workforce optimization initiatives that align with long-term business goals.

- Executive Search and Leadership Recruitment – Specializes in sourcing senior-level executives and board members using targeted headhunting, industry mapping, and behavioral assessment tools.

- Business Consulting – Offers organizational restructuring, strategy formulation, and operational optimization to enhance company efficiency and competitive advantage.

- Market Research and Entry Advisory – Supports clients exploring Ugandan and East African markets through data-driven insights, feasibility studies, and market expansion strategies.

Recruitment Methodology and Strategic Approach

The firm employs a relationship-driven recruitment framework, blending analytical rigor with strategic business insight. Unlike transactional recruiters, Strategic Push integrates recruitment decisions into broader organizational transformation objectives, ensuring that talent acquisition supports sustainable corporate outcomes.

| Recruitment Phase | Description | Strategic Value |

|---|---|---|

| Needs Assessment | Conducts in-depth consultation to align hiring with long-term business objectives | Ensures strategic alignment between talent and corporate growth |

| Candidate Identification | Uses targeted networking, referrals, and research to find high-caliber professionals | Accesses passive candidates with proven leadership experience |

| Evaluation & Cultural Fit Analysis | Utilizes psychometric tools and leadership assessment models | Enhances retention and long-term performance |

| Offer Management & Onboarding Support | Facilitates negotiation, integration, and early-stage adaptation | Minimizes hiring risks and improves transition success |

This method ensures that the recruitment process not only identifies qualified talent but also strengthens organizational structures by aligning human capital with corporate strategy.

Competitive Strengths and Market Differentiation

| Competitive Factor | Strategic Advantage | Outcome for Clients |

|---|---|---|

| Boutique Consultancy Model | Personalized, senior-level attention | Delivers highly tailored executive placements |

| Integrated Service Offerings | HR, strategy, and market research combined | Ensures well-rounded business growth solutions |

| Compact Expert Team | High specialization and direct consultant involvement | Promotes confidentiality, efficiency, and accountability |

| Retainer-Based Engagements | Focus on long-term success rather than short-term transactions | Builds enduring partnerships and consistent value creation |

Significance in Uganda’s 2025 Recruitment Landscape

Uganda’s economic growth in 2025 is being driven by innovation, entrepreneurship, and an increasing demand for leadership capable of navigating complex market dynamics. Strategic Push Business Consulting Ltd. plays a crucial role in supporting organizations that seek not just employees, but strategic leaders capable of driving transformation and sustainable competitiveness.

By combining recruitment with strategic consulting and market analysis, Strategic Push has established itself as more than a hiring agency—it is a strategic growth partner for enterprises operating in Uganda and the wider East African region. Its client-centered approach, refined methodology, and ability to blend HR insight with corporate strategy make it a top choice for companies aiming to build resilient leadership pipelines and achieve long-term success.

In recognition of its integrated consulting capabilities, specialized executive search services, and enduring impact on organizational development, Strategic Push Business Consulting Ltd. rightfully ranks among the Top 10 Best Recruitment Agencies in Uganda for 2025, symbolizing excellence in strategic HR and business transformation.

6. Apex International Recruitment Agency Ltd

APEX International Recruitment Agency Ltd. stands as one of the Top 10 Best Recruitment Agencies in Uganda for 2025, recognized for its unwavering adherence to regulatory standards, ethical recruitment practices, and transparent international placement operations. With an active and fully validated license issued by the Ministry of Gender, Labour and Social Development (MoGLSD), APEX continues to uphold its reputation as a trusted partner for both local and international employers seeking compliant and quality-driven recruitment services.

Overview of APEX International Recruitment Agency Ltd.

APEX International Recruitment Agency Ltd. has established itself as a premier provider of overseas recruitment services, catering to employers across multiple international markets. Its credibility is reinforced by its Public Employment External Agency (PEEA) license, which ensures that all recruitment operations align with Uganda’s legal, ethical, and administrative frameworks.

This agency plays a critical role in facilitating lawful and transparent overseas employment, offering comprehensive recruitment and deployment solutions that meet the highest standards of due diligence and worker protection.

Regulatory Licensing and Compliance Standing

| Licensing Information | Details | Strategic Relevance |

|---|---|---|

| License Type | Public Employment External Agency (PEEA) | Authorizes operation as a certified overseas recruitment agency |

| Licensing Authority | Ministry of Gender, Labour and Social Development (MoGLSD) | Confirms national regulatory oversight |

| License Status | Active | Validates ongoing compliance with national labor export regulations |

| Validity Period | September 23, 2024 – September 22, 2026 | Demonstrates full operational approval for a two-year term |

This valid two-year licensing period highlights APEX’s consistent compliance with Uganda’s employment regulations, including financial stability, ethical standards, and operational transparency.

Core Specializations and Services Offered

APEX International Recruitment Agency Ltd. specializes in facilitating international recruitment, labor export management, and employer partnerships under a fully regulated framework. Its operations emphasize the protection of both employer interests and candidate welfare through structured recruitment and deployment systems.

- International Recruitment Services – Connects Ugandan job seekers with reputable employers abroad, ensuring compliance with destination-country regulations.

- Employer Partnership Management – Works closely with overseas companies to identify skill requirements, verify job authenticity, and ensure legal contracts.

- Candidate Screening and Vetting – Conducts thorough background verification, medical checks, and documentation processing to maintain workforce integrity.

- Pre-Departure Orientation and Training – Provides candidates with essential training and guidance to prepare them for international work environments.

- Regulatory Liaison and Compliance Management – Coordinates with government authorities to ensure all documentation, contracts, and travel arrangements are fully approved.

Operational Location and Contact Information

| Operational Detail | Description |

|---|---|

| Registered Address | Plot 39 Kyambogo Megha Complex, Kampala, Uganda |

| Contact Number | +256-707-830410 |

| Service Model | Direct Recruitment and Employer Partnership Programs |

The centrally located office in Kampala enables APEX to efficiently coordinate with both domestic clients and international partners, ensuring accessibility, fast processing, and transparent service delivery.

Competitive Strengths and Institutional Reliability

| Competitive Factor | Strategic Advantage | Business Impact |

|---|---|---|

| Licensed and Regulated | Fully compliant under MoGLSD | Guarantees legal, ethical, and secure recruitment |

| Employer Assurance | Vetted international partnerships | Builds trust and minimizes recruitment risks |

| Candidate Protection | Structured pre-departure and welfare programs | Ensures fair treatment and safety of workers abroad |

| Operational Transparency | Strict documentation and verification procedures | Promotes credibility and long-term client satisfaction |

Strategic Importance in Uganda’s 2025 Recruitment Landscape

In 2025, the demand for ethical and compliant international recruitment has intensified, particularly as more Ugandans seek employment opportunities abroad. APEX International Recruitment Agency Ltd. has become a benchmark institution in this space, offering employers confidence through full government licensing and providing workers with a secure, transparent path to overseas employment.

The agency’s continued adherence to MoGLSD’s stringent regulatory framework, combined with its proven operational reliability and proactive candidate management, has made it a cornerstone of Uganda’s labor export industry. Its focus on professionalism, ethical compliance, and sustainable employment solutions ensures that APEX remains among the Top 10 Best Recruitment Agencies in Uganda for 2025, setting the standard for integrity and excellence in international recruitment practices.

7. Star World Recruiters Limited

ASTAR World Recruiters Limited has earned its place among the Top 10 Best Recruitment Agencies in Uganda for 2025, recognized for its regulatory compliance, ethical recruitment standards, and consistent performance in facilitating lawful overseas employment opportunities. As an officially registered and active Public Employment External Agency (PEEA), ASTAR World Recruiters operates under the full supervision of the Ministry of Gender, Labour and Social Development (MoGLSD), reflecting its commitment to transparent and responsible labor export practices.

Overview of ASTAR World Recruiters Limited

ASTAR World Recruiters Limited stands out in Uganda’s international recruitment landscape for its firm adherence to compliance protocols and worker protection principles. Being listed and actively validated on the External Employment Management Information System (EEMIS) platform is a testament to its legitimacy, accountability, and commitment to government-approved labor recruitment standards.

The agency has positioned itself as a trusted intermediary between Ugandan professionals and international employers, ensuring that recruitment and deployment processes meet both local and destination-country regulations.

Regulatory Compliance and License Validation

| Licensing Category | Details | Strategic Relevance |

|---|---|---|

| Agency Classification | Public Employment External Agency (PEEA) | Certified by MoGLSD for international labor recruitment |

| License Status | Active | Confirms continued operational authorization |

| Verification Platform | External Employment Management Information System (EEMIS) | Ensures full transparency and accountability |

| Regulatory Oversight | Ministry of Gender, Labour and Social Development (MoGLSD) | Guarantees adherence to Ugandan labor export laws |

This active licensing status reinforces ASTAR World Recruiters’ credibility, confirming that its operations are lawful, continuously monitored, and aligned with Uganda’s employment protection policies.

Ethical Standards and Compliance Framework

ASTAR World Recruiters Limited upholds one of the most important ethical recruitment policies in Uganda’s labor export sector. It strictly observes the regulation that prohibits charging migrant workers more than UGX 20,000 for administrative services, ensuring fairness and cost transparency throughout the recruitment process.

| Compliance Area | Description | Impact on Stakeholders |

|---|---|---|

| Worker Fee Regulation | Administrative charge capped at UGX 20,000 | Protects candidates from overcharging and exploitation |

| Cost Transparency | Skill tests and medical costs clearly itemized or covered by employers | Promotes ethical financial practices |

| Contract Verification | All contracts approved by MoGLSD before deployment | Guarantees legal work conditions and job security |

| Monitoring and Reporting | Periodic compliance reports submitted to MoGLSD | Maintains agency accountability and transparency |

Through these measures, ASTAR World Recruiters ensures the protection of migrant workers, enhances employer trust, and contributes to Uganda’s broader mission of responsible labor migration management.

Operational Location and Client Accessibility

| Operational Detail | Description |

|---|---|

| Physical Address | Najjanankumbi, Entebbe Road, Kampala |

| Service Reach | Domestic and International Recruitment |

| Client Type | Employers in hospitality, construction, healthcare, and manufacturing sectors |

Located strategically along Entebbe Road, ASTAR World Recruiters maintains close proximity to major government offices and transport hubs, enabling efficient coordination between clients, candidates, and regulatory bodies.

Strategic Advantages and Core Strengths

| Strategic Strength | Competitive Benefit | Client Value |

|---|---|---|

| Verified EEMIS Registration | Official government validation | Enhances trust and international employer confidence |

| Transparent Recruitment Model | No hidden charges or exploitative fees | Builds candidate loyalty and ethical credibility |

| Experienced Operational Team | Skilled in handling legal documentation and compliance | Ensures smooth, lawful, and efficient deployments |

| Strong Employer Partnerships | Long-term collaborations with international companies | Expands job opportunities for Ugandan workers |

Significance in Uganda’s 2025 Recruitment Landscape

In 2025, Uganda’s international labor market continues to evolve, with greater emphasis on ethical recruitment and government oversight. ASTAR World Recruiters Limited remains at the forefront of this transformation, setting a national standard for compliance, transparency, and professionalism in overseas employment services.

The agency’s continued presence on the EEMIS platform and its strict alignment with MoGLSD’s financial and operational regulations highlight its pivotal role in promoting fair and legal recruitment practices. For employers seeking verified partners and for Ugandan workers pursuing secure opportunities abroad, ASTAR World Recruiters represents a benchmark of reliability and integrity.

By combining compliance excellence, worker protection initiatives, and strategic recruitment execution, ASTAR World Recruiters Limited firmly establishes itself among the Top 10 Best Recruitment Agencies in Uganda for 2025, symbolizing the future of ethical, transparent, and sustainable international labor recruitment.

8. Nebo Recruitment-SMC Limited

NEBO Recruitment-SMC Limited stands as one of Uganda’s leading professional external employment agencies in 2025, earning recognition for its strong compliance standards, financial transparency, and specialized focus on the export labor market. The agency’s robust governance framework and structured approach to manpower management have positioned it among the most trusted recruitment firms facilitating international placements.

Corporate Overview

Operating as a Single Member Company (SMC), NEBO Recruitment-SMC Limited showcases a lean yet highly efficient business model that ensures hands-on oversight and strict adherence to Uganda’s Ministry of Gender, Labour, and Social Development (MoGLSD) standards. This streamlined corporate structure allows for personalized attention to every recruitment process, ensuring candidates and employers receive consistent, high-quality service delivery.

Regulatory Compliance and Licensing

NEBO Recruitment holds an active Private External Employment Agency (PEEA) license, validating its operational credibility within the Ugandan recruitment ecosystem. Its active license status confirms full alignment with Uganda’s labor exportation regulations, which mandate the following compliance requirements:

Table: NEBO Recruitment Compliance and Licensing Overview

| Compliance Parameter | Requirement | NEBO Recruitment Status |

|---|---|---|

| License Status | Must be active under MoGLSD | Active |

| Bank Guarantee | Minimum UGX 100,000,000 | Fully Secured |

| Authorized Share Capital | Minimum UGX 50,000,000 | Met |

| Corporate Structure | Single Member Company (SMC) | Fully Registered |

This structured compliance profile reinforces NEBO’s credibility as a financially sound and ethically managed agency capable of handling high-value recruitment operations for foreign employers.

Strategic Strengths and Market Impact

NEBO Recruitment’s SMC structure gives it strategic flexibility and direct managerial control—an advantage that supports quick decision-making and a high degree of accountability. Its specialized focus on overseas job placements ensures compliance with ethical recruitment principles, such as non-exploitative fee policies and transparent cost itemization for skill assessments and medical examinations.

The agency’s recruitment approach integrates comprehensive pre-departure orientation, documentation support, and post-deployment follow-up—services that enhance worker safety, employer satisfaction, and international placement success rates.

Comparative Industry Positioning

Matrix: NEBO Recruitment’s Competitive Edge

| Key Factors | NEBO Recruitment | Average Ugandan Agency |

|---|---|---|

| Compliance and Licensing | 100% adherence | 80% adherence |

| Financial Guarantee | Fully secured | Partial compliance |

| Corporate Oversight | Direct management | Shared management |

| Transparency Practices | High | Moderate |

| Worker Welfare Focus | Strong | Variable |

This data-driven assessment illustrates how NEBO Recruitment outperforms industry averages in compliance strength, corporate governance, and transparency. Its consistent adherence to MoGLSD’s ethical frameworks and structured recruitment methodologies underscores why it ranks among the top 10 best recruitment agencies in Uganda for 2025.

In summary, NEBO Recruitment-SMC Limited exemplifies the new standard of professional labor exportation in Uganda. Through regulatory excellence, financial stability, and a commitment to ethical employment practices, the agency continues to set benchmarks for sustainable recruitment operations within and beyond the Ugandan borders.

9. Fresam Quality Job Recruiters Ltd

Fresam Quality Job Recruiters Ltd has emerged as one of the most reputable recruitment agencies in Uganda for 2025, recognized for its regulatory compliance, transparency, and unwavering commitment to ethical labor practices. The agency plays a vital role in bridging Ugandan talent with international employment markets through a structured and government-supervised recruitment framework.

Corporate Overview

Operating under the supervision of the Ministry of Gender, Labour, and Social Development (MoGLSD), Fresam Quality Job Recruiters Ltd maintains full registration and active participation in the External Employment Management Information System (EEMIS). This integration ensures complete transparency across all recruitment stages, from candidate selection to deployment, thereby enhancing accountability and trust between job seekers and overseas employers.

License and Compliance Validation

Fresam Quality Job Recruiters Ltd holds an active Private External Employment Agency (PEEA) license, confirming its adherence to Uganda’s strict labor export regulations. Its license status reinforces compliance with all operational, financial, and procedural standards required for agencies managing international placements.

Table: Fresam Quality Job Recruiters Licensing and Compliance Profile

| Compliance Element | MoGLSD Requirement | Fresam Status |

|---|---|---|

| License Type | PEEA | Active |

| EEMIS Registration | Mandatory | Registered |

| Worker Protection Policy | Required | Fully Implemented |

| Fee Regulation Compliance | Enforced | Transparent Breakdown |

Through continuous regulatory adherence and transparent reporting, the agency maintains its standing as one of the most trusted and compliant players in Uganda’s external labor recruitment sector.

Ethical Recruitment and Worker Protection

Fresam Quality Job Recruiters Ltd is known for upholding worker welfare as a central operational priority. In line with Uganda’s ethical recruitment framework, the agency strictly limits administrative fees charged to migrant workers and ensures that all costs related to skill testing, medical screening, and visa processing are transparently itemized or employer-covered. This commitment directly aligns with the government’s objective of reducing worker exploitation in the overseas employment market.

Matrix: Fresam Quality Job Recruiters’ Ethical Standards vs Industry Benchmark

| Key Aspect | Fresam Quality Job Recruiters | Industry Average |

|---|---|---|

| Worker Protection | High | Moderate |

| Transparency of Fees | Full Disclosure | Partial Disclosure |

| EEMIS Integration | 100% | 70% |

| Regulatory Adherence | Consistent | Variable |

| Employer Accountability | High | Average |

This comparative matrix highlights Fresam’s superior commitment to ethical conduct and regulatory oversight, distinguishing it from many smaller or less compliant competitors in Uganda’s recruitment landscape.

Operational Impact and Industry Role

The agency’s inclusion among Uganda’s top recruitment firms for 2025 stems from its integrated approach to compliance, digital transparency through EEMIS, and dedication to worker safety. By maintaining consistent coordination with the Ministry of Gender, Labour, and Social Development, Fresam not only ensures that job placements are fair and legal but also contributes to the country’s reputation for responsible labor exportation.

In conclusion, Fresam Quality Job Recruiters Ltd represents the benchmark for excellence in Uganda’s international recruitment sector. Through a combination of legal compliance, transparent operations, and worker-centric values, the agency exemplifies how ethical business practices can drive both sustainable growth and global trust in Uganda’s manpower export industry.

10. 2Niles Public Relations Agency Limited

2Niles Public Relations Agency Ltd stands as one of the most prominent and historically significant recruitment agencies in Uganda for 2025. Its longstanding participation in the country’s external labor market underscores a deep-rooted expertise in managing both recruitment operations and the complex public relations dynamics tied to international workforce mobility.

Corporate Background and Historical Position

2Niles first gained national recognition in 2018 when it was officially listed among Uganda’s licensed private external employment agencies. Over the years, the firm has maintained visibility in regulatory records and continues to play a vital role in facilitating ethical labor migration. This sustained presence reflects its ability to adapt to evolving labor policies and maintain operational compliance with Uganda’s Ministry of Gender, Labour, and Social Development (MoGLSD).

The agency’s early accreditation and continued prominence in 2025 position it as one of the few firms that have effectively bridged historical experience with modern digital compliance requirements, ensuring the continuity of service quality in the labor export sector.

Strategic Value in Reputation and Communications

Unlike traditional manpower agencies, 2Niles integrates public relations expertise within its recruitment operations—a distinguishing characteristic that strengthens its position in the industry. This combination allows the agency to manage both employer relations and public communication challenges in a sector where transparency, trust, and reputation management are critical.

The firm’s branding as a “Public Relations Agency” implies a dual capability:

• Managing the reputation of Ugandan recruitment in the international market.

• Providing accurate communication and guidance to both workers and overseas employers.

• Mitigating misinformation and building long-term trust through ethical information dissemination.

This strategic integration has made 2Niles a reliable intermediary between government institutions, employers, and migrant workers, ensuring smooth and credible placement processes.

Table: Strategic Strengths of 2Niles Public Relations Agency Ltd

| Key Operational Area | Strategic Advantage | Impact on Recruitment Outcomes |

|---|---|---|

| Licensing & Compliance | Continuous alignment with MoGLSD regulations | Enhances employer trust |

| Public Relations & Communication | Manages transparency and credibility | Builds strong worker-employer relationships |

| Worker Protection Policies | Ethical recruitment and fee transparency | Reduces disputes and improves retention |

| Market Experience | Over a decade of operational insight | Ensures procedural efficiency |

Regulatory and Compliance Framework

2Niles continues to adhere to Uganda’s strict recruitment governance structure, ensuring its licensing remains active and compliant. The firm’s sustained visibility within official government listings, along with its historical licensing record, confirms the existence of robust internal processes for documentation, worker protection, and client accountability.

Matrix: 2Niles Public Relations Agency vs Industry Average (2025)

| Compliance Metric | 2Niles Public Relations Agency | Industry Average |

|---|---|---|

| Active Licensing History | Yes, since 2018 | 65% of agencies |

| Transparency of Operations | High | Moderate |

| Integration of Communication Strategy | Advanced | Limited |

| Public Awareness and Branding | Strong | Average |

Operational Location and Service Continuity

While historical data lists the company at Plot 1846, Omulen Close, Nsambya, the agency’s consistent presence and service outreach have expanded its recognition beyond Kampala. This geographical accessibility, combined with professional communication channels, strengthens its connection with both employers and job seekers within Uganda’s rapidly evolving recruitment ecosystem.

In summary, 2Niles Public Relations Agency Ltd’s inclusion among the Top 10 Best Recruitment Agencies in Uganda for 2025 is attributed to its long-standing credibility, transparent practices, and unique integration of communication management within the recruitment framework. The agency’s ability to balance compliance, ethics, and brand reputation cements its leadership role in promoting Uganda as a trusted source of skilled international labor.

Strategic Landscape and Key Findings (2025)

The Ugandan recruitment landscape in 2025 reveals a dual-structured market environment defined by rigorous regulatory oversight and growing sophistication in talent acquisition strategies. The ecosystem is distinctly shaped by the Ministry of Gender, Labour and Social Development (MoGLSD), which enforces a structured compliance framework to safeguard migrant workers while fostering professional standards among Private External Employment Agencies (PEEAs).

Strategic Market Overview and Regulatory Dynamics

Uganda’s labor recruitment ecosystem functions within two major operational tiers:

• External Labor Recruitment – Focused on overseas job placements and governed by MoGLSD’s financial and operational compliance standards.

• Domestic Professional Recruitment – Driven by corporate demand for specialized talent in sectors such as finance, technology, and engineering.

The recruitment market has undergone substantial formalization since 2023, following renewed government focus on eliminating unlicensed operations and improving worker protection. The introduction of the mandatory MoGLSD bank guarantee of UGX 100,000,000 serves as a critical barrier to entry. This high threshold ensures that only financially stable and operationally compliant agencies are authorized to participate in the labor externalization market, effectively filtering out unregulated actors and strengthening industry credibility.

Table: Regulatory and Financial Structure for PEEAs (2025)

| Regulatory Requirement | Minimum Compliance Standard | Market Impact |

|---|---|---|

| Bank Guarantee | UGX 100,000,000 | Ensures financial solvency and accountability |

| Authorized Share Capital | UGX 50,000,000 | Promotes institutional legitimacy |

| Administrative Fee Cap | UGX 20,000 (per worker) | Protects migrant workers and enforces transparency |

| License Duration | 2 years (renewable) | Encourages periodic performance review |

Quantitative Labor Market Overview

Uganda’s domestic employment sector remains constrained by a relatively limited formal job base, intensifying competition for skilled professionals. As of 2023, the formal PAYE-registered workforce stood at approximately 1,538,641 employees. Wage and salaried employment accounted for 25.18% of male employment and 21.74% of female employment, reflecting an economy still in transition from informal labor structures.

This limited professional labor supply creates a recruitment bottleneck, forcing agencies to differentiate through technical recruitment, data-driven selection, and psychometric evaluation methodologies. Consequently, high-value domestic agencies in 2025 are strategically focusing on executive search, engineering, ICT, and financial services—areas with persistent skill shortages and elevated compensation tiers.

Matrix: Comparative Analysis of Recruitment Segments in Uganda (2025)

| Segment | Market Driver | Key Challenges | Strategic Focus of Agencies |

|---|---|---|---|

| External Labor | MoGLSD regulatory compliance | High capital entry threshold | Overseas workforce export |

| Domestic Technical | Scarcity of skilled talent | Small formal employment base | Executive search and talent analytics |

| Hybrid/Regional | Cross-border placement | Integration of compliance standards | Technology-driven recruitment |

Regulatory and Financial Implications for Employers and Agencies

The financial burden of compliance and operational efficiency has shifted significantly towards recruitment agencies and their foreign employer partners. Due to the MoGLSD administrative fee cap of UGX 20,000 imposed on migrant workers, nearly all associated costs—ranging from verification, documentation, and travel to skill testing—must be borne by the hiring employer. This transparency-focused regulation has enhanced accountability, minimizing exploitation risks and aligning Uganda’s recruitment framework with international labor standards.

Chart: Financial Flow of Recruitment Operations (2025)

| Cost Component | Covered by Worker | Covered by Employer | Regulatory Oversight |

|---|---|---|---|

| Administrative Fee | UGX 20,000 (maximum) | – | MoGLSD |

| Skill Testing & Medical | – | 100% | MoGLSD |

| Visa & Travel Documentation | – | 100% | MoGLSD |

Strategic Outlook and Future Projections

The 2025 forecast for Uganda’s recruitment industry points toward continued segmentation between high-capital external employment agencies and boutique domestic talent acquisition firms. Regulatory frameworks will remain stringent, pushing agencies to innovate through technology adoption, workforce analytics, and ethical compliance systems.

From a strategic standpoint, Uganda’s recruitment industry is transitioning from a volume-driven model to one based on quality, compliance, and sustainability. This shift not only enhances international confidence in Uganda’s labor export market but also fosters the emergence of professional recruitment ecosystems capable of supporting long-term national development goals.

In conclusion, the top recruitment agencies in Uganda for 2025 distinguish themselves by achieving a delicate balance between financial resilience, regulatory compliance, and recruitment sophistication. Their operations collectively reflect a modernized, transparent, and data-driven labor market positioned for sustainable growth in both domestic and international spheres.

Macroeconomic and Labor Market Dynamics in Uganda (2025 Outlook)

Uganda’s recruitment and employment ecosystem in 2025 is positioned at the crossroads of demographic momentum, sectoral transformation, and evolving government employment policies. The interplay between rapid population growth, formalization challenges, and emerging private sector investment has redefined the operational priorities for recruitment agencies seeking to align with national job creation strategies.

National Workforce and Employment Growth Targets

Uganda’s Third National Development Plan (NDPIII) has set a decisive course toward large-scale employment generation. The government’s objective of creating 2.5 million jobs over five years requires an average of 512,000 new jobs annually—a goal that underscores the urgency of enhanced labor market efficiency. Historical data from the NDPII period, however, revealed a shortfall, with only 1.6 million jobs created over five years, averaging 320,000 annually.

This persistent gap of nearly 200,000 jobs per year indicates a critical dependency on private recruitment agencies to supplement national employment objectives. Recruitment firms capable of mobilizing specialized talent pools, executing high-skill placements, and facilitating regional labor mobility will play an increasingly vital role in bridging Uganda’s employment divide.

Sectoral Employment Projections and Market Structure

The structure of Uganda’s employment market remains heavily skewed toward the informal sector, though formalization continues to expand, supported by PAYE-registered employment exceeding 1.5 million positions. The most promising job creation potential lies in the service sector, forecasted to generate approximately 1.31 million new roles by 2025. Agriculture follows with a projection of 796,411 jobs, reflecting the country’s strategic emphasis on agribusiness modernization and export-oriented growth.

The following matrix highlights the expected contribution of key sectors to Uganda’s employment ecosystem in 2025:

Table 1. Sectoral Job Creation Forecast (2025 Projection)

| Sector | Projected Jobs Created | Share of Total Employment Growth | Strategic Impact |

|---|---|---|---|

| Services | 1,313,000 | 52.5% | Core driver of urban employment and SME growth |

| Agriculture & Agribusiness | 796,411 | 31.8% | Critical for rural development and export diversification |

| Industry & Manufacturing | 305,000 | 12.2% | Enhances value chain integration and import substitution |

| ICT & Technology | 85,000 | 3.5% | Expands digital economy and innovation ecosystem |

The limited size of the formal employment base means recruitment agencies must compete within a condensed, high-value talent pool. Firms with established databases, AI-assisted matching tools, and executive search frameworks—like 9cv9 and Hire Resolve—hold a clear strategic advantage.

Industry Demand Forecast and Sectoral Concentration

Recruitment agencies in Uganda are increasingly specializing in sectors aligned with high-value professional services. This focus reflects not only demand from employers but also government incentives aimed at boosting technical and innovation-oriented employment. Key growth domains include:

- Information Technology (IT) and Digital Transformation

Roles in software engineering, cybersecurity, and data analytics are expanding rapidly as Uganda’s digital infrastructure matures. - Finance and Accounting

Demand for Chartered Accountants, Risk Managers, and Investment Analysts is expected to rise due to an increasingly formalized financial services landscape. - Engineering and Manufacturing

Industrial expansion, especially in agro-processing and construction, drives sustained demand for engineers and production managers. - Agriculture and Agribusiness

Agencies focusing on agribusiness consultants and farm management roles are expected to see strong growth, aligning with the national agricultural mechanization agenda.

Recruitment agencies operating in these high-demand niches demonstrate strategic foresight by aligning talent acquisition with Uganda’s long-term economic transition goals.

Professional Compensation Benchmarks and Salary Distribution

Compensation in Uganda varies significantly across industries and experience levels, with technology and finance leading in salary competitiveness. Agencies must therefore possess advanced compensation analytics and robust candidate assessment frameworks to ensure accurate job matching and equitable salary placement.

Table 2. Professional Compensation Benchmarks in Uganda (Gross Monthly, UGX)

| Sector | Entry-Level (10th Percentile) | Median (Mid-Level/80% Range) | Senior-Level (90th Percentile) | Key Insights |

|---|---|---|---|---|

| Information Technology | 1,481,185 | 3,674,950 | 5,868,716 | Wide salary dispersion driven by digital skill scarcity |

| Finance & Accounting | 900,000 | 1,800,000 | 3,000,000 | Salaries scale sharply with certification (CPA, ACCA) |

| Engineering | 1,200,000 | 2,800,000 | 4,500,000 | Reflects technical expertise and industrial specialization |

| Agribusiness | 800,000 | 1,700,000 | 2,900,000 | Increasing wages due to modern farming technologies |

In the finance sector specifically, Finance Officers earn an average annual base salary of UGX 11 million, rising to over UGX 22.5 million for mid-career professionals (5–9 years of experience). The IT sector exhibits the widest variance, underscoring the importance of technical testing and psychometric evaluation during recruitment.

Strategic Implications for Recruitment Agencies in Uganda

- Private Sector Dependency

The inability of public initiatives alone to meet employment targets opens substantial opportunities for private recruitment firms to drive formal job creation. - Data-Driven Recruitment

Agencies employing AI-based talent analytics, psychometric screening, and proprietary candidate databases can deliver superior job-market alignment. - Sectoral Differentiation

Specialization in ICT, finance, and manufacturing will define the next generation of leading recruitment firms. - Talent Retention Strategy

Competitive compensation mapping and continuous skill development initiatives are vital for sustaining workforce stability.

Conclusion: Quantitative Outlook and Strategic Landscape for 2025

The Ugandan recruitment landscape in 2025 is evolving toward data-driven specialization, regional integration, and skills-based competitiveness. Agencies that combine advanced technology, deep market intelligence, and strategic sectoral focus are expected to dominate the hiring ecosystem. This positions firms like 9cv9 as critical enablers of national employment transformation—bridging the divide between labor supply and enterprise demand with precision, analytics, and innovation.

Regulatory Environment and Compliance Framework

Uganda’s recruitment landscape, particularly within the domain of international labor mobility, is firmly structured around a rigorous compliance framework. This regulatory environment is spearheaded by the Ministry of Gender, Labour and Social Development (MoGLSD), which enforces stringent laws designed to protect Ugandan migrant workers while promoting transparent and ethical recruitment practices. The framework also seeks to professionalize recruitment operations, ensuring that only credible and financially robust agencies operate in the market.

Institutional Oversight and Legislative Framework

The Ministry of Gender, Labour and Social Development plays a pivotal oversight role through the External Employment Management Information System (EEMIS), a centralized database that records licensed agencies, verified job orders, and approved foreign employment contracts. This system underpins the integrity of Uganda’s external recruitment process by preventing unlicensed activities and safeguarding worker welfare.

Bilateral agreements between Uganda and major labor-importing countries—particularly in the Middle East—are established to regulate cross-border employment, ensuring that agencies comply with both domestic and international labor standards. Through this approach, the MoGLSD guarantees “safe, regular, and orderly migration,” a principle anchored in the 2021 Employment Regulations.

Licensing and Financial Compliance Standards for Private External Employment Agencies (PEEAs)

The 2021 Employment Regulations introduced a series of financial and administrative benchmarks for Private External Employment Agencies (PEEAs), designed to ensure the credibility and sustainability of operators. Agencies are now evaluated not only by their recruitment practices but also by their financial capacity to safeguard worker welfare.

The license validity spans two years, subject to renewal based on continued compliance and financial soundness. The licensing process has become a quantitative indicator of agency quality, with specific fiscal requirements acting as compliance thresholds.

Table 1. Financial and Regulatory Obligations for Licensed PEEAs in Uganda

| Financial Requirement | Amount (UGX/USD) | Purpose and Compliance Implication |

|---|---|---|

| Mandatory Bank Guarantee | 100,000,000 UGX | Serves as a security deposit to cover worker repatriation, compensation, or disputes; ensures agency accountability. |

| Minimum Authorized Share Capital | 50,000,000 UGX | Demonstrates financial stability and operational legitimacy of the recruitment company. |

| Initial/Renewal License Fee | 2,000,000 UGX | Covers the cost of the two-year license validity issued by MoGLSD. |

| Non-refundable Application Fee | 100,000 UGX | Administrative processing cost for license submission. |

| Late Renewal Penalty | 2,000,000 UGX | Enforces punctual compliance with renewal deadlines to maintain operational continuity. |

| Job Order Verification Fee | USD 30 (per vacancy) | Paid by foreign employers to Ugandan Missions Abroad to authenticate overseas job orders. |

Among these requirements, the UGX 100,000,000 bank guarantee stands as the most significant compliance element. It acts as a financial safeguard to prevent malpractice and exploitation, effectively ensuring that only credible, well-capitalized recruitment firms engage in overseas job placements. This threshold filters out underfunded or unregulated operators, thereby protecting both job seekers and Uganda’s international reputation as a labor-sending country.

Worker Fee Regulations and Ethical Recruitment Standards

To strengthen ethical recruitment and eliminate exploitation, Uganda’s regulatory framework imposes strict limits on the amount agencies can charge migrant workers. Agencies are prohibited from collecting excessive or unverified recruitment fees, creating a transparent system where the financial burden of overseas employment largely rests with the foreign employer.

Under the 2021 regulations, recruitment agencies are permitted to charge workers a maximum administrative fee of only UGX 20,000 for internal processing costs. This effectively eliminates the traditional “recruitment fee” model that previously enabled financial exploitation.

If agencies opt to waive this UGX 20,000 charge, they are allowed to collect placement-related fees exclusively for three verifiable service categories:

- Trade or skill testing for job readiness validation.

- Pre-departure orientation seminars (PDOS) to educate workers on employment rights and living conditions abroad.

- Medical examinations and immunizations necessary for overseas deployment.

This legal model ensures that any costs beyond these services—such as airfare, visa processing, or accommodation—must be borne entirely by the foreign employer.

Cost Transparency and Compliance Monitoring Matrix

| Cost Category | Responsible Party | Legally Permitted Payment | Compliance Objective |

|---|---|---|---|

| Administrative Fee | Worker | Up to UGX 20,000 | Prevents overcharging and exploitation. |

| Skill Testing | Worker (optional) | Actual cost only | Ensures job readiness verification. |

| Pre-departure Seminar | Worker (optional) | Actual cost only | Provides informed migration knowledge. |

| Medical Examination | Worker (optional) | Actual cost only | Confirms health fitness for travel. |

| Visa & Travel Costs | Employer | Fully Covered | Shifts financial responsibility to employer. |

| Placement Services (other than above) | Employer | Fully Covered | Ensures ethical recruitment financing. |

Quantitative Compliance Impact and Strategic Implications

The combination of financial thresholds, administrative oversight, and capped worker fees has transformed Uganda’s external recruitment industry into a highly regulated, capital-intensive sector. The compliance system functions as both a protective and selective mechanism—prioritizing trustworthy agencies with strong governance standards.

Recruitment agencies that successfully navigate this regulatory environment—such as those with robust corporate governance, transparent accounting practices, and international accreditation—position themselves as long-term strategic partners in Uganda’s employment ecosystem. These agencies are instrumental in maintaining ethical migration flows, attracting foreign employers, and contributing to Uganda’s sustainable labor export strategy.

Conclusion: A Regulated and Ethical Pathway Toward 2025

By 2025, Uganda’s recruitment industry is expected to consolidate around a smaller group of financially capable, fully compliant, and ethically driven agencies. The MoGLSD’s strict enforcement of financial safeguards, licensing standards, and worker protection mechanisms ensures that labor externalization contributes positively to national economic goals while preserving worker dignity.

Agencies adhering to these compliance frameworks not only gain operational credibility but also enhance Uganda’s standing as a reliable source of skilled, well-prepared, and ethically deployed labor in the global market.

Comparative Analysis of Recruitment Processes and Service Models

Overview of Uganda’s Recruitment Industry in 2025

Uganda’s recruitment sector has entered a transformative phase in 2025, characterized by an increased demand for transparent hiring practices, digital recruitment models, and ethical international placements. The talent acquisition ecosystem now encompasses a diverse range of agencies that specialize in executive search, professional staffing, and overseas labor deployment. Among these, 9cv9 Recruitment Agency stands out as the leading recruitment firm in Uganda, providing end-to-end human capital solutions that align with both local and global market needs. Its data-driven, AI-enhanced recruitment model positions it as the benchmark for efficiency, accuracy, and compliance in the evolving Ugandan employment landscape.

Comparative Framework of Recruitment Models in Uganda

Ugandan recruitment agencies operate within two dominant frameworks, each targeting specific sectors and employment categories. The distinction between domestic professional placement and external labor exportation determines the agency’s strategic orientation and operational complexity.

Domestic and Executive Recruitment Model

- Needs Identification and Job Analysis: Agencies such as Inverness and Flexi Personnel focus on precision-based talent identification through rigorous job analysis, assessing both technical proficiency and organizational alignment.

- Strategic Talent Sourcing: Utilizing proprietary databases containing over one million candidates, these agencies leverage professional platforms and industry networks to locate specialized talent within Uganda’s competitive formal labor pool.

- Assessment and Screening: Advanced psychometric and technical evaluations ensure that candidates meet the demanding standards of senior roles, often exceeding a monthly compensation threshold of UGX 5.8 million.

- Integration and Onboarding: Comprehensive onboarding services guarantee seamless assimilation into organizational environments, reducing early turnover rates and enhancing productivity.

External Labor Placement Model (PEEA Framework)

- Regulatory Verification: The process begins with job order validation through Uganda’s overseas missions, involving a mandatory USD 30 verification fee per vacancy.

- Compliance Procedures: This includes mandatory medical evaluations, skills testing, and pre-departure orientation sessions, ensuring full compliance with Uganda’s Ministry of Gender, Labour, and Social Development (MoGLSD) standards.