Key Takeaways

- Social security insurance in Vietnam provides important benefits and protections for workers and their families, including healthcare, retirement pensions, and unemployment benefits.

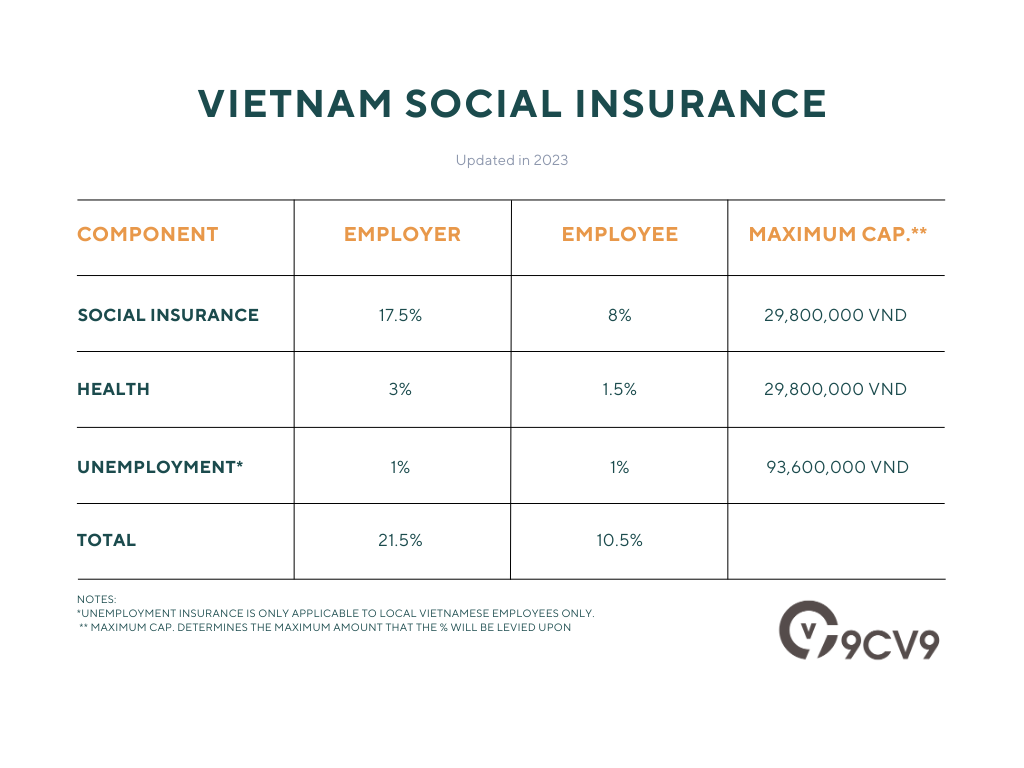

- There are 3 main statutory social security insurance, namely, the main social insurance, health insurance, and unemployment insurance.

- The total rate payable by the Employer is 21.5% and the total rate payable by the Employee is 10.5%.

If you’re living or working in Vietnam, you may be wondering what social security insurance is and how it works.

Social security insurance is an important safety net that provides financial protection to individuals and families in the event of illness, injury, disability, retirement, or death.

In Vietnam, social security insurance is mandatory for all employees and volunteers for self-employed individuals, and it’s designed to help ensure that everyone has access to basic health care and income security.

Navigating the world of social security insurance in Vietnam can be complex and overwhelming, especially if you’re not familiar with the language or the local regulations.

That’s why we’ve created “The Ultimate Guide to Social Security Insurance in Vietnam: Everything You Need to Know.”

This comprehensive guide provides a detailed overview of social security insurance in Vietnam, including the benefits, eligibility requirements, application process, and challenges.

Whether you’re a local or an expatriate, this guide will help you understand the basics of social security insurance in Vietnam and how it can benefit you and your family.

You’ll learn about the different types of social security insurance available, the benefits provided by the system, and the specific eligibility requirements for employees, self-employed individuals, and retirees.

We’ll also walk you through the process of applying for social security insurance in Vietnam and provide tips on how to navigate any challenges or issues that may arise.

Overall, “The Ultimate Guide to Social Security Insurance in Vietnam: Everything You Need to Know” is an essential resource for anyone looking to protect themselves and their loved ones in Vietnam.

By taking advantage of the benefits and resources available through social security insurance, you can ensure that you have the financial security and peace of mind you need to thrive in this vibrant and dynamic country.

So, let’s dive in and explore everything you need to know about social security insurance in Vietnam.

Before we venture further into this article, we like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Vietnam with a strong presence all over the world.

With over six years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of social security insurance in Vietnam.

If your company needs HR, hiring or corporate services, you can use 9cv9 corporate services. Book a consultation slot here, or send over an email to [email protected].

The Ultimate Guide to Social Insurance in Vietnam: Everything You Need to Know (Updated in 2023)

- Overview of Social Security Insurance in Vietnam

- Purpose and Benefits of Social Security Insurance in Vietnam

- How to Claim Social Security Insurance Benefits in Vietnam

- How to Apply for Social Security Insurance in Vietnam

- Social Security Insurance for Expats in Vietnam

- Challenges and Issues with Social Security Insurance in Vietnam

1. Overview of Social Security Insurance in Vietnam

Social security insurance is a mandatory system that provides financial protection to individuals and families in the event of illness, injury, disability, retirement, or death.

In Vietnam, social security insurance is administered by the Vietnam Social Security (VSS), which is a government agency responsible for managing social security programs and benefits.

Three main types of Social Security Insurance in Vietnam

- Social Insurance (SI): This type of insurance is mandatory for all employees and provides coverage for sickness, maternity, work-related injuries and diseases, retirement, and survivor benefits.

- Health Insurance (HI): This type of insurance is mandatory for all employees and provides coverage for medical expenses, including hospitalization, outpatient care, and prescription drugs.

- Unemployment Insurance (UI): This type of insurance is mandatory for all employees and provides coverage for unemployment benefits in the event of job loss.

Self-employed individuals and voluntary contributors can also participate in the social security insurance system by opting to enroll in the voluntary SI and HI programs.

To be eligible for social security insurance benefits in Vietnam, individuals must meet certain criteria, including age, work history, and contributions made to the social security system.

The specific eligibility requirements vary depending on the type of insurance and the benefits being claimed.

Social Insurance (SI)

According to the table above, the amount of contribution needed for social insurance is 17.5% from the Employer, and 8% from the Employee.

Social Insurance (SI) in Vietnam is divided into three categories, which include sickness and maternity, occupational diseases and accidents, and retirement and death.

As of 1 December 2018, the contribution rate for sickness and maternity was 3%.

For occupational diseases and accidents, the contribution rate was 0.5%, with employers contributing the full amount.

As for retirement and death, the contribution rate from employers is 14.0%, with employees contributing an additional 8.0%.

Social Insurance (SI) contributions are based on an employee’s salary, certain allowances, and other regular payments.

However, the total amount subject to SI contributions is capped at 20 times the base salary.

Since 1 July 2019, the base salary for SI contributions in Vietnam is VND 1,490,000 per month. It’s worth noting that the base salary is subject to change every year, except for 2020 and 2021.

For employers in high-risk industries, there’s an opportunity to apply for a lower employer contribution rate for occupational diseases and accidents. This reduced rate is 0.3% instead of the current regulated rate of 0.5% on the salary subject to SI contributions, including both Vietnamese and foreign employees. However, companies must meet specific conditions to be eligible for this reduction.

Examples of the Calculations for Social Insurance

Case 1: Under the Maximum Cap

Let’s say an employee’s monthly salary is VND 10,000,000 and they work for a company in the private sector.

To calculate the monthly SI contribution, we first need to determine the capped salary subject to SI contribution. As of 2023, the capped salary is 20 times the basic salary, which is VND 1,490,000 per month. Therefore, the capped salary is VND 29,800,000 per month.

The maximum capped salary for SI is VND 29,800,000 per month

– 9cv9

As the gross salary is below the capped salary, we will just take the full amount of the gross salary for the computation.

The contributions for each type of Social Insurance (SI) are as follows:

- Employer’s contribution: VND 10,000,000 x 17.5% = VND 1,750,000

- Employee’s contribution: VND 10,000,000 x 8% = VND 800,000

So in total, the employee’s monthly SI contribution is VND 1,750,000 + VND 800,000 = VND 2,550,000

Case 2: Above the Maximum Cap

Let’s say an employee’s monthly salary is VND 100,000,000 and they work for a company in the private sector.

As the employee’s monthly salary is above the capped amount, we will take the capped amount as the number to multiply upon.

The contributions for each type of Social Insurance (SI) are as follows:

- Employer’s contribution: VND 29,800,000 x 17.5% = VND 5,215,000

- Employee’s contribution: VND 29,800,000 x 8% = VND 2,384,000

So in total, the employee’s monthly SI contribution is VND 5,215,000 + VND 2,384,000 = VND 7,599,000

Health Insurance (HI)

Compulsory Health Insurance (HI) contributions are a requirement for both Vietnamese and foreign individuals employed under Vietnam labor contracts.

As per the regulations, HI contribution rates are 4.5% of the income subject to HI contribution, with 3% contributed by the employer and 1.5% by the employee.

The income subject to HI contribution includes salary, certain allowances, and other regular payments, but this is capped at 20 times the basic salary for HI contributions.

The basic salary, which is used as a reference to determine social insurance and health insurance contributions, was set at VND 1,490,000 per month as of 1 July 2019. However, this basic salary is subject to change each year, except for 2020 and 2021.

It is important to note that individuals who fail to contribute to the HI program will be liable to pay an HI penalty of 0.05% per day on the unpaid contribution amount until they settle the overdue payment. The penalty amount, however, is capped at 20% of the unpaid contribution amount.

Therefore, it is essential for individuals to ensure that they fulfill their HI contribution obligations on time to avoid penalties.

Examples of the Calculations for Health Insurance

Case 1: Under the Maximum Cap

Let’s say an employee’s monthly salary is VND 10,000,000 and they work for a company in the private sector.

To calculate the monthly HI contribution, we first need to determine the capped salary subject to HI contribution. As of 2023, the capped salary is 20 times the basic salary, which is VND 1,490,000 per month. Therefore, the capped salary is VND 29,800,000 per month.

The maximum capped salary for HI is VND 29,800,000 per month

– 9cv9

As the gross salary is below the capped salary, we will just take the full amount of the gross salary for the computation.

The contributions for each type of Health Insurance (HI) are as follows:

- Employer’s contribution: VND 10,000,000 x 3% = VND 300,000

- Employee’s contribution: VND 10,000,000 x 1.5% = VND 150,000

So in total, the employee’s monthly HI contribution is VND 300,000 + VND 150,000 = VND 450,000

Case 2: Above the Maximum Cap

Let’s say an employee’s monthly salary is VND 100,000,000 and they work for a company in the private sector.

As the employee’s monthly salary is above the capped amount, we will take the capped amount as the number to multiply upon.

The contributions for each type of Health Insurance (HI) are as follows:

- Employer’s contribution: VND 29,800,000 x 3% = VND 894,000

- Employee’s contribution: VND 29,800,000 x 1.5% = VND 447,000

So in total, the employee’s monthly HI contribution is VND 894,000 + VND 447,000 = VND 1,341,000

Unemployment Insurance (UI)

Under Vietnam’s social security system, unemployment insurance (UI) is one of the three statutory social insurance programs.

Unlike social insurance (SI) and health insurance (HI), which apply to both Vietnamese and foreign individuals, UI contributions are only mandatory for Vietnamese employees.

Both the employer and employee are required to contribute 1% each on the income subject to UI contribution. This income includes salary, certain allowances, and other regular payments.

However, the contributions are capped at 20 times the minimum regional salaries for UI contributions.

Effective from 1 July 2022, the minimum regional salaries for UI contributions range from VND 3,250,000 to VND 4,680,000 per month, depending on the region.

Examples of the Calculations for Unemployment Insurance (UI)

Case 1: Under the Maximum Cap

Let’s say an employee’s monthly salary is VND 10,000,000 and they work for a company in the private sector in Ho Chi Minh City.

To calculate the monthly UI contribution, we first need to determine the capped salary subject to UI contribution. As of 2023, the capped salary is 20 times the minimum regional salaries, which vary from VND 3,250,000 to VND 4,680,000 per month. Therefore, the capped salary is VND 65,000,000 per month to VND 93,600,000 per month.

The maximum capped salary for UI is between VND 65,000,000 per month to VND 93,600,000 per month

– 9cv9

Since the employee is working in Ho Chi Minh City, we will take the capped amount as VND 93,600,000.

As the gross salary is below the capped salary, we will just take the full amount of the gross salary for the computation.

The contributions for each type of Unemployment Insurance (HI) are as follows:

- Employer’s contribution: VND 10,000,000 x 1% = VND 100,000

- Employee’s contribution: VND 10,000,000 x 1% = VND 100,000

So in total, the employee’s monthly UI contribution is VND 100,000 + VND 100,000 = VND 200,000

Case 2: Above the Maximum Cap

Let’s say an employee’s monthly salary is VND 100,000,000 and they work for a company in the private sector.

As the employee’s monthly salary is above the capped amount, we will take the capped amount as the number to multiply upon.

The contributions for each type of Health Insurance (HI) are as follows:

- Employer’s contribution: VND 93,600,000 x 1% = VND 936,000

- Employee’s contribution: VND 93,600,000 x 1% = VND 936,000

So in total, the employee’s monthly SI contribution is VND 936,000 + VND 936,000 = VND 1,872,000

It’s important for employers in Vietnam to stay up-to-date with the latest regulations and requirements related to social security insurance, including UI contributions, to ensure compliance with the law and avoid any penalties or legal issues.

It’s important to note that these rates and calculations can change over time, so it’s important to stay up to date with the latest regulations and guidelines.

Overall, social security insurance in Vietnam is designed to provide a basic safety net to help individuals and families maintain financial stability and access essential services in times of need.

In the next sections, we’ll explore the benefits provided by social security insurance in Vietnam and the eligibility requirements in more detail.

2. Purpose and Benefits of Social Security Insurance in Vietnam

The primary purpose of social security insurance in Vietnam is to provide financial protection to individuals and families in the event of illness, injury, disability, retirement, or death.

Social security insurance is designed to help ensure that everyone has access to basic healthcare and income security, regardless of their income level or social status.

By providing a safety net for those in need, social security insurance helps to reduce poverty, promote social equity, and improve the overall well-being of the population.

The benefits provided by social security insurance in Vietnam vary depending on the type of insurance and the benefits being claimed.

Here are some of the key benefits of each type of insurance:

Social Insurance (SI) Benefits

- Sickness benefits: provides financial assistance to employees who are unable to work due to illness or injury.

- Maternity benefits: provides financial assistance to female employees during their pregnancy and maternity leave.

- Work-related injury and disease benefits: provides financial assistance to employees who suffer work-related injuries or diseases.

- Retirement benefits: provides a pension to employees who have reached retirement age or have completed the required contribution period.

- Survivor benefits: provides financial assistance to the dependents of employees who have passed away.

Health Insurance (HI) Benefits:

- Medical expenses: provides coverage for hospitalization, outpatient care, and prescription drugs.

- Disease prevention and health promotion: provides access to preventive health services and health education programs.

Unemployment Insurance (UI) Benefits:

- Unemployment benefits: provides financial assistance to employees who have lost their jobs due to reasons beyond their control.

By providing these benefits, social security insurance helps to reduce the financial burden of medical expenses, disability, and retirement and promotes social equity by ensuring that everyone has access to basic income security and healthcare services.

Additionally, social security insurance encourages individuals to participate in the formal labor market and contribute to the social security system, which helps to sustain the overall system and ensure its long-term viability.

Applications to selected demographics

- Benefits for Employees:

Employees in Vietnam are required to participate in the social security insurance system, which includes Social Insurance (SI), Health Insurance (HI), and Unemployment Insurance (UI).

Here are some of the specific benefits available to employees:

- Sickness Benefits: Employees who are unable to work due to illness or injury are eligible for sickness benefits, which provide financial assistance equal to 75% of their average monthly salary for up to 180 days.

- Maternity Benefits: Female employees are entitled to maternity benefits, which provide financial assistance equal to 100% of their average monthly salary for a period of 6 months. Male employees may also be entitled to paternity leave.

- Work-related Injury and Disease Benefits: Employees who suffer work-related injuries or diseases are entitled to medical treatment, rehabilitation, and compensation for their loss of income and other expenses.

- Retirement Benefits: Employees who have reached the retirement age (currently 60 for men and 55 for women) or have completed the required contribution period (currently 20 years for men and 15 years for women) are entitled to a pension. The amount of the pension is based on the employee’s average monthly salary and the number of years of contributions.

- Survivor Benefits: The dependents of employees who have passed away are entitled to survivor benefits, which provide financial assistance to help cover the cost of living expenses.

- Benefits for Self-Employed Individuals:

Self-employed individuals in Vietnam can also participate in the social security insurance system by enrolling in the voluntary Social Insurance (SI) and Health Insurance (HI) programs. Here are some of the specific benefits available to self-employed individuals:

- Sickness Benefits: Self-employed individuals who are unable to work due to illness or injury are eligible for sickness benefits, which provide financial assistance equal to 75% of their average monthly income for up to 180 days.

- Maternity Benefits: Self-employed women are entitled to maternity benefits, which provide financial assistance equal to 100% of their average monthly income for a period of 6 months.

- Health Insurance Benefits: Self-employed individuals who enroll in the voluntary Health Insurance program are entitled to medical treatment, rehabilitation, and compensation for their medical expenses.

- Retirement Benefits: Self-employed individuals who have completed the required contribution period are entitled to a pension, which is based on their average monthly income and the number of years of contributions.

- Survivor Benefits: The dependents of self-employed individuals who have passed away are entitled to survivor benefits, which provide financial assistance to help cover the cost of living expenses.

- Benefits for Retirees:

Retirees in Vietnam are entitled to receive a pension from the social security insurance system. The amount of the pension is based on the retiree’s average monthly salary and the number of years of contributions. Retirees may also be eligible for other benefits, such as healthcare coverage and survivor benefits.

Overall, the social security insurance system in Vietnam provides a range of benefits to employees, self-employed individuals, and retirees, helping to ensure that everyone has access to basic income security and healthcare services.

3. How to Claim Social Security Insurance Benefits in Vietnam

If you are eligible for social security insurance benefits in Vietnam, you can claim them by following these steps:

- Gather the necessary documents: You will need to have certain documents on hand to support your claims, such as your ID card, social security insurance book, medical records, and proof of income.

- Fill out the application form: You can obtain the application form for your specific benefit from the social security insurance agency in your area or download it from their website. Be sure to fill out the form completely and accurately.

- Submit the application and supporting documents: Once you have completed the application form, you will need to submit it along with the required supporting documents to the social security insurance agency. You can do this in person, by mail, or online, depending on the agency’s procedures.

- Wait for the agency to review your claim: The agency will review your application and supporting documents to determine your eligibility for the benefit you are claiming. This process can take several weeks or even months, so be patient.

- Receive your benefit payment: If your claim is approved, the social security insurance agency will begin making payments to you. The payment frequency and amount will depend on the specific benefit you are receiving.

It’s important to note that the process for claiming social security insurance benefits in Vietnam may vary depending on the type of benefit you are claiming and the specific procedures of the social security insurance agency in your area.

4. How to Apply for Social Security Insurance in Vietnam

If you are an employee or self-employed individual in Vietnam, you will automatically be enrolled in the social security insurance system, including Social Insurance (SI), Health Insurance (HI), and Unemployment Insurance (UI).

However, if you are not automatically enrolled or if you are a foreigner living and working in Vietnam, you will need to apply for social security insurance.

Here are the steps to apply:

- Determine your eligibility: To be eligible for social security insurance in Vietnam, you must be a Vietnamese citizen or a foreigner who is legally employed or self-employed in the country. You will need to provide proof of your employment status and identity when applying.

- Choose the appropriate program: There are different programs for social security insurance in Vietnam, including Social Insurance (SI), Health Insurance (HI), and Unemployment Insurance (UI). You should determine which program(s) you are eligible for and need to enroll in.

- Collect the necessary documents: You will need to prepare certain documents to support your application, including your ID card or passport, proof of employment or self-employment, and proof of income.

- Complete the application form: You can obtain the application form from the social security insurance agency in your area or download it from their website. The form will require you to provide personal information, employment information, and details about the program(s) you are applying for.

- Submit the application and supporting documents: Once you have completed the application form, you will need to submit it along with the required supporting documents to the social security insurance agency. You can do this in person, by mail, or online, depending on the agency’s procedures.

- Wait for approval: The social security insurance agency will review your application and supporting documents to determine your eligibility for the program(s) you are applying for. This process can take several weeks or even months, so be patient.

- Receive your insurance card: If your application is approved, you will receive a social security insurance card, which you will need to present when accessing healthcare services or making a claim for benefits.

Overall, applying for social security insurance in Vietnam involves providing proof of your employment status and identity, completing an application form, and submitting the form and supporting documents to the social security insurance agency.

In case of any doubts or questions, it is recommended to consult with the relevant authorities or with the 9cv9 Corporate Service team for further guidance. Book a free consultation slot here.

5. Social Security Insurance for Expats in Vietnam

Foreigners who are legally working in Vietnam must participate in the social security insurance system in the country.

According to Clause 1 and 2, Article 2 of Decree No. 143/2018/NĐ-CP, foreign individuals who are working in Vietnam and have obtained work permits, practicing certificates, practicing licenses issued in Vietnam, indefinite-term employment contracts, or employment contracts that are valid for at least one year with employers in Vietnam are required to participate in the compulsory Social Insurance program.

It is mandatory for foreigners who are working in Vietnam to contribute to the social insurance program

– 9cv9

However, certain employees are excluded from this requirement, such as those who are intra-company transferees as stipulated in Clause 1, Article 3 of the Government’s Decree No. 11/2016/ND-CP dated February 3rd, 2016, providing details of the implementation of certain articles of the Labour Code regarding foreign employees working in Vietnam.

Additionally, employees who have attained retirement age under Clause 1, Article 187 of the Labour Code are also excluded.

For male employees, the retirement age is 60 years and 3 months if they retire in 2021, while for female employees, the retirement age is 55 years and 4 months if they retire in 2021.

It is important to note that these regulations apply to all foreign individuals working in Vietnam, regardless of their nationality.

Here’s what expatriates need to know about social security insurance in Vietnam:

- Enrollment: If you are an expatriate working legally in Vietnam, you will be automatically enrolled in the social security insurance system, and your employer will deduct contributions from your salary. Your contributions will be based on your income and the specific requirements of each program.

- Benefits: As an expatriate participating in the social security insurance system, you will be eligible for the same benefits as Vietnamese citizens, including healthcare services, retirement pensions, and unemployment benefits.

- Duration of coverage: The duration of your social security insurance coverage will depend on the terms of your employment contract in Vietnam. If you leave your job or move to a new company, your coverage will continue as long as you continue to work legally in the country.

- Claiming benefits: If you need to claim benefits from the social security insurance system, you will need to follow the same procedures as Vietnamese citizens. This involves submitting a claim to the relevant social security insurance agency and providing supporting documentation to support your claim.

- Social security agreements: Vietnam has signed social security agreements with a number of other countries, which can affect the social security coverage of expatriates from those countries. If you are an expatriate from one of these countries, you should check the terms of the agreement to understand your social security coverage in Vietnam.

In case of any doubts or questions, it is recommended to consult with the relevant authorities or with the 9cv9 Corporate Service team for further guidance. Book a free consultation slot here.

Withdrawal of Social Security Insurance

Foreign individuals who have contributed to the Vietnamese Social Insurance system for at least 20 years and have reached the pension age, or have permanently left Vietnam, are eligible to withdraw their Social Insurance allowance.

In addition, those who suffer from a life-threatening illness as determined by the Ministry of Health may also be eligible to receive the allowance.

Furthermore, if a foreign individual’s employment contract has been terminated or their professional license has expired without the possibility of renewal, they may also be able to withdraw their Social Insurance allowance.

Decree 143/2018/ND-CP outlines the regulations for determining the one-time Social Insurance benefit payment for foreign employees in Vietnam.

According to Clause 7 Article 9 of this decree, the payment amount is calculated based on the following formula:

One-time Social Insurance payment = 2 x Average monthly salary used for calculating Social Insurance premiums x Number of years of contributions to Social Insurance.

To determine the length of the payment period, the yearly period of Social Insurance premium payments is rounded as follows:

- For periods with odd months between 1 and 6 months, the period is rounded up to ½ year.

- For periods with odd months between 7 and 11 months, a full year is counted.

It is important to note that the average monthly salary used for calculating Social Insurance premiums is determined by the government and is subject to change.

Additionally, the actual payment amount may vary depending on the specific circumstances of each case, and it is advisable to consult with the relevant authorities to determine the exact payment amount.

Application process for foreigners to withdraw their Social Security

Foreign employees in Vietnam who have terminated their employment contract, or whose work permit, practicing certificate, or practicing license has expired without renewal, have the right to apply for a One-Time Social Insurance Payment within 10 days from the termination or expiry date of their employment contract.

To apply for the payment, the foreign employee must submit a dossier that includes all required documents to the Social Insurance Department.

Within a maximum of 5 working days after receiving the dossier, the Social Insurance Department will review and process the application, and the employee will receive the settlement results.

The settlement results may include relevant documents that can be obtained in person at the Social Insurance Department, sent via public postal service, or through electronic transactions.

The payment can be received directly at the Social Insurance Agency, through the public postal service, or through a personal bank account.

If the foreign employee authorizes another person to receive the payment on their behalf, they must follow the “authorization to receive social insurance and unemployment benefits” procedure and provide the original authorization contract as prescribed by law.

It is essential to ensure that all necessary documents are provided and that the correct procedures are followed to avoid any delays or complications in the application process.

In case of any doubts or questions, it is recommended to consult with the relevant authorities or with the 9cv9 Corporate Service team for further guidance. Book a free consultation slot here.

6. Challenges and Issues with Social Security Insurance in Vietnam

While social security insurance in Vietnam provides important benefits and protections for workers and their families, there are also some challenges and issues that need to be addressed.

Here are some of the most significant challenges and issues with social security insurance in Vietnam:

- Coverage gaps: While the social security insurance system covers a large percentage of the population in Vietnam, there are still gaps in coverage, particularly for informal and self-employed workers. This can lead to disparities in benefits and leave some vulnerable workers without adequate protection.

- Low participation rates: Despite mandatory participation in the social security insurance system for many workers, participation rates are still relatively low, particularly among small and medium-sized enterprises. This can undermine the effectiveness of the system and limit the benefits it can provide.

- Administrative challenges: The social security insurance system in Vietnam is complex and can be difficult to navigate, particularly for workers and businesses that are not familiar with the system. This can lead to delays and errors in processing claims and accessing benefits.

- Insufficient funding: The social security insurance system in Vietnam is funded through contributions from workers and their employers, but funding levels are often insufficient to meet the needs of the system. This can lead to delays in processing claims and providing benefits, as well as a lack of investment in infrastructure and technology to improve the system.

- Aging population: Vietnam is experiencing an aging population, which puts pressure on the social security insurance system to provide adequate pensions and healthcare for retirees. This is a long-term challenge that will require significant investment and policy changes to address.

Overall, social security insurance in Vietnam faces a range of challenges and issues, including coverage gaps, low participation rates, administrative challenges, insufficient funding, and an aging population.

Addressing these challenges will require a coordinated effort from the government, businesses, and workers to improve the system and ensure that it provides adequate protection for all.

Conclusion

Social security insurance in Vietnam is a crucial system that provides important benefits and protections for workers and their families.

As we have seen in this ultimate guide, the system is complex and has many moving parts, but understanding its requirements and benefits is essential for all workers and employers operating in Vietnam.

By enrolling in the social security insurance system, workers can access a range of benefits, including healthcare services, retirement pensions, and unemployment benefits.

However, there are also significant challenges and issues facing the system, including coverage gaps, low participation rates, administrative challenges, insufficient funding, and an aging population.

Addressing these challenges will require ongoing efforts and investments from the government, businesses, and workers to ensure that the system can provide adequate protection for all.

As we look ahead to the future of social security insurance in Vietnam, it’s clear that the system will continue to evolve and adapt to the changing needs of workers and society.

This will require ongoing investments in infrastructure, technology, and policy reforms to ensure that the system is able to meet the needs of workers and provide adequate protection for all.

We hope that this guide has been informative and helpful for those seeking to understand social security insurance in Vietnam.

By understanding the benefits and requirements of the system, workers and employers can make informed decisions and ensure that they are fully protected under the social security insurance system.

If you need help, 9cv9 Corporate Team stands ready to deliver the best and the most affordable trading company registration and compliance services. Book a free consultation slot here.

If you find this article useful, why not share it with your sales friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

![Writing A Good CV [6 Tips To Improve Your CV] 6 Tips To Improve Your CV](https://blog.9cv9.com/wp-content/uploads/2020/06/2020-06-02-2-100x70.png)