Key Takeaways

- AI-driven analytics and automation are transforming absence management into a strategic HR function.

- SMEs are the fastest-growing segment, demanding simplified, cost-effective solutions.

- Compliance agility, cybersecurity, and seamless HR system integration are top vendor and buyer priorities.

In today’s evolving workplace, where hybrid models, employee well-being, and digital transformation are driving HR priorities, absence management software has become a cornerstone of operational efficiency. By 2025, the absence management software market has matured into a strategic technology segment, enabling organizations to address compliance, productivity, and workforce planning challenges with greater precision. From large enterprises managing globally dispersed teams to small and mid-sized businesses navigating rapid growth, demand for intelligent, automated, and scalable leave management solutions has never been higher.

Also, read our top research guide on the Top 6 Absence Management Software to Boost HR Productivity.

The market’s momentum in 2025 is fueled by several interrelated trends:

- The rise of hybrid and remote work arrangements has made traditional, manual leave tracking systems obsolete.

- Regulatory compliance has become more complex, especially in industries such as healthcare, finance, and government where leave entitlements, medical leave, and accommodations must be documented and reported with audit-level accuracy.

- Employees are increasingly prioritizing mental health, flexible schedules, and transparent PTO (paid time off) policies, pushing HR teams to implement more employee-centric absence solutions.

As a result, companies are no longer viewing absence management tools as optional add-ons but as core components of their Human Resource Information Systems (HRIS). The growing integration of these tools with time tracking, payroll, and benefits systems reflects their vital role in optimizing workforce operations and improving employee experience.

Market Dynamics and Growth Outlook

The global absence management software market is experiencing sustained growth, with forecasts projecting an impressive CAGR through 2034. Cloud-based and SaaS platforms are leading adoption, especially among small and medium-sized enterprises (SMEs) seeking affordable, easy-to-deploy solutions with minimal IT infrastructure needs. Meanwhile, large enterprises are investing in highly configurable platforms powered by artificial intelligence (AI), predictive analytics, and compliance automation features.

According to recent industry reports, the market value is set to surpass significant milestones by the end of 2025, driven by:

- The increasing need for real-time visibility into employee leave trends

- The acceleration of digital transformation across HR departments

- The emergence of sophisticated reporting and analytics tools for forecasting absenteeism and minimizing disruptions

- Strategic mergers and acquisitions within the HR tech sector, streamlining product portfolios and expanding capabilities

Competitive Landscape and Innovation Trends

Vendors are differentiating themselves in 2025 through a mix of AI-enhanced automation, self-service capabilities, and mobile-first design. The most successful platforms offer a blend of simplicity and power—enabling HR professionals to manage all aspects of employee time off, from vacation and sick leave to FMLA, maternity leave, and other complex absence types, within a single, integrated interface.

Major players are also doubling down on data security and compliance, responding to growing concerns around employee data protection and regional data sovereignty. SOC 2, GDPR, and HIPAA compliance are now standard across most enterprise-grade solutions.

Furthermore, the market is witnessing the rise of modular and industry-specific offerings. For example:

- Healthcare providers need tools that accommodate union agreements and shift scheduling

- Tech startups prefer integrations with platforms like Slack, Google Workspace, or Microsoft Teams

- Manufacturers look for integration with physical time clocks and labor compliance audits

Strategic Importance for Businesses in 2025

Investing in absence management software in 2025 is not just about tracking who’s in or out of the office. It’s about optimizing workforce capacity, reducing burnout, meeting legal obligations, and building a culture of trust and transparency. Companies that fail to modernize their leave management processes risk increased compliance violations, disengaged employees, and operational inefficiencies.

As HR leaders prepare for the future of work, absence management is becoming a strategic priority. This blog provides an in-depth exploration of the current state of the market in 2025—covering trends, segmentation, challenges, and opportunities shaping its trajectory. Whether you are a vendor, enterprise buyer, or HR strategist, understanding this landscape will be critical for making informed decisions and achieving sustainable workforce success.

The State of the Absence Management Software Market in 2025

- Executive Summary

- Market Overview: Size, Valuation, and Dynamics

- Key Market Trends

- Growth Drivers

- Market Segmentation Analysis

- Competitive Landscape

- User Reviews and Sentiment Analysis

- Pricing and Monetization Models

- Regulatory and Security Considerations

- Opportunities and Challenges

- Future Outlook and Strategic Recommendations

- Recommendations

1. Executive Summary

The absence management software market in 2025 stands at a critical inflection point, shaped by accelerating digital transformation across human capital operations, evolving workforce models, and rising regulatory complexity. What was once a peripheral HR function has become an enterprise-wide imperative for cost control, compliance, and employee engagement.

Market Overview and Forecasts

- The U.S. absence management software market is projected to reach USD 354.26 million in 2025.

- A compound annual growth rate (CAGR) of 9.6% is expected from 2025 to 2034, with the U.S. market forecasted to surpass USD 810.58 million by the end of that period.

- Globally, the market is on track to expand from USD 1.2 billion in 2023 to USD 2.9 billion by 2032, growing at a CAGR of 10.2%.

- Growth is closely linked to developments in the broader HR tech ecosystem, including time tracking, workforce analytics, and payroll integration.

Key Growth Drivers

Workforce Transformation & Operational Demand

- Remote and hybrid work models have redefined how and where absences occur, increasing demand for location-agnostic, cloud-native systems.

- The rising cost of unplanned absences, estimated to exceed billions annually across major economies, has triggered strong ROI-driven adoption.

- Increasing emphasis on employee well-being and burnout prevention necessitates visibility into time-off patterns and behavioral indicators.

Regulatory Pressures and Compliance Complexity

- Ever-changing federal, state, and local leave laws in markets like the U.S., EU, and Asia-Pacific require software that can adapt in real-time.

- Businesses face mounting pressure to comply with regulations such as:

- FMLA, ADA, and HIPAA (U.S.)

- GDPR (EU)

- ISO/IEC 27001 standards (global cybersecurity)

- Regulatory non-compliance is associated with reputational risk, litigation costs, and operational disruptions.

Technology Convergence

- Artificial Intelligence (AI) and Machine Learning (ML) are transforming absence data into actionable insights for HR and C-suite leaders.

- Integration with cloud computing, mobile-first UIs, and self-service portals has elevated user expectations.

- The increasing overlap with Human Capital Management (HCM) platforms is blurring product categories, pushing for all-in-one modular architectures.

Deployment Trends by Architecture

| Deployment Model | Market Share (2025 Est.) | Key Characteristics | Adoption Segments |

|---|---|---|---|

| Cloud-Based SaaS | 63% | Scalable, subscription-based, remote access | SMEs, growing enterprises |

| On-Premise | 37% | Customizable, locally hosted, tighter data control | Highly regulated industries, government |

- Cloud-based platforms dominate due to:

- Faster implementation cycles

- Reduced IT overhead

- Remote accessibility for distributed teams

- On-premise solutions retain niche appeal in:

- Industries requiring strict data localization

- Enterprises with complex legacy systems

Market Segmentation Insights

By Organization Size

| Organization Size | 2025 Market Value (USD M) | CAGR 2025–2034 | Growth Drivers |

|---|---|---|---|

| Large Enterprises | 213.44 | 8.2% | Integration depth, analytics, AI-powered configuration |

| SMEs | 140.82 | 11.4% | Cost-efficiency, ease of use, mobile compatibility |

- Large Enterprises:

- Demand configurable, scalable, and enterprise-grade compliance engines.

- Prioritize API connectivity with ERP, payroll, and workforce planning systems.

- Small & Medium Businesses (SMBs):

- Seek affordable, ready-to-deploy, intuitive SaaS tools.

- Often benefit from vendor-bundled HR suites and mobile-first interfaces.

Competitive Landscape and Industry Movements

Key Dynamics

- HCM giants (e.g., Workday, SAP SuccessFactors, UKG) are consolidating smaller vendors to integrate absence tools into broader suites.

- Niche players (e.g., AbsenceSoft, Timetastic) are excelling through industry-specific modules and faster deployment cycles.

- Increasing competition has driven:

- User experience upgrades

- Mobile app availability

- Real-time data dashboards

Strategic Imperatives for Vendors

- Invest in compliance-as-a-service modules.

- Build multi-country leave rule engines to support global expansion.

- Strengthen data protection architecture, especially for healthcare and finance sectors.

Risks and Challenges

- Implementation complexity continues to plague large rollouts, especially in global organizations.

- Data privacy breaches remain a top concern, demanding zero-trust security frameworks and employee data encryption.

- Training gaps among HR teams may result in underutilization or compliance failures.

- Market saturation in North America and Western Europe could limit vendor differentiation without vertical-specific capabilities.

Outlook: Toward a Strategic Role in Workforce Management

- The trajectory of absence management software is shifting from administrative automation to strategic enablement.

- Future innovations will likely include:

- Predictive absence modeling using workforce analytics

- Integration with employee wellness programs

- AI-driven leave policy recommendations

Conclusion: Strategic Growth Awaits

In 2025, organizations that view absence management as a core strategic function—not merely an HR utility—will gain measurable advantages in compliance, productivity, and talent retention. Vendors that respond with adaptable, secure, and intelligent platforms will lead in a market defined by both regulatory volatility and digital opportunity.

2. Market Overview: Size, Valuation, and Dynamics

Market Size & Forecast: U.S. and Global Outlook

The absence management software industry in 2025 is witnessing accelerated growth, largely driven by digital transformation, rising compliance obligations, and the global shift toward intelligent human resource technologies. The sector reflects a critical intersection of workforce management needs, regulatory change, and enterprise digitization strategies.

United States Market Trajectory

- The U.S. absence management software market is projected to reach USD 354.26 million in 2025.

- This marks a solid growth from USD 324.41 million in 2024, driven by both enterprise-level digitalization and compliance modernization.

- Forecasts estimate that by 2034, the U.S. market will surge to USD 810.58 million, delivering a CAGR of 9.6% from 2025 to 2034.

- The adoption is especially strong among large and mid-sized enterprises seeking integrated compliance and workforce continuity tools.

Global Market Expansion

- Globally, the market is expected to grow from approximately USD 1.2 billion in 2023 to USD 2.9 billion by 2032, with a CAGR of 10.2%.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East are contributing significantly due to rapid enterprise software adoption and growing regulatory frameworks for leave and labor rights.

Interconnected Growth: Absence Management, HR Software, and Attendance Systems

The growth of absence management platforms is deeply entwined with broader HR technology domains, particularly time & attendance systems and HCM platforms.

Key Interdependencies

- As HR departments evolve toward centralized digital ecosystems, absence management software is increasingly embedded within larger HCM or WFM (Workforce Management) suites.

- Enterprises now demand integrated, cloud-first platforms that consolidate payroll, leave, time tracking, and compliance into a unified interface.

Comparative Market Growth Analysis: 2024–2034

| Market Segment | 2024 Value | 2025 Projection | 2033/2034 Forecast | CAGR (2025–2033/34) | Base Year | Forecast Period |

|---|---|---|---|---|---|---|

| U.S. Absence Management | USD 324.41 Million | USD 354.26 Million | USD 810.58 Million | 9.6% | 2024 | 2025–2034 |

| Global Absence Management | USD 1.2 Billion* | – | USD 2.9 Billion | 10.2% | 2023 | 2023–2032 |

| Global Time & Attendance Software | USD 3.06 Billion | – | USD 5.58 Billion | 6.55% | 2024 | 2025–2033 |

| Global HR Software Market | USD 21.04 Billion | USD 54.6 Billion | USD 50.46 Billion (2032) | 11.55% (to 2032) | 2024 | 2025–2032 |

*Estimated base global absence management value in 2023.

Key Drivers Fueling Market Acceleration

Enterprise-Wide Digitalization of HR Functions

- Increased adoption of cloud-based HCM platforms that integrate absence tracking with payroll, scheduling, and benefits administration.

- Growing demand for mobile-first, AI-enabled HR tools that offer real-time tracking, insights, and automation.

Compliance and Regulatory Pressures

- Complex and evolving leave laws (e.g., FMLA, state-specific paid leave mandates) are compelling businesses to adopt compliant absence solutions.

- Increased legal risk associated with manual leave tracking systems is accelerating software adoption.

Hybrid and Remote Work Models

- Persistent hybrid work has introduced new challenges in leave visibility and approval workflows.

- Employers are investing in systems that can manage geographically dispersed teams and varying local labor laws.

Strategic Implications and Competitive Differentiators

Rise of Platform Integration

- Vendors that integrate absence management into broader HR suites (e.g., payroll, benefits, scheduling) are better positioned for long-term client retention.

- Interoperability with HRIS, ERP, and third-party compliance systems is becoming a baseline expectation.

Niche Specialization and Market Entry Barriers

- Vendors offering specialized compliance features (such as multilingual leave law compliance) or AI-based absence forecasting are securing competitive advantages.

- Point solutions with limited integration capability may struggle as buyers favor modular, extensible systems.

Industry Outlook: Maturity and Strategic Opportunity

- The absence management software market is maturing beyond basic automation to become a strategic tool for workforce optimization.

- AI and predictive analytics are being leveraged to forecast leave trends, identify burnout risks, and optimize resource allocation.

- As enterprises shift towards employee-centric HR strategies, absence management platforms will increasingly play a role in shaping organizational resilience, culture, and compliance.

3. Key Market Trends

The landscape of absence management software is undergoing rapid transformation in 2025. Key technological, organizational, and workforce shifts are driving market momentum, reshaping product strategies, and redefining enterprise priorities. Below is a detailed exploration of the core trends catalyzing this evolution.

1. Proliferation of Remote and Hybrid Workforces

Structural Workforce Shifts

- The U.S. remote workforce is expected to reach 36.2 million by 2025, constituting approximately 14% of the adult population.

- This reflects a fivefold increase from pre-pandemic benchmarks, reinforcing the permanence of hybrid and remote models.

Strategic Implications for Software Vendors

- Demand for location-agnostic platforms has intensified.

- Systems must now accommodate:

- Multi-jurisdictional compliance

- Geo-specific leave regulations

- Real-time synchronization across devices and locations

Technology Requirements

- Cloud-native architecture

- Mobile-first design

- Secure remote access capabilities

- Enhanced data residency and compliance mapping to align with regional labor laws

2. Automation as a Core Productivity Lever

Administrative Overload in HR

- Studies reveal that HR teams spend over 50% of their time managing repetitive, low-value administrative tasks.

- This inefficiency costs organizations up to USD 70,000 per manager annually in lost productivity.

Automation-Driven Efficiency

- Absence management software automates:

- Leave requests and approval workflows

- Absence tracking and documentation

- Compliance alerts and audit readiness

Value Proposition

- Reduces human error

- Increases processing speed

- Frees HR professionals to focus on strategic, employee-centric functions

3. Employee Well-being and Mental Health Integration

Evolving HR Mandates

- Organizations are embracing a more holistic approach to employee well-being.

- Mental health support is emerging as a non-negotiable component of modern absence management strategies.

Product Development Focus

- Integration of:

- Stress and burnout monitoring tools

- Return-to-work support programs

- Self-service wellness dashboards

- Platforms are being designed not just to track leave, but to understand and respond to the reasons behind it.

4. Cloud Deployment Dominance

Cloud vs. On-Premise: Strategic Shift

| Deployment Mode | Key Advantages | Enterprise Preference (2025) |

|---|---|---|

| Cloud | Scalability, lower upfront costs, real-time data | Increasing dominance across sectors |

| On-Premise | Custom security controls, data sovereignty | Retained in highly regulated industries |

Cloud Market Outlook

- Cloud-based absence management is becoming the default deployment model, especially for mid-to-large enterprises.

- It supports:

- Global expansion

- Dynamic policy enforcement

- Seamless updates and scalability

5. Rise of Artificial Intelligence and Predictive Analytics

AI Integration Trends

- AI is transforming absence management from an administrative system into a predictive, decision-enabling platform.

- Key use cases include:

- Anomaly detection in absenteeism

- Workforce forecasting

- Proactive burnout prevention

Adoption Projections and Strategic Urgency

- 76% of HR leaders believe they will lag behind competitors without AI adoption within 12–24 months.

- 41% of business leaders plan to redesign workflows using AI.

Impact on Talent Strategy

- HR professionals must now develop:

- Data literacy

- Analytical proficiency

- Competency in interpreting AI-driven insights

Matrix: Strategic Impact of Key Trends on Absence Management

| Trend | Enterprise Impact | Software Capability Required |

|---|---|---|

| Remote & Hybrid Work | Jurisdictional compliance complexity | Cloud-native, location-aware platforms |

| Automation | Reduced admin burden, improved processing speed | Workflow automation, rule-based triggers |

| Mental Health Focus | Enhanced employee retention and satisfaction | Integrated well-being tools, sentiment tracking |

| Cloud-Based Adoption | Lower IT overhead, faster deployment, global scalability | SaaS delivery, modular upgrades, centralized access |

| AI & Predictive Insights | Strategic planning, workforce optimization, burnout prevention | ML algorithms, anomaly detection, forecasting models |

Conclusion: Absence Management as a Strategic Pillar in 2025

In 2025, absence management software is no longer a peripheral HR function. It has evolved into a core element of enterprise workforce strategy, requiring intelligent design, seamless integration, and a focus on employee experience. Vendors that align with these macro trends—particularly those leveraging AI, cloud, and mental health innovation—will be positioned for long-term market leadership.

4. Growth Drivers

The 2025 landscape of absence management software is defined by strategic, compliance-driven, and operational catalysts that continue to elevate the technology from a back-office utility to an essential enterprise platform. Below is a detailed examination of the core factors fueling market expansion, supported by tangible business implications.

1. Urgency for Operational Efficiency and Automation

Strategic Workforce Management Challenges

- HR departments remain under intense pressure to manage employee absences accurately, transparently, and efficiently.

- Manual absence tracking systems are prone to:

- Calculation errors in payroll

- Misalignment with legal entitlements

- Redundant administrative overhead

Automation-Driven Solutions

- Absence management software eliminates inefficiencies by:

- Automating absence request, approval, and tracking

- Reducing manual intervention and error margins

- Integrating with payroll systems for seamless processing

Quantifiable Value Impact

- HR professionals dedicate over 50% of their time to repetitive administrative tasks.

- This inefficiency translates to approximately USD 70,000 per manager per year in lost productivity.

- Vendors leveraging these metrics can frame their solutions as productivity-boosting assets rather than discretionary software expenses.

2. Compliance with Rapidly Evolving Labor Legislation

Legal Complexity Across Jurisdictions

- Federal, state, and local leave policies are becoming more:

- Granular

- Time-sensitive

- Employee-centric

Software as a Compliance Safeguard

- Automated systems help mitigate risks by:

- Enforcing leave policies dynamically

- Flagging potential policy breaches

- Generating real-time compliance reports

- Critical for sectors such as healthcare, education, and government where regulatory scrutiny is higher.

Risk Avoidance and Legal Intelligence

- Non-compliance can result in:

- Fines, lawsuits, and reputational damage

- Disruption to operations and employee relations

- Software vendors are increasingly embedding legal update engines and localized compliance modules to maintain market relevance.

3. Proliferation of Remote and Hybrid Work Models

Workforce Decentralization

- Hybrid work has redefined employee presence and absence visibility.

- By 2025, over 36 million American workers will operate remotely, necessitating:

- Anywhere-accessible leave systems

- Geo-fenced compliance protocols

- Device-agnostic tracking and self-service options

Platform Requirements

- Cloud-first infrastructure

- Integrated time zone and location rules

- Synchronized policy management across regions

4. Increasing Recognition of Absenteeism’s Economic Impact

Unmanaged Absences: Hidden Cost Centers

- Absenteeism can lead to:

- Workforce disruptions

- Increased overtime costs

- Reduced employee morale

Investment Justification for Businesses

- Advanced absence management software enables:

- Workforce planning with real-time visibility

- Absence trend analytics for forecasting

- Proactive intervention in high-risk cases

5. Integration with ERP and Enterprise HR Ecosystems

Unified Digital Infrastructure

- Businesses are prioritizing consolidated HR tech stacks to:

- Eliminate data silos

- Achieve single-source-of-truth reporting

- Drive automation across recruitment, payroll, and benefits

ERP Market Growth as an Enabler

- The global ERP software market is expected to grow at a CAGR of 10%, making ERP-HR integration a strategic focus.

- Absence management solutions are now expected to:

- Plug into ERP systems (e.g., SAP, Oracle, Workday)

- Enable bidirectional data exchange for real-time workforce planning

- Support customized workflows by industry verticals

📊 Table: Comparative Impact of Growth Drivers on Software Capabilities

| Growth Driver | Business Challenge Addressed | Software Feature Response |

|---|---|---|

| Operational Efficiency & Automation | High admin workload, human error | Workflow automation, digital forms, real-time tracking |

| Compliance Complexity | Legal risk and outdated policy enforcement | Built-in rule engines, alert systems, policy automation |

| Remote/Hybrid Workforce | Location variance, scheduling inconsistency | Cloud-native access, mobile apps, geo-compliance features |

| Financial Impact of Absenteeism | Productivity loss, staffing gaps | Predictive analytics, absence heatmaps, workforce forecasting |

| ERP & HRIS Integration | Fragmented systems, duplicated data entry | API connectors, native integrations, modular plug-ins |

Conclusion: A Shift from Administrative Utility to Strategic Asset

The convergence of automation, legal compliance, remote work, financial risk mitigation, and systems integration has catalyzed the rise of absence management software as a core business enabler in 2025. It is now viewed not just as a process improvement tool, but as a critical element of enterprise resilience and workforce optimization.

5. Market Segmentation Analysis

6. Deployment Mode

The landscape of the absence management software market in 2025 reveals nuanced dynamics shaped by deployment preferences, enterprise priorities, and technological evolution. Segmenting the market by deployment mode—primarily between cloud-based and on-premise solutions—offers key insights into strategic positioning, vendor innovation, and end-user decision-making patterns.

Deployment Mode Segmentation: Evolving Infrastructure Preferences

The bifurcation between cloud-native and on-premise deployments continues to define how businesses select, scale, and secure their absence management systems. Each approach appeals to unique operational demands, regulatory environments, and digital maturity levels within organizations.

Cloud-Based Absence Management Solutions: Rapid Ascendance and Long-Term Dominance

- Adoption Surge Across Enterprise Sizes

- Cloud-based solutions have emerged as the dominant deployment model, largely due to their scalability, remote accessibility, and cost efficiency.

- The proliferation of hybrid work models and distributed teams has intensified the demand for systems accessible in real time from any location or device.

- Strategic Benefits Driving Cloud Investment

- Facilitates real-time reporting, seamless integration with other cloud-based HR systems (e.g., payroll, benefits, time-tracking).

- Enhances user experience through automation, analytics, and AI-driven leave insights.

- Growing Trust in Cloud Security Standards

- Modern cloud platforms increasingly meet enterprise-grade security and compliance benchmarks (e.g., SOC 2, ISO 27001, HIPAA).

- Organizations are prioritizing secure cloud deployments over traditional infrastructure, pushing vendors to prove robust cybersecurity postures.

- Predicted Market Continuity

- Cloud deployments are forecast to sustain their lead in the U.S. absence management space through 2025 and beyond, particularly among large enterprises and mid-market adopters.

On-Premise Deployments: Sustained Relevance Amid Regulatory and Privacy Demands

- Continued Growth in Regulated Industries

- Despite cloud’s momentum, on-premise deployments are not becoming obsolete. Specific sectors—such as healthcare, government, and defense—continue to prefer on-premise installations due to control over sensitive data.

- Enterprise-Controlled Security Posture

- Companies operating in jurisdictions with strict data residency laws or internal cybersecurity mandates maintain a preference for on-premise solutions due to perceived superior privacy and governance capabilities.

- Hybrid and Private Cloud Opportunities

- Vendors targeting this segment are increasingly exploring private cloud or hybrid cloud options that combine localized data control with cloud-like flexibility.

- This signals a broader trend: enterprises are not rejecting the cloud—they are demanding customized, secure, and compliant cloud environments tailored to industry-specific risk profiles.

Comparative Market Data: U.S. Deployment Mode Trends (2022–2024)

| Deployment Mode | 2022 (USD Million) | 2023 (USD Million) | 2024 (USD Million) | Trend Analysis |

|---|---|---|---|---|

| On-Premise | 128.22 | 139.01 | 150.85 | Stable YoY growth attributed to regulated industries and enterprise-level installations |

| Cloud-Based | 144.58 | 158.34 | 173.56 | Accelerated growth with strong adoption across hybrid workforces and mid-to-large organizations |

Strategic Implications for Vendors and Buyers

For Software Providers

- Cloud-native vendors must continue investing in platform extensibility, mobile optimization, and AI-powered leave intelligence.

- Vendors supporting on-premise or hybrid deployments should strengthen security assurance programs and support data localization mandates.

For Buyers

- Organizations should assess total cost of ownership, data compliance obligations, and integration capability before finalizing deployment models.

- Enterprises in transition should evaluate multi-tenant SaaS and private cloud solutions as bridges between legacy infrastructure and full cloud migration.

Deployment Preference Matrix: Drivers Influencing Adoption Model

| Factor | Cloud-Based | On-Premise |

|---|---|---|

| Scalability | High | Moderate |

| Compliance Flexibility | Increasing via secure certifications | High (custom policies) |

| Data Control | Limited (shared infrastructure) | Full (localized infrastructure) |

| Initial Cost | Lower (subscription model) | Higher (CAPEX-intensive) |

| Integration | Seamless with modern HR ecosystems | Complex with legacy systems |

| Time-to-Deploy | Fast (weeks) | Slow (months) |

| Best Fit For | Agile enterprises, hybrid teams | Regulated sectors, large enterprises |

A. By Organization Size

As the global workforce becomes increasingly diverse and digitalised, the adoption of absence management software is being shaped profoundly by the size and operational maturity of organisations. In 2025, distinct behavioural patterns and investment priorities are emerging between Large Enterprises and Small to Medium-sized Enterprises (SMEs)—each influencing product design, go-to-market strategy, and growth trajectories.

This segmentation is not merely demographic; it reflects the structural, technical, and operational complexity that governs how different types of businesses deploy HR technologies.

Large Enterprises: Driving Demand for Enterprise-Grade Capabilities

Market Characteristics:

- Large corporations continue to dominate in overall market share due to their expansive workforces and longstanding investments in digital transformation.

- In 2024, large enterprises represented the majority of enterprise software expenditure, particularly in industries with large-scale shift-based operations such as manufacturing, logistics, and healthcare.

Key Adoption Drivers:

- Need for Configurability and Control

- Preference for deeply configurable platforms that can be tailored to complex, multi-location, and unionised work environments.

- Demand for high levels of administrative oversight, compliance automation, and system-wide reporting.

- Integration with Existing Enterprise Systems

- Emphasis on seamless interoperability with core HRIS platforms (Workday, SAP SuccessFactors, Oracle HCM).

- APIs and custom connectors are prerequisites for integration with payroll, time tracking, and ERP systems.

- Advanced Functionality Expectations

- Advanced AI-driven absenteeism forecasting, predictive analytics, and cross-border compliance features are often required.

- Deployment models include private cloud or hybrid environments, reflecting security and control concerns.

Strategic Considerations:

- Solutions must support enterprise-level governance, auditing, and workflow automation.

- Consultative sales and long implementation cycles are common; buying decisions often span IT, HR, compliance, and procurement.

Small and Medium-Sized Enterprises (SMEs): The Engine of Market Expansion

Market Characteristics:

- SMEs represent the fastest-growing segment within the absence management software market from 2025 to 2034.

- In 2024, SMEs accounted for an estimated 80% of total HR software demand in the U.S., signalling widespread digital adoption beyond the enterprise tier.

Growth Catalysts:

- Cloud-Native Simplicity

- Increased reliance on SaaS-based absence management platforms that require minimal configuration and zero infrastructure maintenance.

- Adoption is driven by affordability, ease of use, and subscription-based pricing flexibility.

- Time and Resource Constraints

- SMEs seek tools that reduce administrative burden and automate routine absence tracking tasks.

- High interest in bundled features such as self-service employee portals, mobile apps, and compliance templates.

- Volume Opportunity

- An estimated 3.2 million SMBs in the U.S. are potential users of modern absence management solutions.

- This segment is seen as the primary driver of volume-based growth in the market, especially for vendors offering scalable SaaS models.

Strategic Considerations:

- Vendors must adopt channel-focused or indirect sales strategies supported by digital marketing and integrations with popular SME HR stacks (e.g., Gusto, BambooHR, Zoho People).

- Solutions that offer pre-configured templates, rapid deployment, and intuitive UX are critical for adoption.

Side-by-Side Comparison: Enterprise vs SME Requirements

| Criteria | Large Enterprises | SMEs |

|---|---|---|

| Workforce Size | 1,000+ employees | <1,000 employees |

| Key Priorities | Configurability, compliance automation, integrations | Simplicity, affordability, automation |

| Preferred Deployment | Hybrid or Private Cloud | Multi-tenant SaaS |

| Sales Approach | Direct, consultative, RFP-driven | Self-serve or partner-driven |

| Integration Needs | Complex HRIS/ERP stack | Basic or standalone HR platforms |

| AI/Analytics Use | High demand for predictive and operational analytics | Interest in dashboards and absence summaries |

| Implementation Timeframe | 3–12 months (custom setups) | <4 weeks (plug-and-play models) |

| Support Requirements | 24/7, enterprise SLAs, custom onboarding | Chat/email support, onboarding wizards |

Market Revenue by Organization Size (U.S. Market, USD Million)

| Organization Size | 2022 | 2023 | 2024 | Projected CAGR (2025–2034) |

|---|---|---|---|---|

| Large Enterprises | 166.41 | 180.64 | 213.44 | Moderate (stable investment cycles) |

| SMEs | 106.39 | 116.71 | 140.82 | High (fastest-growing subsegment) |

Strategic Implications for Vendors

Dual Track Product and Sales Strategy:

- No universal solution can address both markets effectively.

- Vendors should consider developing modular platforms that allow scalability and configuration based on organization size.

Recommended Actions:

- For SME-focused vendors:

- Emphasize usability, onboarding speed, and cost transparency.

- Leverage marketplaces, partner ecosystems, and online channels.

- For enterprise-oriented providers:

- Prioritize depth of functionality, compliance support, and ecosystem extensibility.

- Offer professional services and custom SLAs.

B. By End-User Industry

In 2025, the demand for absence management software is profoundly shaped by industry-specific dynamics, regulatory environments, and operational structures. Each vertical faces unique challenges related to workforce availability, compliance mandates, and scheduling complexity—making absence tracking and leave automation critical components of broader workforce management strategies.

From highly regulated sectors like healthcare and financial services to operationally intensive industries such as manufacturing and retail, the landscape reveals a clear movement toward tailored, industry-specific solutions. Below is a breakdown of key sectors influencing market direction and software design.

Banking, Financial Services, and Insurance (BFSI): Leading Sectoral Growth

Key Insights:

- BFSI is forecast to achieve the highest compound annual growth rate (CAGR) from 2025 to 2034.

- The rise in employee training on advanced financial tools and compliance mandates is driving increased demand for reliable absence tracking systems.

Market Drivers:

- Strict internal governance and audit trails necessitate accurate time-off documentation.

- Frequent regulatory audits in banking and insurance elevate the need for real-time visibility into employee availability.

- Remote and hybrid workforces in financial institutions are adopting cloud-first absence management platforms for centralized control.

Strategic Opportunities for Vendors:

- Provide automated compliance alerts aligned with financial service labor laws.

- Offer audit-ready reporting systems integrated with LMS (learning management systems) and payroll.

Manufacturing: Operational Complexity Driving Rapid Adoption

Key Insights:

- Manufacturing is among the fastest-growing segments due to its reliance on structured workforce patterns and regulated labor environments.

- High volume shift work and just-in-time production workflows demand real-time visibility into employee attendance.

Market Drivers:

- Complex shift rotations and union-specific labor contracts call for configurable rule engines.

- Absence in critical roles can directly lead to production delays or quality risks.

Strategic Opportunities for Vendors:

- Integrate with manufacturing execution systems (MES) and shop floor management tools.

- Focus on mobile-enabled tracking and hands-free kiosks for industrial environments.

Healthcare: Compliance-Driven Software Evolution

Key Insights:

- Although exact CAGR figures are not specified, healthcare remains a top-tier adopter of absence management software.

- The industry is highly compliance-sensitive, governed by mandates like HIPAA, FMLA, and state-level leave regulations.

Market Drivers:

- The necessity to track multiple credentialing and license renewals per staff member.

- 24/7 staffing models and emergency scheduling needs require automated absence substitution workflows.

Strategic Opportunities for Vendors:

- Offer HIPAA-compliant platforms with built-in document tracking.

- Develop features that support staff redeployment and credential validation.

Retail and E-commerce: High-Turnover Workforce Needs Scalable Tools

Key Insights:

- In 2024, retail led the time and attendance software category, capturing 20.6% of market share.

- Dynamic workforce scheduling and seasonal employment trends are key challenges in this vertical.

Market Drivers:

- Frequent employee churn and multi-location staffing demand centralised but flexible scheduling tools.

- Varied leave policies between full-time and part-time workers require granular policy configuration.

Strategic Opportunities for Vendors:

- Enable mobile-first self-service portals for shift swaps and leave requests.

- Focus on real-time sync with POS systems and store-level dashboards.

Government & Public Sector: Steady Adoption Fueled by Modernization

Key Insights:

- This sector continues to experience stable year-over-year growth, spurred by digital transformation initiatives across federal, state, and local levels.

Market Drivers:

- Union agreements and public employment policies necessitate transparent leave administration.

- Government departments demand audit-friendly tracking tools and compliance with civil service laws.

Strategic Opportunities for Vendors:

- Customize platforms to accommodate civil service leave structures.

- Emphasize data sovereignty, security certifications, and on-premise deployment options.

IT & Telecom: Customization vs. Commercial Solutions

Key Insights:

- This vertical often resists off-the-shelf HR software due to robust in-house development capabilities.

- However, the growing complexity of hybrid workforces and global compliance is opening doors for modular SaaS offerings.

Market Drivers:

- High prioritization of data security and API-driven architecture.

- Emphasis on customizability and scalability often leads to in-house builds.

Strategic Opportunities for Vendors:

- Offer developer-friendly platforms with open APIs and flexible workflows.

- Position solutions as complementary rather than replacement tools—e.g., plug-and-play modules for niche use cases (e.g., vacation banks, global time-off policies).

Absence Management Market Size by Industry (U.S., USD Millions)

| End-User Industry | 2022 | 2023 | 2024 |

|---|---|---|---|

| BFSI | 68.20 | 74.64 | 81.75 |

| Manufacturing | 45.83 | 49.66 | 53.85 |

| Healthcare | 48.97 | 53.82 | 59.21 |

| Retail & E-commerce | 34.51 | 37.85 | 41.56 |

| Government & Public Sector | 34.37 | 37.08 | 40.03 |

| Other Industries | 40.92 | 44.31 | 48.01 |

Industry-Specific Capabilities Matrix: Vendor Design Imperatives

| Capability | BFSI | Manufacturing | Healthcare | Retail | Gov/Public Sector | IT & Telecom |

|---|---|---|---|---|---|---|

| Compliance Automation | ✓✓✓ | ✓✓ | ✓✓✓✓ | ✓✓ | ✓✓✓ | ✓✓✓ |

| Mobile Access | ✓✓ | ✓✓✓✓ | ✓✓ | ✓✓✓✓ | ✓ | ✓✓✓ |

| Shift Planning & Scheduling | ✓ | ✓✓✓✓ | ✓✓ | ✓✓✓ | ✓✓ | ✓✓ |

| Credential & License Tracking | ✓✓✓✓ | ✓ | ||||

| Custom Integration/API Support | ✓✓ | ✓✓ | ✓ | ✓✓ | ✓ | ✓✓✓✓ |

| Leave Policy Flexibility | ✓✓ | ✓✓✓ | ✓✓ | ✓✓✓✓ | ✓✓✓ | ✓✓✓✓ |

| Deployment Model Flexibility | ✓✓✓ | ✓✓ | ✓✓✓ | ✓✓✓ | ✓✓✓✓ | ✓✓✓✓ |

✓ = Low need, ✓✓ = Moderate, ✓✓✓ = High, ✓✓✓✓ = Essential

Strategic Outlook

Verticalization of Product Design:

- Vendors must move beyond generic offerings and invest in vertical-specific product enhancements.

- For example, HIPAA compliance modules for healthcare or SOC 2-ready features for BFSI.

Tailored GTM Strategies:

- Effective market penetration requires custom messaging, vertical case studies, and regulatory references to resonate with target buyers.

- Collaboration with industry consultants, unions, and HR service providers will become increasingly vital.

7. Competitive Landscape

The competitive terrain of the absence management software market in 2025 reveals a highly dynamic, innovation-driven environment shaped by established software giants, emerging vertical specialists, and strategic consolidation. Market participants are increasingly adopting AI, integrated HCM solutions, and predictive workforce planning to maintain relevance and secure long-term growth.

1. Leading Players and Strategic Positioning

1.1 Dominant Enterprise-Level Providers

- Oracle HCM Cloud, SAP SuccessFactors, and Workday continue to dominate large enterprise accounts.

- Offer end-to-end Workforce Management (WFM) and Human Capital Management (HCM) suites.

- Prioritise enterprise-grade configurability, deep system integrations, and multi-jurisdiction compliance.

- ADP, a recognized leader in payroll and HR platforms, maintains strong market share via its integrated absence tracking, benefits, and compliance modules.

1.2 SMB-Focused Innovators

- Key players include Gusto, BambooHR, Rippling, and Zenefits.

- Focus on affordability, ease of use, and integration with payroll and employee self-service platforms.

- SMBs prefer platforms with intuitive interfaces, mobile compatibility, and bundled HR automation.

1.3 Niche and Specialized Vendors

- AbsenceSoft: Known for superior FMLA and ADA compliance tools, especially in highly regulated industries like healthcare and education.

- Replicon: Offers global time-off policy compliance, timesheets, and unified resource tracking.

- Vacation Tracker and Leave Dates: Cater to startups and SMEs with simple pricing models and plug-and-play functionality.

Market Share Evolution

- The enterprise segment holds the majority of current market share due to higher contract values and broader integration needs.

- However, SMBs are growing at a significantly faster CAGR, indicating a redistribution of future market share.

2. Mergers, Acquisitions, and Strategic Alliances

Strategic mergers and acquisitions are reshaping the competitive landscape, enabling companies to broaden capabilities, expand into adjacent verticals, and acquire advanced technologies—particularly AI-driven tools.

2.1 Major 2024–2025 Transactions

| Acquirer | Target | Value (USD) | Strategic Focus |

|---|---|---|---|

| ADP | WorkForce Software | $1.2 Billion | Enterprise WFM integration (absence, scheduling, forecasting) |

| Symplr | Smart Square (AMN) | $75 Million | AI-based predictive scheduling for healthcare |

| Deel | PaySpace, Hofy, Zavvy | Undisclosed | Consolidation of payroll, benefits, hybrid workforce support |

| Workday | HiredScore | Undisclosed | AI-powered talent intelligence and automation |

| SAP | SuccessFactors Time Suite | N/A | Cloud-based time tracking with real-time analytics |

| UKG + Google Cloud | Partnership | N/A | Generative AI integration across HR functions |

2.2 Strategic Implications

- Market Consolidation: Major HCM providers are absorbing niche absence management platforms to offer comprehensive, end-to-end solutions.

- AI as a Differentiator: Acquisitions increasingly focus on acquiring AI capabilities—especially in predictive scheduling, compliance automation, and real-time resource optimization.

- Shift Toward Platform Ecosystems:

- Vendors are evolving into HR operating systems, offering modules that encompass payroll, leave tracking, compliance, and performance management.

- Standalone absence tracking tools must now justify their ROI through superior niche features or integration flexibility.

3. Competitive Matrix: Capability Positioning by Vendor Type

| Vendor Type | Key Players | Target Market | Core Strengths |

|---|---|---|---|

| Enterprise-Grade Suites | SAP, Workday, Oracle, ADP | Large Enterprises | Advanced analytics, global compliance, deep integration |

| SMB-Oriented Solutions | Gusto, BambooHR, Rippling | Startups / SMEs | User experience, fast setup, cost-efficiency |

| Specialized Compliance | AbsenceSoft, Replicon | Regulated Industries | FMLA, ADA, global PTO, jurisdictional customization |

| Modular Point Solutions | Vacation Tracker, Leave Dates | Small Teams / Startups | Low cost, ease of use, basic scheduling needs |

4. Industry-Wide Trends Shaping Competition

- AI Integration Becomes Standard:

- Predictive analytics for absenteeism patterns

- Smart scheduling based on historical leave data

- Natural language chatbots for leave request automation

- Vertical-Specific Productization:

- Healthcare: HIPAA-compliant tracking + credential management

- BFSI: Regulatory audit trails and leave compliance

- Manufacturing: Shift scheduling + fatigue risk analytics

- Unified Cloud Platforms:

- Centralized dashboards across time, attendance, payroll, and performance

- API-first architecture enabling plug-ins with ERP and CRM tools

- Strategic Partnerships Rising:

- Co-development with tech giants (e.g., Google Cloud, AWS)

- Alliances with consulting and outsourcing firms to penetrate enterprise accounts

Conclusion: Strategic Outlook

The competitive landscape for absence management software in 2025 underscores a decisive shift toward intelligent, unified workforce platforms. Market leaders are consolidating through acquisition and investing heavily in AI, industry-specific compliance, and seamless integration capabilities.

While large vendors strengthen their enterprise dominance, SMB-centric disruptors continue to grow rapidly by emphasizing agility, simplicity, and affordability. As the market becomes increasingly crowded, success will depend on a vendor’s ability to differentiate through innovation, industry verticalization, and partner ecosystems.

Vendors looking to maintain or expand market share must adopt a dual strategy:

- Deep, scalable feature sets for large clients

- Lightweight, cost-effective SaaS options for SMBs

- Modular architecture to flexibly adapt to shifting workforce and compliance dynamics

8. User Reviews and Sentiment Analysis

1. User Feedback Overview: Challenges in Manual Absence Tracking

1.1 Recurring Pain Points Without Absence Software

Organizations that continue to rely on manual absence tracking—such as spreadsheets, emails, or verbal requests—face several operational inefficiencies:

- Approval Delays and Communication Gaps

- HR teams often report excessive hours spent chasing down email threads and reminding managers of outstanding leave approvals.

- These delays create bottlenecks in payroll, scheduling, and resource allocation.

- Human Error and Compliance Risks

- Manual inputs increase the likelihood of payroll inaccuracies and unintentional policy violations.

- Failure to accurately record leave types (e.g., FMLA, PTO, sick leave) could result in legal exposure.

- Lack of Real-Time Visibility

- Without centralized visibility, managers unknowingly approve overlapping time-off requests, causing unanticipated staffing shortages.

- Operational disruptions and diminished productivity are common consequences.

- Policy Enforcement Complexity

- Inconsistent interpretation of leave policies leads to both over-approvals and unfair rejections.

- Employees are often unaware of their full entitlements, reducing satisfaction and trust.

- Integration Gaps

- Disconnected HR systems result in duplicate data entry across payroll, scheduling, and compliance platforms.

- This fragmentation leads to inefficiencies and reporting discrepancies.

2. Feature Expectations: What Users Demand from Leading Solutions

2.1 Functional Priorities Identified in Reviews

Users are increasingly selective, seeking platforms that go beyond basic tracking. The most highly rated features include:

- Streamlined Workflows

- Fast employee call-out and leave request submissions.

- Automated approval routing with real-time notifications.

- Live Attendance Dashboards

- Real-time visibility into who is off, for what reason, and when they’ll return.

- Custom Leave Policy Configuration

- Full control to tailor policies to organizational or jurisdictional requirements (e.g., FMLA, vacation, sick, bereavement).

- Integration with Key Systems

- Seamless compatibility with HRIS, payroll, and workforce scheduling systems to eliminate silos.

- Multilingual and Mobile Accessibility

- Especially vital for global workforces and frontline teams with limited desktop access.

- Advanced Analytics & Absenteeism Reporting

- Data visualization tools to identify leave trends, forecast resource gaps, and support workforce planning.

- Automated Compliance Alerts

- Proactive notifications for approaching leave limits, legal thresholds, or FMLA triggers.

3. Comparative Table: Top-Rated Absence Management Software (2025 Edition)

| Software | Rating (G2/Gartner) | Target Audience | Key Features | Strengths | Weaknesses | Starting Price |

|---|---|---|---|---|---|---|

| Rippling | 4.8 / 5 (G2) | All-in-One HR, IT, Payroll | Policy customization, mobile access, integrations, real-time reporting | Unified platform, intuitive UI, automation, broad ecosystem | Feature overload, steep learning curve for new users | From $8/user/month |

| Workday WFM | 4.7 / 5 (Gartner) | Global Enterprises | Global compliance, talent & workforce management, learning tools | Cloud-based, highly scalable, ideal for complex global structures | Pricing opaque, onboarding may require significant resources | Custom pricing |

| HROne | 4.8 / 5 (G2), 4.6 (Gartner) | SMBs & Mid-Markets | Digital transformation, real-time dashboards, workflows | Agile, collaborative, easy to scale | Limited international localization | ₹85/user/month |

| BambooHR | 4.5 / 5 (G2) | SMBs + Broader HRMS Use | Custom leave policies, mobile app, integrated suite | Built-in communications hub, integrations, customizable plans | Add-ons can inflate costs, pricing transparency issues | From $6.19/user/month |

| edays | 4.3 / 5 (PeopleManagingPeople) | Global SMEs | Auto-alerts, policy customization, multi-language support | Handles complex leave types, robust compliance engine | Time-consuming setup, limited mobile functionality | Custom pricing |

| Absence.io | 5-star badge (Capterra) | Global Businesses | Vacation calendar, time tracking, policy automation | 7-language support, calendar-based UX, intuitive interface | No documented downsides in public reviews | Free trial, flexible plans |

| TeamSense | Highly rated | Frontline/Deskless Teams | SMS-first callouts, manager dashboards, no app required | High mobile adoption, ease of use, fast onboarding | Limited integrations with larger HR suites | Usage-based pricing |

| Vacation Tracker | Not rated (PMPeople) | Remote Teams | Self-service leave portal, calendar integration, instant notifications | Simplifies team coordination, works well with Slack/MS Teams | Lacks granular time tracking, fewer HRIS integrations | From $1/user/month |

| actiPLANS | Not rated | Small-Midsize Enterprises | PTO rules, easy UI, reports, resource planning | One-click approvals, fast deployment | Request edits not allowed, limited integrations | From $1.90/user/month |

| Buddy Punch | Not rated | SMBs (Hourly Workforce) | PTO tracking, geofencing, biometric login | Facial recognition, GPS validation, highly accurate | U.S.-centric payroll module, high base fee | From $3.99/user/month + $19 base |

4. Platform Design vs. Niche Functionality: What Users Value Most

4.1 The Tradeoff Between Integrated Suites and Best-of-Breed Tools

- All-in-One Platforms (e.g., Rippling, Workday)

- Appeal to organizations seeking consolidated HR ecosystems.

- Prioritized for reducing manual data transfer and tool switching.

- Support “single source of truth” in employee data.

- Niche Solutions (e.g., Absence.io, TeamSense)

- Provide targeted functionality such as FMLA compliance, SMS call-outs, or localized leave policies.

- Ideal for specific workforce types or compliance-heavy sectors.

- Often easier to adopt, configure, and support.

5. Design and Usability: A Deciding Factor for Adoption

5.1 Key UX Considerations Raised by Users

- Simplicity and Speed

- Users frequently emphasize the value of systems that minimize cognitive load.

- “One-click approvals” and mobile optimization improve user experience, especially for frontline and deskless teams.

- Mobile Accessibility & Multilingual Support

- SMS-first solutions like TeamSense cater exceptionally well to decentralized or non-desk employees.

- Tools with multi-language UIs significantly enhance usability across global workforces.

- Feature Overload vs. Feature Depth

- While comprehensive systems are valued, excessive complexity without guidance is cited as a barrier to adoption.

- In-app onboarding, tutorials, and contextual help are increasingly demanded.

6. Strategic Takeaways for Buyers

| Buyer Persona | Recommended Software Type | Top Priority | Suggested Vendor Examples |

|---|---|---|---|

| Large Enterprise (Global Ops) | Integrated Suite | Compliance, automation, global HRIS | Workday, Rippling |

| Mid-Market Growth Company | Scalable All-in-One | Centralization, fast onboarding | BambooHR, HROne |

| SMB or Startup | Cost-Effective, Feature-Focused | Ease of use, pricing transparency | actiPLANS, Vacation Tracker |

| Frontline Workforce (Deskless) | SMS-Based, No-App | Fast communication, mobile-first tools | TeamSense |

| Highly Regulated Industries | Compliance-Focused, Custom Policy Logic | FMLA tracking, audit trails | edays, Absence.io |

9. Pricing and Monetization Models

As organizations continue to prioritize workforce efficiency and compliance, the absence management software landscape is evolving rapidly, with varied pricing models catering to distinct organizational needs—from SMEs to multinational enterprises.

I. Key Trends in Pricing Models

1. Subscription-Based Pricing (Most Prevalent)

- Per-user Monthly Fees:

- Standard across the sector.

- Rates vary based on features and company size.

- Example:

- Vacation Tracker: from $1/user/month

- Replicon: from $6/user/month

2. Tiered Feature Bundles

- Bundled Functionality:

- Multiple tiers offering scaled features (e.g., analytics, integrations).

- Allows customers to scale as needed without overpaying upfront.

3. Hybrid Models

- Base Fee + Per-User Pricing:

- Combines flat-rate base fee and user-specific charges.

- Example:

- Buddy Punch: $19/month base + $3.99/user/month

4. Per-Location Subscription

- Suitable for businesses with multiple physical sites.

- Example:

- Homebase: $20/location/month

5. Custom Enterprise Pricing

- Tailored to large organizations with complex requirements.

- Typically includes implementation support and integration with enterprise systems.

- Examples: edays, FoxHire, Rippling (full suite)

6. Free Plans & Trials

- Onboarding Strategy:

- 7, 14, and 30-day free trials common.

- LeaveBoard: Free for <9 users.

- Connecteam: Free tier for small teams.

7. Annual Billing Discounts

- Cost Savings Incentives:

- Up to 20–30% discounts for upfront yearly commitments.

- BambooHR, Rippling: Annual-only billing models.

8. Usage-Based Pricing (Niche Use-Cases)

- Ideal for deskless or mobile-first workforces.

- Example: TeamSense offers pay-as-you-use plans.

9. One-Time Licensing

- Mostly phased out but still applicable for on-premise deployment.

- Requires upfront CAPEX rather than OPEX.

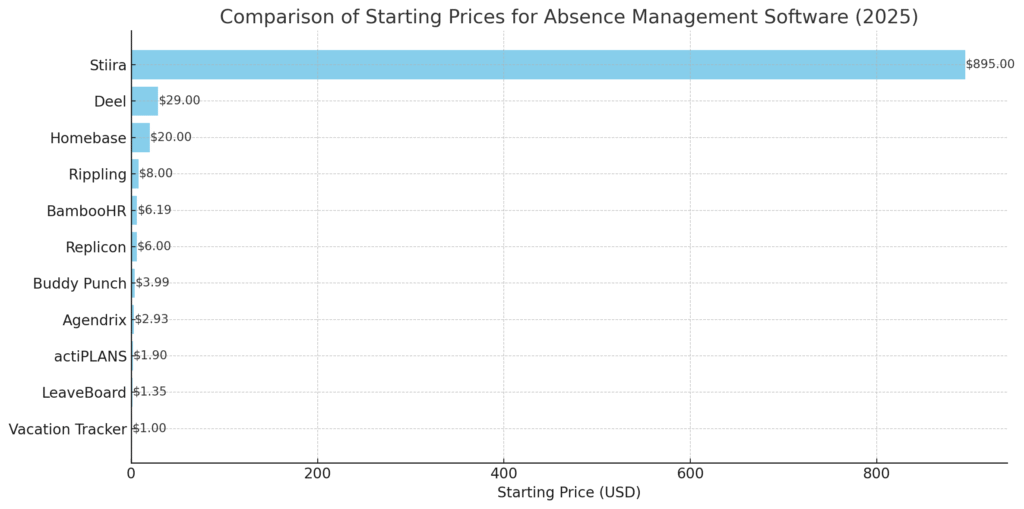

II. Pricing Matrix by Software Provider

| Software Name | Target Audience / Niche | Pricing Model | Starting Price (USD) | Free Trial/Plan Available |

|---|---|---|---|---|

| LeaveBoard | Small teams (<9 users) | Per-user monthly | Free, then $1.35/user | ✔ |

| Vacation Tracker | SMB leave tracking | Per-user monthly | $1.00/user | ✔ (7 days) |

| actiPLANS | Simple PTO tracking | Per-user monthly | $1.90/user | ✔ (30 days) |

| Agendrix | Mobile shift scheduling | Per-user monthly | $2.93/user | ✔ (21 days) |

| Buddy Punch | SMB time tracking | Base + per-user monthly | $3.99 + $19 base | ✔ (14 days) |

| Replicon | Global compliance & policies | Per-user monthly | $6.00/user | ✔ (14 days) |

| BambooHR | HRMS leave suite | Per-user monthly (annual only) | $6.19/user | ✔ (7 days) |

| Rippling | Unified HR/IT/payroll | Per-user monthly (annual only) | $8.00/user | Demo |

| Deel | Global contractor workforce | Monthly subscription | $29.00/month | ✔ |

| Homebase | Hourly & shift workers | Per-location monthly | $20.00/location | ✔ |

| Stiira | In-house enterprise-level leave systems | Tiered headcount (monthly) | $895+/month | ✘ |

III. Pricing Visualisation: Starting Cost Comparison

The following bar chart illustrates starting prices across popular platforms, showcasing how pricing ranges from freemium models to enterprise solutions:

[See chart above]

IV. Key Cost Drivers for Buyers

1. Workforce Size

- Larger teams demand higher-tier plans or enterprise contracts.

- Example: Stiira charges based on employee tiers (e.g., $1,995/month for 3,000 staff).

2. Feature Complexity

- Basic PTO tracking is inexpensive.

- AI-driven insights, global policy handling, and audit trails add significant value and cost.

3. Integration Requirements

- Deep integrations with payroll, ERP, or CRM systems often gated behind premium tiers.

4. Deployment Method

- Cloud-based SaaS dominates.

- On-premise licensing still exists but includes upfront implementation charges.

5. Customer Support and Onboarding

- Premium support is often available only at higher pricing tiers.

- Enterprise plans include training, onboarding, and white-glove service.

V. The Shift Toward Value-Based Pricing

- ROI is now a central marketing narrative.

- Factorial reports a 380% ROI for a 100-employee company, saving $13,689 annually post-implementation.

- Vendors must move from listing features to proving financial returns and efficiency gains.

VI. Recommendations for Buyers (Especially SMBs)

- Avoid hidden costs: Scrutinize for add-ons like implementation, training, or API access.

- Prioritize total cost of ownership (TCO), not just monthly fees.

- Demand transparent pricing breakdowns from vendors.

- Scale wisely: Choose platforms that offer affordable growth pathways.

- Test before buying: Use trials to evaluate UI, integration, and feature utility.

Conclusion

The absence management software market in 2025 demonstrates a mature yet segmented pricing landscape. Vendors are refining their models to align with diverse buyer personas—from startups seeking simplicity to global firms demanding configurability and integration.

The trend is clear: while affordability remains a priority for SMBs, value-based pricing and ROI articulation are becoming standard across the industry.

10. Regulatory and Security Considerations

As workforce regulations tighten and cybersecurity threats intensify, absence management software must not only automate leave tracking but also deliver robust compliance and data protection functionalities. Organizations operating in multi-jurisdictional environments face growing complexity, requiring dynamic solutions that align with both local regulations and global data security standards.

1. Navigating the Complex Web of Compliance Regulations

1.1 Legislative Volatility Across Federal, State, and Global Arenas

- In 2025, businesses must contend with a highly fluid legislative environment, particularly in the United States.

- Employers are subject to:

- Federal laws like the Family and Medical Leave Act (FMLA)

- State-specific mandates such as the New York Paid Family Leave (NY PFL)

- Local ordinances and global labor laws in cross-border jurisdictions

1.2 Dynamic Compliance Management

- Static rule-based systems are increasingly obsolete; enterprises require adaptive platforms that can evolve in real-time.

- Key platform capabilities:

- Automated compliance enforcement of PTO, sick leave, parental leave, and disability policies

- Regulatory alerts when thresholds are breached (e.g., accrued leave caps)

- Configurable policy engines for regional-specific application of laws

- Detailed audit trails and real-time reporting tools to support inspections and legal reviews

1.3 Vendor-Supported Legal Monitoring

- Leading providers such as FINEOS have in-house legal and compliance teams to:

- Continuously monitor evolving federal and local mandates

- Implement updates directly into software rule engines

- Reduce client exposure to compliance gaps and audit penalties

1.4 Strategic Imperative for Global Enterprises

- For multinational employers:

- Software must provide comprehensive, multi-country regulatory mappings

- Platforms should support country-specific entitlement rules and multilingual interfaces

- Outsourcing leave administration or deploying best-in-class SaaS platforms becomes vital to mitigate compliance risks across jurisdictions.

2. Heightened Focus on Data Privacy and Cybersecurity Standards

2.1 Sensitivity of HRIS Data

- Absence management systems store critical Personally Identifiable Information (PII):

- Social Security Numbers

- Bank details

- Health-related leave justifications

- Disciplinary records and performance evaluations

- This data makes HR systems prime targets for cybercriminals.

2.2 Core Cybersecurity Features for 2025

- Essential safeguards include:

- End-to-end encryption for data at rest and in transit

- Role-based access control (RBAC) with Multi-Factor Authentication (MFA)

- Automated software patching and threat vulnerability scanning

- Real-time security event logging and anomaly detection systems

2.3 Human Element & Employee Awareness

- 68% of security breaches originate from non-malicious human error

- 95% of incidents are attributable to preventable employee actions

- Mitigation requires:

- Company-wide phishing and social engineering training

- Use of in-app security prompts and onboarding modules

- Continuous security awareness campaigns, especially for HR professionals

3. Industry Standards & Certifications

| Security Framework | Description | Relevance to Absence Management Software |

|---|---|---|

| SOC 2 (Type I & II) | Developed by AICPA to ensure controls around security, availability, and privacy | Minimum compliance benchmark for SaaS HR vendors |

| ISO 27001 | International standard for information security management systems (ISMS) | Adopted by vendors like Absence.io and edays |

| GDPR, CCPA, HIPAA | Regional and sectoral regulations for data protection | Non-compliance leads to significant penalties and fines |

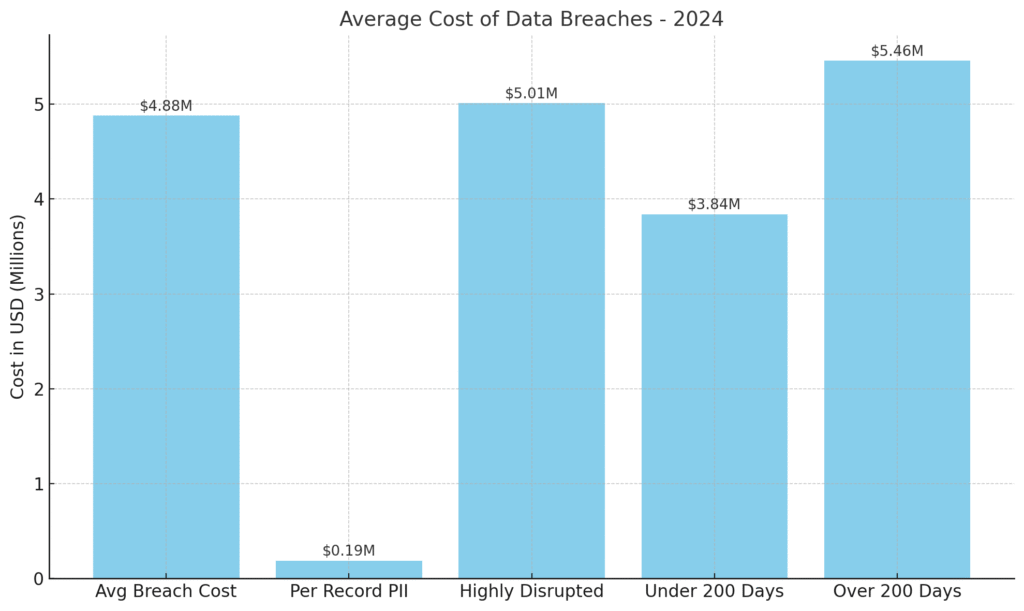

4. Breach Trends and Cost Insights (2024–2025)

4.1 Data Breach Costs Escalating

| Metric | Value (USD) | Year |

|---|---|---|

| Average Breach Cost | $4.88 Million | 2024 |

| Per Record (Employee PII) | $189 | 2024 |

| Highly Disrupted Organizations | $5.01 Million | 2024 |

| If Resolved < 200 Days | $3.84 Million | 2024 |

| If Resolved > 200 Days | $5.46 Million | 2024 |

- Involvement of law enforcement in ransomware cases has shown to reduce breach costs by $1 million.

- The longer a breach remains undetected, the higher the financial loss.

4.2 Emerging Threat Vectors

- Over 60% of top-clicked phishing emails in Q1 2025 impersonated HR or IT departments

- 49.7% of phishing simulations targeted HR staff specifically

- Supply chain attacks are increasing:

- By 2025, 45% of organizations are predicted to experience such attacks

- Example: VeriSource Services breach in April 2025 compromised data from 4 million employees and dependents

4.3 The Role of AI in Risk Reduction

- Organizations utilizing AI and security automation reported:

- Breach cost savings of up to $1.88 million

- Faster detection and mitigation cycles

- AI-powered systems delivered adaptive response to zero-day threats

5. Strategic Recommendations for HR Technology Buyers

- Prioritize vendors with:

- SOC 2 Type II and ISO 27001 certification

- Documented track record of timely compliance updates

- Integrated legal expertise for real-time law monitoring

- Ensure platform supports:

- Granular permission settings

- International labor law mapping

- Security-first design principles

- Internally, organizations should:

- Launch cybersecurity upskilling programs

- Simulate phishing drills and penetration tests

- Perform regular third-party audits

11. Opportunities and Challenges

📈 Market Outlook: Opportunities in 2025

The global absence management software landscape in 2025 reveals an evolving terrain shaped by AI breakthroughs, shifting workforce expectations, and the broader digitalization of HR operations. Organizations are navigating a pivotal moment to transition absence tracking into a strategic, data-driven function.

🔍 Key Opportunities for Market Expansion and Innovation

1. AI-Powered Predictive Analytics and Intelligent Automation

- Enhanced Forecasting Capabilities: AI enables smarter leave forecasting, scheduling optimization, and early identification of absenteeism trends.

- Compliance Automation: AI-driven engines streamline adherence to federal and multi-jurisdictional leave laws.

- Strategic Workforce Planning: Predictive modeling allows HR teams to anticipate staffing gaps, improving resource allocation and minimizing disruption.

2. Employee Well-being and Mental Health Integration

- Support for Holistic Wellness: Software now incorporates features to manage mental health-related leaves, reflecting evolving employer responsibilities.

- Experience Personalization: Employee-centric dashboards and intuitive leave processes promote trust, satisfaction, and long-term retention.

3. Remote & Hybrid Work Optimization

- Flexible Time Management: Solutions are being tailored to accommodate asynchronous schedules, geolocation independence, and varying labor laws.

- Global Workforce Enablement: Platforms now support international compliance and multilingual interfaces, expanding usability across borders.

4. Strategic HR Enablement

- Reduced Administrative Burden: By automating repetitive tasks, HR professionals can reallocate time toward policy optimization and people analytics.

- Data-Driven Policy Making: Aggregated leave trends empower organizations to refine time-off policies and promote fair usage.

5. SMB Segment Expansion

- Explosive Growth Potential: The U.S. SMB sector is expected to adopt absence management solutions at a projected CAGR of over 15%.

- Market Size: Over 3.2 million U.S. small businesses remain untapped, offering scalable revenue opportunities.

- Affordability as a Differentiator: Vendors targeting this segment with competitively priced, easy-to-implement platforms are poised for high conversion.

6. Seamless Ecosystem Integrations

- Interoperability with HRIS & ERP Systems: Demand is rising for solutions that plug directly into payroll, talent management, and enterprise resource planning tools.

- API-first Strategies: Scalable API ecosystems allow faster deployment and customizable extensions, increasing vendor stickiness.

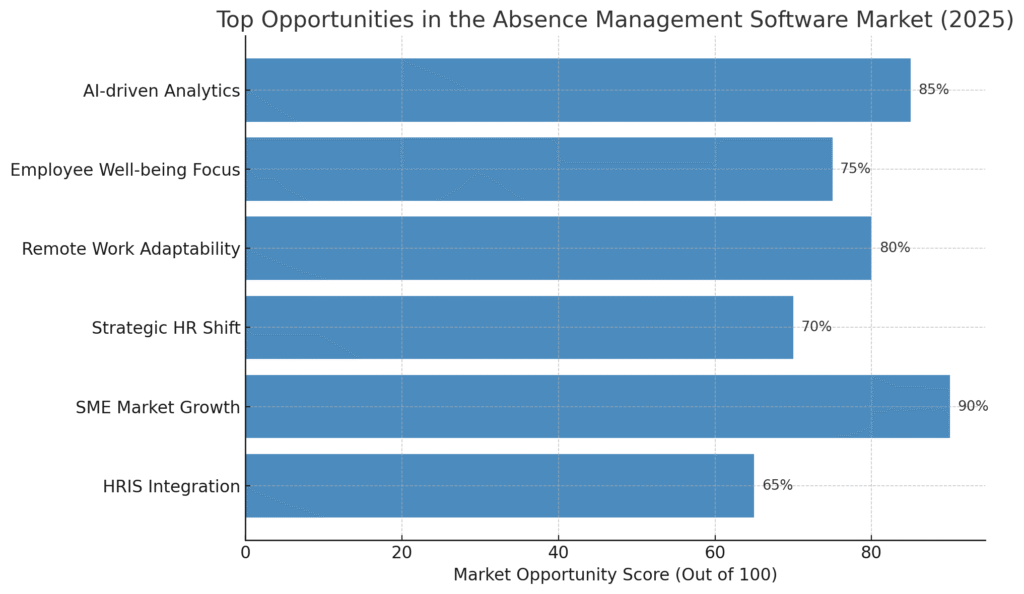

📊 Opportunity Landscape Visualization: 2025

| Opportunity Segment | Market Impact Score (/100) | Adoption Growth Forecast |

|---|---|---|

| AI-driven Predictive Analytics | 85 | High |

| Employee Well-being Tools | 75 | High |

| Remote Work Flexibility | 80 | Medium-High |

| Strategic HR Shift | 70 | Medium |

| SME Market Expansion | 90 | Very High |

| HRIS Integration | 65 | Medium |

Source: Industry Research & Analyst Insights, 2025

📈 Visualized Below

👉 (Chart shows opportunity impact by segment)

⚠️ Market Barriers: Challenges in 2025

Although rich in potential, the absence management software market faces multi-dimensional headwinds — spanning compliance, data privacy, operational complexity, and cybersecurity.

🔒 Regulatory, Security & Compliance Risks

1. Rapidly Evolving Leave Legislation

- Regulatory Fragmentation: Inconsistent laws across U.S. states and countries require continuous software updates and compliance recalibration.

- Software Agility Required: Vendors must adopt adaptive frameworks to quickly incorporate legislative changes like new public holidays or caregiving leave.

2. Cybersecurity Threats and Human Error

- High Data Sensitivity: Employee PII (e.g., medical leave data) is a prime target for cyberattacks.

- Human-Caused Breaches:

- 68% of incidents are attributed to unintentional human errors.

- Over 60% of HR-targeted phishing attempts were successful in Q1 2025.

- Supply Chain Vulnerabilities: By 2025, 45% of enterprises are expected to face third-party or vendor-linked attacks.

3. High Costs of Data Breaches (2024–2025 Trends)

| Breach Scenario | Estimated Financial Impact |

|---|---|

| Average Data Breach Cost | $4.88M |

| Per PII Record Cost (Employee Data) | $189 |

| With Law Enforcement (Ransomware) | -$1M (Cost Reduction) |

| Resolution < 200 Days | $3.84M |

| Resolution > 200 Days | $5.46M |

🔽 Costs rise significantly with delayed incident resolution.

🧩 Operational & Market Adoption Hurdles

4. Implementation Complexity

- Lengthy Deployment Cycles: Configuration delays and change management slow down time-to-value.

- Low Adoption Rates: User training gaps lead to underutilization of full system capabilities, limiting ROI.

5. Intense Competitive Pressure

- Low Market Concentration: No single vendor dominates; this democratizes access but also intensifies pricing and feature competition.

- Emerging Entrants vs. Incumbents: Niche players must specialize or innovate to survive against enterprise HRIS platforms expanding into absence management.

6. Cost Sensitivity in SMBs

- Affordability Barrier: Premium platforms may price out small firms unless tiered pricing or modular features are offered.

- Demand for Plug-and-Play Solutions: SMBs favor tools requiring minimal setup and ongoing support.

7. Complexity of Modern Leave Management

- Rising Diversity of Leave Types: From Juneteenth to caregiver leave, legal and cultural observances complicate policy design.

- Disconnect in Communication:

- 77% of employers believe policies are well-explained.

- Only 68% of employees agree — revealing a communication gap.

8. Mental Health and Psychological Disability Claims

- Specialized Case Handling: Software must evolve to accommodate mental health-related absences, which often require nuanced documentation and review workflows.

🔐 Cybersecurity as a Shared Responsibility

Best Practices for Vendors

- User-Centric Security Features: Inline guidance, error-prevention UX, SOC 2/ISO 27001 compliance.

- Secure-by-Design Architecture: Encryption, RBAC, multi-factor authentication, and breach detection systems.

Best Practices for Employers

- Ongoing Cybersecurity Training: Focused on HR professionals handling sensitive data.

- Zero Trust Adoption: Ensure internal access control matches external threat resilience.

12. Future Outlook and Strategic Recommendations

The global absence management software market is poised for sustained growth, driven by accelerating digital transformation in HR functions, increasing regulatory demands, and rising emphasis on employee well-being. As organizations confront the complexities of hybrid work, compliance management, and talent retention, absence management solutions are emerging as critical enablers of operational resilience and workforce optimization.

Market Forecast and Technological Evolution

Projected Market Growth

- The U.S. absence management software market is expected to grow at a CAGR of 9.6%, reaching USD 810+ million by 2034.

- This growth reflects not only rising demand for scalable digital HR tools but also increasing recognition of absence management as a business-critical function.

Global Trends Driving Demand

- Cloud-first adoption: SaaS-based HR systems continue to dominate due to ease of deployment, remote accessibility, and lower upfront costs.

- AI and automation: Intelligent automation is transitioning from a competitive advantage to a foundational capability across enterprise HR systems.

- Agentic AI emergence: These AI systems will automate complex, multistep workflows, eliminating repetitive tasks and improving real-time decision-making accuracy.

Technological Innovation Priorities

- Talent Intelligence: Shift from administrative tracking to strategic workforce planning using predictive analytics and behavioral data.

- Personalized UX: Interfaces adapt to individual users’ needs, preferences, and roles—enhancing usability and engagement.

- Well-being-First Design: Systems now prioritize mental health, caregiving support, burnout prevention, and emotional safety as part of their core feature sets.

Table: U.S. Absence Management Software Market Forecast (2024–2034, USD Million)

| Year | Market Size (USD Million) | CAGR (%) |