Key Takeaways

- Empowering Instant Purchases: BNPL revolutionizes the shopping experience, enabling users to make immediate purchases and defer payments, fostering financial flexibility.

- Navigating Responsible Use: Learn essential tips for responsible BNPL usage, including budgeting, understanding terms, and monitoring spending habits to avoid potential pitfalls.

- Future Trends Unveiled: Explore emerging trends shaping the future of BNPL, from widespread merchant adoption to sustainability initiatives, providing a glimpse into the evolving landscape of modern finance.

In an era where convenience and flexibility reign supreme in consumer choices, the Buy Now, Pay Later (BNPL) phenomenon has emerged as a transformative force in the way we approach and experience shopping.

As the digital landscape continues to reshape traditional commerce, understanding the intricacies of BNPL becomes not just a matter of financial literacy but a key aspect of modern consumer empowerment.

The Rise of Buy Now, Pay Later

Picture this: You’re browsing your favorite online store, and that pair of shoes you’ve been eyeing for weeks suddenly beckons you.

The temptation is real, but so is the hesitation. Enter Buy Now, Pay Later – a financial model that has swiftly woven itself into the fabric of contemporary retail therapy.

Defining Buy Now, Pay Later

At its core, Buy Now, Pay Later is more than a payment option; it’s a financial paradigm shift.

This revolutionary concept allows consumers to acquire goods or services instantly and defer payment over time, disrupting the traditional immediacy associated with purchases.

But what sets BNPL apart from conventional credit mechanisms, and how does it actually work?

Unpacking the Mechanism

The mechanics of Buy Now, Pay Later are as fascinating as they are game-changing.

Imagine a seamless transaction process where you select your desired products, proceed to checkout, and instead of the usual upfront payment, you’re presented with the option to defer the financial commitment.

This is the essence of BNPL, a dance between instant gratification and financial pragmatism.

Navigating the Landscape

As the BNPL landscape continues to evolve, it’s crucial to understand the key players, their roles, and the dynamics shaping this financial ecosystem.

From established financial institutions to innovative fintech disruptors, a multitude of service providers has entered the scene, each with its own nuances and offerings.

The Allure of Flexibility

What makes BNPL truly alluring is the flexibility it extends to consumers.

No longer bound by the constraints of immediate payments, shoppers can indulge in their desires without straining their wallets.

This newfound freedom is not just about the purchase itself but about reshaping the entire experience of acquiring goods and services.

Beyond the Hype: Pros and Cons

However, as with any financial innovation, the allure of Buy Now, Pay Later comes with its own set of considerations.

While the flexibility and convenience are undeniable, understanding the potential risks, such as interest rates and their impact on credit scores, is paramount.

It’s a balancing act between seizing the benefits and navigating the pitfalls.

In this comprehensive exploration of “Buy Now, Pay Later (BNPL): What It Is And How It Works,” we embark on a journey to demystify this financial revolution.

From the fundamental principles to the nitty-gritty details, this blog aims to be your guiding light in navigating the dynamic landscape of BNPL, empowering you to make informed decisions in the ever-evolving world of modern commerce.

Join us as we delve into the heart of BNPL, unraveling its complexities and envisioning its future implications. Your shopping experience will never be the same again.

Buy Now, Pay Later (BNPL): What It Is And How It Works

- Understanding Buy Now, Pay Later

- How Buy Now, Pay Later Works

- Benefits of Using Buy Now, Pay Later

- Risks and Considerations

- Comparing Buy Now, Pay Later with Traditional Payment Methods

- Tips for Responsible Use of Buy Now, Pay Later

- Emerging Trends in Buy Now, Pay Later

1. Understanding Buy Now, Pay Later (BNPL): A Deep Dive

In a world where financial innovation is reshaping the consumer landscape, Buy Now, Pay Later (BNPL) has emerged as a transformative force, redefining the dynamics of purchasing.

Let’s delve into the core principles and mechanics that underpin this modern financial phenomenon.

Definition and Core Principles of BNPL

- Definition: Buy Now, Pay Later is a financial model that allows consumers to make immediate purchases and defer payment over a specified period.

- Core Principles:

- Instant Gratification: BNPL offers consumers the ability to acquire goods or services without the immediate burden of payment.

- Deferred Payments: The distinguishing feature is the flexibility to repay the amount over time, typically in installments.

Evolution of BNPL in the Financial Landscape

- Historical Context:

- The roots of BNPL can be traced back to layaway plans in the early 20th century, where customers reserved items and paid in installments.

- The digital revolution and e-commerce boom in the late 20th century laid the groundwork for the modern BNPL we know today.

- Market Growth:

- The global buy now pay later market size was worth USD 256.54 billion in 2022 and is estimated to reach an expected value of USD 3,892.19 billion by 2031 at a CAGR of 30.5% during the forecast period.

Key Features and Components of BNPL

- Zero or Low-Interest Rates:

- Many BNPL services offer zero or low-interest rates, making it an attractive alternative to traditional credit cards.

- Online Integration:

- BNPL is seamlessly integrated into online shopping platforms, allowing users to select the option during checkout.

- Transparent Terms:

- Transparent terms and conditions, including clear information on repayment schedules and any associated fees, are essential aspects of BNPL.

BNPL in Action: Real-Life Examples

- Afterpay:

- Founded: 2014

- Model: Afterpay allows users to pay for their purchases in four interest-free installments, with payments due every two weeks.

- User Base: Afterpay has over 20 million active customers globally.

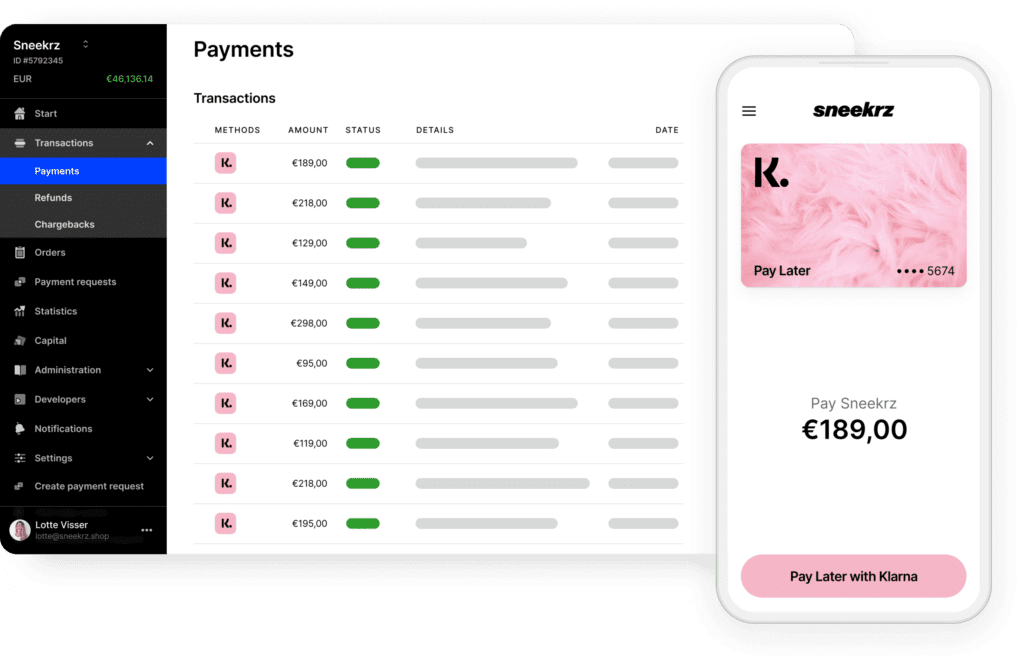

- Klarna:

- Founded: 2005

- Model: Klarna provides a variety of payment options, including installment plans and the ability to delay payment for up to 30 days.

- Growth: Klarna’s valuation reached $45.6 billion after a funding round in 2021, making it one of the most valuable fintech companies globally.

User Experience: How BNPL Works in Practice

- Selecting BNPL at Checkout:

- Users opt for BNPL during the checkout process, often presented with options like “Pay in 4” or “Pay Later.”

- Approval Process:

- BNPL providers often conduct a quick approval process, leveraging technology to assess the user’s creditworthiness in real-time.

- Flexible Repayment:

- Users enjoy the freedom to repay the amount in installments, offering a personalized and adaptable payment schedule.

Statistics and Trends

- Consumer Adoption:

- BNPL is now so popular that 42% of American consumers have used it at least once, according to a 2021 survey by Credit Karma.

- Merchant Adoption:

- Global Reach:

In this exploration of “Understanding Buy Now, Pay Later,” we’ve uncovered the historical roots, market growth, key features, real-life examples, user experience, and pertinent statistics.

As we navigate the intricate landscape of BNPL, it becomes evident that this financial model is not just a trend but a substantial shift in consumer behavior and financial dynamics.

2. How Buy Now, Pay Later (BNPL) Works: A Comprehensive Guide

Unraveling the mechanics of Buy Now, Pay Later (BNPL) is essential for consumers navigating the modern landscape of online shopping and financial transactions.

In this deep dive, we’ll explore the step-by-step process, the key players involved, and shed light on how BNPL is transforming the way we make purchases.

Step-by-Step Breakdown of the BNPL Process

- Selection of Products/Services:

- Users browse through their favorite online stores, adding items to their cart just like any other traditional online shopping experience.

- Checkout and Payment Options:

- When proceeding to checkout, users encounter a variety of payment options, among which is the BNPL choice.

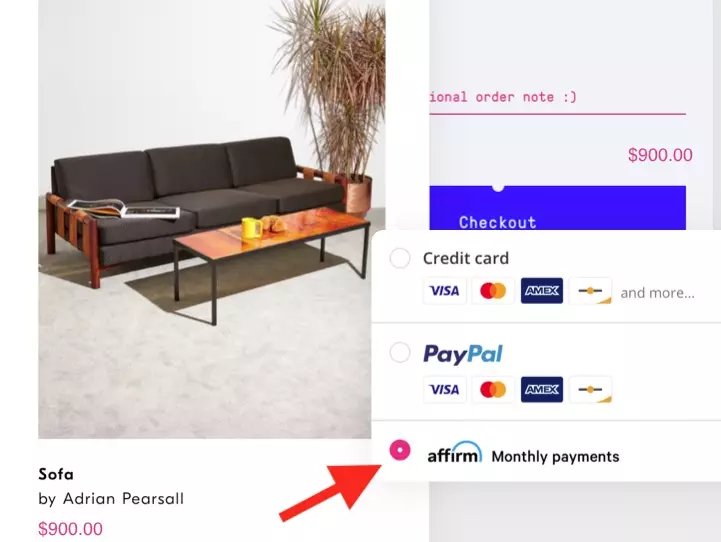

- BNPL Service Providers Involved:

- BNPL providers like Afterpay, Klarna, and Affirm are commonly integrated into the checkout process. Users may choose their preferred provider based on terms and conditions.

Exploring the Flexibility and Convenience Offered

- Deferred Payments:

- One of the primary attractions of BNPL is the ability to defer payments. Users can enjoy the instant gratification of receiving their purchases without the immediate financial impact.

- Interest-Free Periods:

- Many BNPL services offer interest-free periods, allowing users to repay the total amount without incurring additional charges if paid within a specified timeframe.

- Customizable Repayment Plans:

- BNPL often provides users with flexibility in choosing their repayment plans, such as spreading the cost over several weeks or months.

Integration with E-Commerce Platforms

- Seamless Integration:

- BNPL services are seamlessly integrated into major e-commerce platforms, allowing users to choose BNPL options at the point of purchase without navigating away from the site.

- Merchant Partnerships:

- BNPL providers often form partnerships with online merchants, expanding their reach and giving users the option to use BNPL across a variety of retailers.

Mobile App Accessibility

- User-Friendly Apps:

- Most BNPL providers offer user-friendly mobile apps, providing a convenient way for users to manage their purchases, track payments, and stay informed about upcoming installments.

- Notifications and Reminders:

- Apps often include features like push notifications and reminders to keep users informed about upcoming payments, ensuring transparency and accountability.

In essence, the workings of Buy Now, Pay Later encapsulate a seamless online shopping experience coupled with financial flexibility.

With a focus on user experience, it becomes evident that BNPL is not just a transactional method but a dynamic shift in how consumers approach and manage their finances in the digital age.

3. Benefits of Using Buy Now, Pay Later (BNPL): Empowering Your Purchasing Experience

Embracing Buy Now, Pay Later (BNPL) goes beyond mere convenience; it introduces a paradigm shift in how consumers approach and engage in transactions.

Let’s explore the myriad benefits that make BNPL an attractive option for shoppers worldwide.

Enhanced Purchasing Power for Consumers

- Instant Access to Desired Items:

- BNPL allows consumers to acquire products or services immediately, eliminating the need to save up for larger purchases.

- Breaking Down Cost Barriers:

- By spreading payments over time, users can afford higher-priced items without compromising their monthly budget.

Mitigating Financial Strain with Deferred Payments

- Flexibility in Repayment:

- BNPL offers users the flexibility to repay the total amount in smaller, manageable installments over weeks or months.

- Interest-Free Periods:

- Many BNPL services provide interest-free periods, encouraging users to pay within a specific timeframe to avoid additional charges.

Potential Rewards and Incentives from BNPL Providers

- Cashback and Discounts:

- BNPL providers often offer cashback or discounts for timely repayments, providing users with additional savings.

- Loyalty Programs:

- Some BNPL platforms have loyalty programs that reward frequent users with exclusive perks, creating a sense of value for ongoing engagement.

Financial Inclusion and Accessibility

- Alternative to Traditional Credit:

- BNPL serves as an accessible financial tool for individuals without a traditional credit history, broadening the scope of financial inclusion.

- Easy Approval Processes:

- BNPL providers often employ quick approval processes, leveraging technology for real-time credit assessments and enabling a broader user base.

User-Centric Approach to Shopping

- Seamless Online Experience:

- BNPL integrates seamlessly into the online shopping experience, allowing users to choose this option during the checkout process.

- No Upfront Payments:

- Users can enjoy their purchases without the immediate burden of upfront payments, making the shopping experience more enjoyable.

Statistics and Insights into BNPL Adoption

- Global Growth:

- According to a report, BNPL is set to surpass US$1 billion in transaction value by 2026, underscoring its widespread acceptance and growth.

- Consumer Preference:

Empowering Small and Medium Enterprises (SMEs)

- Increased Conversions for Merchants:

- BNPL can boost conversion rates for merchants as it reduces cart abandonment, particularly for higher-ticket items.

- Attracting a Broader Customer Base:

- SMEs can attract a diverse customer base by offering BNPL options, catering to individuals with varying budget constraints.

In summary, the benefits of using Buy Now, Pay Later extend far beyond mere transactional advantages. With enhanced purchasing power, mitigated financial strain, potential rewards, and a user-centric approach, BNPL is reshaping the way consumers engage with the world of commerce.

As the statistics indicate, this financial model is not just a trend but a fundamental shift in how we approach and experience financial transactions.

4. Risks and Considerations in Buy Now, Pay Later (BNPL): Navigating the Financial Landscape

While Buy Now, Pay Later (BNPL) offers unprecedented convenience, it’s crucial for consumers to be aware of potential risks and considerations.

This comprehensive exploration sheds light on the darker side of BNPL, ensuring users make informed decisions in this evolving financial landscape.

Interest Rates and Fees Associated with BNPL

- Variable Interest Rates:

- Some BNPL services may have variable interest rates, especially if users miss repayment deadlines. These rates can significantly impact the overall cost of the purchase.

- Late Payment Fees:

- Missing payment deadlines often results in late fees, adding an extra financial burden to users. Understanding the fee structure is essential for responsible use.

Impact on Credit Scores and Financial Responsibility

- Credit Reporting Practices:

- While some BNPL services don’t impact credit scores, others may report missed payments to credit bureaus, potentially affecting creditworthiness.

- Overspending Risks:

- The ease of BNPL can lead to impulsive buying behavior, risking users exceeding their budget and facing financial strain in the long run.

Potential Pitfalls and Challenges for Users

- Overcommitment:

- Users may underestimate their ability to repay, leading to overcommitment and a cycle of debt. Transparent terms and self-assessment are critical in avoiding this pitfall.

- Limited Regulatory Framework:

- In some regions, the regulatory framework for BNPL may be limited, exposing users to potential risks without adequate consumer protection.

User Experiences and Notable Cases

- High-Profile Cases:

- Instances of users facing challenges with BNPL have been reported. For example, a user overspending on luxury items through BNPL, only to struggle with repayments later.

- Customer Complaints:

- Platforms like the Better Business Bureau (BBB) may contain customer complaints against specific BNPL providers, offering insights into potential pitfalls.

Statistics and Insights into BNPL Challenges

- Consumer Debt Concerns:

- According to a report, concerns are rising about consumer debt related to BNPL, prompting regulatory scrutiny in some markets.

- Missed Payments Impact:

- A study indicates that 21% of BNPL users have missed payments, showcasing the potential financial challenges associated with this payment model.

Regulatory Scrutiny and Industry Oversight

- Emerging Regulations:

- Regulatory bodies in various countries are starting to scrutinize BNPL practices, aiming to ensure consumer protection and responsible lending.

- Industry Initiatives:

- Some BNPL providers are proactively enhancing their transparency and disclosure practices to align with emerging regulatory standards.

In navigating the BNPL landscape, understanding the risks and considerations is paramount.

From interest rates and credit impacts to potential pitfalls and industry challenges, consumers must approach BNPL with a discerning eye.

As regulatory scrutiny increases, the industry is evolving, and users can contribute to a healthier financial ecosystem by staying informed and making judicious financial decisions.

5. Comparing Buy Now, Pay Later (BNPL) with Traditional Payment Methods: Decoding the Choices

Navigating the myriad payment options available can be overwhelming for consumers.

In this comprehensive comparison, we dissect the differences between Buy Now, Pay Later (BNPL) and traditional payment methods, providing insights to empower your financial choices.

Advantages and Disadvantages in Comparison to Credit Cards

- Interest Rates:

- BNPL:

- Often offers zero or low-interest rates, especially when users adhere to repayment schedules.

- Credit Cards:

- Typically carry higher interest rates, especially for revolving balances.

- BNPL:

- Flexibility:

- BNPL:

- Allows users to spread payments over time, providing flexibility and budget-friendly options.

- Credit Cards:

- Users can choose to pay the full amount or make minimum payments, offering flexibility but with potential long-term interest costs.

- BNPL:

Suitability for Different Types of Purchases

- High-Ticket Items:

- BNPL:

- Ideal for higher-ticket items, enabling users to break down the cost into manageable installments.

- Credit Cards:

- Offers a credit limit that can be utilized for significant purchases, with the flexibility to repay over time.

- BNPL:

- Everyday Expenses:

- BNPL:

- May not be the most practical for routine, smaller expenses due to installment structures.

- Credit Cards:

- Suited for everyday spending, allowing users to accumulate rewards and manage monthly bills.

- BNPL:

Credit Score Impacts and Financial Responsibility

- Credit Score Considerations:

- BNPL:

- Some providers don’t impact credit scores, making it appealing for those cautious about their credit history.

- Credit Cards:

- Usage can impact credit scores, requiring responsible management for positive effects.

- BNPL:

- Financial Responsibility:

- BNPL:

- Encourages responsible spending with transparent terms, but users need to manage repayments effectively.

- Credit Cards:

- Requires financial discipline to avoid accumulating debt and paying high-interest rates.

- BNPL:

Merchant Acceptance and Global Usage

- Merchant Integration:

- BNPL:

- Increasingly integrated into online shopping platforms, providing users with a seamless checkout experience.

- Credit Cards:

- Widely accepted both online and offline, offering versatility in payment options.

- BNPL:

- Global Usage:

- BNPL:

- Gaining popularity globally, with diverse providers catering to different markets.

- Credit Cards:

- Established worldwide, offering universal acceptance but subject to varying interest rates and fees.

- BNPL:

Transparency and Disclosures

- Terms and Conditions:

- BNPL:

- Generally transparent with upfront information on repayment schedules and any associated fees.

- Credit Cards:

- Terms and conditions can vary, and users need to carefully review interest rates, annual fees, and other charges.

- BNPL:

User Experience and Digital Integration

- Seamless Integration:

- BNPL:

- Seamlessly integrated into online shopping platforms, reducing friction in the purchasing process.

- Credit Cards:

- May require manual entry of card details, potentially creating more steps during the checkout process.

- BNPL:

- Mobile App Accessibility:

- BNPL:

- Providers often offer user-friendly apps for managing purchases and payments on the go.

- Credit Cards:

- Traditional banking apps may offer card management features but might lack the specialized focus on purchases.

- BNPL:

Emerging Trends in Payment Methods

- Blockchain and Cryptocurrency:

- As an emerging trend, blockchain-based payment methods and cryptocurrencies are gaining traction, providing an alternative to both BNPL and traditional methods.

In weighing the pros and cons of Buy Now, Pay Later against traditional payment methods, users gain the power to make informed financial decisions.

Whether considering interest rates, suitability for different purchases, or the impact on credit scores, understanding these nuances ensures a tailored approach to individual financial needs.

As the landscape of payment methods evolves, users are presented with a spectrum of choices, each carrying its own set of advantages and considerations.

6. Tips for Responsible Use of Buy Now, Pay Later (BNPL): Navigating the Financial Waters

Buy Now, Pay Later (BNPL) can be a powerful financial tool when used responsibly.

To ensure a positive and sustainable experience, consider these tips that delve into best practices, potential pitfalls, and strategies for maximizing the benefits of BNPL.

Budgeting and Planning for BNPL Payments

- Create a Purchase Plan:

- Develop a clear plan for your purchases, identifying what items are essential and align with your budget.

- Allocate Repayment Budget:

- Set aside a specific budget for BNPL repayments to avoid unexpected financial strain.

Read and Understand Terms and Conditions

- Transparent Information:

- Thoroughly read the terms and conditions of the BNPL service, ensuring you understand repayment schedules, interest rates, and potential fees.

- Example: Afterpay’s Clear Disclosure:

- Afterpay, a leading BNPL provider, is known for its transparent communication, providing users with clear information on repayment schedules and any associated charges.

Monitor Spending Habits to Avoid Overcommitment

- Regularly Review Purchases:

- Periodically review your BNPL transactions to track spending and ensure it aligns with your financial goals.

- Set Spending Limits:

- Establish self-imposed limits on BNPL spending to avoid overcommitting to purchases.

Prioritize Essential Purchases

- Distinguish Between Wants and Needs:

- Reserve BNPL for essential purchases rather than non-essential or impulsive buys.

- Example: Using BNPL for Necessary Appliances:

- Consider using BNPL for essential items like home appliances or educational resources, where spreading payments can be practical.

Budget for Repayments Alongside Other Financial Obligations

- Incorporate Repayments in Monthly Budget:

- Include BNPL repayments in your monthly budget alongside other financial commitments such as rent, utilities, and groceries.

- Avoid Overlapping Payments:

- Be mindful of overlapping BNPL payments to prevent strain on your financial resources.

Leverage Interest-Free Periods

- Timely Repayments for Zero Interest:

- Paying within the interest-free period offered by BNPL services can maximize benefits and avoid additional costs.

- Example: Klarna’s “Pay Later” Option:

- Klarna’s “Pay Later” option provides a grace period, allowing users to defer payment for a specified duration without incurring interest.

Be Mindful of Your Credit Score

- Credit Score Impact:

- Understand how BNPL usage may impact your credit score and make informed decisions to protect your creditworthiness.

- Example: Affirm’s Reporting Practices:

- Affirm, a BNPL provider, reports positive payment behavior to credit bureaus, potentially contributing to a positive credit history.

Choose Reputable BNPL Service Providers

- Research Provider Reputation:

- Before using a BNPL service, research its reputation, customer reviews, and adherence to ethical business practices.

- Example: Trustpilot Ratings for BNPL Providers:

- Websites like Trustpilot provide user reviews that can offer insights into the experiences of others with specific BNPL providers.

Utilize BNPL for Financial Planning, Not Impulse Spending

- Strategic Purchasing:

- Use BNPL strategically for planned purchases rather than succumbing to impulsive buying urges.

- Example: Budgeting for Seasonal Sales:

- Plan ahead for seasonal sales and utilize BNPL for anticipated purchases during these events.

In conclusion, responsible use of Buy Now, Pay Later involves a combination of strategic planning, budgeting, and understanding the terms and conditions of the service.

By incorporating these tips into your financial practices, you can harness the benefits of BNPL while avoiding potential pitfalls and ensuring a positive and sustainable financial experience.

7. Emerging Trends in Buy Now, Pay Later (BNPL): Shaping the Future of Financial Transactions

Buy Now, Pay Later (BNPL) is a dynamic and evolving space within the financial industry.

Keeping a pulse on emerging trends is essential for understanding how this payment model is reshaping consumer behaviors and the financial landscape.

Integration of BNPL into Everyday Retail

- Widespread Merchant Adoption:

- BNPL is increasingly becoming a standard payment option across a diverse range of merchants, from small businesses to large retailers.

- Global Expansion:

- According to a study, BNPL services are expanding globally, reaching new markets and demographics.

Partnerships Between BNPL Providers and Retailers

- Strategic Collaborations:

- BNPL providers are forming strategic partnerships with retailers, offering exclusive deals and promotions to incentivize BNPL usage.

- Example: Affirm’s Partnership with Shopify:

- Affirm’s collaboration with Shopify allows merchants on the platform to offer BNPL services, expanding Affirm’s reach to a broader audience.

BNPL in Physical Retail Spaces

- In-Store BNPL Adoption:

- BNPL is not limited to online transactions; some providers are exploring opportunities to bring BNPL services into physical retail spaces.

- QR Code Payments:

- Innovations such as QR code payments are being explored, allowing users to initiate BNPL transactions in-store seamlessly.

Hybrid BNPL and Credit Card Solutions

- Combined Payment Options:

- Some financial institutions are exploring hybrid solutions that combine elements of BNPL with traditional credit card features.

- Example: Citi Flex Pay:

- Citi’s Flex Pay allows credit card users to convert certain transactions into installment plans, blending traditional credit with installment flexibility.

Expansion into Different Sectors Beyond Retail

- Healthcare Financing:

- BNPL is extending into sectors beyond retail, with healthcare providers offering BNPL options for medical expenses.

- Education Financing:

- BNPL services are being explored for education-related expenses, allowing students to manage tuition and other costs over time.

Sustainability and Ethical Consumerism

- Green Financing Options:

- BNPL providers are exploring sustainable financing options, allowing users to make eco-friendly choices without immediate financial strain.

- Example: Klarna’s Focus on Sustainability:

- Klarna has introduced initiatives to promote sustainable shopping and offers services like “GiveOne” to support climate-positive projects.

Financial Inclusion Initiatives

- Accessible Credit for Underserved Markets:

- Some BNPL providers are focusing on financial inclusion, providing accessible credit options for individuals with limited access to traditional banking services.

- Example: BNPL in Emerging Markets:

- In emerging markets, BNPL is gaining traction as a tool for financial inclusion, addressing the needs of unbanked or underbanked populations.

Regulatory Developments and Consumer Protection

- Regulatory Scrutiny:

- Regulatory bodies are increasingly scrutinizing BNPL practices, aiming to ensure consumer protection and responsible lending.

- Example: ASIC Review in Australia:

- The Australian Securities and Investments Commission (ASIC) conducted a review of the BNPL industry, resulting in recommendations for improved consumer protections.

Enhanced Technology and User Experience

- AI and Risk Assessment:

- BNPL providers are leveraging artificial intelligence for real-time risk assessments, improving approval processes and tailoring offerings to individual users.

- Seamless Mobile Apps:

- Continuous improvements in mobile app interfaces provide users with seamless experiences for managing BNPL transactions on the go.

Cryptocurrency Integration and Blockchain Solutions

- Blockchain-Based BNPL:

- Emerging trends suggest exploration of blockchain-based BNPL solutions, introducing decentralized and secure transactions.

- Example: BNPL on the Blockchain:

- Prototypes and discussions within the blockchain community explore the potential of integrating BNPL capabilities on blockchain platforms.

Personalized Financial Wellness Features

- Budgeting Tools:

- BNPL providers are incorporating budgeting tools and financial wellness features into their platforms to empower users with greater control over their finances.

- Educational Resources:

- Some providers offer educational resources to help users understand the implications of BNPL usage and make informed financial decisions.

In conclusion, the evolving landscape of Buy Now, Pay Later is marked by innovation, strategic collaborations, and a widening scope of applications beyond traditional retail.

As BNPL continues to adapt to consumer needs and regulatory frameworks, these emerging trends are shaping the future of financial transactions and paving the way for a more inclusive and technologically advanced financial ecosystem.

Conclusion

In the ever-evolving landscape of financial transactions, Buy Now, Pay Later (BNPL) has emerged as a transformative force, reshaping the way consumers approach purchases.

As we’ve delved into the intricacies of BNPL, from its fundamental principles to real-world applications, it becomes evident that this payment model is more than just a transactional convenience; it represents a paradigm shift in the intersection of finance and consumer behavior.

The Core Principles Unveiled

BNPL, at its essence, embodies the spirit of instant gratification and financial flexibility.

The ability to acquire desired goods or services without the immediate burden of payment provides users with a sense of empowerment and control over their purchasing experience.

Deferred payments, often with zero or low-interest rates, add a layer of financial adaptability that resonates with the modern consumer.

Evolution and Growth

Tracing the historical roots of BNPL from layaway plans to its digital transformation highlights its resilience and adaptability.

The global BNPL market’s projected growth, as reported by Adroit Market Research, speaks volumes about its acceptance and adoption by consumers worldwide.

What began as a solution to ease online transactions has grown into a multifaceted financial tool with applications in various sectors beyond traditional retail.

Key Players in Action

Examining the real-life examples of BNPL providers like Afterpay and Klarna unveils the diverse models and offerings within the BNPL sphere.

With millions of active users globally and soaring valuations, these companies have not only disrupted the financial landscape but have become synonymous with a new era of consumer finance.

User Experience: A Seamless Journey

BNPL’s integration into online shopping platforms has streamlined the user experience.

The selection of BNPL at checkout, quick approval processes, and flexible repayment options contribute to a seamless and user-friendly transactional journey.

The rise of mobile apps further enhances accessibility, offering users the ability to manage their purchases on-the-go.

Statistics and Trends: A Glimpse into the Future

As we explore the statistics and trends surrounding BNPL, the figures paint a picture of a payment model that is not just a trend but a significant force in the financial landscape.

The global transaction value projections, consumer adoption rates, and merchant acceptance highlight BNPL’s staying power and its increasing integration into the fabric of commerce.

Navigating Responsible Use

The benefits of BNPL are accompanied by responsibilities.

From budgeting and understanding terms to monitoring spending habits and considering credit score impacts, users can navigate the BNPL landscape responsibly.

Learning from examples of transparent providers like Afterpay and understanding the potential risks ensures that users harness the advantages of BNPL without falling into financial pitfalls.

The Future Unfolds: Emerging Trends in BNPL

The conclusion of our exploration brings us to the doorstep of emerging trends that promise to shape the future of BNPL.

From its integration into everyday retail to partnerships, sustainability initiatives, and advancements in technology, BNPL is poised for continued evolution.

As blockchain solutions, hybrid payment methods, and personalized financial wellness features come to the forefront, the horizon of possibilities widens.

In conclusion, Buy Now, Pay Later is not just a payment model; it’s a dynamic and evolving financial ecosystem. As users, businesses, and regulators engage with BNPL, its impact resonates far beyond the transactional moment.

It represents a shift towards financial inclusivity, technological innovation, and a redefined relationship between consumers and their finances.

As we stand at the crossroads of this financial frontier, the journey with Buy Now, Pay Later continues to unfold, promising new avenues and possibilities for the savvy consumer in the ever-expanding realm of modern finance.

If your company needs HR, hiring, or corporate services, you can use 9cv9 hiring and recruitment services. Book a consultation slot here, or send over an email to [email protected].

If you find this article useful, why not share it with your hiring manager and C-level suite friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

People Also Ask

What is a buy now, pay later BNPL loan?

A Buy Now, Pay Later (BNPL) loan allows consumers to make immediate purchases and defer payment. Typically offered in installment plans, BNPL loans provide flexibility with interest-free periods. Users enjoy instant access to products/services while spreading the cost over manageable repayments.

What is BNPL payment?

BNPL (Buy Now, Pay Later) payment is a flexible financial solution allowing users to make immediate purchases without upfront payment. Users can split the cost into installments, often with interest-free options. It provides convenience, accessibility, and a modern approach to managing expenses.

What is BNPL called?

BNPL stands for Buy Now, Pay Later. It’s a modern payment model that enables consumers to make immediate purchases and defer payment, often in interest-free installments. This flexible approach has gained popularity for its convenience and adaptability in various retail and online transactions.

![Writing A Good CV [6 Tips To Improve Your CV] 6 Tips To Improve Your CV](https://blog.9cv9.com/wp-content/uploads/2020/06/2020-06-02-2-100x70.png)