Key Takeaways

- Professional Employer Organizations (PEOs) offer a variety of services, including HR, payroll, benefits administration, and risk management.

- When choosing a PEO, consider factors such as pricing, services offered, and the PEO’s reputation and experience.

- Partnering with a PEO can help streamline your business operations and reduce administrative burden, allowing you to focus on your core business functions.

As a business owner, you have a lot on your plate.

From managing day-to-day operations to developing new strategies for growth, your time and energy are in high demand.

One area that can be particularly challenging to manage is “human resources (HR)”.

From payroll processing to benefits administration, HR tasks can be time-consuming and complex.

That’s where Professional Employer Organizations (PEOs) come in.

A PEO is a company that provides outsourced HR services to businesses.

When you partner with a PEO, they become the employer of record for your employees, taking on administrative and legal responsibilities while you maintain control over your employees’ day-to-day work.

PEOs offer a wide range of services, including payroll processing, benefits administration, and HR management.

By outsourcing these tasks to a PEO, you can save time and money while ensuring compliance with employment laws and regulations.

The numbers and statistics back the claim that PEO is crucial and essential for all businesses.

According to a recent study, small businesses that use PEOs grow 7 to 9 percent faster, have 10 to 14 percent lower employee turnover, and are 50 percent less likely to go out of business.

According to a recent study, small businesses that use PEOs grow 7 to 9 percent faster, have 10 to 14 percent lower employee turnover, and are 50 percent less likely to go out of business.

– 9cv9

But how do you choose the right PEO for your business?

In this article, we’ll explore what PEOs do and provide tips for choosing the right one for your needs.

We’ll discuss the benefits of using a PEO, such as cost savings, access to expertise, and improved compliance.

We’ll also provide guidance on selecting a PEO, including how to determine your business needs, research potential providers, and evaluate proposals.

With this information, you can make an informed decision and find the right PEO partner to support your business growth and success.

If you are also looking for a recruitment agency, then good news for you. We have written a guide on what recruitment agencies do and how to choose one as well here.

What Do Professional Employer Organizations (PEO) Do? (And Tips for Choosing One)

- What Do Professional Employer Organizations (PEOs) Do?

- 9 Tips for Choosing the Best PEO for Your Business

- How Much Does a PEO Cost?

- Pros and Cons of Using a PEO Over In-House Services

1. What Do Professional Employer Organizations (PEOs) Do?

Professional Employer Organizations (PEOs) provide outsourced HR services to businesses.

When you partner with a PEO, they become the employer of record for your employees, taking on administrative and legal responsibilities while you maintain control over your employees’ day-to-day work.

PEOs offer a wide range of services, including payroll processing, benefits administration, and HR management.

A) Payroll Processing

One of the primary services that PEOs offer is payroll processing.

This includes calculating taxes, withholding deductions, and issuing paychecks. PEOs also file payroll taxes and prepare year-end tax forms.

By outsourcing payroll processing to a PEO, you can save time and reduce administrative costs.

B) Administrative Services

PEOs also provide benefits administration services.

This includes enrolling employees in health insurance plans, retirement plans, and other benefits programs.

PEOs handle billing and claims administration for these benefits, relieving you of the administrative burden.

Additionally, PEOs can provide access to a wider range of benefits than you may be able to offer on your own, potentially making your business more attractive to potential employees.

C) Recruiting and Talent Acquisition

In addition to payroll and benefits administration, PEOs can assist with all aspects of HR management.

This includes recruiting and onboarding new employees, conducting performance reviews, and managing terminations.

PEOs can also provide HR guidance and support to help you stay compliant with employment laws and regulations.

D) HR Compliance

Finally, PEOs can help mitigate risks and improve compliance.

They provide safety training, conduct background checks, and manage unemployment claims.

They also stay up-to-date on employment laws and regulations to ensure compliance.

Overall, PEOs can help streamline your HR tasks, reduce costs, and improve compliance.

By partnering with a PEO, you can focus on growing your business and serving your customers, while leaving HR administration to the experts.

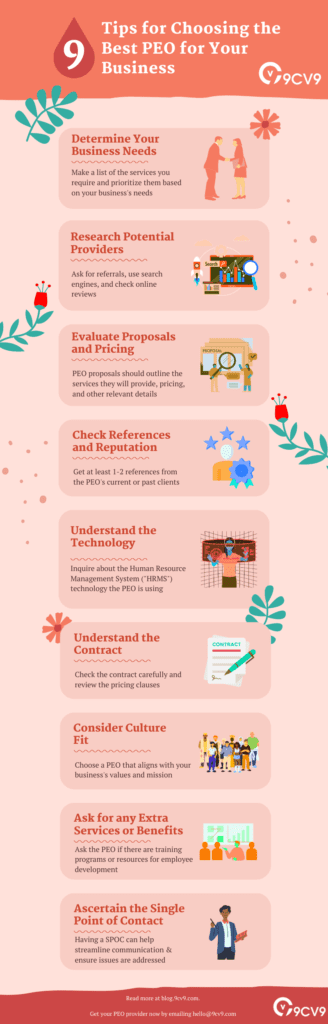

2. 9 Tips for Choosing the Best PEO for Your Business

Choosing the right Professional Employer Organization (PEO) can be a critical decision for your business.

Here are some tips to help you select the right PEO.

A) Determine Your Business Needs

Before you start researching PEOs, identify your business’s specific HR needs.

This may include payroll processing, benefits administration, HR management, or compliance support.

Make a list of the services you require and prioritize them based on your business’s needs.

- Payroll

For small and mid-sized companies, managing payroll and filing taxes can be a daunting task that can incur additional expenses and fines due to non-compliance.

According to the National Small Business Association, small businesses spend an average of 1.7b pounds each time they run payroll.

This cost can add up quickly, especially for growing businesses.

Outsourcing payroll services to a PEO can save you time and money by providing a simplified and automated online HRMS and payroll system.

This means that you can focus on running your business and leave the payroll-related tasks to the experts.

Plus, partnering with a PEO can help ensure that you stay compliant with state and federal regulations, avoiding costly fines and legal issues down the line.

- Human Resources

Managing human resources functions can be time-consuming and take away from other important tasks necessary for growing your business.

A PEO can help by taking on tasks such as sourcing, recruiting, onboarding, and tracking attendance, allowing you to focus on what really matters.

Additionally, PEOs often utilize HRMS tools, providing you with an easy-to-use online system for managing your HR functions.

By outsourcing your HR tasks to a PEO, you can save time and money while ensuring compliance with all HR-related regulations.

- Compliance and Risk Management

Compliance and risk management are two important aspects that need to be taken care of by every business.

However, managing them on your own can be both time-consuming and costly.

By outsourcing these tasks to a PEO, you can focus on your core business operations while the PEO takes care of ensuring your business is compliant with all regulations and mitigating risks.

With their expertise, a PEO can help you establish a more secure future for your business.

From handling insurance claims to keeping up-to-date with regulatory compliance, partnering with a PEO can help you avoid potential legal issues and fines.

With a PEO, you can rest easy knowing your business is in good hands.

B) Research Potential Providers

Once you have identified your business’s HR needs, research potential PEO providers.

Researching potential PEO providers can help you find a provider that meets your business needs. Here are some steps you can take:

- Ask for referrals: Reach out to other business owners or industry associations for recommendations.

- Use Google or other Search engines: PEO providers are everywhere and they are on the search engines. Simply type “<Your location> PEO” and a few good PEO providers will appear in the search results. Do avoid the “sponsored” results as those are paid ads and might not be reflective of the good PEO providers.

- Check online reviews: Look for online reviews of the PEO provider to see what other businesses have said about their experience. Our best bet is always to read the reviews made by other businesses and startups on the PEO providers. Top PEO providers will have tons of solid good reviews by their clients backing their services up.

Look for providers that specialize in your industry or have experience working with businesses of your size.

Consider factors such as reputation, customer reviews, and pricing (Read the “How much does a PEO cost?” below to understand the pricing).

C) Evaluate Proposals and Pricing

When you have identified several potential PEO providers, request proposals from each of them.

These proposals should outline the services they will provide, pricing, and other relevant details.

Compare the proposals and evaluate each provider’s strengths and weaknesses.

Consider the pricing by each of the PEO to ensure they are reasonable and competitive (Read on the “How much does a PEO cost?” below to understand the pricing)

D) Check References and Reputation

Before choosing a PEO, ask for references from current or former clients.

Contact these references and ask about their experience working with the provider.

Consider factors such as customer service, reliability, and quality of services.

It is also essential to assess their reputation in the market.

This can be done by conducting due diligence research and asking for audited financial reports, local licenses, and client references.

You can also ask questions to gauge their experience, such as the number of companies they partner with, their industry-specific experience, employee representation, client retention rate, and how long they have been in business.

Social media reviews and accolades & awards can also provide valuable insights into the PEO’s reputation.

A PEO’s reputation can affect your business, so it is important to choose a trustworthy and transparent partner.

In addition, a good PEO should have a positive impact on your company culture.

They should prioritize employee satisfaction and retention, and provide solutions to meet your HR needs.

The right PEO should help your business thrive and succeed.

E) Understand the Technology They are Using

Choosing the right Professional Employer Organization (PEO) involves more than just considering their services and pricing.

The type of technology or software that the PEO uses is also a critical factor to consider.

When selecting a PEO, inquire about the Human Resource Management System (“HRMS”) technology they offer, especially if you already have existing tools and software in place.

A good PEO’s HRMS platform should be simple to use and benefit both employers and employees.

With web-based payroll portals, employers can streamline payroll processing and easily manage their back office in one place.

The PEO’s HRMS system should simplify workers’ compensation calculations and payments, generate on-demand payroll reports, manage and access payroll information, complete payroll in minutes, not hours, and easily track deductions.

By streamlining these processes, the HRMS system keeps employees satisfied and helps employers stay compliant with the relevant regulations.

F) Understand the Contract

Understanding a PEO contract is important because it outlines the terms and conditions of the partnership between your company and the PEO.

Here are some tips to help you understand a PEO contract:

- Read the contract thoroughly: Take the time to read the contract carefully and make sure you understand all the terms and conditions. If there is anything that you don’t understand, ask for clarification.

- Pay attention to the fees: Look for any hidden fees or additional costs that may not be included in the initial proposal. Make sure you understand how the fees are calculated and when they are due.

- Check the services included: Review the services included in the contract and make sure they align with the needs of your company. If there are any services that you don’t need, ask if they can be removed or if there are any options to customize the contract.

- Review termination clauses: Make sure you understand the termination clauses and the process for ending the partnership. Some contracts may require a notice period or have fees for early termination.

- Understand liability: It is important to understand who is responsible for liability in case of any legal issues or employee disputes. Make sure this is clearly outlined in the contract.

- Seek legal advice: If you are unsure about any aspect of the contract, seek legal advice. A lawyer with experience in PEO contracts can help you understand the legal implications of the agreement.

By following these tips, you can ensure that you fully understand the PEO contract and are able to make an informed decision about whether to enter into a partnership with the PEO.

G) Consider Culture Fit

Finally, consider the cultural fit between your business and the PEO provider.

Choose a provider that aligns with your business’s values and mission. This can help ensure a positive working relationship and better results.

Furthermore, when deciding to work with a Professional Employer Organization (PEO), it’s important to have clarity on the services that you can expect from them.

As the Employer of Record (EOR) for your employees, the PEO will be responsible for handling many employment-related matters on your behalf.

To ensure that your needs are being met, it’s important to ask the right questions and understand what services will be provided.

H) Ask for any Extra Services or Benefits

In addition to payroll and benefits administration, it is important to consider if the PEO offers professional development and employee training opportunities.

These services can attract potential candidates and maximize the potential of your existing workforce.

Ask the PEO if they provide training programs and if they offer resources for employee development.

It is essential to ensure that your PEO has the right tools and resources to support your employees and help them grow within your organization.

By partnering with a PEO that offers these services, you can create a positive and productive work culture that will ultimately benefit your business.

I) Ascertain the Single Point of Contact (SPOC)

One key consideration is who will be the single point of contact (SPOC) for your account on a day-to-day basis.

This person will be responsible for managing your relationship with the PEO and addressing any questions or concerns you may have.

Having a dedicated SPOC can help streamline communication and ensure that issues are addressed promptly.

It’s also important to know whether you will have an assigned HR advisor or PEO specialist.

This person can help you navigate complex HR issues, such as compliance with labor laws and regulations, and provide guidance on best practices for managing your workforce.

In addition to HR support, you’ll also want to know whether you’ll have an employee payroll specialist available to take your calls.

This person can help answer questions about payroll processing, tax withholding, and other payroll-related matters.

Having access to a payroll specialist can help ensure that your employees are paid accurately and on time.

Finally, you’ll want to know who your employees can contact for payslips and payroll queries.

This information should be clearly communicated to your employees to avoid confusion or frustration.

By understanding the services that you can expect from the PEO, you can make an informed decision about whether they’re the right fit for your business.

By following these tips, you can select the right PEO provider for your business’s needs.

Partnering with a PEO can help streamline your HR tasks, reduce costs, and improve compliance, allowing you to focus on growing your business.

As mentioned earlier in this article, businesses that use PEOs grow 7 to 9 percent faster, have 10 to 14 percent lower employee turnover, and are 50 percent less likely to go out of business.

3. How Much Does a PEO Cost?

The cost of a Professional Employer Organization (PEO) can vary depending on several factors, such as the size of your business, the scope of services you require, and the level of support you need.

Here are some factors that can affect the cost of a PEO:

- Size of Business: PEOs typically charge a per-employee fee or a percentage of the total payroll, so the larger your business, the more you can expect to pay.

- Services Required: The more services you require, such as payroll processing, benefits administration, and HR management, the more you can expect to pay.

- Industry: Some industries may require additional services, such as safety training or compliance support, which can increase the cost of a PEO.

- Level of Support: Some PEOs offer different levels of support, such as basic, standard, or premium packages, each with a different price point.

- Customization: Some PEOs offer customized packages tailored to your business’s specific needs, which can affect the cost.

Typically, most PEOs will charge for their services in one of two ways: a percentage of your total payroll or a flat per-employee-per-year fee.

The exact rate or price you’ll pay for a PEO will depend on the specific bundle of services you choose.

Before signing up with a PEO, it’s essential to have a clear understanding of what services you’ll receive and how much you’ll pay for them.

Ask the PEO to provide you with a detailed breakdown of the package, including line items for each service.

This way, you can better assess which services you’re receiving and determine if there are any gaps that need to be addressed.

It’s also worth noting that some key services may not be included in the standard package offered by a PEO.

For example, if you’re looking for motor insurance coverage for your employees, this may not be automatically included in the package.

In such cases, you may need to ask the PEO to add this service to their proposal and discuss the associated costs.

Another important consideration when working with a PEO is to understand any additional fees or charges that may be incurred.

Some PEOs may charge setup fees or require a minimum commitment period. Additionally, if you decide to terminate your agreement with the PEO, there may be termination fees that apply.

By taking the time to understand the cost structure and services offered by a PEO, you can make an informed decision about whether they’re the right fit for your business.

Don’t hesitate to ask questions and seek clarification on any aspects of the proposal that you’re unsure about.

It’s important to carefully evaluate the cost of a PEO and compare it to the value it provides in terms of time and cost savings, improved compliance, and other benefits.

When evaluating the cost of a PEO, consider the total cost of ownership, including any additional fees or charges, such as setup fees, termination fees, or additional services fees.

Additionally, be sure to compare the costs of different PEO providers and negotiate pricing and terms to ensure that you get the best value for your business.

4. Pros and Cons of Using a PEO Over In-House Services

Using a Professional Employer Organization (PEO) can offer many benefits to businesses, such as streamlined HR processes, cost savings, and improved compliance.

However, there are also some drawbacks to consider when deciding whether to use a PEO over in-house HR services.

Here are some pros and cons of using a PEO:

Pros:

- Cost Savings: PEOs can help businesses save money by reducing HR administrative costs, such as payroll processing, benefits administration, and compliance.

- Access to Expertise: PEOs have a team of HR experts who can provide guidance and support in areas such as compliance, employee relations, and benefits administration.

- Improved Compliance: PEOs can help ensure that businesses comply with state and federal laws related to HR, reducing the risk of penalties and fines.

- Scalability: PEOs can help businesses scale up or down quickly, providing HR support as needed without the need to hire additional staff.

- Improved Benefits: PEOs can provide access to a wider range of benefits, such as health insurance and retirement plans, which can help businesses attract and retain top talent.

Cons:

- Less Control: Using a PEO means giving up some control over HR processes, which may not be ideal for some businesses.

- Potential Conflicts of Interest: PEOs act as co-employers, which can create conflicts of interest between the PEO and the business.

- Less Customization: PEOs may offer less customization than in-house HR services, as they typically provide a set package of services.

- Integration Challenges: Integrating PEO services with existing HR systems can be challenging and may require additional resources.

- Long-Term Costs: While PEOs can offer cost savings in the short term, the long-term costs may be higher due to ongoing fees and potential termination costs.

Using a PEO can offer many benefits to businesses, but it’s important to carefully evaluate the pros and cons and determine whether a PEO is the right fit for your business’s needs.

Consider factors such as cost, level of control, customization, and long-term costs when making your decision.

Conclusion

Working with a professional employer organization (PEO) can offer significant benefits to your business.

By outsourcing HR and payroll functions to a PEO, you can save time and resources, while also ensuring compliance with relevant laws and regulations.

When choosing a PEO, it’s important to do your research and consider factors such as pricing, services offered, and the PEO’s reputation in the industry.

By taking the time to find the right PEO partner for your business, you can ensure a smooth transition and a successful long-term relationship.

Remember, a PEO can offer a range of services beyond just HR and payroll, such as benefits administration, risk management, and even recruitment.

By partnering with a PEO, you can free up valuable time and resources that can be redirected toward other core business functions.

So, if you’re considering working with a PEO, take the time to do your due diligence and find a partner that aligns with your business goals and values.

With the right PEO by your side, you can streamline HR and payroll functions, reduce risk, and focus on growing your business.

If your company needs PEO services, you can use 9cv9 corporate services. Book a consultation slot here, or send over an email to [email protected].

If you find this article useful, why not share it with your business friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

People Also Ask

Are PEOs typically used by small businesses?

Yes, PEOs are typically used by small businesses. Small businesses often lack the resources to manage HR tasks and may not have a dedicated HR department. Partnering with a PEO allows small businesses to outsource their HR tasks to a third-party provider who can handle tasks like payroll, benefits administration, compliance, and risk management. This can help small businesses save time and money while ensuring they remain compliant with employment regulations.

What is the difference between using a PEO and simply outsourcing your HR?

Outsourcing HR involves contracting a third-party company to handle specific HR functions. PEOs, on the other hand, act as co-employers with their clients, assuming more extensive responsibilities for HR functions such as benefits administration, payroll processing, and compliance management.

How does the co-employment arrangement work?

In a co-employment arrangement with a PEO, the PEO becomes the employer of record for certain HR-related purposes, while the client company remains the employer of record for all other purposes. This means that the PEO takes on responsibility for payroll, benefits administration, workers’ compensation insurance, and other HR-related tasks. However, the client company still retains control over the day-to-day management of its employees and the direction of its business. The PEO and client company share certain legal responsibilities and liabilities related to employment, hence the term “co-employment.”

What type of liability does the PEO provider assume on behalf of its small business customers?

PEO assumes several liabilities on behalf of small businesses such as worker’s compensation insurance, unemployment insurance, employee benefits administration, and payroll taxes. Additionally, they also take on the responsibility of ensuring compliance with labor laws and regulations, thereby reducing the risk of penalties and lawsuits for the business.

Will I lose control of my business by using a PEO?

No, partnering with a PEO does not mean losing control of your business. The PEO takes on certain HR responsibilities but the business owner retains control over business operations, strategy, and decision-making. The co-employment model allows for shared responsibility while maintaining the autonomy of the business owner.

![Writing A Good CV [6 Tips To Improve Your CV] 6 Tips To Improve Your CV](https://blog.9cv9.com/wp-content/uploads/2020/06/2020-06-02-2-100x70.png)