Key Takeaways

- The top 10 Digital Asset Management software in 2026 prioritize AI-driven automation, headless architecture, and seamless enterprise integration to power modern content supply chains.

- Leading DAM platforms differentiate through scalable pricing models, advanced search intelligence, and deep CMS, CRM, and e-commerce connectivity for global digital operations.

- Selecting the right Digital Asset Management software depends on architectural fit, total cost of ownership, compliance needs, and long-term content orchestration strategy.

The global digital economy in 2026 is defined by content velocity. Brands, enterprises, and institutions are producing and distributing more digital assets than at any other point in history. High-resolution images, 4K and 8K video, 3D product renders, immersive AR experiences, AI-generated visuals, and multilingual marketing campaigns are now standard components of modern business operations. In this environment, managing digital content is no longer a back-office task. It is a strategic priority. This is why understanding the top 10 Digital Asset Management software in the world in 2026 has become essential for organizations seeking scalability, operational efficiency, and long-term brand protection.

Digital Asset Management software, commonly referred to as DAM software, has evolved far beyond simple file storage systems. What began as centralized repositories for marketing images has matured into intelligent content orchestration platforms. Today’s leading DAM solutions integrate artificial intelligence, headless architecture, API-driven distribution, compliance automation, and real-time analytics. They do not merely store assets; they transform, optimize, track, and distribute them across global digital ecosystems.

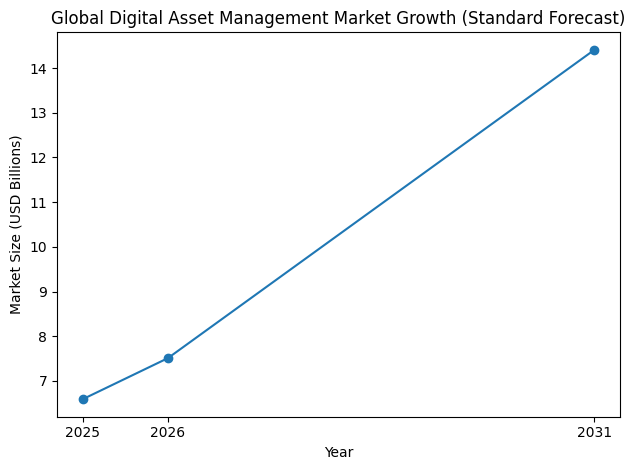

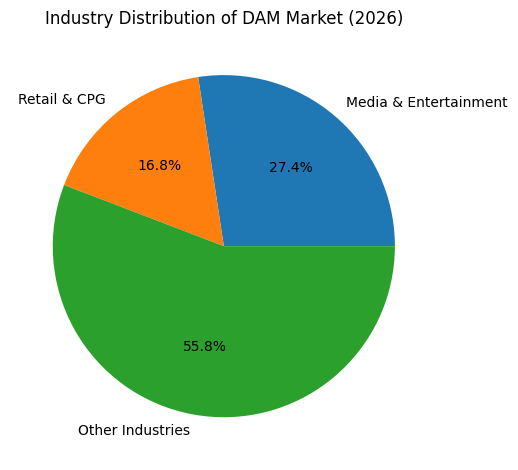

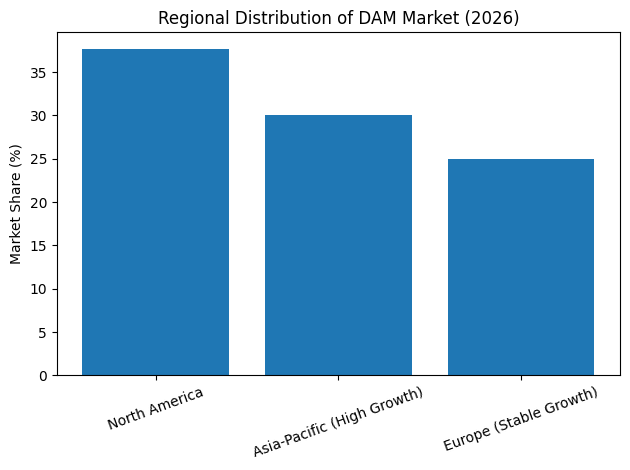

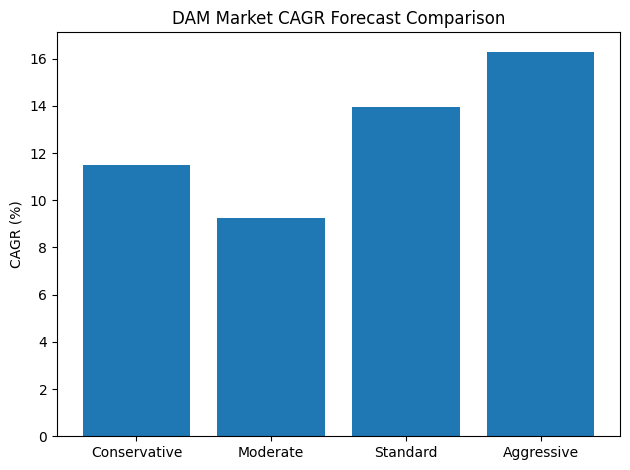

In 2026, the stakes are higher than ever. The global Digital Asset Management market has surpassed multi-billion-dollar valuations, reflecting the urgency with which enterprises are investing in content infrastructure. Organizations across media and entertainment, retail, consumer packaged goods, manufacturing, healthcare, higher education, and e-commerce are deploying enterprise DAM platforms to handle content complexity at scale. Without a modern DAM system, companies face duplicated production costs, inconsistent brand messaging, compliance risks, and delayed time-to-market.

The top 10 Digital Asset Management software platforms in 2026 represent a diverse range of architectural philosophies and strategic strengths. Some solutions focus on enterprise orchestration and deep customization, offering advanced AI automation and petabyte-scale storage. Others prioritize user-friendly design and rapid onboarding for mid-market teams. Still others emphasize programmable media transformation and API-first delivery models that support global e-commerce performance.

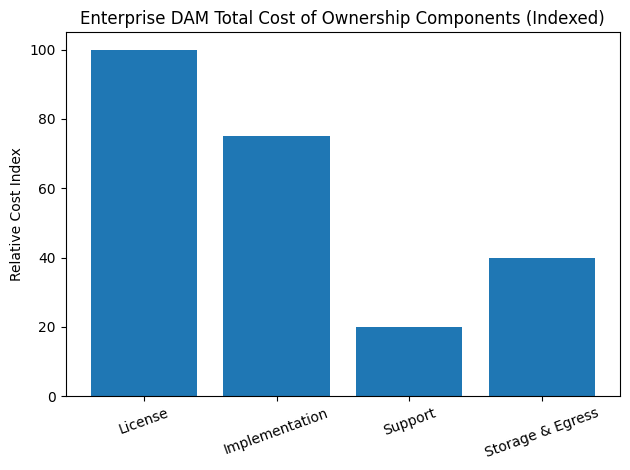

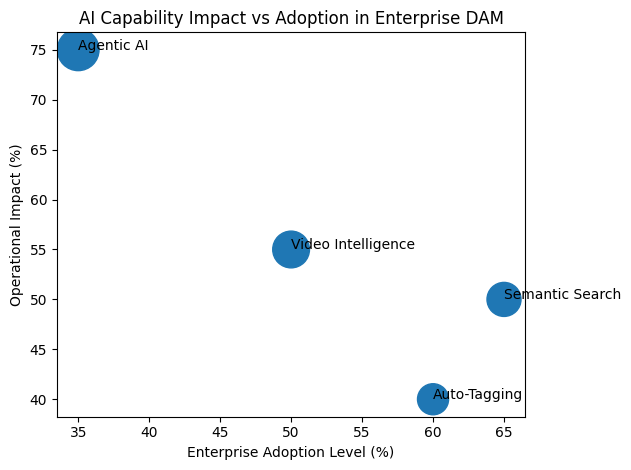

Selecting the best Digital Asset Management software in 2026 requires more than comparing feature lists. Organizations must evaluate integration depth with CMS, CRM, ERP, and e-commerce platforms. They must assess AI capabilities such as auto-tagging, facial recognition, semantic search, and agentic workflows. They must model total cost of ownership, including licensing, storage expansion, API usage, and long-term scalability. Most importantly, they must ensure architectural alignment with their digital transformation roadmap.

Another defining trend shaping the top DAM platforms in 2026 is the rise of headless and cloud-native infrastructure. Modern enterprises demand flexible content distribution across websites, mobile applications, streaming platforms, retail marketplaces, and emerging digital touchpoints. API-first DAM systems enable seamless omnichannel delivery, reducing the time between content creation and customer engagement. This “time to glass” advantage has become a competitive differentiator in industries where speed directly impacts revenue.

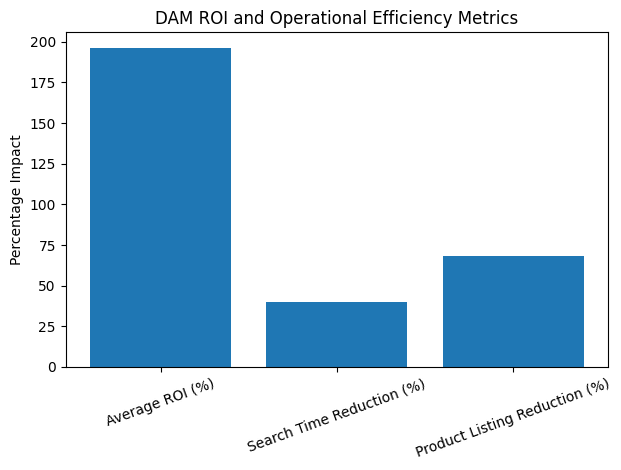

Artificial intelligence is also redefining the Digital Asset Management landscape. Leading DAM software platforms now incorporate AI-driven automation that reduces manual tagging, accelerates search, and even predicts optimal asset variations for specific markets. Agentic AI capabilities are emerging as a transformative innovation, allowing systems to autonomously manage repetitive workflows such as image resizing, rights expiration tracking, and metadata enrichment. For organizations managing tens of thousands or millions of assets, these efficiencies translate into measurable return on investment.

Compliance and governance have become equally critical considerations. With stricter data protection regulations, global licensing agreements, and brand consistency standards, DAM software must provide audit trails, permission controls, and automated rights management. Enterprises operating across multiple regions rely on DAM platforms to protect intellectual property and prevent costly legal exposure.

This comprehensive guide to the top 10 Digital Asset Management software in the world in 2026 provides an in-depth comparison of leading platforms, examining pricing structures, architectural strengths, AI capabilities, industry alignment, and scalability. Whether an organization is a global enterprise seeking advanced content orchestration or a growing marketing team transitioning from fragmented file storage systems, understanding the competitive landscape of DAM software is critical to making an informed decision.

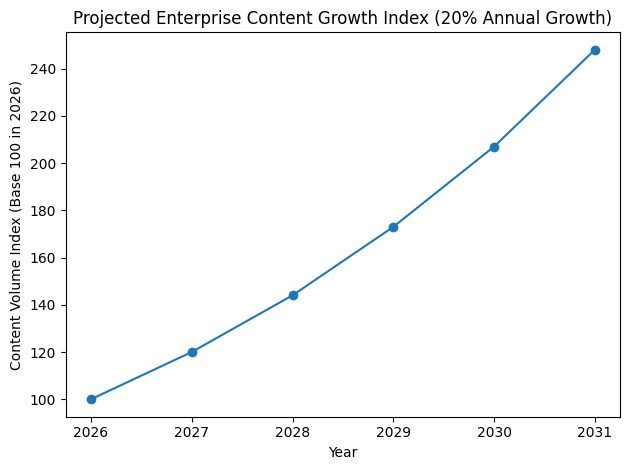

In the 2026 digital economy, content is currency. Every image, video, design file, and product asset represents potential revenue, brand equity, and competitive advantage. The right Digital Asset Management software does more than organize files. It enables organizations to scale operations, protect brand integrity, accelerate digital campaigns, and unlock measurable financial performance. As content volumes continue to grow at an estimated 20 to 30 percent annually, the platforms featured in this guide define the technological backbone of modern enterprise content strategy.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Best Digital Asset Management Software in 2026.

If you like to get your company listed in our top B2B software reviews, check out our world-class 9cv9 Media and PR service and pricing plans here.

Top 10 Best Digital Asset Management Software in 2026

- Adobe Experience Manager Assets

- Bynder

- Aprimo

- Orange Logic (OrangeDAM)

- Acquia DAM (Widen)

- Canto

- MediaValet

- Brandfolder

- Cloudinary

- Kontainer

1. Adobe Experience Manager Assets

By 2026, Digital Asset Management software has evolved into a foundational layer of enterprise digital infrastructure. Organizations operating across global markets now manage millions of multimedia assets including product images, campaign videos, brand guidelines, and localized marketing materials. DAM platforms are expected to deliver not only storage and retrieval, but also automation, AI-driven metadata enrichment, compliance governance, omnichannel distribution, and measurable operational efficiency.

Among the top 10 Digital Asset Management software platforms in the world in 2026, Adobe Experience Manager Assets consistently ranks as one of the most advanced enterprise-grade solutions. Positioned for large multinational corporations, the platform bridges creative production with digital distribution, aligning asset workflows with marketing execution and customer experience systems.

Platform Architecture and Cloud Transformation

Adobe Experience Manager Assets transitioned into a fully cloud-native environment through AEM as a Cloud Service. This transformation eliminated many of the infrastructure limitations associated with legacy deployments and introduced containerized auto-scaling capabilities.

The architectural profile of the platform can be summarized as follows:

| Component | Technical Description | Enterprise Benefit |

|---|---|---|

| Deployment Model | Fully managed cloud-native service | Reduced IT overhead and infrastructure maintenance |

| Infrastructure Framework | Container-based auto-scaling architecture | High availability during traffic spikes |

| Upgrade Management | Continuous, automated updates | No downtime during system upgrades |

| Global Distribution Support | Multi-region performance optimization | Seamless global rollout across domains |

| Ecosystem Integration | Deep Adobe Experience Cloud connectivity | Unified marketing and content supply chain |

This infrastructure allows global brands to synchronize asset management with analytics, personalization engines, and campaign orchestration systems.

Artificial Intelligence and Automation Capabilities

Artificial intelligence plays a central role in Adobe Experience Manager Assets. The integration of Adobe Sensei enables enterprises to automate repetitive processes while maintaining brand consistency.

Core AI capabilities include:

| AI Capability | Functional Application | Operational Impact |

|---|---|---|

| Bulk Auto-Tagging | Automated metadata generation at scale | Significant reduction in manual data entry |

| Smart Crop | Focal-point detection for multi-channel formats | Optimized image presentation across devices |

| Rendition Automation | Real-time generation of device-specific outputs | Faster multi-platform publishing |

| Content Intelligence | Context-aware search and classification | Improved asset discoverability |

| Rights Monitoring | AI-assisted asset expiration tracking | Reduced compliance risks |

These features enable enterprises to process thousands of assets simultaneously while maintaining governance controls.

Core Enterprise Feature Framework

Adobe Experience Manager Assets is engineered for complex global operations. It supports multilingual asset management, version control, and advanced digital rights enforcement.

The core enterprise feature matrix is outlined below:

| Feature Category | Description | Enterprise Value |

|---|---|---|

| Creative Tool Integration | Direct connection to Photoshop and InDesign | Seamless designer-to-DAM workflow |

| Version Control System | Multi-level revision tracking | Controlled asset lifecycle management |

| Digital Rights Management | Automated rights enforcement and expiration alerts | Global compliance and legal protection |

| Smart Search Engine | AI-enhanced metadata filtering | Faster internal collaboration |

| API and Integration Layer | Enterprise-grade extensibility | Custom integration with CRM, CMS, and ERP systems |

Licensing Structure and Financial Commitment

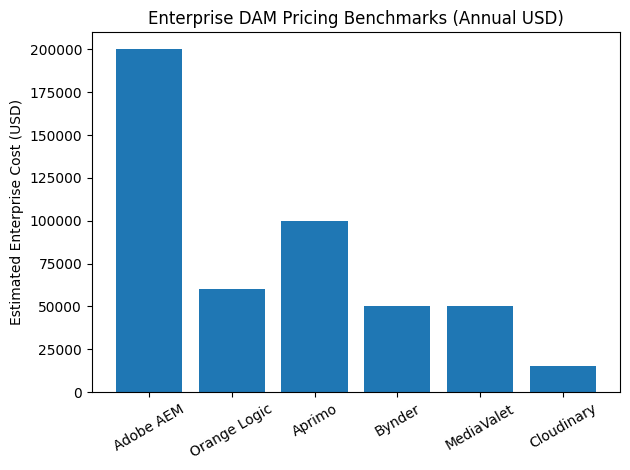

Adobe Experience Manager Assets is widely recognized as a premium-tier DAM solution. Its pricing structure reflects enterprise scalability and integration depth.

Estimated financial commitments in 2026 include:

| Cost Component | Estimated Annual Range (USD) | Financial Implication |

|---|---|---|

| Core DAM License | 30,000 and above | Entry-level enterprise investment |

| Full Enterprise Suite | 60,000 to 80,000 | Includes Sites and Forms integration |

| Large Global Deployment | 100,000 to 200,000+ | Multi-domain enterprise operations |

| Cloud Storage and Support | 15 to 25 percent of license cost | Ongoing operational expense |

| Implementation Services (One-Time) | 500,000 to 5,000,000+ | Global rollout and customization |

For multinational enterprises, the total cost of ownership extends beyond licensing to include customization, migration, and partner-led implementation.

Implementation Complexity and Timeline

Deployment cycles for Adobe Experience Manager Assets typically span six to twelve months, depending on organizational complexity.

Implementation impact factors include:

| Implementation Variable | Deployment Influence | Risk Level |

|---|---|---|

| Global Domain Count | Increased configuration and governance mapping | High |

| Legacy System Migration | Data transformation and metadata restructuring | Moderate to High |

| Custom Integrations | Extended development and QA cycles | Moderate |

| Regulatory Compliance | Additional workflow and approval layers | High |

| Change Management Programs | Enterprise-wide training and adoption strategy | Moderate |

Large enterprises often rely on certified integration partners, which significantly increases initial project expenditure but ensures strategic alignment.

Enterprise Market Perception

Enterprise users frequently describe Adobe Experience Manager Assets as robust, scalable, and strategically valuable, particularly for organizations already invested in the Adobe ecosystem.

Strength and limitation comparison:

| Evaluation Area | Market Feedback Summary | Business Impact |

|---|---|---|

| Scalability | Highly capable for global operations | Supports hundreds of domains |

| AI Automation | Mature and effective | Reduces manual creative workload |

| User Interface | Complex for non-technical teams | Requires training investment |

| Licensing Transparency | Often perceived as complicated | Budget forecasting challenges |

| Ecosystem Integration | Seamless within Adobe suite | Accelerated campaign deployment |

Operational and Business Impact

Organizations adopting Adobe Experience Manager Assets frequently report measurable performance improvements.

Business impact indicators:

| Performance Metric | Observed Outcome | Strategic Benefit |

|---|---|---|

| Creative Cycle Time | Noticeable reduction | Faster campaign launches |

| Metadata Processing | Automated at scale | Thousands of labor hours saved annually |

| Asset Retrieval Efficiency | Improved internal search accuracy | Cross-department productivity |

| Compliance Monitoring | Automated expiration tracking | Reduced legal exposure |

Competitive Position in the Top 10 DAM Platforms (2026)

In comparison with other leading Digital Asset Management platforms in 2026, Adobe Experience Manager Assets maintains a strong enterprise-focused position.

Competitive positioning matrix:

| Evaluation Criteria | Adobe Experience Manager Assets Position | Market Tier Classification |

|---|---|---|

| Enterprise Scalability | Very High | Global Enterprise Tier |

| AI and Automation | Advanced and Mature | Industry Leader |

| Ease of Use | Moderate Complexity | Enterprise-Focused |

| Pricing Accessibility | Premium Tier | High Investment Requirement |

| Implementation Simplicity | Complex | Requires Specialist Partners |

| Ecosystem Depth | Extensive Adobe Integration | Strategic Marketing Infrastructure |

Conclusion

Adobe Experience Manager Assets continues to be one of the most influential Digital Asset Management software platforms globally in 2026. It operates not merely as a content repository, but as a strategic enterprise system connecting creative production, AI automation, governance, and digital distribution.

Although the platform requires substantial financial and operational commitment, organizations managing large-scale, multi-language, multi-brand environments often consider it a long-term infrastructure investment. Its combination of cloud-native scalability, artificial intelligence integration, and ecosystem connectivity secures its position among the top Digital Asset Management software solutions in the world.

2. Bynder

By 2026, Bynder has secured a strong position among the top 10 Digital Asset Management software platforms worldwide. The company has differentiated itself by focusing heavily on usability, marketing enablement, and brand governance rather than purely technical infrastructure depth. With more than 4,000 global customers across sectors such as telecommunications, consumer goods, healthcare, and retail, Bynder is widely regarded as one of the most intuitive DAM solutions available for marketing-driven organizations.

Global brands such as Vodafone and Campari Group have adopted Bynder to streamline asset discovery, centralize brand control, and improve collaboration across geographically distributed teams. In contrast to more technically complex enterprise DAM platforms, Bynder’s value proposition is built around simplicity, speed of deployment, and marketing productivity.

Platform Architecture and SaaS Infrastructure

Bynder operates as a pure Software-as-a-Service (SaaS) platform. This architecture eliminates the need for on-premise installations or hybrid deployment models, allowing organizations to launch and scale rapidly without significant infrastructure overhead.

The platform architecture can be summarized as follows:

| Component | Technical Structure | Strategic Advantage |

|---|---|---|

| Deployment Model | Fully cloud-based SaaS | Rapid deployment with minimal IT complexity |

| System Access | Browser-based interface | Universal access across global teams |

| Brand Portals | Customizable external access gateways | Secure sharing with agencies and regional partners |

| Data Hosting | Centralized cloud storage | Single source of truth for brand assets |

| API Connectivity | Open integration framework | Integration with CRM, CMS, and creative tools |

One of Bynder’s most distinctive capabilities is the Brand Portal. These portals function as controlled, branded environments where approved stakeholders can access pre-approved content without interacting directly with the full DAM backend. This feature enhances governance while maintaining ease of use for non-technical users.

Artificial Intelligence and Search Capabilities

Bynder places strong emphasis on search efficiency and asset discoverability. Its AI-powered search engine is designed to minimize duplication and accelerate file retrieval across large content libraries.

Core AI functionality includes:

| AI Capability | Functional Description | Operational Outcome |

|---|---|---|

| Smart Search Engine | Context-based metadata recognition | Faster asset retrieval across departments |

| Duplicate Detection | Automated identification of redundant files | Reduced storage waste and improved content hygiene |

| Metadata Automation | Suggested tagging based on content recognition | Reduced manual tagging workload |

| Visual Search | Image-based search queries | Simplified discovery for creative teams |

| Centralized Asset Indexing | Unified asset repository | Reliable brand consistency across regions |

The platform’s centralized indexing reinforces its positioning as a “single source of truth” for global brand assets.

Subscription Model and Cost Structure

Bynder utilizes a tiered subscription pricing model that scales according to organizational size, number of users, storage requirements, and module selection.

Estimated pricing framework in 2026:

| Pricing Tier | Estimated Cost (USD) | Target Organization Type |

|---|---|---|

| Entry-Level Plan | 450 per month (5,400 annually) | Small marketing teams |

| Mid-Market Tier | 15,000 to 40,000 annually | Growing regional organizations |

| Enterprise Tier | 50,000 to 100,000+ annually | Global multi-brand enterprises |

| Advanced Modules Add-Ons | Variable pricing | Creative Workflow, Brand Templates, Analytics |

Primary cost drivers include:

| Cost Driver | Financial Impact Description |

|---|---|

| Number of Users | Increased licensing costs as power users scale |

| Storage Volume | Tier-based pricing adjustments |

| Workflow Modules | Additional feature-based subscription upgrades |

| Custom Integrations | Potential implementation service fees |

While the base pricing appears accessible compared to some enterprise competitors, costs can increase substantially as advanced modules and larger user bases are added.

Implementation Speed and Efficiency Metrics

One of Bynder’s strongest differentiators is its relatively fast implementation cycle. Compared to enterprise-grade DAM systems that may require up to a year for deployment, Bynder implementations typically conclude within two to four months.

Implementation comparison overview:

| Implementation Factor | Bynder Average Timeline | Enterprise DAM Average Timeline |

|---|---|---|

| Initial Setup | 2 to 4 months | 6 to 12 months |

| Infrastructure Setup | Minimal (SaaS) | Extensive configuration |

| Training Requirements | Low to moderate | Moderate to high |

| External Partner Access | Brand Portal-based | Often requires complex permissions |

In documented enterprise use cases, Siemens Healthineers reported financial savings exceeding 3.5 million euros and more than 15,000 hours saved in file searching after deploying Bynder. These metrics highlight the platform’s direct operational impact.

Enterprise User Experience and Market Feedback

From a global communications and brand management perspective, Bynder is frequently praised for ease of use and onboarding transparency. Enterprise reviewers emphasize its intuitive interface and reduced friction in daily workflows.

User sentiment analysis:

| Evaluation Area | Market Feedback Summary | Organizational Impact |

|---|---|---|

| User Interface | Highly intuitive, minimal training required | Faster adoption across large employee bases |

| AI Search | Powerful and reliable | Reduced time spent locating assets |

| Onboarding Support | Responsive and transparent | Smooth implementation experience |

| Customization Flexibility | Moderate compared to modular platforms | Potential limitation for highly technical needs |

| Cost Scalability | Can increase with power user growth | Budget considerations for expansion |

For large enterprises with tens of thousands of employees, the simplified interface significantly reduces dependency on IT departments for daily asset retrieval.

Business Impact and Time-to-Market Acceleration

Organizations adopting Bynder often report measurable improvements in productivity and campaign speed. The platform reduces internal friction by decreasing the number of steps required to locate and deploy approved content.

Business performance outcomes include:

| Performance Metric | Observed Outcome | Strategic Benefit |

|---|---|---|

| Asset Search Time | Significant reduction | Improved team productivity |

| Campaign Launch Speed | Faster regional rollouts | Accelerated time-to-market |

| File Duplication Rate | Decreased redundancy | Improved brand consistency |

| Cross-Regional Collaboration | Simplified sharing via Brand Portals | Stronger global-local alignment |

The reduction in search friction and asset confusion translates directly into marketing agility, especially in organizations managing multiple markets and language variations.

Competitive Position in the 2026 DAM Landscape

Within the global top 10 Digital Asset Management platforms, Bynder occupies a strategic position between mid-market agility and enterprise scalability.

Competitive positioning matrix:

| Evaluation Criteria | Bynder Position | Market Classification |

|---|---|---|

| Ease of Use | Very High | Marketing-Centric DAM |

| AI Search Capabilities | Advanced | Competitive with enterprise leaders |

| Enterprise Scalability | High | Suitable for large global teams |

| Customization Depth | Moderate | Less modular than highly technical DAM systems |

| Pricing Accessibility | Flexible Tiered Model | Scalable but potentially increasing at scale |

| Implementation Speed | Fast | Strong advantage over complex enterprise platforms |

Conclusion

Bynder has established itself as one of the most influential Digital Asset Management software platforms in 2026 by prioritizing usability, brand governance, and rapid implementation. Its SaaS-native architecture, powerful AI search capabilities, and customizable Brand Portals enable organizations to centralize assets while maintaining operational simplicity.

Although customization depth may not match highly modular enterprise DAM systems, Bynder’s intuitive design and measurable efficiency gains make it particularly attractive to marketing-driven global enterprises seeking speed, transparency, and improved time-to-market.

3. Aprimo

In 2026, Aprimo occupies a distinctive position within the top 10 Digital Asset Management software platforms globally by operating at the intersection of Digital Asset Management (DAM) and Marketing Resource Management (MRM). Unlike traditional DAM platforms that focus primarily on storage and distribution, Aprimo is designed for enterprise organizations that require governance, workflow orchestration, budget oversight, and structured content operations within a unified system.

Aprimo is particularly suited to fast-moving, compliance-sensitive industries such as consulting, financial services, pharmaceuticals, and large-scale B2B enterprises. Its value proposition centers on operational control, structured scalability, and data-driven marketing performance insights.

Platform Architecture and Modular Design

Aprimo’s architecture is built around a highly modular framework, allowing enterprises to configure the system according to operational requirements. Instead of managing assets as fixed files alone, Aprimo enables content componentization, where individual content elements such as disclaimers, copy blocks, product descriptions, or regulatory statements can be stored and dynamically assembled.

Core architectural structure:

| Component | Functional Description | Enterprise Advantage |

|---|---|---|

| Deployment Model | Cloud-based enterprise SaaS | Scalable infrastructure with centralized governance |

| Modular Framework | Configurable modules (Productivity, Spend Management, DAM) | Tailored system aligned with business complexity |

| Content Componentization | Reusable structured content blocks | Dynamic asset assembly and compliance control |

| Integration Layer | Enterprise-grade APIs and connectors | Seamless integration with CRM, ERP, and CMS systems |

| Governance Engine | Advanced permissions and approval workflows | Structured multi-level content validation |

This modularity allows organizations to design workflows around business processes rather than adapting processes to rigid software limitations.

Content Intelligence and AI Capabilities

Aprimo has been a pioneer in introducing the concept of Content Intelligence within enterprise DAM systems. This capability moves beyond asset storage and tagging by analyzing how content performs across digital channels.

AI and analytics capability matrix:

| AI Capability | Functional Application | Strategic Impact |

|---|---|---|

| Content Intelligence | Cross-channel engagement analysis | Data-driven future content strategy |

| Auto-Tagging | Automated metadata enrichment | Reduced manual classification effort |

| Duplicate Detection | Identification of redundant assets | Improved content hygiene and cost efficiency |

| Performance Attribution | Linking assets to campaign engagement metrics | ROI visibility for marketing leadership |

| Predictive Content Insights | Data modeling for future asset performance | Smarter resource allocation |

Through Content Intelligence, marketing teams can identify which assets drive the highest engagement and replicate successful content structures across markets.

Pricing Structure and Financial Positioning

Aprimo is positioned as a premium enterprise solution with a customized pricing model based on storage volume and selected modules.

Estimated pricing overview in 2026:

| Pricing Category | Estimated Annual Cost (USD) | Target Segment |

|---|---|---|

| Entry-Level Configuration | Starting at 20,000 | Mid-sized enterprises with structured workflows |

| Standard Enterprise Setup | 20,000 to 60,000 | Multi-department marketing organizations |

| Advanced Enterprise Deployment | 60,000 to 100,000+ | Large global enterprises with modular add-ons |

| Add-On Modules | Custom pricing | Productivity, Spend Management, Advanced Analytics |

Primary cost determinants:

| Cost Driver | Financial Impact Explanation |

|---|---|

| Storage Volume | Tier-based cost escalation |

| Number of Modules | Increased subscription complexity |

| Workflow Customization | Higher configuration and onboarding investment |

| Enterprise User Volume | Expanded licensing commitments |

Although Aprimo delivers high functionality depth, satisfaction metrics indicate that perceived cost relative to value averages around 67 percent, reflecting its positioning as a strategic, long-term enterprise investment rather than a budget solution.

Technical Performance and Feature Ratings

Aprimo consistently scores highly in areas related to governance and workflow automation. Enterprise evaluations indicate strong system robustness and operational control.

Performance evaluation summary:

| Evaluation Metric | Score / Rating | Interpretation |

|---|---|---|

| Permissions and Access Management | 81 out of 100 | Strong multi-layer governance control |

| Workflow Management | 82 out of 100 | Highly structured approval and task automation |

| AI Tagging and Duplicate Detection | High satisfaction | Reliable automation capabilities |

| Cost Relative to Value | 67 percent | Premium pricing perception |

| Overall Enterprise Satisfaction | 9.3 out of 10 | Strong alignment with strategic enterprise needs |

These metrics highlight Aprimo’s strengths in compliance-driven and process-heavy marketing environments.

Enterprise User Experience and Operational Feedback

From a strategic marketing and IT administration perspective, Aprimo is often described as a highly customizable and structured platform capable of aligning tools to specific enterprise workflows.

User sentiment breakdown:

| Evaluation Area | Enterprise Feedback Summary | Operational Implication |

|---|---|---|

| Customization Capability | Highly adaptable to business requirements | Tailored workflows and governance models |

| Project Management Tools | Strong automation for content lifecycle | Streamlined movement from creation to DAM storage |

| AI Automation | Superior auto-tagging and duplicate discovery | Improved operational efficiency |

| Power Workspace Interface | Complex for non-technical users | Requires structured training programs |

| Backend Mastery | Time-intensive learning curve | Investment in administrative expertise |

While powerful, the platform’s backend configuration requires significant familiarity, particularly for administrators managing modular expansions.

Business Impact and Organizational Efficiency

Aprimo’s unified structure often eliminates fragmented communication between marketing, legal, compliance, and creative departments. By consolidating workflows and asset storage within one environment, enterprises experience measurable efficiency gains.

Business impact metrics:

| Performance Indicator | Observed Outcome | Strategic Benefit |

|---|---|---|

| Content Discovery | Centralized single source | Reduced internal communication delays |

| Email Volume Related to Tasks | Noticeable reduction | Improved productivity and faster approvals |

| Asset Lifecycle Tracking | Automated workflow routing | Enhanced compliance control |

| Campaign Coordination | Structured project visibility | Stronger cross-functional alignment |

The elimination of manual stakeholder follow-ups significantly reduces operational friction and improves overall marketing throughput.

Competitive Position in the 2026 DAM Ecosystem

Within the top 10 Digital Asset Management software platforms globally in 2026, Aprimo differentiates itself through governance depth and marketing operations integration.

Competitive positioning matrix:

| Evaluation Criteria | Aprimo Position | Market Classification |

|---|---|---|

| Governance and Permissions | Very High | Enterprise Compliance Tier |

| Workflow Automation | Advanced | Marketing Operations Leader |

| AI and Content Intelligence | Mature and Data-Driven | Strategy-Oriented DAM |

| Ease of Use | Moderate to Complex | Process-Heavy Enterprise System |

| Pricing Accessibility | Premium Tier | High Strategic Investment |

| Modular Flexibility | Extensive | Customizable Enterprise Platform |

Conclusion

Aprimo remains one of the most strategically advanced Digital Asset Management platforms in 2026, particularly for enterprises that require structured marketing operations, modular scalability, and performance-based content insights. By combining DAM with Marketing Resource Management capabilities, Aprimo transforms asset management into a governance-driven, intelligence-informed marketing engine.

Although the platform demands a higher financial and administrative commitment, its strong workflow automation, Content Intelligence innovation, and centralized governance framework position it as a leading solution for complex enterprise marketing ecosystems.

4. Orange Logic (OrangeDAM)

By 2026, Orange Logic, widely recognized through its OrangeDAM platform, has positioned itself as a disruptive force within the top 10 Digital Asset Management software solutions globally. Frequently acknowledged in analyst evaluations as a Leader for Enterprise Content Orchestration, the platform distinguishes itself by going beyond traditional asset storage to enable structured orchestration of content ecosystems.

Orange Logic is particularly favored by media-intensive industries such as broadcasting, publishing, sports organizations, entertainment conglomerates, and multinational corporations managing vast content archives. Its architecture and pricing philosophy make it attractive to enterprises with large user bases and petabyte-scale data requirements.

Enterprise Content Orchestration Framework

Unlike conventional DAM systems that primarily manage asset storage and retrieval, OrangeDAM is architected around orchestration. This approach treats content as a dynamic, interconnected ecosystem involving workflows, storage layers, metadata intelligence, automation agents, and distribution endpoints.

Core orchestration components:

| Component | Functional Description | Strategic Enterprise Value |

|---|---|---|

| Content Orchestration Engine | Centralized management of assets and workflows | End-to-end visibility across content lifecycle |

| Modular Toolset | 130+ configurable DAM tools | Extreme customization capability |

| Workflow Automation | Multi-step, rules-based task management | Structured compliance and approval routing |

| Cross-Team Collaboration | Shared environment for creative, legal, and marketing | Unified content governance |

| High-Speed Processing Layer | Optimized performance for massive datasets | Efficient handling of petabyte-scale content |

This orchestration-centric model enables enterprises to manage not only current production workflows but also long-term archival and historical content repositories.

Composable Infrastructure and BYOS Architecture

One of Orange Logic’s most distinctive technical innovations is its composable infrastructure with Bring Your Own Storage (BYOS) support. Rather than forcing clients into proprietary storage models, OrangeDAM allows enterprises to connect their existing cloud storage environments.

Technical architecture overview:

| Infrastructure Element | Description | Enterprise Benefit |

|---|---|---|

| Deployment Model | Enterprise SaaS with composable architecture | Flexible integration with existing IT environments |

| Bring Your Own Storage | Integration with AWS S3, Azure, IBM Cloud | Cost control and infrastructure continuity |

| Unlimited Storage Model | No platform-imposed storage caps | Scalable content growth without artificial limits |

| Performance Optimization | High-speed indexing and retrieval | Rapid asset access across global teams |

| API and Integration Layer | Enterprise-grade extensibility | Integration with CMS, CRM, MAM, and ERP systems |

The BYOS model allows enterprises to leverage existing cloud agreements, often reducing redundancy and optimizing storage expenditures.

Artificial Intelligence and Agentic Innovation

Orange Logic has invested heavily in AI-driven automation and orchestration intelligence. In 2026, the platform’s Agentic AI Studio stands out as a differentiating innovation.

AI capability matrix:

| AI Capability | Functional Application | Strategic Impact |

|---|---|---|

| Agentic AI Studio | Creation of custom AI agents for multi-step automation | Reduced manual oversight and task execution |

| Automated Compliance Checks | Rule-based validation of assets | Improved regulatory governance |

| 3D Asset Transformation | Automated rendering and format adaptation | Media and gaming industry efficiency |

| Intelligent Metadata Analysis | Contextual asset understanding | Improved search precision |

| DNA Mapping (Upcoming) | AI trained on brand and behavioral patterns | Predictive, personalized platform interactions |

The introduction of DNA Mapping aims to create brand-aware AI systems that learn organizational behavior patterns, improving workflow suggestions and asset categorization over time.

Pricing Structure and Cost Model

Orange Logic operates under a flat-fee enterprise pricing model, which differs significantly from per-seat subscription models common among competitors.

Pricing overview in 2026:

| Pricing Category | Estimated Annual Cost (USD) | Financial Implication |

|---|---|---|

| Base Enterprise License | Starting at 60,000 | Flat enterprise access |

| User Seat Charges | None | Unlimited user scalability |

| Storage Costs | Managed via BYOS model | Dependent on existing cloud agreements |

| Custom Configuration | Variable | Based on orchestration complexity |

Key pricing advantage analysis:

| Pricing Factor | Orange Logic Model | Traditional DAM Model Comparison |

|---|---|---|

| User-Based Fees | Unlimited users included | Per-seat cost escalation |

| Adoption Scalability | No additional cost for expansion | Increased costs with each new user |

| Storage Model | External BYOS integration | Often bundled and tier-restricted |

| Total Cost Predictability | High | Variable and usage-dependent |

The absence of per-user fees eliminates what many enterprises describe as a “tax on adoption,” making the platform especially attractive to organizations with thousands of users across departments.

Technical Performance and Enterprise Reliability

OrangeDAM is frequently praised for its high-performance architecture, particularly in environments handling massive content libraries.

Performance characteristics:

| Performance Area | Enterprise Feedback Summary | Operational Outcome |

|---|---|---|

| Large Data Handling | Efficient at petabyte-scale | Suitable for media and archival environments |

| System Stability | High reliability | Continuous uptime for global operations |

| Live Support | 24/7 real-time assistance | Reduced operational downtime |

| Customization Depth | Extensive configuration flexibility | Highly tailored workflow ecosystems |

The platform’s robust live support infrastructure contributes significantly to enterprise satisfaction.

Enterprise User Experience and Adoption Considerations

From a media and entertainment perspective, users describe OrangeDAM as purpose-built for orchestration rather than simple storage. The depth of configuration tools allows enterprises to design highly complex systems aligned with operational strategy.

User sentiment summary:

| Evaluation Area | Enterprise Observation | Business Implication |

|---|---|---|

| Feature Breadth | Extensive toolset (130+ tools) | Powerful but configuration-intensive |

| Learning Curve | Steep during initial setup | Requires structured technical onboarding |

| Adoption Cost | Unlimited users removes scaling friction | Encourages cross-department usage |

| AI Innovation | Advanced agent-based automation | Enhanced operational efficiency |

| Performance Speed | High-speed system response | Supports real-time production environments |

The depth of features requires a well-defined technical strategy to fully leverage the orchestration ecosystem.

Business Impact and Organizational Transformation

Orange Logic enables enterprises to unify both real-time production workflows and historical archival systems into a single content environment. This consolidation reduces fragmentation across creative, legal, compliance, and marketing teams.

Business performance outcomes:

| Performance Indicator | Observed Outcome | Strategic Benefit |

|---|---|---|

| Asset Centralization | Unified current and archival repositories | Reduced system fragmentation |

| Cross-Department Collaboration | Shared orchestration layer | Improved operational alignment |

| Adoption Rate | Increased due to unlimited user model | Enterprise-wide utilization |

| Workflow Efficiency | Automated multi-step task routing | Faster asset approval and compliance checks |

By merging orchestration, AI automation, and scalable storage infrastructure, OrangeDAM enables organizations to manage complex content ecosystems without expanding licensing overhead.

Competitive Position in the 2026 DAM Ecosystem

Within the top 10 Digital Asset Management software platforms in 2026, Orange Logic holds a distinct position as a high-performance orchestration-driven solution.

Competitive positioning matrix:

| Evaluation Criteria | Orange Logic Position | Market Classification |

|---|---|---|

| Enterprise Scalability | Very High | Large-Scale Enterprise Tier |

| AI Innovation | Advanced Agent-Based Automation | Innovation Leader |

| Pricing Scalability | Unlimited User Flat Fee | Cost-Efficient for Large User Bases |

| Customization Depth | Extensive (130+ tools) | Highly Configurable Platform |

| Ease of Initial Adoption | Moderate to Complex | Strategy-Driven Implementation |

| Media and Archival Support | Exceptional | Media-Heavy Industry Specialist |

Conclusion

Orange Logic (OrangeDAM) stands out in 2026 as a transformative force in Digital Asset Management by redefining the category through Enterprise Content Orchestration. Its composable infrastructure, Bring Your Own Storage model, and Agentic AI innovations provide enterprises with unprecedented scalability and flexibility.

While the platform demands a strategic implementation approach and technical clarity, its flat-fee unlimited user model and high-performance architecture make it particularly compelling for global corporations and media-intensive industries. As content ecosystems continue to grow in complexity, Orange Logic remains one of the most forward-thinking DAM solutions in the global market.

5. Acquia DAM (Widen)

In 2026, Acquia DAM, built on the foundation of the Widen Collective, maintains a strong presence among the top 10 Digital Asset Management software platforms globally. The platform is particularly recognized for its ability to bridge Digital Asset Management (DAM) and Product Information Management (PIM), making it highly attractive to manufacturing, retail, consumer goods, and distribution-focused enterprises.

Acquia DAM differentiates itself by combining structured product data with rich media asset management. This dual capability positions it as a strategic solution for organizations that manage large product catalogs alongside high volumes of supporting marketing content.

Strategic Integration Within the Digital Experience Ecosystem

Acquia DAM functions as the media engine within the broader Acquia Open Digital Experience Platform (DXP). Its tight integration with Drupal and marketing automation ecosystems enables organizations to synchronize product data, content assets, and digital experiences.

Technical integration overview:

| Integration Component | Functional Description | Enterprise Benefit |

|---|---|---|

| Deployment Model | Cloud-based enterprise SaaS | Scalable and centralized infrastructure |

| Native Drupal Integration | Seamless content synchronization | Unified web publishing workflows |

| Marketing Automation Connectors | Integration with campaign and personalization tools | Streamlined campaign execution |

| Unified DAM + PIM Tier | Combined product data and asset management | Single interface for product-driven content |

| API and Connector Framework | Enterprise extensibility | Integration with ERP and eCommerce platforms |

The unified DAM + PIM capability allows organizations to manage product attributes, SKU data models, specifications, and associated media within one centralized environment.

DAM + PIM Unified Architecture

Acquia DAM’s combined data and media management structure is particularly valuable for product-centric organizations that require precision and compliance across thousands of SKUs.

Unified system capability matrix:

| Capability Area | Functional Application | Operational Outcome |

|---|---|---|

| Product Data Modeling | Centralized SKU and specification management | Improved product accuracy |

| Media-Linked Product Records | Direct association of assets with product entries | Faster content deployment |

| Documentation Attachment | Usage rights and compliance files linked to images | Reduced legal exposure |

| Metadata Synchronization | Structured tagging across assets and product attributes | Improved discoverability |

| Multi-Channel Publishing | Direct content flow to web and commerce systems | Faster product launches |

This integration reduces silos between marketing teams and product information managers, creating a cohesive digital supply chain.

Pricing Structure and Subscription Tiers

Acquia DAM operates under a tiered annual subscription model tailored to organizational size and storage requirements.

Estimated subscription overview for 2026:

| Subscription Tier | User Limit | Storage Allocation | Estimated Annual Cost (USD) |

|---|---|---|---|

| Workgroup Plan | Up to 50 users | 1 TB | 15,000 and above |

| Professional Tier | Expanded user capacity | Multi-terabyte | 25,000 to 60,000 |

| Enterprise Plan | Unlimited users | Up to 10 TB | 60,000 to 80,000+ |

Primary cost variables:

| Cost Driver | Financial Impact Description |

|---|---|

| User Volume | Higher tiers support expanded team access |

| Storage Requirements | Multi-terabyte needs increase subscription pricing |

| Integration Complexity | Custom connectors may increase service fees |

| Advanced Configuration | PIM alignment and workflow customization costs |

The availability of an unlimited-user enterprise tier makes the platform scalable for large marketing and product teams.

Search Performance and Metadata Strength

Acquia DAM is widely recognized for its advanced tagging framework and faceted search functionality. Unlike traditional folder-based systems, the platform relies heavily on structured metadata fields.

Search and metadata capabilities:

| Feature Area | Functional Description | Efficiency Impact |

|---|---|---|

| Comprehensive Tagging | Multi-field metadata architecture | Enhanced precision search |

| Faceted Search | Filtering by numeric ranges and date fields | Faster discovery of complex assets |

| Rights Documentation Linking | Direct attachment of contracts and licenses | Clear compliance tracking |

| Structured Taxonomy Support | Customizable metadata hierarchies | Improved brand governance |

| Performance Optimization | Rapid indexing of large asset libraries | Reduced search latency |

The ability to filter assets using structured date ranges, product categories, and numeric specifications significantly improves retrieval speed compared to legacy folder-based repositories.

Enterprise User Experience and Market Feedback

From a manufacturing and retail marketing perspective, users frequently describe Acquia DAM as reliable, fast, and well-suited for large product-driven teams.

User sentiment analysis:

| Evaluation Area | Market Feedback Summary | Organizational Implication |

|---|---|---|

| Onboarding Experience | Structured and professional | Smooth initial adoption |

| Search Speed | Highly efficient | Improved productivity |

| Rights and Documentation Link | Valuable for compliance tracking | Reduced legal risk |

| System Integration | Occasional communication gaps between connected tools | Requires IT oversight |

| Post-Implementation Support | Variable responsiveness | Dependent on account management quality |

Some users report limitations in interconnected “daisy-chained” systems, where multiple platforms may not synchronize perfectly without ongoing configuration management.

Business Impact and Risk Reduction

Acquia DAM provides measurable operational and compliance advantages, particularly in industries where product accuracy and licensing control are critical.

Business performance outcomes:

| Performance Indicator | Observed Outcome | Strategic Benefit |

|---|---|---|

| Asset Identification Accuracy | Faster subject recognition | Improved campaign preparation |

| License Tracking | Centralized documentation attachment | Reduced risk of expired talent usage |

| Cross-Team Collaboration | Unified product and marketing data | Stronger operational alignment |

| Search Efficiency | Significant time savings | Reduced manual file retrieval effort |

For manufacturing enterprises managing thousands of product images and legal agreements, the centralized tracking of talent licenses and usage rights substantially lowers exposure to compliance violations.

Competitive Position in the 2026 DAM Market

Within the global top 10 Digital Asset Management software platforms in 2026, Acquia DAM occupies a unique niche centered on product-driven digital ecosystems.

Competitive positioning matrix:

| Evaluation Criteria | Acquia DAM Position | Market Classification |

|---|---|---|

| DAM + PIM Integration | Strong | Product-Centric Enterprise Tier |

| Search and Metadata Depth | Advanced | Metadata-Driven Platform |

| Enterprise Scalability | High | Large Marketing Teams |

| Ecosystem Integration | Native to Acquia DXP and Drupal | Digital Experience-Focused |

| Ease of Use | User-Friendly for Marketing Teams | Moderate Complexity |

| Pricing Accessibility | Tiered Enterprise Pricing | Mid-to-High Investment Range |

Conclusion

Acquia DAM, built on the legacy of the Widen Collective, remains a powerful solution in 2026 for organizations that require seamless integration between digital asset management and structured product information. Its unified DAM + PIM model, strong metadata architecture, and integration with digital experience platforms make it especially valuable for manufacturing and retail enterprises.

Although integration complexity and post-implementation support experiences may vary, the platform’s strong search performance, compliance tracking capabilities, and scalable user tiers secure its position among the leading Digital Asset Management software solutions worldwide.

6. Canto

By 2026, Canto continues to hold a dominant position in the mid-market Digital Asset Management software segment. While enterprise-focused platforms emphasize orchestration, modular customization, and complex governance layers, Canto differentiates itself by prioritizing usability, speed, and visual accessibility. It is widely selected by growing marketing departments, creative agencies, educational institutions, and regional enterprises that require structured asset governance without heavy technical overhead.

Canto’s value proposition centers on immediate usability. Organizations transitioning from unstructured file-sharing environments such as shared drives and cloud storage folders frequently choose Canto as their first formal DAM platform.

Cloud-Native Architecture and Deployment Simplicity

Canto operates as a fully cloud-native SaaS platform designed for rapid implementation. Its infrastructure is optimized for performance speed and user accessibility rather than extensive backend configuration.

Technical architecture overview:

| Component | Functional Description | Strategic Advantage |

|---|---|---|

| Deployment Model | Cloud-native SaaS | Minimal IT involvement required |

| User Interface | Visual-first, intuitive dashboard | Rapid user adoption |

| Folder Structure | Simplified hierarchical organization | Easy navigation for non-technical teams |

| Branded Portals | External sharing hubs | Fast and secure distribution to partners |

| API Integration | Standard marketing tool connectors | Moderate extensibility |

This streamlined architecture allows organizations to migrate from shadow IT environments into a governed DAM structure within weeks rather than months.

Core Capabilities and Visual Intelligence

Canto’s competitive strength lies in its visual-first approach to search and discovery. Rather than relying exclusively on manually assigned metadata, the platform incorporates image recognition technologies.

AI and visual capability matrix:

| Capability Area | Functional Application | Operational Benefit |

|---|---|---|

| Visual Search | Search by image attributes and visual similarity | Faster asset discovery without complex tagging |

| Face Recognition | Identification of specific individuals in images | Efficient talent and event photo retrieval |

| Smart Tagging | Automated metadata suggestions | Reduced manual classification |

| Branded Portals | Easy-to-configure external asset sharing | Controlled distribution without backend exposure |

| Rapid Preview Engine | Instant asset rendering after upload | Improved user experience |

The platform’s ability to quickly render uploaded assets and enable near-instant previewing is frequently cited as one of its most appreciated features.

Pricing Structure and Market Accessibility

Canto uses a customized pricing model based on organizational size, storage requirements, and selected features. Although pricing is not publicly standardized, industry benchmarks in 2026 place the platform within a mid-market cost range.

Estimated pricing overview:

| Pricing Tier Category | Estimated Annual Cost (USD) | Target Organization Type |

|---|---|---|

| Entry-Level Mid-Market | 10,000 to 20,000 | Small to growing marketing teams |

| Standard Growth Tier | 20,000 to 50,000 | Multi-department mid-sized enterprises |

| Advanced Mid-Market Tier | 50,000 to 75,000 | Larger organizations with higher storage demands |

Key pricing factors:

| Cost Driver | Financial Impact Explanation |

|---|---|

| Storage Volume | Increased asset library size raises subscription tier |

| User Count | Scalable user access within negotiated plans |

| Portal Usage | Additional external portals may increase cost |

| Custom Integrations | May require professional service support |

While pricing transparency requires direct vendor engagement, Canto maintains high satisfaction ratings among its target market.

Operational Speed and Onboarding Efficiency

Canto is frequently recognized for its fast onboarding and straightforward migration process. Organizations moving from decentralized systems such as Google Drive or Dropbox often complete migration within a short implementation window.

Implementation comparison overview:

| Implementation Factor | Canto Performance | Enterprise DAM Average |

|---|---|---|

| Setup Timeline | Weeks | 6 to 12 months |

| Training Requirements | Minimal | Moderate to high |

| IT Dependency | Low | High |

| Configuration Complexity | Simple structure | Advanced customization layers |

This rapid deployment capability makes Canto especially attractive to organizations seeking quick operational improvement without large transformation projects.

User Satisfaction and Market Perception

Canto maintains exceptionally high user satisfaction metrics, including a G2 satisfaction score of 99 in 2026. Users consistently highlight speed, ease of use, and intuitive navigation as key advantages.

User sentiment analysis:

| Evaluation Area | Market Feedback Summary | Organizational Implication |

|---|---|---|

| Upload and Preview Speed | Immediate asset visibility | Improved workflow continuity |

| Interface Design | Highly visual and user-friendly | Minimal onboarding friction |

| Folder and Tagging Model | Simple and logical | Accessible to non-technical users |

| Pricing Transparency | Requires custom quote | Budget planning requires vendor discussion |

| Enterprise Depth | Less complex metadata handling | May not suit highly regulated industries |

While the platform excels in usability, it may feel less suited for enterprises requiring highly intricate metadata schemas or multi-layer compliance workflows.

Business Impact and Marketing Productivity

Canto enables growing marketing teams to centralize fragmented content libraries into a unified brand hub. This shift from “piecemeal” systems to structured DAM governance significantly improves discoverability and collaboration.

Business performance outcomes:

| Performance Indicator | Observed Outcome | Strategic Benefit |

|---|---|---|

| Asset Discovery Rate | Increased by approximately 50 percent | Faster campaign preparation |

| Shadow IT Reduction | Consolidated multiple storage systems | Improved brand governance |

| Team Collaboration | Centralized access to approved assets | Reduced duplication of effort |

| External Sharing Efficiency | Quick portal deployment | Simplified partner communication |

For mid-sized organizations scaling marketing operations, the improvement in discovery speed and reduction of duplicated storage systems represent immediate operational gains.

Competitive Position in the 2026 DAM Ecosystem

Within the global top 10 Digital Asset Management software platforms in 2026, Canto occupies a clear mid-market leadership position.

Competitive positioning matrix:

| Evaluation Criteria | Canto Position | Market Classification |

|---|---|---|

| Ease of Use | Very High | Mid-Market Leader |

| Visual AI Capabilities | Advanced Visual Search | User-Centric DAM |

| Enterprise Scalability | Moderate | Growing Organizations |

| Implementation Speed | Very Fast | Rapid Deployment Platform |

| Pricing Accessibility | Mid-Range Custom Model | Flexible but Negotiated |

| Metadata Complexity | Moderate | Less suited for highly complex governance |

Conclusion

Canto remains one of the most effective Digital Asset Management platforms in 2026 for mid-market organizations seeking speed, simplicity, and visual-first asset discovery. Its cloud-native design, face recognition technology, and fast onboarding process make it particularly suitable for teams transitioning from decentralized file systems into a governed DAM environment.

Although it may not offer the orchestration depth or modular complexity of enterprise-focused platforms, Canto’s strong usability, high satisfaction ratings, and measurable improvements in asset discovery solidify its place among the leading DAM solutions globally.

7. MediaValet

By 2026, MediaValet has solidified its reputation as a pure-cloud Digital Asset Management platform built exclusively on Microsoft Azure. Its strategic alignment with the Microsoft ecosystem positions it as a preferred solution for regulated industries, public institutions, higher education, healthcare, and non-profit organizations seeking enterprise-grade security with simplified scalability.

Unlike hybrid or multi-cloud DAM providers, MediaValet’s exclusive Azure architecture provides standardized infrastructure, global redundancy, and compliance-ready hosting. This makes the platform particularly appealing to organizations already leveraging Microsoft 365, Azure Active Directory, and other Microsoft enterprise services.

Azure-Based Architecture and Global Infrastructure

MediaValet differentiates itself through its full commitment to Microsoft Azure infrastructure. This approach ensures consistent performance, enterprise security certifications, and worldwide data distribution capabilities.

Technical architecture overview:

| Infrastructure Component | Functional Description | Enterprise Benefit |

|---|---|---|

| Hosting Environment | Built exclusively on Microsoft Azure | Enterprise-grade compliance and reliability |

| Global Redundancy | Multi-region Azure data centers | High availability and disaster recovery readiness |

| Security Framework | Azure-native identity and encryption layers | Strong protection for regulated industries |

| System Integration | Seamless compatibility with Microsoft ecosystem | Simplified IT alignment |

| Scalability Model | Elastic cloud-based resource allocation | Performance stability during content growth |

The Azure backbone allows MediaValet to deliver predictable performance and security assurance, which is especially critical for organizations managing sensitive data and regulated communications.

Pricing Philosophy and Unlimited User Model

One of MediaValet’s most distinctive differentiators in 2026 is its inclusive pricing model. Unlike many enterprise DAM platforms that charge per user, MediaValet includes unlimited users, unlimited administrator training, and unlimited product support within its base pricing structure.

Pricing overview in 2026:

| Pricing Category | Estimated Cost Range (USD) | Key Characteristics |

|---|---|---|

| Entry-Level Tier | Approximately 500 per month | Suitable for small to mid-sized teams |

| Mid-Market Configuration | 10,000 to 30,000 annually | Growing multi-department organizations |

| Enterprise Deployment | 50,000 and above annually | Large-scale asset libraries |

| Included in Base Pricing | Unlimited users and support | No seat-based cost expansion |

Primary cost drivers:

| Cost Driver | Financial Impact Explanation |

|---|---|

| Storage Volume | Increased fees for large asset libraries |

| High-Resolution Video | 4K and high-bitrate files raise storage consumption |

| Advanced Integrations | Specialized connectors may increase subscription costs |

| Custom Workflows | Additional configuration services |

Although storage expansion can significantly increase pricing, the unlimited user structure encourages organization-wide adoption without incremental licensing penalties.

AI Capabilities and Video Intelligence

MediaValet leverages Azure Cognitive Services to enhance its search and media analysis capabilities. This is particularly relevant in 2026, as video has become the fastest-growing asset type in enterprise content libraries.

AI and intelligence capability matrix:

| AI Capability | Functional Application | Operational Benefit |

|---|---|---|

| Audio Video Intelligence | Automated transcription of video content | Improved searchability of multimedia assets |

| Facial Recognition | Identification of individuals within video files | Efficient event and talent management |

| Speech-to-Text Tagging | Automatic metadata generation from spoken dialogue | Reduced manual video annotation |

| Image Recognition | Context-based asset categorization | Enhanced discoverability |

| Smart Metadata Enrichment | AI-assisted tagging suggestions | Faster content indexing |

These AI-driven features enable organizations to index, search, and repurpose video content with far greater efficiency than traditional manual tagging methods.

Operational Speed and Return on Investment

MediaValet is widely recognized for its relatively fast deployment cycle and measurable return on investment. Industry benchmarks indicate that organizations typically realize ROI within approximately 11 months of implementation.

Implementation comparison overview:

| Implementation Factor | MediaValet Performance | Enterprise DAM Average |

|---|---|---|

| Deployment Timeline | Moderate, streamlined SaaS | Often 6 to 12 months |

| Training Access | Unlimited administrator sessions | Limited in many competitors |

| User Expansion | No additional license cost | Seat-based expansion fees |

| ROI Realization | Approximately 11 months | Often 12 to 18 months |

The absence of user-based cost barriers significantly accelerates adoption across departments.

User Experience and Market Perception

From the perspective of non-profit and higher education organizations, MediaValet is frequently praised for its organizational clarity and support accessibility.

User sentiment analysis:

| Evaluation Area | Market Feedback Summary | Organizational Impact |

|---|---|---|

| Ease of Organization | Structured and intuitive | Faster content retrieval |

| Support Availability | Unlimited product support | Reduced dependency on external consultants |

| Video Management | Superior compared to many mid-market DAMs | Strong multimedia governance |

| Storage Pricing Sensitivity | Cost increases with large video libraries | Budget planning required for rapid content growth |

| Reporting Features | Adequate but not advanced MRM-level analytics | May require external reporting tools |

The unlimited support model contributes significantly to positive satisfaction scores, particularly for organizations lacking extensive in-house technical teams.

Business Impact and Organizational Scalability

MediaValet enables enterprises and institutions to scale their digital asset libraries without proportionally increasing licensing costs. This is particularly beneficial for distributed organizations operating across multiple regions.

Business performance outcomes:

| Performance Indicator | Observed Outcome | Strategic Benefit |

|---|---|---|

| Organization-Wide Adoption | Increased due to unlimited users | Broad institutional engagement |

| Asset Accessibility | Centralized approved content | Reduced use of outdated materials |

| Video Search Efficiency | Faster identification of multimedia assets | Improved campaign and event turnaround |

| Regional Office Alignment | Shared centralized library | Consistent brand messaging |

In one example from the non-profit sector, MediaValet enabled dozens of regional offices to access a unified asset repository without increasing licensing costs, ensuring consistent distribution of approved campaign materials.

Competitive Position in the 2026 DAM Ecosystem

Within the global top 10 Digital Asset Management platforms in 2026, MediaValet holds a distinctive position as a secure, Azure-native DAM optimized for scalability and video intelligence.

Competitive positioning matrix:

| Evaluation Criteria | MediaValet Position | Market Classification |

|---|---|---|

| Cloud Infrastructure | Fully Azure-Native | Security-Focused DAM |

| User Pricing Model | Unlimited Users Included | Adoption-Friendly Enterprise Model |

| AI Video Intelligence | Advanced Azure Cognitive Services | Multimedia-Optimized Platform |

| Enterprise Scalability | High | Suitable for Distributed Organizations |

| Reporting Depth | Moderate | Less MRM-Oriented |

| Storage Sensitivity | Dependent on Video Growth | Scalable but Storage-Driven Pricing |

Conclusion

MediaValet stands out in 2026 as a cloud-pure Digital Asset Management solution built entirely on Microsoft Azure, offering enterprise-grade security, global redundancy, and inclusive pricing structures. Its unlimited user model removes traditional licensing barriers, encouraging widespread organizational adoption.

Although storage growth, particularly with high-resolution video, can increase costs, the platform’s strong AI-driven multimedia intelligence, comprehensive support, and Azure-native architecture make it one of the most strategically secure and scalable DAM solutions in the global market.

8. Brandfolder

By 2026, Brandfolder has established itself as one of the most visually refined Digital Asset Management platforms in the global top 10 DAM ecosystem. Positioned between mid-market agility and enterprise scalability, Brandfolder is widely recognized for its emphasis on brand governance, creative collaboration, and external asset visibility.

The platform is particularly well-suited for creative agencies, marketing departments, consumer brands, and organizations that regularly distribute assets to press, retailers, resellers, and external stakeholders. Rather than prioritizing complex backend orchestration, Brandfolder focuses on brand presentation, usage transparency, and intuitive user experience.

Visual-First Architecture and User Interface Design

Brandfolder differentiates itself through a design-forward interface that prioritizes visual clarity and structured brand presentation. Its architecture is optimized for high-visibility brand sharing environments.

Platform architecture overview:

| Component | Functional Description | Strategic Advantage |

|---|---|---|

| Deployment Model | Cloud-based SaaS | Rapid implementation and scalability |

| Visual Asset Interface | Image-first search and preview design | Faster creative adoption |

| Collection Management | Structured asset grouping | Organized brand campaigns and launches |

| External Sharing Controls | Secure public and private asset portals | Controlled distribution to partners |

| API and Integrations | Native connectors with creative and project tools | Seamless workflow alignment |

The visual-first interface enhances user adoption, especially among creative teams that rely heavily on design presentation.

Brand Intelligence and Asset Analytics

One of Brandfolder’s most innovative features in 2026 is its Brand Intelligence capability. This real-time analytics dashboard allows organizations to monitor how assets are being used both internally and externally.

Brand Intelligence capability matrix:

| Feature Area | Functional Application | Business Outcome |

|---|---|---|

| Asset Popularity Tracking | Real-time insights into most downloaded assets | Data-driven content optimization |

| Access Monitoring | Visibility into who is accessing brand materials | Improved governance and accountability |

| Share Activity Analytics | Tracking of external distribution activity | Strategic partner performance analysis |

| Version Control Visibility | Monitoring of outdated versus active assets | Reduced brand inconsistency |

| Engagement Metrics | Usage trends across campaigns | Refined brand strategy planning |

This analytics-driven approach provides marketing leaders with insights into asset performance beyond simple download counts.

Integration Ecosystem and Workflow Alignment

Brandfolder supports native integrations with widely used creative and project management tools, enhancing cross-team efficiency.

Integration overview:

| Integration Category | Example Tools | Operational Benefit |

|---|---|---|

| Project Management | Smartsheet | Coordinated campaign planning |

| Design Collaboration | Canva | Simplified creative production |

| Marketing Automation | CRM and CMS connectors | Streamlined asset publishing |

| Cloud Storage Sync | Standard enterprise connectors | Improved data continuity |

These integrations allow creative teams to maintain workflow continuity without switching platforms excessively.

Pricing Structure and Cost Sensitivity

Brandfolder operates within the premium mid-to-high-tier pricing range. Its pricing model often includes per-seat licensing, which can impact larger organizations as adoption grows.

Estimated pricing overview for 2026:

| Pricing Tier Category | Estimated Annual Cost (USD) | Target Organization Type |

|---|---|---|

| Entry-Level Premium Tier | Starting at 19,200 annually | Growing marketing teams |

| Mid-Tier Deployment | 30,000 to 70,000 | Multi-department enterprises |

| Enterprise Deployment | 100,000 and above | Large global brands and agencies |

Primary cost drivers:

| Cost Driver | Financial Impact Explanation |

|---|---|

| Per-Seat Licensing | Increased cost as team size grows |

| Advanced Workflow Tools | Premium-tier feature gating |

| Storage Volume | Scaling asset libraries |

| Custom Integrations | Enterprise-level configuration support |

Although pricing reflects its premium positioning, some organizations report that per-seat costs can act as a growth constraint for expanding teams.

User Experience and Market Sentiment

From an agency and creative director perspective, Brandfolder is often praised for its intuitive implementation and customization flexibility. Its structured collections and easy file replacement system are particularly appreciated.

User sentiment analysis:

| Evaluation Area | Market Feedback Summary | Organizational Impact |

|---|---|---|

| Implementation Ease | Straightforward and efficient | Quick time-to-value |

| Visual Search Experience | Highly intuitive | Faster asset discovery |

| File Version Replacement | Simple filename replacement logic | Reduced confusion over outdated files |

| Cost Structure | Per-seat pricing sensitivity | Budget considerations for scaling teams |

| Advanced Workflow Access | Often reserved for higher tiers | Tier-based capability limitations |

The ability to group documents into visually organized collections supports campaign-specific asset distribution and client presentations.

Business Impact and Operational Efficiency

Brandfolder’s high-visibility sharing model significantly reduces communication friction between creative teams and external stakeholders.

Business performance outcomes:

| Performance Indicator | Observed Outcome | Strategic Benefit |

|---|---|---|

| Email Reduction | Approximately 30 percent fewer asset-related emails | Increased creative productivity |

| Asset Replacement Efficiency | Quick version updates using consistent filenames | Stronger brand consistency |

| Client Distribution Speed | Faster delivery to press and partners | Accelerated campaign execution |

| External Visibility Control | Real-time asset access monitoring | Improved compliance oversight |

For agencies managing multiple client brands, the ability to centralize and track distribution reduces time spent on administrative follow-ups.

Competitive Position in the 2026 DAM Ecosystem

Within the global top 10 Digital Asset Management software platforms in 2026, Brandfolder holds a specialized position focused on brand visibility and external distribution.

Competitive positioning matrix:

| Evaluation Criteria | Brandfolder Position | Market Classification |

|---|---|---|

| Visual User Experience | Very High | Brand-Focused DAM |

| Asset Analytics Visibility | Advanced Brand Intelligence | Usage Transparency Leader |

| Enterprise Scalability | Moderate to High | Agency and Marketing Department Tier |

| Pricing Model | Per-Seat Premium | Growth-Sensitive Cost Structure |

| Workflow Complexity | Moderate | Less Orchestration-Focused |

| External Sharing Control | Strong | High-Visibility Distribution Platform |

Conclusion

Brandfolder remains one of the most visually elegant and brand-focused Digital Asset Management platforms in 2026. Its Brand Intelligence analytics, intuitive collection management, and deep creative tool integrations make it particularly effective for agencies and marketing teams that prioritize asset visibility and external sharing.

Although per-seat pricing may limit scalability for rapidly growing organizations, Brandfolder’s emphasis on design clarity, real-time asset usage tracking, and streamlined distribution workflows secures its place among the leading DAM solutions globally.

9. Cloudinary

By 2026, Cloudinary occupies a distinctive position within the top 10 Digital Asset Management software platforms worldwide. Unlike traditional DAM systems that emphasize repository management and governance workflows, Cloudinary is widely recognized as an API-first programmable media platform. Its focus extends beyond asset storage to automated transformation, optimization, and global delivery.

Cloudinary is particularly dominant in e-commerce, SaaS platforms, digital marketplaces, and web application environments where performance, scalability, and real-time media transformation are mission-critical. For development-driven organizations, Cloudinary functions less as a conventional DAM and more as a core infrastructure layer for digital media delivery.

Programmable Media and the One-File Approach