Key Takeaways

- Global Web3 salaries in 2026 offer competitive base pay, enhanced by token grants and equity for long-term incentives.

- Sectors like Infrastructure, DePIN, and Layer 2 protocols lead with the highest compensation packages worldwide.

- Companies now prioritize hybrid-skilled professionals and transparent pay structures to attract top Blockchain talent.

In 2026, the blockchain and Web3 industry has matured into one of the most dynamic, fast-evolving, and globally integrated sectors in the digital economy. With a growing number of enterprises, startups, and decentralized autonomous organizations (DAOs) embracing blockchain-powered infrastructures, the demand for talent in this field is at an all-time high. From smart contract developers and protocol engineers to DeFi analysts and token economists, the talent spectrum has diversified, and so has the structure of compensation.

The salaries in the blockchain and Web3 industry are no longer determined by traditional benchmarks alone. Instead, they reflect a complex mix of factors—technological specialization, project funding stage, geographical flexibility, token-based rewards, governance participation, and more. As the lines blur between traditional finance, decentralized technologies, and next-gen infrastructure like DePIN and Layer 2 solutions, professionals are experiencing compensation packages that are unlike any conventional tech roles. Web3 roles often come with global salary bands, token grants, and remote-first work setups, reshaping the way people are paid and incentivized in a borderless digital workforce.

Moreover, 2026 has seen a significant shift in how compensation is structured. A growing number of companies are offering hybrid packages that include base salaries in fiat or stablecoins, equity stakes in legal entities, and token allocations tied to protocol success. These packages are often paired with innovative vesting models, performance-based release schedules, and governance rights that provide long-term alignment between contributors and projects.

This guide offers an in-depth exploration of salary trends, compensation structures, and hiring dynamics within the blockchain and Web3 ecosystem worldwide. It covers critical insights into how different job functions are compensated across regions, how sector-specific roles such as DeFi, infrastructure, GameFi, and DePIN impact earning potential, and how professionals can evaluate offers based on volatility-adjusted token valuations.

With rising competition for talent, advanced recruitment strategies, and the increasing use of AI tools in both hiring and application processes, understanding the full scope of compensation in this domain has become essential for both job seekers and employers. Whether you are a seasoned blockchain developer, a Web3 product strategist, or a company aiming to attract top-tier crypto talent, this comprehensive salary guide will help you navigate the evolving financial landscape of the decentralized internet in 2026.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of A Complete Guide to Salaries in the Blockchain & Web3 Industry globally for 2026.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Salaries in the Blockchain & Web3 Industry in 2026: A Complete Guide

- Macroeconomic Drivers and Global Market Sentiment

- Technical Roles and Engineering Compensation

- Non-Technical Roles: The Rise of the Crypto-Professional

- Geographic Benchmarking: The Global Talent Map

- Sector-Specific Compensation: Infrastructure vs. DeFi vs. DePIN

- Compensation Structure: Base, Tokens, and Equity

- Recruitment and Talent Retention Strategies

- Future Outlook

1. Macroeconomic Drivers and Global Market Sentiment

a. General Market Statistics (January 2026)

As the global Blockchain and Web3 landscape continues to evolve in 2026, job opportunities in this field are experiencing strong momentum. With advancements in artificial intelligence integration and increasingly standardized regulations, the compensation dynamics across Web3 roles are rapidly changing. This guide offers a deep dive into current salary trends, role-based disparities, and market-driven forces that shape earnings in the blockchain workforce worldwide.

Key Market Shifts and Influencing Trends in 2026

The Blockchain and Web3 employment ecosystem in early 2026 is shaped by:

- Artificial Intelligence Integration: AI tools are becoming essential in smart contract automation, protocol optimization, and blockchain analytics. These developments have significantly elevated job requirements and compensation.

- Global Regulatory Developments: The implementation of regulations such as the Markets in Crypto-Assets (MiCA) in Europe and the GENIUS Act in the U.S. is creating new compliance-focused job roles and higher salary brackets for legal and operational experts.

- Remote-First Workforce Culture: The persistent preference for remote work is driving global talent competition, with many employers offering token-based compensation to attract high-caliber professionals.

Global Salary Benchmarks Across Web3 Roles in 2026

Web3 salaries vary significantly depending on job function, seniority, region, and compensation structure (fiat vs. crypto). The following table outlines the salary ranges and distribution patterns observed in early 2026.

Global Web3 Salary Distribution Table – 2026

| Metric Description | Value / Range |

|---|---|

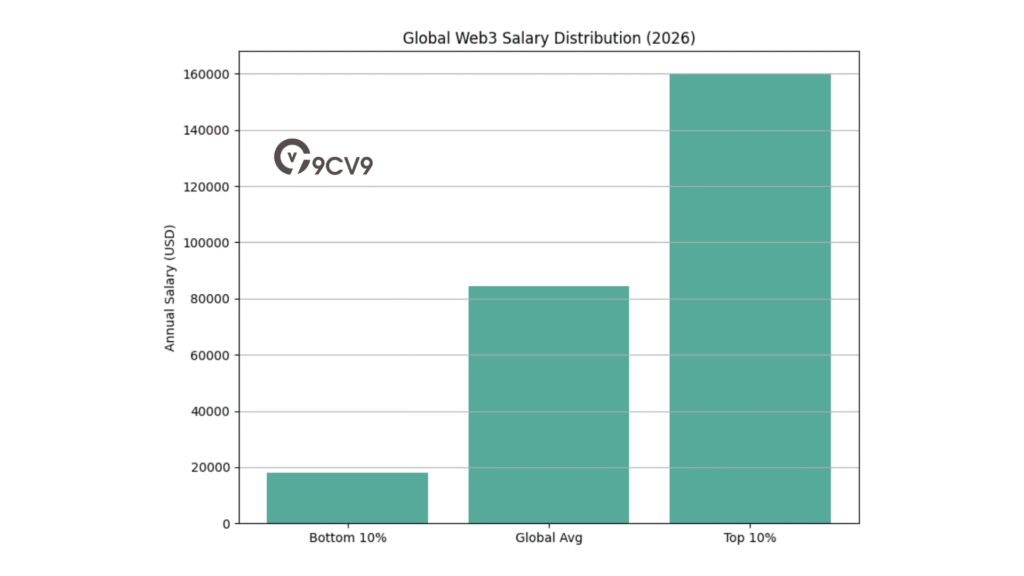

| Global Average Web3 Salary | $84,318 / year |

| Bottom 10% of Global Web3 Salaries | $18,000 / year |

| Top 10% of Global Web3 Salaries | $160,000 / year |

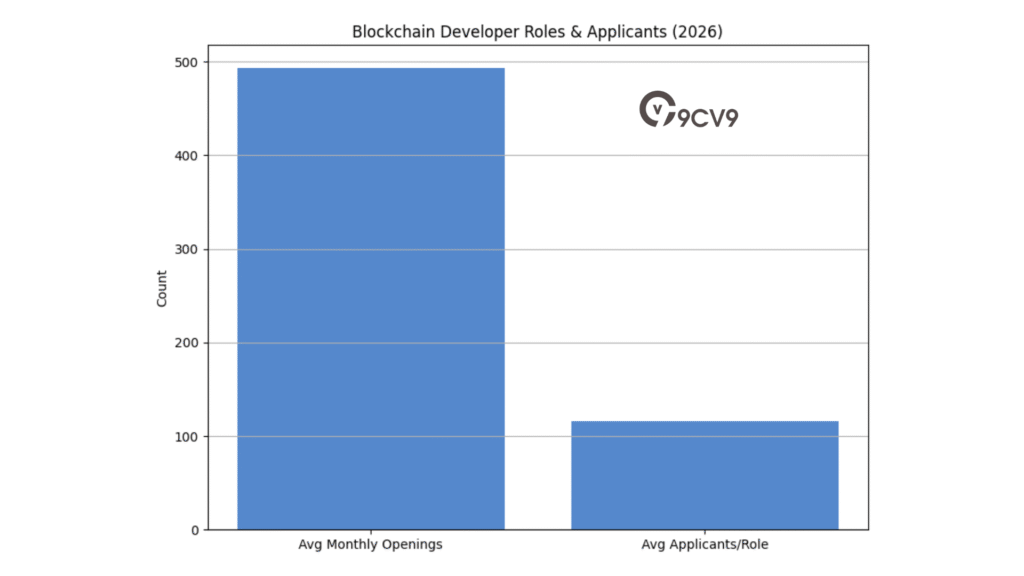

| Average Monthly New Blockchain Developer Roles | 493 openings |

| Average Number of Applicants per Blockchain Role | 116 candidates |

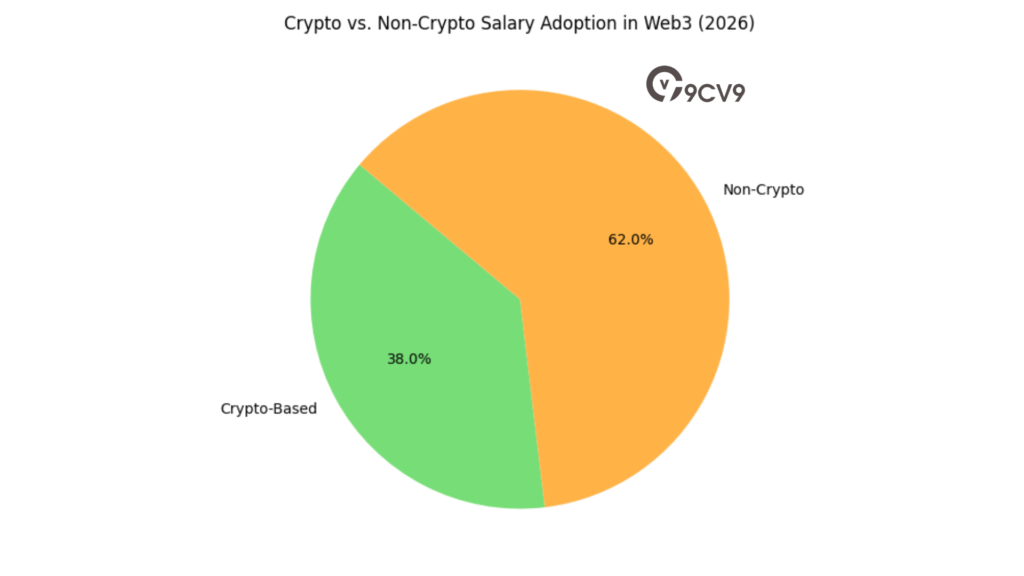

| Percentage of Roles Offering Crypto Payments | 38% |

| Workers Earning Less Than $4,000/Month | 70% of workforce |

| Industry Workers Reporting Layoffs in 2025 | 48% |

| Professionals Intending to Stay in Web3 Sector | 80% |

Detailed Role-Based Salary Ranges in Blockchain & Web3 – 2026

To understand the distribution further, here’s a breakdown of salaries by role type:

| Role Type | Entry-Level (Annual) | Mid-Level (Annual) | Senior-Level (Annual) | Average Salary |

|---|---|---|---|---|

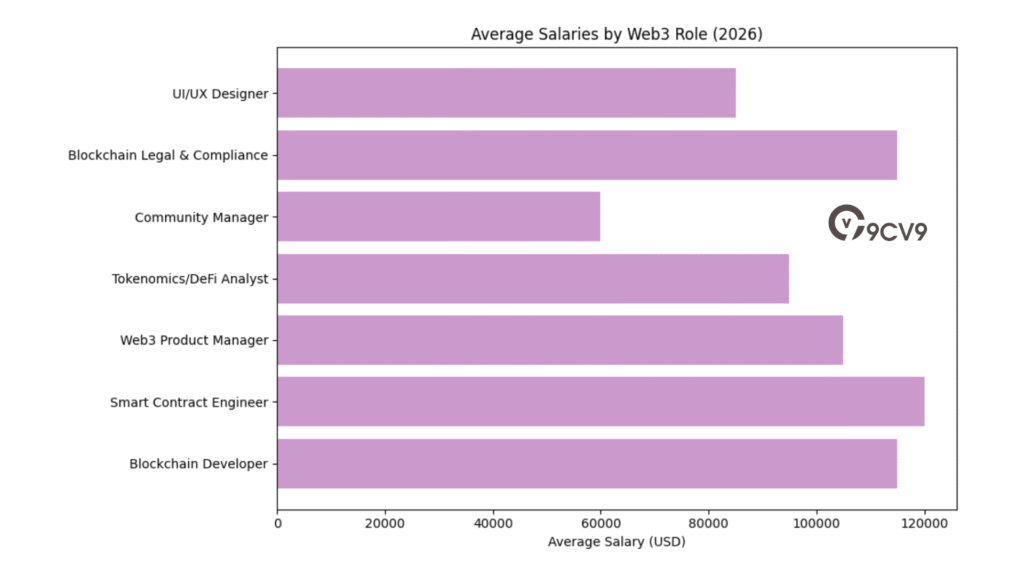

| Blockchain Developer | $55,000 – $85,000 | $90,000 – $130,000 | $140,000 – $190,000 | $115,000 |

| Smart Contract Engineer | $60,000 – $90,000 | $100,000 – $140,000 | $150,000 – $200,000 | $120,000 |

| Web3 Product Manager | $50,000 – $75,000 | $85,000 – $115,000 | $130,000 – $170,000 | $105,000 |

| Tokenomics/DeFi Analyst | $45,000 – $70,000 | $80,000 – $110,000 | $120,000 – $150,000 | $95,000 |

| Community Manager | $30,000 – $50,000 | $55,000 – $75,000 | $80,000 – $100,000 | $60,000 |

| Blockchain Legal & Compliance | $65,000 – $95,000 | $105,000 – $135,000 | $145,000 – $190,000 | $115,000 |

| UI/UX Designer (Web3 Projects) | $40,000 – $65,000 | $70,000 – $100,000 | $110,000 – $140,000 | $85,000 |

Token-Based Compensation and Equity Trends

An emerging characteristic of the Web3 sector is the increasing adoption of crypto token payments and equity in decentralized projects.

| Compensation Element | Common Trends Observed in 2026 |

|---|---|

| Crypto-Based Salary | Offered in 38% of Web3 roles, often with vesting |

| Token Allocations | Provided as part of compensation for early hires |

| Stablecoin Payment Options | Becoming more common in remote and DAO roles |

| Equity in DAO Projects | Offered in governance tokens or profit shares |

Workforce Realities and Income Inequality

Despite the upward shift in salary benchmarks for high-demand roles, a large portion of the Web3 workforce continues to face challenges:

- Income Disparity: While the top-tier engineers and product leaders earn six-figure incomes, over 70% of workers earn less than $4,000 per month.

- Job Security Concerns: Nearly half of respondents in a 2025 industry survey indicated they were laid off without severance, highlighting the volatility of early-stage blockchain ventures.

- Resilience and Optimism: Despite instability, 80% of professionals surveyed expressed their intent to remain in the field, motivated by remote flexibility and the long-term growth potential of token-based rewards.

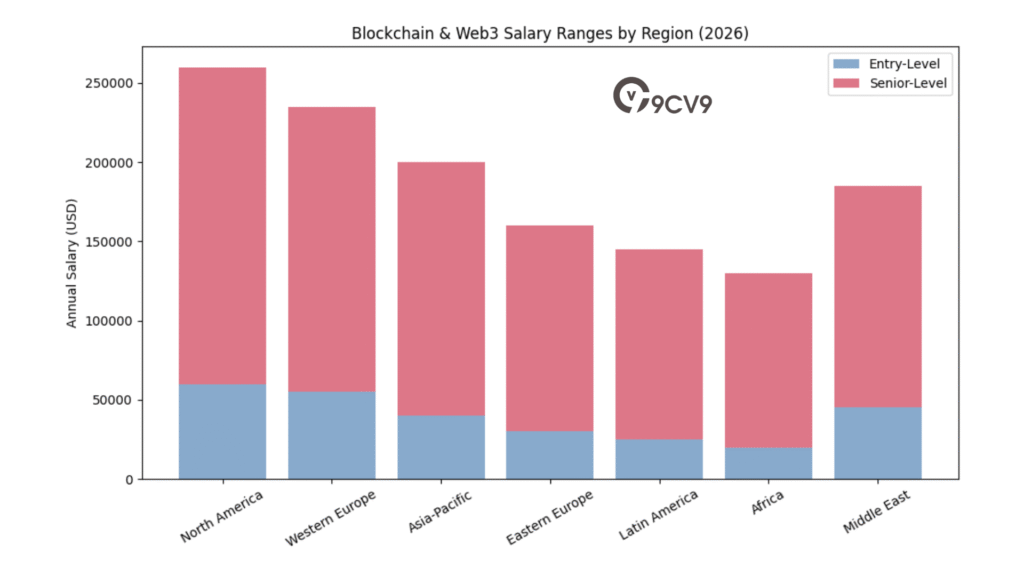

Regional Salary Patterns in Blockchain & Web3

Regional dynamics play a significant role in salary levels, with mature markets typically offering higher compensation.

| Region | Entry-Level Salary Range | Senior-Level Salary Range | Notes on Compensation Type |

|---|---|---|---|

| North America | $60,000 – $100,000 | $150,000 – $200,000 | Mostly fiat + performance bonuses |

| Western Europe | $55,000 – $90,000 | $140,000 – $180,000 | Increasing crypto equity in startups |

| Asia-Pacific | $40,000 – $75,000 | $120,000 – $160,000 | Mix of fiat, crypto, and tokens |

| Eastern Europe | $30,000 – $60,000 | $90,000 – $130,000 | Primarily crypto compensation |

| Latin America | $25,000 – $50,000 | $80,000 – $120,000 | Mostly token and equity-based payments |

| Africa | $20,000 – $45,000 | $70,000 – $110,000 | Strong focus on remote DAO work |

| Middle East | $45,000 – $70,000 | $100,000 – $140,000 | Regulatory clarity driving enterprise roles |

Conclusion: Navigating Web3 Careers in 2026

The global Blockchain and Web3 job market in 2026 is evolving rapidly, shaped by regulation, technology integration, and decentralized work cultures. While high earnings are accessible for those with strong technical expertise or niche knowledge, the sector still presents challenges in job stability and fair pay distribution. As the industry continues to mature, candidates equipped with both blockchain fundamentals and cross-functional skills—such as AI, cybersecurity, and compliance—will be best positioned to command higher salaries and sustainable careers.

This detailed salary guide aims to help professionals, hiring managers, and investors understand compensation benchmarks across roles and regions, enabling smarter career and hiring decisions in the dynamic Web3 economy.

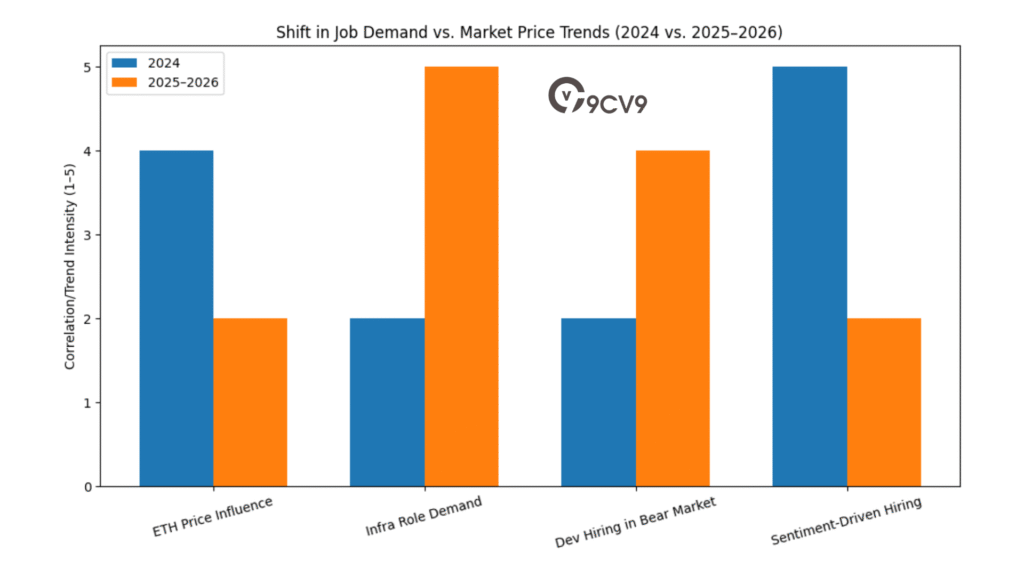

b. Correlation with Market Performance

In previous years, the number of job opportunities in the blockchain and Web3 sector often rose or fell depending on the market prices of major cryptocurrencies—especially Ethereum (ETH). When ETH prices surged, job postings increased. When prices dropped, hiring usually slowed down. This trend was widely observed and accepted across the industry.

However, by late 2025 and into early 2026, a significant shift in this pattern has emerged. The connection between asset prices and job openings has weakened. While ETH and other major coins still impact overall industry sentiment, hiring trends—especially for technical infrastructure roles—have become more stable and long-term in nature.

Job Demand Trends vs. Market Price Volatility

A deeper look into the data shows that even when the prices of major digital assets experienced fluctuations, the demand for specific roles—such as protocol engineers, DevOps specialists, and infrastructure developers—remained consistent. This shift highlights that blockchain companies are increasingly focusing on building long-term solutions and preparing for institutional partnerships, regardless of market volatility.

Industry Insight Table: Comparing Market Price Trends vs. Job Demand

| Indicator | 2024 Trend | 2025–2026 Shift Observed |

|---|---|---|

| ETH Price Influence on Job Openings | Strong correlation | Weaker and less direct |

| Infrastructure Role Demand During Market Dips | Declined during price drops | Remained stable |

| Developer Hiring in Bear Markets | Reduced or frozen | Continued hiring for protocol upgrades |

| Sentiment-Driven Hiring Decisions | Common across all departments | Limited to marketing & community roles |

Why the Decoupling Matters

The weakening link between crypto asset prices and job creation in 2026 signals the blockchain industry’s maturity. Companies are now building with a long-term perspective rather than reacting to short-term price movements. Institutional players, venture capitalists, and technology-driven startups are investing in foundational development—such as Layer 1 and Layer 2 solutions, cross-chain interoperability, and regulatory compliance systems.

As a result, professionals working in areas like infrastructure engineering, blockchain protocol development, tokenomics design, and compliance engineering enjoy greater salary stability, even during periods of market decline.

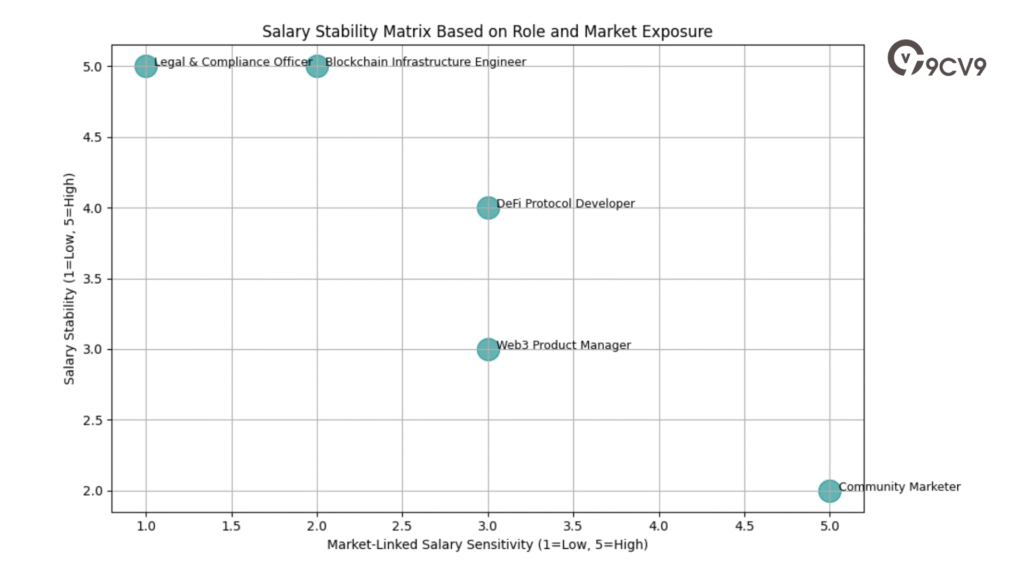

Salary Stability Matrix Based on Role and Market Exposure

| Role Category | Market-Linked Salary Sensitivity | Salary Stability in 2026 | Notes |

|---|---|---|---|

| Blockchain Infrastructure Engineer | Low | High | Driven by long-term roadmap needs |

| Web3 Product Manager | Medium | Moderate | Slight fluctuation based on product funding cycles |

| Community and Growth Marketer | High | Low | Closely tied to market sentiment and token performance |

| DeFi Protocol Developer | Medium | High | Backed by venture capital and protocol funding |

| Legal and Compliance Officer | Low | High | Growth fueled by regulatory frameworks like MiCA |

Conclusion: From Speculation to Sustainability

The 2026 Web3 job market reflects a more grounded and forward-looking approach. The days when hiring decisions were purely driven by coin prices are gradually fading. Instead, what drives demand now is protocol utility, infrastructure reliability, and regulatory alignment.

For job seekers and employers alike, this means that salary trends are becoming more predictable in critical roles—especially those involved in building the backbone of decentralized ecosystems. This also positions the Blockchain and Web3 sector as a more dependable career field for professionals looking beyond the ups and downs of token markets.

2. Technical Roles and Engineering Compensation

a. Blockchain Developer Salary Benchmarks

In 2026, technical roles in the blockchain and Web3 sector continue to command the highest salaries across the industry. The core reason behind this trend lies in the high-level expertise required to build secure, scalable, and interoperable decentralized systems. These systems are the foundation of the Web3 economy, and the engineers responsible for their development are both scarce and in high demand.

Key Differences Between Web3 Developers and Blockchain Engineers

The Web3 ecosystem has matured to a point where clear distinctions exist between different types of technical professionals:

- Web3 Developers: Typically focused on building the front-end of decentralized applications (dApps), user interface integrations, wallet connectivity, and basic smart contract interactions.

- Blockchain Engineers: Specialize in deep protocol-level development, smart contract logic, cryptographic systems, and infrastructure deployment across blockchain networks.

This separation of responsibilities allows companies to hire based on the specific technological needs of their products and protocols, leading to more accurate salary segmentation across job categories.

Global Blockchain Developer Salary Benchmarks – 2026

The table below outlines average and maximum salary figures for various technical roles in the Web3 domain as of January 2026:

Blockchain & Web3 Engineering Salary Table – Global Benchmarks (2026)

| Role Title | Average Annual Salary (USD) | Maximum Annual Salary (USD) |

|---|---|---|

| Protocol Engineer | $160,000 | $262,000+ |

| Smart Contract Developer | $104,500 | $250,000 |

| Full-Stack Web3 Developer | $125,000 | $250,000 |

| Web3 DevOps Engineer | $155,500 | $250,000+ |

| Frontend Web3 Developer | $119,500 | $262,000+ |

| Architect Developer | $160,000 | $275,000 |

Hourly Rate Matrix for Blockchain Technical Roles – 2026

| Role Type | Average Hourly Rate (USD) | Highest Hourly Rate (USD) |

|---|---|---|

| Blockchain Developer | $78 | $136 |

| Smart Contract Engineer | $72 | $130 |

| Web3 Infrastructure Dev | $80 | $140 |

These figures demonstrate the substantial earnings potential for engineers, especially those working with protocols and complex blockchain infrastructures.

High-Paying Technical Roles Driving the Web3 Infrastructure Evolution

The premium compensation for roles like Protocol Engineers and DevOps specialists highlights the market’s pivot toward more advanced technical infrastructure. Companies are no longer just launching experimental dApps—they are now building production-grade platforms that must support millions of users across multiple blockchain networks.

This push toward reliability and scalability explains the heightened demand for professionals skilled in:

- Layer 1 and Layer 2 protocol implementation

- Multi-chain deployment and cross-chain communication

- On-chain security auditing and automated testing pipelines

- Advanced DevOps practices for decentralized environments

Role Functionality and Compensation Alignment Table

| Technical Role | Key Responsibilities | Why the High Salary? |

|---|---|---|

| Protocol Engineer | Designing base-layer blockchain logic and cryptographic systems | Directly impacts scalability and consensus security |

| Web3 DevOps Engineer | Managing CI/CD pipelines and multi-network deployments | Essential for performance and security in production apps |

| Full-Stack Web3 Developer | Handling both frontend and smart contract integration | Versatile skill set valued in small-to-mid sized teams |

| Smart Contract Developer | Writing and auditing Solidity or Vyper contracts | High risk; directly tied to asset and protocol security |

| Architect Developer | Designing modular systems for blockchain platforms | Guides entire product infrastructure and scalability plans |

Conclusion: Specialized Technical Talent Powers the Web3 Industry in 2026

As blockchain platforms become more sophisticated and their user bases expand, the need for skilled engineers has never been higher. Organizations are competing globally for a limited pool of experienced developers who can deliver secure, scalable, and robust systems.

In 2026, top-tier salaries reflect more than just seniority—they signify a combination of deep protocol knowledge, high-impact responsibilities, and the ability to build reliable decentralized infrastructure. Whether building next-generation smart contracts or optimizing cross-chain performance, technical professionals remain the most valuable asset in the Web3 job market.

b. Historical Salary Trends for Technical Talent

The evolution of salaries for blockchain developers and Web3 engineers between 2021 and 2026 reflects how compensation has shifted in response to market speculation, venture capital influx, token release cycles, and broader industry maturity. From periods of extreme salary spikes to more sustainable compensation models, the historical data paints a detailed picture of how technical salaries in Web3 have developed globally.

Salary Volatility and Market Influences

In certain peak moments—particularly in late 2024—salary reports for top technical roles indicated unusually high figures. These anomalies, which included averages reported above $1 million, were likely due to early token allocations, executive hiring for newly launched protocols, or short-term reward mechanisms tied to startup funding rounds. These were not reflective of industry-wide norms but represented isolated events during speculative market phases.

By contrast, the current trend as of January 2026 shows a strong market correction. Average yearly salaries for experienced and specialized technical professionals have settled around a sustainable global benchmark of $181,000, with a clear industry shift toward long-term equity models and deferred compensation through token vesting.

Historical Salary Trends for Blockchain Developers and Web3 Engineers (2021–2026)

| Time Period | Reported Average Yearly Salary (USD) |

|---|---|

| January 2022 | $239,000 |

| January 2023 | $409,000 |

| January 2024 | $184,000 |

| November 2024 | $1,139,000 |

| January 2025 | $377,000 |

| December 2025 | $272,000 |

| January 2026 | $181,000 |

Key Observations from the Historical Salary Chart

- 2022–2023: A significant rise occurred in 2023 due to bullish sentiment and aggressive startup scaling.

- November 2024: An extraordinary spike in reported salaries skewed averages due to large token allocations and speculative executive hiring. This was not representative of most developers in the space.

- 2025: A gradual correction began as the funding climate tightened and token values normalized.

- 2026: The market has matured, with more emphasis on structured salaries, deferred equity, and sustainable compensation models.

Understanding Effective Compensation in Web3

In the Web3 space, salaries often include more than just cash payments. Many technical professionals are offered token incentives, project equity, and performance-based rewards. However, the value of these benefits can vary greatly depending on the timing of token generation events, vesting schedules, and the liquidity of the tokens received.

Compensation Structure Evolution Matrix (2021–2026)

| Compensation Element | Early-Stage (2021–2023) | Mature Stage (2024–2026) |

|---|---|---|

| Base Salary Focus | Less important | More structured and benchmarked |

| Token Incentives | High risk, high reward | Integrated into vesting schedules |

| Signing Bonuses | Common in competitive hiring | Less frequent but more strategic |

| Long-Term Equity | Rare and loosely defined | More standardized across DAO/startups |

| Vesting and Lock-In Period | Often unclear or short | Clearer terms, 2–4 year vesting norms |

Conclusion: From Exuberance to Equity-Oriented Compensation

The Web3 and blockchain industry has moved past its hyper-volatile compensation era. While high salaries are still possible—particularly for top-tier protocol engineers and smart contract developers—the focus has now shifted toward stability, transparent equity structures, and sustainable rewards.

This change benefits both professionals and employers by reducing financial unpredictability and aligning incentives with long-term project success. As the industry continues to grow in complexity and institutional backing, professionals entering the blockchain field in 2026 can expect compensation packages that are competitive, realistic, and designed for long-term contribution rather than short-term speculation.

c. Specialization and Language Premiums

In 2026, expertise in specific programming languages plays a crucial role in defining salary structures across the global Blockchain and Web3 industry. As blockchain protocols and decentralized applications become more complex, companies are seeking developers with in-depth knowledge of language stacks that power both core infrastructure and user-facing products.

Professionals with specialized knowledge in high-performance and blockchain-native languages are increasingly valued. These languages are closely linked with the core systems of decentralized finance, gaming platforms, and scalable blockchain networks. The salary variations associated with each programming language reflect the current demand and the strategic importance of these skills in Web3 product development.

Global Average Salary Matrix by Programming Language in Blockchain & Web3 – 2026

| Programming Language / Stack | Use Case Focus | Average Annual Salary (USD) | Maximum Annual Salary (USD) |

|---|---|---|---|

| Rust | Solana, Layer 1 Protocols, High-Performance Systems | $155,000 | $225,000+ |

| Go | Ethereum Infrastructure, Backend Microservices | $170,000 | $200,000+ |

| Solidity | Smart Contracts for EVM-Based Networks | $100,326 | $180,000 – $210,000 |

| Unity | GameFi, Web3 Gaming with Real-Time Graphics | $130,000 | $228,000 |

| Python | Blockchain Analytics, AI Integration, Data Stacks | $112,382 | $160,000+ |

Why Rust and Go Earn Higher Compensation

Rust and Go are associated with critical backend systems in Web3. Rust, for instance, is the backbone of Solana and is known for its speed, memory safety, and concurrency, making it ideal for performance-driven protocols. Go is widely used in Ethereum infrastructure projects, especially in backend architecture, node development, and microservice scalability. Due to their technical difficulty and smaller developer pool, both languages earn significant salary premiums.

Solidity’s Continued Relevance in Smart Contract Development

Solidity remains the foundational language for developers building decentralized applications on the Ethereum Virtual Machine (EVM). Although the average salary for Solidity developers is slightly lower than Rust and Go experts, top performers—especially those working on high-value DeFi protocols—can still command salaries exceeding $200,000. The prevalence of Solidity in the broader ecosystem ensures steady demand and wide-ranging job opportunities.

Unity and the Rising GameFi Sector

The GameFi industry has evolved significantly in 2026, transitioning from simple play-to-earn models to immersive, fun-first gaming experiences powered by blockchain infrastructure. Unity has become the go-to engine for building Web3 games, allowing developers to blend traditional game development with blockchain-based reward systems. This rising demand is reflected in the high salary ceiling for Unity developers, particularly those working on large-scale GameFi platforms.

Python’s Role in Data, AI, and Blockchain Analytics

Python remains a highly relevant language in the Web3 space, particularly for roles focused on artificial intelligence, blockchain analytics, and data automation. While not a core blockchain development language, Python supports backend services, performance monitoring, and machine-learning integrations, making it valuable for projects requiring data-driven insights.

Programming Language Compensation Comparison Table – 2026

| Language | Primary Blockchain Role | Difficulty to Master | Developer Availability | Salary Competitiveness |

|---|---|---|---|---|

| Rust | Layer 1 Protocols, Runtime Optimization | High | Low | Very High |

| Go | Infrastructure & Node Development | Medium-High | Medium | High |

| Solidity | Smart Contract Development (EVM Networks) | Medium | High | Moderate-High |

| Unity | Blockchain Game Development (GameFi) | Medium | Medium-High | High |

| Python | Blockchain AI, Data Engineering, Analytics | Low-Medium | High | Moderate |

Conclusion: Specialized Language Skills Drive Higher Salaries in Web3

In the global Web3 job market of 2026, programming language expertise is no longer a general skill—it’s a strategic asset. Developers who master in-demand languages such as Rust and Go are positioned to secure top-tier roles with premium compensation, particularly in protocol engineering and blockchain infrastructure.

Meanwhile, the GameFi space is expanding the scope of Web3 development by incorporating tools like Unity, creating new, well-paid opportunities for game developers entering the decentralized ecosystem. As Web3 projects continue to push the boundaries of scalability, usability, and performance, the demand for skilled language specialists will remain one of the strongest drivers of salary growth in the industry.

d. Seniority and Experience Tiers

In the 2026 global Blockchain and Web3 job landscape, the meaning of seniority has evolved far beyond simply counting years of experience. Employers in this space now assess seniority based on the developer’s technical contributions, especially in areas like secure smart contract deployment, participation in decentralized governance, and involvement in successful Web3 protocol launches.

This shift toward performance-based evaluation has reshaped salary structures across the experience spectrum. Developers who can demonstrate hands-on achievements—such as writing audited, bug-free smart contracts or building secure Layer 1 or Layer 2 infrastructure—are commanding significantly higher compensation packages.

Global Web3 Salary by Seniority Level – 2026 Benchmark

| Experience Tier | Average Global Salary (USD) | Average US-Based Salary (USD) |

|---|---|---|

| Junior (0–2 Years) | $35,000 | $93,000 |

| Mid-Level (2–5 Years) | $63,000 | $158,000 |

| Senior (5+ Years) | $100,000 | $215,000 |

| Lead / Principal | $150,000 | $230,000+ |

| CTO / Head of Engineering | $150,000 – $224,000 | $300,000 – $375,000 |

The chart above illustrates the substantial salary increases that come with higher levels of proven expertise and strategic impact. The jump from junior to senior level compensation frequently exceeds 200%, largely due to the heightened expectations around code security and protocol reliability.

Factors Driving Salary Differences Between Experience Tiers

Blockchain and Web3 projects operate in an environment where technical mistakes can lead to multi-million-dollar losses. Therefore, employers place immense value on individuals who have proven their ability to deliver robust, exploit-resistant code and manage high-stakes deployments.

Some of the core differentiators for higher-tier talent include:

- Audited Smart Contract Histories: Developers with code that has passed formal third-party audits are trusted more with mission-critical responsibilities.

- Governance Participation: Engineers involved in DAO decision-making processes are viewed as more aligned with decentralized operations and protocol strategy.

- Security Track Record: A history of launching protocols without critical bugs or exploits significantly increases hiring value.

Skill-Based Salary Impact Matrix – Web3 Roles in 2026

| Competency Area | Influence on Salary Uplift | Notes |

|---|---|---|

| Exploit-Free Smart Contract Deployment | Very High | Demonstrates maturity and reduces project risk |

| DAO Governance Involvement | Moderate | Shows alignment with decentralized business models |

| Audit and Testing Framework Mastery | High | Enhances confidence in production readiness |

| Community-Based Open Source Contributions | Moderate | Recognized in reputation scoring, especially in DAO hiring |

| Multi-Chain Deployment Experience | High | Valuable for cross-chain protocol development |

Retention Bonuses and Token-Based Incentives for Senior Talent

Due to fierce global competition for top-tier blockchain engineers, many organizations are now offering retention packages to prevent high-performing talent from being poached. These packages often include token-based bonuses, long-term vesting equity in the form of governance tokens, and milestone-based incentives tied to protocol development or launch stages.

Common Retention Strategies for Senior Engineers – 2026

| Incentive Type | Description | Target Group |

|---|---|---|

| Token Retention Bonuses | Additional tokens vested over 12–36 months | Senior & Lead Developers |

| Equity in DAO Governance | Voting rights and revenue-sharing through governance tokens | Principal Engineers & CTOs |

| Launch Milestone Bonuses | One-time bonuses upon achieving key technical deployments | Protocol Engineers |

| Developer Pool Allocations | Reserve tokens allocated to high-impact contributors | Multi-chain DevOps Engineers |

Conclusion: Experience-Driven Compensation Defines Web3 Salaries in 2026

In 2026, the Blockchain and Web3 industry rewards developers based not only on their years of experience but also on their direct technical impact, audit histories, and contributions to decentralized ecosystems. The large salary gap between junior and senior talent is a reflection of the critical nature of secure coding in decentralized systems and the financial consequences of technical errors.

With employers prioritizing talent who can deliver production-ready, secure, and scalable solutions, experience tiers have become more meaningful than ever. Developers aiming for senior positions should focus on building a proven track record of secure smart contract deployments, multi-chain architecture, and participation in protocol governance to unlock the highest salary bands in this competitive global market.

3. Non-Technical Roles: The Rise of the Crypto-Professional

a. Non-Tech Salary Overview (January 2026)

In 2026, one of the most notable transformations in the global Blockchain and Web3 job market is the rapid elevation of non-technical roles. What was once a developer-dominated industry has expanded to require a wide range of professionals who can translate complex blockchain systems into scalable business operations, community strategies, legal compliance, and user-centric products.

Unlike traditional tech industries, Web3 companies now demand that even non-engineering professionals possess a working knowledge of on-chain activities, decentralized governance mechanisms (like DAOs), token incentives, and the broader regulatory environment. This growing complexity has significantly raised the value—and salaries—of these roles.

Compensation Benchmark Table: Non-Technical Web3 Roles (January 2026)

| Position | Average Annual Salary (USD) | Maximum Annual Salary (USD) |

|---|---|---|

| Legal Counsel | $170,000 | $275,000 |

| Product Manager | $170,000 | $265,000 |

| Finance Manager | $148,000 | $277,000 |

| HR / People Operations | $137,000 | $242,000 |

| Sales / Business Dev | $134,000 | $270,000 |

| Marketing Manager | $120,000 | $225,000 |

| Community Manager | $80,000 | $178,000 |

These salary benchmarks reflect a significant upward adjustment compared to traditional tech roles. In Web3, these positions often require a hybrid of domain expertise, blockchain fluency, and cross-functional execution skills.

Why Non-Technical Web3 Roles Now Command Higher Salaries

Several factors are contributing to this shift in compensation dynamics:

- Deeper Skill Requirements: Non-technical professionals must now understand token economics, DAO governance, and decentralized user behavior to make effective decisions.

- Cross-Functional Responsibility: Many non-tech roles serve as the interface between developers and users, requiring strong communication and strategic alignment across teams.

- Regulatory Complexity: As the industry matures, especially with global frameworks like MiCA in full effect, legal and compliance roles require both regulatory knowledge and crypto fluency.

- Talent Scarcity: There is a shortage of professionals who combine traditional expertise in finance, law, marketing, or HR with an understanding of decentralized systems.

High-Growth Roles: Legal, Compliance, and Governance

The most dramatic rise in compensation has occurred within legal and compliance functions. As more jurisdictions implement crypto-specific regulatory frameworks, professionals who can interpret and implement these laws while advising decentralized organizations are in extremely high demand.

Regulatory Talent Compensation Matrix – 2026

| Role Type | Core Responsibility | Market Demand Level | Compensation Growth (Since 2024) |

|---|---|---|---|

| Legal Counsel (Crypto Focused) | Interpret legal frameworks like MiCA, draft DAO terms | Very High | +32% |

| Compliance Officer (Web3-native) | Manage regulatory risk, token compliance, audit mechanisms | Extremely High | +41% |

| Governance Strategist | Design DAO models, voting frameworks, governance protocols | High | +26% |

Operational and Community Roles: Strategic in DAO Success

In decentralized organizations, roles such as HR, Community Management, and Product Ownership are evolving beyond traditional corporate definitions. These professionals play a direct role in shaping token incentive structures, coordinating with distributed teams across time zones, and engaging with communities that function as both users and stakeholders.

Community and Ops Role Comparison – Web3 vs. Traditional Tech

| Position | Traditional Tech Focus | Web3 Role Expansion | Salary Impact |

|---|---|---|---|

| HR / People Ops | Hiring, benefits, retention | DAO contributor onboarding, decentralized payroll | +15–20% |

| Community Manager | Social media, events | On-chain engagement, governance facilitation | +25–30% |

| Product Manager | Feature roadmap and delivery | Token utility design, protocol roadmap ownership | +20–25% |

Conclusion: The Rise of the Crypto-Professional in 2026

The Blockchain and Web3 industry of 2026 is no longer exclusive to coders and developers. Non-technical professionals who bring both conventional industry expertise and a strong grasp of decentralized technologies are increasingly seen as mission-critical hires.

From legal advisors navigating regulatory complexity to product managers shaping token economies, these roles form the operational backbone of the decentralized future. As demand continues to rise and the talent pool remains limited, compensation for these professionals is expected to remain highly competitive throughout the Web3 ecosystem.

b. Detailed Analysis: Web3 Product Management

In the evolving Web3 industry of 2026, the role of a Product Manager (PM) is far more advanced than in traditional tech companies. Web3 Product Managers are expected to operate at the intersection of technology, user experience, token economics, and decentralized governance. These professionals are not only responsible for delivering features or managing product roadmaps but also for shaping smart contract lifecycles, coordinating liquidity provisioning, and aligning with community governance frameworks across decentralized autonomous organizations (DAOs).

This expanded scope has made Web3 product management a high-value and high-pressure function, particularly within venture-backed startups and blockchain protocol firms operating in leading innovation hubs.

Salary Comparison Table for Web3 Product Managers by Location – 2026

| Location | Average Annual Salary (USD) | Average Hourly Wage (USD) |

|---|---|---|

| Cupertino, California | $196,665 | $94.55 |

| Sitka, Alaska | $192,032 | $92.32 |

| Wyoming | $190,110 | $91.40 |

| San Francisco, California | $187,806 | $90.29 |

| Remote (Global Average) | $80,000 | $42.00 |

This salary matrix highlights a striking disparity between on-site product managers in the U.S. and remote, globally distributed PMs. Professionals working within high-cost urban centers like Silicon Valley often earn more than double their remote counterparts due to the proximity to startup capital, venture ecosystems, and protocol headquarters.

Factors Influencing Product Manager Salaries in Web3

The large gap in earnings across geographies and roles is not random. It reflects the combination of skill expectations, project complexity, and institutional backing. Below is a breakdown of the most common elements influencing salary levels for Web3 Product Managers:

Key Variables Driving Web3 PM Compensation

| Factor | Description | Salary Impact |

|---|---|---|

| Location (On-site vs. Remote) | Proximity to major Web3 hubs leads to higher salary benchmarks | Very High |

| Venture Funding of Employer | Backing from top-tier investors boosts compensation capacity | High |

| Protocol Experience (DeFi/NFT/Gaming) | Specialized knowledge of smart contracts, liquidity, tokenomics | High |

| DAO Governance Participation | Familiarity with community voting, incentive alignment | Moderate |

| Multi-Chain Product Exposure | Experience building for multiple L1s or L2s | Moderate |

| Open Source Contributions | Recognition in community-led development | Moderate |

Skills and Knowledge Areas Critical for 2026 Web3 PMs

Web3 Product Managers must develop proficiency in several blockchain-specific domains that have a direct impact on product execution and ecosystem adoption. These include:

- Smart Contract Lifecycle Management: From deployment to upgrade planning and incident handling

- Liquidity Strategy and Token Economics: PMs often help design incentive structures for staking, farming, or liquidity bootstrapping

- Decentralized Governance and DAO Tooling: Understanding how community proposals, voting, and execution flows work in decentralized environments

- Cross-Chain Deployment and Scaling: Navigating integrations across Ethereum, Solana, Polygon, and other ecosystems

Competency Matrix: Web3 PM Role Scope in 2026

| Core Competency Area | Level of Importance in Web3 Product Role | Common in Traditional PM Roles? |

|---|---|---|

| Smart Contract Architecture | Critical | Rare |

| DAO Proposal Lifecycle Management | Essential | Uncommon |

| Token Utility & Emissions Planning | High | Not Applicable |

| Liquidity Mechanism Understanding | Important | Rare |

| Frontend & Wallet UX Coordination | Important | Common |

| Agile Delivery and Roadmapping | Fundamental | Common |

Conclusion: Strategic, Technical, and Token-Aware – The New PM Standard in Web3

The 2026 Web3 ecosystem demands a new breed of Product Managers—those who are not just organizational coordinators but blockchain-native strategists. They need to understand not only user needs and feature prioritization but also how tokenomics influence product adoption and how community governance shapes product evolution.

Salaries for Web3 PMs reflect this expanded skill set. While remote roles offer strong global opportunities, professionals working in U.S.-based or venture-funded hubs continue to earn premium compensation. As more decentralized platforms mature and user experience becomes central to blockchain success, the demand for multidisciplinary PMs with both business and on-chain fluency is expected to grow significantly.

c. Marketing and Community Dynamics

In 2026, the function of marketing and community engagement in the Blockchain and Web3 ecosystem has fundamentally shifted from hype-driven campaigns to long-term ecosystem development. The professionals shaping user engagement are now deeply embedded in protocol architecture, brand expansion, and decentralized community governance.

Community Architects, Technical Content Strategists, Growth Leads, and Brand Developers are no longer seen as peripheral support staff—they are now considered critical to protocol success. These roles help educate users, onboard developers, and build vibrant communities that strengthen the value and utility of blockchain platforms.

Global Salary Matrix: Web3 Marketing Roles by Experience – 2026

| Experience Level | Median Annual Salary (USD) | Common Salary Range (USD) |

|---|---|---|

| Junior (0–2 years) | $65,000 | $60,000 – $70,000 |

| Mid-Level (2–5 years) | $115,000 | $100,000 – $120,000 |

| Senior (5–10 years) | $160,000 | $150,000 – $180,000 |

| Executive / CMO | $210,000 | $400,000 – $1,000,000+ (Total) |

These figures show how compensation has matured, especially at the executive level, where marketing leaders play a central role in brand strategy, community token incentive models, and growth-based KPIs. For Chief Marketing Officers (CMOs) at top blockchain protocols, the base salary is often only a small component of total compensation. Performance-based bonuses, token allocations, and DAO voting rights regularly push total earnings well into seven-figure territory.

Tokenized Incentives and Performance-Based Structures in Web3 Marketing

High-level marketing professionals, particularly those working at exchanges, DeFi protocols, and Layer 1 foundations, often receive a significant portion of their compensation through token-based incentives. These packages are designed to align incentives with protocol growth, community engagement, and product adoption metrics.

Executive-Level Marketing Compensation Breakdown – 2026

| Compensation Component | Description | Common Allocation (% of Total) |

|---|---|---|

| Base Salary | Fixed annual cash income | 15–25% |

| Token Allocation | Governance or utility tokens with vesting | 40–50% |

| Performance Bonus | Revenue, user base, or engagement-based incentives | 20–30% |

| Equity or DAO Voting Rights | Governance participation or equity in DAO LLCs | 5–10% |

This structure reflects the Web3 philosophy of decentralization and ownership. Marketing executives are no longer incentivized purely through short-term KPIs like ad spend or click-through rates—they are rewarded for long-term contributions to user retention, community growth, and revenue scalability.

Expanded Marketing Roles in the Web3 Landscape

As Web3 projects become more productized and user-centric, traditional marketing functions have evolved into highly specialized, blockchain-native disciplines. These include:

- Community Architects: Design token-based engagement systems, organize DAO-driven events, and align content strategies with community voting cycles

- Technical Writers & Content Strategists: Translate whitepapers, protocol upgrades, and complex smart contract features into digestible formats

- Growth Hackers / Ecosystem Marketers: Execute multi-chain campaigns to attract developers, liquidity providers, and node operators

- Brand Stewards: Build trusted narratives for decentralized organizations that compete in increasingly saturated markets

Functionality and Compensation Matrix: Web3 Marketing Roles – 2026

| Role Type | Strategic Focus | Market Demand Level | Compensation Tier |

|---|---|---|---|

| Community Architect | On-chain engagement design, DAO alignment | High | Mid–High |

| Technical Content Strategist | Developer onboarding, documentation, protocol updates | Moderate–High | Mid |

| Growth Lead | KPI-focused scaling, campaign-driven growth | Very High | High |

| Brand/Creative Director | Narrative control, cross-platform identity, partnership | Moderate | Mid–High |

Conclusion: Strategic, Token-Aware, and DAO-Aligned Marketing Professionals Are Driving Web3 Growth in 2026

The Blockchain and Web3 industry in 2026 is no longer driven by speculative hype—it is powered by strategic growth models, community-led governance, and authentic brand trust. The professionals behind this evolution are highly compensated for their ability to translate complex technologies into compelling narratives and engaged communities.

As projects compete for user attention and developer loyalty in a decentralized world, the demand for experienced, blockchain-native marketing professionals continues to rise. Their compensation packages reflect the strategic weight they now carry, marking a clear shift in how Web3 organizations invest in sustainable ecosystem expansion.

4. Geographic Benchmarking: The Global Talent Map

a. Top-Paying Regions by Mid-Level Salaries (USD)

Although the Blockchain and Web3 workforce continues to operate with a remote-first mindset in 2026, salary trends around the world reveal that geography still significantly affects how much professionals earn. Factors such as local cost of living, tax structures, regulatory environments, and employer location all play a major role in shaping total compensation and take-home pay.

A growing pattern of Geographic Arbitrage is being observed, especially among startups headquartered in high-paying markets like the United States and Western Europe. These companies often hire skilled talent from lower-cost regions such as Latin America, Southeast Asia, and Eastern Europe. This approach helps organizations reduce payroll costs while still acquiring experienced professionals capable of delivering high-quality output.

Global Salary Benchmark Table for Mid-Level Web3 Professionals – 2026

| Country / Region | Average Mid-Level Salary (USD) |

|---|---|

| United States | $145,000 |

| Switzerland | $140,000 |

| Singapore | $135,000 |

| Germany | $115,000 |

| United Arab Emirates | $110,000 |

| United Kingdom | $108,000 |

| Remote (Global Avg) | $93,000 |

| India | $42,000 |

| Brazil | $38,000 |

This table demonstrates the substantial salary differences between high-income regions and emerging markets. While talent in countries like Brazil or India may earn less in absolute terms, their cost-adjusted earnings can often provide a competitive quality of life.

Why Top Regions Like the U.S., Switzerland, and Singapore Pay More

Several economic and structural factors explain why countries like the United States, Switzerland, and Singapore offer significantly higher salaries for mid-level Web3 professionals:

- Regulatory Leadership: Switzerland and Singapore have developed strong legal frameworks to support blockchain development, attracting leading projects and venture capital.

- Tax and Investment Incentives: These countries offer favorable environments for Web3 startups and capital flows.

- Institutional Capital and Startup Density: The U.S. remains the global hub for venture-backed crypto startups, particularly in cities like San Francisco, New York, and Miami.

Web3 Salary Progression Example: Singapore Blockchain Developers (2026)

| Experience Level | Monthly Salary (SGD) | Notes |

|---|---|---|

| Junior Developer (0–2 yrs) | 4,330 SGD | Entry-level roles at fintech and DeFi firms |

| Mid-Level (3–7 yrs) | 6,500 SGD | Strong command of Solidity or Rust expected |

| Senior (10+ yrs) | 9,000 SGD | Often include project leadership responsibilities |

| Lead/Principal (20+ yrs) | 10,000+ SGD | Strategic roles with protocol or architecture scope |

Singapore’s structured salary growth model reflects its long-standing focus on fintech development and career longevity. Professionals there benefit from consistent pay increases aligned with experience and certifications, especially in areas like compliance, DeFi engineering, and cross-chain protocol work.

Geographic Arbitrage Matrix: Hiring Strategies in Web3 Startups – 2026

| Employer Region | Common Hiring Targets | Reason for Geographic Choice |

|---|---|---|

| U.S. and Europe | Latin America, Southeast Asia | Lower labor costs, high technical skill availability |

| Singapore and UAE | India, Eastern Europe | Growing regional blockchain ecosystems, strong talent |

| Switzerland and Germany | Remote-first teams globally | Compliance advantage, decentralized team structures |

Conclusion: Geography Still Matters in a Decentralized Industry

While Web3 promotes decentralization, salary data in 2026 clearly shows that location still plays a pivotal role in defining compensation levels. Professionals based in high-income countries enjoy premium salaries, especially when working for protocol foundations or heavily funded DAOs. Meanwhile, workers in emerging markets are increasingly integrated into global projects through cost-optimized hiring models.

For professionals and employers alike, understanding the geographic variables that influence pay—such as regulation, local industry maturity, and tax policy—is essential for making informed career and talent acquisition decisions in the global Web3 economy.

b. The Dubai/UAE Competitive Advantage

Dubai and the wider UAE region have rapidly emerged as one of the most attractive destinations for Blockchain and Web3 professionals in 2026. With a well-defined regulatory framework, zero percent personal income tax, and a proactive government strategy to position the region as a fintech innovation center, Dubai is offering both financial and professional advantages that are hard to match globally.

Through the support of the Virtual Assets Regulatory Authority (VARA) and streamlined visa policies, Dubai has successfully created a welcoming environment for blockchain companies, crypto exchanges, and decentralized startups. These advantages are now reflected in the city’s growing role as a magnet for top global Web3 talent.

Income Comparison: Dubai vs. Global Cities

One of Dubai’s strongest selling points is its tax-free salary structure. A Web3 professional earning $95,000 annually in Dubai retains almost the same take-home pay as someone earning $135,000 in New York City, once personal income taxes are accounted for.

Net Salary Equivalency Table – 2026

| Location | Gross Salary Needed for Equivalent Take-Home (USD) |

|---|---|

| Dubai, UAE | $95,000 |

| New York, USA | $135,000 |

| London, UK | $128,000 |

| Berlin, Germany | $123,000 |

| Singapore | $118,000 |

This favorable income structure, combined with high-quality infrastructure, modern lifestyle, and a thriving tech ecosystem, makes Dubai one of the most lucrative locations for blockchain professionals seeking both high earnings and a premium standard of living.

Salary Benchmarks for Web3 Roles in Dubai – 2026

| Role Title | Monthly Salary (AED) | Annual Salary Equivalent (USD) |

|---|---|---|

| Smart Contract Auditor | 40,000 – 70,000 | $130,000 – $228,000 |

| Tokenization Specialist | 35,000 – 60,000 | $114,000 – $195,000 |

| Compliance Manager | 30,000 – 50,000 | $98,000 – $163,000 |

| Blockchain Developer | 25,000 – 40,000 | $81,000 – $130,000 |

| DeFi Risk Analyst | 22,000 – 35,000 | $71,000 – $114,000 |

These salary ranges position Dubai competitively against traditional Web3 powerhouses like the United States, Switzerland, and Singapore. The city’s emphasis on protocol auditing, digital asset tokenization, and regulatory compliance reflects its long-term vision of becoming a global hub for next-generation finance.

Visa Sponsorship and Accessibility for Global Talent

What further strengthens Dubai’s advantage is its inclusive employment and relocation policy. According to 2026 labor data, approximately 97% of Web3 jobs in Dubai include visa sponsorship, making it the most open high-paying Web3 job market for international professionals.

Talent Accessibility Matrix – Dubai vs. Other Global Hubs

| City / Region | Visa Sponsorship Availability | Tax Efficiency | Market Demand for Web3 Roles | Talent Accessibility Rating |

|---|---|---|---|---|

| Dubai, UAE | 97% | Very High | High | Excellent |

| Singapore | 78% | Moderate | High | Very Good |

| London, UK | 62% | Low | High | Moderate |

| New York, USA | 55% | Low | Very High | Moderate |

| Berlin, Germany | 60% | Low–Moderate | Medium | Moderate |

Dubai’s strategic initiatives have helped to lower the barriers of entry for overseas developers, analysts, and compliance professionals, providing fast-track relocation options and long-term residence visas tailored specifically for digital economy workers.

Conclusion: Why Dubai Leads the Web3 Salary and Talent Market in 2026

With its zero-tax regime, competitive salaries, streamlined work visas, and regulatory clarity under VARA, Dubai has positioned itself as a top-tier global destination for Blockchain and Web3 professionals. The local job market not only matches global salary standards but also provides better net earnings, fewer bureaucratic hurdles, and increasing access to growth opportunities in decentralized finance, tokenization, and Web3 compliance.

As more organizations look for scalable, cost-efficient, and regulation-friendly locations to base their operations, Dubai’s position as a leading crypto employment hub is expected to strengthen further in the coming years.

c. The United States and Canada: High Variance Hubs

In 2026, North America continues to be one of the highest-paying regions globally for Web3 professionals. However, compensation in the United States and Canada is no longer concentrated in just a few tech metropolises. Due to the increasing acceptance of fully remote work and the decentralised structure of Web3 startups, salary opportunities have begun to spread more evenly across secondary and emerging markets.

While the average annual salary for a blockchain developer in the United States stands at approximately $140,477, recent data reveals that professionals in certain lesser-known Canadian cities are earning even more—benefiting from both high compensation and improved quality of life.

Web3 Salary Data by Selected North American Cities – 2026

| City / Province / State | Role Title | Annual Salary (USD) |

|---|---|---|

| Kentville, Nova Scotia | Web3 Developer | $178,607 |

| Whitehorse, Yukon | Web3 Developer | $177,471 |

| San Jose, California | Software Engineer | $167,420 |

| San Francisco, California | Software Engineer | $158,320 |

This trend showcases how the remote-first culture of blockchain development has unlocked access to high-paying opportunities for professionals in cities not traditionally seen as tech hubs. These new salary frontiers are emerging in areas offering either lower tax obligations, more affordable living costs, or lifestyle advantages, all while maintaining proximity to venture capital or technical ecosystems through hybrid and remote setups.

Comparative Matrix: Web3 Salary Potential by North American Region – 2026

| Region | Average Salary Range (USD) | Notable Advantage | Market Trend |

|---|---|---|---|

| Traditional US Tech Cities (SF, NYC) | $140,000 – $170,000 | Strong VC ecosystem, legacy infrastructure | Saturated and highly competitive |

| Emerging Canadian Cities | $150,000 – $180,000 | Lower cost of living, favorable remote laws | Growing demand, increased salaries |

| US Midwestern & Mountain States | $120,000 – $150,000 | Lower taxes, flexible remote opportunities | Expanding due to relocation trends |

| Canadian West & East Coast | $125,000 – $155,000 | Quality lifestyle, government-backed innovation zones | Gradual rise in crypto employment |

Why High Salaries Are Shifting to Unconventional Locations

Several key forces are influencing this redistribution of high-paying roles across the North American Web3 industry:

- Remote Work Normalization: The decentralized nature of blockchain projects allows companies to recruit talent regardless of physical location, giving professionals in smaller markets access to global compensation standards.

- Regional Cost Optimisation: Web3 firms and DAOs are strategically hiring in areas where high-skilled talent exists but living costs and tax burdens are lower, thus increasing both take-home pay for employees and reducing burn rates for employers.

- Lifestyle Preferences: Developers are relocating from major metro areas to cities with better work-life balance, lower housing costs, and community-driven ecosystems—without sacrificing earning potential.

Talent Strategy and Compensation Model Matrix – North America 2026

| Employer Type | Talent Targeting Strategy | Salary Benchmark Level | Remote Flexibility |

|---|---|---|---|

| US-Based Protocol Startups | Compete for top-tier talent nationally | High | Full Remote |

| Canadian Web3 Foundations | Attract local + global developers | Very High | Hybrid / Remote |

| Venture-Backed DAOs | Location-agnostic hiring | High | Fully Decentralised |

| Compliance & Legal Blockchain Firms | Regional specialists in low-cost areas | Moderate–High | Partial Remote |

Conclusion: North America’s Web3 Salary Landscape Is Redefining Geographic Boundaries

The Web3 revolution in North America has expanded beyond Silicon Valley, Toronto, and New York. High-paying roles are increasingly available in under-the-radar cities that offer compelling tax benefits, strong infrastructure, and the ability to support a remote global workforce.

For blockchain professionals equipped with in-demand skills such as smart contract auditing, token design, and cross-chain deployment, 2026 presents a unique opportunity to earn competitive salaries without needing to relocate to traditional tech centers. This democratization of talent across borders is helping to reshape where innovation and opportunity thrive in the decentralized economy.

5. Sector-Specific Compensation: Infrastructure vs. DeFi vs. DePIN

a. Compensation by Project Category

In the global Web3 talent landscape of 2026, salary levels and total compensation packages vary significantly depending on the sector in which a professional works. Not all blockchain projects offer the same earning potential. Compensation is directly influenced by the technical complexity, business model, funding structure, and long-term economic value of the sector.

Among all categories, infrastructure and protocol development remain the most lucrative career paths. These roles are considered foundational to the entire ecosystem, as they enable scalability, security, and interoperability across decentralized networks. In contrast, sectors like GameFi, NFTs, and service agencies offer more modest compensation, although they may present upside in token equity or creative royalties.

Median Total Compensation by Sector – Global Web3 Industry (2026)

| Sector / Category | Estimated Median Total Compensation (USD) | Key Drivers of Value |

|---|---|---|

| Infrastructure (Layer 1 / 2) | $145,000 – $160,000 | Protocol security, scalability, cross-chain logic |

| Centralized Exchanges | $135,000 – $150,000 | Strong fiat revenues, equity-based compensation |

| Layer 2 / Rollups (ZK, Optimism) | $130,000 – $145,000 | Technical specialization in zero-knowledge tech |

| DeFi Protocols | $110,000 – $130,000 | High token upside, complex smart contracts |

| GameFi / NFT Projects | $100,000 – $125,000 | High frontend demand (Unity, Unreal), user UX |

| Web3 Agencies / Services | $80,000 – $105,000 | Contract-based work, lower funding predictability |

This data shows that developers, engineers, and technical leads working in infrastructure-focused roles are often paid the highest due to the essential nature of their contributions to protocol design and performance. These roles often include performance-based token bonuses, especially if tied to Layer 1 or Layer 2 scalability improvements.

Compensation Matrix: Technical Specialization vs. Sector Value – 2026

| Sector | Complexity Level | Common Role Types | Upside Potential | Job Security Level | Compensation Tier |

|---|---|---|---|---|---|

| Infrastructure (L1/L2) | Very High | Protocol Engineers, Systems Architects | High | High | Top |

| DeFi Protocols | High | Smart Contract Devs, Token Strategists | Very High | Medium | Upper-Mid |

| Layer 2 / Rollups | Very High | ZK Engineers, Bridge Developers | Moderate–High | High | Upper-Mid |

| Centralized Exchanges | Medium–High | Backend Devs, Security Analysts | Moderate | Very High | Upper-Mid |

| GameFi / NFT | Medium | Unity Devs, UI/UX Designers | Moderate | Low–Medium | Mid |

| Web3 Service Agencies | Low–Medium | Freelancers, Consultants | Low | Project-Based | Lower Tier |

Why Infrastructure Roles Pay More in 2026

Several key reasons explain the salary dominance of the infrastructure sector:

- Capital-Intensive Nature: Infrastructure projects are usually funded by major VCs, foundations, or DAOs with long-term economic roadmaps.

- Scarcity of Talent: Engineers with skills in protocol design, ZK cryptography, and consensus mechanisms remain rare.

- Protocol Risk Management: Mistakes in core infrastructure carry the highest potential financial and security risks, justifying higher compensation.

Sector Risk-Reward Analysis for Web3 Careers – 2026

| Sector | Reward Potential | Volatility / Risk | Long-Term Viability | Common Bonus Structures |

|---|---|---|---|---|

| Infrastructure | Very High | Low–Medium | Very High | Token vesting, equity, retention |

| DeFi | High | Medium–High | High | Governance tokens, staking bonuses |

| Centralized Exchanges | Medium–High | Low | High | Equity, fiat bonuses |

| GameFi / NFTs | Moderate | High | Medium | NFT royalties, performance bonuses |

| Agencies / Freelancers | Low | Project-Based | Low–Medium | Per-project payments, flexible hours |

Conclusion: Sector Choice Strongly Impacts Web3 Salary Trajectories

For professionals exploring career paths in Web3, the sector they enter plays a significant role in determining their earning potential, job security, and long-term growth. While infrastructure-focused roles offer the highest compensation in 2026, other sectors like DeFi and GameFi may provide alternative paths to wealth via token exposure or creative involvement.

Understanding the compensation dynamics across each sector helps professionals make better decisions aligned with their skills, risk tolerance, and long-term career goals in the fast-evolving global blockchain economy.

b. The DePIN and Hardware Boom

In 2026, one of the most dynamic shifts in the Blockchain and Web3 job market is the rapid rise of Decentralized Physical Infrastructure Networks (DePIN). These projects blend traditional physical systems—such as routers, energy grids, wireless networks, and edge devices—with blockchain-based coordination and incentive layers. The goal is to decentralize infrastructure ownership and allow communities to earn directly from contributing to and maintaining physical networks.

As this sector continues to grow, it is creating significant new career paths, especially for hardware engineers, network infrastructure specialists, and blockchain-integrated protocol designers. DePIN marks a major evolution in an industry that has historically been dominated by purely software-based roles.

DePIN vs. Traditional Hardware Industry Salary Trends – 2026

| Role Title | Average Annual Salary in Web3 (USD) | % Difference vs. Traditional Roles |

|---|---|---|

| Hardware Engineer (Web3) | $120,000 | +16.8% |

| Hardware Engineer (Traditional Tech) | $102,750 | — |

| DePIN Protocol Designer | $146,000 – $206,000 | Up to +50% |

Hardware engineers entering the Web3 ecosystem now find themselves earning significantly more than their counterparts in conventional technology sectors. This is largely due to the complex nature of integrating real-world data and hardware output into blockchain environments, where accuracy, uptime, and security are crucial.

Key Drivers Behind DePIN Salary Premiums

The higher salaries within DePIN-focused roles can be attributed to a number of structural and economic factors:

- On-Chain Incentive Integration: Engineers and designers must connect physical network usage (like bandwidth sharing or energy distribution) with real-time token rewards.

- Protocol-to-Hardware Interfacing: There is a growing need for professionals who can develop low-latency, high-throughput connections between blockchain ledgers and decentralized IoT or server hardware.

- Security and Decentralization: Unlike centralized telcos or data centers, DePIN requires experts to solve for decentralized coordination, failure tolerance, and hardware trustlessness.

DePIN Job Function and Compensation Matrix – 2026

| Role Category | Primary Responsibilities | Salary Range (USD) | Talent Demand Level |

|---|---|---|---|

| Hardware Engineer (DePIN) | Device integration, sensor networks, firmware + blockchain sync | $110,000 – $135,000 | High |

| DePIN Protocol Designer | Build token logic, staking models, hardware-incentive bridges | $146,000 – $206,000 | Very High |

| Network Infrastructure Engineer | Configure node deployment, distributed routing, edge computing | $120,000 – $160,000 | High |

| Systems Reliability Analyst | Ensure hardware uptime, fault tolerance, SLA enforcement | $100,000 – $140,000 | Moderate–High |

| DePIN DevOps Specialist | Pipeline automation, firmware versioning, node telemetry | $105,000 – $145,000 | High |

Why DePIN is Reshaping Infrastructure Ownership

At the core of DePIN’s growing appeal is the philosophy of user-owned infrastructure. Instead of relying on centralized cloud giants or telecom monopolies, decentralized protocols now allow individual users to host, operate, and earn from physical devices—turning communities into micro-infrastructure providers.

This shift fundamentally changes the business model. Rather than subscription-based billing from centralized firms, users are rewarded through on-chain tokens tied to hardware performance, uptime, and data contribution.

Economic Model Comparison: Traditional Infra vs. DePIN

| Infrastructure Model | Ownership | Revenue Model | User Incentive Mechanism |

|---|---|---|---|

| Traditional Cloud / Telecom | Centralized corporations | Monthly billing, usage caps | None |

| Decentralized Physical Networks (DePIN) | Distributed users | On-chain rewards, tokenized data | Direct token-based income |

Conclusion: DePIN Opens New Frontiers for Technical Talent in Blockchain

The growth of DePIN marks a major milestone in the evolution of Web3—introducing real-world utility, decentralized ownership, and new layers of technical specialization. For engineers with backgrounds in IoT, telecommunications, energy systems, and hardware design, 2026 presents a compelling opportunity to transition into high-paying roles that blend physical infrastructure with blockchain technologies.

As user communities increasingly seek autonomy over the infrastructure they use, DePIN roles are expected to see sustained demand, competitive compensation, and an expanding set of real-world applications across telecom, energy, data storage, and beyond.

6. Compensation Structure: Base, Tokens, and Equity

a. Base Salary Models

In 2026, salary frameworks in the Blockchain and Web3 sector have evolved into sophisticated models that cater to both short-term financial stability and long-term wealth creation. As the industry matures, companies now follow a three-pillar compensation system, blending base salaries with token allocations and equity stakes. This structure allows organizations to attract top global talent while aligning contributors with the long-term success of decentralized protocols and platforms.

The combination of fixed income, crypto-based assets, and ownership incentives has become a defining feature of Web3 employment, offering a dynamic alternative to traditional compensation methods.

Overview of Web3 Compensation Framework – 2026

| Compensation Component | Description | Purpose |

|---|---|---|

| Base Salary | Paid monthly in fiat or stablecoins | Ensures financial stability |

| Token Grants | Allocation of governance or utility tokens | Aligns incentives with project performance |

| Equity / DAO Shares | Ownership in legal entities or tokenized DAO units | Encourages long-term commitment |

This structure ensures that employees are not only compensated for their immediate contributions but are also directly invested in the protocol’s long-term growth and success.

Base Salary Models: Flexible, Global, and Crypto-Compatible

Organizations across the Web3 ecosystem in 2026 now use multiple methods to deliver base compensation. The flexibility in payment methods reflects the industry’s decentralized and global-first nature.

Base Salary Model Comparison – 2026

| Payment Method | Description | Adoption Rate (Est.) | Notes |

|---|---|---|---|

| Traditional Fiat | Salaries paid in national currencies such as USD, EUR, or SGD | 52% | Standard in hybrid firms or regulatory-heavy countries |

| Partial Cryptocurrency | 25–100% of base salary in stablecoins (e.g., USDC, USDT) | 38% | Popular for cross-border teams and global contractors |

| Crypto-Native Full Pay | 100% of base paid in tokens or stablecoins | 10% | Common in DAOs and early-stage DeFi startups |

Stablecoin-based compensation has grown in popularity due to its ease of global distribution, lower transaction costs, and faster settlement times. Many remote-first companies allow employees to choose the preferred breakdown between fiat and crypto.

Role-Based Global Salary Banding

One of the major innovations in 2026 is the wide adoption of location-agnostic salary bands. Rather than adjusting pay based on where an employee lives, crypto-native companies now evaluate compensation based on role complexity, scope of responsibility, and contribution impact.

This shift supports a more equitable salary system, ensuring that skilled professionals in emerging markets receive fair compensation relative to their expertise—not their geography.

Global Salary Banding Example by Role Complexity – 2026

| Role Type | Complexity Level | Global Average Salary (USD) | Payment Model Trend |

|---|---|---|---|

| Protocol Engineer | High | $160,000 – $200,000 | Fiat + Token Split |

| Smart Contract Developer | High | $135,000 – $180,000 | Token Heavy |

| Product Manager (Web3) | Medium–High | $110,000 – $150,000 | Hybrid (Fiat + Equity) |

| Marketing / Community Lead | Medium | $90,000 – $130,000 | Fiat with Bonus Token Allocation |

| Community Manager | Low–Medium | $60,000 – $95,000 | Stablecoin Preferred |

Token Grants: Long-Term Incentive Design

Token-based compensation has matured significantly. In 2026, most grants include structured vesting schedules (commonly 12–36 months) and are tied to performance or project milestones. These grants may include governance rights, DAO voting privileges, and access to early liquidity rounds.

Token Vesting Structure – Common Practice in 2026

| Vesting Period | Vesting Frequency | Cliff Period | Grant Type |

|---|---|---|---|

| 36 Months | Monthly | 6 Months | Governance Tokens |

| 24 Months | Quarterly | 3 Months | Utility + Reward Tokens |

| 12 Months | Lump Sum / Events | No Cliff | Performance / Airdrop Bonuses |

Equity and DAO Ownership

For companies structured as legal entities (or hybrid DAOs with LLC foundations), equity may still play a role, particularly for executives and founding team members. In community-driven DAOs, equivalent ownership may be expressed through locked token shares, voting rights, or contributor reward pools.

Conclusion: Compensation in Web3 Aligns Financial Stability with Protocol Loyalty

By 2026, the Blockchain and Web3 industry has introduced compensation models that go far beyond fixed monthly salaries. Professionals entering the space can now expect packages that balance immediate income with meaningful ownership, designed to reward not only contribution but long-term alignment with the project’s mission.

These evolving salary frameworks ensure that talent across regions and backgrounds can participate in the global Web3 economy while benefiting from the growth of the decentralized systems they help build.

b. Traditional Equity and Token Components

In 2026, Blockchain and Web3 companies are redefining what it means to be a stakeholder. Unlike traditional startups that focus solely on equity ownership through stock options, Web3 firms offer professionals a hybrid model—providing access to both corporate equity and protocol-level token allocations. This dual-exposure model is designed to reward both business performance and protocol growth, aligning contributors with the broader success of the decentralized ecosystem.

The result is a compensation structure that goes beyond salary—giving team members a voice in governance, participation in liquidity events, and direct ownership in the underlying protocol’s value creation.

Ownership Models in Web3 Compensation Structures – 2026

| Asset Type | Typical Allocation (Senior Individual Contributor) | Key Features |

|---|---|---|

| Traditional Equity | 0.1% – 2.0% | Structured as stock options in the legal entity |

| Token Grants | 10% – 20% of total supply allocated to team pool | Vesting schedules apply, often tied to milestones |

| Governance Rights | Included via tokens | Enables voting on upgrades, proposals, treasury use |

This model not only compensates professionals for their labor but also gives them strategic influence through on-chain voting rights, especially in projects governed by DAOs (Decentralized Autonomous Organizations).

Equity vs. Token Compensation Matrix – Key Differences in 2026

| Component | Equity in Corporate Entity | Token Allocation in Protocol |

|---|---|---|

| Ownership Structure | Traditional stock or options | Governance or utility tokens |

| Liquidity Timeline | Typically 4–7 years (exit-dependent) | Earlier liquidity via decentralized exchanges |

| Use Case | Business ownership, financial return | Protocol participation, staking, governance |

| Vesting Schedule | 3–4 years, often with a 1-year cliff | 1–3 years, milestone or performance-based |

| Tax Implication | Country-specific capital gains rules | May involve income + capital gains (jurisdiction-dependent) |

Unlike equity that depends on acquisition or IPO for liquidity, token-based rewards can often be realized earlier, especially when the protocol lists its tokens on public markets. For many professionals, this early liquidity offers financial flexibility while still allowing long-term alignment through vesting.