Key Takeaways

- AI-powered debt collection software in 2026 improves recovery rates by up to 60% while reducing operational costs significantly.

- Top platforms like HighRadius, FICO, and Credgenics lead with automation, compliance, and real-time payment integrations.

- Scalable cloud-based tools now cater to both large enterprises and fast-growing SMEs across finance, healthcare, and telecom sectors.

In 2026, the global debt collection industry is undergoing a dramatic transformation. With rising loan defaults, expanding credit markets, and increasing financial pressure on both consumers and enterprises, the demand for smarter, faster, and more compliant recovery solutions has never been greater. Businesses across sectors—finance, telecom, utilities, healthcare, retail, and government—are actively shifting away from manual collection processes and legacy systems in favor of advanced, AI-driven debt collection software that automates workflows, improves recovery rates, reduces operational costs, and ensures regulatory compliance.

Debt collection software has evolved far beyond simple reminder systems or manual call management tools. The most advanced platforms in 2026 now feature predictive analytics, machine learning, automated omnichannel outreach, real-time payment integration, and behavioral science-based engagement strategies. These capabilities enable companies to not only recover more outstanding debt but also preserve customer relationships and reduce churn through empathetic and customized communication.

One of the biggest shifts in this space is the rise of Agentic AI—intelligent digital agents that act independently across the entire collections lifecycle. These AI models can analyze borrower behavior, choose the right outreach channel (email, SMS, voice, push notifications), and even modify messaging based on sentiment or urgency. Combined with secure customer portals, embedded payment gateways, and seamless integrations with ERP and CRM systems, these tools are redefining how businesses manage accounts receivable (AR) and collections at scale.

In 2026, market research indicates that the global debt collection software industry is valued between USD 5.3 to 5.4 billion and is projected to grow at a CAGR of over 9% through 2030. North America remains the largest market by revenue share, while Asia-Pacific leads in growth rate due to rapid digital adoption in countries like India, China, and Southeast Asia. Meanwhile, SaaS-based deployment models are enabling small and mid-sized enterprises (SMEs) to access enterprise-grade tools at lower costs, fueling adoption across all business sizes.

Whether you’re a CFO looking to improve cash flow, a collections manager seeking more efficient agent workflows, or a fintech startup scaling your lending operation, choosing the right debt collection software can significantly impact your recovery performance, customer satisfaction, and regulatory standing. But with hundreds of vendors in the market—each offering a different mix of features, integrations, and pricing models—it can be difficult to identify which solutions truly deliver measurable ROI and operational excellence.

This in-depth guide explores the top 10 best debt collection software platforms in the world in 2026. Each featured solution has been carefully evaluated across key criteria such as technology innovation, recovery performance, scalability, ease of implementation, user feedback, and compliance capabilities. From global leaders like HighRadius, FICO, and SAP to innovative disruptors like Credgenics, Symend, and Upflow, this list includes a diverse range of tools tailored for both enterprise and SMB needs.

In the sections ahead, you’ll gain insight into how each platform works, who it’s best suited for, and what kind of results you can expect in terms of recovery uplift, cost reduction, automation rates, and customer engagement. We’ll also provide data-driven benchmarks, implementation timelines, ROI comparisons, and industry adoption trends to help you make the most informed decision.

By the end of this blog, you’ll have a comprehensive understanding of the global debt collection software landscape in 2026—equipped with the knowledge to select the right technology partner that aligns with your organization’s goals for financial efficiency, risk mitigation, and digital transformation.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Best Debt Collection Software To Try in 2026.

If you like to get your company listed in our top B2B software reviews, check out our world-class 9cv9 Media and PR service and pricing plans here.

Top 10 Best Debt Collection Software To Try in 2026

- athenaCollector

- SAP Collections and Dispute Management

- HighRadius Autonomous Receivables

- C&R Software – Debt Manager

- Billtrust Unified AR

- FICO Debt Management Solutions

- Upflow

- Symend

- TrueAccord

- Credgenics

1. athenaCollector

athenaCollector stands out as one of the most widely adopted revenue cycle and medical billing software solutions globally. Tailored for the healthcare industry, this platform helps providers efficiently manage claims, payments, and patient balances using a cloud-based, highly secure system.

Key Features and Capabilities

- Real-Time Claim Scrubbing: Automatically detects and flags errors such as incorrect dates, missing attachments, or coding mistakes before claims are submitted. This minimizes denials and improves approval rates.

- Integrated Billing and Clinical Data: Seamlessly links with athenaClinicals, enabling providers to view a complete financial and clinical snapshot of each patient.

- Dynamic Rules Engine: Continuously updated with over 4,500 annual changes to keep up with evolving payer rules and billing policies.

- Advanced Analytics Dashboard: Offers benchmarking tools to compare practice performance with peers and identify inefficiencies.

- Secured Cloud Infrastructure: Ensures HIPAA-compliant data storage and access from multiple devices, supporting both small clinics and large hospital networks.

Performance and Satisfaction Metrics

| Metric | Data |

|---|---|

| Global Market Share | 67.44% of healthcare-focused billing software |

| Active Clients | 5,485 (88.16% based in the US) |

| Issue Resolution Efficiency | 87% resolved within 1 business day |

| Customer Satisfaction Rating | 95% |

Pricing Structure

athenaCollector operates on a percentage-of-collections model, meaning that fees are charged based on the total amount successfully collected. The rate varies depending on factors like:

- Practice size

- Complexity of specialty (e.g., cardiology vs. dermatology)

- Monthly volume of claims processed

This flexible pricing allows smaller practices to get started without large upfront costs while scaling effectively for larger health systems.

User Experience Insights

Users report that athenaCollector dramatically improves the speed and accuracy of their revenue cycle processes. One healthcare practice highlighted that the software helped streamline responsibilities across billing and coding teams, improved receivables turnover, and facilitated on-site payment collections. However, some users have noted challenges such as:

- Occasional system lag or glitches

- A steeper learning curve for full platform usage

- Limited ability to communicate with providers outside the athenahealth ecosystem

- Lack of transparency in pricing details

Visual Summary: athenaCollector Highlights

| Feature | Description |

|---|---|

| Claim Scrubbing | Flags invalid data before submission |

| Integration with EHR | Syncs billing with patient records (athenaClinicals) |

| Real-Time Analytics | Tracks collection rates, benchmarks, and patient volume |

| Cloud-Based Platform | Access from anywhere with secure data encryption |

| Support and Service Quality | 87% of issues resolved in 1 day, 95% satisfaction rating |

Ideal For

- Private clinics

- Multi-specialty hospitals

- Revenue cycle management companies

- Healthcare systems needing full EHR + billing integration

Conclusion

athenaCollector remains a front-runner in debt collection for the healthcare sector in 2026. With its smart automation features, continuously updated rules engine, and integration with electronic health records, it empowers healthcare providers to enhance their collections while ensuring compliance and data security.

2. SAP Collections and Dispute Management

SAP Collections and Dispute Management is widely recognized as a powerful and comprehensive solution designed to handle large volumes of receivables, disputes, and collections for multinational corporations. Positioned within the broader SAP S/4HANA suite, this platform plays a central role in automating financial operations for global businesses managing millions in accounts receivable.

By 2026, the solution has become more intelligent and automated, using AI and machine learning to reduce manual work and improve communication between finance and customer service teams.

Core Functional Capabilities

SAP’s platform is specifically built to manage complex financial workflows across multiple departments and geographies. Its key capabilities include:

- Automated Dispute Creation: When there’s a mismatch in payments—such as partial payments, missing line items, or incorrect amounts—the system automatically creates a dispute case. These cases are tracked through a structured lifecycle with clear status updates and audit trails.

- AI-Powered Email Processing: The 2026 version integrates with Enterprise Service Management (ESM) to automatically extract data from incoming customer emails. Using Optical Character Recognition (OCR) and AI, it identifies invoice numbers, dispute reasons, and open items, eliminating repetitive manual work.

- Real-Time Data Integration: All information flows directly into SAP’s FI-AR module. This centralizes data and reduces the need for back-and-forth communication between finance, sales, and customer support departments.

- Decision Optimizer Tools: Built-in analytics help teams prioritize disputes based on dollar value, customer history, and risk levels. This feature improves recovery strategies and enhances operational control.

Performance and Business Impact

SAP Collections and Dispute Management delivers measurable improvements in efficiency and financial control for large corporations.

| Performance Indicator | Value |

|---|---|

| Global Market Share (2026) | 7.60% |

| Active Corporate Clients | 618 large enterprises worldwide |

| Payment Application Time Saved | 25% faster compared to manual systems |

| Processing Speed & Accuracy Gain | 90% improvement in overall financial workflows |

| Average ROI Timeframe | 36 months from full implementation |

Pricing and Licensing Structure

SAP offers flexible pricing under its Finance Premium Plan:

| Plan Type | Starting Price (USD) | Deployment Model | Licensing Notes |

|---|---|---|---|

| SAP Finance Premium Plan | 408 per user/month | Public Cloud | Tiered pricing applies for bulk licenses |

| Average Licensing Discount | 21% (for long-term users) | Hybrid options also available | Discounts often negotiated during enterprise contracts |

This pricing reflects the enterprise nature of SAP, where most clients require customization, consulting, and full integration with existing systems.

Software Architecture and Usability Observations

| Feature | Description |

|---|---|

| ERP Integration | Full alignment with SAP S/4HANA Financials |

| Audit Reporting | Supports vendor payment reports like FBL1N for detailed tracking |

| User Interface Complexity | Steep learning curve due to traditional GUI and T-code navigation |

| AI Automation | Reduces workload by extracting and classifying disputes from emails |

| Implementation Timeline | Multi-year deployment for large-scale enterprises |

While SAP’s system is reliable and accurate, users often describe it as complex and challenging for new finance or AP team members. Understanding the financial terms, T-codes, and workflow mapping often requires professional training or external consulting support.

Real User Feedback

Enterprise finance teams using SAP Collections and Dispute Management report significant improvements in invoice tracking and audit reporting accuracy. One user emphasized that once data is entered into the system, it becomes accessible across all departments, ensuring consistent and reliable financial reporting. However, some also mentioned that new users may struggle due to the system’s heavy reliance on technical SAP transaction codes and advanced accounting concepts.

Ideal Users and Industry Fit

| Target Industry | Use Case Example |

|---|---|

| Manufacturing Conglomerates | Managing vendor disputes across global subsidiaries |

| Energy and Utilities | Tracking bulk invoice payments from government entities |

| Large Retail Chains | Automating resolution of partial payments and deductions |

| Telecommunications Firms | Handling large-volume monthly billing discrepancies |

Conclusion

SAP Collections and Dispute Management remains a top-tier solution for large enterprises in 2026. It excels at managing disputes, automating collection workflows, and connecting financial operations across complex global structures. While it may not be suitable for small businesses due to its scale and complexity, it offers a powerful return on investment for organizations that prioritize audit-ready reporting, dispute automation, and enterprise-wide integration.

3. HighRadius Autonomous Receivables

HighRadius has emerged as one of the most advanced debt collection software platforms in 2026, specifically built for mid-sized to large enterprises seeking to optimize their invoice-to-cash process. It brings together artificial intelligence, robotic process automation, and deep financial integration into one unified platform aimed at the Office of the CFO.

With a strong reputation across industries such as manufacturing, retail, energy, and B2B services, HighRadius is helping organizations accelerate collections, reduce operational costs, and improve working capital by making receivables processes faster and smarter.

Key Platform Capabilities

HighRadius functions as a centralized solution for receivables automation, removing inefficiencies caused by disconnected systems and manual tasks.

| Capability | Description |

|---|---|

| Predictive AI Models | Uses machine learning models (Random Forest, LightGBM, Gradient Trees) to forecast payment behavior and flag risk accounts. |

| Autonomous Collections | Automates dunning campaigns, adjusts frequency based on payment trends, and prioritizes delinquent accounts with the highest risk. |

| AI-Powered Worklists | Dynamically ranks accounts for follow-up based on 20+ data points, such as aging, risk score, and customer history. |

| RPA-Driven Invoice Submission | Uses bots to upload invoices across more than 600 Accounts Payable portals, reducing manual work for finance teams. |

| Unified Credit-to-Cash Operations | Merges billing, credit approval, collections, and cash application into one intelligent ecosystem. |

Business Performance and ROI Metrics

The measurable outcomes delivered by HighRadius across its global customer base are significant and consistent.

| Metric | Result |

|---|---|

| Reduction in Days Sales Outstanding (DSO) | 10% average decrease, leading to faster cash inflow |

| Team Productivity Gain | 30–40% improvement by automating repetitive tasks |

| Net Bad Debt Recovery | 20–30% increase through AI-led prioritization of recovery efforts |

| Implementation Time | Around 8 months for full deployment |

| ROI Realization Period | 17 months on average, post go-live |

These gains translate into substantial financial returns, especially for firms dealing with large customer bases, complex credit terms, and multi-channel payment inflows.

AI Agent Infrastructure and Workflow Intelligence

At the heart of HighRadius is a powerful AI engine orchestrated by over 180 autonomous agents. These agents are trained to handle a wide range of finance tasks without manual intervention.

| AI Functionality | Underlying Technology |

|---|---|

| Payment Date Prediction | Random Forest, Gradient Boosted Trees |

| Blocked Order Release Decisioning | LightGBM AI models |

| Remittance Matching | Natural Language Processing + OCR |

| Risk-Based Prioritization | Multi-factor predictive scoring |

This advanced AI architecture ensures HighRadius is not just automating tasks—it is actively making decisions that improve financial performance.

User Experience and Operational Feedback

HighRadius users often highlight its intuitive interface, advanced automation, and tangible cost-saving benefits. One real-world enterprise user noted the platform allowed them to reduce their full-time staff requirement by automating tasks equivalent to three employees, at the cost of just 1.25 FTEs. Other major benefits include:

- Strong AI-driven worklist functionality that accurately ranks high-priority accounts

- Automated remittance capture from emails and customer payment portals

- Clear improvement in accuracy and speed of the cash application process

However, there are areas where users have shared improvement suggestions:

- System updates are batch-based, causing occasional delays in real-time visibility

- Some essential customizations require additional paid enhancements

- Occasional software bugs have been reported, although customer service is highly responsive

Pricing and Implementation Overview

HighRadius follows a modular pricing approach based on user count, features activated, and company revenue tier. While pricing details are not publicly disclosed, typical enterprise deployments include setup, integration, and AI training costs. ROI is generally achieved within the first 17 months.

| Pricing Factor | Influence on Cost |

|---|---|

| Number of AI Modules Activated | Higher modules = higher pricing |

| Integration Depth | Real-time ERP and AP portal integrations add cost |

| Support Package | Premium SLAs priced separately |

Industries Best Suited for HighRadius

| Industry Sector | Use Case Example |

|---|---|

| Manufacturing | Managing global receivables across subsidiaries |

| B2B Distribution | Automating invoice delivery and follow-ups across AP portals |

| Energy & Utilities | Reducing DSO for high-volume, recurring billings |

| Enterprise Software | Improving payment accuracy and dispute resolution rates |

Recognition and Awards

For three consecutive years, HighRadius has been listed as a leader in the Gartner Magic Quadrant for Invoice-to-Cash Applications. Its AI-driven transformation of the collections space sets a new standard for enterprise financial automation in 2026.

Conclusion

HighRadius Autonomous Receivables is setting the benchmark for AI-powered debt collection software in 2026. With deep automation, predictive intelligence, and unified financial workflows, it helps enterprises reduce risk, recover cash faster, and streamline finance operations. Though some technical limitations exist, its strong support, consistent ROI delivery, and innovation in automation make it one of the top 10 global solutions in the collections software space.

4. C&R Software – Debt Manager

C&R Software’s Debt Manager has established itself as one of the most powerful debt collection platforms in the world, especially favored by large banks and financial institutions. In 2026, the software is responsible for managing over $8 trillion in active debt accounts, a figure that reflects its widespread global use and scalability across complex financial ecosystems.

Designed for institutions operating in highly regulated environments, Debt Manager enables full control and transparency across the entire debt lifecycle, from early-stage delinquency to final legal recovery. Its robust architecture, paired with modular AI tools, makes it a critical tool for organizations seeking compliance, precision, and operational efficiency.

Core Functional Capabilities

Debt Manager brings together several intelligent components designed to improve both collector productivity and debtor outcomes. These components work together to ensure smarter resource allocation, improved compliance, and faster recoveries.

| Feature | Description |

|---|---|

| FitAgent | A context-sensitive interface that adapts based on account status, showing only the most relevant data to each collector. This improves user efficiency and reduces cognitive overload. |

| FitAdmin | A self-service configuration tool that empowers business users (not just IT) to update workflows, strategies, and business rules without coding. |

| FitLogic | A predictive decision engine that uses data modeling to segment accounts by propensity to pay, allowing companies to prioritize high-yield cases. |

| Full Lifecycle Coverage | Handles early-stage reminders, payment plans, charge-offs, legal recovery, and asset management in one platform. |

| Global Deployment Model | Used in over 60 countries, including major Tier 1 banks in the UK, US, and Asia Pacific. |

Quantitative Performance Insights

Debt Manager has demonstrated strong, consistent results across operational efficiency, compliance, and recovery outcomes.

| Performance Metric | Value/Result |

|---|---|

| Total Value of Accounts Managed | $8 trillion in active balances |

| Global Financial Institutions Using It | 100+ banks and credit organizations |

| Operational Expenditure Savings | 40% average reduction in back-office costs |

| Collection and Recovery Rate Increase | 25% improvement from AI-based account segmentation |

| Number of Accounts Processed | Over 20 million, with high concurrency and data security controls |

| Certification and Compliance | PA-DSS and PCI-DSS certified with full audit trail capabilities |

Technology Architecture and AI Decision Engine

Debt Manager stands out due to its FitLogic engine, which transforms data into actionable insights. It continuously learns from historical payment behavior and refines the prioritization of collection strategies.

| AI-Powered Component | Role in Collections Process |

|---|---|

| Segmentation Algorithms | Rank accounts based on risk level, past behavior, and potential for recovery |

| Dynamic Strategy Adjustment | Real-time change of contact frequency, tone, and timing based on customer response |

| Predictive Modeling | Forecasts probable resolution dates and assigns collector resources accordingly |

| Decision Trees | Visual mapping of optimal strategies based on real-time conditions |

Operational Benefits for Large Institutions

Debt Manager offers a central platform that integrates smoothly with other banking systems, ensuring data consistency, compliance, and audit readiness. Banks using Debt Manager report major gains in:

- Training Efficiency: FitAgent drastically reduces new staff onboarding time by showing only relevant fields based on task

- Security and Compliance: Full audit trails meet global regulatory demands, including for financial services regulators in the US, UK, EU, and APAC

- Strategic Control: FitAdmin allows internal teams to pivot rapidly without external vendor involvement

Real-World Feedback from Enterprise Users

A senior recovery manager at a leading UK bank described Debt Manager as their “single source of truth,” emphasizing its role in bringing together all parts of the collections workflow in one place. According to the user, the platform’s dynamic segmentation and smart prioritization allow their team to make better decisions faster, leading to higher recovery rates and better resource planning.

However, the same user acknowledged that smaller institutions may find the system challenging to configure without dedicated IT support. The platform is optimized for scale, and while it delivers exceptional value in large environments, leaner teams might struggle with initial setup complexity.

Implementation, Licensing, and Scalability

Debt Manager is typically deployed under an enterprise licensing agreement, with scalable modules available for credit unions, banks, and government agencies.

| Category | Insight |

|---|---|

| Deployment Options | On-premise and cloud-based configurations available |

| Integration Model | API-compatible with leading core banking, ERP, and CRM systems |

| Licensing Type | Enterprise agreements based on account volume and user tiers |

| Scalability | Supports millions of concurrent account actions and role-based access |

| Implementation Timeline | Varies by client size, typically 6–12 months with full training support |

Industries Best Suited for Debt Manager

| Sector | Key Use Case |

|---|---|

| Banking & Financial Services | Large-scale collections across consumer lending and corporate credit |

| Government Agencies | Tax and fine recovery, legal collections, and payment plan enforcement |

| Utilities & Telecom | Late bill reminders, payment plans, and legal escalation workflows |

| Healthcare Collections | Managing patient account recovery in regulated environments |

Conclusion

C&R Software’s Debt Manager is a global leader in enterprise debt collection in 2026. Its ability to manage high volumes of accounts, comply with strict financial regulations, and deliver measurable performance improvements has made it the platform of choice for the world’s largest banks. With flexible configuration tools, powerful AI segmentation, and a full suite of recovery lifecycle support, Debt Manager is positioned as one of the top 10 debt collection platforms worldwide.

5. Billtrust Unified AR

Billtrust Unified AR is one of the world’s leading debt collection and accounts receivable (AR) automation platforms in 2026, specifically tailored for B2B organizations across over 40 industries. With a strong focus on eliminating manual invoicing, reducing delays in payments, and enabling electronic processing, Billtrust has helped companies manage and collect receivables more efficiently, securely, and profitably.

The platform is known for powering large-scale receivables operations and has processed over $1 trillion in invoice dollars. Its success comes from combining invoice delivery, payment capture, and collections follow-up into a seamless digital workflow that supports real-time decision-making.

Platform Capabilities and Automation Benefits

Billtrust Unified AR streamlines the entire accounts receivable journey—from invoice creation to payment collection—allowing businesses to manage high volumes of transactions with reduced manual effort.

| Core Capability | Description |

|---|---|

| Business Payments Network | Connects to thousands of buyers and suppliers to speed up electronic invoice adoption and payments |

| AR Workflow Automation | Automates recurring manual tasks like invoice generation, reminders, cash application, and reconciliation |

| Credit and Collections Tools | Simplifies credit applications and automates dunning processes based on payment behavior |

| Real-Time Access and Invoicing | Enables teams to access, review, and send invoices instantly across platforms |

| Seamless Multi-Industry Support | Built to adapt to different industries including manufacturing, logistics, and wholesale distribution |

Performance Metrics and Financial Outcomes

Independent research conducted by IDC in 2025 demonstrated the clear return on investment for companies using Billtrust. These benefits continue into 2026 with improved tools and more intelligent automation.

| Key Metric | Value Achieved |

|---|---|

| Return on Investment (ROI) | 384%, or $4.84 return for every $1 spent |

| Payback Period | 9 months on average |

| Cost Savings | $1.8 million saved annually on credit card fees per business |

| AR Team Productivity | 52% more transactions handled per team member |

| Invoice Volume Capacity | Scales to millions of digital invoices monthly |

These metrics highlight how the platform helps companies reduce processing costs, speed up collections, and unlock cash flow.

Automation Architecture and Integration Tools

Billtrust’s intelligent automation is supported by a robust architecture that supports ERP integration, third-party systems, and customer portals. It bridges the gap between AR and payment systems to create an uninterrupted, digital-first receivables strategy.

| Automation Component | Function and Benefit |

|---|---|

| E-Invoicing Engine | Converts paper invoices into electronic formats automatically |

| Cash Application Automation | Matches payments to invoices using AI-powered remittance extraction |

| Credit Application Management | Digitizes customer credit checks and scoring workflows |

| Collections Follow-Up Engine | Sends auto-reminders, escalations, and custom payment plans |

| Real-Time Dashboard | Provides instant visibility into outstanding balances and payment trends |

Customer Experience and Feedback

Users from industries such as manufacturing and distribution have reported that Billtrust significantly improved the way their collections teams operate. The platform’s interface is described as easy to navigate, which helped reduce training time for AR professionals.

One user stated that the platform allowed them to move away from paper-based credit applications and invoice handling entirely, resulting in smoother collections and better control over receivables. Manual data entry was nearly eliminated, and real-time invoice tracking improved response times with clients.

However, the same user pointed out that integrating Billtrust with older legacy systems was somewhat challenging and required custom solutions, which extended the implementation period to about five months.

Implementation Model and Enterprise Scalability

Billtrust offers flexible deployment options, allowing integration into both cloud-based and on-premise systems. It supports businesses of all sizes, though its full capabilities are especially beneficial for mid-to-large enterprises processing high transaction volumes.

| Deployment Model | Notes |

|---|---|

| Cloud-Based SaaS Platform | Standard offering with full feature access |

| ERP System Integration | Compatible with SAP, Oracle, Microsoft Dynamics, NetSuite |

| Implementation Timeline | Typically 4–6 months depending on ERP complexity |

| Support and Training | Includes onboarding, live support, and AI-guided user interfaces |

| Scalability | Built to support global operations with multi-currency and compliance controls |

Industries Benefiting Most from Billtrust

| Industry Sector | Use Case Example |

|---|---|

| Wholesale & Distribution | Managing recurring invoicing cycles and credit approvals |

| Manufacturing | Reducing DSO and automating collections on bulk orders |

| Transportation & Logistics | Enabling digital billing and collections for large client networks |

| Energy & Utilities | Streamlining AR workflows with digital payments and reminders |

Conclusion

Billtrust Unified AR is a powerful, scalable, and proven platform for automating debt collection and accounts receivable processes in 2026. By helping businesses reduce payment processing costs, speed up invoice-to-cash cycles, and empower AR teams with modern automation tools, Billtrust plays a key role in digital financial transformation. Its real-time dashboards, intelligent workflows, and strong ROI performance secure its place as one of the top 10 global debt collection software solutions in today’s B2B economy.

6. FICO Debt Management Solutions

FICO Debt Management Solutions, formerly known as FICO Debt Manager, is one of the most advanced platforms for collections and recovery operations worldwide in 2026. Trusted by major government bodies, banks, and payment processors, this platform combines FICO’s globally recognized expertise in credit analytics with powerful decision automation and compliance tools. The software is currently in use across approximately 90 countries, making it one of the most globally deployed debt recovery systems available today.

FICO’s strength lies in its ability to handle both high-volume consumer debt and complex commercial cases, while ensuring strict compliance with regulatory requirements such as FDCPA, CFPB, and GDPR. Its intelligent architecture makes it highly adaptable to different industries and debt types.

Key Functional Features and Intelligence Tools

FICO’s platform offers a comprehensive suite of tools that enhance operational performance and ensure accurate decision-making during collections.

| Feature | Functionality Description |

|---|---|

| Blaze Advisor Rules Engine | A business rules engine that automates decisions based on pre-set conditions and real-time data. Used to tailor recovery strategies at scale. |

| Mathematical Optimization Engine | Calculates the best action (e.g., contact method, timing, offer) for each debtor to maximize recovery rates. |

| Credit Scoring Integration | Seamlessly incorporates FICO scores to assess risk levels and payment likelihood. |

| Multi-Account Linking | Merges multiple debts tied to a single customer or household to simplify recovery management. |

| Security and Compliance Controls | Designed for data-sensitive environments with robust encryption and audit logs, supporting regulatory compliance across jurisdictions. |

Analytical Performance and Quantitative Impact

The platform has been proven to deliver measurable improvements in collections through advanced modeling and automation strategies. According to internal performance benchmarks and customer-reported data:

| Metric | Value Achieved |

|---|---|

| Average Lift in Recovery Rate (Optimization) | +4% |

| Additional Lift Using Predictive Models | +4% |

| Global Reach | Deployed in over 90 countries |

| Starting Price for Small Users | $49 (basic configurations); enterprise pricing varies |

| Security Certifications | Compliant with FDCPA, CFPB, GDPR, PCI-DSS |

By layering optimization algorithms with predictive modeling, FICO helps organizations recover more while investing fewer manual hours.

Platform Architecture and Recovery Strategy Matrix

FICO leverages its legacy in scoring systems to inform intelligent collection decisions at each phase of the debt lifecycle.

| Recovery Strategy Decision Layer | Description |

|---|---|

| Risk Assessment Layer | Pulls in FICO credit data and debtor history to rank likelihood of recovery |

| Decision Engine Layer | Applies rules via Blaze Advisor to suggest optimal next actions |

| Optimization Layer | Uses mathematical modeling to find the most cost-effective recovery steps |

| Execution Layer | Automates outreach (email, phone, letter), repayment plans, and escalations |

This layered framework ensures the platform adapts to the unique needs of different industries, from personal loans to corporate receivables.

Real-World Feedback and Operational Insights

Users from the financial services sector report strong improvements in control and efficiency when using FICO’s tools. A review from a senior operations manager noted that the ability to link multiple loan accounts per customer helped reduce internal confusion and centralized customer management.

The Blaze Advisor engine, while extremely powerful, was reported to be difficult to set up. Several users mentioned a steep learning curve and non-intuitive UI layout, particularly when navigating tabs for setup and financial workflows. Despite these challenges, users emphasized that the platform’s compliance strength and forecasting accuracy made it a dependable tool for collections and audits.

Cost, Deployment, and Scalability Model

FICO’s pricing is modular and flexible based on user size, region, and feature requirements.

| Pricing Category | Details |

|---|---|

| Small Business Plans | Start around $49/month for basic access |

| Enterprise Licenses | Custom pricing based on volume, features, and country |

| Implementation Timeline | Typically 4–9 months depending on complexity of systems |

| Deployment Options | Cloud, on-premise, and hybrid models supported |

| Integration Capabilities | Works with leading banking, ERP, and CRM systems |

FICO also provides professional services for configuration, compliance audits, and performance optimization, helping organizations get the most from the system.

Industries Best Served by FICO Debt Management

| Industry | Use Case Example |

|---|---|

| Retail Banking | Managing delinquent credit card, mortgage, and personal loan portfolios |

| Government and Defense Agencies | Handling overpayment collections and tax recovery operations |

| Payment Processors and Fintech | Automating overdue settlement recovery with secure credit risk modeling |

| Telecommunications and Utilities | Executing large-scale dunning strategies for late-paying customers |

Conclusion

FICO Debt Management Solutions continues to be one of the most sophisticated and effective debt recovery platforms in 2026. Its blend of predictive analytics, AI-driven optimization, and compliance tools makes it an ideal choice for organizations needing to manage complex, high-risk portfolios. While its configuration may require technical expertise, the long-term benefits in recovery rates, regulatory assurance, and strategic automation place FICO among the top 10 debt collection software solutions globally.

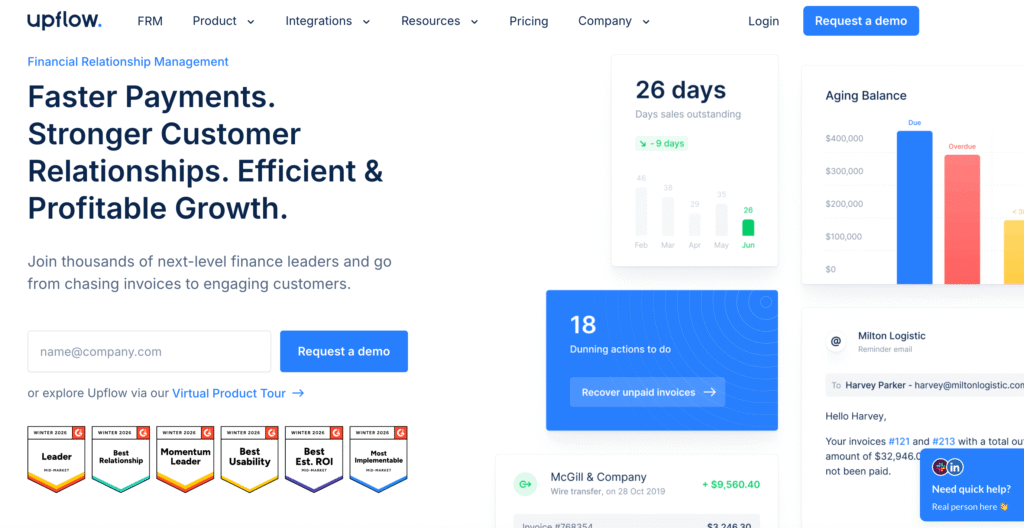

7. Upflow

Upflow has positioned itself as a next-generation solution for B2B accounts receivable and debt collections, offering a fresh and collaborative approach to financial relationship management in 2026. Rather than treating collections as a purely transactional or legal process, Upflow focuses on strengthening payment relationships between businesses, streamlining communication, and simplifying invoice settlement workflows.

Designed for growth-focused companies, Upflow stands out by providing intuitive dashboards, real-time forecasting, and customer-facing payment portals, all integrated into commonly used systems like NetSuite, Sage Intacct, Slack, and Salesforce. This makes it a favorite among start-ups, scale-ups, and mid-market businesses looking to improve collection speed without the burden of legacy enterprise platforms.

Platform Features and Collaborative Collections Capabilities

Upflow empowers finance teams to improve their cash flow through automation and relationship-driven workflows. Its strength lies in making collections efficient, predictable, and respectful of customer experiences.

| Key Feature | Function and Benefit |

|---|---|

| AI-Powered Email Tagging | Automatically scans customer messages to detect intent, like “Promise to Pay,” enhancing forecasting accuracy |

| Customer Self-Service Portal | Clients can access all invoices, download statements, and make instant payments through secure, digital methods |

| Payment Automation & Autopay | Enables recurring digital payments with reminders and confirmations, reducing delays and friction |

| ERP & CRM Integrations | Syncs bi-directionally with platforms like NetSuite, QuickBooks, Sage Intacct, Salesforce, and Slack |

| Real-Time Visibility Dashboards | Gives finance teams full control and clarity over outstanding receivables and collection statuses |

Performance Metrics and Operational Results

Upflow’s platform is built around driving quick wins in receivables automation without requiring heavy technical investments. Its ability to process payments quickly and automate dunning communications helps businesses gain immediate ROI.

| Operational Metric | Outcome Achieved |

|---|---|

| Payment Reconciliation Time | Reduced from 4–5 days to 24–48 hours |

| Invoice Visibility for Customers | 100% real-time access via web-based portal |

| Payment Delay Reduction | Significant decrease through automated reminders |

| Forecasting Accuracy | Improved via AI-analyzed client communications and behavior patterns |

| Support Load on Finance Teams | Lowered by shifting interactions to self-service digital portals |

These improvements not only shorten the Days Sales Outstanding (DSO) cycle but also create smoother communication between finance teams and their clients.

Pricing Structure and Plans by Growth Stage

Upflow offers three distinct pricing plans based on a company’s revenue size and automation needs. This tiered approach ensures businesses receive the right level of tooling and support based on their current scale.

| Plan Name | Target Business Type | Description and Focus Area |

|---|---|---|

| Grow Plan | Start-ups ($0–$10M ARR) | Helps build best practices and establish invoice discipline |

| Scale Plan | Scale-ups ($10M–$50M ARR) | Adds forecasting dashboards, integrations, and workflow automation |

| Strategic Plan | Enterprises ($50M+ ARR) | Delivers in-depth insights, custom dashboards, and proactive engagement models |

Each plan includes core functionality such as the customer portal, automated reminders, and dashboard views. More advanced plans come with payment behavior tracking, escalation workflows, and more customization.

Platform Architecture and Integration Ecosystem

Upflow is built to work alongside modern cloud-based tools, helping finance teams stay nimble and avoid heavy IT dependencies.

| Integration Area | Connected Platforms |

|---|---|

| Accounting & ERP | NetSuite, QuickBooks, Xero, Sage Intacct |

| CRM & Communication | Salesforce, Slack, HubSpot |

| Payment Gateways | Stripe, GoCardless, SEPA, ACH |

| Data & Reporting | CSV Export, API Access, Real-Time Dashboards |

This wide connectivity ensures finance leaders can act quickly with data-driven decisions across platforms they already use.

User Reviews and Operational Feedback

Real users consistently highlight Upflow’s clean interface, ease of use, and low barrier to adoption. Finance professionals note that the platform enables quick access to overdue invoices, tracks at-risk receivables, and sends automated but polite reminders to customers—helping maintain strong client relationships while collecting payments faster.

A typical review pointed out that the customer portal is a standout feature, allowing clients to resolve their payments without needing back-and-forth with the finance team. While this significantly improved cash flow, the reviewer also noted two limitations:

- Upflow is not built for handling complex legal recovery processes involving litigation or court documentation.

- Workflow customization options are somewhat limited compared to legacy enterprise-grade systems, which may be a drawback for companies with highly unique processes.

Use Case Fit by Industry and Company Stage

Upflow performs best in industries that rely on relationship-based B2B billing cycles, such as SaaS, consulting, wholesale, and logistics.

| Company Stage | Best Use Cases |

|---|---|

| Start-Ups | Automating manual invoice follow-ups and improving cash visibility |

| Growth-Stage Companies | Centralizing collections without hiring additional headcount |

| Mid-Market Enterprises | Enhancing forecasting and improving client payment experience |

Conclusion

Upflow has become a preferred platform for modern, relationship-driven debt collections in 2026. Its focus on customer experience, automation, and real-time visibility has made it a top choice for fast-growing companies that want to manage receivables more intelligently and collaboratively. While it may not be suitable for legal recovery-heavy operations, its performance, simplicity, and fast time-to-value make it one of the top 10 debt collection software platforms in the world today.

8. Symend

Symend has gained global recognition in 2026 as one of the most advanced behavioral engagement platforms designed specifically for managing customer delinquencies with a human-centered approach. Unlike traditional debt collection systems that rely heavily on penalties and repetitive outreach, Symend blends behavioral science, artificial intelligence, and digital communications to create more meaningful and effective interactions with past-due customers.

With over 250 million delinquency cases addressed, Symend is a preferred solution for enterprise organizations in telecommunications, utilities, and financial services that want to improve recovery rates while reducing customer churn and maintaining strong brand loyalty.

Platform Capabilities and Human-Centered Approach

Symend transforms the collections process from one of pressure into one of partnership. Its platform is designed to understand customer behavior at a deeper psychological level and tailor engagement strategies that encourage resolution without friction.

| Capability | Description |

|---|---|

| Delinquency Archetype Mapping | Uses behavioral models to classify customers based on emotional response, financial situation, and communication preferences |

| AI-Optimized Engagement Journeys | Dynamically adjusts outreach strategies based on live behavior signals, delivering the right message at the right time |

| Digital-First Experience | Replaces intrusive calls with personalized email, SMS, or app notifications that resonate with customer psychology |

| Integration with Core Systems | Compatible with telecom billing systems, utility CRMs, and financial services platforms |

| Empathy-Focused Strategy Design | Balances resolution goals with brand reputation by treating debt as a shared human burden |

Proven Performance Metrics and Operational ROI

Organizations that use Symend report significant gains across customer experience, recovery efficiency, and operational cost savings. This makes Symend not just a software tool, but a business enabler.

| Metric | Outcome Achieved |

|---|---|

| Return on Investment (ROI) | Over 10x for enterprise deployments |

| Recovery Rate Improvement | Up to 10% increase compared to traditional methods |

| Operational Expenditure Savings | 85% reduction in agent-driven interactions |

| Reduction in Customer Churn | Up to 30% fewer voluntary disconnects or cancellations |

| Self-Cure Rate via Digital Outreach | Up to 26.6% of customers resolve delinquencies without live agent intervention |

| Outbound Call Reduction | Up to 80% fewer outbound calls, preserving customer goodwill |

These results demonstrate how behavior-driven design can deliver financial benefits while building long-term customer relationships.

Behavioral Strategy Architecture and Journey Mapping

Symend’s platform is built to design, launch, and optimize personalized outreach journeys that evolve over time. Each journey considers a wide range of variables, including the customer’s payment history, emotional cues, and engagement trends.

| Behavioral Engagement Layer | Functionality |

|---|---|

| Archetype Engine | Categorizes customers into profiles such as “Forgetful,” “Overwhelmed,” or “Avoidant” |

| Journey Builder | Creates modular digital paths based on emotional tone and urgency levels |

| Response Analyzer | Monitors real-time behavior like clicks, opens, and replies to fine-tune future messages |

| Channel Orchestration | Coordinates email, SMS, in-app, and web messages across multiple touchpoints |

| Brand Tone Manager | Ensures all communication aligns with a brand’s customer-centric voice |

This approach enables Symend clients to avoid the aggressive tactics of traditional debt collection, instead promoting trust, resolution, and retention.

User Feedback and Industry Insights

Users in the telecom and utility industries frequently praise Symend’s ability to manage surging delinquency volumes without overwhelming call centers. One enterprise user reported that during a peak operational period, Symend’s platform helped them maintain high engagement without expanding their workforce.

They highlighted a 26.6% digital self-cure rate through email outreach alone, while outbound calls dropped by 80%, and customer satisfaction remained strong. However, it was also noted that for complex or high-value negotiations, live agent support is still necessary. Symend’s greatest strength lies in early-stage intervention, automated reminders, and proactive outreach.

Deployment Options and Scalability

Symend offers flexible deployment based on organizational size and existing tech stack. It is not designed as a legal collections tool but rather as a preventative and customer engagement platform focused on delinquency management.

| Deployment Model | Notes |

|---|---|

| Cloud-Based SaaS | Standard model for fast deployment and lower upfront cost |

| Enterprise Integration | Connects with CRMs, billing systems, and engagement tools |

| Typical Implementation Timeline | 3–5 months with full behavioral journey design |

| Team Requirements | Minimal IT; behavioral design team support included |

| Global Language Support | Multilingual engagement journeys available |

Industries and Use Cases Where Symend Excels

Symend is best suited for organizations where customer lifetime value and brand trust are top priorities. It is particularly impactful in industries where clients may fall behind on payments due to life events, not neglect.

| Industry | Use Case |

|---|---|

| Telecommunications | Preventing disconnects from past-due mobile and internet services |

| Utilities | Reducing late bill payments while maintaining energy service continuity |

| Consumer Lending | Supporting at-risk customers through proactive, personalized messaging |

| Subscription Services | Retaining customers who miss payments due to temporary hardship |

Conclusion

Symend has reshaped how enterprise organizations approach debt collection in 2026. By replacing punitive methods with science-backed digital engagement and emotional intelligence, the platform not only helps recover more revenue but also protects brand equity and customer relationships. With strong performance across ROI, churn reduction, and digital resolution rates, Symend firmly secures its place among the top 10 debt collection software platforms in the world today.

9. TrueAccord

TrueAccord stands as one of the most advanced AI-driven debt collection platforms in the world in 2026. It offers a fully digital, customer-first approach that has been adopted by major banks, eCommerce platforms, fintech lenders, and large-scale service providers. With its patented HeartBeat machine learning engine, the platform is redefining how businesses manage overdue accounts and engage with consumers in a respectful, personalized, and scalable manner.

Unlike traditional agencies, TrueAccord relies almost entirely on automated digital outreach, allowing consumers to resolve debts on their own terms—without pressure, phone calls, or agent interventions. This has made the platform extremely popular among companies looking to protect customer relationships while increasing collection efficiency.

AI-Driven Personalization and Automation Capabilities

At the heart of TrueAccord’s success is its proprietary HeartBeat engine. This intelligent system analyzes real-time consumer behavior to continuously adapt communication strategies.

| Feature | Description |

|---|---|

| HeartBeat Machine Learning Engine | Customizes every debtor’s journey by selecting the optimal channel, message tone, and timing |

| 24/7 Self-Service Portal | Allows consumers to view their balances, choose payment plans, and pay securely anytime |

| Multi-Channel Engagement | Includes email, SMS, push notifications, and web—all fully automated and behavior-aware |

| Scalable API Architecture | Enables seamless integration with clients’ CRM, ERP, or billing platforms |

| Flexible Payment Arrangements | Provides installment plan options that align with customer preferences and ability to pay |

This intelligent automation not only improves recovery rates but also protects brand image by eliminating aggressive tactics and empowering consumers to resolve accounts independently.

Performance Metrics and Quantifiable Business Impact

TrueAccord consistently outperforms traditional debt collection methods across multiple industries. Its digital approach results in faster resolution, higher liquidation rates, and increased productivity for finance teams.

| Performance Indicator | Outcome Achieved |

|---|---|

| Liquidation Rate Improvement | 40%–60% higher than traditional agencies |

| Telecom Case Study: Liquidation Uplift | Up to 35% increase after switching to TrueAccord |

| Collector Productivity Increase (AI-based) | 2x to 4x gain due to automation |

| Human-Free Debt Resolution Rate | 98% of resolved debts handled without agent interaction |

| Starting Price | $8.00 per user/month (basic API access and feature set) |

These performance levels are especially valuable for companies dealing with large volumes of consumer debt, such as subscription services, online lenders, and digital retailers.

Technology Framework and Communication Matrix

TrueAccord’s core technology stack is designed for digital engagement at scale. The HeartBeat engine continuously refines its communication algorithms to better match customer behavior and preferences.

| Communication Channel | Behavior-Based Optimization Strategy |

|---|---|

| Preferred for high-engagement users; personalized subject lines | |

| SMS | Used for time-sensitive updates or non-responders |

| Push Notifications | Delivered via integrated apps; ideal for younger demographics |

| Web Portal | Centralized location for account management and payments |

| Omnichannel Sync | Ensures consistent messaging across all channels |

This omnichannel approach allows companies to reach customers without creating friction, ensuring faster resolution and higher satisfaction.

User Experiences and Platform Observations

Clients frequently choose TrueAccord to improve both collections performance and customer experience. A notable user from a large eCommerce firm shared that TrueAccord helped them maintain their customer-first philosophy even during the collections process. Their customers appreciated the discreet and respectful messaging, and some even returned post-resolution as active buyers.

However, users also shared important caution points:

- Data Accuracy is Critical: If incorrect account data is fed into the system, HeartBeat can trigger persistent automated communications that may result in poor customer sentiment.

- Public Reputation Variance: Despite high internal success, debtor-facing reviews—especially on platforms like Trustpilot—tend to be low (around 2.0 rating), often due to disputes over validation or account ownership.

| Feedback Category | Observed Insight |

|---|---|

| Customer Experience | Highly personalized and respectful outreach |

| Platform Efficiency | Nearly eliminates manual effort in collections |

| Risk Factors | System depends heavily on initial data integrity |

| Brand Perception | Mixed among debtors; low reviews often reflect frustration with process |

Industries That Benefit Most from TrueAccord

TrueAccord is particularly effective for consumer-facing organizations that prioritize digital experience, recurring billing, and scalable outreach.

| Industry | Best Use Case Example |

|---|---|

| eCommerce & Subscription Services | Recovering missed payments while preserving customer loyalty |

| Consumer Lending & BNPL | Offering repayment options tailored to each borrower’s profile |

| Telecommunications | Managing high-volume accounts with automated engagement workflows |

| Digital Banking & Fintech | Scalable recovery that aligns with a tech-driven brand image |

Conclusion

TrueAccord is a standout in the 2026 debt collection software landscape. With its AI-powered HeartBeat engine, fully digital outreach model, and scalable architecture, it enables businesses to collect more while doing less—and to do so with empathy and respect. Although companies must remain mindful of data accuracy and brand perception among end consumers, the platform’s measurable improvements in collection rates, operational savings, and customer retentionfirmly place it among the top 10 debt recovery tools in the world today.

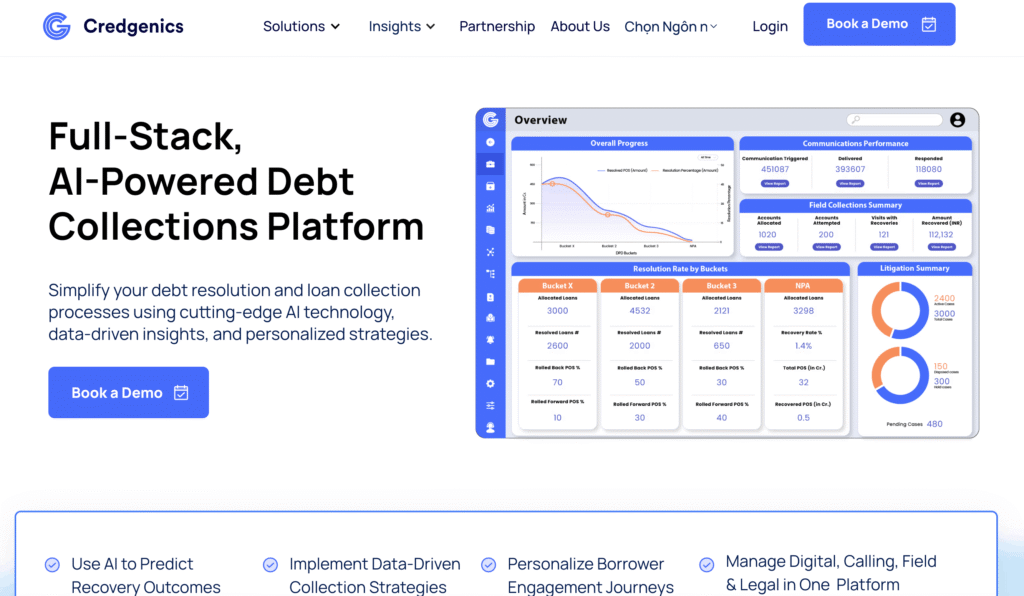

10. Credgenics

Credgenics has rapidly emerged as one of the most influential debt recovery software platforms in the world in 2026. Originally launched to address inefficiencies in India’s loan collections ecosystem, it has now gained widespread adoption across Southeast Asia, helping private banks, non-banking financial companies (NBFCs), and fintech lenders manage growing volumes of overdue accounts with speed, accuracy, and cost efficiency.

With more than 98 million loan accounts managed and over USD 250 billion in recoverable assets processed in FY24 alone, Credgenics offers a comprehensive SaaS-based collections ecosystem. It combines digital borrower engagement, field operations, litigation tracking, and AI-powered analytics—all in one scalable solution.

Core Features and Smart Recovery Capabilities

Credgenics is structured as a full-stack platform designed to modernize both digital and field-based recovery operations. It enables organizations to automate their collections lifecycle, reduce operational friction, and boost recovery rates in both urban and rural markets.

| Capability | Description |

|---|---|

| Multilingual Digital Communications | Sends borrower reminders in over 8 languages via SMS, email, IVR, and WhatsApp |

| AI-Driven Segmentation | Classifies accounts based on risk, payment intent, geography, and delinquency duration |

| Litigation Management Suite | Tracks legal escalations, court case workflows, and compliance events |

| CG Collect Mobile App | Empowers field agents with real-time tracking, offline support, and route optimization |

| Customizable Dashboards | Visualizes KPIs such as recovery timelines, daily collections, and borrower responsiveness |

These tools make the platform particularly strong in rural and semi-urban markets, where network coverage is limited and door-to-door recovery remains essential.

Quantitative Performance Results and Financial Impact

Credgenics delivers measurable outcomes that appeal to both traditional financial institutions and digital-first lenders. Its performance metrics reveal a powerful combination of faster collections, lower costs, and greater outreach reach.

| Key Performance Metric | Impact Delivered (2024–2026) |

|---|---|

| Annual Revenue Growth | 40% year-on-year growth in FY24–25 |

| Average Collection Uplift | 25% increase across user base |

| Recovery Timeline Acceleration | 30% faster recoveries compared to manual systems |

| Operating Cost Reduction | 40% decrease in outreach and logistics-related expenses |

| Daily Collection Boost (Neo-Bank Case) | 6x increase in average agent collections post CG Collect deployment |

| Institutional Adoption | Used by 100+ private banks, NBFCs, and microfinance lenders globally |

These numbers show how Credgenics has become a scalable solution for end-to-end debt lifecycle management.

Smart Field Collections with CG Collect Mobile App

One of Credgenics’ most impactful innovations is the CG Collect app, a mobile field collection tool designed to digitize rural and semi-urban recovery.

| CG Collect Feature | Operational Advantage |

|---|---|

| Real-Time Geo-Tagging | Tracks collector locations and collection outcomes instantly |

| Route Optimization | Maximizes agent efficiency in remote and hard-to-reach territories |

| Offline Mode | Supports recovery operations even in no-network zones |

| Instant Receipt Generation | Sends real-time digital receipts to borrowers via SMS or email |

| Security and Access Controls | Ensures secure login, role-based access, and device-level encryption |

This tool is especially critical in Tier 2 and Tier 3 cities, where cash payments, physical addresses, and offline capabilities are still central to debt collection workflows.

Client Testimonial and Real-World Impact

One leading neo-bank reported significant improvements after implementing Credgenics across their field and digital collection teams. By leveraging AI-led segmentation and omnichannel outreach, they reduced collection time by 35%and achieved a 30% drop in outreach costs in just six months.

Additionally, their field recovery rates jumped dramatically thanks to the mobile app, leading to a 6x increase in average daily collections. However, the client also noted that optimal results depend on having a robust data infrastructure and a modular AI architecture that can fully utilize Credgenics’ potential.

| Feedback Category | Insights from Real Users |

|---|---|

| Outreach Efficiency | High volume messaging across channels reduces dependency on call centers |

| Technology Advantage | Secure and modular, with scalable AI—but needs clean data inputs |

| Regional Adaptability | Performs well even in non-metro and low-connectivity areas |

| Ease of Integration | Works smoothly with major core banking and NBFC platforms |

Industry Applications and Regional Use Cases

Credgenics is versatile enough to support a variety of institutions across different stages of the lending lifecycle, from microfinance to consumer lending and enterprise banking.

| Sector | Example Use Case |

|---|---|

| Retail & Consumer Lending | Reducing bounce rates on EMI loans and postpaid credit |

| Microfinance Institutions | Supporting cash recovery operations in rural villages |

| Fintech & Neo-Banks | Automating repayment follow-ups for small-ticket loans |

| Traditional Banks & NBFCs | Managing NPA portfolios with full legal escalation workflows |

Conclusion

Credgenics is redefining digital debt collection in emerging and frontier markets in 2026. Its powerful combination of digital outreach, intelligent field enablement, multilingual communications, and litigation workflow management makes it a top-tier choice for financial institutions operating at scale. By delivering fast recovery, reduced costs, and better borrower engagement, Credgenics firmly secures its spot among the top 10 debt collection software solutions in the world today.

Global Debt Collection Software Market Overview and Forecasts for 2026

The global market for debt collection software is undergoing significant transformation in 2026, driven by rapid digitalization, increased regulatory pressure, and growing demand for automated solutions in credit and receivables management. With more organizations seeking scalable, cloud-based, and AI-powered tools, this industry is now a critical component of financial infrastructure across both developed and emerging economies.

Market Size Growth and Regional Expansion

The size of the global debt collection software market has reached new heights. In 2025, the market was valued at approximately USD 5.24 billion, and current projections show it could grow to USD 7.21 billion by 2030, representing a compound annual growth rate (CAGR) of 9.23%. Other forecasts are even more optimistic, estimating growth from USD 5.34 billion in 2024 to as much as USD 9.27 billion by 2030, implying a CAGR of 9.6%.

A deeper look reveals that growth is not evenly distributed across the globe. While North America holds the largest share—between 30.4% and 40%—the Asia-Pacific region is the fastest-growing, with projected growth rates exceeding 13% annually. This acceleration is largely fueled by financial digitization in high-population countries like India and China, the expansion of fintech services, and increased adoption of Buy-Now-Pay-Later (BNPL) and gig economy platforms.

Table: Global Debt Collection Software Market Forecasts

| Forecast Period | Estimated Market Size (USD) | CAGR (%) | Fastest Growing Region |

|---|---|---|---|

| 2024 – 2030 | $5.34 B → $9.27 B | 9.60% | Asia-Pacific |

| 2025 – 2030 | $5.24 B → $7.21 B | 9.23% | Asia-Pacific |

| 2025 – 2035 | $1.44 B → $3.47 B | 9.20% | Asia-Pacific |

| 2026 – 2032 | $4.98 B → $9.22 B | 9.19% | Asia-Pacific |

| 2024 – 2033 | $5.32 B → $12.24 B | 9.70% | Asia-Pacific |

Enterprise Adoption Patterns and Market Penetration

The enterprise sector remains the largest user base for debt collection software. As of 2024, large enterprises represented 57% of the market due to their complex receivables processes and stringent regulatory requirements. However, small and medium-sized enterprises (SMEs) are now the fastest-growing segment, expanding at a CAGR of 13.4%, enabled by the rise of cloud-native SaaS platforms that offer affordability and scalability.

Currently, over 8,133 businesses globally are using dedicated debt collection tools, with the United States accounting for 88.16% of these deployments. This concentration highlights both early maturity in U.S. markets and emerging opportunities in other regions, especially Asia, Europe, and Latin America.

Table: User Segmentation by Enterprise Type

| Enterprise Category | Market Share (2024) | CAGR (2024–2030) | Adoption Enablers |

|---|---|---|---|

| Large Enterprises | 57% | 8.2% | Legacy debt portfolios, regulatory needs |

| SMEs | 43% | 13.4% | SaaS affordability, low IT dependency |

Application-Based Market Segmentation and Adoption Drivers

The use of debt collection platforms is closely tied to industry-specific billing complexity, customer contact volumes, and risk exposure. In 2026, finance companies, collection agencies, law firms, healthcare providers, and telecom operators are among the most prominent adopters.

Table: Industry Segmentation by Adoption Share and Drivers

| Industry Sector | Adoption Share (%) | Key Drivers for Adoption |

|---|---|---|

| Finance Companies | 35% | Rise in NPLs, stricter regulations, need for auditability |

| Collection Agencies | 28% | Efficiency, multi-account tracking, automation |

| Law Firms & Government | 15% | Legal compliance, document control, workflow digitization |

| Retail & E-Commerce | 12% | BNPL expansion, cross-border billing, seasonal spikes |

| Healthcare | Varies (High) | Revenue Cycle Management, denial reduction |

| Telecom & Utilities | Varies (High) | Customer churn control, service continuity optimization |

For example, athenaCollector, one of the leading healthcare-focused collection platforms, supports over 5,485 customers by automating claim scrubbing and integrating real-time patient financial data. In parallel, industries like telecom and e-commerce use solutions such as TrueAccord and Symend to manage high-volume delinquency through AI-powered digital outreach.

Technology Trends Driving Adoption in 2026

Several technology trends are accelerating adoption across all sectors:

| Technology Feature | Impact on Debt Collection Workflows |

|---|---|

| AI & Machine Learning | Predicts payment behavior, automates prioritization of accounts |

| Cloud-Based SaaS Models | Reduces IT costs, enables fast deployment, improves scalability |

| Behavioral Science Integration | Improves engagement and resolution rates through empathetic design |

| Mobile Field Collection Apps | Enables rural and offline recovery (e.g., Credgenics’ CG Collect) |

| API and ERP Integration | Supports seamless data exchange with CRMs, billing, and legal tools |

These innovations are particularly beneficial for financial institutions, micro-lenders, and credit service providers operating in multi-regional and multilingual environments.

Conclusion

The global debt collection software industry in 2026 is characterized by agile platforms, digital-first engagement, intelligent automation, and deep integration across financial ecosystems. With strong market growth, rising enterprise demand, and a shift toward customer-friendly recovery models, software solutions like athenaCollector, SAP, FICO, TrueAccord, HighRadius, Symend, and Credgenics are not just tools—they are essential enablers of revenue recovery, regulatory compliance, and operational resilience.

Technological Evolution in Debt Collection: The Rise of Agentic AI in 2026

In 2026, debt collection is being transformed by a new generation of intelligent software powered by Agentic Artificial Intelligence (AI). This shift represents a major leap forward from older rule-based automation tools, as modern platforms now use large language models (LLMs), predictive analytics, and behavioral decisioning to independently manage the full lifecycle of borrower engagement.

Agentic AI doesn’t just execute pre-coded instructions—it interprets context, adapts in real time, and personalizes each interaction with a level of nuance similar to human agents. These intelligent systems are changing how debt is collected, recovered, and resolved at scale, helping organizations unlock higher recovery rates, lower operational costs, and better customer experiences.

Agentic AI vs Traditional Automation: Key Differences

Unlike static systems that rely on simple logic trees, Agentic AI platforms in 2026 deliver adaptive responses based on customer intent, emotional readiness, and engagement history. This enables more empathetic and effective recovery strategies, with 24/7 execution and zero fatigue.

| Feature | Traditional Automation | Agentic AI (2026) |

|---|---|---|

| Decision Model | Predefined “if-then” rules | Dynamic predictive modeling and behavioral analytics |

| Engagement Personalization | Generic response trees | Customized per user archetype and context |

| Real-Time Learning | Manual updates required | Self-improving with every interaction |

| Channels Supported | Email, SMS, calls | Omnichannel including in-app, chatbot, social, embedded UI |

| Outcome Optimization | Fixed scripts | Goal-oriented conversation design |

Operational Benefits of Agentic AI Across the Collection Lifecycle

Agentic AI enhances performance at every stage—from early outreach to final resolution—by automating decisions and optimizing interactions.

| Operational Metric | Traditional Methods | AI-Powered Platforms (2026) | Efficiency Gain |

|---|---|---|---|

| Recovery Rate | Baseline | +10% to +25% | Up to 25% |

| Cost per Recovery | $10.00 (example) | $1.00 (example) | 90% Reduction |

| Agent Workload | High manual dependency | 60% to 85% less manual load | Up to 85% |

| Resolution Time | 4–5 days | 24 to 48 hours | Over 50% Faster |

| Debtor Satisfaction | Standard | +10% improvement | 10% Gain |

This dramatic improvement is made possible through the platform’s ability to determine not just whether a customer is financially capable of repaying—but also whether they are psychologically ready to engage. This intent-based recovery design is now a standard feature in many of the top 10 global debt collection platforms.

Invisible Payments and Seamless Settlement Experience

Another key advancement in 2026 is the integration of Invisible Payments, where debt resolution becomes part of the user’s everyday digital journey. Enabled by real-time payment rails and open finance APIs, borrowers can now repay through embedded links in apps, websites, and even within digital wallets—without friction or delay.

| Payment Channel Evolution | 2015–2020 Model | 2026 Model (Invisible Payments) |

|---|---|---|

| Collection Method | Manual payments via portal/call | Auto-triggered, background-settled via apps or SMS links |

| Payment Authorization | Multi-step entry + OTP | Biometric + one-tap confirmation |

| Customer Experience | Interruptive, high-friction | Seamless, embedded in everyday actions |

| Resolution Completion Time | 2–5 days | Instantly settled on engagement |

By removing the pain points of traditional payments, invisible settlement mechanisms promote on-time compliance, reduce payment abandonment, and improve both collection velocity and customer trust.

Compliance by Design: Built-in Trust and Auditability

With increased regulatory scrutiny in digital finance, the best platforms now use Compliance by Design principles. Instead of layering compliance as an afterthought, policy rules—such as communication frequency limits, consent validation, and disclosure requirements—are now embedded directly into the platform logic.

| Compliance Factor | Traditional Collection Tools | AI-Powered Systems (2026) |

|---|---|---|

| Consent Management | Manual uploads and audits | Real-time, API-verified consent tagging |

| Channel Limiting | Script-based call volume controls | Embedded throttling by customer type and risk profile |

| Disclosure Standards | Static templates | Dynamic, geo-compliant, and audit-ready formats |

| Regulatory Reporting | Periodic manual exports | Real-time dashboards with full audit logs |

This shift ensures every borrower interaction is automatically compliant, fully auditable, and aligned with local regulations like FDCPA, GDPR, and CFPB.

Conclusion

The rise of Agentic AI, invisible payments, and real-time compliance is defining the future of debt recovery in 2026. With platforms now capable of delivering personalized, emotionally intelligent, and regulation-compliant interactions at scale, debt collection has become more precise, respectful, and effective than ever before.

These breakthroughs are not just shaping new expectations—they are cementing the leading role of intelligent automation in the global debt recovery software ecosystem. As adoption widens, organizations leveraging these technologies will benefit from faster payments, lower costs, and stronger customer relationships.

Market Dynamics in 2026: Regional Distribution and Evolving Revenue Models in Debt Collection Software

The global landscape of debt collection software in 2026 is being shaped by two powerful forces: regional market maturity and disruptive pricing innovations. While North America continues to lead in overall revenue generation, other regions—particularly Asia-Pacific—are witnessing rapid digital adoption, driven by financial inclusion initiatives, mobile-first lending, and gig economy expansion.

At the same time, pricing models have shifted from rigid, legacy structures to dynamic, value-driven frameworks. Software vendors are now offering more flexible payment schemes tailored to client size, digital maturity, and performance outcomes.

Regional Trends in Debt Collection Technology Adoption

The adoption of debt collection platforms varies greatly by geography, industry focus, and stage of digital transformation. Countries with mature financial systems tend to have the highest number of users, while emerging markets are catching up fast due to SaaS accessibility and mobile integration.

Table: Geographic Adoption of Debt Collection Software (2025–2026)

| Region | Total Customer Count (Sample) | Market Share % (Est.) | Dominant Industry Segment |

|---|---|---|---|

| United States | 6,733 | 88.16% | Healthcare, Financial Services, Cloud |

| United Kingdom | 254 | 3.33% | Banking, Telecommunications |

| India | 171 | 2.24% | Digital Lending, SME Banking |

| Asia-Pacific (Other) | High Growth | N/A | Gig Economy, BNPL, Retail |

| Europe (Other) | 487 | 6.27% | Manufacturing, Utilities |

The United States dominates global software usage, particularly in sectors like revenue cycle management (RCM), insurance billing, and enterprise banking. However, Asia-Pacific, led by countries such as India, Vietnam, and Indonesia, is experiencing the fastest year-on-year growth, supported by cloud-native financial ecosystems and mobile-first debt servicing platforms.

Pricing Models and Revenue Strategies in 2026

Debt collection software providers now offer a wide range of pricing structures depending on deployment style, usage volume, and industry-specific requirements. While traditional players like SAP continue to operate on per-user billing models, modern SaaS platforms such as TrueAccord, Upflow, and Credgenics have adopted outcome-based or revenue-tiered models to attract growth-stage businesses.

Table: Pricing Comparison of Top Debt Collection Software Providers (2026)

| Software Vendor | Deployment Model | Pricing Logic | Estimated Cost Entry Point |

|---|---|---|---|

| athenaCollector | Cloud / SaaS | % of Monthly Collections | Variable based on practice volume |

| SAP Collections | Hybrid / Cloud | Per User / Block Licensing | $408 / user / month |

| HighRadius | Cloud / SaaS | ROI-Based Subscription Model | Custom Enterprise Quote |