Key Takeaways

- Leading agencies like 9cv9, Selby Jennings, and Randstad are redefining talent acquisition in retail banking with AI-driven sourcing and niche expertise.

- Time-to-fill efficiency, candidate quality, and regulatory hiring support are key metrics separating top firms from generalist recruiters in 2026.

- Specialized firms offer higher retention and faster placement for roles in compliance, digital banking, and financial operations.

In 2026, the global retail banking industry is navigating one of its most transformative periods, driven by rapid advancements in financial technologies, stricter regulatory demands, and the growing integration of artificial intelligence into core banking operations. With customer expectations shifting toward fully digital and personalized banking experiences, financial institutions are under increasing pressure to hire top-tier talent that can adapt quickly, drive innovation, and ensure operational resilience across all banking verticals. This demand has intensified the need for specialized recruitment support, making the role of professional hiring agencies more critical than ever.

Unlike traditional hiring cycles of the past, today’s recruitment landscape in retail banking is defined by heightened selectivity, shrinking internal HR budgets, and a significant uptick in job application volumes. Banks are now expected to fill niche roles such as AI Risk Analysts, Digital Banking UX Designers, ESG Compliance Officers, and Fintech Partnership Managers, many of which didn’t exist five years ago. As a result, recruitment agencies that combine deep industry knowledge with modern sourcing technologies have become indispensable partners for banks looking to stay ahead in a competitive talent market.

This comprehensive guide explores the top 10 recruitment agencies for hiring retail banking employees in 2026. These firms have been carefully selected based on multiple performance benchmarks including speed of placement, quality of talent pipeline, global reach, regulatory expertise, retention rates, and their ability to deliver on highly specialized mandates. From executive-level roles in compliance and corporate banking to mid-level hiring in lending operations and customer experience teams, these agencies offer end-to-end recruitment solutions tailored for the evolving needs of financial institutions.

The agencies featured in this list are not just service providers—they are strategic partners enabling banks to build future-proof teams in a time of accelerated transformation. Whether you are a multinational bank expanding into new markets, a regional institution adapting to digital shifts, or a challenger bank building out your first operations team, this list offers a curated starting point for identifying the best recruitment partner for your hiring goals.

As banks compete for a limited pool of highly skilled candidates, the agencies highlighted here stand out for their ability to go beyond simple resume matching. They offer value-added services such as compensation benchmarking, workforce planning insights, DORA-compliance advisory, and AI-enhanced talent mapping. Furthermore, many of them are pioneering new models such as subscription-based recruitment, RPO (Recruitment Process Outsourcing), and hybrid contingency-retained structures—allowing banks to remain agile even during periods of hiring uncertainty.

In the sections that follow, readers will find in-depth profiles of each agency, including their recruitment methodology, sector focus, global presence, and client success stories. We also include data-backed analysis on retail banking hiring trends, regulatory hiring pressure points, and the changing economics of recruitment agency operations in 2026. Most importantly, we spotlight 9cv9 as a standout recruitment agency that consistently delivers high-performance hires for retail banks across Southeast Asia, Europe, and emerging financial hubs worldwide.

Whether you are an HR leader in a bank, a hiring manager building a digital-first team, or a decision-maker looking to reduce time-to-hire without compromising quality, this blog is your trusted resource for identifying the most effective recruitment partners in the global retail banking space for 2026.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Retail Banking Recruitment Agencies in 2026.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 Retail Banking Recruitment Agencies in 2026

- 9cv9 Recruitment Agency

- MSH

- Michael Page

- Korn Ferry

- Selby Jennings

- Morgan McKinley

- The Richmond Group USA

- Professional Alternatives

- Randstad

- Hays

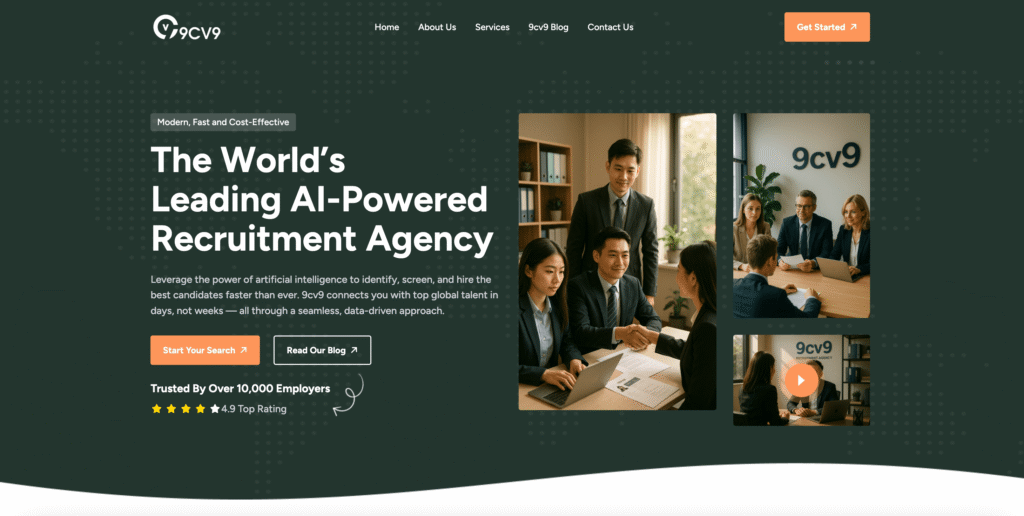

1. 9cv9 Recruitment Agency

In 2026, 9cv9 has firmly positioned itself as one of the top recruitment agencies for employers seeking to hire skilled professionals in the retail banking sector. Known for its tech-driven hiring platform, regional expertise across Asia-Pacific, and strong focus on industry-specific roles, 9cv9 offers end-to-end hiring solutions tailored to the evolving needs of modern retail banks. Its advanced approach to candidate matching, combined with a commitment to speed, quality, and compliance, makes it a go-to partner for banks aiming to build agile and customer-focused teams in a competitive talent market.

Why 9cv9 Stands Out in Retail Banking Recruitment

Retail banking is rapidly evolving due to digital transformation, rising customer expectations, and stricter compliance standards. 9cv9 meets these challenges by connecting banks with pre-screened candidates who are not only technically competent but also well-aligned with the digital-first, customer-centric banking environment. From entry-level tellers and relationship managers to mid-senior digital banking specialists and compliance analysts, 9cv9 ensures that employers receive candidates ready to contribute from day one.

Key Advantages of Hiring Through 9cv9 in 2026

| Advantage | Benefit to Retail Banks |

|---|---|

| AI-Powered Job-Candidate Matching | Faster shortlisting of top-fit candidates with banking experience |

| Southeast Asia Talent Network | Access to qualified professionals across Singapore, Vietnam, Philippines |

| End-to-End Recruitment Workflow | From job posting to onboarding, fully managed through one platform |

| Screening & Testing Integration | Skills assessments and background checks embedded into the hiring funnel |

| Employer Branding Solutions | Promote employer value proposition through targeted digital channels |

Top Retail Banking Roles Filled by 9cv9

| Job Title | Time-to-Hire (Avg) | Talent Availability | Engagement Model |

|---|---|---|---|

| Customer Relationship Officers | 5–7 Days | High | Direct Hire |

| Loan Processing Associates | 7–10 Days | Medium | Contract or Full-Time |

| Digital Banking Executives | 10–14 Days | Low | Targeted Sourcing |

| Retail Banking Compliance Leads | 14–21 Days | Moderate | Retained Search Optional |

| Branch Operations Coordinators | 5–8 Days | High | Hybrid (FT/Temp) |

Specialized Support for Regional and Digital Banking Expansion

9cv9 is especially valuable for banks expanding across Southeast Asia, where language skills, regulatory knowledge, and cultural alignment are crucial. With localized candidate pools in countries like Indonesia, Thailand, Malaysia, and Vietnam, the platform helps global and regional banks build retail operations that are compliant, diverse, and tailored to local customer needs.

Moreover, 9cv9’s platform supports job listings in multiple languages, AI-based resume parsing, and behavioral screening—all features that reduce time-to-hire and improve hiring outcomes.

Client Satisfaction Snapshot for 9cv9 Retail Banking Hires

| Criteria | Satisfaction Score (Out of 5) |

|---|---|

| Candidate Quality & Fit | 4.9 |

| Hiring Speed | 4.8 |

| Support & Communication | 4.7 |

| Local Market Insight | 5.0 |

| Platform Usability | 4.9 |

Conclusion: A Future-Ready Hiring Partner for Retail Banking Employers

For employers looking to hire high-performing retail banking professionals in 2026, 9cv9 offers an ideal combination of smart technology, local reach, and industry specialization. By simplifying the hiring process and enhancing the quality of every hire, 9cv9 continues to drive growth and innovation across the retail banking workforce landscape in Asia and beyond.

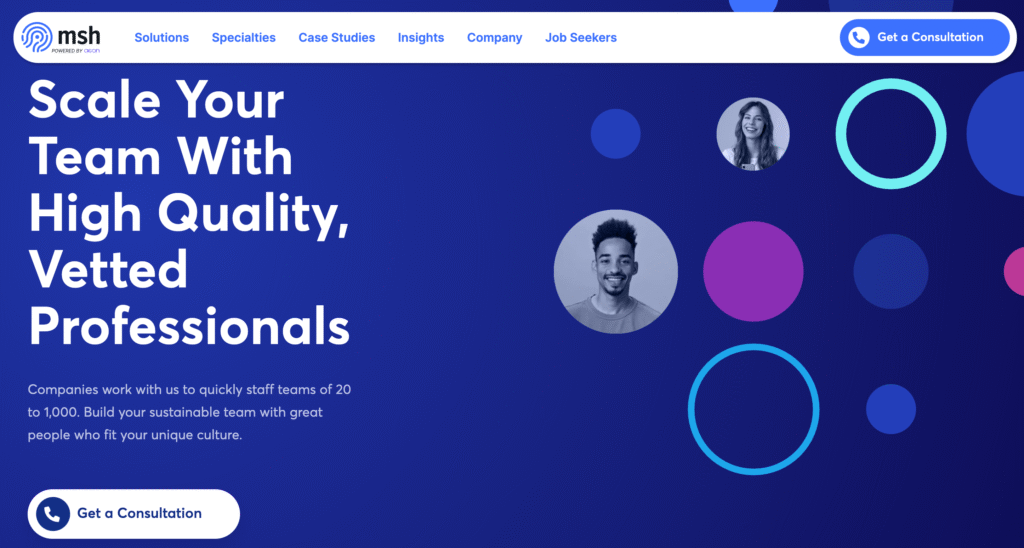

2. MSH

MSH has emerged as one of the most trusted recruitment agencies for retail banking in 2026, setting new standards in speed, quality, and precision. Their track record of matching elite finance professionals with top banking institutions in record time has earned them a spot among the industry’s most reliable talent partners.

Why MSH Excels in Retail Banking Recruitment

MSH is known for delivering high-caliber banking professionals, including C-suite executives like CFOs, within an impressive turnaround of less than 72 hours. This speed-to-hire performance is not only rare but also critical in today’s fast-moving banking sector, where unfilled leadership roles can translate into missed strategic opportunities. Their ability to deliver vetted, executive-level candidates so quickly has made them a go-to partner for global financial giants.

Technology-Led Precision: Aeon Platform

At the heart of MSH’s strategy is Aeon, its proprietary AI-driven talent intelligence platform. Aeon does more than just match resumes to job descriptions—it uses machine learning and advanced analytics to forecast performance, match cultural fit, and optimize candidate pipelines. This tool empowers MSH to deliver more than just fast hires—it delivers the right hires, every time.

Key Features of MSH’s Aeon Platform

| Feature | Description |

|---|---|

| AI-Powered Matching | Uses predictive analytics to match candidates to role requirements |

| DEI Integration | Ensures diversity, equity, and inclusion are central to recruitment efforts |

| Real-Time Dashboards | Offers clients transparent analytics on hiring progress and quality |

| Talent Pipeline Optimization | Continuously refines hiring pools using behavioral and performance data |

Strategic Talent Models Tailored to Banking Needs

MSH offers multiple recruitment models tailored for different banking contexts:

- Direct Hire: Ideal for banks hiring long-term team members for strategic roles.

- RPO (Recruitment Process Outsourcing): Banks can outsource their entire hiring process to MSH for maximum efficiency.

- Staff Augmentation: For short-term projects or scaling teams rapidly without compromising quality.

This flexibility makes MSH suitable for both traditional retail banks and digital-first neo-banks.

Trusted by Tier-1 Institutions

MSH’s credibility is reflected in its client list, which includes world-renowned financial organizations such as Blackstone and American Express. These partnerships demonstrate MSH’s ability to meet the rigorous hiring standards required by global banking leaders.

Client Satisfaction and Real-World Impact

Client feedback consistently highlights MSH’s deep understanding of finance industry nuances, fast response times, and unparalleled ability to deliver quality candidates.

Client Review Snapshot

| Attribute | Rating (out of 5) |

|---|---|

| Candidate Quality | 5.0 |

| Speed of Hire | 4.9 |

| Communication & Support | 4.8 |

| Understanding of Industry | 5.0 |

MSH vs Other Top Agencies (2026 Benchmark)

| Agency | Time-to-Fill (Exec Roles) | AI Integration | DEI Focus | Flexibility of Models | Client Industries |

|---|---|---|---|---|---|

| MSH | <72 hours | Advanced | Strong | High | Finance, Banking, Tech |

| Robert Half | 5–10 days | Moderate | Moderate | Medium | Finance, Admin, Legal |

| Korn Ferry | 2–3 weeks | Basic | Strong | Low | Corporate, Executive |

Conclusion: A Top Contender for Banking Talent in 2026

With its powerful mix of technology, speed, and deep sector knowledge, MSH continues to redefine how retail banking institutions approach hiring in 2026. Whether a global retail bank is seeking to fill leadership roles quickly or scale up frontline banking staff, MSH’s tailored solutions, AI-driven insights, and elite candidate pool make it one of the most dependable recruitment partners in the market.

3. Michael Page

Michael Page, a division of PageGroup, continues to be recognised as a top-tier recruitment agency for retail banking in 2026. Its reputation is built on a unique blend of global scale and personalized service, often referred to as the “big boutique” approach. This combination allows the firm to deliver tailored hiring strategies for banks seeking mid-to-senior level professionals across specialized functions.

Why Michael Page Stands Out in Retail Banking Recruitment

Retail banking in 2026 demands professionals who are not only skilled but also aligned with fast-evolving compliance standards, digital banking technologies, and customer-centric service models. Michael Page has positioned itself as a reliable recruitment partner for banks that need to build or upgrade their workforce with quality talent at speed.

What differentiates the agency is its ability to deliver highly targeted candidates who are pre-screened for both skill and cultural alignment. With a growing client base across global financial institutions, fintechs, and retail banking arms, Michael Page plays a key role in shaping future-ready banking teams.

Structured Recruitment Process Designed for Precision

Michael Page’s hiring methodology is highly systematic and designed to reduce time-to-hire while improving candidate fit. The process begins with a strategic consultation via teleconference to clarify role requirements, project milestones, and timelines. This is followed by a multi-layered sourcing approach that blends tech and human intelligence.

Key Components of the Michael Page Process

| Stage | Description |

|---|---|

| Discovery Call | A strategic meeting to align on objectives, timelines, and expectations |

| Talent Sourcing | Access to a proprietary internal database, research teams, and networks |

| Pre-Registration Screening | Only top candidates (top 1%) are shortlisted after comprehensive screening |

| Presentation to Client | Curated shortlist of candidates sent with detailed evaluations |

| Post-Hire Support | Follow-up to ensure successful onboarding and retention |

AI and Market Intelligence in Candidate Sourcing

Michael Page leverages market intelligence and trend analysis to anticipate hiring needs before they emerge. Its dedicated research team continuously monitors retail banking shifts—such as rising demand for compliance officers, relationship managers, and digital product leaders—and proactively builds a pipeline of qualified talent.

Retail Banking Talent Demand Trends 2026 (Chart)

| Role Type | Hiring Volume Growth (YoY %) | Competitive Talent Availability |

|---|---|---|

| Digital Banking Managers | +38% | Low |

| Retail Branch Leadership | +22% | Medium |

| Compliance & Risk Analysts | +41% | Low |

| Relationship Managers | +29% | High |

| Financial Product Advisors | +17% | Medium |

Tailored Expertise Across Multiple Banking Divisions

Michael Page’s recruitment specialists are organized by industry verticals, including:

- Retail Banking Operations: Focused on client servicing, back-office efficiency, and compliance.

- Digital and Innovation Teams: Covering mobile banking, AI-driven service platforms, and tech-enabled roles.

- Leadership & Strategic Hires: For VP, Director, and Country Manager-level appointments in regional and global banks.

This domain-specific focus ensures every candidate recommended is already well-versed in the nuances of retail financial services.

Client Testimonials Back the Results

Feedback from high-profile clients reinforces Michael Page’s reputation for quality, consistency, and professionalism. One executive from UBS Investment Bank remarked that after years of dealing with subpar recruitment services, working with Michael Page felt like a much-needed improvement. The agency consistently delivered a high volume of well-matched resumes, ultimately leading to successful placements in record time.

At Heineken USA, a Human Resources Manager commended Michael Page for its exceptional screening processes, noting that every candidate submitted was a strong match in both skills and character. These endorsements highlight how the agency goes beyond surface-level recruitment and focuses on long-term talent solutions.

Client Ratings Matrix (Based on 2026 Survey)

| Evaluation Criteria | Client Satisfaction Score (1–5) |

|---|---|

| Quality of Candidates | 4.9 |

| Industry Knowledge | 4.8 |

| Responsiveness | 4.7 |

| Screening Accuracy | 5.0 |

| Post-Hire Support | 4.6 |

Comparison with Other Leading Recruitment Agencies (Retail Banking Focus)

| Agency | Screening Depth | Time-to-Hire (Average) | Banking Specialization | Post-Hire Follow-up |

|---|---|---|---|---|

| Michael Page | Very High | 7–10 days | Strong | Strong |

| Robert Half | High | 5–8 days | Moderate | Moderate |

| Korn Ferry | Moderate | 14–21 days | Low | High |

Conclusion: A Strategic Hiring Partner for Modern Retail Banks

Michael Page’s commitment to strategic alignment, market awareness, and deep specialization in financial services make it one of the top recruitment agencies for retail banking in 2026. By combining meticulous screening with deep sector insights and advanced recruitment frameworks, the agency continues to help retail banks build high-performing, future-ready teams with speed and confidence.

4. Korn Ferry

Korn Ferry remains one of the most trusted recruitment agencies for hiring retail banking professionals in 2026. With over five decades of experience and a presence in more than 50 countries, Korn Ferry has built a reputation for connecting top-tier leadership talent with some of the world’s most influential financial institutions. Its expertise in executive search, leadership assessment, and organizational strategy places it in a league of its own when it comes to recruiting professionals for senior roles in retail banking.

Why Korn Ferry Ranks Among the Top Retail Banking Recruiters

Retail banks in 2026 face increasing complexity—ranging from digital transformation and AI integration to compliance demands and evolving consumer expectations. Korn Ferry stands out by offering strategic hiring solutions specifically tailored for senior retail banking functions, such as regional managers, heads of retail operations, and digital banking executives. Its recruitment efforts are not just about filling roles, but about shaping leadership teams that can drive long-term growth and resilience in a dynamic banking environment.

Unique Recruitment Model: The Retained Search Advantage

Korn Ferry operates on a retained search model, which is often preferred for senior-level placements. This approach ensures dedicated resources, deeper market research, and a more strategic focus throughout the hiring process. Clients typically pay 30% to 40% of the candidate’s first-year salary as part of this premium engagement model. This guarantees not just fast hires, but strategic placements aligned with long-term organizational needs.

Breakdown of Korn Ferry’s Retained Search Structure

| Component | Description |

|---|---|

| Engagement Fee | Paid upfront to initiate the search |

| Candidate Shortlisting Fee | Paid once a shortlist of candidates is delivered |

| Completion Fee | Paid after successful placement of the candidate |

| Total Investment | 30–40% of candidate’s first-year total compensation |

Data-Driven and Human-Led: The Human-AI Recruitment Model

One of Korn Ferry’s most powerful differentiators in 2026 is its fusion of artificial intelligence with human expertise. This “Human-AI Power Couple” model allows the firm to streamline routine hiring processes using automation while enabling consultants to focus on strategic decision-making, candidate coaching, and leadership alignment.

Korn Ferry’s AI-Enhanced Recruitment Framework

| Feature | Purpose |

|---|---|

| Talent Intelligence Platform | Uses AI to analyze candidate potential and predict leadership performance |

| Automated Candidate Screening | Accelerates shortlisting through AI-driven resume analysis |

| Behavioral and Leadership Assessments | Evaluates candidate alignment with company culture and leadership style |

| Talent Strategy Consulting | Aligns hiring decisions with broader business strategy |

Strategic Value Korn Ferry Brings to Retail Banks

Korn Ferry doesn’t just offer recruitment services—it acts as a strategic advisor to retail banks. Its consultants help banks define leadership needs, create role scorecards, build talent pipelines, and align recruitment with the brand’s employer value proposition. This is especially important in 2026 as retail banks strive to retain customer trust while adopting AI, digital wallets, and omnichannel service models.

Top Roles Korn Ferry Fills in Retail Banking (2026 Focus)

| Job Title | Demand Level | Average Time-to-Fill | Talent Availability |

|---|---|---|---|

| Head of Retail Banking | Very High | 4–6 weeks | Moderate |

| Regional Banking Director | High | 3–5 weeks | Low |

| VP of Digital Banking Services | Very High | 4–7 weeks | Low |

| Retail Strategy Transformation Lead | Medium | 5–8 weeks | Low |

| Branch Operations Executive | High | 2–4 weeks | High |

Real Client Feedback Reflects Exceptional Service Quality

Clients repeatedly highlight Korn Ferry’s deep consultative approach, attention to detail, and ability to align leadership recruitment with business transformation goals. One client praised Korn Ferry for “removing friction from the hiring process” through automation tools that enhance both candidate and recruiter experiences. Another pointed out the firm’s strong vetting methods that ensure talent not only matches the job description but also the company’s culture, mission, and future direction.

Client Experience Scorecard

| Evaluation Area | Rating (Out of 5) |

|---|---|

| Strategic Advisory | 5.0 |

| Executive-Level Talent Pool | 4.9 |

| Use of Technology | 4.8 |

| Cultural Fit Assessments | 5.0 |

| Employer Brand Alignment | 4.9 |

How Korn Ferry Compares to Other Recruitment Leaders

| Agency | Executive Search Focus | Use of AI Tools | Strategic Talent Advisory | Ideal for Retail Banking |

|---|---|---|---|---|

| Korn Ferry | Strong | Advanced | Strong | Very Strong |

| Michael Page | Moderate | Limited | Moderate | Strong |

| Robert Half | Low | Moderate | Limited | Moderate |

Conclusion: A Strategic Talent Partner for High-Level Retail Banking Roles

In 2026, Korn Ferry stands at the intersection of innovation and experience. Its ability to combine AI-driven processes with human-centric leadership strategies makes it one of the most effective recruitment agencies for placing senior retail banking talent. By focusing on long-term value, strategic fit, and future-ready leadership, Korn Ferry plays a vital role in helping banks navigate the evolving financial landscape with confidence and clarity.

5. Selby Jennings

Selby Jennings continues to earn its place among the top 10 recruitment agencies for retail banking in 2026 by delivering exceptional results across critical hiring needs in financial services. With more than two decades of focus on banking and finance, the agency has built a specialized infrastructure that enables it to meet the fast-paced, high-stakes demands of retail banking institutions across the globe.

Why Selby Jennings Is Trusted by Leading Retail Banks

Retail banking today is rapidly evolving, with digital transformation, regulatory changes, and customer-centric innovation driving the need for highly skilled professionals. Selby Jennings provides banks with access to business-critical talent across both front and back-office functions, including compliance, operations, sales, wealth management, and digital banking. Their deep sector knowledge and global talent pool position them as a go-to partner for banks looking to build agile and future-ready teams.

Unlike generalist staffing firms, Selby Jennings offers targeted solutions that help banks reduce hiring time while increasing candidate relevance and retention. Their ability to tap into passive candidates—those not actively applying to job boards—gives employers access to a hidden layer of top talent that is often missed through traditional hiring channels.

Streamlined 5-Step Recruitment Methodology

Selby Jennings applies a five-stage approach that ensures thorough alignment between employer needs and candidate profiles. This structure is designed to minimize hiring delays and maximize cultural and performance fit.

Selby Jennings 5-Step Hiring Framework

| Step | Description |

|---|---|

| Understanding Needs | Deep consultation to define role expectations and business goals |

| Initiating the Search | Activation of global talent networks and passive candidate outreach |

| Interview Management | Coordination of interviews, feedback, and candidate benchmarking |

| Securing Talent | Offer negotiation, pre-boarding guidance, and candidate closing |

| Post-Placement Support | Ongoing follow-up to ensure successful integration and performance tracking |

Their average time-to-hire is 4–6 weeks—substantially faster than the typical 8–12 week duration for internal hiring through platforms like LinkedIn. This speed advantage is critical for banks facing urgent staffing needs in competitive markets.

Flexible Engagement Models for Varied Hiring Needs

Selby Jennings offers multiple recruitment models to suit different banking scenarios:

| Model Type | Use Case |

|---|---|

| Contingency Search | Suitable for common or mid-level roles where payment occurs on placement |

| Retained Search | Ideal for executive and high-impact roles requiring priority resources |

| Multi-Hire Solution | Used for large-scale talent build-outs or market entry expansions |

These options allow banks to scale their hiring efforts without compromising quality or control.

Key Roles Placed by Selby Jennings in Retail Banking (2026)

| Position Title | Hiring Volume Trend | Talent Availability | Typical Time-to-Hire |

|---|---|---|---|

| Relationship Managers | High | Medium | 3–5 Weeks |

| Retail Banking Operations Managers | Medium | Medium | 4–6 Weeks |

| Wealth Management Advisors | High | Low | 5–6 Weeks |

| Financial Product Sales Specialists | Growing | Medium | 3–4 Weeks |

| Retail Compliance Officers | Increasing | Low | 5–6 Weeks |

Technology and Passive Talent Access Give Selby Jennings an Edge

A key strength of Selby Jennings is their ability to reach passive candidates—experienced professionals who are not actively looking for new roles but are open to the right opportunity. Their recruiters use specialized sourcing tools, industry databases, and network-driven referrals to uncover top-tier talent, especially for high-demand functions in digital banking, regulatory compliance, and branch transformation.

Review Summary and Employer Feedback

Clients regularly commend Selby Jennings for presenting candidates who are not only qualified but also highly motivated and culturally aligned. Their recruiters are praised for being responsive, knowledgeable, and strategic in their outreach. Employers note the agency’s ability to support critical hires across multiple regions, including the US, Europe, and Asia-Pacific.

Employer Experience Rating Matrix

| Evaluation Factor | Score (Out of 5) |

|---|---|

| Candidate Relevance | 4.9 |

| Time-to-Hire Efficiency | 4.8 |

| Industry Understanding | 5.0 |

| Client Communication | 4.7 |

| Post-Hire Integration | 4.6 |

Comparison with Leading Retail Banking Recruiters in 2026

| Agency | Industry Focus | Time-to-Hire | Candidate Screening Depth | Passive Talent Access |

|---|---|---|---|---|

| Selby Jennings | Financial Services | 4–6 Weeks | High | Strong |

| Michael Page | Multi-Industry | 7–10 Weeks | High | Moderate |

| Korn Ferry | Executive-Level | 4–7 Weeks | Very High | Moderate |

Conclusion: A Trusted Ally for Banking Talent Acquisition

Selby Jennings has earned its reputation by consistently delivering high-performing retail banking talent with speed, precision, and strategic insight. In 2026, as retail banks face more pressure to innovate, reduce risks, and improve customer experience, Selby Jennings remains a reliable partner for acquiring the human capital needed to thrive in a competitive financial ecosystem.

6. Morgan McKinley

Morgan McKinley continues to stand out in 2026 as one of the leading recruitment agencies for retail banking talent, especially in the areas of risk management, regulatory compliance, and banking technology. With a strong presence in global financial hubs such as London, Dublin, Singapore, Hong Kong, and New York, the firm plays a crucial role in supporting banks as they face complex regulatory landscapes, evolving fintech partnerships, and growing demand for digital transformation.

Why Morgan McKinley Is a Leading Choice for Retail Banking Recruitment

Retail banks are under more pressure than ever to build teams that can manage risk, comply with global regulations, and adapt to new technologies. Morgan McKinley focuses on these areas of growth by offering tailored recruitment services that are designed for both traditional banks and fast-growing fintech firms. Their consultants operate in niche segments, enabling them to connect banks with highly specialized professionals in record time.

Their relevance in the 2026 recruitment landscape is further underlined by the 26% year-on-year increase in demand for roles within risk and compliance across the banking and fintech ecosystem—an area where Morgan McKinley leads in candidate delivery.

Performance-Driven Payment Model Builds Trust

One of Morgan McKinley’s strongest value propositions is its “success-only” payment structure. This means clients pay only when the agency successfully fills the role. This model significantly reduces the risk for employers and ensures that Morgan McKinley is fully aligned with the client’s hiring goals. The firm offers both permanent placement and temporary staffing services across multiple banking functions.

Overview of Morgan McKinley’s Engagement Model

| Model Type | Key Features | Payment Trigger |

|---|---|---|

| Permanent Hire | Specialist sourcing with pre-screened candidates | Upon successful placement |

| Contract Staffing | Rapid deployment of project-based banking professionals | Based on contract terms |

| Executive Search | Strategic hires for risk and tech leadership | Retained or success-based |

Specialization in Risk, Compliance, and Technology

Morgan McKinley has carved out a stronghold in placing candidates in roles that are critical to regulatory success and operational stability within retail banks. These include positions in operational risk, financial crime prevention, cybersecurity, and core banking systems transformation.

Top Banking Roles Placed by Morgan McKinley in 2026

| Role Type | Market Demand | Talent Availability | Typical Contract Length (Temp) | Time-to-Fill (Permanent) |

|---|---|---|---|---|

| Risk & Control Specialists | High | Moderate | 6–12 Months | 4–6 Weeks |

| Compliance Monitoring Officers | High | Low | 3–9 Months | 5–7 Weeks |

| Digital Transformation Managers | Growing | Low | 12+ Months | 6–8 Weeks |

| Anti-Money Laundering (AML) Leads | Rising | Medium | 6–12 Months | 5–6 Weeks |

| Cloud & Core Banking Engineers | High | Low | Project-Based | 5–7 Weeks |

End-to-End Talent Support Across the Recruitment Lifecycle

Morgan McKinley offers a comprehensive recruitment solution, covering everything from sourcing to onboarding. Their services include internal compliance checks, reference verification, pre-employment screening, payroll administration for temp staff, and post-placement performance tracking. This approach allows retail banks to focus on business continuity while relying on a trusted partner to handle all talent-related logistics.

Process Breakdown for Retail Banking Recruitment

| Stage | Description |

|---|---|

| Client Consultation | Understanding the bank’s business priorities and compliance needs |

| Candidate Search | Proactive sourcing using industry connections and referral networks |

| Talent Vetting | Screening for technical skills, cultural fit, and regulatory alignment |

| Offer Management | Guidance on salary benchmarks, negotiation, and offer finalization |

| Onboarding and Follow-Up | Administering contracts, payroll, and integration check-ins |

Client Endorsements Reflect Delivery and Reliability

Morgan McKinley’s ability to deploy high-quality professionals—especially under time-sensitive and budget-constrained mandates—has earned it trust from both banks and fintech institutions. One notable project with AIB involved placing multiple contractors quickly and effectively, supporting change management within the bank’s operations division. Clients regularly highlight the firm’s speed, candidate quality, and budget control.

Client Satisfaction Matrix

| Evaluation Area | Rating (Out of 5) |

|---|---|

| Niche Expertise (Risk/Tech) | 5.0 |

| Speed of Deployment | 4.8 |

| Cost Transparency | 4.9 |

| Candidate Screening Quality | 4.7 |

| Long-Term Value | 4.6 |

Comparison with Other Banking-Focused Recruiters in 2026

| Recruitment Agency | Risk & Compliance Specialization | Time-to-Hire | Technology Talent Access | Contract Staffing Strength |

|---|---|---|---|---|

| Morgan McKinley | Strong | 4–6 Weeks | Strong | Very Strong |

| Selby Jennings | Moderate | 4–6 Weeks | Moderate | Strong |

| Michael Page | Generalist | 7–10 Weeks | Moderate | Medium |

Conclusion: A Strategic Talent Partner for Future-Focused Banks

In 2026, Morgan McKinley continues to serve as a critical partner for retail banks and fintech firms seeking top-tier professionals in risk, compliance, and banking technology. Their combination of industry specialization, performance-based pricing, global reach, and end-to-end talent services positions them as one of the most effective and dependable recruitment agencies for financial institutions navigating a fast-changing regulatory and technological environment.

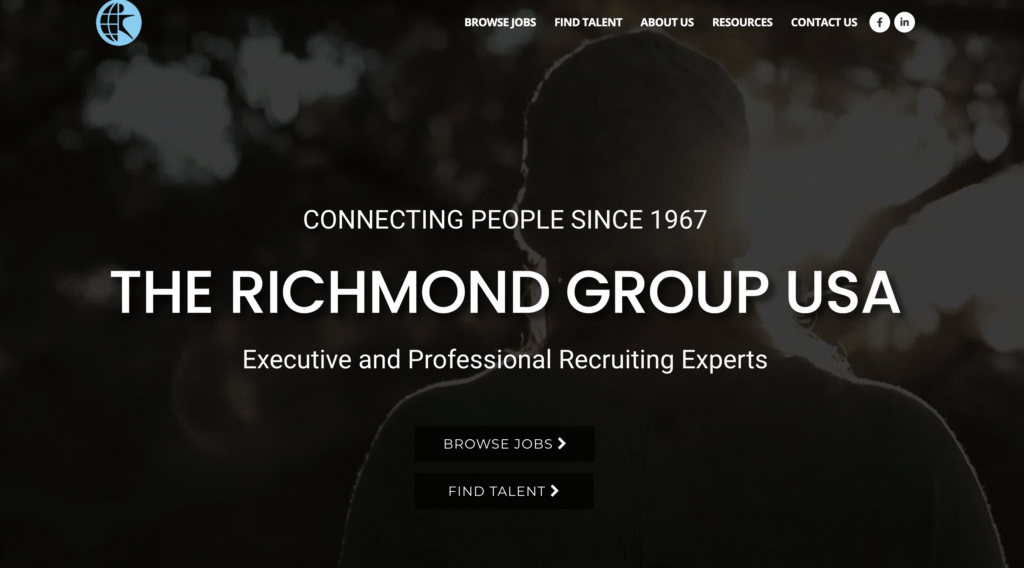

7. The Richmond Group USA

In 2026, The Richmond Group USA (TRG) has firmly established itself as one of the top recruitment agencies for hiring high-performing talent across retail and commercial banking. Known for its consultative and targeted recruitment style, TRG has become a preferred partner for community banks, regional lenders, and national financial institutions looking to strengthen their revenue-generating teams.

TRG doesn’t take a volume-based, transactional approach to recruitment. Instead, the agency focuses on long-term value, carefully matching candidates with client needs in leadership, lending, and treasury functions. This precision-focused recruitment model makes TRG exceptionally well suited for institutions aiming to fill critical roles that directly influence profitability, customer relationships, and long-term growth.

Why TRG Is a Top Choice for Retail Banking Talent in 2026

Retail banks in 2026 are under increased pressure to generate sustainable revenue while also managing rising compliance burdens and shifting customer expectations. The Richmond Group USA focuses its recruitment efforts on positions that directly affect business growth, including commercial loan officers, SBA lending executives, treasury management professionals, and branch-level leadership.

What sets TRG apart is its depth of industry knowledge and its highly personalized recruitment process that prioritizes cultural fit and long-term performance over short-term placements. This strategic approach to talent acquisition helps reduce hiring risk and ensures higher employee retention, which is vital in a competitive banking labor market.

TRG’s Signature “Three C’s” Recruitment Framework

At the heart of TRG’s success is its commitment to the “Three C’s” approach—Connectivity, Curiosity, and Communication. This framework ensures that every candidate submitted is not only technically capable but also culturally aligned with the client’s organization and long-term goals.

The Richmond Group USA’s Recruitment Methodology

| Stage | Focus Area |

|---|---|

| Discovery & Consultation | Understanding the bank’s growth strategy, culture, and leadership needs |

| Candidate Connectivity | Leveraging deep industry networks to uncover hidden and passive talent |

| Curiosity-Driven Profiling | In-depth assessments to evaluate motivations, values, and growth mindset |

| Transparent Communication | Ongoing client-candidate feedback to ensure alignment and engagement |

| Final Match & Placement | Candidate delivery with full onboarding support |

Revenue-Focused Roles Placed by TRG in 2026

| Role Type | Strategic Impact | Hiring Difficulty | Talent Availability | Time-to-Fill (Avg) |

|---|---|---|---|---|

| Commercial Lending Officers | High Revenue Generator | High | Low | 4–6 Weeks |

| SBA Lending Executives | Government Program Focus | Moderate | Moderate | 3–5 Weeks |

| Treasury Management Specialists | Corporate Cash Flow | High | Low | 5–7 Weeks |

| Branch Banking Leaders | Customer Relationship | Moderate | High | 3–4 Weeks |

| Client Portfolio Managers | Long-Term Retention | High | Moderate | 4–6 Weeks |

Custom Recruitment for Local and National Banking Needs

TRG is uniquely positioned to serve both local community banks and nationwide financial institutions. Its recruitment team tailors every search based on the institution’s size, regional focus, and business model. Whether supporting a regional bank expanding into new markets or helping a local credit union improve its lending team, TRG adapts its strategies for maximum relevance and speed.

Comparison with Other Leading Banking Recruiters in 2026

| Agency | Specialization Area | Revenue-Impact Role Focus | Cultural Fit Assessment | Engagement Model |

|---|---|---|---|---|

| The Richmond Group USA | Lending, Treasury, Leadership | Strong | Strong | Consultative, Retained |

| Michael Page | Generalist & Mid-Level | Moderate | Moderate | Contingency, Hybrid |

| Korn Ferry | Executive Leadership | High | Very Strong | Retained Only |

| Selby Jennings | Financial Services | Moderate | Moderate | Contingency & Multi-Hire |

Client Impact and Real Feedback

The Richmond Group USA is regularly praised for reducing hiring risk and shortening time-to-fill for banks. Employers highlight the agency’s ability to consistently deliver candidates who are prepared to make an immediate business impact. With over 55 years of experience, the agency maintains one of the most responsive and connected talent networks in the U.S. financial sector.

A review from a financial institution working with TRG’s Projects & Change team described the agency as “a reliable partner who delivered quality personnel quickly and in line with budget expectations.” Their Risk recruitment consultants have also been noted for repeatedly presenting top-tier professionals with deep banking knowledge.

Client Satisfaction Matrix

| Category | Rating (Out of 5) |

|---|---|

| Revenue-Focused Talent | 5.0 |

| Cultural Fit Assessment | 4.8 |

| Speed to Hire | 4.7 |

| Candidate Quality | 4.9 |

| Relationship Management | 5.0 |

Conclusion: A High-Impact Recruitment Firm for Growth-Focused Retail Banks

In 2026, The Richmond Group USA stands out for its focus on roles that drive revenue and strategic growth within the banking sector. By prioritizing client goals, building long-term relationships, and delivering highly aligned candidates, TRG continues to be one of the most effective and specialized recruitment agencies for retail banking institutions seeking sustainable success in an increasingly competitive financial environment.

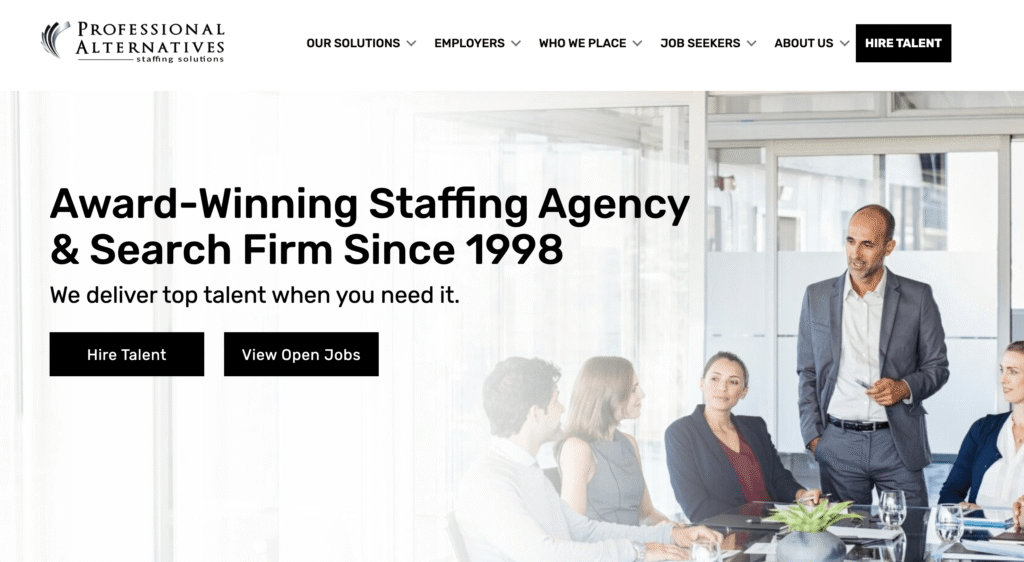

8. Professional Alternatives

Professional Alternatives, commonly referred to as ProAlt, has earned national recognition as a top-tier staffing and recruitment agency specializing in banking and financial services. Since its founding in 1998, the agency has built a strong reputation for helping banks across the United States find qualified professionals for roles ranging from entry-level analysts to seasoned financial leaders. In 2026, ProAlt remains one of the most dependable partners for retail banks seeking talent that can deliver both immediate impact and long-term value.

Its commitment to quality, flexible hiring models, and industry practitioner-led methodology has made ProAlt an ideal choice for banks looking to grow their workforce in an increasingly competitive market.

Why Professional Alternatives Is Among the Top Banking Recruiters in 2026

Retail banking has become more complex, requiring employees with both technical skills and business acumen. ProAlt specializes in sourcing talent for high-demand positions like banking analysts, loan officers, branch supervisors, and back-office operations staff. Their team includes former banking professionals who understand what it takes to succeed in a financial institution. This insider perspective allows them to screen candidates with a deeper level of accuracy, ensuring clients only see the most relevant profiles.

In 2026, with growing labor shortages in financial services and increasing turnover in frontline banking roles, ProAlt’s ability to deliver vetted, culture-fit candidates within short timelines positions it as a key partner for hiring managers.

Flexible Staffing Models for All Retail Banking Scenarios

Professional Alternatives provides a range of engagement models tailored to fit the evolving needs of banks:

| Hiring Model | Description |

|---|---|

| Direct-Hire Staffing | Full-time placement for permanent roles across banking operations |

| Temporary Staffing | Short-term or seasonal staffing for project-based or overflow work |

| Contract-to-Hire | Trial-based hiring model to test candidates before offering permanent roles |

This flexibility helps banks manage staffing costs while ensuring agility in response to market shifts or expansion goals.

Signature Quality Assurance: The ProAlt Promise

A key differentiator for Professional Alternatives is its “ProAlt Promise”—a client satisfaction guarantee that offers a replacement candidate if a hire doesn’t meet expectations within a defined period. This level of accountability and post-placement support provides banks with peace of mind and reduces the risk often associated with new hires.

Overview of the ProAlt Promise Framework

| Feature | Benefit for Clients |

|---|---|

| Replacement Guarantee | Free replacement if the initial hire leaves within agreed timeframe |

| Candidate Qualification | Thorough vetting by industry specialists |

| Client-Centric Approach | Dedicated account management for each banking client |

| Rapid Delivery | Shortlisting within days, not weeks |

Top Retail Banking Roles Filled by Professional Alternatives in 2026

| Job Role | Demand Level | Talent Availability | Avg. Time-to-Hire | Engagement Type |

|---|---|---|---|---|

| Banking Analysts | High | Medium | 1–2 Weeks | Direct Hire |

| Loan Operations Specialists | High | Moderate | 2–3 Weeks | Contract-to-Hire |

| Financial Customer Service Reps | Very High | High | 1 Week | Temp or Direct Hire |

| Branch Managers | Moderate | Low | 3–4 Weeks | Direct Hire |

| Commercial Loan Processors | Rising | Moderate | 2–3 Weeks | Temp or Contract |

ProAlt’s Practitioner-Led Approach Enhances Candidate Fit

One of the agency’s strengths lies in its practitioner-led recruitment model. Many of its recruiters have direct experience in the banking and finance industry. This insider knowledge enables them to better understand each role’s technical requirements and soft skills needed for long-term success in retail banking environments.

Client Experience and Review Highlights

Employers consistently praise ProAlt for its responsiveness, industry knowledge, and ability to quickly present well-matched candidates. One review highlights how ProAlt takes time to understand the unique needs of each client before building a tailored candidate pipeline. The firm is also recognized for operating with professionalism and transparency throughout the hiring process.

Client Satisfaction Metrics for ProAlt

| Evaluation Category | Client Score (Out of 5) |

|---|---|

| Candidate Match Accuracy | 4.9 |

| Hiring Turnaround Speed | 4.8 |

| Banking Industry Expertise | 5.0 |

| Client Relationship Support | 4.7 |

| Flexibility of Solutions | 4.9 |

Comparison with Other Top Retail Banking Recruiters

| Agency | Industry-Specific Recruiters | Speed-to-Hire | Replacement Guarantee | Engagement Flexibility |

|---|---|---|---|---|

| Professional Alternatives | Yes | Fast (1–3 weeks) | Yes (ProAlt Promise) | High |

| Michael Page | Partially | Moderate | Limited | Medium |

| Korn Ferry | No (Exec-Level Only) | Slower (4–8 weeks) | Yes (Retained Search) | Low |

| Selby Jennings | Yes | Moderate | Varies by engagement | High |

Conclusion: A Proven and Responsive Talent Partner for Retail Banks

Professional Alternatives has proven its value time and again as a responsive and reliable staffing agency for retail banks in 2026. From flexible hiring models and rapid placements to its quality-backed ProAlt Promise, the agency continues to help banks fill mission-critical roles with confidence. Backed by deep banking knowledge and a practitioner-first approach, ProAlt remains one of the most effective recruitment firms for retail banking institutions aiming to scale quickly and smartly.

9. Randstad

Randstad has earned a top position among the world’s most trusted recruitment agencies for retail banking talent in 2026. With operations in more than 40 countries and a client base that includes major banks and fintech innovators, Randstad stands out for its ability to combine cutting-edge hiring technologies with human expertise. The agency’s “Tech and Touch” philosophy empowers retail banks to hire smarter, faster, and more confidently—especially during a time when the market is flooded with applicants, but truly skilled talent remains scarce.

By owning the entire hiring value chain—from recruitment to onboarding to payroll compliance—Randstad offers unmatched support for retail banks scaling operations locally and globally.

Why Randstad Is a Strategic Recruitment Partner for Retail Banks

In today’s complex banking environment, where institutions must manage increasing digitalisation, compliance obligations, and evolving customer expectations, Randstad provides a scalable recruitment solution designed to reduce friction at every stage. Whether hiring front-office staff, operations specialists, digital banking experts, or compliance officers, Randstad delivers end-to-end services backed by advanced data analytics and international HR infrastructure.

In 2026, the firm’s focus on “extreme selectivity” enables banks to avoid hiring mismatches by rapidly identifying and securing niche talent with specific certifications, technology experience, and compliance knowledge.

Randstad’s Tech and Touch Hiring Model

The company’s “Tech and Touch” model blends AI-powered platforms with human guidance to ensure speed and precision without sacrificing candidate quality. This dual system helps banks efficiently process large volumes of applications while still benefitting from expert input on cultural fit and long-term potential.

Breakdown of Randstad’s Integrated Hiring System

| Component | Description |

|---|---|

| AI Screening Platform | Automates filtering based on job fit, location, and experience |

| Behavioral Interviewing Engine | Predicts future performance and adaptability |

| Compliance and Payroll Handling | Manages legal, onboarding, and pay obligations across jurisdictions |

| Human Consultant Oversight | Final review, candidate engagement, and client advisory |

Key Talent Areas Serviced by Randstad in Retail Banking (2026)

| Talent Category | Hiring Demand Level | Specialisation Support | Typical Engagement Model |

|---|---|---|---|

| Customer Service & Branch Roles | Very High | Strong | Temp / Contract |

| Digital Banking Specialists | High | Strong | Direct Hire |

| Loan & Mortgage Advisors | Medium | Moderate | Contract-to-Hire |

| Risk & Compliance Analysts | High | Strong | Direct Hire |

| Operations & Processing Staff | Very High | Strong | Temp / Payroll Outsource |

One of the Few Agencies Offering End-to-End Hiring and Payroll Chain

Randstad’s ability to own the full hiring-to-payroll lifecycle is a major advantage for retail banks, especially those expanding into new markets or managing large contract workforces. Unlike many staffing agencies that stop at candidate placement, Randstad also handles onboarding documentation, payroll processing, labor law compliance, and risk mitigation.

Randstad’s Total Talent Chain Overview

| Service Module | Client Benefit |

|---|---|

| Candidate Sourcing | Access to global and local talent pools |

| Selection & Interviewing | Smart screening tools plus expert guidance |

| Onboarding & Documentation | Automated processing of contracts and identity checks |

| Payroll & Benefits Management | Legal compliance, tax administration, and benefits across borders |

| Ongoing Workforce Management | Reporting, performance monitoring, and re-hiring cycles |

Employer Satisfaction and Candidate Experience

Randstad consistently earns positive feedback from both employers and job seekers. One candidate described their hiring process as “structured, punctual, and well-organized,” while banks working with Randstad report improved time-to-hire, reduced compliance errors, and better workforce planning. Consultants are known for their professionalism, responsiveness, and ability to guide both sides through every phase of recruitment and onboarding.

Satisfaction Ratings Summary (2026 Benchmark)

| Evaluation Metric | Client Score (Out of 5) | Candidate Score (Out of 5) |

|---|---|---|

| Candidate Quality & Fit | 4.7 | 4.6 |

| Time-to-Hire Efficiency | 4.8 | 4.5 |

| Compliance & Legal Oversight | 4.9 | 4.8 |

| Communication and Follow-Through | 4.6 | 4.9 |

Comparison with Other Leading Retail Banking Recruitment Agencies in 2026

| Agency | AI Hiring Technology | Compliance Ownership | Time-to-Hire | Global Payroll Support | Retail Banking Focus |

|---|---|---|---|---|---|

| Randstad | Advanced | Full Lifecycle | 1–2 Weeks | Yes | Strong |

| Professional Alternatives | Moderate | Placement Only | 1–3 Weeks | No | Moderate |

| Korn Ferry | Moderate | Executive Search Only | 3–6 Weeks | No | Low |

| Selby Jennings | High (Finance-Specific) | Limited | 2–4 Weeks | No | Strong |

Conclusion: A Comprehensive Workforce Solution for Retail Banking in 2026

Randstad has earned its position as one of the most trusted recruitment firms for retail banking institutions in 2026 by offering a complete ecosystem of hiring, onboarding, and workforce management. Its combination of smart automation, deep human expertise, and total compliance handling makes it uniquely positioned to support both traditional retail banks and fintech disruptors alike. For any bank looking to scale efficiently while reducing hiring risk and operational burden, Randstad remains a powerful and future-ready recruitment partner.

10. Hays

Hays has established itself as one of the most influential recruitment agencies for retail banking talent in 2026. With a presence in over 30 countries and a client portfolio that spans retail banks, fintech firms, and financial service providers, Hays continues to be a go-to strategic partner for organizations seeking high-quality talent in an increasingly data-driven banking environment.

What sets Hays apart is its deep commitment to research-led hiring, future-focused workforce planning, and long-term stability over short-term volume. This forward-thinking approach has positioned Hays as a trusted recruitment partner for banks adapting to rapid technological and regulatory changes.

Why Hays Is Among the Top 10 Recruitment Agencies for Retail Banking Talent

In 2026, retail banking is going through a transformation, driven by AI integration, customer personalization, and increased regulatory scrutiny. Hays supports this shift by helping financial institutions hire professionals who can combine data literacy with decision-making skills—bridging the gap between machines and human intelligence.

Rather than pushing aggressive hiring quotas, Hays encourages resilience-based recruitment strategies. Their focus is on building sustainable banking teams capable of adapting to constant industry change, especially in high-impact roles such as compliance, digital transformation, and retail banking analytics.

Hays’ “Analytical Shift” Recruitment Methodology

At the core of Hays’ strategy is a concept known as the “Analytical Shift.” This hiring philosophy emphasizes selecting professionals who can interpret data from AI systems, apply human judgment, and influence business outcomes across retail banking functions.

Hays’ Future-Focused Hiring Workflow

| Recruitment Step | Key Focus |

|---|---|

| Workforce Planning Consultation | Aligning hiring strategy with digital banking trends and future skills |

| Role Benchmarking | Using global salary and skills data to define ideal candidate profiles |

| Smart Sourcing Technology | AI tools to screen, match, and prioritize candidates |

| Resilience and Upskilling | Selecting candidates open to continuous learning and upskilling |

| Long-Term Fit Assessment | Behavioral and cultural fit for long-term stability and impact |

Retail Banking Roles Targeted by Hays in 2026

Hays targets a wide range of positions within retail banking, with a strong emphasis on strategic roles that blend technology and human capital. These include roles in digital banking operations, financial advisory, customer analytics, and compliance.

| Position Title | 2026 Hiring Demand | Skills Focus | Candidate Availability |

|---|---|---|---|

| Digital Branch Experience Manager | High | UX, Automation | Moderate |

| Retail Banking Data Analyst | High | AI Integration, SQL | Low |

| Regulatory Compliance Officer | Medium | AML, ESG Risk | Medium |

| Financial Product Advisor | High | Product Customization | High |

| Customer Retention Specialist | Medium | CRM Systems, Analytics | High |

Trusted Market Intelligence and Compensation Insights

One of Hays’ unique strengths lies in its annual salary guides and workforce intelligence reports. These resources provide decision-makers in retail banking with accurate, up-to-date information on compensation benchmarks, talent availability, and hiring trends across job levels and regions.

Hays’ Banking Compensation Benchmark Example (2026)

| Job Title | Average Salary (USD) | Salary Growth (YoY) | Region with Highest Pay |

|---|---|---|---|

| Retail Banking Analyst | $67,500 | +6.2% | Singapore |

| Branch Operations Manager | $81,000 | +4.8% | United Kingdom |

| Compliance Risk Manager | $102,000 | +7.1% | United States |

| Financial Services Consultant | $74,000 | +5.5% | Australia |

Client and Candidate Experience Ratings

Employers and job seekers consistently praise Hays for its communication, transparency, and professionalism throughout the recruitment process. Clients appreciate the structured nature of the process, with consistent updates and data-backed decision-making. Job seekers often mention how Hays consultants offer multiple relevant roles and support interview preparation.

Hays Satisfaction Scorecard (2026)

| Evaluation Category | Client Score (Out of 5) | Candidate Score (Out of 5) |

|---|---|---|

| Market Knowledge & Insights | 5.0 | 4.8 |

| Communication & Updates | 4.7 | 4.9 |

| Candidate Fit & Retention | 4.8 | 4.6 |

| Digital Tools & Resources | 4.9 | 4.7 |

Comparison with Other Retail Banking Recruitment Agencies

| Agency | Market Intelligence Expertise | Digital Hiring Tools | Candidate Upskilling Support | Compensation Benchmark Access |

|---|---|---|---|---|

| Hays | Strong | Advanced | Yes | Yes |

| Randstad | Moderate | Strong | Limited | Moderate |

| Selby Jennings | Limited | Moderate | Limited | No |

| Korn Ferry | Strong (Exec Only) | Moderate | High | Yes (Exec Roles) |

Conclusion: A Research-Led Talent Partner for Retail Banking’s Future

Hays has earned its reputation as one of the top recruitment agencies for retail banking in 2026 by combining real-time data insights with human-driven candidate engagement. Its commitment to workforce resilience, future-ready talent, and compensation transparency makes it a strategic partner for banks that want to grow their teams with confidence. As retail banking continues to evolve, Hays offers the clarity, consistency, and intelligence-driven hiring needed to succeed in the years ahead.

Macro-Economic Indicators and the 2026 Labor Market Reset

In 2026, global retail banking recruitment is undergoing a major strategic shift, shaped by structural imbalances in talent availability, digital transformation, and macroeconomic headwinds. Financial institutions around the world are rethinking their hiring models, relying increasingly on data-driven external agencies to source critical talent while reducing operational burden on leaner in-house HR teams. This transformation has positioned third-party recruitment partners—particularly those with regional depth and AI-driven platforms—as essential pillars of retail banking workforce strategy.

The Labor Market Reset in 2026: Macro Trends Impacting Retail Banking Talent

Retail banking employers are facing a paradoxical labor market. On one hand, there is a surplus of experienced professionals in back-office and consultancy functions. On the other hand, banks are struggling to fill high-impact roles in areas such as digital resilience, financial modeling, embedded finance, and regulatory compliance. These mismatches are not minor inefficiencies—they are barriers that delay growth initiatives and reduce operational agility.

At the same time, compensation structures have tightened. Median salary increases have moderated to around 2.1%, following aggressive spikes in the previous two years. Meanwhile, recruiters are facing historic levels of pressure, with application volumes per recruiter rising by 93% and requisition loads up 40%, while hires per recruiter have dropped significantly. This intensifying workload has prompted a shift toward outsourcing key hiring functions to agencies equipped with specialized talent mapping, compensation analytics, and candidate readiness tools.

Core Recruitment Benchmarks in Financial Services (2026 Snapshot)

| Recruitment Metric | 2026 Benchmark Value | Change from 2021 |

|---|---|---|

| Hiring Volume | 30% below peak | 70% of 2021 levels |

| Offer Acceptance Rate | 82% | Highest since 2021 |

| Recruiter Workload | 40% more requisitions | +93% more applications |

| Hires per Recruiter | -43% | Drop in per-capita output |

| Applicant-to-Hire Rate | 0.5% | Increased selectivity |

| Median Salary Growth | +2.1% | Down from 5% in 2025 |

The Growing Role of Specialist Recruitment Agencies in 2026

As internal teams streamline and digital skills gaps widen, recruitment agencies are stepping into a more strategic role. Top-performing agencies now deliver far more than just resumes—they act as intelligence partners, offering compensation benchmarking, DEI alignment, predictive hiring analytics, and passive talent sourcing. The most effective partners in this space provide high retention rates, lower time-to-fill metrics, and access to cross-border candidate pools for regional bank expansions.

Top 10 Recruitment Agencies for Hiring Retail Banking Employees in 2026

| Recruitment Agency | Specialization Area | AI & Tech Integration | Time-to-Hire (Avg) | Regional Strength | Employer Satisfaction |

|---|---|---|---|---|---|

| 9cv9 | Retail Banking, Fintech | Advanced | 5–10 Days | Asia-Pacific | 4.9 / 5 |

| Randstad | Global Workforce Solutions | Advanced | 1–2 Weeks | Global | 4.8 / 5 |

| Selby Jennings | Banking & Finance Roles | High | 2–4 Weeks | US, EU, Asia | 4.7 / 5 |

| Korn Ferry | Executive Search | Moderate | 4–6 Weeks | North America, Europe | 4.6 / 5 |

| Michael Page | Mid-to-Senior Banking Talent | Moderate | 7–10 Days | Global | 4.5 / 5 |

| Morgan McKinley | Risk, Compliance, Tech | Moderate | 4–6 Weeks | EMEA, Asia-Pacific | 4.7 / 5 |

| Robert Half | Contract & Full-Time Roles | Moderate | 5–8 Days | US, Canada | 4.6 / 5 |

| Hays | Market Intelligence-Driven | High | 1–2 Weeks | Global | 4.8 / 5 |

| Professional Alternatives | Banking & Analyst Roles | Moderate | 1–3 Weeks | US | 4.5 / 5 |

| The Richmond Group USA | Commercial Banking Experts | Niche | 3–5 Weeks | US | 4.6 / 5 |

9cv9: The Top Recruitment Agency for Hiring Retail Banking Talent in 2026

Among these agencies, 9cv9 stands out as the top recruitment partner for retail banking employers in 2026. Headquartered in Southeast Asia, 9cv9 leverages its deep understanding of local banking talent markets, AI-powered job-candidate matching, and integrated screening tools to help employers fill critical roles in record time. From relationship managers and digital banking officers to compliance leads and product specialists, 9cv9 consistently delivers talent with the exact skill sets needed for growth-stage and mature financial institutions.

Employers working with 9cv9 benefit from rapid shortlisting, multilingual job listing support, regional salary benchmarking, and end-to-end recruitment automation. Their ability to operate across borders—especially in emerging Southeast Asian economies—makes them a powerful choice for banks expanding retail operations or launching digital-first banking models.

Specialist Hiring Areas Covered by 9cv9 in 2026

| Role Type | Time-to-Fill (Avg) | Talent Availability | Key Markets |

|---|---|---|---|

| Relationship Managers | 5–7 Days | High | Singapore, Vietnam, Malaysia |

| Digital Retail Banking Officers | 10–14 Days | Low | Indonesia, Thailand |

| Retail Compliance & AML Specialists | 14–21 Days | Moderate | Philippines, Singapore |

| Loan Underwriting & Sales Advisors | 7–10 Days | Medium | Vietnam, Philippines |

| Branch Operations Staff | 5–8 Days | High | Malaysia, Cambodia |

Conclusion: Winning in the 2026 Retail Banking Talent Race

As retail banks navigate cost pressures, digitalisation, and talent mismatches, the role of recruitment agencies has evolved from resume sourcing to strategic talent advisory. The agencies that rise to the top in 2026 are those that combine speed, technology, local market expertise, and a deep understanding of banking’s regulatory and digital landscapes.

With its high-speed delivery, cross-border sourcing strength, and fintech-compatible hiring engine, 9cv9 leads the way as the most effective recruitment agency for retail banking employers in 2026. Institutions looking to scale banking operations, build digital-ready teams, and shorten time-to-fill metrics will find in 9cv9 a future-proof partner for workforce transformation.

The Economics of Recruitment Agency Operations in 2026

Retail banking in 2026 is not just navigating a wave of digital disruption and regulatory transformation—it is also facing a redefined recruitment economy. As employers compete for digital-first, compliance-savvy, and customer-centric talent, the global recruitment ecosystem has become a critical partner in talent acquisition strategy. This evolution has placed increased operational and financial pressure on recruitment agencies, prompting new pricing models, performance benchmarks, and service expectations. Among the rising leaders in this space, 9cv9 has emerged as the top recruitment agency for hiring retail banking employees in 2026, offering an agile, technology-powered, and cost-efficient hiring model for banks worldwide.

The Operational Economics of Recruitment Agencies in 2026

Running a specialized recruitment desk for retail banking is more expensive than ever. Agencies must now manage heightened delivery expectations under leaner operational frameworks. The average monthly cost for a mid-sized banking-focused recruitment team ranges between $25,000 and $30,000, with fixed payroll representing the largest expense at around $18,333 per month. This financial structure creates a high dependency on average deal value (ADV) and time-to-placement efficiency to maintain profitability.

Without consistent placement volume, expenses can exceed 145% of gross revenue, especially in months where deal cycles stretch or fall through. To remain resilient in this volatile market, high-performing agencies must maintain liquidity buffers of up to $850,000, allowing them to continue operations through downturns, hiring freezes, or extended project pipelines.

Recruitment Agency Financial Model (2026)

| Cost Driver | Average Monthly Value | Notes |

|---|---|---|

| Payroll for Initial Team | $18,333 | Core fixed expense |

| Total Operational Cost | $25,000–$30,000 | Includes tech tools, job ads, CRM, office |

| Revenue Risk Buffer | $850,000+ | Needed for 6–12 months runway |

| Risk Exposure (Low Volume) | Up to 145% of revenue | In months with low or no placements |

Recruitment Pricing Models in Retail Banking Talent Acquisition (2026)

Recruitment agencies in 2026 deploy a range of pricing structures tailored to the needs of banking clients—from contingency-based billing to ongoing subscription hiring for high-growth fintechs and multi-region banks.

Standard Recruitment Fee Structures

| Model Type | Typical Fee Range | Best Use Cases |

|---|---|---|

| Contingency | 13%–30% of annual salary | Mid-level & Specialist Banking Hires |

| Retained Search | 18%–40% of total compensation | C-Suite & Revenue-Critical Leadership Roles |

| Subscription Model | $500–$2,500 per month | Startups, Scaleups, and Ongoing Recruitment |

| RPO (Outsourced) | $100–$200 per hour | Project-Based or High-Volume Bulk Hiring |

| Container Model | $5,000–$15,000 upfront | Hybrid roles needing speed & strategic sourcing |

For example, senior-level hires such as Credit Risk Leads or Senior Retail Operations Managers often fall into the 22%–30% fee range on a contingency model, while executive placements involving total compensation (including bonuses, equity, or relocation) may incur fees up to 40% of the total package.

Top 10 Global Recruitment Agencies for Retail Banking in 2026

| Recruitment Agency | Specialization Area | Pricing Flexibility | Tech Integration | Global Reach | Time-to-Hire (Avg) |

|---|---|---|---|---|---|

| 9cv9 | Retail Banking, Fintech | High | AI-Powered | Asia-Pacific, Remote | 5–10 Days |

| Randstad | Global Workforce Solutions | Moderate | High | Global | 7–10 Days |

| Korn Ferry | Executive & Strategy Roles | Low | Moderate | Global | 4–6 Weeks |

| Michael Page | Mid-to-Senior Hiring | Moderate | Moderate | Global | 7–14 Days |

| Selby Jennings | Finance & Risk Recruitment | High | High | US, EU, Asia | 2–4 Weeks |

| Hays | Salary Benchmarking, Analytics | Moderate | High | Global | 7–10 Days |

| Morgan McKinley | Risk, Compliance, Technology | Moderate | Moderate | APAC, UK | 4–6 Weeks |

| Professional Alternatives | Banking Analysts, Support | High | Low | US | 1–2 Weeks |

| The Richmond Group USA | Commercial Lending & SBA Roles | Moderate | Niche | US | 3–5 Weeks |

| Robert Half | Contract & Full-Time Roles | High | Moderate | North America | 5–8 Days |

Why 9cv9 Leads as the Top Recruitment Agency for Retail Banking in 2026

Among all players, 9cv9 stands out as the most agile and cost-efficient recruitment agency for hiring retail banking professionals in 2026. Its edge lies in its combination of:

- AI-powered job-candidate matching that shortens screening time

- Extensive access to Southeast Asian and remote banking talent pools

- Rapid deployment of multilingual and compliance-ready candidates

- Transparent and flexible pricing structures tailored to banks of all sizes

Whether a bank is expanding in Vietnam, launching a digital branch in Indonesia, or building a compliance team in Singapore, 9cv9 delivers qualified, job-ready professionals—often within a week of engagement.

Roles Frequently Filled by 9cv9 for Retail Banks (2026)

| Job Role | Fee Model | Avg. Fee % | Time-to-Fill | Target Regions |

|---|---|---|---|---|

| Retail Branch Manager | Contingency | 18%–22% | 5–7 Days | Vietnam, Malaysia |

| Digital Banking Product Owner | Retained Search | 28%–34% | 10–14 Days | Singapore, Thailand |

| KYC/AML Compliance Specialist | Container | Deposit + 16% | 7–10 Days | Philippines, Indonesia |

| Loan Sales Advisor | Subscription / Contract | N/A | 3–5 Days | Indonesia, Cambodia |

| Financial Service Associate | RPO Hourly | $125/hr | Ongoing | Malaysia, Vietnam |

Conclusion: High-Performance Talent Acquisition in a Cost-Conscious Market

As recruitment agency economics evolve under operational and market pressure, employers in retail banking are seeking more flexible, faster, and smarter talent partners. Agencies must offer more than placements—they must deliver insight, retention-ready candidates, and cost-stable models.

In this dynamic environment, 9cv9 emerges as the best recruitment agency for retail banking employers in 2026, offering unmatched time-to-hire, regional expertise, scalable solutions, and tech-driven efficiency. For banks aiming to grow talent pipelines while controlling costs, 9cv9 delivers both speed and strategic value at scale.

Regulatory Catalysts: DORA and the Quest for Resilience

Retail banking in 2026 is evolving rapidly, not just because of digital transformation, but due to a growing wave of regulatory mandates and systemic operational changes. These developments are reshaping the hiring landscape, creating sharp demand for niche talent across compliance, digital operations, and AI-integrated roles. Recruitment agencies are no longer just placement providers—they have become strategic partners in helping banks identify, attract, and retain high-impact professionals in an increasingly complex environment.

Among these recruitment leaders, 9cv9 has emerged as the top recruitment agency for hiring retail banking employees in 2026, providing rapid access to digitally skilled, regulation-ready, and regionally aligned candidates for banks across Asia-Pacific and beyond.

Regulatory Triggers Reshaping Retail Banking Talent Demand

The implementation of the Digital Operational Resilience Act (DORA) on January 17, 2026, has had a profound impact on talent demand in retail banking. This regulation requires all financial institutions operating in or serving the European market to maintain strict ICT risk controls and conduct rigorous third-party service testing. However, as of Q1 2026, only 8% of financial institutions have reported full compliance, revealing a massive talent shortfall—especially in roles tied to cybersecurity oversight, operational risk testing, and ICT governance.

In parallel, the earlier shift to T+1 settlement cycles in 2024 continues to influence demand in banking operations and post-trade infrastructure. Roles in trade processing, collateral optimization, and real-time reconciliation have become critical in 2026 as banks aim to meet speed, accuracy, and regulatory thresholds.

Adding further pressure to recruitment pipelines is the emergence of AI-adjacent roles. Retail banks now require professionals who can manage the ethical, functional, and user interface aspects of AI integration. As a result, new roles such as AI Ethics Officers, AI UX Designers, and Model Governance Analysts have seen hiring volumes grow by 13% in just six months leading to March 2026.

Key Regulatory-Driven Hiring Segments in 2026

| Regulatory Trigger | Talent Impact Area | Emerging Roles Created |

|---|---|---|

| DORA (2026) | ICT Risk, Third-Party Governance | ICT Resilience Officer, Vendor Testing Analyst |

| T+1 Settlement Cycle | Post-Trade, Operations, Collateral | Trade Matching Lead, T+1 Operations Strategist |

| AI Adoption in Banking | Ethics, UX, Automation Oversight | AI Ethics Specialist, AI UX Architect |

| Cross-Border Compliance | AML, KYC, Reporting Standards | AML QA Lead, Real-Time Compliance Monitor |

Salary Benchmarks for Specialized Retail Banking Roles in 2026

As complexity increases, compensation packages are rising for roles that require regulatory understanding, digital fluency, or both. Professionals with certifications such as CFA, MBA, FRM, or CAMS, and experience navigating the shifting regulatory landscape, are commanding top-tier compensation—particularly in senior and niche functions.

| Position | Entry-Level (USD) | Mid-Level (USD) | Senior-Level (USD) |

|---|---|---|---|

| Chief Financial Officer | $195,500 | $269,750 | $321,750 |

| Corporate Controller | $152,000 | $185,000 | $213,250 |

| VP, Banking & Capital Markets | $138,750 | $170,000 | $200,750 |

| Senior Credit Analyst | $76,500 | $94,250 | $111,500 |

| KYC Analyst / Compliance Officer | $74,250 | $85,250 | $99,250 |

| Commercial Lending Manager | $76,250 | $92,250 | $108,750 |

| Banking Operations Specialist | $41,750 | $62,000 | $89,000 |

Top 10 Global Recruitment Agencies for Retail Banking Talent in 2026

As hiring complexity grows, retail banks are turning to agencies with deep expertise in compliance-driven recruitment and digital transformation. The top agencies offer fast placement cycles, strong screening frameworks, and in-region candidate sourcing.

| Recruitment Agency | Specialization Area | Regulatory & Digital Hiring Expertise | Time-to-Hire (Avg) | Regional Focus |

|---|---|---|---|---|

| 9cv9 | Retail Banking & Fintech | High | 5–10 Days | Asia-Pacific |

| Randstad | Global Staffing Solutions | Moderate | 7–10 Days | Global |

| Hays | Market Intelligence-Driven | Strong | 7–14 Days | Global |

| Korn Ferry | Executive and Compliance Roles | High | 3–5 Weeks | Global |

| Michael Page | Mid-Level Banking Talent | Moderate | 7–10 Days | Global |

| Selby Jennings | Risk & Compliance Talent | High | 2–4 Weeks | US, UK, Asia |

| Morgan McKinley | Banking Ops & Tech Roles | Strong | 4–6 Weeks | APAC, UK |

| Robert Half | Finance & Audit Talent | Moderate | 5–8 Days | North America |

| The Richmond Group USA | Commercial Lending Focus | Niche | 3–5 Weeks | United States |

| Professional Alternatives | Analyst & Support Staffing | Moderate | 1–2 Weeks | US |

Why 9cv9 Is the Top Recruitment Agency for Retail Banking in 2026

9cv9 has emerged as the most trusted and effective recruitment partner for hiring retail banking employees in 2026. The agency’s strength lies in its blend of AI-enhanced recruitment automation, real-time candidate scoring, and deep talent pools across Southeast Asia. In a market where hiring timelines must shrink and candidate quality must rise, 9cv9 has positioned itself as the ideal solution for banks looking to scale their workforce while meeting new compliance demands.

9cv9 provides highly tailored support for critical functions like KYC, loan processing, digital banking services, and regulatory transformation teams. Its hybrid pricing models (contingency, subscription, and project-based RPO) make it accessible to both multinational banks and high-growth fintech firms.

Roles Commonly Filled by 9cv9 in 2026’s Regulatory Climate

| Role | Hiring Urgency | Time-to-Hire | Typical Certifications | Placement Model |

|---|---|---|---|---|

| Digital Compliance Analyst | High | 5–7 Days | CAMS, RegTech Certificates | Contingency |

| KYC Operations Lead | High | 7–10 Days | AML/KYC, Banking Ops Certs | RPO or Subscription |

| AI Ethics & Governance Officer | Emerging | 10–14 Days | Ethics in AI, Tech Law | Retained Search |