Key Takeaways

- Armenia’s salary landscape in 2026 is highly skills-driven, with technology and finance offering global-level pay while traditional sectors remain modestly paid.

- Low taxation, limited employer payroll costs, and affordable living expenses give professionals strong purchasing power and high savings potential.

- Location, experience, and sector choice remain the biggest salary drivers, with Yerevan leading incomes and regional cities gradually closing the gap.

Salaries in Armenia in 2026 reflect a country that is steadily transitioning from a cost-competitive economy into a skills-driven and globally connected labor market. Over the past few years, Armenia has undergone meaningful economic, regulatory, and structural changes that have reshaped how wages are set, how income is distributed, and how professionals evaluate career opportunities within the country. As a result, understanding salary levels in Armenia today requires more than a simple look at average wages. It requires context around sectors, taxation, cost of living, location, demographics, and government policy.

In 2026, Armenia stands at a critical point of maturity. The economy has moved beyond post-shock recovery and is now operating in a more stable growth phase. This stability has allowed businesses to plan compensation more strategically and has enabled the government to introduce reforms aimed at formalizing employment, strengthening social protection, and improving long-term workforce quality. For professionals, employers, investors, and foreign talent, salaries in Armenia are no longer defined purely by low costs but increasingly by value, productivity, and global relevance.

One of the most important shifts shaping Armenia’s salary landscape is the rise of high-value industries. Information technology, software development, finance, insurance, and professional services have become dominant wage leaders. These sectors operate under global demand conditions and often compete directly with employers in Europe, North America, and the Middle East for talent. As a result, compensation in these fields has become increasingly detached from traditional local wage benchmarks, creating a high-income tier within the Armenian labor market.

At the same time, large segments of the workforce remain employed in traditional industries such as manufacturing, construction, agriculture, education, healthcare, retail, and public administration. Salaries in these sectors continue to follow domestic economic conditions, public budgets, and regulatory constraints. This has led to visible wage dispersion across industries, regions, and skill levels, making sector choice one of the most decisive factors in earning potential in 2026.

Government policy also plays a growing role in shaping salary outcomes. The planned increase in the minimum wage, the rollout of mandatory health insurance, and updates to taxation and immigration frameworks are directly influencing both gross and net income. While some of these measures introduce additional payroll deductions or compliance requirements, they are designed to improve long-term social stability, workforce health, and economic resilience. Understanding how these policies affect take-home pay is essential for anyone assessing real income in Armenia.

Taxation remains one of Armenia’s strongest structural advantages. A flat personal income tax system, minimal employer-side payroll costs, and targeted incentives for technology and startup ecosystems create a transparent and predictable compensation environment. For high-earning professionals and international companies, this translates into higher net income and lower total employment costs compared to many regional and European markets.

Geography further complicates the salary picture. Yerevan continues to dominate as the country’s primary employment and income hub, concentrating most high-paying roles and international companies. However, regional provinces and secondary cities are beginning to narrow the gap through industry specialization, infrastructure development, and the spread of remote and hybrid work models. In many cases, lower living costs outside the capital significantly improve purchasing power even when nominal salaries are lower.

Cost of living is another critical lens through which Armenian salaries must be evaluated. While wages may appear modest when converted into foreign currencies, everyday expenses remain relatively low by international standards. Housing, transportation, utilities, and food costs allow many professionals, especially in high-skill roles, to achieve strong savings rates and financial stability. This balance between income and expenses has made Armenia increasingly attractive to remote workers, returning diaspora professionals, and foreign specialists seeking efficiency rather than headline salaries.

Demographic factors such as experience, education, age, and gender also strongly influence salary outcomes. Experience remains the single most powerful driver of income growth, particularly in high-skill sectors. Education improves early-career prospects but delivers the greatest return when aligned with market demand. Persistent gender pay gaps and regional disparities highlight structural challenges that continue to shape income distribution across the workforce.

Finally, Armenia’s immigration reform scheduled for 2026 adds a strategic layer to the labor market. By simplifying access for specialized foreign talent while introducing quota-based planning, the country is moving toward a more regulated and intentional approach to workforce development. This reform is expected to reinforce salary premiums for high-value roles while maintaining balance within the domestic labor market.

This guide brings all of these elements together into a single, comprehensive analysis of salaries in Armenia for 2026. It examines average wages, sector-specific compensation, taxation and payroll structures, cost of living, regional differences, demographic influences, and future outlooks. Whether you are a professional planning your career, an employer setting compensation strategies, an investor assessing market entry, or a foreign specialist considering relocation, this guide provides the clarity and context needed to understand Armenia’s evolving salary landscape in 2026 and beyond.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of A Complete Guide to Salaries in Armenia for 2026.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

A Complete Guide to Salaries in Armenia for 2026

- Macroeconomic Context and Salary Trends in Armenia

- National Wage Standards and Minimum Wage Framework

- Mandatory Health Insurance and Payroll Impact

- Sector-Based Salary Analysis Across Industries

- Geographic Salary Differences Across Regions

- Experience, Education, and Demographic Salary Drivers

- Popular Job Roles and Representative Salaries

- Taxation, Payroll Deductions, and Net Income

- Immigration Reform and Foreign Workforce Impact

- Cost of Living and Purchasing Power Analysis

- Strategic Salary Outlook and Future Trends

1. Macroeconomic Context and Salary Trends in Armenia

The Armenian salary environment in 2026 is shaped by a clear shift from extraordinary post-shock growth toward a more balanced and sustainable economic phase. After experiencing exceptionally high expansion in the years immediately following 2022, Armenia is now entering a period of steadier progress that aligns more closely with its long-term economic capacity. This transition creates a more predictable foundation for wage planning, hiring strategies, and compensation benchmarking across sectors.

Economic growth in 2026 is expected to remain strong by regional standards, settling in the range of medium-to-high single-digit expansion. Rather than signaling slowdown or instability, this moderation reflects a normalization of growth after an unusual surge. For employers and employees alike, this environment supports gradual salary increases rather than sharp, inflation-driven adjustments.

GDP Growth and Its Impact on Wages

Armenia’s real GDP growth is forecast to remain close to the five-percent mark in 2026. This level of growth is widely seen as sustainable and supportive of long-term income expansion. When economies grow at this pace, salary increases tend to follow productivity gains rather than short-term shocks.

From a labor market perspective, this means:

• Employers can plan multi-year compensation structures with greater confidence

• Wage growth is more closely tied to skills, experience, and sector demand

• Salary inflation pressures are lower than during boom years

As Armenia converges toward its long-term growth potential, average salaries are expected to rise steadily, particularly in sectors linked to domestic consumption, investment, and high-value services.

Inflation Stability and Purchasing Power

One of the most important factors influencing real salaries in 2026 is price stability. Inflation in Armenia is expected to remain within a narrow and controlled range, close to the central bank’s target level. This stability plays a critical role in protecting workers’ purchasing power.

For employees, controlled inflation means that nominal salary increases translate more directly into real income gains. For employers, it reduces the need for frequent wage adjustments simply to offset rising living costs.

Expected inflation conditions support:

• Predictable annual salary reviews

• More accurate long-term employment contracts

• Stable household consumption patterns

In practical terms, even moderate salary increases in 2026 are likely to feel meaningful to workers compared to periods of higher inflation.

Currency Conditions and International Salary Comparison

The Armenian Dram is projected to remain broadly stable against major international currencies in 2026. Exchange-rate stability is particularly important for companies engaged in outsourcing, IT services, remote work, and export-oriented industries.

A stable currency environment benefits the salary market by:

• Making Armenian wages easier to compare internationally

• Reducing currency risk for foreign employers hiring local talent

• Supporting consistent pricing of labor costs in cross-border contracts

This stability strengthens Armenia’s position as a competitive labor market for international firms while maintaining reasonable income expectations for local professionals.

Investment Activity and Job Creation

Investment continues to play a central role in shaping Armenia’s employment and salary outlook. Strong growth in capital investment has supported job creation, infrastructure development, and expansion in private enterprise. These investments directly influence wage levels by increasing demand for skilled labor.

Key effects on salaries include:

• Higher pay premiums in construction, engineering, and project management

• Rising demand for finance, accounting, and compliance professionals

• Spillover salary growth in supporting services and logistics

While exports face some volatility due to regional trade conditions, domestic demand and investment-led growth help anchor overall wage stability.

Government Policy and Long-Term Salary Potential

Policy reforms and regional integration efforts are viewed as important upside factors for salaries beyond 2026. Measures aimed at regulatory improvement, closer alignment with European standards, and enhanced regional connectivity are expected to gradually raise productivity and income ceilings.

Over time, these developments can lead to:

• Higher average salaries in regulated professions

• Stronger wage growth in logistics and trade-related roles

• Improved compensation structures in public and semi-public sectors

Although these effects are gradual, they contribute to a positive long-term salary trajectory.

Key Economic Indicators Influencing Salaries

Economic Indicator | 2025 Projection | 2026 Forecast | Salary Impact

Real GDP Growth | 4.8% – 6.0% | 4.9% – 5.3% | Supports steady wage growth

Inflation | Around 3% | 2.8% – 3.3% | Preserves real income gains

Exchange Rate | Approximately stable | Largely stable | Improves salary predictability

Policy Interest Rate | Moderately restrictive | Gradually easing | Encourages hiring and investment

Public Debt Ratio | Slightly above 50% | Below 52% | Maintains fiscal wage capacity

Labor Force Conditions and Employment Structure

Labor force participation in Armenia remains below the levels seen in many developed economies, while unemployment remains in the low-to-mid teens. Despite this, total employment has reached historically high levels, reflecting expanding job availability rather than full labor utilization.

This combination creates a mixed salary environment:

• Employers face competition for experienced specialists

• Entry-level and low-skill wages grow more slowly

• Skill shortages push up salaries in high-growth sectors

Limited workforce diversification and gaps in advanced expertise remain structural challenges. However, these same gaps are driving salary premiums for professionals with in-demand skills.

Sector-Level Salary Pressure Matrix

Sector | Talent Availability | Salary Pressure | Outlook

Information Technology | Limited | High | Strong upward pressure

Construction and Infrastructure | Moderate | Medium-High | Stable growth

Finance and Professional Services | Moderate | Medium | Gradual increase

Manufacturing | Adequate | Low-Medium | Modest growth

Retail and Hospitality | High | Low | Limited wage acceleration

Overall Salary Outlook for Armenia in 2026

Armenia’s salary environment in 2026 is defined by stability rather than volatility. Moderate economic growth, controlled inflation, currency predictability, and ongoing investment create conditions for steady and sustainable wage increases. While not all sectors benefit equally, professionals with in-demand skills are well positioned for income growth, and employers gain a clearer framework for long-term compensation planning.

For businesses, workers, and policymakers, the Armenian labor market in 2026 represents a phase of consolidation and maturation, where salary growth becomes more closely aligned with productivity, skills, and long-term economic fundamentals.

2. National Wage Standards and Minimum Wage Framework

Armenia’s salary structure in 2026 is strongly influenced by national wage laws and statutory labor protections. These regulations define the lowest acceptable pay levels, set working hour limits, and determine mandatory compensation premiums. Together, they form the baseline that employers must follow and employees can rely on when negotiating wages.

Minimum Wage Policy and Government Objectives

The minimum wage acts as the foundation of Armenia’s income system and is closely tied to social protection goals. For 2026, the government has indicated an intention to raise the monthly minimum wage to 85,000 Armenian Dram, compared to the 75,000 Dram level set in early 2025. This planned increase reflects an effort to reduce income pressure on low-earning households and to better align wages with everyday living costs.

The proposed increase represents a rise of just over thirteen percent. This adjustment is mainly driven by higher food and household expenses, which have been affected by global price movements. Policymakers view the minimum wage not only as a labor market tool but also as a mechanism to narrow the gap between earnings and basic living expenses.

Cost of Living Alignment and Ongoing Debate

Despite public announcements, the implementation of the higher minimum wage remains a subject of domestic debate. By late 2025, the draft state budget for 2026 did not clearly include funding provisions for the full increase. This has raised concerns among labor groups and economists about whether the policy will be fully executed on schedule.

The sensitivity of this issue is linked to the cost of living. Estimates suggest that the existing minimum wage still falls short of covering the full consumer basket for a single adult. While the minimum food basket represents a little over half of total living costs, non-food expenses such as utilities, transport, and basic services push the total consumer basket above the current minimum wage level. This gap reinforces pressure on the government to follow through with wage adjustments.

Statutory Wage and Salary Benchmarks

The table below summarizes key legally relevant wage indicators shaping the Armenian salary environment in 2026.

Statutory Labor Indicator | 2025 Level (AMD) | 2026 Target or Estimate (AMD) | Approximate USD Range

Minimum Monthly Wage | 75,000 | 85,000 | 190 – 216

Minimum Hourly Wage | 500 | Around 570 | 1.27 – 1.45

Average Monthly Nominal Wage | 293,729 | Around 310,000 | 747 – 788

Private Sector Average Wage | 317,740 | Around 335,000 | 808 – 852

Public Sector Average Wage | 230,290 | Around 245,000 | 586 – 623

Projected figures are based on prevailing wage growth trends and policy signals.

Working Hours and Standard Employment Rules

Armenian labor law defines a standard work week of forty hours, typically spread across five working days. The maximum allowable working time per day is eight hours. These limits apply across most sectors and are designed to protect employee well-being while providing clarity for employers.

Any work beyond the standard schedule is classified as overtime and must be compensated at higher rates. These rules are strictly regulated and are an important part of total income for many workers, particularly in manufacturing, services, and infrastructure-related roles.

Overtime, Night Work, and Hazard Pay

Employees who work additional hours or under special conditions are legally entitled to pay premiums. These supplements can significantly raise monthly earnings for certain occupations.

Compensation rules include:

• Overtime on regular working days must be paid at fifty percent above the standard hourly rate

• Work performed on public holidays or designated rest days requires a one hundred percent premium

• Night work, defined as duties carried out between ten in the evening and six in the morning, must include an additional thirty percent premium

• Jobs classified as hard, unhealthy, or dangerous also require a minimum thirty percent wage supplement

These premiums are mandatory and cannot be replaced with time off unless explicitly allowed by law.

Wage Structure Comparison Matrix

Employment Type | Base Pay Level | Premium Opportunities | Income Stability

Minimum Wage Roles | Low | Limited | Moderate

Private Sector Professional | Medium to High | Overtime, bonuses | High

Public Sector Employee | Medium | Limited premiums | High

Industrial and Shift Work | Medium | Night and hazard pay | Medium-High

Overall Impact on Salaries in Armenia for 2026

National wage standards in Armenia provide a structured and predictable salary environment for 2026. The planned minimum wage increase, combined with clearly defined overtime and premium rules, supports income stability for lower-paid workers while preserving flexibility for higher earners to increase take-home pay through additional hours or specialized work conditions.

For employees, these regulations establish clear income protections. For employers, they define transparent cost structures that can be planned into hiring and expansion strategies. As a result, statutory wage rules remain a central pillar of Armenia’s broader salary landscape in 2026.

3. Mandatory Health Insurance and Payroll Impact

A major change to Armenia’s salary and payroll system comes into effect at the start of 2026 with the rollout of the General Health Insurance reform. This reform directly affects how much employees and self-employed individuals take home each month, making it a critical factor in understanding real salaries in Armenia for 2026.

Under the new system, health insurance becomes mandatory for most working individuals. The annual insurance cost is set at 129,600 Armenian Dram, which equals a monthly amount of 10,800 Dram per insured person. Rather than being optional or employer-dependent, this contribution becomes a fixed part of the compensation structure across the economy.

How the Health Insurance Contribution Works

The reform changes net salaries by introducing new payroll deductions and by redirecting part of existing social contributions. Instead of placing the full burden on workers, the government has designed a tiered system that adjusts contributions based on income level. This approach aims to protect low- and middle-income earners from sharp drops in take-home pay.

The insurance premium is funded through a mix of redirected stamp duty payments, direct salary deductions, and state budget support. As a result, the real impact on monthly income varies significantly depending on how much a person earns.

Salary-Based Contribution Structure

The table below explains how the insurance cost is shared across different income groups.

Monthly Gross Salary Range | How the Insurance Is Funded | Monthly Impact on Take-Home Pay

200,001 – 500,000 AMD | Most of the premium is covered by redirected stamp duty and state budget support | Around 300 AMD reduction

500,001 – 1,000,000 AMD | Majority funded through redirected stamp duty, remainder deducted from salary | Temporary deduction, recoverable later

Above 1,000,000 AMD | Full insurance premium paid by the employee, partial recovery later | Higher short-term reduction

Impact on Low- and Middle-Income Earners

Employees earning between 200,001 and 500,000 Dram per month experience the smallest change in net income. For this group, most of the insurance premium is covered without adding new deductions. A large portion of the existing stamp duty payment is simply redirected to the insurance fund, while the state contributes the remaining amount.

As a result, these employees see only a very small reduction in their monthly take-home pay. This design ensures that workers close to the minimum and average wage levels are largely protected from financial strain.

Impact on Upper-Middle Income Earners

Workers earning between 500,001 and 1,000,000 Dram per month face a slightly higher short-term impact. In their case, most of the insurance premium is covered by redirecting stamp duty payments, but a remaining portion is deducted directly from salary.

However, this deduction is not a permanent loss. Starting from the following tax year, these employees can fully recover the deducted amount through the personal income tax declaration process. In practical terms, the insurance payment functions as a deferred tax credit rather than a permanent pay cut.

Impact on High Earners

Employees earning more than 1,000,000 Dram per month contribute the full monthly insurance premium in addition to continuing to pay the maximum stamp duty amount. This group carries the largest upfront cost under the reform.

To partially offset this burden, high earners become eligible for a social credit in the following year. While this credit does not cover the full insurance cost, it reduces the long-term financial impact.

Health Insurance Rules for Social Package Recipients

Employees who receive a social package and earn more than 200,001 Dram per month are included in the first phase of the reform. These individuals must actively apply to redirect the monthly social package amount toward the insurance premium.

If this redirection is not completed, they may need to cover the insurance payment separately, which could affect their net income more significantly.

Obligations for Individual Entrepreneurs

Self-employed individuals and individual entrepreneurs are also included in the General Health Insurance system. Those with annual revenues exceeding 2,400,001 Dram must pay the full annual insurance premium of 129,600 Dram.

Unlike salaried employees, this payment must be made as a single lump sum by April 20, 2026. Failure to meet this deadline results in suspension of insurance coverage, which can limit access to healthcare services until payment is completed.

Comparison of Insurance Impact by Worker Type

Worker Category | Payment Method | Cash Flow Impact | Recovery Option

Lower-income employees | Mostly state-funded | Minimal | Not required

Mid-income employees | Partial salary deduction | Temporary | Full recovery via tax filing

High-income employees | Full monthly payment | Higher upfront cost | Partial recovery later

Individual entrepreneurs | Annual lump sum | One-time outflow | No automatic recovery

Overall Effect on Armenia’s Salary Landscape

The General Health Insurance reform marks a structural shift in how salaries are calculated in Armenia in 2026. While gross wages remain unchanged, net pay becomes more closely linked to social contributions and long-term benefits. For most workers, especially those earning below or near the average wage, the impact on take-home income is limited.

For employers, the reform adds clarity and standardization to payroll planning. For employees, it introduces a predictable system that trades small or temporary income adjustments for guaranteed healthcare coverage. As a result, health insurance contributions become a permanent and essential component of Armenia’s overall salary framework in 2026.

4. Sector-Based Salary Analysis Across Industries

a. Information Technology and High-Skill Salaries

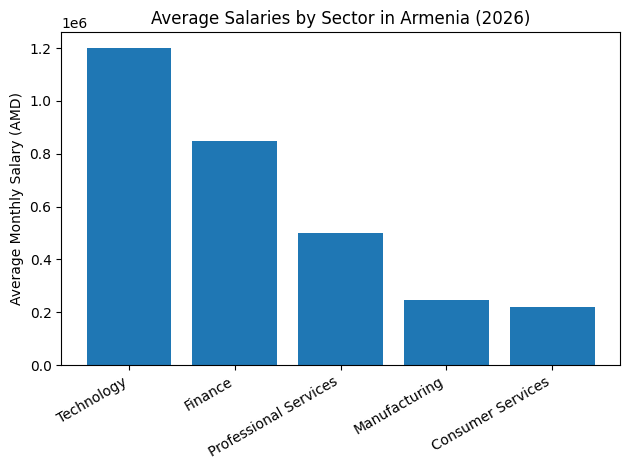

The Information and Communication Technology sector remains the strongest driver of wage growth in Armenia. Rapid expansion in software development, digital services, and research-based roles has pushed salaries far beyond the national average. By late 2025, average monthly pay in this sector had reached levels close to three times the economy-wide mean, and this trend is expected to continue into 2026.

Strong business growth has been a key factor behind these salary levels. Sector revenues expanded sharply, increasing demand for skilled professionals and intensifying competition among employers. As a result, experienced specialists command very high compensation packages.

How ICT Salaries Are Structured

Pay practices in the technology sector differ from most other industries in Armenia. Salaries are commonly discussed and negotiated in net, take-home terms rather than gross amounts. This reflects the sector’s international orientation and the frequent involvement of foreign employers or clients.

Another defining feature is the wide gap between junior and senior roles. Entry-level professionals earn solid incomes by local standards, but experienced specialists can earn several times more. This gap is significantly wider than in many Western European markets, where higher living costs compress differences between junior and senior pay.

Typical ICT Salary Ranges by Role and Experience

IT Specialization | Junior Level (1–2 years) AMD | Mid-Level (3–4 years) AMD | Senior Level (5+ years) AMD

Java Developer | 450,000 – 650,000 | 850,000 – 1,250,000 | 1,350,000 – 2,000,000

Python Developer | 420,000 – 580,000 | 820,000 – 1,180,000 | 1,300,000 – 1,950,000

JavaScript Developer | 400,000 – 600,000 | 750,000 – 1,100,000 | 1,200,000 – 1,800,000

C# Developer | 400,000 – 550,000 | 800,000 – 1,200,000 | 1,300,000 – 1,900,000

Frontend Developer (Typical) | Around 390,000 | Around 1,000,000 | Around 1,850,000

Backend Developer (Typical) | Around 450,000 | Around 1,250,000 | Around 2,200,000

Data Scientist | Entry-level below 200,000 | Mid-range around 650,000 | High-end above 935,000

UI and UX Designer | 300,000 – 500,000 | 600,000 – 1,200,000 | 1,200,000 – 1,800,000

DevOps Engineer | 500,000 – 700,000 | 900,000 – 1,700,000 | 1,700,000 – 2,200,000

Technical Lead | Not common | 1,400,000 – 2,200,000 | Above 2,200,000 in some cases

Salary Growth Pressure in Advanced Specializations

The strongest salary growth pressure is concentrated in highly specialized roles, particularly those linked to artificial intelligence, machine learning, infrastructure automation, and research-heavy engineering. Demand for these skills far exceeds supply within the local labor market.

As a result, senior-level compensation in advanced technology roles is expected to grow by high single-digit percentages through 2026. This upward pressure is most visible in roles that combine deep technical expertise with leadership or system design responsibilities.

Role of International Employers in Wage Levels

The presence of major international technology companies has reinforced Armenia’s high-wage technology environment. Global firms such as NVIDIA, ServiceTitan, and Synopsys have established significant operations in Yerevan. Their hiring standards and global pay benchmarks influence salary expectations across the entire market.

These companies not only pay above-average wages but also set reference points for local employers, pushing overall compensation levels higher in the technology ecosystem.

Sector Salary Comparison Matrix

Sector | Relative Pay Level | Salary Growth Outlook | Competition for Talent

Information Technology | Very High | Strong | Very High

Finance and Professional Services | High | Moderate | High

Construction and Infrastructure | Medium | Stable | Medium

Manufacturing | Medium-Low | Modest | Low-Medium

Education and Agriculture | Low | Limited | Low

Overall Sectoral Salary Outlook for 2026

Sector-based pay differences remain a defining feature of Armenia’s salary structure in 2026. The technology sector continues to pull ahead, driven by global demand, skill shortages, and international investment. Other sectors experience steadier and more modest wage growth, often tied to domestic demand and public funding limits.

For professionals planning careers or employers setting compensation strategies, industry selection plays a decisive role in income outcomes. In Armenia’s evolving economy, high-skill and globally connected sectors offer the strongest salary potential heading into 2026.

b. Finance and Insurance Compensation Levels

The financial and insurance industry stands as one of the strongest pillars of Armenia’s salary structure in 2026. It consistently ranks just below the technology sector in terms of compensation and plays a key role in setting upper-middle and high-income benchmarks across the economy. Strong institutional stability, expanding financial services, and rising demand for advanced expertise continue to support above-average wages in this field.

Why Financial Services Pay Above the National Average

Armenia’s banking and insurance ecosystem has matured significantly in recent years. A stable banking system, increased regulatory sophistication, and growing use of complex financial and insurance products have raised the value of skilled professionals in this sector. As a result, average salaries in finance remain well above the national median.

By late 2025, average monthly nominal wages in financial and insurance activities exceeded 720,000 Armenian Dram. This places the sector firmly in the high-income category and makes it an attractive option for professionals with strong analytical, regulatory, and managerial skills.

Key Roles Driving High Compensation

Certain roles within finance and insurance command particularly strong pay due to their impact on profitability, compliance, and risk management. Financial analysts working for international firms or large domestic institutions often earn substantially more than the average employee. Mid-to-senior professionals in these roles can earn around one million Dram per month, reflecting both technical expertise and responsibility levels.

Management positions further elevate earning potential. Senior accounting and finance managers are responsible for regulatory compliance, financial reporting, and strategic planning. These roles attract salaries that comfortably exceed the one-million Dram threshold, especially in institutions with foreign ownership or cross-border operations.

Average Salary Levels in Financial and Insurance Roles

Role Category | Typical Monthly Salary Range (AMD) | Relative Position in Market

Entry-Level Finance Specialist | 400,000 – 550,000 | Above national average

Financial Analyst (Mid–Senior) | Around 1,010,000 | High-income tier

Insurance Risk Specialist | 650,000 – 900,000 | Upper-middle income

Accounting Manager | 1,150,000 and above | Senior management level

Senior Finance Manager | 1,300,000 – 1,600,000 | Top-tier compensation

Wage Growth Expectations Heading into 2026

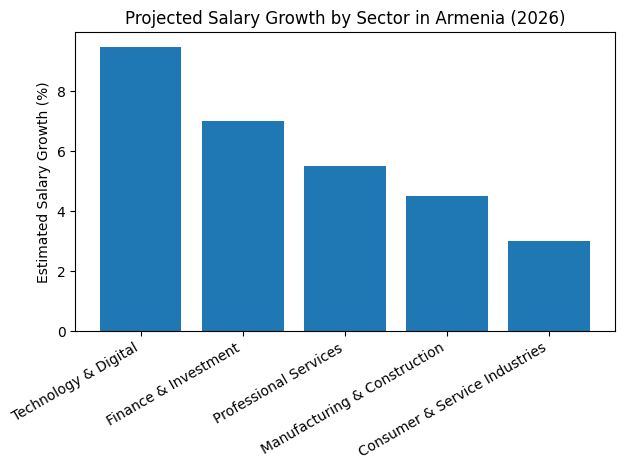

Looking toward 2026, wages in the financial and insurance sector are expected to grow at a moderate but steady pace. Forecasts point to growth of just under seven percent, reflecting a balance between expanding service demand and a relatively stable supply of qualified professionals.

This level of growth suggests that finance salaries will continue to rise faster than inflation but more slowly than those in cutting-edge technology fields. For employees, this means predictable income growth. For employers, it offers manageable labor cost planning without sharp wage shocks.

Management Premiums and Career Progression

Career progression in finance offers clear salary milestones. Moving from technical or analytical roles into management brings a substantial pay increase. Accounting managers, compliance leaders, and finance directors often see compensation jump sharply due to increased accountability and regulatory exposure.

This structure encourages long-term career development within the sector, as professionals can steadily move from above-average pay into top-tier income brackets without switching industries.

Finance Sector Salary Comparison Matrix

Factor | Financial Sector | National Average | Technology Sector

Base Salary Level | High | Medium | Very High

Salary Growth Rate | Moderate | Moderate | Strong

Income Stability | Very High | High | Medium-High

Management Premium | Significant | Moderate | Very High

The financial and insurance sector remains one of the most reliable high-paying industries in Armenia for 2026. Strong institutional demand, regulatory complexity, and the importance of risk management ensure sustained demand for skilled professionals. While salary growth is more measured than in technology, compensation levels remain attractive, particularly for experienced analysts and managers.

For professionals seeking stability, structured career progression, and consistently above-average pay, finance and insurance continue to represent one of the strongest salary pathways in Armenia’s evolving labor market.

c. Mining and Quarrying Wage Structure

Mining and quarrying continue to play a critical role in Armenia’s economy, especially outside the capital. In 2026, this sector remains one of the highest-paying traditional industries, largely due to the physical risks, remote locations, and technical demands involved in extraction work. While it does not match the absolute salary levels seen in high-technology roles in Yerevan, mining still offers strong earning potential compared to the national average.

Economic Importance of the Mining Sector

Mining is a cornerstone of regional economic activity, particularly in provinces such as Syunik. It supports local employment, infrastructure development, and export revenues. Unlike many service-based industries, mining generates high economic output per worker, making it one of the few regional sectors that can rival the capital’s technology industry in terms of productivity.

This strong productivity explains why mining wages remain elevated despite the sector’s exposure to global commodity price cycles and environmental scrutiny.

Average Wage Levels and Risk Premium

The average monthly wage in Armenia’s mining and quarrying sector is slightly above 550,000 Armenian Dram. This level of pay reflects a built-in risk premium, as mining work often involves hazardous conditions, physically demanding tasks, and strict safety requirements.

Compared to the national average salary, mining wages are clearly higher. However, they remain well below the compensation levels seen in mining industries in more developed economies, where higher labor costs, stricter safety regulations, and larger-scale operations push wages significantly higher.

Mining Wage Comparison Overview

Category | Average Monthly Wage (AMD) | Relative Position

Mining and Quarrying | Around 554,000 | Above national average

National Average (All Sectors) | Around 310,000 | Baseline

Technology Sector Average | Significantly higher | Top tier

Mining in Developed Economies | Much higher | Global benchmark

Regional Impact on Salaries

One of the defining features of mining wages in Armenia is their regional concentration. In areas where alternative high-paying jobs are limited, mining companies often offer salaries that stand out sharply from local averages. This makes the sector especially important for income stability in non-urban regions.

In practical terms, mining wages can support higher living standards in provincial areas than similar income levels would provide in Yerevan, where housing and service costs are higher.

Productivity and Output per Worker

Mining holds a unique position in Armenia’s economy because of its high output per employee. When measured by economic contribution rather than salary alone, mining is one of the most productive sectors in the country. This productivity allows companies to sustain above-average wages even when operating outside major urban centers.

Mining Sector Salary and Risk Matrix

Factor | Mining and Quarrying | National Average | Technology Sector

Base Pay Level | High | Medium | Very High

Risk Exposure | Very High | Low | Low

Regional Concentration | Strong | Mixed | Capital-focused

Productivity per Worker | Very High | Medium | Very High

Long-Term Salary Outlook for Mining in 2026

Looking ahead, mining salaries in Armenia are expected to remain stable rather than rapidly increasing. Wage growth is likely to track inflation and productivity improvements rather than experience sharp jumps. Global commodity demand, environmental regulations, and investment in safety technology will all influence future compensation levels.

Overall Role of Mining in Armenia’s Salary Landscape

In the context of Armenia’s salary structure in 2026, mining and quarrying represent a high-paying, high-risk sector with strong regional importance. While it does not offer the explosive income growth seen in technology, it provides dependable above-average wages and remains one of the few industries outside Yerevan capable of generating exceptional economic value per worker.

For professionals willing to work in demanding conditions or outside major cities, mining continues to offer a solid and respected income pathway within Armenia’s broader labor market.

d. Manufacturing and Construction Salaries

Manufacturing and construction form the backbone of Armenia’s traditional economy and remain major employers across both urban and regional areas. In 2026, these sectors continue to offer stable but relatively modest wages compared to high-paying industries such as technology and finance. Their salary levels are closely tied to domestic economic conditions, investment cycles, and input costs.

Manufacturing Sector Salary Conditions

Manufacturing wages in Armenia sit below the national average, reflecting the sector’s focus on labor-intensive production and tighter profit margins. Average monthly pay in manufacturing is slightly above 240,000 Armenian Dram, making it a lower-to-mid income sector within the overall salary landscape.

Pay levels in manufacturing are influenced by several factors:

• Dependence on domestic and regional demand

• Sensitivity to energy and raw material prices

• Limited automation in many sub-industries

• Strong competition from lower-cost producers abroad

While wages remain modest, manufacturing jobs often provide steady employment and predictable working hours, which continue to appeal to a large portion of the workforce.

Construction Sector Salary Conditions

Construction salaries are closely aligned with manufacturing wages, averaging just under 250,000 Armenian Dram per month. Despite relatively modest pay, construction activity has expanded rapidly, with project volumes growing strongly toward the end of 2025. This expansion is driven by infrastructure investment, housing demand, and public works projects.

However, construction wages do not always rise at the same pace as project volume. The sector is highly cost-sensitive, and increases in material prices or regulatory requirements often limit how much employers can raise base pay.

Manufacturing and Construction Wage Comparison

Sector | Average Monthly Wage (AMD) | Relative Pay Level | Employment Stability

Manufacturing | Around 244,500 | Below national average | High

Construction | Around 246,000 | Below national average | Medium

National Average (All Sectors) | Around 310,000 | Baseline | High

Sensitivity to Economic Fluctuations

Both manufacturing and construction are highly exposed to changes in the domestic economy. When consumer demand slows or public investment is delayed, hiring and wage growth tend to weaken. Conversely, periods of economic expansion can quickly boost employment, even if wage increases remain limited.

Construction is particularly vulnerable to:

• Fluctuations in raw material costs

• Delays in government-funded projects

• Seasonal demand patterns

• Financing conditions and interest rates

These factors explain why construction wages often lag behind overall economic growth.

Impact of Regulatory and Environmental Standards

Recent policy changes have introduced stricter environmental and safety requirements in construction projects. Measures such as dust control, improved waste handling, and enhanced site safety standards increase project costs but also raise the demand for skilled oversight roles.

As a result, while general labor wages may remain constrained, higher-skilled positions are expected to see stronger pay growth. Roles such as site managers, safety officers, and compliance specialists are becoming more valuable as regulations tighten.

Construction Skill-Based Salary Matrix

Role Type | Skill Requirement | Salary Pressure | 2026 Outlook

General Construction Labor | Low to Medium | Low | Stable

Skilled Trades (Electricians, Welders) | Medium | Moderate | Gradual increase

Site Managers | High | High | Strong demand

Safety and Compliance Officers | High | High | Rising wages

Overall Outlook for Manufacturing and Construction Salaries in 2026

In Armenia’s 2026 salary landscape, manufacturing and construction remain essential but lower-paying sectors. Wage growth is expected to be modest and closely linked to domestic economic performance rather than global demand. However, increasing regulatory complexity and project scale are gradually reshaping pay structures, especially in construction.

For workers with basic skills, these sectors offer stability rather than high income. For those who invest in technical training, management capabilities, or safety expertise, manufacturing and construction can still provide opportunities for above-average earnings within Armenia’s evolving labor market.

e. Public Sector Pay in Education and Healthcare

Public sector employment plays a vital social role in Armenia, covering government administration, education, healthcare, and essential public services. In 2026, public sector salaries continue to trail behind private sector compensation in nominal terms, even though recent wage increases show stronger growth momentum than in some private industries.

Overall Public Sector Pay Structure

Public sector wages are primarily shaped by state budgets, policy priorities, and long-term workforce planning rather than direct market competition. As a result, salaries tend to be more stable but lower than those offered by private employers, particularly in high-skill or revenue-generating industries.

Average monthly pay in public administration stands at slightly above 320,000 Armenian Dram. This level places public administration close to the national average, but still below sectors such as finance, technology, and mining. Despite lower base pay, public sector jobs often offer greater employment stability, predictable working hours, and structured career progression.

Education Sector Salary Conditions

Education remains one of the lowest-paid sectors in Armenia. Average monthly salaries in education are slightly above 156,000 Armenian Dram, placing it near the bottom of the national wage distribution. This gap reflects long-standing budget constraints, limited alternative funding sources, and the large size of the education workforce.

Although education salaries increased at a relatively strong pace in recent years, the starting base remains low. As a result, even notable percentage increases translate into modest absolute gains for teachers and academic staff.

Healthcare Sector Salary Conditions

Healthcare salaries occupy a middle position within the public sector. Average monthly pay is slightly above 257,000 Armenian Dram, but this figure hides large internal differences. Medical professionals working in state-funded hospitals and clinics typically earn significantly less than those employed in private medical centers.

Specialists, surgeons, and senior doctors in private facilities often earn multiples of the public-sector average, while nurses and junior medical staff in public institutions remain closer to the national median.

Public Versus Private Sector Wage Growth

One notable trend is that public sector salaries have recently grown faster than private sector wages. Public wages increased by close to eight percent, while private sector pay rose at a slower pace. This reflects targeted government efforts to reduce income gaps in socially important professions, even if overall pay levels remain lower.

However, faster growth does not fully close the gap, especially in sectors where private employers can rapidly adjust compensation to attract scarce talent.

Average Salary Comparison by Sector

Industry Sector | Average Monthly Wage (AMD) | Approximate Annual Growth

Information and Communication | 849,531 | 7.2%

Financial and Insurance Activities | 727,107 | 6.8%

Mining and Quarrying | 554,433 | 5.4%

Public Administration and Defense | 377,488 | 7.9%

Transportation and Storage | 339,718 | 4.2%

Arts, Entertainment and Recreation | 330,896 | 3.5%

Professional, Scientific and Technical | 294,031 | 5.1%

Construction | 246,014 | 8.5%

Manufacturing | 244,512 | 6.4%

Healthcare and Social Services | 257,240 | 4.8%

Wholesale and Retail Trade | 227,841 | 3.2%

Education | 156,364 | 7.9%

Accommodation and Food Service | 154,379 | 2.8%

Other Services | 150,498 | 2.1%

Public Sector Salary Position Matrix

Category | Salary Level | Growth Rate | Job Stability | Career Predictability

Public Administration | Medium | High | Very High | High

Education | Very Low | High | Very High | Medium

Healthcare | Medium-Low | Moderate | High | Medium

Private Sector Average | Medium-High | Moderate | Medium | Medium

Overall Public Sector Salary Outlook for 2026

In the context of Armenia’s overall salary structure in 2026, public sector pay remains modest but increasingly supported by policy-driven wage growth. Education and healthcare continue to lag behind most private industries in absolute income levels, despite above-average growth rates in recent years.

For workers, public sector employment offers stability, social benefits, and long-term security rather than high earnings. For policymakers, the challenge remains balancing fiscal limits with the need to retain skilled professionals in essential public services. As a result, public sector salaries are expected to rise gradually, narrowing gaps at the margins but not eliminating them in the near term.

5. Geographic Salary Differences Across Regions

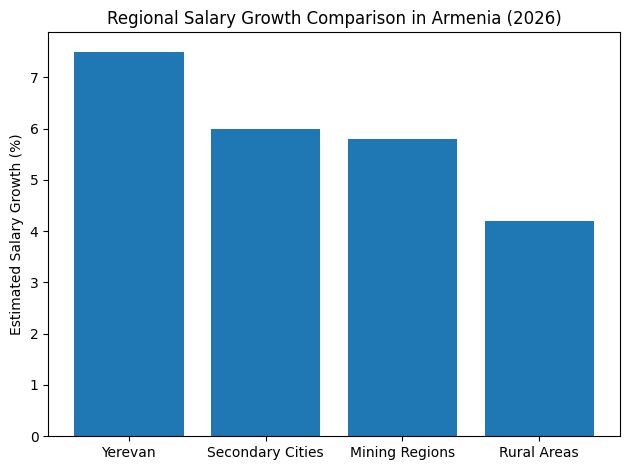

Salary levels in Armenia vary strongly by location. One of the most important factors shaping income in 2026 is geography, with a clear divide between the capital city and the rest of the country. Where a person works often matters as much as what job they do.

The Capital Versus the Regions Salary Gap

Armenia’s labor market is highly centralized. High-paying roles in technology, finance, consulting, and professional services are concentrated in Yerevan, which acts as the country’s main economic engine. Most international companies, large employers, and fast-growing startups are based in or around the capital.

As a result, professionals in Yerevan often earn significantly more than those in regional cities or rural areas. In many cases, salaries in the capital can be two to three times higher for similar roles.

For example, a skilled technology professional in Yerevan may earn between 1,000,000 and 1,500,000 Armenian Dram per month, while a public-sector worker such as a teacher in a rural area may earn closer to 250,000 Dram. This gap reflects both employer concentration and differences in local demand for specialized skills.

Cost of Living Differences

Higher salaries in Yerevan are partly offset by higher living costs. Housing, transportation, dining, and everyday services are more expensive in the capital than elsewhere in the country. Average monthly living expenses for a single person in Yerevan, including rent and basic needs, are estimated at just over 300,000 Armenian Dram.

In contrast, regional cities and provinces offer much lower living costs. While salaries are lower, purchasing power can sometimes be comparable, especially for workers in stable roles with modest housing expenses.

Regional Provinces with Above-Average Wages

Although Yerevan dominates high-paying employment, several regions stand out for offering stronger wages due to industry concentration and targeted investment.

Syunik Province Salary Profile

Syunik consistently reports some of the highest regional wages in the country. This is largely driven by large-scale mining operations, particularly copper and molybdenum extraction. In certain months, average salaries in Syunik can rival those of the capital, especially for technical and operational roles linked to mining.

Vayots Dzor Wage Growth

Vayots Dzor has recorded the fastest wage growth in recent years. Salary increases are supported by the expansion of wine production, agri-business, and boutique tourism. While absolute wages remain lower than in Yerevan, the rapid growth rate signals improving income opportunities in the region.

Armavir’s Economic Advantage

Armavir benefits from its proximity to the capital and strong activity in agriculture and light manufacturing. Investments in food processing and logistics have helped push average wages upward faster than the national average, narrowing the gap with Yerevan.

Shirak and the Rise of Secondary Cities

Shirak, centered around Gyumri, has historically had lower wage levels. However, income growth has accelerated as Gyumri develops into a secondary technology and creative hub. New IT offices, outsourcing centers, and digital startups are gradually lifting average pay in the region.

Urban Salary Comparison Across Major Cities

City | Typical Salary Level | Cost of Living | Salary Gap vs Yerevan

Yerevan | Very High | High | Baseline

Gyumri | Medium | Low | 15%–30% lower

Vanadzor | Medium | Low | 15%–30% lower

Vanadzor and Gyumri offer lower operating costs for businesses and lower living expenses for workers. This makes them attractive locations for back offices, outsourcing teams, and regional operations.

Remote Work and Changing Salary Patterns

The spread of remote and hybrid work is gradually reshaping geographic salary differences. Professionals living in secondary cities are increasingly working for Yerevan-based or international employers. This allows them to earn salaries closer to capital-city levels while benefiting from lower regional living costs.

In practice, this trend is narrowing income gaps for skilled professionals outside the capital, even though the broader Yerevan-versus-regions divide remains strong.

Geographic Salary Comparison Matrix

Location | Salary Potential | Living Costs | Long-Term Outlook

Yerevan | Very High | High | Strong growth

Mining Regions | High | Medium-Low | Stable

Secondary Cities | Medium | Low | Improving

Rural Areas | Low | Very Low | Limited growth

Overall Geographic Salary Outlook for 2026

In 2026, Armenia’s salary landscape remains highly location-dependent. Yerevan continues to dominate high-income opportunities, but selected regions and secondary cities are gaining ground through industry specialization, investment, and remote work adoption.

For professionals, choosing where to work involves balancing salary potential against living costs. For employers, regional cities offer cost advantages and growing talent pools. Geography, therefore, remains a central factor in understanding salaries in Armenia in 2026.

6. Experience, Education, and Demographic Salary Drivers

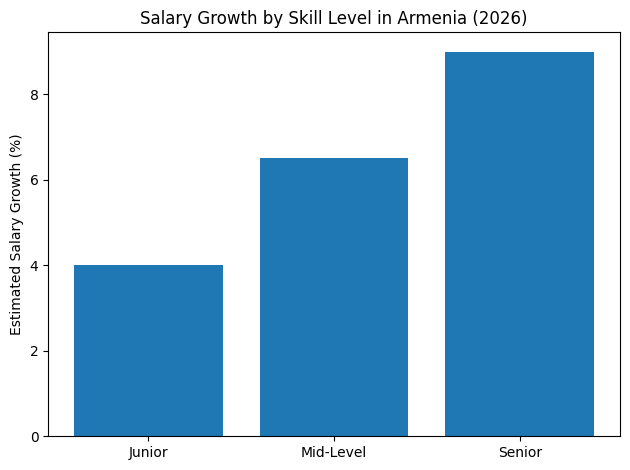

Salary levels in Armenia in 2026 are shaped less by job titles alone and more by who holds the role. Factors such as work experience, education level, age, and gender strongly influence earning potential across nearly all industries. Among these, experience stands out as the most decisive factor, especially in high-skill and fast-growing sectors.

Why Experience Matters Most in Salary Outcomes

Experience remains the strongest determinant of income in the Armenian labor market. Employers place high value on proven skills, decision-making ability, and the capacity to work independently. This is most visible in technology and other knowledge-based industries, where productivity differences between junior and senior professionals are substantial.

In high-demand sectors, salary progression accelerates sharply after the first few years of work. Professionals who move beyond entry-level roles often see rapid income growth as they take on greater responsibility and specialized tasks.

Salary Differences by Experience Level

The table below illustrates how experience alone can multiply earnings, particularly in technology-driven roles.

Experience Level | Typical Monthly Earnings | Income Growth Pattern

Junior Level (0–2 years) | Low to moderate | Entry-stage compensation

Mid-Level (3–5 years) | Strong increase | Skills-driven jump

Senior Level (6–9 years) | Very high | Leadership and expertise premium

Lead or Management (10+ years) | Top-tier | Strategic responsibility premium

In the technology sector, the income gap between junior and senior professionals can exceed five times. By the time a professional reaches a leadership or management position, monthly compensation can move well beyond standard salary ceilings seen in traditional industries.

In more established sectors such as finance, accounting, and administration, the experience premium is narrower but still significant. Experienced professionals typically earn between thirty and fifty percent more than entry-level employees, reflecting accumulated institutional knowledge and regulatory expertise.

Education and Its Influence on Early Career Salaries

Education plays a crucial role in shaping starting salaries and early career momentum. Higher education generally improves access to better-paying roles, particularly in analytical, technical, and management positions. However, education alone does not guarantee higher pay; it works most effectively when combined with relevant experience and market demand.

In some high-demand niches such as artificial intelligence, fintech, or advanced analytics, candidates with fewer years of experience but strong technical skills may earn more than highly educated professionals in lower-demand roles.

Education, Experience, and Salary Comparison

Education Level | Role Example | Experience | Average Monthly Gross (AMD)

Primary Education | HR Consultant | 3–5 years | Around 80,000

Bachelor’s Degree | Restaurant Manager | 1–2 years | Around 252,000

Bachelor’s Degree | UX Designer | 6–10 years | Around 480,000

Master’s Degree | Data Analyst | 3–5 years | Around 447,000

Master’s Degree | Senior Executive | 10+ years | 640,000 – 865,000

This comparison shows that education boosts earning potential most when paired with experience and roles in high-value sectors. Market demand can sometimes outweigh formal qualifications, especially in fast-evolving industries.

Gender Differences in Earnings

A noticeable gender pay gap continues to exist in Armenia’s labor market. On average, men earn significantly more than women, with the difference approaching one-fifth of average monthly income. Some estimates suggest the gap may be even wider when accounting for the concentration of men in senior leadership and high-paying industries.

Two structural factors contribute to this gap:

Vertical segregation, where men are more likely to occupy senior and executive positions

Horizontal segregation, where men are more prevalent in higher-paying sectors such as technology, mining, and engineering

These patterns reduce average earnings for women even when qualifications and experience levels are similar.

Average Earnings by Gender

Category | Average Monthly Wage (AMD) | Difference

Men | Around 308,000 | Baseline

Women | Around 264,000 | About 17% lower

Age and Salary Progression

Earnings in Armenia also follow a clear age-related pattern. Income typically rises as workers gain experience and peaks during mid-career years. After this point, earnings often stabilize or decline slightly, especially for those who remain in traditional or public-sector roles.

Average Salary by Age Group

Age Group | Average Monthly Wage (AMD) | Earning Trend

Under 24 | Around 214,000 | Entry-level phase

25–34 | Around 291,000 | Rapid growth

35–44 | Around 321,000 | Peak earning years

45–54 | Slightly below peak | Stable

55 and above | Around 272,000 | Gradual decline

This pattern reflects both career progression and sectoral distribution, as younger workers dominate fast-growing industries while older workers are more likely to remain in lower-paying public or traditional roles.

Demographic Salary Influence Matrix

Factor | Impact on Salary | Strength of Influence

Experience | Very High | Strongest

Education | Medium to High | Conditional

Age | Medium | Career-linked

Gender | Medium | Structural

Sector Choice | Very High | Market-driven

Overall Demographic Salary Outlook for Armenia in 2026

In Armenia’s 2026 salary landscape, experience outweighs nearly every other factor in determining income. Education sets the foundation, but long-term earnings depend heavily on accumulated skills, sector choice, and career progression. Gender and age still influence pay outcomes, reflecting structural patterns rather than individual performance alone.

For individuals, investing in skills and gaining experience in high-demand sectors remains the most reliable path to higher income. For employers and policymakers, addressing demographic imbalances will be key to building a more inclusive and competitive labor market in the years ahead.

7. Popular Job Roles and Representative Salaries

Understanding common job roles and their pay levels helps readers form realistic salary expectations in Armenia for 2026. The roles below represent a broad mix of executive, professional, service, and manual occupations. Salary figures reflect average monthly gross income and are influenced by experience, sector, company size, and performance-based incentives.

Executive and Senior Management Roles

Senior leadership positions command the highest salaries in Armenia due to their strategic responsibility and decision-making authority. These roles are most common in large domestic firms, multinational companies, and fast-growing technology or finance businesses.

Job Role | Average Monthly Gross Salary (AMD) | Typical Bonuses and Benefits

Chief Executive Officer | 865,464 | Performance bonuses, company car, health coverage

IT Director | 760,622 | Technology allowances, stock options

Leasing Director | 714,312 | Sales commissions and incentive schemes

Call Center Director | 699,960 | KPI-based bonuses

Pilot | 631,500 | Insurance coverage and flight-related premiums

Technology and High-Skill Professional Roles

Technology and analytical roles continue to offer strong earning potential, especially in companies serving international clients or operating in high-demand niches.

Job Role | Average Monthly Gross Salary (AMD) | Typical Bonuses and Benefits

Lead Developer | 607,777 | Stock options in startups, performance bonuses

IT Architect | 527,837 | Flexible working arrangements

IT Specialist | 266,760 | Equipment allowances and training support

Financial Analyst | 347,542 – 1,010,000 | Annual performance reviews and bonuses

Accountant | 567,000 | Professional training and certification support

Sales, Operations, and Customer-Facing Roles

Roles focused on sales, operations, and customer interaction offer moderate base pay, often supplemented by commissions or performance incentives.

Job Role | Average Monthly Gross Salary (AMD) | Typical Bonuses and Benefits

Sales Representative | 518,800 | Commission-based earnings

Customer Service Representative | 297,527 | Language and shift premiums

Restaurant Manager | 252,000 | Performance-based incentives

Cashier | 150,338 | Overtime pay opportunities

Education, Services, and Entry-Level Roles

These roles form the backbone of everyday economic activity. While salaries are lower than the national average, they often come with stable employment and basic social protections.

Job Role | Average Monthly Gross Salary (AMD) | Typical Bonuses and Benefits

Assistant Teacher | 145,436 | Social benefit packages

Cleaner | 141,492 | Statutory minimum protections

Seamstress | 139,717 | Productivity-based bonuses

General Laborer | 148,507 | Standard health insurance

Salary Distribution Overview

If shown in a salary bar chart, executive and senior technology roles would form the tallest bars, clearly above the national average. Mid-level professionals in finance, sales, and IT would cluster in the middle range, while service, education, and manual roles would appear near the lower end. This distribution highlights the strong influence of skill level, responsibility, and sector choice on earnings.

Job Salary Tier Matrix

Salary Tier | Typical Roles | Income Position

Top Tier | CEOs, IT Directors, Pilots | Highest income bracket

Upper-Middle Tier | Developers, Analysts, Accountants | Strong earning potential

Middle Tier | Sales, Customer Service, IT Support | Near national average

Lower Tier | Education assistants, service staff, laborers | Below average but stable

Overall View of Popular Job Salaries in 2026

In Armenia’s 2026 labor market, salary outcomes vary widely by occupation. Leadership and high-skill technical roles dominate the upper end of the pay scale, while service and public-facing roles remain more modestly paid. Performance bonuses, commissions, and benefits play an important role in total compensation, particularly in executive, sales, and technology positions.

For job seekers, understanding these representative salary ranges helps align career planning with income expectations. For employers, these benchmarks support competitive and realistic compensation strategies in Armenia’s evolving salary landscape.

8. Taxation, Payroll Deductions, and Net Income

Understanding taxes and payroll deductions is essential when evaluating real take-home pay in Armenia in 2026. The country operates a relatively simple and predictable system that benefits both employees and employers. A flat personal income tax, limited employer-side social costs, and targeted incentives for technology companies make Armenia attractive for high-skilled professionals and international businesses.

Personal Income Tax and Flat-Rate Advantage

Armenia applies a flat personal income tax system, which means the same tax rate applies regardless of income level. For most employees, the standard Personal Income Tax rate is set at twenty percent of gross salary. This simplicity makes it easier for workers to estimate net income and for companies to manage payroll.

Unlike progressive tax systems, higher earners do not move into higher tax brackets. As income rises, the effective tax rate remains stable, which significantly benefits senior professionals, managers, and specialists with high salaries.

Tax Incentives for the Technology Sector

To support innovation and attract global technology firms, Armenia offers several tax incentives specifically designed for high-tech and startup companies. These incentives directly improve net salaries for eligible employees and reduce overall payroll costs for employers.

Key technology-related tax benefits include:

• Research and development salary cap, where personal income tax on qualifying R&D roles is capped at ten percent

• Full income tax refunds for startups with thirty or fewer employees when hiring new staff, available for up to seven years

• Turnover tax option, allowing eligible technology companies to pay a one-percent turnover tax instead of standard profit tax, provided most revenue comes from high-tech activities

These measures make Armenia especially competitive for software engineers, researchers, and startup founders.

Personal Income Tax Impact Overview

Income Type | Standard PIT Rate | Reduced Rate Eligibility | Net Salary Impact

General Employment | 20% | No | Moderate tax burden

R&D Tech Roles | 20% | Capped at 10% | Higher take-home pay

Startup Employees | 20% | 100% refund | Maximum net benefit

Mandatory Pension Contributions

In addition to income tax, employees contribute to the mandatory pension system. This applies to individuals born after January 1, 1974. Pension payments are deducted directly from gross salary and are structured to limit the burden on higher earners.

The pension contribution rates are tiered:

• For monthly gross salaries below 500,000 Armenian Dram, employees contribute five percent

• For monthly gross salaries above 500,000 Armenian Dram, employees contribute ten percent minus a fixed amount of 27,500 Dram, up to a defined ceiling

These contributions fund individual pension accounts and form part of long-term retirement savings rather than a general social tax.

One notable feature of Armenia’s system is the absence of mandatory employer pension or social security contributions. This keeps total employment costs very close to the employee’s gross salary, making hiring more affordable for companies.

Pension Contribution Comparison

Gross Monthly Salary | Employee Pension Rate | Employer Contribution

Below 500,000 AMD | 5% | None

Above 500,000 AMD | Adjusted 10% formula | None

Stamp Duty Contributions for the Insurance Fund

Employees are also required to make monthly payments to the Insurance Fund for Servicemen, commonly referred to as the Zinpak fund. This contribution is fixed in amount rather than percentage-based and depends on salary level.

Stamp duty tiers are as follows:

Monthly Salary Range | Monthly Zinpak Contribution (AMD)

Up to 100,000 | 1,500

100,001 – 200,000 | 3,000

200,001 – 500,000 | 5,500

500,001 – 1,000,000 | 8,500

Above 1,000,000 | 15,000

From 2026 onward, part of this contribution will be redirected toward the new mandatory health insurance system for applicable salary groups. This change does not eliminate the stamp duty but alters how the funds are allocated.

Overall Payroll Cost Structure

One of Armenia’s strongest advantages is the low gap between gross salary and total employer cost. Since employers are not required to make additional social security or pension contributions, payroll expenses remain predictable and transparent.

Payroll Cost Comparison Matrix

Cost Element | Employee Pays | Employer Pays

Personal Income Tax | Yes | No

Pension Contribution | Yes | No

Stamp Duty | Yes | No

Health Insurance (from 2026) | Yes, partly redirected | No mandatory share

Net Salary Outlook for 2026

In 2026, Armenia’s tax and payroll system continues to favor simplicity and transparency. Employees benefit from predictable deductions and flat tax rates, while employers face minimal additional payroll costs. Technology professionals gain further advantages through targeted incentives that significantly raise net take-home pay.

For professionals evaluating job offers and for companies planning compensation packages, understanding this structure is critical. Armenia’s payroll model remains one of the most business-friendly in the region, supporting competitive salaries while keeping compliance straightforward.

9. Immigration Reform and Foreign Workforce Impact

Armenia is introducing a major reform of its immigration and work permit framework in 2026. This reform directly affects foreign professionals, international employers, and salary planning for companies operating in the country. The new system is designed to make the labor market more structured, transparent, and aligned with international standards, while still allowing Armenia to attract skilled foreign talent.

Purpose and Direction of the 2026 Immigration Reform

From August 1, 2026, Armenia will move away from flexible, case-by-case work authorization toward a more regulated and centralized system. The reform reflects the government’s intention to balance two goals at the same time: simplifying access for high-value specialists while maintaining tighter control over the size and composition of the foreign workforce.

For employers, this means clearer rules and fewer procedural uncertainties. For foreign workers, it introduces stricter entry requirements but also more predictable legal pathways.

Removal of Local Labor Availability Checks

One of the most important changes is the removal of labor market testing. Employers will no longer need to prove that no Armenian worker is available before hiring a foreign professional. This significantly shortens recruitment timelines and makes Armenia more competitive for international hiring, especially in high-skill sectors.

This change is particularly relevant for technology, engineering, finance, and research roles where local talent shortages already exist.

Introduction of an Annual Quota System

At the same time, Armenia will introduce an annual quota system for foreign residents. Quotas will be set by industry or professional category and reviewed at a national level. This shifts decision-making from individual employers to a centralized workforce planning model.

While quotas add an extra layer of control, they also create clearer expectations for businesses planning long-term hiring strategies involving foreign staff.

New Work Entry Visa Requirement

Foreign nationals who plan to work in Armenia will be required to obtain a specific work entry visa before arriving in the country. Entering Armenia as a tourist and later changing status to work will no longer be allowed.

This change affects salary planning and onboarding timelines, as employers must factor in visa processing before employment begins. The work entry visa carries a fixed state fee, making upfront costs more predictable for both sides.

Residence Permits and Biometric Registration

All foreign professionals will be required to appear in person to complete biometric registration, including fingerprints and signatures, before receiving residence permits. This aligns Armenia with global identity verification standards and reduces administrative ambiguity.

Residence permits will also follow a revised fee structure, reflecting the shift toward a more formalized immigration system.

Updated State Fees for Foreign Workers

The reform introduces higher and more clearly defined state duties for residence permits:

Permit Type | Validity Period | State Fee (AMD)

Temporary residence for work | 1 year | 150,000

Permanent residence | 5 years | 250,000

These costs are typically factored into compensation packages for foreign employees, especially in senior or specialist roles.

Special Pathways for High-Value Contributors

Despite tighter controls, Armenia is expanding access for specific categories of foreign professionals. Investors who make significant economic contributions can qualify immediately for a five-year residence permit. In addition, scientific, research, and innovative startup activities are now formally recognized as valid grounds for temporary residence.

These provisions support Armenia’s strategy to attract expertise in technology, innovation, and knowledge-based industries without relying solely on traditional employment models.

Foreign Workforce Access Matrix

Foreign Worker Category | Ease of Entry | Salary Expectations | Residency Stability

Highly skilled specialists | High | Above average | Strong

Startup and research professionals | Medium-High | Competitive | Medium

General foreign workers | Medium | Market-based | Quota-dependent

Short-term or low-skill roles | Low | Limited | Restricted

Salary and Labor Market Implications

For salaries in Armenia in 2026, the immigration reform is likely to reinforce wage premiums for specialized foreign talent. Easier hiring for skilled roles increases competition for top candidates, while quotas limit oversupply. As a result, foreign professionals with in-demand skills may command higher compensation packages, especially when relocation and permit costs are included.

For local workers, the reform aims to protect job access through quota management rather than employer-level restrictions, maintaining balance in the labor market.

Overall Impact on Armenia’s Salary Landscape in 2026

The 2026 immigration reform marks a shift toward a more regulated and globally aligned labor market. Armenia is replacing informal flexibility with structured access, predictable costs, and centralized planning. For employers, this improves clarity. For foreign professionals, it raises entry standards while offering clearer long-term pathways.

In the context of salaries in Armenia for 2026, the reform supports higher-value employment, encourages investment-driven and innovation-led hiring, and positions the country as a more mature destination for international talent.

10. Cost of Living and Purchasing Power Analysis

When assessing salaries in Armenia for 2026, income figures only tell part of the story. Real financial comfort depends heavily on living costs and purchasing power. While nominal salaries in Armenia are lower than those in Western Europe or North America, everyday expenses are also significantly lower. This balance allows many professionals to maintain strong savings rates and a comfortable lifestyle.

Why Purchasing Power Matters More Than Nominal Salary

In international comparisons, Armenian salaries may appear modest when converted to foreign currencies. However, the cost of housing, food, transportation, and services remains relatively affordable. As a result, the portion of income left after essential expenses is often higher than in more expensive global cities.

This dynamic is especially attractive to skilled professionals, remote workers, and returning diaspora talent who earn above-average salaries but want to reduce living costs without sacrificing quality of life.

Living Costs in the Capital City

Yerevan remains the most expensive place to live in the country. It concentrates high-paying jobs, international companies, and modern services, which naturally drives up prices. Even so, overall living costs remain moderate by international standards.

Average monthly expenses for a single person in Yerevan are estimated at just over 300,000 Armenian Dram. This estimate includes rent, utilities, food, transportation, and basic lifestyle spending. For professionals earning senior-level salaries, these costs represent only a small share of total income.

For example, a senior technology professional earning well above one million Dram per month can comfortably cover all living expenses and still retain a large portion of income as savings or discretionary spending.

Typical Monthly Expenses in Yerevan

Expense Category | Estimated Monthly Cost (AMD) | Approximate USD Range