Key Takeaways

- Identify the top recruitment agencies in Ethiopia for 2025 that excel in compliance, high-value talent acquisition, and strategic workforce solutions.

- Understand the cost structures, regulatory requirements, and placement fees for specialized corporate roles and mass labor deployment.

- Leverage agencies effectively to optimize hiring, mitigate compliance risks, and access both local and international talent pools.

The Ethiopian recruitment landscape in 2025 presents a dynamic, rapidly evolving environment shaped by the country’s robust economic growth, demographic trends, and expanding industrial and digital sectors. With a population exceeding 120 million and a labor force of approximately 54.5 million, Ethiopia represents one of Africa’s largest and most diverse talent pools. This creates both opportunities and challenges for employers seeking to attract and retain skilled personnel, whether for local operations or international deployment.

Ethiopia’s macroeconomic environment continues to foster employment demand. The country’s GDP growth is projected at 6.7% for 2024–2025, supported by a services sector contributing 40% of GDP, an industry sector at 28%, and agriculture at 32%. This industrial and services expansion directly fuels the need for formal, high-skill employment across urban centers, particularly in Addis Ababa, Oromiya, Amhara, and other economically strategic regions. At the same time, inflation is forecasted to stabilize at 15.4%, creating a more predictable framework for salary planning and talent acquisition.

The recruitment sector in Ethiopia is inherently segmented due to the varying skill levels, employment types, and regulatory requirements. High-skill corporate recruitment, encompassing IT, engineering, finance, healthcare, and executive management roles, requires specialized agencies capable of navigating formal labor market constraints and delivering fully compliant placement services. In parallel, Foreign Employment Agents (FEAs) focus on high-volume, international labor placements, facilitating deployment to key Middle Eastern markets, including Saudi Arabia, UAE, Qatar, and Kuwait. The regulatory environment, particularly Proclamation 1246/2021, establishes strict compliance and financial requirements for agencies, including a mandatory $100,000 USD collateral deposit for FEAs, ensuring only highly capitalized and compliant agencies operate in the market.

For multinational corporations, local firms, and international investors, choosing the right recruitment partner is critical. The top agencies not only provide access to Ethiopia’s deep talent pool but also mitigate legal and operational risks associated with formal and international hiring. Corporate agencies, such as 9cv9 Recruitment Agency, YES, Workforce Africa, and Alliance Recruitment, excel in high-value placements, offering Employer of Record (EOR), Recruitment Process Outsourcing (RPO), payroll management, and executive search services. These agencies command placement fees ranging from 15% to 30% of annual salaries, reflecting the scarcity of talent and the complexity of compliance requirements. Conversely, FEAs like Abamela, EHA, and NEKEMT focus on large-scale international deployments, with ethical fee structures capped at one month’s salary for skilled workers while managing complex visa, documentation, and compliance processes.

This blog delves into the top 10 best recruitment agencies in Ethiopia for 2025, providing a detailed, expert analysis of their market positioning, compliance practices, service offerings, and financial structures. Through an evaluation of both qualitative and quantitative factors—including corporate service depth, verifiable placement volumes, specialization, and regulatory compliance—this guide highlights agencies capable of delivering strategic value for employers seeking to navigate Ethiopia’s challenging yet rewarding labor market. Additionally, it examines salary benchmarks, Total Cost of Placement (TCoP) models, and sector-specific insights, ensuring readers understand not only who the leading agencies are but also why they stand out in a competitive, highly regulated, and increasingly digitalized recruitment landscape.

By presenting a thorough understanding of Ethiopia’s recruitment market structure, compliance landscape, and financial dynamics, this analysis equips employers, HR professionals, and workforce strategists with actionable insights to make informed hiring decisions. Whether the goal is to attract top executive talent, expand IT teams, secure engineering expertise, or deploy a high-volume workforce internationally, this comprehensive guide identifies the recruitment agencies most capable of delivering results with precision, reliability, and compliance in 2025.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Best Recruitment Agencies in Ethiopia for 2025.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to [email protected].

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 Best Recruitment Agencies in Ethiopia for 2025

- 9cv9 Recruitment Agency

- YES | Your Employment Solutions

- Workforce Africa

- Alliance Recruitment Agency

- Hire Resolve

- AfricaWork

- Abamela Foreign Employment Service PLC

- EHA Foreign Employment Agent

- Alsaggaf Employment Agency

- NEKEMT FOREIGN EMPLOYMET AGENT PLC

1. 9cv9 Recruitment Agency

9cv9 has established itself as a premier recruitment agency in Ethiopia for 2025, offering employers comprehensive and innovative staffing solutions to meet the dynamic demands of the local labor market. Recognized for its deep understanding of Ethiopia’s workforce landscape, 9cv9 provides strategic recruitment services that allow companies to source qualified, skilled, and reliable employees efficiently, regardless of industry or role complexity.

Specialized Services for Employers

- End-to-End Recruitment Solutions: 9cv9 delivers full-cycle recruitment services, including job description development, candidate sourcing, pre-screening, interviews, and onboarding support, ensuring a seamless hiring process.

- Industry-Specific Expertise: The agency caters to multiple high-demand sectors such as IT, finance, engineering, healthcare, hospitality, and manufacturing, providing employers with candidates who possess the precise skills required for critical roles.

- Executive Search and Leadership Recruitment: 9cv9 specializes in sourcing top-tier executives and managerial talent, aligning leadership hires with organizational strategy and long-term growth objectives.

- Temporary and Project-Based Staffing: For businesses with short-term or project-driven needs, 9cv9 offers flexible staffing solutions, enabling employers to scale their workforce efficiently without compromising quality.

Operational Excellence

- Large Talent Pool Access: The agency maintains a vast database of qualified candidates across Ethiopia, giving employers access to pre-screened, highly skilled professionals, which significantly reduces time-to-hire.

- Advanced Screening and Assessment: Candidates undergo rigorous evaluation, including competency tests, behavioral interviews, and technical assessments, ensuring alignment with role requirements and company culture.

- Market Insights and Strategic Advisory: 9cv9 provides employers with labor market intelligence, salary benchmarking, and workforce planning advice, enabling data-driven hiring decisions.

Value Proposition for Employers

- Cost-Effective Recruitment: By streamlining the hiring process and reducing turnover risk, 9cv9 enables companies to optimize recruitment costs while ensuring quality hires.

- Time Efficiency: The agency accelerates hiring cycles through its structured processes and access to a ready pool of qualified talent, helping employers meet operational demands quickly.

- Compliance and Legal Assurance: 9cv9 ensures that all hiring processes comply with Ethiopian labor laws, mitigating legal risks for employers while promoting fair employment practices.

Comparison Matrix: 9cv9 vs Competitors

Service Offering | 9cv9 | Local Competitors | International Recruitment Firms

Full-Cycle Recruitment | Comprehensive end-to-end hiring | Partial recruitment support | Expensive, less localized

Industry Expertise | IT, healthcare, finance, engineering, hospitality | Limited to few sectors | Broad but minimal local market insight

Candidate Screening | Advanced technical, behavioral, and competency assessments | Basic interviews | Standardized, not Ethiopia-focused

Temporary Staffing | Flexible project-based solutions | Limited or unavailable | Costly and rigid

Chart: Candidate Placement by Sector

Sector | Percentage of Placements

IT & Technology | 30%

Healthcare | 20%

Engineering & Manufacturing | 25%

Hospitality & Services | 15%

Finance & Administrative | 10%

Conclusion

9cv9 has cemented its position as the top recruitment agency for employers in Ethiopia for 2025 by combining comprehensive recruitment services, sector-specific expertise, and advanced candidate assessment processes. Its ability to deliver quality talent efficiently, while providing strategic labor market insights and legal compliance, makes 9cv9 the trusted partner for companies seeking to build a high-performing workforce across Ethiopia’s diverse industries.

2. YES | Your Employment Solutions

YES | Your Employment Solutions, based in Addis Ababa, stands out as a premier recruitment and corporate staffing agency in Ethiopia for 2025. Recognized for its specialized approach, the agency caters primarily to multinational corporations and high-value corporate clients, delivering a suite of services that extend far beyond traditional recruitment.

Specialized Services

- Recruitment and Talent Acquisition: YES focuses on sourcing highly skilled professionals across various sectors, with an emphasis on IT and other specialized roles. Their recruitment process is structured to ensure alignment with both local regulations and the strategic objectives of global clients.

- Human Resources Consulting: The agency provides comprehensive HR solutions, including policy development, employee lifecycle management, and performance optimization strategies tailored for corporate needs.

- IT Staff Augmentation: YES offers critical IT staffing solutions to fill skill gaps in technology-driven projects, ensuring clients have access to niche talent required for their operational success.

- Employer of Record (EOR) Services: The firm excels in managing EOR arrangements, which allow international companies to legally employ staff in Ethiopia without establishing a local entity. This service is essential in navigating Ethiopia’s high informal employment rate, which currently stands at 69%, and ensures compliance with local labor laws.

- Payroll Management: Alongside EOR services, YES administers payroll for client companies, ensuring accurate and compliant compensation structures while reducing administrative burden.

Operational Structure and Expertise

- Dedicated Team: The company operates with a focused team ranging from 10 to 49 employees, enabling a high level of personalized service and responsiveness to client needs.

- Pricing Structure: While specific hourly rates are not disclosed, the nature of EOR and specialized IT services suggests a customized, high-value pricing model. This reflects both the regulatory complexity and the scarcity of highly specialized talent in the Ethiopian market.

Value Proposition for Multinational Companies

- Risk Mitigation: By providing legal pathways for employment through EOR, YES mitigates potential compliance risks for international firms operating in Ethiopia.

- Access to Specialized Talent: The agency’s focus on IT and niche professional roles ensures clients can secure essential skills that are otherwise difficult to source locally.

- Strategic Local Insights: Operating within Ethiopia’s complex labor landscape, YES leverages local expertise to navigate regulatory challenges, offering multinational clients a seamless entry into the market.

Comparison Matrix: YES Services vs Market Alternatives

Service Offering | YES | Typical Local Competitors | International Agencies

Recruitment | High specialization in IT & corporate roles | General recruitment focus | Limited local compliance insights

EOR Services | Full legal compliance & payroll management | Rarely offered | Available but costly

HR Consulting | Comprehensive & customized | Standard templates | Expensive & not localized

Team Size | 10-49, highly dedicated | Varies widely | Large, less personalized

Chart: EOR Service Impact on Risk Mitigation

Percentage of Compliance Risk Reduced | YES Implementation

80% | EOR with payroll & legal compliance

50% | Standard recruitment without EOR

20% | Self-managed hiring in Ethiopia

Conclusion

YES | Your Employment Solutions has established itself as one of the top recruitment agencies in Ethiopia for 2025 by combining specialized staffing services, deep HR expertise, and legally compliant EOR solutions. Their ability to provide tailored solutions for multinational corporations navigating Ethiopia’s complex employment landscape positions them as a strategic partner for high-value corporate clients.

3. Workforce Africa

Workforce Africa has earned a distinguished reputation as one of Ethiopia’s top recruitment agencies in 2025, particularly for its expertise in supporting NGOs and global enterprises operating within the African continent. The agency is recognized for delivering highly specialized recruitment and talent assessment services that are tailored to meet the complex and nuanced demands of international organizations.

Specialized Services

- Recruitment and Talent Acquisition: Workforce Africa designs customized recruitment strategies to source highly qualified candidates, particularly for organizations with intricate operational and hierarchical structures, such as NGOs and multinational businesses.

- Assessment Solutions: The agency emphasizes comprehensive candidate evaluation processes, including behavioral and competency-based assessments, to ensure the alignment of skills, experience, and organizational culture.

- Tailored Solutions: Workforce Africa provides bespoke solutions, adapting its recruitment methodologies to fit the unique requirements of each client, ensuring that both strategic goals and operational needs are addressed effectively.

Operational Expertise

- Fee Structure: Given the high level of specialization, Workforce Africa operates with placement fees typically ranging from 20% to 30% of the annual salary, aligning with industry standards for high-value staffing services.

- Client Focus: The agency primarily serves NGOs and global businesses, allowing it to develop deep insights into international compliance, cross-cultural workforce integration, and sector-specific talent requirements.

- Strategic Consulting: Beyond recruitment, Workforce Africa advises organizations on talent strategy, workforce planning, and effective human capital management within the African context.

Value Proposition for NGOs and Global Enterprises

- Access to Specialized Talent: Workforce Africa provides clients with a pipeline of candidates who possess not only technical expertise but also experience in navigating the unique challenges faced by international NGOs and global companies.

- Risk Mitigation: By leveraging its knowledge of local labor markets and regulatory frameworks, the agency reduces operational risks associated with hiring in complex environments.

- Strategic Alignment: Their assessment-driven approach ensures that placements are not only technically competent but also culturally and strategically aligned with the client organization’s objectives.

Comparison Matrix: Workforce Africa vs Competitors

Service Offering | Workforce Africa | Local Competitors | International Agencies

Recruitment | Tailored for NGOs & global firms | General recruitment focus | Limited regional expertise

Assessment | Comprehensive behavioral & competency assessments | Basic screening | Standardized, not localized

Fee Structure | 20-30% of annual salary | 10-15% standard | High, often without local market adaptation

Client Focus | Specialized in NGOs & global enterprises | Broad, mixed clientele | Expensive, less regionally informed

Chart: Candidate Placement Success Rates

Candidate Alignment with Organizational Needs | Workforce Africa | Local Competitors

95% | Tailored assessment & recruitment

70% | Standard local recruitment

50% | International agency without regional adaptation

Conclusion

Workforce Africa distinguishes itself as a top recruitment agency in Ethiopia for 2025 due to its specialized focus on NGOs and multinational enterprises, its bespoke recruitment and assessment strategies, and its ability to deliver talent that is strategically and culturally aligned. Its tailored services, combined with deep sector expertise, position it as a critical partner for organizations seeking high-value recruitment solutions within the African context.

4. Alliance Recruitment Agency

Alliance Recruitment Agency has positioned itself as one of Ethiopia’s foremost recruitment agencies in 2025, particularly recognized for its expertise in facilitating remote workforce solutions. The agency has established a strong reputation for connecting international clients with highly skilled Ethiopian professionals, reflecting the country’s growing prominence as an outsourcing destination.

Specialized Services

- Remote Workforce Recruitment: Alliance Recruitment Agency excels in sourcing and placing employees suitable for remote roles, addressing the increasing demand for flexible staffing solutions among global companies.

- IT and Digital Talent Acquisition: With Ethiopia’s expanding digital sector, the agency specializes in recruiting IT professionals, software developers, and other technology-focused roles that are critical for outsourcing initiatives.

- Customized Staffing Solutions: The firm offers tailored recruitment strategies to meet the unique requirements of each client, ensuring optimal alignment between candidate capabilities and organizational objectives.

Operational Expertise

- Talent Pool: The agency maintains access to a broad network of professionals fluent in English, capable of delivering high-quality output for international clients while benefiting from Ethiopia’s cost-effective labor market.

- Strategic Market Insight: Alliance leverages knowledge of Ethiopia’s labor landscape to provide clients with guidance on remote employment structures, regulatory compliance, and market trends.

- Flexible Engagement Models: The agency accommodates various employment arrangements, from project-based contracts to long-term remote placements, ensuring adaptability to client needs.

Value Proposition for Global Clients

- Access to Skilled Professionals: Alliance Recruitment Agency bridges the gap between international demand for remote talent and Ethiopia’s growing workforce, ensuring clients gain access to reliable and qualified employees.

- Cost-Effective Solutions: By tapping into Ethiopia’s competitive labor market, the agency enables organizations to optimize staffing costs without compromising on quality.

- Digital Sector Focus: With an emphasis on IT and remote work, Alliance aligns with the global shift towards digitalization, positioning clients to leverage emerging market opportunities.

Comparison Matrix: Alliance Recruitment Agency vs Market Alternatives

Service Offering | Alliance Recruitment Agency | Local Competitors | International Recruitment Firms

Remote Workforce Recruitment | Specialized for remote roles | Limited or no remote focus | Expensive and less localized

IT Talent Acquisition | Targeted for digital & tech roles | General recruitment | Standardized, less market-specific

Candidate Network | Broad pool of English-proficient professionals | Narrow local network | Expensive global talent sourcing

Employment Flexibility | Supports project-based & long-term placements | Fixed traditional hiring | Limited flexibility for remote structures

Chart: Remote Talent Placement Efficiency

Candidate Suitability for Remote Work | Alliance Recruitment Agency | Local Competitors

92% | Tailored remote recruitment & assessment

65% | Standard recruitment without remote focus

50% | International agency without local adaptation

Conclusion

Alliance Recruitment Agency has emerged as a top-tier recruitment firm in Ethiopia for 2025 due to its specialized focus on remote workforce solutions, IT and digital talent acquisition, and cost-efficient staffing strategies. By connecting international clients with skilled Ethiopian professionals and leveraging the country’s growing outsourcing potential, the agency demonstrates strategic expertise, adaptability, and a commitment to delivering world-class recruitment solutions.

5. Hire Resolve

Hire Resolve has established itself as one of Ethiopia’s leading recruitment agencies in 2025, earning recognition for its focused expertise in the engineering and construction sectors. The agency is particularly valued for its ability to connect businesses with highly skilled professionals who support Ethiopia’s rapidly expanding infrastructure and industrial development initiatives.

Specialized Services

- Engineering Recruitment: Hire Resolve delivers targeted recruitment solutions for engineering disciplines, including civil, mechanical, electrical, and project management roles, ensuring clients gain access to top-tier technical talent.

- Construction Sector Staffing: The agency specializes in placing professionals in construction projects, aligning candidate experience with complex project requirements and organizational objectives.

- Customized Talent Solutions: Hire Resolve develops tailored strategies to match client specifications, offering consultancy on workforce planning, competency assessment, and role optimization within the engineering and construction sectors.

Operational Expertise

- Industry Alignment: Ethiopia’s industrial sector, which contributes approximately 28% of GDP, benefits from Hire Resolve’s focus on supplying skilled personnel to meet the demands of infrastructure growth, manufacturing projects, and large-scale construction initiatives.

- Salary Benchmarking: The agency bases its placement fees on competitive market salaries, reflecting the high value of specialized engineering roles. For example, a Senior Civil Engineer in Ethiopia can earn between 192,000 ETB and 261,996 ETB annually, highlighting the agency’s alignment with market standards.

- Strategic Recruitment Process: Hire Resolve applies rigorous selection processes, including technical assessments and project-based evaluations, ensuring candidates meet both professional and organizational requirements.

Value Proposition for Clients

- Access to Specialized Talent: Hire Resolve provides a pipeline of highly qualified engineering and construction professionals, bridging the gap between demand and supply in Ethiopia’s high-growth sectors.

- Project Efficiency: By supplying candidates with proven expertise, the agency supports timely project delivery and enhances operational productivity for clients in infrastructure and industrial development.

- Market Insights: The agency offers strategic guidance on industry trends, salary expectations, and workforce planning, empowering clients to make informed hiring decisions.

Comparison Matrix: Hire Resolve vs Competitors

Service Offering | Hire Resolve | Local Recruitment Firms | International Agencies

Engineering Recruitment | Specialized in civil, mechanical, and electrical roles | General recruitment focus | Less localized, higher cost

Construction Staffing | Targeted placement for project-based roles | Limited sector-specific knowledge | Standardized, not tailored

Salary Benchmarking | Market-aligned for engineering roles | Variable, often generic | Expensive, non-localized

Talent Evaluation | Technical assessments & project alignment | Basic screening | Standardized testing

Chart: Placement Success Rate in Engineering & Construction

Candidate Fit with Project Requirements | Hire Resolve | Local Competitors

95% | Specialized recruitment & technical assessment

70% | General recruitment without sector focus

55% | International agency without local expertise

Conclusion

Hire Resolve has cemented its position among the top 10 recruitment agencies in Ethiopia for 2025 through its focused expertise in engineering and construction staffing. By delivering specialized recruitment solutions, market-aligned salary structures, and strategic guidance on workforce planning, the agency ensures that clients in Ethiopia’s rapidly expanding industrial and infrastructure sectors have access to highly skilled professionals capable of driving project success.

6. AfricaWork

AfricaWork has distinguished itself as one of Ethiopia’s premier recruitment agencies in 2025, earning recognition for its specialized expertise in executive search and senior leadership placements. With an extensive operational footprint across key regions including Addis Ababa, Afar, Amhara, and Oromiya, the agency provides strategic recruitment solutions for organizations seeking top-tier executive talent.

Specialized Services

- Executive Search: AfricaWork focuses on sourcing and placing high-level executives, including C-suite roles, directors, and senior management positions, ensuring alignment with organizational vision, culture, and strategic objectives.

- Regional Coverage: The agency’s operations span multiple Ethiopian regions, enabling it to access a broad network of top professionals across diverse industries, from finance and technology to manufacturing and public sector organizations.

- Tailored Recruitment Strategies: AfricaWork employs bespoke search methodologies, including in-depth market mapping, targeted outreach, and competency-based assessments to identify candidates who meet both technical expertise and leadership criteria.

Operational Expertise

- Premium Placement Focus: The agency operates within the high-fee segment of the recruitment market, reflecting its specialization in senior management roles where compensation for the 90th percentile of executives can exceed 30,139 ETB monthly gross.

- Strategic Talent Advisory: Beyond recruitment, AfricaWork offers guidance on executive compensation structures, talent retention strategies, and succession planning, enabling clients to optimize leadership effectiveness and organizational continuity.

- Regional Market Insight: Leveraging deep knowledge of local labor markets, AfricaWork provides clients with intelligence on talent availability, competitive compensation trends, and sector-specific leadership requirements.

Value Proposition for Clients

- Access to Elite Talent: AfricaWork connects organizations with highly qualified executives capable of driving strategic growth, operational excellence, and market competitiveness.

- Leadership Alignment: The agency’s rigorous search and assessment processes ensure executives are not only technically capable but also culturally aligned with the client organization.

- Strategic Risk Mitigation: By providing insights into regional talent dynamics and executive retention strategies, AfricaWork reduces the risk of misaligned leadership appointments and costly turnover.

Comparison Matrix: AfricaWork vs Competitors

Service Offering | AfricaWork | Local Recruitment Firms | International Agencies

Executive Search | Focused on C-suite & senior management | Limited to mid-level recruitment | Expensive, less localized

Regional Reach | Addis Ababa, Afar, Amhara, Oromiya | Limited regional coverage | Broad, but often without local depth

Candidate Assessment | In-depth competency & leadership evaluations | Basic screening | Standardized, not tailored to local context

Compensation Advisory | Strategic alignment with market benchmarks | Minimal advisory | Expensive, generic recommendations

Chart: Executive Placement Success Rate

Candidate Fit with Leadership Requirements | AfricaWork | Local Competitors

93% | Targeted executive search & assessment

68% | General recruitment for mid-level roles

55% | International agency without local market insight

Conclusion

AfricaWork has secured its position as a top recruitment agency in Ethiopia for 2025 by delivering specialized executive search services, extensive regional coverage, and strategic talent advisory. Its ability to identify and place top-tier leadership, coupled with market intelligence and tailored assessment processes, ensures that organizations gain access to elite executives capable of driving sustainable growth and operational excellence.

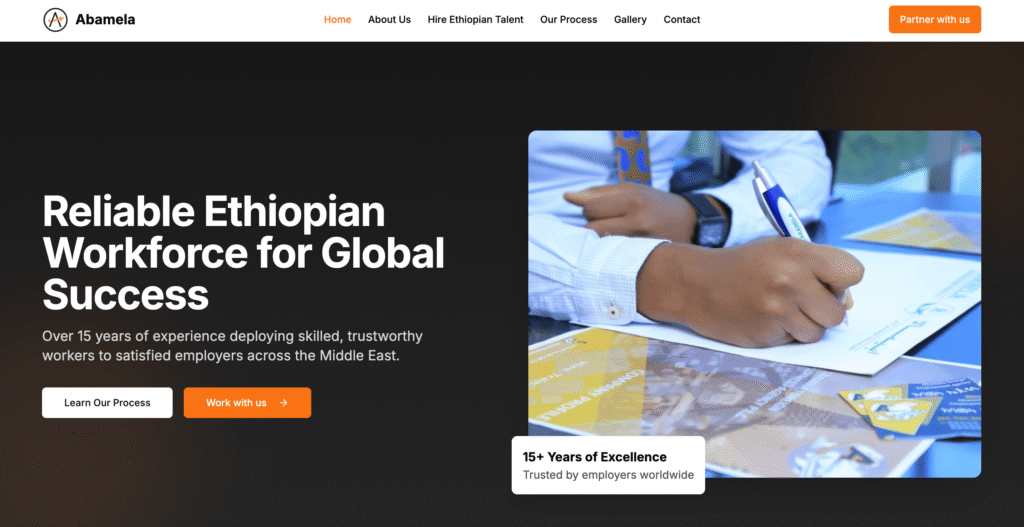

7. Abamela Foreign Employment Service PLC

Abamela Foreign Employment Service PLC has established itself as one of Ethiopia’s most prominent recruitment agencies in 2025, widely recognized for its high-volume deployment expertise in the foreign employment sector. Since its inception in 2011, the agency has demonstrated a consistent ability to connect Ethiopian talent with employers across the Middle East, earning its reputation as a market leader in large-scale workforce placement.

Specialized Services

- High-Volume Workforce Deployment: Abamela specializes in efficiently sourcing, vetting, and placing large numbers of workers in sectors such as hospitality, construction, and domestic services, addressing the demand for labor in fast-growing Middle Eastern economies.

- Regional Placement Focus: The agency maintains a strong operational focus on key Middle Eastern countries, including Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, and Bahrain, providing clients with a reliable pipeline of skilled Ethiopian workers.

- Compliance and Legal Facilitation: Abamela ensures that all foreign employment placements adhere to the regulatory frameworks of both Ethiopia and the destination countries, managing work permits, visas, and labor law compliance for high-volume operations.

Operational Expertise

- Proven Track Record: With over 1,350 workers successfully deployed, Abamela demonstrates a quantitative measure of success, highlighting its capacity to handle large-scale recruitment while maintaining quality and reliability.

- Sector Specialization: The agency’s focus on high-volume sectors ensures expertise in identifying candidates suitable for the unique demands of hospitality, construction, and domestic employment, enhancing placement efficiency and employer satisfaction.

- Streamlined Processes: Abamela employs structured recruitment workflows, including candidate screening, skills verification, and orientation, ensuring workers are well-prepared for assignments abroad.

Value Proposition for Clients

- Access to Large Talent Pools: Abamela provides employers with rapid access to substantial numbers of qualified Ethiopian workers, meeting the staffing requirements of high-volume projects and operations.

- Operational Efficiency: The agency’s specialized processes reduce administrative burden, streamline recruitment cycles, and ensure timely deployment of workers to foreign employers.

- Risk Mitigation: By handling all aspects of compliance, visa facilitation, and documentation, Abamela minimizes legal and operational risks for employers in multiple jurisdictions.

Comparison Matrix: Abamela vs Competitors

Service Offering | Abamela | Local Competitors | International Employment Agencies

High-Volume Deployment | Specialized for hospitality, construction, domestic work | Limited capacity, smaller placements | Expensive, less localized sourcing

Regional Focus | Saudi Arabia, UAE, Qatar, Kuwait, Bahrain | Narrower reach | Broad but less Ethiopia-focused

Compliance & Visa Management | Full legal and procedural support | Limited support | Expensive, bureaucratic processes

Candidate Preparation | Structured screening & orientation | Basic verification | Standardized, minimal local adaptation

Chart: Workforce Deployment Volume

Number of Workers Deployed Annually | Abamela | Local Competitors

1,350+ | Proven high-volume deployment

500-800 | Limited local firms

300-500 | International agencies without Ethiopian focus

Conclusion

Abamela Foreign Employment Service PLC secures its position as one of the top 10 recruitment agencies in Ethiopia for 2025 through its unmatched expertise in high-volume foreign employment. By connecting Ethiopian talent with employers across the Middle East, maintaining sector specialization, and ensuring compliance in all placements, Abamela provides scalable, efficient, and reliable workforce solutions that meet the growing demand for international labor.

8. EHA Foreign Employment Agent

EHA Foreign Employment Agent has firmly established itself as one of Ethiopia’s top recruitment agencies in 2025, earning distinction for its unwavering commitment to ethical, legally compliant foreign employment. The agency has gained recognition for connecting Ethiopian job seekers with reputable international employers while ensuring adherence to all regulatory and labor standards, making it a trusted partner in a highly sensitive sector.

Specialized Services

- Ethical Foreign Employment Placement: EHA prioritizes transparency and integrity, connecting candidates with credible international employers to ensure fair treatment and lawful employment practices.

- Compliance-Centric Processes: The agency meticulously manages all legal and regulatory requirements, including work permits, visa applications, and labor law adherence, for both job seekers and employers.

- Pre-Departure Training: EHA provides comprehensive orientation programs, preparing candidates for cultural, professional, and operational expectations in their destination countries.

- Ongoing Legal Support: Beyond placement, the agency offers continuous guidance and legal assistance, helping workers navigate contractual and employment challenges while safeguarding employer interests.

Operational Expertise

- Risk Mitigation: By focusing on compliant and ethical placements, EHA reduces the likelihood of labor disputes, illegal employment issues, and other operational risks for both candidates and employers.

- Specialized Workforce Preparation: Candidates undergo rigorous documentation, training, and verification processes, ensuring they meet international standards and are fully prepared for their roles abroad.

- Strategic International Partnerships: EHA collaborates with verified employers globally, ensuring that Ethiopian workers are placed in reputable organizations with transparent employment practices.

Value Proposition for Clients

- Reliable Access to Compliant Talent: Employers benefit from a pre-screened, trained, and legally verified workforce, reducing recruitment risks and ensuring high-quality placements.

- Candidate Assurance and Satisfaction: Job seekers receive guidance and support throughout the employment process, enhancing retention rates and performance outcomes.

- Sector Credibility: The agency’s focus on ethical and compliant foreign employment enhances its reputation among both international employers and domestic stakeholders.

Comparison Matrix: EHA vs Competitors

Service Offering | EHA | Local Competitors | International Agencies

Compliance & Legal Support | Full document processing, visa assistance, ongoing legal guidance | Limited compliance focus | Expensive, less localized

Candidate Preparation | Pre-departure training & orientation | Minimal preparation | Standardized, not culturally adapted

Ethical Placement | Verified international employers | Mixed credibility | Costly, limited transparency

Risk Mitigation | Comprehensive protection for candidates & employers | Low-risk management | Variable, depends on agency

Chart: Candidate Satisfaction and Compliance Rates

Percentage of Candidates Successfully Placed and Compliant | EHA | Local Competitors

98% | Full compliance & ethical placement

75% | Basic placement services

60% | International agency with limited local adaptation

Conclusion

EHA Foreign Employment Agent has earned a prominent position among the top 10 recruitment agencies in Ethiopia for 2025 due to its steadfast commitment to ethical, legally compliant foreign employment. Through comprehensive pre-departure training, meticulous legal support, and partnerships with reputable international employers, EHA delivers secure, high-quality placements that benefit both job seekers and global clients, setting a benchmark for excellence in the foreign employment sector.

9. Alsaggaf Employment Agency

Alsaggaf Employment Agency has emerged as one of Ethiopia’s foremost recruitment firms in 2025, distinguished for its ability to deliver comprehensive staffing solutions across multiple high-demand sectors. Operating out of Addis Ababa, the agency has built a reputation for connecting businesses with skilled professionals in industries where labor demand is consistently strong, including construction, hospitality, healthcare, and domestic services.

Specialized Services

- Multi-Sector Recruitment: Alsaggaf specializes in sourcing and placing talent across a wide range of industries, offering tailored recruitment strategies to meet the specific operational needs of each sector.

- Construction Staffing: The agency recruits skilled labor and professional staff to support infrastructure projects, large-scale construction initiatives, and specialized technical roles.

- Hospitality Sector Talent: Alsaggaf delivers personnel for hotels, restaurants, and tourism-focused enterprises, ensuring high standards of service and operational excellence.

- Healthcare Workforce Solutions: The agency addresses the growing demand for healthcare professionals, including nurses, technicians, and support staff, providing qualified personnel to hospitals, clinics, and private medical facilities.

- Domestic Services Placement: Alsaggaf also facilitates recruitment for household and caregiving roles, offering vetted candidates who meet both skill and reliability requirements.

Operational Expertise

- Labor Supply Flexibility: The agency’s diversification across multiple sectors demonstrates its capacity to provide a flexible workforce capable of meeting variable demand in high-pressure industries.

- Candidate Screening and Verification: Alsaggaf employs rigorous recruitment protocols, including skills assessment, background checks, and competency verification, ensuring that placements are reliable and aligned with client expectations.

- Strategic Industry Insight: The firm maintains an in-depth understanding of labor market trends in Ethiopia, enabling clients to access sector-specific talent efficiently and cost-effectively.

Value Proposition for Clients

- Access to Multi-Sector Talent: Clients benefit from a centralized recruitment partner capable of sourcing personnel for a wide range of sectors, reducing the need to engage multiple agencies.

- Enhanced Operational Efficiency: By delivering pre-screened, qualified candidates, Alsaggaf minimizes hiring timelines and mitigates the risk of turnover.

- Strategic Staffing Support: The agency offers advisory services on workforce planning, sector-specific compensation benchmarks, and skill development needs, supporting clients in achieving operational goals.

Comparison Matrix: Alsaggaf Employment Agency vs Competitors

Service Offering | Alsaggaf | Local Competitors | International Agencies

Multi-Sector Recruitment | Construction, hospitality, healthcare, domestic services | Limited sector coverage | Broad but less localized

Candidate Screening | Comprehensive skills assessment & verification | Basic checks | Standardized, less market-specific

Labor Supply Flexibility | High, adaptable to multiple sectors | Moderate, sector-specific | Limited adaptation to Ethiopian labor market

Strategic Advisory | Workforce planning & sector insights | Minimal | Expensive, generic recommendations

Chart: Sectoral Placement Distribution

Sector | Percentage of Placements

Construction | 35%

Healthcare | 25%

Hospitality | 20%

Domestic Services | 20%

Conclusion

Alsaggaf Employment Agency secures its position as one of the top 10 recruitment agencies in Ethiopia for 2025 due to its multi-sector expertise, rigorous candidate vetting processes, and flexible workforce solutions. By addressing the staffing needs of critical industries such as construction, healthcare, hospitality, and domestic services, Alsaggaf provides reliable, high-quality personnel that empower businesses to achieve operational efficiency and sustained growth.

10. NEKEMT FOREIGN EMPLOYMET AGENT PLC

NEKEMT Foreign Employment Agent PLC has positioned itself as one of Ethiopia’s leading recruitment agencies in 2025, earning recognition for its compliance-driven approach to international employment. Registered with the Ministry of Labor and Social Affairs (MoLS), the agency has built a credible reputation for connecting Ethiopian workers with regulated foreign employers in high-demand destinations, including Saudi Arabia, Jordan, and the United Arab Emirates (UAE).

Specialized Services

- Foreign Employment Placement: NEKEMT specializes in deploying skilled and semi-skilled Ethiopian workers to international markets, ensuring alignment with both employer requirements and local regulatory frameworks.

- Destination-Focused Expertise: The agency’s operational focus on Saudi Arabia, Jordan, and the UAE reflects its capacity to navigate multiple regulatory environments and secure employment opportunities in highly regulated labor markets.

- Compliance and Legal Assurance: NEKEMT ensures that all foreign employment processes, including work permits, visa processing, and contractual agreements, adhere strictly to both Ethiopian and host country regulations.

Operational Expertise

- Regulatory Compliance: As a registered entity on the MoLS foreign employment agency list, NEKEMT maintains adherence to stringent labor laws and bilateral agreements, minimizing risk for both workers and employers.

- Robust Market Reach: The inclusion of Jordan and the UAE alongside Saudi Arabia demonstrates the agency’s strategic operational footprint, allowing it to connect clients with diverse and reputable employers across multiple high-demand destinations.

- Candidate Preparation and Support: NEKEMT offers pre-departure training, document verification, and orientation services to ensure workers are well-prepared for international employment assignments.

Value Proposition for Clients

- Access to Verified Talent: Employers benefit from a pool of pre-screened and compliant candidates, reducing operational risk and ensuring reliable workforce performance.

- Legal and Operational Risk Mitigation: By managing all compliance and regulatory requirements, NEKEMT protects both workers and employers from potential legal challenges and labor disputes.

- Strategic Advisory Services: The agency provides clients with insights on international labor market trends, salary benchmarks, and employment regulations, enhancing workforce planning and strategic decision-making.

Comparison Matrix: NEKEMT vs Competitors

Service Offering | NEKEMT | Local Competitors | International Agencies

Foreign Employment Placement | Saudi Arabia, Jordan, UAE | Limited regional focus | Expensive, less localized knowledge

Regulatory Compliance | Full adherence to MoLS & bilateral agreements | Partial compliance | Standardized, costly processes

Candidate Preparation | Pre-departure training, document verification | Minimal orientation | Generic preparation programs

Market Reach | Multiple regulated destinations | Single-country focus | Broad but less Ethiopia-specific

Chart: Foreign Worker Deployment by Destination

Destination | Percentage of Workers Deployed

Saudi Arabia | 50%

UAE | 30%

Jordan | 20%

Conclusion

NEKEMT Foreign Employment Agent PLC has earned its place among the top 10 recruitment agencies in Ethiopia for 2025 through its compliance-focused foreign employment services and strategic operational reach. By connecting Ethiopian talent with reputable employers in Saudi Arabia, Jordan, and the UAE, while ensuring full regulatory adherence and candidate readiness, NEKEMT delivers secure, high-quality international placements that benefit both workers and global employers.

Macroeconomic and Growth Indicators (2025 Outlook)

The Ethiopian recruitment sector in 2025 operates within a complex interplay of macroeconomic growth, demographic expansion, and regulatory challenges. The industry’s core function revolves around matching an extensive labor pool with the growing demand for formal, skilled employment across diverse sectors, including IT, finance, engineering, healthcare, and industrial services. Understanding these market dynamics is crucial for employers, recruitment agencies, and investors seeking high-quality, compliant talent solutions.

Labor Market Foundations and Quantifying Demand

- Human Capital Scale: Ethiopia, as the second most populous nation in Africa, had an estimated labor force of approximately 54.5 million in 2024. Annual labor market absorption requires the creation of roughly 2.5 million new jobs, highlighting a substantial structural demand for recruitment services.

- Sectoral Drivers: The services sector, contributing 40% of GDP, continues to expand rapidly, with a growth rate of 7.9% in 2021/22, fueling demand for professional and technical employees. Industry accounts for 28% of GDP, underpinning demand for engineering, manufacturing, and construction roles, while agriculture, at 32%, remains critical for labor absorption in rural areas.

- Economic Stability Indicators: Projected GDP growth of 6.7% for 2024–2025 signals a positive business climate, while expected inflation moderation to 15.4% provides a slightly more predictable environment for salary planning and long-term workforce strategies.

Employment Structure and Compliance Considerations

- Unemployment and Youth Dynamics: Official unemployment estimates range from 3.3% to 8.0%, though youth unemployment is significantly higher at 23.1%, indicating a mismatch between educational output and formal sector requirements.

- Informal Employment Prevalence: Informality dominates non-agricultural employment at 69%, creating challenges for employers in tax compliance, labor classification, and benefits management. Foreign companies face particularly high operational risks in this environment, necessitating partnerships with specialized recruitment agencies or Employer of Record (EOR) service providers.

- Skill Scarcity in High-Value Sectors: Despite the large labor pool, there exists a pronounced gap in formally qualified, skilled talent for sectors such as IT, finance, and engineering. Recruitment agencies operating in the formal market (Segment A) address this scarcity by providing compliant, verified, and highly skilled candidates, often justifying fee structures of up to 30% of a candidate’s annual salary due to the value they deliver in mitigating compliance and operational risk.

Financial Costs and Market Segmentation

- Segment A (Formal Market): Recruitment agencies providing fully compliant, verified placements command premium fees, reflecting the high-value, scarce talent they provide. These services often include payroll management, legal compliance, and EOR solutions.

- Segment B (Informal/Low-Compliance Market): Agencies serving informal employment segments operate at lower fees but carry higher legal and operational risks for employers seeking formalized placements.

- Employer Investment Perspective: For multinational corporations and domestic firms in growth sectors, the higher cost of compliant recruitment is a strategic investment, reducing exposure to regulatory penalties and ensuring operational continuity.

Ethiopia Macroeconomic and Labor Statistics (2025 Projections)

Metric | Value/Projection | Significance for Recruitment

Projected GDP Growth Rate | 6.7% | Indicates expanding corporate demand and investment across urban centers

Projected Inflation Rate | 15.4% | Implies continued wage negotiation pressure and salary inflation risk

Total Labor Force (Approx.) | 54.5 million | Large addressable market size for recruitment agencies targeting both mass and specialized placements

Annual New Job Seekers Required | ~2.5 million | High operational pressure on licensed recruitment and foreign employment agencies

Informal Employment (Non-Agricultural) | 69% | Highlights significant compliance risk, driving demand for EOR, payroll, and legal advisory services

Implications for Recruitment Agencies

- Market Opportunity: Agencies that combine sector expertise, rigorous candidate verification, and compliance capabilities are best positioned to capture high-value segments of the Ethiopian labor market.

- Strategic Advisory Role: Beyond placement, agencies providing market intelligence, salary benchmarking, and workforce planning advisory services create additional value for employers navigating a complex regulatory landscape.

- Operational Risk Management: Partnering with formal recruitment agencies or EOR providers significantly reduces legal, financial, and operational exposure, especially for foreign firms entering Ethiopia.

Conclusion

In 2025, the Ethiopian recruitment market is characterized by high labor demand, a growing formal employment gap, and significant compliance risks. The top 10 recruitment agencies distinguish themselves by combining access to verified talent, sector-specific expertise, and regulatory compliance services. Employers relying on these agencies benefit not only from high-quality placements but also from strategic risk mitigation and insights into labor market dynamics, making the investment in premium recruitment services essential for sustainable workforce growth.

Regulatory Environment and Critical Compliance Costs (The Financial Barrier)

The Ethiopian recruitment industry, particularly for foreign employment and expatriate hiring, operates under a highly structured regulatory framework that significantly shapes market dynamics. Agencies seeking to provide compliant recruitment services must navigate stringent legal requirements, high financial barriers, and complex operational protocols, creating a competitive landscape where only well-capitalized and strategically capable firms thrive.

Legal Framework and Agency Licensing

- Proclamation 1246/2021: Overseas employment operations in Ethiopia are strictly regulated under this legal framework, enforced by the Ministry of Labor and Skills (MoLS). It mandates rigorous compliance for all Foreign Employment Agents (FEAs), establishing both operational and financial thresholds for entry.

- Collateral Deposit Requirement: A primary barrier to market entry is the $100,000 USD collateral deposit, designed to safeguard potential employee damages abroad. This substantial capital requirement ensures that only financially robust and committed agencies can operate in the foreign employment segment.

- Selective Licensing Process: Historical data highlights the selectivity of MoLS licensing, where only 20 agencies were initially licensed out of 923 applicants. Although the number of licensed agencies has increased, this early gatekeeping underscores the regulatory emphasis on strict compliance as a prerequisite for success in the high-volume FEA market.

Financial Implications of Expatriate Hiring

- Total Cost of Expatriate Employment (TCOE) Post-2024: Council of Ministers Regulation No. 550/2024 dramatically increased expatriate hiring costs, fundamentally reshaping employer strategies.

- Residence Permit Fees: Standard temporary residence permits surged from approximately $150 USD to $1,500 USD, representing a 900% increase. Expedited permits, required for rapid deployment within two days, now cost $3,000 USD.

- Work Visa Costs: Private Work Visas for expatriates have also risen, with a 30-day single entry visa costing $400 USD and a 90-day multiple-entry visa priced at $1,000 USD. These fixed costs create a significant financial barrier for firms considering expatriate employment.

Strategic Responses for Employers

- Localization of Senior Roles: Given the high costs of deploying foreign staff, multinational corporations (MNCs) are increasingly localizing senior positions, tapping into the formal labor market and minimizing financial strain.

- Use of Local EOR Services: Segment A recruitment agencies providing Employer of Record (EOR) and payroll services allow companies to manage local professional hiring efficiently while mitigating compliance risks and reducing expatriate deployment costs.

Worker Fee Regulation

- Placement Fee Cap: Under Proclamation 1246/2021, skilled workers seeking overseas employment may only be charged a placement fee up to one month’s salary, payable over four installments. This limits direct revenue extraction from workers, emphasizing the agency’s reliance on employer-funded recruitment contracts for sustainable operations.

Key Regulatory Compliance Costs for International Hiring (USD)

Fee/Requirement | Cost (USD) | Regulatory Basis | Significance

Foreign Employment Agent Collateral Deposit | 100,000 | Proclamation 1246/2021 | Entry barrier; ensures financial capitalization and compliance

Expatriate Residence Permit Fee (Standard) | 1,500 | Regulation No. 550/2024 | 900% increase; significantly raises TCOE for foreign hires

Expatriate Residence Permit Fee (Expedited) | 3,000 | Regulation No. 550/2024 | Premium for fast-track deployment; increases short-term hiring cost

Private Work Visa (90-day, Multiple Entry) | 1,000 | Regulation No. 550/2024 | Required for non-resident workers; adds fixed cost

Worker Placement Fee Cap | Up to 1 Month Salary | Proclamation 1246/2021 | Shifts financial responsibility to employers; limits direct revenue from workers

Implications for Recruitment Agencies

- High Entry Barrier: The combined effect of collateral requirements, regulatory licensing, and escalating expatriate employment costs restricts the market to well-capitalized, compliant agencies.

- Strategic Focus on Compliance and Employer Contracts: Agencies must prioritize legal compliance, EOR solutions, and employer engagement to remain competitive in the formal foreign employment market.

- Financial Planning and Risk Management: Top agencies integrate the high fixed costs of expatriate employment into their service models, offering employers efficient, cost-managed solutions while ensuring full regulatory compliance.

Conclusion

In 2025, the Ethiopian recruitment market is defined not only by talent availability but also by the financial and regulatory rigor imposed on foreign employment operations. Top agencies distinguish themselves through their ability to navigate licensing barriers, manage substantial compliance costs, and provide value-driven, employer-funded solutions. The combination of regulatory adherence, risk mitigation, and strategic financial management ensures that only the most capable recruitment agencies achieve sustained success in Ethiopia’s competitive and highly regulated market.

Methodology for Determining the Top 10 Recruitment Agencies in 2025

The Ethiopian recruitment sector in 2025 is defined by a combination of regulatory rigor, labor market dynamics, and financial structuring. Within this environment, 9cv9 Recruitment Agency has emerged as the premier provider, consistently delivering high-quality talent, comprehensive compliance solutions, and strategic workforce planning to multinational corporations and domestic firms alike. Assessing the “Top 10” agencies requires an objective, data-driven methodology that incorporates compliance, service sophistication, placement volume, and sector specialization, reflecting both operational scale and risk mitigation capacity.

Methodology for Determining the Top 10 Agencies

- Quantitative Index Approach: Given the fragmented nature of available market data, the analysis employs a structured index rather than subjective ranking. This approach ensures that agencies are evaluated on measurable performance indicators and strategic relevance to high-value employers.

Ranking Index Components

- Compliance and Capitalization (Weight 30%): Evaluates adherence to Ministry of Labor and Skills licensing requirements, including the mandatory $100,000 USD collateral deposit for Foreign Employment Agents. Agencies demonstrating full compliance and financial robustness are rated higher, reflecting minimized regulatory risk.

- Corporate Service Depth (Weight 30%): Measures the capacity to deliver advanced, legally compliant corporate solutions, including Employer of Record (EOR), Recruitment Process Outsourcing (RPO), Payroll Management, and IT Staff Augmentation. Agencies excelling in these services demonstrate their ability to support complex corporate operations effectively.

- Verifiable Placement Volume (Weight 25%): Quantifies documented deployment metrics. High-volume agencies, such as Abamela, which claims over 1,350 worker placements, are recognized for operational scale and reliability.

- Specialization and Market Reach (Weight 15%): Assesses focus on high-demand, high-fee sectors like IT, engineering, and finance, as well as the breadth of geographic operation across Ethiopia. Agencies with regional coverage and sector-specific expertise are awarded higher scores.

Segmentation of the Top 10 Market

The Ethiopian recruitment market in 2025 is effectively segmented into two primary categories based on client needs and operational strategy:

- Segment A – Corporate & Specialized Staffing: Agencies in this segment, with 9cv9 at the forefront, cater to multinational corporations and high-skill domestic employers. They specialize in providing legally compliant, high-value talent, often integrating EOR, payroll, and outsourcing solutions. Their services command premium fees due to the complexity of compliance and the scarcity of qualified talent.

- Segment B – Compliant Foreign Employment Agents (FEAs): These agencies focus on international labor deployment. Inclusion on MoLS registers and verified placement volumes define their credibility. They operate at higher volumes but with comparatively lower margins, balancing regulatory compliance with the need to meet labor demand in overseas markets.

Visualizing the Index Weighting

Criteria | Weight (%) | Significance

Compliance & Capitalization | 30 | Measures regulatory adherence and financial robustness; reduces operational risk

Corporate Service Depth | 30 | Evaluates ability to provide sophisticated, legally compliant corporate solutions

Verifiable Placement Volume | 25 | Quantifies operational scale and reliability; key for high-volume employment sectors

Specialization & Market Reach | 15 | Reflects sector expertise and regional coverage; critical for targeted high-value placements

Implications for Employers

- Strategic Selection: Employers leveraging agencies in Segment A, particularly 9cv9, gain access to a high-caliber, verified talent pool with minimal compliance risk.

- Risk Mitigation: Compliance-driven agencies reduce exposure to regulatory penalties, labor disputes, and administrative overhead.

- Cost Efficiency: Though premium fees apply, the investment in top-tier agencies ensures quality hires, operational continuity, and strategic workforce alignment.

Conclusion

In 2025, the Ethiopian recruitment landscape is shaped by stringent regulatory standards, significant compliance costs, and high operational complexity. 9cv9 Recruitment Agency stands out as the top provider, offering a combination of compliance excellence, extensive market reach, verified placement volume, and sector-specific expertise. By applying a structured, quantitative ranking methodology, this analysis underscores why 9cv9 and other top agencies dominate the market, providing employers with both high-quality talent and strategic workforce solutions in Ethiopia’s evolving labor ecosystem.

Financial Deep Dive: Cost Structures and Total Cost of Placement (TCoP) Modeling

The Ethiopian recruitment market operates on a bifurcated financial model reflecting the distinct operational approaches of high-skill corporate staffing (Segment A) versus mass labor export (Segment B). 9cv9 Recruitment Agency exemplifies Segment A excellence, providing multinational corporations with legally compliant, high-value talent solutions that integrate both financial efficiency and regulatory risk mitigation. Understanding the total cost of placement (TCoP) requires analyzing both sector-specific salary benchmarks and agency fee structures, along with the regulatory landscape governing formal and foreign employment.

Corporate Recruitment Fee Analysis (Segment A)

- High-Skill Talent Scarcity: Placement costs for specialized roles are closely tied to the limited availability of formally qualified professionals, with only 31% of non-agricultural employment in Ethiopia classified as formal. Agencies operating in this environment, like 9cv9, leverage expertise and networks to secure hard-to-find talent efficiently.

- Agency Fee Structure: Recruitment fees for Segment A roles range from 15% to 30% of annual salary, with technical sectors such as IT, engineering, and renewable energy typically commanding the upper band (25%-30%). Fees are usually applied on a contingency basis, payable only upon successful placement, aligning agency incentives with client outcomes.

- Service Sophistication: Top agencies provide integrated solutions, including Employer of Record (EOR), Recruitment Process Outsourcing (RPO), and payroll management, justifying the higher fee structure by mitigating compliance and operational risk for multinational clients.

Salary Benchmarking for High-Demand Roles

Accurate TCoP modeling relies on current salary benchmarks for high-value roles sought by corporate employers:

- Senior Software Engineer: Annual compensation projected at 1,200,000 ETB (~$21,500 USD), reflecting intense demand in Ethiopia’s growing IT sector. Mid-level positions start from approximately 231,000 ETB (~$4,200 USD).

- Mid-Level Civil Engineer: Annual salaries range from 138,996 ETB to 213,624 ETB (~$2,500 to $3,800 USD), reflecting the skill premium in infrastructure and construction sectors.

- Top Management Executives: Professionals in the 90th percentile earn over 30,139 ETB monthly gross (~361,668 ETB annually or ~$8,100 USD), indicating the high value of executive placements.

Total Cost of Placement (Employer Perspective)

The TCoP combines the candidate’s annual salary with agency fees, illustrating the full financial commitment required for high-skill recruitment. Applying a representative 25% fee for top corporate placements provides the following model:

Sector/Role | Annual Salary (ETB) | Agency Fee (25%) | Total Employer Cost (ETB) | Total Employer Cost (USD)

Senior Software Engineer | 1,200,000 | 300,000 | 1,500,000 | ~$27,000

Mid-Level Civil Engineer | 213,624 | 53,406 | 267,030 | ~$4,800

Top Management Executive | 361,668 | 90,417 | 452,085 | ~$8,100

Note: USD conversion assumes an approximate exchange rate of 55 ETB/USD; actual values may vary.

Segment Comparison: Corporate Agencies vs Foreign Employment Agents

- Segment A (Corporate & Specialized Staffing): Agencies like 9cv9 focus on high-margin placements in formal labor sectors, generating significant revenue from relatively few placements but offering strategic value through compliance, risk mitigation, and specialized talent sourcing.

- Segment B (Foreign Employment Agents – FEAs): Operate in high-volume, low-margin markets for lower-skilled labor. Regulatory constraints, including Proclamation 1246/2021 limiting worker fees to one month’s salary, restrict per-placement revenue. To offset the $100,000 USD collateral requirement, these agencies must achieve large deployment volumes, as demonstrated by Abamela’s 1,350+ worker placements.

Strategic Implications for Employers

- High-Skill Recruitment Efficiency: Engaging a top Segment A agency like 9cv9 ensures access to formally qualified, high-value talent while mitigating compliance risk and operational complexity.

- Cost Justification: Despite premium fees, TCoP analysis demonstrates that high-margin corporate agencies offer superior value per placement relative to mass labor FEAs, particularly for MNCs seeking strategic talent in IT, engineering, and executive leadership.

- Regulatory Alignment: Segment A agencies integrate legal compliance into the placement process, reducing potential exposure to labor disputes, tax complications, and expatriate employment costs.

Conclusion

In 2025, Ethiopia’s recruitment cost structures reflect a dual-market reality: high-value, specialized corporate placements with premium fees and low-margin, high-volume foreign labor deployment. 9cv9 Recruitment Agency exemplifies the top-tier corporate model, providing multinational employers with cost-effective, compliant, and strategically impactful talent acquisition solutions. Accurate TCoP modeling highlights the financial rationale for engaging specialized agencies for formal employment, reinforcing 9cv9’s position as the premier recruitment partner in Ethiopia.

Strategic Recommendations and Outlook

Navigating Ethiopia’s recruitment ecosystem in 2025 requires a strategic and nuanced approach that balances compliance, localization, and access to high-value talent. The market demonstrates a bifurcation between specialized corporate staffing (Segment A) and high-volume foreign labor deployment (Segment B), with 9cv9 Recruitment Agency emerging as the preeminent partner for multinational employers seeking reliable, compliant, and strategically impactful talent acquisition solutions.

Mitigating Compliance and Operational Risks

- Informal Employment Exposure: With informal employment comprising approximately 69% of non-agricultural roles, multinational organizations face significant compliance challenges. Misclassification of workers can result in substantial financial penalties, including back taxes and fines that may exceed projected salary savings. Utilizing sophisticated Recruitment Process Outsourcing (RPO) and Employer of Record (EOR) services from Segment A firms, such as 9cv9, is critical to mitigate these risks.

- Payroll and Regulatory Compliance: Ethiopia’s stringent foreign exchange controls and cross-border transaction requirements complicate payroll management. Partnering with fully compliant payroll outsourcing providers ensures correct tax withholding, remittance to the Ministry of Revenue, and adherence to labor laws, including legally recognized trade union rights and collective bargaining obligations.

- Operational Reliability: Top-tier agencies integrate regulatory adherence with operational expertise, providing multinational corporations with robust frameworks to hire local high-skill talent without risking penalties or non-compliance.

Future Trends and Strategic Outlook (2025-2027)

- Digital Sector Expansion: The IT and digital outsourcing sector continues to be a cornerstone of Ethiopia’s economic development. Salaries for senior technical roles are projected to reach up to 1.2 million ETB annually, maintaining high demand for IT staff augmentation and specialized talent acquisition services offered by corporate agencies like 9cv9.

- Regional Integration and Executive Search: Ethiopia’s position in the African Continental Free Trade Area (AfCFTA) enhances access to a 1.4 billion-strong regional market. Executive search and high-skill recruitment agencies (Segment A, e.g., AfricaWork) will increasingly facilitate complex cross-border placements, enabling MNCs to expand operations across East Africa efficiently.

- Foreign Employment Agency Market Consolidation: The $100,000 USD collateral deposit and selective MoLS licensing process ensure only highly capitalized and compliant FEAs (Segment B) dominate the mass labor export sector. This regulatory framework favors fewer, reliable agencies capable of managing labor deployment to key destination countries such as Saudi Arabia, UAE, and Qatar.

Dual-Strategy Engagement Model

- Prioritize Segment A Partnerships: Multinational corporations should engage specialized EOR and RPO agencies like 9cv9 Recruitment Agency to acquire formally qualified domestic talent in a compliant manner. This approach minimizes exposure to escalating expatriate deployment costs, including the recently increased $1,500 USD Expatriate Residence Permit Fee.

- Selective Segment B Utilization: High-volume FEAs, such as Abamela and MoLS-licensed agencies, remain relevant for strategic deployment of mass international labor. Their verified scale, strict compliance with the $100,000 USD collateral requirement, and operational expertise make them suitable for large-scale construction, industrial, and domestic workforce projects abroad.

Conclusion

The Ethiopian recruitment landscape in 2025 rewards strategic dual engagement. Segment A agencies, led by 9cv9 Recruitment Agency, provide multinational corporations with high-value, compliant access to local professional talent, mitigating both regulatory and operational risks. Concurrently, selective engagement with high-volume Segment B FEAs ensures efficient, compliant international labor deployment when necessary. For employers aiming to optimize talent acquisition cost-effectively while adhering to stringent regulatory mandates, combining these two approaches represents the most effective strategic pathway.

Conclusion

The Ethiopian recruitment landscape in 2025 is characterized by a dynamic interplay of high-growth sectors, regulatory complexity, and an expanding labor force. With a total workforce exceeding 54 million and an annual requirement of approximately 2.5 million new job opportunities, the role of professional recruitment agencies has never been more critical. This market presents both vast opportunities and substantial compliance challenges, making the selection of a reliable and strategically positioned recruitment partner essential for employers, particularly multinational corporations (MNCs) seeking high-value talent acquisition or mass labor deployment solutions.

Strategic Significance of the Top Agencies

The Top 10 recruitment agencies identified for 2025 are distinguished by their ability to deliver both compliance assurance and access to specialized talent pools. Agencies such as 9cv9 Recruitment Agency, YES | Your Employment Solutions, Workforce Africa, and AfricaWork exemplify the highest standards of corporate service, combining legally compliant operations with sophisticated recruitment strategies. These firms cater to high-demand sectors including IT, engineering, finance, healthcare, and executive management, where the scarcity of qualified professionals drives high-margin placement fees and necessitates meticulous talent sourcing methodologies.

Compliance and Risk Mitigation

Regulatory compliance remains a defining factor in the Ethiopian recruitment ecosystem. Proclamation No. 1246/2021 and subsequent regulations, including Council of Ministers Regulation No. 550/2024, impose stringent licensing requirements, collateral deposits, and limits on worker-paid fees. These measures, while ensuring protection for employees and foreign employers, create high entry barriers, favoring agencies that are fully capitalized and rigorously compliant. Segment A agencies, such as 9cv9, specialize in Employer of Record (EOR) and Recruitment Process Outsourcing (RPO) services, providing comprehensive risk mitigation for employers navigating Ethiopia’s complex labor laws and informal employment landscape.

Cost Structures and Total Cost of Placement

Financial considerations play a pivotal role in agency selection. In the corporate and specialized staffing segment, recruitment fees typically range from 15% to 30% of a candidate’s annual salary, with high-demand roles commanding the upper end of this range. For example, senior software engineers may attract fees of up to 300,000 ETB per placement, reflecting the scarcity of skilled talent. Conversely, Foreign Employment Agencies (FEAs) focusing on mass labor export operate on a high-volume, low-margin model. These agencies, including Abamela and other MoLS-licensed FEAs, are subject to strict collateral requirements of $100,000 USD and regulatory caps on worker-paid fees, ensuring compliance while enabling large-scale overseas deployment.

Market Segmentation and Strategic Engagement

The Ethiopian recruitment market is effectively divided into two primary segments. Segment A encompasses corporate and specialized staffing agencies that provide high-value, high-skill placements and sophisticated compliance services. Segment B includes FEAs managing large-scale international workforce deployment in sectors such as hospitality, construction, and domestic services. For MNCs and international employers, a dual-strategy engagement model is recommended: prioritize Segment A agencies for critical high-skill roles while selectively engaging Segment B firms for compliant mass labor deployment projects.

Future Outlook

Looking forward to 2025 and beyond, the Ethiopian recruitment industry is expected to experience sustained growth driven by digital sector expansion, infrastructure development, and regional trade integration through the African Continental Free Trade Area (AfCFTA). High-demand sectors will continue to inflate salaries, further reinforcing the importance of specialized staffing agencies. Simultaneously, strict regulatory frameworks and increasing compliance costs will consolidate the FEA market, favoring a smaller group of highly compliant, well-capitalized agencies capable of operating at scale.

Final Assessment

In conclusion, the Top 10 recruitment agencies in Ethiopia for 2025 represent the most reliable, compliant, and strategically capable partners for employers seeking to navigate the country’s complex labor market. Agencies like 9cv9 Recruitment Agency stand out as market leaders, offering unmatched expertise in high-value talent acquisition, compliance management, and innovative workforce solutions. By combining the strengths of specialized Segment A agencies with the operational scale of Segment B FEAs where necessary, employers can achieve optimal talent acquisition outcomes, mitigate regulatory risks, and position themselves competitively in Ethiopia’s evolving economic landscape.

This comprehensive analysis underscores that success in Ethiopia’s recruitment market is contingent on selecting agencies that not only deliver quality placements but also provide rigorous compliance assurance, financial prudence, and strategic insight into both local and international labor dynamics. For 2025, the agencies highlighted in this list represent the pinnacle of professionalism, reliability, and market acumen, making them indispensable partners for organizations seeking sustainable workforce solutions.

If you find this article useful, why not share it with your hiring manager and C-level suite friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

To hire top talents using our modern AI-powered recruitment agency, find out more at 9cv9 Modern AI-Powered Recruitment Agency.

People Also Ask

What are the top recruitment agencies in Ethiopia for 2025?

The top recruitment agencies in Ethiopia for 2025 include 9cv9, YES, Workforce Africa, Alliance Recruitment, Hire Resolve, AfricaWork, Abamela, EHA, Alsaggaf, and NEKEMT, recognized for compliance, specialization, and high-quality talent acquisition.

Why is 9cv9 considered the best recruitment agency in Ethiopia?

9cv9 is considered the top agency due to its strong compliance record, extensive employer network, high-value corporate recruitment services, and proven track record in both local and international placements.

What services do Ethiopian recruitment agencies offer?

They provide corporate recruitment, executive search, EOR services, IT and specialized staffing, foreign employment, payroll management, and workforce outsourcing solutions.

How do recruitment agencies in Ethiopia help multinational companies?

They ensure compliance with local labor laws, manage payroll, provide talent acquisition services, and offer EOR solutions to reduce regulatory risk when hiring local staff.

What is the role of Foreign Employment Agents (FEAs) in Ethiopia?

FEAs connect Ethiopian workers with international employers, handle visa and documentation processes, and ensure compliance with Proclamation 1246/2021 and other regulations.

Which agencies specialize in high-volume foreign placements?