Venture capital firms or VC are private equity and financing investors that provide capital to mainly, startups and small businesses with high growth potential.

Usually, the VC originates its funding source from investment banks, well-off investors, or any other financial institution.

Venture capital is arguably the primary source of funding, especially for tech startups.

Entrepreneurs often rely on venture capitalists, because banks or other sources of financial institutions might feel that it is too risky to invest in small businesses or startup companies.

VC funding is different from other forms of financing because VC funding is usually provided in exchange for equity of the company.

They expect a high return on their investment through a stake in the company – following the well-known adage of “high risk, high returns”.

Meanwhile, a normal financial institution providing debt usually asks entrepreneurs to pay back the amount of the loan plus interest. They typically do not take equity in this arrangement.

The money that VC firms invested comes in various ways including private funds, public pension funds, corporations, foundations, individuals, etc.

Finding the right VC firm for your small business or startup company can be nerve-wracking.

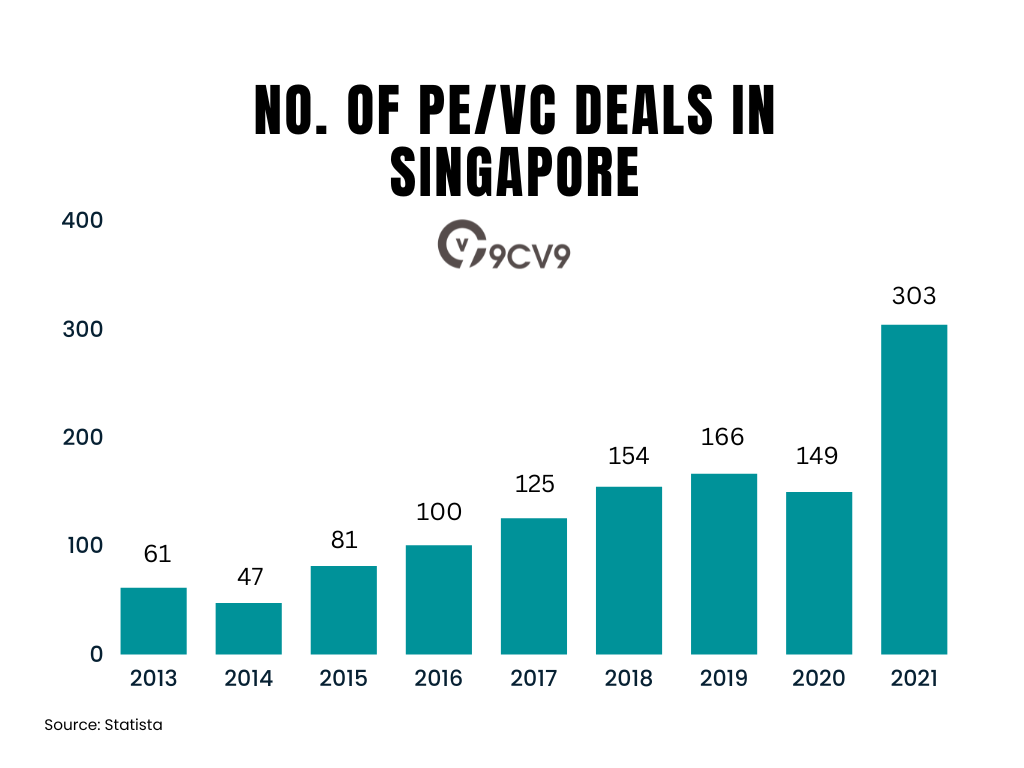

According to Statista.com, the number of private equity (PE) and venture capital (VC) deals in Singapore reached 303 deals in 2021.

The number is relatively small if we compare it to the data from the United States.

According to Statista.com, the number of venture capital deals in the U.S. reached 15,855 deals in 2021.

That said, Singapore is one of the most attractive locations to raise a VC funding round due to the relative abundance of investment firms, venture capitalists, angel investors, family offices, etc on the sunny island.

If you are considering starting a business in Singapore and are currently searching for venture capital firms, here are some best options for you in 2023 (in no particular order):

Venture Capital and Private Equity Funds in Singapore (Updated in 2023)

- Antler

- B Capital Group

- DreamLabs

- EDBI

- Golden Gate

- Insignia Venture Partners

- Jungle Ventures

- Monk’s Hills Venture

- Quest Ventures

- Rikvin Ventures

- Sequoia

- Vertex Ventures

- 500 Startups

Antler

Since 2018, Antler has helped create and invested in more than 600 founders and 120 portfolio companies around the globe.

Antler has offices in 25 cities across 6 continents including New York, London, Berlin, Singapore, Seoul, Jakarta, Tokyo, Sydney, and more.

Their goal is to back up more than 6,000 companies by 2030.

They run a venture builder/accelerator-like program that screens founders beforehand and brings them through a curated 5-10 agenda before a demo day for the founders to pitch to their investment committee or to external invite-only investors.

If you are chosen by their Investment Committee to be invested, Antler will invest a sum of USD$125,000 for 10% equity.

Do note that if your startup were to be invested, there is a program fee of US$45,000 to be deducted from the investment amount, which leaves you technically with $80,000 for your startup operations.

Investment Cheque Size of Antler

Antler typically invests around US$125,000 for 10% equity at the pre-seed round. Do note upon investment, there is a US$45,000 program fee to be deducted from that investment.

Keen to explore? Apply to their program here.

For more inquiries, feel free to email:

- joinantler.sg@antler.co

- hello@antler.co

B Capital Group

This venture capital firm was founded in 2015 by Raj Ganguly and Eduardo Saverin.

The firm invests in early-stage startups in the technology sector, with a focus on industries such as financial technology, healthcare, and enterprise software.

B Capital Group’s vision is to help the world’s most promising startups.

Currently, they have managed around $6.2B in assets and have more than 125 portfolio companies.

Other than Singapore, B Capital Group has offices in Los Angeles, Miami, San Francisco, New York, Hong Kong, and Beijing.

Their investment thesis is primarily into companies that are emerging in the fintech and healthcare industries.

They have made investments in companies such as GoJek, K Health, and PolicyBazaar.

B Capital Group invests in early-stage companies and provides both financial and strategic support to help these startups grow and succeed.

The firm’s investment strategy is focused on identifying and supporting innovative companies that have the potential to transform their industries and create significant value for their stakeholders.

Investment Cheque Size of B Capital Group

B Capital Group typically invests in the range of $5 million to $30 million per startup, although the exact amount can vary depending on the stage of the company and its specific funding needs.

Keen to explore? Send over an email to:

- ir@bcapgroup.com

- media@bcapgroup.com

Dream Labs

Dream Labs is a leading venture capital firm in Singapore, specializing in early-stage investments in technology and innovation.

With a team of experienced investors and a strong network of resources, Dream Labs helps entrepreneurs turn their ideas into successful businesses.

The firm is committed to investing in startups that have the potential to disrupt traditional industries and drive growth in the tech sector.

At Dream Labs, the focus is on providing more than just financial support to portfolio companies.

The firm’s investment team works closely with entrepreneurs to help them develop their businesses, offering mentorship, strategic guidance, and access to a vast network of industry experts and business leaders.

Whether it’s through introductions to key customers and partners or assistance in recruiting top talent, Dream Labs is dedicated to helping portfolio companies reach their full potential.

Dream Labs aim is to work with entrepreneurs who seek to invent new market categories. Their focus is to renew, restore, revive, and recycle.

Mainly, they are interested to put in investments for companies in the Fintech, E-commerce, health, Cleantech, and energy industries.

Their office and headquarters are in Singapore. With around $50 million to invest, they will provide funding for companies that have impactful ideas for society.

Investment Cheque Size of Dream Labs

The investment amount can vary greatly depending on the stage of the startup and its funding needs. Some startups may receive seed funding in the range of a few hundred thousand dollars, while others may receive millions of dollars in later-stage funding.

Keen to explore? Send over an email to

- info@dreamlabs.sg

EDBI

EDBI (Economic Development Board of Singapore Investments) is a Singapore-based investment company with a focus on investing in innovative technology companies.

Investing since 1991, EDBI was established as the investment arm of the Economic Development Board of Singapore, with the goal of driving innovation and growth in the technology sector.

EDBI invests in companies across a range of industries, including life sciences, cleantech, advanced manufacturing, and digital technologies.

The firm’s investment team is made up of experienced professionals with a deep understanding of the technology industry, and they work closely with entrepreneurs to help them achieve their goals.

In addition to providing financial support, EDBI offers its portfolio companies a range of services and resources to help them succeed.

This includes access to a network of industry experts and business leaders, mentorship and coaching from experienced investors, and strategic guidance on key business issues such as fundraising, product development, and marketing.

EDBI has a global reach, with a network of resources and partners that span multiple regions, including Asia, Europe, and North America.

The firm is committed to creating value for its portfolio companies and helping to drive the growth and development of the technology industry in Singapore and beyond.

EDBI has made many successful investments in innovative technology companies and established itself as a leading venture capital firm in the region.

The firm’s mission is to help entrepreneurs bring their ideas to market and to contribute to the growth and development of the technology sector in Singapore and beyond.

They select high-growth technology sectors ranging from Information and Communication Technology (ICT), Emerging Technology (ET), Healthcare (HC), and other strategic industries.

EDBI’s most notable exits are Jago, Carousell, Carro, and more.

As a leading global investor, they are consistently working towards supporting the future economic pillars of Singapore.

Based on Crunchbase, EDBI has made 162 investments. Their most recent investment was on Dec 21, 2022, on Doctor Anywhere, which raised $38.8M.

Investment Cheque Size of EDBI

According to Unicorn Nest, the investment cheque size is around US$50 – US$100m.

Keen to explore? Send over an email to

- infohq@edbi.com

Golden Gate Ventures

Golden Gate Ventures is a leading Southeast Asian venture capital firm that invests in early-stage startups.

With a focus on technology and internet-enabled businesses, the firm has a proven track record of identifying and supporting the region’s most promising entrepreneurs.

Golden Gate Ventures leverages its extensive network and expertise to help founders build successful companies, and provides access to capital, mentorship, and growth opportunities.

Their headquarters are in Singapore and they have 3 other offices – 1 in Jakarta, Indonesia, and the other two are in Vietnam, in the cities of Ha Noi, and Ho Chi Minh.

Golden Gate has invested in more than 70 companies with 9 unicorns across their portfolio.

Some of the companies that they invested in are Carousell, Chilibeli, and Redmart.

Investment Cheque Size of Golden Gate Ventures

Golden Gate Ventures typically invests in the range of US$1m to US$5m per round.

Keen to explore? Send over an email to

- hello@goldengate.vc

Insignia Venture Partners

Insignia Venture Partners is a leading venture capital firm that invests in early-stage technology startups.

Since 2017, Insignia Venture Partners have invested in more than 70 emerging technology companies.

With a focus on Southeast Asia and India, they are dedicated to identifying and supporting the region’s most promising entrepreneurs.

They have a proven track record of identifying and supporting the region’s most promising entrepreneurs and have a deep understanding of the technology and internet landscape in the region.

Insignia Venture Partners leverages its extensive network and expertise to help founders build successful companies, providing access to capital, mentorship, and growth opportunities.

They specialize in early investments in South East Asian companies and have their headquarters in Singapore.

Other than 70+ companies, Insignia also invested in unicorns Carro, GoTo, Ajaib, and Appier.

In August 2022, Insignia Venture Partners announced that they have closed US$516m across three Southeast Asian Funds. This will provide a lot of firepower for their existing and incoming startup founders.

Investment Cheque Size of Insignia Venture Partners

Insignia Venture Partners typically invests in the range of US$100k to US$25m per round.

Keen to explore? Send over an email to

- hello@insignia.vc

Jungle Ventures

Jungle Ventures is a venture capital firm that invests in startups reimagining the future of Southeast Asia.

They are committed to empowering entrepreneurs and providing them with the resources they need to build successful businesses.

With a focus on technology and innovation, Jungle Ventures invests in early-stage startups that have the potential to disrupt traditional industries and create new ones.

From capital and mentorship to network access, Jungle Ventures provides everything their portfolio companies need to grow and succeed.

With 11 successful exits, Jungle Ventures become the first independent, Singaporean VC to invest across both India and Southeast Asia.

This company has around $1Bn+ assets under its management. They already made more than 35 investments and more than 50 founders in 8 countries.

A few examples of their exits are Sociolla, the largest beauty platform in Indonesia, and Livspace, the largest home decor and furnishing marketplace in South & South East Asia.

Investment Cheque Size of Jungle Ventures

Insignia Venture Partners typically invests in the range of US$2m to US$10m per round.

Keen to explore? Send over an email to

- contact@jungle.vc

Monk’s Hill Ventures

In 2014, Peng T. Ong and Kuo-Yi Lim founded Monk’s Hill Ventures.

Monk’s Hill Ventures is a venture capital firm investing in early-stage tech companies, primarily Series A, in Southeast Asia.

Monk’s Hill Ventures is not your typical venture capital firm.

They are a team of industry experts and experienced entrepreneurs who are passionate about helping early-stage technology startups reach their full potential.

With a focus on innovation in Southeast Asia, Monk’s Hill Ventures invests in the most promising businesses with a track record of success.

From capital to mentorship and network access, Monk’s Hill Ventures provides their portfolio companies with the resources they need to thrive.

Their offices are in Singapore, Jakarta, and Vietnam.

Today, they have invested in over 30 fast-growing tech companies in Southeast Asia. Some of the companies are Botmd in the health-tech industry, Dagangan in the e-commerce industry, and Credibook in the fintech industry.

Investment Cheque Size of Monk’s Hill Ventures

Monk’s Hill Ventures typically invests in the range of US$2m to US$5m per round.

Keen to explore? Send over an email to

- info@monkshill.com

Quest Ventures

Quest Ventures has focused on an overarching ‘digital economy’ strategy across Asia since 2011.

Quest Ventures is on a mission to help early-stage technology startups succeed.

With a focus on Southeast Asia and a commitment to innovation, they are dedicated to empowering entrepreneurs and providing them with the resources they need to build successful businesses.

It is a top venture capital firm in artificial intelligence, e-commerce and marketplaces, entertainment, finance, food, insurance, logistics, media, property, sports, and the Islamic digital economy.

As of 31 December 2021, Quest Ventures has managed around US$40m of assets and more than 100 companies are in their portfolio across the funds.

Quest Ventures is also in the top 10 list of most active investors in Southeast Asia and Central Asia.

Investment Cheque Size of Quest Ventures

Quest Ventures typically invests in the range of US$100k to US$500k per round.

Keen to explore? Send over an email to

- info@questventures.com

Rikvin Ventures

Rikvin Ventures is a venture capital firm based in Singapore.

It provides early-stage financing to startups and emerging companies across Southeast Asia and India.

Rikvin Ventures focuses on investing in companies operating in the technology, internet, and digital media sectors.

Their goal is to help entrepreneurs build successful businesses by providing access to capital, mentorship, and growth opportunities.

Rikvin Ventures is known for its hands-on approach to investing, working closely with its portfolio companies to help them achieve their goals and grow their businesses.

This company focuses on its approach to building the companies of tomorrow which are disruptive, scalable, and people-focused.

Rikvin Ventures invest in various kinds of industries such as clean tech, fin-tech, e-commerce, waste management, healthcare, and energy.

Their mission is to invest in entrepreneurs with ideas that will disrupt traditional ways of thinking and generate strong commercial returns.

Investment Cheque Size of Rikvin Ventures

Varies.

Keen to explore? Send over an email to

- hello@rikvinventures.com

Sequoia Capital

Sequoia Capital is a global venture capital firm that was founded in 1972 and has its headquarters in Menlo Park, California.

It has a presence in several countries, including Singapore.

The firm invests in early-stage startups as well as later-stage companies and has a reputation for backing successful technology companies such as Apple, Google, and PayPal.

Sequoia Capital’s focus is on helping entrepreneurs build disruptive and innovative companies.

They provide capital, expertise, and a network of resources to help their portfolio companies grow and succeed.

In addition to investing, Sequoia Capital provides mentorship and strategic guidance to help founders navigate the challenges of starting and growing a business.

Sequoia Capital has a track record of making successful investments and is widely recognized as one of the leading venture capital firms in the world.

Sequoia Capital is one of the most experienced companies in the capital and investment field.

This company has contributed more than 20% of the NASDAQ total value and has partnered with and helped famous figures such as Steve Jobs, Elon Musk, and many others.

Investment Cheque Size of Sequoia Capital

Sequoia Capital typically invests in the range of US$1m to US$12m per round.

Keen to explore? Send over an email to

- startindia@sequoiacap.com

Vertex Ventures

Vertex Ventures is a venture capital firm based in Singapore with a focus on early-stage technology startups.

The firm invests in a wide range of sectors, including software, e-commerce, and digital media, among others.

Vertex Ventures has a strong presence in Southeast Asia and India, and its goal is to help entrepreneurs build successful businesses by providing access to capital, mentorship, and growth opportunities.

In addition to its investment activities, Vertex Ventures is known for its hands-on approach to working with portfolio companies.

The firm’s partners provide strategic guidance and support to help founders navigate the challenges of starting and growing a business.

Vertex Ventures has a reputation for backing successful startups and is considered one of the leading venture capital firms in the region.

Not only supporting entrepreneurs from Singapore, Vertex Ventures is also one of the leading global VCs for India and Southeast Asia.

Vertex Ventures have invested in more than 78 startups in Singapore.

Some of their notable consumers are Grab, ChattyBao, and Dailybox.

Investment Cheque Size of Vertex Ventures

Vertex Ventures typically invests in the range of US$2m to US$15m per round.

Keen to explore? Send over an email to

- helloasia@vertexventures.com

500 Startups

500 Startups is a global venture capital firm that was founded in 2010 and has its headquarters in Silicon Valley.

The firm has a presence in several countries, including Singapore, and provides seed and early-stage financing to startups.

500 Startups invests in a wide range of sectors, including technology, e-commerce, and digital media, among others.

500 Startups is known for its hands-on approach to working with portfolio companies.

In addition to investing, the firm provides mentorship, resources, and strategic guidance to help entrepreneurs build successful businesses.

The firm’s goal is to help startups achieve product-market fit and grow their businesses to the next level.

500 Startups has a reputation for backing successful startups and is widely recognized as one of the leading early-stage venture capital firms in the world.

In addition to investing, the firm runs an accelerator program that provides startups with access to mentorship, resources, and a global network of entrepreneurs and investors.

Across Southeast Asia, the 500 Southeast Asia family has invested in over 250 companies.

This company has offices in Singapore and Kuala Lumpur, Malaysia.

500 Global is arguably one of the most active investors in the world, and one of the top most diverse venture capital firms in the world.

Their mission is to uplift people and economies around the world through entrepreneurship.

The companies that 500 Global has invested in helped create thousands of jobs and delighted millions of customers all over the world.

Some of their top centaurs are Stockbit, Alodokter, Lingokids, and Pomelo.

They also invested in Asia unicorns such as Grab, Bukalapak, Carsome, Carousell, and Prenetics.

Investment Cheque Size of 500 Startups

Vertex Ventures typically invests in the range of US$2m to US$15m per round.

Keen to explore? Send over an email to

- global.launch@500.co

- info@500startups.com

- info@500.co

Or….Business Angel Investors

Other than the venture capital firms listed above, there are also investors such as angel investors.

Angel investors are investors that typically use their own personal funds (instead of using other investors’ funds like those of venture capital firms).

In this respect, the investment process can be shorter with some angel investors reportedly making the investment with just one meetup over coffee.

Some business angel investors are Business Angel Network Southeast Asia or BANSEA.

Not only focusing on investing money, but angel investors also offer personal mentorship from their personal investing endeavors or work experiences.

They will invest their time as well and will spend a substantial amount of time with the entrepreneur to help grow the startup.

In Summary

In conclusion, Singapore is home to a thriving startup ecosystem and a number of well-established venture capital firms.

These firms provide early-stage financing to startups and help entrepreneurs build successful businesses.

They offer capital, mentorship, resources, and strategic guidance to help startups achieve product-market fit and grow their businesses to the next level.

Some of the leading venture capital firms in Singapore include Sequoia Capital, Vertex Ventures, 500 Startups, and others.

These firms have a proven track record of making successful investments and are widely recognized as some of the leading venture capital firms in the region.

The presence of these venture capital firms is a testament to Singapore’s strong commitment to promoting innovation and entrepreneurship.

They play a critical role in supporting the growth and development of the startup ecosystem and helping entrepreneurs turn their ideas into successful businesses.

If you find this article useful, why not share it among your startup founder counterparts, and also leave a nice comment below?

We at 9cv9 Research Team strive to bring the latest and most meaningful data, guide, and statistics to your doorstep.