Key Takeaways

- PEO Industry Growth: Discover how the PEO industry continues to thrive, with significant annual increases in both the number of PEOs and worksite employees, underscoring their pivotal role in modern HR management.

- Cost Savings and Efficiency: Learn about the substantial cost-saving opportunities offered by PEO partnerships, enabling businesses to streamline HR administration and allocate resources more strategically for accelerated growth.

- Regional Insights: Gain valuable insights into regional trends, including key markets such as Florida, Texas, California, and New York, and understand how businesses across different regions leverage PEO services to drive success in 2024 and beyond.

In the fast-paced realm of Human Resources (HR), staying ahead of the curve is not merely advantageous; it’s imperative. As we navigate the intricate landscape of workforce management in 2024, the role of Professional Employer Organizations (PEOs) has become increasingly pivotal.

PEOs have emerged as dynamic partners, offering a gamut of services ranging from HR administration and payroll management to compliance assistance and employee benefits provision.

Understanding the pulse of PEO statistics and trends is no longer an option—it’s a strategic necessity for HR professionals seeking to optimize their operations and elevate organizational success.

Embark with us on a journey into the heart of contemporary HR dynamics, as we delve deep into the labyrinth of PEO statistics and trends shaping the industry landscape in 2024 and beyond.

Picture this: a scenario where HR professionals possess a panoramic view of the latest industry statistics, coupled with actionable insights into emerging trends.

This vision is not just a mirage but a tangible reality awaiting those who dare to immerse themselves in the wealth of knowledge we’re about to unravel.

As we embark on this voyage, it’s crucial to grasp the essence of PEOs and their transformative impact on HR paradigms.

Professional Employer Organizations serve as catalysts for organizational growth, offering a holistic suite of services designed to alleviate administrative burdens and empower HR departments to focus on strategic initiatives.

From startups seeking scalability to established enterprises navigating complex regulatory landscapes, PEOs have emerged as indispensable allies in the quest for operational excellence.

But what lies beneath the surface of this burgeoning industry?

What are the statistical indicators that illuminate the trajectory of PEOs in 2024?

More importantly, what trends are reshaping the contours of HR outsourcing, and how can HR professionals harness these insights to steer their organizations toward unprecedented success?

These are the questions that propel us forward, igniting a quest for knowledge and foresight that transcends conventional boundaries.

Our mission is clear: to equip HR professionals with a comprehensive toolkit of statistics and trends, empowering them to navigate the ever-evolving terrain of workforce management with confidence and precision.

In the chapters that follow, we’ll embark on an expedition through the corridors of PEO statistics, dissecting market trends, adoption patterns, and growth projections.

We’ll unravel the intricate tapestry of compliance and regulatory updates, offering insights into navigating the labyrinth of legal complexities with ease.

But our journey doesn’t end there.

We’ll delve into the realm of employee benefits and satisfaction, exploring the symbiotic relationship between PEOs and workforce well-being.

From comprehensive benefits packages to cutting-edge technological advancements, we’ll explore how PEOs are revolutionizing the employee experience and fostering a culture of engagement and retention.

Moreover, we’ll conduct a cost-effectiveness analysis, unveiling the economic rationale behind PEO partnerships and quantifying the return on investment (ROI) for organizations embracing this transformative model.

Armed with data-driven insights, HR professionals will be empowered to make informed decisions that drive bottom-line results and fuel long-term growth.

As we peer into the crystal ball of the future, we’ll forecast emerging trends and industry shifts, offering a glimpse into the evolving landscape of HR outsourcing.

From AI-driven innovations to the rise of niche PEO services, we’ll decode the signals that herald a new era of possibility and opportunity for HR professionals worldwide.

In essence, this blog isn’t just a repository of information—it’s a beacon of knowledge, guiding HR professionals through the maze of uncertainty and illuminating a path toward excellence.

Join us as we embark on this odyssey of discovery, where the quest for insights leads to a destination of unparalleled success. The journey begins now.

Top 30 PEO Statistics and Trends All HR Should Know in 2024 (Latest)

- The PEO market is worth USD 60 billion

- The PEO Market is expected to reach USD 152 billion by 2031, a CAGR of 11%

- PEOs provide services to more than 200,000 small and mid-sized businesses

- PEOs employ 4.5 million people

- There are 523 PEOs in the United States

- The PEO industry’s worksite employees were paid USD 305 billion

- The PEO industry’s clients represent 17% of all employers

- Awareness of PEOs rose to 65%, a 44% increase since 2018

- 33% of decision-makers have used a PEO

- Nearly 50% of PEO clients are in the manufacturing, professional, scientific, and technical services, or construction sectors

- 50% of companies using PEOs have been in business for between five and nine years

- 42% of younger decision makers (25-34 years old) reported using a PEO

- Almost 80% of PEOs think they are responsible for ensuring the financial preparedness of their staff

- PEO clients are more likely than non-PEO members to accommodate workers following a severe illness or disability

- PEO members are 50% less likely to go out of business

- PEO members are more likely to grow 7% to 9% faster

- 48% of businesses chose a PEO after doing their own research

- 98% of PEO clients report satisfaction with their PEO provider

- PEOs provide HR services at a cost close to $450 lower per employee

- Companies that partner with a PEO experience a 21% savings

- 70% of companies that work with a PEO report revenue growth twice that of comparable non-PEO firms

- The ROI of working with a PEO is 27.2% per year

- The federal government spent USD 10,081,570 on PEOs

- The government awarded 38 contracts to 27 companies. The average value per company was $373,391

- More than half of all PEO clients are located in Florida (25%), Texas (13%), California (11%), and New York (10%)

- Total employment represented by the PEO industry is roughly 3x the size of each of the largest employers

- PEOs have grown at an average 7.5% compounded annual growth rate since 2008

- The number of WSEs in PEOs has grown every year, except for 2020

- Number of PEOs increased by 4% per year from 2020 to 2022

- Number of PEO Worksite Employees (WSEs) increased by 7% per year from 2020 to 2022

1. The PEO market is worth USD 60 billion

(Straits Research)

This figure indicates a sizable demand for PEO services worldwide, reflecting the growing recognition of the benefits offered by PEO partnerships in HR management. A market value of USD 60 billion in 2022 suggests that PEOs have become integral players in the broader landscape of workforce management, catering to the needs of businesses across various sectors and industries. This substantial valuation underscores the industry’s maturity and underscores its role as a key enabler of organizational growth and efficiency. Such a large market size signifies the widespread adoption of PEO services by businesses seeking to streamline HR processes, mitigate compliance risks, and enhance employee benefits offerings. It also reflects the increasing complexity of HR management in the modern business environment, driving demand for specialized outsourcing solutions provided by PEOs.

2. The PEO Market is expected to reach USD 152 billion by 2031, a CAGR of 11%

(Straits Research)

This forecast indicates a robust growth trajectory for the PEO market, with a projected doubling of its value within the next decade. Such growth prospects underscore the increasing demand for PEO services as businesses continue to grapple with complex HR challenges and seek efficient solutions to manage their workforce effectively. The projected CAGR of 11% signifies a steady and sustainable growth rate, reflecting the ongoing evolution and maturation of the PEO industry. This growth is likely driven by several factors, including the globalization of businesses, regulatory complexities, and the growing recognition of the value proposition offered by PEO partnerships.

3. PEOs provide services to more than 200,000 small and mid-sized businesses

(Napeo)

This highlights the widespread adoption and relevance of Professional Employer Organizations (PEOs) within the business community. It underscores the significant role that PEOs play in supporting small and mid-sized businesses (SMBs) by offering a wide range of HR-related services. These services may include payroll administration, employee benefits management, compliance assistance, risk management, and HR consulting, among others. It also indicates a substantial market presence and demonstrates the value proposition they offer to businesses seeking to streamline their HR operations and focus on core business activities.

4. PEOs employ 4.5 million people

(Napeo)

This statistic underscores the significant role that PEOs play in providing employment opportunities and supporting workforce management for a large number of individuals. These individuals may be employed by client companies that have partnered with PEOs for HR outsourcing services. Alternatively, they may work directly for PEOs themselves in roles such as HR specialists, payroll administrators, benefits coordinators, and other support staff.

5. There are 523 PEOs in the United States

(Napeo)

This statistic highlights the significant presence of PEOs in the United States, demonstrating the industry’s maturity and widespread adoption among businesses seeking HR outsourcing solutions. With over 500 PEOs operating in the country, businesses have a variety of options to choose from when selecting a PEO partner to meet their specific needs.

6. The PEO industry’s worksite employees were paid USD 305 billion

(Napeo)

The figure of $305 billion reflects the aggregate wages earned by employees who are under the worksite of PEOs. It highlights the substantial workforce that is directly or indirectly managed by PEOs, encompassing a diverse range of industries, roles, and geographic locations. By managing HR functions for businesses across various sectors, PEOs enable companies to focus on their core operations while ensuring compliance with employment laws and regulations.

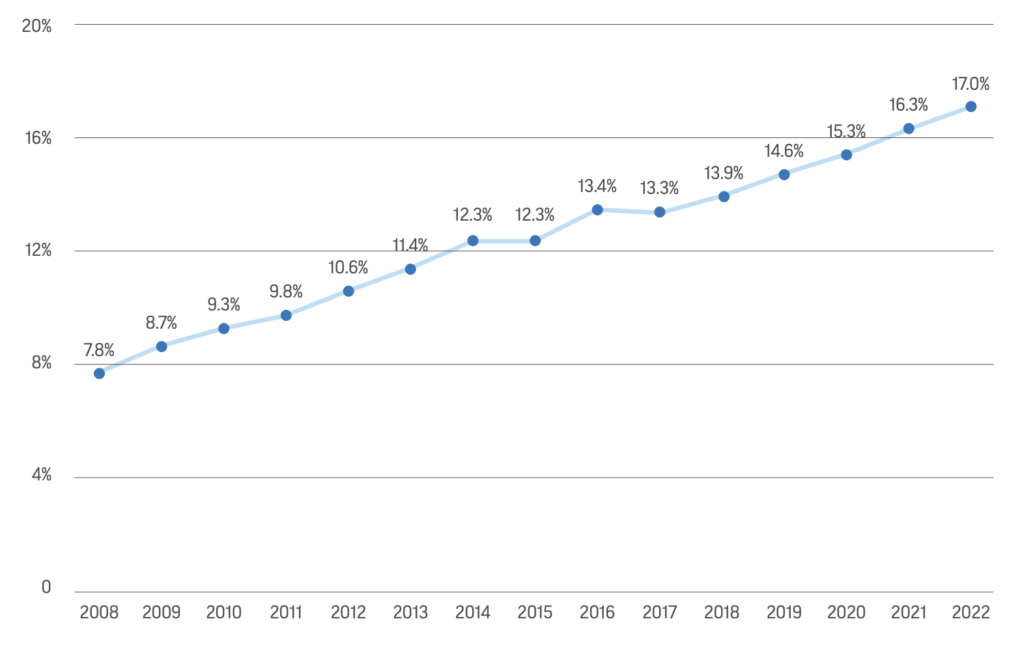

7. The PEO industry’s clients represent 17% of all employers

(Napeo)

The PEO industry’s 208,000 clients represent 17% of all employers with between 10 and 99 employees and this provides valuable insight into the penetration and significance of Professional Employer Organizations (PEOs) within a specific segment of the small and mid-sized business (SMB) market. This indicates a substantial market presence for PEOs, with a large number of SMBs recognizing the value proposition offered by outsourcing HR functions to PEOs.

8. Awareness of PEOs rose to 65%, a 44% increase since 2018

(Napeo)

This indicates a significant and notable trend in the awareness and recognition of Professional Employer Organizations (PEOs) among businesses and industry professionals. It also highlights the growing recognition of PEOs as valuable partners in HR management and workforce solutions. This suggests that more businesses are becoming aware of the benefits and services offered by PEOs, leading to increased consideration and adoption of PEO partnerships.

9. 33% of decision-makers have used a PEO

(US Chamber)

The fact that 33% of decision-makers have used a PEO indicates a substantial level of adoption and experience with PEO services among this influential group. Decision-makers, such as business owners, CEOs, and HR managers, play a pivotal role in shaping organizational strategies and initiatives, including decisions related to HR management and workforce solutions.

10. Nearly 50% of PEO clients are in the manufacturing, professional, scientific, and technical services, or construction sectors

(Napeo)

This indicates a significant presence of PEOs within these industries. This suggests that businesses operating in these sectors recognize the value proposition offered by PEOs and actively engage with them to address their HR needs.

11. 50% of companies using PEOs have been in business for between five and nine years

(Guardian)

PEOs are particularly attractive to businesses that are past the initial startup phase but are still in the relatively early stages of their development. These businesses have likely achieved a degree of stability and growth, but may still be navigating challenges associated with scaling operations, managing HR functions, and ensuring compliance.

12. 42% of younger decision makers (25-34 years old) reported using a PEO

(Napeo)

This indicates a relatively high level of adoption and familiarity with PEO services among this age group. This suggests that younger professionals, who may be more tech-savvy and open to innovative solutions, are actively leveraging PEO partnerships to address their HR needs.

13. Almost 80% of PEOs think they are responsible for ensuring the financial preparedness of their staff

(Guardian)

This underscores the holistic approach that PEOs take towards workforce management. It indicates that PEOs recognize the importance of addressing not only HR-related functions but also broader aspects of employee welfare, including financial readiness.

14. PEO clients are more likely than non-PEO members to accommodate workers following a severe illness or disability

(Guardian)

This highlights the proactive and supportive stance taken by PEO clients towards accommodating workers facing severe illness or disability. It indicates that businesses partnering with PEOs are more inclined to prioritize employee well-being and provide necessary accommodations to support employees during challenging circumstances.

15. PEO members are 50% less likely to go out of business

(Napeo)

This implies that businesses that partner with PEOs have a significantly higher chance of remaining operational compared to those that do not utilize PEO services. This suggests that PEOs may offer tangible benefits or support structures that contribute to business stability and resilience.

16. PEO members are more likely to grow 7% to 9% faster

(Napeo)

This suggests a significant advantage for businesses that partner with PEOs in terms of expansion and development. This implies that PEOs may provide strategic support, resources, and expertise that contribute to accelerated growth trajectories for client businesses.

17. 48% of businesses chose a PEO after doing their own research

(Guardian)

This underscores the significance of informed decision-making and due diligence in selecting a PEO provider. This suggests that businesses recognize the importance of thoroughly evaluating their options, understanding the services offered, and assessing the suitability of PEO partnerships for their specific needs.

18. 98% of PEO clients report satisfaction with their PEO provider

(Napeo)

suggests that the vast majority of PEO clients are highly content with the services, support, and value provided by their PEO provider. This implies that PEOs are effectively meeting or exceeding the expectations of their clients and delivering on their promises in terms of HR management, compliance assistance, employee benefits administration, and other services.

19. PEOs provide HR services at a cost close to $450 lower per employee

(Napeo)

This implies that businesses can achieve cost savings and efficiencies by outsourcing their HR functions to PEOs. This suggests that PEOs may leverage economies of scale, specialized expertise, and streamlined processes to deliver HR services more cost-effectively compared to managing HR functions in-house.

20. Companies that partner with a PEO experience a 21% savings

(Napeo)

This underscores the significant impact that PEOs can have on reducing overhead expenses related to HR functions. This suggests that PEOs are able to deliver HR administrative services more efficiently and cost-effectively compared to managing these functions in-house.

21. 70% of companies that work with a PEO report revenue growth twice that of comparable non-PEO firms

(Napeo)

This underscores the significant impact that PEO partnerships can have on business performance and financial outcomes. This suggests that PEOs play a crucial role in driving revenue growth and business success for their clients.

22. The ROI of working with a PEO is 27.2% per year

(Napeo)

This underscores the substantial financial benefits that businesses can realize through PEO partnerships. This suggests that the cost savings achieved by outsourcing HR functions to a PEO more than offset the expenses associated with the partnership, resulting in a highly favorable ROI.

23. The federal government spent USD 10,081,570 on PEOs

(Anything Research)

This indicates a substantial financial commitment by the federal government to utilize PEO services. This suggests that PEOs play a significant role in supporting government agencies and departments in managing HR functions, compliance requirements, and workforce management initiatives.

24. The government awarded 38 contracts to 27 companies. The average value per company was $373,391

(Anything Research)

This suggests that there is a diverse pool of PEO providers serving the government’s needs. This indicates that the government may engage with multiple vendors to ensure access to a range of expertise, services, and solutions to meet its HR management requirements.

25. More than half of all PEO clients are located in Florida (25%), Texas (13%), California (11%), and New York (10%)

(Napeo)

This suggests that these states have a high demand for PEO services or are particularly conducive to PEO operations. This may be attributed to various factors such as the size of the business landscape, industry diversity, regulatory environment, and economic factors.

26. Total employment represented by the PEO industry is roughly 3x the size of each of the largest employers

(Napeo)

This suggests that PEOs collectively manage a considerable portion of the workforce, providing HR services, benefits administration, and other employment-related support to a large number of businesses and employees. Moreover, the comparison to the largest employers highlights the scale of the PEO industry relative to individual corporations or entities that traditionally employ large numbers of workers. This indicates that PEOs aggregate employment across numerous client companies, spanning various industries and sectors, to achieve a substantial footprint in the labor market.

27. PEOs have grown at an average 7.5% compounded annual growth rate since 2008

(Napeo)

This suggests that PEOs have experienced robust demand for their services and have successfully capitalized on opportunities for expansion in the HR outsourcing market. It underscores the resilience and adaptability of PEOs in navigating economic fluctuations, regulatory changes, and market dynamics over the years. Despite various challenges, PEOs have demonstrated the ability to evolve, innovate, and capture market share, contributing to their sustained growth momentum.

28. The number of WSEs in PEOs has grown every year, except for 2020

(Napeo)

This underscores the industry’s overall expansion and increasing adoption of PEO services by businesses. This suggests that businesses are increasingly turning to PEOs to manage their workforce, HR functions, and related responsibilities.

29. Number of PEOs increased by 4% per year from 2020 to 2022

(Napeo)

This suggests a steady expansion of the PEO industry during this timeframe. This growth rate reflects the industry’s ability to attract new entrants, expand service offerings, and capitalize on opportunities within the HR outsourcing market.

30. Number of PEO Worksite Employees (WSEs) increased by 7% per year from 2020 to 2022

(Napeo)

This growth rate reflects the industry’s ability to attract new clients, expand service offerings, and effectively manage the employment needs of businesses across various sectors. It also highlights the industry’s resilience and adaptability, particularly in the face of challenges such as the COVID-19 pandemic.

Conclusion

Exploring the top PEO statistics and trends for 2024 provides invaluable insights into the evolving landscape of HR management and workforce solutions. As businesses navigate an increasingly complex and competitive environment, Professional Employer Organizations (PEOs) emerge as indispensable partners in driving efficiency, compliance, and strategic growth.

Throughout this comprehensive exploration, we’ve delved into a multitude of compelling statistics and trends that underscore the profound impact of PEOs on businesses of all sizes and industries. From impressive growth rates to substantial cost savings, and from enhanced employee satisfaction to improved business outcomes, the data paints a clear picture of the value proposition offered by PEO partnerships.

One of the most striking findings is the consistent growth trajectory of the PEO industry, with both the number of PEOs and the number of PEO Worksite Employees (WSEs) experiencing substantial annual increases. This growth reflects the growing recognition among businesses of the benefits of outsourcing HR functions to specialized providers, allowing them to focus on their core competencies while leveraging the expertise and resources of PEOs.

Furthermore, the statistics reveal a strong correlation between PEO engagement and various positive outcomes, including accelerated revenue growth, higher levels of employee satisfaction, and increased likelihood of business survival. Businesses that partner with PEOs consistently report lower HR administration costs, higher revenue growth rates, and greater overall satisfaction with their HR management.

Moreover, the data highlights regional trends in PEO adoption, with certain states emerging as key markets for PEO services. States such as Florida, Texas, California, and New York lead the pack in terms of PEO client concentration, reflecting both the diverse business landscapes and the strategic importance of these regions for PEO providers.

As we look ahead to the remainder of 2024 and beyond, it’s clear that PEOs will continue to play a pivotal role in shaping the future of HR management. With their proven track record of delivering tangible value, driving business growth, and ensuring compliance with ever-evolving regulations, PEOs are well-positioned to remain essential partners for businesses seeking to optimize their workforce strategies.

In conclusion, the latest PEO statistics and trends underscore the transformative impact of PEO partnerships on businesses’ HR functions and overall success. By staying informed and leveraging the insights provided in this analysis, HR professionals can make informed decisions and harness the full potential of PEOs to drive their organizations forward in 2024 and beyond.

If you find this article useful, why not share it with your friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

If you are keen to find a job or internship, then click on 9cv9 Job Portal now.

People Also Ask

What is the percentage of PEO?

The percentage of PEO (Professional Employer Organization) typically ranges from 2% to 4% of a company’s total gross payroll, varying based on factors such as the size of the organization, industry, and specific services required.

What is the rate of PEO?

The rate of PEO (Professional Employer Organization) services can vary widely depending on factors such as company size, industry, location, and specific services needed. On average, PEO fees typically range from 2% to 12% of total annual payroll expenses.

Who has the largest PEO?

TriNet is one of the largest PEOs in the United States, serving over 16,000 clients and managing millions of employees. ADP TotalSource and Insperity are also notable contenders in the PEO industry.

Source: