Key Takeaways

- Comprehensive Budgeting Features: The top budget apps of 2025 offer all-in-one solutions, combining expense tracking, savings goals, and financial planning to help users stay on top of their finances.

- Customization and Flexibility: Many apps allow you to create custom categories, set spending limits, and track multiple accounts, making it easy to tailor your budget to fit your personal or family needs.

- User-Friendly and Secure: With intuitive interfaces, real-time alerts, and strong security features, these apps ensure that managing your finances is both easy and safe, no matter your experience level.

Managing personal finances has never been more critical than it is in 2025.

With rising global inflation, evolving spending habits, and the increasing complexity of modern financial systems, staying on top of your money is no longer optional—it’s a necessity.

Budgeting is the cornerstone of financial stability, and the digital era has made this process easier than ever with the advent of advanced budgeting apps.

These apps are no longer just simple tools for tracking expenses.

In 2025, the best budget apps have transformed into comprehensive financial assistants, offering powerful features like AI-driven insights, real-time synchronization with your bank accounts, personalized financial advice, and even tools for achieving sustainability goals.

Whether you’re looking to save for a specific goal, monitor your daily spending, or plan for long-term investments, there’s a budgeting app designed to meet your unique needs.

As we dive deeper into an age of technological innovation, the sheer number of options available can feel overwhelming.

From apps that focus on simplicity and user-friendliness to those equipped with advanced analytics and integrations, choosing the right one is crucial for effective financial management.

This guide aims to simplify your decision-making process by highlighting the top 10 best budget apps in 2025, based on their features, usability, affordability, and overall value.

Whether you’re a student trying to stretch your monthly allowance, a busy professional seeking streamlined expense tracking, or a family looking to align spending with savings goals, these apps cater to a wide range of users. They offer solutions that can help you:

- Gain clarity over your financial habits.

- Set achievable budgeting goals.

- Receive actionable insights to improve your money management.

This blog will not only review the best budget apps in 2025 but also provide insights into what makes a budgeting app effective and how these tools are evolving to meet the demands of modern users. From integration with AI technologies to enhanced security features, these apps are designed to give you more control over your finances with minimal effort.

By the end of this guide, you’ll have a clear understanding of which app aligns best with your financial goals and how to maximize its potential for long-term success. So, whether you’re a seasoned budgeter or just starting your financial journey, this guide will equip you with the knowledge to make informed choices, ensuring you stay on track toward achieving financial freedom.

Before we venture further into this article, we would like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over nine years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of the Top 10 Best Budget Apps in 2025.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates. Find out more here, or send over an email to hello@9cv9.com.

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Top 10 Best Budget Apps in 2025: A Complete Guide

- YNAB

- EveryDollar

- Goodbudget

- PocketGuard

- Quicken Simplifi

- Empower Personal Dashboard

- Honeydue

- Monarch

- Household account book

- Spendee

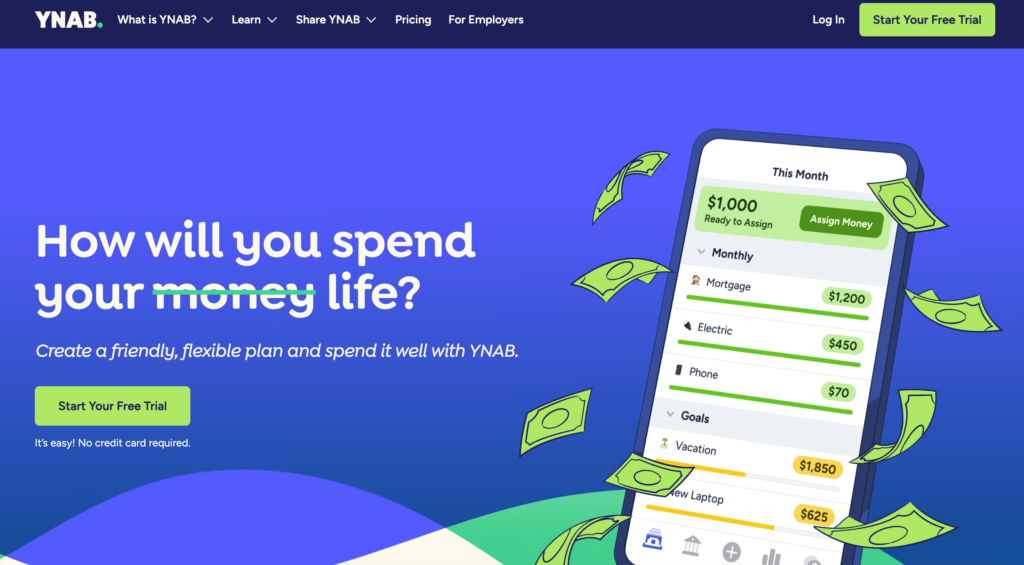

1. YNAB

YNAB (You Need a Budget) has consistently ranked as one of the most effective tools for personal finance management, and in 2025, it continues to be a game-changer. This app’s standout feature is its adherence to the zero-based budgeting system, which empowers users to proactively plan their financial future. Unlike traditional budgeting apps that focus primarily on tracking past transactions, YNAB prompts users to allocate every dollar they earn toward specific goals or categories—ensuring no money is left unaccounted for.

This proactive approach encourages a highly intentional relationship with money, helping users understand their spending habits, prioritize savings, and tackle debt with clarity. For example, as soon as you receive your income, YNAB guides you to allocate it across categories like bills, savings, investments, and discretionary spending. This methodology not only enhances awareness of financial habits but also helps users develop a disciplined approach to money management.

Feature-Rich and Versatile

YNAB’s extensive feature set makes it a hands-on tool designed for users who want total control over their finances:

- Real-Time Account Synchronization: YNAB links seamlessly with your bank accounts, credit cards, loans, and savings accounts to provide accurate, up-to-date financial data.

- Multi-Device Access: Available on desktop, mobile, iPad, and Apple Watch, the app ensures you can manage your budget from anywhere, even offline.

- Customizable Spending Categories: Users can tailor budgeting categories to reflect their unique financial goals and priorities.

- Powerful Goal Tracking: YNAB’s target-setting features allow you to visualize progress toward savings or debt repayment goals.

Educational and Supportive Tools

For those new to budgeting, YNAB’s robust educational resources set it apart. The platform offers free live workshops, tutorials, and expert advice to guide users in mastering the zero-based budgeting technique. Its dedicated customer support team is also known for providing exceptional assistance.

Advanced Security for Peace of Mind

In 2025, data security is paramount, and YNAB excels in this area. The app employs bank-grade encryption, two-factor authentication, and third-party audits to ensure user data remains secure.

Why YNAB is Ideal for Certain Users

YNAB is designed for individuals and families who are serious about taking control of their finances. While it requires consistent engagement to maximize its benefits, the rewards are substantial. Users who commit to the app’s system often report significant financial improvements—on average, $600 saved within the first two months and $6,000 saved within the first year, according to YNAB.

Key Features at a Glance

- Cost: $14.99 per month or $109 per year, with a 34-day free trial. College students get one year free with proof of enrollment.

- Unique Selling Point: Zero-based budgeting that assigns every dollar a “job.”

- Bank Synchronization: Links to bank accounts, credit cards, and loans for automated transaction imports.

- Cross-Device Compatibility: Accessible on iOS, Android, desktops, and Apple Watch.

- Ad-Free Experience: A distraction-free platform focused solely on money management.

- Debt Management Tools: Includes a loan payoff calculator to accelerate debt repayment.

- Reports and Analytics: Offers visually engaging graphs and charts to track spending and net worth.

Why You May Hesitate

While YNAB offers exceptional value, it isn’t for everyone. Its hands-on approach requires time and commitment, making it less suitable for users seeking a fully automated budgeting tool. Additionally, the subscription cost may deter those who prefer free options, though the savings potential often outweighs the expense.

Final Verdict

YNAB’s comprehensive feature set, combined with its zero-based budgeting philosophy, makes it one of the best budgeting apps in 2025. For individuals willing to invest time in their financial health, YNAB provides unparalleled tools and insights to achieve financial goals, manage debt, and build wealth—all within a secure and supportive platform.

2. EveryDollar

EveryDollar earns its place among the top budgeting apps by offering a streamlined approach to zero-based budgeting. Designed to assign every dollar you earn a specific purpose, the app provides users with a practical and intuitive framework for managing their finances. Developed by renowned financial expert Dave Ramsey, EveryDollar empowers users to take control of their spending, saving, and financial planning, regardless of their experience with budgeting. Its straightforward interface, coupled with goal-focused features, makes it a standout choice for those seeking a balance between simplicity and effectiveness.

What Makes EveryDollar Unique

EveryDollar adopts the zero-based budgeting methodology, ensuring that no dollar goes unaccounted for. The app offers two versions—free and premium—to cater to different user needs:

- Free Version: Users manually input their income and expenses, categorize their spending, and set reminders for bills. This hands-on approach fosters greater awareness of financial habits and encourages proactive money management.

- Premium Version: This paid tier elevates the experience by syncing with bank accounts, automatically importing transactions, and generating customized financial reports. It also offers tailored recommendations based on your spending patterns, providing actionable insights to refine your budget.

Key Features That Enhance Financial Management

EveryDollar’s suite of features is designed to simplify budgeting while delivering meaningful insights:

- Bank Integration: Securely link multiple financial accounts to automatically track transactions and monitor balances.

- Paycheck Planning: Optimize your income by mapping out spending across pay periods, ensuring you never overspend or overlook upcoming expenses.

- Financial Roadmap: Visualize your progress toward long-term financial goals, such as eliminating debt or increasing net worth, with tools that keep you motivated.

- Unlimited Budget Categories: Customize your budget to reflect your unique lifestyle, from everyday essentials to niche indulgences like hobbies or pet care.

Advantages of Choosing EveryDollar

- User-Friendly Design: The app’s clean interface makes budgeting accessible, even for beginners.

- Goal-Oriented Features: Whether you’re saving for a dream vacation or working toward becoming debt-free, EveryDollar keeps your objectives front and center.

- Flexibility for All Budgets: The free version is ideal for those starting out, while the premium version offers advanced tools for in-depth financial tracking and analysis.

Considerations Before Committing

While EveryDollar excels in simplicity and functionality, there are aspects to weigh before diving in:

- Limited Free Version: The free tier lacks advanced features like transaction syncing and custom reports, which are often essential for comprehensive budgeting.

- Premium Cost: At $79.99 annually or $17.99 monthly, the premium version may not fit tight budgets. However, the 14-day free trial offers an opportunity to test its features before committing.

Why EveryDollar Deserves Recognition

EveryDollar is more than just a budgeting app—it’s a tool for financial transformation. Its emphasis on assigning every dollar a job ensures accountability and fosters intentionality with money. With features tailored for both beginners and seasoned budgeters, it’s a versatile platform that adapts to your financial journey. Whether you’re striving to save, eliminate debt, or plan for major life milestones, EveryDollar provides the structure and insights needed to achieve success.

By making budgeting approachable and empowering users to take charge of their finances, EveryDollar stands as a testament to the power of simplicity and purpose in money management.

3. Goodbudget

Goodbudget brings the time-tested envelope budgeting system into the digital age, offering a modern yet hands-on approach to financial management. It stands out by prioritizing financial planning over reactive expense tracking, empowering users to allocate their income with purpose. Whether you’re managing household finances, saving for big goals, or tackling debt, Goodbudget provides a structured framework to keep your spending in check.

Unlike apps that automate every step, Goodbudget encourages active participation, fostering a deeper understanding of your financial habits. By allowing users to manually assign funds to virtual envelopes, it builds a stronger connection to their financial goals, making it a top contender for those who value intentionality in budgeting.

What Sets Goodbudget Apart

Goodbudget adopts a manual, interactive approach that aligns with the traditional envelope system while integrating digital convenience:

- Envelope System: Users allocate funds into virtual envelopes designated for specific expenses, such as groceries, rent, or savings. This method ensures every dollar has a job, minimizing overspending.

- Manual Input for Deeper Awareness: The app doesn’t connect directly to bank accounts, requiring users to manually input income, expenses, and balances. This hands-on process fosters accountability and encourages thoughtful financial decisions.

- Cross-Platform Access: Goodbudget is available on both mobile and web platforms, making it easy to manage your budget from anywhere. The app syncs seamlessly across devices, ensuring real-time updates for shared budgets.

Key Features and Benefits

Goodbudget offers a robust set of features tailored to promote effective budgeting and financial planning:

- Expense Tracking: Monitor spending, split transactions, and check balances for envelopes.

- Goal and Annual Envelopes: Save for long-term objectives by allocating funds to goal-specific envelopes.

- Debt Tracking: Track debt repayment progress and estimate when you’ll achieve a debt-free status.

- Scheduled Transactions: Automate recurring payments and fill envelopes in advance for better planning.

- Reports and Insights: Generate detailed reports on income, spending, and debt to evaluate your financial health.

- Budget Sharing: Share budgets with partners or family members, enabling collaborative financial management.

- Cloud Backup: Safeguard data with cloud storage and access it from multiple devices.

- Import Features: Upload bank statements or CSV files for a streamlined budgeting experience.

- Customizable Budget Periods: Adapt your budget to suit monthly, annual, or irregular financial cycles.

Why Couples and Families Love Goodbudget

Goodbudget shines as a collaborative tool for couples and families, offering:

- Shared Budgeting: Manage joint expenses and track shared financial goals with ease.

- Digital Envelopes for Big Goals: Save for significant milestones, like a wedding or home purchase, by prioritizing these goals within the app.

- Educational Resources: Access courses and articles to enhance financial literacy and budgeting skills.

Considerations Before Choosing Goodbudget

While Goodbudget is a versatile and powerful tool, it may not suit everyone:

- Manual Data Entry: Users must input every transaction manually, which may be time-consuming for those accustomed to automated apps.

- No Real-Time Syncing with Banks: Unlike some competitors, Goodbudget doesn’t sync directly with bank accounts, requiring users to regularly update account balances.

Pricing

- Free Version: Limited to one account, two devices, and 20 envelopes—ideal for basic budgeting.

- Premium Version: For $10 per month or $80 annually, users gain access to unlimited envelopes, up to five devices, and advanced features for comprehensive financial management.

Why Goodbudget is a Top Choice for 2025

Goodbudget excels in fostering intentional budgeting habits through its interactive envelope system. It’s particularly well-suited for users who value active participation in managing their finances or those seeking a collaborative platform for shared budgets. By combining simplicity with powerful tools like debt tracking, goal-setting, and detailed reporting, Goodbudget proves to be an indispensable ally in achieving financial stability and success.

For individuals and families who prioritize mindful spending and long-term financial planning, Goodbudget stands as a testament to the enduring value of the envelope budgeting method in today’s digital landscape.

4. PocketGuard

PocketGuard has earned its place as one of the top budgeting apps in 2025 by offering a blend of simplicity and robust financial oversight. Designed to make money management intuitive, it eliminates unnecessary complexity while delivering actionable insights to help users avoid overspending. PocketGuard’s standout features, particularly the “In My Pocket” tool, empower users to make informed financial decisions by showing exactly how much disposable income remains after accounting for essential expenses, bills, and savings goals.

For those who seek a no-nonsense approach to budgeting with powerful automation and bank connectivity, PocketGuard offers a reliable and user-friendly platform tailored to streamline your financial journey.

What Makes PocketGuard Unique

PocketGuard stands apart from other budgeting apps by integrating cutting-edge tools and algorithms that simplify financial management:

- “In My Pocket” Feature: This signature tool uses an advanced algorithm to calculate the funds available for discretionary spending after factoring in income, bills, necessities, and savings goals. It serves as a real-time safeguard against overspending.

- Automatic Expense Categorization: The app automatically organizes expenses into categories while offering users the flexibility to adjust them for greater customization.

- Account Synchronization: PocketGuard links directly to your bank accounts and credit cards, ensuring seamless transaction tracking and up-to-date account balances.

- Bill Tracking and Negotiation: Beyond simply tracking bill payments, PocketGuard takes it a step further by helping users negotiate better rates for their recurring expenses, offering a unique edge in cost management.

Key Features and Benefits

PocketGuard’s feature set is tailored to those seeking straightforward yet effective financial management tools:

- Savings Goal Integration: Create and track savings goals effortlessly, ensuring you stay on track for future plans or big purchases.

- Spending Alerts: Receive notifications when you approach or exceed category limits, promoting accountability and preventing budget overruns.

- Expense Hashtags: Group related expenses using hashtags for more intuitive reporting and tracking.

- Cross-Platform Availability: Offered on both iOS and Android, PocketGuard ensures compatibility with most devices, allowing users to manage finances on the go.

- Advanced Security Measures: Bank-level encryption, along with PIN codes and biometric security options like Touch ID and Face ID, safeguard sensitive information.

Who Should Use PocketGuard?

PocketGuard is ideal for individuals who need a straightforward app to hold them accountable and ensure they stay within their financial limits. Whether you struggle with impulse spending or need a tool to help track bills, PocketGuard provides clear, actionable insights into your financial situation. The app is particularly suited for:

- Budget-Conscious Users: Those who want to control their spending without being overwhelmed by unnecessary features.

- Savers: Individuals aiming to set and achieve savings goals while staying mindful of everyday expenses.

- Bill Trackers: Users who appreciate automated bill tracking and assistance with negotiating lower rates.

Cost Structure

PocketGuard is available in both free and premium versions:

- Free Version: Offers basic budgeting features suitable for everyday expense tracking.

- PocketGuard Plus: For $12.99/month or $74.99/year (equivalent to $6.25/month with a 50% savings), users unlock premium features such as advanced savings tools and unlimited categorization options.

Pros and Cons of PocketGuard

Pros

- User-friendly design with minimal learning curve.

- Real-time tracking of disposable income through the “In My Pocket” feature.

- Syncs with bank accounts and credit cards for seamless updates.

- Bill negotiation and savings goal tracking add value.

Cons

- Limited customization compared to some competitors.

- Premium features require a subscription.

Why PocketGuard is a Top Choice in 2025

PocketGuard excels in simplifying complex financial management tasks, making it an excellent tool for users who want a no-frills solution to track spending, manage bills, and save effectively. Its powerful automation, coupled with real-time insights, empowers users to make better financial decisions without unnecessary effort. By offering advanced features like savings goal integration and bill negotiation in an easy-to-use interface, PocketGuard strikes a balance between functionality and accessibility.

For anyone seeking to maintain financial discipline, avoid overspending, and achieve long-term savings, PocketGuard proves to be a standout app in the competitive landscape of budgeting tools.

5. Quicken Simplifi

Quicken Simplifi stands out as one of the top budgeting apps of 2025 due to its robust suite of features tailored for managing household finances. It goes beyond basic expense tracking by offering tools for collaborative budgeting, automated insights, and custom alerts, all designed to simplify financial management for families and individuals alike. With its intuitive interface and a focus on flexibility, Simplifi enables users to track their financial health effortlessly and make smarter financial decisions.

What Makes Quicken Simplifi Unique?

Unlike other budgeting apps, Quicken Simplifi provides an all-in-one solution that integrates budgeting, savings goals, and real-time financial tracking into a cohesive platform. Here’s why it excels:

- Collaborative Budgeting: Simplifi allows multiple users, such as partners or financial advisors, to join a shared budget, making it ideal for households or collaborative financial planning.

- Unlimited Savings Goals: Users can create and manage an unlimited number of savings goals across their existing accounts. These goals are seamlessly integrated into the budgeting plan, allowing for effortless savings without needing new accounts.

- Customizable Alerts: Real-time notifications keep users informed about unusual transactions, upcoming bills, or spending thresholds, ensuring they remain in control of their finances.

- Insightful Reports: Pre-built reports provide valuable insights into spending, income, net savings, and even investment performance, with options to filter and customize data for specific time frames.

Key Features and Benefits

- The Spending Plan:

Simplifi automatically analyzes all linked accounts, income, bills, and expenses to generate a personalized and flexible budget. This dynamic spending plan allows users to track their financial status in real time and make adjustments as needed to stay on track. - Automatic Transaction Categorization:

Transactions are automatically categorized for streamlined expense tracking, reducing manual effort while providing a clear overview of spending habits. - Reports Packed with Insight:

Simplifi offers detailed reports that help users visualize their financial progress. Whether it’s spending patterns, income trends, or investment performance metrics like Time-Weighted Return (TWR) and Internal Rate of Return (IRR), these reports empower users to make data-driven decisions. - Unlimited Savings Goals:

Simplifi is uniquely designed to encourage savings without complexity. Users can set, adjust, or pause multiple savings goals across their accounts, incorporating them directly into their budgets to ensure financial growth. - Real-Time Alerts:

Customized alerts notify users of critical financial updates, such as unexpected transactions or balances nearing limits, fostering a proactive approach to financial management.

Who Should Use Quicken Simplifi?

Quicken Simplifi is best suited for families, couples, or individuals seeking a comprehensive tool to manage household finances collaboratively. Its ability to integrate all financial elements into a single platform makes it ideal for:

- Families: Streamline shared budgets and monitor expenses across multiple accounts.

- Planners: Gain insights into financial trends and make informed decisions with detailed reports.

- Savers: Stay motivated with unlimited and easily adjustable savings goals.

Pros and Cons of Quicken Simplifi

Pros

- Comprehensive financial management in a single platform.

- Unlimited savings goals integrated into budgeting plans.

- Real-time alerts for better oversight and accountability.

- Detailed reports for smarter financial decisions.

Cons

- No free trial available, which may deter some users.

- Subscription pricing varies depending on the purchase platform (App Store, Google Play, or website).

Cost Structure

Quicken Simplifi operates on a subscription-based model with pricing available through its website or app stores. While there isn’t a free trial, the subscription cost unlocks a wide range of premium features designed to enhance financial clarity and control.

Why Quicken Simplifi is a Top Budget App in 2025

Quicken Simplifi earns its spot among the top budgeting apps of 2025 due to its exceptional ability to provide clarity, flexibility, and collaboration in household financial management. By offering a comprehensive view of accounts, automated insights, and actionable tools, Simplifi empowers users to confidently handle their finances. Whether you’re tracking expenses, saving for future goals, or analyzing investments, Simplifi delivers an all-encompassing solution for achieving financial wellness.

6. Empower Personal Dashboard

Empower Personal Dashboard, formerly known as Personal Capital, has solidified its position as one of the best budgeting apps in 2025 due to its unique combination of wealth management and spending tracking features. While primarily designed as an investment tool, its budgeting capabilities cater to individuals who seek a detailed understanding of their financial health. The app seamlessly integrates multiple accounts, provides a clear snapshot of spending patterns, and delivers advanced tools for monitoring net worth and planning for retirement.

What Sets Empower Personal Dashboard Apart?

Empower Personal Dashboard excels by providing a holistic view of finances, consolidating everything from basic banking to complex investments into one interface. Here’s why it stands out:

- Comprehensive Account Integration: Users can link all financial accounts, including checking, savings, credit cards, mortgages, loans, IRAs, 401(k)s, and investment portfolios, to gain a unified view of their financial landscape.

- Customizable Spending Snapshots: The app categorizes transactions automatically, allowing users to track monthly spending by category and adjust categories to suit their preferences.

- Net Worth Tracker: Empower offers a clear calculation of net worth, helping users understand their financial position and make data-driven decisions.

- Advanced Retirement Planning Tools: With a retirement planner and calculator, users can test hypothetical scenarios to ensure they stay on track for their retirement goals.

- Investment Insights: The app compares the current portfolio allocation to target allocations designed to optimize returns while minimizing risks.

Key Features and Benefits

- Unified Financial Management

Empower Personal Dashboard provides a centralized platform where users can monitor all their financial accounts in one place. This integration eliminates the need for multiple apps, offering a streamlined experience for managing everything from everyday spending to long-term investments. - Net Worth Tracking

The app’s net worth tracker is a standout feature, enabling users to see the difference between their assets and liabilities. This metric serves as a foundation for making informed decisions about budgeting, saving, and investing. - Spending and Budgeting Tools

While primarily an investment tool, Empower includes essential budgeting features. Users can view spending trends, categorize transactions, and monitor monthly expenses by category or merchant. This functionality allows for automatic tracking and ensures users can adjust their financial habits as needed. - Retirement Planning

Empower’s retirement tools offer unparalleled value for individuals aiming to secure their financial future. With the retirement planner, users can determine whether they are on track for their desired retirement age, while the calculator allows for scenario testing to refine their strategies. - Investment Monitoring

The app provides sophisticated investment insights, comparing the current portfolio allocation to recommended target allocations. This feature ensures that users can optimize their investment strategy to align with their financial goals while minimizing unnecessary risks. - Top-Tier Security Measures

Empower prioritizes the security of user data. With multiple layers of encryption and a dedicated security team, the app ensures financial information remains private and protected.

Who Should Use Empower Personal Dashboard?

Empower Personal Dashboard is ideal for individuals seeking a balance between tracking everyday expenses and managing long-term wealth. It is particularly suited for:

- Investors: Those who want detailed insights into their portfolios alongside basic budgeting tools.

- Retirement Planners: Individuals focused on creating and achieving retirement goals.

- Holistic Financial Managers: Users looking for an all-in-one platform to monitor banking, debt, and investments seamlessly.

Pros and Cons of Empower Personal Dashboard

Pros

- Comprehensive integration of accounts for a unified financial view.

- Advanced tools for net worth tracking and retirement planning.

- Customizable spending categories for better budget management.

- Free to use, with no subscription fees.

Cons

- Limited in-depth budgeting capabilities compared to specialized apps.

- Focus on investment tools may not appeal to users seeking granular spending analysis.

Cost Structure

Empower Personal Dashboard is entirely free to use, making it an excellent choice for individuals seeking advanced wealth management tools without the burden of subscription fees.

Why Empower Personal Dashboard is Among the Best Budgeting Apps

Empower Personal Dashboard stands out in 2025 for its ability to blend investment insights with essential budgeting tools. While it may not cater to users seeking ultra-detailed budgeting features, its strength lies in its holistic approach to financial management. By offering tools for tracking wealth, analyzing spending, and planning for the future, Empower ensures users have everything they need to achieve their financial goals—all within a secure and user-friendly platform.

7. Honeydue

Honeydue has carved a niche as one of the best budgeting apps for couples by addressing the unique financial management needs of partnerships. Whether you’re newly cohabitating or celebrating decades together, Honeydue offers a collaborative platform that allows couples to align their financial goals. Its intuitive design promotes transparency, encourages communication, and helps couples stay on top of their shared and individual finances.

What Makes Honeydue Stand Out?

Honeydue distinguishes itself by fostering financial collaboration. Unlike other budgeting apps, it is specifically tailored to manage joint finances while respecting individual preferences. Its features encourage accountability, financial planning, and real-time communication between partners.

Key Features and Benefits

1. Comprehensive Financial Synchronization

Honeydue enables both partners to sync a variety of financial accounts, including:

- Bank accounts

- Credit cards

- Loans

- Investments

The app supports over 20,000 financial institutions across five countries, ensuring accessibility for a broad audience. Importantly, it allows users to control how much financial information they share, offering flexibility for couples at different stages of their relationship.

2. Expense Categorization and Budgeting Tools

The app automatically categorizes expenses, saving time and effort. For greater customization, users can create their own categories to reflect specific spending habits. Honeydue’s budgeting tools let couples set monthly spending limits on each category, ensuring financial goals remain attainable. Alerts notify both partners when spending approaches or exceeds these limits, promoting accountability.

3. Bill Coordination and Payment Reminders

Managing shared bills can often lead to misunderstandings, but Honeydue simplifies this process. The app sends timely reminders for upcoming bills to prevent missed payments or penalties. Whether it’s rent, utilities, or subscriptions, Honeydue ensures both partners stay informed.

4. Built-In Communication Tools

Honeydue strengthens financial collaboration with integrated chat features. Partners can discuss transactions, clarify spending, or simply send emojis to express their thoughts. This real-time communication fosters transparency and helps partners stay aligned on their financial journey.

5. Strong Security Measures

Financial data security is a priority for Honeydue. The app employs industry best practices, including encryption and advanced authentication protocols, to safeguard user information and protect financial identities.

Why Honeydue Excels for Couples

Honeydue is not just a budgeting app; it’s a relationship tool that enhances financial communication and trust. By offering a shared platform, it helps couples work together to manage money effectively, regardless of whether their finances are fully merged or partially shared.

Ideal Use Cases

- Newly Cohabitating Couples: For those adjusting to shared financial responsibilities.

- Long-Term Partnerships: To streamline complex joint finances.

- Couples Seeking Transparency: For those who want to maintain clarity and accountability in their financial lives.

Pros and Cons

Pros

- Tailored for couples, promoting collaboration and communication.

- Supports a wide range of financial institutions across multiple countries.

- Allows for customizable spending categories and budget limits.

- Provides timely bill reminders to avoid penalties.

- Offers flexibility in sharing financial information.

Cons

- Focuses more on tracking past transactions than proactive financial planning.

- Lacks some advanced budgeting tools found in other apps.

Cost Structure

Honeydue is entirely free to use, making it an attractive option for couples seeking an efficient and cost-effective budgeting solution.

Why Honeydue is Among the Best Budgeting Apps

Honeydue shines as one of the top budgeting apps in 2025 due to its unique focus on couples and shared financial management. It combines intuitive tools, real-time communication, and robust security measures to help partners build a stronger financial foundation. Whether it’s tracking expenses, coordinating bills, or fostering transparency, Honeydue offers a comprehensive solution that meets the dynamic needs of modern relationships.

8. Monarch

Monarch has secured its place among the top 10 best budgeting apps in 2025, standing out as a robust, all-in-one financial management tool. Designed for individuals seeking a comprehensive approach to money management, Monarch offers features that extend beyond basic budgeting to encompass net worth tracking, investment analysis, and progress monitoring for major financial goals.

Why Monarch Excels as a Top Budgeting App

Monarch’s success lies in its ability to deliver a seamless and highly customizable financial management experience. With a user-friendly interface and advanced features, it enables users to track their financial health holistically, making it a standout choice for those who value precision, clarity, and control in their budgeting journey.

Key Features and Benefits

1. Advanced Financial Tracking Dashboard

Monarch provides users with an intuitive and visually appealing dashboard that consolidates critical financial data into one accessible platform. Key tools include:

- Net Worth Tracker: Gives users a real-time overview of their financial standing by calculating the difference between total assets and liabilities.

- Investment Portfolio Analysis: Breaks down and monitors investment performance, ensuring users stay informed about their financial growth.

- Recurring Expense Tracker: Tracks ongoing obligations like subscriptions, loan payments, or utility bills, ensuring nothing slips through the cracks.

2. Goal Setting and Progress Tracking

A unique highlight of Monarch is its robust goal management system. Users can:

- Create personalized financial goals, from saving for a vacation to paying off debt.

- Monitor progress through detailed analytics, ensuring accountability and motivation.

- Prioritize goals to align with changing financial priorities or life events.

3. Comprehensive Account Integration

Monarch simplifies financial tracking by seamlessly linking to multiple account types, including:

- Bank accounts and credit cards

- IRAs and 401(k)s

- Mortgages and personal loans

This integration ensures that all financial data is consolidated in one place, making it easier to manage and analyze.

4. Customizable Expense Categorization

Users can modify expense categories to reflect their unique spending habits. This flexibility ensures that budgets are tailored to individual lifestyles, providing a clearer picture of where money is going.

5. Collaboration Made Easy

Monarch supports collaboration by allowing users to invite others, such as a financial advisor or a partner, to view and contribute to financial plans. This feature is especially beneficial for shared financial goals or professional guidance.

6. Security You Can Trust

Monarch employs industry-leading security practices to safeguard user data. With advanced encryption and authentication measures, users can confidently manage their finances knowing their information is protected.

Availability and Cost

- Pricing:

- $8.33/month (billed annually at $99.99)

- $14.99/month (billed monthly)

- Platforms: Available on iOS (App Store), Android (Google Play), and a web version for desktop users.

Why Monarch is Among the Best Budgeting Apps in 2025

Pros

- Comprehensive dashboard consolidates all financial data in one place.

- Seamless syncing with diverse financial accounts.

- Detailed tools for goal creation, prioritization, and tracking progress.

- Allows collaboration at no additional cost, making it ideal for couples or those working with financial advisors.

- Tracks recurring expenses to provide a holistic financial overview.

Cons

- While feature-rich, its premium cost may be a consideration for budget-conscious users.

Conclusion

Monarch stands out as a premier budgeting app by offering an unparalleled suite of features that cater to both individual and collaborative financial management needs. Its powerful tracking capabilities, customizable tools, and focus on goal-oriented planning make it an excellent choice for users seeking a sophisticated, all-encompassing approach to personal finance in 2025.

9. Household Account Book

Household Account Book earns its place among the top 10 best budgeting apps of 2025, offering a unique blend of functionality and charm that appeals to those seeking an approachable, visually engaging tool to manage their finances. Its lighthearted design and straightforward features make it particularly suitable for individuals who may feel overwhelmed by overly complex financial apps.

Why Household Account Book Stands Out

This app sets itself apart with its whimsical approach to budgeting, featuring cartoon illustrations and interactive storytelling that transform the often mundane task of tracking expenses into a delightful experience. Designed for simplicity, it allows users to focus on key financial insights without requiring advanced financial knowledge or technical expertise.

Key Features and Benefits

1. Effortless Expense and Income Tracking

Household Account Book simplifies financial management by providing an easy-to-use platform for tracking income and expenses. Users can:

- Log earnings and spending quickly to see their net balance at the end of each month.

- Avoid financial surprises by maintaining an accurate, up-to-date record of their transactions.

2. Visual Spending Analysis

A standout feature of the app is its visually appealing pie chart breakdown. This feature provides:

- A clear, categorized view of spending habits.

- Insight into what percentage of income is allocated to different expense categories, such as food, entertainment, or savings.

3. Interactive Comic Storyline

The app incorporates a playful and motivational element with its ongoing comic story featuring two friends on a savings journey. Users unlock new parts of the story as they actively use the app, creating a sense of reward and encouragement to continue their budgeting efforts.

4. Downloadable Wallpapers

For users who enjoy customization, the app offers free downloadable wallpapers featuring its adorable mascot, Pisuke. This adds a personal and creative touch to the app experience, further enhancing its appeal.

Who Will Benefit Most from Household Account Book?

This app is ideal for:

- Individuals who prefer a lighthearted, non-intimidating approach to budgeting.

- People who struggle to save money and need a fun, motivational tool to stay on track.

- Those looking to understand their monthly spending habits in detail without navigating complicated charts or financial jargon.

- Fans of cute, visually engaging content who appreciate aesthetics in their financial tools.

Pros of Household Account Book

- Charming Visuals: The app’s mascot and cartoon illustrations make budgeting less daunting and more engaging.

- Simplicity: A user-friendly interface ensures that anyone, regardless of financial literacy, can easily track expenses and income.

- Motivational Features: The interactive comic story adds a gamified element, rewarding consistent usage.

- Spending Insights: The pie chart feature provides a clear overview of spending patterns, helping users identify areas to cut back.

- Free Extras: Downloadable wallpapers give users a fun way to personalize their experience.

Why It’s One of the Best in 2025

Household Account Book is more than just a budgeting app—it’s a tool that makes financial management enjoyable and accessible for everyone. By combining essential features with a playful, creative design, the app has found a unique way to encourage users to stay on top of their finances. Its simplicity and charm make it a perfect choice for those new to budgeting or looking for a tool that doesn’t feel like work.

Conclusion

For those who value simplicity and a touch of whimsy in their financial management tools, Household Account Book is a top contender. Its visually engaging approach, coupled with practical features like expense tracking and spending analysis, makes it an excellent choice for users of all ages. Whether you’re new to budgeting or seeking a more enjoyable way to manage your money, this app delivers on functionality and fun, ensuring it remains one of the best in 2025.

10. Spendee

Spendee has firmly established itself as one of the top 10 best budgeting apps in 2025, offering a comprehensive suite of features designed to cater to a wide range of financial needs. Its intuitive interface, customizable options, and support for various financial scenarios make it an excellent choice for individuals, couples, and families seeking a robust tool to manage their money effectively.

Why Spendee Stands Out

What makes Spendee exceptional is its ability to provide users with an all-encompassing view of their finances. Whether tracking cash flow, managing expenses across multiple currencies, or integrating with modern financial tools like crypto wallets and e-wallets, Spendee simplifies financial management while offering flexibility and convenience.

Key Features and Benefits

1. Comprehensive Cash Flow Management

Spendee ensures users always have a clear picture of their finances by:

- Syncing Unlimited Wallets: Track financial accounts, including traditional wallets, crypto wallets, and e-wallets, for a complete overview of your cash flow.

- Customizable Wallets: Create separate wallets for specific events, categories, or financial goals to organize your finances more effectively.

2. Powerful Budgeting Tools

The app empowers users to take control of their spending habits through:

- Budget Creation: Set and monitor budgets for different expense categories to ensure responsible spending.

- Expense Tracking Automation: Spendee Premium enables bank account syncing, automating expense tracking and minimizing manual input.

3. Multi-Currency Support

For individuals managing finances across borders or traveling frequently, Spendee offers:

- Seamless management of expenses in multiple currencies.

- Real-time conversions to help track spending in various regions.

4. Collaborative Financial Management

Spendee allows users to share wallets with a partner, spouse, or family member, making it an ideal choice for:

- Joint financial planning.

- Tracking shared expenses, such as household bills or event budgets.

5. Flexible Subscription Options

Spendee caters to diverse financial needs and budgets with multiple subscription plans:

- Spendee Plus: At $14.99/month, it provides unlimited wallet connections, budget setting, and advanced cash flow insights.

- Spendee Premium: For $22.99/month, users unlock the full suite of features, including automated expense tracking via bank account syncing.

- Free Version: Ideal for users seeking a straightforward budgeting tool, it enables manual income and expense tracking with no upfront cost.

6. Trial Period for New Users

Spendee offers a 7-day free trial for all plans, allowing users to explore its premium features and determine the best fit for their financial needs.

Why Spendee is One of the Best in 2025

Spendee’s ability to adapt to various financial scenarios makes it an invaluable tool for anyone looking to streamline their budgeting process. Its innovative features, such as crypto wallet integration and multi-currency support, ensure it remains relevant in an increasingly digital financial landscape. Additionally, the app’s flexibility in subscription plans and its focus on collaborative financial management set it apart as a leader in the budgeting app space.

Conclusion

Spendee is not just a budgeting app—it’s a versatile financial management platform designed to meet the needs of modern users. Whether you’re an individual looking to gain control over your spending, a couple managing joint finances, or someone juggling expenses across different currencies, Spendee delivers a tailored experience that simplifies budgeting. With its comprehensive features, intuitive design, and flexibility, Spendee rightfully earns its spot as one of the best budgeting apps of 2025.

Conclusion

In 2025, managing personal finances has never been more accessible, thanks to the remarkable advancements in budgeting apps. Whether you’re an individual striving to track expenses, a couple looking to coordinate financial goals, or a family seeking to simplify household budgeting, these top 10 budget apps provide tailored solutions for diverse financial needs. This guide has showcased the standout features, unique benefits, and innovative tools that make these apps indispensable for effective money management in a fast-paced world.

Why Budget Apps Matter in 2025

The complexity of modern finances—spanning from multiple income streams to cryptocurrencies and international transactions—requires smarter and more dynamic tools than ever before. Budget apps are no longer simple expense trackers; they have evolved into comprehensive financial platforms offering:

- Automated tracking of income, expenses, and savings.

- Goal-setting features to motivate and guide long-term financial planning.

- Real-time insights into cash flow, spending habits, and net worth.

- Customizable options to adapt to individual and shared financial situations.

These apps are not just tools—they are essential companions in achieving financial independence and stability.

Tailored Choices for Every Need

Each app highlighted in this guide serves a specific audience with unique priorities:

- Honeydue supports couples in harmonizing their finances, fostering transparency and teamwork.

- Monarch excels with its advanced tracking and goal-setting tools, making it a powerhouse for individuals with diverse financial portfolios.

- Household Account Book appeals to users who appreciate simplicity, delightful visuals, and motivational elements like storytelling.

- Spendee provides unparalleled flexibility for users managing multiple wallets, currencies, and even cryptocurrencies.

These examples underscore how varied and versatile budget apps have become, offering solutions for nearly every financial scenario.

How to Choose the Right Budget App

Selecting the best budget app depends on understanding your financial goals, habits, and lifestyle:

- For Collaborative Management: Apps like Honeydue and Spendee allow shared wallets and transparent communication, making them ideal for couples or families.

- For Advanced Financial Planning: Monarch stands out with features like investment tracking and net worth monitoring, perfect for users with complex financial needs.

- For Simplicity and Motivation: Household Account Book offers user-friendly functionality and charming storytelling elements, motivating users to save more.

- For Multi-Currency and Crypto Support: Spendee’s ability to handle diverse financial instruments ensures it meets the needs of global users and tech-savvy individuals.

Evaluate your requirements, explore free trials, and prioritize apps that align with your financial aspirations.

The Future of Budgeting Apps

As technology continues to evolve, budgeting apps are poised to become even more sophisticated, incorporating features like AI-driven financial insights, advanced predictive analytics, and seamless integration with emerging financial tools. These innovations will further enhance the ability of users to make informed financial decisions and achieve their goals with greater ease.

Empowering Financial Success in 2025 and Beyond

The top 10 budget apps of 2025 offer more than just convenience—they empower users to take control of their finances, reduce stress, and work toward a financially secure future. By leveraging the advanced features and tools these apps provide, anyone can build better financial habits, save smarter, and plan effectively for short- and long-term goals.

Budgeting in 2025 is no longer about tedious spreadsheets or manual calculations. With the right app at your fingertips, managing money becomes a seamless, engaging, and highly rewarding experience. Whether you’re just starting on your financial journey or looking for advanced tools to optimize your portfolio, one of these apps is ready to meet your needs and help you thrive financially.

Embrace the future of budgeting—download one of these top apps today and take the first step toward mastering your finances in 2025.

If you find this article useful, why not share it with your hiring manager and C-level suite friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

People Also Ask

What are the best budget apps for 2025?

The top budget apps in 2025 include Mint, YNAB, PocketGuard, and Quicken Simplifi, which offer features like expense tracking, goal setting, and automated budgeting to help you manage your finances effectively.

How do budget apps help with personal finance?

Budget apps simplify personal finance by tracking income, expenses, and savings goals, providing users with insights into their financial habits. They offer real-time tracking and alerts for upcoming bills and overspending.

Can budget apps track multiple accounts?

Yes, many budget apps, like Mint and Empower, allow users to link and manage multiple accounts, including checking, savings, credit cards, investments, and loans, for a holistic view of their finances.

Are budget apps free?

Several budget apps, such as Mint and Honeydue, are free to use with essential features. However, premium versions like YNAB and Spendee offer additional features like advanced goal setting and syncing to bank accounts for a subscription fee.

How do I set up a budget with a budget app?

To set up a budget, link your financial accounts to the app, categorize your income and expenses, set spending limits for each category, and track your progress regularly to stay within your budget.

Can I track my savings goals with a budget app?

Yes, most budget apps allow you to set and track savings goals. Apps like YNAB and Simplifi even let you allocate savings goals to specific accounts, helping you monitor progress and stay motivated.

What is the best budget app for couples?

Honeydue is ideal for couples, allowing both partners to track joint finances, set limits on categories, and send bill reminders. It also enables syncing bank accounts and loans and provides a platform for communication between partners.

Which budget app is best for managing investments?

Empower Personal Dashboard is great for managing investments, offering features like portfolio tracking and net worth calculation. It also connects to various accounts like IRAs, 401(k)s, and brokerage accounts.

Are there budget apps for small businesses?

While most budget apps focus on personal finance, some apps like Mint and QuickBooks offer small business features, such as tracking business expenses, categorizing income, and generating financial reports.

What are the benefits of using a budget app?

Budget apps provide numerous benefits, including automatic expense tracking, real-time alerts for overspending, easy-to-understand reports, and the ability to set and track savings goals, helping you improve financial discipline.

Can budget apps help with debt repayment?

Yes, budget apps like Mint and YNAB allow you to track your debt payments, set goals for reducing debt, and monitor progress. They also provide insights into how much you owe and how long it will take to become debt-free.

Are budget apps secure?

Most budget apps use encryption and industry-standard security practices to protect your financial data. Apps like Empower and Mint prioritize user privacy by using multiple layers of security.

What features should I look for in a budget app?

When choosing a budget app, look for features like expense tracking, goal setting, account syncing, customizable categories, real-time alerts, and investment tracking to ensure it meets all your financial management needs.

Can I use budget apps on multiple devices?

Yes, most budget apps are available across multiple platforms, such as mobile phones, tablets, and desktops, so you can manage your finances from anywhere at any time.

Do budget apps help with bill payments?

Yes, apps like Honeydue and Simplifi offer bill reminder features, notifying you and your partner when bills are due to ensure timely payments and avoid penalties.

How accurate are budget apps?

Budget apps are highly accurate in tracking income and expenses as long as the data is entered correctly. Many apps sync directly with financial institutions, ensuring real-time updates for precise financial management.

Can budget apps track cryptocurrency transactions?

Yes, apps like Spendee allow users to link their cryptocurrency wallets, enabling them to track crypto transactions alongside traditional financial accounts, giving a full overview of their finances.

How can I use a budget app to reduce spending?

By setting spending limits for each category, tracking your purchases, and receiving alerts when nearing those limits, budget apps help you become more conscious of unnecessary expenses and stick to your financial goals.

Do I need a bank account to use a budget app?

While having a bank account makes it easier to link accounts and track transactions automatically, you can still use most budget apps manually by entering your income and expenses without syncing a bank account.

What is the most user-friendly budget app?

Apps like Mint and Household Account Book are praised for their user-friendly interfaces, offering simple, straightforward navigation that makes managing finances easy for beginners.

Can I track investments with budget apps?

Yes, apps like Empower Personal Dashboard and Monarch allow you to link and track investments, offering tools to monitor your portfolio, compare allocations, and ensure you are on track to meet financial goals.

How do budget apps categorize expenses?

Budget apps automatically categorize your expenses based on transaction data from linked accounts. You can further customize these categories to better reflect your spending habits and financial goals.

What is the best app for saving money in 2025?

Simplifi and YNAB are excellent choices for saving money, as they offer features that allow you to set and track multiple savings goals, integrate with your accounts, and automatically allocate funds toward savings.

Are budget apps compatible with all banks?

Most major budget apps are compatible with over 20,000 financial institutions across different countries. However, it’s always a good idea to check the app’s compatibility with your specific bank before using it.

What is the difference between free and paid budget apps?

Free budget apps offer basic features like expense tracking and bill reminders, while paid apps provide additional functionalities like automatic syncing with bank accounts, advanced reporting, and the ability to manage investments.

How do I share my budget with someone else?

Apps like Honeydue and Monarch allow you to collaborate with a partner, financial advisor, or family member by sharing access to your budget and financial goals, making it easier to manage joint finances.

Are there budget apps for people with no financial experience?

Yes, apps like Household Account Book and Mint are designed for beginners, offering simple features like expense tracking and visual charts to help users understand their financial habits without overwhelming them.

How do I track my net worth with a budget app?

Apps like Empower and Monarch offer net worth tracking by calculating the difference between your assets (savings, investments) and liabilities (loans, credit card debt), giving you a clear picture of your financial health.

Can budget apps help me save for retirement?

Yes, Empower and Monarch have retirement planning tools that allow you to track progress towards retirement goals, estimate future savings, and adjust contributions to ensure you stay on track for retirement.

What is the best budget app for tracking multiple currencies?

Spendee is ideal for users who manage finances in multiple currencies, offering a feature that allows you to track different currencies in one app and even create wallets for specific events or categories.

How do budget apps handle tax-related information?

Most budget apps don’t handle tax filing directly, but they can generate reports on income, expenses, and deductions, which can be useful when preparing your tax returns.

Can I cancel my subscription to a paid budget app?

Yes, you can cancel your subscription to paid budget apps like YNAB or Spendee at any time, though some apps may offer refunds depending on the terms and conditions outlined during the sign-up process.

Do budget apps help me stick to my financial goals?

Yes, apps like YNAB and Simplifi help users set financial goals, track their progress, and make adjustments as needed to ensure they remain on track to meet their savings, debt repayment, and budgeting objectives.