Updated: 2023

Welcome to the dynamic realm of employment in Vietnam, where the fusion of rich cultural heritage and rapid economic growth has created a vibrant marketplace for businesses seeking to expand their horizons.

As globalization continues to connect businesses across borders, the prospect of hiring employees in Vietnam presents itself as an enticing opportunity.

However, like any international venture, understanding the nuances of the local job market, employment regulations, and cultural dynamics is imperative for a successful and seamless recruitment process.

In this extensively researched and meticulously crafted factsheet, we delve deep into the intricacies of hiring employees in Vietnam, providing you with the most up-to-date information to empower your decision-making.

Whether you’re a multinational corporation looking to establish a presence in this flourishing Southeast Asian country or a burgeoning startup eyeing the diverse talent pool Vietnam offers, this guide aims to be your go-to resource.

Before we venture further into this article, we like to share who we are and what we do.

About 9cv9

9cv9 is a business tech startup based in Singapore and Asia, with a strong presence all over the world.

With over seven years of startup and business experience, and being highly involved in connecting with thousands of companies and startups, the 9cv9 team has listed some important learning points in this overview of this comprehensive and updated factsheet.

If your company needs recruitment and headhunting services to hire top-quality employees, you can use 9cv9 headhunting and recruitment services to hire top talents and candidates.

Find out more here, or send an email to hello@9cv9.com.

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

Hiring Employees in Vietnam – Complete, Updated, and Informative Factsheet

- Basic Information

- Why Do People Hire Employees from Vietnam?

- Which Cities Do I Look for Employees in Vietnam?

- Which are the Top Universities to Hire Employees in Vietnam?

- Which are the Top Job Portals to Post a Job and Hire Employees in Vietnam?

- What is the Average Salary of a Vietnamese Employee?

- What are the Computations for Income Tax in Vietnam?

- What Are The Working Hours in Vietnam?

- What Benefits Must I Provide to My Employees in Vietnam?

- Paid Leaves for Vietnamese Employees in Vietnam

- How Do I Pay My Vietnamese Employee?

- Can Vietnamese Employees be Paid in Foreign Currencies?

1. Basic Information

Capital of Vietnam: Hanoi

Currency: Vietnamese Dong (VND)

Languages: Vietnamese, with English fast being adopted by the young population

Payroll Frequency: Monthly

GDP per Capita (USD): 4,163.5 (2022)

Social Insurance Tax by Employer: 21.5%

Population: 98,926,979 (2023)

2. Why Do People Hire Employees from Vietnam?

In the global landscape of talent acquisition, Vietnam has emerged as a compelling destination for businesses seeking skilled professionals and a dynamic workforce.

From the flourishing tech hubs of Ho Chi Minh City to the industrious industrial sectors in Hanoi, the country offers a diverse pool of talent.

Let’s delve into the key factors that make hiring employees from Vietnam an increasingly popular choice.

Top 8 Reasons Why People Hire Employees from Vietnam

- Economic Growth and Stability

- Young and Skilled Workforce

- Cost-Effective Labor

- Government Support and Business-Friendly Policies

- Language Proficiency

- Low Cost of Living

- Strategic Geographical Location

- Tech and Innovation Hub

Economic Growth and Stability

- Between 2002 and 2022, GDP per capita increased 3.6 times, reaching almost US$3,700.

- Vietnam’s economic growth outpaced many other countries, solidifying its position as a key player in the global market.

Young and Skilled Workforce

- The median age in Vietnam was 31.6 years in 2020, which signifies a vibrant and energetic workforce.

- Over 60% of the population is under the age of 35, contributing to a tech-savvy and adaptable talent pool.

Cost-Effective Labor

- Vietnam offers competitive labor costs compared to many Western countries and even some Asian counterparts.

- The average monthly wage in Vietnam is significantly lower than in many developed countries, making it an attractive option for cost-effective talent acquisition

- The common minimum wage is VND 1,800,000 (USD 74).

Government Support and Business-Friendly Policies

- The Vietnamese government has implemented various reforms in recent years to create a conducive environment for foreign businesses.

Language Proficiency

- English proficiency is rising in Vietnam, especially among the younger population.

- According to the EF English Proficiency Index, Vietnam’s English proficiency has improved, ensuring effective communication in an international business setting.

Low Cost of Living

- Vietnam boasts a low cost of living compared to many Western countries, making it an attractive destination for expatriates and businesses seeking affordable operational expenses.

- The reasonable cost of living in Vietnam extends to accommodation, transportation, and daily necessities, contributing to a more economically favorable environment for residents and businesses alike.

Strategic Geographical Location

- Vietnam’s location in Southeast Asia provides strategic access to the ASEAN market and facilitates global business connectivity.

- Vietnam’s strategic location has contributed to its role as an attractive destination for companies looking to establish regional headquarters.

Tech and Innovation Hub

- Ho Chi Minh City has emerged as a vibrant tech hub, fostering innovation and attracting startups and multinational corporations.

- The Vietnam Software and IT Services Association (VINASA) reported a substantial increase in the number of tech companies and startups in recent years, showcasing the country’s evolving tech ecosystem.

Also, read more on a personal account of why companies and startups are looking toward Vietnam for tech talents, developers, and engineers.

As businesses increasingly look beyond traditional borders for talent, Vietnam stands out as a beacon of opportunity.

The combination of economic growth, a youthful workforce, cost-effective labor, and government support creates a fertile ground for organizations seeking to expand their global footprint.

By understanding the factors that make Vietnam an attractive hiring destination, businesses can strategically leverage this potential and tap into a diverse and skilled pool of professionals.

3. Which Cities Do I Look for Employees in Vietnam?

Vietnam’s diverse landscape presents a myriad of opportunities for businesses looking to tap into the country’s skilled workforce.

From bustling metropolises to emerging tech hubs, the choice of the city plays a pivotal role in the success of your talent acquisition strategy.

Here’s a comprehensive guide to the cities you should consider when hiring employees in Vietnam.

Ho Chi Minh City (HCMC) – The Economic Powerhouse

- Ho Chi Minh City, formerly Saigon, is Vietnam’s economic powerhouse and the largest city in the country.

- HCMC is home to a diverse talent pool, particularly in industries such as finance, technology, and manufacturing.

Also, read our most complete guide on the top recruitment agencies in Ho Chi Minh City, Vietnam to get started engaging some top agencies to hire rare talents in Ho Chi Minh City, Vietnam.

Hanoi – The Political and Cultural Capital

- Hanoi, the capital of Vietnam, is renowned for its rich cultural heritage and historical significance.

- Hanoi’s workforce excels in fields such as government, education, and research, making it an ideal location for businesses in these sectors.

Da Nang – Emerging Tech Hub

- Da Nang is gaining recognition as an emerging tech hub in Vietnam.

- The city’s emphasis on technology and innovation has led to a growing pool of skilled professionals in the IT and software development sectors.

Can Tho – Mekong Delta’s Economic Hub

- Can Tho, located in the heart of the Mekong Delta, is a key economic hub in the southern region.

- The city’s economic significance makes it a prime location for businesses involved in agriculture, trade, and services.

Hai Phong – Thriving Industrial Center

- Hai Phong, situated in the north, is a major industrial and seaport city.

- Businesses in manufacturing, logistics, and shipping may find Hai Phong’s skilled workforce and strategic location advantageous.

Bien Hoa – Industrial Heartland in the South

- Bien Hoa, located in Dong Nai Province, is a key industrial center in southern Vietnam.

- The city’s proximity to Ho Chi Minh City and its industrial focus make it an attractive location for businesses involved in manufacturing and production.

In the quest for the right talent in Vietnam, understanding the unique dynamics of each city is paramount. Whether you’re drawn to the economic vibrancy of Ho Chi Minh City, the cultural richness of Hanoi, or the emerging tech scene in Da Nang, each city offers distinct advantages for businesses.

By aligning your hiring strategy with the strengths of these key cities, you can strategically position your organization to thrive in Vietnam’s dynamic and ever-evolving job market.

4. Which are the Top Universities to Hire Employees in Vietnam?

As businesses seek to tap into Vietnam’s growing talent pool, understanding the academic landscape and identifying top-notch universities becomes crucial.

Here’s an in-depth exploration of some of the leading educational institutions in Vietnam, known for producing skilled graduates ready to contribute to the workforce.

Vietnam National University, Hanoi (VNU-Hanoi)

- VNU-Hanoi is a prestigious institution and the flagship university in the country.

- The university excels in fields such as engineering, economics, and social sciences, producing graduates with a strong foundation in these disciplines.

Ho Chi Minh City University of Technology (HCMUT)

- HCMUT is a leading institution, especially renowned for its focus on technology and engineering.

- The university has consistently ranked high in engineering and technology programs, producing graduates sought after by industries driving innovation.

FPT University

- FPT University is a private institution known for its emphasis on technology and business education.

- FPT University collaborates closely with industry partners to ensure its programs align with current market needs, producing graduates with practical skills.

University of Da Nang (UD)

- The University of Da Nang is a multi-disciplinary institution with a strong emphasis on research and innovation.

- The university has gained recognition for its research output, making it an ideal source for graduates with a strong academic and research foundation.

Ton Duc Thang University (TDTU)

- TDTU is a dynamic university located in Ho Chi Minh City, known for its modern campus and diverse academic programs.

- TDTU places a strong emphasis on preparing students for the global workforce, making it an attractive source of talent with an international outlook.

Hanoi University of Science and Technology (HUST)

- HUST is a leading technical institution with a history dating back to 1956.

- HUST is recognized for its innovation and technology transfer initiatives, producing graduates with a strong entrepreneurial spirit.

In the pursuit of hiring top-tier talent in Vietnam, forging connections with renowned universities is a strategic approach.

Whether you’re looking for engineering expertise, business acumen, or research capabilities, these institutions serve as fertile grounds for cultivating the skilled professionals your organization needs.

By understanding the strengths and specializations of these universities, businesses can align their hiring strategies with the academic excellence that defines Vietnam’s emerging workforce.

5. Which are the Top Job Portals to Post a Job and Hire Employees in Vietnam?

In the evolving landscape of digital recruitment, staying abreast of the leading job portals is essential for businesses aiming to hire top-tier talent in Vietnam.

From established platforms to emerging players, including 9cv9, here’s a comprehensive guide to the prominent job portals where you can post job listings and engage with potential candidates.

9cv9

- Example: 9cv9 is an emerging job portal startup gaining popularity for its user-friendly interface and focus on connecting employers with skilled professionals.

- Key Features:

- Free job posting for cost-effective recruitment.

- Growing user base indicative of its potential influence in the job market.

- Best for hiring tech engineers, developers, and UX/UI designers.

VietnamWorks

- Example: VietnamWorks is a pioneering job portal with a strong reputation for connecting employers with a diverse range of talent.

- Key Features:

- Extensive candidate database across various industries.

- Advanced search and filtering options for targeted recruitment.

- Employer branding opportunities to enhance visibility.

JobStreet Vietnam

- Example: JobStreet, a well-established job portal in the region, maintains a dedicated platform for the Vietnamese job market.

- Key Features:

- Regional reach, allowing exposure to candidates across Southeast Asia.

- Employer branding tools for enhanced visibility.

- Customized solutions for companies of all sizes.

CareerLink.vn

- Example: CareerLink.vn is a local job portal known for its user-friendly interface and an extensive network of job seekers.

- Key Features:

- Industry-specific job categories for targeted recruitment.

- Featured employer options for increased visibility.

- Regular job fairs and events for networking opportunities.

ITviec

- Example: ITviec is a specialized job portal catering specifically to Vietnam’s IT and tech industry.

- Key Features:

- Niche specialization in the tech industry.

- Company profiles and reviews for transparent employer branding.

- Community engagement through tech events and forums.

- Example: LinkedIn, a professional networking platform, has gained significant traction in Vietnam as a tool for both job seekers and employers.

- Key Features:

- Extensive professional network for direct outreach to potential candidates.

- Employer branding opportunities through company profiles.

- Job posting and recruitment advertising options.

To learn more about Job Posting websites in Vietnam, read our top guide here: Top Free Job Posting Sites in Vietnam to Hire Employees.

By incorporating these top job portals, including the emerging player 9cv9, businesses can strategically position themselves to access diverse talent pools, enhance visibility, and streamline their recruitment processes in Vietnam’s competitive job market.

6. What is the Average Salary of a Vietnamese Employee?

National Overview

According to Statista, the average monthly income per capita in Vietnam was approximately 4.2 million VND (Vietnamese Dong), equivalent to around USD 200.

Industry-Specific Salaries

- In the technology sector, where the demand for skilled professionals is high, the average salary tends to be more competitive.

- Salaries can vary significantly based on the industry, with technology, finance, and manufacturing often offering higher compensation.

- Skilled professionals with in-demand expertise may command higher salaries.

Regional Variances

- Salaries in major cities like Ho Chi Minh City and Hanoi are generally higher than in smaller towns or rural areas.

- Employers may need to adjust salaries based on the location of the job to align with living expenses.

- Urban areas often offer a higher standard of living but come with increased costs.

Experience and Education Impact

- Professionals with advanced degrees or significant work experience may command higher salaries.

- A software developer with 1-3 years of experience earns an average monthly salary of USD 2,000, while a developer with 8-12 years of experience can earn up to USD 7,000 or more.

- Education, certifications, and years of experience contribute to salary differentials.

- Continuous learning and career advancement can positively impact earning potential.

How much would a Vietnamese Employee expect when moving or changing for a new job?

Typically, when Vietnamese employees consider transitioning to a new job, they often expect a salary increase ranging between 15% to 30%. This expectation aligns with their anticipation of enhanced career prospects, additional responsibilities, or a more favorable work environment.

How much would a Vietnamese Employee expect for an increase in salary after each year?

Typically, there will be a salary review process before the Tet or the Chinese New Year of the next year. Most Vietnamese employees will expect an increase of 10% to 20% of their current base salary.

Understanding the average salary landscape in Vietnam involves considering national averages, industry-specific data, regional variances, and the impact of experience and education.

Employers seeking to attract and retain top talent should stay informed about prevailing salary trends, keeping in mind the dynamic nature of the job market in Vietnam.

7. What are the Computations for Income Tax in Vietnam?

Navigating the intricacies of income tax computations is a crucial aspect of employment in Vietnam. Understanding the specific calculations and regulations that govern income tax is essential for both employers and employees to ensure compliance with Vietnamese tax laws.

This section delves into the detailed computations for income tax in Vietnam, shedding light on the factors that influence tax liability and providing clarity on the steps involved in determining taxable income.

Whether you are an employer seeking to fulfill tax obligations or an employee looking to comprehend your tax liabilities, this comprehensive exploration aims to demystify the complexities of income tax computations in the Vietnamese context.

Progressive Tax Rates

Vietnam employs a progressive tax system with multiple income brackets and corresponding tax rates. As of 2022, the tax rates range from 5% to 35%.

Taxable Income Components

- For a monthly income of 15 million VND (approximately USD 660), the taxable income is calculated after deducting specific allowances.

- Deductions for social insurance, health insurance, unemployment insurance, and a standard deduction of 9 million VND per month are considered.

Tax Exemptions and Incentives

- Vietnam offers specific tax exemptions and incentives, such as tax breaks for individuals working in certain geographical areas or industries.

- Understanding available exemptions and incentives can optimize tax planning strategies.

- Staying informed about updates to tax laws is crucial for leveraging available benefits.

Navigating income tax computations in Vietnam involves considering progressive tax rates, deductible components, annual settlements, and potential exemptions.

Individuals and businesses should stay abreast of tax regulations and seek professional advice to ensure accurate calculations and optimize their tax positions.

8. What Are The Working Hours in Vietnam?

In the vibrant professional landscape of Vietnam, understanding the nuances of working hours is pivotal for both employers and employees.

The structure of a workday significantly impacts productivity, work-life balance, and overall job satisfaction.

This section explores the working hours in Vietnam, offering insights into the standard practices, legal regulations, and cultural considerations that shape the country’s professional landscape.

Standard Working Hours

- The standard working week consists of 40 hours, typically spread across five days.

- This equates to an 8-hour workday, reflecting the conventional full-time employment structure.

- Overtime may be applicable for work exceeding these standard hours.

- The labor code states that normal working hours cannot exceed eight hours a day or 48 hours per week.

Flexible Work Arrangements

- Some industries and companies in Vietnam may adopt flexible work schedules, allowing employees to adjust their daily hours.

- Flexibility is becoming more prevalent, particularly in sectors accommodating remote or non-traditional work setups.

- Policies may vary between companies and industries.

Overtime and Compensation

- Vietnamese labor laws stipulate that overtime work exceeding the standard hours must be compensated at higher rates, with the exact rates varying based on factors such as the day of the week and whether the work is performed during normal working hours or on holidays.

- Employers are obligated to compensate employees for overtime work, fostering fair labor practices.

- Understanding the overtime policies specific to the industry and company is essential.

- The overtime work time cannot exceed 12 hours a day, 40 hours a month, and 200 hours a year.

- For overtime work time that exceeds 200 hours a year, there are some special conditions.

Industry-Specific Variances

- Industries such as manufacturing and retail may have different work hour norms compared to sectors like technology or finance.

- Work hour expectations can vary significantly between industries.

- Employers and employees should be aware of industry-specific norms and regulations.

Understanding the working hours in Vietnam involves recognizing the standard workweek, exploring flexible arrangements, and being aware of industry-specific variances.

As the landscape of work continues to evolve, staying informed about labor laws and company policies ensures a balanced approach to work hours and contributes to a healthy work-life equilibrium.

9. What Benefits Must I Provide to my Employees in Vietnam?

As businesses thrive in the dynamic economic landscape of Vietnam, understanding the essential benefits required by law is integral for fostering a positive employer-employee relationship.

This section explores the statutory benefits that employers are mandated to provide to their workforce in Vietnam.

Delving into both legal requirements and best practices, the aim is to equip employers with comprehensive knowledge about the benefits necessary for maintaining compliance, promoting employee welfare, and creating a supportive work environment.

Social Insurance

- Vietnamese labor laws mandate employers to contribute to social insurance for their employees. Employers have to contribute 17.5%, with Employees contributing 8%.

- Social insurance covers sickness, maternity, workplace accidents, retirement, and death.

- Social insurance is compulsory even for foreign workers in Vietnam.

- There is a cap on the wage used to calculate contributions, set at 20 times the common minimum wage for social and health insurance (currently VND 36 million or around US$1,488.53) and 20 times the regional minimum wage for unemployment insurance.

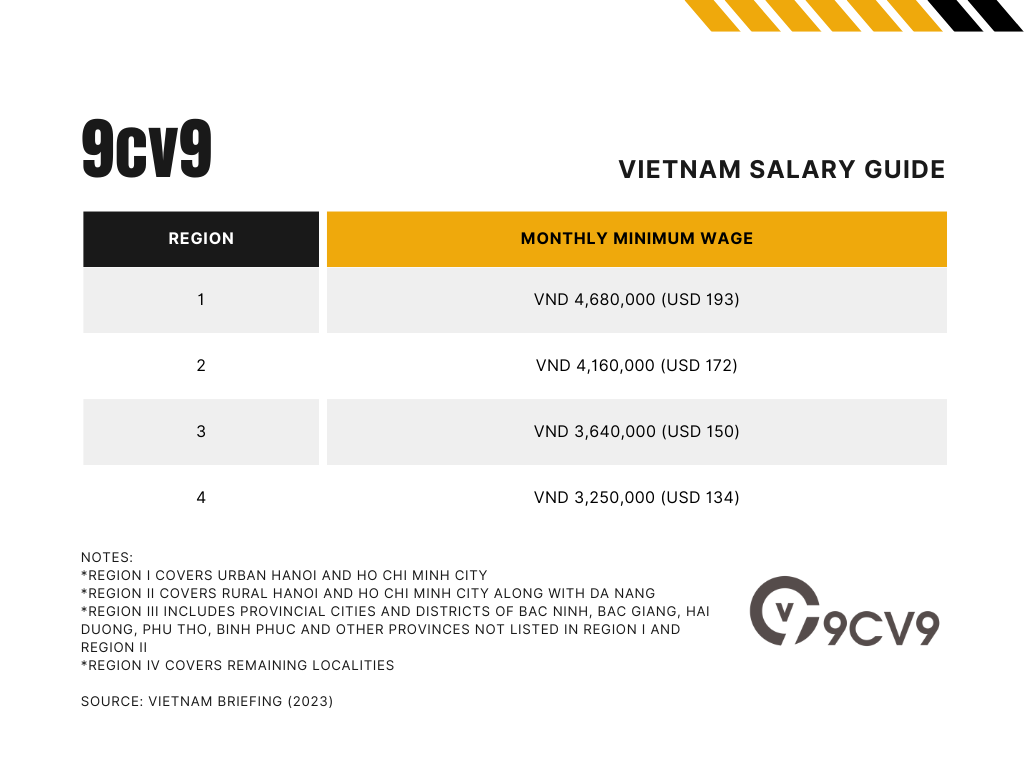

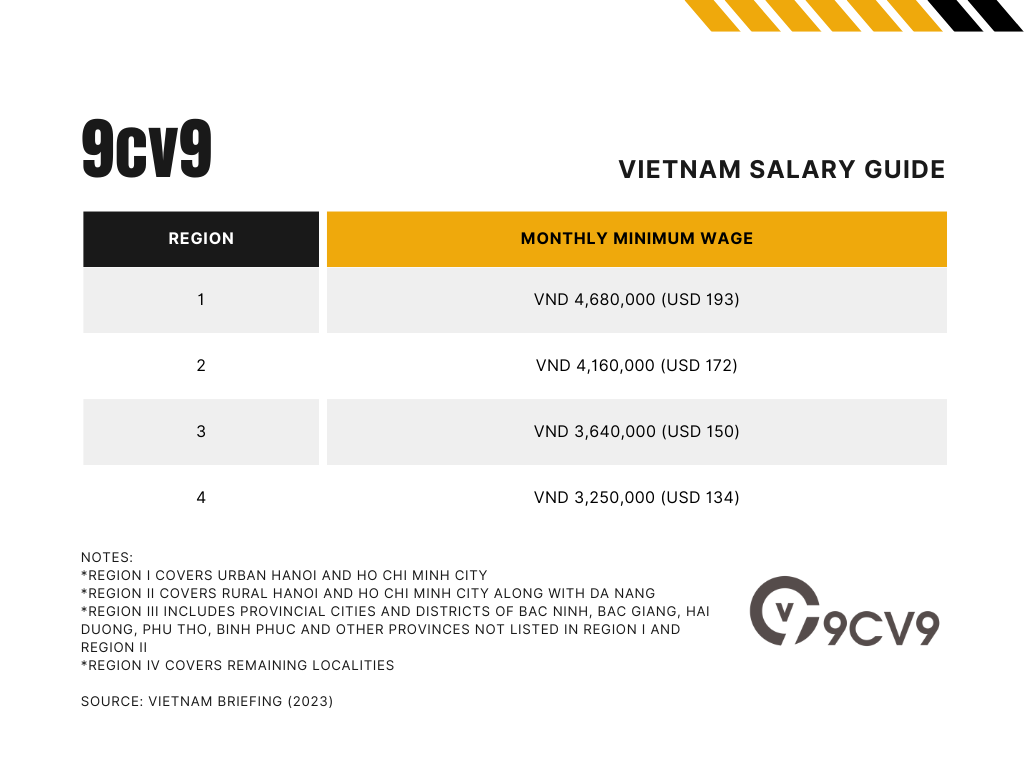

- The table below shows the minimum salary of each region.

To learn more about Social Insurance, read our top guide: The Ultimate Guide to Social Insurance in Vietnam: Everything You Need to Know.

Health Insurance

- Health insurance is compulsory in Vietnam, and employers are required to contribute to their employees’ health insurance. Employers are required to contribute 3% and Employees are required to contribute 1.5% of salary, certain allowances, and other regular payments.

- The amount used to compute the income for health insurance contribution is capped at 20 times the basic salary.

- Health insurance provides coverage for medical expenses and is crucial for employee well-being.

Unemployment Insurance

- Employers are obligated to contribute to unemployment insurance, providing financial support to employees during periods of job loss. The employer and employee contributions are 1% each on the income subject to the unemployment insurance contribution.

- Unemployment insurance offers a safety net for employees facing job loss.

- The amount used to compute the income for health insurance contribution is capped at 20 times the minimum regional salaries.

Trade Union Fees

- In Vietnam, trade union fees are compulsory contributions deducted from employees’ salaries, to support and finance the activities of the trade unions at various levels, including enterprise, industry, and national levels.

- As of 2023, the trade union fee is paid by the Employer and this is 1% of the taxable income by the Vietnamese employee.

- Not all companies need to pay this trade union fee with only enterprises with 10 or more workers needing to establish a trade union and pay the fees.

13th Month Bonus

- The 13th-month bonus, also known as the Tet bonus, is a customary annual bonus in Vietnam, equivalent to one month’s salary, typically provided to employees before the Vietnamese Lunar New Year (Tet) holiday.

- It is a significant cultural and financial tradition, demonstrating employers’ appreciation for their employees’ hard work throughout the year and aligning with the festive spirit of Tet.

Other Benefits and Allowances

- In addition to the mandatory benefits, companies may offer other benefits such as meal allowances, transportation allowances, and bonuses.

- While not mandated by law, additional benefits contribute to employee satisfaction and retention.

- Employers have flexibility in designing supplementary benefit packages.

Ensuring compliance with mandatory benefits is essential for employers in Vietnam.

The legal framework dictates contributions to social insurance, health insurance, and unemployment insurance, promoting the overall well-being of the workforce.

Understanding these requirements and considering additional benefits can contribute to a positive working environment and foster employee loyalty.

10. Paid Leaves for Vietnamese Employees in Vietnam

Navigating the intricacies of paid leaves is a pivotal aspect of employment in Vietnam, ensuring the well-being and work-life balance of the workforce.

This section explores the various categories of paid leaves available to Vietnamese employees, delving into maternity and paternity leave entitlements, annual leave policies, and special circumstances.

Paid Annual Leave

- Employees with 5 years or less of service are entitled to 12 days of annual leave, increasing with additional years of service.

- Employees working less than 1 year will have a prorated amount according to the months worked. For example, if the employee worked for 6 full months, he/she will be entitled to 6 days of paid annual leave.

- Employees can get an extra day of annual leave for every 5 years of working for the same company.

- Workers who fall under specific categories, including those who are underage, disabled, laboring under strenuous, toxic, or hazardous conditions, and individuals enduring harsh living conditions, are eligible for a leave entitlement of 14 days.

- Employees exposed to exceptionally demanding, unsafe, or perilous working conditions are eligible for 16 days of leave.

- In instances where an employee, as a consequence of termination or job loss, has not availed themselves of accrued annual leave or has remaining unused annual leave, the employer is obliged to remunerate the employee for the untaken leave days.

Other Paid Leave

- Leave with Full Pay for Personal Reasons:

- Marriage:

- Entitled to 3 days of leave with full pay.

- Marriage of Worker’s Children:

- Entitled to 1 day of leave with full pay.

- Death in the Family:

- Death of natural or adoptive father, mother, spouse, or birth or adopted children: 3 days with full pay.

- Marriage:

- Leave without Pay for Specific Family Events:

- Entitled to 1 day off without pay for:

- Death of paternal or maternal grandfather or grandmother, sibling.

- Marriage of father, mother, or sibling.

- Entitled to 1 day off without pay for:

Paid Sick Leave

Vietnamese employees are entitled to sick leave payments administered by the National Social Insurance department, contingent upon presenting a valid doctor’s letter.

The standard sick leave duration is a maximum of 30 days per month or 180 days per year, covered by Social Insurance.

However, certain companies may offer additional sick leave as an employment benefit, especially for less severe illnesses that may not necessitate a doctor’s visit, enhancing employee welfare beyond the statutory requirements.

- Sick Leave Entitlements Based on Social Insurance Premiums:

- Under 15 years of paid social insurance premiums: 30 days.

- Between 15 and under 30 years of paid social insurance premiums: 40 days.

- Full 30 years or more of paid social insurance premiums: 60 days.

- Sick Leave for Heavy, Hazardous, or Dangerous Occupations:

- Under 15 years of paid social insurance premiums: 40 days.

- Between 15 and under 30 years of paid social insurance premiums: 50 days.

- Full 30 years or more of paid social insurance premiums: 70 days.

- Sick Leave for Diseases Requiring Long-Term Treatment:

- Employees on the Ministry of Health-issued list of diseases requiring long-term treatment.

- Maximum of 180 days in a year, including holidays and weekends.

- If treatment extends beyond the specified period, entitlement to continue sick leave, not exceeding the period of social insurance premium payment.

Public Holidays

- New Year’s Day (1st of Jan): 1 day

- Lunar New Year (Jan-Feb): 5 days

- Hung Kings Commemoration Day: 1 day

- Victory Day: 1 day

- International Labour Day: 1 day

- National Day: 2 days

- Foreign workers in Viet Nam are entitled to 1 traditional New Year’s day and 1 National Day of their country.

Maternity Leave

- Female employees are entitled to a 6-month leave before and after childbirth.

- Additional leave of 1 month per infant for mothers of twins or more.

- Pregnancy-Related Leave:

- The leave period before childbirth is capped at 2 months.

- Duration of leave increases with the progression of pregnancy:

- 1 to 3 months of pregnancy: 20 working days off.

- 3 to 6 months of pregnancy: 40 working days off.

- Over 6 months of pregnancy: 50 working days off.

- Miscarriage or termination of pregnancy grants women leave.

- Salary During Maternity Leave:

- Law on Social Insurance stipulates 100% of the average salary during the 6-month maternity leave.

- Negotiable additional leave days if a female employee wishes for a longer absence.

- Childcare Allowances and Benefits:

- Lump-sum allowance is equivalent to two months of the common minimum salary per child after childbirth or adoption.

- Female employees with children under twelve months old are entitled to sixty minutes per working day for childcare.

- Return to Work Requirements:

- If a woman chooses to return to work after four months of maternity leave, a permission document from a qualified medical center stating fitness for work is required.

Paternity Leave

- Male employees paying social insurance can take paternity leave within the first 30 days of the baby’s birth.

- Paid Leave for Normal and Surgical Deliveries:

- Five days of paid leave for a normal delivery.

- Seven days of paid leave for a surgical delivery.

- For twin births, the leave allowance is increased to 10 to 14 days.

- For multiple births, three working days off for each baby after the third one.

- Special Circumstances:

- If the male employee is the sole participant in the social insurance program and the baby’s mother faces health risks or passes away, the male employee is entitled to leave until the child turns six months.

- Lump Sum Allowance:

- Male employees receive a lump sum of VND 2,980,000 (or USD 123) per child, equivalent to double the basic salary.

Unraveling the intricacies of paid leaves for Vietnamese employees is paramount for fostering a harmonious and employee-friendly work environment.

From maternity and paternity entitlements to annual leave policies, this guide has navigated through the diverse landscape of paid leaves in Vietnam.

Ensuring a comprehensive understanding of these provisions is not only a legal necessity for employers but also a means to prioritize the well-being and work-life balance of the workforce.

Whether you are an employer striving for compliance or an employee seeking clarity on your entitlements, this exploration serves as a valuable resource in navigating the nuanced realm of paid leaves in the Vietnamese professional landscape.

11. How Do I Pay My Vietnamese Employee?

Effectively managing salary disbursements for Vietnamese employees involves understanding the intricacies of payment methods, legal obligations, and considerations unique to the local context.

This section navigates the complexities of paying Vietnamese employees, covering everything from preferred payment methods and frequency to compliance with tax regulations.

Payment Methods and Frequency

- Payment for Hourly, Daily, or Weekly Wage Workers:

- Payment upon completion of the respective work hour, day, or week.

- Lump sum payment option, agreed upon by both parties, with a maximum payment period of 15 days.

- Payment for Monthly Wage Workers:

- Monthly or semi-monthly wage payment for those receiving a monthly wage.

- Payment timing is to be agreed upon by both parties, adhering to a fixed cyclical period.

- Payment for Piece Work or Piece Rate Workers:

- Payment frequency as per agreement between the employer and the worker.

- Workers engaged in work spanning multiple months are entitled to a monthly wage advance for completed work during the month.

- Force Majeure and Delayed Payment:

- In cases of force majeure causing unavoidable delays, the employer must take all possible measures.

- The delay in wage payment is not to exceed 30 days.

- Suppose payment is delayed by 15 days or more. In that case, the employer is obligated to compensate the worker with an amount at least equal to the interest on the deferred payment, calculated based on the applicable deposit interest rate for one month as announced by the bank where the enterprise holds its wage payment account at the time of payment.

Compliance with Tax Regulations

- Employers must deduct income tax from employees’ salaries and remit it to the relevant authorities as per Vietnamese tax regulations.

- Complying with tax regulations is crucial for both employers and employees.

- Employers must accurately calculate and withhold income tax based on applicable rates.

Consideration of Benefits and Allowances

- In addition to base salaries, employers may need to disburse other benefits and allowances, such as bonuses or transportation allowances.

- Ensuring timely and accurate payment of benefits contributes to employee satisfaction.

- Employers should clearly communicate the structure of salary components, including any additional allowances.

Effectively paying Vietnamese employees involves adhering to legal requirements, embracing digital payment methods, ensuring tax compliance, and transparently managing additional benefits.

Employers should prioritize timely and secure salary disbursements to foster a positive work environment and promote financial well-being among their workforce.

12. Can Vietnamese Employees be Paid in Foreign Currencies?

Understanding the legal framework, potential challenges, and preferences of the local workforce is essential for effective payroll management.

This section explores the nuances of paying Vietnamese employees in foreign currencies, shedding light on the regulations governing this aspect and offering insights into the practical implications for both employers and employees.

Legal Framework

- Salaries have to be paid in the local currency, Vietnamese Dong (VND), even if they work for foreign companies.

- Salaries denominated in US Dollars must be converted into Vietnamese Dong to comply with local regulations

- Mandatory components such as social insurance, personal income tax, and trade union payments must undergo conversion into Vietnamese Dong, with the official foreign exchange rate established by the Vietnamese government.

Potential Challenges for Foreign Currency Payments

- While some multinational companies may prefer to pay employees in foreign currencies to align with global payroll systems, this can pose challenges due to legal restrictions. Hence, is best to use 9cv9 EOR to pay your workers in Vietnam.

Find out more here, or send an email to hello@9cv9.com.

Or just post 1 free job posting here at 9cv9 Hiring Portal in under 10 minutes.

While there may be preferences for paying in foreign currencies, Vietnamese labor laws prioritize salary payments in VND.

Employers should consider the legal framework, potential challenges, employee preferences, and exchange rate dynamics when deciding on the currency for salary disbursements.

By aligning with local regulations and considering employee needs, employers can streamline payroll processes and maintain a harmonious working relationship.

Conclusion

This comprehensive guide serves as a valuable resource for businesses and employers navigating the intricate landscape of hiring employees in Vietnam.

From understanding the vibrant labor market to deciphering legal obligations, this factsheet provides a 360-degree view of the hiring process in the Vietnamese context.

As we’ve explored the key considerations, from sourcing talent in top universities to leveraging job portals, every aspect has been meticulously covered. The discussion on salary structures, tax computations, and working hours offers practical insights to both employers and employees.

Moreover, the exploration of the unique cultural aspects, including holiday regulations and the significance of the 13th-month bonus, contributes to a nuanced understanding of the work environment in Vietnam.

The emphasis on legal obligations, such as trade union fees and compliance with government policies, underscores the importance of responsible and ethical business practices.

In the ever-evolving employment landscape, staying informed about the latest trends and regulations is paramount.

This factsheet, being a testament to current and relevant information, ensures that employers can make strategic decisions aligned with legal requirements and market trends.

The inclusion of examples, statistics, and data throughout the guide adds a layer of practicality, allowing businesses to make well-informed choices.

Whether you are a seasoned entrepreneur expanding operations or a newcomer venturing into the Vietnamese job market, this factsheet aims to empower you with the knowledge needed to navigate the complexities of hiring employees in Vietnam successfully.

The dynamic blend of SEO-optimized content and informative insights positions this guide as a go-to reference, offering a holistic understanding of the hiring landscape in this dynamic Southeast Asian nation.

As Vietnam continues to be a hotspot for business opportunities, leveraging this comprehensive guide ensures a strategic and well-informed approach to building a skilled and thriving workforce in this promising market.

If your company needs HR, hiring, or corporate services, you can use 9cv9 hiring and recruitment services. Book a consultation slot here, or send over an email to hello@9cv9.com.

If you find this article useful, why not share it with your hiring manager and C-level suite friends and also leave a nice comment below?

We, at the 9cv9 Research Team, strive to bring the latest and most meaningful data, guides, and statistics to your doorstep.

To get access to top-quality guides, click over to 9cv9 Blog.

People Also Ask

Why Hire Employees in Vietnam?

Hiring employees in Vietnam offers a strategic advantage due to a skilled and cost-effective workforce, favorable economic growth, and a business-friendly environment. The country’s dynamic market, cultural richness, and competitive operational costs make it an attractive destination for businesses seeking growth and efficiency.

How to Hire Employees in Vietnam?

To hire employees in Vietnam, follow these steps: 1. Understand local labor laws. 2. Utilize top job portals like 9cv9. 3. Tap into talent from leading universities. 4. Consider local customs in the hiring process. 5. Adhere to salary and benefit regulations. 6. Leverage professional agencies for recruitment support.

What is the salary range for hiring Employees in Vietnam?

Salary ranges for hiring employees in Vietnam vary by industry and location. On average, entry-level positions may start at $300-$500 per month, while mid-level roles range from $700-$1,500. Senior management positions can command higher salaries, reaching $2,000-$5,000 or more, depending on qualifications and experience.

Source: